Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - REGIONS FINANCIAL CORP | rf-20160331xexhibit991.htm |

| EX-99.2 - EXHIBIT 99.2 - REGIONS FINANCIAL CORP | rf-20160331xexhibitx992.htm |

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf-20160331x8k.htm |

1st Quarter Earnings Conference Call April 15, 2016 Exhibit 99.3

A solid start to 2016 2016 Strategic Initiatives ▪ Grow and diversify revenue streams ▪ Disciplined expense management ▪ Effectively deploy capital • Results reflect growth in total revenue, lower adjusted expenses(2) and positive operating leverage • Expanded customer base as checking accounts, households, credit cards and wealth accounts grew • Recognized by Temkin Group and Greenwich Associates for providing industry-leading customer service and customer experiences • Submitted capital plan First Quarter Highlights ($ in millions, except per share data) 1Q16 1Q15 Change Net Income(1) $257 $218 18% Diluted EPS - Continuing Operations $0.20 $0.16 25% Average Loans and Leases 81,510 77,942 5% Average Deposits 97,750 95,783 2% Total Adjusted Revenue (FTE)(2) $1.4B $1.3B 7% Adjusted efficiency ratio(2) 60.6% 64.9% 430 bps (1) Available to common shareholders (2) Non-GAAP; see appendix for reconciliation Demonstrates we are successfully executing on our strategic plan 2

Loans and leases reflect solid growth 1Q15 2Q15 3Q15 4Q15 1Q16 $77.9 $79.2 $80.6 $80.8 $81.5 ($ in billions) Average loan and lease balances Quarter-over-Quarter: • Loan and lease balances up $750MM or 1% • Business lending balances increased 1%, driven by Corporate Banking and Real Estate Banking • Consumer lending experienced another strong quarter as almost every category experienced growth and production increased 3% Year-over-Year: • Loan and lease balances up $4 billion or 5% • Business lending achieved solid growth as balances increased 4%; all lending groups achieved growth including Corporate Banking, Commercial Banking and Real Estate Banking • Consumer lending balances increased 5%, driven by new initiatives 3

Average deposits experienced growth Low-cost deposits Time deposits + Other 1Q15 2Q15 3Q15 4Q15 1Q16 87.3 88.9 89.1 89.7 90.4 8.5 $95.8 8.2 $97.1 8.1 $97.2 7.8 $97.5 7.4 $97.8 ($ in billions) Quarter-over-Quarter: • Deposits up $262MM • Low-cost deposits up $712MM or 1% • Deposit costs steady at 11 basis points • Funding costs up 2 basis points to 28 basis points Year-over-Year: • Total deposits up $2B or 2% • Low-cost deposits up $3B or 4% 4

Increased net interest income and other financing income and net interest margin Net Interest Income and Other Financing Income (FTE) Net Interest Margin 1Q15 2Q15 3Q15 4Q15 1Q16 $856 3.18% 3.16% 3.13% 3.08% 3.19% Quarter-over-Quarter: • Adjusted net interest income and other financing income (FTE) up $12MM or 1%(1) ◦ Primary drivers of increase were higher loan balances and increases in short-term interest rates ◦ Additionally, there were several items unlikely to repeat that benefited income, including lower premium amortization and higher dividend income related to trading assets ◦ Offset by lower dividends on Federal Reserve Stock and one less day in the quarter Year-over-Year: • Net interest income and other financing income (FTE) up $51MM or 6% ◦ Increase driven by loan growth, balance sheet optimization strategies and higher short-term rates (1) During the fourth quarter of 2015, Regions corrected the accounting for certain leases which had previously been included in loans. The cumulative effect on pre-tax income lowered net interest income and other financing income $15 million, therefore net interest income and other financing income would have been $871 million. The correction also reduced the net interest margin by 5 basis points and would have been 3.13%. The company does not expect this adjustment to have a material impact to net interest income and other financing income or net interest margin in any future reporting period. ($ in millions) 5 (1) $883 $855 $839$832

Non-interest income driven by growth in revenue diversification initiatives 1Q15 2Q15 3Q15 4Q15 1Q16 41 40 46 39 37 38 59 66 54 75 69 98 97 102 100 106 85 90 93 96 95 161 168 167 166 159 7 96 13 12 470 940 590 1,180 497 994 514 1,028 506 1,012 (1) Non-GAAP; see appendix for reconciliation (2) Total Wealth Management income presented above does not include the portion of service charges on deposit accounts and similar smaller dollar amounts that are also attributable to the Wealth Management segment. Quarter-over-Quarter: • Adjusted non-interest income increased 1%(1) driven by revenue diversification initiatives • Capital markets income increased $13MM or 46% • Wealth Management income increased $6MM or 6% • Service charges declined 4%, impacted by seasonality and posting order changes that went into effect in early November 2015 • Bank owned life insurance increased $14MM Year-over-Year: • Adjusted non-interest income increased $45MM or 10%(1) driven by growth in checking accounts and credit card accounts, higher bank owned life insurance income, as well as new revenue initiatives • Capital markets income increased $21MM, more than double 1Q15 • Wealth Management income increased $8MM or 8% • Service charges declined 1% impacted by posting order changes $470 $590 $497 $514 Selected Items(1) Other Capital Markets Wealth Management Income(2) Mortgage Income Card and ATM fees Service charges on deposit accounts ($ in millions) $506 6 (2) 20 27 29 28

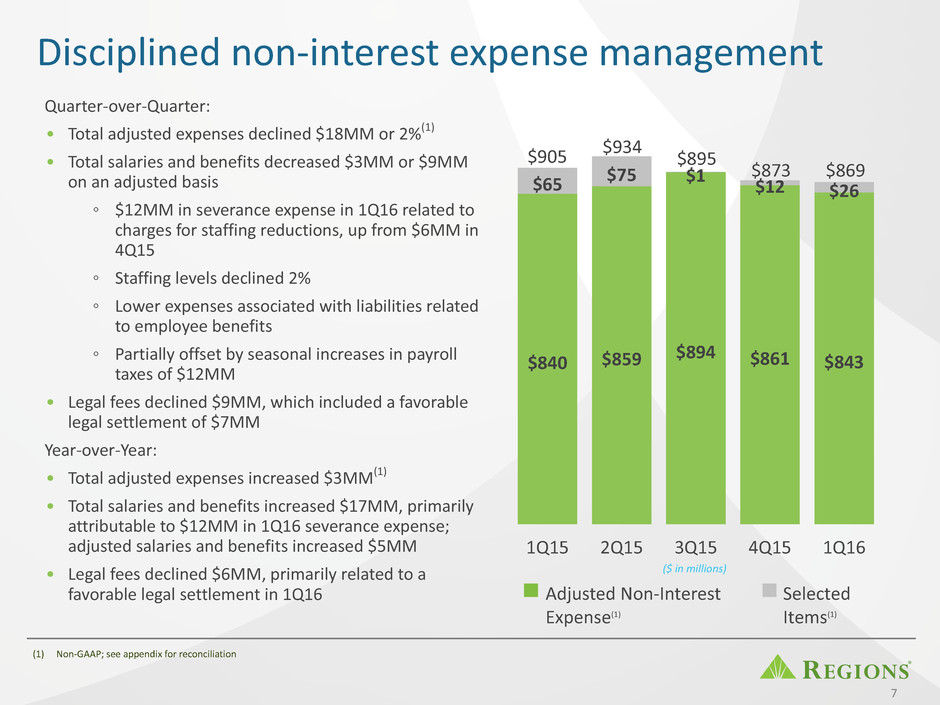

Disciplined non-interest expense management 1Q15 2Q15 3Q15 4Q15 1Q16 $840 $859 $894 $861 $843 $65 $75 $1 $12 $26 Quarter-over-Quarter: • Total adjusted expenses declined $18MM or 2%(1) • Total salaries and benefits decreased $3MM or $9MM on an adjusted basis ◦ $12MM in severance expense in 1Q16 related to charges for staffing reductions, up from $6MM in 4Q15 ◦ Staffing levels declined 2% ◦ Lower expenses associated with liabilities related to employee benefits ◦ Partially offset by seasonal increases in payroll taxes of $12MM • Legal fees declined $9MM, which included a favorable legal settlement of $7MM Year-over-Year: • Total adjusted expenses increased $3MM(1) • Total salaries and benefits increased $17MM, primarily attributable to $12MM in 1Q16 severance expense; adjusted salaries and benefits increased $5MM • Legal fees declined $6MM, primarily related to a favorable legal settlement in 1Q16 (1) Non-GAAP; see appendix for reconciliation ($ in millions) Selected Items(1) Adjusted Non-Interest Expense(1) $905 $934 $895 $873 $869 7

Net Charge-Offs Net Charge-Offs ratio 1Q15 2Q15 3Q15 4Q15 1Q16 $54 $46 $60 $78 $68 0.28% 0.23% 0.30% 0.38% 0.34% NPLs Coverage Ratio 1Q15 2Q15 3Q15 4Q15 1Q16 $800 $751 $789 $782 $993 137% 149% 141% 141% 116% Classified Loans Special Mention 1Q15 2Q15 3Q15 4Q15 1Q16 1,727 1,787 1,838 1,937 2,640 1,097 $2,824 1,163 $2,950 1,416 $3,254 1,434 $3,371 985 $3,625 1Q15 2Q15 3Q15 4Q15 1Q16 478 471 480 479 477 666 576 483 483 464 Net charge-offs and ratio NPLs and coverage ratio(1) Criticized and classified loans(2) Troubled debt restructurings (1) Excludes loans held for sale (2) Includes commercial and investor real estate loans only (3) The All Other category includes TDRs classified as held for sale for the following periods : $19MM in 1Q15, $18MM in 2Q15, $14MM in 3Q15, $8MM in 4Q15 and $8MM in 1Q16. $1,303$1,312 $1,404$1,505 361 357 349 341 Residential First Mortgage All Other (3) Home Equity ($ in millions) ($ in millions) ($ in millions) ($ in millions) $1,276 335 Increases in NPLs and criticized and classified loans driven by risk rating migration in energy portfolio 8

Industry leading capital and liquidity ratios 1Q15 2Q15 3Q15 4Q15 1Q16 12.2% 12.1% 11.7% 11.7% 11.6% 1Q15 2Q15 3Q15 4Q15 1Q16 11.2% 11.1% 10.8% 10.7% 10.7% 1Q15 2Q15 3Q15 4Q15 1Q16 80% 83% 83% 83% 83% Tier 1 capital ratio(1) Common equity Tier 1 ratio – Fully phased-in pro-forma(1)(2) Loan-to-deposit ratio(3) • Returned $255MM to shareholders, including the repurchase of $175MM of common stock and $80MM in dividends • Transitional basis Basel III Common Equity Tier 1 ratio estimated at 10.9%(1), well above current regulatory minimums • At period end, Regions was fully compliant with the final Liquidity Coverage Ratio rule (1) Current quarter ratios are estimated (2) Non-GAAP; see appendix for reconciliation (3) Based on ending balances 9

2016 Expectations . (1) 2016 non-interest income reflects the negative impact from posting order change of approximately $10M-$15M per quarter. • Average loan growth of 3% - 5% relative to 4Q15 average balances • Average deposit growth of 2% - 4% compared to 4Q15 average balances • Net interest income and other financing income up 2% - 4% • Adjusted non-interest income up 4% - 6%(1) • Adjusted expenses flat to up modestly; full year efficiency ratio <63% • Adjusted operating leverage of 2% - 4%(1) • Net charge-offs of 25 - 35 bps; given current price of oil, expect to be at the higher end of range 10

Appendix 11

• Total commitments declined; however, direct balances increased - driven primarily by higher utilization and new loans to creditworthy borrowers • Allowance for loan and lease losses was 8% of direct energy balances at 3/31/16 vs 6% at 12/31/15 • No second lien exposure outstanding within the energy portfolio • Leveraged loans account for 12% of energy related balances; the majority are Midstream • Expectations for energy related charge-offs for the remainder of 2016 are $50-$75 million • Should oil prices average $25 a barrel through the end of 2017, Regions could experience additional charge-offs of approximately $100 million • Utilization rate has remained between 40-60% since 1Q10 Energy lending overview Total energy As of 3/31/16 As of 12/31/15 ($ in millions) Loan / Lease Balances Balances Including Related Commitments % Utilization $ Criticized % Criticized Loan / Lease Balances Balances Including Related Commitments % Utilization $ Criticized % Criticized Oilfield services and supply (OFS) $984 $1,435 69% $461 47% $969 $1,565 62% $329 34% Exploration and production (E&P) 956 1,653 58% 660 69% 910 1,748 52% 433 48% Midstream 545 1,042 52% 40 7% 441 970 45% 40 9% Downstream 87 378 23% — — 71 394 18% — — Other 144 321 45% 39 27% 142 317 45% 21 15% Total direct 2,716 4,829 56% 1,200 44% 2,533 4,994 51% 823 32% Indirect 503 1,015 50% 59 12% 519 965 54% 62 12% Direct and indirect 3,219 5,844 55% 1,259 39% 3,052 5,959 51% 885 29% Operating leases 159 159 — 72 45% 162 162 — 15 9% Total energy $3,378 $6,003 56% $1,331 39% $3,214 $6,121 53% $900 28% Note: Securities portfolio contained ~$166MM of high quality, investment grade corporate bonds that are energy related at 3/31/16, down from ~$229MM at 12/31/15. In an effort to mitigate the risk of future downgrades, the company reduced energy related corporate bond exposure, incurring a $4MM security loss. A leveraged relationship is defined as senior cash flow leverage of 3x or total cash flow leverage of 4x except for Midstream Energy which is 6x total cash flow leverage. 12

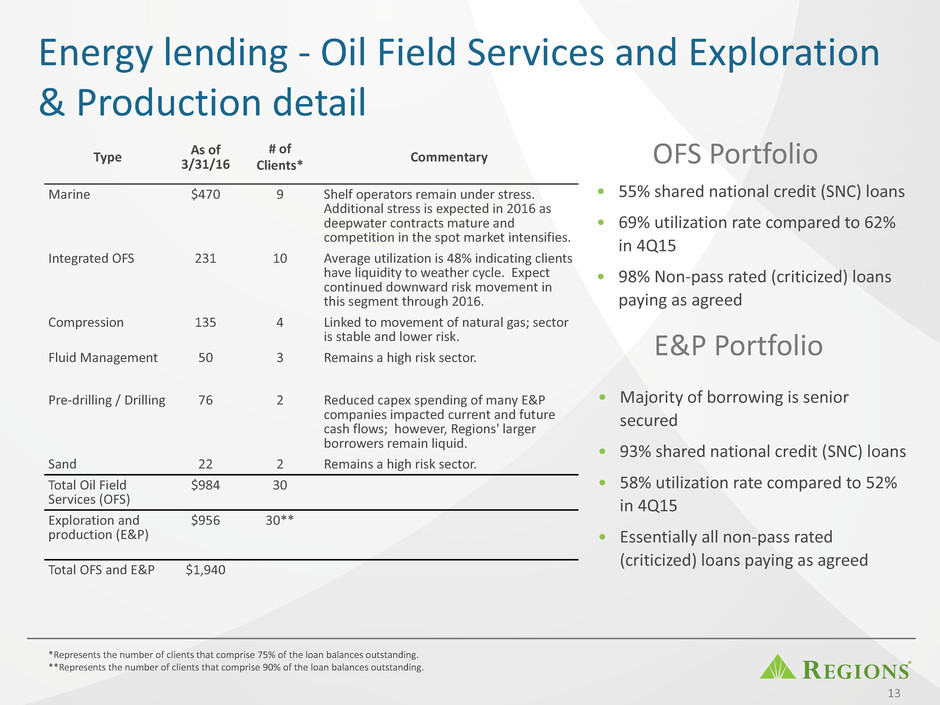

Energy lending - Oil Field Services and Exploration & Production detail Type As of3/31/16 # of Clients* Commentary Marine $470 9 Shelf operators remain under stress. Additional stress is expected in 2016 as deepwater contracts mature and competition in the spot market intensifies. Integrated OFS 231 10 Average utilization is 48% indicating clients have liquidity to weather cycle. Expect continued downward risk movement in this segment through 2016. Compression 135 4 Linked to movement of natural gas; sector is stable and lower risk. Fluid Management 50 3 Remains a high risk sector. Pre-drilling / Drilling 76 2 Reduced capex spending of many E&P companies impacted current and future cash flows; however, Regions' larger borrowers remain liquid. Sand 22 2 Remains a high risk sector. Total Oil Field Services (OFS) $984 30 Exploration and production (E&P) $956 30** Total OFS and E&P $1,940 • 55% shared national credit (SNC) loans • 69% utilization rate compared to 62% in 4Q15 • 98% Non-pass rated (criticized) loans paying as agreed E&P Portfolio • Majority of borrowing is senior secured • 93% shared national credit (SNC) loans • 58% utilization rate compared to 52% in 4Q15 • Essentially all non-pass rated (criticized) loans paying as agreed *Represents the number of clients that comprise 75% of the loan balances outstanding. **Represents the number of clients that comprise 90% of the loan balances outstanding. OFS Portfolio 13

Loan balances by select states Texas Louisiana Note: Intelligence from our customer assistance program (CAP) reveals no noticeable increase in assistance requests in these markets to date. Commercial - Non-Energy, $4,323 Commercial - Energy (Direct), $1,387 Consumer Non- Real Estate Secured, $880 Consumer Real Estate Secured, $861 Investor Real Estate, $1,489 Investor Real Estate Balances by City ($ in millions) Office Retail Multi-Family Single Family Other Total Houston $13 $48 $333 $102 $17 $513 Dallas 199 28 191 46 68 532 San Antonio — 26 78 51 43 198 Other 29 43 157 2 15 246 Total $241 $145 $759 $201 $143 $1,489 Investor Real Estate Balances by City ($ in millions) Office Retail Multi-Family Single Family Other Total Baton Rouge $48 $4 $21 $38 $19 $130 New Orleans 6 8 1 2 16 33 Other 3 44 23 2 23 95 Total $57 $56 $45 $42 $58 $258 Commercial - Non-Energy, $2,258 Commercial - Energy (Direct), $556 Consumer Non-Real Estate Secured, $282 Consumer Real Estate Secured, $1,099 Investor Real Estate, $258 14 $4.5B$8.9B

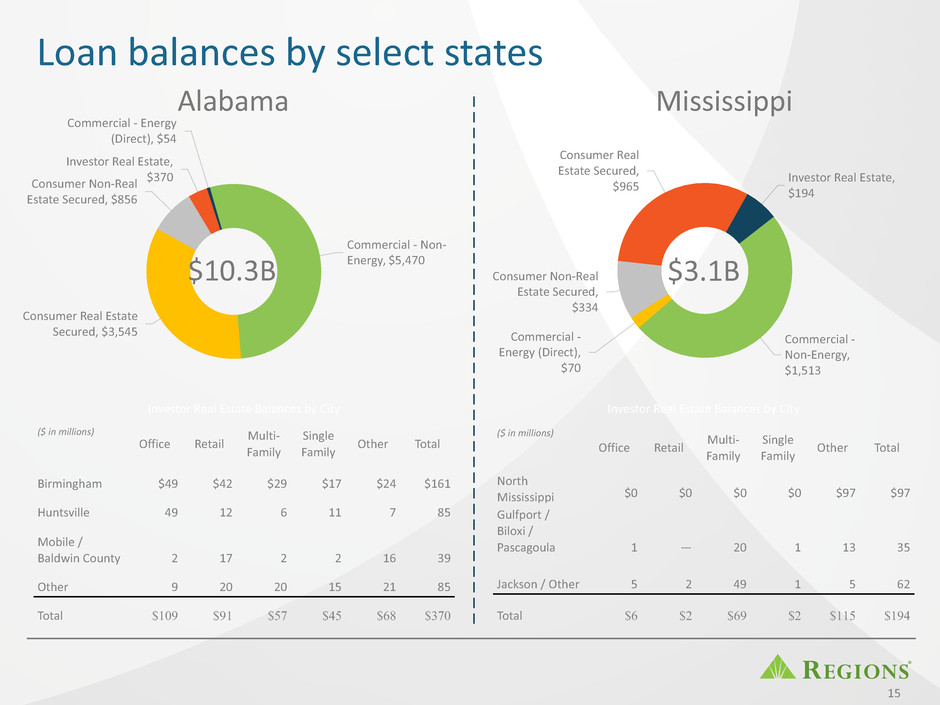

Loan balances by select states Alabama Mississippi Commercial - Non- Energy, $5,470 Consumer Real Estate Secured, $3,545 Consumer Non-Real Estate Secured, $856 Investor Real Estate, $370 Commercial - Energy (Direct), $54 Commercial - Non-Energy, $1,513 Commercial - Energy (Direct), $70 Consumer Non-Real Estate Secured, $334 Consumer Real Estate Secured, $965 Investor Real Estate, $194 15 $3.1B$10.3B Investor Real Estate Balances by City ($ in millions) Office Retail Multi-Family Single Family Other Total Birmingham $49 $42 $29 $17 $24 $161 Huntsville 49 12 6 11 7 85 Mobile / Baldwin County 2 17 2 2 16 39 Other 9 20 20 15 21 85 Total $109 $91 $57 $45 $68 $370 Investor Real Estate Balances by City ($ in millions) Office Retail Multi-Family Single Family Other Total North Mississippi $0 $0 $0 $0 $97 $97 Gulfport / Biloxi / Pascagoula 1 — 20 1 13 35 Jackson / Other 5 2 49 1 5 62 Total $6 $2 $69 $2 $115 $194

Non-GAAP reconciliation: Non-interest income, non-interest expense and efficiency ratio NM - Not Meaningful (1) Regions recorded $50 million and $100 million of contingent legal and regulatory accruals during the second quarter of 2015 and the fourth quarter of 2014, respectively, related to previously disclosed matters. The fourth quarter of 2014 accruals were settled in the second quarter of 2015 for $2 million less than originally estimated and a corresponding recovery was recognized. (2) Branch consolidation, property and equipment charges in the second quarter of 2015 resulted from the transfer of land, previously held for future branch expansion, to held for sale based on changes in management's intent. (3) Insurance proceeds are related to the settlement of the previously disclosed 2010 class-action lawsuit. (4) Excluding $23 million of FDIC insurance assessment adjustments to prior assessments recorded in the third quarter of 2015, the adjusted efficiency ratio would have been 65.0%. (5) During the fourth quarter of 2015, Regions corrected the accounting for certain leases, for which Regions is the lessor. These leases had been previously classified as capital leases but were subsequently determined to be operating leases. The aggregate impact of this adjustment lowered net interest income and other financing income $15 million. Excluding the negative impact of the $15 million, the adjusted efficiency ratio would have been 62.7%. The table below presents computations of the efficiency ratio (non-GAAP), which is a measure of productivity, generally calculated as non-interest expense divided by total revenue. Management uses this ratio to monitor performance and believes this measure provides meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non- GAAP). Net interest income and other financing income on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the efficiency ratio. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Quarter Ended ($ amounts in millions) 3/31/2016 12/31/2015 9/30/2015 6/30/2015 3/31/2015 1Q16 vs. 4Q15 1Q16 vs. 1Q15 ADJUSTED EFFICIENCY RATIO, ADJUSTED NON-INTEREST INCOME/EXPENSE- CONTINUING OPERATIONS Non-interest expense (GAAP) $ 869 $ 873 $ 895 $ 934 $ 905 $ (4) (0.5)% $ (36) (4.0)% Adjustments: Professional, legal and regulatory expenses(1) — — — (48) — — NM — NM Branch consolidation, property and equipment charges(2) (14) (6) (1) (27) (22) (8) 133.3 % 8 (36.4)% Loss on early extinguishment of debt — — — — (43) — NM 43 (100.0)% Salary and employee benefits—severance charges (12) (6) — — — (6) 100.0 % (12) NM Adjusted non-interest expense (non-GAAP) A $ 843 $ 861 $ 894 $ 859 $ 840 $ (18) (2.1)% $ 3 0.4 % Net interest income and other financing income (GAAP) $ 862 $ 836 $ 836 $ 820 $ 815 $ 26 3.1 % $ 47 5.8 % Taxable-equivalent adjustment 21 20 19 19 17 1 5.0 % 4 23.5 % Net interest income and other financing income, taxable-equivalent basis B $ 883 $ 856 $ 855 $ 839 $ 832 $ 27 3.2 % $ 51 6.1 % Non-interest income (GAAP) C $ 506 $ 514 $ 497 $ 590 $ 470 $ (8) (1.6)% $ 36 7.7 % Adjustments: Securities (gains) losses, net 5 (11) (7) (6) (5) 16 (145.5)% 10 (200.0)% Insurance proceeds(3) (3) (1) — (90) — (2) 200.0 % (3) NM Leveraged lease termination gains, net — — (6) — (2) — NM 2 (100.0)% Adjusted non-interest income (non-GAAP) D $ 508 $ 502 $ 484 $ 494 $ 463 $ 6 1.2 % $ 45 9.7 % Total revenue, taxable-equivalent basis B+C $ 1,389 $ 1,370 $ 1,352 $ 1,429 $ 1,302 $ 19 1.4 % $ 87 6.7 % Adjusted total revenue, taxable-equivalent basis (non-GAAP) B+D=E $ 1,391 $ 1,358 $ 1,339 $ 1,333 $ 1,295 $ 33 2.4 % $ 96 7.4 % Adjusted efficiency ratio (non-GAAP)(4)(5) A/E 60.6% 63.4% 66.8% 64.5% 64.9% 16

Non-GAAP reconciliation: Basel III common equity Tier 1 ratio – fully phased-in pro-forma (1) Current quarter amounts and the resulting ratio are estimated. (2) Regions continues to develop systems and internal controls to precisely calculate risk-weighted assets as required by Basel III on a fully phased-in basis. The amount included above is a reasonable approximation, based on our understanding of the requirements. As of and for Quarter Ended 17 The calculation of the fully phased-in pro-forma "Common equity Tier 1" (CET1) is based on Regions’ understanding of the Final Basel III requirements. For Regions, the Basel III framework became effective on a phased-in approach starting in 2015 with full implementation beginning in 2019. The calculation provided below includes estimated pro-forma amounts for the ratio on a fully phased-in basis. Regions’ current understanding of the final framework includes certain assumptions, including the Company’s interpretation of the requirements, and informal feedback received through the regulatory process. Regions’ understanding of the framework is evolving and will likely change as analysis and discussions with regulators continue. Because Regions is not currently subject to the fully-phased in capital rules, this pro-forma measure is considered to be a non-GAAP financial measure, and other entities may calculate it differently from Regions’ disclosed calculation. A company's regulatory capital is often expressed as a percentage of risk-weighted assets. Under the risk-based capital framework, a company’s balance sheet assets and credit equivalent amounts of off-balance sheet items are assigned to broad risk categories. The aggregated dollar amount in each category is then multiplied by the prescribed risk-weighted percentage. The resulting weighted values from each of the categories are added together and this sum is the risk-weighted assets total that, as adjusted, comprises the denominator of certain risk-based capital ratios. Common equity Tier 1 capital is then divided by this denominator (risk-weighted assets) to determine the common equity Tier 1 capital ratio. The amounts disclosed as risk-weighted assets are calculated consistent with banking regulatory requirements on a fully phased-in basis. Since analysts and banking regulators may assess Regions’ capital adequacy using the fully phased-in Basel III framework, we believe that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. ($ amounts in millions) 3/31/2016 12/31/2015 9/30/2015 6/30/2015 3/31/2015 Basel III Common Equity Tier 1 Ratio—Fully Phased-In Pro-Forma (1) Stockholder's equity (GAAP) $ 17,211 $ 16,844 $ 16,952 $ 16,899 $ 17,051 Non-qualifying goodwill and intangibles (4,947) (4,958) (4,913) (4,902) (4,910) Adjustments, including all components of accumulated other comprehensive income, disallowed deferred tax assets, threshold deductions and other adjustments (71) 286 41 183 1 Preferred stock (GAAP) (820) (820) (836) (852) (868) Basel III common equity Tier 1—Fully Phased-In Pro-Forma (non-GAAP) A $ 11,373 $ 11,352 $ 11,244 $ 11,328 $ 11,274 Basel III risk-weighted assets—Fully Phased-In Pro-Forma (non-GAAP) (2) B $ 106,320 $ 106,188 $ 104,645 $ 102,479 $ 101,027 Basel III common equity Tier 1 ratio—Fully Phased-In Pro-Forma (non-GAAP) A/B 10.7% 10.7% 10.8% 11.1% 11.2 %

Forward-looking statements This presentation may include forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • Any impairment of our goodwill or other intangibles, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations of the reporting unit, or other factors. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, which could increase our funding costs. • Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • Changes in laws and regulations affecting our businesses, such as the Dodd-Frank Act and other legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our ability to obtain a regulatory non-objection (as part of the comprehensive capital analysis and review ("CCAR") process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the liquidity coverage ratio "LCR" rule), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. • The Basel III framework calls for additional risk-based capital surcharges for globally systemically important banks. Although we are not subject to such surcharges, it is possible that in the future we may become subject to similar surcharges. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. 18

Forward-looking statements continued The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors" of Regions' Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission. The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward-looking statements that are made from time to time. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non-financial benefits relating to our strategic initiatives. • The success of our marketing efforts in attracting and retaining customers. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • The risks and uncertainties related to our acquisition and integration of other companies. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third-party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act. • The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. • Our inability to keep pace with technological changes could result in losing business to competitors. • Our ability to identify and address cyber-security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information; increased costs; losses; or adverse effects to our reputation. • Significant disruption of, or loss of public confidence in, the Internet and services and devices used to access the Internet could affect the ability of our customers to access their accounts and conduct banking transactions. • Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or proprietary information; increase our costs; negatively affect our reputation; and cause losses. • Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders. • Changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board ("FASB") or other regulatory agencies could materially affect how we report our financial results. • Other risks identified from time to time in reports that we file with the Securities and Exchange Commission ("SEC"). • The effects of any damage to our reputation resulting from developments related to any of the items identified above. 19

® 20