Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PILGRIMS PRIDE CORP | a2016_q1coverforslides.htm |

Pilgrim’s Pride Corporation Financial Results for First Quarter Ended March 27, 2016

Statements contained in this presentation that share our intentions, beliefs, expectations or predictions for the future, denoted by the words “anticipate,” “believe,” “estimate,” “should,” “expect,” “project,” “plan,” “imply,” “intend,” “foresee” and similar expressions, are forward-looking statements that reflect our current views about future events and are subject to risks, uncertainties and assumptions. Such risks, uncertainties and assumptions include the following matters affecting the chicken industry generally, including fluctuations in the commodity prices of feed ingredients and chicken; actions and decisions of our creditors; our ability to obtain and maintain commercially reasonable terms with vendors and service providers; our ability to maintain contracts that are critical to our operations; our ability to retain management and other key individuals; certain of our reorganization and exit or disposal activities, including selling assets, idling facilities, reducing production and reducing workforce, resulted in reduced capacities and sales volumes and may have a disproportionate impact on our income relative to the cost savings; risk that the amounts of cash from operations together with amounts available under our exit credit facility will not be sufficient to fund our operations; management of our cash resources, particularly in light of our substantial leverage; restrictions imposed by, and as a result of, our substantial leverage; additional outbreaks of avian influenza or other diseases, either in our own flocks or elsewhere, affecting our ability to conduct our operations and/or demand for our poultry products; contamination of our products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; changes in laws or regulations affecting our operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause our costs of business to increase, cause us to change the way in which we do business or otherwise disrupt our operations; competitive factors and pricing pressures or the loss of one or more of our largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels; and the impact of uncertainties of litigation as well as other risks described herein and under “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”). Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations. “EBITDA” is defined as net income (loss) plus interest, income taxes, depreciation and amortization. “Adjusted EBITDA” is defined as the sum of EBITDA plus restructuring charges, reorganization items and loss on early extinguishment of debt less net income attributable to noncontrolling interests. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements. EBITDA is presented because we believe it provides meaningful additional information concerning a company’s operating results and its ability to service long-term debt and to fund its growth, and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results under U.S. Generally Accepted Accounting Principles (GAAP), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company's financial results calculated in accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under GAAP and should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with GAAP. Cautionary Notes and Forward-Looking Statements 2

Egg Sets Up Slightly YTD vs 2015 Source: USDA 3 211,832.0 190,260.0 207,152.0 210,279.0 209,274.0 180,000 185,000 190,000 195,000 200,000 205,000 210,000 215,000 1/ 9 1/ 23 2/ 6 2/ 20 3/ 5 3/ 19 4/ 2 4/ 16 4/ 30 5/ 14 5/ 28 6/ 11 6/ 25 7/ 9 7/ 23 8/ 6 8/ 20 9/ 3 9/ 17 10 /1 10 /1 5 10 /2 9 11 /1 2 11 /2 6 12 /1 0 12 /2 4 Th ou sa nd Eg g United States, Selected 19 Poultry Chicken, broiler Sets '11-'15 Range '14 '15 '16 '16 Est '11-'15 Avg

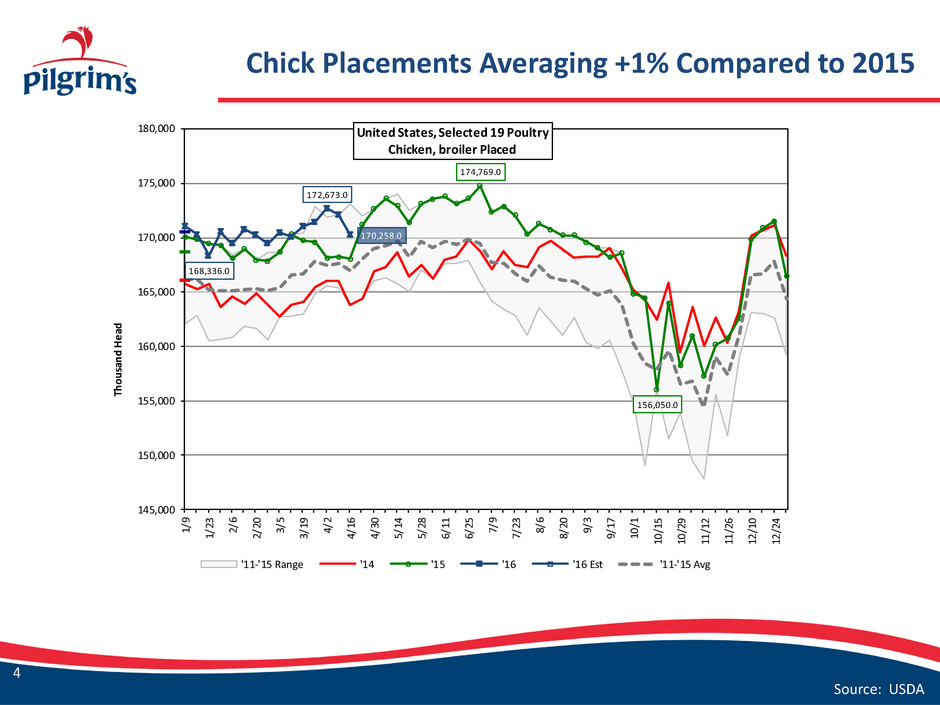

Chick Placements Averaging +1% Compared to 2015 Source: USDA 4 174,769.0 156,050.0 168,336.0 172,673.0 170,258.0 145,000 150,000 155,000 160,000 165,000 170,000 175,000 180,000 1/ 9 1/ 23 2/ 6 2/ 20 3/ 5 3/ 19 4/ 2 4/ 16 4/ 30 5/ 14 5/ 28 6/ 11 6/ 25 7/ 9 7/ 23 8/ 6 8/ 20 9/ 3 9/ 17 10 /1 10 /1 5 10 /2 9 11 /1 2 11 /2 6 12 /1 0 12 /2 4 Th ou sa nd H ea d United States, Selected 19 Poultry Chicken, broiler Placed '11-'15 Range '14 '15 '16 '16 Est '11-'15 Avg

Jumbo Bird Continues to Gain Market Share Source: USDA 5

Hatching layers in March were up 1% from 2015. Monthly pullet placements are volatile and less reflective of flock growth. Hatching Layers at Moderate Growth Source: USDA 6

Cold Storage Beginning to Decline Source: USDA Overall inventories higher than 2015 but leg quarters are a lot lower. Total chicken starting to decline month to month. 7

Cutout Values Improving and Contract Still at Strong Levels Source: PPC 8

Cutout Value Improving Due to Leg Quarters and Tenders Source: USDA 9

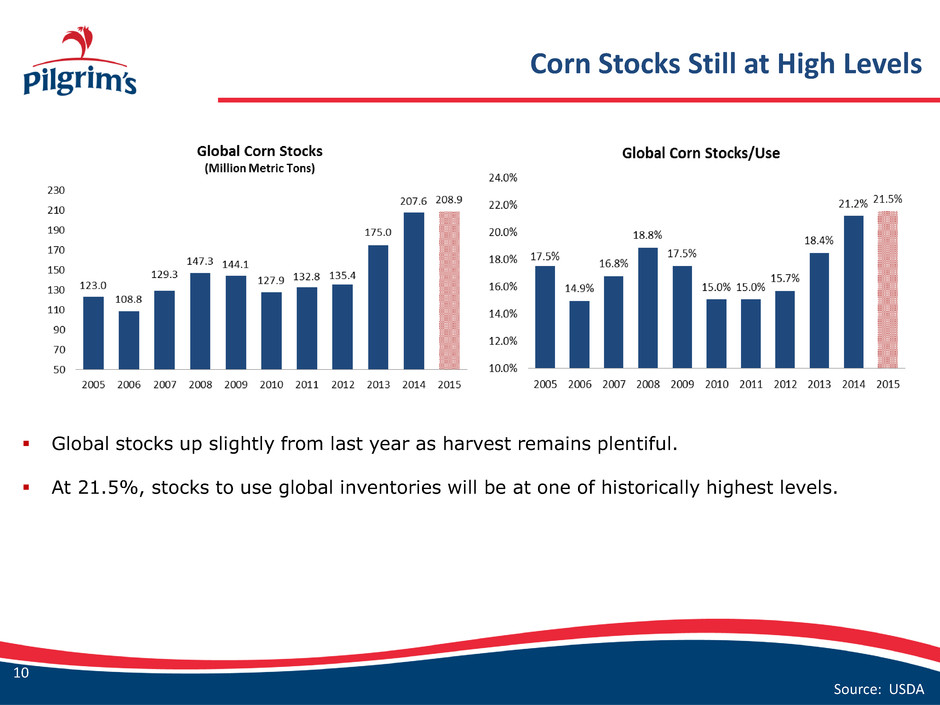

Corn Stocks Still at High Levels Global stocks up slightly from last year as harvest remains plentiful. At 21.5%, stocks to use global inventories will be at one of historically highest levels. Source: USDA 10

Global Soybean Inventories Expanding Record crops in US, Brazil and Argentina all contributing to record global stocks for oilseeds. Stocks/Use globally remains at high levels. Source: USDA 11

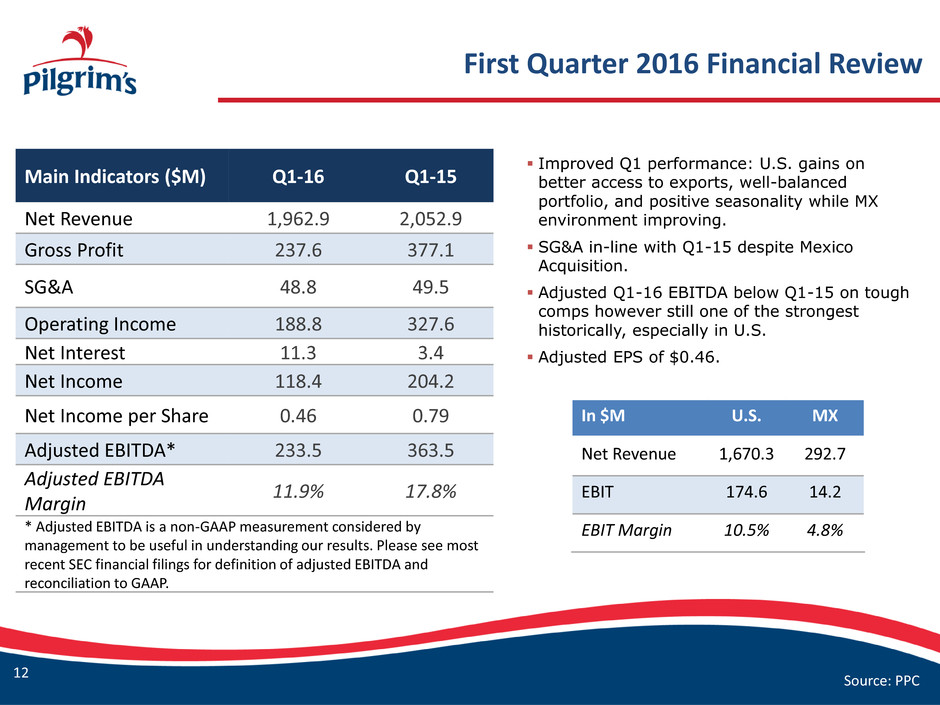

First Quarter 2016 Financial Review Improved Q1 performance: U.S. gains on better access to exports, well-balanced portfolio, and positive seasonality while MX environment improving. SG&A in-line with Q1-15 despite Mexico Acquisition. Adjusted Q1-16 EBITDA below Q1-15 on tough comps however still one of the strongest historically, especially in U.S. Adjusted EPS of $0.46. Main Indicators ($M) Q1-16 Q1-15 Net Revenue 1,962.9 2,052.9 Gross Profit 237.6 377.1 SG&A 48.8 49.5 Operating Income 188.8 327.6 Net Interest 11.3 3.4 Net Income 118.4 204.2 Net Income per Share 0.46 0.79 Adjusted EBITDA* 233.5 363.5 Adjusted EBITDA Margin 11.9% 17.8% * Adjusted EBITDA is a non-GAAP measurement considered by management to be useful in understanding our results. Please see most recent SEC financial filings for definition of adjusted EBITDA and reconciliation to GAAP. In $M U.S. MX Net Revenue 1,670.3 292.7 EBIT 174.6 14.2 EBIT Margin 10.5% 4.8% 12 Source: PPC

Net Debt Remains Low Source: PPC Free Cash Flow generation of $141MM in the quarter. Net debt multiple remains low at 0.40x LTM EBITDA. 13 307.1

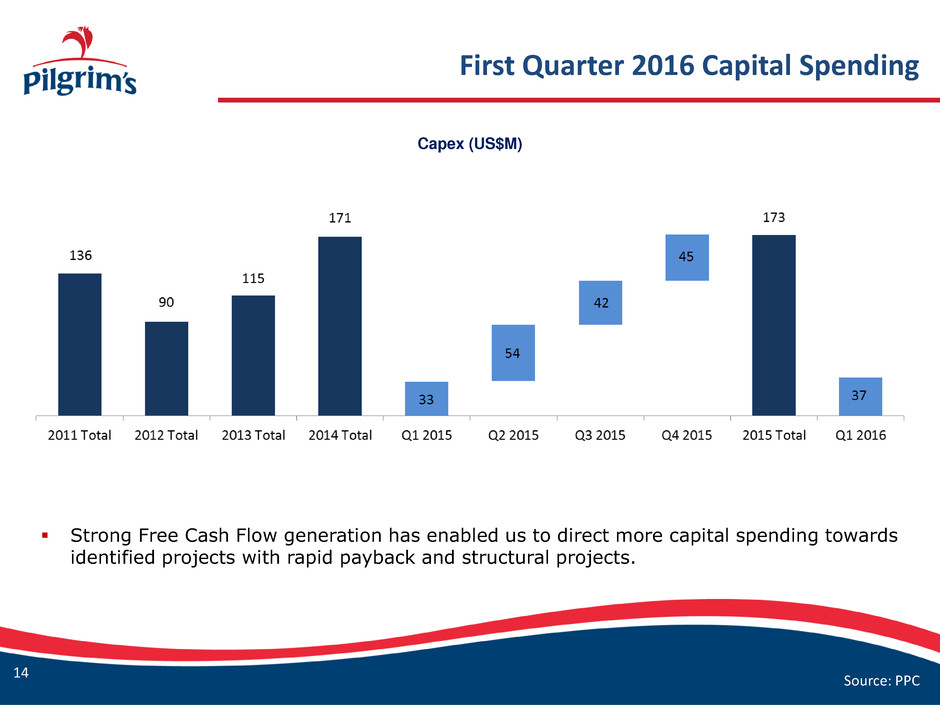

First Quarter 2016 Capital Spending Capex (US$M) Source: PPC Strong Free Cash Flow generation has enabled us to direct more capital spending towards identified projects with rapid payback and structural projects. 14

Investor Relations Contact Investor Relations: Dunham Winoto Director, Investor Relations E-mail: IRPPC@pilgrims.com Address: 1770 Promontory Circle Greeley, CO 80634 USA Website: www.pilgrims.com 15

Appendix: EBITDA Reconciliation “EBITDA” is defined as the sum of net income (loss) plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is calculated by adding to EBITDA certain items of expense and deducting from EBITDA certain items of income that we believe are not indicative of our ongoing operating performance consisting of: (i) income (loss) attributable to non-controlling interests, (ii) restructuring charges, (iii) reorganization items, (iv) losses on early extinguishment of debt and (v) foreign currency transaction losses (gains). EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the US (“GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under GAAP. They should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with GAAP. Source: PPC 16 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Thirteen Weeks Ended March 27, 2016 March 29, 2015 (In thousands) Net income $ 118,011 $ 204,193 Add: Interest expense, net 11,340 3,365 Income tax expense (benefit) 62,604 111,494 Depreciation and amortization 42,391 36,152 Minus: Amortization of capitalized financing costs 928 725 EBITDA 233,418 354,479 Add: Foreign currency transaction losses (gains) (235 ) 8,974 Restructuring charges — — Minus: Net income (loss) attributable to noncontrolling interest (360 ) (22 ) Adjusted EBITDA $ 233,543 $ 363,475

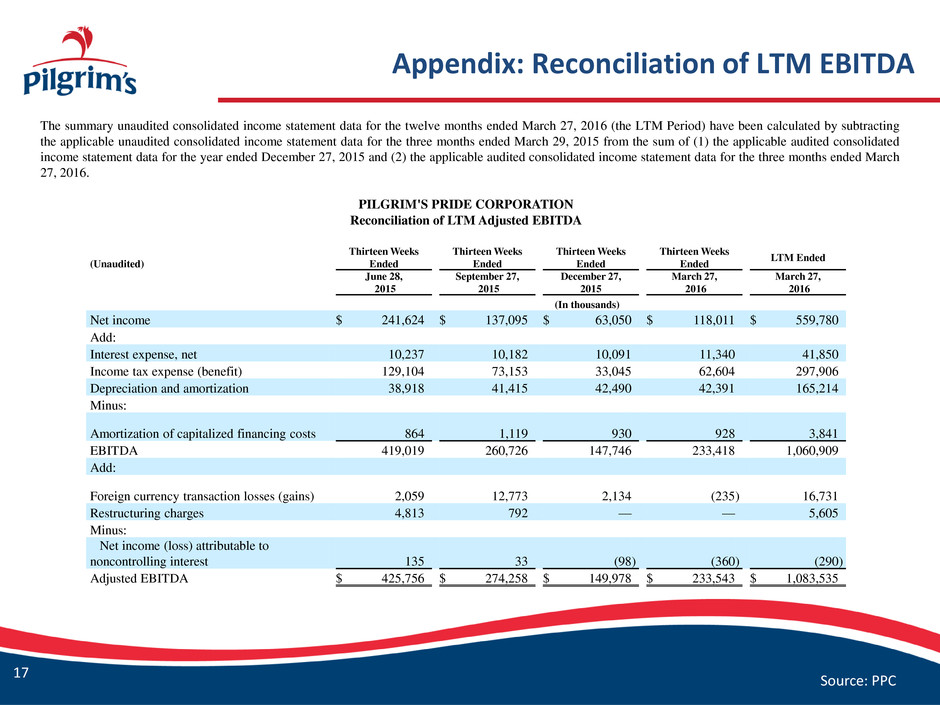

Appendix: Reconciliation of LTM EBITDA Source: PPC The summary unaudited consolidated income statement data for the twelve months ended March 27, 2016 (the LTM Period) have been calculated by subtracting the applicable unaudited consolidated income statement data for the three months ended March 29, 2015 from the sum of (1) the applicable audited consolidated income statement data for the year ended December 27, 2015 and (2) the applicable audited consolidated income statement data for the three months ended March 27, 2016. 17 PILGRIM'S PRIDE CORPORATION Reconciliation of LTM Adjusted EBITDA (Unaudited) Thirteen Weeks Ended Thirteen Weeks Ended Thirteen Weeks Ended Thirteen Weeks Ended LTM Ended June 28, 2015 September 27, 2015 December 27, 2015 March 27, 2016 March 27, 2016 (In thousands) Net income $ 241,624 $ 137,095 $ 63,050 $ 118,011 $ 559,780 Add: Interest expense, net 10,237 10,182 10,091 11,340 41,850 Income tax expense (benefit) 129,104 73,153 33,045 62,604 297,906 Depreciation and amortization 38,918 41,415 42,490 42,391 165,214 Minus: Amortization of capitalized financing costs 864 1,119 930 928 3,841 EBITDA 419,019 260,726 147,746 233,418 1,060,909 Add: Foreign currency transaction losses (gains) 2,059 12,773 2,134 (235 ) 16,731 Restructuring charges 4,813 792 — — 5,605 Minus: Net income (loss) attributable to noncontrolling interest 135 33 (98 ) (360 ) (290 ) Adjusted EBITDA $ 425,756 $ 274,258 $ 149,978 $ 233,543 $ 1,083,535

Appendix: Reconciliation of EBITDA Margin Source: PPC EBITDA margins have been calculated using by taking the unaudited EBITDA figures and income statement components, then dividing by Net Revenue for the applicable period. 18 PILGRIM'S PRIDE CORPORATION Reconciliation of EBITDA Margin (Unaudited) Thirteen Weeks Ended Thirteen Weeks Ended March 27, 2016 March 29, 2015 March 27, 2016 March 29, 2015 (In thousands) Net income from continuing operations $ 118,011 $ 204,193 6.01 % 9.95 % Add: Interest expense, net 11,340 3,365 0.58 % 0.16 % Income tax expense (benefit) 62,604 111,494 3.19 % 5.43 % Depreciation and amortization 42,391 36,152 2.16 % 1.76 % Minus: Amortization of capitalized financing costs 928 725 0.05 % 0.04 % EBITDA 233,418 354,479 11.89 % 17.27 % Add: Foreign currency transaction losses (gains) (235 ) 8,974 (0.01 )% 0.44 % Restructuring charges — — — % — % Minus: Net income (loss) attributable to noncontrolling interest (360 ) (22 ) (0.02 )% — % Adjusted EBITDA $ 233,543 $ 363,475 11.90 % 17.71 % Net Revenue: $ 1,962,937 $ 2,052,919 $ 1,962,937 $ 2,052,919

Appendix: Reconciliation of Adjusted Earnings Source: PPC A reconciliation of net income (loss) attributable to Pilgrim's Pride Corporation per common diluted share to adjusted net income (loss) attributable to Pilgrim's Pride Corporation per common diluted share is as follows: 19 PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Earnings (Unaudited) Thirteen Weeks Ended March 27, 2016 March 29, 2015 (In thousands, except per share data) Net income (loss) attributable to Pilgrim's Pride Corporation $ 118,371 $ 204,215 Loss on early extinguishment of debt — 68 Foreign currency transaction losses (gains) (235 ) 8,974 Income (loss) before loss on early extinguishment of debt and foreign currency transaction losses (gains) 118,136 213,257 Weighted average diluted shares of common stock outstanding 255,147 259,929 Income (loss) before loss on early extinguishment of debt and foreign currency transaction losses (gains) per common diluted share $ 0.46 $ 0.82

Appendix: Reconciliation of Adjusted EPS Source: PPC A reconciliation of GAAP earnings per share (EPS) to adjusted earnings per share (EPS) is as follows: 20 PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) Thirteen Weeks Ended March 27, 2016 March 29, 2015 (In thousands, except per share data) GAAP EPS $ 0.46 $ 0.79 Loss on early extinguishment of debt — — Foreign currency transaction losses (gains) — 0.03 Adjusted EPS $ 0.46 $ 0.82 Weighted average diluted shares of common stock outstanding 255,147 259,929

Appendix: Net Debt / Cash Position Reconciliation Source: PPC Net debt is defined as total long term debt less current maturities, plus current maturities of long term debt and notes payable, minus cash, cash equivalents and investments in available-for-sale securities. Net debt is presented because it is used by management, and we believe it is frequently used by securities analysts, investors and other parties, in addition to and not in lieu of debt as presented under GAAP, to compare the indebtedness of companies. A reconciliation of net debt is as follows: 21 PILGRIM'S PRIDE CORPORATION Reconciliation of Net Debt (Unaudited) Thirteen Weeks Ended December 29, 2013 December 28, 2014 December 27, 2015 March 29, 2015 March 27, 2016 (In thousands) Long term debt, less current maturities $ 501,999 $ 3,980 $ 985,509 $ 1,150,441 $ 986,400 Add: Current maturities of long term debt and notes payable 410,234 262 28,812 133 21,665 Minus: Cash and cash equivalents 508,206 576,143 439,638 478,037 574,888 Minus: Available-for-sale securities 96,902 — — — — Net debt (cash position) $ 307,125 $ (571,901 ) $ 574,683 $ 672,537 $ 433,177