Attached files

| file | filename |

|---|---|

| EX-31.4 - EXHIBIT 31.4 - NorthStar Asset Management Group Inc. | nsam12311510-ka42916ex314.htm |

| EX-31.3 - EXHIBIT 31.3 - NorthStar Asset Management Group Inc. | nsam12311510-ka42916ex313.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission File Number: 001-36301

NORTHSTAR ASSET MANAGEMENT GROUP INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 46-4591526 (IRS Employer Identification No.) |

399 Park Avenue, 18th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Annual Report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015, was $3,505,602,157. As of April 27, 2016, the registrant had issued and outstanding 189,108,183 shares of common stock, $0.01 par value per share and 5,210,113 shares of performance common stock, $0.01 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Explanatory Note

NorthStar Asset Management Group Inc. (the “Company,” “NSAM,” “we,” “us” or “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to amend our Annual Report on Form 10-K for the year ended December 31, 2015, originally filed with the Securities and Exchange Commission (the “SEC”) on February 29, 2016 (the “Original Filing”), to include information required by Items 10 through 14 of Part III of Form 10-K. The reference on the cover of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted.

In accordance with Rule 12b-15 of the rules and regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14, and Part IV, Item 15, of the Original Filing are hereby amended and restated in their entirety, and new certifications have been included with this Amendment as required by Rule 13a-14(a) under the Exchange Act. This Amendment does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing. As used herein, the term “Annual Report” refers to the Original Filing, as amended by this Amendment.

NORTHSTAR ASSET MANAGEMENT GROUP INC.

FORM 10-K/A

(Amendment No. 1)

TABLE OF CONTENTS

Index | Page | ||

3

PART III.

Item 10. Directors, Executive Officers and Corporate Governance

DIRECTORS AND EXECUTIVE OFFICERS

Our board of directors (our “Board of Directors” or “Board”) presently consists of eight members. Stockholders vote on the election of our directors on an annual basis. All of our directors, except for Mr. Tylis, were elected by the stockholders at the 2015 annual meeting of stockholders. Our directors are currently serving on our Board for a term ending at the 2016 annual meeting of stockholders and until their successors are duly elected and qualified.

Our executive officers are appointed annually by our Board and serve at the discretion of our Board.

The following sets forth certain information concerning our Board of Directors and executive officers. The directors and executives listed below are leaders in business as well as in the real estate and financial communities because of their intellectual acumen and analytic skills, strategic vision and their records of outstanding accomplishments over several decades. We believe that each director has been appointed in part because of his or her ability and willingness to understand our unique position and evaluate and implement our strategies.

The information below includes each director’s and executive officer’s name, principal occupation, business history and certain other information, including, for directors, the specific experience, qualifications, attributes and skills that led our Board to conclude that each such person should serve as a director of our company.

NAME | AGE | POSITION |

David T. Hamamoto | 56 | Executive Chairman |

Stephen E. Cummings | 60 | Independent Director |

Judith A. Hannaway | 64 | Independent Director |

Oscar Junquera | 62 | Independent Director |

Justin Metz | 42 | Independent Director |

Wesley D. Minami | 59 | Independent Director |

Louis J. Paglia | 58 | Independent Director |

Albert Tylis | 42 | CEO, President and Member of our Board |

Daniel R. Gilbert | 46 | Chief Investment and Operating Officer, NSAM Ltd |

Debra A. Hess | 52 | Chief Financial Officer |

Ronald J. Lieberman | 46 | Executive Vice President, General Counsel and Secretary |

David T. Hamamoto. Mr. Hamamoto is our Executive Chairman, a position he has held since August 2015, having previously served as our Chairman and Chief Executive Officer from January 2014 until August 2015. Mr. Hamamoto also serves as Chairman of NorthStar Realty Finance Corp. (“NorthStar Realty”), a position he has held since October 2007 (having previously served as a director since October 2003). Mr. Hamamoto previously served as NorthStar Realty’s Chief Executive Officer from October 2004 until August 2015 and as President from October 2004 until April 2011. Mr. Hamamoto has been Chairman of the board of directors of NorthStar Realty Europe Corp. (“NorthStar Europe”) since October 2015 and has served as one of its directors since June 2015. Additionally, since December 2013, Mr. Hamamoto serves as a member of the advisory committee of RXR Realty LLC (“RXR Realty”), a leading real estate operating and investment management company focused on high‑quality real estate investments in the New York Tri‑State area and a co‑sponsor of NorthStar/RXR New York Metro Real Estate, Inc. (“NorthStar/RXR”). Mr. Hamamoto also serves as a member of the executive committee of Island Hospitality Management Inc. since January 2015. Mr. Hamamoto previously served as Chairman of NorthStar Real Estate Income Trust, Inc. (“NS Income”) from February 2009 until August 2015 and served as its Chief Executive Officer from February 2009 until January 2013. In addition, Mr. Hamamoto served as Chairman of NorthStar Healthcare Income, Inc. (“NS Healthcare”) from January 2013 until January 2014, and of NorthStar Real Estate Income II, Inc. (“NS Income II”) from December 2012 until August 2015. Mr. Hamamoto also served as Co‑Chairman of NorthStar/RXR from March 2014 until August 2015. Previously, Mr. Hamamoto served as Executive Chairman from March 2011 until November 2012, and as Chairman, from February 2006 until March 2011, of the board of directors of Morgans Hotel Group Co. In July 1997, Mr. Hamamoto co‑founded NorthStar Capital Investment Corp., for which he served as Co‑Chief Executive Officer until October 2004. From 1983 to 1997, Mr. Hamamoto worked for Goldman, Sachs & Co. where he was co‑head of the Real Estate Principal Investment Area and general partner of the firm between 1994 and 1997. During Mr. Hamamoto’s tenure at Goldman, Sachs & Co., he initiated the firm’s effort to build a real estate principal investment business under the auspices of the Whitehall Funds. Mr. Hamamoto holds a Bachelor of Science from Stanford University in Palo Alto, California and a Master of Business Administration from the Wharton School of Business at the University of Pennsylvania in Philadelphia, Pennsylvania.

As a founder, Chairman, former Chief Executive Officer and President of NorthStar Realty and as a founder of our company, Mr. Hamamoto offers our Board an intuitive perspective of the business and operations of the Company as a whole. Mr. Hamamoto

4

also has significant experience in all aspects of the commercial real estate markets, which he gained initially as co-head of the Real Estate Principal Investment Area at Goldman, Sachs & Co. Mr. Hamamoto is able to draw on his extensive knowledge to develop and articulate sustainable initiatives, operational risk management and strategic planning, which qualify him to serve as a director of the Company.

Stephen E. Cummings. Mr. Cummings has been one of our independent directors since June 2014. Mr. Cummings currently serves as President and Chief Executive Officer of MUFG Union Bank, N.A., the banking subsidiary of MUFG Americas Holdings Corporation, where he has authority over all The Bank of Tokyo-Mitsubishi UFJ’s (BTMU) U.S. businesses, including its New York branch and other branch offices. Mr. Cummings is also a member of the Board of Directors of MUFG Union Bank. From September 2014 to April 2015, Mr. Cummings served as Group Managing Director of UBS Investment Bank, having previously served as Head of Investment Banking-Americas Corporate Client Solutions for UBS Investment Bank from November 2012 to August 2014 and Chairman for the Investment Bank in the Americas for UBS Investment Bank from April 2011 to April 2015. Mr. Cummings previously served as an independent director of NorthStar Realty from December 2009 until July 2014. From 2004 to 2008, Mr. Cummings was Senior Executive Vice President, Head of Corporate and Investment Banking and a member of Wachovia Corporation’s Operating Committee. From 1998 to 2004, Mr. Cummings served in a number of different leadership roles at Wachovia (and First Union Corporation, a predecessor to Wachovia), including their Mergers and Acquisitions, Investment Banking and Capital Markets Divisions. Before joining Wachovia, Mr. Cummings served as Chairman and Chief Executive Officer of Bowles Hollowell Conner & Co. from 1993 to 1998. Mr. Cummings began his investment banking career in 1979 in the Corporate Finance Division of Kidder, Peabody & Co. Incorporated in New York and joined Bowles Hollowell Conner & Co. in 1984. Mr. Cummings holds a Bachelor of Arts in administrative science from Colby College and a Master of Business Administration from Columbia University Graduate School of Business.

Mr. Cummings has significant financial experience, developed through his role as President and Chief Executive Officer of MUFG Union Bank, N.A., and his prior roles as Head of Investment Banking-Americas Corporate Client Solutions and Chairman for the Investment Bank in the Americas for UBS Investment Bank, as well as Senior Executive Vice President, Head of Corporate and Investment Banking and a member of Wachovia Corporation’s Operating Committee. Mr. Cummings has also served in a number of executive positions with oversight of financial operations, merger and acquisition and capital markets activities. As a business executive with senior management responsibilities, Mr. Cummings’s leadership and experience qualify him to serve as a director of the Company.

Judith A. Hannaway. Ms. Hannaway has been one of our independent directors since June 2014. Ms. Hannaway also serves as an independent director of NorthStar Realty and NorthStar Europe, positions she has held since September 2004 and October 2015, respectively. During the past five years, Ms. Hannaway has acted as a consultant to various financial institutions. Prior to acting as a consultant, Ms. Hannaway was previously employed by Scudder Investments, a wholly‑owned subsidiary of Deutsche Bank Asset Management, as a Managing Director. Ms. Hannaway joined Scudder Investments in 1994 and was responsible for Special Product Development including closed‑end funds, off shore funds and REIT funds. Prior to joining Scudder Investments, Ms. Hannaway was employed by Kidder Peabody & Co. Incorporated as a Senior Vice President in Alternative Investment Product Development. Ms. Hannaway joined Kidder Peabody & Co. Incorporated in 1980 as a Real‑Estate Product Manager. Ms. Hannaway holds a Bachelor of Arts from Newton College of the Sacred Heart and a Master of Business Administration from Simmons College Graduate Program in Management.

Ms. Hannaway has had significant experience at major financial institutions and has broad ranging financial services expertise and experience in the areas of financial reporting, risk management and alternative investment products. Ms. Hannaway’s financial-related experience qualifies her to serve as a director of the Company.

Oscar Junquera. Mr. Junquera has been one of our independent directors since June 2014. Mr. Junquera also serves as an independent director of NorthStar Europe, a position he has held since October 2015. Additionally, Mr. Junquera is on the board of directors of Toroso Investments LLC. Mr. Junquera previously served as a member of the board of directors of HF2 Financial Management Inc. from February 2013 to April 2015 and as an independent director of NorthStar Realty from April 2011 until July 2014. Mr. Junquera is also the founder of PanMar Capital llc., a private equity firm specializing in the financial services industry and has been their Managing Partner since its formation in January 2008. Mr. Junquera worked on matters related to the formation of PanMar Capital llc. from July 2007 until December 2008. From 1980 until June 2007, Mr. Junquera was at PaineWebber, which was sold to UBS AG in 2000. He began at PaineWebber in the Investment Banking Division and was appointed Managing Director in 1988, Group Head-Financial Institutions in 1990 and a member of the Investment Banking Executive Committee in 1995. Following the sale of PaineWebber to UBS in 2000, Mr. Junquera was appointed Global Head of Asset Management Investment Banking at UBS and was responsible for establishing and building the bank’s franchise with mutual fund, institutional, high net worth and alternative asset management firms, as well as banks, insurance and financial services companies active in asset management. Mr. Junquera has served on the Board of Trustees of the Long Island Chapter of the Nature Conservancy and is a supporter of various other charitable organizations. Mr. Junquera holds a Bachelor of Science from the University of Pennsylvania’s Wharton School and a Master of Business Administration from Harvard Business School.

Mr. Junquera has over 25 years of investment banking experience, most recently as a Managing Director in the Global Financial Institutions Group at UBS Investment Bank and Global Head of Asset Management Investment Banking. Mr. Junquera’s experience covers a unique cross-section of strategic advisory and capital markets activities, including the structuring and distribution of investment funds and permanent capital vehicles, which qualifies him to serve as a director of the Company.

5

Justin Metz. Mr. Metz has been one of our independent directors since June 2014. Mr. Metz is also the Managing Principal of the Related Companies’ real estate fund management team, which he founded in April 2009, operating from offices in New York, Chicago, Boston, Dallas and Los Angeles and staffed with industry veterans. The fund management platform currently manages capital on behalf of sovereign wealth funds, public pension plans, multi-managers, endowments, Taft Hartley plans and family offices across the following strategies: distressed and value added real estate opportunities, origination and acquisition of construction and transitional loans and multifamily housing opportunities across the United States. Prior to joining Related Companies, Mr. Metz served as a Managing Director at Goldman Sachs. During his 12 years at Goldman Sachs, Mr. Metz held numerous positions of increasing responsibility and served on various boards and investment committees. Mr. Metz is a principal shareholder of Related Fund Management, LLC and Sousa Holdings, LLC. Mr. Metz holds a Bachelor of Arts from the University of Michigan.

Mr. Metz has significant real estate investment and asset management experience. Over the past 20 years, Mr. Metz has been involved in the acquisition and development of real estate assets, securities and loans globally. Mr. Metz’s real estate investment experience, coupled with his leadership experience from his service on various boards and investment committees, qualify him to serve as a director of the Company.

Wesley D. Minami. Mr. Minami has been one of our independent directors since June 2014. Mr. Minami also serves as an independent director of NorthStar Realty and NorthStar Europe, positions he has held since September 2004 and October 2015, respectively. Mr. Minami served as President of Billy Casper Golf LLC from 2003 until March 2012, at which time he ceased acting as President and began serving as Principal. From 2001 to 2002, he served as President of Charles E. Smith Residential Realty, Inc., a REIT that was listed on the New York Stock Exchange (“NYSE”). In this capacity, Mr. Minami was responsible for the development, construction, acquisition and property management of over 22,000 high‑rise apartments in five major U.S. markets. He resigned from this position after completing the transition and integration of Charles E. Smith Residential Realty, Inc. from an independent public company to a division of Archstone‑Smith Trust, an apartment company that was listed on the NYSE. From 1997 to 2001, Mr. Minami worked as Chief Financial Officer and then Chief Operating Officer of Charles E. Smith Residential Realty, Inc. Prior to 1997, Mr. Minami served in various financial service capacities for numerous entities, including Ascent Entertainment Group, Comsat Corporation, Oxford Realty Services Corporation and Satellite Business Systems. Mr. Minami holds a Bachelor of Arts in Economics, with honors, from Grinnell College and a Master of Business Administration in Finance from the University of Chicago.

Mr. Minami, who has served as President of a publicly-traded REIT, chief financial officer and chief operating officer of a real estate company and in various financial service capacities, brings corporate finance, operations, public company and executive leadership expertise to our Board. Mr. Minami’s diverse experience, real estate background and understanding of financial statements qualify him to serve as a director of the Company.

Louis J. Paglia. Mr. Paglia has been one of our independent directors since June 2014. Mr. Paglia also serves as an independent director of NorthStar Realty, a position he has held since February 2006. Mr. Paglia also serves as a director of Arch Capital Group Ltd. (NASDAQ: ACGL), a position he has held since July 2014. Mr. Paglia is the founding member of Oakstone Capital LLC, a private investment firm, since January 2016. He previously founded Customer Choice LLC in April 2010, a data analytics company serving the electric utility industry. From April 2002 to March 2006, Mr. Paglia was the Executive Vice President of UIL Holdings Corporation, an electric utility, contracting and energy infrastructure company. Mr. Paglia was also President of UIL Holdings’ investment subsidiaries. From July 2002 through April 2005, Mr. Paglia also served as UIL Holdings’ Chief Financial Officer. From 1999 to 2001, Mr. Paglia was Executive Vice President and Chief Financial Officer of eCredit.com, a credit evaluation software company. Prior to 1999, Mr. Paglia served as the Chief Financial Officer for TIG Holdings Inc. and Emisphere Technologies, Inc. Mr. Paglia holds a Bachelor of Science from Massachusetts Institute of Technology and a Master of Business Administration from the Wharton School of Business at the University of Pennsylvania.

Mr. Paglia brings a career of broad ranging financial expertise, having held several chief financial officer positions, including at three public companies. Mr. Paglia’s extensive accounting, finance and risk management expertise qualify him to serve as a director of the Company.

Albert Tylis. Mr. Tylis has been a member of our board of directors since August 2015. Mr. Tylis also serves as our Chief Executive Officer and President since August 2015 and January 2014, respectively. Mr. Tylis has also served as a member of NorthStar Realty's and NorthStar Europe's respective board of directors since August 2015 and October 2015, respectively. Previously, Mr. Tylis served as NorthStar Realty's President from January 2013 until August 2015, Co‑President from April 2011 until January 2013, Chief Operating Officer from January 2010 until January 2013, Secretary from April 2006 until January 2013, and an Executive Vice President and General Counsel from April 2006 until April 2011. Mr. Tylis served as Chief Operating Officer of NS Income from October 2010 until January 2013. He has further served as Chairman of the board of directors of NS Healthcare from April 2011 until January 2013. Prior to joining our company, Mr. Tylis was the Director of Corporate Finance and General Counsel of ASA Institute and from September 1999 through February 2005, Mr. Tylis was a senior attorney at the law firm of Bryan Cave LLP, where he was a member of the Corporate Finance and Securities Group, the Transactions Group, the Banking, Business and Public Finance Group and supported the firm’s Real Estate Group. Additionally, Mr. Tylis has served as a member of the advisory committee of RXR Realty LLC since December 2013. Mr. Tylis holds a Bachelor of Science from the University of Massachusetts at Amherst and a Juris Doctor from Suffolk University Law School.

6

As our Chief Executive Officer and President and as one of our board members and our former President of NorthStar Realty, Mr. Tylis’s senior executive experience and deep knowledge of our operations and business strengthen the Company’s board of directors’ collective qualifications, skills and experience, which qualifies him to serve as a director of the Company.

Daniel R. Gilbert. Mr. Gilbert has served as Chief Investment and Operating Officer of NorthStar Asset Management Group, Ltd, a subsidiary of NSAM, a position he has held since June 2014. Mr. Gilbert has also served as NorthStar Realty’s Chief Investment and Operating Officer since January 2013. Mr. Gilbert serves as the Chairman, Chief Executive Officer and President of NS Income, positions he has held since August 2015, January 2013 and March 2011, respectively. Mr. Gilbert further serves as Chairman, Chief Executive Officer and President of NS Income II, positions he has held since December 2012 and, with respect to his role as Chairman, since August 2015. Mr. Gilbert has also served as the Executive Chairman of NS Healthcare since January 2014, having previously served as Chief Executive Officer from August 2012 to January 2014 and Chief Investment Officer from October 2010 to February 2012. Mr. Gilbert further serves as the Co‑Chairman, Chief Executive Officer and President of NorthStar/RXR, positions he has held since March 2014 and, with respect to his role as Co‑Chairman, since August 2015. Mr. Gilbert has also served as Chairman, Chief Executive Officer and President of NorthStar Corporate Income Master Fund and its two feeder funds (collectively, “NorthStar Corporate Income Fund”), positions he has held since November 2015 and, with respect to his role as Chairman, since January 2016. Prior to his current role at NorthStar Realty, Mr. Gilbert served as its Co‑President from April 2011 until January 2013 and in various other senior management positions since our initial public offering in October 2004. Mr. Gilbert also served as an Executive Vice President and Managing Director of Mezzanine Lending of NorthStar Capital Investment Corp. Prior to that role, Mr. Gilbert was with Merrill Lynch & Co. (“Merrill Lynch”) in its Global Principal Investments and Commercial Real Estate Department and prior to joining Merrill Lynch, held accounting and legal‑related positions at Prudential Securities Incorporated. Mr. Gilbert currently serves on the Board of Directors of the Investment Program Association. Mr. Gilbert holds a Bachelor of Arts degree from Union College in Schenectady, New York.

Debra A. Hess. Ms. Hess has served as our Chief Financial Officer since January 2014. Ms. Hess also serves as Chief Financial Officer of NorthStar Realty, a position she has held since July 2011. Until August 2015, Ms. Hess served as Chief Financial Officer and Treasurer of NS Income, NS Healthcare, NS Income II and NorthStar/RXR, positions she had held from October 2011, March 2012, December 2012 and March 2014, respectively. Ms. Hess also served as Interim Chief Financial Officer of NorthStar Europe from June 2015 to November 2015. Ms. Hess has significant financial, accounting and compliance experience at public companies. Ms. Hess previously served as Chief Financial Officer and Compliance Officer of H/2 Capital Partners, where she was employed from August 2008 to June 2011. From March 2003 to July 2008, Ms. Hess was a managing director at Fortress Investment Group, where she also served as Chief Financial Officer of Newcastle Investment Corp., a Fortress portfolio company and a NYSE‑listed alternative investment manager. From 1993 to 2003, Ms. Hess served in various positions at Goldman, Sachs & Co., including as Vice President in Goldman Sachs’ Principal Finance Group and as a Manager of Financial Reporting in Goldman Sachs’ Finance Division. Prior to 1993, Ms. Hess was employed by Chemical Banking Corporation in the corporate credit policy group and by Arthur Andersen & Company as a supervisory senior auditor. Ms. Hess holds a Bachelor of Science in Accounting from the University of Connecticut in Storrs, Connecticut and a Master of Business Administration in Finance from New York University in New York, New York.

Ronald J. Lieberman. Mr. Lieberman has served as our Executive Vice President, General Counsel and Secretary since January 2014. Mr. Lieberman has also served as NorthStar Realty’s Executive Vice President, General Counsel and Secretary since April 2012, April 2011 and January 2013, respectively. Mr. Lieberman has served as Executive Vice President, General Counsel and Secretary of NS Healthcare since January 2013, April 2011 and April 2011, respectively. Mr. Lieberman also serves as Executive Vice President, General Counsel and Secretary for NorthStar/RXR, positions he has held since March 2014. In addition, Mr. Lieberman has served as Executive Vice President, General Counsel and Secretary of NorthStar Corporate Income Fund since November 2015. Mr. Lieberman further serves on the Executive Committee of American Healthcare Investors, LLC. In addition, since February 2016, Mr. Lieberman has served as a member of the board of directors of Griffin‑American Healthcare REIT IV, Inc. Until August 2015, Mr. Lieberman had served as General Counsel and Secretary of NS Income and NS Income II from October 2011 and December 2012, respectively, and as Executive Vice President of each of these companies from January 2013 and March 2013, respectively. Prior to joining our company, Mr. Lieberman was a partner in the Real Estate Capital Markets practice at the law firm of Hunton & Williams LLP. Mr. Lieberman practiced at Hunton & Williams from September 2000 until March 2011 where he advised numerous REITs, and specialized in capital markets transactions, mergers and acquisitions, securities law compliance, corporate governance and other board advisory matters. Prior to joining Hunton & Williams, Mr. Lieberman was the associate general counsel at Entrade, Inc., during which time Entrade was a public company listed on the NYSE. Mr. Lieberman began his legal career at Skadden, Arps, Slate, Meagher and Flom LLP. Mr. Lieberman holds a Bachelor of Arts, Master of Business Administration and Juris Doctor, each from the University of Michigan in Ann Arbor, Michigan.

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE GUIDELINES AND CODE OF ETHICS

We are committed to good corporate governance practices and, as such, we have adopted our Corporate Governance Guidelines and Codes of Ethics discussed below to enhance our effectiveness. These guidelines and codes are available on our website at www.nsamgroup.com under the heading “Investor Relations—Corporate Governance.” You can also receive a copy

7

of our Corporate Governance Guidelines and Code of Business Conduct and Ethics, without charge, by writing to the General Counsel at NorthStar Asset Management Group Inc., 399 Park Avenue, 18th Floor, New York, New York 10022.

Our Corporate Governance Guidelines are designed to assist our Board in exercising its responsibilities. Our Corporate Governance Guidelines govern, among other things, Board composition, Board member qualifications, responsibilities and education, management succession and self‑evaluation. Our Code of Business Conduct and Ethics relates to the conduct of our business by our employees, officers and directors. We intend to maintain high standards of ethical business practices and compliance with all laws and regulations applicable to our business, including those relating to doing business outside the United States. Specifically, among other things, our Code of Business Conduct and Ethics prohibits employees from providing gifts, meals or anything of value to government officials or employees or members of their families without prior written approval from the Company’s General Counsel. We have also adopted a Code of Ethics for Senior Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer and all other senior financial officers of our company. We will disclose any amendments or waivers from the Code of Ethics for Senior Financial Officers on our website.

DIRECTOR INDEPENDENCE

Of our eight directors, our Board affirmatively determined that Messrs. Cummings, Junquera, Metz, Minami and Paglia and Ms. Hannaway are independent under the NYSE listing standards. In determining director independence, our Board reviewed, among other things, any transactions or relationships that currently exist or that have existed since our incorporation, between each director and the Company and its subsidiaries, affiliates and equity investors, independent auditors or members of senior management. In particular, our Board reviewed current or recent business transactions or relationships or other personal relationships between each director and the Company, including such director’s immediate family and companies owned or controlled by the director or with which the director was affiliated. Our Board also considered the participation of each director on boards of directors of other companies that we or our affiliates manage. The purpose of this review was to determine whether any such transactions or relationships failed to meet any of the objective tests under the NYSE rules for determining independence or were otherwise sufficiently material as to be inconsistent with a determination that the director is independent.

BOARD LEADERSHIP STRUCTURE

Our Board believes it is important to select its Chairman and the Company’s Chief Executive Officer in the manner it considers to be in the best interests of the Company at any given point in time. The members of our Board possess considerable business experience and in‑depth knowledge of the issues the Company faces, and are therefore in the best position to evaluate the needs of the Company and how best to organize the Company’s leadership structure to meet those needs. Accordingly, the Chairman and Chief Executive Officer positions may be filled by one individual or by two different individuals. After careful consideration, our Board believes that the most effective leadership structure for the Company at this time is to separate the roles of Chairman and Chief Executive Officer. Currently, Mr. Hamamoto serves as Executive Chairman of the Board and Mr. Tylis serves as our Chief Executive Officer. With Mr. Hamamoto as Executive Chairman of our Board, we are able to continue to benefit from his experience, knowledge, leadership and vision, which Mr. Hamamoto has provided as a founder of our company, and serving as our Chairman since our inception in 2014. Our Board appointed Mr. Tylis as our Chief Executive Officer in August 2015. Our Board believes that having a Chief Executive Officer with the senior executive experience and deep knowledge of our operations and business, including those of our managed companies, such as Mr. Tylis and who can be dedicated to our business currently best serves the interests of the Company. Our Board continually evaluates the Company’s leadership structure and could in the future decide to combine the Chairman and Chief Executive Officer positions if it believes that doing so would serve the best interests of the Company.

To promote the independence of our Board and appropriate oversight of management, the independent directors select a Lead Non-Management Director, currently Ms. Hannaway, to facilitate free and open discussion and communication among the independent directors of our Board and management. The Lead Non-Management Director presides at all executive sessions at which only non‑management directors are present. These meetings are held in conjunction with the regularly scheduled quarterly meetings of our Board, but may be called at any time by our Lead Non‑Management Director or any of our other independent directors. In 2015, our independent directors met six times in executive session without management present following Board meetings and met outside of regularly scheduled Board meetings on a number of occasions. Our Lead Non-Management Director sets the agenda for these meetings and discusses issues that arise during those meetings with our Chairman and Chief Executive Officer, as appropriate. Our Lead Non‑Management Director also discusses Board meeting agendas with our Chairman and Secretary and may request the inclusion of additional agenda items for meetings of our Board. As provided in our Corporate Governance Guidelines, the individual who serves as the Lead Non‑Management Director is expected to rotate every two years.

BOARD’S ROLE IN RISK OVERSIGHT

Risk is inherent with every business and how well a business manages risk can ultimately determine its success. Our management team is responsible for our risk exposures on a day‑to‑day basis by identifying the material risks we face, implementing appropriate risk management strategies that are responsive to our risk profile, integrating consideration of risk and risk management into our decision‑making process and, if necessary, promulgating policies and procedures to ensure that information with respect to material risks is transmitted to our Board. Our Board, as a whole and through its committees, has the responsibility to oversee and monitor these risk management processes by informing itself of material risks and evaluating

8

whether management has reasonable controls in place to address the material risks; our Board is not responsible, however, for defining or managing our various risks. Our Board is regularly informed by management of potential material risks and activities related to those risks at Board meetings. Members of our management team generally attend all Board meetings and are readily available to our Board to address any questions or concerns raised by our Board on risk management and any other matters.

MAJORITY VOTING STANDARD POLICY FOR ELECTION OF DIRECTORS

Our Corporate Governance Guidelines provide that in any non‑contested election of directors, any director nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her offer to resign to the Board for its consideration. The Nominating and Corporate Governance Committee will consider such offer and recommend to the Board whether to accept the offer to resign. No later than the next regularly scheduled Board meeting to be held at least ten days after the date of the election, the Board will decide whether to accept the offer to resign. The Board will promptly and publicly disclose its decision, which may be on the Company’s website or by other means. If the resignation is not accepted, the director will continue to serve until the next annual meeting of stockholders and until the director’s successor is duly elected and qualified or until the director’s earlier resignation or removal. The Nominating and Corporate Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation.

DIRECTORS OFFER OF RESIGNATION POLICY

Our Corporate Governance Guidelines provide that, whenever a member of our Board accepts a position with a company that is competitive to the Company’s business or violates our Code of Ethics, Corporate Governance Guidelines or any other Company policy applicable to members of our Board, such Board member must offer his or her resignation to the Nominating and Corporate Governance Committee for its consideration. The Nominating and Corporate Governance Committee will consider the resignation offer, giving due consideration to all relevant factors that it deems appropriate under the circumstances, including, without limitation, any requirement of the NYSE or any rule or regulation promulgated under the Exchange Act, and will recommend to our Board the action to be taken with respect to any such resignation offer.

DIRECTOR NOMINATION PROCEDURES

The Nominating and Corporate Governance Committee generally believes that, at a minimum, candidates for membership on our Board should have demonstrated an ability to make a meaningful contribution to our Board’s oversight of our business and affairs and have a record and reputation for honest and ethical conduct. The Nominating and Corporate Governance Committee recommends director nominees to our Board based on, among other things, its evaluation of a candidate’s experience and skills, relevant industry background and knowledge, integrity, ability to make independent analytical inquiries and a willingness to devote adequate time and effort to Board responsibilities. The Nominating and Corporate Governance Committee does not have a specific diversity policy with respect to its director nomination process, but strives to create diversity in perspective, background and experience in our Board as a whole and seeks to have our Board nominate candidates who have such diverse perspectives, backgrounds and experiences.

When seeking to identify and recommend qualified candidates to the Board for Board membership, the Nominating and Corporate Governance Committee may solicit recommendations from members of the Board, our executive officers and any other source it deems appropriate, including firms, engaged at our expense, that specialize in identifying director candidates. The Nominating and Corporate Governance Committee will also consider candidates recommended by stockholders in accordance with the procedures in our bylaws.

The Nominating and Corporate Governance Committee anticipates that once a person has been identified as a potential candidate, the Nominating and Corporate Governance Committee will collect and review publicly‑available information regarding such person to assess whether the person should be considered further. If the Nominating and Corporate Governance Committee determines that the candidate warrants further consideration, the chairman or another member of the Nominating and Corporate Governance Committee will contact the person. If the person expresses a willingness to be considered and to serve on our Board, the Nominating and Corporate Governance Committee will request information from the candidate, review the person’s accomplishments and qualifications, including in light of any other candidates that the Nominating and Corporate Governance Committee might be considering and conduct one or more interviews with the candidate. In certain instances, members of the Nominating and Corporate Governance Committee may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first‑hand knowledge of the candidate’s accomplishments.

COMMUNICATIONS WITH THE BOARD

Our Board has established a process to receive communications from interested parties, including stockholders. Interested parties may contact the Lead Non‑Management Director, any member or all members of our Board by writing to any of them at c/o General Counsel at NorthStar Asset Management Group Inc., 399 Park Avenue, 18th Floor, New York, New York 10022. All such communications received by the office of our General Counsel will be opened solely for the purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service or patently offensive material will be forwarded promptly to the addressee(s).

9

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than 10% of a registered class of our equity securities to file reports of beneficial ownership of such securities on Forms 3, 4 and 5 with the SEC. Officers, directors and persons who own more than 10% of a registered class of our equity securities are required to furnish us with copies of all Forms 3, 4 and 5 that they file. Based solely on our review of the copies of such forms we received or written representations from certain reporting persons that no filings on such forms were required for those persons, we believe that all such filings required to be made during and with respect to the fiscal year ended December 31, 2015 by Section 16(a) of the Exchange Act were timely made.

INFORMATION ABOUT OUR BOARD OF DIRECTORS AND ITS COMMITTEES

During the year ended December 31, 2015, our Board met on 12 occasions. Each director then serving attended at least 75% of the aggregate number of meetings of our Board and of all committees on which he or she served.

We do not currently maintain a policy requiring our directors to attend the annual meeting of stockholders. Mr. Hamamoto and Mr. Tylis attended the 2015 annual meeting of stockholders.

Our Board has appointed an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these standing committees has adopted a committee charter, which is available on our website at www.nsamgroup.com under the heading “Investor Relations—Corporate Governance” or by writing to the General Counsel at NorthStar Asset Management Group Inc., 399 Park Avenue, 18th Floor, New York, New York 10022 to request a copy, without charge. Each committee of our Board is composed exclusively of independent directors, as defined by the listing standards of the NYSE. Moreover, the Compensation Committee is composed exclusively of individuals referred to as “non‑employee directors” in Rule 16b‑3 of the Exchange Act and “outside directors” in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”).

In addition, in March 2016, our Board of Directors announced that it had formed a Special Committee comprised of three of our independent directors, who are not on the board of directors of NorthStar Realty, to continue the previously announced strategic alternatives process.

The following table shows the current membership of the various committees:

COMMITTEE MEMBERSHIPS | ||||||||

AUDIT COMMITTEE | COMPENSATION COMMITTEE | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | SPECIAL COMMITTEE | |||||

INDEPENDENT DIRECTOR | ||||||||

Stephen E. Cummings | — | — | C | M | ||||

Judith A. Hannaway(1) | — | C | M | — | ||||

Oscar Junquera | M | M | — | M | ||||

Justin Metz | — | M | — | M | ||||

Wesley D. Minami | C, E | — | M | — | ||||

Louis J. Paglia | M, E | — | — | — | ||||

NUMBER OF MEETINGS HELD IN 2015 | 9 | 7 | 3 | — | ||||

C | Committee Chair | M | Committee Member | E | Audit Committee Financial Expert |

(1) Lead Non-Management Director

AUDIT COMMITTEE

Our Board has determined that all three members of the Audit Committee are independent and financially literate under the rules of the NYSE and are “audit committee financial experts,” as that term is defined by the SEC. The Audit Committee is responsible for, among other things, engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non‑audit fees and assisting our Board in its oversight of our internal controls over financial reporting.

10

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Our Board has determined that all members of the Nominating and Corporate Governance Committee are independent under the rules of the NYSE. The Nominating and Corporate Governance Committee is responsible for, among other things, seeking, considering and recommending to our Board qualified candidates for election as directors and recommending a slate of nominees for election as directors at the annual meeting. It also periodically prepares and submits to our Board for adoption the Nominating and Corporate Governance Committee’s selection criteria for director nominees. It reviews and makes recommendations on matters involving the general operation of our Board and our corporate governance and annually recommends to our Board nominees for each committee of our Board. In addition, the Nominating and Corporate Governance Committee annually facilitates the assessment of our Board’s performance as a whole and of the individual directors and reports thereon to our Board.

COMPENSATION COMMITTEE

Our Board has determined that all members of the Compensation Committee are independent under the rules of the NYSE. The Compensation Committee is responsible for, among other things, determining compensation for our executive officers, administering and monitoring our equity compensation plans, evaluating the performance of our executive officers and producing an annual report on executive compensation for inclusion in our annual meeting proxy statement. The Compensation Committee may delegate some or all of its duties to a subcommittee comprising one or more members of the Compensation Committee. The Compensation Committee reviews and approves proposals made by our Chief Executive Officer regarding total compensation of senior executives. The Compensation Committee Report is included later within this Annual Report.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

There are no Compensation Committee interlocks or employee participation on the Compensation Committee.

DIRECTOR COMPENSATION

DETERMINATION OF COMPENSATION AWARDS

The Nominating and Corporate Governance Committee has responsibility for making recommendations to our Board regarding non-employee director compensation. Our goal is the creation of a reasonable and balanced Board compensation program that aligns the interests of our Board with those of our stockholders. We use a combination of cash and stock‑based incentive compensation to attract and retain highly‑qualified candidates to serve on our Board. In setting director compensation, we consider the significant amount of time that directors expend in fulfilling their duties to us, the skill‑level required by us of members of our Board and competitive pay practice data. The Nominating and Corporate Governance Committee discusses its recommendations with our Chief Executive Officer and ultimately makes a recommendation to our Board with respect to all non‑employee director compensation. In 2015, the Nominating and Corporate Governance Committee engaged a compensation consultant, FTI Consulting, Inc., to assist it in reviewing competitive practice data regarding non-employee director compensation and to advise it in connection with making recommendations to our Board with respect to the amount and form of such compensation.

NON‑EMPLOYEE DIRECTORS

Our non-employee directors’ fees are as follows: (i) board members receive an annual director’s cash retainer fee of $90,000; (ii) the chairpersons of the Audit Committee and Compensation Committee receive an additional annual fee of $35,000; (iii) the chairperson of the Nominating and Corporate Governance Committee receive an additional annual fee of $30,000; (iv) members of the Audit Committee (other than the chairperson) receive an additional annual fee of $20,000; (v) members of the Compensation Committee and Nominating and Corporate Governance Committee (other than the chairpersons) receive an additional annual fee of $15,000; (vi) the Lead Non‑Management Director of our Board receives an additional annual fee of $50,000; (vii) each Board member receives an additional $1,000 for attendance at Board meetings in excess of ten meetings per year; and (viii) each member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee receives an additional $1,000 for attendance at each committee meeting that exceeds six meetings per year.

In connection with their re-election to the Board, our non-employee directors automatically receive equity awards with a value of approximately $120,000. These annual equity awards are granted on the first business day following each annual meeting of our stockholders and are fully vested upon grant.

We will also automatically grant to any person who first becomes a non-employee director an initial equity award with a value of approximately $120,000. These initial equity awards are granted on the date such non-employee director first becomes a director and generally vest annually over a period of three years from the date of grant.

Equity awards to our non-employee directors may be in the form of restricted common stock, restricted stock units (“RSUs”) or units of partnership interest which are structured as profits interests in our operating partnership (“LTIP units”). The actual number of shares, RSUs or LTIP units that we grant is determined by dividing the fixed value of the grant by the closing sale

11

price of our common stock on the NYSE on the grant date. In 2015, non-employee director equity awards were issued in the form of restricted common stock.

In addition, in April 2016, members of the Special Committee received a fee of $120,000 for their services on such committee. The Board reserved the right at a subsequent date to consider additional compensation for members of the Special Committee, as it deems appropriate.

DIRECTOR COMPENSATION FOR 2015

The following table provides information concerning the compensation of our non-employee directors for 2015:

NAME | FEES EARNED OR PAID IN CASH ($) | STOCK AWARDS ($)(1) | TOTAL ($) |

Stephen E. Cummings | $120,000 | $120,000 | $240,000 |

Judith A. Hannaway | $190,000 | $120,000 | $310,000 |

Oscar Junquera | $129,000 | $120,000 | $249,000 |

Justin Metz | $105,000 | $120,000 | $225,000 |

Wesley D. Minami | $143,000 | $120,000 | $263,000 |

Louis J. Paglia | $113,000 | $120,000 | $233,000 |

Total | $800,000 | $720,000 | $1,520,000 |

(1) | As of December 31, 2015, except for unvested shares of common stock of 4,167 held by each independent director, none of our directors held any unexercised option awards or unvested stock awards that had been granted by us as director compensation. Each of the stock awards in 2015 was in the form of restricted common stock. |

DIRECTOR STOCK OWNERSHIP GUIDELINES

Our Board adopted the following minimum stock ownership guidelines for non-management members of our Board:

TITLE | GUIDELINE |

Directors | A multiple of 3X annual director cash retainer |

Ownership will include: (i) shares or LTIP units owned individually and by a person’s immediate family members or trusts for the benefit of his or her immediate family members; (ii) RSUs or LTIP units not yet vested; (iii) shares or LTIP units held in a 401(k) plan; and (iv) shares or LTIP units held in deferred or other compensation plans. Directors will not be permitted to sell or otherwise transfer any shares or LTIP units unless and until such time as they meet these stock ownership guidelines. We believe that requiring ownership of our stock creates alignment between directors and stockholders and encourages directors to act to increase stockholder value. As of the date of this Annual Report, all of our directors are in compliance with our stock ownership guidelines and there are currently no pledges of stock, LTIP units, RSUs or other equity awards by directors.

12

Item 11. Executive Compensation and Other Information

COMPENSATION DISCUSSION AND ANALYSIS

This section describes the compensation that we paid to our named executive officers for 2015. The Compensation Committee is responsible for making all decisions that we make relating to the compensation of our named executive officers.

EXECUTIVE SUMMARY

We are a top performing global asset management company with an executive team that has a proven track record of generating superior long-term total stockholder return, or TSR. We have structured our executive compensation programs to attract, retain and appropriately incentivize our executive officers and align their interests with those of our stockholders.

Highlights Relating to our Executive Compensation

SUPERIOR LONG-TERM TSR PERFORMANCE |

• The compensation relating to 2015 performance resulted from programs we put into effect at the beginning of 2015, prior to our 2015 annual meeting, and those programs were generally consistent with the programs that had driven our long term superior performance even prior to our spin-off from NorthStar Realty. • Even with our short-term TSR underperformance in 2015, we have significantly outperformed our peers and relevant industry and market indices over each of the last three, five and ten years. • Our five-year compounded, annual TSR through the end of 2015 was 29.1%, which is nearly three times higher than the average of our peer group, and substantially higher than relevant indices, including the MSCI US REIT Index, the Russell 3000 Index and the SNL US Asset Manager Index. |

STRONG OPERATING PERFORMANCE; TOTAL COMPENSATION AND G&A IN LINE WITH PEERS |

• We had a strong year of operating performance in 2015, driven by the increase from $21.7 billion to $37.6 billion in assets under management, including $1.4 billion of capital raised by retail companies we manage. This resulted in an approximate 50% increase in our revenues in 2015 compared to 2014 (inclusive of management fees that would have been received in 2014 prior to our spin-off from NorthStar Realty) and a significant increase in our CAD per share. • We believe that on a company-wide basis, our total compensation and general and administrative expenses for 2015 are at or below the median compared to the compensation and general and administrative expenses of companies in our peer group, both as a percentage of total revenues and as a percentage of total assets under management. |

PAY FOR PERFORMANCE ALIGNMENT |

• We have created strong alignment between our executives and our stockholders through our use of long-term equity awards that vest based on continued employment and/or absolute or relative TSR performance over four-year performance periods. As a demonstration of this alignment and in consideration of our short term TSR underperformance, the total value of outstanding unvested equity awards of our named executive officers, measured pursuant to SEC rules, decreased by 76.4% from December 31, 2014 to December 31, 2015, which is significantly greater than the decrease in our stock price over the same period. Accordingly, the realized compensation of our executives is significantly lower than what we have previously reported. |

SUBSTANTIAL EXECUTIVE COMPENSATION CHANGES |

• Despite significant operational achievements in 2015, we have recently experienced short-term underperformance and share the frustration of our stockholders in this regard. In this context, and taking into account input we received from our stockholders, including the results of our say-on-pay vote at our 2015 annual meeting, the Compensation Committee has significantly modified and materially reduced the size of our current executive compensation programs that will govern 2016 executive compensation in a manner that we believe will continue to focus our executives on long-term value creation and further strengthen alignment with our stockholders in light of our short-term TSR underperformance. • For example, we have decreased the size of the potential 2016 annual cash bonus pool as a percentage of the applicable revenue metric by 46% over the pool size for 2015, decreased the size of the potential 2016 annual long-term bonus pool as a percentage of the applicable revenue metric by 55% over the pool size for 2015, increased the performance-based equity component of the 2016 annual long-term bonus to 60% of total long-term bonuses from 36.7% in 2015, and increased the TSR performance hurdles that must be met in order for our executive officers to earn the performance-based equity awards to be granted as a portion of long-term bonus. |

13

TSR PERFORMANCE HIGHLIGHTS

The effectiveness of our pay for performance compensation program is evidenced by a high degree of alignment of management and stockholder interests that has been fostered over many years and which has contributed to our superior long-term TSR performance, when taking into account the combined performance of our Company, NorthStar Realty (in which our business was embedded prior to our spin-off in June 2014 and which we continue to manage) as well as NorthStar Europe, which was spun-off from NorthStar Realty in October 2015 (the “NRE Spin-off”) and which we also continue to manage.

Our TSR has performed well above market generating a 221% TSR (or a 12.4% compounded annual TSR) for our stockholders over the past ten years, as illustrated below.

10-Year TSR as of December 31, 2015 | TSR as of December 31, 2015 | ||||||||

| One-year | Three-year | Five-year | Ten-year | |||||

MSCI US REIT Index | 2.52% | 11.06% | 11.88% | 7.35% | |||||

Russell 3000 Index | 0.48% | 14.74% | 12.18% | 7.35% | |||||

SNL U.S. Asset Manager Index | -14.72% | 11.40% | 8.94% | 6.04% | |||||

SNL U.S. Finance REIT Index | -8.30% | 0.47% | 3.60% | -2.37% | |||||

Peer Group Average | -20.11% | 10.68% | 8.86% | 4.18% | |||||

NorthStar Asset Management Group, Inc.(1) | -40.1% | 25.4% | 29.1% | 12.4% | |||||

TSR Peer Ranking(2) | 3rd lowest | 2nd | 1st | 1st | |||||

(1) | Reflects long-term TSR performance of us, NorthStar Realty and NorthStar Europe on a combined basis. The graph assumes an investment of $100 on December 30, 2005 and the reinvestment of any dividends. The stock price performance shown on this graph is not necessarily indicative of future price performance. |

(2) | Reflects our TSR ranking among all peer companies that were publicly traded for the entire applicable period, which included six companies for the ten-year period, 10 companies for the five-year period, 11 companies for the three-year period and 13 companies for the one-year period. |

2015 OPERATING PERFORMANCE HIGHLIGHTS

In 2015, we had a strong year of operating performance as reported in our year end financial results, including the following notable achievements:

• | From December 31, 2014 to date, increased assets under management from $21.7 billion to $37.6 billion |

• | Acquired The Townsend Group, a leading global provider of investment management and advisory services focused on real assets with approximately $14 billion of assets under management and approximately $170 billion of assets for which it provides advisory services |

• | Raised $1.4 billion of capital in retail companies we manage, representing an approximately 20% increase compared to 2014 |

• | NorthStar Securities, our wholly-owned broker dealer subsidiary and dealer-manager for our retail product offerings, was the second largest capital raiser in the non-traded REIT market in 2015 |

• | Developed multiple new product channels, including co-sponsored closed-end funds |

• | High EBITDA multiple business |

PAY FOR PERFORMANCE ALIGNMENT

We have created strong alignment between our executives and our stockholders through our use of long-term equity awards that vest based on continued employment and/or absolute or relative TSR performance over four-year performance periods. As a result, when our stock price declines our executive officers are directly impacted as the value of their unvested equity awards is reduced, as is the likelihood of earning awards that are based on future TSR performance. As a demonstration of this alignment,

14

the total value of outstanding unvested equity awards of our named executive officers, measured pursuant to SEC rules, decreased by 76.4% from December 31, 2014 to December 31, 2015, as illustrated in the table below:

NAME | MARKET VALUE OF UNVESTED EQUITY AWARDS AT FISCAL YEAR END(1) | PERCENTAGE CHANGE | ||||||

2014 | 2015 | |||||||

David T. Hamamoto | $77.7 | $18.4 | -76.3 | % | ||||

Albert Tylis | $51.6 | $12.3 | -76.2 | % | ||||

Daniel R. Gilbert | $51.6 | $12.3 | -76.2 | % | ||||

Debra A. Hess | $14.6 | $3.4 | -76.9 | % | ||||

Ronald J. Lieberman | $8.9 | $2.0 | -77.5 | % | ||||

(1) | Dollars in millions. Information based on aggregate values set forth in the Outstanding Equity Awards at Fiscal Year End 2015 table presented in this Annual Report and the aggregate value set forth in the Outstanding Equity Awards at Fiscal Year End 2014 table presented in the proxy statement for our 2015 annual meeting. Please refer to the footnotes to these tables for explanation regarding the calculation of the amounts set forth therein. |

EXECUTIVE COMPENSATION CHANGES

For 2015 and 2016, we have heard our stockholders and have made several substantial changes to the structure of our executive compensation programs to further strengthen our pay for performance alignment and the alignment of the long-term interests of our management with our stockholders, including the following:

| Significant Expected Reduction in 2016 Overall Compensation. The vast majority of our executive compensation is comprised of annual cash bonuses and long-term bonuses paid in equity under our Executive Incentive Bonus Plan, or the NSAM Incentive Plan. For 2016, the Compensation Committee made significant reductions in the size of potential annual cash bonuses and long-term bonuses, as described below, and as a result, we expect significant reductions in the total compensation of our executive officers for 2016. |

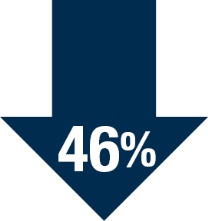

| 46% Reduction in Annual Cash Bonus Opportunity. For 2016, the Compensation Committee reduced the size of the annual cash bonus pool to 7.0% of our revenues (less commission expenses, plus equity in earnings including CAD adjustments), which represents a 46% reduction from the percentage pool size for 2015, which was 13%. As a result, even after considering anticipated increases in our revenues, we expect significant reductions in the annual cash bonuses for our executive officers for 2016. |

| 55% Reduction in Long-Term Equity Bonus Opportunity. For 2016, the Compensation Committee also significantly reduced the size of the long-term bonus pool to 1.25 times the annual cash bonus pool for 2016, which represents a 55% reduction from the percentage pool size for 2015. As a result, even after considering anticipated increases in our revenues, we expect significant reductions in the long-term bonuses for our executive officers for 2016. |

15

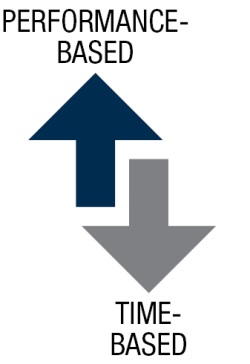

| Significant Shift to TSR Performance-Based Component of Long-Term Bonus. For 2016, the Compensation Committee shifted the components of our long-term bonus to significantly increase the percentage of long-term bonuses that will only be earned based on TSR performance over a four-year period from the beginning of the initial plan year. For both 2014 and 2015, a total of 36.7% of the total long-term bonuses earned were granted in equity awards that remained subject to the achievement of robust TSR performance hurdles over four years, with the remainder being granted as equity awards that vested based solely on continued employment. For 2016, the Compensation Committee increased the percentage of the long-term bonuses payable in equity awards subject to TSR performance hurdles to 60%. Based on our recent TSR underperformance as well as stockholder feedback, the Compensation Committee believed that it was appropriate to tie an increased portion of our executive officer’s compensation directly to our long-term TSR performance. |

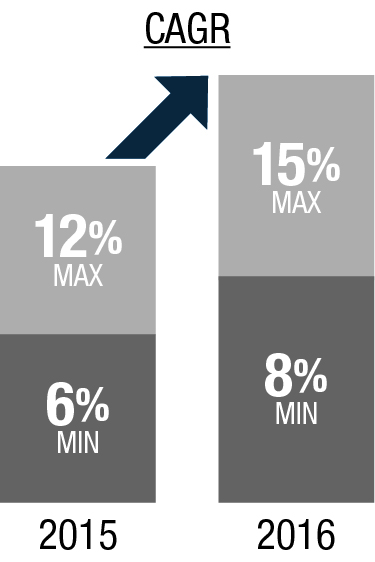

| Higher TSR Hurdles in Long-Term Bonus Awards, raising minimum hurdle by 33% and upper hurdle by 25%. For 2016, the Compensation Committee increased the TSR performance hurdles that must be met in order for our executive officers to earn the performance-based equity awards to be granted as a portion of long-term bonus. In order to fully earn the portion of these awards that is based on our TSR performance, we would have to achieve compounded annual TSR equal to or greater than 15% over the period from January 1, 2016 to December 31, 2019. Our executive officers will not earn any of these awards if our compounded annual TSR is less than 8% and will earn from 25%-100% if performance is between these minimum and maximum hurdles. Accordingly, based on our trailing average stock price as of December 31, 2015, we would need to attain TSR (including the impact of the deemed reinvestment of dividends during the performance period) equal to or greater than $20.80 per share in order for these awards to be fully earned. Based on our recent TSR underperformance as well as stockholder feedback and notwithstanding our superior long-term TSR performance, the Compensation Committee believed that it was appropriate to require our executive officers to meet higher TSR hurdles in order to fully earn their awards for 2016. |

| Higher Annual Cash Bonus Performance Hurdles. For 2015, the performance hurdles that our executive officers were required to achieve in order to earn their annual cash bonuses were significantly higher than the hurdles established for 2014. The CAD per share hurdles, on a combined basis, were approximately 20% higher than the hurdles utilized for 2014 and the sponsored company capital raising hurdles were 37.5% to 60% higher than the hurdles utilized for 2014. We continue to drive operational performance through the use of robust performance-based metrics and we have structured awards for 2016 to continue this trend. In particular, the maximum NSAM CAD hurdle is 40% higher in 2016 than it was in 2015. |

COMPENSATION PRACTICES

We believe that our executive compensation programs provide appropriate performance-based incentives to attract and retain leadership talent in the highly competitive market in which we operate, to align management and stockholder interests and to continue to drive our long-term track record of superior returns to stockholders. The following are key features of our executive compensation programs:

16

What We Do | What We Don’t Do | ||||

| In 2016, we significantly reduced total opportunity and total compensation. We recalibrate compensation programs on an annual basis. |  | We do not provide tax gross-ups on payments made in connection with a change of control. | ||

| Pay for performance - the vast majority of total compensation is tied to performance (i.e., not guaranteed) and salaries comprise a small portion of each executive’s overall compensation opportunity. |  | We do not provide guaranteed bonuses. | ||

| Create alignment with stockholders - our equity incentive awards are subject to time-based, multi-year vesting schedules to enhance executive officer retention. |  | We do not provide for single trigger cash severance in connection with a change of control. | ||

| Utilize robust long-term TSR hurdles (8-15% CAGR) for performance-based equity awards. |  | We do not pay dividends or distributions on unearned equity awards subject to performance-based vesting. | ||

| Impose a clawback policy with respect to incentive payments. | ||||

| Follow robust stock ownership guidelines for our executives and directors. | ||||

2015 Say-on-Pay Vote

At our 2015 annual meeting, a non-binding, advisory resolution approving the compensation paid to our named executive officers, as disclosed in our proxy statement for our 2015 annual meeting, including the Compensation Discussion and Analysis, compensation tables and narrative discussions, was approved by our stockholders. As our 2015 annual meeting occurred after we had established the structure of our executive compensation for 2015, the Compensation Committee did not consider the voting results on this resolution in determining compensation policies and decisions for 2015. However, the Compensation Committee did consider the voting results in connection with the decisions it made in structuring our executive compensation programs for 2016, as well as feedback from our stockholders, each of which influenced the meaningful changes highlighted above.

COMPENSATION POLICIES AND OBJECTIVES

The Compensation Committee has designed and administered our executive compensation programs with the intention of incentivizing long-term superior performance. Compensation of our executive officers has reflected and supported the goals and strategies that we established. Our compensation programs have been designed to link compensation with performance and to provide competitive levels of compensation relative to our peers and other companies that may compete for the services of our named executive officers. We compensate our named executive officers through a mix of base salary, bonus (both cash and equity based) and long-term equity compensation. The Compensation Committee has established the following primary objectives in determining the compensation of our executive officers:

• | to align our executive officers’ interests with the long-term interests of our stockholders; |

• | to provide rewards consistent with corporate performance; |

• | to attract and retain highly qualified executives that we expect to contribute to our success by paying competitive levels of compensation; and |

• | to motivate executives to contribute to drive our performance in a dynamic marketplace. |

With the adoption of the NSAM Incentive Plan and the creation of performance metrics annually under this plan, the Compensation Committee believes that it has closely tied the compensation for our named executive officers to our performance, closely aligned management’s interests with those of stockholders, created both long-term and short-term goals and objectives and created a meaningful retention tool for our named executive officers. Additionally, the Compensation Committee believes that the NSAM Incentive Plan provides a competitive compensation framework for a management team that

17

has performed at a high level for an extended period of time and markedly outperformed companies in its competitive space over the long-term.

COMPENSATION CONSULTANT AND BENCHMARKING

The Compensation Committee approves all compensation and equity awards for our named executive officers, which in 2015 included our Executive Chairman, our Chief Executive Officer and President, the Chief Investment and Operating Officer of NorthStar Asset Management Group, Ltd, our Chief Financial Officer and our Executive Vice President, General Counsel and Secretary. The Compensation Committee largely considers compensation for our executive officers in light of competitive compensation levels, among other factors, and has sole authority to retain compensation consultants to assist in the evaluation of executive officer compensation. The Compensation Committee engaged FTI Consulting, Inc. as its compensation consultant and used FTI Consulting, Inc.’s compensation consulting services with respect to 2015 compensation. In evaluating compensation for our named executive officers for 2015 and establishing the structure of 2015 awards under the NSAM Incentive Plan, the Compensation Committee relied on materials prepared by FTI Consulting, Inc.

In connection with establishing the structure of 2015 awards under the NSAM Incentive Plan, FTI Consulting, Inc. reviewed historical results of a peer group comprised of the following companies:

American Capital, Ltd. | Fifth Street Asset Management, Inc. |

Annaly Capital Management, Inc. | Fortress Investment Group LLC |

Apollo Global Management, LLC | iStar Financial |

Ares Management L.P. | Kennedy-Wilson Holdings, Inc. |

Blackstone Group, L.P. (real estate division) | Och-Ziff Capital Management Group LLC |

Brookfield Asset Management, Inc. | SL Green Realty Corp. |

Cohen & Steers, Inc. | |

The Compensation Committee did not target a singular percentile or range of percentiles to be used in determining the amount of our named executive officer compensation and did not base the structure of our compensation programs for our named executive officers on that of any particular firm or group of firms. Instead, the Compensation Committee used this information generally to assist it in understanding the compensation practices of similar types of companies, our relative performance compared to these companies and how our compensation programs compare to these companies. Also, in analyzing our 2015 compensation and structuring our executive compensation programs for 2016, the Compensation Committee reviewed annualized peer group data as of September 30, 2015 provided by FTI Consulting, Inc. Specifically, the Compensation Committee reviewed our peer group’s compensation expense as a percentage of total revenues, compensation expense as a percentage of total assets, compensation expense as a percentage of total assets under management and compensation expense as a percentage of market capitalization. Based on the data presented, our estimated compensation expense ranged from slightly above median to significantly below median. The Compensation Committee viewed this data as reinforcing its belief that the overall size of our compensation program was appropriate on a company-wide basis. Nevertheless, based on more recent short-term TSR performance as well as stockholder feedback, in 2016, the Compensation Committee made significant reductions to executive compensation for 2016, which should only improve our ranking against our peers in these various metrics.

PROCESS FOR DETERMINING COMPENSATION AWARDS

In determining compensation for 2015 and long-term compensation arrangements, the Compensation Committee worked with FTI Consulting, Inc. and our management to establish the terms of and formulate performance metrics under the NSAM Incentive Plan for 2015.