Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Axion Power International, Inc. | s102934_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Axion Power International, Inc. | s102934_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Axion Power International, Inc. | s102934_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Axion Power International, Inc. | s102934_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________________ to _______________________________

Commission File Number 001-22573

AXION POWER INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 65-0774638 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation organization) | Identification No.) | |

| 3601 Clover Lane | ||

| New Castle, Pennsylvania | 16105 | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant’s telephone number, including area code | (724) 654-9300 | |

Securities Registered under Section 12(b) of the Act

None

Securities Registered under Section 12(g) of the Act

Common Stock, par value $.005 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $11,525,426.

The number of shares of outstanding common stock of the registrant as of April 8, 2016 was 15,669,456.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated by reference in Part III hereof to the extent stated herein.

TABLE OF CONTENTS

| PART I | 3 | |

| Item 1. | Our Business | 3 |

| Item 1A. | Risk Factors. | 14 |

| Item 2. | Properties. | 20 |

| Item 3. | Legal Proceedings. | 20 |

| Item 4. | Mine Safety Disclosures. | 20 |

| PART II | 21 | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases Equity of Securities. | 21 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 21 |

| Item 8. | Financial Statements and Supplementary Data. | 28 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 55 |

| Item 9A | Controls and Procedures. | 56 |

| PART III | 56 | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 56 |

| Item 11. | Executive Compensation. | 60 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 64 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 64 |

| Item 14. | Principal Accountant Fees and Services. | 65 |

| PART IV | 66 | |

| Item 15. | Exhibits. | 66 |

2

Cautionary Note Regarding Forward-Looking Information

This Annual Report on Form 10-K, in particular the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the energy storage device industry, all of which are subject to various risks and uncertainties.

When used in this Annual Report on Form 10-K as well as in reports, statements, and information we have filed with the Securities and Exchange Commission (the “Commission’ or “SEC”), in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this periodic report that are not statements of historical fact may be deemed to be forward-looking statements. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors.

Overview

We are an innovative energy solutions company that pioneered the development of carbon/lead batteries. We have also developed the know-how and engineering expertise to integrate our advanced batteries into energy storage systems, renewable energy systems, off-grid applications, automotive and other applications. We sell batteries, energy storage systems and engineering services as part of our product offerings, and we can assist battery end users to adapt our batteries to applications where a wide voltage window, fast recharge and long life benefits are required. Our PbC batteries and battery components, which utilize activated carbon for the battery’s negative electrode, have application in a variety of energy storage systems.

Axion Power Corporation, our wholly owned subsidiary, was formed in September 2003 to acquire and develop certain innovative battery technology. Since inception, Axion Power Corporation has been engaged in research and development of new technology for the production of our PbC (lead carbon) batteries. On December 31, 2003, Axion Power Corporation engaged in a reverse acquisition with Tamboril Cigar Company, a public shell company whereby Axion Power Corporation became a wholly owned subsidiary of Tamboril, which changed its name to Axion Power International, Inc. Tamboril was originally incorporated in Delaware in January 1997 and operated a wholesale cigar business until December 1998, after which date it was an inactive public shell until the reverse acquisition and subsequent name change to Axion Power International, Inc.

Since fiscal 2011, we have set out to accomplish the following goals, which we have achieved:

| · | Transition the business to develop, design, manufacture and sell advanced energy storage devices, components and systems that are based on our patented PbC technology |

| o | Fully transitioning out of the manufacture of standard and specialty lead-acid batteries; this initiative started in fiscal 2014 and ended with the recent sale of our remaining antique car and specialty racing car battery products |

| · | Upgrade the battery plant to achieve fully AGM-centric (Absorbed Glass Mat) operation |

| o | Upgrading of Casting, Pasting, Assembly, Filling and Formation processes completed in 2013 |

| · | Implement latest generation Automatic Electrode Line |

| o | Line designed, built, installed, and commissioned and operational in 2013 |

| · | Move from an R&D development stage organization and toward becoming one with market-specific products |

| o | ISO approved processes |

| o | Utilizing lead acid platform for lead carbon processing in 2015 |

| · | Continue improvement of next generation materials and product development |

| o | Currently under-way with lower cost and greater energy/power content in 2016 |

| · | Develop the PowerCube which “paved the way” for interconnection initiatives with PJM Interconnection and other applications |

| o | Design and permitting processes are in process for frequency regulation system deployment |

3

Our principal executive office is located at 3601 Clover Lane, New Castle, PA 16105. Our telephone number is (724) 654-9300. Our website is www.axionpower.com. We own various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including PbCR, our corporate logo and PowerCubeTM.1

The Energy Storage Industry

According to “Energy Storage Industry Gaining Momentum”, New York Times, October 25, 2015, “as energy policies, technologies and markets shift to encourage the growth of renewable power plants, rooftop solar and decentralized systems like microgrids, storage is gaining more investment and interest while regulators are moving to require its inclusion in renewable energy developments and wholesale electricity markets.” The article further states whether to smooth out variations in the output from wind and solar farms, feed power to the grid at times of peak demand or store it for use when renewable plants or the grid go down, utilities, islands and big institutions like the military are experimenting with different battery systems and chemistries. We strive to have our technology included in the handful of systems capable of consistently, competently and cost effectively providing solutions to meet these needs.

The market is set to grow at a rapid pace over the next few years. A recent Forbes article states that the contributing factors include state regulation to include renewable energy and utilities and private sector consumers investing in both more economical battery storage systems as well as solar solutions. The article also cites a recent GTM research report which states that 220 megawatts of energy storage was to be deployed in 2015 with the amount in 2019 potentially exceeding 800 megawatts.2 The Energy Storage Association cites even more aggressive figures on its website, including “annual installation size of 6 gigawatts (GW) in 2017 and over 40 GW by 2022 — from an initial base of only 0.34 GW installed in 2012 and 2013.”3

The energy storage industry has traditionally been based on battery, flywheel, capacitor, thermal, chemical systems, power to gas, gravity, pumped storage hydroelectricity, and compressed air systems, to provide a temporary or back-up source for energy. The major industries utilizing energy storage systems have been automotive for stop/start, hybrid and electric vehicle applications, heavy duty truck and rail for hybrid applications, renewable energy for storage and smoothing, and electrical utilities for back-up, energy smoothing and frequency regulation, robotic and auto guided vehicles, e-bikes and scooters and other emerging specialty uses.

The electric power sector’s demands for energy storage continue to increase. The amount of electricity which can be generated is relatively fixed over short periods of time, although demand for electricity fluctuates throughout the day. Energy storage devices and systems store electrical energy for use as required, even during periods when power is not generated. Electrical storage devices can manage the amount of power required to supply customers at times when need is greatest, which is typically during peak load. These devices assist in regulating the flow of power from renewable energy applications, like wind and solar power. The result is a system which is smoother and more dispatchable, which makes it easier for grid operators to control the power output from those sources. Energy storage devices and systems can also balance microgrids to achieve a good match between generation and load. They can provide frequency regulation, to maintain the balance between the network's load and power generated, and can achieve a more reliable power supply for high tech industrial facilities.

There are several revenue opportunities (e.g. peak shaving, load shifting, synchronized reserve, etc.) that can be accessed when a storage component is included in a renewable energy application. The greatest current rate of return is achieved when the storage asset is focused on the frequency regulation sector of the demand response market. Revenue rates are set per the Federal Regulatory Energy Commission’s “pay for

performance” regulations (FERC Order No. 755 adopted in 2011 and FERC Order No. 784 adopted in 2013), which means that systems that respond faster than other systems, and respond with measured accuracy within the parameter guidelines, will be paid at the highest revenue rate. Solar photovoltaic farms as a stand- alone system cannot effectively participate in the ancillary markets because of lack of availability (evening hours), intermittency and other factors. When a solar photovoltaic farm is combined with a storage source, we believe the revenue provided by the system, when augmented with tax subsidies, is increased by more than double when combined with participation in ancillary services such as frequency regulation. In addition, the storage system in this application can be a source of emergency power if the grid goes completely down.

1 Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this annual report. You should not rely on our website or any such information in making your decision whether to purchase our common stock. All other trademarks or trade names referred to in this annual report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this report are referred to without the R and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

2 “The Energy Storage Market is About to Boom”, www.forbes.com, dated September 9, 2015 by Lyndsey Gilpin.

3 http://energystorage.org/energy-storage/facts-figures.

4

Our Business

Our business objectives are aimed at providing PbC batteries, electronics and systems to meet a variety of consumer and business needs. To achieve these objectives, the overall business strategy includes collaborative working relationships that could allow the following to occur:

| · | Manufacture of batteries using our proprietary electrodes thereby allowing us to solely focus on the electrode manufacture |

| · | Distribution of PbC batteries and product systems by established commercial organizations to allow shorter time to market |

| · | Licensing of PbC products to established companies for use in their systems design and sale to broaden the acceptance of the technology |

| · | Territorial intellectual property and applications licensing to facilitate global expansion and development of PbC uses beyond the capabilities of limited Axion resources |

| · | Direct marketing and sale of batteries and systems with a very focused effort by Axion on discrete applications and markets. |

During 2015, a directed effort was undertaken to define target markets of interest, which was focused on five key areas:

| · | Power grid stabilization |

| · | Micro-hybrid vehicles |

| · | Hybrid commercial trucks |

| · | Automated guided vehicles |

| · | Off-grid and renewable energy storage |

The nearer term market opportunities are the non-vehicle targets and significant work is in process to:

| · | Provide target markets with custom engineered solutions |

| · | Leverage and potentially profitably grow this custom-focused business model |

| · | Build and explore synergistic relationships within the customer and supplier spheres |

| · | Explore and commercialize both market-wide and custom solutions, including new applications for PbC technology |

| · | Use market feedback to improve and enhance PbC technology performance. |

Our plan to reach its goals over the balance of 2016 is comprised of the following:

| · | Complete restructuring and completion of combination of the Greenridge and Clover Lane facilities |

| · | Complete ongoing cost cutting and efficiency increase measures |

| · | Continue to identify and work with strategic partners to reach business objective |

| · | Commence initiative to obtain corporate and brand identity and increase market awareness of technology and products through effective public relations and marketing campaign |

| · | Identify discrete products with broad market demand utilizing the PbC technology such as a new generation residential energy storage system and a remote, off-grid lighting system. |

Our Technology

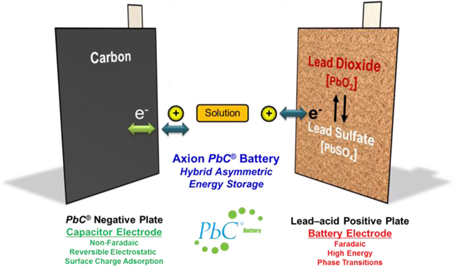

Our proprietary PbC battery technology is a hybrid asymmetric energy storage device. This asymmetric design (lead positive and carbon negative) allows the battery to be charged faster and cycled longer compared to traditional lead-based battery chemistries. The performance gain can be attributed to the removal of the failure mechanism of lead–acid batteries. During charge and discharge, the positive electrode undergoes the same chemical reaction that occurs in a conventional lead–acid battery, i.e. lead dioxide reacts with acid and sulfate ions to form lead sulfate and water. However, in our proprietary carbon negative electrode the PbC battery does not undergo a chemical reaction. Instead, the high surface area of the activated carbon electrode stores protons from the acid on the carbon surface of the electrode.

5

With the inclusion of our non-Faradaic proprietary activated carbon negative electrode, the mechanism known as sulfation is completely eliminated. Therefore, our PbC battery maintains maximum charge acceptance, while conventional lead–acid batteries show significant charge acceptance decline early in use (a difference of up to 2 orders of magnitude).

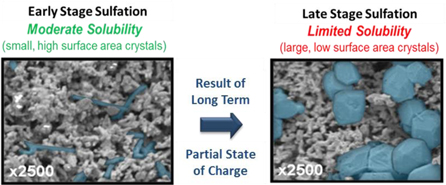

By incorporating the proprietary PbC carbon negative electrode, our batteries offer a distinct advantage over lead–acid technology, when operated under partial state-of-charge conditions. In such applications, the energy storage device is rarely, if ever, provided the opportunity to become fully charged. The lack of reaching full charge for a lead-acid device results in constant and ever rising presence of lead sulfate crystals on the lead negative plate.

Initially, these small, high surface area crystals are easily dissolved. During repetitive cycling of a classic lead-acid battery, these crystals grow in size and are significantly more difficult to dissolve. This change limits the ability to charge, thereby decreasing the charge acceptance and increasing the charge time. This ultimately results in the rapid failure of lead-acid batteries. Our batteries completely replace the lead negative with proprietary activated carbon electrode creating a non-faradaic reaction. Due to the lack of this chemical reaction and no lead sulfate crystals, PbC battery charge acceptance does not degrade in partial state-of-charge operation.

Example of Lead-Acid Battery Failure

Our proprietary PbC technology is protected by 14 issued U.S. patents and other proprietary features and structures. In addition, there are a number of additional patent applications in process at any point in time. Presently, we have no obligation to pay any royalties or license fees with respect to the commercialization of the proprietary PbC technology.

Our proprietary carbon negative electrode assemblies are fabricated from readily available raw materials, using both proprietary and standard manufacturing processes and techniques. Our PbC batteries are assembled with the same equipment and methodology commonly used for manufacturing conventional lead-acid batteries. Our batteries use significantly less lead than standard lead-acid batteries with a comparable footprint and are significantly lighter (per our testing, in the order of magnitude of 30%). Moreover, the lead, plastics, and acid employed, are the same as lead-acid batteries, and can be routinely recycled at existing recycling facilities.

6

Our PbC batteries exhibit a lower initial power and energy output to a conventional lead-acid battery. By pairing lead and carbon as the positive and negative electrodes, and technology displays an engineered optimization between lead-acid and super capacitor performance. Although the PbC battery sacrifices the high initial energy output of a lead-acid battery, it makes up for this disparity by its superior useful life cycle (20x longer cycle life). In terms of work, or “energy output over time,” the PbC technology provides significantly more life cycle value compared to other battery chemistries. The proprietary PbC battery is able to deliver a significant amount of work compared to other battery technologies that claim high energy density.

A unique performance characteristic of our carbon electrode technology is its innate ability to self-equalize the voltage of all energy storage components without a separate battery management system. In a series string all battery modules are forced to work in unison. If individual battery modules’ voltages are allowed to rise beyond the voltage of their counterparts, they will become subject to extreme overcharge and will likely fail. Conversely, if individual battery modules’ voltages are allowed to drop below the voltage of their counterparts, they will become subject to extreme over-discharging during operation and will likely fail. Ultimately, our PbC technology, when used in high energy series string applications (notably grid-tied energy storage systems) provides longer life, higher power, higher energy, fewer battery replacements, limited down-time and lower cost compared to lead-acid and lithium battery strings.

Development History

In February 2006, we commenced operations at our Clover Lane facility in New Castle, PA. We have utilized this space to manufacture our PbC and specialty lead-acid battery products and to continue to produce and test prototypes which incorporate our PbC technology. Our Clover Lane plant has allowed us to manufacture lead-acid batteries for sale under the Axion brand name; to manufacture for third parties under specific contract arrangements; or to manufacture prototypes of PbC batteries for testing by our customers. During 2015, we exited the manufacture and sale of Axion brand name lead batteries and sold our legacy antique and racing car battery product lines. This sale was made in conjunction with our strategy to focus our future business solely on our PbC technology and product lines.

In November 2010, we expanded into our Green Ridge facility, which is less than ½ mile from our Clover Lane facility in New Castle, PA, to house offices, research & development, carbon electrode manufacturing and warehousing. A new robotic carbon electrode manufacturing line was installed at our Green Ridge Road facility which provided the manufacturing framework and capability for improvements in our quality, cost and ability to deliver our proprietary carbon electrodes. As part of our comprehensive 2015 restructuring efforts to reduce cash burn, we determined to relocate equipment, labs and offices to our Clover Lane facility from Green Ridge, and this relocation will be completed in the first half of 2016.

From March 2011 through 2013, we utilized our Clover Lane facility capability and capacity primarily to contract manufacture specialty lead-acid batteries for a third party. The flooded lead-acid batteries were manufactured in our facility, with the purchaser carrying the cost of inventory and providing the raw materials required. As 2014 progressed, we experienced a wind down of our flooded lead-acid battery contract, and we are in the processing of consolidating our facilities, as there is currently no active manufacturing taking place.

With the financial assistance provided by the Pennsylvania Energy Development Authority and Commonwealth Financing Authority grants, we commissioned our first PowerCube product onsite at our Clover Lane facility in 2011. The PowerCube was fully assembled and integrated by us and, in addition to the batteries, contains a racking system, electronics and power equipment, battery management system, climate control and fire suppression systems. As part of this undertaking, we entered into a partnership with Viridity Energy and PJM Interconnection (the largest regional power transmission organization in the US which coordinates the movement of wholesale electricity for more than 61 million people in all or parts of 13 states). The PowerCube was network-connected to the PJM system and while connected allowed us to respond through Viridity to curtailment and demand response signals from PJM and then participate in frequency regulation. Due to the implementation of the FERC “pay for performance” provisions, there are economic incentives to utilize our PowerCube as fast response to these signals from PJM increases at the utility will pay on a per kilowatt basis based on set performance metrics. This PowerCube is currently undergoing retrofitting to incorporate performance enhancements for use in demonstrations at potential customer sites.

The experience gained from the Power Cube, and the successful performance of this battery storage system, have provided a major confidence factor to support a 12.5 MW project at Sharon, PA. Axion has leased a site and is in the approval process. A financial partner will be needed to underwrite the significant capital expense of the project.

Since the PowerCube can be scaled, we also commenced development of smaller PowerCube units (mini-cubes). These mini-cube applications included residential storage (at levels down to 10 kilowatt) and small commercial storage. The units can be connected to wind and solar power sources in addition to filtering power directly from the grid. The end product will provide backup power, power quality, power smoothing, and potential peak shaving. We are working with installers and integrators and have begun to take this product to market in North America, as was the case with the Washington Naval Yard which was brought online in 2012 and has continued to function. The experience gained with the PowerCube is invaluable in designing systems for frequency regulation and other projects.

Recent Developments

During 2014 and 2015, we quoted on a number of battery storage projects but were not awarded any contracts. In 2015, we successfully filed for a 12.5 MW storage project with PJM Interconnection; we anticipate that additional requirements and gating process will continue through the Fall of 2016. Our prior work with ePower Engine Systems, a third party entity that develops and markets auxiliary power systems for trucks and with Norfolk Southern for hybrid railroad engine applications continue to be monitored, but it is not expected that there will be any near term business from either project.

7

Effective as of July 1, 2014, Thomas Granville resigned as our Chief Executive Officer and Chairman of the Board due to certain unanticipated adverse health concerns and remained as a director and as an employee as Special Assistant to the CEO. On August 3, 2014, he resigned as a director but retained a consulting role with us until August 2015.

Effective as of July 1, 2014, David DiGiacinto, who was appointed to our Board of Directors on February 1, 2014, was appointed as our Chief Executive Officer and Chairman of the Board. Also, effective on July 1, 2014, Charles Trego, who was our Chief Financial Officer from April 1, 2010 until August 2, 2013 and has been a Director since September 27, 2013, was appointed as our Chief Financial Officer. Mr. Trego remains as a Director, although he resigned from the Audit Committee. In January 2015, Richard Bogan and Don Farley were appointed as Directors and due to Mr. DiGiacinto’s untimely death that same month, Mr. Farley was appointed as Chairman. In January 2016, D. Walker Wainwright resigned as a Director, and in February 2016, we appointed Stanley Hirschman and Robert Maruszewski to our Board. On February 1, 2016, Richard Bogan was appointed as our Chief Executive Officer and remains a director, although he is no longer a member of any of our Board committees.

On August 1, 2014, we entered into warrant exchange agreements with the holders of the senior warrants issued in conjunction with our May 7, 2013 senior convertible note financing. Pursuant to the warrant exchange agreements, the holders exchanged all of these warrants for shares of our common stock at a ratio of 1.7 shares for each warrant exchanged, in a transaction exempt from registration under Section 3(a)(9) of the Securities Act of 1933, as amended. Warrants to purchase 9,875 shares of our common stock were exchanged for 16,788 shares of our common stock.

Pursuant to the warrant exchange agreements, the holders agreed to the following limitations on the resale of the shares:

| · | Through October 31, 2014, each holder may only sell, pledge, assign or otherwise transfer up to 10% of the number of shares issued to it. |

| · | From November 1, 2014 through January 31, 2015, each holder may sell, pledge, assign or otherwise transfer up to an additional 25% of the number of shares issued to it (up to an aggregate of 35% inclusive of the 10% set forth in the bullet point above). |

| · | Through January 31, 2015, each holder may not sell shares during any trading day in an amount, in the aggregate, exceeding 15% of the composite aggregate share trading volume of our common stock measured at the time of each sale of securities during such trading day as reported on Bloomberg. |

| · | However, each holder may sell shares in excess of those permitted under the bullet points above on any trading day on which the VWAP for our common stock for the preceding trading day is at least $332.50 or less than $35.00. |

The warrant exchange agreements contain customary covenants regarding maintenance by us of current reporting status under the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

Effective October 29, 2014, we consummated an underwritten public offering consisting of 53,572 shares of common stock, together with Series A warrants to purchase 53,572 shares of our common stock and Series B warrants to purchase 1,875,000 shares of its common stock for gross proceeds to us of approximately $6.1 million and net proceeds of $5.5 million. The public offering price for each share of common stock, together with one Series A warrant and one Series B warrant, was $113.75. The Series A warrants may be exercised for a period of five years and have an exercise price of $17.50 per share of common stock. The Series B warrants may be exercised for a period of 15 months and have an exercise price of $113.75 per share of common stock. In connection with the offering, we granted to the underwriter a 45-day option to acquire up to 8,036 additional shares of common stock and/or up to 8,036 additional Series A warrants and/or up to 281,250 additional Series B warrants. We also closed on the underwriter’s exercise of the over-allotment option on the Series A warrants and the Series B warrants. We voluntarily delisted from Nasdaq, and as of February 8, 2015, our common stock and Series A warrants are now listed on the OTCQB under the symbols “AXPW” and “AXPWW”, respectively.

Salary Deferral Agreements:

Effective October 4, 2014 for David DiGiacinto, and November 1, 2014 for Charles Trego, Phillip Baker and Vani Dantam, our then four most highly compensated employees entered into salary deferral agreements with us pursuant to which each agreed to defer portions of their salary for one year from the date of effectiveness of the salary deferral agreement, as set forth on the table below. The deferred portions of the salaries are to be paid to each such employee by the earlier of December 31, 2015 and the occurrence of one of the following events: (i) consummation by us of any subsequent financing transactions with at least $6,000,000 in gross proceeds in the aggregate; (ii) a change in control or (iii) a sale of all or substantially all of our assets. The deferred wages have not been paid as a result of a covenant with our current investors from our November 2015 financing, in which we covenanted to not pay back payables to insiders until June 2016. The amounts of salary deferred for each executive is set forth in the table below:

8

| Employee Name | Effective Date of Deferral | Total Deferral | December 31, 2014 | December 31, 2015 | ||||||||||

| David DiGiacinto | October 4, 2014 | $ | 162,055 | (1) | $ | 31,250 | $ | - | ||||||

| Charles Trego | November 1, 2014 | $ | 50,000 | $ | 7,692 | $ | 46,154 | |||||||

| Phillip Baker | November 1, 2014 | $ | 39,800 | $ | 6,123 | $ | 39,800 | |||||||

| Vani Dantam | November 1, 2014 | $ | 45,000 | $ | 6,923 | $ | 19,038 | (2) | ||||||

| (1) | Mr. DiGiacinto was deceased on January 25, 2015, and his deferred salary (through the date of his demise) was paid to his estate in the second quarter of 2015. |

| (2) | Mr Dantam resigned from the Company in March 2015. |

Board of Directors Committee Appointments

Our Board of Directors appointed directors to the following committees on February 9, 2016. All directors appointed to the Committees meet the definition of independence as set forth in the Nasdaq rules except Mr. Trego, and the directors appointed to the Audit Committee meet the additional definition of “independent” as set forth in Rule 10A-3 as promulgated under the Securities Exchange Act of 1934, as amended.

| Committee Name | Chairman | Members | ||

| Audit Committee | Stanley A. Hirschman | Robert A. Maruszewski and Michael Kishinevsky | ||

| Compensation Committee | Robert A. Maruszewski | Michael Kishinevsky and Charles Trego |

Binding Letter of Intent with LCB International, Inc.

On June 13, 2015, we entered into a Binding Letter of Intent with LCB International, Inc., a British Virgin Islands corporation, regarding an exclusive license of our intellectual property portfolio of PbC technology for various applications (including, but not limited to related e-energy solutions for motive and stationary applications, including, but not limited to e-scooter, commercial, light and off road vehicles and grid storage of our PbC technology in the People’s Republic of China, Taiwan, Macao and Hong Kong). Despite negotiations between the parties during the third quarter of 2015, they were unable to reach agreement on definitive documentation, and the parties are currently exploring the possibility of a revised transaction structure revolving around a technology license structure.

Sharon PA Project

On June 12, 2015, we entered into a 30 month and 18-day option to enter into an energy frequency regulation lease for the subject property. The option fee is $4,000 per month for months 1 thru 18 and $6,000 per month thereafter, and we can extend the option for an additional six months upon notice at least 30 days prior to the initial lease term. The option agreement permits us to exercise the option at any time during the option term.

We are also preparing filings seeking regulatory approval for a 12.5MW frequency regulation project at Sharon PA that is enabled by a lease option for the site with a 2.5 MW “phase 1 rollout” including possible expansion to a 12.5MW project at a later date, subject to regulatory approval. Carbon electrodes were prepared for PbC battery manufacturing trials with select U.S. based battery companies, a key goal of our strategy.

On June 26, 2015, we executed an amendment pursuant to which it extended the lease option for an additional six months upon the same terms and conditions. As of March 1, 2016, we have completed our feasibility study with PJM and are commencing our impact study, with results scheduled to be published on or about September 30, 2016.

Reverse Stock Split

On July 14, 2015, we effected a 1-for-35 reverse split of our common stock and Series A warrants. The number of Series B warrants was not impacted by the 1-for -35 reverse split. All share related and per share information has been adjusted to give effect to the reverse stock split from the beginning of the earliest periods presented.

Bridge Notes

On August 7, 2015, we entered into a securities purchase agreement with several accredited investors, including one of our directors pursuant to which it is selling $600,000 principal amount of convertible notes to the investors. The transaction was approved by our Board of Directors on August 5, 2015. These bridge notes carry an original issue discount of 15% so that the gross amount of proceeds to us (before expenses) was $510,000. The bridge notes bear interest at the rate of 12% per annum, and the interest is payable in cash upon repayment of the notes or in shares of our common stock upon conversion of the notes. The notes have a term of 90 days from the date of issuance, which may be extended at the option of the investor with respect to all or any portion of a note (i) in the event that and for so long as an event of default is occurring under a note, (ii) through the date that all shares issued upon conversion of the note may be resold under Rule 144 without restriction and/or (iii) through the date that is 10 business days after the consummation of a change in control transaction, all as specified in these bridge notes. The conversion price for the notes is $1.75 per share. The holders of the notes were issued one five-year warrant for each $1.00 of principal amount of the note invested (510,000 warrants in total). Each warrant has an exercise price of $1.75 per share. The agreement, notes and warrants contain other terms and provisions which are customary for a transaction of this nature, including standard representations and warranties and events of default. The transaction is exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended, and Regulation D, as promulgated thereunder. The bridge notes and interest have been satisfied in the following manner: On November 5, 2015, $363,530 was rolled into the 2015 senior convertible notes; $235,294 in principal and $7,074 in interest was paid in cash on November 11, 2015 and the final payment of $12,353 was paid on January 5, 2016, which included $2,353 for interest.

9

Nasdaq Notification

On August 25, 2015, we received a written notification from the Nasdaq Stock Market LLC that we did not meet the minimum of $2,500,000 in stockholders’ equity for continued listing (as set forth in Listing Rule 5550(b)(1)) as a result of the report of shareholders equity of $570,824 in our Form 10-Q for the period ended June 30, 2015, which was largely as a result of the valuation of our Series B Warrants for the quarter ended June 30, 2015. The notification did not result in the immediate delisting of our common stock, and its common stock continued to trade uninterrupted on the Nasdaq Capital Market.

On November 20, 2015, we received written notification that based upon review of the Company’s submissions and its filings with the SEC, Nasdaq had granted us an extension until February 22, 2016, to demonstrate regained compliance with this minimum shareholders’ equity requirement. Evidence of compliance was to be set forth in a Current Report on Form 8-K to be filed on or before February 22, 2016, and we would have had to show a minimum shareholders’ equity of $2,500,000 at the end of the period in which it regained compliance as reported in the periodic report (on Form 10-K or 10-Q as applicable) for the period in which compliance is regained.

We voluntarily delisted from the Nasdaq Capital Market and moved to the OTCQB effective February 8, 2016.

$9,000,000 Private Placement

On November 4, 2015, we entered into a financing transaction for the sale of convertible notes and warrants issued by us with gross proceeds of $9,000,000 to us. Upon closing of the sale of the notes and warrants, we received cash proceeds of $1.85 million and deposit of an additional $7.15 million into a series of control accounts in our name. We are permitted to withdraw funds from our control accounts (i) in connection with certain conversions of the notes or (ii) otherwise, as follows: $1,000,000 on each 30-day anniversary of the commencing on the 30th day after the effective date of a registration statement being filed in connection with the transaction until there are no more funds in the control accounts, subject in each instance to equity conditions set forth in the convertible notes.

We received approximately $1.7 million in net proceeds at closing, which occurred on November 5, 2015, after deducting our placement agent’s fee of $138,750. Offering expenses, other than our placement agent’s fee, were approximately $100,000, which were paid out of the proceeds at closing. At each release of funds, we were to receive approximately $925,000 in net proceeds, after deducting our placement agent’s fee of $75,000. As a result of the January 28, 2016 amendment agreements, we received an additional $1.8 million on that date and will receive approximately $668,750 in net proceeds, after deducting our placement agent’s fee of approximately $50,000, on each of May 2, 2016, and the first trading day of the next subsequent seven months concluding in December 2016.

The initial conversion price of the notes was $1.23 per share, and the initial exercise price of the 10,975,608 warrants was $1.29 per share.

As a result of “rollover” of $363,530 of principal amount and accrued and unpaid interest of our August 2015 bridge notes, an additional convertible note in the principal amount of $363,530 and an additional 443,328 warrants were issued effective the date of the rollover.

On February 12, 2016, our registration statement with respect to this financing was declared effective by the SEC, and as of April 8, 2016, we have issued 11,701,474 shares of our common stock to the investors as a result of the first pre installment payment under the convertible notes.

Special Shareholders Meeting

On December 4, 2015, we filed a Definitive Schedule 14A regarding a Special Meeting of Shareholders, which was to be held on January 15, 2016, to approve the issuance of shares issuable upon conversion of notes and exercise of warrants delivered as a result of our November 2015 financing in order to satisfy Nasdaq Listing Rule 5635(a).

Despite the concerted efforts of our management and Board of Directors, in conjunction with the proxy solicitation firm retained to assist in this process, only 864,096 shares were voted, of which 753,227 shares were voted in favor of the proposal, 88,349 shares were voted against the proposal, and 22,520 shares abstained from voting. Despite the overwhelming margin of support of the proposal from the shares which did vote, the total number voted was far less than the 1,967,365 shares needed to constitute a quorum to hold the Special Meeting of Shareholders. Thus, we were unable to hold the Special Meeting.

Our Sales and Marketing Strategy

Over the last few years, our PbC technology evolved through the research, development, prototype and early adoption stages. On a parallel path, we explored potential existing as well as potential future market applications that our product might profitably service. Throughout the process, different PbC configurations, along with various ancillary components, were subject to trial and error testing. Our strategy was to find markets where:

10

| · | our product demonstrated superior performance to the current products of choice; or | |

| · | where our product demonstrated a measurable cost savings alternative to those products; or | |

| · | where it provided a combination of the two. |

The end result of this process was the identification of specific target markets; the development of an improved PbC battery product that can be sold into those markets as a standalone unit as part of an entire Axion energy storage system such as our PowerCube; or as the battery component of someone else’s energy storage system. The PowerCube includes not only PbC batteries but also all of the electronics necessary to accumulate or dispatch power from those batteries. The containerized Cube unit also includes battery racking, Axion’s battery management system, all necessary wiring and a fire suppression system.

On January 28, 2015, we announced a strategic marketing, sales and reselling agreement with privately owned Portland OR-based Pacific Energy Ventures LLC, a technology and project development firm specializing in the renewable energy and energy storage sectors, which has been terminated in March 2016 due to lack of identifiable results.

Our sales cycle time varies greatly depending on the particular market and the specific customer’s product knowledge and expectations, but generally speaking, excluding the transportation market, the time required to introduce our product to a new customer - through sale conclusion - is 4 to 6 months. We will continue to seek relationships with industry leaders in the various market segments to better penetrate targets that are suitable for our PbC systems. Most projects require some upfront expense to initiate the system development. This would be for battery production and software development to integrate the technology as a component in various component systems such as with the ongoing ePower project.

Our Patents and Intellectual Property

We own 14 issued U.S. patents at the date of this report covering various aspects of our PbC technologies, and we typically have a number of patent applications in process at any point in time. There is no assurance that any of the pending patent applications will ultimately be granted. Our issued patents are:

| · | U.S. Patent No. 9,251,969 (expires May 2032) –Process for the Manufacture of Carbon Sheet for an Electrode | |

| · | U.S. Patent No. 6,466,429 (expires May 2021) - Electric double layer capacitor | |

| · | U.S. Patent No. 6,628,504 (expires May 2021) - Electric double layer capacitor | |

| · | U.S. Patent No. 6,706,079 (expires May 2022) - Method of formation and charge of the negative polarizable carbon electrode in an electric double layer capacitor | |

| · | U.S. Patent No. 7,006,346 (expires April 2024) - Positive Electrode of an electric double layer capacitor | |

| · | U.S. Patent No. 7,110,242 (expires February 2021) - Electrode for electric double layer capacitor and method of fabrication thereof | |

| · | U.S. Patent No. 7,119,047 (expires February 2021) - Modified activated carbon for carbon for capacitor electrodes and method of fabrication thereof | |

| · | U.S. Patent No. 7,569,514 (expires May 22, 2021) - Method of Fabrication of Modified Activated Carbon | |

| · | U.S. Patent No. 7,881,042 (expires March 2027) – Cell Assembly for an Energy Storage Device using PTFE Binder in Activated Carbon Electrodes | |

| · | U.S. Patent No. 7,998,616 (expires February 2028) – Negative Electrode for a Hybrid Energy Storage Device | |

| · | U.S. Patent No. 8,023,251 (expires November 2028) – Hybrid Energy Storage Device and Method of Making Same | |

| · | U.S. Patent No. 8,192,865 (expires October 2027) – Negative Electrode for a Hybrid Energy Storage Device | |

| · | U.S. Patent No. 8,202,653 (expires February 2028) – Electrode Grid Structure | |

| · | U.S. Patent No. 8,347,468 (expires February 2031) – Method of Making a Current Collector |

11

Presently, we have no obligation to pay any royalties or license fees with respect to the commercialization of our PbC device technology, and we are not subject to any field of use restrictions. We believe our patents and patent applications, along with our trade secrets, know-how and other intellectual property are necessary to our success.

Our ability to compete effectively with other companies will depend on our ability to maintain and protect the PbC device intellectual property and technology. We plan to file additional patent applications in the future. However, the degree of protection offered by our existing patents or the likelihood that our future applications will be granted, or the degree of protection afforded by future patents, if granted, is uncertain. Competitors in both the United States and foreign countries, many of which have substantially greater resources and have made substantial investment in competing technologies, may have, or may apply for and obtain patents that may prevent, limit or interfere with our ability to make and sell products based on our PbC device technology. Competitors may also intentionally infringe on our patents. The prosecution and defense of patent litigation is both costly and time-consuming, even if the outcome is favorable to us. An adverse outcome in the defense of a patent infringement suit could subject us to significant liabilities to third parties and prevent us from using all or any portion of the technology covered by such a patent. Although third parties have not asserted any infringement claims against us to date, there is no assurance that third parties will not assert such claims in the future.

We also rely on trade secrets and know-how, and there is no assurance that others will not independently develop the same or similar technology or obtain unauthorized access to our trade secrets, know-how and other unpatented technology. To protect our rights in these areas, we require all employees, consultants, advisors and collaborators to enter into strict confidentiality agreements. These agreements may not provide meaningful protection for our unpatented technology in the event of an unauthorized use, misappropriation or disclosure. While we have attempted to protect the unpatented proprietary technology that we develop or acquire, and will continue to attempt to protect future proprietary technology through patents, copyrights and trade secrets, we believe that our success will depend, to a large extent, upon continued innovation and technological expertise.

In general, the level of protection afforded by a patent is directly proportional to the ability of the patent owner to protect and enforce those rights through legal action. Since our financial resources are limited, and patent litigation can be both expensive and time consuming, there can be no assurance that we will be able to successfully prosecute an infringement claim in the event that a competitor develops a technology or introduces a product that infringes on one or more of our patents or patent applications. There can be no assurance that our competitors will not independently develop other technologies that render our proposed products obsolete. In general, we believe the best protection of our proprietary technology will come from market position, technical innovation, speed-to-market, and product performance. There is no assurance that we will realize any benefit from our intellectual property rights.

Our Competition

Our PbC technology is competitive with technologies being developed by a number of new and established companies engaged in the manufacture of energy storage components, devices and systems. In addition, many universities, research institutions and other companies are developing advanced electrochemical energy storage technologies including:

| · | symmetric supercapacitors; |

| · | asymmetric supercapacitors with organic electrolytes; |

| · | nickel metal hydride batteries; |

| · | lithium-ion batteries; |

| · | other advanced lead-acid devices; and |

| · | flow batteries. |

Other business entities are developing advanced energy production technologies like fuel cells, solar cells and windmills which may use our products, or, in some cases, compete with our products. Since some of our competitors are developing technologies that may ultimately have costs similar to, or lower than, our projected costs, there can be no assurance we will be able to compete effectively.

Our competitors with more diversified product offerings may be better positioned to withstand changing market conditions. Some of our competitors own, partner with, or have longer term or stronger relationships with suppliers of raw materials and components, which could result in them being able to obtain raw materials on a more favorable basis than us. It is possible that new competitors or alliances among existing competitors could emerge and rapidly acquire significant market share, which would harm our business.

The development of technology, equipment and manufacturing techniques and the operation of a facility for the automated production of rechargeable batteries require large capital expenditures. In order to minimize our capital investment in manufacturing facilities and establish strong brand name recognition for our products, our overall strategy is to negotiate strategic alliances and other production agreements with established battery manufacturers that want to add high-performance co-branded products to their existing product lines. There can be no assurance that our PbC platform technology business model will succeed in the battery industry.

12

Our Employees

As of December 31, 2015, we employed a full time staff of 16, including a six member scientific and engineering team, and five people who are involved principally in manufacturing. We are not subject to any collective bargaining agreements, and we believe we have a good relationship with our employees. On March 31, 2015, we accepted the resignation of Vani Dantam, Vice President of Sales and Marketing. Charles Trego resigned as our Chief Financial Officer on October 2, 2015 although he remains a director, and Danielle Baker, our Controller, was appointed as our Chief Accounting Officer.

On February 1, 2016, Richard H. Bogan was appointed as our Chief Executive Officer at which time he resigned from all Board Committee appointments but remains director.

Description of Properties

On March 10, 2013, we exercised our option for a five-year renewal on our lease on existing space at our manufacturing plant located at 3601 Clover Lane in New Castle, Pennsylvania. We have utilized this space to manufacture our PbC and specialty lead-acid battery products and to continue to produce and test prototypes which incorporate our developed technology. prototypes for our own use and testing, With the Company restructuring plan, the electrode robotic production line will be relocated to the Clover Lance facility along with; labs and offices formerly housed in the Green Ridge facility. Our facility has been fully tested and found to be in compliance with emission standards established by new federal guidelines in accordance with the Clean Air Act–Title III.

The salient terms of the renewal lease are as follows:

| · | The renewal term commenced on March 31, 2013 with a term of five years. |

| · | The lease may be extended for one additional five-year term with future rent to be negotiated at a commercially reasonable rate. |

| · | The battery manufacturing facility includes 70,438 square feet of floor space, including 7,859 square feet of office, locker, lab and lunch area, 46,931 square feet of manufacturing space, 1,488 square feet of dedicated lab space, 9,200 square feet of storage buildings and 5,000 square feet of basement area. | |

| · | The rental amount for the initial term is $16,700 per month, which is fixed through March 2015. In addition to the monthly rental, we are obligated to pay all required maintenance costs, taxes and special assessments, maintain public liability insurance, and maintain fire and casualty insurance for an amount equal to 100% of the replacement value of the leased premises. |

| · | On May 26, 2011 we executed an addendum to the existing lease agreement which resulted in the lease of an additional 2,160 square feet of additional space for $500 per month. There were no other changes to the existing lease. |

| · | With the execution of the addendum we now lease 72,598 square feet for a monthly rent of $17,200 on a “triple net” basis. |

| · | On March 10, 2013, we exercised our option for a five-year renewal on our existing lease space. The lease may be extended for one additional five-year term with future rent to be negotiated at a commercially reasonable rate. |

| · | The battery manufacturing facility includes 70,438 square feet of floor space, including 7,859 square feet of office, locker, lab and lunch area, 46,931 square feet of manufacturing space, 1,488 square feet of dedicated lab space, 9,200 square feet of storage buildings and 5,000 square feet of basement area. |

| · |

The rental amount for the renewal term is $17,200 per month, which is fixed through 2018. In addition to the monthly rental, we are obligated to pay all required maintenance costs, taxes and special assessments, maintain public liability insurance and maintain fire and casualty insurance for an amount equal to 100% of the replacement value of the leased premises. |

On November 4, 2010, we entered into a commercial lease with Becan Development, LLC to lease a 45,000 square foot building, located at 209 Green Ridge Road in New Castle, PA, which we currently occupy to house offices, research and development, electrode manufacturing and warehousing.

The salient terms of the lease are as follows:

| · | The term commenced on January 1, 2011 and the term expired on December 31, 2015. We continue to occupy the facility on a month to month basis on the same rental terms at a reduced rent of $15,000 and expect to be vacated by May 1, 2016. |

| · | The lease may be extended for two five-year terms, by giving notice not less than 30 nor more than 120 days before the expiration of the initial term or first renewal term (as applicable). The renewal leases shall be on terms substantially similar to the terms of the initial lease except for any adjustment to rent, if warranted, as mutually agreed upon by Lessor and us. |

| · | The rental amount for the initial term is $19,297 per month and is on a “triple net” basis. |

| · | We also have a right of first refusal to purchase the property within 30 days of receipt of notice of a third party offer from lessor upon substantially the same terms as those offered by the third party. |

| · | The lease contains market terms on standard provisions such as defaults and maintenance. |

13

On August 28, 2015, we signed a promissory note with each of the two landlords deferring lease payments until December 31, 2015. The aggregate amount of the promissory notes is $291,975 earning interest at 12% per annum compounded monthly.

As of the date of this annual report, the remaining balance on the Clover Lane note is $137,600 and is to be paid off as follows: an additional $17,200 per month through August 1, 2016, and the remaining balance on the Greenridge note is $100,000 to be paid in monthly installments of $25,000 until paid in full on April 30, 2016.

Legal Proceedings

From time to time, we are involved in lawsuits, claims, investigations and proceedings, including pending opposition proceedings involving patents that arise in the ordinary course of business. There are no matters pending that we expect to have a material adverse impact on our business, results of operations, financial condition or cash flows.

You should carefully consider the risks described below together with all of the other information included in this Annual Report on Form 10-K, as well as all other information included in all other filings, incorporated herein by reference, when evaluating the Company and its business. If any of the following risks actually occurs, our business, financial condition, and results of operations could suffer. In that case, the price of our common stock could decline and our stockholders may lose all or part of their investment.

Investing in our common stock is very speculative and involves a high degree of risk. You should carefully consider all of the information in this report before making an investment decision. The following are among the risks we face related to our business, assets and operations. They are not the only risks we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also arise. Any of these risks could materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the trading price of our common stock. You should not purchase our shares unless you can afford to lose your entire investment.

RISKS RELATED TO OUR FINANCIAL POSITION

We have a history of operating losses. We expect to incur operating losses and negative cash flow in the future and we may never achieve or sustain an operating profit or positive cash flow.

We have historically incurred substantial operating losses of $5.8 million and $11.4 million for the years ended December 31, 2015 and 2014, respectively. At December 31, 2015, we had retained earnings deficit of $122.6 million. These operating losses have had, and will continue to have, an adverse effect on our balance sheet, statement of operations and comprehensive loss, and statements of cash flows. Because of the numerous risks and uncertainties associated with our business, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then sustain profitability would have a material adverse effect on our results of operations and business.

Our independent registered public accounting firm’s report for the fiscal year ended December 31, 2015 includes an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern.

Due to the uncertainty of our ability to meet our cash requirements to fund our current operations, working capital, and non-current liabilities, in their report on our audited annual financial statements as of and for the year ended December 31, 2015, our independent registered public accounting firm included an explanatory paragraph regarding concerns about our ability to continue as a going concern. Recurring losses from operations raise substantial doubt about our ability to continue as a going concern. Other factors include our lack of customers for our product and the possibility of having to make cash payments as part of the payments due with respect to our $9.0 million principal amount of 2015 Senior Notes issued by us to our investors therein. If we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. In addition, the inclusion of an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern and our lack of cash resources may materially adversely affect our share price and our ability to raise new capital or to meet existing contractual obligations with third parties (including product warranties) or to enter into new critical contractual relations with third parties.

We are in the early stages of commercialization, do not have current customers and our PbC products may never achieve significant commercial market acceptance.

Our success depends on our ability to develop and market PbC products that are recognized as superior to those currently existing in the marketplace. Most of our potential customers currently use other products using different technology and may be reluctant to change those methods to a new technology. We also have no current customers, and we may not be able to attract customers for our products in a timely manner, if at all. Market acceptance will depend on many factors, including our ability to convince potential customers that our PbC battery solution is an attractive alternative to existing products. We will need to demonstrate that our products provide reliable and cost-effective alternatives to existing products. Compared to most competing technologies, our technology is relatively new, and most potential customers have limited knowledge of, or experience with, our products. Prior to adopting our technology, potential customers may be required to devote significant time and effort to testing and validating our products. Many factors influence the perception of a new technology, including its use by leaders in the industry. If we are unable to continue to induce these leaders to adopt our technology, acceptance and adoption of our products could be slowed. In addition, if our products fail to gain significant acceptance in the marketplace and we are unable to expand our customer base, we may never generate sufficient revenue to achieve or sustain profitability.

14

Our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.

The sales cycle for our products is lengthy, which makes it difficult for us to accurately forecast revenue in a given period, and may cause revenue and operating results to vary significantly from period to period. Some potential customers for our products typically need to commit significant time and resources to evaluate the technology used in our products and their decision to purchase our products may be further limited by budgetary constraints, lack of funding and numerous layers of internal review and approval, which are beyond our control. We spend substantial time and effort assisting potential customers in evaluating our products, including providing demonstrations and validation. Even after initial approval by appropriate decision makers, the negotiation and documentation processes for the actual adoption of our products can be lengthy. As a result of these factors, based on our experience to date, our sales cycle, the time from initial contact with a prospective customer to routine commercial utilization of our products, has varied and can sometimes be several months or longer, which has made it difficult for us to accurately project revenues and other operating results. In addition, the revenue generated from sales of our products may fluctuate from time to time due to market and general economic conditions. As a result, our financial results may fluctuate on a quarterly basis which may adversely affect the price of our common stock.

We will need to raise additional funds through debt or equity financings in the future to achieve our business objectives and to satisfy our cash obligations, which would dilute the ownership of our existing shareholders and possibly subordinate certain of their rights to the rights of new investors.

We will need to raise additional funds through debt or equity financings in order to complete our ultimate business objectives, including funding working capital to support fulfillment of future orders for our products to pay-off our subordinated notes. We also may choose to raise additional funds in debt or equity financings if they are available to us on reasonable terms to increase our working capital, strengthen our financial position or to make acquisitions. Any sales of additional equity or convertible debt securities would result in dilution of the equity interests of our existing shareholders, which could be substantial. Additionally, if we issue shares of preferred stock or convertible debt to raise funds, the holders of those securities might be entitled to various preferential rights over the holders of our common stock, including repayment of their investment, and possibly additional amounts, before any payments could be made to holders of our common stock in connection with an acquisition of us. Such preferred shares, if authorized, might be granted rights and preferences that would be senior to, or otherwise adversely affect, the rights and the value of our common stock. Also, new investors may require that we and certain of our shareholders enter into voting arrangements that give them additional voting control or representation on our board of directors.

RISKS RELATED TO OUR BUSINESS OPERATIONS

We depend on key personnel, and our business may be severely disrupted if we lose the services of our key executives, employees, and consultants.

If any of our key personnel do not continue in their present positions, we may not be able to easily replace them and our business may be severely disrupted. We face competition for such personnel. If any of these individuals joins a competitor or forms a competing company, we could lose important know-how and experience and incur substantial expense to recruit and train suitable replacements. Our Compensation Committee remains committed to keeping our key personnel in place as we move further into our commercialization stage of our PbC product. Currently, all of our key personnel have employment contracts that include non-compete provisions.

We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.

Our ability to manage our potential growth properly will require us to continue to improve our business processes, as well as our reporting systems and procedures. If our current infrastructure is unable to handle our growth, we may need to expand our infrastructure and staff and implement new decision making and reporting systems. The time and resources required to implement such expansion and systems could adversely affect our decision making and operations. Our expected future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain, and integrate additional employees. Our future financial performance and our ability to commercialize our products and to compete effectively will depend, in part, on our ability to manage this potential future growth effectively, without compromising quality and customer satisfaction.

15

Our operations expose us to litigation, tax, environmental and other legal compliance risks.

We are subject to a variety of litigation, tax, environmental, health and safety and other legal compliance risks. These risks include, among other things, possible liability relating to product liability matters, personal injuries, intellectual property rights, contract-related claims, government contracts, taxes, health and safety liabilities, environmental matters and compliance with U.S. and foreign laws, competition laws and laws governing improper business practices. We or one of our business units could be charged with wrongdoing as a result of such matters. If convicted or found liable, we could be subject to significant fines, penalties, repayments or other damages (in certain cases, treble damages). As a business with potential international reach, we are subject to complex laws and regulations in the U.S. and other countries in which we choose to operate. Those laws and regulations may be interpreted in different ways. They may also change from time to time, as may related interpretations and other guidance. Changes in laws or regulations could result in higher expenses and payments, and uncertainty relating to laws or regulations may also affect how we conduct our operations and structure our investments and could limit our ability to enforce our rights.

In the area of taxes, changes in tax laws and regulations, as well as changes in related interpretations and other tax guidance in the countries and jurisdictions that we choose to operate could materially impact our tax receivables and liabilities and our deferred tax assets and tax liabilities. Additionally, in the ordinary course of business, we are subject to examinations by various authorities, including tax authorities. There could be investigations launched in the future by governmental authorities in various jurisdictions. The potentially future global and diverse nature of our operations means that these risks will continue to exist and additional legal proceedings and contingencies will arise from time to time. Our results may be affected by the outcome of legal proceedings and other contingencies that cannot be predicted with certainty.

In the sourcing of our products throughout the world, we process, store, dispose of and otherwise use large amounts of hazardous materials, especially lead and acid. As a result, we are subject to extensive and changing environmental, health and safety laws and regulations governing, among other things: the generation, handling, storage, use, transportation and disposal of hazardous materials; remediation of polluted ground or water; emissions or discharges of hazardous materials into the ground, air or water; and the health and safety of our employees. Compliance with these laws and regulations results in ongoing costs. Failure to comply with these laws or regulations, or to obtain or comply with required environmental permits, could result in fines, criminal charges or other sanctions by regulators. From time to time we have had instances of alleged or actual noncompliance that have resulted in the imposition of fines, penalties and required corrective actions. Our ongoing compliance with environmental, health and safety laws, regulations and permits could require us to incur significant expenses, limit our ability to modify or expand our facilities or continue production and require us to install additional pollution control equipment and make other capital improvements. In addition, private parties, including current or former employees, could bring personal injury or other claims against us due to the presence of, or exposure to, hazardous substances used, stored or disposed of by us or contained in our products.

Changes in environmental and climate laws or regulations, including laws relating to greenhouse gas emissions, could lead to new or additional investment in production designs and could increase environmental compliance expenditures. Changes in climate change concerns, or in the regulation of such concerns, including greenhouse gas emissions, could subject us to additional costs and restrictions, including increased energy and raw materials costs. Additionally, we cannot assure you that we have been or at all times will be in compliance with environmental laws and regulations or that we will not be required to expend significant funds to comply with, or discharge liabilities arising under, environmental laws, regulations and permits, or that we will not be exposed to material environmental, health or safety litigation.

We are subject to stringent federal and state environmental and safety regulation, and we do not carry environmental impairment insurance, so we may suffer material adverse effects if any fines are ever imposed.

We use or generate certain hazardous substances in our research and manufacturing facilities. We are subject to varying regulations including OSHA and CERCLA and state equivalents. We do not carry environmental impairment insurance. We believe that all permits and licenses required for our current business activities are in place. Although we do not know of any material environmental, safety or health problems in our property or processes, there can be no assurance that problems will not develop in the future which could have a material adverse effect on our business, results of operation, or financial condition.

Our products contain hazardous materials including lead, and any discharge could lead to monetary damages and fines.