Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bison Merger Sub I, LLC | d175318d8k.htm |

Investor Presentation April 2016 Exhibit 99.1

Forward-Looking Statements and Non-GAAP Financial Measures This presentation contains forward-looking statements. These statements can be identified by the use of forward-looking terminology including “will,” “may,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” or other similar words. These statements discuss future expectations including company growth expectations, demand for our products, capacity expansion plans, market trends, liquidity, transportation services, commercial product launches and research and development plans and may contain projections of financial condition or of results of operations, or state other “forward-looking” information. These forward-looking statements involve risks and uncertainties. Many of these risks are beyond management’s control. When considering these forward-looking statements, you should keep in mind the risk factors, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and other cautionary statements in the company’s SEC filings. Forward-looking statements are not guarantees of future performance or an assurance that our current assumptions or projections are valid. Our actual results and plans could differ materially from those expressed in any forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or future events, except as required by law. This presentation includes certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA and Adjusted EPS, and Adjusted Diluted EPS. These non-GAAP financial measures are used as supplemental financial measures by our management to evaluate our operating performance and compare the results of our operations from period to period without regard to the impact of our financing methods, capital structure or non-operating income and expenses. Adjusted EBITDA is also used by our lenders to evaluate our compliance with covenants. We believe that these measures are meaningful to our investors to enhance their understanding of our financial performance. These measures should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP and may differ from similarly titled measures used by other companies. For a reconciliation of such measures to the most directly comparable GAAP term, please see slides 25-26 of this presentation

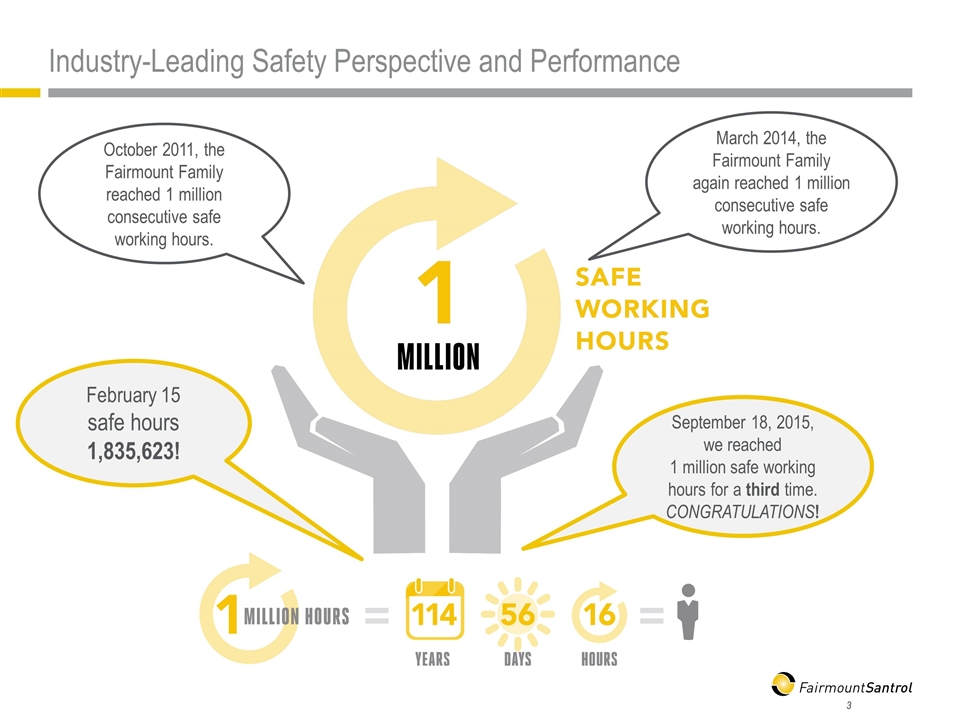

Industry-Leading Safety Perspective and Performance October 2011, the Fairmount Family reached 1 million consecutive safe working hours. September 18, 2015, we reached 1 million safe working hours for a third time. CONGRATULATIONS! March 2014, the Fairmount Family again reached 1 million consecutive safe working hours. February 15 safe hours 1,835,623!

Two Complementary Business Segments Oil & Gas – Proppant Solutions Product Lines Include: Northern White Frac Sand Texas Gold Frac Sand (mined in Voca, TX) Resin-Coated Frac Sand Self-Suspending Proppant Technology, Propel SSPTM Activators Water-Soluble Ball Sealers (Bioballs) Industrial & Recreational Product Lines Include: High-Purity Silica Sand Custom-Blended Materials Resin-Coated Sand Foundry Resins

Fairmount Santrol Positioned to Compete in All Market Cycles – A Leading Solutions Provider Differentiated in Every Area of the Value Chain Operational Scale Approximately 800 million tons of proven mineral reserves Stated annual capacity 14.8 million tons of sand 2.3 million tons of coating Distribution Industry-leading integrated logistics 40+ Proppant terminals 9 I&R terminals Unit train capable 7 destinations 2 sand origin facilities Product Portfolio Technology & Innovation Broad product suite addresses 98% of Proppant market Northern White Sand Texas Gold Value-added coated products Propel SSPTM Hybrid Proppant/Fluid System Broad I&R product suite Proprietary product and process technologies Phenolic resin development & manufacturing facility R&D culture and infrastructure Commitment to People, Planet & Prosperity

Fairmount Santrol Is Focused on Health, Safety & the Environment We are built on a foundation of sustainable development and giving back _____________________ Source: Company website and corporate filings Reached over 1.8M safe working hours (268 days) in 2015 and into 2016 Contributed ~15,000 hours of volunteer time in 2015 Over 3,500 learning opportunities offered through 16 Empower U courses 30 Zero Waste Facilities Reduced 90% of waste sent to landfills since 2009 Planted > 538,000 trees since 2007 to offset greenhouse gases Annual net SD Pays: $5M - $9M since 2012 ~$3.9 M invested into communities in 2014, ~$2.3 M in 2015 PROSPERITY PEOPLE PLANET

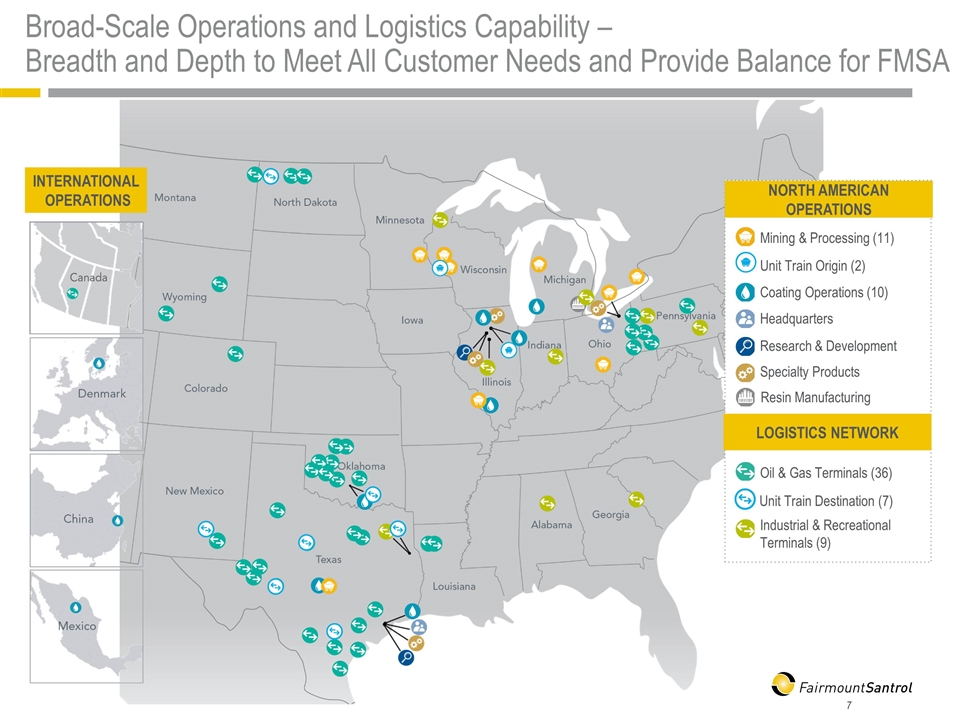

Broad-Scale Operations and Logistics Capability – Breadth and Depth to Meet All Customer Needs and Provide Balance for FMSA Coating Operations (10) Mining & Processing (11) Oil & Gas Terminals (36) Unit Train Destination (7) NORTH AMERICAN OPERATIONS LOGISTICS NETWORK Industrial & Recreational Terminals (9) Unit Train Origin (2) Headquarters INTERNATIONAL OPERATIONS Research & Development Specialty Products Resin Manufacturing

High-Purity Silica Sands Northern White Frac Sand (99.8% crystalline silica quartz) Texas Gold™ sand Application: 2,000-7,000 psi Resin-Coated Ceramics HyperProp G2® Coated bauxite GGL G2® Coated Intermediate Strength Ceramic Application: 15,000- 20,000 psi Resin-Coated Sand Curable Resin-Coated Sand CoolSet® Super LC® Super DC® OptiProp® G2 Precured or Partially Cured Resin-Coated Sand TLC® THS® PowerProp® Application: 2,000-15,000 psi & Flowback Protection A Product Line Serving 98% of the Proppant Market From low to high closure pressures and for all flowback environments Self-Suspending Proppant Propel SSP TM Proppant Transport Technology A proppant + fluid system in one Proppant coated with a polymer to transform into a fluid Application: Based on substrate

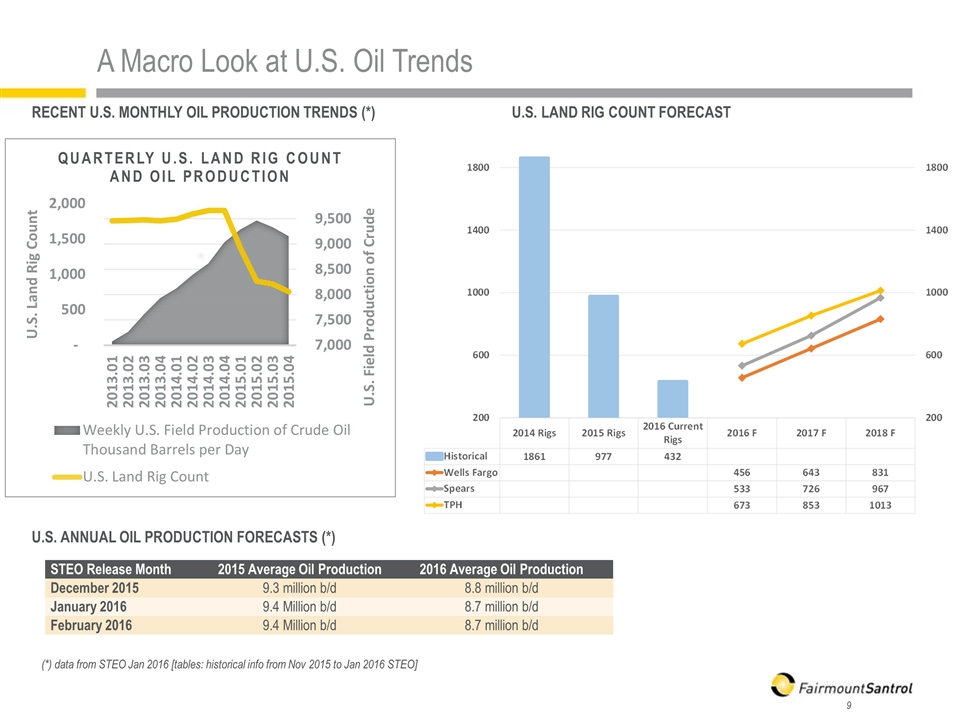

A Macro Look at U.S. Oil Trends RECENT U.S. monthly Oil Production TRENDS (*)U.S. Land Rig Count FORECAST U.S. Annual Oil Production Forecasts (*) STEO Release Month 2015 Average Oil Production 2016 Average Oil Production December 2015 9.3 million b/d 8.8 million b/d January 2016 9.4 Million b/d 8.7 million b/d February 2016 9.4 Million b/d 8.7 million b/d (*) data from STEO Jan 2016 [tables: historical info from Nov 2015 to Jan 2016 STEO]

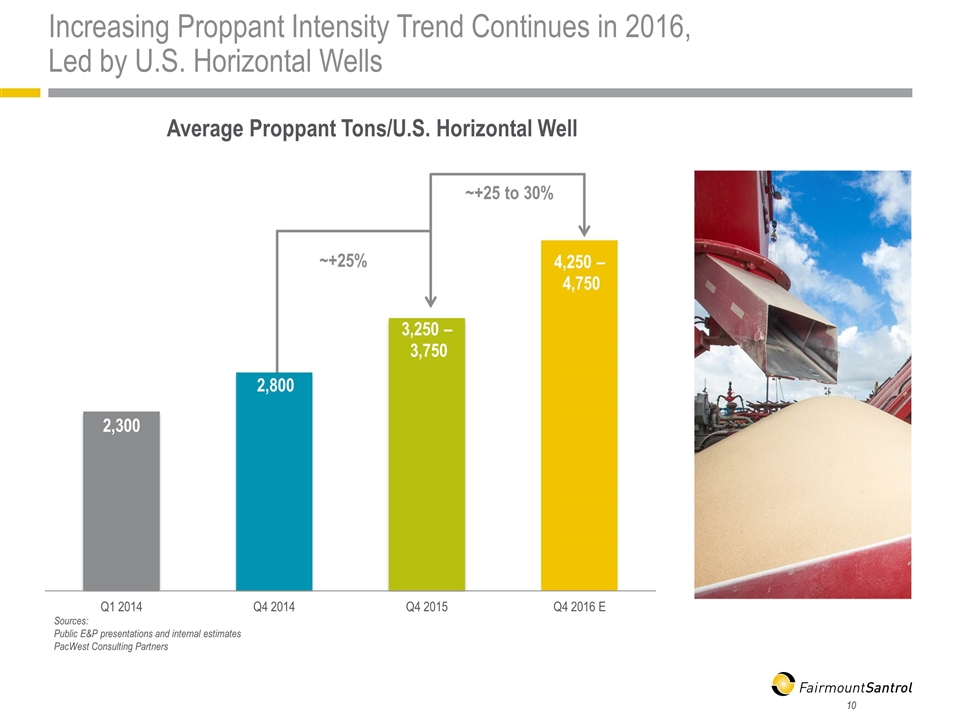

Increasing Proppant Intensity Trend Continues in 2016, Led by U.S. Horizontal Wells Sources: Public E&P presentations and internal estimates PacWest Consulting Partners ~+25 to 30% Average Proppant Tons/U.S. Horizontal Well ~+25%

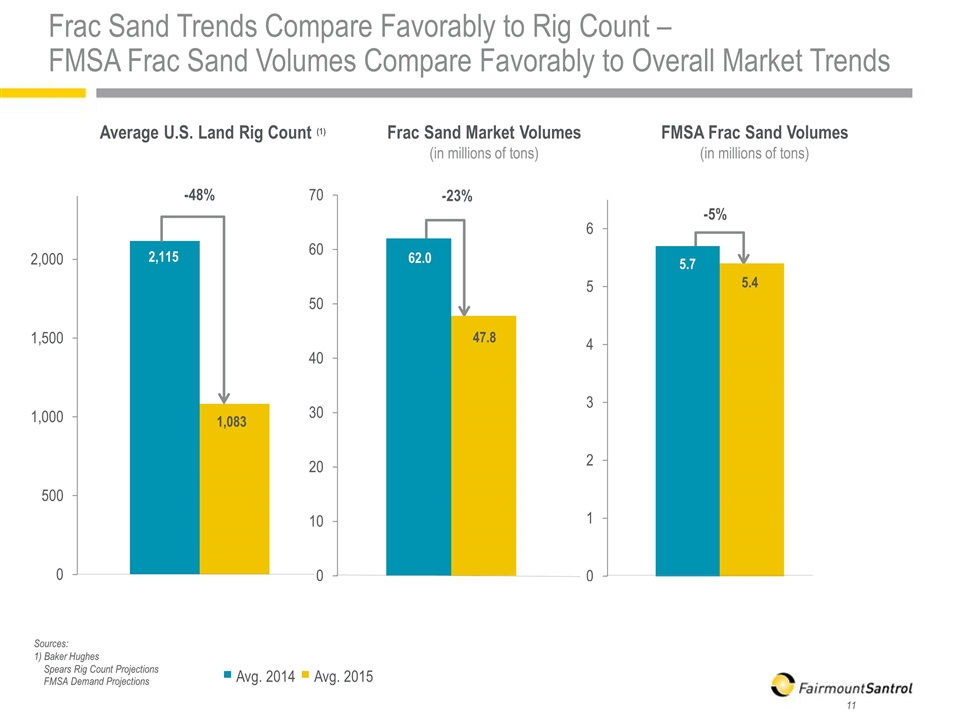

Frac Sand Trends Compare Favorably to Rig Count – FMSA Frac Sand Volumes Compare Favorably to Overall Market Trends Frac Sand Market Volumes (in millions of tons) -48% -23% Sources: 1) Baker Hughes Spears Rig Count Projections FMSA Demand Projections FMSA Frac Sand Volumes (in millions of tons) Average U.S. Land Rig Count (1) Avg. 2014 Avg. 2015

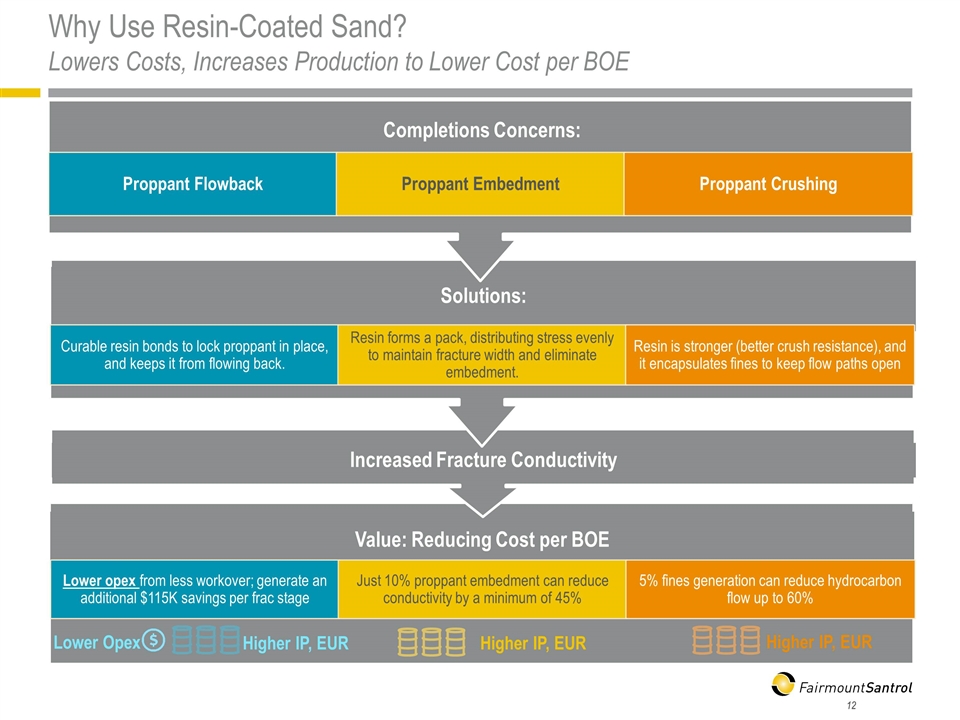

Value: Reducing Cost per BOE Increased Fracture Conductivity Solutions: Why Use Resin-Coated Sand? Lowers Costs, Increases Production to Lower Cost per BOE Lower opex from less workover; generate an additional $115K savings per frac stage Just 10% proppant embedment can reduce conductivity by a minimum of 45% 5% fines generation can reduce hydrocarbon flow up to 60% Curable resin bonds to lock proppant in place, and keeps it from flowing back. Resin forms a pack, distributing stress evenly to maintain fracture width and eliminate embedment. Resin is stronger (better crush resistance), and it encapsulates fines to keep flow paths open Completions Concerns: Proppant Flowback Proppant Embedment Proppant Crushing Lower Opex Higher IP, EUR Higher IP, EUR Higher IP, EUR

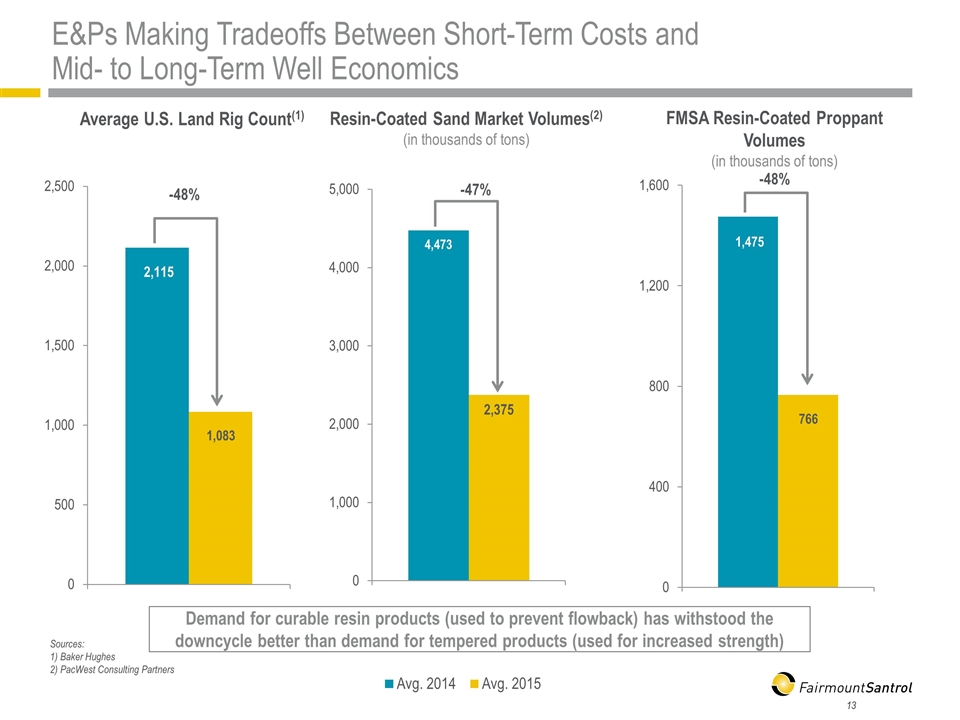

E&Ps Making Tradeoffs Between Short-Term Costs and Mid- to Long-Term Well Economics Resin-Coated Sand Market Volumes(2) (in thousands of tons) Average U.S. Land Rig Count(1) -48% -48% FMSA Resin-Coated Proppant Volumes (in thousands of tons) -47% Sources: 1) Baker Hughes 2) PacWest Consulting Partners Demand for curable resin products (used to prevent flowback) has withstood the downcycle better than demand for tempered products (used for increased strength)

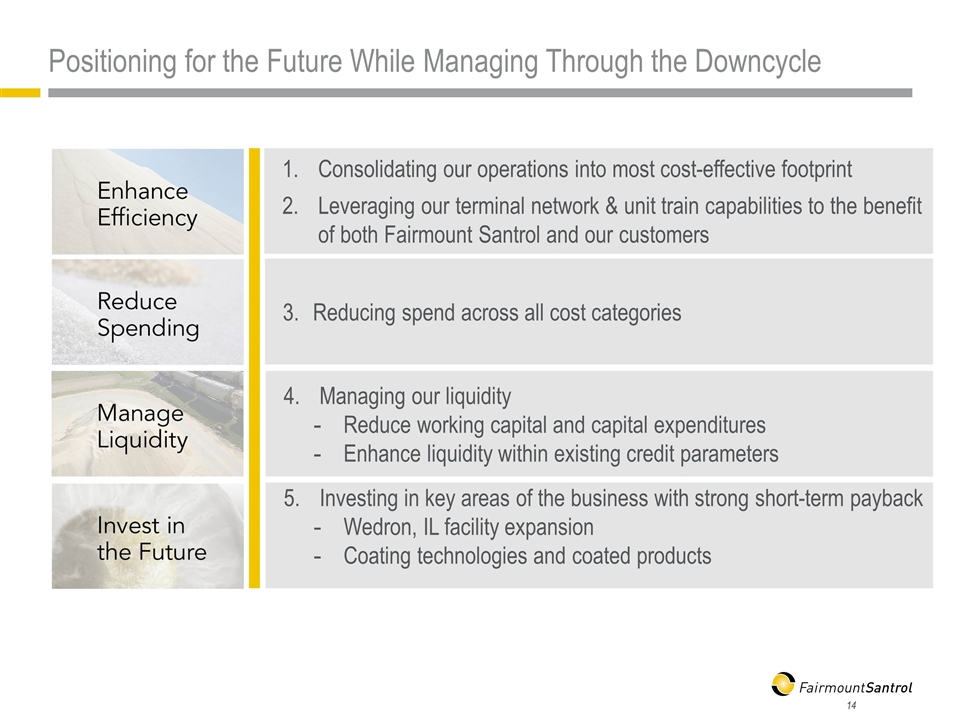

Positioning for the Future While Managing Through the Downcycle Consolidating our operations into most cost-effective footprint Leveraging our terminal network & unit train capabilities to the benefit of both Fairmount Santrol and our customers 3. Reducing spend across all cost categories Managing our liquidity Reduce working capital and capital expenditures Enhance liquidity within existing credit parameters Investing in key areas of the business with strong short-term payback Wedron, IL facility expansion Coating technologies and coated products

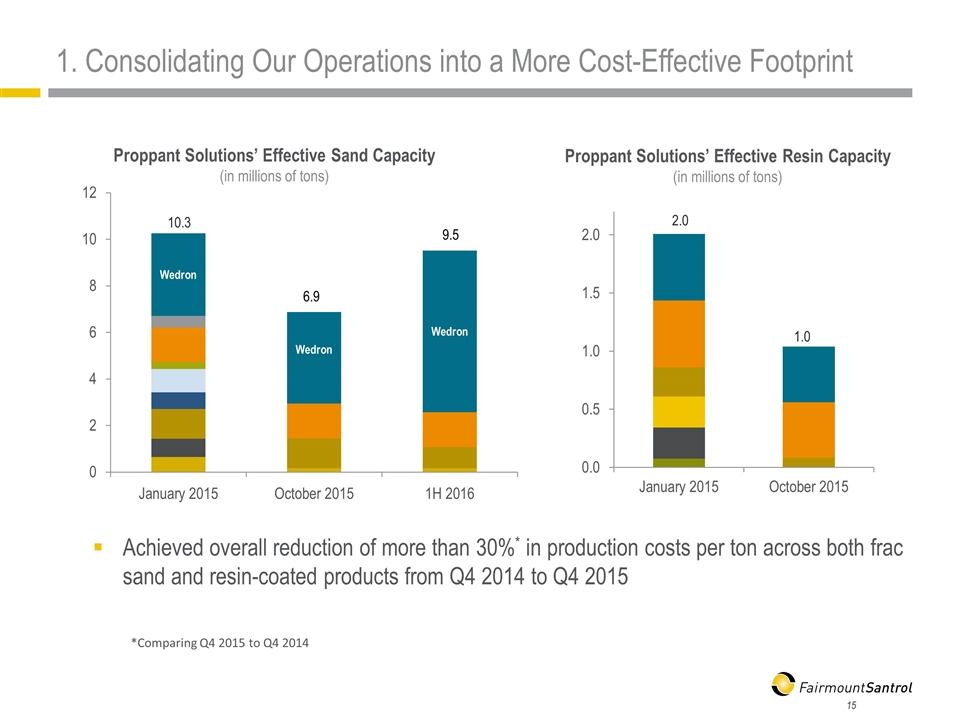

1. Consolidating Our Operations into a More Cost-Effective Footprint Proppant Solutions’ Effective Sand Capacity (in millions of tons) Proppant Solutions’ Effective Resin Capacity (in millions of tons) Achieved overall reduction of more than 30%* in production costs per ton across both frac sand and resin-coated products from Q4 2014 to Q4 2015 *Comparing Q4 2015 to Q4 2014

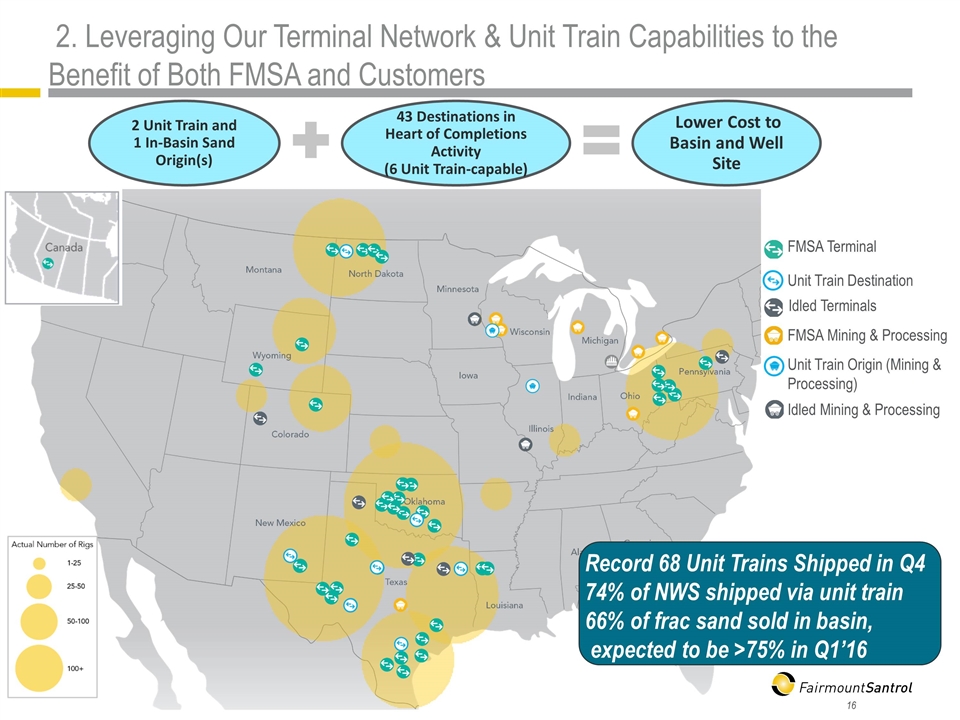

FMSA Terminal FMSA Mining & Processing Unit Train Destination Unit Train Origin (Mining & Processing) 2. Leveraging Our Terminal Network & Unit Train Capabilities to the Benefit of Both FMSA and Customers Record 68 Unit Trains Shipped in Q4 74% of NWS shipped via unit train 66% of frac sand sold in basin, expected to be >75% in Q1’16 Idled Terminals Idled Mining & Processing 2 Unit Train and 1 In-Basin Sand Origin(s) Lower Cost to Basin and Well Site 43 Destinations in Heart of Completions Activity (6 Unit Train-capable)

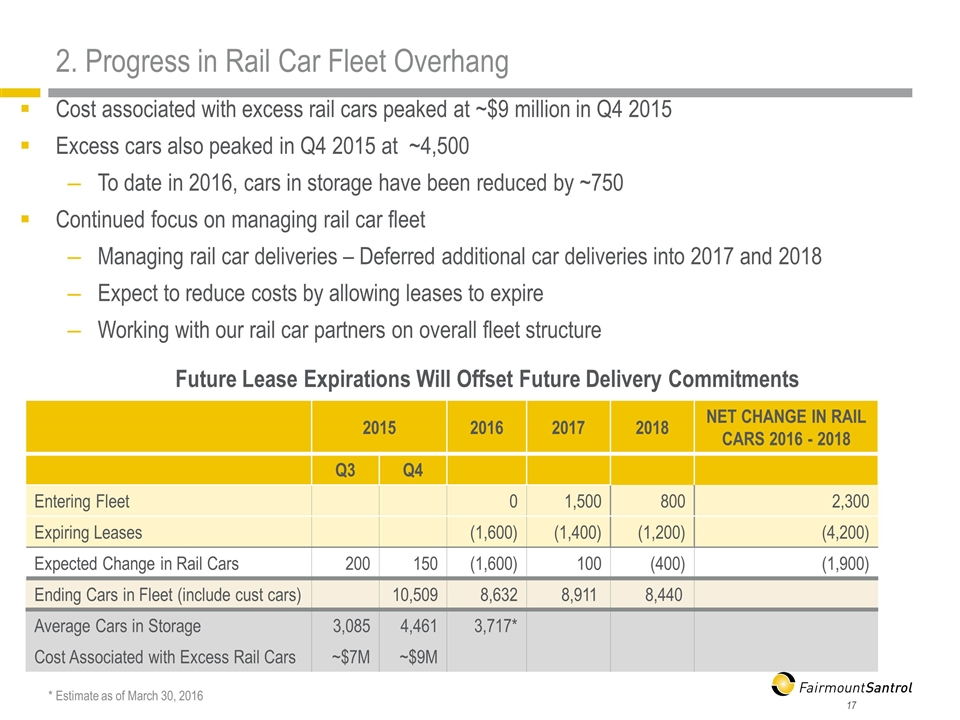

2. Progress in Rail Car Fleet Overhang Cost associated with excess rail cars peaked at ~$9 million in Q4 2015 Excess cars also peaked in Q4 2015 at ~4,500 To date in 2016, cars in storage have been reduced by ~750 Continued focus on managing rail car fleet Managing rail car deliveries – Deferred additional car deliveries into 2017 and 2018 Expect to reduce costs by allowing leases to expire Working with our rail car partners on overall fleet structure Future Lease Expirations Will Offset Future Delivery Commitments 2015 2016 2017 2018 NET CHANGE IN RAIL CARS 2016 - 2018 Q3 Q4 Entering Fleet 0 1,500 800 2,300 Expiring Leases (1,600) (1,400) (1,200) (4,200) Expected Change in Rail Cars 200 150 (1,600) 100 (400) (1,900) Ending Cars in Fleet (include cust cars) 10,509 8,632 8,911 8,440 Average Cars in Storage 3,085 4,461 3,717* Cost Associated with Excess Rail Cars ~$7M ~$9M * Estimate as of March 30, 2016

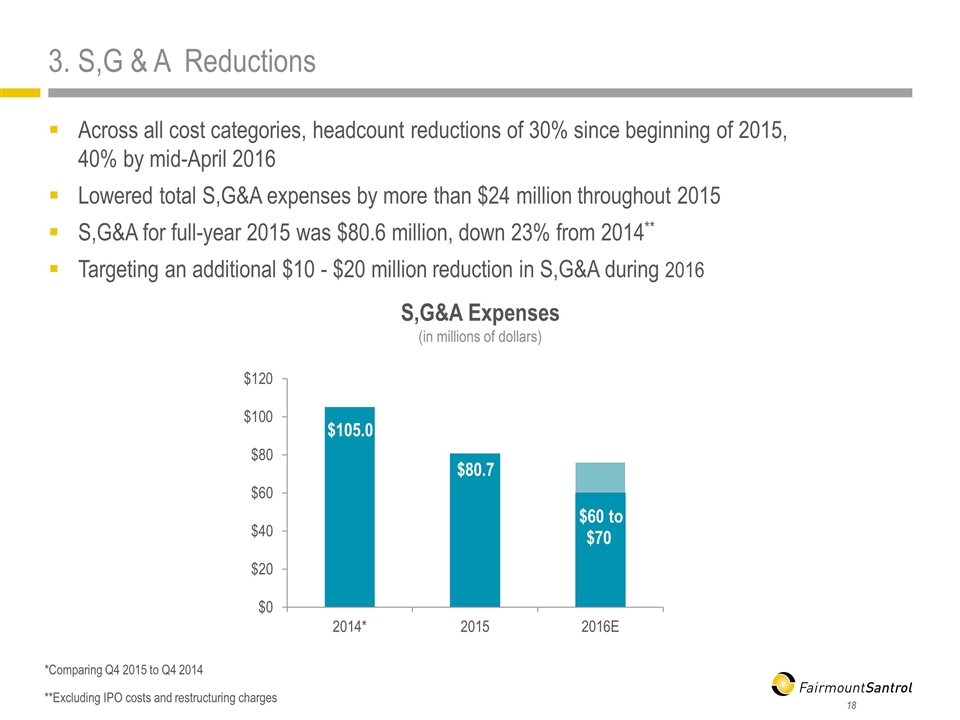

3. S,G & A Reductions Across all cost categories, headcount reductions of 30% since beginning of 2015, 40% by mid-April 2016 Lowered total S,G&A expenses by more than $24 million throughout 2015 S,G&A for full-year 2015 was $80.6 million, down 23% from 2014** Targeting an additional $10 - $20 million reduction in S,G&A during 2016 S,G&A Expenses (in millions of dollars) *Comparing Q4 2015 to Q4 2014 **Excluding IPO costs and restructuring charges

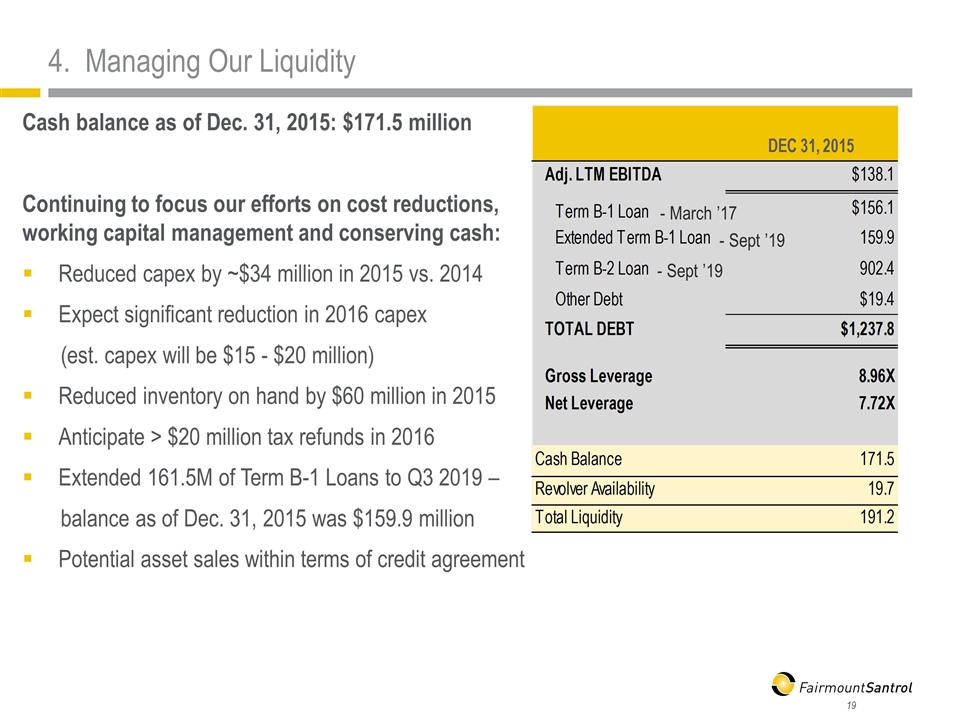

4. Managing Our Liquidity Cash balance as of Dec. 31, 2015: $171.5 million Continuing to focus our efforts on cost reductions, working capital management and conserving cash: Reduced capex by ~$34 million in 2015 vs. 2014 Expect significant reduction in 2016 capex (est. capex will be $15 - $20 million) Reduced inventory on hand by $60 million in 2015 Anticipate > $20 million tax refunds in 2016 Extended 161.5M of Term B-1 Loans to Q3 2019 – balance as of Dec. 31, 2015 was $159.9 million Potential asset sales within terms of credit agreement - March ’17 - Sept ’19 - Sept ’19 DEC 31, 2015 Adj. LTM EBITDA $138.1 Term B-1 Loan $156.1 Extended Term B-1 Loan 159.9 Term B-2 Loan 902.4 Other Debt $19.399999999999864 TOTAL DEBT $1,237.8 Gross Leverage 8.9630702389572772 Net Leverage 7.721216509775525 Cash Balance 171.5 Revolver Availability 19.7 Total Liquidity 191.2

5. Investing in Key Areas of the Business: Lower-Cost, Optimally Located Wedron, IL Facility Expansion Expansion on track: December 1.5 million tons Additional 1.5 million tons April 1 Total capacity 8.5M tons (7M tons of frac sand) Why Wedron? Access to high-quality Northern White frac sand reserves Product distribution most suited to market demand Lowest cost facility in our network Optimally located along Class 1 railway system Unit train capable Low-cost delivery into key oil and gas basins Optimally co-located with state-of-the-art resin coating facility – reducing costs and enhancing efficiencies

5. Investing in Key Areas of the Business: Coating Technologies and Coated Products Product development for new and existing coated products Enhancing current products Introducing new products for changing market conditions CoolSet™ product launched during downcycle Pipeline of products in development to help customers continue to lower their cost per BOE – expect to commercially launch the first of these new products in Q2 2016 New products for I&R market Next-generation Signature Gold™ series for foundry applications Polymeric sand for building products industry Process technologies to enhance operational efficiencies and product quality Additional technical sales resources New Products Will Leverage Existing Infrastructure with Minimal Capital Requirements

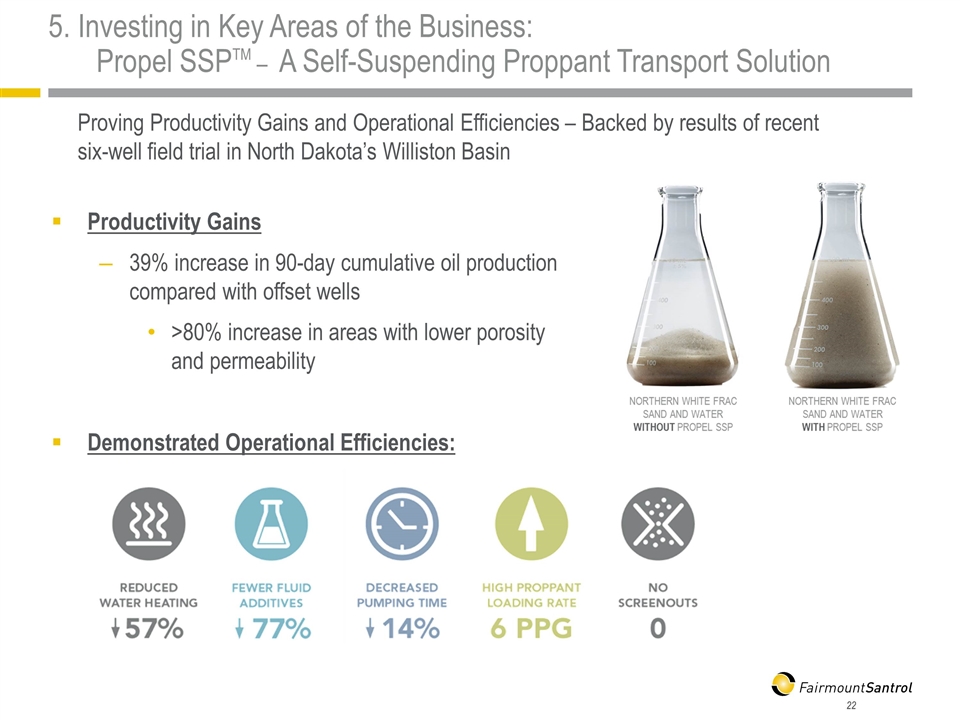

Proving Productivity Gains and Operational Efficiencies – Backed by results of recent six-well field trial in North Dakota’s Williston Basin Productivity Gains 39% increase in 90-day cumulative oil production compared with offset wells >80% increase in areas with lower porosity and permeability Demonstrated Operational Efficiencies: 5. Investing in Key Areas of the Business: Propel SSPTM – A Self-Suspending Proppant Transport Solution

Scalability and flexibility of sand and valued-added coated product offerings to match market needs Advantaged distribution network with key unit train origins and destinations Long-term customer relationships Fairmount Santrol Positioned to Compete in All Market Cycles – A Leading Solutions Provider Differentiated in Every Area of the Value Chain Tightly managing costs and maximizing efficiencies in near term Selectively investing in key areas that will best position us today and for eventual recovery Proactively managing liquidity and debt structure NEAR-TERM FOCUS CUSTOMERS VALUE OUR DIFFERENTIATED BUSINESS MODEL

Thank You & Questions www.FairmountSantrol.com

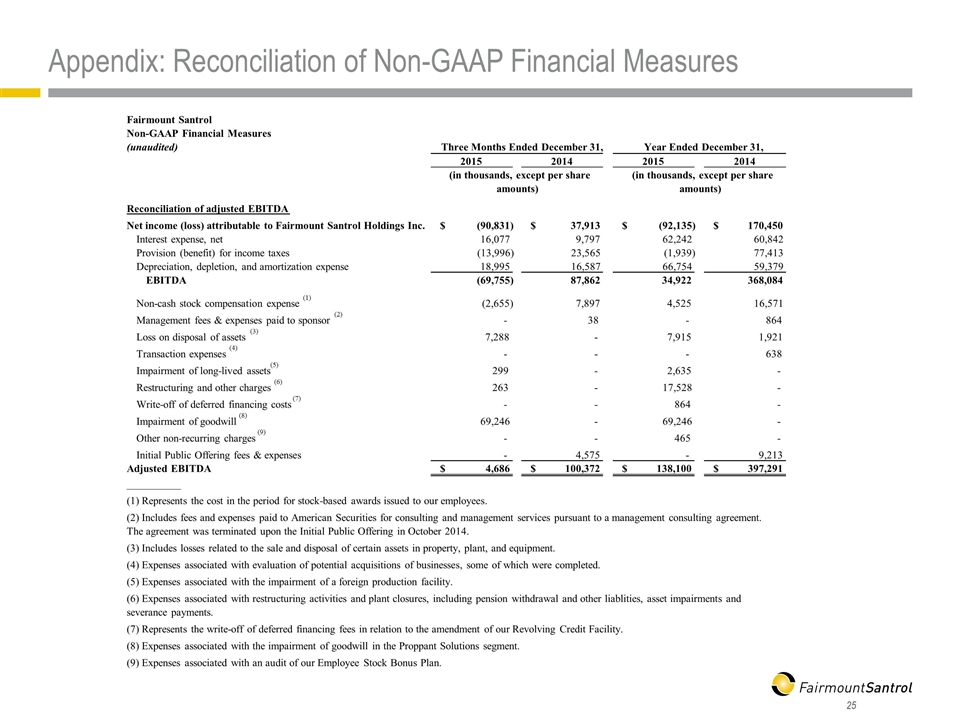

Appendix: Reconciliation of Non-GAAP Financial Measures Fairmount Santrol Non-GAAP Financial Measures (unaudited) 2015 2014 2015 2014 Reconciliation of adjusted EBITDA Net income (loss) attributable to Fairmount Santrol Holdings Inc. (90,831) $ 37,913 $ (92,135) $ 170,450 $ Interest expense, net 16,077 9,797 62,242 60,842 Provision (benefit) for income taxes (13,996) 23,565 (1,939) 77,413 Depreciation, depletion, and amortization expense 18,995 16,587 66,754 59,379 EBITDA (69,755) 87,862 34,922 368,084 Non-cash stock compensation expense (1) (2,655) 7,897 4,525 16,571 Management fees & expenses paid to sponsor (2) - 38 - 864 Loss on disposal of assets (3) 7,288 - 7,915 1,921 Transaction expenses (4) - - - 638 Impairment of long-lived assets (5) 299 - 2,635 - Restructuring and other charges (6) 263 - 17,528 - Write-off of deferred financing costs (7) - - 864 - Impairment of goodwill (8) 69,246 - 69,246 - Other non-recurring charges (9) - - 465 - Initial Public Offering fees & expenses - 4,575 - 9,213 Adjusted EBITDA 4,686 $ 100,372 $ 138,100 $ 397,291 $ __________ (1) Represents the cost in the period for stock-based awards issued to our employees. (3) Includes losses related to the sale and disposal of certain assets in property, plant, and equipment. (4) Expenses associated with evaluation of potential acquisitions of businesses, some of which were completed. (5) Expenses associated with the impairment of a foreign production facility. (7) Represents the write-off of deferred financing fees in relation to the amendment of our Revolving Credit Facility. (8) Expenses associated with the impairment of goodwill in the Proppant Solutions segment. (9) Expenses associated with an audit of our Employee Stock Bonus Plan. (6) Expenses associated with restructuring activities and plant closures, including pension withdrawal and other liablities, asset impairments and severance payments. Three Months Ended December 31, Year Ended December 31, (in thousands, except per share amounts) (in thousands, except per share amounts) (2) Includes fees and expenses paid to American Securities for consulting and management services pursuant to a management consulting agreement. The agreement was terminated upon the Initial Public Offering in October 2014.

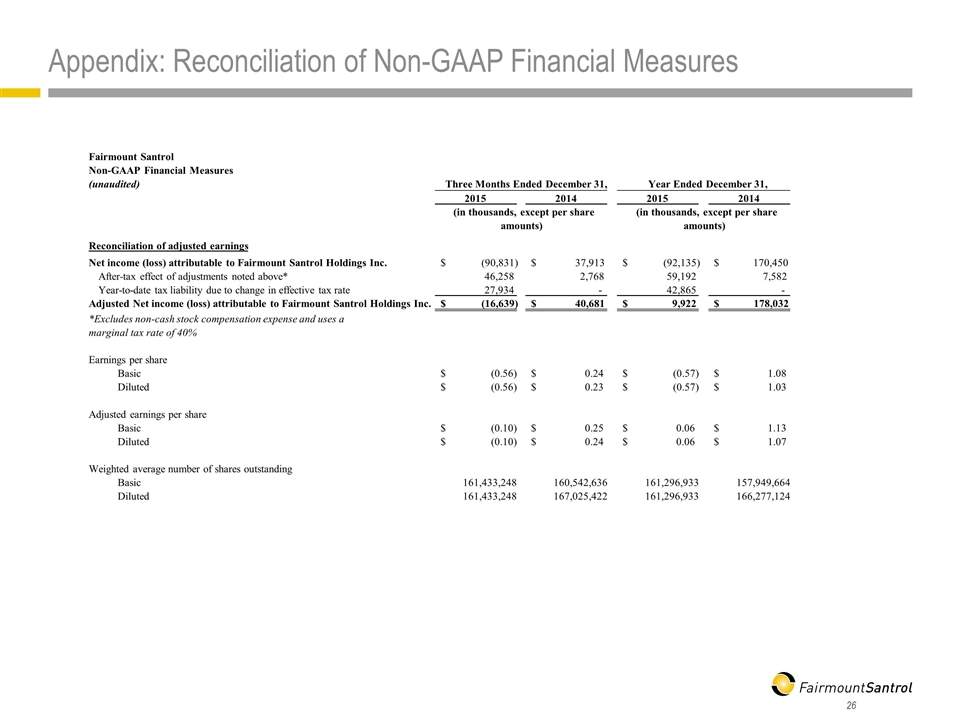

Appendix: Reconciliation of Non-GAAP Financial Measures Fairmount Santrol Non-GAAP Financial Measures (unaudited) 2015 2014 2015 2014 Reconciliation of adjusted earnings Net income (loss) attributable to Fairmount Santrol Holdings Inc. (90,831) $ 37,913 $ (92,135) $ 170,450 $ After-tax effect of adjustments noted above* 46,258 2,768 59,192 7,582 Year-to-date tax liability due to change in effective tax rate 27,934 - 42,865 - Adjusted Net income (loss) attributable to Fairmount Santrol Holdings Inc. (16,639) $ 40,681 $ 9,922 $ 178,032 $ Earnings per share Basic (0.56) $ 0.24 $ (0.57) $ 1.08 $ Diluted (0.56) $ 0.23 $ (0.57) $ 1.03 $ Adjusted earnings per share Basic (0.10) $ 0.25 $ 0.06 $ 1.13 $ Diluted (0.10) $ 0.24 $ 0.06 $ 1.07 $ Weighted average number of shares outstanding Basic 161,433,248 160,542,636 161,296,933 157,949,664 Diluted 161,433,248 167,025,422 161,296,933 166,277,124 *Excludes non-cash stock compensation expense and uses a marginal tax rate of 40% Three Months Ended December 31, Year Ended December 31, (in thousands, except per share amounts) (in thousands, except per share amounts)