Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

|

|

OR

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number: 000-54918

MCORPCX, INC.

(Exact name of registrant as specified in its charter)

California

(State or other jurisdiction of incorporation or organization)

201 Spear Street, Suite 1100

San Francisco, CA 94105

(Address of principal executive offices, including zip code)

(415) 526-2655

(Registrant's telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Securities registered pursuant to section 12(g) of the Act:

|

|

NONE

|

COMMON STOCK

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X]

Indicate by check mark if the registrant is required to file reports pursuant to Section 13 or Section 15(d) of the Act: YES [X] NO [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ X ] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

[ ]

|

Accelerated Filer

|

[ ]

|

|

Non-accelerated Filer (Do not check if a smaller reporting company)

|

[ ]

|

Smaller Reporting Company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES [ ] NO [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of June 30, 2015: $0.85.

At March 30, 2016, 20,426,158 shares of the registrant's common stock were outstanding.

TABLE OF CONTENTS

|

Page

|

||

|

3

|

||

|

Business.

|

3

|

|

|

Risk Factors.

|

7

|

|

|

Unresolved Staff Comments.

|

7

|

|

|

Properties.

|

8

|

|

|

Legal Proceedings.

|

8

|

|

|

Mine Safety Disclosure.

|

8

|

|

|

8

|

||

|

Market for Our Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

|

8

|

|

|

Selected Financial Data.

|

11

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of

Operation.

|

11

|

|

|

Quantitative and Qualitative Disclosures About Market Risk.

|

18

|

|

|

Financial Statements and Supplementary Data.

|

18

|

|

|

Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

35

|

|

|

Controls and Procedures.

|

36

|

|

|

Other Information.

|

37

|

|

|

37

|

||

|

Directors, Executive Officers and Corporate Governance.

|

37

|

|

|

Executive Compensation.

|

43

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

46

|

|

|

Certain Relationships and Related Transactions, and Director Independence.

|

47

|

|

|

Principal Accountant Fees and Services.

|

49

|

|

|

50

|

||

|

Exhibits and Financial Statement Schedules.

|

50

|

|

|

53

|

||

|

54

|

||

PART I

General

McorpCX, Inc. ("we," "us," "our," the "Company" or "Touchpoint Metrics") was incorporated in the State of California on December 14, 2001. We are a customer experience (CX) management solutions company dedicated to helping organizations improve customer experiences, increase customer loyalty, reduce costs and increase revenue. The Company operated as Innes Group, Inc., dba MCorp Consulting until filing a Certificate of Amendment to its Articles of Incorporation that changed the name of the Company to Touchpoint Metrics, Inc. effective October 18, 2011. During Q1 2015, the Company filed a d/b/a (doing business as) with the State of California Secretary of State to begin doing business as McorpCX. On June 11, 2015, at the Company's Annual General Meeting, shareholders passed a resolution to change the name of the Company to McorpCX, Inc.

We are engaged in the business of developing and delivering technology-enabled products - such as Touchpoint Mapping®, an on-demand ("cloud based") suite of customer experience management software and providing value-added professional services that help large, medium and small organizations improve their customer experience management capabilities by improving their customer listening and customer experience management capabilities. Our technology is intended to enable an organization's personnel to leverage a common application to see where and how to improve their customers' experiences across multiple channels and touchpoints, including web, sales, marketing, contact center, social, mobile, physical locations and others.

Our value-added and professional services are intended to help primarily large and medium organizations plan, design and deliver better customer experiences through the analysis and review of client data gathered by our application. Other services include customer experience training, strategy consulting and business process optimization, and are directed toward increasing our customers' adoption of our products and services, helping maximize their return on investment, and improving our customers' efficiency.

We maintain our primary business address at 201 Spear Street, Suite 1100, San Francisco, CA 94105. Our telephone number is (415) 526-2655. Our registered agent for service of process is Northwest Registered Agents, Inc. Our web address is http://www. mcorp.cx. The inclusion of our internet address in this report does not include or incorporate by reference into this report any information contained on, or accessible through, our website. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, amendments to those reports and other Securities and Exchange Commission, or SEC, filings are available free of charge through our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. Additionally, copies of materials filed by us with the SEC may be accessed at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or at www.sec.gov. For information about the SEC's Public Reference Room, contact 1-800-SEC-0330.

Our common stock trades on the TSX Venture Exchange in Canada under the symbol "MCX" and on the OTCQB® Venture Marketplace in the United States under the symbol "MCCX".

Products and Services

Customer experience (CX) is defined as the sum of all experiences a customer has with a company, its goods and its services, across various touchpoints and over the duration of their relationship with that company. Customer experience management is a series of disciplines, methodologies and processes used to comprehensively understand, plan, measure and manage a customer's experiences, with the goal of improving customer perceptions. A majority of corporate executives have publicly stated that customer experience management is an important part of their organization's strategic agenda, and that it is critical to their future success. While we believe that there are multiple reasons for this, we believe that one of the most widely recognized is the ability of an improved customer experience to help an organization increase customer loyalty, better compete in otherwise commoditized businesses, and drive greater revenue.

While the customer experience management ecosystem is broad and complex, our software solutions are primarily focused on the needs of large, medium and small organizations interested in voice-of-the-customer insights, and a straightforward way to measure and improve customer experience over time. By gathering and analyzing customer experience data, our solutions help companies better understand both the positive and negative customer perceptions of customer experience and the specific interactions that drive these perceptions. Our services help primarily large and medium organizations interpret and take action on customer data, including the ability to plan, design and deliver better customer experiences.

Touchpoint Mapping® On-Demand

Our current software product is called Touchpoint Mapping® On-Demand which we released in 2013. Pricing of Touchpoint Mapping On-Demand varies based on breadth of insights sought, number of employees, number of customers and customer segments, frequency of insights gathered and other variables.

Touchpoint Mapping On-Demand is a research-based software solution designed to improve customer and employee experience, brand, and loyalty. It is meant to be a comprehensive customer experience solution for customer-centric organizations to measure and gather customer data across all their touchpoints, channels and interactions with their customers. Data is analyzed and can be displayed across multiple axes including customer segments, location, time and many other variables of interest to personnel within an organization.

Our software solution gives companies the ability to pinpoint which specific touchpoints are meeting customer wants and needs and which are not, by measuring the gap between customer expectations and the actual customer experience they receive. In addition to customer data, we can collect data from an organization's employees to identify any gaps between customer and employee perceptions of experience, and can collect data from prospective and competitors' customers to provide insight on the competitive market. Our solution also provides companies with the ability to coordinate disparate resources across the organization to develop, execute and manage their brand and customer experience strategies.

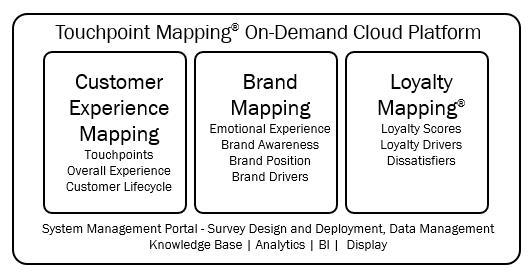

Touchpoint Mapping On-Demand is delivered through a cloud-based platform. The platform, accessible from our client portal, provides access to survey deployment, gives the ability to manage customer data and facilitates access to customer-driven business intelligence (BI) by displaying data in a series of online dashboards. Touchpoint Mapping On-Demand includes and integrates three primary measurement areas, including customer experience, mapping, brand mapping, and loyalty mapping, which are delivered through our cloud platform as illustrated below.

Customer Experience Mapping

Customer Experience Mapping measures customer experience in three areas. The first is the degree to which individual customer interactions or touchpoints meet customer wants. The second is a measure of the overall and most recent customer experiences. And the third is a measure of the customer experience across different stages of the customer relationship lifecycle.

Brand Mapping

Brand Mapping measures brand perceptions in four areas. The first area is the degree to which the brand meets the emotional needs of customers. The second is overall awareness of an organization in its respective market. The third is how an organization is perceived by customers in the context of its competitors. And the fourth is the degree to which brand drives engagement with an organization.

Loyalty Mapping®

Loyalty Mapping measures customer loyalty in four areas. The first area is through a loyalty-based customer segmentation model, segmenting customers into four groups based on degree of loyalty. The second is through loyalty metrics, such as Customer Satisfaction Score (CSAT) and Net Promoter Score (NPS®), or other loyalty metrics an organization may wish to assess. The third area is the measurement of loyalty drivers, which can include brand, individual touchpoints and other areas such as channel or overall experience. The last area is the measurement of dissatisfiers, which are aspects of the brand and the experience responsible for creating customer dissatisfaction.

Professional Services

MCorpCX, Inc. provides customer experience consulting services including customer experience management consulting in the areas of strategy development, planning, education, training and best practices, and includes the articulation of customer-centric strategies and implementation roadmaps in support of these strategies. Our software-enabled services leverage the analytical frameworks of, and in most cases the data gathered through, Touchpoint Mapping On-Demand®, with a particular focus on analytical solutions in support of customer experience improvement.

We expect that our client services managers will work to drive product adoption and value by working with Touchpoint Mapping On-Demand customers over time to identify key performance indicators as measured by our software, leverage best practices, and improve customer experience, brand and customer loyalty. We offer value-added and professional services that include custom data analysis, roadmap development, implementation planning and customer experience training, among other services.

Our Strategy

Since our founding, we have been focused on customer experience improvement. The methodologies we developed and delivered as a professional services firm since that time form the foundation for our software and software enabled services today, as well as continuing to inform the delivery of our value added and professional services. After making a decision to focus on the development of on-demand and software-enabled solutions which automated significant aspects of our business, we released the initial version of our cloud-based software, Touchpoint Mapping On-Demand, to a broader market in 2013. While professional services continue to represent a majority of our revenue, we anticipate that they will continue to migrate to a secondary – though strategically critical - focus of the company. Our belief is that a combination of growing market demand for customer experience management solutions and increasing market adoption of on-demand, cloud-based software will help to pave the way for future growth of our company through a distributed, cloud-based technology solution delivered through direct sales as well as indirect sales through a planned global partner and reseller distribution channel.

Our ability to achieve our objectives will stem in large part from our ability to successfully commercialize Touchpoint Mapping® On-Demand, the licensing and adoption of our systems and methodologies, and the development of direct and indirect sales and distribution channels through which we can distribute our products and services.

Competition

The market for customer experience management solutions is highly competitive and increasingly fragmented. It is subject to rapidly changing technology, shifting organizational priorities and requirements, frequent introductions of new products and services, and increased marketing activities of other industry participants.

Multiple competitors exist in the overlapping areas of on-demand and traditional marketing research, customer relationship management (CRM) software, management consulting and customer experience management consulting. For example, many CRM software companies are beginning to include customer experience-specific insights as adjunct capabilities to their existing platforms, and others have rebranded their existing CRM software or customer satisfaction research software as customer experience software, which has the potential to create unforeseen competitive barriers and market confusion.

Many of our current and potential competitors have a larger market presence, greater name recognition, access to more potential customers and substantially greater financial, technical, sales and marketing, management, support and other resources than we have. As a result, many of our competitors are likely able to respond more quickly than we can to new or changing opportunities and technologies, and may devote greater resources to the marketing, promotion and sale of their products than we can.

Given the growth of customer experience management as a business discipline and on-demand software as a way for companies to better understand and manage customer experiences across their business, there are likely many competitors we have not identified. Additionally, we expect that new competitors will continue to enter the customer experience management and on demand customer experience software markets with competing products and services as the market continues to rapidly develop and mature. It is possible if not likely that these new competitors could rapidly acquire significant market share.

There are many potential unforeseen and significant market and competitive risks associated our current products and services. Though we released Touchpoint Mapping® On-Demand in 2013, we cannot predict the timing or probability of generating material sales revenue from it. As of this filing, we have yet to engage the necessary sales and marketing staff or the capabilities required to identify, develop, and close material product sales opportunities, and currently lack sufficient resources to market and sell our products in the manner which we believe is required to achieve our product sales and revenue growth objectives. It is our expectation that numerous unforeseen challenges will be encountered as we continue to develop, market, distribute and sell our products and services. We cannot assure you that that we will be able to compete successfully against current or potential competitors, or that competition will not have a material adverse effect on our business, financial condition and operations.

Dependence on Major Customers

The Company sells its products and services under various terms to a broad range of companies across multiple industries ranging from start-ups to Fortune 500 companies, with sales concentrated among a few large clients. For the twelve months ended December 31, 2015 and 2014, the percentage of the Company's total sales to its largest costumer was 41.6% and 47.1%, respectively, while sales to the Company's second largest customer accounted for 12.44% and 19.71%, respectively of the Company's total sales over those same time periods. See "Note 6 Concentrations" in the Notes to Financial Statements in this report.

Research and Development

We engage in the development of Software as a Service (SaaS) technology. Research and development costs incurred during the preliminary project stage are expenses as incurred and capitalization of such costs begins when technological feasibility is established. Capitalized software development costs, net of amortization, were $61,224 and $91,378 as of December 31, 2015 and 2014, respectively.

Insurance

We maintain health, dental, workmen's compensation, general liability, commercial auto, and professional liability/E&O insurance policies.

Employees

We currently have four full-time employees and thirteen independent contractors. None of our employees are represented by a labor union or covered by a collective bargaining agreement. We have never experienced any employment-related work stoppages and consider relations with our employees to be good. We intend to hire more employees and independent contractors on an as-needed basis.

Offices

We have three business addresses. Our headquarters is located at 201 Spear Street, Suite 1100, San Francisco, CA 94105. We also have a business office in San Anselmo, California located at 251 Sir Francis Drake Boulevard, 94960. We lease the aforementioned pursuant to a 36-month lease entered into on August 15, 2010 and extended on February 26, 2013 through August 31, 2016. Our monthly rental payments were $1,840 until August 31, 2013, $2,044 per month through August 31, 2014, and $2,095 through August 31, 2015 and $2,146 through December 31, 2015.

In 2016 we continue to lease an office at 251 Sir Francis Drake Blvd. in San Anselmo California and our rental payments will be $2,146 until September 2016. On January 1, 2016 we leased another office in San Anselmo located at 255 Sir Francis Drake Blvd., pursuant to a 12-month lease. Our monthly rental payment is $1,339.

Our office in Charlotte, North Carolina is located at 15720 John J. Delaney Dr., Suite 300, 28277. We lease the San Francisco and Charlotte spaces from DaVinci Virtual LLC, pursuant to a commercial lease on a month to month basis. Our monthly rental is $199 per month for our San Francisco location and $95 per month for our Charlotte, North Carolina location.

Costs and Effects of Compliance with Local, State and Federal Environmental Laws

Given the nature of the Company's business operations, local, state and federal environmental laws do not impose any material costs or have any material effect on the Company.

Government Regulation

We are not currently subject to direct federal, state or local regulation other than regulations applicable to businesses.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

None.

Our corporate headquarters are in a leased space located in San Francisco, California. The Company also leases office space in San Anselmo, California and Charlotte, North Carolina. We lease the San Anselmo office pursuant to a 36-month lease entered into on August 15, 2010 and extended on February 26, 2013 through August 31, 2016. Our monthly rental was $1,840 until August 31, 2013, $2,044 per month through August 31, 2014, and $2,095 per month through August 31, 2015 and $2,146 through December 31, 2015.

In 2016 we continue to lease an office at 251 Sir Francis Drake Blvd. in San Anselmo California and our rental payments will be $2,146 until September 2016. On January 1, 2016 we leased another office in San Anselmo located at 255 Sir Francis Drake Blvd., pursuant to a 12-month lease. Our monthly rental payment is $1,339.

We lease the San Francisco and Charlotte spaces pursuant to a commercial lease on a month to month basis. Our total monthly rental for the two locations is $294. See "Item 1. Business – Offices" for more information concerning our three business addresses.

In 2007, we completed the purchase of an undeveloped tract of real property located in the unincorporated area of Blue Lakes, County of Lake, California. The real property contains five acres of land. It has no fixtures or improvements located thereon. The purchase price was $85,000 and it is carried on our books for this amount, and is included in the long term assets classification of our balance sheet as "Property and equipment, net." The real property is not used by us for our operations. It is currently unencumbered, unoccupied, remains undeveloped and unimproved, and has no associated carrying costs.

We believe that our existing facilities and offices are adequate to meet our current requirements. If we require additional space, we believe that we will be able to obtain such space on acceptable, commercially reasonable terms.

Although the Company from time to time may be involved with disputes, claims and litigation related to the conduct of its business, there are no material legal proceedings pending to which the Company is a party or to which any of its property is subject, and the Company's management does not know of any such action being contemplated.

ITEM 4. MINE SAFETY DISCLOSURES.

None.

ITEM 5. MARKET FOR OUR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our common stock is traded in the United States on the OTCQB, operated by the OTC Markets Group. Our symbol is "MCCX." Additionally, on February 2, 2016, the Company's shares of common stock became listed for trading on the TSX Venture Exchange in Canada under the symbol "MCX". On March 7, 2016, the closing price of our common stock was $1.85.

The following table shows the quarterly range of high and low bid information for our common stock over the fiscal quarters for the last two fiscal years as quoted on the OTCQB. We obtained the following high and low bid information from the OTCQB. These over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions.

|

Fiscal Year – 2015

|

High Bid

|

Low Bid

|

|

|

|

|||

|

Fourth Quarter: 10/01/15 to 12/31/15

|

$1.75

|

$0.58

|

|

|

Third Quarter: 07/01/15 to 09/30/15

|

$0.85

|

$0.53

|

|

|

Second Quarter: 04/01/15 to 06/30/15

|

$1.10

|

$0.58

|

|

|

First Quarter: 01/01/15 to 03/31/15

|

$1.05

|

$0.25

|

|

|

Fiscal Year – 2014

|

High Bid

|

Low Bid

|

|

|

|

|||

|

Fourth Quarter: 10/01/14 to 12/31/14

|

$0.40

|

$0.15

|

|

|

Third Quarter: 07/01/14 to 09/30/14

|

$0.30

|

$0.12

|

|

|

Second Quarter: 04/01/14 to 06/30/14

|

$0.43

|

$0.19

|

|

|

First Quarter: 01/01/14 to 03/31/14

|

$0.50

|

$0.43

|

|

Holders

There are 98 holders of record for our common stock. There are a total of 20,426,158 shares of common stock outstanding. As some of our shares of common stock are held in "street name" by brokers on behalf of shareholders, we are unable to estimate the total number of beneficial holders of our common stock represented by these record holders.

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section 15(g) of the Securities Exchange Act of 1934

Since our shares of common stock are considered to be "penny stocks" under Rule 3a51-1 promulgated under the Exchange Act, the provisions of Section 15(h) of the Exchange Act and the rules promulgated thereunder are applicable to brokers and dealers who engage in transactions in our shares. Section 15(h) provides, among other things, that a broker-dealer engaging in a transaction in our shares of common stock must (1) approve the customer for the specific transaction and receive from the customer a written agreement to the transaction; (2) furnish the customer a disclosure document describing: (i) the risks of investing in penny stocks in both public offerings and secondary trading, (ii) the broker/dealer's duties to the customer and of the rights of remedies available to customers with respect to violations of these duties, (iii) terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, and (iv) FINRA's toll free telephone number for information on the disciplinary history of broker/dealers and their associated persons; (3) disclose to the customer the current market quotation for our common stock; and (4) disclose to the customer the amount of compensation the firm and its broker will receive for the trade. In addition, after executing the sale, a broker-dealer must send to its customer monthly account statements showing the market value of each penny stock held in the customer's account. Consequently, the Section 15(h) and the rules promulgated thereunder may affect the ability of broker/dealers to sell our shares of common stock and also may affect a shareholder's ability to sell shares of our common stock in the secondary market.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table presents information as of December 31, 2015 with respect to compensation plans under which shares of our common stock may be issued.

|

Plan category

|

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(a)

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

|

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

in column (a)) (c)

|

|

Equity compensation plans

approved by security holders

|

None

|

None

|

None

|

|

Equity compensation plans

not approved by securities holders

|

1,730,000

|

$0.70

|

312,616

|

|

Total

|

1,730,000

|

$0.70

|

312,616

|

Recent Sales of Unregistered Securities

On February 2, 2016, the Company completed a private placement of 3,660,000 restricted shares of our common stock to nine persons in consideration of $2,745,000 or $0.75 per share. The private placement was completed in connection with and as a condition of listing of the Company's common stock on the TSX Venture Exchange. The shares were sold in pursuant to the exemption from registration contained in Regulation S of the Securities Act of 1933, as amended, in that the transactions took place outside of the United States of America with non-US persons. No commissions were paid by the Company in connection with this offering. We completed this offering our shares of common stock pursuant to Rule 903 of Regulation S of the Securities Act of 1933, as amended (the "Securities Act") on the basis that the sale of such shares was completed in "offshore transactions", as defined in Rule 902(h) of Regulation S. We did not engage in any "directed selling efforts", as defined in Regulation S, in the United States in connection with the sale of this shares or our common stock. The investors represented to us that the investors were not U.S. persons, as defined in Regulation S, and were not acquiring the Shares for the account or benefit of a U.S. person.

Purchases of Equity Securities

During the three months ended December 31, 2015, there were no purchases of shares of common stock made by, or on behalf of, the Company or any "affiliated purchaser," as defined by Rule 10b-18 of the Exchange Act.

Common Stock

Our authorized capital stock consists of 30,000,000 shares of common stock, no par value per share. The holders of our common stock:

|

*

|

have equal ratable rights to dividends from funds legally available if and when declared by our board of directors;

|

|

*

|

are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs;

|

|

*

|

do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and

|

|

*

|

are entitled to one non-cumulative vote per share on all matters on which stockholders may vote.

|

All shares of common stock now outstanding are fully paid for and non-assessable and all shares of common stock which are the subject of this public offering, when issued, will be fully paid for and non-assessable. We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the State of California for a more complete description of the rights and liabilities of holders of our securities. All material terms of our common stock have been addressed in this section.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Cautionary Statement

This Management's Discussion and Analysis includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: "believe," "expect," "plan", "estimate," "anticipate," "intend," "project," "will," "predicts," "seeks," "may," "would," "could," "potential," "continue," "ongoing," "should" and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this Form 10-K. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or from our predictions. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

Overview

We are a customer experience (CX) management solutions company that develops and delivers technology products such as Touchpoint Mapping®, an on-demand ("cloud based") suite of customer experience management software, that also provides professional and related services designed to help organizations improve customer experiences, increase customer loyalty, reduce costs and increase revenue.

We believe that delivering better customer experiences is a powerful, sustainable way for any organization to differentiate from their competition. We are engaged in the business of developing and delivering technology-enabled products and professional services that help large, medium and small organizations to do this by improving their customer listening and customer experience management capabilities.

Our current product, Touchpoint Mapping® On-Demand, is a research-based software solution designed to be a comprehensive customer experience solution for customer-centric organizations to measure and gather customer data across all their touchpoints, channels and interactions with their customers. Touchpoint Mapping® On-Demand is designed to enable an organization's personnel to see where and how to improve brand and customer loyalty, and their customers' experiences across multiple channels and touchpoints, including web, sales, marketing, contact center, social, mobile, physical locations and others.

Our value-added and professional services help primarily large and medium organizations plan, design and deliver better customer experiences and organize to do so, in addition to analysis and review of client data gathered through our application. Other services include customer experience training, strategy consulting and business process optimization, and are directed toward increasing our customers' adoption of our products and services, helping our customers maximize their return on investment, and improving our customers' efficiency.

Development of our software is ongoing, as Touchpoint Mapping® On-Demand is refined and improved based on customer feedback, and as it is customized for specific organizations and industry sectors. The services delivered with Touchpoint Mapping® On-Demand may include consulting and additional research services, as well as services such as assessment, integration, implementation and additional offline analysis and reporting of data. Customer experience consulting and professional services are offered primarily through our consulting services group.

Though we released Touchpoint Mapping® On-Demand in 2013, we cannot predict the timing or probability of generating material sales revenue from it. As of this filing, we have yet to engage the necessary sales and marketing staff or the capabilities required to identify, develop, and close material product sales opportunities, and currently lack sufficient resources to market and sell our products in the manner which we believe is required to achieve our product sales and revenue growth objectives.

Sources of Revenue

Our revenue consisted primarily of professional and software-enabled consulting services, product sales and other revenues in 2015 and 2014. Consulting services include customer experience management consulting in the areas of strategy development, planning, education, training and program design, and includes the articulation of customer-centric strategies and implementation roadmaps in support of these strategies. Product revenue is from productized and software-enabled service sales not elsewhere classified, while other revenue includes reimbursement of related travel costs and out-of-pocket expenses.

While our plan of operations is based on migrating the majority of our service revenue from these categories to recurring SaaS subscription fees, we anticipate that fees for professional and software-enabled consulting services will remain a significant revenue source in the near future. As of December 31, 2015, we have successfully delivered certain features and functionality of our software product, Touchpoint Mapping® On-Demand, to several clients. However, we have not obtained material stand-alone sales commitments for Touchpoint Mapping® On-Demand, and do not anticipate being able to do so until we engage the necessary sales and marketing staff to develop and execute product sales opportunities.

Should we successfully obtain material sales commitments for Touchpoint Mapping® On-Demand, we anticipate that subscription agreements and related professional services associated with delivering our software solutions will become a source of significant revenue. Subscriptions and associated professional services pricing are based on our gross margin objectives, growth strategies and the specific needs of our clients' organizations, measured primarily by the following metrics: breadth of insights sought, number of employees, number of customers and customer segments, frequency of insights gathered, and other variables.

Subscription agreements for our software solutions are offered as monthly term agreements which contain a minimum commitment period of at least 12 months, and which include related setup, upgrades, hosting and support. Professional services include consulting fees related to implementation, customization, configuration, training and other value added services.

Based on data gathered during the implementation stage of on-demand software and software-enabled services engagements, we believe that the average time it will take our clients from placing an order to live deployment of our products is between 30 and 45 days. We typically invoice clients upon inception of subscription agreements for setup and total subscription fees contracted over the term of the agreements, with payment due within 30 days.

Professional services related to the subscription agreements are invoiced at the inception of the professional services agreement at one-third or fifty percent of total fees, with the balance of payments due over the duration of the contract as project milestones are met. Amounts invoiced are recorded in accounts receivable and deferred revenue or revenue, depending on whether revenue recognition criteria have been met.

Operating Expenses

Cost of Goods Sold

Cost of goods sold consists primarily of expenses directly related to providing professional and consulting services. Those expenses include contract labor, third-party services, and materials and travel expenses related to providing professional services to our clients. As certain features of Touchpoint Mapping® On-Demand were made available for general release in 2014, costs of goods also included product-related hosting and monitoring costs, licenses for products embedded in the application, amortization of capitalized software development costs, related sales commissions, service support, account management and subscriptions, as applicable.

Should our client base grow, we intend to continue to invest additional resources in our hosting, technical support and professional services capabilities, as well as our utilization of third-party licensed software. We expect our professional services costs to increase in absolute dollars as we increase our overall revenue, but expect that professional services as a percentage of total revenue will decrease as we continue to shift our business towards sales of on-demand software solutions and software-enabled services. Because cost as a percentage of revenue is higher for professional services revenue than for software product sales revenue, a decrease in professional services as a percentage of total revenue will likely increase gross profit as a percentage of total revenue.

General and Administrative Expenses

General and administrative expenses consist primarily of salary and related expenses for management, client delivery, finance and accounting, and sales personnel. Expenses also include contract services, marketing and promotion, professional fees, software license fee expenses, administrative costs, insurance, rent and a portion of travel expenses and other overhead.

Sales and marketing expenses are currently reflected in salaries and wages, commissions, contract labor, marketing and promotion, and other related overhead expense categories. Since we will be recognizing revenue over the terms of the subscriptions or professional services engagements, we expect to experience a delay between increases in selling and marketing expenses and the recognition of revenue. We expect to continue to incur significant sales and marketing expenses in both absolute dollars and as a percentage of expenses as we hire sales and additional marketing personnel and increase the level of marketing activities.

We expect that total general and administrative expenses will increase as we continue to add personnel in connection with the growth of our business. In addition to increases in sales and marketing and research and development expenses, we anticipate we will also incur additional employee salaries and related expenses, professional service fees and insurance costs related to the growth of our business and operations to meet the requirements of a public company.

Critical Accounting Policies and Estimates

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses and related disclosures. We evaluate our estimates and assumptions on an ongoing basis.

Our estimates are based on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Our actual results could differ from these estimates. We believe that the assumptions and estimates associated with revenue recognition, income taxes, stock-based compensation, research and development costs and impairment of long-lived assets have the greatest potential impact on our financial statements. Therefore, we consider these to be our critical accounting policies and estimates.

Revenue Recognition

We enter into arrangements with multiple-deliverables that generally include nonrefundable setup fees, subscription fees, professional services and consulting fees. We account for multiple-element arrangements by following ASC 605-25, Revenue Recognition: Multiple-Element Arrangements, as amended by Accounting Standards Update (ASU) 2009-13, Multiple-Deliverable Revenue Arrangements.

Under the accounting guidance, in order to treat deliverables in a multiple-deliverable arrangement as separate units of accounting, the deliverables must have standalone value upon delivery. To date, we have concluded that subscription services and the associated nonrefundable setup fees do not have standalone value as such services are not sold separately, while professional services and consulting fees included in multiple-deliverable arrangements executed have standalone value as they are often sold separately and will have value to the customer on a standalone basis.

Under the accounting guidance, when multiple-deliverables included in an arrangement are separated into different units of accounting, the arrangement consideration is allocated to the identified separate units based on a relative selling price hierarchy. We determine the relative selling price for a deliverable based on its vendor-specific objective evidence of selling price ("VSOE"), if available, third-party evidence ("TPE"), if VSOE is not available; and our best estimate of selling price ("BESP"), if neither VSOE nor TPE is available. Due to the relatively recent introduction of the Touchpoint Mapping® On-Demand, and its related services, and due to differences in our service offerings compared to other parties and the lack of availability of relevant third-party pricing information, we have determined that VSOE and TPE are not practical alternatives. Therefore, the Company uses BESP to determine selling price of significant deliverables.

We determine BESP by considering our overall pricing objectives and market conditions. Significant pricing practices taken into consideration include our discounting practices, the size and volume of our transactions, the customer demographic and our market strategy. The determination of BESP is made through consultation with and approval by management, taking into consideration our market strategy. As our market strategy evolves, we may modify our pricing practices in the future, which could result in changes in relative selling prices, including BESP. Revenue recognition requires judgment, including whether the arrangement includes multiple elements, and if so, whether VSOE or TPE of fair value exists for those elements. A portion of revenue may be recorded as unearned due to undelivered elements. Changes to the elements in a software arrangement, the ability to identify VSOE, TPE or BSEP for those elements, and the fair value of the respective elements could materially impact the amount of earned and unearned revenue. Judgment is also required to assess whether future releases of certain software represent new products or upgrades and enhancements to existing products. Variations in the actual outcome of these variables could materially impact our financial statements.

Income Taxes

No provision for income taxes at this time is being made due to the offset of cumulative net operating losses. A full valuation allowance has been established for deferred tax assets based on a "more likely than not" threshold. The ability to realize deferred tax assets depends on our ability to generate sufficient taxable income within the carry forward periods provided under the United States Internal Revenue Code of 1986, as amended and the rules promulgated thereunder. While the Company's statutory tax rate can range from 15% - 39% depending on taxable income level, the effective tax rate is 0% due to the effects of the valuation allowance described above. The Company does not have any material uncertainties with respect to its provisions for income taxes.

Stock-Based Compensation

Stock-based compensation cost is measured at the grant date using a Black-Scholes valuation model and is recognized as expense over the requisite service period. Determining the fair value of stock-based awards at the grant date requires judgment and assumptions, including expected volatility. In addition, judgment is also required in estimating the amount of stock-based awards that are expected to be forfeited. If actual results differ significantly from these estimates, stock-based compensation expense and our results of operations could be impacted.

Research and Development Costs

Costs incurred to develop Software as a Service (SaaS) products and technology enabled services consist of external direct costs of materials and services and payroll and payroll-related costs for employees who directly devote time to the project. Research and development costs incurred during the preliminary project stage were expensed as incurred. Capitalization begins when technological feasibility is established. Costs incurred during the operating stage of the software application relating to upgrades and enhancements are capitalized to the extent that they result in the extended life of the product. All other costs are expensed as incurred. Amortization of software development costs commences when the product is available for general release to customers. The capitalized costs are amortized on a straight line basis over the three year expected useful life of the software.

Impairment of Long-Lived Assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate an asset's carrying value may not be recoverable. If such circumstances are present, we assess the recoverability of the long-lived assets by comparing the carrying value to the undiscounted future cash flows associated with the related assets. If the future net undiscounted cash flows are less than the carrying value of the assets, the assets are considered impaired and an expense, equal to the amount required to reduce the carrying value of the assets to the estimated fair value, is recorded in the statements of operations. Significant judgment is required to estimate the amount and timing of future cash flows and the relative risk of achieving those cash flows.

Assumptions and estimates about future values and remaining useful lives are complex and often subjective. They can be affected by a variety of factors, including external factors such as industry and economic trends, and internal factors such as changes in our business strategy and our internal forecasts. Impairment charges could materially decrease our future net income and result in lower asset values on our balance sheet.

Results of Operations

|

|

Year Ended

|

Change from

|

Percent Change

|

|||||||||||||

|

|

2015

|

2014

|

Prior Year

|

from Prior Year

|

||||||||||||

|

Revenue

|

$

|

1,334,732

|

$

|

2,056,678

|

$

|

(721,946

|

)

|

(35

|

%)

|

|||||||

Revenues decreased for the year ended December 31, 2015 primarily due to decreased sales of our consulting services.

|

|

Year Ended

|

Change from

|

Percent Change

|

|||||||||||||

|

|

2015

|

2014

|

Prior Year

|

from Prior Year

|

||||||||||||

|

Cost of Goods Sold

|

$

|

490,716

|

$

|

536,606

|

$

|

(45,890

|

)

|

(9

|

%)

|

|||||||

Cost of goods sold decreased by $45,890 during the year ended December 31, 2015 as compared to the same period in 2014 mainly as a result of a decrease of approximately $30,000 in professional fees, including contract labor, marketing & promotion, and research vendors in 2015 combined with a decrease of $32,000 in reimbursable expenses such as lodging, meals and entertainment and transportation in the same period, being partially offset by an increase of approximately $18,000 in other professional fee costs and $2,000 in other increases.

|

|

Year Ended

|

Change from

|

Percent Change

|

|||||||||||||

|

|

2015

|

2014

|

Prior Year

|

from Prior Year

|

||||||||||||

|

Salaries and Wages

|

$

|

994,214

|

$

|

992,281

|

$

|

1,933

|

|

0.19

|

%

|

|||||||

Salaries and wages increased for the year ended December 31, 2015 as compared to the same period in 2014 mainly due to a reduction in staff salaries and related benefits of approximately $239,000 in 2015 and a decrease in commissions of $14,000 over the same period, being partially offset by increases in officer salaries of $144,000 due to the hiring of a new officer in 2015 and stock based compensation expense of $111,000.

|

|

Year Ended

|

Change from

|

Percent Change

|

|||||||||||||

|

|

2015

|

2014

|

Prior Year

|

from Prior Year

|

||||||||||||

|

Contract Services

|

$

|

182,429

|

$

|

130,104

|

$

|

52,325

|

40.22

|

%

|

||||||||

Contract services expenses increased $52,325 during the year ended December 31, 2015 as compared to the same period in 2014. The increase was primarily due increases in business development expenses of $21,000, corporate and investor relations expenses of $58,000, marketing expenses of $17,000 and product development expenses of $8,000. These increases were offset by decreases in contract accounting and administration costs of $52,000.

|

|

Year Ended

|

Change from

|

Percent Change

|

|||||||||||||

|

|

2015

|

2014

|

Prior Year

|

from Prior Year

|

||||||||||||

|

Other General and Administrative

|

$

|

659,154

|

$

|

395,849

|

$

|

263,305

|

|

66.52

|

%

|

|||||||

Other general and administrative costs increased $263,305 for the year ended December 31, 2015 as compared to the same period in 2014 primarily due to increased expenses in all of the following categories: marketing and promotion, administration, professional fees, and insurance.

|

|

Year Ended

|

Change from

|

Percent Change

|

|||||||||||||

|

|

2015

|

2014

|

Prior Year

|

from Prior Year

|

||||||||||||

|

Other Income/Expense

|

$

|

12,428

|

$

|

12,278

|

$

|

150

|

1.22

|

%

|

||||||||

Other income (expense) remained relatively flat during the period. Fluctuations in other income (expense) are primarily related to unrealized gains and losses associated with the revaluation of a promissory note from Canadian dollars to United States dollars.

Liquidity and Capital Resources

We measure our liquidity in a variety of ways, including the following:

|

December 31,

2015

|

December 31,

2014

|

|||||||

|

Cash and Cash Equivalents

|

$

|

492,733

|

$

|

649,063

|

||||

|

Working Capital

|

$

|

349,740

|

$

|

638,707

|

||||

Anticipated Uses of Cash

In 2015, our primary areas of investment were professional staff to support our services business, as well as staff to support SaaS product delivery and client relationship management. We also invested in product development and sales and marketing activities, including sales and staff, marketing and sales automation software and other related services.

In 2016, our primary areas of investment are expected to continue to be professional staff to support our services business, as well as staff to support SaaS product delivery and manage client relationships. We also anticipate investments in product development and sales and marketing activities, including building our sales and marketing staff, marketing and advertising services, and other related activities. A secondary area of investment may include the hiring of business development staff to support the development of our indirect distribution channels.

We currently plan to fund these planned expenditures with cash flows generated from ongoing operations during this period and/or additional capital raised through debt financing and/or through sales of common stock. We will consider raising capital through debt financing and/or additional sales of common stock if necessary. We do not intend to pay dividends in the foreseeable future.

Based upon the current level of our operations and our current expectations for future periods in light of the current economic environment, we believe that cash flow from our operations and available cash, together with available borrowings, will be adequate to finance the capital requirements for our business during the next 12 months. In the future we may make acquisitions of businesses or assets or commitments to additional capital projects. To achieve the long-term goals of expanding our assets and earnings, including through acquisitions, capital resources will be required. Depending on the size of a transaction, the capital resources that will be required can be substantial. The necessary resources will be generated from cash flow from operations, cash on hand, borrowing against our assets or the issuance of securities.

Debt Obligations

On September 16, 2011, we executed a $100,000 (Canadian dollars) note with Brad Holland. The note is structured to incur a balloon payment of the principal and 4% APR non-compounding accrued interest on its amended maturity date of September 16, 2016. As of December 31, 2015, principal and accrued interest was $70,829 and $4,135, respectively.

On September 7, 2011, we executed a $50,000 note with McLellan Investment Corporation, an unrelated party. The note is structured to incur a balloon payment of the principal and 4% APR non-compounding accrued interest on its amended maturity date of September 7, 2016. As of December 31, 2015, principal and accrued interest was $50,000 and $2,583, respectively.

Cash Flow for the Years Ended December 31, 2015 and 2014

Operating Activities. Net cash (used in) provided by operating activities decreased by $605,579 (or >100%), to ($582,445) used in operation for the twelve months ended December 31, 2015 compared to $23,134 provided by operations for the twelve months ended December 31, 2014. The decrease in cash provided by operating activities was attributable primarily to a ($997,474) reduction in net income, partially offset by increases in cash flow due to the change in net working capital of $174,167 and increases in cash flow due to the change in other adjustments of $217,728. The increase of cash flow from net working capital was primarily due to collections in accounts receivable.

Days Sales Outstanding (DSO) during the year ended December 31, 2015 was approximately 31 days compared to approximately 29 days during the year ended December 31, 2014. This was a direct result of entering into services agreements with clients whose payment terms more closely matched our historical 30 days.

Investing Activities. Net cash used in investing activities for the years ended December 31, 2015 and 2014 amounted to $87,635 and $28,061, respectively and primarily consisted of capitalized software development costs.

Financing Activities. Net cash provided by financing activities for years ended December 31, 2015 and 2014 amounted to $513,750 and $0, respectively and cash provided in 2015 was the result of the sale of our restricted common stock during that year.

Off Balance Sheet Arrangements

We did not have any off balance sheet arrangements as of December 31, 2015.

Contractual Obligations

We lease two facilities in northern California, under operating leases both expected to expire in 2016. We do not have any debt capital lease obligations. As of December 31, 2015, the following table summarizes our contractual obligation under the foregoing lease agreement and the effect such obligation is expected to have on our liquidity and cash flow in future periods:

|

|

Payments Due by Period

|

|||||||||||||||||||

|

|

Total

|

Less Than

|

More Than

|

|||||||||||||||||

|

|

1 Year

|

1-3 Years

|

3-5 Years

|

5 Years

|

||||||||||||||||

|

Operating lease obligations (a)

|

$

|

33,239

|

$

|

33,239

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||

|

Purchase obligations (b)

|

$

|

18,387

|

$

|

18,387

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||

|

(a)

|

The operating lease obligations presented reflect future minimum lease payments due under the non-cancelable portions of our operating lease.

|

|

(b)

|

Purchase obligations primarily represent non-cancelable contractual obligations related to SaaS licenses.

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

MCORPCX, INC.

INDEX TO THE FINANCIALS

|

F-1

|

||

|

F-2

|

||

|

FINANCIAL STATEMENTS

|

||

|

F-3

|

||

|

F-4

|

||

|

F-5

|

||

|

F-6

|

||

|

F-7

|

||

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

McorpCX, Inc.

San Francisco, California

We have audited the accompanying balance sheet of McorpCX, Inc. as of December 31, 2015, and the related statements of operations, stockholders' equity, and cash flows for the year ended December 31, 2015. These financial statements are the responsibility of the entity's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of McorpCX, Inc. as of December 31, 2015, and the results of its operations and its cash flows for the year ended December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company incurred net losses for the year ended December 31, 2015. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are described in Note 14. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MALONEBAILEY, LLP

www.malonebailey.com

Houston, Texas

March 30, 2016

F-1

To the Board of Directors and Stockholders

McorpCX, Inc.

We have audited the accompanying balance sheets of McorpCX, Inc. ("the Company") as of December 31, 2014 and the related statements of income, changes in stockholders' equity and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company, at December 31, 2014, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

DAVID LEE HILLARY, JR. CPA, CITP

David Lee Hillary, Jr., CPA, CITP

Noblesville, Indiana

March 5, 2014

|

5797 East 169th Street, Suite 100 Noblesville, IN 46062

|

317-222-1416

|

www.HillaryCPAgroup.com

|

F-2

McorpCX, Inc.

|

|

December 31,

|

December 31,

|

||||||

|

|

2015

|

2014

|

||||||

|

|

||||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

492,733

|

$

|

649,063

|

||||

|

Accounts receivable

|

114,805

|

162,340

|

||||||

|

Total current assets

|

607,538

|

811,403

|

||||||

|

Long term assets:

|

||||||||

|

Property and equipment, net

|

89,725

|

91,048

|

||||||

|

Capitalized software development costs, net

|

61,224

|

91,378

|

||||||

|

Intangible assets, net

|

83,072

|

68,906

|

||||||

|

Other assets

|

23,541

|

53,955

|

||||||

|

Total assets

|

$

|

865,100

|

$

|

1,116,690

|

||||

|

Liabilities and Shareholders' Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Accounts payable

|

$

|

133,046

|

$

|

79,492

|

||||

|

Deferred revenue

|

118,034

|

91,319

|

||||||

|

Other current liabilities

|

6,718

|

1,885

|

||||||

|

Total current liabilities

|

257,798

|

172,696

|

||||||

|

Notes payable

|

50,000

|

50,000

|

||||||

|

Notes payable-related party

|

70,829

|

86,171

|

||||||

|

Total liabilities

|

378,627

|

308,867

|

||||||

|

Commitments and contingencies

|

-

|

-

|

||||||

|

Shareholders' equity:

|

||||||||

|

Common stock, $0 par value, 30,000,000 shares authorized,

16,766,158 and 16,081,158 shares issued and outstanding at

December 31, 2015 and December 31, 2014, respectively

|

-

|

-

|

||||||

|

Additional paid-in capital

|

3,339,503

|

2,666,502

|

||||||

|

Accumulated deficit

|

(2,853,030

|

)

|

(1,858,679

|

)

|

||||

|

Total shareholders' equity

|

486,473

|

807,823

|

||||||

|

Total liabilities and shareholders' equity

|

$

|

865,100

|

$

|

1,116,690

|

||||

The accompanying notes are an integral part of these statements.

F-3

McorpCX, Inc.

|

Year Ending

|

||||||||

|

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Revenue

|

||||||||

|

Consulting services

|

$

|

1,125,490

|

$

|

1,803,997

|

||||

|

Products & other

|

209,242

|

252,681

|

||||||

|

Total revenue

|

1,334,732

|

2,056,678

|

||||||

|

Cost of goods sold

|

||||||||

|

Labor

|

253,435

|

265,473

|

||||||

|

Products and other

|

237,281

|

271,133

|

||||||

|

Total cost of goods sold

|

490,716

|

536,606

|

||||||

|

Gross profit

|

844,016

|

1,520,072

|

||||||

|

Expenses

|

||||||||

|

Salaries and wages

|

994,214

|

992,281

|

||||||

|

Contract services

|

182,429

|

130,104

|

||||||

|

Other general and administrative

|

659,154

|

395,849

|

||||||

|

Total expenses

|

1,835,797

|

1,518,234

|

||||||

|

Net operating income (loss)

|

(991,781

|

)

|

1,838

|

|||||

|

Interest income (expense)

|

(14,998

|

)

|

(10,993

|

)

|

||||

|

Other income (expense)

|

12,428

|

12,278

|

||||||

|

Income (loss) before income taxes

|

(994,351

|

)

|

3,123

|

|||||

|

|

||||||||

|

Income tax provision

|

-

|

-

|

||||||

|

Net income (loss)

|

$

|

(994,351

|

)

|

$

|

3,123

|

|||

|

Net income (loss) per share-basic and diluted

|

$

|

(0.060

|

)

|

$

|

0.000

|

|||

|

Weighted average common shares

outstanding-basic and diluted

|

16,492,158

|

16,081,158

|

||||||

The accompanying notes are an integral part of these statements.

F-4

McorpCX, Inc.

|

Common Stock

|

Additional

Paid in

|

Retained

Earnings

(Accumulated

|

||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit)

|

Total

|

||||||||||||||||

|

Balance at December 31, 2013

|

16,081,158

|

$

|

-

|

$

|

2,618,274

|

$

|

(1,861,414

|

)

|

$

|

756,860

|

||||||||||

|

Stock based compensation - stock options

|

-

|

-

|

48,228

|

(388

|

)

|

47,840

|

||||||||||||||

|

Net income

|

-

|

-

|

-

|

3,123

|

3,123

|

|||||||||||||||

|

Balance at December 31, 2014

|

16,081,158

|

$

|

-

|

$

|

2,666,502

|

$

|

(1,858,679

|

)

|

$

|

807,823

|

||||||||||

|

Stock based compensation - stock options

|

-

|

-

|

159,251

|

-

|

159,251

|

|||||||||||||||

|

Common stock issued for cash

|

685,000

|

-

|

513,750

|

-

|

513,750

|

|||||||||||||||

|

Net loss

|

-

|

-

|

-

|

(994,351

|

)

|

(994,351

|

)

|

|||||||||||||

|

Balance at December 31, 2015

|

16,766,158

|

$

|

-

|

$

|

3,339,503

|

$

|

(2,853,030

|

)

|

$

|

486,473

|

||||||||||

The accompanying notes are an integral part of these statements.

F-5

McorpCX, Inc.

|

December 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income (loss)

|

$

|

(994,351

|

)

|

$

|

3,123

|

|||

|

Adjustments to reconcile net income to net cash provided by operations:

|

||||||||

|

Depreciation and amortization

|

103,462

|

75,806

|

||||||

|

Stock compensation expense

|

159,251

|

47,840

|

||||||

|

Loss on disposal of assets

|

1,484

|

-

|

||||||

|

Unrealized gain on foreign currency translation

|

(14,158

|

)

|

(13,829

|

)

|

||||

|

Realized loss on foreign currency translation

|

(911

|

)

|

-

|

|||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

47,535

|

(87,362

|

)

|

|||||

|

Other assets

|

30,415

|

(48,002

|

)

|

|||||

|

Accounts payable

|

53,281

|

(30,624

|

)

|

|||||

|

Other current liabilities

|

(273

|

)

|

-

|

|||||

|

Deferred revenue

|

26,715

|

88,069

|

||||||

|

Accrued interest

|

5,105

|

(11,887

|

)

|

|||||

|

Net cash (used in) provided by operating activities

|

(582,445

|

)

|

23,134

|

|||||

|

INVESTING ACTIVITIES

|

||||||||

|

Equipment purchases

|

(2,597

|

)

|

(1,811

|

)

|

||||

|

Capitalized web development costs

|

(40,863

|

)

|

(26,250

|

)

|

||||

| Capitalized software development costs | (44,175 | ) | - | |||||

|

Net cash used in investing activities