Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TEMPUR SEALY INTERNATIONAL, INC. | d143358d8k.htm |

| EX-99.1 - EX-99.1 - TEMPUR SEALY INTERNATIONAL, INC. | d143358dex991.htm |

| EX-10.1 - EX-10.1 - TEMPUR SEALY INTERNATIONAL, INC. | d143358dex101.htm |

Exhibit 99.2

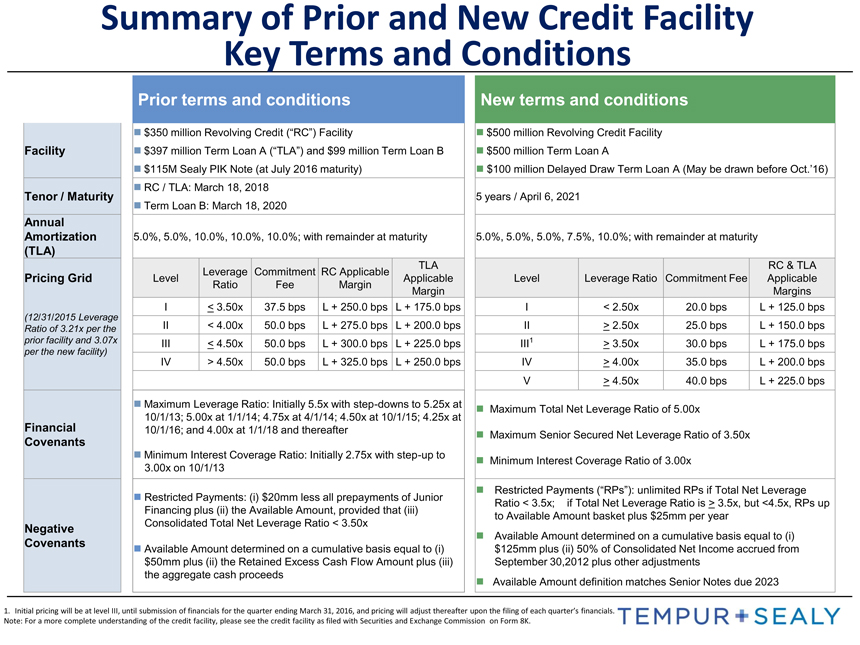

Summary of Prior and New Credit Facility Key Terms and Conditions Prior terms and conditions n $350 million Revolving Credit (“RC”) Facility Facility n $397 million Term Loan A (“TLA”) and $99 million Term Loan B n $115M Sealy PIK Note (at July 2016 maturity) n RC / TLA: March 18, 2018 Tenor / Maturity n Term Loan B: March 18, 2020 Annual Amortization 5.0%, 5.0%, 10.0%, 10.0%, 10.0%; with remainder at maturity (TLA) Leverage Commitment RC Applicable TLA Pricing Grid Level Applicable Ratio Fee Margin Margin I < 3.50x 37.5 bps L + 250.0 bps L + 175.0 bps (12/31/2015 Leverage Ratio of 3.21x per the II < 4.00x 50.0 bps L + 275.0 bps L + 200.0 bps prior facility and 3.07x III < 4.50x 50.0 bps L + 300.0 bps L + 225.0 bps per the new facility) IV > 4.50x 50.0 bps L + 325.0 bps L + 250.0 bps n Maximum Leverage Ratio: Initially 5.5x with step-downs to 5.25x at 10/1/13; 5.00x at 1/1/14; 4.75x at 4/1/14; 4.50x at 10/1/15; 4.25x at Financial 10/1/16; and 4.00x at 1/1/18 and thereafter Covenants n Minimum Interest Coverage Ratio: Initially 2.75x with step-up to 3.00x on 10/1/13 n Restricted Payments: (i) $20mm less all prepayments of Junior Financing plus (ii) the Available Amount, provided that (iii) Negative Consolidated Total Net Leverage Ratio < 3.50x Covenants n Available Amount determined on a cumulative basis equal to (i) $50mm plus (ii) the Retained Excess Cash Flow Amount plus (iii) the aggregate cash proceeds New terms and conditions n $500 million Revolving Credit Facility n $500 million Term Loan A n $100 million Delayed Draw Term Loan A (May be drawn before Oct.’16) 5 years / April 6, 2021 5.0%, 5.0%, 5.0%, 7.5%, 10.0%; with remainder at maturity RC & TLA Level Leverage Ratio Commitment Fee Applicable Margins I < 2.50x 20.0 bps L + 125.0 bps II > 2.50x 25.0 bps L + 150.0 bps III1 > 3.50x 30.0 bps L + 175.0 bps IV > 4.00x 35.0 bps L + 200.0 bps V > 4.50x 40.0 bps L + 225.0 bps n Maximum Total Net Leverage Ratio of 5.00x n Maximum Senior Secured Net Leverage Ratio of 3.50x n Minimum Interest Coverage Ratio of 3.00x n Restricted Payments (“RPs”): unlimited RPs if Total Net Leverage Ratio < 3.5x; if Total Net Leverage Ratio is > 3.5x, but <4.5x, RPs up to Available Amount basket plus $25mm per year n Available Amount determined on a cumulative basis equal to (i) $125mm plus (ii) 50% of Consolidated Net Income accrued from September 30,2012 plus other adjustments n Available Amount definition matches Senior Notes due 2023 1. Initial pricing will be at level III, until submission of financials for the quarter ending March 31, 2016, and pricing will adjust thereafter upon the filing of each quarter’s financials. Note: For a more complete understanding of the credit facility, please see the credit facility as filed with Securities and Exchange Commission on Form 8K.