Attached files

| file | filename |

|---|---|

| EX-99 - EX-99 - FIRSTMERIT CORP /OH/ | d184423dex99.htm |

| EX-31.2 - EX-31.2 - FIRSTMERIT CORP /OH/ | d184423dex312.htm |

| EX-31.1 - EX-31.1 - FIRSTMERIT CORP /OH/ | d184423dex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-11267

(Exact name of registrant as specified in its charter)

| Ohio | 34-1339938 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| III Cascade Plaza, 7th Floor, Akron Ohio | 44308 | |

| (Address of principal executive offices) | (Zip Code) | |

(330) 996-6000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, without par value | The NASDAQ Stock Market LLC | |

| 5.875% Non-Cumulative Perpetual Preferred Stock, Series A, without par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2015 the aggregate market value of the registrant’s common stock (the only common equity of the registrant) held by non-affiliates of the registrant was $3,453,043,279 based on the closing sale price as reported on the NASDAQ Global Select Market.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class |

Outstanding as of February 19, 2016 | |

| Common Stock, no par value | 165,754,538 |

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

We filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (“Form 10-K”) with the U.S. Securities and Exchange Commission (“SEC”) on February 22, 2016. We are filing this Amendment No. 1 to the Form 10-K (“Form 10-K/A”) solely for the purpose of including in Part III the information that was to be incorporated by reference from our definitive proxy statement for the 2016 annual meeting of shareholders, because our definitive proxy statement will not be filed with the SEC within 120 days after the end of our fiscal year ended December 31, 2015. This Form 10-K/A hereby amends and restates in their entirety the Form 10-K cover page and Items 10 through 14 of Part III.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, this Form 10-K/A also contains new certifications by the principal executive officer and the principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15(a)(3) of Part IV is amended to include the currently dated certifications as exhibits. Because no financial statements have been included in this Form 10-K/A and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Except as expressly noted in this Form 10-K/A, this Form 10-K/A does not reflect events occurring after the original filing of our Form 10-K or modify or update in any way any of the other disclosures contained in our Form 10-K including, without limitation, the financial statements. Accordingly, this Form 10-K/A should be read in conjunction with our Form 10-K and our other filings with the SEC.

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. |

Directors

Lizabeth Ardisana, Age 64

Ms. Ardisana has served as a director of FirstMerit since 2013 and is a member of the Compensation Committee. Ms. Ardisana is a principal owner of ASG Renaissance, a technical and communications services firm. She holds a bachelor’s degree in Mathematics and Computer Science from the University of Texas, a master’s degree in Mechanical Engineering from the University of Michigan and a master’s degree in Business Administration from the University of Detroit. Ms. Ardisana was a member of the board of directors of Citizens Republic Bancorp, Inc. from 2004 until 2013. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Ms. Ardisana has developed through her extensive experience in business allow her to provide continued regional business expertise to the Board of Directors.

Steven H. Baer, Age 66

Mr. Baer has served as a director of FirstMerit since 2007 and is a member of the Risk Management Committee. Mr. Baer currently is a partner at High Ridge Partners, Inc., Chicago, Illinois, a private turnaround, restructuring and financial consulting firm. From October 2003 until October 2013, Mr. Baer was a member of Rally Capital, LLC, Chicago, Illinois, a private investment banking and financial consulting firm. Mr. Baer holds a BSBA and an MSBA in Economics from the University of Denver. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Baer has developed through his educational background in economics and his professional experiences in commercial banking, real estate and investment banking allow him to provide continued financial and regional business expertise to the Board of Directors.

Karen S. Belden, Age 73

Ms. Belden has served as a director of FirstMerit since 1996 and is a member of the Company’s Risk Management Committees. Ms. Belden is retired. Ms. Belden was a realtor with DeHoff Realtors, Canton, Ohio until January 2014, and remains active with the Stark County, Ohio Board of Realtors. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Ms. Belden has developed through her extensive experience in the real estate field, as well as her knowledge of the northeast Ohio business community and markets, and her experience as a director of FirstMerit, allow her to provide continued local business and real estate expertise to the Board of Directors.

R. Cary Blair, Age 76

Mr. Blair has served as a director of FirstMerit since 1996 and is a member of the Company’s Compensation and Executive Committees. Formerly, Mr. Blair served as Chairman and CEO of the Westfield Group, Westfield Center, Ohio, a group of financial services and insurance companies, and as a director for The Davey Tree Expert Company, a public company provider of horticultural services based in Kent, Ohio. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Blair has developed through his leadership experience in the financial services and insurance fields and his experiences as a director of FirstMerit and The Davey Tree Expert Company, allow him to provide continued financial and regional business expertise to the Board of Directors.

John C. Blickle, Age 65

Mr. Blickle has served as a director of FirstMerit since 1990 and is a member of the Company’s Audit, Compensation, Corporate Governance and Nominating, Risk and Executive Committees. Mr. Blickle is the President of Rubber City Arches, LLC, Akron, Ohio, which is the owner and operator of 20 McDonald’s franchises located throughout northeast Ohio. Previously, Mr. Blickle served in the accounting field and has extensive public accounting experience qualifying him as a financial expert for purposes of serving on and chairing the Audit Committee of the Board of Directors. The Corporate

Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Blickle has developed through his educational background in business and accounting, his business and leadership experiences in the northeast Ohio market, as well as his knowledge and experience as a director of FirstMerit, allow him to provide continued accounting, local business and corporate governance expertise to the Board of Directors.

Robert W. Briggs, Age 74

Mr. Briggs has served as a director of FirstMerit since 1996 and is a member of the Company’s Executive and Risk Management Committees. In April 2014, Mr. Briggs became the President and CEO of the Northeast Ohio Council on Higher Education. Mr. Briggs was the President of the GAR Foundation until his retirement on December 31, 2011, is Chair of the John S. and James L. Knight Foundation, and is a Partner and Chairman Emeritus of the law firm of Buckingham, Doolittle & Burroughs, LLP, Akron, Ohio. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Briggs has developed through his education and experiences in the legal field generally and in the northeast Ohio business market, his leadership roles in philanthropic foundations, as well as his knowledge and experience as a director of FirstMerit, allow him to provide continued legal and local business expertise to the Board of Directors.

Richard Colella, Age 80

Mr. Colella has served as a director of FirstMerit since 1998 and is a member of the Company’s Risk Management Committee. Mr. Colella was Managing Partner of the law firm of Colella & Weir, P.L.L., Lorain, Ohio until June 2015. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Colella has developed through his education and experiences in the legal field generally and in the northeast Ohio business market, as well as his knowledge and experience as a director of FirstMerit, allow him to provide continued legal and local business expertise to the Board of Directors.

Robert S. Cubbin, Age 58

Mr. Cubbin has served as a director of FirstMerit since 2013 and is a member of the Audit Committee. Mr. Cubbin is the President and CEO of Meadowbrook Insurance Group, Inc., a risk management organization. He holds a bachelor’s degree from Wayne State University and a law degree from the Detroit College of Law. Mr. Cubbin has served as a member of the board of directors of Meadowbrook Insurance Group, Inc. since 1995 and as a member of the board of directors of Kelly Services, Inc. since August 2014. Previously, he was a member of the board of directors of Citizens Republic Bancorp, Inc. from 2008 until 2013. Mr. Cubbin served in the insurance field and has extensive public company experience qualifying him as a financial expert for purposes of serving on the Audit Committee of the Board of Directors. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Cubbin has developed through his public company background and business experience allow him to provide continued business expertise to the Board of Directors.

Gina D. France, Age 57

Ms. France has served as a director of FirstMerit since 2004 and is a member of the Company’s Audit and Corporate Governance and Nominating Committees. Ms. France is the President of France Strategic Partners LLC, Medina, Ohio, a private strategic and transaction advisory firm. Ms. France also serves as a director of Cedar Fair LP, Sandusky, Ohio, a regional amusement-resort operator and as a director of CBIZ, Inc., a professional business services provider. Previously, Ms. France served as an investment banker with Lehman Brothers and a managing director of Ernst & Young LLP, providing her with education and business experiences qualifying her as a financial expert for purposes of serving on the Audit Committee of the Board of Directors. Ms. France holds a Master of Management (Finance) degree from the J.L. Kellogg Graduate School of Management at Northwestern University. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Ms. France has developed through her education and leadership experiences in the investment banking, accounting and financial services industries, allow her to provide continued financial and regional business expertise to the Board of Directors.

Paul G. Greig, Age 60

Mr. Greig has served as Chairman, President and CEO of FirstMerit since 2006 and is a member of the Company’s Executive Committee. Mr. Greig is also the Chairman, President and CEO of FirstMerit Bank. Prior to joining FirstMerit, Mr. Greig served as President and CEO of Charter One Bank, Illinois from 2005-2006 and President and CEO of Bank One, Wisconsin from 1999-2005. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Greig has developed through his education and experiences in the banking and financial services industries, as well as his significant leadership positions with FirstMerit, allow him to provide continued business and leadership insight to the Board of Directors.

Terry L. Haines, Age 69

Mr. Haines has served as a director of FirstMerit since 1991 and is a member of the Company’s Compensation and Corporate Governance and Nominating Committees. Mr. Haines is currently retired and formerly served as a director of Ameron International Corporation, a public company producer of fiberglass-composite piping, concrete and steel pipe systems and specialized construction products and as Chairman, President and CEO of A. Schulman, Inc., Akron, Ohio, a public company manufacturer and wholesaler of plastic materials. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Haines has developed through his public company leadership experiences, his knowledge of the northeast Ohio business market, as well as his knowledge and experience as a director of FirstMerit, allow him to provide continued regional business and public company leadership expertise to the Board of Directors.

J. Michael Hochschwender, Age 55

Mr. Hochschwender has served as a director of FirstMerit since 2005 and is a member of the Company’s Audit and Compensation Committees. Mr. Hochschwender is the President and CEO of The Smithers Group, Akron, Ohio, a private group of companies that provides technology-based services to global clientele in a broad range of industries, and holds an M.B.A. from the Wharton School of Business, University of Pennsylvania. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Hochschwender has developed through his education and business leadership experiences in the northeast Ohio business market allow him to provide continued regional business and leadership expertise to the Board of Directors.

Philip A. Lloyd II, age 69

Mr. Lloyd has served as a director of FirstMerit since 1988 and is a member of the Company’s Risk Management and Executive Committees. Mr. Lloyd is CEO of McDowell Family LLC and McDowell Properties, LLC, family owned entities involved in investments and investment real estate. Prior to his retirement from the firm in April 2011, Mr. Lloyd had been Of Counsel with the Vorys law firm, Akron, Ohio. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Lloyd has developed through his education and extensive experiences in the legal field and the northeast Ohio business market, his knowledge and experience as a director of FirstMerit, as well as his significant ownership interest in FirstMerit, allows him to provide continued legal and local business expertise to the Board of Directors.

Russ M. Strobel, age 63

Mr. Strobel has served as a director of FirstMerit since 2012 and is a member of the Risk Management Committee. Mr. Strobel is the retired chairman, CEO and president of Nicor Inc. and Nicor Gas Company, Naperville, Ill. Prior to joining Nicor in 2000, Mr. Strobel served as a partner in the law firms of Altheimer & Gray, Jenner & Black and Friedman & Koven. Mr. Strobel holds a bachelor’s degree from Northwestern University and a law degree with high honors from the University of Illinois. The Corporate Governance and Nominating Committee believes that the attributes, skills and qualifications Mr. Strobel has developed through experiences in the legal field and his business experience, allows him to provide continued legal and local business expertise to the Board of Directors.

Executive Officers

The following persons were the executive officers of the Corporation as of March 31, 2016. Unless otherwise stated, each listed position was held on January 1, 2011.

| Name |

Age | Date Appointed To FirstMerit |

Position and Business Experience | |||

| Paul G. Greig | 60 | 05/18/2006 | President and Chief Executive Officer of FirstMerit and of FirstMerit Bank since May 18, 2006; Chairman of FirstMerit Bank since January 1, 2007. | |||

| Sandra E. Pierce | 57 | 02/01/2013 | Vice Chairman of FirstMerit and Chairman of FirstMerit, Michigan; previously President and Chief Executive Officer of Charter One Bank Michigan from 2004 through June 30, 2012. | |||

| Terrence E. Bichsel | 67 | 09/16/1999 | Senior Executive Vice President and Chief Financial Officer of FirstMerit and FirstMerit Bank. | |||

| N. James Brocklehurst | 50 | 07/07/2010 | Executive Vice President, Retail, since July 7, 2010; previously Senior Vice President, Retail Banking of FirstMerit. | |||

| Mark DuHamel | 58 | 02/16/2005 | Executive Vice President, Deputy Chief Financial Officer, since May 26, 2015 and Corporate Development Officer; previously Treasurer since February 16, 2005. | |||

| David G. Goodall | 50 | 05/16/2013 | Vice Chairman and Chief Commercial Banking Officer of FirstMerit Corporation since June 1, 2015; previously Senior Executive Vice President, Commercial Banking since November 11, 2009. | |||

| Carlton E. Langer | 61 | 02/21/2013 | Executive Vice President, Chief Legal Officer and Corporate Secretary of FirstMerit since February 21, 2013; previously, Senior Vice President, Assistant Counsel and Assistant Secretary FirstMerit since February 16, 2010. | |||

| Christopher J. Maurer | 67 | 05/22/1999 | Executive Vice President, Chief Human Resources Officer. | |||

| Mark D. Quinlan | 55 | 01/02/2013 | Executive Vice President and Chief Information Officer of FirstMerit since January 2, 2013; previously Executive Vice President, Chief Information and Operations Officer of Associated Banc-Corp from November 2005 to April 2012. | |||

| William P. Richgels | 65 | 05/01/2007 | Senior Executive Vice President, Chief Credit Officer since May 1, 2007. | |||

| Michael G. Robinson | 52 | 08/01/2012 | Executive Vice President, Wealth Management since August 1, 2012; previously Managing Director in Asset Management of JPMorgan Private Bank, from 1985 through July 2012. | |||

| Julie C. Tutkovics | 45 | 05/21/2015 | Executive Vice President, Chief Marketing Officer since May 2013; previously, Senior Vice President, Chief Marketing Officer since November 15, 2010. | |||

| Brian C. Williams | 57 | 11/01/2014 | Executive Vice President, Chief Risk Officer since November 1, 2014; previously Executive Vice President, Director Audit Services of FirstMerit since June 8, 2008. | |||

| Nancy H. Worman | 68 | 12/20/2014 | Executive Vice President and Chief Accounting Officer since December 20, 2014; previously Senior Vice President and Corporate Controller of FirstMerit since November 1, 2003. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires FirstMerit’s directors, officers and persons who own beneficially more than ten percent of its common shares (“Section 16 Filers”) to file reports of ownership and transactions in the common shares with the Commission and to furnish FirstMerit with copies of all such forms filed. FirstMerit understands from the information provided to the Company by its Section 16 Filers that all transactions have been timely reported, except that: (1) due to administrative error, one Section 16(a) filing reporting Mark Quinlan’s vesting of a restricted stock award was late; and (2) due to administrative error, two transactions regarding the vesting of performance-based RSUs above target and applicable share withholding for withholding taxes were reported late in one Section 16(a) amended filing for each of Messrs. Bichsel, Brocklehurst, DuHamel, Goodall, Greig, Langer, Maurer, Richgels and Robinson and Ms. Steiner (Mr. Goodall’s filing only reflected the vesting transaction).

Code of Business Conduct and Ethics

FirstMerit has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”) that covers all employees, including its principal executive, financial and accounting officers, and is posted on FirstMerit’s website www.firstmerit.com. In the event of any amendment to, or waiver from, a provision of the Code of Ethics that applies to its principal executive, financial or accounting officers, FirstMerit intends to disclose such amendment or waiver on its website.

Procedures for Recommending Directors Nominees

The Corporate Governance and Nominating Committee will consider candidates for directors of FirstMerit, including those recommended by a shareholder who submits the person’s name and qualifications in writing. The Corporate Governance and Nominating Committee has no specific minimum qualifications for a recommended candidate, and does not consider shareholder recommended candidates differently from other candidates that are suggested by Board members, executive officers or other sources.

The Corporate Governance and Nominating Committee considers:

| • | personal qualities and characteristics, accomplishments and reputation in the business community; |

| • | current knowledge and contacts in the communities in which FirstMerit does business; |

| • | ability and willingness to commit adequate time to Board and committee matters; |

| • | the fit of the individual’s skills with those of other directors and potential directors in building a Board that is effective and responsive to the needs of FirstMerit; |

| • | diversity of viewpoints, background, experience and other demographics; and |

| • | the ability of the nominee to satisfy the independence requirements of NASDAQ. |

As listed above, diversity of viewpoints, background, experience and other demographics is one of several criteria on which the Corporate Governance and Nominating Committee bases its evaluation of potential candidates for director positions. The inclusion of diversity in the listed criteria reflects the Board of Director’s belief that diversity is an important component of an effective Board, and the Corporate Governance and Nominating Committee considers diversity aspects when it evaluates director candidates and their specific skills, expertise and background.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its responsibility to oversee the accounting and financial reporting process of FirstMerit. The Audit Committee members currently are John C. Blickle (Chair), Robert S. Cubbin, Gina D. France and J. Michael Hochschwender. The Board has determined that it has three “audit committee financial experts” serving on its Audit Committee. John C. Blickle, Robert S. Cubbin and Gina D. France each have been determined to have the attributes listed in the definition of “audit committee financial expert” set forth in the Instruction to Item 407(d)(5)(i) of Regulation S-K and in the NASDAQ listing requirements. Mr. Blickle acquired these attributes through education and experience as a certified public accountant. Ms. France acquired these attributes through education and her experience in the investment banking industry. Mr. Cubbin acquired these attributes through his experience in the insurance industry. All of the Audit Committee members are considered independent for purposes of NASDAQ listing requirements.

| ITEM 11. | EXECUTIVE COMPENSATION. |

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with FirstMerit’s management. Based upon this review and discussion, the Compensation Committee recommends to the Board of Directors that the Compensation Discussion and Analysis be included in FirstMerit’s Annual Report on Form 10-K for the year ended December 31, 2015.

Compensation Committee:

R. Cary Blair, Chair

Lizabeth Ardisana

John C. Blickle

Terry L. Haines

J. Michael Hochschwender

Compensation Committee Interlocks and Insider Participation

During the last completed fiscal year, none of the members of the Compensation Committee was an officer or employee, or formerly an officer, of FirstMerit or any of its subsidiaries. None of such directors had any business or financial relationship with FirstMerit requiring disclosure under this heading in this report.

COMPENSATION DISCUSSION & ANALYSIS

In our Executive Summary, we will discuss:

| • | Continuing outreach to shareholders; |

| • | Key business performance results and returns to shareholders; |

| • | 2015 CEO pay and our pay-for-performance results; and |

| • | Changes to our incentive compensation plans for our named executive officers (or NEOs) for 2015. |

The balance of our Compensation Discussion & Analysis, or CD&A, will further discuss:

| • | Compensation plans and incentive awards provided to our NEOs for 2015; and |

| • | Details and analysis regarding our compensation practices and policies for 2015. |

| GLOSSARY OF KEY ABBREVIATIONS | ||

| ICP | Incentive Compensation Plan | |

| NEO | Named Executive Officer | |

| NPA | Non-Performing Assets | |

| OREO | Other Real Estate Owned | |

| ROAA | Return on Average Assets | |

| ROACE | Return on Average Common Equity | |

| ROATE | Return on Average Tangible Equity | |

| RSU | Restricted Stock Unit | |

| SERP | Supplemental Executive Retirement Plan | |

EXECUTIVE SUMMARY

Our executive compensation programs and awards in 2015 were generally consistent with the programs utilized in 2014. We determined to carry into 2015 the design of our 2014 programs with minimal changes in part as a reflection of the 93% favorable vote we received on our 2015 Say on Pay vote, as well as the significant program changes we had already completed in recent years in response to feedback from our shareholders. It is also our belief that our programs appropriately balance the interests of the company, shareholders, and executives. We remain committed to providing compensation that motivates and rewards our corporate success, and we believe that the modifications to our program in recent years have enhanced that effort.

Investor Outreach

In 2015, we once again embarked on a robust investor outreach program. We engaged with our 25 largest investors, representing 55% of our investor base, in order to gather feedback regarding our executive compensation program.

We take the opinions of our shareholders very seriously, and were pleased to engage in productive discussions with many of them. The Compensation Committee carefully considered the views expressed by shareholders and potential impacts to our compensation program for 2015 and beyond. While investors had a variety of opinions, we consistently heard that investors were pleased with our executive compensation program overall, and particularly with the responsiveness of the Compensation Committee in making program changes in 2014 in response to investor feedback. We were pleased that our strongly favorable Say on Pay vote in 2015 was in line with the favorable comments we were hearing from our shareholders.

Incentive Plan Changes & Mix of Pay

We have made significant changes to our short-term cash incentive program (or ICP) and our equity incentive plan over recent years based on the feedback we received from our shareholders. We believe that the plans resulting from this process are easier to understand for both investors and participants, facilitate clear understanding and appreciation of the rigor of the performance goals, and enhance the connection between the long-term success of our company and the rewards to our executives. While the structure of the 2015 ICP is unchanged from 2014, the changes to our equity plan originally contemplated in 2014 were not implemented until 2015 due to tax considerations that prevented us from adequately modifying our NEOs’ 2014 awards.

In the tables below we summarize the changes in both our ICP and equity incentive plan since 2012.

Short-Term ICP Timeline

| 2012 |

2013 |

2014 |

2015 | |||||

| Award Determination | Discretionary | Formula driven | Formula driven | Formula driven | ||||

| Performance Metrics | 8 financial categories

10 strategic categories |

14 corporate performance categories

Individual performance |

6 corporate performance categories

Individual performance |

6 corporate performance categories

Individual performance | ||||

| Performance Assessment | Discretionary | 9 metrics assessed relative to plan

5 metrics assessed relative to peers |

All corporate performance assessed relative to plan | All corporate performance assessed relative to plan | ||||

| Performance Assessment Modifier | None | Formula-driven switch in goal weightings based on differential in performance results | None | None | ||||

| Form of Payment | Cash | Cash | Cash | Cash | ||||

Equity Incentive Plan Timeline

| 2012 |

2013 |

2014 |

2015 | |||||

| Award Determination | Granted at a set percent of salary or salary grade midpoint | Granted at a set percent of salary or salary grade midpoint | Granted at a set percent of salary or salary grade midpoint | Granted at a set percent of salary or salary grade midpoint | ||||

| Performance Metrics | N/A | Return on Average Common Equity (ROACE) relative to peers | ROACE relative to peers | ROACE relative to peers | ||||

| Performance Assessment | N/A | Relative performance over 3 distinct 1-year periods | Relative performance over 3 distinct 1-year periods | Relative performance over the subsequent 3-year period | ||||

| Vesting Period | Equal increments over 3 years | Performance-vested awards vest in 3 annual installments

Time-vested awards vest in 3 equal annual installments |

Performance-vested awards vest in 3 annual installments

Time-vested awards vest in 3 equal annual installments |

Performance-vested awards vest after 3 years

Time-vested awards vest in 3 equal annual installments | ||||

| Form of Payment | 100% time-vested restricted stock | 52% performance-vested RSUs

48% time-vested RSUs |

52% performance-vested RSUs

48% time-vested RSUs |

60% performance-vested RSUs

40% time-vested RSUs | ||||

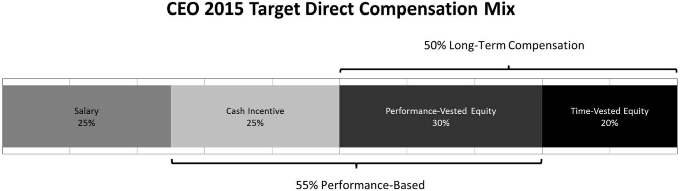

2015 Mix of Pay

We believe that our executive compensation program strikes an appropriate balance between fixed and variable pay as well as short- and long-term pay, particularly following the changes to our incentive plans for 2014 and 2015 as described above. The exhibit below presents the mix of direct compensation at target performance for our CEO in 2015.

Our 2015 Performance

2015 was another successful year for FirstMerit in the key financial and operational areas that have been the hallmarks of our historical success, and that we believe truly drive long-term company value:

| • | Strong, Predictable Earnings Base: We achieved our 67th consecutive quarter of profitability in 2015. |

| • | Solid Organic Growth: We experienced robust growth in our commercial, retail, and wealth banking product areas, in addition to extending our market opportunities by further expansion of the Chicago, Wisconsin, and southeast Michigan markets. |

| • | Industry-Leading Deposit Base: We maintained a top-three deposit market share position in 12 of the markets in which we operate, and we have one of the lowest deposit costs in the industry. |

| • | Disciplined Capital Allocation: Our primary focus in 2015 continued to be organic growth and shareholder dividends, as demonstrated by the fact that we have paid a dividend every quarter as a public company, dating back to 1981. In addition, we increased our quarterly dividend to shareholders by 6.25% in the third quarter of 2015. |

| • | Best-in-Class Regulatory Management: We proactively invested to enhance our regulatory management and compliance in the short-term in order to best position the company for the long-term. |

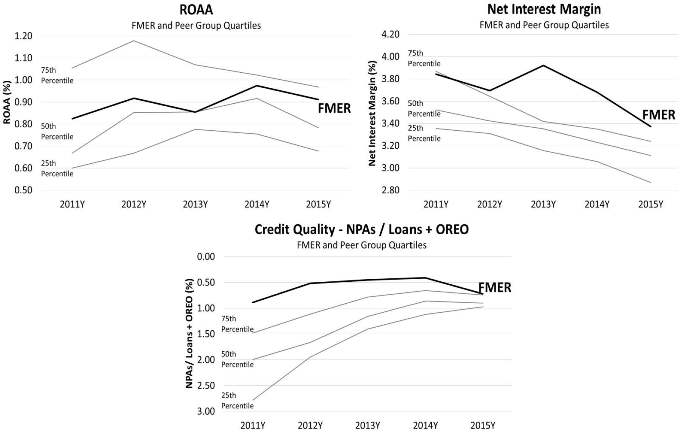

As was the case in 2014, the results of our continued focus on the basic fundamentals of sound banking listed above in 2015 was that we continued our trend of outperforming our peers on the key operational measures that we believe translate to long-term success in our industry, including profitability, net interest margin, and credit quality. Our performance in each of those categories over the last five years relative to our peers is demonstrated in the graphs below through (1) Return on Average Assets (ROAA) and (2) Non-Performing Assets (NPA)/Loans + Other Real Estate Owned (OREO), both of which are utilized in our ICP, and (3) net interest margin. See below for a listing of our peers.

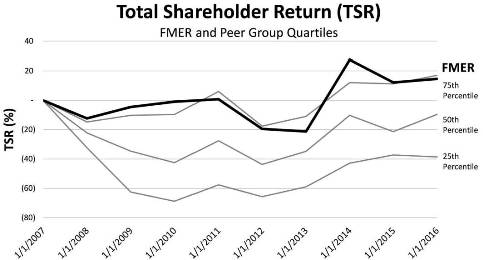

In 2015, we matched strong operational performance with competitive shareholder return. Our total shareholder return over one-year and three-year periods are both near the median of our peer group. We believe that our emphasis on profitability and credit quality position FirstMerit well to achieve strong shareholder return over the long-term. FirstMerit has historically provided strong long-term returns to shareholders under a variety of economic conditions. The graph below illustrates that our shareholder return since the beginning of the economic downturn has generally been above the 75th percentile of our peer group.

2015 Compensation

The cornerstone of our executive compensation program remains competitive pay for outstanding performance. We seek to ensure that the compensation received by our executives is aligned with our performance, and that a significant portion of our executives’ pay is wholly contingent on the achievement of the annual performance goals that drive our success as an organization as well as value to our shareholders.

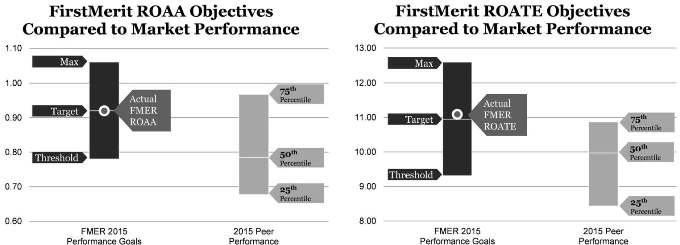

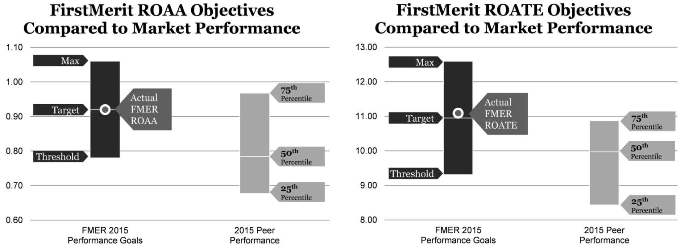

In following our pay-for-performance philosophy, we annually establish performance objectives as part of our ICP that we believe represent meaningful and challenging performance. The exhibits below affirm our belief in the rigor of our goal-setting by illustrating that the target performance levels for two of our primary ICP goals represent profitability significantly greater than that achieved by our peers. In other words, our NEOs would not receive target-level ICP awards for our ROAA and Return on Average Tangible Equity (ROATE) goals unless we outperformed the median, and in the case of ROATE the 75th percentile, of our peers.

Note: Actual performance data shown for FirstMerit differs from our GAAP-reported financials due to the exclusion of certain one-time non-recurring items. Data shown is consistent with the performance calculations used in determining ICP awards for 2015, as shown below. See Exhibit 99 to this Amendment, which is incorporated by reference herein, for reconciliation of our non-GAAP financial measures to our results as reported under GAAP.

We choose not to measure total shareholder return directly in our incentive plans because of the number of factors beyond management’s control that influence our stock price, including macroeconomic conditions, overall financial industry performance, and investor expectations. Rather, we choose to focus our incentive plans on corporate earnings and credit quality, which are performance measures that are within management’s control and that we believe drive long-term shareholder value creation. In addition, our shareholders have not generally expressed a specific preference for the use of total shareholder return in our incentive plans. See below for further discussion of the metrics chosen for our 2015 incentive plans.

INTRODUCTION

This CD&A describes FirstMerit’s 2015 compensation program for our NEOs. The objective of our executive compensation program is to attract, retain, and motivate the key leaders who serve our company and our shareholders. In particular, the following pages explain the process for, and objectives and structure of, the executive compensation decisions made by our Compensation Committee and our Board of Directors for 2015. This CD&A is intended to be read in conjunction with the tables and related disclosure below, which provide detailed historical compensation information for our NEOs. For 2015, our NEOs are:

| Name |

Title | |

| Paul G. Greig |

Chairman, President and Chief Executive Officer | |

| Terrence E. Bichsel |

Senior Executive Vice President and Chief Financial Officer | |

| Sandra E. Pierce |

Vice Chairman, FirstMerit Corporation, and Chairman & CEO, FirstMerit Michigan | |

| William P. Richgels |

Senior Executive Vice President and Chief Credit Officer | |

| David G. Goodall |

Former Vice Chairman and Chief Commercial Banking Officer |

RESPONSE TO 2015 SAY ON PAY VOTE

We were pleased that our advisory vote on NEO compensation conducted at our 2015 Annual Meeting resulted in a 93% favorable vote. This result represents a significant improvement from our 2014 Say on Pay proposal, which received only a 41% favorable vote. We believe that the 2015 result is an affirmation of our responsiveness to the perspectives of our shareholders, as well as the substantial compensation plan changes in 2014 and early 2015 that resulted from our discussions with shareholders. Even in light of our strong results in 2015, we remain committed to engaging in regular investor outreach and careful consideration of our executive compensation plans and programs, in order to affirm that our compensation programs properly motivate corporate success and are aligned with the interests of shareholders. We believe that the modifications to our program in recent years have enhanced that effort, and will continue to advance it into the future.

2015 COMPENSATION DECISION PROCESS

Compensation Committee’s Philosophy on Named Executive Officer Compensation

Decisions regarding our executive compensation programs and pay levels are made in the context of our compensation philosophy, which is established and implemented by the Compensation Committee. Our guiding philosophy seeks to balance and align the interests of shareholders and executives through a combination of fixed and performance-based pay, as well as short and long-term pay, all while not encouraging excessive risk-taking that could harm our business. Pay elements are specifically designed to encourage and reward the achievement of our short-term and long-term objectives and the creation of long-term shareholder value. For each NEO, the compensation package is also intended to represent a fair and competitive compensation arrangement.

The four major objectives of the compensation program for our NEOs are:

| • | Attraction and Retention - Attract and retain senior executives with large bank and managerial experience who can preserve and increase long-term shareholder value by strengthening the core financial performance metrics that ultimately drive our long-term success. The Compensation Committee recognizes the need to provide competitive overall compensation opportunities to retain our high-performing executives and attract new executive talent. |

| • | Alignment with Shareholders - Link executive compensation rewards with increases in long-term shareholder value and its key financial and operational drivers, with the goal of ultimately aligning shareholder investment and executive compensation interests, including through meaningful executive share ownership levels. |

| • | Pay for Performance - Motivate executives to be accountable for, and accomplish, the strategic and financial objectives approved by the Board of Directors by providing above-median compensation for superior performance, and below-median compensation when performance is less than expected. |

| • | Risk Balance - Effectively design, develop and monitor sound incentive compensation programs that appropriately balance compensation risks and financial results, with the ultimate goal of promoting the stability and soundness of FirstMerit. |

The Compensation Committee compares our executive compensation pay levels and program designs with data sources that reflect our competitive marketplace for executive compensation and account for the size of our operations. These data sources have been provided to the Compensation Committee by its compensation consultant and have generally consisted of industry-specific compensation surveys and an analysis of pay levels provided to comparable executives at selected peer group financial institutions. In general, we review the compensation of our CEO compared to market on an annual basis, and we review the compensation of our other executives compared to market on an as-needed basis.

We intend to position our targeted total direct compensation (salary, annual cash incentives, and equity incentives) for each executive near the assessed median competitive level for comparable executives, assuming targeted performance is achieved. We believe it is appropriate to pay median compensation for target performance because we generally establish target performance objectives at or above the median performance level of our peer group, as demonstrated by the charts above. In addition, the charts above demonstrate our sustained record of success compared to our peers. Actual total direct compensation in any given year may be above or below the target level based on corporate and individual performance. We believe that overall compensation opportunities for our NEOs in 2015 were competitive with those offered by financial services institutions that are similar to us in asset size and operations based on market and historical comparisons as discussed further below.

ROLES IN DETERMINING 2015 NAMED EXECUTIVE OFFICER COMPENSATION

The Role of the Compensation Committee

2015 compensation for the NEOs was determined under programs adopted by the Compensation Committee and in many cases approved by the Board of Directors. The Compensation Committee established our executive compensation philosophy, policy, elements, and strategy and reviewed executive compensation proposals for approval by the Board of Directors. Specifically, the Compensation Committee:

| • | Approved 2015 salary adjustments for NEOs other than the CEO; |

| • | Determined the NEOs eligible to participate in the ICP for 2015; |

| • | Reviewed 2015 corporate performance results and the CEO’s assessment of 2015 individual performance results to determine final 2015 ICP award payouts for our NEOs other than the CEO; |

| • | Oversaw administration of our benefit plans and perquisites; |

| • | Assessed and monitored the performance, design, function and potential risk components of our compensation programs for our NEOs; and |

| • | Administered the annual comprehensive CEO performance assessment, in which Mr. Greig’s performance is evaluated in both narrative and numerical form by each independent member of the Board of Directors. |

In addition, the Compensation Committee recommended to the Board of Directors: (1) the 2015 salary adjustment for the CEO; (2) the corporate performance measures and targets for the 2015 ICP; (3) the final 2015 ICP award payout for our CEO; (4) the type and amount of our 2015 equity awards to the NEOs; (5) executive benefits, retirement plans, and limited perquisites; and (6) executive employment, severance and change in control agreements. The Compensation Committee also reviewed and discussed all aspects of each NEO’s compensation.

Role of Management

Members of management assist the Compensation Committee by providing recommendations that management believes will establish appropriate and market-competitive compensation plans for executive officers consistent with FirstMerit’s compensation philosophy. As part of this process, management collaborates with management’s independent compensation consultant to identify relevant market data, review potential compensation plan designs, and discuss industry trends before making recommendations to the Compensation Committee. In 2015:

| • | Management recommended base salaries as well as cash and equity incentive targets for NEOs other than the CEO; |

| • | Management proposed incentive metrics and planned performance levels for the ICP; and |

| • | Mr. Greig assessed the individual performance in 2015 of each NEO other than the CEO relative to expectations for the purposes of determining 2015 ICP award payouts. |

The Compensation Committee reviews and discusses management’s recommendations in conjunction with its own independent compensation consultant in making compensation decisions or recommendations to the full Board. Mr. Greig’s compensation is discussed in executive session without members of management present, including Mr. Greig.

Role of the Compensation Consultants

In January 2015, the Compensation Committee again retained Gough Management Company (or Gough), as permitted by the Compensation Committee Charter, to provide the Compensation Committee with independent advice on executive compensation matters and to assist in making compensation recommendations to the Board of Directors. During 2015, Gough assisted the Compensation Committee by preparing information on competitive compensation levels and practices for the CEO and other executives, compiling information relating to CEO compensation from selected peer banks (see “Competitive Benchmarking for 2015” below), advising the Compensation Committee regarding its evaluation of and response to the 2015 Say on Pay vote, and assisting in the re-design of FirstMerit’s

equity incentive plan for 2015. Pursuant to the terms of its retention, Gough reported directly to the Compensation Committee, which retains sole authority to select, retain, terminate, and approve the fees and other retention terms of its relationship with Gough. Gough does not provide any services for FirstMerit outside those provided to the Compensation Committee.

In 2015, management again engaged McLagan, a compensation consultant affiliated with Aon Hewitt, to provide compensation information for certain executive officers, advise the company regarding its evaluation of and response to the 2015 Say on Pay and shareholder proposal votes, and assist with the re-design and implementation of FirstMerit’s equity incentive plan for 2015. Pursuant to the terms of its retention, McLagan reported directly to management. Aon Hewitt also provided advice to management on the administration of our executive retirement plans and programs and assistance in the administration of other retirement plans and programs that are generally available to all FirstMerit employees. Aon Hewitt reported directly to management in this role.

In 2015, the Compensation Committee reviewed its relationship with Gough, as well as its or FirstMerit’s receipt of any direct or indirect executive and director compensation assistance from McLagan and Aon Hewitt. Considering all relevant factors, including those set forth in Rule 10C-1(b)(4)(i) through (vi) under the Securities Exchange Act of 1934, the Compensation Committee determined that it is not aware of any conflict of interest that has been raised by the work performed by any of Gough, McLagan or Aon Hewitt. In addition, the Compensation Committee has assessed the independence of Gough, McLagan and Aon Hewitt, as required under Nasdaq listing rules.

OUR COMPENSATION POLICIES

We design our executive compensation program to be driven by performance, rewarding to executives, value-creating for shareholders, and compatible with strong governance. The following table sets forth the best practices that we adhere to in designing and determining our executive compensation.

Compensation Best Practices

Compensation philosophy

We believe that our philosophy of compensation promotes long-term decision-making, careful consideration of risks to our organization, clear connection between pay and performance, attraction and retention of talented executives, and alignment between incentive pay and shareholder interests.

Competitive benchmarking

We assess the competitiveness of certain executive compensation programs compared to the organizations with which we compete for executive talent in order to make fully-informed decisions on pay levels and practices.

Performance-based pay

More than 50% of our CEO’s target compensation, and nearly 50% of our other NEOs’ target compensation, is earned based exclusively on the attainment of specific performance goals.

Pay for long-term performance

More than 50% of each NEO’s variable compensation is paid in stock, which vests over three years. A substantial portion of the awards will not vest if performance goals over the vesting period are not met. The value of the awards to executives upon vesting varies based on changes in our stock price.

Robust share ownership guidelines

Our CEO must own shares of our common stock worth at least five times his base salary. Each of our other NEOs must own shares worth at least two and a half times his or her base salary.

Anti-hedging/anti-pledging policies

Our executives and directors are prohibited from engaging in any hedging of FirstMerit shares, including buying or selling puts or calls, short sales, or any other hedging transaction. Executives and directors are also prohibited from holding FirstMerit shares in a margin account or otherwise pledging FirstMerit shares as collateral for a loan.

Robust clawback policy

Our clawback policy allows us to recover erroneously paid cash and equity incentive awards in the case of certain financial restatements.

Shareholder outreach

We regularly hold conversations with our shareholders to gain their perspectives on the structure of our compensation program.

SPECIFIC CONSIDERATIONS REGARDING 2015 COMPENSATION

Competitive Benchmarking for 2015

For 2015, Gough again provided the Compensation Committee with an analysis of Mr. Greig’s targeted total direct compensation opportunity compared to the compensation opportunities of CEOs at a peer group of financial institutions similar to FirstMerit in size and business profile. In December 2014, the Compensation Committee reviewed the peer group used to evaluate compensation in 2014, along with the criteria used to establish the group. The Compensation Committee determined that both the peer group criteria and the member banks remained relevant for FirstMerit in 2015, and accordingly determined that no changes should be made to the 2015 peer group.

The members of the peer group met the following criteria as of September 30, 2014:

| • | Banks and thrifts with assets between $17.5 and $65 billion; |

| • | Commercial banking focus; |

| • | Located exclusively in the continental United States; |

| • | Not managed by executives with controlling ownership; and |

| • | Not a target of a publicly-announced acquisition. |

In addition to the criteria listed above, the Compensation Committee eliminated from consideration a limited number of institutions that, while they otherwise met the stated criteria, reflect significant differences from FirstMerit in key organizational areas, such as specific business line focus.

We believe that the resulting comparator group represents an accurate indicator of the companies with which we compete for executive talent. The Compensation Committee approved the following peer group of 18 institutions for 2015:

| Total Assets | Total Assets | |||||||||

| 12/31/2014 | 12/31/2014 | |||||||||

| Company Name |

($000) | Company Name |

($000) | |||||||

| Associated Banc-Corp |

$ | 26,821,774 | Hancock Holding Co. | $ | 20,747,266 | |||||

| BOK Financial Corp. |

29,089,698 | Huntington Bancshares Inc. | 66,298,010 | |||||||

| City National Corp. |

32,597,232 | People’s United Financial Inc. | 35,997,100 | |||||||

| Comerica Inc. |

69,186,000 | Susquehanna Bancshares Inc. | 18,661,390 | |||||||

| Commerce Bancshares Inc. |

23,994,280 | Synovus Financial Corp. | 27,051,231 | |||||||

| Cullen/Frost Bankers Inc. |

28,277,775 | TCF Financial Corp. | 19,394,611 | |||||||

| First Horizon National Corp. |

25,668,187 | Webster Financial Corp. | 22,533,172 | |||||||

| First Niagara Financial Group |

38,551,038 | Wintrust Financial Corp. | 20,010,727 | |||||||

| First Republic Bank |

48,350,202 | Zions Bancorp. | 57,208,874 | |||||||

|

|

|

|||||||||

| FirstMerit |

$ | 24,902,347 | ||||||||

|

|

|

|||||||||

The median asset size of the peer group was $27.7 billion as of December 31, 2014, compared to FirstMerit’s asset size at that time of $24.9 billion.

After determining the final group of 18 peers for 2015, statistical regression was used to adjust peer compensation data based on FirstMerit’s asset size relative to the peer group. This regression analysis allowed us to pinpoint specific target and maximum compensation values relative to peers for our CEO based on the distribution of these amounts relative to organization size. We considered actual, target, and maximum compensation levels for peer CEOs as well as the regressed data as part of the process in determining our CEO’s 2015 base salary, 2015 target and maximum ICP opportunities, and 2015 target and maximum equity incentive opportunity.

For 2015, the Compensation Committee did not engage in the benchmarking of compensation for NEOs other than the CEO, but reserves the right to do so in the future. Decisions regarding compensation programs for the other NEOs in 2015 were made primarily in consideration of corporate and individual performance, internal compensation comparisons, and our historical practices. Based on past compensation evaluations, it is our belief that compensation paid to other NEOs is within the range of general market practice for similarly-positioned executives.

ELEMENTS OF 2015 NAMED EXECUTIVE OFFICER COMPENSATION

The following table outlines the major elements of 2015 total compensation for our NEOs:

| Compensation Element |

Purpose |

Link to Performance |

Fixed/ Performance Based |

Short/ Long-Term | ||||

| Base Salary | Helps attract and retain executives through market-competitive base pay | Changes based on individual and corporate performance | Fixed | Short-Term | ||||

| Annual Cash ICP | Encourages achievement of short-term strategic and financial performance metrics that create long-term shareholder value | Based on achievement of short-term, pre-defined corporate performance objectives and an assessment of individual performance | Performance Based |

Short-Term | ||||

| Performance-Vested RSU Awards | Aligns executives’ long-term compensation interests with shareholders’ investment interests while encouraging the achievement of annual operational goals that drive long-term company value | Award amount is determined based on, for Mr. Greig, a fixed percentage of salary, and for other NEOs, a fixed percentage of salary grade midpoint, with award vesting based on ROACE compared to a peer group | Performance Based |

Long-Term | ||||

| Time-Vested RSU Awards | Aligns executives’ long-term compensation interests with shareholders’ investment interests while creating a retention incentive through multi-year vesting | Award amount is determined based on, for Mr. Greig, a fixed percentage of salary, and for other NEOs, a fixed percentage of salary grade midpoint, with vesting conditioned on attainment of a specified level of corporate profitability in the year of grant | Fixed | Long-Term | ||||

| Defined Benefit and Defined Contribution Retirement Plans |

Provides market-competitive income security into retirement and creates a retention incentive through use of multi-year vesting, similar to the structure of retirement benefits for our general employee population | — | Fixed | Long-Term | ||||

| Benefits and Perquisites | Establishes limited perquisites in line with market practice, as well as health and welfare benefits on the same basis as our general employee population | — | Fixed | Short-Term | ||||

ANALYSIS OF KEY COMPENSATION DECISIONS FOR 2015

Base Salary

The Compensation Committee considers general market movement, individual performance, and the recommendation of Mr. Greig (for all executives other than himself) in making base salary adjustments. The base salary for Mr. Greig is recommended by the Compensation Committee to the full Board of Directors for approval. Before providing a recommendation to the Board, the Compensation Committee considers base salaries paid to CEOs in the peer group as well as the projected market salary rate increase for the upcoming year, which for 2015 was 3%, as provided by Gough. In addition, the Compensation Committee considers the results of the annual evaluation of Mr. Greig’s performance completed by each of the independent members of our full Board of Directors, which in early 2015 resulted in a score of 9.4 on a scale from one to 10.

Mr. Greig considers the results of each NEO’s annual performance review, any expected changes to the NEO’s role within our organization, pay positioning relative to other members of our executive team, and the approved merit increase budget for our general employee population before providing his recommendations to the Compensation Committee.

Effective July 1, 2015, each of FirstMerit’s NEOs except Mr. Goodall received base salary increases ranging from 2.3% to 3%. The Compensation Committee believes these modest increases were appropriate and in line with the general movement of base salaries in our executive marketplace. In the case of our CEO, Mr. Greig’s 2015 base salary, after the July 2015 increase of 2.3%, was within 1% of the projected 2015 median salary level of our peer CEOs. We believe this positioning relative to market is appropriate considering his contributions to the success of FirstMerit.

Mr. Goodall’s salary was increased effective June 1, 2015 in conjunction with his promotion to Vice Chairman and Chief Commercial Banking Officer. Due to the significant increase in the scope of his responsibilities, Mr. Goodall’s salary was increased by 24.5%.

Base salaries for each of the NEOs are shown in the table below:

| Name |

2014 Base Salary ($) | 2015 Base Salary ($) | ||||||

| Paul G. Greig |

1,034,000 | 1,057,782 | ||||||

| Terrence E. Bichsel |

471,500 | 482,400 | ||||||

| Sandra E. Pierce |

563,800 | 576,800 | ||||||

| William P. Richgels |

471,500 | 485,700 | ||||||

| David G. Goodall |

401,700 | 500,000 | ||||||

2015 SHORT-TERM CASH INCENTIVE PLAN

Background

Our short-term ICP is designed to motivate executives to attain superior annual performance in key areas that we believe create long-term value for FirstMerit and its shareholders. Payouts under the 2015 ICP were contingent on performance in the following categories:

| • | Corporate financial performance relative to planned performance; and |

| • | Individual performance. |

By implementing pay methodologies that utilize well-defined performance metrics and measure financial, strategic, and individual performance, the Compensation Committee believes that it can motivate our NEOs to achieve our business goals and enhance long-term shareholder value without creating incentives for excessive risk-taking.

2015 Performance Objectives

The corporate performance objectives selected for the 2015 ICP reflect the annual operating measures that are within management’s control, and that will ultimately drive shareholder value over the long-term. Sixty percent of the total target incentive score is conditioned upon various measures of our corporate profitability, which is fundamental to the value of our company and long-term stock price appreciation. An additional 20% of the target incentive score is based on measures of our credit quality, which reflects our safety and soundness as a banking organization and is a key focus of our regulators. Each of the corporate performance measures selected by the Compensation Committee for our 2015 ICP are commonly used in the banking industry to assess annual performance for incentive plan purposes.

Under the corporate performance portion of the 2015 ICP, a target level and a threshold-to-maximum range of performance were established for each of the six corporate performance objectives in the 2015 plan. For measures of our profitability, threshold performance was defined as 85% of target level, and maximum as 115% of target. For measures of our credit quality, in which better performance is characterized by a lower number, threshold performance was defined as 110% of target level, and maximum as 90% of target.

In addition to corporate financial performance, the 2015 ICP took into consideration the individual performance of the NEOs. Payouts under the individual performance portion (the remaining 20% of the target incentive score) of the plan were tied to the results of each NEO’s annual performance evaluation by Mr. Greig, or in the case of Mr. Greig by the independent members of the full Board of Directors.

Performance below threshold for any objective would have resulted in no incentive payment with respect to that objective, while the payment for any one objective and the plan as a whole was capped for performance above maximum.

The performance metrics and weightings that were used to calculate 2015 ICP awards for executive officers were as follows:

| Performance Metrics |

Weight | |||

| Profitability |

60 | % | ||

| Net Income |

15 | % | ||

| Pre-Provision / Pre-Tax Income |

15 | % | ||

| ROAA |

15 | % | ||

| ROATE |

15 | % | ||

| Credit Quality |

20 | % | ||

| Net Charge-offs / Average Loans |

10 | % | ||

| NPA / Loans & OREO |

10 | % | ||

| Individual Performance |

20 | % | ||

| Performance Evaluation |

20 | % | ||

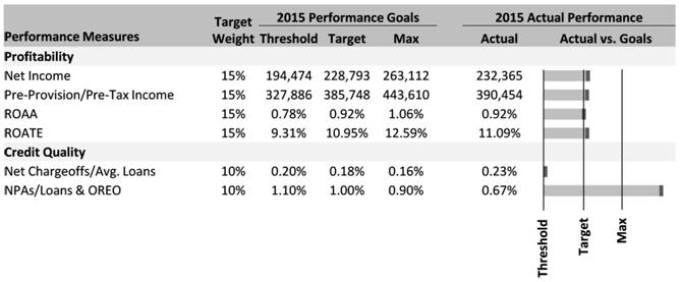

Following the establishment of the performance criteria to be used in assessing performance as shown above, the Compensation Committee in collaboration with management selected target performance levels for each of the objectives that it believed would represent meaningful and challenging performance in 2015. As illustrated in the charts below, the target performance expectations established for our two profitability measures that can be compared externally, ROAA and ROATE, represented profitability significantly greater than that achieved by our peers. In other words, our NEOs would not receive target-level ICP awards for these particular goals unless we outperformed the median of our peers. In addition, our credit quality remains better than that of our peers, as seen in the exhibit above. These analyses reaffirm our belief that the objectives established for our 2015 ICP were robust and challenging to achieve.

Note: Actual performance data shown for FirstMerit differs from our GAAP-reported financials due to the exclusion of certain one-time non-recurring items. Data shown is consistent with the performance calculations used in determining ICP awards for 2015, as shown below. See Exhibit 99 to this Amendment, which is incorporated by reference herein, for reconciliation of our non-GAAP financial measures to our results as reported under GAAP.

2015 ICP Award Opportunities

The Compensation Committee annually establishes ICP award opportunities for each NEO as a percentage of his or her salary, with the Board of Directors ratifying Mr. Greig’s ICP award opportunities. Historically, award opportunities have been designed to produce total cash compensation that is near the 50th percentile of competitive market levels for performance at target. We believe it is appropriate to target annual incentives near the peer group 50th percentile because it is our internal principle to set target performance expectations at or above the peer group 50th percentile when such comparisons are possible. Gough’s compensation review indicated that Mr. Greig’s 2015 cash compensation opportunity at target was between the 50th and 75th percentiles of target cash compensation opportunities for CEOs in our peer group, consistent with our philosophy and with the industry outperformance required to achieve our ICP targets, as illustrated above. Likewise, maximum incentive levels have also been established to reflect competitive market levels.

The 2015 ICP award opportunity (as a percentage of base salary) for each of our NEOs with the exception of Mr. Goodall is unchanged from 2014 levels. Mr. Goodall’s ICP award opportunity increased from 2014 in conjunction with his promotion to Vice Chairman and Chief Commercial Banking Officer in order to provide better alignment with internal pay equity considerations and the external competitive market.

The Compensation Committee and the Board of Directors established the following ICP award opportunities for 2015 (as a percentage of base salary):

| 2015 ICP Opportunity as % of Salary | ||||||||||||

| Named Executive Officer |

Threshold | Target | Maximum | |||||||||

| Paul G. Greig |

40 | % | 100 | % | 200 | % | ||||||

| Terrence E. Bichsel |

24 | % | 60 | % | 108 | % | ||||||

| Sandra E. Pierce |

30 | % | 85 | % | 150 | % | ||||||

| William P. Richgels |

24 | % | 60 | % | 108 | % | ||||||

| David G. Goodall |

30 | % | 85 | % | 150 | % | ||||||

Corporate Performance Results

The chart below depicts the performance targets established by the Compensation Committee for each ICP category, as well as the level of actual performance achieved in 2015 (goals expressed in thousands of dollars unless otherwise indicated).

The results shown above exclude the following items from the calculation of FirstMerit’s performance on the ICP’s four profitability objectives, as approved by the Compensation Committee in January 2016:

| • | the after-tax impact of $1.9 million in one-time expenses related to branch and building closures; and |

| • | the after-tax impact of $949,000 in one-time business restructuring expense. |

Individual Performance Results

Each of the NEOs received a performance rating of “exceeds” or “excellent” in their 2015 performance evaluation, and therefore received the maximum award payable under the individual portion of the plan. Factors cited in performance evaluations included our executives’ strategic leadership within each executive’s area of authority and for the company as a whole, as well as the strong operating results achieved by FirstMerit in 2015. The average score on the evaluation of Mr. Greig’s 2015 performance, which was conducted by each independent member of the Board of Directors in early 2016, was 9.1 on a scale from one to 10.

Final ICP Awards for 2015

In January 2016, the Compensation Committee determined the degree to which our financial and strategic performance goals were achieved during 2015, as reflected in the chart above. The CEO (or the Board of Directors in the case of the CEO) then determined the degree to which the individual performance goals were achieved during 2015 for each executive.

The following payments under the 2015 ICP were made upon approval by the Compensation Committee and, with respect to our CEO, the ratification of the independent members of the full Board of Directors:

| Named Executive Officer |

2015 ICP Award | ICP Award as a % of Target |

||||||

| Paul G. Greig |

$ | 1,312,282 | 124 | % | ||||

| Terrence E. Bichsel |

$ | 339,362 | 117 | % | ||||

| Sandra E. Pierce |

$ | 568,949 | 116 | % | ||||

| William P. Richgels |

$ | 341,684 | 117 | % | ||||

| David G. Goodall |

$ | 493,194 | 116 | % | ||||

2015 EQUITY PLAN

Background

Our equity incentive plan is intended to align the compensation interests of executives with the investment interests of shareholders, while also rewarding executives for strong operational performance. In 2015, our equity incentive plan consisted of two distinct award types: performance-vested restricted stock units (or RSUs) and time-vested RSUs. Sixty percent of the number of RSUs awarded to each participating NEO will vest, if at all, based on FirstMerit’s corporate performance over the vesting period, while the remaining RSUs awarded will vest based on time, continued service, and (as a threshold matter) attainment of a minimum level of corporate profitability. The use of performance-vested and time-vested awards in combination gives executives the consistent opportunity to increase their ownership interest in FirstMerit and connects the long-term value of their compensation to our long-term stock performance, while also encouraging the achievement of the operational goals that drive our long-term company value.

2015 Equity Award Targets

The number of RSUs awarded to Mr. Greig in 2015 was based on a fixed percentage of his salary. The number of RSUs awarded to each participating executive other than the CEO in 2015 was based on a fixed percentage of his or her position’s salary grade midpoint, a practice which is intended to create a certain level of parity in awards to executives at a similar organizational level. However, the Compensation Committee, or the CEO for all executives other than himself, generally retains the right to recommend awards less than the target amount, or to grant no awards to the executive in a given year, if performance or other conditions warrant.

The 2015 equity award opportunity (as a percentage of salary or salary grade midpoint) for each of our NEOs with the exception of Mr. Goodall is unchanged from 2014 levels. Mr. Goodall’s equity award opportunity increased from 2014 in conjunction with his promotion to Vice Chairman and Chief Commercial Banking Officer in order to provide better alignment with internal pay equity considerations and the external competitive market.

Early in 2015, the Compensation Committee established a target equity award for each of our participating NEOs as described above. Target equity award levels for 2015 are shown in the table below:

| Named Executive Officer |

Target Equity Award as % of Salary or Salary Grade Midpoint | |

| Paul G. Greig |

200% | |

| Terrence E. Bichsel |

100% | |

| Sandra E. Pierce |

100% | |

| William P. Richgels |

100% | |

| David G. Goodall |

100% |

Regarding Mr. Greig’s target equity award, Gough’s review of peer CEO compensation indicated that Mr. Greig’s total direct compensation opportunity at target was comparable to the target total direct compensation opportunity among peer CEOs. The Compensation Committee felt that this positioning was appropriate due to FirstMerit’s sustained record of strong performance, as demonstrated in the charts above, and Mr. Greig’s contributions to that success as leader of our organization.

Following approval by the Board of Directors, the following equity awards were granted to our NEOs in April 2015 based on the approach described above:

| Named Executive Officer |

2015 Equity Award (Target # of Performance-Vested Units) |

2015 Equity Award (# of Time- Vested Units) |

2015 Equity Award (Grant Date Fair Value) |

|||||||||

| Paul G. Greig |

65,095 | 43,397 | $ | 2,115,594 | ||||||||

| Terrence E. Bichsel |

14,493 | 9,662 | $ | 471,023 | ||||||||

| Sandra E. Pierce |

20,000 | 13,334 | $ | 650,013 | ||||||||

| William P. Richgels |

14,493 | 9,662 | $ | 471,023 | ||||||||

| David G. Goodall |

12,604 | 8,403 | $ | 409,637 | ||||||||

Performance-vested awards

For 2015, 60% of the participating NEOs’ equity awards were granted in the form of performance-vested RSUs, which is an increase from our historical practice of granting 52% of NEOs’ equity awards in the form of performance-vested RSUs. These awards vest, if at all, on the third anniversary of the award date, with the number of RSUs ultimately vesting determined by FirstMerit’s ROACE over the three-year performance period from 2015-2017 compared to that of its pre-established peer group. The use of a three-year performance period represents a change from our historical practice of having awards vest in equal installments over three years, based on three successive one-year performance periods. We made the changes described above in response to shareholder feedback, with the desire of increasing the proportion of awards that are subject to performance-vesting and extending the performance period over multiple years.

We chose ROACE as the performance measure for our performance-vested awards because it is a measurement of our corporate profitability, which is fundamental to the value of our company and long-term stock price appreciation. Specifically, ROACE shows how efficiently we use investor funds (common equity) to generate profits.

Financial performance is measured based on financial statements filed with the SEC for FirstMerit and its peers. The Compensation Committee has the ability to exclude from financial performance calculations certain one-time events that either positively or negatively impact incentive awards for executives. However, such exclusions are limited in nature, and the parameters for determining which one-time events may be excluded are established at the beginning of the performance year.

The table below details the required level of performance and subsequent award vesting for the 2015 award:

| Threshold | Target | Maximum | ||||

| ROACE Compared to Peers |

30th Percentile | 50th Percentile | 70th Percentile | |||

| Number of RSUs Vesting (as % of Target) |

25% | 100% | 175% |

Vesting is pro-rated on a straight-line basis for performance between threshold and target or target and maximum, and no awards vest if performance in the preceding three-year period was below the 30th percentile of the peer group.

In February 2016, the Compensation Committee determined that it was appropriate to exclude the following items from the calculation of FirstMerit’s 2015 ROACE:

| • | the after-tax impact of $1.9 million in one-time expenses related to branch and building closures; and |

| • | the after-tax impact of $949,000 in one-time business restructuring expense. |

FirstMerit’s ROACE during 2015 was 8.28% after the exclusion of one-time items, which was equal to the 56th percentile of the peer group. Therefore, one-third of the performance-vested RSUs granted in 2013 and 2014 vested in February 2016 at 119% of the target award amount.

Time-vested awards

The remaining RSUs granted in 2015 to each participating NEO, or 40% of the total RSU award, vest in equal installments on each of the first three anniversaries of the grant date, subject to the executive’s continued employment. In addition, none of these awards would vest if FirstMerit’s net income after adjustment for one-time expenses in 2015 did not exceed 15% of our 2014 net income. Due to this minimum corporate profitability requirement, while we think of these RSU awards and describe these RSU awards as “time-vested” for purposes of our CD&A, we report them as an incentive award for purposes of the compensation tables below, as our NEOs will not be able to receive shares in settlement of these RSU awards if the threshold net income is not achieved.

The corporate profitability performance condition was satisfied at the end of 2015 based on actual 2015 performance.

Dividend equivalents

We pay dividend equivalents on unvested RSUs as follows:

| • | Time-vested RSUs: Dividend equivalents are paid quarterly in cash. |