Attached files

| file | filename |

|---|---|

| EX-31.3 - EX-31.3 - POLYCOM INC | d132792dex313.htm |

| EX-31.4 - EX-31.4 - POLYCOM INC | d132792dex314.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-27978

POLYCOM, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3128324 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 6001 America Center Drive, San Jose, California | 95002 | |

| (Address of principal executive offices) | (Zip Code) | |

(408) 586-6000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value $0.0005 per share | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act (the “Exchange Act”). Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 in Exchange Act). Yes ¨ No x

As of June 30, 2015, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the Registrant, based on the closing sale price of such shares on the NASDAQ Global Select Market on June 30, 2015, was approximately $1,518,085,174. Shares of common stock held by each executive officer and director have been excluded in that such persons may under certain circumstances be deemed to be affiliates. This determination of executive officer or affiliate status is not necessarily a conclusive determination for other purposes.

135,620,260 shares of the Registrant’s common stock were outstanding as of April 21, 2016.

Table of Contents

2

Table of Contents

On February 29, 2016, we filed an Annual Report on Form 10-K for our fiscal year ended December 31, 2015 (the “Original Form 10-K”) with the U.S. Securities and Exchange Commission (“SEC”). This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends Part III of the Original Form 10-K to include information that we, in reliance on General Instruction G(3) to Form 10-K, originally intended to be incorporated by reference from our definitive proxy statement for our next annual meeting of stockholders. General Instruction G(3) to Form 10-K permits registrants to incorporate by reference certain information from a definitive proxy statement that involves the election of directors if such definitive proxy statement is filed with the SEC within 120 days after the end of a company’s fiscal year. We will not file our definitive proxy statement involving the election of directors within 120 days of the end of our fiscal year as originally intended. Accordingly, we are amending Part III of the Original Form 10-K as set forth below.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this Amendment No. 1.

Except as stated herein, this Amendment No. 1 does not reflect events occurring after the filing of the Original Form 10-K with the SEC on February 29, 2016, and no attempt has been made in this Amendment No. 1 to modify or update other disclosures as presented in the Original Form 10-K.

3

Table of Contents

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Executive Officers of the Registrant

The names of each of our executive officers, their ages, their positions with Polycom and other biographical information as of April 18, 2016, are set forth below.

| Name |

Age | Position(s) | ||||

| Peter A. Leav (1) |

45 | Chief Executive Officer, President and Director | ||||

| Laura J. Durr |

55 | Chief Financial Officer, Chief Accounting Officer, and Executive Vice President | ||||

| Sayed M. Darwish |

50 | Chief Legal Officer, Executive Vice President of Corporate Development and Secretary | ||||

| Michael J. Frendo |

55 | Executive Vice President of Worldwide Engineering | ||||

| (1) | Member of the Board of Directors. |

Our executive officers are appointed by, and serve at the discretion of, the Board of Directors. There is no family relationship between any of our executive officers or directors.

Biographical information about Mr. Leav is set forth under “Directors of the Registrant” below.

Ms. Durr has served as our Chief Financial Officer, Chief Accounting Officer, and Executive Vice President since May 2014. Ms. Durr also served as our Senior Vice President, Worldwide Controller and Principal Accounting Officer from September 2013 to May 2014, Senior Vice President, Worldwide Controller and Chief Accounting Officer from October 2011 to September 2013, Vice President, Worldwide Controller and Chief Accounting Officer from March 2005 to October 2011 and as Assistant Controller from March 2004 to March 2005. Prior to joining Polycom, Ms. Durr served as the Director of Finance and Administration for QuickSilver Technology, Inc. from February 2003 to March 2004, as an independent consultant from July 2002 to February 2003 and as the Corporate Controller for C Speed Corporation from April 2001 to June 2002. From October 1999 to October 2000, Ms. Durr was a business unit Controller at Lucent Technologies, Inc. after Lucent’s acquisition of International Network Services, where she served as the Corporate Controller from May 1995 to October 1999. Ms. Durr also spent six years in various capacities at Price Waterhouse LLP. Ms. Durr is a certified public accountant and holds a B.S. in Accounting from San Jose State University.

Mr. Darwish has served as our Chief Legal Officer, Executive Vice President of Corporate Development and Secretary since February 2012. Mr. Darwish also served as our Executive Vice President, Chief Administrative Officer, General Counsel and Secretary from February 2011 to February 2012, Senior Vice President, Chief Administrative Officer, General Counsel and Secretary from January 2008 to February 2011, Senior Vice President, General Counsel and Secretary from July 2007 to January 2008 and Vice President, General Counsel and Secretary from August 2005 to July 2007. Prior to joining Polycom, from December 2003 to August 2005, Mr. Darwish served in various legal positions at EMC Corporation, ultimately as Vice President and General Counsel for EMC Corporation’s Software Group after EMC’s acquisition of Documentum, Inc., where he served as Vice President, General Counsel and Secretary from July 2000 to December 2003. Prior to that, Mr. Darwish served as Vice President and General Counsel for Luna Information Systems, served in various positions, including as General Counsel and Vice President, Legal and HR, for Forté Software, Inc. through its acquisition by Sun Microsystems, Inc., served as Corporate Counsel at Oracle Corporation, and was an associate in the law firm of Brobeck, Phleger & Harrison. Mr. Darwish is a graduate of the University of San Francisco School of Law, J.D. cum laude, and holds a B.S. in Mathematics and a B.A. in Economics from the University of Illinois, Urbana.

4

Table of Contents

Mr. Frendo has served as our Executive Vice President of Worldwide Engineering since May 2014. Prior to joining Polycom, Mr. Frendo served as Senior Vice President of Architecture at Infinera Corporation, an optical telecommunications company, from March 2010 to May 2014. Prior to that, Mr. Frendo served as General Manager of the Unified Communications Solutions Business Unit and Senior Vice President at Avaya, Inc., a business collaboration and communications solutions company, from October 2008 to March 2010. Before Avaya, Mr. Frendo held various corporate executive, engineering and business unit leadership roles including General Manager of the High End Security Business unit at Juniper Networks, Inc., Senior VP of Worldwide Engineering for McDATA Corporation and Vice President for Systems and Software Engineering in Cisco’s Voice Technology Group. Mr. Frendo holds a Ph.D. and Master of Engineering in Electrical Engineering from McMaster University and a B.S. in Computer Science from the University of Western Ontario.

Directors of the Registrant

The names of each member of our Board of Directors (the “Board”), their ages, their positions with Polycom and other biographical information as of April 18, 2016, are set forth below. There are no family relationships among any of our directors or executive officers. Beneath the biographical details of each director listed below, we have also detailed the specific experience, qualifications, attributes or skills of each director that led the Board to conclude that each director should serve on the Board.

| Name |

Age | Position | ||||

| Peter A. Leav |

45 | Chief Executive Officer, President and Director | ||||

| Martha H. Bejar (1)(2) |

54 | Director | ||||

| Gary J. Daichendt (3) |

64 | Chairman of the Board of Directors | ||||

| Robert J. Frankenberg (1)(2) |

68 | Director | ||||

| John A. Kelley, Jr. (2)(3) |

66 | Director | ||||

| D. Scott Mercer (1)(3) |

65 | Director | ||||

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of Corporate Governance and Nominating Committee |

Peter A. Leav has been a director of Polycom and Polycom’s President and Chief Executive Officer since December 2013. Prior to joining Polycom, Mr. Leav served as Executive Vice President and President, Industry and Field Operations of NCR Corporation, a global technology company, from June 2012 to November 2013. Mr. Leav served as Executive Vice President, Global Sales, Professional Services and Consumables of NCR from November 2011 to June 2012, and as Senior Vice President, Worldwide Sales of NCR from January 2009 to October 2011. Prior to joining NCR, he served as Corporate Vice President and General Manager of Motorola, Inc., a provider of mobility products and solutions across broadband and wireless networks, from November 2008 to January 2009, as Vice President and General Manager from December 2007 to November 2008, and as Vice President of Sales from December 2006 to December 2007. From November 2004 to December 2006, Mr. Leav was Director of Sales for Symbol Technologies, Inc., an information technology company. Prior to this position, Mr. Leav was Regional Sales Manager at Cisco Systems, Inc., a manufacturer of communications and information technology networking products, from July 2000 to November 2004. Mr. Leav has served on the board of directors of HD Supply, Inc. since October 2014. Mr. Leav holds a B.A. from Lehigh University.

Qualifications to serve as director: Mr. Leav is uniquely qualified to contribute to Polycom’s future delivery on its strategic initiatives through his strong background in operations, general management and sales, spanning more than 20 years in the communications, technology and services industry. During his career, Mr. Leav has a proven track record of driving revenue and shareholder value, while leading global organizations at such companies as NCR and Motorola and regional organizations at Cisco Systems and Tektronix. In addition, Mr. Leav has a comprehensive understanding of Polycom’s business, operations, competition and financial position.

5

Table of Contents

Martha H. Bejar has been a director of Polycom since October 2013. Ms. Bejar has served as co-founder of Red Bison Advisory Group LLC, a company involved in providing telecommunications and enterprise technology solutions, since January 2014. Previously, Ms. Bejar served as Chief Executive Officer and director of Flow Mobile, Inc., a communications company offering broadband wireless access services, from January 2012 to December 2015. Prior to joining Flow Mobile, Ms. Bejar served as chairperson and Chief Executive Officer of Wipro Infocrossing, a U.S.-based cloud services affiliate of Wipro Limited, from March 2011 to January 2012. Ms. Bejar served as President of Worldwide Sales and Operations at Wipro Technologies Inc., an information technology services affiliate of Wipro Limited, from June 2009 to April 2011. From 2007 to 2009, Ms. Bejar worked at Microsoft, Inc., a computer software company, where she was corporate vice president for the communications sector. Prior to joining Microsoft, Ms. Bejar held various positions at Nortel Networks Corporation, a telecommunications and data networking company, including as Regional President from 2004 to 2007, President of North America Sales, Sales Engineering and Sales Operations from 2002 to 2004 and General Manager from 1997 to 2002. Ms. Bejar has served on the board of directors of CenturyLink, Inc. since January 2016 as well as the boards of a number of private and non-profit companies. Ms. Bejar received an Advanced Management Program degree from Harvard University Business School and holds a B.S. in Industrial Engineering from the University of Miami, and a Masters in Business Administration from Nova Southeastern University.

Qualifications to serve as director: Ms. Bejar is independent and has significant senior management expertise in the telecommunications and IT sectors, including as Chief Executive Officer of Flow Mobile and Wipro Infocrossing. Ms. Bejar’s experience as a senior executive officer of technology companies gives her a strong skill set working in different business models with a focus on business intelligence and analytics, wireless solutions, unified communications, and social networking market demand. Ms. Bejar brings experience in technology, planning, operations, and strategy. Ms. Bejar currently serves on Polycom’s Audit Committee and Compensation Committee.

Gary J. Daichendt has been a director of Polycom since August 2015. In February 2016, Mr. Daichendt was appointed Chairman of the Board. Mr. Daichendt has been a managing member of Theory R Properties LLC, a commercial real estate firm, since October 2002. Mr. Daichendt served as President and Chief Operating Officer of Nortel Networks Corporation, a supplier of communication equipment, from March 2005 to June 2005. Prior to joining Nortel Networks, Mr. Daichendt served in a number of senior executive positions at Cisco Systems, Inc., a manufacturer of communications and information technology networking products, including as Executive Vice President, Worldwide Operations from August 1998 to December 2000, and as Senior Vice President, Worldwide Operations from September 1996 to August 1998. Mr. Daichendt served on the board of directors of ShoreTel, Inc. from May 2007 to February 2015 and Emulex Corporation from February 2014 to May 2015, and has served on the board of directors of NCR Corporation since April 2006 and Juniper Networks, Inc. since May 2014. Mr. Daichendt holds a B.A. in Mathematics from Youngstown State University, and a M.S. in Mathematics from Ohio State University.

Qualifications to serve as director: Mr. Daichendt is independent and has extensive executive management experience, including serving in a number of senior executive positions at Nortel Networks Corporation and Cisco Systems, Inc. Mr. Daichendt brings significant expertise in sales, marketing, channel development and operations, as well as in the telecommunications and technology industries, which are directly relevant to the challenges and opportunities Polycom faces. Mr. Daichendt’s significant board experience has exposed him to best practices and approaches that are beneficial to Polycom. Mr. Daichendt currently serves as Polycom’s Chairman of the Board and is a member of the Corporate Governance and Nominating Committee.

Robert J. Frankenberg has been a director of Polycom since October 2013. Mr. Frankenberg is the owner of NetVentures, a management consulting firm. Mr. Frankenberg served as Chairman of Kinzan, Inc., an internet services software platform provider, from December 1999 to July 2006. Prior to joining Kinzan, Mr. Frankenberg served as Chairman, President and Chief Executive Officer of Encanto Networks, Inc., an eBusiness software and services company, from June 1997 until July 2000. From April 1994 to August 1996, Mr. Frankenberg served as Chairman and Chief Executive Officer of Novell, Inc., a networking software company. Prior to joining Novell,

6

Table of Contents

Mr. Frankenberg held various positions at Hewlett-Packard Corporation, an information technology company, including as Corporate Vice President and General Manager. Mr. Frankenberg served on the board of directors of National Semiconductor from April 1999 to September 2011 and Wave Systems Corp. from December 2011 to June 2015, and has served on the boards of directors of Nuance Communications, Inc. since March 2000 and Rubicon Project, Inc. since April 2014, as well as the boards of a number of private and non-profit companies. Mr. Frankenberg holds a B.S. in Computer Engineering from San Jose State University.

Qualifications to serve as director: Mr. Frankenberg is independent and has significant senior management expertise in the technology industry, including previously as Chairman and Chief Executive Officer of Novell, one of the largest networking software companies in the world, where he led the business through a major strategy change to focus the company on the network software business. Mr. Frankenberg’s experience as chairman, president and chief executive officer of various technology companies and his significant board experience provides expertise in technology, business operations, corporate development, strategy, financial reporting, governance and board best practices. Mr. Frankenberg currently serves as the chairperson of Polycom’s Compensation Committee and is a member of the Audit Committee.

John A. Kelley, Jr. has been a director of Polycom since March 2000. Mr. Kelley has served as the Chief Executive Officer of CereScan Corp., a provider of high-definition functional brain imaging, since July 2009 and as Chairman of the board of directors of CereScan since March 2009. Previously, Mr. Kelley served as the Chairman, President and Chief Executive Officer of McDATA Corporation, a provider of storage networking and data infrastructure solutions until McDATA was acquired by Brocade Communications Systems, Inc., a data infrastructure company, in January 2007. Mr. Kelley started at McDATA as President and Chief Operating Officer in August 2001. Prior to joining McDATA, Mr. Kelley served as Executive Vice President of Networks at Qwest Communications International, Inc. from August 2000 to December 2000. He served as President of Wholesale Markets for U.S. West, Inc. from May 1998 to July 2000. From 1995 to April 1998, Mr. Kelley served as Vice President and General Manager of Large Business and Government Accounts and President of Federal Services for U.S. West. Prior to joining U.S. West, Mr. Kelley was the Area President for Mead Corporation’s Zellerbach Southwest Business Unit from 1991 to 1995, and held senior positions at Xerox Corporation and NBI, Inc. Mr. Kelley served on the board of directors of Emulex Corporation as Chair of the Compensation Committee from February 2014 until Emulex was acquired in May 2015. Mr. Kelley is also a director of Circadence Corporation, a private company. Mr. Kelley holds a B.S. in business management from the University of Missouri, St. Louis.

Qualifications to serve as director: Mr. Kelley is independent and has broad experience, knowledge and expertise in the communications and networking industries, including as chief executive officer of McDATA and in senior management positions at large telecommunications companies. Mr. Kelley’s strategic and operational experience as a senior executive officer and as chief executive officer in the telecommunications and networking industries is directly relevant to many of the strategic and operational issues faced by Polycom, including strategic planning, operations, finance, governance and industry consolidation. Mr. Kelley currently serves as chairperson of Polycom’s Corporate Governance and Nominating Committee and is a member of the Compensation Committee.

D. Scott Mercer has been a director of Polycom since November 2007. From April 2008 to April 2011, Mr. Mercer served as the Chief Executive Officer of Conexant Systems, Inc., a semiconductor solutions company that provides products for imaging, video, audio and Internet connectivity applications. Mr. Mercer also served on the board of directors of Conexant from May 2003 to April 2011 and served as Chairman of the board of directors of Conexant from August 2008 to April 2011. Mr. Mercer served as interim Chief Executive Officer of Adaptec, Inc., a provider of software and hardware-based storage solutions, from May 2005 through November 2005. Mr. Mercer also served as a senior vice president and advisor to the chief executive officer of Western Digital Corporation, a supplier of disk drives to the personal computer and consumer electronics industries, from February 2004 through December 2004. Prior to that, Mr. Mercer was a Senior Vice President and the Chief Financial Officer of Western Digital Corporation from October 2001 through January 2004. From June 2000 to

7

Table of Contents

September 2001, Mr. Mercer served as Vice President and Chief Financial Officer of Teralogic, Inc. From June 1996 to May 2000, Mr. Mercer held various senior operating and financial positions with Dell, Inc. Mr. Mercer has served as a director of QLogic Corporation since September 2010 and Sandisk Corporation since September 2013, as well as director of a private company. Mr. Mercer holds a B.S. in Accounting from California Polytechnic University, Pomona.

Qualifications to serve as director: Mr. Mercer is independent and an audit committee financial expert, with significant senior management and operational experience over the last 28 years in a number of technology companies. Mr. Mercer’s experience as a senior executive officer, including as both chief executive officer and chief financial officer, of high growth technology companies gives him a strong skill set in planning, operations, compliance and finance matters. Further, Mr. Mercer has significant public board experience, which adds to his relevant knowledge and experience. Mr. Mercer currently serves as the chairperson of Polycom’s Audit Committee and is a member of the Corporate Governance and Nominating Committee.

Code of Business Ethics and Conduct

We maintain a Code of Business Ethics and Conduct, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Corporate Governance Principles and the Code of Business Ethics and Conduct are available on our website, www.polycom.com, under the tabs “Company” and “Investor Relations—Corporate Governance.” We will disclose on our website any amendment to the Code of Business Ethics and Conduct, as well as any waivers of the Code of Business Ethics and Conduct that are required to be disclosed by the rules of the SEC or The NASDAQ Stock Market LLC (“NASDAQ”).

Audit Committee

The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, currently consists of D. Scott Mercer, Martha H. Bejar and Robert J. Frankenberg, each of whom is “independent” as defined by the listing standards of NASDAQ. Mr. Mercer is the chairperson of the Audit Committee. The Board has determined that Mr. Mercer is an “audit committee financial expert” as defined in the rules of the SEC.

Process for Recommending Candidates for Election to the Board of Directors

There have been no material changes to the procedures by which security holders may recommend nominees to our Board since the date of our proxy statement for our 2015 Annual Meeting of Stockholders.

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16 of the Exchange Act, Polycom’s directors, executive officers and any persons holding more than 10% of Polycom’s common stock are required to report initial ownership of the Polycom common stock and any subsequent changes in ownership to the SEC. Specific due dates have been established by the SEC, and Polycom is required to disclose in this Amendment No. 1 any failure to file required ownership reports by these dates. Based solely upon the copies of Section 16(a) reports that Polycom received from such persons for their transactions during fiscal 2015, and the written representations received from certain of such persons that no reports were required to be filed for them during fiscal 2015, Polycom is aware of no late Section 16(a) filings.

8

Table of Contents

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction

This section discusses our executive compensation philosophy and practices and analyzes the Compensation Committee’s decisions related to the compensation of our named executive officers (“NEOs”) for fiscal 2015, who were:

| Name |

Position | |

| Peter A. Leav | President and Chief Executive Officer (“CEO”) | |

| Laura J. Durr | Chief Financial Officer (“CFO”), Chief Accounting Officer and Executive Vice President | |

| Sayed M. Darwish | Chief Legal Officer, Executive Vice President, Corporate Development and Secretary | |

| Michael J. Frendo | Executive Vice President of Worldwide Engineering |

Executive Summary

Our executive compensation program is designed to reflect our pay for performance philosophy while finding, keeping and engaging executives who embolden our culture and strengthen our position in the extremely competitive and rapidly-changing high-technology industry.

2015 Performance

We are a global leader in helping organizations achieve new levels of teamwork, efficiency and productivity by unleashing the power of human collaboration. More than 400,000 companies and institutions worldwide defy distance with secure video, voice and content solutions from Polycom to increase productivity, speed time to market, provide better customer service, expand education and save lives. Polycom was founded in 1990 with the vision of transforming the way people communicate. Over time, we have transformed a simple device—the speaker phone—into an indispensable business tool that has enabled the progress of governments, agencies and companies around the world. In 2015, we celebrated our 25th anniversary. Our company is proud to be a global leader in video, voice and content collaboration solutions serving industries and enterprises of all shapes and sizes.

Our market is evolving in that traditional offices and meeting rooms have begun giving way to open and mobile work spaces, as well as small huddle rooms. Communications solutions are now being delivered through a multitude of emerging technologies and by a number of new market entrants. This presents the business need, and inherent opportunity for Polycom to adapt and compete effectively in this rapidly changing marketplace and to deliver an even greater number of end-user devices at more affordable price points. We believe that our heritage, experience, knowledge and vision for this industry provide us a distinct competitive advantage in this regard. To that end, we completed the second year of a multi-year transition by launching a new set of products designed to target the dynamic and expanding marketplace. One of our most promising new products is the Polycom® RealPresence TrioTM smart hub, a derivative of our iconic speaker phone that now offers video and content sharing capabilities. With over 5.5 million speaker phones installed in the world today, we believe the RealPresence Trio solution creates an unmatched opportunity for product replacements and upgrades of existing voice-only products.

Our total annual revenue was $1.27 billion in 2015, down 6 percent from the prior year and generally attributable to market dynamics described above. Our share price performance also declined in 2015, in line with

9

Table of Contents

revenue and market dynamics. Despite these challenges, we maintained steady gross profit margin levels and executed on our strategy to improve operating performance and earnings per share, while investing in the future of our business through the development and introduction of new products. Our Board of Directors and management team remain focused on delivering improved operating performance and earnings per share, as we believe those factors are fundamental to long-term share price appreciation. Some of our other 2015 accomplishments included:

| • | Introduced several new, innovative collaboration solutions in the marketplace, including the Polycom® RealPresence TrioTM, Polycom® RealPresence CentroTM and Polycom® RealPresence DebutTM solutions. |

| • | Non-GAAP operating margins and diluted earnings per share increased 8% and 6% year-over-year, respectively; and on a GAAP basis, by 101% and 67%, respectively. |

| • | Non-GAAP operating expenses were reduced by 8% year-over-year; and by 12% on a GAAP basis. |

| • | Revenue from UC Personal Devices grew 13% year-over-year. |

| • | Generated $120 million in operating cash flow. |

| • | $90 million of common stock was repurchased, demonstrating our continued commitment to returning capital to our stockholders. |

2015 Pay Reflected 2015 Performance

In 2015, our compensation program for our NEOs remained consistent with our philosophy of paying for performance. As a result of stockholder feedback and our continued effort to align executive compensation with market benchmark data, we changed our philosophy to target the total direct compensation (“TDC”) of our executive officers to the median of our selected peer group for 2015. Below is a summary illustrating the result of each of our compensation components for our NEOs in fiscal 2015. The Compensation Committee continues to focus on variable compensation elements in order to drive performance.

| NEO Compensation Component |

Fiscal 2015 Results | |

| Base Salary See pages 20-21 for more details |

• NEOs did not receive a salary increase in 2015, consistent with the majority of our employees globally as we continued to direct our resources to investment in core areas of the business. | |

| Short-Term Cash Incentives See pages 21-23 for more details |

• Target bonuses did not change in 2015. • The maximum cap on bonuses payable for 2015 was reduced to 200% of target from 250% of target for 2014 as part of our on-going practice of benchmarking executive compensation against market practice. | |

| • On an annualized basis, bonuses were funded at approximately 82% of the NEOs’ respective targeted amounts.

• For the first half of 2015, we achieved 96% of our target revenue objective and 103% of our target non-GAAP operating income objective. As a result, bonuses payable to NEOs were funded at 99% of their respective first-half target amounts.

| ||

10

Table of Contents

| NEO Compensation Component |

Fiscal 2015 Results | |

| • For the second half of 2015, we achieved 87% of our target revenue objective and 85% of our target non-GAAP operating income objective. As a result, bonuses payable to NEOs were funded at 65% of their respective second-half target amounts. | ||

| Long-term Performance-based Equity Incentives See pages 23-26 for more details |

• Based on Total Shareholder Return (“TSR”) performance at the 55th percentile for the applicable performance period for the 12-month period measured from December 1, 2014 to November 30, 2015, our CEO earned 105% of the target number of performance shares awarded to him, as part of the second vesting tranche of Mr. Leav’s new hire grant. | |

| • Based on TSR performance at the 47th percentile for the applicable performance period for the 12-month period measured from July 1, 2014 to June 30, 2015, our CEO earned 94% of the target number of performance shares awarded to him, as part of the first tranche of Mr. Leav’s August 2014 grant. | ||

| • Based on TSR performance at the 50th percentile for the applicable performance period for the 12-month period measured from January 1, 2015 to December 31, 2015, our NEOs earned 100% of the target number of performance shares awarded to them. | ||

11

Table of Contents

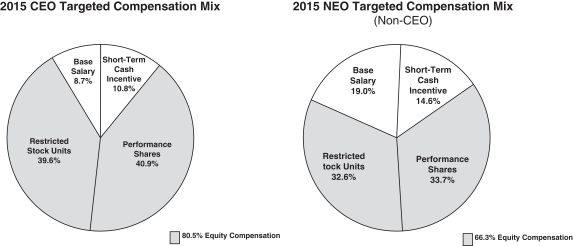

NEO Targeted Compensation Mix

The charts below illustrate the mix of total direct compensation (which includes base salary, short-term cash incentives and equity awards) for our NEOs. Consistent with the pay for performance philosophy of our executive compensation program, our targeted pay mix for our CEO is weighted toward performance-based pay and emphasizes variable compensation with his short-term cash incentive target set at 125% and with 50% of his equity as performance-based. The equity awards to our NEOs in 2015 were comprised of 50% RSUs and 50% PSUs; however, the slight variance in percentages of equity compensation shown in the charts below is due to the two different valuation methodologies used for accounting purposes (i.e., PSU value is calculated in accordance with FASB ASC Topic 718, and RSU value is based on the closing market price on the date of grant).

Note: The 2015 CEO Targeted Compensation Mix reflects Mr. Leav’s annualized base salary, annual target bonus opportunity and his equity award grants. The 2015 NEO Targeted Compensation Mix (Non-CEO) reflects annualized base salary, annual target bonus opportunity and equity award grants for all other NEOs.

12

Table of Contents

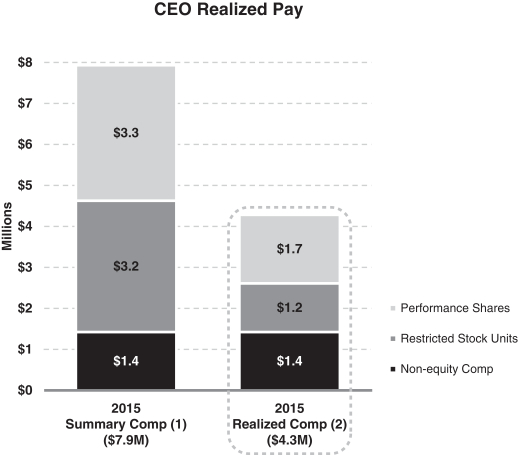

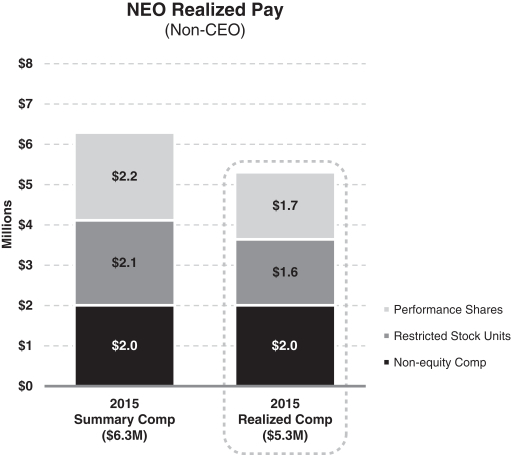

Summary of Realized Pay for 2015

The actual compensation realized by our NEOs in fiscal 2015 is summarized in the charts below, along with the compensation reflected in the Summary Compensation Table on page 31. The “Summary Comp” data includes actual cash compensation (base salary and bonus) earned for 2015 performance, plus the full grant date fair value of performance shares and restricted stock units (“RSUs”) granted in 2015, which does not reflect pay actually realized by our NEOs in 2015. Therefore, to illustrate the pay actually realized by our NEOs in 2015, the “Realized Comp” data includes actual cash compensation earned for 2015 performance, plus the value realized from performance shares and RSUs that vested in 2015, including from awards granted prior to 2015.

| (1) | Note that 2015 was the first year Mr. Leav received an annual equity award. Due to his new hire compensation package in 2013, Mr. Leav did not receive an annual equity award in 2014, resulting in the year-over-year compensation increase reflected in the Summary Compensation Table. |

| (2) | Mr. Leav’s 2015 Realized Comp includes the value realized from the vesting of (i) one-third of the new hire award he received in 2013 and (ii) one-third of a performance share award he received in the second half of 2014. |

13

Table of Contents

How We Pay for Performance and Align with Stockholder Interests

Our executive compensation program includes the following features designed to focus on pay for performance and corporate governance while aligning with the interests of our stockholders:

| • | Competitive Compensation. We use peer market data to offer competitive compensation in order to find, keep and engage world class executives. Actual pay is largely dependent on performance. For 2015, in response to stockholder feedback, we changed our executive compensation philosophy to target the median of our peer group with respect to target total direct compensation. |

| • | Performance-based Compensation. A significant portion of our NEOs’ compensation consists of performance-based incentives based on TSR and achievement of our key financial goals. |

| • | Rigorous Performance Metrics. Our short-term cash incentive performance goals are challenging and designed to reward only significant achievement. |

| • | Award Caps. For 2015, performance-based awards under our long-term, equity-based incentive plans remained capped at 150%. Awards under the short-term cash incentive plan were capped at 200%, which was a reduction from a cap of 250% in 2014, as part of our on-going practice to align executive compensation with market practice. |

| • | Annual Review of Executive Compensation Program. On an annual basis, we review and obtain a stockholder advisory vote on our executive compensation program. |

| • | On-going Stockholder Outreach. During the year, we engaged with stockholders to provide them with an opportunity for continued feedback on executive compensation and other matters of importance. |

14

Table of Contents

| • | Regular Review of Share Utilization. We regularly review market competitiveness, overhang and burn rates to ensure that we are engaging in responsible granting practices, taking into account our hiring and retention needs as well as overall dilutive impact. |

| • | No Option Repricing without Stockholder Approval. Option repricing without stockholder approval is not permitted under our 2011 Equity Incentive Plan. |

| • | Severance Program. Our executive severance plan is competitive with our peers and is reviewed regularly. |

| • | No 280G Tax Gross-ups. Our agreements with our executives do not provide for any tax gross-ups in connection with any payments that might be received upon a change in control. |

How We Mitigate Excessive Risk Taking Behavior

Our executive compensation program includes the following features designed to mitigate risk and discourage decisions that maximize short-term results at the expense of long-term value:

| • | Independent Compensation Consultant. The Compensation Committee has engaged Radford, an Aon Hewitt Company, as its independent compensation consultant in the areas of executive compensation and governance. |

| • | Annual Risk Review. The Compensation Committee and Radford annually review and assess our compensation program for risk and have determined that our compensation programs do not create risk that is reasonably likely to have a material adverse effect on the company. |

| • | Executive Compensation Clawback Policy. We have a clawback policy for performance-based cash and performance-based equity awards granted to executive officers if the company is required to provide a material restatement of our financial statements for any of the prior three fiscal years due to any fraud or intentional misconduct by an executive officer. |

| • | CEO and Executive Officer Stock Ownership Guidelines. We maintain stock ownership guidelines that apply to our executive officers. The stock ownership guideline for our CEO is 3x base salary and 5,000 shares for our other executive officers. |

| • | Director Stock Ownership Guidelines. We maintain stock ownership guidelines that apply to members of our Board at 3x their annual cash retainer. |

| • | No Hedging of Polycom Stock. All employees, including NEOs, are prohibited from hedging Polycom’s stock. |

Results of 2015 Advisory Vote on Executive Compensation and Stockholder Outreach

We value the input of our stockholders on our executive compensation program. We conducted a stockholder outreach program during 2015 with major holders of Polycom stock, representing approximately 60% of our outstanding shares, to solicit their feedback on our executive compensation practices. Additionally, our CEO speaks with our largest shareholders on a quarterly basis. At the 2015 Annual Meeting, over 97% of our stockholders voted in support of our executive compensation program.

The Compensation Committee was mindful of the continued support our stockholders expressed for many aspects of our compensation philosophy. The Compensation Committee carefully considered the feedback received from stockholders when making compensation decisions for 2015, and for planning and implementing the framework for making compensation decisions for 2016. As a result, the Committee implemented certain changes and maintained others in line with stockholder feedback, including the following:

| • | For 2015, we changed our executive compensation philosophy from targeting TDC between the median and 75th percentile of our selected peer group to targeting the median (50th percentile) and maintained this philosophy for 2016. |

15

Table of Contents

| • | For 2015, we evaluated and made changes to our selected peer group, removing two companies that were outside of our peer group in terms of market capitalization, headcount and, in one case, revenue as well, to ensure our executive compensation continues to be measured against appropriate peer companies. |

| • | For 2016 compensation decisions, as part of our regular evaluation of our selected peer group, we added four new appropriately-sized companies to our selected peer group to increase the group size and better align the group to our financial profile. We will continue to evaluate and, where appropriate, make changes to our selected peer group. |

| • | We continued to make a significant portion of our executive compensation performance-based in 2015 and to date in 2016. The Compensation Committee continues to believe that our performance shares measured based on TSR performance relative to the NASDAQ Composite Index (the “NASDAQ Index”) companies drive and reward the appropriate behavior by closely aligning with stockholder interests. |

| • | Performance targets of our short-term cash incentive program continue to be challenging and results-driven. |

Overview of Compensation Program and Philosophy

Our executive compensation program and philosophy are designed to find, keep and engage talented executives responsible for the success of Polycom. Our executive compensation program emphasizes paying for performance and requiring achievement of financial and strategic objectives while taking into account individual performance. Our program’s objectives:

| • | Offer a total compensation program that considers the compensation practices of our peer companies to recruit and retain top executive talent; |

| • | Motivate executive officers to achieve quantitative financial goals by linking the achievement of these goals with compensation in a direct and meaningful way; |

| • | Provide short-term cash incentives that take into account our overall financial performance relative to corporate objectives and individual contributions by executives; and |

| • | Align the financial interests of executive officers with those of our stockholders by providing significant long-term, equity-based incentives while carefully considering both stockholder dilution and compensation expense. |

These objectives function as a guide in setting our executive officers’ compensation and in assessing the appropriate balance between different elements of compensation. For 2015, rather than using pre-established policies or formulas to allocate compensation among various elements, we targeted the median (50th percentile) for TDC relative to selected peer companies, as described in more detail below.

Role and Authority of Our Compensation Committee

Our Compensation Committee currently consists of directors Robert J. Frankenberg (Chair), Martha H. Bejar and John A. Kelley. Betsy Atkins served on our Compensation Committee until she resigned from the Board effective April 15, 2016. Mr. Frankenberg served on the Compensation Committee during all of 2015 and was appointed Chair in February 2016. Mr. Kelley was appointed to the Compensation Committee in March 2015 and Ms. Bejar was appointed in February 2016. Prior to Mr. Frankenberg’s appointment as Chair, Ms. Atkins served as Chair in 2015 through February 2016. Each Compensation Committee member qualified during his or her service on the Compensation Committee in 2015 and/or 2016, as applicable, as (i) an “independent director” under the requirements of The NASDAQ Stock Market LLC, (ii) a “non-employee director” under Rule 16b-3 of the Securities Exchange Act of 1934, and (iii) an “outside director” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

16

Table of Contents

The Compensation Committee oversees our compensation policies, plans and benefit programs. It has the final decision-making authority with respect to the compensation of our executive officers, including the NEOs, other than for the CEO, whose compensation is recommended by the Compensation Committee but determined by the independent members of the full Board. As administrator of the equity compensation plan, the Compensation Committee certifies the results of all performance share awards, including those for the CEO. In carrying out its responsibilities, the Compensation Committee engages outside consultants and consults with Polycom’s Human Resources department. The Compensation Committee also may obtain advice and assistance from internal or external legal, accounting or other advisers and may delegate certain responsibilities to one or more of its members or Polycom’s directors or to management. For example, the Compensation Committee has authorized management to create country-specific rules to enable administration of equity awards in compliance with the laws of the jurisdictions in which such awards may be granted.

Role of Executive Officers in Compensation Decisions

The Compensation Committee regularly meets with our CEO to obtain recommendations regarding the compensation of the other NEOs and employees. Typically, our CEO annually reviews the performance of our other executive officers and shares his performance assessment with the Compensation Committee. Our CEO’s performance assessment of each executive officer generally addresses financial and non-financial objectives and the executive officer’s performance over a given year and his corresponding compensation recommendations. In establishing an executive officer’s actual compensation, the Compensation Committee may take into account the CEO’s performance assessment of the executive officer. However, the Compensation Committee is not bound by and does not always accept those recommendations. With respect to the CEO’s compensation, the Compensation Committee considers the factors described above, as well as corporate performance as a whole and competitive market data when reviewing and making recommendations to the independent members of the full Board. Once the targeted amounts for the CEO are set by the independent members of the Board, the CEO’s short-term cash incentive compensation and long-term performance-based equity incentives are determined solely on the achievement of corporate performance, subject to the terms of such plans as described below.

Our CEO and other executives, as requested by the Compensation Committee, attend Compensation Committee meetings, but they are excused from meetings when certain matters of executive compensation are discussed, as appropriate. The Compensation Committee and independent members of the full Board make decisions with respect to the CEO’s compensation package without the CEO present.

Role of Compensation Consultant

For 2015, the Compensation Committee engaged Radford to provide compensation consulting services. Radford serves at the discretion of the Compensation Committee. Radford provided the following services for 2015:

| • | Reviewed executive compensation relative to the market and our performance and assisted with recommendations relating to executive compensation, including recommendations for base salary, bonus targets and long-term, equity-based incentives for our NEOs and other executives; |

| • | Updated the Compensation Committee regarding executive compensation developments, including a comparison of our pay practices compared to the peer companies and the market in general; |

| • | Attended Compensation Committee meetings as requested; |

| • | Supported the company in preparation of filings with the Securities and Exchange Commission; |

| • | Provided such other assistance as the Compensation Committee or management requested, including reviewing our executive compensation philosophy, reviewing our practices of targeting various compensation components in relation to the market, and updating our peer group of companies used in analyzing our executive compensation program for the year; and |

| • | Reviewed non-employee director compensation and severance practices. |

17

Table of Contents

Peer Companies

The Compensation Committee compares and analyzes our executive officers’ compensation with those of its peer group of companies, consisting of two groups. First, a specified group of companies (the “Specified Peer Group”) is chosen based on both their respective businesses and business models and appropriate size with regard to revenues, market capitalization and number of employees (generally one-third to three times the size of Polycom to ensure that there is an appropriate fit in terms of size, number of employees and business similarity). Second, a broader set of companies’ data is compiled by Radford from companies in the Radford Global Technology Survey (the “Survey Data”). The Compensation Committee primarily uses Radford’s market information derived from a blend of the Specified Peer Group and the Survey Data (the “Peer Companies”) to assist it in setting executive compensation. However, the data presented to the Compensation Committee also typically includes separate market pay information compiled by Radford based on companies comprising the Specified Peer Group as well as composite information based on companies Radford selected from the Survey Data. The survey data is used to validate the data from the Specified Peer Group and to avoid having companies in the Specified Peer Group whose executive compensation widely differs from others in the Specified Peer Group (i.e., outliers) from unduly influencing the Compensation Committee’s decisions. Further, the Survey Data is useful in obtaining a broader understanding of the compensation levels being paid across a larger group of similarly-sized technology companies, as we compete with a broader group of companies than our Specified Peer Group in attracting and retaining executive talent. It should be noted that some of the Specified Peer Group companies are included in the Survey Data. The Compensation Committee did not review individual companies that Radford selected from the survey group.

In 2014, the Compensation Committee, with the assistance of Radford, reviewed our then-current Specified Peer Group as well as updated Survey Data to determine our 2015 Specified Peer Group. Based on our then-current market value, trailing twelve-month revenue and headcount and ranges recommended by Radford, the 2015 Specified Peer Group targeted communications equipment and software companies with revenues between approximately $460 million and $4.11 billion, market capitalization between approximately $570 million and $5.10 billion and employee headcount between slightly above 1,000 and slightly above 11,000. The table below sets forth our 2015 Specified Peer Group, which was used to aid the Compensation Committee in making compensation decisions during 2015:

| 2015 Specified Peer Group | ||||

| • Autodesk, Inc. |

• JDS Uniphase Corporation |

• Red Hat, Inc. | ||

| • Brocade Communications Systems, Inc. |

• Juniper Networks, Inc. |

• Riverbed Technology, Inc. | ||

| • Cadence Design Systems, Inc. |

• Logitech International S.A. |

• Synopsys, Inc. | ||

| • Citrix Systems, Inc. |

• Netgear, Inc. |

• TIBCO Software, Inc. | ||

| • F5 Networks, Inc. |

• Nuance Communications, Inc. |

• Trimble Navigation Limited | ||

| • Informatica Corporation |

• Plantronics, Inc. |

• VeriSign, Inc. | ||

For 2015, based on feedback through our stockholder outreach during the year, the Compensation Committee updated the Specified Peer Group to remove salesforce.com due to the size of its market capitalization and headcount, and NetApp, Inc. due to the size of its market capitalization, headcount and revenue, which was larger than the applicable criteria. In addition, the Compensation Committee decided to add Netgear, Inc., which fit within the applicable criteria. Although Juniper Networks, Inc. had a market capitalization and revenue larger than the targeted range, both management and the Compensation Committee believed that its continued inclusion in the Specified Peer Group for 2015 was appropriate because it is viewed as a competitor for talent. BMC Software, Inc. was removed from the 2015 Specified Peer Group after it became a private company.

18

Table of Contents

Components of Compensation

The principal components of our executive compensation program include:

| • Base salary |

• Termination and change-in-control arrangements | |

| • Short-term cash incentives |

• Retirement benefits provided under a 401(k) plan | |

| • Long-term, equity-based incentives |

• Executive perquisites and generally available benefit programs | |

We believe each of these components is necessary to help us attract and retain the executive talent on which our success depends. These components also allow us to reward performance throughout the year and to provide incentives that balance appropriately the executive’s focus between our short-term and long-term strategic goals. The Compensation Committee believes that this set of components is effective and will continue to be effective in achieving the objectives of our compensation program and philosophy.

Compensation Review Cycle

Typically, the Compensation Committee, with the assistance of Radford, initially reviews executive compensation market data for a particular fiscal year in the fourth quarter of the preceding year and approves each executive officers’ compensation (other than for the CEO, whose compensation is recommended by the Compensation Committee but determined by the independent members of the full Board) in the first quarter of that particular fiscal year. However, the Compensation Committee may review one or more components at any time as considered necessary or appropriate to ensure the components remain competitive and appropriately designed to reward performance. For CEO compensation, the Compensation Committee makes recommendations to the independent members of the Board. Each quarter, the Compensation Committee reviews our TSR performance progress and the corresponding projected payouts under the long-term, equity-based incentive programs.

Target Total Direct Compensation

For 2015, the Compensation Committee approved a change in philosophy to target the positioning of our executives’ TDC at the median of our Peer Companies within a competitive range (+/- 30%). The Compensation Committee believed that targeting the median for TDC was appropriate based on market analysis and to further align executive compensation with performance.

Tally Sheets

For 2015, the Compensation Committee reviewed compensation tally sheets that showed the total compensation package for each executive officer in the prior year. Tally sheets include base salary, short-term cash incentives, target total cash compensation (i.e., the sum of salary and target cash incentives), long-term, equity-based incentives, target TDC and market data for each of these compensation components, as well as information regarding an executive officer’s employee benefits and perquisites and estimates of severance or other benefits payable in the event of specified terminations of employment. The tally sheets provide target and maximum amounts for the prior year with respect to short-term cash incentives, long-term, equity-based incentives and any other applicable benefits. The purpose of the tally sheets is to provide the Compensation Committee with a comprehensive snapshot of each executive officer’s compensation based on the prior year’s compensation decisions to allow the Compensation Committee to make more informed compensation decisions for the current year.

Relevant Factors in Compensation Decisions

In setting the target compensation for a particular NEO, the Compensation Committee considers both individual and corporate performance as well as market data with respect to similarly situated individuals at the

19

Table of Contents

Peer Companies. Consequently, if there are differences in the amount or type of compensation paid among the NEOs, including the CEO, the differences primarily are due to a similar disparity among positions within the Peer Companies, as well as factors such as an NEO’s tenure, new hire incentives, experience, skills, knowledge, responsibilities and performance. These and other subjective factors may influence the Compensation Committee’s decision regarding the compensation level and package that is appropriate for a particular NEO. However, the weight given to these factors by the Compensation Committee cannot be quantified and is not determined under a formula.

Non-GAAP Measures

We use non-GAAP measures of operating results, which are adjusted to exclude certain costs, expenses, gains, and losses we believe appropriate to enhance an overall understanding of our past financial performance and also our prospects for the future. These adjustments are made with the intent of providing both management and investors a more complete understanding of our underlying operational results and trends and our marketplace performance. For example, the non-GAAP results are an indication of our baseline performance before gains, losses, or other charges that are considered by management to be outside of our core operating results. In addition, these adjusted non-GAAP results are among the primary indicators management uses as a basis for its planning and forecasting of future periods. As a result, the Compensation Committee also utilizes non-GAAP measures as a means for measuring and rewarding executive performance, as appropriate. Our 2015 non-GAAP operating income, which was used as one of the measures to evaluate short-term cash incentives, excluded stock-based compensation expense, the effect of stock-based compensation expense on warranty rates, amortization of purchased intangibles, restructuring costs, transaction-related expenses, and costs associated with our former CEO separation and related SEC investigation.

2015 Target Total Direct Compensation

In setting 2015 compensation, the Compensation Committee targeted the median of our Peer Companies for TDC, subject to the consideration of the other relevant factors discussed above that may result in variances in target TDC from the intended positioning among the Peer Companies. The Compensation Committee believed that this positioning range for target TDC was also appropriate considering, in part, that the level of corporate performance achievement required to pay short-term cash incentives at target levels is intentionally challenging, as discussed in more detail below.

In the first half of 2015, when the Compensation Committee determined 2015 TDC for our NEOs, all such NEOs were within the targeted range of the median for target TDC of our Peer Companies.

Base Salary

Our NEOs and other employees receive a base salary to compensate them for services rendered on a day-to-day basis. Increases generally are awarded within the context of our overall annual merit increase budget before considering more specific individual and market competitive factors. The Compensation Committee does not apply specific formulas to determine adjustments.

In 2015, the Compensation Committee did not increase base salaries for our executive officers. This decision aligned with management’s decision toward making significant investments in a number of areas that supported our long-term plan and strategy, including bringing new solutions to market. Because the majority of employees did not receive a base salary increase in 2015, management requested, and the Compensation Committee agreed, that the NEOs be treated consistently with the rest of the workforce.

20

Table of Contents

The following table shows each NEO’s base salary levels at the end of fiscal year 2014 as well as for all of fiscal year 2015:

| Named Executive Officer |

Annual Base Salary as of December 31, 2014 ($) |

Annual Base Salary for 2015 ($) |

Increase (%) | |||||||||

| Peter A. Leav |

700,000 | 700,000 | — | |||||||||

| Laura J. Durr |

440,000 | 440,000 | — | |||||||||

| Sayed M. Darwish |

438,576 | 438,576 | — | |||||||||

| Michael J. Frendo |

350,000 | 350,000 | — | |||||||||

Short-Term Cash Incentives

2015 Short-Term Cash Incentives

To focus each executive officer on the importance of achieving our goals, typically a substantial portion of the officer’s potential annual compensation is set in the form of short-term cash incentive compensation tied to achievement of those goals. We maintain the Performance Bonus Plan, which is administered by the Compensation Committee and under which our NEOs may participate and be eligible to receive bonuses. However, as noted above, the CEO’s compensation, including short-term cash incentive compensation, is recommended by the Compensation Committee then determined by the independent members of our Board.

Performance Bonus Plan. Our Performance Bonus Plan is intended to focus our executive officers on executing on our annual operating plan and maximizing our delivery of rewards to its stockholders and employees. The Performance Bonus Plan is intended to permit the payment of bonus awards that qualify as performance-based compensation under Section 162(m) of the Code. Under the Performance Bonus Plan, bonuses become payable only if the performance goals set by the Compensation Committee at the beginning of the applicable performance period are achieved. In setting the performance goals, the Compensation Committee assesses the anticipated difficulty and relative importance to the success of Polycom of achieving the performance goals. Accordingly, the actual awards (if any) payable for any given year will vary depending on the extent to which actual performance meets, exceeds or falls short of the goals approved by the Compensation Committee. The Compensation Committee has the discretion to determine whether a bonus will be paid in the event an executive terminates employment before the bonus is scheduled to be paid. In addition, the Compensation Committee only has the discretion to decrease (not increase) the bonuses that otherwise would be paid under the Performance Bonus Plan based on actual performance against the specified goals.

For 2015, the Compensation Committee approved two, six-month performance periods under the Performance Bonus Plan, one beginning on January 1, 2015 and the other on July 1, 2015. There were two financial performance goals under the Performance Bonus Plan for each performance period—revenue and non-GAAP operating income—which were measured against corresponding target amounts established in conjunction with our 2015 annual operating plan. These comparisons yielded an achievement percentage for each of the applicable performance goals, which were then further compared to a pre-determined matrix that yielded a percentage to be applied to each participating NEO’s target bonus amount. We believe that our revenue and non-GAAP operating income are important financial metrics that best reflect our performance as a company. They serve as appropriate measurements for the Performance Bonus Plan since they are commonly used by financial analysts as key performance metrics to evaluate companies such as ours and drive stockholder value. The Compensation Committee, in consultation with Radford, approved the performance goals, which were the same metrics that applied to 2014 bonuses, in order to motivate and align the NEOs to meet these company-wide objectives.

Each participating NEO’s target bonus amount was allocated equally between the two performance periods. The Compensation Committee believed that a semi-annual bonus plan would provide incentives that drive

21

Table of Contents

achievement of the fiscal 2015 annual operating plan, but also would maintain flexibility to set performance goals for the second half of the year based on the market conditions at that time if necessary and appropriate. Our competitive landscape evolved throughout 2015 and has been shaped by a number of significant forces, including the global macroeconomic environment, customers reevaluating their overall UC information technology (IT) strategies, and the market’s continued move to cloud and software-based solutions. We believe our competitive landscape will continue to change rapidly. Given the need to adjust quickly to the markets in which we compete, the Compensation Committee believes that having a semi-annual bonus plan more accurately reflects our business dynamics, while allowing for a plan that is challenging but achievable. There were no adjustments to our 2015 annual operating plan goals for the second half of the year. This semi-annual plan design was intended to ensure that the goals remained challenging but achievable with significant effort and taking into account market practices. The potential award that each participating NEO could receive under the Performance Bonus Plan for fiscal 2015 ranged from 0% to 200% of target (as noted above, the maximum potential award was reduced from 250% of target for 2014 to 200% of target for 2015). No bonus is payable if a minimum of 80% of achievement of each applicable performance goal was not met. At 80% achievement of each applicable performance goal, a maximum potential award of 50% of target is attainable. Achievement of 100% of each applicable performance goal results in a maximum potential award of 100% of target. In order to attain the maximum 200% of target, 125% of each applicable performance goal would need to be achieved, which we consider unlikely even with significant effort.

Target Bonuses. For fiscal 2015, the Compensation Committee determined that the target short-term cash incentive percentages for our NEOs were competitive and, therefore, maintained the same target percentages as in the previous year.

Actual Bonuses. The actual award (if any) payable for 2015 depended on the extent that actual performance met, exceeded or fell short of the pre-approved performance goals. On an annualized basis, bonuses were funded at approximately 82% of the NEOs’ respective targeted amounts. For the first half-year of 2015, we achieved the company-wide revenue objective under our annual operating plan at 96% of target and the company-wide non-GAAP operating income objective under our annual operating plan at 103% of target. As a result, bonuses were paid to the NEOs under the Performance Bonus Plan at 98.7% of each of his or her respective first-half year target amount. For the second half of 2015, we achieved the company-wide revenue objective under our annual operating plan at 87% of target and the company-wide non-GAAP operating income objective under our annual operating plan at 85% of target. This resulted in bonuses paid under the Performance Bonus Plan to the NEOs for the second half-year performance period during 2015 equal to 65% of each of his or her respective second-half year target amount.

The following table describes actual awards paid to our NEOs under the Performance Bonus Plan, for all of 2015 based on the achievement levels of the performance goals over the two, six-month performance periods:

| Named Executive Officer |

2015 Target Award as Percentage of Earned Base Salary (%) |

2015 Target Award Amount Based on Base Salary ($) (1) |

2015 Actual Award Amount ($) |

2015 Actual Award as Percentage of Target Award (%) |

||||||||||||

| Peter A. Leav |

125 | 875,000 | 716,188 | 82 | ||||||||||||

| Laura J. Durr |

80 | 352,000 | 288,112 | 82 | ||||||||||||

| Sayed M. Darwish |

75 | 328,932 | 269,231 | 82 | ||||||||||||

| Michael J. Frendo |

75 | 262,500 | 214,857 | 82 | ||||||||||||

| (1) | The 2015 target bonus amount is calculated as the sum of the target bonus amounts for the two, six-month performance periods. The target bonus amount for each performance period is based on the participating NEO’s actual salary earned during the period and the applicable target bonus as a percent of base salary. |

Difficulty in Achieving Performance Targets under the Performance Bonus Plan for 2015. Achievement of the performance goals under the Performance Bonus Plan was measured against targets set forth in our 2015

22

Table of Contents

annual operating plan, which was developed by management. The annual operating plan was developed based on a rigorous process set by management to ensure that the competitive landscape in which the company competes, market dynamics and market growth rates, as applicable, were considered. Consideration was also given to historical trends and anticipated future trends and incorporated the views of key business leaders, including each geographic theater head and solutions management. For 2015, specific emphasis was placed on developing an annual operating plan that would result in improved operating performance and continue the focus on operating margin improvement similar to 2014. The annual operating plan was designed to drive profitable growth with an optimized cost structure, yet still enable investment in key areas. Accordingly, the plan was intentionally challenging and expected to be achieved by management and Polycom as a whole only with significant effort and skill. The Board reviewed and evaluated the metrics and the process by which management developed the annual operating plan before ultimately approving of the plan. As the performance goals and target levels set by the Compensation Committee are based on our annual operating plan, the difficulty in achieving the performance goals at the target levels reflects the inherent difficulty in achieving the goals and objectives set forth in the annual operating plan. Achievement of a maximum payout requires substantial efforts by the executive officer and very high levels of company performance.

The following table sets forth prior year payouts of cash incentive compensation received by our NEOs (at such time) under the Performance Bonus Plan (or other applicable plan under which the then-NEOs participated in certain years, but all NEOs participated in the Performance Bonus Plan in 2015), as a percentage of their target bonus amount based upon actual earnings:

| Fiscal Year |

Range of Cash Incentive Payouts | |

| 2011 |

96% | |

| 2012 |

39% | |

| 2013 |

73%-86% | |

| 2014 |

92%-102% | |

| 2015 |

82% |

Long-Term, Equity-Based Incentives

The goal of our long-term, equity-based incentive program is to align the interests of executive officers with our stockholders. The Compensation Committee determines the size of long-term, equity-based incentives based on competitive market data, individual performance and the value of unvested equity awards already held by each individual, comparable awards made to individuals in similar positions at the Peer Companies and equity plan management.

Equity Award Practices

Equity-based awards are granted to our employees, including executive officers, under our equity plans and are “value-based,” which means the number of shares granted are determined based on the intended dollar value to be delivered to plan participants (to provide market competitive grants) and company stock price. All equity awards are approved by the Compensation Committee on the grant date, and all option grants (as applicable) have a per share exercise price equal to the fair market value of our common stock on the grant date. The Compensation Committee has not delegated authority to grant stock options or other equity awards under the 2011 Equity Incentive Plan; therefore, the authority to grant equity awards currently resides solely with the Compensation Committee and, in the case of the CEO, the independent members of the full Board.

The Compensation Committee historically has not had, and does not intend to establish, any program, plan or practice of timing the grant of equity awards to executive officers in coordination with the release of material non-public information that is likely to result in either an increase or decrease in the price of our common stock. In addition, to the extent our stock price immediately increases following the grant of equity awards, recipients will not realize the full value of such increase given that full value equity awards typically vest over a three-year

23

Table of Contents

period (with the use of one- and two-year awards as deemed appropriate in certain instances), and options typically vest over a four-year period (with the use of two-year awards as deemed appropriate in certain instances).

2015 Equity Awards

Annual Equity Awards. For 2015 annual equity award grants, the Compensation Committee, with the assistance of Radford, reviewed our long-term, equity-based incentive program including the competitive position of the outstanding equity positions held by our NEOs in February 2015. The Compensation Committee also reviewed the competitive data of our Peer Companies, including the value of options and other equity awards granted to executives of our Peer Companies and their retention values, and the dilutive effect of the awards on both an individual basis and with respect to the company’s executives as a group. The Compensation Committee considered Mr. Leav’s equity award recommendations for the executive officers, other than himself. After considering the recommendations made by Mr. Leav, as well as retention objectives, target TDC, the competitiveness of the individual’s compensation relative to the market, 2014 individual performance and expected future contributions and observations on the market by Radford, the Compensation Committee approved the following annual equity grants in February 2015 to the NEOs (other than for Mr. Leav, whose award was recommended by the Compensation Committee and approved by the independent members of the full Board) listed below (to view all grants made in 2015 on one table, please refer to our “Grants of Plan-Based Awards in 2015” table):

| Named Executive Officer |

2015 RSUs (#) |

Target 2015 Performance Shares (#) |

2015 RSUs and Target Performance Share Values ($)(1) |

|||||||||

| Peter A. Leav |

231,790 | 231,790 | 6,156,342 | |||||||||

| Laura J. Durr |

55,000 | 55,000 | 1,460,800 | |||||||||

| Sayed M. Darwish |

42,500 | 42,500 | 1,128,800 | |||||||||

| Michael J. Frendo |

55,000 | 55,000 | 1,460,800 | |||||||||

| (1) | The stock price used to determine the number of shares to be granted under the annual equity awards was $13.2775 per share, based on the trailing 20-day average from January 16, 2015. On February 27, 2015, the effective date of the NEOs’ performance share awards and RSU grants, the fair market value (or closing trading price) of our common stock on NASDAQ was $13.82. |

In 2015, we granted a mix of 50% performance shares and 50% time-based RSUs to our NEOs. The Compensation Committee believes that this mix of equity awards appropriately balances our objectives of aligning the NEOs’ long-term interests with those of our stockholders: (i) emphasizing pay for performance by requiring a substantial portion of the awards to be earned only upon achievement of company performance goals, (ii) providing incentive to remain with us through vesting criteria that span multiple years, and (iii) granting full value awards that retain some level of value notwithstanding negative fluctuations in our stock price, all while being mindful of stockholder dilution and compensation expense.