Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Shiner International, Inc. | exhibit31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Shiner International, Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Shiner International, Inc. | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Shiner International, Inc. | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________to _______________.

Commission File No. 001-33960

SHINER INTERNATIONAL,

INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 98-0507398 |

| (State or Other Jurisdiction of | (I.R.S. Employer Identification No.) |

| Incorporation or Organization) |

19th Floor, Didu Building, Pearl River Plaza

No. 2

North Longkun Road

Haikou, Hainan Province, China

570125

(Address of Principal Executive Offices, including zip

code)

011-86-898-68581104

(Registrant’s Telephone

Number, Including Area Code)

Securities registered under Section 12(b) of the Exchange Act:

| Common Stock, $0.001 par value | N/A |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

As of April 6, 2016, there were 27,941,491 shares of the registrant's common stock outstanding.

As of June 30, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates was approximately $6.68 million. Shares of the registrant’s common stock held by each executive officer and director and each by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

Documents Incorporated by Reference

None.

Annual Report on Form 10-K

For the Year

Ended December 31, 2015

TABLE OF CONTENTS

Page

| PART I | ||

| Item 1. | Business | 5 |

| Item 1A. | Risk Factors | 17 |

| Unresolved Staff Comments | 31 | |

| Item 2. | Properties | 31 |

| Item 3. | Legal Proceedings | 32 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 32 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 33 |

| Item 6. | Selected Financial Data | 34 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 36 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 41 |

| Item 8. | Financial Statements and Supplementary Data | 41 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 41 |

| Item 9A. | Controls and Procedures | 41 |

| Item 9B. | Other Information | 42 |

| PART III | ||

| Item 10. | Directors and Executive Officers of the Registrant | 43 |

| Item 11. | Executive Compensation | 46 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 47 |

| Item 13. | Certain Relationships and Related Transactions | 48 |

| Item 14. | Principal Accountant Fees and Services | 49 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 50 |

| SIGNATURES | 55 | |

| EXHIBITS | ||

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, the factors discussed in “Risk Factors” included elsewhere is this Annual Report on Form 10-K.

Because the factors discussed in this report could cause our actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events, except as required by law. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Use of Terms

Except as otherwise indicated by the context, all references in this report to:

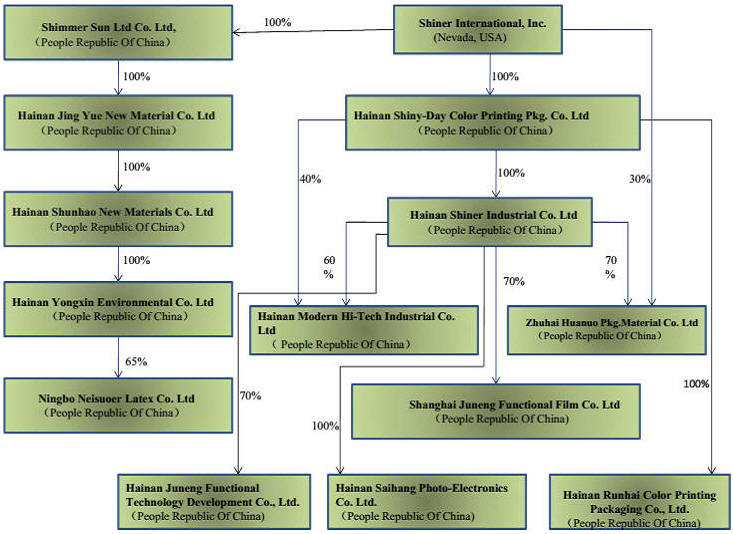

- “Shiner,” “Company,” “we,” “us” or “our” are to Shiner International, Inc., a Nevada corporation, and its direct and indirect subsidiaries: (i) Hainan Shiner Industrial Co., Ltd., or “Hainan Shiner,” (ii) Hainan Shiny-Day Color Printing Packaging Co., Ltd., or “Shiny-Day,” (iii) Hainan Modern Hi-Tech Industrial Co., Ltd., or “Hainan Modern,” (iv) Zhuhai Modern Huanuo Packaging Material Co., Ltd., or “Zhuhai Modern,” (v) Shimmer Sun Ltd., or “Shimmer Sun,” (vi) Hainan Jingyue New Material Co., Ltd., or “Jingyue,” (vii) Hainan Shunhao New Material Co., Ltd., or “Shunhao,” (viii) Hainan Yongxin Environmental Co., Ltd., or “Yongxin,” ,” (ix) Hainan Runhai Color Printing Packaging Co., or “Hainan Runhai,” (x) Hainan Saihang Photoelectric Co. Ltd., or “Hainan Saihang, ” (xi) Hainan Juneng Functional Film Co., or “Hainan Juneng” and (xii) Ningbo Neisuoer Latex Co., Ltd., or “Ningbo.”

- “SEC” are to the United States Securities and Exchange Commission;

- “Securities Act” are to the Securities Act of 1933, as amended; and “Exchange Act” are to the Securities Exchange Act of 1934, as amended;

- “RMB” are to Renminbi, the legal currency of China; and “US dollar,” “USD,” and “$” are to the legal currency of the United States; and

- “China,” “Chinese” and “PRC” are to the People’s Republic of China.

PART I

ITEM 1. BUSINESS.

Overview

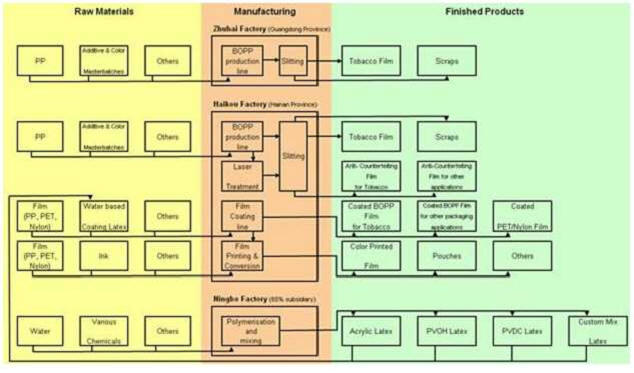

We were incorporated in Nevada in November 2003, but since July 2007, have been headquartered in Hainan, China. Through our operating subsidiaries, Hainan Shiner, Shiny-Day, Hainan Modern, Zhuhai Modern, Shimmer Sun, and Ningbo we manufacture and sell packaging and anti-counterfeit plastic film to manufacturers and producers in China. We sell anti-counterfeit film, coated film, and color printing, in international markets through a network of distributors and converters.

Our primary business consists of the manufacture and distribution of technology driven advanced packaging film products in five business segments: bi-axially oriented polypropylene, or BOPP, film for wrapping tobacco; water-based latex; coated film; color printed packaging; and advanced film. Our products are sold to customers in the food, tobacco, chemical, medical and pharmaceutical, personal care, electronics, automotive, construction, graphics, music and video publishing industries. Our current production capacity consists of: five coated film lines with a capacity of 15,000 tons a year; two BOPP tobacco film production lines with a capacity of 13,500 tons a year; one BOPP film production line with a capacity of 7,000 tons a year; three color printing lines; four anti-counterfeit film lines with a capacity of 2,500 tons a year; and two water-based latex reaction kettles with a capacity of 3,000 tons a year.

- 4 -

The table below shows the percentage of revenue by each of our business segments for the years ended December 31, 2015 and 2014:

| Percent of Total Revenue | ||||||

| Product | 2015 | 2014 | ||||

| BOPP tobacco film | 52% | 55% | ||||

| Water-based latex | 1% | 1% | ||||

| Coated film | 35% | 32% | ||||

| Color printed packaging | 5% | 5% | ||||

| Advanced film | 7% | 7% | ||||

| 100% | 100% | |||||

We have 49 patents issued by the State Intellectual Property Office of China. We have another 13 patent applications relating to our products and manufacturing processes pending. Although our patents and processes provide us a competitive advantage, we do not believe the loss of any single patent would have a material adverse effect on our business.

While our primary business consists of the manufacture and distribution of technology driven advanced packaging film products, we have historically advanced minimal funds to customers and other unrelated third parties that are non-interest bearing and payable upon demand. On April 17, 2014, Hainan Shiner, our primary operating subsidiary, drew down entirely on a RMB120 million (approximately $19.5 million) credit facility collateralized by the common stock of Hainan Shiner, our buildings and our land use rights. The facility bears interest at 7.35% per annum and is due and payable on April 17, 2017. Under the terms of the credit facility agreement, the proceeds of the funds borrowed under the credit facility are to be used solely for the construction of an office building and research facility at the Hainan Xiandai Packaging Industrial Park, and for the purchase of research and development equipment. However, on April 30, 2014, we loaned the entire proceeds of the credit facility to unrelated third parties. The business purpose for these loans was for us to make the spread between the amount of interest we pay on the credit facility and the amount of interest we can charge. Such parties have not provided us with significant collateral on such loans, other than a written guarantee from each of the borrowers and an unrelated fourth party. We do not consider this practice of lending money to third parties to be a new business segment as we deem this practice to be temporary. See our disclosures under Liquidity and Capital Resources for more information regarding our lending activities. During the twelve months ended December 31, 2015, approximately $13.1 million of these other receivables were outstanding.

Our principal executive offices are located at 19th Floor, Didu Building, Pearl River Plaza, No. 2 North Longkun Road, Haikou, Hainan Province, China 570125. Our telephone number is +86-898-68581104 and our website is www.shinerinc.com.

Corporate History and Structure

We were incorporated in Nevada on November 12, 2003 as Cartan Holdings Inc. Until July 23, 2007, we were an exploration stage company involved in the search for mineral deposits and owned a 100% undivided right, title and interest in and to the mineral property known as the “Cartan Mineral Claim,” which expired on December 15, 2007.

Acquisition of Shiny-Day

On July 23, 2007, we entered into a Share Exchange Agreement and Plan of Reorganization with Sino Palace Holdings Limited, or “Sino Palace,” a corporation formed under the laws of the BVI. Pursuant to the share exchange agreement, we acquired from Sino Palace all of the issued and outstanding capital stock of Shiny-Day, a PRC company, in exchange for the issuance of an aggregate of 16,500,000 shares of our common stock to the stockholders of Sino Palace. As a result of the acquisition, Shiny-Day and its subsidiaries, Zhuhai Modern and Shiner Industrial became our wholly-owned subsidiaries.

-

Shiny-Day, formed on March 19, 2004 and acquired on July 23, 2007 with a registered capital of $8,000,000, engages in the business of manufacturing and sales of color printing, plastic and rubber type products.

-

Shiner Industrial, formed on May 21, 2003 with a registered capital of RMB100,000 ($15,873), engages in the business of manufacture and sales of plastic film, packaging materials, PVDC latex and PVOH and R&D, manufacture, application and sales of anti-counterfeit film.

- 5 -

- Zhuhai Modern, formed on October 27, 2006 with a registered capital of RMB5,000,000 ($79,365), engages in the business of manufacturing and sales of color printing, plastic and rubber type products, and packaging materials and R&D for flexible packaging materials.

In late 2009, in an effort to improve efficiencies, reduce expenses and take advantage of favorable tax treatment, we consolidated the operations that were previously carried on by three of our subsidiaries – Hainan Shiner, Shiny-Day and Hainan Modern – into Shiner International. Shiny-Day and Hainan Modern are currently inactive subsidiaries of the Company.

Establishment of Shanghai Juneng

On September 20, 2010, we commenced operations of our 70% majority-owned subsidiary, Shanghai Juneng. The remaining 30% minority interest in Shanghai Juneng is held by Shanghai Shifu Material Co., Ltd., an unaffiliated third-party. Shanghai Juneng was formed on July 21, 2010 for the purpose of wholesale and retail sales of plastic film and packaging materials, chemical products, labels and anti-counterfeit film. Shanghai Juneng currently markets and sells food safety packaging products to domestic food producers.

Acquisition of Shimmer Sun

On May 2, 2011, we entered into an equity transfer agreement with Fu Zhiyong, pursuant to which we acquired Shimmer Sun from Fu Zhiyong for an aggregate purchase price of $3.2 million. The Company paid $1.3 million in cash and the remaining $1.9 million was recorded as “other payables” which was paid by September 30, 2011. As a result of the transaction, Shimmer Sun became our wholly-owned subsidiary and its subsidiaries and indirect subsidiaries, Jingyue, Shunhao, Yongxin and Ningbo became our indirect subsidiaries.

-

Jingyue, formed on January 25, 2011 with a registered capital of HK$3,900,000 ($495,237), engages in the sale of plastic film packaging, printing products, anti-counterfeit and packaging materials, water-based latex, and related consulting and technological services.

-

Shunhao, formed on March 15, 2011 with a registered capital of RMB2,500,000 ($396,825) , engages in the sale of plastic film, packaging and printing products, anti-counterfeit and packaging materials, water-based latex, and related consulting and technological services.

-

Yongxin, formed on April 15, 2011 with a registered capital of RMB2,000,000 ($317,460), engages in the sale of water- based latex, plastic film and packaging printing products, and R&D application and sale of anti- counterfeit technology products.

-

The acquisition gave Shiner a 65% controlling interest in Shimmer Sun’s subsidiary, Ningbo. Ningbo, formed on May 8, 2007 with a registered capital of RMB 2,080,000 ($330,158), engages in the manufacture, R&D and processing of PVDC latex series of products and being an import and export agent for latex products and technologies.

In the fourth quarter of 2014, the Company established a new subsidiary, Hainan Juneng Functional Technololgy Development Co., Ltd., through its operating subsidiary, Hainan Shiner. Hainan Juneng is owned 70% by Hainan Shiner and 30% by Hainan Rixin Hotel Management Co., Ltd, an unrelated third party. Hainan was formed to engage in the development, promotion and sale of functional thin film technology but has not conducted any business to date.

The Company also formed Hainan Runhai Color Printing Packaging Co. and Hainan Saihang Photoelectric Co. Ltd., in 2014. Hainan Runhai is a 100% subsidiary of Shiner Industrial and Hainan Saihang is a 100% subsidiary of Hainan Shiny-Day. Hainan Runhai was formed to engage in the development and sale of digital and electronic products but has not conducted any business to date.

The following chart reflects our organizational structure as of the date of this report:

- 6 -

Our Growth Strategy

Our principal business objective is to grow our market share in the flexible packaging film business and continue to expand domestically and internationally by pursuing the following key strategies:

-

Increase our market share by expanding our sales network and customer service. We believe the flexible packaging industry in China has substantial growth potential. In order to penetrate the key markets, we plan to set up a processing factory and warehouse in Shanghai. We plan to attract new customers and increase our market share by increasing our existing sales and marketing activities and strengthening our customer service within and outside of China. We plan to strengthen our customer service network by establishing a global customer service center located in Shanghai.

-

Continue to expand our production capacity with a focus on key geographic markets. We plan to increase our production capacity through potential acquisitions or installation of new production lines, or both, to meet the expected increase in the demand for our products. We foresee industry consolidation and believe we are well positioned to benefit from such a market trend. We believe we are in a position to acquire companies with advanced technology and a good customer base to expand our production capacity.

-

Strengthen our R&D capabilities, expand our product portfolio and improve our production efficiency. In order to maintain our competitiveness, we will continue to strengthen our R&D capabilities through staff training, equipment upgrades and collaborative R&D programs. We will focus our R&D efforts on the expansion of our product portfolio to meet the changing needs of our customers and the growing demands for packaging products. Moreover, we intend to develop technologies that would help us improve production efficiency and product quality while lowering production costs.

- 7 -

-

Strategically explore value-enhancing acquisitions and/or joint ventures to further grow our market share. To date, we have relied on organic expansion to achieve growth. We may strategically explore value-enhancing acquisitions and/or joint ventures to further grow our market share. We may also consider targeted acquisitions or investments where we stand to gain access to additional production capacity or proprietary technology relating to packaging, which we believe may further enhance our current products and services, and expand our position in key markets.

-

Further expand and penetrate selective international markets. We plan to continue our efforts to move beyond the PRC market and establish new sales offices in select markets to grow as a flexible packaging provider in 2012 and beyond. These new sales offices will allow us to maintain closer relationships and contacts with the end users of our products, improving our responsiveness and our ability to gather intelligence and feedback.

Industry Overview and Outlook

PRC Package Industry

We manufacture and distribute advanced packaging film products in China. China’s packaging industry has grown steadily since the mid-1980s with one of the highest growth rates in the international packaging market. Domestic consumption has always been considered by the Chinese government as one of the key drivers for national economic growth. Over the past several years, the Chinese government has released a number of industry policies and measures to encourage domestic consumption that would benefit the packaging industry. In July 2008, the Ministry of Finance of China established a fund to support the development of new and innovative products and technologies for the packaging industry, focusing on environmental protection, energy efficiency and renewable applications. China has been the second largest packaging market in the world since 2008. According to the China Packaging Federation, the Chinese packaging market reached over RMB1.0 trillion (approximately $147.5 billion) in 2009, over RMB1.4 trillion (approximately $216.7 billion) in 2011, and over RMB1.8 trillion (approximately $285.3 billion) in 2012. According to Euromonitor International’s Packaging Industry in China Report in January 2013, the packaging industry became China’s 14th largest industry sector and contributes about 2.7% of the country’s GDP.

Market Trends

With the mild recovery of the global economy, and growing consumer confidence in the Chinese domestic markets, we are cautiously optimistic that consumption of our products will continue to grow. We are experiencing an increase of inquiries from food manufacturers on how to comply with the Food Safety Law that went into effect in 2009. This renewed interest from manufacturers affects our entire breadth of products and we are confident this will lead to an overall improvement in our business. We believe we are well positioned to be the prime beneficiary of increased domestic consumption, a growing world economy, and increased market penetration as the full impact of the Food Safety Law requirements are realized.

We believe there are several positive trends that will continue to accelerate our growth, consumer demand for packaged goods, which offer convenience, quality, aesthetics and lifestyle branding will grow as Chinese consumers find themselves with increasing disposable income and as more purchases are made in supermarkets and away from wet markets and small independent food stores. We are well positioned to take advantage of these trends by providing retail foods and consumer goods manufacturers with beautiful printed flexible packaging.

-

Rapid Economic Growth and Rising Disposable Income. The growth of the flexible packaging industry is highly correlated with economic growth as the demand for packaging products is driven by improving demographic trends, including living standards and urbanization, as well as expanding industrial output. According to China National Bureau of Statistics, China is one of the fastest growing economies, its GDP having grown rapidly with a compound annual growth rate of 16.0% in the past five years. Per capita disposable income of urban households had a compound annual growth rate of 11.8% over the past ten years and per capita disposable income of rural households had a compound annual growth rate of 9.6% during the same period. China’s economy is expected to continue to grow in the next few years with an average GDP growth forecast of 8.4% from 2009 to 2014 by the World Bank.

-

High Growth of the Domestic Consumer Sectors. The main customers of the flexible packaging industry are consumer and industrial goods manufacturers that use corrugated paper cartons for packaging and shipping their products, including food and beverage, daily necessities, pharmaceuticals, and consumer goods. Catalyzed by the high growth of per capita disposable income and a series of favorable government policies, retail sales of consumer goods in China have grown rapidly and reached RMB18.4 trillion (approximately $2.8 trillion) in 2011, representing a compound annual growth rate (“CAGR”) of 17.1% from 2004, according to China National Bureau of Statistics. The continued robust growth in retail sales of consumer goods has had a significant positive impact on the demand for flexible packaging products.

- 8 -

- Substitution to Other Packaging Materials Due to Environmental Concerns. With environmental concerns becoming an increasingly important topic around the world, the Chinese government is demanding more environmentally friendly properties in packaging materials. Packaging materials are expected to be energy saving, toxic-free, reusable, degradable and multi-functional. Compared to packaging materials made of metal, plastic, wood or glass, flexible packaging film has always been regarded as relatively “greener packaging” due to its lighter weight and degradable qualifies, along with the ease of storage, shipment and processing.

Products

We produce customized, high-quality and competitively priced products used by manufacturers in a variety of applications, including producers of foods such as baked goods, beverages, candy and confections, dairy, fruits/vegetables and nuts, and consumer goods, like pharmaceuticals, tobacco, cosmetics and compact discs. Our packaging provides protection from tampering and contamination and preserves the texture, flavor and integrity of perishable items. In addition, we provide printing services for a variety of consumer products. Packaged goods require different porosity levels for humidity, gases, as well as fragrance and heat resistance barriers depending on whether the item is edible or a non-food product.

Flexible Packaging Material

We primarily use biaxially-oriented polypropylene (“BOPP”) as the base film from which more sophisticated films, such as advanced, coated and tobacco films are produced. There are multiple manufacturers of BOPP film in China qualified to meet international standards. BOPP refers to the manufacture of polypropylene films using an orienting system. BOPP is manufactured by three different processes, with resulting films having different properties. BOPP films are widely used in printing, lamination and over-wrap packaging. The main benefits of BOPP films are its stiffness, durability, high tensile strength and clear optics. The film is lightweight, non-toxic, odorless, transparent, glossy, temperature and moisture-resistant, and retains high barrier resistance, making it suitable for many forms of flexible packaging, printing, laminating, and other applications. We sell our products to packaging customers and distributors in China and throughout Asia, and have been expanding out international business in the Middle East, Australia, North America and Europe.

Upon request of our customers we may use different base films to create products customized to our customers’ needs. The base films include: biaxially-oriented polyethylene terephthalate (“BoPET”), a polyester film made from stretched polyethylene terephthalate (“PET”) that is used for its high tensile strength, chemical and dimensional stability, transparency, reflectivity and gas and aroma barrier properties; and biaxially-oriented polyamide film (“BOPA”), a nylon film used for its high tensile strength, high flex-/stress-crack and puncture resistance, barrier to gases, flavors and odors and high resistance to oil, greases, hydrocarbons and chemicals. Each base film can undergo one of three different processes to create films with different properties. A sequential or double bubble process is used for coating the films, in which a base film, generally a BOPP, BoPET or BOPA film is coated with a water-based latex compound. That compound is usually acrylic, Polyvinylidene Chloride (“PVDC”) or polyvinyl alcohol (“PVOH”), which enhance the moisture and oxygen barrier properties of the film while retaining its functionality. Films can be single or double coated with co-extruded structures, in transparent, opaque, or metalized varieties. In the metalized variety, the base film is usually coated with aluminum foil, which gives the film stronger insulation and anti-pressure properties.

Coated film is a functional packaging film in which a thin layer of polyolefin-based film is sealed either on one or both sides of the film with a varying type of chemical substance (coating layer). Depending on which coating layer is used, coated films have greater endurance and tensile strength and can be produced in heat-resistant, shrink-wrapped, peelable or other varieties. Coated film is a functional packaging film with moisture and oxygen barrier property, flavor and aroma preservation properties, as well as their superior clarity and printability. We currently produce 17 varieties of regular coated packaging films and can produce irregular coated packaging films according to the requirements of customers. As a result of these capabilities and our technology, we believe we provide the most diverse film product offering in China.

BOPP tobacco film is a box over-wrap film designed to meet the industry requirements for packaging appearance, product freshness and clear optics.

We provide color printing services that consist of surface printing and reverse printing services used mainly by consumer goods manufacturers and beverage companies. We provide printing services to our clients in our effort to provide value-added services and a one-stop-shop experience. Our printing capabilities span a range of products, such as food, drugs, cosmetics and chemicals. We use alcohol-soluble, benzene free printing ink to meet international environmental and safety standards.

- 9 -

Advanced Film

Advanced film is a specialty product derived from BOPP film and embossed with an advanced technology, multi-dimensional insignia that creates eye-catching images and makes it easier for user’s to increase brand identity. We use proprietary technology to develop specialized advanced film products. Losses from piracy and counterfeiting affect a wide number of industries including: music and video publishing, food, medicine, cosmetics, cigarettes and liquor. Advanced film is generally used in the packaging of high-end cigarettes, DVDs and other frequently imitated or pirated products.

Manufacturing

Our production facilities for packaging film are located in Haikou, Hainan Province in the PRC and our water-based latex production facilities are located in Ningbo, Zhejiang Province. Our production facilities are more fully discussed in Item 2, “Properties.”

Our products have been ISO9001:2000 accredited since 2003. We believe stringent quality control standards are crucial to our success and the continuous growth of our business. In order to maintain such standards, we conduct inspection at all stages during the production process. In that regard, we have adopted a quality management system covering the sourcing of raw materials, each stage of production, the delivery of final products, and post-sales quality control. We also provide employees with continuous training in order to help reduce the frequency of repeated errors. Below chart is our production process.

Our current production capacity consists of:

- five coated film lines with a total capacity of 15,000 tons a year;

- one BOPP tobacco film production line with a total capacity of 3,500 tons a year;

- one BOPP film production line with a total capacity of 10,000 tons a year;

- three color printing lines;

- four advanced film lines with a total capacity of 2,500 tons a year; and

- Two water-based latex reaction kettles with a total capacity of 3,000 tons a year.

Awards and Certifications

Our subsidiary, Shiner Industrial, has received the following awards and certificates, each of which, we believe, is an indication of our achievements, the quality of our products and makes us more attractive to potential customers and therefore a more competitive company both in the local and international markets:

- 10 -

| Date | Award/Certificate | Issuing Authority |

| November 2003 (1) | ISO 9001:2000 Certificate | China Certification Center for Quality Mark |

| September 2007 | Key High-Tech Enterprise of the National Torch Program | Ministry of Science and Technology |

| January 2010 | Awarded as one of the Top Ten Leading Enterprises in China food packaging industry | CNTV.COM, the website for China Network Television |

| December 2010 | Designated as “Advanced Enterprise of Chinese Plastic Industry” | China Packaging Federation |

| December 2010 | 2010 China Packaging Brand Excellence Award | China Packaging Federation |

| December 2010 | Key High-Tech Enterprise of the National Torch Program | Ministry of Science and Technology |

| May 2011 | Packaging Film Public R&D Platform | Hainan Provincial Department of Commerce |

| July 2011 | Hainan independent innovation excellent research and development team | Hainan Industry and Information Department |

| September 2011 | High and New Technology Enterprise Certificate | Provincial Science and Technology Department |

| November 2013 | National & Local Joint Engineering Research Center of Functional Film Technology | State Development and Reform Commission |

| November 2013 | The First List of national Intellectual Property demonstration enterprise | National Bureau of Intellectual Property |

| November 2013 | Science and Technical advanced unit for 2013 | National Bureau of Intellectual Property |

| (1) |

ISO 9000 certification has become an international reference for quality management requirements in business-to-business dealings. This certification enables us to compete on many more markets around the world and provides our customers with assurances about our quality, safety and reliability. |

Sales and Marketing

Our sales and marketing strategy focuses on establishing and maintaining a reputation for consistent and stable production of innovative high quality packaging film at competitive prices, providing dependable and efficient customer support services, and building stable and enduring relationships with our customers.

We sell our packaging film and services to dozens of food, beverage, and consumer goods manufacturers throughout the world, with a focus on the PRC market. Our customers are located in 20 provinces, three municipalities and three autonomous regions in the PRC. Our sales group is divided into two teams, a domestic sales team focusing on the PRC market and an international sales team focusing on the European, North American, Southeast Asian, Australasian and Middle Eastern markets. We currently have 30 full time sales representatives servicing our domestic and international customers. The majority of our sales professionals are university graduates and 10 of them have more than 10 years industry experience. We seek to expand our market share in the European and North American markets that we believe possess growth potential. Our domestic sales team is divided into five major sales regions in the PRC based on the location of our customers - Guangdong and Guangxi, Northwest China, Southwest China, Northeast China and Eastern China.

Our sales representatives maintain regular contact with customers to track product performance to ensure customer satisfaction. They are responsible for handling inquiries, processing and allocating orders to our production team, confirming orders and product specifications from customers, and providing after-sales services such as gathering market information and conducting surveys. In addition, these sales personnel are also responsible for handling ad hoc product inquiries and for cultivating relationships with potential new customers. Through regular contact with our customers, we are able to ascertain the current and future demand for existing products and the potential demand for new products.

In the international market, our sales team has adopted a strategic regional sales and marketing system and established an extensive sales and marketing network throughout North America, Europe and Southeast Asia. We have entered into preliminary letters of intent with potential representatives and agents in Southeast Asia, Europe, and the United States in relation to marketing and distribution of our products.

- 11 -

We have refocused our marketing and sales strategy to match our customer focused business strategy. Our marketing activities are geared towards supporting the activities of our sales team by keeping abreast of industry trends, interacting with existing customers, cultivating new relationships and building brand awareness. By visiting our customers in the PRC regularly and nurturing close relationships it enables us to identify market trends, understand customers’ evolving needs, adjust and manage our production processes and proactively resolve customers’ issues and concerns. These regular contacts, visits, and interviews allow us to gain insight into the latest market trends and to capture business opportunities ahead of our competitors. We also distribute marketing materials we produce from time to time to our customers in person during such visits or otherwise by email or mail. Because of the attractive location of our plant and facilities in Haikou on Hainan Island, generally known as the “Hawaii” of China, we frequently invite potential customers to visit and inspect our operations first-hand and we also host many of the annual tobacco and other large industry management conventions.

We participate regularly in industry exhibitions and international trade fairs held in the PRC and internationally. To attract new customers and to maintain brand awareness in the industry, we regularly advertise our Company and products in industry magazines and on our own website. Members of our senior management team are frequent speakers at industry events and also give interviews to industry magazines from time to time to raise our profile.

Raw Materials and Suppliers

Major raw materials required in the manufacturing processes for our packaging products include petroleum-based resins and mixing chemicals, which are primarily supplied to us by large chemical companies. For these raw materials, we generally maintain purchase contracts for a period of up to six months. However, for many other materials, we can generally choose from multiple producers and such orders are placed on an “as-needed” monthly basis.

As all BOPP film is petroleum based, the effects of any short-term fluctuations in the price of oil will be averaged into the earnings over the period due to the cyclical nature of production, inventory and sales. Any long-term increases in the price of oil will have an adverse impact on our earnings. However, as there are currently no synthetics or substitute materials available in the market, management believes that any long-term increase in the price of oil will be made up for by an increase in sale prices by all film producers.

The base materials for many of Shiner Industrial’s products are derived from petroleum. Approximately 34% of the raw materials for Hainan Shiner’s BOPP tobacco film operation are imported from multi-national chemical companies such as Sumitomo Chemical Co., Ltd. In contrast, only about 4% of the raw materials for our coated films are imported because the current base BOPP film can be supplied through qualified domestic suppliers in China. All of the raw materials for our color printing operations are purchased domestically in China. There are numerous suppliers for these raw materials. We generally select a supplier based on the best combination of quality, price and service. There are no raw materials used in our color printing production process that are provided by any sole supplier.

BOPP is a major raw material for our flexible packaging films; our new BOPP film line produces sufficient basic BOPP film to satisfy our coated film production needs.

In general, we do not have long term contracts with our suppliers. We maintain relationships with two to three approved suppliers for each raw material purchased and generally experience no delay in meeting our production needs on a timely basis. Currently, raw materials are readily available and we expect to continue to successfully manage raw material supplies without significant supply interruptions. Our largest suppliers accounted for more than 12% of raw material purchases in 2015.

Customers

Our customers are composed mainly of consumer products manufacturers, distributors, printers and packaging industry distributers. About 80% of our customers are in China, with the remainder in Southeast Asia, Europe and North America. While most of our products are sold in the international market, our color printing business mainly serves customers in China who are looking for one-stop service to fulfill their printing and packaging needs by a single vendor.

- 12 -

Flexible Packaging Material

We are the leading producer of coated film in China, with approximately 30% market share of the Chinese domestic coated film output in 2015. Our domestic competitors exist only in the form of smaller rivals with an average annual capacity of several hundred metric tons. Approximately 70% of our sales are made directly to customers and the remaining 30% of our sales are made through domestic distributors servicing one-off, small-scale packaging operations. We believe we are the leading producer of coated films nationally, and enjoy a reputation both for first-rate quality and service. We maintain contracts with our larger customers generally for periods ranging from six months to one year. Smaller customers, those that constitute less than 2% of our overall sales are subject to pre-payment on all orders.

During 2015, our top 10 customers accounted for approximately 93% of our total international coated film sales, with an average sale of $680,000 per customer. Approximately 72% of our exported coated film is sold to printing and packaging companies located in Australia with the remainder sold to companies located in the United States, Europe, New Zealand and Turkey. Approximately 28% of our exported coated film sales are made to the “converter” industry, which represents mass packaging operations mainly in Southeast Asia and Eastern Europe that serve as packaging hubs for products sold in the US and European markets. Rolls of finished coated film are sent to the converters where they print, cut, fold, and insert re-sealable zips to form pouches for items such as dried fruits, nuts, beverages and dairy products like cheese and yogurt. Our largest international customer, Impak Films Pty. Ltd., an Australian packaging distributor, accounted for approximately 11% of our coated film sales and 4% of our total sales in 2015.

As tobacco remains one of the state-controlled industries in China, all of our domestic BOPP tobacco film sales are made to provincial cigarette manufacturers who can buy only from pre-approved domestic manufacturers meeting the quality and technical specifications as well as the standard price requirements of the Chinese government. We currently sell our BOPP tobacco film to 28 of 32 provincial cigarette manufacturers (representing approximately 70% of this market) and have contracts to sell over 5,000 metric tons of film per year to the state owned cigarette company of China.

The main customers of our color printing business are brand-name food and commodity companies in China that have strict requirements for quality and service. We believe our customers are also attracted to the one-stop service that we offer by fulfilling both their packaging film and printing requirements. Our largest customer, Chun Guang Foodstuff Co., Ltd., accounted for 40% of color printing sales in 2015.

Advanced Film

We introduced advanced film products in 2005 as a superior alternative to the industry’s hologram printed films.Our largest customer in the international market is Vietnam Tobacco Imports and Exports Co., or “Vintaba”, the tobacco production company of the Government of Vietnam. Vintaba accounted for approximately 54% of our advanced produce sales. A majority of our customers are brand name producers seeking to protect copyrights and reduce the occurrence of pirated product. According to the American Film Institute, the Chinese film market suffers a loss of $2.7 billion each year due to piracy, including the annual loss of $1.6 billion from piracy of CDs and DVDs.

At the Sixth Global Congress to Combat Counterfeiting & Piracy in February 2011, International Chamber of Commerce Secretary General Jean-Guy Carrier reported that “the total impact of illicit trade in “fakes” is staggering, with more than $1.0 trillion in annual losses to global economies, governments and consumers and potentially more than two million jobs at risk.” Reports from the Congress showed that the trade of counterfeit cigarettes currently accounts for 6% of the global tobacco trading and manufacturing and selling counterfeit cigarettes in the global market has reached approximately 150 billion units per year. According to new research of the Business Software Alliance, the percentage of counterfeit software in the global market increased to 45% in 2013 from 41% in 2008, resulting in more than $55 billion in losses to the industry.

Research and Development

We highly value our strong R&D support team. Our R&D team includes 28 engineers and technicians with each person holding a Bachelor’s or other advanced degree, and most of whom have direct or related field experience. Our R&D team strives to improve our production process, product quality and product compatibility to reinforce our competitive advantage in the market. In particular, our R&D efforts are focused on: (i) identifying processes that improve our cost-efficiency and our customers’ production efficiency; (ii) identifying alternative production materials to generate comparable performance at a lower cost to our customers.

Our R&D team is the first point of contact for customers in the event of quality related concerns and assists customers with identifying and resolving problems, offering effective and efficient solutions and facilitating discussion with our production team. Our R&D team has a long track record of experience in the flexible packaging industry and is capable of translating customer requests into solutions.

- 13 -

We built Hainan Film Engineering Center in Haikou, which has four well-equipped professional laboratories. In addition, we also set up R&D centers in both of our Hainan and Zhuhai locations. Our engineers have designed two of our coated film production lines. By designing our own production lines, we intend to reduce our fixed asset investment by approximately 35% and better meet our specific manufacturing needs. The director of our research department has over 15 years’ experience in the industry.

During 2015 and 2014, we spent approximately $2.6 million and $3.2 million respectively, on R&D projects with the majority expended on new product trials and experimental manufacturing techniques, including fog prevention and high heat shrinkable films.

In 2015, we spent approximately $1.6 million in the development of functional coatings of coated films and functional BOPP film. Functional coatings and film are designed to meet certain functional requirements of our customers and market, such as improved sealing and barrier properties. All R&D costs are funded through our operating cash flow and are expensed as incurred.

In addition to in-house R&D, we have sponsored several projects with research institutions and universities in China to which we retain all proprietary rights for the research funded by us. We also have a formal agreement with China’s Science & Technology University, Hainan University and Hainan Normal University through 2015 for which we have proprietary rights to all findings based upon dedicated research conducted on our behalf. We also have informal alliances with Fudan University in Shanghai, Sun Yat Sen University (Zhong Shan) in Guangzhou and Tsinghua University in Beijing.

Intellectual Property

We hold 49 patents on both products and production equipment that have been issued by the State Intellectual Property Office of China.

| Name of Patents | Patent No. | Issue Date | ||||

| Acrylic Acid Coated Film & Its Manufacturing Methods | ZL2005100777111.3 | Jan 31,2007 | ||||

| Two way stretched polypropylene film substrate with no bottom glue coating and Non bottom adhesive coating film | US 9068097 | Jun 30,2015 | ||||

| BOPP Shrinkable Monofilm & Its Manufacturing Methods | ZL03149870.1 | Nov 15,2006 | ||||

| Production System of Microwave Drying Coated Film | ZL03149871.X | March 22,2006 | ||||

| A Kind of Low heat-seal Coated Film | ZL2012205042172 | Mar 27,2013 | ||||

| A Kind of Transparent Coated Film apply to Sandwich Packing | ZL2012205041856 | Mar 27,2013 | ||||

| A kind of low temp. sealing high barrier coated film for heat sensitive food packing | ZL2012205041822 | Mar 27,2013 | ||||

| A kind of high barrier laminated film for air fresher packing | ZL201220471388.X | Mar 4,2013 | ||||

| A kind of Biax-oriented fringed BOPP | ZL201220459128.0 | Mar 12,2013 | ||||

| A kind of non primer coated film and its manufacturing method | ZL201010177656.2 | Apr 3,2013 | ||||

| A Kind of laminated Coated Film for ketchup bag packing | ZL2013200765856 | Jul 24,2013 | ||||

| A kind of heat sealable PVDC coated film manufacturing method | ZL201110119077.7 | Aug 21,2013 | ||||

| A Kind of Coated Film& Its Manufacturing Methods | ZL200510075370.2 | May 16,2007 | ||||

| BOPP Shrinkable Tobacco film & Its Manufacturing Methods | ZL01118669.0 | May 14, 2008 | ||||

| Manufacturing Methods for Heat Shrinkable Coated Films | ZL031498728 | March 27, 2009 | ||||

| A Kind of Heat-sealed BOPP Film | ZL200810177464.4 | March 24, 2010 | ||||

| Ultrathin biaxial stretching polypropylene film for rolling paper packaging & Its Manufacturing Methods | ZL201310033169.2 | May 6,2015 | ||||

| A Modified PVOH Coated Film for Print & Its Manufacturing Methods | ZL201010208100.5 | January 11, 2012 | ||||

| Methods for Producing Coated Film | US8007873B2 | August 30, 2011 | ||||

| A Kind of Ultraviolet-proof Coated Film Manufacturing Methods | ZL201010210692.4 | Jul 25,2012 | ||||

| A Kind of No Base Coated Film Manufacturing Methods | ZL200910215431.9 | Oct 10,2012 | ||||

| A kind of new film structure for fresh meat packing | ZL2013200925821 | Sep 25,2013 | ||||

| A vapor barrier type polyvinylidene chloride coated film manufacturing method | ZL201110119076.2 | Apr 09,2014 | ||||

| A plastic film coated with acrylic polyurethane rubber manufacturing method | ZL201210361249.6 | Apr 30,2014 | ||||

| A low shrinkage temperature of polyolefin heat shrinkable film and its manufacturing method | ZL201210570489.7 | Oct 01,2014 | ||||

| A kind of used for flour packaging composite membrane | ZL201420014511.4 | Oct 01,2014 | ||||

| Self-adhesive polyvinylidene chloride emulsion bottomless glue coating method and the implementation of the method of coating system | ZL201210572943.2 | Nov 26,2014 | ||||

| Chocolate thermal food coating film coating method and the implementation of the method of coating systems | ZL201210572302.7 | Jan 21, 2015 | ||||

| A low friction two-way stretch polypropylene heat sealing membrane and its manufacturing method | ZL201210569786.X | Feb 18, 2015 |

- 14 -

| Two-way stretch large size of polypropylene high shrinkable film cutting and winding process | ZL201210570488.2 | Feb 18, 2015 | ||||

| A high gloss two-way stretch polypropylene heat sealing membrane and its manufacturing method | ZL201210571747.3 | Jan 26, 2015 | ||||

| A holographic mould shrinkage film and its manufacturing method | ZL201210294383.9 | Jan 28,2015 | ||||

| A system used for double coating membrane flip | ZL201210572050.8 | Feb 04,2015 | ||||

| A plastic tag and its manufacturing method | ZL201310237880X | Feb 05,2015 | ||||

| A betelnut packaging composite membrane and its preparation method | ZL201310184488.3 | Feb 12,2015 | ||||

| A high resistance oxygen cooking polyvinylidene chloride resistant coating film and its manufacturing method | ZL201210294409.X | Mar 05,2015 | ||||

| A PET laser transfer film without slab joint and its preparation method | ZL201310254466.X | Mar 10,2015 | ||||

| A two-way stretch polypropylene heat sealing membrane and its manufacturing method | ZL201210570487.8 | Mar 12,2015 | ||||

| A kind of cigarette packing two-way stretch polypropylene shrinkable film and its manufacturing method and application | ZL201210570229.X | Mar 24,2015 | ||||

| A kind of Low temperature heat sealing high barrier coating film & Its Manufacturing Methods | ZL201210294382.4 | May 20,2015 | ||||

| Coating method for coating film of double coated PVDC emulsion in accordance with sandwich food package and Coating system | ZL201210572944.7 | Jun 6,2015 | ||||

| A kind of Method for producing bactericidal poly offset two vinyl chloride coating film | ZL201210294385.8 | Jun 24,2015 | ||||

| a kind of Polyolefin thermal shrinkage film with high shrinkage rate & Its Manufacturing Methods | ZL201210570571X | Jul 15,2015 | ||||

| A kind of Post curing method of polyvinyl alcohol coating film | ZL201210571976.5 | Oct 28,2015 | ||||

| A kind of Composite film for flour packaging & Its Manufacturing Methods | ZL201410011003.5 | Oct 28,2015 | ||||

| A kind of Latex feeding method in latex coating process for coating film and charging device | ZL201210571978.4 | Oct 28,2015 | ||||

| The recovery method of PVDC coating film | ZL201210571977X | Oct 28,2015 | ||||

| A kind of Bidirectional stretching polypropylene common cigarette packaging film & Its Manufacturing Methods | ZL201210570455.8 | Nov 18,2015 | ||||

| A kind of Cooking and cooking poly partial two vinyl chloride coating film & Its Manufacturing Methods | ZL201110202562.0 | Dec 16,2015 |

We have additional products and production equipment for which 50 patent applications are currently pending. Our current patents expire between 2015 and 2030. We also have two trademarks issued by the State Intellectual Property Office of China.

Employees

We have a centralized labor management system for our operating subsidiaries. Labor and employment affairs of each subsidiary are managed by our central human resources department. Currently, we have 393 full-time, and no part-time employees. The following table sets forth the number of our employees by function.

| Number of | |||

| Department | Employees | ||

| Executives | 15 | ||

| R&D | 28 | ||

| Human Resources | 4 | ||

| Manufacturing | 298 | ||

| Finance | 20 | ||

| Marketing & Sales | 25 | ||

| Other | 3 | ||

| Total | 393 |

Each employee must enter into multiple employment contracts, including a non-competition agreement, which are then filed with the municipal government. All employees receive a base monthly salary. Executive employees are also entitled to a year-end bonus based upon our overall performance results, seniority and individual performance and contribution to the Company. Production employees are entitled to a monthly bonus calculated on the basis of the quality of the products produced, and their respective contribution to volume, safe production, correct use of equipment and energy saving. Our production employees are not subject to collective bargaining agreements. However, we maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

- 15 -

Our employees in China participate in a state pension plan mandated by Chinese municipal and provincial governments. Benefits include social security, pension benefits, and medical insurance. The Company contributes approximately 37% of annual salaries to the pension plan on behalf of all qualified employees.

We believe that we are in material compliance with relevant PRC labor laws.

Regulation

The Food Safety Law of the PRC, or the “Food Safety Law,” was enacted on February 28, 2009 by the Standing Committee of the National People’s Congress and became effective on June 1, 2009. The Implementation Regulations of the Food Safety Law, or the “Implementation Regulations,” were subsequently promulgated on July 20, 2009 and were immediately effective.

Pursuant to the Food Safety Law and its Implementation Regulations, the Chinese government regulates food manufacturers (producers and processors) and operators (distributors and caterers), as well as manufacturers of (i) food additives, (ii) packaging materials, containers, detergents and disinfectants used with food and (iii) tools and equipment used in production and processing of food. Under this law, manufacturers who are engaged in the production of food, food additives and food related products must comply with applicable food safety standards and must satisfy inspection and approval procedures with regard to their products before sending them into the market. In addition, food manufacturers are required to check business permits and product qualification certificates of their suppliers from whom they purchase food materials, additives and related products and to inspect such products to ensure that they conform to applicable food safety standards. Any violation of the Food Safety Law and its Implementation Regulations may result in legal liabilities, such as warnings, fines, damages, or even in criminal liabilities for serious violations.

Shiner has been appointed a “Standards Creator” in Coated Film by the Standardization Administration of the PRC. As such, Shiner has been working closely with various government agencies to assist the regulatory authorities in drafting new packaging guidelines that that will help ensure a safe food supply as outlined in the Food Safety Law. It is our belief that large domestic Chinese food manufacturers will utilize coated film packaging to meet the requirements detailed in the Food Safety Law standards.

Additionally, our products are subject to regulation by agencies of the provincial government of Haikou responsible for food packaging and hygiene and the regulatory schemes of international governmental authorities governing the food safety, quality and hygiene of our customers. The safety, quality and hygiene requirements of many of our customers, especially those located internationally, exceed government requirements in China. Our PVDC and all coated films have already met FDA requirements, as well as the requirements for food products packaging sold in the European Economic Community, or the “EEC.”

Business registrations, our production processes, and certain products are certified on a regular basis and must be in compliance with the laws, rules and regulations of various governments and industry agencies. Our subsidiaries have been assessed and certified as meeting the requirements of ISO 9001:2000 for designing and manufacturing BOPP films, PVDC coated film, BOPP laser holographic advanced film for packaging by the SGS Group.

We are also subject to China’s National Environmental Protection Law as well as a number of other national and local laws and regulations regarding pollutant discharge for air, water and noise pollution. We believe we are in compliance with such laws and regulations.

In each of 2015 and 2014, we incurred expenses of approximately $15,000 to comply with governmental and environmental regulations in China.

Competition

We believe our expertise in manufacturing specialty films provides us a distinct advantage over competitors in China, most of whom are focused mainly on commodity films, such as BOPP, BoPET, PVC and BOPA. We are the leading producer of coated films in China with limited domestic competition only in the form of smaller rivals with an average annual capacity of several hundred metric tons. Internationally, we face competition from industry leaders such as DuPont Energy Co., Innovia Films Ltd. and Exxon Mobil Corporation. Each of these corporations has much larger production capacity than us and has a strong reputation as they have significant experience in the coated films market.

- 16 -

As tobacco remains a state-owned and operated industry in China, the government buys only from approved PRC domestic vendors and competition exists only in the form of other domestic film companies. In addition, each province is required to maintain two to three suppliers. Thus, competition among qualified players is limited. In the domestic market there are several qualified large producers including: Jiangsu Zhongda New Material Group Co., Ltd., Foshan Plastics Group Co., Ltd, Zhanjiang Packaging Enterprises Ltd., Yunnan Kunlene Film Industries Co., Ltd., Yunnan Hongta Plastics Co., Ltd., Hubei Firsta Packaging Co., Ltd. As we have attained certification as a government supplier, a certain level of annual sales is guaranteed to us from the government of China. In the international market, we face competition from large multi-nationals as well as Southeast Asian and Japanese firms. We believe we have a price advantage over our Western competitors due to our lower production costs.

Our advanced film is unique; as such we do not have a direct competitor for this product. However, established international producers such as Applied Extrusion Technologies, Inc. and Innovia Films Ltd. do produce their own advanced films based mainly on printed holograms, which are relatively simple to duplicate. Rather than direct competition, we are focusing on marketing efforts on awareness and educating buyers as to the superior quality of our products over these hologram-based counterfeit films.

We are the largest color printing service provider in Hainan province and rank approximately 20th in the overall Chinese market. Due to low operating costs, the printing industry is highly fragmented with approximately 4,000 soft packaging and printing companies in China. As a result, competition in China is fierce and industry margins are low. Accordingly, we maintain our printing services mainly as a convenience for current film customers who are more concerned with quality, service, and one-stop printing and packaging service than with price.

The primary barriers to enter the market include obtaining a printing license and significant capital investment in large-scale production facilities. We believe our competitive advantages over domestic players are better cost-efficiencies due to economies of scale and significant order volumes, long standing relationships with customers, advanced technologies and equipment deployed in our manufacturing process, high product quality with competitive cost structure and a well-known brand name. Our competitive advantages over international players include significant production capacity, a large existing customer base, the flexibility to customize our products, better local knowledge and connections in the PRC, lower price resulting from our lower cost structure and competitive product quality.

Competitive Strengths

We believe we are able to effectively compete in both the domestic Chinese and international markets by means of proven quality, cost advantages and a service team that supports our customers before, during and after the sale process in order to build long-term customer relationships. Our customer-oriented perspective permeates each business unit and is largely responsible for our ability to penetrate new markets and successfully build on sales to new customers.

-

Established long-term relationships with reputable customers in diversified end markets. We have established an extensive customer base in a wide variety of industries, including food, beverage, cigarette, pharmaceuticals, chemicals, and other consumer and industrial goods. We believe this wide range of end markets reflects the strength of our experience and reputation as a qualified flexible packaging and advanced film producer, as well as the broad range of available markets for our products. Many of our customers are PRC’s Top 500 enterprises, and we believe we are well positioned to benefit from our established customer relationships.

-

Ability to provide customized products and solutions. As part of our differentiation strategy, we work closely with customers to understand and design innovative products based on our ability to formulate different blends of resins and additives to produce film with specific properties for our customers based on their unique requirements. This strategic advantage is difficult for our competitors to duplicate given the technological and manufacturing flexibility that it demands. As a result of our diverse, high quality product offering, we have been able to increase pricing of our certain coated film products.

-

One-stop service. We are able save customers both lead-time and costs by providing one-stop service in which we not only sell the film but also develop the production processes that produce the end packaging product.

-

Advanced production facilities and stringent quality control. We continually invest in our production capabilities and furnish our facilities with advanced equipment. Our products have been ISO9001:2000 accredited since 2003. We believe stringent quality control standards are crucial to our success and the continuous growth of our business. In order to maintain such standards, we conduct inspection at all stages during the production process. In that regard, we have adopted a quality management system covering the sourcing of raw materials, each stage of production, the delivery of final products, and post-sales quality control. We also provide employees with continuous training in order to help reduce the frequency of repeated errors.

- 17 -

- Strong R&D capabilities. We have an experienced R&D team of 22 professionals. The team has successfully developed new products and technologies, which have led to 16 patents and 10 pending patent applications. We also work with reputable academic and research institutions to undertake specific R&D projects. In 2006, we entered into a five-year research agreement with China’s Science & Technology University. Under the terms of this agreement, six professors, all holding advanced degrees, work in conjunction with our R&D team. Shiner owns the proprietary rights to all findings to dedicated research projects which are undertaken at our request. We pay the university estimated fees of $12,850 annually under this agreement. This agreement was renewed in 2010 for an additional five years under the same terms.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

We could lose control of Hainan Shiner, our primary operating subsidiary, if we are unable to repay our loan or if we are unable to obtain a waiver for unsanctioned use of proceeds as a result of our temporary lending operations.

On April 17, 2014, Hainan Shiner, our primary operating subsidiary, drew down entirely on a RMB120 million (approximately $19.5 million) credit facility collateralized by the common stock of Hainan Shiner, our buildings and our land use rights. The facility bears interest at 7.35% per annum and is due and payable on April 17, 2017. Under the terms of the credit facility agreement, the proceeds of the funds borrowed under the credit facility are to be used solely for the construction of an office building and research facility at the Hainan Xiandai Packaging Industrial Park, and for the purchase of research and development equipment. However, on April 30, 2014, we loaned the entire proceeds of the credit facility to unrelated third parties as set forth below. Such parties have not provided us with significant collateral on such loans, other than a written guarantee from each of the borrowers and an unrelated fourth party. The use of the proceeds from the credit facility to provide such loans constitutes a breach under the credit facility agreement. Unless and until we obtain a waiver from the lender for such use of proceeds, the lender has the right to declare a breach of the trust agreement and enforce its right to ownership of the stock, buildings and land use rights of Hainan Shiner, our primary operating subsidiary. Furthermore, if any of the borrowers are unable to fulfill their obligations under our loans to them and their guarantees fail, we will be obligated to repay the credit facility in its entirety. If we are unable to repay this debt in full by the due date we could lose control of Hainan Shiner, our buildings and our land use rights. For more information regarding such third party loans see Note 3 to our financial statements.

We cannot be certain that our product innovations and marketing successes will continue.

We believe our past performance has been based on, and our future success will depend upon, in part, our ability to continue to improve our existing products through product innovation and to develop, market and produce new products. We cannot assure you that we will be successful in the introduction, marketing and production of new products or product innovations, or that we will develop and introduce in a timely manner innovations to our existing products which satisfy customer needs or achieve market acceptance. Although we have developed products that have met customers’ requirements in the past, there is no assurance that any of our R&D efforts will necessarily lead to any new or enhanced products or generate sufficient market share to justify commercialization. We must continually improve our current products and develop and introduce new or enhanced products that address the requirements of our customers and are competitive in terms of functionality, performance, quality and price in order to maintain and increase our market share. If our new products are unable to gain market acceptance, we would be forced to write-off the related inventory and would not be able to generate future revenue from our investment in R&D. In such event, we would be unable to increase our market share and achieve and sustain profitability. Our failure to develop new products and introduce them successfully and in a timely manner could harm our ability to grow our business and could have a material adverse effect on our business, results of operations and financial condition.

Our advanced technology may not satisfy the changing needs of our customers.

- 18 -

With any advanced product authentication technology, including the technology of our current and proposed products, there are risks that the technology may not successfully address all of our customers’ needs. While we have already established successful relationships with Chinese customers with regard to our products, our customers’ ultimate needs may change or vary, thus introducing variables which may affect the ability of our proposed products to address all of our customers’ ultimate technology needs in an economically feasible manner.

Our growth strategy and future success depends upon commercial acceptance of products incorporating technologies we have developed and are continuing to develop. Technological trends have had and will continue to have a significant impact on our business. Our results of operations and ability to remain competitive are largely based upon our ability to accurately anticipate customer and market requirements. Our success in developing, introducing and selling new and enhanced products depends upon a variety of factors, including:

- accurate technology and product selection;

- timely and efficient completion of product design and treatment;

- timely and efficient implementation of manufacturing processes;

- product performance; and

- product support and effective sales and marketing.

We may not be able to accurately forecast or respond to commercial and technological trends in the industries in which we operate.

We may not be able to keep pace with rapid technological changes in the advanced film product industry.

The advanced film product authentication industry is a relatively new industry and market, especially in China and other parts of Asia, and continues to evolve in terms of customer/market needs, applications, and technology. We believe we have hired or engaged personnel and outside consultants who have experience and are recognized within the industry to be experts. With respect to technology, while we continue to seek out and develop “next generation” technology through acquisition, strategic partnerships, and our own R&D, there is no guarantee that we will be able to keep pace with technological developments and market demands in this evolving industry and market. Technological changes, process improvements, or operating improvements that could adversely affect us include:

- development of new technologies by our competitors or counterfeiters;

- changes in product requirements of our customers; and

- improvements in the alternatives to our technologies.

We may not have sufficient funds to devote to R&D, or our R&D efforts may not be successful in developing products in the time, or with the characteristics, necessary to meet customer needs. If we do not adapt to such changes or improvements, our competitive position, operations and prospects would be materially affected.

Intense competition in the advanced and packaging markets may adversely affect our operating results.

We operate in highly competitive and rapidly evolving fields, and new developments are expected to continue at a rapid pace. We believe there are few barriers to entry into many of our markets. As a result, we may experience competition resulting from new manufacturers of various types of film in our product lines. Competitors may succeed in developing alternative technologies and products that are more effective, easier to use or less expensive than those which have been or are being developed by us or that would render our technology and products obsolete and non-competitive. Any of these actions by our competitors could adversely affect our sales.

In addition, we face competition from a substantial number of companies, which sell similar and substitute packaging products. Although we believe we have developed strategic relationships in China to best penetrate China’s market, we face competition from other providers, some of which have greater financial and human resources, have had a longer operating history, and have greater name recognition than we do. Many of these competitors have substantially greater financial and technical resources, production and marketing capabilities, and may have extensive production facilities, well-developed sales and marketing staffs and substantial financial resources. Competitive products are also available from a number of local manufacturers. This results in competition that is highly price sensitive. We also compete on the basis of quality, service, timely delivery and differentiation of product properties.

An increase in competition could result in material selling price reductions or loss of our market share. This could materially adversely affect our operations and financial condition.

- 19 -

We are a major purchaser of many commodities that we use for raw materials in the manufacturing process of our products, and price changes for the commodities we depend on may adversely affect our profitability.

With the rapid growth of China’s economy, the demand for certain raw materials is great while the supply may be more limited. This may affect our ability to secure the necessary raw materials we need in a cost-effective manner, including chemicals and other items needed for production of our products at the volume of purchase orders that we anticipate receiving.