Attached files

| file | filename |

|---|---|

| EX-99.1 - Q1 2016 EARNINGS RELEASE - CINCINNATI BELL INC | earningsreleaseq12016.htm |

| 8-K - CINCINNATI BELL INC. 8-K - CINCINNATI BELL INC | a8-kearningsreleaseshellq1.htm |

Cincinnati Bell First Quarter 2016 Results May 5, 2016

Today's Agenda Highlights, Segment Results and Financial Overview Ted Torbeck, President & Chief Executive Officer Question & Answer 2

Safe Harbor This presentation and the documents incorporated by reference herein contain forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason. 3

Non GAAP Financial Measures This presentation contains information about adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP financial measures used by Cincinnati Bell management when evaluating results of operations and cash flow. Management believes these measures also provide users of the financial statements with additional and useful comparisons of current results of operations and cash flows with past and future periods. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures. Detailed reconciliations of Adjusted EBITDA, net debt and free cash flow (including the Company’s definition of these terms) to comparable GAAP financial measures can be found in the earnings release on our website at www.cincinnatibell.com within the Investor Relations section. 4

Ted Torbeck President & Chief Executive Officer 5

Highlights and Financial Overview $188 $75 $108 $8 $(4)$(3) $190 $72 $103 $10 $(5)$(4) 6 Entertainment & Communications IT Services & Hardware Eliminations Corporate Revenue RevenueAdjusted EBITDA Adjusted EBITDA $293 $289 $79 $77 Q1 2015 Q1 2016 ▪ Strong first quarter Adjusted EBITDA of $77 million, with Adjusted EBITDA margins of 27% ▪ Revenue from strategic products totaled $152 million, up 21% compared to prior year ▪ Entertainment and Communications revenue totaled $190 million, up $2 million from prior year Fioptics Revenue totaled $58 million, up 37% year-over-year Record-high first quarter Fioptics video and internet subscriber net activations ▪ Strategic IT Services and Hardware revenue increased 18% compared to the prior year First Quarter 2016 Highlights __ __ ($ in millions)

Revenue Adj. EBITDA Adj. EBITDA Margin Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 $188 $182 $185 $188 $190 $75 $70 $68 $69 $72 40% 39% 37% 37% 38% Entertainment & Communications Revenue and Adjusted EBITDA [1] [1] Revenue for backhaul services provided to our discontinued wireless operations totaled $3 million in Q1 2015 7 ▪ Strategic revenues for the quarter totaled $106 million, up 23% year-over-year ▪ Adjusted EBITDA totaled $72 million in the first quarter, resulting in Adjusted EBITDA margins of 38% ▪ Record-high total internet subscribers of 292,400 at the end of the first quarter, up 19,700 subs compared to a year ago ▪ Voice line loss was 2% – improved from 6% in the prior year Business lines increased 3% Residential line decreased 8% __ __ ($ in millions)

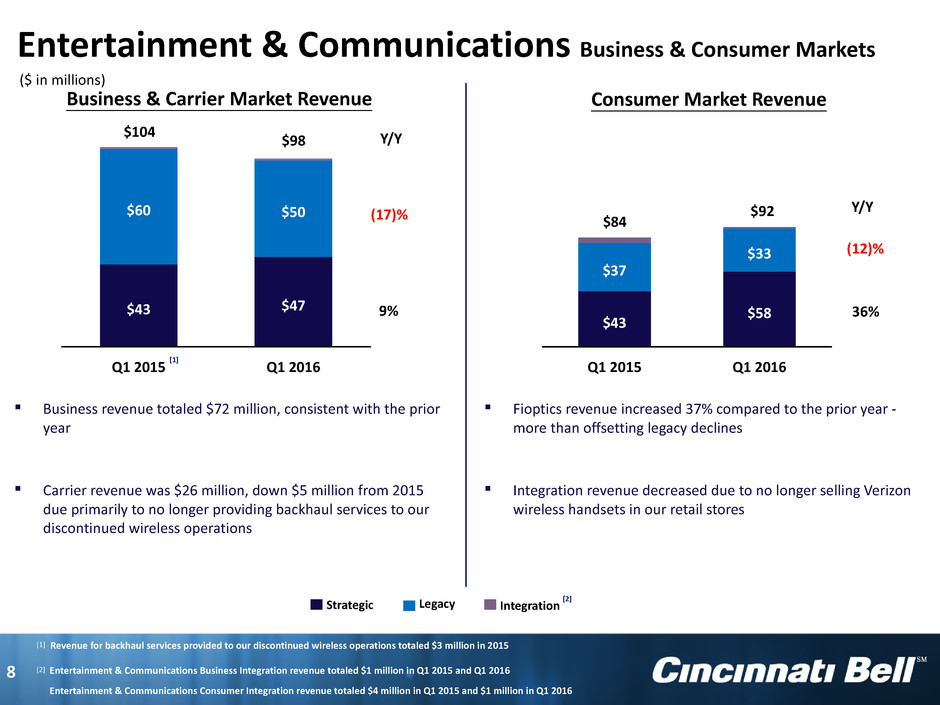

Legacy IntegrationStrategic [2] 8 Q1 2015 Q1 2016 $43 $47 $60 $50 Entertainment & Communications Business & Consumer Markets $104 $98 Business & Carrier Market Revenue [1] Entertainment & Communications Business Integration revenue totaled $1 million in Q1 2015 and Q1 2016 Entertainment & Communications Consumer Integration revenue totaled $4 million in Q1 2015 and $1 million in Q1 2016 [2] Revenue for backhaul services provided to our discontinued wireless operations totaled $3 million in 2015 Consumer Market Revenue Q1 2015 Q1 2016 $43 $58 $37 $33 $84 $92 ▪ Fioptics revenue increased 37% compared to the prior year - more than offsetting legacy declines ▪ Integration revenue decreased due to no longer selling Verizon wireless handsets in our retail stores ▪ Business revenue totaled $72 million, consistent with the prior year ▪ Carrier revenue was $26 million, down $5 million from 2015 due primarily to no longer providing backhaul services to our discontinued wireless operations [1] ($ in millions) Y/Y (17)% 9% Y/Y (12)% 36%

9 Q1 2015 Q1 2016 $21 $29 $15 $22$6 $7 $42 $58 Fioptics Update Fioptics Revenue Q1 2015 Q1 2016 96 120123 165 65 83 Total Fioptics Subscribers Video Internet Voice ▪ Fioptics is available to 454 thousand addresses, or 57% of Greater Cincinnati Passed 22 thousand new addresses in Q1 2016 ▪ Fioptics Penetration: Video – 26%, Internet – 36%, Voice – 18% ▪ Total video churn was 2.4% for the quarter Single-family churn was 1.9% Apartment churn was 4.2% ▪ Fioptics monthly ARPU for the quarter was up approximately 6% from 2015. Q1 2016 ARPUs are as follows: Video – $83, Internet – $47, Voice – $28 __ __ __ ($ in millions) Y/Y 17% 47% 38%

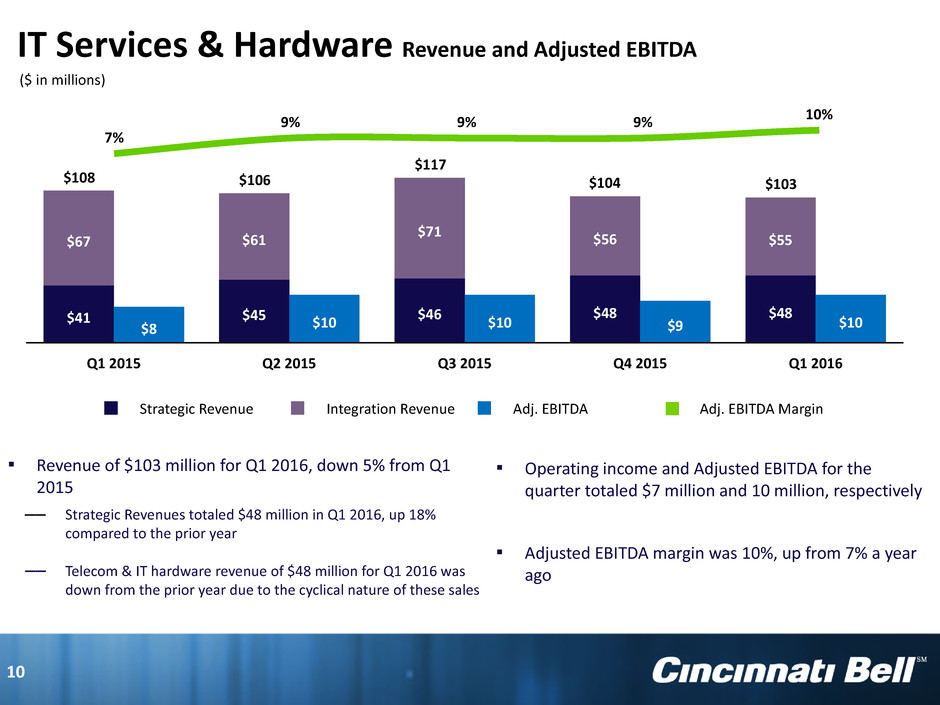

Strategic Revenue Integration Revenue Adj. EBITDA Adj. EBITDA Margin Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 $41 $45 $46 $48 $48 $67 $61 $71 $56 $55 $8 $10 $10 $9 $10 7% 9% 9% 9% 10% IT Services & Hardware Revenue and Adjusted EBITDA 10 ▪ Revenue of $103 million for Q1 2016, down 5% from Q1 2015 Strategic Revenues totaled $48 million in Q1 2016, up 18% compared to the prior year Telecom & IT hardware revenue of $48 million for Q1 2016 was down from the prior year due to the cyclical nature of these sales ▪ Operating income and Adjusted EBITDA for the quarter totaled $7 million and 10 million, respectively ▪ Adjusted EBITDA margin was 10%, up from 7% a year ago $108 $106 $117 $104 $103 __ __ ($ in millions)

Q1 2016 Free Cash Flow and Capital Expenditures Free Cash Flow Capital Expenditures Q1 2016 Adjusted EBITDA $ 77 Interest Payments (8) Capital Expenditures (62) Pension and OPEB Payments (3) Dividends from CyrusOne 2 Working Capital and Other 2 Free Cash Flow $ 8 Selected 2016 Free Cash Flow Items ▪ Interest payments ~ $75 million ▪ Pension and OPEB payments ~ $12 million ▪ CyrusOne dividends ~ $10 million ▪ Capital expenditures: $265 - $275 million Q1 2016 Construction $ 17 Installation 13 Value Added 7 Total Fioptics $ 37 Other Strategic 17 Total Strategic Investment 54 Maintenance 8 $ 62 11 ($ in millions)

2016 Guidance 2016 Guidance Revenue $ 1.2 billion Adjusted EBITDA $303 million* * Plus or minus 2 percent 12

Appendix 13

Consolidated Results ($ in millions, except per share amounts) Three Months Ended March 31, 2016 2015 Revenue $ 288.9 $ 292.9 Costs and expenses Cost of services and products 162.7 166.2 Selling, general and administrative 53.2 52.2 Depreciation and amortization 43.4 32.6 Other — 4.8 Operating Income 29.6 37.1 Interest expense 20.3 32.7 Gain on extinguishment of debt (2.4) — Other expense, net — 3.5 Income from continuing operations before income taxes 11.7 0.9 Income tax expense 4.7 0.6 Income from continuing operations 7.0 0.3 Income from discontinued operations, net of tax — 48.9 Net income 7.0 49.2 Preferred stock dividends 2.6 2.6 Net income applicable to common shareholders $ 4.4 $ 46.6 Basic and diluted net earnings per common share Earnings (loss) from continuing operations $ 0.02 $ (0.01) Earnings from discontinued operations — 0.23 Basic and diluted net earnings per common share $ 0.02 $ 0.22 . 14

Revenue Classifications - Entertainment and Communications Strategic Legacy Integration Data Voice Video Services and Other Fioptics Internet DSL (1) (> 10 meg) Ethernet Private Line MPLS (2) SONET (3) Dedicated Internet Access Wavelength Audio Conferencing Fioptics Voice VoIP (4) Fioptics Video Wiring Projects DSL (< 10 meg) DS0 (5), DS1, DS3 TDM (6) Traditional Voice Long Distance Switched Access Digital Trunking Advertising Directory Assistance Maintenance Information Services Wireless Handsets and Accessories 15 (1) Digital Subscriber Line (2) Multi-Protocol Label Switching (3) Synchronous Optical Network (4) Voice of Internet Protocol (5) Digital Signal (6) Time Division Multiplexing

Revenue Classifications - IT Services and Hardware Professional Services Unified Communications Cloud Services Monitoring and Management Telecom & IT Hardware Strategic Integration Consulting Staff Augmentation Voice Monitoring Managed IP Telephony Solutions Virtual Data Centers Storage Backup Network Monitoring/Management Security Installation Maintenance Hardware Software Licenses 16

Revenue – MD&A Strategic, Legacy and Integration ($ in millions) Q1 2016 Entertainment and Communications IT Services and Hardware Total Eliminations Total Strategic Data $ 58.1 $ — Voice 17.2 — Video 29.0 — Services and other 1.3 — Professional services — 22.3 Management and monitoring — 8.1 Unified communications — 7.5 Cloud services — 10.2 Total Strategic 105.6 48.1 153.7 (2.2) 151.5 Legacy Data $ 27.1 $ — Voice 53.0 — Services and other 3.1 — Total Legacy 83.2 — 83.2 (0.3) 82.9 Integration Services and other $ 1.5 $ — Professional services — 3.9 Unified communications — 2.6 Telecom and IT hardware — 47.9 Total Integration 1.5 54.4 55.9 (1.4) 54.5 Total Revenue $ 190.3 $ 102.5 $ 292.8 $ (3.9) $ 288.9 Eliminations 0.4 3.5 3.9 $ 189.9 $ 99.0 $ 288.9 17

Revenue – MD&A Strategic, Legacy and Integration ($ in millions) Q1 2015 Entertainment and Communications IT Services and Hardware Total Eliminations Total Strategic Data $ 48.4 $ — Voice 14.7 — Video 21.4 — Services and other 1.7 — Professional services — 20.6 Management and monitoring — 7.3 Unified communications — 6.7 Cloud services — 6.1 Total Strategic 86.2 40.7 126.9 (2.1) 124.8 Legacy Data $ 32.8 $ — Voice 61.0 — Services and other 3.8 — Total Legacy 97.6 — 97.6 (0.2) 97.4 Integration Services and other $ 4.3 $ — Professional services — 3.5 Unified communications — 2.9 Telecom and IT hardware — 60.5 Total Integration 4.3 66.9 71.2 (0.5) 70.7 Total Revenue $ 188.1 $ 107.6 $ 295.7 $ (2.8) $ 292.9 Eliminations 0.3 2.5 2.8 $ 187.8 $ 105.1 $ 292.9 18