Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Marathon Petroleum Corp | mpc8-kirpacket.htm |

Table of Contents: Lisa D. Wilson 419/421-2071 lisadwilson@marathonpetroleum.com Income Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Consolidated Statements of Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3 Teresa R. Homan 419/421-2965 Consolidated Balance Sheets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 thoman@marathonpetroleum.com Consolidated Statements of Cash Flows (YTD) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 Net Property, Plant and Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Refining & Marketing Segment - Supplemental Financial and Operating Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Refining & Marketing Segment - Supplemental Operating Data By Region . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Speedway Segment - Supplemental Financial and Operating Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Midstream Segment - Supplemental Financial and Operating Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Investor Relations Segment Earnings Before Interest, Taxes, Depreciation & Amortization (Segment EBITDA) . . . . . . . . . . . . . . . . . . . . . . 11 539 South Main Street Findlay, OH 45840-3229 May 2, 2016 Segment EBITDA represents segment earnings before interest and financing costs, interest income, income taxes and depreciation and amortization expense. Segment EBITDA is used by some investors and analysts to analyze and compare companies on the basis of operating performance. Segment EBITDA should not be considered as an alternative to net income attributable to MPC, income before income taxes, cash flows from operating activities or any other measure of financial performance presented in accordance with accounting principles generally accepted in the United States. Segment EBITDA may not be comparable to similarly titled measures used by other entities. reviewed on our website at: www.marathonpetroleum.com First Quarter 2016 Additional information regarding Investor Relations, Financial Highlights, and News Releases can be

Year Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr (In millions) 2012 2013 2014 2015 2015 2015 2015 2015 2016 Income from operations by segment: (a) 1 Refining & Marketing (b) 5,022$ 3,131$ 3,538$ 1,292$ 1,181$ 1,434$ 179$ 4,086$ (62)$ 2 Speedway (b) 310 375 544 168 127 243 135 673 167 3 Midstream (c)(d) 277 275 342 90 103 93 94 380 167 Items not allocated to segments: 4 Corporate and other unallocated items (321) (261) (277) (79) (75) (75) (70) (299) (67) 5 Minnesota assets sale settlement gain 183 - - - - - - - - 6 Pension settlement expenses (124) (95) (96) (1) (1) (2) - (4) (1) 7 Impairments (e) - - - - - (144) - (144) (129) 8 Income from operations (b) 5,347 3,425 4,051 1,470 1,335 1,549 338 4,692 75 9 Net interest and other financial income (costs) (d) (109) (179) (216) (81) (64) (70) (103) (318) (142) 10 Income before taxes 5,238 3,246 3,835 1,389 1,271 1,479 235 4,374 (67) 11 Income tax provision 1,845 1,113 1,280 486 432 521 67 1,506 11 12 Net income 3,393 2,133 2,555 903 839 958 168 2,868 (78) 13 Net income attributable to noncontrolling interests 4 21 31 12 13 10 (19) 16 (79) 14 Net income attributable to MPC 3,389$ 2,112$ 2,524$ 891$ 826$ 948$ 187$ 2,852$ 1$ 15 Effective tax rate 35% 34% 33% 35% 34% 35% 29% 34% (17%) (a) (b) (c) (d) (e) The fourth quarter and full-year 2015 includes transaction costs of $32 million and $36 million, respectively, related to the MarkWest merger. The Midstream segment results for the fourth quarter and full-year 2015 reflect $26 million and $30 million of these costs, respectively. The remaining $6 million is included in net interest and other financial income (costs) in both periods. Reflects an impairment charge in third quarter 2015 for the cancellation of the Residual Oil Upgrader Expansion ("ROUX") project and a goodwill impairment in first quarter 2016. Income Summary Marathon Petroleum Corporation We revised our operating segment presentation in the first quarter of 2016 in connection with the contribution of our inland marine business to MPLX; our inland marine business, which was previously included in Refining & Marketing, is now included in Midstream. Comparable prior period information has been recast to reflect our revised segment presentation. The fourth quarter and full-year 2015 includes a non-cash LCM inventory valuation charge of $370 million, which reduced Refining & Marketing and Speedway segment income by $345 million and $25 million, respectively. The first quarter 2016 includes a non-cash LCM inventory valuation charge of $15 million, which reduced Refining & Marketing segment income. Includes the results of MarkWest from the December 4, 2015 merger date. 2

Year Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2012 2013 2014 2015 2015 2015 2015 (a) 2015 (a) 2016 (a) 1 82,492$ 100,254$ 98,102$ 17,240$ 20,581$ 18,758$ 15,679$ 72,258$ 12,830$ 2 68,668 87,401 83,770 13,044 16,366 14,165 12,008 55,583 9,701 3 280 357 505 76 82 61 89 308 107 4 - - - - - - 370 370 15 5 5,709 6,263 6,685 1,832 1,939 1,988 1,933 7,692 1,826 6 - - - - - 144 - 144 129 7 995 1,220 1,326 363 362 364 413 1,502 490 8 1,223 1,248 1,375 358 393 392 433 1,576 378 9 270 340 390 97 104 95 95 391 109 10 77,145 96,829 94,051 15,770 19,246 17,209 15,341 67,566 12,755 11 5,347 3,425 4,051 1,470 1,335 1,549 338 4,692 75 12 1 - - - - - - - - 13 (110) (179) (216) (81) (64) (70) (103) (318) (142) 14 5,238 3,246 3,835 1,389 1,271 1,479 235 4,374 (67) 15 1,353 1,090 1,522 488 442 515 (73) 1,372 13 16 492 23 (242) (2) (10) 6 140 134 (2) 17 1,845 1,113 1,280 486 432 521 67 1,506 11 18 3,393 2,133 2,555 903 839 958 168 2,868 (78) 19 4 21 31 12 13 10 (19) 16 (79) 20 3,389$ 2,112$ 2,524$ 891$ 826$ 948$ 187$ 2,852$ 1$ 21 680 630 570 545 541 535 531 538 529 22 4.97$ 3.34$ 4.42$ 1.63$ 1.52$ 1.77$ 0.35$ 5.29$ 0.003$ 23 684 634 574 549 544 538 535 542 531 24 4.95$ 3.32$ 4.39$ 1.62$ 1.51$ 1.76$ 0.35$ 5.26$ 0.003$ 25 0.60$ 0.77$ 0.92$ 0.25$ 0.25$ 0.32$ 0.32$ 1.14$ 0.32$ (a) (b) (c) (d) Dividends paid per common share (d) Includes the results of MarkWest from the December 4, 2015 merger date. Reclassifications of data have been made for 2012 to conform to current classifications. Reflects an impairment charge in third quarter 2015 for the cancellation of the Residual Oil Upgrader Expansion ("ROUX") project and a goodwill impairment in first quarter 2016. All historical share and per share data are retroactively restated on a post-split basis to reflect the two-for-one stock split in June 2015. Net income attributable to MPC per share Diluted: Number of shares (millions) Net income attributable to MPC per share NET INCOME ATTRIBUTABLE TO MPC Per common share data: (d) Basic: Number of shares (millions) Deferred Total provision for income taxes Net income Less: net income attributable to noncontrolling interests Net interest and other financial costs Income before income taxes Income tax provision (benefit) Current Other taxes Total costs and expenses Income from operations Related party net interest and other financial income Inventory market valuation charges (credits) Consumer excise taxes Impairment expense Depreciation and amortization (c) Selling, general and administrative expenses (b) REVENUES AND OTHER INCOME: COSTS AND EXPENSES: Cost of revenues (b) Purchases from related parties CONSOLIDATED STATEMENTS OF INCOME Marathon Petroleum Corporation (In millions except per-share data) 3

Dec. 31 Dec. 31 Dec. 31 Dec. 31 Mar. 31 2012 2013 2014 2015 2016 1 4,860$ 2,292$ 1,494$ 1,127$ 308$ 2 4,610 5,559 4,058 2,927 2,602 3 1,383 1,797 2,219 2,180 2,044 4 1,761 2,367 2,955 2,804 2,761 5 231 425 302 438 399 6 74 100 166 173 164 7 - - - (370) (385) 8 3,449 4,689 5,642 5,225 4,983 9 110 197 145 192 204 10 13,029 12,737 11,339 9,471 8,097 11 321 463 865 3,622 3,807 12 12,643 13,921 16,261 25,164 25,319 13 930 938 1,566 4,019 3,649 14 280 308 394 839 886 15 27,203$ 28,367$ 30,425$ 43,115$ 41,758$ 16 6,785$ 8,234$ 6,661$ 4,743$ 4,083$ 17 364 406 427 503 302 18 325 373 463 460 459 19 598 513 647 184 145 20 19 23 27 29 215 21 112 275 354 426 391 22 8,203 9,824 8,579 6,345 5,595 23 3,322 3,355 6,575 11,896 11,351 24 2,050 2,304 2,014 3,285 3,356 25 1,266 771 1,099 1,179 1,216 16 257 781 768 735 746 27 15,098 17,035 19,035 23,440 22,264 28 11,694 10,920 10,751 13,237 12,902 29 411 412 639 6,438 6,592 30 12,105 11,332 11,390 19,675 19,494 31 27,203$ 28,367$ 30,425$ 43,115$ 41,758$ 32 666 594 547 531 530 (a) (b) (c) (d) Includes related party payables. Presented on a post-split basis to reflect two-for-one stock split in June 2015. Total equity Total liabilities and equity Net shares outstanding at Balance Sheet date (d) Includes related party receivables. We adopted the updated Financial Accounting Standards Board debt issuance cost standard as of June 30, 2015. We reclassified unamortized debt issuance costs related to term debt from other noncurrent assets to total debt. Total liabilities EQUITY MPC stockholders' equity Noncontrolling interests Long-term debt (b) Deferred income taxes Defined benefit postretirement plan obligations Deferred credits and other liabilities Consumer excise taxes payable Accrued taxes Debt due within one year Other current liabilities Total current liabilities LIABILITIES Current liabilities: Accounts payable (c) Payroll and benefits payable Equity method investments Property, plant and equipment, net Goodwill Other noncurrent assets (b) Total assets Lower of cost or market reserve Total inventories Other current assets Total current assets Inventories: Crude oil and refinery feedstocks Refined products Materials and supplies Merchandise ASSETS Current assets: Cash and cash equivalents Receivables, less allowance for doubtful accounts (a) CONSOLIDATED BALANCE SHEETS Marathon Petroleum Corporation (In millions) 4

Dec. 31 Dec. 31 Dec. 31 Mar. 31 Jun. 30 Sep. 30 Dec. 31 Mar. 31 2012 2013 2014 2015 2015 2015 2015 2016 1 3,393$ 2,133$ 2,555$ 903$ 1,742$ 2,700$ 2,868$ (78)$ 2 - - - - - 144 144 129 3 995 1,220 1,326 363 725 1,089 1,502 490 4 - - - - - - 370 15 5 153 (124) 151 26 57 51 80 30 6 492 23 (242) (2) (12) (6) 134 (2) 7 (177) (6) (21) (5) (4) (6) (7) (25) 8 11 (18) 17 2 14 8 25 28 9 59 (21) (3) (12) 18 9 4 (18) 10 851 (940) 1,642 691 179 931 1,292 325 11 (115) (305) (786) 205 102 86 80 226 12 (1,223) 1,464 (1,547) (939) (591) (1,707) (2,400) (810) 13 53 (21) 18 (42) (46) (46) (31) 17 14 4,492 3,405 3,110 1,190 2,184 3,253 4,061 327 15 (1,369) (1,206) (1,480) (389) (764) (1,277) (1,998) (745) 16 (190) (1,515) (2,821) - - - (1,218) - 17 53 16 27 11 12 14 21 77 18 54 (51) (269) (10) (104) (165) (246) (59) 19 (1,452) (2,756) (4,543) (388) (856) (1,428) (3,441) (727) 20 - - - - - - - 188 21 (23) (25) 3,223 103 97 91 746 (560) 22 108 48 26 21 26 29 33 1 23 (1,350) (2,793) (2,131) (209) (617) (773) (965) (75) 24 (407) (484) (524) (136) (272) (443) (613) (169) 25 407 - 221 - - - - 315 26 - (21) (27) (9) (18) (29) (40) (121) 27 - - - - - - - - 28 - 39 - - - - - - 29 - - (172) - (175) (175) (175) - 30 6 19 19 12 18 25 27 2 31 (1,259) (3,217) 635 (218) (941) (1,275) (987) (419) 32 1,781 (2,568) (798) 584 387 550 (367) (819) 33 3,079 4,860 2,292 1,494 1,494 1,494 1,494 1,127 34 4,860$ 2,292$ 1,494$ 2,078$ 1,881$ 2,044$ 1,127$ 308$ 34 4,920$ 3,207$ 3,804$ 1,245$ 2,476$ 3,934$ 5,085$ 604$ (a) (b) Includes changes in related party receivables. Includes changes in related party payables. Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Cash Flow from Operations, excluding changes in working capital Tax settlement with Marathon Oil Corporation Contingent consideration payments All other - net Net cash provided by (used in) financing activities Common stock repurchased Dividends paid Net proceeds from issuance of MPLX LP common units Distributions to noncontrolling interests Contributions from (distributions to) Marathon Oil FINANCING ACTIVITIES: Commercial paper - net Debt - net Issuance of common stock Additions to property, plant and equipment Acquisitions, net of cash acquired Disposal of assets Investments and other - net Net cash provided by (used in) investing activities Current accounts payable and accrued liabilities (b) All other - net Net cash provided by operating activities INVESTING ACTIVITIES: Net gain on disposal of assets Equity method investments, net Changes in the fair value of derivative instruments Changes in: Current receivables (a) Inventories Impairment expense Depreciation and amortization Inventory market valuation charges (credits) Pension and other postretirement benefits, net Deferred income taxes Increase (decrease) in cash and cash equivalents OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash provided by operating activities: CONSOLIDATED STATEMENTS OF CASH FLOWS (YTD) Marathon Petroleum Corporation (In millions) 5

Dec. 31 Dec. 31 Dec. 31 Mar. 31 Jun. 30 Sep. 30 Dec. 31 Mar. 31 (In millions) 2012 2013 2014 2015 2015 2015 2015 2016 1 Refining & Marketing (a) 9,805$ 10,708$ 10,753$ 10,722$ 10,674$ 10,535$ 10,634$ 10,609$ 2 Speedway 1,108 1,281 3,464 3,447 3,484 3,556 3,686 3,673 3 Midstream (a)(b) 1,532 1,671 1,760 1,780 1,804 1,862 10,455 10,657 4 Corporate and Other 198 261 284 292 321 341 389 380 5 Total 12,643$ 13,921$ 16,261$ 16,241$ 16,283$ 16,294$ 25,164$ 25,319$ (a) (b) Net Property, Plant and Equipment Marathon Petroleum Corporation We revised our operating segment presentation in the first quarter of 2016 in connection with the contribution of our inland marine business to MPLX; our inland marine business, which was previously included in Refining & Marketing, is now included in Midstream. Comparable prior period information has been recast to reflect our revised segment presentation. Includes MarkWest net property, plant and equipment from the December 4, 2015 merger. 6

Year Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2012 2013 2014 2015 2015 2015 2015 2015 2016 1 5,022 3,131 3,538 1,292 1,181 1,434 179 4,086 (62) 2 784 989 1,020 261 261 262 268 1,052 273 3 682 2,049 1,043 223 207 256 359 1,045 243 4 1,618 2,086 2,138 2,246 2,341 2,359 2,257 2,301 2,158 5 1,599 2,075 2,125 2,233 2,329 2,345 2,248 2,289 2,148 6 17.85 13.24 15.05 16.14 14.84 17.27 12.70 15.25 9.98 7 1,195 1,661 1,714 1,731 1,731 1,731 1,731 1,731 1,794 8 100 96 95 97 103 101 95 99 89 9 1,195 1,589 1,622 1,672 1,789 1,744 1,638 1,711 1,603 10 168 213 184 180 162 168 201 177 171 11 1,363 1,802 1,806 1,852 1,951 1,912 1,839 1,888 1,774 12 53 53 52 56 55 56 55 55 61 13 28 21 19 20 19 20 20 20 18 14 738 921 869 911 896 911 934 913 899 15 433 572 580 553 631 611 615 603 571 16 26 37 35 36 38 33 35 36 32 17 109 221 276 298 331 292 204 281 234 18 18 31 25 30 28 32 34 31 30 19 62 54 54 50 58 66 49 55 44 20 1,386 1,836 1,839 1,878 1,982 1,945 1,871 1,919 1,810 21 1.00 1.20 1.80 0.79 0.66 1.37 1.71 1.13 2.43 22 1.44 1.36 1.41 1.42 1.33 1.36 1.43 1.39 1.54 23 3.15 4.14 4.86 4.26 3.94 4.17 4.25 4.15 4.14 24 5.59 6.70 8.07 6.47 5.93 6.90 7.39 6.67 8.11 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) Includes utilities, labor, routine maintenance and other operating costs. Includes intersegment sales. Sales revenue less cost of refinery inputs and purchased products, divided by total refinery throughputs. Gross margins for periods prior to fourth quarter 2013 have been recalculated to conform to the current definition. Excludes LCM charge of $345 million for the fourth quarter and full-year 2015 and $15 million for the first quarter 2016. Based on calendar day capacity, which is an annual average that includes downtime for planned maintenance and other normal operating activities. Excludes inter-refinery transfer volumes. Per barrel of total refinery throughputs. We revised our operating segment presentation in the first quarter of 2016 in connection with the contribution of our inland marine business to MPLX; our inland marine business, which was previously included in Refining & Marketing, is now included in Midstream. Comparable prior period information has been recast to reflect our revised segment presentation. Includes non-cash LCM inventory valuation charge of $345 million for the fourth quarter and full-year 2015 and $15 million for the first quarter 2016. Includes acquisition in first quarter 2013 and the third quarter 2014. Total average daily volumes of refined product sales to wholesale, branded and retail (Speedway segment) customers. Includes the impact of the Galveston Bay refinery and related assets beginning on the February 1, 2013 acquisition date. Refinery direct operating costs (dollars per barrel): (j) Turnaround and major maintenance Depreciation and amortization Other manufacturing (k) Total Feedstocks & special products Heavy fuel oil Asphalt Total Refined Product Yields (MBPD) (i) Gasoline Distillates Propane Other charge & blendstocks Total Sour crude oil throughput percentage WTI-priced crude oil throughput percentage Crude oil refining capacity (mbpcd) (h) Crude oil capacity utilization (%) Refinery throughputs (mbpd): (i) Crude oil refined MPC consolidated refined product sales volume (mbpd) (d)(e) Refining & Marketing Operating Statistics (e) R&M segment refined product sales volume (mbpd) (f) Refining & Marketing gross margin ($/bbl) (g) Income from Operations ($MM) (a)(b) Depreciation & Amortization ($MM) (a) Capital Expenditures and Investments ($MM) (a)(c) Refining & Marketing Segment - Supplemental Financial and Operating Data Marathon Petroleum Corporation 7

Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2013 2014 2015 2015 2015 2015 2015 2016 1 964 991 1,031 1,093 1,072 1,043 1,060 991 2 195 182 179 172 180 206 184 217 3 1,159 1,173 1,210 1,265 1,252 1,249 1,244 1,208 4 65 64 70 67 68 69 68 75 5 7 3 5 7 6 4 6 3 6 551 508 523 511 544 557 534 533 7 365 368 342 408 408 408 392 375 8 23 23 25 27 25 26 26 25 9 215 274 307 320 271 247 286 280 10 19 13 15 11 16 19 15 18 11 13 13 14 14 19 18 16 8 12 1,186 1,199 1,226 1,291 1,283 1,275 1,269 1,239 13 1.00 1.82 0.80 0.51 0.80 1.12 0.81 2.62 14 1.09 1.15 1.14 1.06 1.07 1.08 1.09 1.17 15 3.98 4.73 3.99 3.75 4.00 3.78 3.88 3.74 16 6.07 7.70 5.93 5.32 5.87 5.98 5.78 7.53 17 625 631 641 696 672 595 651 612 18 54 45 36 36 28 56 39 36 19 679 676 677 732 700 651 690 648 20 35 33 34 36 36 31 34 39 21 42 44 43 39 43 48 43 42 22 371 361 388 385 367 377 379 366 23 207 212 211 223 203 207 211 196 24 14 13 13 13 10 11 12 9 25 41 43 23 54 59 15 38 34 26 12 13 16 18 16 16 17 12 27 41 41 36 44 47 31 39 36 28 686 683 687 737 702 657 696 653 29 1.47 1.66 0.73 0.89 2.30 2.69 1.64 1.76 30 1.74 1.78 1.85 1.72 1.80 1.97 1.83 2.03 31 4.21 4.76 4.51 4.00 4.25 4.72 4.36 4.36 32 7.42 8.20 7.09 6.61 8.35 9.38 7.83 8.15 33 36 43 35 46 40 61 46 82 (a) (b) (c) (d) Includes the impact of the Galveston Bay refinery and related assets beginning on the February 1, 2013 acquisition date. Includes inter-refinery transfer volumes. Per barrel of total refinery throughputs. Includes utilities, labor, routine maintenance and other operating costs. Depreciation and amortization Other manufacturing (d) Total Inter-refinery transfers (mbpd) Asphalt Total Refinery direct operating costs (dollars per barrel): (c) Turnaround and major maintenance Gasoline Distillates Propane Feedstocks & special products Heavy fuel oil Sour crude oil throughput percentage WTI-priced crude oil throughput percentage Refined Product Yields (MBPD) (b) Midwest Region: Refinery throughputs (MBPD): (b) Crude oil refined Other charge & blendstocks Total Turnaround and major maintenance Depreciation and amortization Other manufacturing (d) Total Heavy fuel oil Asphalt Total Refinery direct operating costs (dollars per barrel): (c) Refined Product Yields (MBPD) (b) Gasoline Distillates Propane Feedstocks & special products Total Sour crude oil throughput percentage WTI-priced crude oil throughput percentage Gulf Coast Region: (a) Refinery throughputs (MBPD): (b) Crude oil refined Other charge & blendstocks Refining & Marketing Segment - Supplemental Operating Data By Region Marathon Petroleum Corporation 8

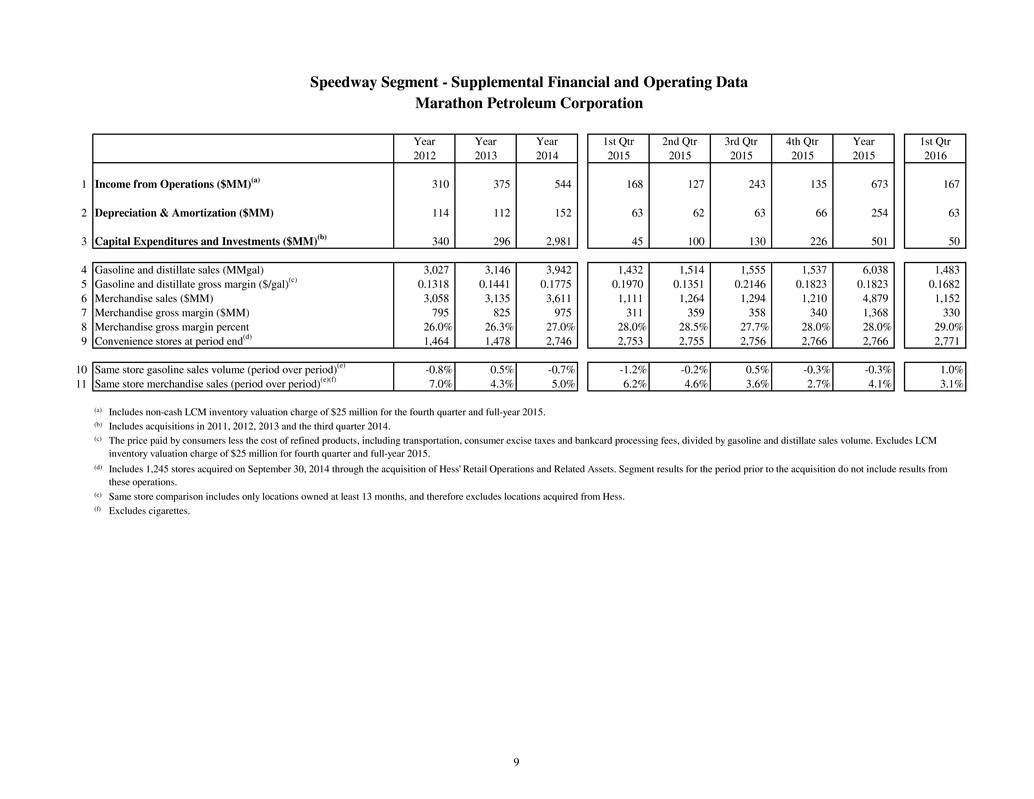

Year Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2012 2013 2014 2015 2015 2015 2015 2015 2016 1 310 375 544 168 127 243 135 673 167 2 114 112 152 63 62 63 66 254 63 3 340 296 2,981 45 100 130 226 501 50 4 3,027 3,146 3,942 1,432 1,514 1,555 1,537 6,038 1,483 5 0.1318 0.1441 0.1775 0.1970 0.1351 0.2146 0.1823 0.1823 0.1682 6 3,058 3,135 3,611 1,111 1,264 1,294 1,210 4,879 1,152 7 795 825 975 311 359 358 340 1,368 330 8 26.0% 26.3% 27.0% 28.0% 28.5% 27.7% 28.0% 28.0% 29.0% 9 1,464 1,478 2,746 2,753 2,755 2,756 2,766 2,766 2,771 10 -0.8% 0.5% -0.7% -1.2% -0.2% 0.5% -0.3% -0.3% 1.0% 11 7.0% 4.3% 5.0% 6.2% 4.6% 3.6% 2.7% 4.1% 3.1% (a) (b) (c) (d) (e) (f) Includes 1,245 stores acquired on September 30, 2014 through the acquisition of Hess' Retail Operations and Related Assets. Segment results for the period prior to the acquisition do not include results from these operations. Same store comparison includes only locations owned at least 13 months, and therefore excludes locations acquired from Hess. Excludes cigarettes. Same store merchandise sales (period over period) (e)(f) Includes non-cash LCM inventory valuation charge of $25 million for the fourth quarter and full-year 2015. Includes acquisitions in 2011, 2012, 2013 and the third quarter 2014. The price paid by consumers less the cost of refined products, including transportation, consumer excise taxes and bankcard processing fees, divided by gasoline and distillate sales volume. Excludes LCM inventory valuation charge of $25 million for fourth quarter and full-year 2015. Merchandise gross margin ($MM) Merchandise gross margin percent Convenience stores at period end (d) Same store gasoline sales volume (period over period) (e) Capital Expenditures and Investments ($MM) (b) Gasoline and distillate sales (MMgal) Gasoline and distillate gross margin ($/gal) (c) Merchandise sales ($MM) Income from Operations ($MM) (a) Depreciation & Amortization ($MM) Speedway Segment - Supplemental Financial and Operating Data Marathon Petroleum Corporation 9

Year Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2012 2013 2014 2015 2015 2015 2015 (a) 2015 (a) 2016 (a) 1 277 275 342 90 103 93 94 380 167 2 74 96 102 26 26 27 65 144 140 3 234 279 604 87 157 156 14,145 14,545 350 4 5 1,191 1,293 1,241 1,221 1,385 1,363 1,137 1,277 1,265 6 980 911 878 886 941 896 934 914 916 7 2,171 2,204 2,119 2,107 2,326 2,259 2,071 2,191 2,181 8 3,075 3,075 3,345 9 5,468 5,468 5,636 10 307 307 312 (a) (b) (c) (d) (e) (f) Includes income from equity method investments. Includes acquisitions in 2013, first quarter 2014 and fourth quarter 2015. Also includes contributions to equity affiliates. On owned common-carrier pipelines, excluding equity method investments. Includes amounts related to unconsolidated equity method investments. Gathering system throughput (million cubic feet per day) (f) Natural gas processed (million cubic feet per day) (f) C2 + NGLs fractionated (mbpd) (f) Includes the results of MarkWest from the December 4, 2015 merger date. We revised our operating segment presentation in the first quarter of 2016 in connection with the contribution of our inland marine business to MPLX; our inland marine business, which was previously included in Refining & Marketing, is now included in Midstream. Comparable prior period information has been recast to reflect our revised segment presentation. Pipeline Throughput (mbpd) (e) Crude oil pipelines Refined product pipelines Total Midstream Segment - Supplemental Financial and Operating Data Marathon Petroleum Corporation Income from Operations ($MM) (b)(c) Depreciation & Amortization ($MM) (b) Capital Expenditures and Investments ($MM) (b)(d) 10

Year Year Year 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr Year 1st Qtr 2012 2013 2014 2015 2015 2015 2015 2015 2016 1 1,599 2,075 2,125 2,233 2,329 2,345 2,248 2,289 2,148 2 585,114 757,397 775,789 201,000 211,907 215,761 206,784 835,452 195,482 3 17.85 13.24 15.05 16.14 14.84 17.27 12.70 15.25 9.98 4 5,022$ 3,131$ 3,538$ 1,292$ 1,181$ 1,434$ 179$ 4,086$ (62)$ 5 784 989 1,020 261 261 262 268 1,052 273 6 5,806$ 4,120$ 4,558$ 1,553$ 1,442$ 1,696$ 447$ 5,138$ 211$ 7 3,027 3,146 3,942 1,432 1,514 1,555 1,537 6,038 1,483 8 0.1318 0.1441 0.1775 0.1970 0.1351 0.2146 0.1823 0.1823 0.1682 9 795$ 825$ 975$ 311$ 359$ 358$ 340$ 1,368$ 330$ 10 310$ 375$ 544$ 168$ 127$ 243$ 135$ 673$ 167$ 11 114 112 152 63 62 63 66 254 63 12 424$ 487$ 696$ 231$ 189$ 306$ 201$ 927$ 230$ 13 32$ 8$ 57$ 9$ 12$ 17$ 24$ 62$ 23$ 14 277$ 275$ 342$ 90$ 103$ 93$ 94$ 380$ 167$ 15 74 96 102 26 26 27 65 144 140 16 351$ 371$ 444$ 116$ 129$ 120$ 159$ 524$ 307$ 17 6,581$ 4,978$ 5,698$ 1,900$ 1,760$ 2,122$ 807$ 6,589$ 748$ 18 972 1,197 1,274 350 349 352 399 1,450 476 19 (321) (261) (277) (79) (75) (75) (70) (299) (67) 20 183 - - - - - - - - 21 (124) (95) (96) (1) (1) (2) - (4) (1) 22 - - - - - (144) - (144) (129) 23 5,347 3,425 4,051 1,470 1,335 1,549 338 4,692 75 24 (109) (179) (216) (81) (64) (70) (103) (318) (142) 25 5,238 3,246 3,835 1,389 1,271 1,479 235 4,374 (67) 26 1,845 1,113 1,280 486 432 521 67 1,506 11 27 3,393 2,133 2,555 903 839 958 168 2,868 (78) 28 4 21 31 12 13 10 (19) 16 (79) 29 3,389$ 2,112$ 2,524$ 891$ 826$ 948$ 187$ 2,852$ 1$ (a) (b) (c) (d) (e) (f) (g) (h) (i) Includes the impact of Hess' retail operations and related assets beginning on the Sept. 30, 2014 acquisition date. The price paid by consumers less the cost of refined products, including transportation, consumer excise taxes and bankcard processing fees, divided by gasoline and distillate sales volume. Excludes LCM inventory valuation charge of $25 million for fourth quarter and full-year 2015. Includes non-cash LCM inventory valuation charge of $25 million for the fourth quarter and full-year 2015. Includes income from MarkWest's equity method investments from the December 4, 2015 merger date. Reflects an impairment charge in third quarter 2015 for the cancellation of the Residual Oil Upgrader Expansion ("ROUX") project and a goodwill impairment in first quarter 2016. Net income attributable to MPC Includes intersegment sales. Sales revenue less cost of refinery inputs and purchased products, divided by total refinery throughputs. Gross margins for periods prior to fourth quarter 2013 have been recalculated to conform to the current definition. Excludes LCM charge of $345 million for the fourth quarter and full-year 2015 and $15 million for the first quarter 2016. We changed our operating segment presentation in the first quarter of 2016 in connection with the contribution of our inland marine business to MPLX; our inland marine business, which was previously included in Refining & Marketing, is now included in Midstream. Comparable prior period information has been recast to reflect our revised segment presentation. Includes non-cash LCM inventory valuation charge of $345 million for the fourth quarter and full-year 2015 and $15 million for the first quarter 2016. Net interest and other financing income (costs) Total income before income taxes Income tax provision Net income Less: Net income attributable to noncontrolling interests Corporate and other unallocated items (c) Minnesota assets sale settlement gain Pension settlement expenses Impairments (i) Income from operations Reconciliation from Segment EBITDA to Net Income Total Segment EBITDA (c) Less: Total segment depreciation and amortization Items not allocated to segments: Segment income from operations (c) Add: Depreciation and amortization (c) Segment EBITDA (c) Add: Depreciation and amortization Segment EBITDA Midstream Segment (h) Income (loss) from equity method investments Gasoline & distillate sales (millions of gallons) Gasoline & distillate gross margin ($/gal) (f) Merchandise gross margin Segment income from operations (g) Segment income from operations (c)(d) Add: Depreciation and amortization (c) Segment EBITDA (c) Speedway Segment (e) Refining & Marketing Segment Refined product sales volume (mbpd) (a) Refined product sales volume (thousands of barrels) (a) Refining & Marketing gross margin ($/bbl) (b) Segment Earnings Before Interest, Taxes, Depreciation & Amortization (Segment EBITDA) Marathon Petroleum Corporation (In millions except where noted) Segment EBITDA 11