Attached files

| file | filename |

|---|---|

| 8-K - DNB FINANCIAL CORPORATION FORM 8-K - DNB FINANCIAL CORP /PA/ | dnb8k.htm |

Exhibit 99.1

WelcomeDNB Financial CorporationAnnual Shareholder MeetingApril 27, 2016

1

Financial Results Gerald F. SoppExecutive Vice PresidentChief Financial Officer

2

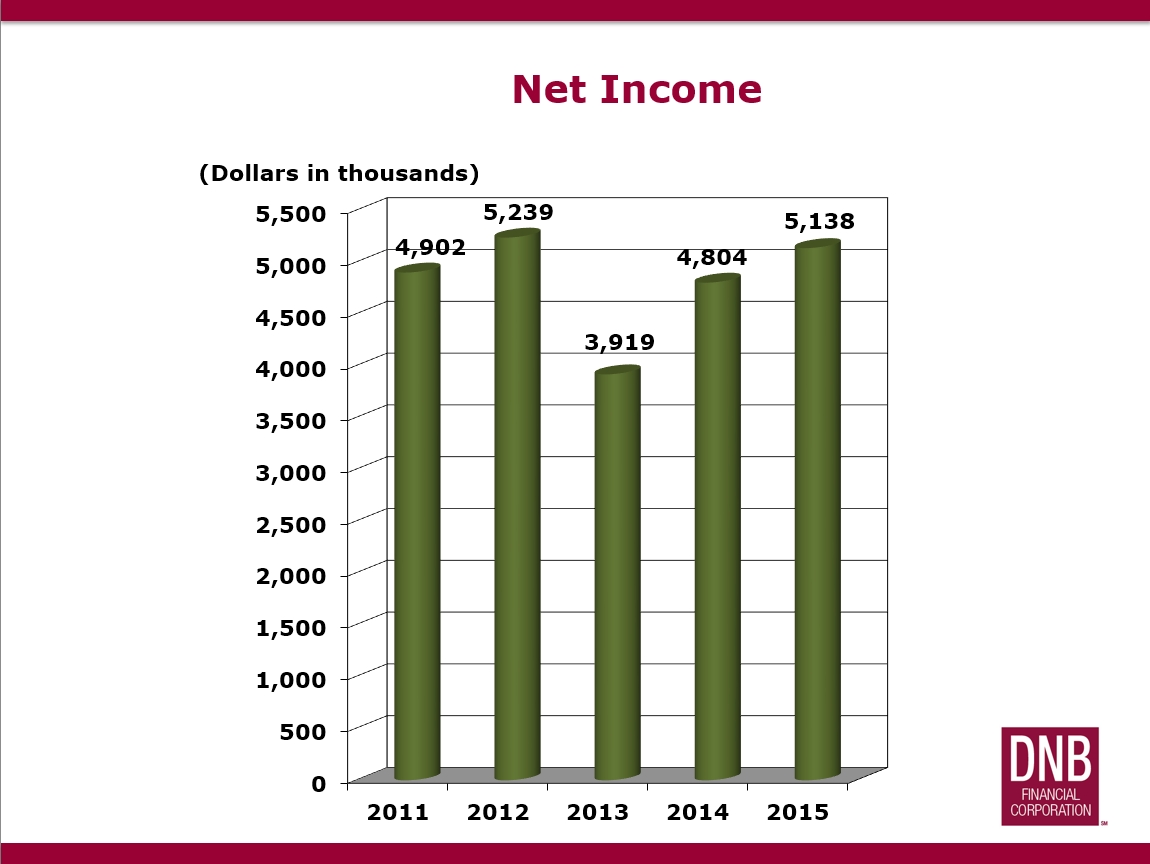

Net Income

3

2015 Major Accomplishments In the first quarter of 2015 the Company issued a subordinated debt note for $9.75 million, using the proceeds to retire 9,750 preferred shares issued under the Small Business Lending Fund (SBLF). Wealth management assets under care increased 16.9% to $191.5 million as of December 31, 2015, from $163.8 million at year-end 2014.Total loans increased 5.7% on a year-over-year basis and 2.4% (not annualized) on a sequential quarter basis. Asset quality remained strong. As of December 31, 2015, non-performing loans were only 1.06% of total loans compared with 1.50% as of December 31, 2014.

4

On December 31, 2015, the Company redeemed the remaining 3,250 shares of Non-Cumulative Perpetual Preferred Stock ($1,000 per share) that was issued to the U.S. Treasury Department in connection with the Small Business Lending Fund (SBLF) program.DNBF stock price increased 36.6% from $21.60 at December 31, 2014 to $29.50 at December 31, 2015. Book value per common share increased 7.3% from $18.32 at December 31, 2014 to $19.65 at December 31, 2015. 2015 Major Accomplishments

5

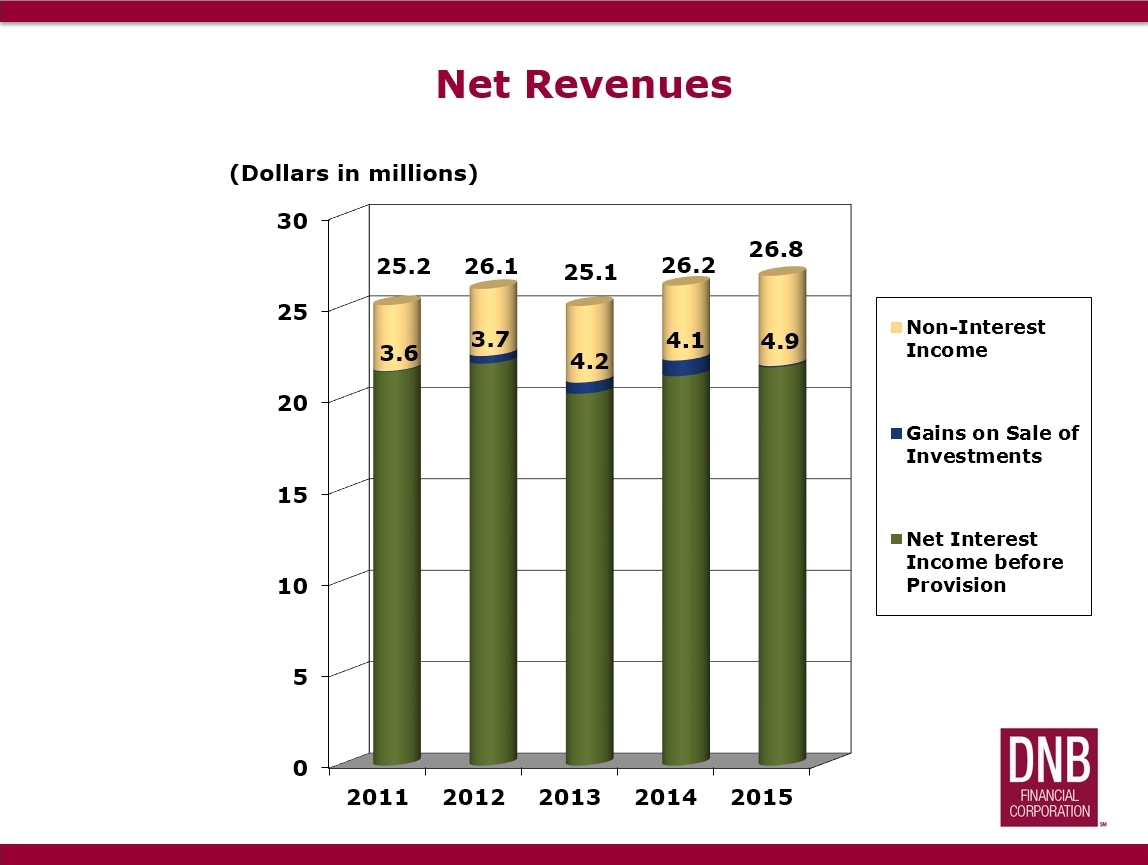

Net Revenues

6

Total Assets

7

Loan and Lease Portfolio

8

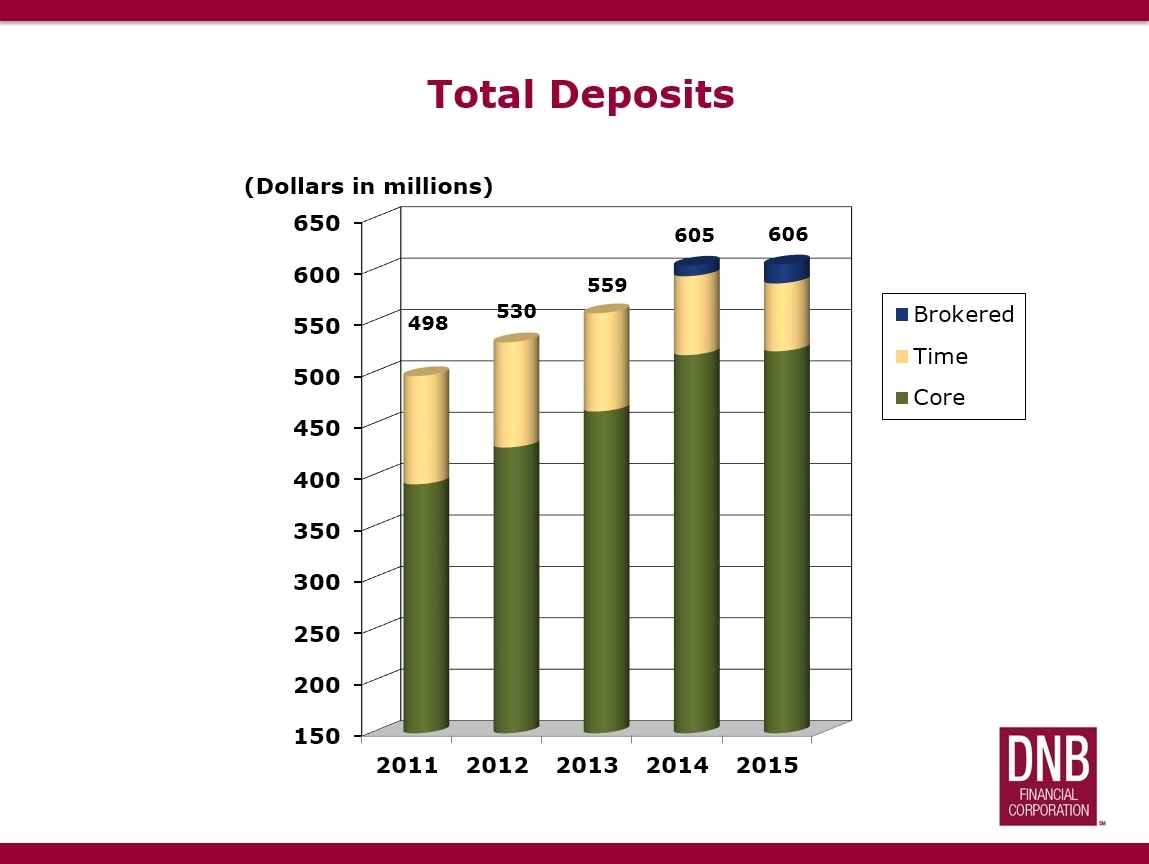

Total Deposits

9

Tangible Common Equity

10

Increasing Shareholder Value

11

First Quarter Results 1Q 2016(pro forma)* 1Q 2016 1Q 2015 Net Income (000’s) $ 1,161 $ 1,556 $ 1,252 Diluted EPS .41 .54 .43 Net Inc available to Common Shareholders (000’s) 1,161 1,556 1,226 Return on Average Assets (annualized) 0.63% 0.84% 0.69% Return on Average Equity (annualized) 8.16% 10.94% 8.13% Loans (000’s) 489,366 464,100 Deposits (000’s) $ 637,055 $ 627,261 *Please refer to Non-GAAP Reconciliation on next slide

12

Reconciliation of Non-GAAP Financial Measures (Dollars in thousands) Three Months Ended March 31, 2016 2015 GAAP net income $ 1,556 $ 1,252 Gains from insurance proceeds (1,150) 0 Salary expense related to restricted stock and SERP 446 0 Acquisition costs -- East River Bank 188 0 Income tax adjustment 122 0 Non-GAAP net income (Core earnings) $ 1,162 $ 1,252

13

Acquisition of East River Bank William J. HiebPresident and Chief Executive Officer

14

Forward-looking Information This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, expectations or predictions of future financial or business performance, conditions relating to DNB and East River, or other effects of the proposed merger of DNB and East River. These forward-looking statements include statements with respect to DNB’s beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, that are subject to significant risks and uncertainties, and are subject to change based on various factors (some of which are beyond DNB’s control). The words "may," "could," "should," "would," "will," "believe," "anticipate," "estimate," "expect," "intend," "plan" and similar expressions are intended to identify forward-looking statements. In addition to factors previously disclosed in the reports filed by DNB with the Securities and Exchange Commission (the “SEC”) and those identified elsewhere in this document, the following factors, among others, could cause actual results to differ materially from forward looking statements or historical performance: the ability to obtain regulatory approvals and satisfy other closing conditions to the merger, including approval by shareholders of DNB and East River; delay in closing the merger; difficulties and delays in integrating the East River business or fully realizing anticipated cost savings and other benefits of the merger; business disruptions following the merger; the strength of the United States economy in general and the strength of the local economies in which DNB and East River conduct their operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; the downgrade, and any future downgrades, in the credit rating of the U.S. Government and federal agencies; inflation, interest rate, market and monetary fluctuations; the timely development of and acceptance of new products and services and the perceived overall value of these products and services by users, including the features, pricing and quality compared to competitors' products and services; the willingness of users to substitute competitors’ products and services for DNB’s products and services; the success of DNB in gaining regulatory approval of its products and services, when required; the impact of changes in laws and regulations applicable to financial institutions (including laws concerning taxes, banking, securities and insurance); technological changes; additional acquisitions; changes in consumer spending and saving habits; the nature, extent, and timing of governmental actions and reforms; and the success of DNB at managing the risks involved in the foregoing. Annualized, pro forma, projected and estimated numbers presented herein are presented for illustrative purpose only, are not forecasts and may not reflect actual results. DNB cautions that the foregoing list of important factors is not exclusive. Readers are also cautioned not to place undue reliance on these forward-looking statements, which reflect management's analysis only as of the date of this press release, even if subsequently made available by DNB on its website or otherwise. DNB does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of DNB to reflect events or circumstances occurring after the date of this press release. For a complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review our filings with the SEC, including our most recent annual report on Form 10-K, as supplemented by our quarterly or other reports subsequently filed with the SEC.

15

Important Additional Informationand Where to Find It DNB intends to file with the SEC a Registration Statement on Form S-4 relating to the proposed merger, which will include a prospectus for the offer and sale of DNB common stock as well as the joint proxy statement of DNB and East River for the solicitation of proxies from their shareholders for use at the meetings at which the merger will be considered. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF DNB AND EAST RIVER ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT-PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY DNB WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the joint proxy statement-prospectus, as well as other filings containing information about DNB, may be obtained at the SEC’s website at http://www.sec.gov, when they are filed by DNB. You will also be able to obtain these documents, when they are filed, free of charge, from DNB at http://investors.dnbfirst.com. In addition, copies of the joint proxy statement-prospectus can also be obtained, when it becomes available, free of charge by directing a request to DNB at 4 Brandywine Avenue, Downingtown, PA 19335-0904 or by contacting Gerald F. Sopp at 484.359.3138 or gsopp@dnbfirst.com or to East River at 4341 Ridge Avenue, Philadelphia, PA 19129 or by contacting Christopher P. McGill at 267.295.6420 or cmcgill@eastriverbank.com. DNB, East River and certain of their directors, executive officers and employees may be deemed to be “participants” in the solicitation of proxies in connection with the proposed merger. Information concerning the interests of the DNB and East River persons who may be considered “participants” in the solicitation will be set forth in the joint proxy statement-prospectus relating to the merger, when it becomes available. Information concerning DNB’s directors and executive officers, including their ownership of DNB common stock, is set forth in DNB’s proxy statement previously filed with the SEC on March 23, 2016.

16

Table of Contents Transaction Summary and RationaleAbout East River BankThe Merger

17

Transaction Summary and Rationale

18

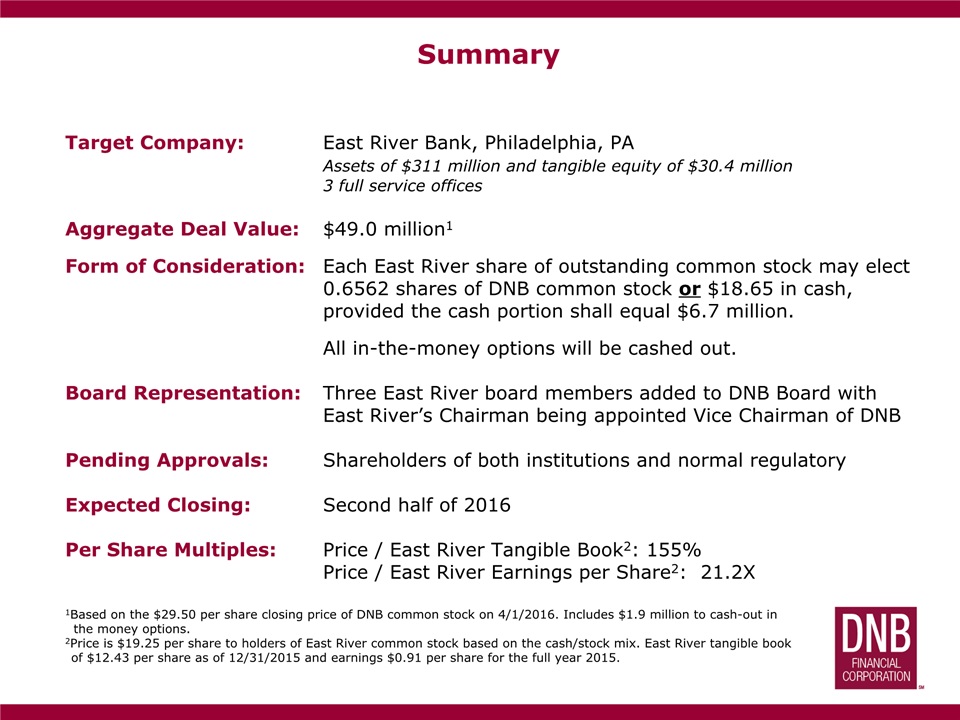

Summary Target Company: East River Bank, Philadelphia, PA Assets of $311 million and tangible equity of $30.4 million 3 full service offices Aggregate Deal Value: $49.0 million1Form of Consideration: Each East River share of outstanding common stock may elect 0.6562 shares of DNB common stock or $18.65 in cash, provided the cash portion shall equal $6.7 million.All in-the-money options will be cashed out.Board Representation: Three East River board members added to DNB Board with East River’s Chairman being appointed Vice Chairman of DNBPending Approvals: Shareholders of both institutions and normal regulatory Expected Closing: Second half of 2016Per Share Multiples: Price / East River Tangible Book2: 155% Price / East River Earnings per Share2: 21.2X 1Based on the $29.50 per share closing price of DNB common stock on 4/1/2016. Includes $1.9 million to cash-out in the money options. 2Price is $19.25 per share to holders of East River common stock based on the cash/stock mix. East River tangible book of $12.43 per share as of 12/31/2015 and earnings $0.91 per share for the full year 2015.

19

Compelling Strategic Value Improved stature in Southeastern PACreates a strong $1.1 billion commercial bank with 15 banking offices.Logical market extension into the heart of the Philadelphia market.One of only six depository institutions with assets over $1 billion headquartered in Southeastern PABetter balance sheetImproves DNB’s loans/deposits ratio from 79% to 91% on a pro-forma basis.Identified synergiesGreater economies of scale and improved efficiencies. Opportunity to further increase pro-forma net interest margin by replacing some of East River’s funding with lower cost DNB deposits.Future OpportunitiesAbility to cross sell DNB’s wealth management to East River clients and in Philadelphia market.Ability of East River expertise in SBA lending to expand across DNB’s western Philadelphia market.Deeper benchAdds 3 talented board members, 2 senior executives and manyother talented individuals to the DNB team.

20

Better Balance Sheet A greater percentage of post-merger assets will be funded by DNB’s lower cost deposits.Opportunity to further increase pro-forma net interest margin by replacing some of East River’s borrowings with lower cost DNB deposits.*Excludes Fed Funds and Repos. Source: SNL Financial. DNB East First River Combined As of 12/31/2015 ($ in millions) Loans $482 $282 $764 Deposits 606 234 840 Loans/deposits 79% 121% 91% Borrowed funds* $49 $46 Full year 2015 Yield on loans 4.31% 4.99% Cost of int. bearing deposits 0.23% 0.89% Cost of funds 0.31% 0.97%

21

Loan Mix1 1As of 12/31/2015.2Combined with no merger adjustments.Source: DNB First and East River bank level data. DNB First $481.8 million East River Bank $282.1 million Combined $763.9 million2 Loan mix becomes more diversified.

22

About

23

East River Bank Overview Date Established: January 23, 2006Headquarters: Philadelphia, PABranches: East Falls, Roxborough and Old City Balance Sheet as of 12/31/2015 Assets $311 million Loans $282 million Deposits $234 million Tangible Equity $30.4 million Tang Eq. / Tang. Assets 9.78% Loans / Deposits 121% NPAs + 90 DPD / Assets 0.45% Income Statement for FY 2015 Net Interest Income $11.0 million Non Interest Income $515 thousand Non Interest Expense $7.8 million Net Income $2.2 million Net Interest Margin 3.79% Return on Avg. Assets 0.76% Return on Avg. Equity 7.73% Source: SNL Financial.

24

Excellent Asset Growth CAGR: 22% East River Bank Assets have grown 22% per year since year end 2006 through year end 2015.Source: SNL Financial.

25

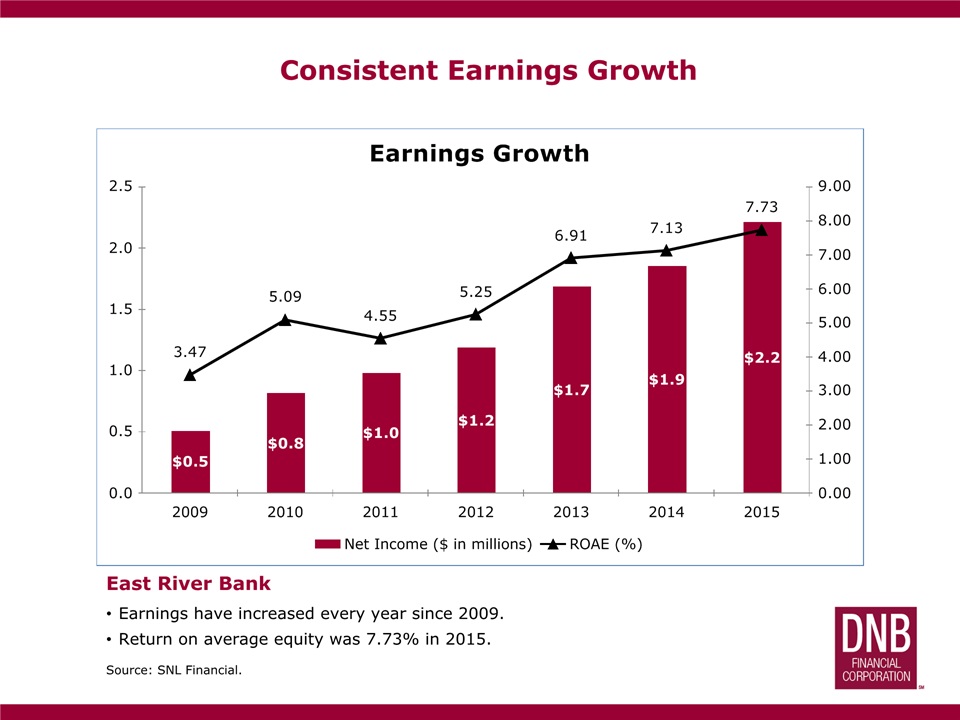

Consistent Earnings Growth East River Bank Earnings have increased every year since 2009.Return on average equity was 7.73% in 2015.Source: SNL Financial.

26

Quality Loan Growth From the end of 2013 to the end of 2015, loans were up $71 million.At the end of 2014 and 2015, NPAs + loans over 90 days past due were low at 0.50% and 0.45% of assets, respectively. From 2013 though 2015, net charge offs were $231,000.Source: SNL Financial. East River Bank

27

The Merger

28

Pro Forma Financial Impact Balance sheetCash consideration of $6.7 million for a portion of common shares plus $1.9 million to “cash-out” optionsCombined pre-tax deal costs of $5.4 millionConservatively marked credits based on extensive due diligence performed, including third party review of the loan portfolioPro-forma capital ratios remain well in excess of regulatory guidelinesIncome statementCost savings of ~ $3.1 million (40%) on East River’s 2015 non-interest expense of $7.8 million85% of cost savings expected to be realized in year 1Some run-off or replacement of East River funding with lower cost DNB depositsPro forma shareholder base1,368,611 shares issued to East River shareholdersExpected pro-forma capitalization greater than $120 million, an increase of over 45%DNB pro forma ownership of 67% and East River pro forma ownership of 33% Source: SNL Financial.

29

Earnings and Tangible Book Impact ~ 23% accretive to earnings in year 1, excluding merger related expenses~ 29% accretive to earnings in year 2Acceptable tangible book dilution with a payback period of 3.9 yearsAnticipated IRR of 18% is well in excess of DNB’s cost of capital

30

Gerald F. Sopp, EVP and CFO(484)-359-3138gsopp@dnbfirst.comhttp://investors.dnbfirst.com/ For more information, Investors may contact: DNB: Ambassador Financial Group, Inc. – Financial Advisor Stradley Ronon Stevens & Young, LLP – Legal CounselEast River: Griffin Financial Group LLC – Financial Advisor Silver, Freedman Taff & Tiernan LLP – Legal Counsel Transaction Advisors

31

32