Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - usell.com, Inc. | v438079_ex99-2.htm |

| 8-K - FORM 8-K - usell.com, Inc. | v438079_8k.htm |

Exhibit 99.1

www.uSell.com

Cautionary Note Regarding Forward Looking Statements Certain statements in this presentation and responses to various questions include forward - looking statements, including statements regarding growth, opportunities for our business model, potential increased gross margins and inventory turns and platform expansion . The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward - looking statements . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs . Important factors that could cause actual results to differ from those in the forward - looking statements include our ability to integrate We Sell Cellular with uSell . com and enhance the We Sell Cellular business with our technology, maintaining and establishing relationships with suppliers . Further information on our risk factors is contained in our filings with the SEC, including the Form 10 - K for the year ended December 31 , 2015 . Any forward - looking statement made by us herein speaks only as of the date on which it is made . Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them . We undertake no obligation to publicly update any forward - looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law . 2

3 Table of Contents Snapshot Who We Are The O pportunity Our Solution Potential Value Creation 1 3 5 2 4

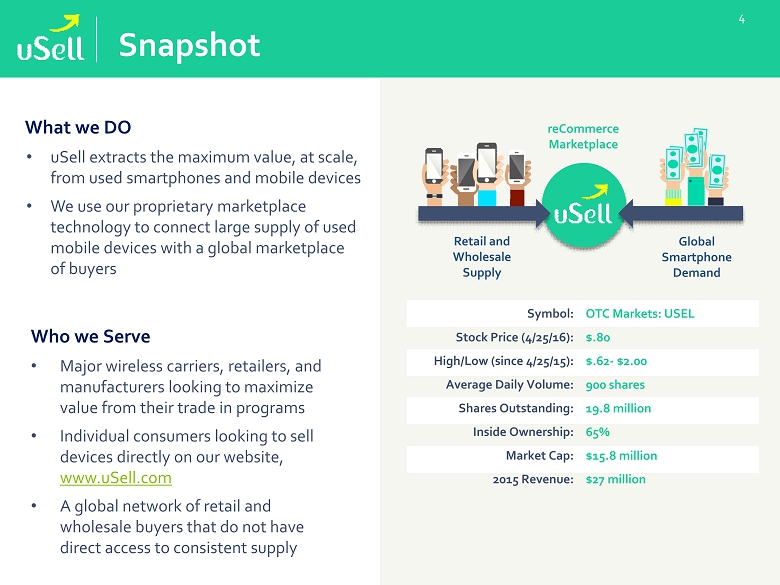

4 Snapshot What we DO • uSell extracts the maximum value, at scale, from used smartphones and mobile devices • We use our proprietary marketplace technology to connect large supply of used mobile devices with a global marketplace of buyers reCommerce Marketplace Retail and Wholesale Supply Global Smartphone Demand Who we Serve • Major wireless carriers, retailers, and manufacturers looking to maximize value from their trade in programs • Individual consumers looking to sell devices directly on our website, www.uSell.com • A global network of retail and wholesale buyers that do not have direct access to consistent supply Symbol: Stock Price (4/25/16): High/Low (since 4/25/15): Average Daily Volume: Shares Outstanding: Inside Ownership: Market Cap: 2015 Revenue: OTC Markets: USEL $.80 $.62 - $2.00 900 shares 19.8 million 65% $15.8 million $27 million

Nik Raman CEO Founder of uSell.com , a direct to consumer trade - in platform driving over 1 million users per month Brian Tepfer Executive Vice President Founder of We Sell Cellular, LLC , an R2 Certified, leading wholesaler and smartphone distributor Consumer Interface, Technology, Systems Wholesale logistics and distribution Who we a re With the acquisition of top smartphone wholesaler We Sell Cellular in 2015, uSell combines the technology behind its industry leading consumer trade in platform with over 14 years of reverse logistics and distribution expertise

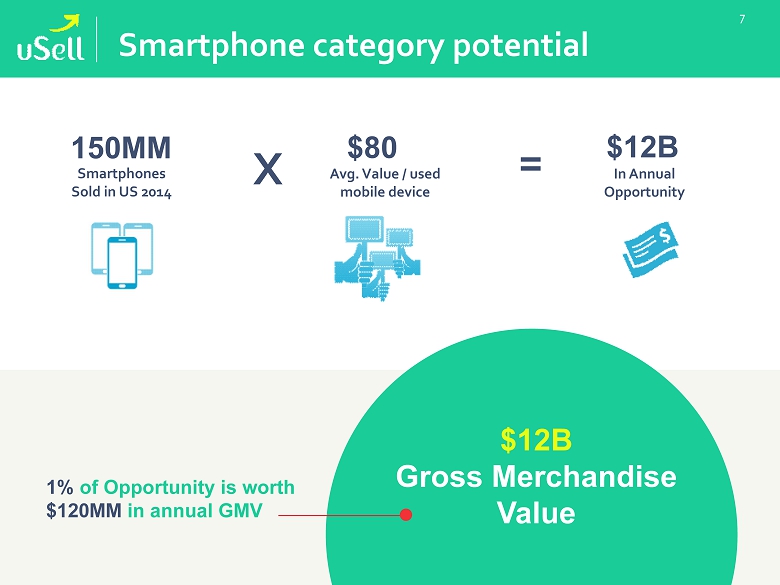

6 Key movements in the industry • Over the last 24 months, all the major wireless carriers have realized that trade - ins can be used to minimize the smartphones subsidies that they had been funding • Carriers are using equipment installment plans (EIPs) and handset leasing plans as a differentiator and key customer acquisition tactic. The model enables consumers to defer the cost of their devices and then trade in their phones at the time of upgrade, at which point the carrier can capture the residual value from these used devices • Between carriers and retailers, it is estimated that these programs have already achieved a 60 - 70% adoption rate. With approximately 150 million phones sold in the US in 2014, the number of used phones traded - in through these programs is set to increase exponentially • As a consequence, these companies are faced with the task of attempting to liquidate huge quantities of a depreciating asset in a profitable yet efficient manner

Smartphone category p otential 150MM Smartphones Sold in US 2014 X $80 Avg. Value / used mobile device = $12B In Annual Opportunity $12B Gross Merchandise Value 7 1 % of Opportunity is worth $ 120MM in annual GMV

8 • There is little to no technology enablement in the industry • The level of testing conducted on devices is often inconsistent and incomplete, thus resulting in poor quality control and lower sales prices • T he capital intensive nature of buying inventory forces them to focus on liquidating the asset as quickly as possible rather than extracting maximum value • There is an over - reliance on a handful of buyers who are able to buy large quantities rather than a diversified base of buyers offering top dollar for devices Our Competition We compete with a small group of wholesalers and logistics providers that purchase devices from major carriers, retailers, and manufactures. Most do not maximize value from devices because:

Our Differentiation • Historically, We Sell Cellular sold devices via traditional, over - the - phone sales, like most industry competitors • By integrating automated selling platforms, we will drive significant price competition By combining uSell’s technology with We Sell Cellular’s supply and warehousing expertise, we will drive more liquidity, resulting in increasing gross margins and inventory turns

10 We believe that by successfully using technology to increase gross margins and inventory turns, we will be able to maximize gross margin dollars while driving significant growth over time Potential Value Creation Gross Margin Percent 5% 7% 9% inventory 1.00 $20,000,000 $20,430,108 $20,879,121 turns 1.25 $25,000,000 $25,537,634 $26,098,901 per month 1.50 $30,000,000 $30,645,161 $31,318,681 Gross Margin Percent 5% 7% 9% inventory 1.00 $1,000,000 $1,430,108 $1,879,121 turns 1.25 $1,250,000 $1,787,634 $2,348,901 per month 1.50 $1,500,000 $2,145,161 $2,818,681 Quarterly Revenue Potential Quarterly Gross Margin Dollars Potential • Assumes average inventory remaining fixed at $ 6.3M (Q4 2015 was $6.25M), without giving effect to additional capital deployed • Gross margins and inventory turnover figures on the chart are within historical ranges • Improving inventory turns and gross margin percent in tandem creates exponential growth in gross margin dollars • uSell has achieved between 2 - 3 inventory turns per month using its automated bidding Platform for volume sourced through uSell.com *Note : Gross margin includes all variable expenses related to buying and selling handsets, including but not limited to the purcha se price of devices, warehouse personnel, shipping, cellular supplies, and fees paid to vendors for the acquisition of devices.