Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Foundation Healthcare, Inc. | fdnh-ex311_8.htm |

| 10-K - 10-K - Foundation Healthcare, Inc. | fdnh-10k_20151231.htm |

| EX-32.1 - EX-32.1 - Foundation Healthcare, Inc. | fdnh-ex321_7.htm |

| EX-32.2 - EX-32.2 - Foundation Healthcare, Inc. | fdnh-ex322_6.htm |

| EX-23.1 - EX-23.1 - Foundation Healthcare, Inc. | fdnh-ex231_9.htm |

| EX-21 - EX-21 - Foundation Healthcare, Inc. | fdnh-ex21_80.htm |

| EX-31.2 - EX-31.2 - Foundation Healthcare, Inc. | fdnh-ex312_10.htm |

Exhibit 10.21

LEASE AGREEMENT

7501 Fannin Houston, Texas

By And Between

CAMBRIDGE PROPERTIES,

a sole proprietorship of Dr. Timothy L. Sharma

(“LANDLORD”)

AND

UNIVERSITY HOSPITAL SYSTEMS, LLP,

a Delaware limited liability partnership

(“TENANT”)

|

|

|

|

|

Page |

|

|

|

|

|

|

|

SEC. 1. |

|

LEASED PREMISES |

|

1 |

|

|

|

|

|

|

|

SEC. 2. |

|

PARKING |

|

1 |

|

|

|

|

|

|

|

SEC. 3. |

|

TERM |

|

3 |

|

|

|

|

|

|

|

SEC. 4. |

|

USE |

|

3 |

|

|

|

|

|

|

|

SEC. 5. |

|

SECURITY DEPOSIT |

|

3 |

|

|

|

|

|

|

|

SEC. 6. |

|

BASE RENT |

|

4 |

|

|

|

|

|

|

|

SEC. 7. |

|

ADDITIONAL RENT |

|

4 |

|

|

|

|

|

|

|

SEC. 8. |

|

SERVICE AND UTILITIES |

|

8 |

|

|

|

|

|

|

|

SEC. 9. |

|

MAINTENANCE, REPAIRS AND USE |

|

9 |

|

|

|

|

|

|

|

SEC. 10. |

|

QUIET ENJOYMENT |

|

9 |

|

|

|

|

|

|

|

SEC. 11. |

|

ALTERATIONS |

|

10 |

|

|

|

|

|

|

|

SEC. 12. |

|

FURNITURE, FIXTURES AND PERSONAL PROPERTY |

|

11 |

|

|

|

|

|

|

|

SEC. 13. |

|

SUBLETTING AND ASSIGNMENT |

|

12 |

|

|

|

|

|

|

|

SEC. 14. |

|

FIRE AND CASUALTY |

|

13 |

|

|

|

|

|

|

|

SEC. 15. |

|

CONDEMNATION |

|

14 |

|

|

|

|

|

|

|

SEC. 16. |

|

DEFAULT BY TENANT |

|

14 |

|

|

|

|

|

|

|

SEC. 17. |

|

REMEDIES OF LANDLORD |

|

15 |

|

|

|

|

|

|

|

SEC. 18. |

|

DEFAULT BY LANDLORD; REMEDIES OF TENANT |

|

16 |

|

|

|

|

|

|

|

SEC. 19. |

|

NON-WAIVER |

|

16 |

|

|

|

|

|

|

|

SEC. 20. |

|

LAWS AND REGULATIONS; RULES AND REGULATIONS |

|

16 |

|

|

|

|

|

|

|

SEC. 21. |

|

ASSIGNMENT BY LANDLORD; LIMITATION OF LANDLORD’S LIABILITY |

|

16 |

|

|

|

|

|

|

|

SEC. 22. |

|

SEVERABILITY |

|

16 |

|

|

|

|

|

|

|

SEC. 23. |

|

SIGNS |

|

17 |

|

|

|

|

|

|

|

SEC. 24. |

|

SUCCESSORS AND ASSIGNS |

|

17 |

|

|

|

|

|

|

|

SEC. 25. |

|

SUBORDINATION |

|

17 |

|

|

|

|

|

|

|

SEC. 26. |

|

TAX PROTEST |

|

17 |

|

|

|

|

|

|

|

SEC. 27. |

|

HOLDING OVER |

|

17 |

|

|

|

|

|

|

|

SEC. 28. |

|

INDEPENDENT OBLIGATION TO PAY RENT |

|

18 |

|

|

|

|

|

|

|

SEC. 29. |

|

INDEMNITY; RELEASE AND WAIVER |

|

18 |

|

|

|

|

|

|

|

SEC. 30. |

|

INSURANCE |

|

18 |

|

|

|

|

|

|

|

SEC. 31. |

|

ENTIRE AGREEMENT |

|

19 |

|

|

|

|

|

|

|

SEC. 32. |

|

NOTICES |

|

19 |

|

|

|

|

|

|

|

SEC. 33. |

|

COMMENCEMENT DATE |

|

19 |

|

|

|

|

|

|

|

SEC. 34. |

|

BROKERS |

|

19 |

|

|

|

|

|

|

i

|

|

|

|

|

Page |

|

|

ESTOPPEL CERTIFICATES |

|

19 |

|

|

|

|

|

|

|

|

SEC. 36. |

|

NAME CHANGE |

|

20 |

|

|

|

|

|

|

|

SEC. 37. |

|

INTENTIONALLY DELETED |

|

20 |

|

|

|

|

|

|

|

SEC. 38. |

|

BANKRUPTCY |

|

20 |

|

|

|

|

|

|

|

SEC. 39. |

|

ROOFTOP USE |

|

20 |

|

|

|

|

|

|

|

SEC. 40. |

|

DEVELOPMENT COSTS |

|

20 |

|

|

|

|

|

|

|

SEC. 41. |

|

HAZARDOUS SUBSTANCES |

|

20 |

|

|

|

|

|

|

|

SEC. 42. |

|

ACKNOWLEDGMENT OF NON-APPLICABILITY OF DTPA |

|

21 |

|

|

|

|

|

|

|

SEC. 43. |

|

ATTORNEYS’ FEES |

|

21 |

|

|

|

|

|

|

|

SEC. 44. |

|

AUTHORITY OF TENANT |

|

21 |

|

|

|

|

|

|

|

SEC. 45. |

|

EXECUTION OF THIS LEASE AGREEMENT |

|

22 |

|

|

|

|

|

|

|

SEC. 46. |

|

WAIVER OF TRIAL BY JURY; COUNTERCLAIM |

|

22 |

|

|

|

|

|

|

|

SEC. 47. |

|

EXHIBITS |

|

22 |

|

|

|

|

|

|

|

SEC. 48. |

|

DTPA INAPPLICABLE |

|

22 |

|

|

|

|

|

|

|

SEC. 49. |

|

WAIVER OF TENANT RIGHTS AND BENEFITS UNDER SECTION 93.012, TEXAS PROPERTY CODE |

|

22 |

|

|

|

|

|

|

|

SEC. 50. |

|

SPECIAL DAMAGES |

|

22 |

|

|

|

|

|

|

|

SEC. 51. |

|

RIGHT OF FIRST OFFER. |

|

22 |

|

|

|

|

|

|

|

SEC. 52. |

|

TEXAS DEPARTMENT OF HEALTH APPROVAL |

|

23 |

|

|

|

|

|

|

|

SEC. 53. |

|

APPROVAL BY LANDLORD’S MORTGAGEE |

|

23 |

|

|

|

|

|

|

|

SEC. 54. |

|

BUILDING PLANS |

|

23 |

|

|

|

|

|

|

|

SEC. 55. |

|

[RIGHTS OF EXISTING TENANTS |

|

23 |

|

EXHIBITS: |

|

|

|

|

|

|

|

|

|

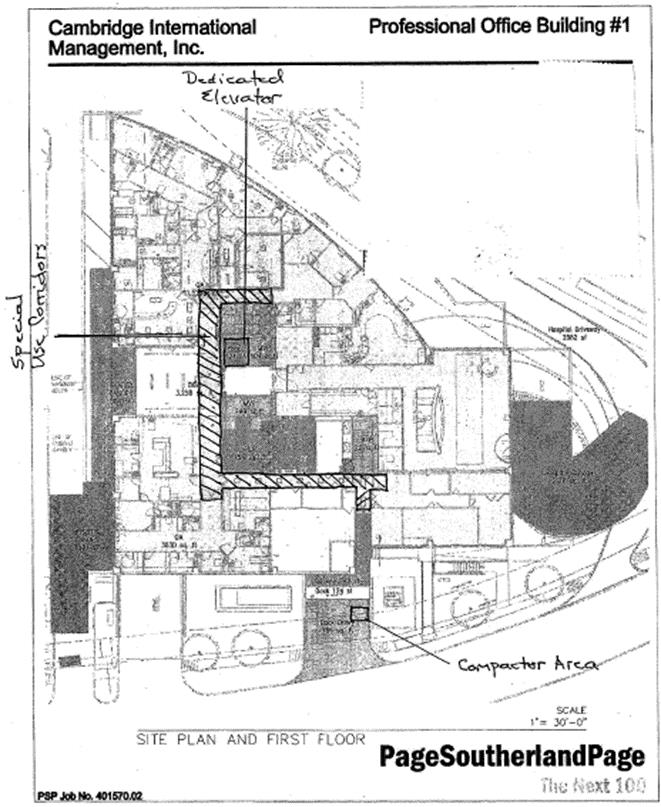

EXHIBIT A |

- |

|

FLOOR PLAN OF THE LEASED PREMISES |

|

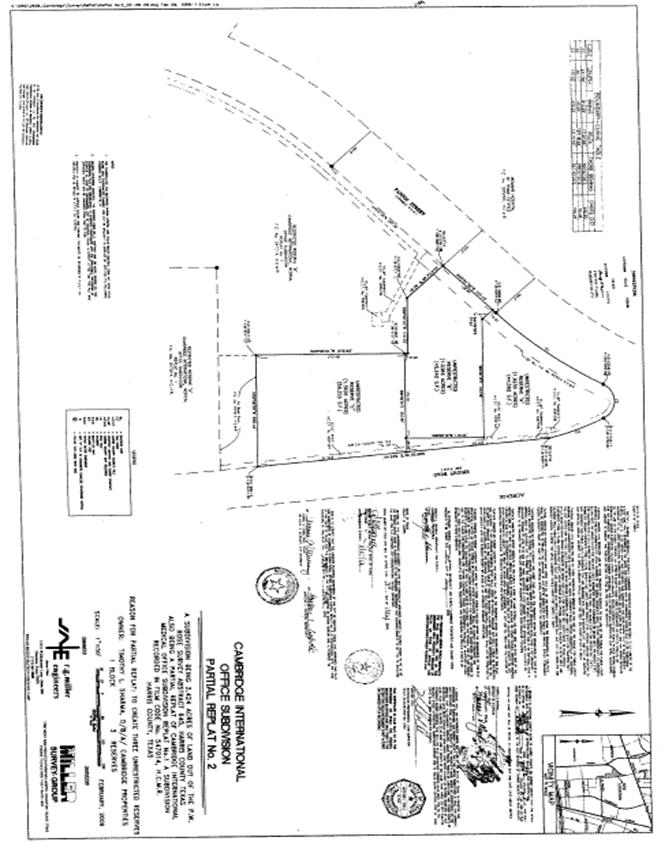

EXHIBIT B |

- |

|

LEGAL DESCRIPTION OF THE LAND |

|

EXHIBIT C |

- |

|

EXTENSION OPTION RIDER |

|

EXHIBIT D |

- |

|

RULES AND REGULATIONS |

|

EXHIBIT E |

- |

|

ACCEPTANCE OF PREMISES MEMORANDUM |

|

EXHIBIT F |

- |

|

TENANT’S ESTOPPEL CERTIFICATE |

|

EXHIBIT G |

- |

|

TENANT’S WORK LETTER |

|

EXHIBIT H |

- |

|

LETTER AGREEMENT |

|

EXHIBIT I |

- |

|

RESTRICTIONS AND EXCLUSIVE USES APPLICABLE TO LEASED PREMISES |

|

EXHIBIT J |

- |

|

PARKING RULES AND REGULATIONS |

ii

This Lease Agreement (this “Lease Agreement”) is made and entered into as of the Effective Date set forth on the signature page between CAMBRIDGE PROPERTIES, a sole proprietorship of Dr. Timothy L. Sharma, hereinafter referred to as “Landlord”, and UNIVERSITY HOSPITAL SYSTEMS, LLP, a Delaware limited liability partnership, hereinafter referred to as “Tenant”.

WITNESSETH:

SEC. l. LEASED PREMISES: In consideration of the mutual covenants as set forth herein, Landlord and Tenant hereby agree as follows:

A. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord for the rental and on the terms and conditions hereinafter set forth approximately 69,050 square feet of Net Rentable Area consisting of approximately 10,532 square feet of Net Rentable Area on the first floor and approximately 19,506 square feet of Net Rentable Area on each of the second, third and fourth floors as indicated on the floor plans attached hereto as Exhibit “A” (the “Leased Premises”) in the office building (the “Building”) located on that certain tract or parcel of land more particularly described by metes and bounds on Exhibit “B” attached hereto and made a part hereof for all purposes (the “Land”), which Building is located at 7501 Fannin Street, Houston, Texas. Facilities and areas of the Building that are intended and designated by Landlord from time to time for the common, general and non-exclusive use of all tenants of the Building are called “Common Areas.” Landlord has the exclusive control over and right to manage the Common Areas. In addition, Landlord shall have the exclusive use and control over all other areas of the Building not designated as Common Areas nor leased exclusively to tenants of the Building, which include, but are not limited to, all risers, horizontal and vertical shafts and telephone closets in the Building.

B. The term “Net Rentable Area” shall mean the net rentable area measured according to standards similar to the standards published by the Building Owners and Managers Association International, Publication ANSI Z 65.1-1996, as amended from time to time. Upon delivery of the Leased Premises, Landlord shall cause Page Southerland Page to calculate the Net Rentable Area of the Building and the Leased Premises. If the Building is ever demolished, altered, remodeled, renovated, expanded or otherwise changed in such a manner as to alter the amount of space contained therein, then the Net Rentable Area of the Building shall be adjusted and recalculated by using the foregoing method of determining Net Rentable Area.

C. The Leased Premises shall be constructed in accordance with the terms of Exhibit “G” attached hereto and made a part hereof.

SEC. 2. PARKING:

A. Landlord hereby agrees to make available to Tenant and Tenant shall lease from Landlord during the full Term of this Lease Agreement parking permits (hereinafter collectively referred to as the “Parking Permits”) for twenty (20) parking spaces (hereinafter collectively referred to as Tenant’s “Building Basement Spaces”) in the basement of the Building (hereinafter referred to as the “Building Basement”), upon the following terms and conditions:

|

|

(1) |

All of Tenant’s Building Basement Spaces will be reserved parking spaces; |

|

|

(2) |

Five (5) of the Parking Permits shall be without charge to Tenant for the first five (5) years of the term of this Lease Agreement (the “Free Parking Permits”). Thereafter, Tenant shall pay for the Free Parking Permits at the then prevailing market rental rate for Building Basement Spaces, as determined by Landlord in its good faith discretion; |

|

|

(3) |

Tenant shall pay for the remaining Parking Permits at a rate equal to $100 per month per Parking Permit plus all applicable taxes thereon; |

|

|

(4) |

Landlord will issue to Tenant parking tags, stickers or access cards for the Parking Permits, or will provide a reasonable alternative means of identifying and controlling vehicles authorized to park in the Building Basement; and |

|

|

parking arrangements for the number of vehicles equal to the number of parking spaces covered by the Parking Permits not provided by Landlord. This abatement and offer of alternative parking arrangements shall be in full settlement of all claims that Tenant might otherwise have against Landlord by reason of Landlord’s failure or inability to provide Tenant with such parking spaces. |

B. Landlord hereby agrees to make available to Tenant during the full Term of this Lease Agreement one hundred eighty-seven (187) parking spaces (the “Garage Parking Spaces”) in the garage owned by Landlord located south of the Building (the “Garage”), sixty (60) of which shall be on a “take and pay” basis (the “Employee Contract Spaces” and the remaining one hundred twenty-seven (127) spaces being hereinafter referred to as the “Allocated Spaces”). Twenty (20) of the Employee Contract Spaces shall be reserved parking spaces. The Garage Parking Spaces shall be leased on the following terms and conditions:

|

|

(1) |

Except as set forth above, the Garage Parking Spaces shall be unreserved parking spaces; provided that Landlord reserves the right to designate the location of such Garage Parking Spaces. |

|

|

(2) |

Tenant shall pay for the reserved Garage Parking Spaces at a rate equal to $100 per month per Garage Parking Space plus all applicable taxes thereon and for unreserved Employee Contract Spaces at a rate equal to $100 per month per Garage Parking Space plus all applicable taxes thereon. To the extent Tenant elects to take and pay for any additional Allocated Spaces, Tenant shall pay for such Allocated Spaces at a rate equal to $100 per month per Allocated Space plus all applicable taxes thereon. |

|

|

(3) |

If for any reason Landlord fails or is unable to provide any of Tenant’s Garage Parking Spaces to Tenant at any time during the Term or any renewals or extensions hereof, and such failure continues for five (5) business days after Tenant gives Landlord written notice thereof, then, in addition to all other rights and remedies available to Tenant, Tenant’s obligation to pay rental for any of Tenant’s Garage Parking Spaces which are not provided by Landlord shall be abated for so long as Tenant does not have the use thereof space and Landlord shall use its diligent good faith efforts to provide alternative parking arrangements for the number of vehicles equal to the number of parking spaces covered by the Garage Parking Spaces not provided by Landlord. This abatement and offer of alternative parking arrangements shall be in full settlement of all claims that Tenant might otherwise have against Landlord by reason of Landlord’s failure or inability to provide Tenant with such parking spaces. |

|

|

(4) |

Notwithstanding anything in this Lease to the contrary, if Tenant fails to provide Landlord with written notice of its desire to use any Allocated Spaces on or prior to the first anniversary of the Commencement Date or for any period thereafter, any such unused space shall be forfeited and Landlord’s obligation to provide any such unused space(s) shall terminate. Except as provided in the following sentence, Landlord shall have no obligation to provide Tenant, and Tenant shall have no right to, any forfeited space(s). If Tenant requests the return of any previously forfeited space(s), Landlord shall reissue such forfeited space(s) only if such permits are available and for so long as such space(s) remain available, as determined by Landlord in its sole, but reasonable, discretion. |

|

|

(5) |

Subject to paragraph (4) above, Landlord shall make the Allocated Spaces available to Tenant on an unreserved basis upon receipt of thirty (30) days written notice. |

C. All parking rentals shall be due and payable to Landlord or its parking manager, as designated in writing by Landlord at the address specified in Section 32 of this Lease (or such other address as may be designated by Landlord in writing from time to time), as additional rent on the first day of each calendar month during the Term.

D. Tenant shall comply with such reasonable, non-discriminatory rules and regulations regarding parking as Landlord may, from time to time, establish, including those Garage rules and regulations, including any sticker or other identification system established by Landlord. Landlord may refuse to permit any person who violates the rules to park in the Garage, and any violation of the rules shall subject the car to removal.

E. Tenant shall defend, indemnify, defend (with counsel reasonably acceptable to Landlord) and hold harmless the Landlord Parties from and against all liabilities, obligations, losses, damages, penalties, claims, actions, suits, costs, expenses and disbursements (including court costs and reasonable attorneys’ fees) resulting directly or indirectly from the use of the Parking Permits. “Landlord Parties” means (a) Landlord, (b) any lender whose loan is secured by a lien against the Building, (c) their respective shareholders, members, partners, affiliates and subsidiaries, successors and assigns, and (d) any directors, officers, employee, agents, or contractor of such persons or entities.

F. Landlord shall provide parking in the Garage or in surface lots for visitors to the Building in an area designated by Landlord and in a capacity determined by Landlord to be appropriate for the Building. Landlord reserves the right to charge and collect a fee for

2

parking in the Garage or in the surface lots in an amount determined by the operator of the Garage to be appropriate. Provided that Tenant has not defaulted under this Lease Agreement, Landlord agrees to allow Tenant to validate the parking ticket of Tenant’s visitors with a stamp or other means approved in advance by Landlord, and to bill Tenant for the parking charges so validated by Tenant on a monthly basis. Said visitor parking charges shall be due and payable to Landlord as additional rent within ten (10) days after Tenant’s receipt of such statement. Alternatively, Landlord may establish a parking validation program whereby tenants may, at their option, purchase prepaid parking validation stickers or other means of identification for specific increments of visitor parking charges, which the tenants may then distribute to their visitors and invitees to be submitted to the Garage attendant as payment for the applicable increment of visitor parking charge.

G. Upon the occurrence of an Event of Default under the Lease Agreement, Landlord shall have the right (in addition to all other rights, remedies and recourse hereunder and at law) to terminate the Parking Permits upon three (3) days written notice to Tenant; provided, however if such Event of Default is cured, then the terminated Parking Permits shall be fully restored to Tenant.

H. In the event Landlord intends to construct improvements on the Complex which affect the use of the Garage, Landlord shall have the right to relocate the Garage Parking Spaces on a temporary basis only to any future parking facilities Landlord may construct on the Land or on other land within a reasonable proximity thereto; provided that such relocation is in a manner which does not have a material adverse affect on the operation of Tenant’s business.

SEC. 3. TERM:

A. The term of this Lease Agreement (the “Term”) shall commence on the earlier to occur of (i) the date upon which Tenant opens for business within the Leased Premises, or (ii) twelve (12) months after the Effective Date (such earlier date being herein referred to as the “Commencement Date”) and, unless sooner terminated or renewed and extended in accordance with the terms and conditions set forth herein, shall expire at 11:59 p.m. on the one hundred twentieth (120th) monthly anniversary of the Commencement Date (the “Expiration Date”).

B. This Lease Agreement shall be effective as of the Effective Date and in the event Tenant or its agents, employees or contractors enter the Leased Premises prior to the Commencement Date, such entry shall be subject to the terms and conditions of this Lease Agreement, except that the Rent (as hereinafter defined) shall not commence to accrue as a result of such entry until the date specified in Section 6 below.

C. Tenant shall have the option and right to extend the Lease Term under the terms and conditions of Exhibit “C” attached hereto.

SEC. 4. USE:

A. Subject to Sections 51 and 52, the Leased Premises shall be used and occupied by Tenant solely for the operation of (i) a general care hospital and related medical and medical/professional uses, (ii) a pharmacy, (iii) a medical diagnostic laboratory, (iv) a MRI/radiology facility, (v) a physical therapy facility and/or (vi) a rehabilitation services facility and no other purpose (the “Permitted Use”). The Leased Premises shall not be used for any purpose which would tend to lower the character of the Building, or otherwise interfere with standard Building operation.

B. Tenant shall have the exclusive right to operate in the Building a general care hospital as a primary and principal use.

SEC. 5. SECURITY DEPOSIT: $115,083.33 payable on the Effective Date (the “Security Deposit”). Upon the occurrence of any Event of Default (as hereinafter defined) by Tenant, Landlord may, from time to time, without prejudice to any other remedy, use the Security Deposit paid to Landlord by Tenant as herein provided to the extent necessary to make good any arrears of Rent (as hereinafter defined) and any other damage, injury, expense or liability caused to Landlord by such Event of Default. Following any such application of the Security Deposit, Tenant shall pay to Landlord on demand the amount so applied in order to restore the Security Deposit to the amount thereof existing prior to such application. Any remaining balance of the Security Deposit shall be returned by Landlord to Tenant within thirty (30) days after the termination of this Lease Agreement; provided, however, Landlord shall have the right to retain and expend such remaining balance (a) to reimburse Landlord for any and all rentals or other sums due hereunder that have not been paid in full by Tenant and/or (b) reasonable costs for cleaning and repairing the Leased Premises if Tenant shall fail to deliver same at the termination of this Lease in a broom clean condition and otherwise in accordance with the terms and conditions of this Lease Agreement. Tenant shall not be entitled to any interest on the security deposit. Such security deposit shall not be considered an advance payment of rental or a measure of Landlord’s damages in case of an Event of Default by Tenant.

3

A. As part of the consideration for the execution of this Lease Agreement, Tenant covenants and agrees and promises to pay as base rent according to the following schedule (the “Base Rent”):

|

Months after Commencement Date |

|

|

|

Rate Per Square Foot of Net Rentable Area |

|

|

|

Annual Base Rent |

|

|

|

Monthly Base Rent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-60 |

|

|

|

$20.00 |

|

|

|

$1,381,000.00 |

|

|

|

$115,083.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

61-120 |

|

|

|

$21.50 |

|

|

|

$1,484,575.00 |

|

|

|

$123,714.58 |

|

Base Rent shall be payable to Landlord at the address specified in Section 32 below (or such other address as may be designated by Landlord in writing from time to time) in legal tender of the United States of America, in advance, without demand, set-off or counterclaim, on the first day of each calendar month during the term hereof and any extensions or renewals hereof; provided, however, the first monthly payment of Base Rent shall be made on the Commencement Date. In the event the final determination of Net Rentable Area within the Leased Premises is not the same as the approximate total square footage of the Leased Premises set forth in Section 1 of this Lease Agreement, then all terms and provisions of this Lease Agreement that are dependent upon the size of the Leased Premises, including, without limitation, Base Rent and Tenant’s pro rata share, will automatically be altered without the need for any further documentation; provided that Tenant agrees to execute an amendment to this Lease Agreement reflecting such changes within ten (10) days after Landlord delivers to Tenant a written lease amendment reflecting such changes.

B. All Rent (as hereinafter defined) shall bear interest from the date due until paid at the greater of (i) two percent (2%) above the “prime rate” per annum of JPMorgan Chase Bank, a New York banking corporation or its successor (“Chase”) in effect on said due date (or if the “prime rate” be discontinued, the base reference rate then being used by Chase to define the rate of interest charged to commercial borrowers) or (ii) twelve percent (12%) per annum (the “Interest Rate”); provided, however, in no event shall the rate of interest hereunder exceed the maximum non-usurious rate of interest (hereinafter called the “Maximum Rate”) permitted by the applicable laws of the State of Texas or the United States of America, and to the extent that the Maximum Rate is determined by reference to the laws of the State of Texas, the Maximum Rate shall be the weekly ceiling (as defined and described in Chapter 303 of the Texas Finance Code, as amended) at the applicable time in effect.

C. If the Term of this Lease as described above commences on other than the first day of a calendar month or terminates on other than the last day of a calendar month, then the installments of Base Rent for such month or months shall be prorated and the installment or installments so prorated shall be paid in advance. The payment for such prorated month shall be calculated by multiplying the monthly installment by a fraction, the numerator of which shall be the number of days of the Term occurring during said commencement or termination month, as the case may be, and the denominator of which shall be the total number of days occurring in said commencement or termination month.

SEC. 7. ADDITIONAL RENT:

A. As part of the consideration for the execution of this Lease Agreement, and in addition to the Base Rent specified above, Tenant covenants and agrees to pay, for each calendar year beginning on the first (1st) day of the fifth (5th) month after the Effective Date, as additional rent (the “Additional Rent”), Tenant’s pro rata share of the Operating Expenses (as hereinafter defined) for that year. Tenant’s pro rata share shall be a fraction, the numerator of which is the Net Rentable Area in the Leased Premises and the denominator of which is the Net Rentable Area in the Building.

B. All Operating Expenses shall be determined in accordance with generally accepted accounting principles, consistently applied and shall be computed on the accrual basis. The term “Operating Expenses” as used herein shall mean all expenses, costs and disbursements in connection with the ownership, operation, maintenance and repair of the Building, the Land, related pedestrian walkways, landscaping, fountains, roadways and parking facilities (including the Building Basement and the Garage) (the Building, the Land and said additional facilities being hereinafter sometimes referred to as the “Complex”), including but not limited to the following:

|

|

(1) |

Wages and salaries of the dedicated on-site personnel of any management company engaged to manage the Complex and of all employees engaged in the operation, security, cleaning and maintenance of the Complex, including customary taxes, insurance and benefits relating thereto. |

|

|

(2) |

All supplies, tools, equipment and materials used in operation and maintenance of the Complex. |

4

|

|

(3) |

Cost of all utilities for the Complex, including but not limited to the costs of water and power, heating, lighting, air conditioning and ventilation. |

|

|

(4) |

Cost of all janitorial service, maintenance and service agreements for the Complex and the equipment therein, including alarm service, security service, window cleaning, janitorial service and elevator maintenance. |

|

|

(5) |

Cost of all insurance relating to the Complex which Landlord may elect to obtain, including but not limited to casualty and liability insurance applicable to the Complex and Landlord’s personal property used in connection therewith; provided that such insurance is comparable to insurance maintained by landlords of comparable buildings or is otherwise required by Landlord’s Mortgagee. |

|

|

(6) |

All taxes and assessments and other governmental charges whether federal, state, county or municipal and whether they be by taxing districts or authorities presently taxing the Leased Premises or by others subsequently created or otherwise, and any other taxes and improvement assessments attributable to the Complex or its operation excluding, however, federal and state taxes on income; provided, however, that if at any time during the Term, the present method of taxation or assessment shall be so changed that the whole or any part of the taxes, assessments, levies, impositions or charges now levied, assessed or imposed on real estate and the improvements thereof shall be discontinued and as a substitute therefor, or in lieu of an addition thereto, taxes, assessments, levies, impositions or charges shall be levied, assessed and/or imposed wholly or partially as a capital levy or otherwise on the rents received from the Complex or the rents reserved herein or any part thereof, then such substitute or additional taxes, assessments, levies, impositions or charges, to the extent so levied, assessed or imposed, shall be deemed to be included within Operating Expenses to the extent that such substitute or additional tax would be payable if the Complex were the only property of the Landlord subject to such tax. It is agreed that Tenant will be responsible for ad valorem taxes on its personal property and on the value of leasehold improvements to the extent that the same exceed standard building allowance. |

|

|

(7) |

Amortization of the cost of installation of capital investment items that are hereafter installed for the purpose of reducing Operating Expenses to the extent of any such reduction or which may be required by any laws, ordinances, orders, rules, regulations and requirements hereafter enacted which impose any duty with respect to or otherwise relate to the use, condition, occupancy, maintenance or alteration of the Complex. All such costs which relate to the installation of such capital investment items shall be amortized over the reasonable life of the capital investment item, with the reasonable life and amortization schedule being determined in accordance with generally accepted accounting principles. |

|

|

(8) |

The property management fees incurred by Landlord and the office expenses for Landlord’s on site office not to exceed three percent (3%) of gross rentals receipts from the Building. |

|

|

(9) |

Cost of repairs and general maintenance (excluding repairs and general maintenance paid by proceeds of insurance or by Tenant or other third parties) for the Complex. |

C. Notwithstanding anything to the contrary set forth in this Lease, in no event, however, shall Operating Expenses include any of the following:

|

|

(1) |

all costs and expenses of leasing space in the Complex, including advertising, promotion, other marketing, commissions, legal fees, allowances, and all costs and expenses of any demolition in, painting, carpeting, or refurbishing of, or alterations or improvements to, any leasable space made for any tenant or occupant or to enhance the marketability thereof or prepare the same for leasing; |

|

|

(2) |

all costs and expenses of providing any above-standard service to any tenant or occupant of, or to any leasable space in, the Building or the Complex, e.g. overtime HVAC, supplemental chilled or condenser water, extra-cleaning, or overtime elevator service, or any other service (or level or amount of any such service) in excess of that required by this Lease to be provided to Tenant free of separate or additional charge; |

|

|

(3) |

any electricity that is above-standard and/or separately metered for any leasable space in the Building (unless electricity is required to be furnished to Tenant free of separate or additional charge); |

5

|

|

(5) |

all costs and expenses arising out of (i) any violation of any law or legal requirement, (ii) any violation or breach of any lease of space in the Building or the Complex, or (iii) other breach of contract; |

|

|

(6) |

ground lease rents; |

|

|

(7) |

except as expressly permitted in Section 7(B) above, depreciation, amortization and debt service and other financing expenses; |

|

|

(8) |

labor costs for personnel above the grade of building manager; all labor costs allocable to any part of an employee’s time during which such employee is not engaged in the operation and maintenance of the Building; |

|

|

(9) |

any amount paid or incurred to any affiliate of Landlord or of any of its agents, in excess of the amount which would have been paid or incurred on an open market basis in the absence of such affiliation; |

|

|

(10) |

general corporate overhead of Landlord or of any of its agents; |

|

|

(11) |

any management fee in excess of that which would have been charged by a reputable unaffiliated management company; and any costs and expenses which, if the Building or the Complex had been managed by such a company being paid such a fee, would have been customarily borne by such company without separate reimbursement; |

|

|

(12) |

costs and expenses of any special events (e.g. receptions, concerts) for which Landlord charges a fee or receives income; |

|

|

(13) |

legal, architectural, engineering, accounting and other professional fees; |

|

|

(14) |

costs and expenses attributable to any hazardous wastes, substances, or materials or any testing, investigation, management, maintenance, remediation, or removal thereof; |

|

|

(15) |

charitable or political contributions; |

|

|

(16) |

costs and expenses arising out of any latent defects in the Building, or the correction thereof; |

|

|

(17) |

the costs of acquisition of all sculptures, paintings, and other works of art; |

|

|

(18) |

any other cost or expense not attributable to the operation, maintenance, replacement, repair and management of the Complex. |

D. If the Term of this Lease Agreement commences or terminates on other than the first day of a calendar year, Tenant’s Additional Rent shall be prorated for such commencement or termination year, as the case may be, by multiplying each by a fraction, the numerator of which shall be the number of days of the Term during the commencement or termination year, as the case may be, and the denominator of which shall be 365, and such calculation shall be made as soon as reasonably possible after the termination of this Lease Agreement, Landlord and Tenant hereby agreeing that the provisions relating to said calculation shall survive the termination of this Lease Agreement.

E. On or about January 1 of each calendar year during the Term, Landlord shall deliver to Tenant Landlord’s good faith estimate (the “Estimated Additional Rent”) of Tenant’s Additional Rent for such year. The Estimated Additional Rent shall be paid in equal installments in advance on the first day of each month. If Landlord does not deliver an estimate to Tenant for any year by January 1 of that year, Tenant shall continue to pay Estimated Additional Rent based on the prior year’s estimate. From time to time during any calendar year, Landlord may revise its estimate of the Additional Rent for that year based on either actual or reasonably anticipated increases in Operating Expenses, and the monthly installments of Estimated Additional Rent shall be appropriately adjusted for the remainder of that year in accordance with the revised estimate so that by the end of the year, the total payments of Estimated Additional Rent paid by Tenant shall equal the amount of the revised estimate.

6

F. Within one hundred fifty (150) days after the end of each calendar year during the Term, or as soon as reasonably practicable thereafter, Landlord shall provide Tenant a statement showing the Operating Expenses for said calendar year, prepared in accordance with generally accepted accounting practices, and a statement prepared by Landlord comparing Estimated Additional Rent paid by Tenant with actual Additional Rent (the “Year-End Statement”). If the Estimated Additional Rent paid by Tenant, if any, exceeds the actual Additional Rent for said calendar year, Landlord shall pay Tenant an amount equal to such excess at Landlord’s option, by either giving a credit against rentals next due, if any, or by direct payment to Tenant within thirty (30) days of the date of such statement. If the actual Additional Rent exceeds Estimated Additional Rent for said calendar year, Tenant shall pay the difference to Landlord within thirty (30) days of receipt of the statement. The provisions of this paragraph shall survive the expiration or termination of this Lease Agreement. The Base Rent, Additional Rent and all other sums of money that become due and payable under this Lease Agreement shall collectively be referred to as “Rent”.

G. Notwithstanding any other provision herein to the contrary, it is agreed that if less than ninety-five percent (95%) of the Net Rentable Area of the Building is occupied during any calendar year or if less than ninety-five percent (95%) of the Net Rentable Area of the Building is not provided with Building standard services during any calendar year, an adjustment shall be made in computing each component of the Operating Expenses for that year which varies with the rate of occupancy of the Building (such as, but not limited to, utility costs, management fees and janitorial costs) so that the total Operating Expenses shall be computed for such year as though the Building had been ninety-five percent (95%) occupied during such year and as though ninety-five percent (95%) of the Building had been provided with Building standard services during that year.

H. Notwithstanding any other provision herein to the contrary, beginning after the expiration of the first Lease year, Operating Expenses (other than Uncontrollable Expenses) will not increase in any Lease year thereafter by more than five percent (5%) of Tenant’s pro rata share of Operating Expenses for the previous full Lease year on a cumulative basis for any two (2) consecutive lease year period (otherwise such cap shall be on a non-cumulative basis). “Uncontrollable Expenses” shall mean personal property taxes, general and special assessments levied by any governmental authority, insurance premiums, utility costs, costs incurred in complying with any law enacted after the Commencement Date, wages and salaries affected by the minimum wage and other costs beyond the reasonable control of Landlord to the extent generally recognized by landlords of comparable buildings as uncontrollable expenses.

I. All Additional Rent shall be paid by Tenant to Landlord contemporaneously with the required payment of Base Rent on the first day of each calendar month, monthly in advance, for each month of the Term, in lawful money of the United States at the address specified in Section 32 below (or such other address as may be designated by Landlord in writing from time to time). No payment by Tenant or receipt by Landlord of an amount less than the amount of Rent herein stipulated to be paid shall be deemed to be other than on account of the stipulated Rent, nor shall any endorsement on any check or any letter accompanying such payment of Rent be deemed an accord and satisfaction, but Landlord may accept such payment without prejudice to his rights to collect the balance of such Rent.

J. Landlord shall maintain in an orderly manner all of its books and records (collectively, the “Records”) pertaining to Operating Expenses for a period of one (1) year after the completion of the calendar year to which such costs were incurred. Landlord shall maintain such records on a current basis, in a mam1er consistent with the provisions of this Lease and in sufficient detail to facilitate, at Tenant’s expense, Tenant’s audit, review and photocopying thereof. Upon reasonable prior notice to Landlord (which shall not be less than ten (10) days prior notice) on or before the earlier of (i) nine (9) months after the end of any calendar year or (ii) three (3) months after receiving a bill for any Operating Expenses applicable to a prior calendar year, the Records shall, during Landlord’s regular business hours at times mutually acceptable to Landlord and Tenant at the office of Landlord or its managing agent, be made available to Tenant, Tenant’s internal auditing personnel and/or an independent auditor selected by Tenant for purposes of auditing, reviewing and photocopying the Records. If Tenant disputes any Year-End Statement and such dispute is not settled by Landlord and Tenant within thirty (30) days after the same arises, or such longer period to which they may mutually agree, such dispute may, at the option of either party, be submitted to arbitration in accordance with Section 37 of this Lease. Pending the determination of any such dispute by agreement, arbitration or otherwise, Tenant shall pay the amounts due (if any) pursuant to the applicable Year-End Statement, and any such payment shall be without prejudice to Tenant’s position. If the dispute shall be determined in Tenant’s favor, then Landlord, within ten (10) days after such determination, shall refund to Tenant the amount of Tenant’s overpayment of the Operating Expenses resulting from compliance with the Year-End Statement; and if it is determined that Tenant underpaid, Tenant shall pay Landlord the amount of Tenant’s underpayment within ten (10) days after such determination. Notwithstanding the foregoing, if Tenant’s pro rata share of Operating Expenses for the year in question were less than stated by more than five percent (5%), Landlord, within thirty (30) days after its receipt of paid invoices therefor from Tenant, shall reimburse Tenant for the reasonable amounts on a non-contingent fee basis paid by Tenant to third parties in connection with such audit by Tenant, such amounts not to exceed $3,000.00. In connection with its audit rights hereunder, Tenant agrees that (i) it will not employ any auditor, accounting firm or consultant who is to be compensated in whole or in part, on a contingency fee basis; (ii) such auditory, accounting firm or consultant will affirmatively covenant in writing to Landlord that it will not solicit or contact engagements from other tenants of the Building in addition to the confidentiality agreement required below; (iii) all copies of Landlord’s records shall be made at Tenant’s or such auditor’s reasonable expense and Landlord shall only be obligated to provide the reasonable, non-exclusive use of its copier(s) to such auditor; and (iv) Tenant may not assign any claim it might have against Landlord to such auditor or any third party.

7

In connection with any such audit or review, Tenant and such accountants shall execute and deliver to Landlord a confidentiality agreement, in form and substance reasonably satisfactory to Landlord, Tenant and Tenant’s accountants, whereby such parties agree not to disclose to any third party any of the information obtained in connection with such review except to its or their officers, directors, employees, agents, advisors, consultants or attorneys on a “need to know” basis or as otherwise required by law or as required in connection with any litigation.

SEC.8. SERVICE AND UTILITIES:

A. Landlord shall furnish the following services and amenities (collectively, the “Required Services”) to Tenant (and its assignees and sublessees permitted hereunder) while occupying the Leased Premises:

|

|

(1) |

At all times, domestic water at those points of supply provided for general use of the tenants of the Building; |

|

|

(2) |

Electric lighting service, central heat, ventilation and air conditioning to the Leased Premises twenty-four (24) hours a day, seven (7) days a week, for the comfortable occupancy of the Leased Premises for Tenant’s purposes; |

|

|

(3) |

From 7:00 a.m. to 6:00 p.m. Monday through Friday, and 8:00 a.m. to 12:00 p.m. Saturdays (“Business Hours”), but not on New Year’s Day (January 1st), Memorial Day, July 4th, Labor Day, Thanksgiving, the Friday following Thanksgiving and Christmas (December 25th), electric lighting service, central heat, ventilation and air conditioning for all public areas and special service areas of the Building. Notwithstanding the foregoing, Landlord shall provide electric lighting service, central heat, ventilation and air conditioning to the lobby of the Building twenty-four (24) hours a day, seven (7) days a week; |

|

|

(4) |

Janitor service on a five (5) day week basis, in the manner and to the extent deemed standard by Landlord during the periods and hours as such services are normally furnished to all tenants in the Building; |

|

|

(5) |

At all times, on-site security personnel and equipment for the Building; provided, however, that Tenant agrees that Landlord shall not be responsible for the adequacy or effectiveness of such security; |

|

|

(6) |

Twenty-four (24) hours a day, seven (7) days a week, electrical facilities to furnish (i) power to operate typewriters, personal computers, calculating machines, photocopying machines and other equipment that operates on 120/208 volts (collectively, the “Low Power Equipment”); provided, however, total rated connected load by the Low Power Equipment shall not exceed an average of five (5) watts per square foot of Net Rentable Area of the Leased Premises and (ii) power to operate Tenant’s lighting and Tenant’s equipment that operates on 277/480 volts (collectively, the “High Power Equipment”); provided, however, total rated connected load by the High Power Equipment shall not exceed an average of two (2) watts per square foot of Net Rentable Area of the Leased Premises. In the event that the Tenant’s connected loads for low electrical consumption (120/208 volts) and high electrical consumption (277/480 volts) are in excess of those loads stated above, and Landlord agrees to provide such additional load capacities to Tenant (such determination to be made by Landlord in its sole discretion), then Landlord may install and maintain, at Tenant’s expense, electrical submeters, wiring, risers, transformers, and electrical panels, and other items required by Landlord, in Landlord’s discretion, to accommodate Tenant’s design loads and capacities that exceed those loads stated above, including, without limitation, the installation and maintenance thereof. If Tenant shall consume electrical current in excess of 0.75 kilowatt hours per square foot of Net Rentable Area in the Leased Premises per month, Tenant shall pay to Landlord the actual costs to Landlord to provide such additional consumption as Additional Rent. Landlord may determine the amount of such additional consumption and potential consumption by either or both: (1) a survey of standard or average tenant usage of electricity or other utilities in the Building performed by a reputable consultant selected by Landlord and paid for by Tenant; or (2) a separate meter in the Leased Premises installed, maintained, and read by Landlord at Tenant’s expense. If any supplemental heating, ventilation and air-conditioning unit is installed in the Leased Premises or serves the Leased Premises (the “Supplemental HVAC Equipment”), Landlord shall install and maintain electrical submeters, at Tenant’s expense, to monitor Tenant’s actual aggregate consumption of electrical power by the Supplemental HVAC Equipment. Tenant shall reimburse Landlord for such consumption as billed as Additional Rent, based on average kilowatt hour or other unit charge over the applicable billing period within thirty (30) days after such billing. |

|

|

(7) |

All Building standard fluorescent bulb replacement in all areas and all incandescent bulb replacement in public areas outside of the Leased Premises, rest rooms and stairwells; and |

8

|

|

(8) |

Non-exclusive passenger elevator service to the Leased Premises at all times and non-exclusive freight elevator service during Business Hours. |

B. Landlord shall have the right to install an electric current meter, sub-meter or check meter in the Leased Premises or portion thereof, as the case may be, (a “Meter”) to measure the amount of electric current consumed in the Leased Premises. The cost of such Meter, special conduits, wiring and panels needed in connection therewith and the installation, maintenance and repair thereof shall be paid by Tenant. Tenant shall pay the utility provider directly for submetered electricity including any taxes and other charges in connection therewith. The parties acknowledge that a portion of the first floor of the Building consisting of approximately 4,889 square feet of Net Rentable Area is leased by Landlord to another tenant. The electrical current consumed by such tenant shall be billed to Tenant as a result of the installation of the Meter. Therefore, Landlord hereby agrees to reimburse Tenant a pro rata portion of Tenant’s electrical bill based on a fraction, the numerator of which is 4,889 and the denominator of which is 69,050, within ten (10) days after receipt of an invoice for same and a copy of such bill.

C. No intem1ption or malfunction of any of such services unless due to Landlord’s non-payment shall constitute an eviction or disturbance of Tenant’s use and possession of the Leased Premises or Building or a breach by Landlord of any of its obligations hereunder or render Landlord liable for damages or entitle Tenant to be relieved from any of its obligations hereunder (including the obligation to pay rent) or grant Tenant any right of set-off or recoupment unless it continues beyond three (3) consecutive business days. In such case, to the extent the Leased Premises or any portion thereof is untenantable, Tenant shall receive an abatement of Rent and all other charges payable hereunder on a per diem basis, commencing on the fourth (4th) business day and continuing until such services are restored and if such interruption continues for more than forty-five (45) consecutive days Tenant may terminate this Lease. In the event less than the entire Leased Premises is subject to such service interruption, the amount of abatement of Rent and other charges Tenant is entitled to receive shall be prorated based upon the percentage of the Leased Premises subject to the service interruption and in which Tenant ceases to operate as a result thereof. In the event of any such interruption within Landlord’s reasonable control, however, Landlord shall use reasonable diligence to restore such service.

SEC. 9. MAINTENANCE, REPAIRS AND USE:

A. Landlord shall provide for the cleaning and maintenance of the Common Areas of the Building as may be required by normal maintenance operations which shall include painting and landscaping surrounding the Building, repairs to the exterior walls, corridors, windows, roof and other structural elements and equipment of the Building, and such additional maintenance as may be necessary because of damages by persons other than Tenant, its agents, employees, invitees, visitors or licensees.

B. Landlord, upon not less than twenty-four (24) hour prior written notice (except in the event of an emergency in which case only such notice as is practicable under the circumstances shall be required), shall have the right to enter the Leased Premises at reasonable hours for the purpose of (i) inspecting the Leased Premises, (ii) making repairs to the Leased Premises permitted or required hereunder, or performing restoration thereof, and (iv) performing the services to be performed by Landlord under this Lease and Tenant shall not be entitled to any abatement or reduction of Rent by reason thereof.

C. Landlord may, at its option and at the cost and expenses of Tenant, repair or replace any damage or injury done to the Complex or any part thereof, caused by Tenant, Tenant’s agents, employees, licensees, invitees or visitors; Tenant shall pay the cost thereof to Landlord within ten (10) days after receipt of written request for same along with evidence substantiating such cost. Tenant agrees to maintain and keep the interior of the Leased Premises in good repair and condition at Tenant’s expense. Tenant agrees not to commit or allow any waste or damage to be committed on any portion of the Leased Premises, and at the termination of this Lease Agreement, by lapse of time or otherwise, to deliver up the Leased Premises to Landlord in broom-clean condition, and upon such termination of this Lease Agreement, Landlord shall have the right to re-enter and resume possession of the Leased Premises.

D. Tenant will not use, occupy or permit the use or occupancy of the Leased Premises for any purpose which is forbidden by law, ordinance or governmental or municipal regulation or order, or permit the maintenance of any public or private nuisance; or keep any substance or carry on or permit any operation which might emit offensive odors or conditions into other portions of the Complex; or permit anything to be done which would increase the fire and extended coverage insurance rate on the Building or contents and if there is any increase in such rates by reason of acts of Tenant, then Tenant agrees to pay such increase promptly upon demand therefor by Landlord.

SEC. 10. QUIET ENJOYMENT:

A. Tenant, on paying the said Rent and performing the covenants herein agreed to be by it performed, shall and may peaceably and quietly have, hold and enjoy the Leased Premises for the said Term.

9

B. Notwithstanding anything herein to the contrary, Landlord hereby expressly reserves the right in its sole discretion to (i) temporarily or permanently change the location of, close, block or otherwise alter any streets, driveways, entrances, corridors, doorways or walkways leading to or providing access to the Building or any part thereof or otherwise restrict the use of same provided such activities do not unreasonably impair Tenant’s access to or use of the Leased Premises, (ii) improve, remodel, add additional floors to or otherwise alter the Building provided such activities do not unreasonably impair Tenant’s access to or use of the Leased Premises, (iii) construct, alter, remodel or repair one or more parking facilities (including garages) on the Land provided such activities do not unreasonably impair Tenant’s access to or use of the Leased Premises, and (iv) convey, transfer or dedicate portions of the Land. In addition, Landlord shall have the right, in its sole discretion, at any time during the Term to attach to any or all of the Building windows a glazing, coating or film or to install storm windows for the purpose of improving the Building’s energy efficiency. Tenant shall not remove, alter or disturb any such glazing, coating or film. The addition of such glazing, coating or film, or the installation of storm windows or the exercise of any of Landlord’s rights pursuant to this Section 10, shall in no way reduce Tenant’s obligations under this Lease Agreement or impose any liability on Landlord and it is agreed that Landlord shall not incur any liability whatsoever to Tenant as a consequence thereof and such activities shall not be deemed to be a breach of any of Landlord’s obligations hereunder. Any diminution or shutting off of light, air or view by any structure which is now or may hereafter be affected on lands adjacent to the Building shall in no way affect this Lease Agreement or impose any liability on Landlord. Noise, dust or vibration or other incidents to new construction of improvements on lands adjacent to the Building, whether or not owned by Landlord, or on the Land shall in no way affect this Lease Agreement or impose any liability on Landlord. Landlord shall use commercially reasonable efforts to minimize any such noise, dust or vibration and to cause vibrations to occur during non-business hours. Tenant agrees to cooperate with Landlord in furtherance of Landlord’s exercise of any of the rights specified in this Section 10. Landlord agrees to notify Tenant within a reasonable time in advance of any alterations, modifications or other actions of Landlord under this Section 10 and all such activities shall be conducted in a manner which does not unreasonably interfere with Tenant’s use of the Leased Premises.

SEC. 11. ALTERATIONS:

A. Tenant shall not make any alterations to the Leased Premises or the Building without first obtaining the written consent of Landlord in each such instance, which consent shall not be unreasonably withheld so long as such alteration (i) would not have an adverse affect on the Building structure or the Building systems or otherwise affect the elevator lobbies or restrooms, (ii) would not affect the exterior appearance of the Building, (iii) comply with all applicable laws, and (iv) would not interfere with another occupant’s normal and customary business operations. Notwithstanding the foregoing, Landlord’s consent shall not be required for any alteration (each, a “Permitted Alteration”) that (i) is limited to the interior of the Leased Premises and the cost of such alteration does not exceed $100,000.00; and (ii) does not adversely affect the structure of the Building or the Building systems. All alterations made by Tenant shall (unless expressly provided to the contrary in this Lease) be made at Tenant’s sole cost and expense (including all expenses for obtaining any required governmental permits and approvals). Landlord hereby agrees that it shall not unreasonably withhold its consent in the event that Tenant desires, at Tenant’s sole cost and expense, to replace the northwest elevator with an elevator of a size typically used in hospitals.

B. Prior to commencing any alteration, Tenant shall give notice (each, an “Alteration Notice”) to Landlord thereof, and, to the extent that good construction practice requires plans and specifications to be prepared with respect to such alteration, such notice shall be accompanied by a copy of such plans and specifications. In the case of any alteration that is not a Permitted Alteration (each, a “Material Alteration”), Landlord, within ten (10) days after its receipt of such notice, shall either (i) give its written consent to such Material Alteration, or (ii) deny its consent and request revisions or modifications to such Material Alteration. If (x) Landlord so denies its consent and requests such revisions or modifications, and (y) Tenant wishes to pursue such Material Alteration, then Tenant shall submit such revisions or modifications to Landlord. Within seven (7) days following receipt by Landlord of such revisions or modifications, Landlord shall give its written consent thereto or shall request other revisions or modifications therein (but relating only to the extent Tenant has failed to comply with Landlord’s earlier requests). The preceding two sentences shall be implemented repeatedly until Landlord gives its written consent to the Material Alteration in question. If (i) Landlord fails to deny its consent to a Material Alteration in a writing that sets forth the reasons for such denial within the aforesaid 10-day period, or (ii) Landlord fails to deny its consent to such a revision or modification of a Material Alteration in a writing that sets forth the reasons for such denial within the aforesaid 7-day period, then Tenant shall submit a second notice to Landlord, and if Landlord fails to respond to such second notice within seven (7) days following receipt thereof by Landlord, Landlord shall be deemed to have consented to such Material Alteration or such revision or modification, as the case may be. Any dispute as to whether Landlord’s denial of consent to a Material Alteration was proper shall be determined by arbitration in accordance with Section 37 below. Landlord’s approval of Tenant’s plans and specifications for any work performed for or on behalf of Tenant shall not be deemed to be a representation by Landlord that such plans and specifications comply with applicable insurance requirements, building codes, ordinances, laws or regulations or that the alterations, additions and improvements constructed in accordance with such plans and specifications will be adequate for Tenant’s use. Tenant shall indemnify, defend (with counsel reasonably acceptable to Landlord) and hold harmless the Landlord Parties from and against all costs (including attorneys’ fees and costs of suit), losses, liabilities, or causes of action arising

10

out of or relating to any alterations, additions or improvements made by Tenant to the Leased Premises, including but not limited to any mechanics’ or materialmen’s liens asserted in connection therewith.

C. Tenant shall perform all Tenant alterations with contractors and subcontractors approved by Landlord, such approval not to be unreasonably withheld, conditioned or delayed.

D. Landlord, upon Tenant’s written request, shall (at no expense to Landlord) furnish or execute promptly any documents, information, consents or other materials which are necessary in connection with Tenant’s efforts to obtain any license or permit for the making of any approved or Material Alteration. Prior to commencement of construction of any alterations, Tenant shall deliver to Landlord the building permit, a copy of the executed construction contract covering the alterations, in each case to the extent applicable, and evidence of contractor’s and subcontractor’s insurance, such insurance being with such companies, for such periods and in such amounts as Landlord may reasonably require, naming the Landlord Parties as additional insureds. Tenant shall pay to Landlord within ten (10) days after receipt of written request along with evidence substantiating such cost, a review fee in the amount of Landlord’s actual reasonable professional costs incurred to compensate Landlord for the cost of review and approval of the plans and specifications to the extent applicable. Tenant shall deliver to Landlord a copy of the “as-built” plans and specifications for all alterations or physical additions so made in or to the Leased Premises to the extent applicable, and shall reimburse Landlord for the cost incurred by Landlord to update its current architectural plans for the Building to the extent applicable.

E. Tenant shall not be deemed to be the agent or representative of Landlord in making any such alterations, physical additions or improvements to the Leased Premises, and shall have no right, power or authority to encumber any interest in the Complex in connection therewith other than Tenant’s leasehold estate under this Lease Agreement. However, should any mechanics’ or other liens be filed against any portion of the Complex or any interest therein (other than Tenant’s leasehold estate hereunder) by reason of Tenant’s acts or omissions or because of a claim against Tenant or its contractors, Tenant shall cause the same to be canceled or discharged of record by bond or otherwise within twenty (20) days after notice by Landlord. If Tenant shall fail to cancel or discharge said lien or liens, within said twenty (20) day period, which failure shall be deemed to be a default hereunder, Landlord may, at its sole option and in addition to any other remedy of Landlord hereunder, cancel or discharge the same and upon Landlord’s demand, Tenant shall promptly reimburse Landlord for all costs incurred in canceling or discharging such lien or liens.

F. Tenant shall cause all alterations, physical additions, and improvements (including fixtures), constructed or installed in the Leased Premises by or on behalf of Tenant to comply with all applicable governmental codes, ordinances, rules, regulations and laws. Tenant acknowledges and agrees that neither Landlord’s review and approval of Tenant’s plans and specifications nor its observation or supervision of the construction or installation thereof shall constitute any warranty or agreement by Landlord that same comply with such codes, ordinances, rules, regulations and laws.

G. Tenant shall be wholly responsible for any accommodations or alterations that are required by applicable governmental codes, ordinances, rules, regulations and laws to be made to the Leased Premises to accommodate disabled employees and customers of Tenant, including, without limitation, compliance with the Americans with Disabilities Act (42 U.S.C. §§ 12101 et seq.) and the Texas Architectural Barriers Act (Tex.Rev.Civ.Stat. Art 9201) (collectively, the “Accommodation Laws”). Except to the extent provided below, Landlord shall be responsible for making all accommodations and alterations to the Common Areas of the Building necessary to comply with the Accommodation Laws. Notwithstanding the foregoing, Landlord may perform, at Tenant’s sole cost and expense, any accommodations or alterations that are required by the Accommodation Laws to any area outside of the Leased Premises which are triggered by any alterations or additions to the Leased Premises or Tenant’s use of the Leased Premises. Landlord represents and warrants that as of the date hereof, the Building complies with all Accommodation Laws and all other applicable governmental codes, ordinances, rules, regulations and laws.

SEC. 12. FURNITURE, FIXTURES AND PERSONAL PROPERTY: Tenant may remove its trade fixtures, office supplies and movable office furniture and equipment not attached to the Building provided: (a) such removal is made prior to the termination of this Lease Agreement; and (b) Tenant promptly repairs all damage caused by such removal. All other property at the Leased Premises and any alterations or additions to the Leased Premises (including wall-to-wall carpeting, paneling or other wall covering) and any other article attached or affixed to the floor, wall or ceiling of the Leased Premises shall become the property of Landlord and shall remain upon and be surrendered with the Leased Premises as a part thereof at the termination of the Lease Agreement by lapse of time or otherwise, Tenant hereby waiving all rights to any payment or compensation therefor. If, however, Landlord so requests in writing prior to the installation of any alteration, addition, fixture, equipment or property (other than those initially installed by Tenant pursuant to Exhibit “G” attached hereto), Tenant will, prior to termination of this Lease Agreement, remove any and all alterations, additions, fixtures, equipment and property placed or installed by Tenant in the Leased Premises and will repair any damage caused by such removal. In addition, Tenant shall be required prior to the termination of this Lease Agreement to remove all of its telecommunications equipment, including, but not limited to, all switches, cabling, wiring, conduit, racks and boards, whether located in the Leased Premises or in the Common Areas. If Tenant does not complete all removals prior to the termination of this Lease

11

Agreement, Landlord may remove such items (or contract for the removal of such items) and Tenant shall reimburse Landlord upon demand for the costs incurred by Landlord in connection therewith.

SEC.13. SUBLETTING AND ASSIGNMENT:

A. Except as otherwise set forth herein, Tenant will not assign this Lease or sublease the Leased Premises or any part thereof or mortgage, pledge and or hypothecate its leasehold interest or grant any concession or license within (or otherwise permit a third party to occupy any portion of) the Leased Premises without the prior express written consent of Landlord, and any attempt to do any of the foregoing without Landlord’s consent shall be void except as specified herein. Any transfer of the majority of the beneficial ownership interest of Tenant (whether stock, partnership interest or otherwise), shall constitute an assignment for purposes of this Lease.

B. Notwithstanding the above, Landlord shall not unreasonably withhold Landlord’s consent to any proposed assignment or subletting by Tenant. Without purporting to limit the circumstances in which it would be reasonable for Landlord to withhold its consent to a proposed assignment or subletting, it shall be deemed reasonable for Landlord to withhold its consent to a proposed assignment or subletting if: (a) the proposed assignee or sublessee does not, in Landlord’s reasonable judgment, possess sufficient financial capability to satisfy the obligations of Tenant hereunder; or (b) the proposed assignee or sublessee proposes to use the Leased Premises for a use other than the Permitted Use; or (c) the nature or identity of such proposed assignee or sublessee would not be in keeping with the type of tenants that are customarily found in comparable projects; or (d) the proposed assignee or sublessee) is a department, representative or agency of any governmental body or then an occupant of any part of the Building or a party with whom Landlord is then negotiating to lease space in the Building or in any adjacent Building owned by Landlord or an affiliate of Landlord, (e) the proposed occupancy would (1) materially increase the office cleaning requirements, (2) impose an extra material burden upon the services to be supplied by Landlord to Tenant hereunder, (3) violate the current rules and regulations of the Building, (4) violate the provisions of any other leases of tenants in the Building or (5) cause material alterations or additions to be made to the Building (excluding the Leased Premises). Landlord shall approve or disapprove a proposed assignment or subletting within twenty (20) days after Landlord’s receipt of a request for approval of an assignment or sublease accompanied by the terms of the proposed assignment or subletting and identity of the proposed assignee or sublessee. If Landlord fails to approve or disapprove any proposed sublease or assignment within such twenty (20) day period, then such proposed sublease or assignment shall be deemed approved.

C. Notwithstanding the foregoing, Landlord’s consent to an assignment or subletting shall not be required if the assignee or subtenant is (a) an “affiliate” (as defined below) of the Tenant, (b) an entity resulting from a merger, consolidation, reorganization or recapitalization of or with Tenant or a purchaser (or other transferee) of all or substantially all of Tenant’s assets and all or substantially all of such Tenant’s liabilities (including the liabilities of Tenant hereunder), so long as the net worth of the resulting entity is equal to or greater than the net worth of the Tenant as of the Effective Date and the assignee agrees to be bound by the terms of this Lease, (c) a third party provider of services incidental to Tenant’s use of the Leased Premises for the Permitted Use so long as such third party’s net worth is equal to or greater than Tenant’s net worth as of the Effective Date, (d) an entity that proposes to use the Leased Premises for the Permitted Use, so long as the net worth of such entity is equal to or greater than Tenant as of the date hereof and as of the Effective Date, or (e) an entity that has a net worth greater than Tenant’s net worth as of the Effective Date and that has entered into a service agreement with Tenant pursuant to the terms of which (i) such entity will provide clinical services for the operation of a medical psychiatric ward in the Leased Premises, (ii) all medical/psychiatric activities will be conducted under Tenant’s hospital license and (iii) all medical/psychiatric patients will be admitted and discharged through Tenant’s general care hospital (each, a “Permitted Transfer”). For purposes hereof, the term “affiliate” means any person or entity means which controls, is controlled by or is under common control with Tenant, including, without limitation, any limited partnership in which Tenant is the general partner. For purposes of the preceding sentence, “control” means either (i) ownership or voting control, directly or indirectly, of 50% or more of the voting stock, partnership interests or other beneficial ownership interests of the entity in question or (ii) the power to direct the management and policies of such entity. Tenant shall give Landlord written notice prior to any such assignment or subletting together with proof reasonably satisfactory to Landlord that the transferee is a permitted transferee as herein described along with a fully executed copy of an instrument approved by Landlord whereby such assignee or sublessee agrees in writing to assume and fully perform and observe the obligations and agreements of Tenant under this Lease Agreement.

D. Notwithstanding any consent by Landlord pursuant to this Section 13, the undersigned Tenant will remain liable (along with each approved assignee who shall automatically become liable for all obligations of Tenant hereunder) and Landlord shall be permitted to enforce the provisions of this instrument directly against the undersigned Tenant and/or any assignee without proceeding in any way against any other person.

E. Any consent by Landlord to a particular assignment or sublease shall not constitute Landlord’s consent to any other or subsequent assignment or sublease, and any proposed sublease or assignment by any assignee or sublessee shall be subject to the provisions of this Section 13 as if it were a proposed sublease or assignment by Tenant.

12

F. Notwithstanding anything to the contrary in this Section 13, Landlord’s consent shall not be required for Tenant to enter into a service agreement with a third party to the extent such agreement does not constitute an assignment of the Lease or a sublease of the Leased Premises.

SEC.14. FIRE AND CASUALTY:

A. If the Building shall be partially or totally damaged or destroyed by fire or other casualty, then, unless this Lease is terminated as hereinafter provided, and whether or not the damage or destruction shall have resulted from the fault or neglect of Tenant or its employees, agents, contractors or invitees, Landlord, at its sole expense to the extent insurance proceeds are made available to it (or otherwise applied by Landlord’s Mortgagee), shall perform Landlord’s Restoration Work (as hereinafter defined) with reasonable dispatch and continuity. “Landlord’s Restoration Work” shall mean all of the work necessary to repair and restore the Building (exclusive of “Tenant’s Improvements”) to substantially the same condition as that in which they were in immediately prior to the happening of the fire or other casualty. For purposes hereof, the term “Tenant Improvements” shall mean any alterations, additions or improvements performed by or on behalf of Tenant. Upon completion of Landlord’s Restoration Work, Tenant shall promptly and diligently complete the Leased Premises (and install Tenant’s fixtures, equipment and other personal property) to substantially the same condition as that in which they were immediately prior to the happening of such fire or other casualty (“Tenant’s Restoration Work”) in accordance with the provisions of this Lease and Exhibit “G” provided that Tenant shall not be entitled to Landlord’s Contribution (as defined in Exhibit “G”).

B. If the Leased Premises shall be partially damaged or destroyed or rendered untenantable or inaccessible, then the Rent and all other charges payable hereunder (including, without limitation the Operating Expenses payable hereunder) shall be abated in proportion to the area of the Leased Premises that has been rendered untenantable or inaccessible for the period from the date of such damage or destruction until the earlier of(a) one hundred fifty (150) days after the date on which Landlord’s Restoration Work is substantially completed and Tenant has reasonable access to the Leased Premises for performance of Tenant’s Restoration Work and (b) the date on which Tenant reoccupies the Leased Premises (or such portion thereof) for the nom1al conduct of its business. If the Leased Premises shall be totally damaged or destroyed or rendered untenantable or inaccessible, Rent and all other charges payable hereunder (including, without limitation the Operating Expenses payable hereunder) shall be fully abated for the period from the date of such damage or destruction until the earlier of (a) one hundred fifty (150) days after the date on which Landlord’s Restoration Work is substantially completed and Tenant has reasonable access to the Leased Premises for performance of Tenant’s Restoration Work and (b) the date on which Tenant reoccupies the Leased Premises (or such portion thereof) for the normal conduct of its business.