Attached files

| file | filename |

|---|---|

| 8-K - 1Q16 EARNINGS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a1q20168-kcoverpage.htm |

| EX-99.1 - 1Q16 EARNINGS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a1q20168-kex991.htm |

April 25, 2016 First Quarter 2016 Financial Review

Statements in this presentation that are based on other than historical data or that express the Company’s expectations regarding future events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Statements based on historical data are not intended and should not be understood to indicate the Company’s expectations regarding future events. Forward-looking statements provide current expectations or forecasts or intentions regarding future events or determinations. These forward-looking statements are not guarantees of future performance or determinations, nor should they be relied upon as representing management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties, and actual results may differ materially from those presented, either expressed or implied, in this presentation. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements include the actual amount and duration of declines in the price of oil and gas, our ability to meet our efficiency and noninterest expense goals, as well as other factors discussed in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) and available at the SEC’s Internet site (http://www.sec.gov). Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments. 2 Forward-Looking Statements

Chairman’s Message 3 First Quarter Highlights: Strong 21% pre-provision net revenue growth over year-ago period Strong loan growth (7.6% annualized), building on the prior quarter’s strength Achieving positive operating leverage: solid progress in 1Q16, expect continuation throughout 2016 Tracking on efficiency initiative • Adjusted noninterest expense declined from the prior quarter, despite seasonally elevated payroll tax and accruals for certain incentive compensation plans • Efficiency ratio improved by 106 basis points from 4Q15 to 68.5% Deploying cash to short-to-medium duration securities Credit quality remains healthy despite continued pressure within O&G portfolio Earnings per share increased slightly vs. year-ago period, substantially restrained due to transitory weakness in energy loan portfolio.

Pre-Provision Net Revenue 4 • Pre-Provision Net Revenue has strengthened measurably over the past year, up 21% y-o-y, continuing to build on positive momentum • This persistent improvement has been principally driven by intense focus on expense control and higher return on liquid assets due to active balance sheet management • This trend is expected to continue in the near term, as loans and fee income sustain positive trajectory 1 Adjusted for items such as severance, provision for unfunded lending commitments, debt extinguishment costs. See the GAAP to non-GAAP reconciling table on slide 28. 151 160 171 174 182 $100 $125 $150 $175 $200 1Q15 2Q15 3Q15 4Q15 1Q16 Pre-Provision Net Revenue1 In Millions

$36,000 $37,750 $39,500 $41,250 $43,000 1Q15 2Q15 3Q15 4Q15 1Q16 Total Loans 35% 40% 45% 50% $44,000 $46,000 $48,000 $50,000 $52,000 1Q15 2Q15 3Q15 4Q15 1Q16 Total Deposits Total Deposits (left) Non-Interest Bearing Deposits as a % of Total (right) Total Loan and Deposit Growth 5 In Millions In Millions • Loan growth has accelerated in the last six months. In 1Q16, normally a seasonally soft growth quarter, it increased at its strongest quarterly rate in nine quarters. • Strong deposit mix, with 44% of total deposits in non-interest bearing accounts

Efficiency Ratio 6 • The efficiency ratio improved to 68.5% (1Q16), from 71.9% a year ago • We remain committed to drive the efficiency ratio to: • Less than or equal to 66% for 2016 • The low 60s for 2017 71.9% 71.1% 69.1% 69.6% 68.5% 60% 65% 70% 75% 1Q15 2Q15 3Q15 4Q15 1Q16 Noninterest Expenses as a Percentage of Net Revenue1 1 Adjusted for items such as severance, provision for unfunded lending commitments, and debt extinguishment costs. See the GAAP to non-GAAP reconciling table on slide 28.

Credit Quality: Overall Credit Quality Remains Generally Strong 7 -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 1Q15 2Q15 3Q15 4Q15 1Q16 Key Credit Quality Ratios Classifieds / Loans Non-O&G Classifieds / Loans Nonperforming Assets / Loans Net Charge-offs / Loans Note: the Net Charge-offs / Loans ratio has been annualized. • Overall healthy credit quality • Relative to December 31, 2015: • Classified loans increased to 3.7% of loans • NPAs increased to 1.3% of loans • Annualized NCOs equaled 0.35% of average loans • Increase in classified loans attributable to O&G loans • Non-O&G classified loans declined by 3.5% • Allowance for credit loss remains strong, at 1.64% of total loans and leases • 1.2x coverage of NPAs • 4.7x coverage of annualized NCOs

On June 1, 2015, Zions announced several organizational and operational changes, including: • Consolidate bank charters from seven to one while maintaining local leadership, local product pricing, and local brands • Create a Chief Banking Officer position; realign responsibility for retail banking, wealth management, and residential mortgage lending • Consolidate risk functions while retaining local credit decision-making • Consolidate various non-customer facing operations (e.g. Accounting, Loan Operations) • Build best-in-class technology infrastructure 8 Zions’ Major Announcement: Organizational Restructure Estimated Percent Complete Today Expected Percent Complete by 2018 100% 100% 100% 100% 75% 100% 75% 100% 25% 80% - 90%

Financial Metric Category 2H15 Goal 2H15 Actual Result FY16 Goal FY16 Result FY17 Goal FY17 Actual Result Adjusted noninterest expense Hold to below $1.6 billion 100% Hold to below $1.6 billion On Track Slightly above $1.6 billion TBD Efficiency Ratio ≤70% 69.4% ≤66% On Track Low 60s TBD Gross cost savings of $120 million 50% ~57% >80% On Track 100% TBD Pay off high cost subordinated debt 100% 100% -- -- -- -- Preferred Equity Dividends -- On Track -- On Track Lower by ~$20 million vs. 2014A TBD On June 1, 2015, Zions announced several financial targets, including: 9 Zions’ Major Announcement: Financial Targets 1 Adjusted noninterest expense excludes severance, restructuring charges, tender premiums, and other similar items, as detailed on slide 28 (“GAAP to Non-GAAP reconciliation”)

Financial Results 10 Three Months Ended (Dollar amounts in millions, except per share data) March 31, 2016 December 31, 2015 March 31, 2015 Earnings Results: Diluted Earnings Per Share 0.38 0.43 0.37 Net Interest Income 453 449 417 Provision for Loan Losses 42 23 (1) Noninterest Income 117 119 117 Noninterest Expense 396 397 393 Pre-Provision Net Revenue 1 182 174 151 Net Earnings (Loss) Applicable to Common Shareholders 79 88 75 Ratios: Return on Average Assets 0.62 % 0.68 % 0.66 % Return on Average Common Equity 4.67 % 5.17 % 4.77 % Tangible Return on Average Tangible Common Equity 5.59 % 6.20 % 5.80 % Net Interest Margin 3.35 % 3.23 % 3.22 % Yield on Loans 4.14 % 4.24 % 4.21 % Yield on Securities 2.30 % 2.13 % 2.49 % Average Cost of Deposits* 0.10 % 0.10 % 0.11 % Efficiency Ratio 1 68.5 % 69.6 % 71.9 % Ratio of Nonperforming Lending-Related Assets to Loans, Leases and OREO 1.33 % 0.87 % 0.81 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.35 % 0.13 % (0.17)% Basel III Common Equity Tier 1 12.14 % 12.22 % 11.76 % * Includes noninterest bearing deposits 1 Adjusted for items such as severance, provision for unfunded lending commitments, and debt extinguishment costs. See the GAAP to non-GAAP reconciling table on slide 28.

Revenue: Net Interest Income Moving meaningfully higher after a period of stability 11 417 424 425 449 453 $400 $420 $440 $460 $480 1Q15 2Q15 3Q15 4Q15 1Q16 Net Interest Income In Millions • Net interest income growth continued its positive trajectory, increasing nearly 8.5% over the year-ago period • On a linked quarter basis, net interest income grew by $4mm over 4Q15 • Approximately $13 million of the 4Q15 net interest income was from recoveries and elevated income from FDIC-supported loans, which did not persist into 2016 • Net interest income is expected to increase throughout 2016 due primarily to continued loan growth and purchases of securities Modeled Annual Change in a +200 Interest Rate Environment Fast Slow Net Interest Income – 1Q16 1 9% 16% Net Interest Income – 4Q15 9% 15% 1 Preliminary analysis, subject to refinement 12-month simulated impact using a static-sized balance sheet and a parallel shift in the yield curve, and is based on statistical analysis relating pricing and deposit migration to benchmark rates (e.g. Libor, U.S. Treasuries). “Fast” refers to an assumption that deposit rates and volumes will adjust at a faster speed. “Slow” refers to an assumption that deposit rates and volumes will adjust at a more moderate speed.

$0 $2,000 $4,000 $6,000 $8,000 $10,000 1Q15 2Q15 3Q15 4Q15 1Q16 Total Securities (end of period balances) Other Securities Municipal Securities Small Business Administration Loan-Backed Securities Agency Securities Agency Guaranteed MBS Securities Active Management of the Balance Sheet: Securities Portfolio Growth Short-to-medium duration portfolio; limited duration extension risk 12 In Millions Added net $1.2B of securities during 1Q16 • Total growth from year ago period: 84% Securities Portfolio Duration • Current: 2.6 years • 200 bps increase from current interest rates: 3.1 years

Loan Growth by Type 13 Source: NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans with low loan-to-value ratios, generally in line with SBA 504 program parameters. Note: Other loans includes municipal and other consumer. C&I (ex-O&G) Owner Occupied (ex-NRE) C&D Term CRE (ex- NRE) 1-4 Family National Real Estate O&G Home Equity Other -20% -10% 0% 10% 20% Year-over-Year Loan Growth • Loan growth in C&I, Term CRE and to a lesser extent Residential Mortgage (1-4 Family) • Declines in in National Real Estate, O&G and Construction and Land Development • Targeting strong growth in C&I and 1-4 family • Expect moderate growth in C&D, mini-perm and stabilized income properties (term CRE) • Expect continued declines in O&G and national real estate

Loans 75% Securities 16% Cash 9% Earning Asset Mix Loans 75% Securities 9% Cash 15% CDOs 1% 3.22% 3.18% 3.11% 3.23% 3.35% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 1Q15 2Q15 3Q15 4Q15 1Q16 Net Interest Margin (NIM) Net Interest Income Drivers Loan yield has been relatively stable; margin higher in part due to mix shift 14 • The reported 1Q16 NIM was 3.35% • If adjusted for two income recoveries in 4Q15, the NIM in 4Q15 would have been 3.18% (as compared to the reported 3.23%) • Mix shift: An increase in securities and loans, and a decrease in cash as a percentage of earning assets was a significant driver of the linked-quarter NIM expansion • Reduction of high-cost debt, completed in November 2015, further contributed to the 1Q16 improvement Loan Yield Securities Yield Interest Expense / Interest Earning Assets: Black Net Interest Margin Cash Yield: White 1Q15 1Q16

$90 $100 $110 $120 1Q15 1Q16 Customer-Related Fee Income 15 7% Growth In Millions • Customer-related fee income increased 7% from the year ago period • Key components of fee income: • Loan Fees: up 38% • Bankcard: up 17% • Treasury management: up 3% • Mortgage fees declined by 34%, principally attributable to portfolio retention Revenue: Fee Income

$0 $100 $200 $300 $400 $500 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Classifieds by O&G Segment $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Loan Balances by O&G Segment Upstream Services Other Oil & Gas (O&G) Portfolio Trends Steadily declining balance trend in O&G services balances 16 In Millions In Millions $0 $100 $200 $300 $400 $500 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Nonaccruals by O&G Segment Allowance for Credit Losses Upstream Services Other In Millions

$0 $200 $400 $600 $800 High Pass Mid Pass Low Pass Special Mention Classified Unfunded O&G Commitments by Loan Grade 17 “Criticized” In Millions • Approximately 80% of the unfunded commitments are in the “pass” grade category, while 20% of the loans are graded “criticized” (which includes “special mention” and “classified”) • About one half of unfunded commitments in the Criticized category is unavailable due to covenant violations or borrowing base restrictions • Total pay downs / payoffs of classified loans in 1Q16: $146 million $1,000 $1,500 $2,000 $2,500 $3,000 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Total O&G Unfunded Commitments In Millions Understanding Unfunded O&G Commitments

$0 $100 $200 $300 $400 $500 $600 $700 $800 Special Mention Classified Non Accrual Payment Status Current Non current Payment Status: Adversely Graded O&G Loans Most of the adversely graded loans remain current on payments 18 • Virtually all Special Mention balances are current • 96% of Classified balances are current • 91% of Nonaccrual balances are current • Nonaccrual loans are a subset of Classified Loans In Millions Non current: More than 30 days past due on any principal or interest payment.

• O&G Loan Loss Expectation • O&G loan losses are estimated to be in the $100 million area in 2016 • Losses are likely to emerge beyond 2016, but are expected to be manageable • Heading into this cycle, Zions’ lack of second lien or mezzanine debt extended to the O&G industry is a significant source of protection against very high loss severity • O&G services loan performance is mixed – both positive and negative surprises, but generally tracking in line with expectations • Strong Reserve Against O&G Loans • Zions’ O&G allowance for credit losses equaled 8.1% of O&G loan balances • Approximately 2 years of loss coverage at trailing six-month charge-off rate Updated O&G Loss Expectation: Moderate increase to reflect lower commodity prices and longer duration 19

2016-2017 Objectives: Growth Through Simplification and Focus 20 • Accelerate Positive Operating Leverage • Accelerate loan growth rates • Invest cash into medium duration securities • Maintain mid-single digit growth rates in core fee income: • Maintain non-interest expenses at or below $1.6 billion through simplification • Compensation: Tighter incentive compensation linked to achievement of articulated efficiency ratio targets • Implement Technology Strategies: Achieve substantial progress on core systems upgrade • Increase the Return on and of Capital • Improvements in operating leverage and loan growth lead to stronger returns on capital • Improved risk profile and risk management should lead to better returns of capital • Execute on our community bank model – doing business on a “local” basis

Next 12-Month Outlook Summary Relative to 1Q16 Results Topic Outlook Comment Loan Balances Increasing • Expect strengthening growth in residential mortgage (mostly short duration ARMs) and general C&I, partially offset by continued attrition from National Real Estate and O&G portfolios Net Interest Income Increasing • Expect continued increases in loans and securities to result in increased net interest income Provisions Stable • On average, quarterly provisions likely to be similar to 1Q16A, reflecting moderate total net charge-offs and loan growth Noninterest Income Slightly to Moderately Increasing • Target growth of mid-single digit for managed noninterest income (excludes securities gains, dividends, etc.) • Dividends from federal agencies are expected to decline by an annualized $5 million relative to 1Q16 levels due to charter consolidation and FAST Act (transportation, H.R. 22) Noninterest Expense Stable • Targeting NIE of less than $1.6 billion in FY16. Includes the effect of higher FDIC assessment (approved by FDIC in March 2016) • Includes continued elevated spending on technology systems overhaul Tax Rate Increasing • Expected to be in a range of approximately 34% to 35% for FY16 Preferred Dividends Declining1 • As reported separately on April 25, 2016, Zions has launched a tender offer for up to $120 million par amount of certain outstanding shares of preferred stock. 21 1 The expectation for declining preferred dividends is relative to the trailing six month results (not just the 1Q16 results), due to the timing of preferred equity dividends.

Appendix 22 O&G Portfolio Detail Houston CRE Portfolio: Sub-type, cash flow coverage, and collateral coverage High Oil & Gas Employment Counties: Consumer credit scores Loan Growth by Bank Brand and Type GAAP to Non-GAAP Reconciliation

O&G Portfolio Detail 23 Note: Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as oil and gas-related, including a particular segment of oil and gas-related activity, e.g., upstream or downstream; typically, 50% of revenues coming from the oil and gas sector is used as a guide. Balances increased modestly in 1Q16, in part due to new originations, but also from some funding of existing loans. Many borrowers continued to delever in 1Q16. Loan downgrades continued, primarily from upstream loans. Zions added to the O&G loan allowance for credit losses during 1Q16. The reserve reflects the downgrading of credits during the same period. Additional downgrades are probable due in part to the Spring 2016 redetermination cycle. Reserve for O&G loans is considered strong at 8.1% of outstanding balances. (In millions) 3/31/16 % of Total 12/31/15 $ Change % Change 3/31/15 Loans and leases: Oil and gas related: Upstream - exploration and production $ 859 32% $ 817 42 5% $ 1078 Midstream – marketing and transportation 649 24% 621 28 5% 654 Downstream – refining 129 5% 127 2 2% 140 Other non-services 43 2% 44 (1) (2)% 57 Oilfield services 734 28% 784 (50) (6)% 959 Energy service manufacturing 229 9% 229 - -% 269 Total loan and lease balances 2,643 100% 2,622 21 1% 3,157 Unfunded lending commitments 2,021 2,151 (130) (6)% 2,432 Total credit exposure $ 4,664 $ 4,773 (109) (2)% $ 5,589 Private equity investments 12 13 (1) (8)% 20 Credit Quality Measures of oil and gas related loans: Criticized loan ratio 37.5 % 30.3 % 15.7 % Classified loan ratio 26.9 % 19.7 % 9.3 % Nonperforming loan ratio 10.8 % 2.5 % 2.1 % Net charge-off ratio, annualized 5.4 % 3.6 % 0.3%

24 Zions’ Commercial Real Estate Portfolio in Texas Houston is approximately 3/5ths of total Texas exposure; Construction and Land Development loans in Houston have declined more than 80% from the prior credit cycle $ $100 $200 $300 $400 $500 Industrial Land Hospitality Other Office Retail Multifamily Commercial Construction Houston (53%) TX-not Houston (47%) $ $100 $200 $300 $400 $500 Other Land Single Family Housing Residential Construction Houston (69%) TX-not Houston (31%) $ $100 $200 $300 $400 $500 Hospitality Industrial Other Office Retail Multifamily Commercial Term Houston (53%) TX-not Houston (47%)

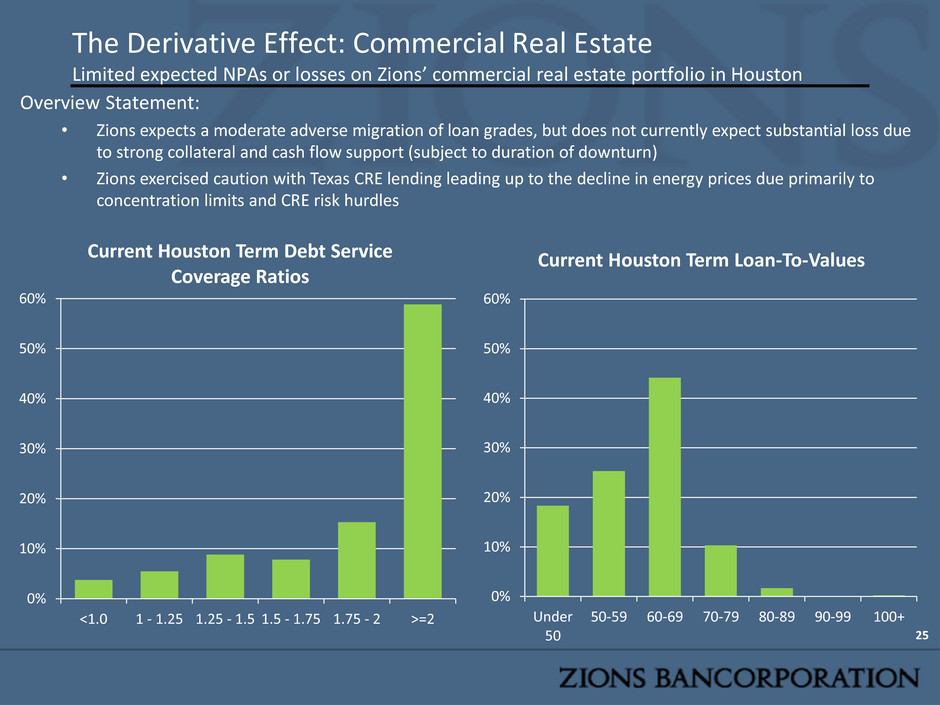

The Derivative Effect: Commercial Real Estate Limited expected NPAs or losses on Zions’ commercial real estate portfolio in Houston 25 Overview Statement: • Zions expects a moderate adverse migration of loan grades, but does not currently expect substantial loss due to strong collateral and cash flow support (subject to duration of downturn) • Zions exercised caution with Texas CRE lending leading up to the decline in energy prices due primarily to concentration limits and CRE risk hurdles 0% 10% 20% 30% 40% 50% 60% <1.0 1 - 1.25 1.25 - 1.5 1.5 - 1.75 1.75 - 2 >=2 Current Houston Term Debt Service Coverage Ratios 0% 10% 20% 30% 40% 50% 60% Under 50 50-59 60-69 70-79 80-89 90-99 100+ Current Houston Term Loan-To-Values

Percentile HOGECs Others HOGECs Others HOGECs Others HOGECs Others HOGECs Others 5% 606 642 600 640 6 2 597 636 9 6 10% 643 677 640 677 3 0 639 674 4 3 50% 753 778 749 781 4 -3 749 780 4 -2 2016 Q1 2015 Q1 1-Year Difference 2014 Q1 2-Year Difference Data includes consumer loans with FICO scores refreshed during the quarter shown. Consumer customers in high oil and gas employment counties (HOGECs) have not experienced substantial credit score deterioration 26 Takeaways: • Consumer loans from high O&G employment counties performing similarly to overall consumer portfolio. Nearly all of these consumer loans are with Amegy (96%) located in Texas, primarily Houston area. • 81% of consumer loans in high-energy counties are Mortgage and HECL • Consumer FICO scores have not deteriorated in counties with high O&G employment, with the 5th, 10th, and 50th percentiles of FICO scores showing slightly favorable movement Credit Score (FICO) Migration in High Oil & Gas Employment Counties

Loan Growth by Affiliate and Type 27 Source: Company documents; NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans generally underwritten using SBA 504 guidelines. Other loans includes Municipal and other consumer. Linked Quarter Loan Growth (all values in millions) Zions Bank California B&T Amegy Nat'l Bank of AZ Nevada State Bank Vectra Commerce Total C&I (ex-O&G) $180 $98 $92 $2 ($32) ($18) $31 $353 Owner Occupied (ex-NRE) $6 ($24) ($3) ($19) ($15) ($21) $1 ($75) C&D $35 ($2) $52 $34 ($9) $18 ($2) $126 Term CRE (ex-NRE) $33 $211 $30 ($31) $48 $30 $8 $329 1-4 Family $14 ($22) $45 ($11) $7 $4 ($1) $36 National Real Estate ($69) $0 $0 $0 $0 $0 $0 ($69) O&G $9 $0 $15 ($3) $0 $0 $0 $21 Home Equity ($18) $13 $17 ($2) $6 ($1) $1 $16 Other ($7) $14 $11 ($0) ($0) $9 $5 $32 Total $183 $288 $259 ($30) $5 $21 $43 $769

GAAP to Non-GAAP Reconciliation 28 (Amounts in thousands) 1Q16 4Q15 3Q15 2Q15 1Q15 Efficiency Ratio Noninterest expense (GAAP) 1 (a) $ 395,573 $ 397,353 $ 391,280 $ 398,997 $ 392,977 Adjustments: Severance costs 3,471 3,581 3,464 1,707 2,253 Other real estate expense (1,329) (536) (40) (445) 374 Provision for unfunded lending commitments (5,812) (6,551) 1,428 (2,326) 1,211 Debt extinguishment cost 247 135 — 2,395 — Amortization of core deposit and other intangibles 2,014 2,273 2,298 2,318 2,358 Restructuring costs 996 777 1,630 679 766 Total adjustments (413) (321) 8,780 4,328 6,962 Add-back of adjustments (b) 413 321 (8,780) (4,328) (6,962) Adjusted noninterest expense (a) + (b) = (c) 395,986 397,674 382,500 394,669 386,015 Taxable-equivalent net interest income (GAAP) (d) 458,242 453,780 429,782 428,015 421,581 Noninterest income 1 (e) 116,761 118,641 125,944 (4,682) 117,338 Combined income (d) + (e) = (f) 575,003 572,421 555,726 423,333 538,919 Adjustments: Fair value and nonhedge derivative income (loss) (2,585) 688 (1,555) 1,844 (1,088) Equity securities gains (losses), net (550) 53 3,630 4,839 3,353 Fixed income securities gains (losses), net 28 (7) (53) (138,436) (239) Total adjustments (g) (3,107) 734 2,022 (131,753) 2,026 Add-back of adjustments 3,107 (734) (2,022) 131,753 (2,026) Adjusted taxable-equivalent revenue (Non-GAAP) (f) - (g) = (h) 578,110 571,687 553,704 555,086 536,893 Adjusted pre-provision net revenue (PPNR) (h) - (c) = (i) $ 182,124 $ 174,013 $ 171,204 $ 160,417 $ 150,878 Efficiency Ratio 1 (c) / (h) 68.5 % 69.6 % 69.1 % 71.1 % 71.9 % 1 In the first quarter of 2016, to be consistent with industry practice, the Company reclassified its bankcard rewards expense from “Other” Noninterest expense to “Other service charges, commissions and fees” in Noninterest income to offset this expense against the associated revenue. Prior period amounts have been reclassified to reflect this change.