Attached files

| file | filename |

|---|---|

| EX-3.2 - EX-3.2 - TRUSTMARK CORP | trmk-ex32_7.htm |

| EX-3.1 - EX-3.1 - TRUSTMARK CORP | trmk-ex31_6.htm |

| 8-K - 8-K - TRUSTMARK CORP | trmk-8k_20160426.htm |

Annual Meeting of Shareholders Jackson, MS April 26, 2016 Building a Premier Regional Financial Services Organization EXHIBIT 99.1

Forward–Looking Statements Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements include, but are not limited to, statements relating to anticipated future operating and financial performance measures, including net interest margin, credit quality, business initiatives, growth opportunities and growth rates, among other things, and encompass any estimate, prediction, expectation, projection, opinion, anticipation, outlook or statement of belief included therein as well as the management assumptions underlying these forward-looking statements. You should be aware that the occurrence of the events described under the caption “Risk Factors” in Trustmark’s filings with the Securities and Exchange Commission could have an adverse effect on our business, results of operations and financial condition. Should one or more of these risks materialize, or should any such underlying assumptions prove to be significantly different, actual results may vary significantly from those anticipated, estimated, projected or expected. Risks that could cause actual results to differ materially from current expectations of Management include, but are not limited to, changes in the level of nonperforming assets and charge-offs, local, state and national economic and market conditions, including conditions in the housing and real estate markets in the regions in which Trustmark operates and the extent and duration of the current volatility in the credit and financial markets as well as crude oil prices, changes in our ability to measure the fair value of assets in our portfolio, material changes in the level and/or volatility of market interest rates, the performance and demand for the products and services we offer, including the level and timing of withdrawals from our deposit accounts, the costs and effects of litigation and of unexpected or adverse outcomes in such litigation, our ability to attract noninterest-bearing deposits and other low-cost funds, competition in loan and deposit pricing, as well as the entry of new competitors into our markets through de novo expansion and acquisitions, economic conditions, including the potential impact of issues relating to the European financial system, and monetary and other governmental actions designed to address the level and volatility of interest rates and the volatility of securities, currency and other markets, the enactment of legislation and changes in existing regulations, or enforcement practices, or the adoption of new regulations, changes in accounting standards and practices, including changes in the interpretation of existing standards, that affect our consolidated financial statements, changes in consumer spending, borrowings and savings habits, technological changes, changes in the financial performance or condition of our borrowers, changes in our ability to control expenses, changes in our compensation and benefit plans, greater than expected costs or difficulties related to the integration of acquisitions or new products and lines of business, cyber-attacks and other breaches which could affect our information system security, natural disasters, environmental disasters, acts of war or terrorism, and other risks described in our filings with the Securities and Exchange Commission. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Except as required by law, we undertake no obligation to update or revise any of this information, whether as the result of new information, future events or developments or otherwise.

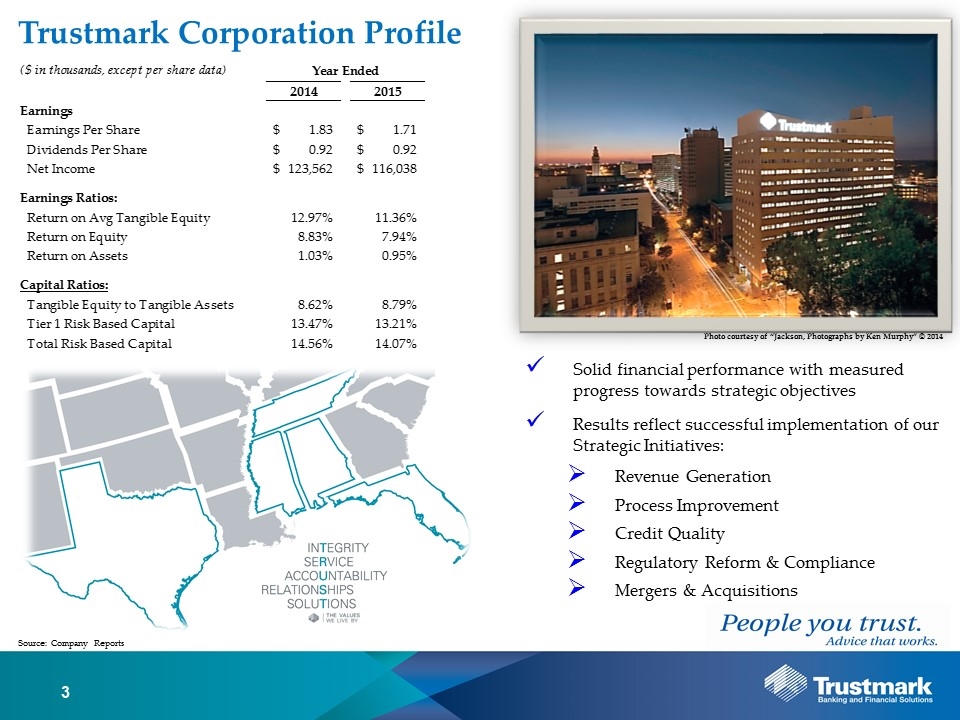

Photo courtesy of “Jackson, Photographs by Ken Murphy” © 2014 Solid financial performance with measured progress towards strategic objectives Results reflect successful implementation of our Strategic Initiatives: Revenue Generation Process Improvement Credit Quality Regulatory Reform & Compliance Mergers & Acquisitions Trustmark Corporation Profile Source: Company Reports

Assessment of 2015 – Strategic Initiatives Executing our Strategic Plan Loan Growth: increase in legacy loan portfolio (LHFI) of $642.0 million, or 10.0%, reflecting diversified growth by market and loan type Insurance: revenue totaled $36.4 million, up 8.8%, the highest level in Trustmark’s history Wealth Management: revenue of $31.4 million, down 3.0%, reflecting impact of volatile market conditions; assets under management and administration & brokerage assets totaled $12.3 billion Mortgage: revenue totaled $30.2, up 21.8%; loan production totaled $1.5 billion in 2015 Deposits: Top 3 and Top 5 position in 62% and 75%, respectively, of markets served; noninterest-bearing deposits represented 31.3% of total deposits Investment in Geographies and People: Banking: three new branch offices across Alabama and Mississippi Insurance: increased Oxford, MS, presence by augmenting production team to better serve the Memphis region Mortgage Banking: addition of 13 loan producers; new loan production offices in Florence and Tuscaloosa, AL, as well as Pensacola, FL Customer Experience: continued investment to improve customer experience – myTrustmark℠, new consumer digital banking platform, and treasury management products Another year of significant achievements as Trustmark continued to provide the service and solutions its customer expect, while also transforming the organization for the future Revenue Generation Source: Company Reports

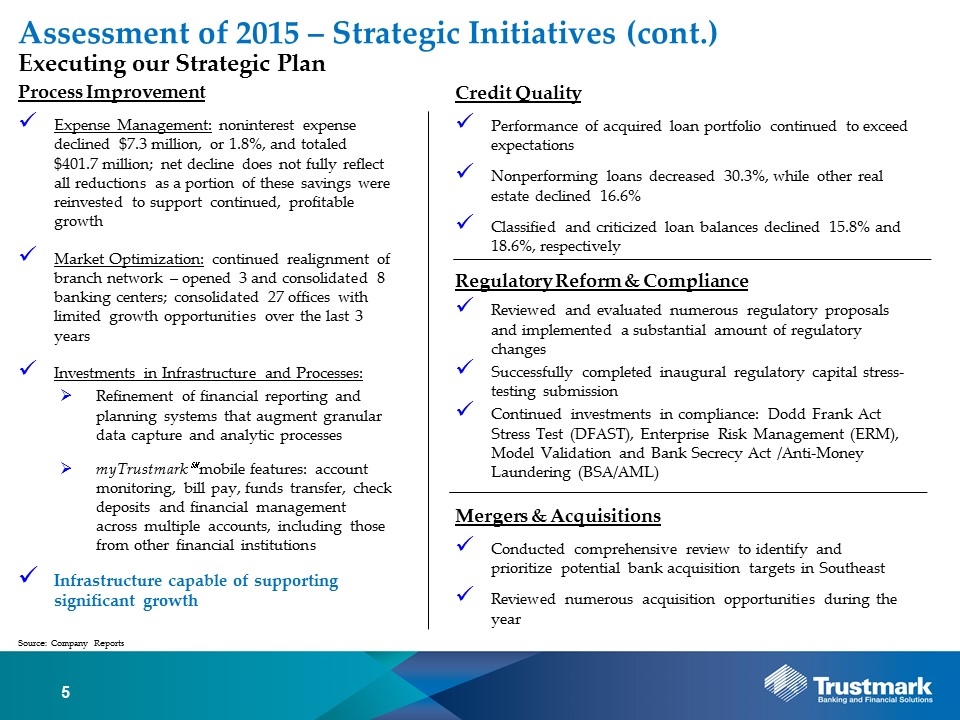

Assessment of 2015 – Strategic Initiatives (cont.) Executing our Strategic Plan Credit Quality Performance of acquired loan portfolio continued to exceed expectations Nonperforming loans decreased 30.3%, while other real estate declined 16.6% Classified and criticized loan balances declined 15.8% and 18.6%, respectively Regulatory Reform & Compliance Reviewed and evaluated numerous regulatory proposals and implemented a substantial amount of regulatory changes Successfully completed inaugural regulatory capital stress-testing submission Continued investments in compliance: Dodd Frank Act Stress Test (DFAST), Enterprise Risk Management (ERM), Model Validation and Bank Secrecy Act /Anti-Money Laundering (BSA/AML) Mergers & Acquisitions Conducted comprehensive review to identify and prioritize potential bank acquisition targets in Southeast Reviewed numerous acquisition opportunities during the year Process Improvement Expense Management: noninterest expense declined $7.3 million, or 1.8%, and totaled $401.7 million; net decline does not fully reflect all reductions as a portion of these savings were reinvested to support continued, profitable growth Market Optimization: continued realignment of branch network – opened 3 and consolidated 8 banking centers; consolidated 27 offices with limited growth opportunities over the last 3 years Investments in Infrastructure and Processes: Refinement of financial reporting and planning systems that augment granular data capture and analytic processes myTrustmark℠ mobile features: account monitoring, bill pay, funds transfer, check deposits and financial management across multiple accounts, including those from other financial institutions Infrastructure capable of supporting significant growth Source: Company Reports

Assessment of 2015 – Our Core Values Who We Are and What We Believe A community-focused, values-guided organization that makes a sustainable difference in the lives of customers and communities we serve Our performance is driven by values that have sustained this organization for more than 126 years These values build strong, long-term relationships, the outcome of which is reflected in our solid financial results Our core values unite Trustmark associates and distinguish us from the competition Values We Live By

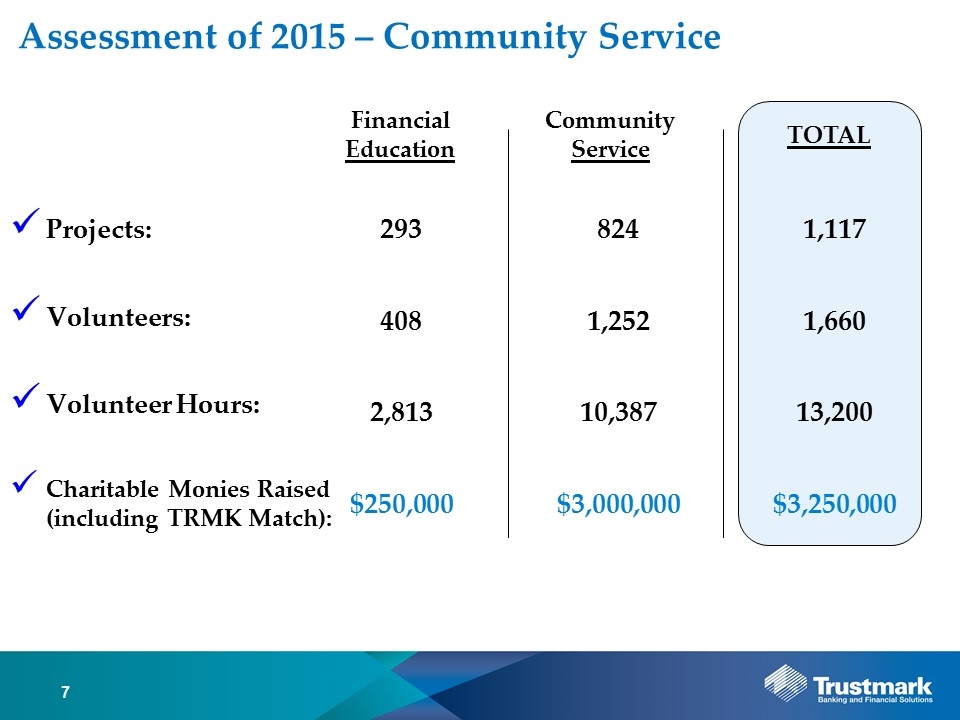

Assessment of 2015 – Community Service Projects: Volunteers: Volunteer Hours: Charitable Monies Raised (including TRMK Match): Financial Education Community Service TOTAL 293 824 1,117 408 1,252 1,660 2,813 10,387 13,200 $250,000 $3,000,000 $3,250,000

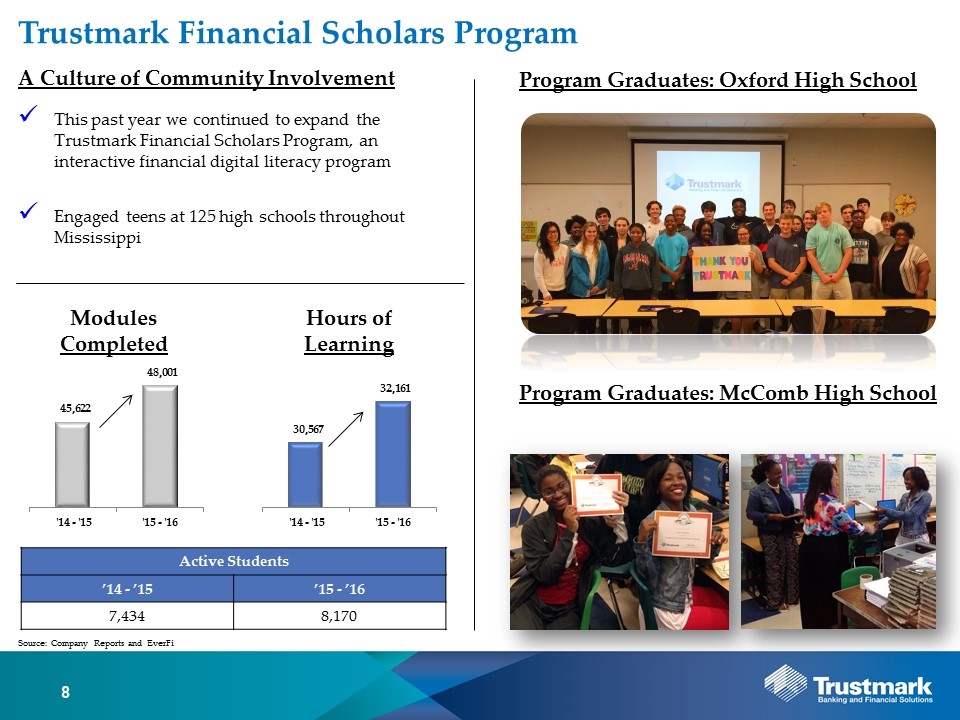

Trustmark Financial Scholars Program Program Graduates: McComb High School Modules Completed Hours of Learning Active Students ’14 - ’15 ’15 - ’16 7,434 8,170 Source: Company Reports and EverFi This past year we continued to expand the Trustmark Financial Scholars Program, an interactive financial digital literacy program Engaged teens at 125 high schools throughout Mississippi A Culture of Community Involvement Program Graduates: Oxford High School

Annual Meeting of Shareholders Jackson, MS April 26, 2016 Building a Premier Regional Financial Services Organization