Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - APRIL 27, 2016 - MIDSOUTH BANCORP INC | mslq103312016er-8kex991.htm |

| 8-K - MIDSOUTH BANCORP FORM 8-K - MIDSOUTH BANCORP INC | form8-kxapril27.htm |

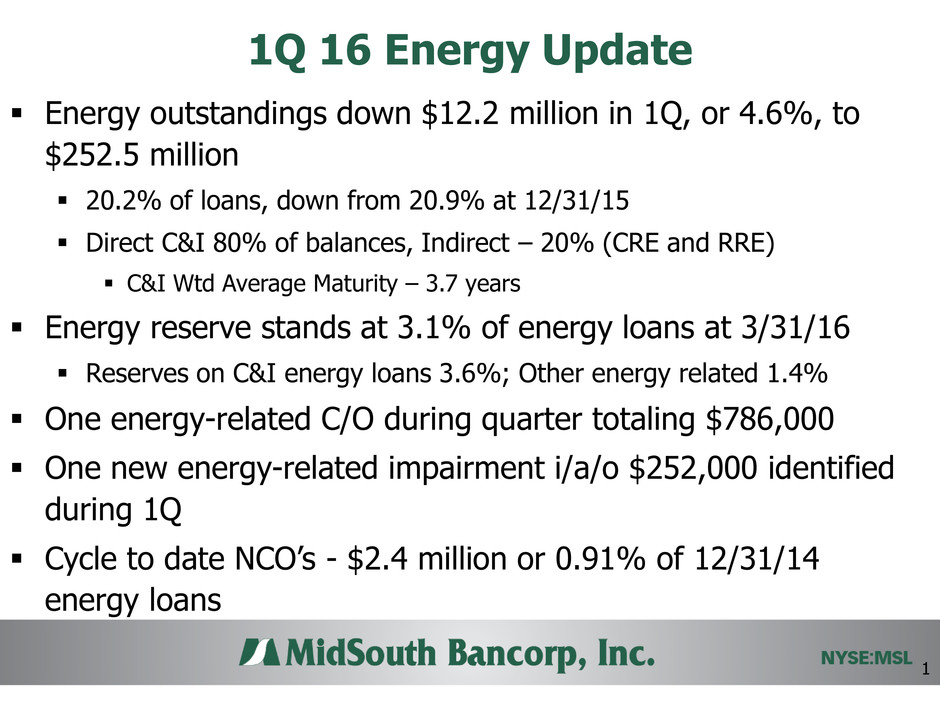

1Q 16 Energy Update Energy outstandings down $12.2 million in 1Q, or 4.6%, to $252.5 million 20.2% of loans, down from 20.9% at 12/31/15 Direct C&I 80% of balances, Indirect – 20% (CRE and RRE) C&I Wtd Average Maturity – 3.7 years Energy reserve stands at 3.1% of energy loans at 3/31/16 Reserves on C&I energy loans 3.6%; Other energy related 1.4% One energy-related C/O during quarter totaling $786,000 One new energy-related impairment i/a/o $252,000 identified during 1Q Cycle to date NCO’s - $2.4 million or 0.91% of 12/31/14 energy loans 1

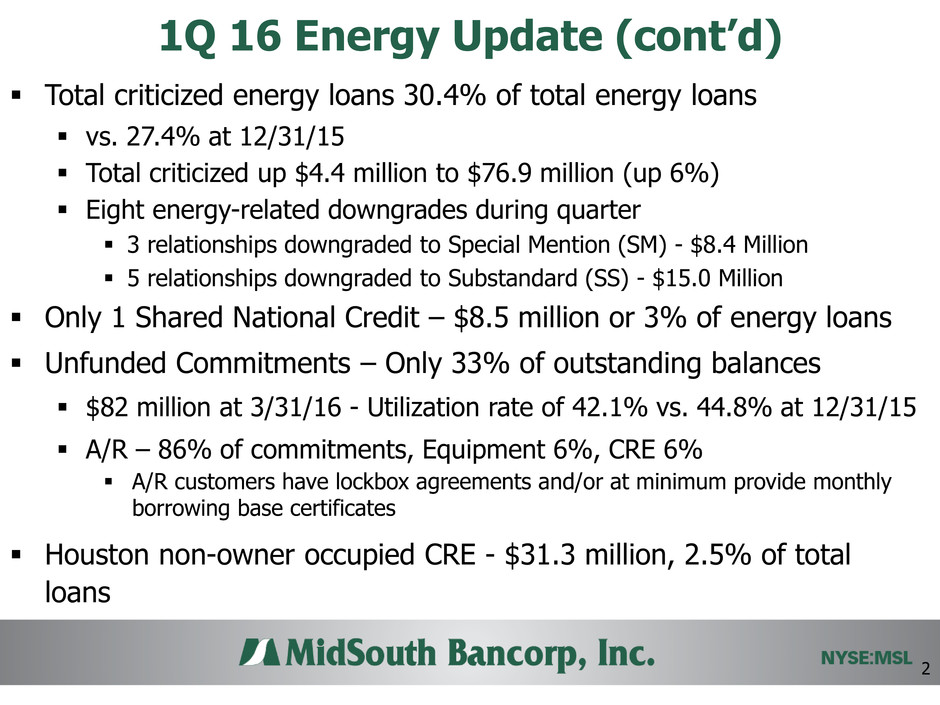

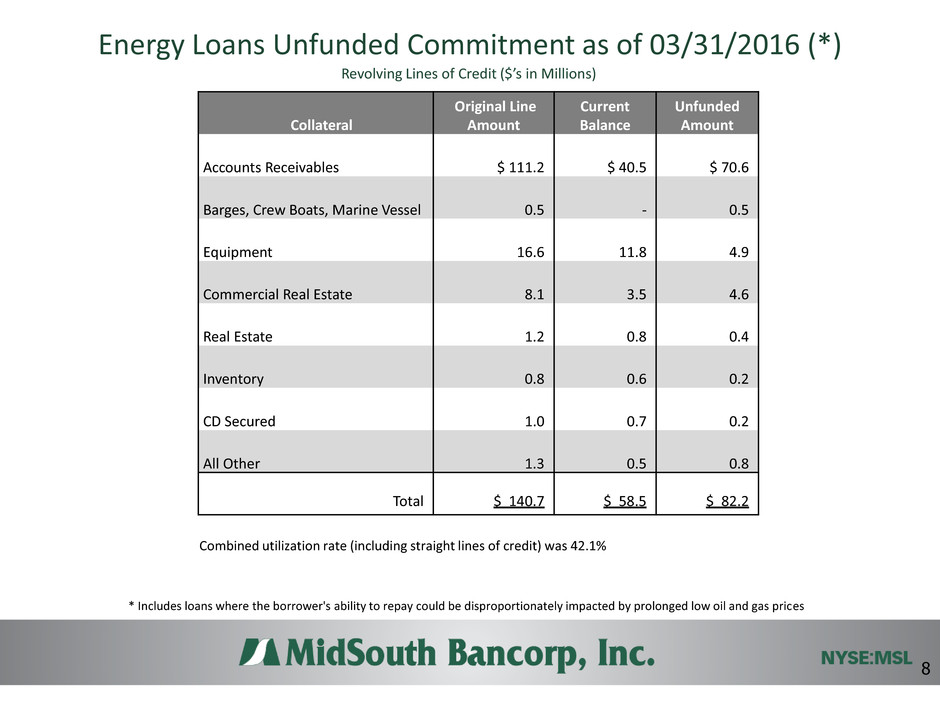

1Q 16 Energy Update (cont’d) Total criticized energy loans 30.4% of total energy loans vs. 27.4% at 12/31/15 Total criticized up $4.4 million to $76.9 million (up 6%) Eight energy-related downgrades during quarter 3 relationships downgraded to Special Mention (SM) - $8.4 Million 5 relationships downgraded to Substandard (SS) - $15.0 Million Only 1 Shared National Credit – $8.5 million or 3% of energy loans Unfunded Commitments – Only 33% of outstanding balances $82 million at 3/31/16 - Utilization rate of 42.1% vs. 44.8% at 12/31/15 A/R – 86% of commitments, Equipment 6%, CRE 6% A/R customers have lockbox agreements and/or at minimum provide monthly borrowing base certificates Houston non-owner occupied CRE - $31.3 million, 2.5% of total loans 2

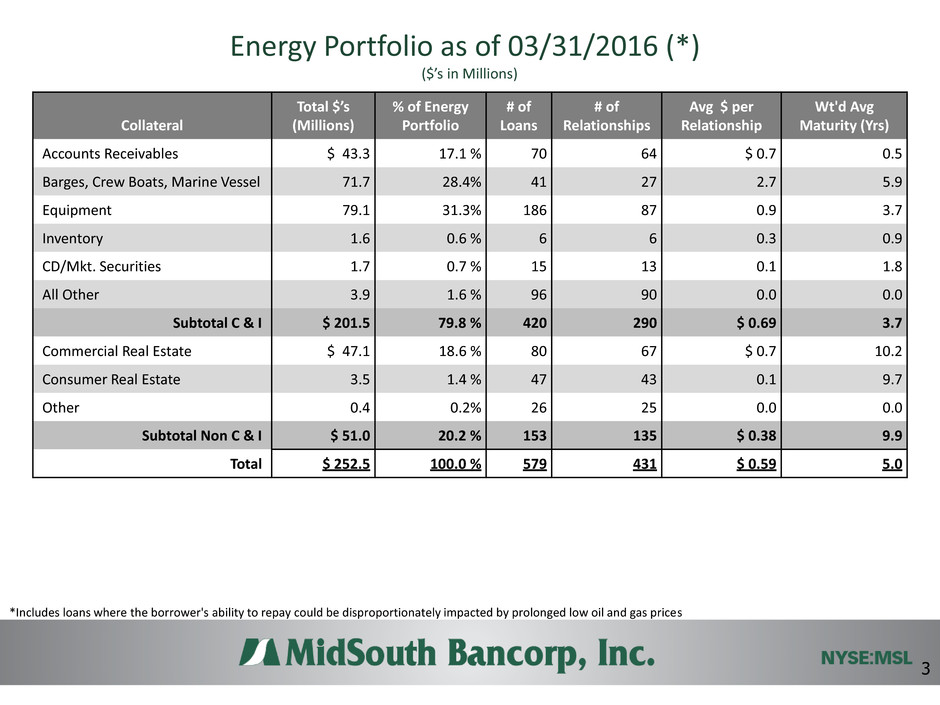

Energy Portfolio as of 03/31/2016 (*) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices Collateral Total $’s (Millions) % of Energy Portfolio # of Loans # of Relationships Avg $ per Relationship Wt'd Avg Maturity (Yrs) Accounts Receivables $ 43.3 17.1 % 70 64 $ 0.7 0.5 Barges, Crew Boats, Marine Vessel 71.7 28.4% 41 27 2.7 5.9 Equipment 79.1 31.3% 186 87 0.9 3.7 Inventory 1.6 0.6 % 6 6 0.3 0.9 CD/Mkt. Securities 1.7 0.7 % 15 13 0.1 1.8 All Other 3.9 1.6 % 96 90 0.0 0.0 Subtotal C & I $ 201.5 79.8 % 420 290 $ 0.69 3.7 Commercial Real Estate $ 47.1 18.6 % 80 67 $ 0.7 10.2 Consumer Real Estate 3.5 1.4 % 47 43 0.1 9.7 Other 0.4 0.2% 26 25 0.0 0.0 Subtotal Non C & I $ 51.0 20.2 % 153 135 $ 0.38 9.9 Total $ 252.5 100.0 % 579 431 $ 0.59 5.0 ($’s in Millions) 3

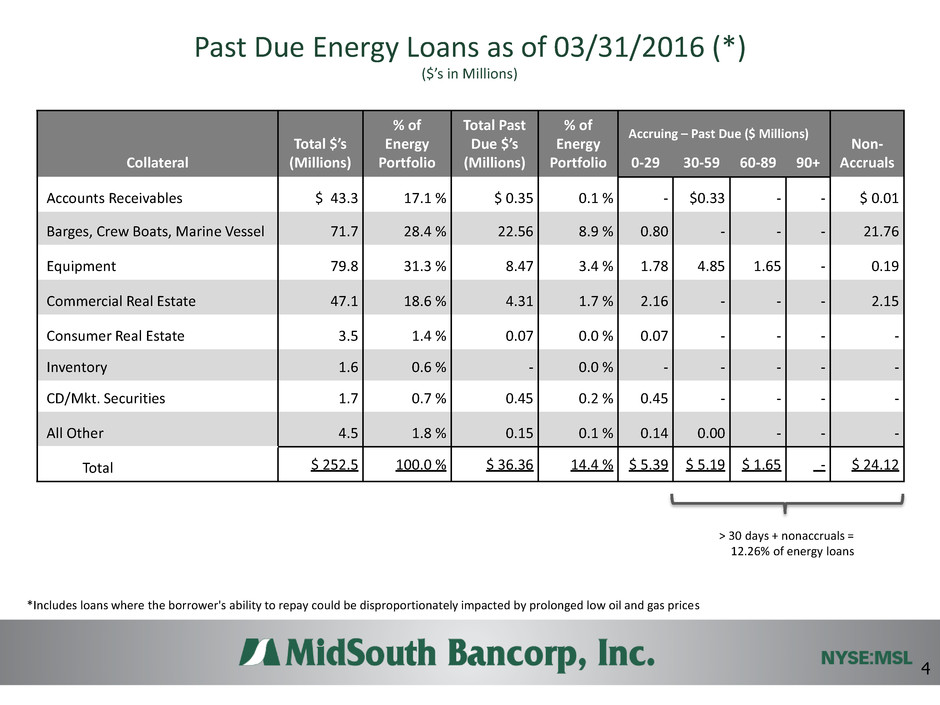

Past Due Energy Loans as of 03/31/2016 (*) Collateral Total $’s (Millions) % of Energy Portfolio Total Past Due $’s (Millions) % of Energy Portfolio 0-29 30-59 60-89 90+ Non- Accruals Accounts Receivables $ 43.3 17.1 % $ 0.35 0.1 % - $0.33 - - $ 0.01 Barges, Crew Boats, Marine Vessel 71.7 28.4 % 22.56 8.9 % 0.80 - - - 21.76 Equipment 79.8 31.3 % 8.47 3.4 % 1.78 4.85 1.65 - 0.19 Commercial Real Estate 47.1 18.6 % 4.31 1.7 % 2.16 - - - 2.15 Consumer Real Estate 3.5 1.4 % 0.07 0.0 % 0.07 - - - - Inventory 1.6 0.6 % - 0.0 % - - - - - CD/Mkt. Securities 1.7 0.7 % 0.45 0.2 % 0.45 - - - - All Other 4.5 1.8 % 0.15 0.1 % 0.14 0.00 - - - Total $ 252.5 100.0 % $ 36.36 14.4 % $ 5.39 $ 5.19 $ 1.65 - $ 24.12 *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices Accruing – Past Due ($ Millions) > 30 days + nonaccruals = 12.26% of energy loans ($’s in Millions) 4

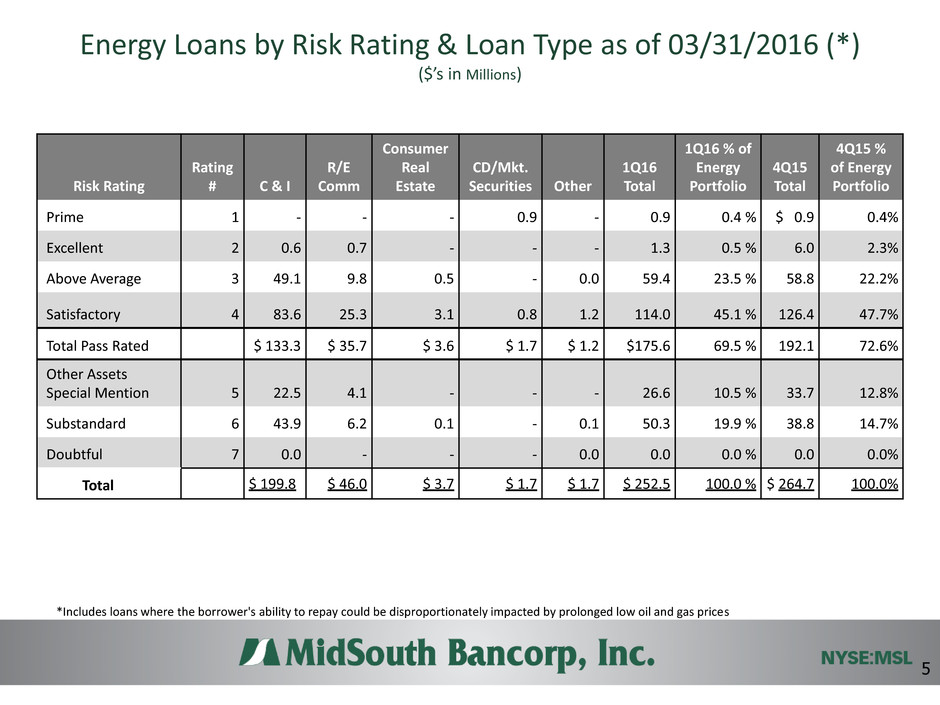

Energy Loans by Risk Rating & Loan Type as of 03/31/2016 (*) ($’s in Millions) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices Risk Rating Rating # C & I R/E Comm Consumer Real Estate CD/Mkt. Securities Other 1Q16 Total 1Q16 % of Energy Portfolio 4Q15 Total 4Q15 % of Energy Portfolio Prime 1 - - - 0.9 - 0.9 0.4 % $ 0.9 0.4% Excellent 2 0.6 0.7 - - - 1.3 0.5 % 6.0 2.3% Above Average 3 49.1 9.8 0.5 - 0.0 59.4 23.5 % 58.8 22.2% Satisfactory 4 83.6 25.3 3.1 0.8 1.2 114.0 45.1 % 126.4 47.7% Total Pass Rated $ 133.3 $ 35.7 $ 3.6 $ 1.7 $ 1.2 $175.6 69.5 % 192.1 72.6% Other Assets Special Mention 5 22.5 4.1 - - - 26.6 10.5 % 33.7 12.8% Substandard 6 43.9 6.2 0.1 - 0.1 50.3 19.9 % 38.8 14.7% Doubtful 7 0.0 - - - 0.0 0.0 0.0 % 0.0 0.0% Total $ 199.8 $ 46.0 $ 3.7 $ 1.7 $ 1.7 $ 252.5 100.0 % $ 264.7 100.0% 5

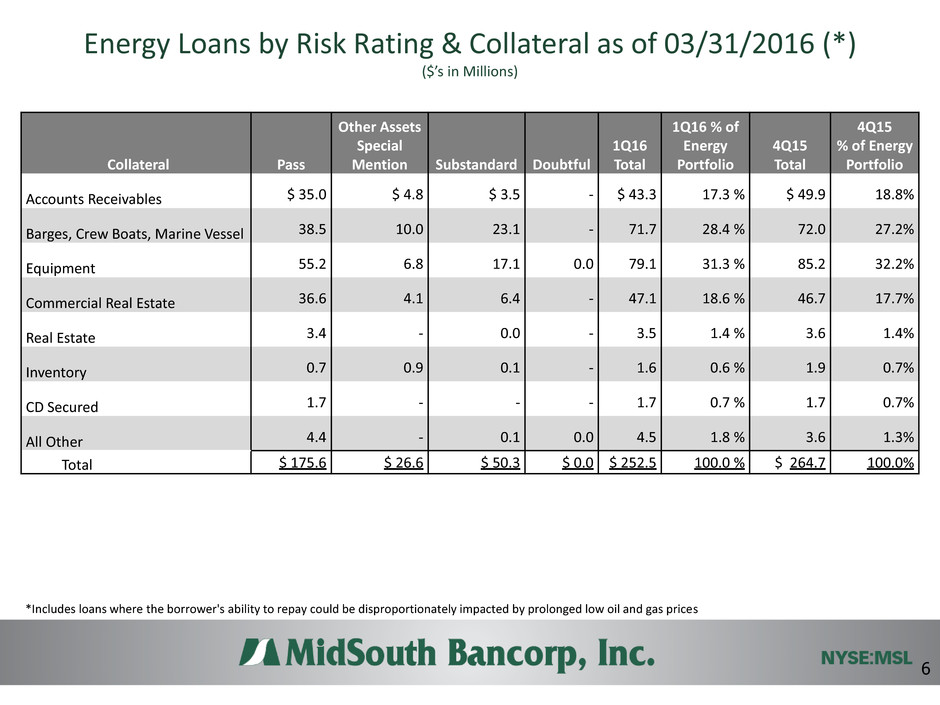

Energy Loans by Risk Rating & Collateral as of 03/31/2016 (*) ($’s in Millions) Collateral Pass Other Assets Special Mention Substandard Doubtful 1Q16 Total 1Q16 % of Energy Portfolio 4Q15 Total 4Q15 % of Energy Portfolio Accounts Receivables $ 35.0 $ 4.8 $ 3.5 - $ 43.3 17.3 % $ 49.9 18.8% Barges, Crew Boats, Marine Vessel 38.5 10.0 23.1 - 71.7 28.4 % 72.0 27.2% Equipment 55.2 6.8 17.1 0.0 79.1 31.3 % 85.2 32.2% Commercial Real Estate 36.6 4.1 6.4 - 47.1 18.6 % 46.7 17.7% Real Estate 3.4 - 0.0 - 3.5 1.4 % 3.6 1.4% Inventory 0.7 0.9 0.1 - 1.6 0.6 % 1.9 0.7% CD Secured 1.7 - - - 1.7 0.7 % 1.7 0.7% All Other 4.4 - 0.1 0.0 4.5 1.8 % 3.6 1.3% Total $ 175.6 $ 26.6 $ 50.3 $ 0.0 $ 252.5 100.0 % $ 264.7 100.0% *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 6

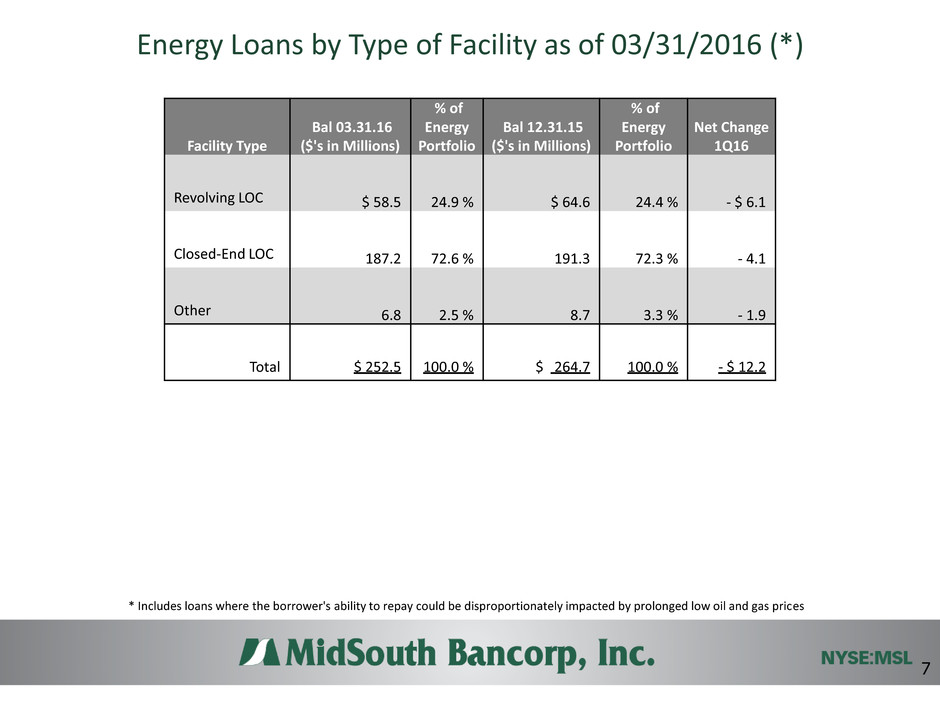

Energy Loans by Type of Facility as of 03/31/2016 (*) Facility Type Bal 03.31.16 ($'s in Millions) % of Energy Portfolio Bal 12.31.15 ($'s in Millions) % of Energy Portfolio Net Change 1Q16 Revolving LOC $ 58.5 24.9 % $ 64.6 24.4 % - $ 6.1 Closed-End LOC 187.2 72.6 % 191.3 72.3 % - 4.1 Other 6.8 2.5 % 8.7 3.3 % - 1.9 Total $ 252.5 100.0 % $ 264.7 100.0 % - $ 12.2 * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 7

Energy Loans Unfunded Commitment as of 03/31/2016 (*) Collateral Original Line Amount Current Balance Unfunded Amount Accounts Receivables $ 111.2 $ 40.5 $ 70.6 Barges, Crew Boats, Marine Vessel 0.5 - 0.5 Equipment 16.6 11.8 4.9 Commercial Real Estate 8.1 3.5 4.6 Real Estate 1.2 0.8 0.4 Inventory 0.8 0.6 0.2 CD Secured 1.0 0.7 0.2 All Other 1.3 0.5 0.8 Total $ 140.7 $ 58.5 $ 82.2 * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices Combined utilization rate (including straight lines of credit) was 42.1% Revolving Lines of Credit ($’s in Millions) 8