Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Aldeyra Therapeutics, Inc. | d105518dex312.htm |

| EX-32.1 - EX-32.1 - Aldeyra Therapeutics, Inc. | d105518dex321.htm |

| EX-31.1 - EX-31.1 - Aldeyra Therapeutics, Inc. | d105518dex311.htm |

| EX-10.23 - EX-10.23 - Aldeyra Therapeutics, Inc. | d105518dex1023.htm |

| 10-K - 10-K - Aldeyra Therapeutics, Inc. | d105518d10k.htm |

| EX-23.1 - EX-23.1 - Aldeyra Therapeutics, Inc. | d105518dex231.htm |

Exhibit 10.24

SUBLEASE

THIS SUBLEASE, made and entered into as of the 7th day of March 2016, by and between PLANCK, LLC, a Delaware Limited Liability Company, having an office and place of business c/o Patch Media, 134 W. 29th St., 11th F1, New York, NY 10001 hereinafter called “Sublessor”, and ALDEYRA THERAPEUTICS, INC., a Delaware corporation, having an office and principal place of business at 131 Hartwell Avenue, Suite 320, Lexington, MA 02421, hereinafter called “Sublessee”.

W I T N E S S E T H:

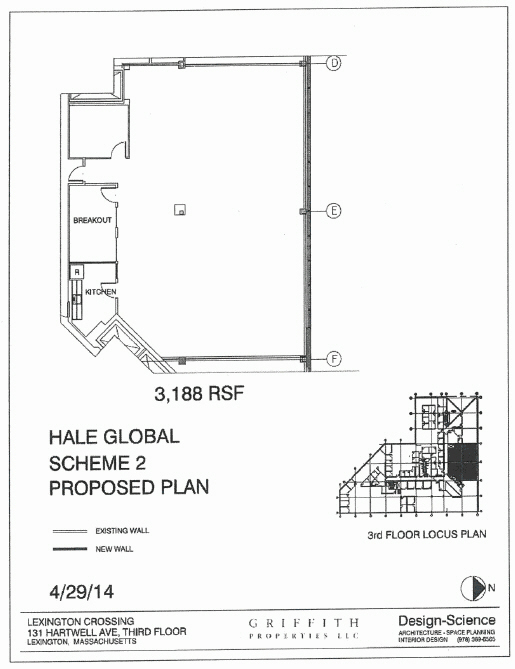

WHEREAS, by a certain written lease agreement dated June 3, 2014 (the “Master Lease”), WLC THREE VI, L.L.C. (“Owner”) leased to Sublessor those certain premises (“Premises”) consisting of approximately 3,188 rentable square feet of space on the 3rd floor of the building (“Building”) located at and commonly known as 131 Hartwell Avenue, Lexington, Massachusetts, which, together with such other improvements and appurtenances therein mentioned, are more particularly described in said Master Lease; and

WHEREAS, Sublessee desires to sublease and hire from Sublessor, and Sublessor is willing to sublet to Sublessee, the entire Premises as described in said Master Lease, as shown on the floor plan attached hereto as Exhibit “A” (hereinafter called the “Sublease Premises”), on the terms and conditions more particularly hereinafter set forth; and

WHEREAS, capitalized terms used but not defined herein shall have the meanings ascribed thereto in the Master Lease.

1 | Page

NOW, THEREFORE, in consideration of the mutual covenants, conditions and agreements herein contained, Sublessor and Sublessee agree as follows:

1. Sublessor, for and in consideration of the rents and covenants specified to be paid, performed and observed by Sublessee, does hereby let, sublet, lease and demise to Sublessee the aforementioned Sublease Premises for the term and according to the covenants and conditions contained herein, together with all rights of Sublessor under the Master Lease with respect to use of the Common Areas, parking and other amenities. Sublessee shall use the Sublease Premises for general office purposes and for no other purpose whatsoever (“Sublessee’s Permitted Use”).

2. This Sublease term (“Term”) shall commence (“Commencement Date”) on the later to occur of (i) March 1, 2016, or (ii) one business day from the date of Owner’s consent to this Sublease, and shall remain in effect until September 29, 2017 (“Expiration Date”), provided that Sublessor covenants that the Sublease Premises shall be vacant, broom clean and free of all personal property of Sublessor on the Commencement Date, Any rights or options of Sublessor under the Master Lease to extend the term of the Master Lease, to expand the Premises, or any rights of first offer or refusal are hereby specifically excluded from this Sublease.

3. (a) Sublessee shall pay to Sublessor as rent for said Sublease Premises for the term of this Sublease, the sum of twenty-one dollars ($21.00) per rentable square foot ($66,948.00) per annum, payable in monthly installments of $5,579.00) in advance commencing on the Commencement Date and thereafter on the first day of each and every month during the term hereof (“Base Rent”). In the event this Sublease commences on a date which is not the first of a month or ends on a day which is not the last day of a month, the first month’s rent and/or the last month’s rent, as applicable, shall be pro-rated on a per diem basis.

Page 2

(b) In addition, Sublessee shall promptly pay Tenant’s Proportionate Share of Operating Expenses and Taxes (which is 4.05% of the increases in Operating Expenses and Taxes over the Base Year, except that the Base Year shall mean calendar year 2016 for Operating Expenses and Tax Fiscal Year 2016, i.e., July 1, 2015 through June 30, 2016, for Taxes) to Sublessor in addition to the direct pass through of excess electricity costs for the Premises as provided in Paragraph 14 of the Master Lease (together, “Additional Rent”). Such amounts shall be payable within ten (10) days after Sublessor presents Sublessee with a bill therefor provided that such bill shall include the invoice received by the Sublessor from the Owner for such cost. Notwithstanding the foregoing, in the event that the electrical supply to the Sublease Premises is separately metered (Sublessor hereby representing that, as of the Commencement Date, the Sublease Premises is not separately metered), then Sublessee shall open an account with the supplier, and shall pay for the amount of electricity consumed in the Sublease Premises directly to the applicable utility provider, provided that to the extent that Base Rent is reduced under the Master Lease on account of such direct metering, then Base Rent under this Sublease shall be reduced by the same amount (it being understood that, except for Operating Expenses and excess electricity costs as provided in Paragraph 14 of the Master Lease, electricity is paid for on a rent inclusion basis under the Master Lease and this Sublease). It shall be a material default under this Sublease if Sublessee fails to timely pay for the electricity consumed in the Sublease Premises as set forth herein. Sublessee hereby acknowledges and agrees that in the event Sublessee wishes to use any utility or service, the cost of which is not included in the base services provided by Owner under the terms of the Master Lease (e.g., HVAC use outside of the normal business hours and other costs described in the Master Lease), Sublessee shall be solely responsible for the cost of any such utility or service utilized by Sublessee, and

Page 3

the cost thereof shall be paid to Sublessor within ten (10) days of billing as Additional Rent, provided that such bill shall include the invoice received by the Sublessor from the Owner for such cost. Sublessor hereby agrees that Sublessee may request such services directly from Owner. Sublessor agrees that it will not impose a surcharge on such costs. Base Rent and all Additional Rent are hereinafter collectively called “Rent”.

(d) Payment of Base Rent and Additional Rent and any other sum due and payable hereunder shall be made to Sublessor and sent to Planck LLC, PO Box 28762, New York, NY 10057-8762 or at such other place as Sublessor may designate in writing, without any offset or deduction whatsoever except as otherwise expressly set forth herein. The parties hereto agree and acknowledge that (i) no endorsement or statement on any check or any letter accompanying any check or payment shall be deemed to be an accord and satisfaction and Sublessor may accept any such check or payment without prejudice to Sublessor’s right to recover the balance or pursue any other remedy provided in this Sublease or at law, and (ii) Sublessee shall be required to pay to Sublessor interest on any sum of money which Sublessee is required to pay to Sublessor pursuant to the terms of this Sublease that is not paid to Sublessor within five (5) business days of the due date and that such interest shall be calculated at an annual rate of 2% above the so-called “prime rate” of Citibank N.A. (or its successor), as announced from time to time, (or the maximum percent permitted by law, whichever is less) from the date that such sum becomes due until the date it is paid.

4. The provisions of the Master Lease are, except as otherwise herein specifically provided, hereby incorporated in this Sublease with the same effect as if entirely rewritten herein, and shall fix the rights and obligations of the parties hereto with respect to the Sublease Premises with the same effect as if Sublessor and Sublessee were, respectively, the landlord and tenant named in the Master Lease. Except with

Page 4

respect to the payment of Rent and the Security Deposit under the Master Lease, Sublessee hereby covenants to perform the covenants and undertakings of Sublessor as tenant under the Master Lease to the extent the same are applicable to the Sublease Premises during the Term of this Sublease, and agrees not to do or permit to be done any act which shall result in a violation of any of the terms and conditions of said Master Lease. Except as otherwise specifically provided herein, Sublessee is to have the benefit of the covenants and undertakings of Owner as landlord in the Master Lease to the extent the same are applicable to the Sublease Premises during the term of this Sublease. It is expressly understood and agreed, however, that SUBLESSOR is not in the position to render any of the services or to perform any of the obligations required of Sublessor by the terms of this Sublease, and that performance by Sublessor of its obligations hereunder are conditioned upon due performance by Owner of its corresponding obligations under the Master Lease. It is further understood and agreed, therefore, that notwithstanding anything to the contrary contained in this Sublease, Sublessor shall not be in default under this Sublease for failure to render such services or perform such obligations required of Sublessor by the terms of this Sublease which are the responsibility of the Owner as landlord under the Master Lease, but Sublessor agrees to take all reasonable measures to insure that Owner performs said obligations. The term “reasonable measures” shall not include legal action against Owner for its failure to so perform unless Sublessee agrees to pay all costs and expenses in connection therewith which shall be payable as Additional Rent. With respect to any obligation of Sublessee to be performed under this Sublease for which a specific time for performance is not set forth herein, when the Master Lease grants Sublessor a specific number of days to perform its obligations thereunder, Sublessee shall have two (2) fewer days to perform. With respect to approval required to be obtained by “Landlord” under the Master Lease, such consent must be obtained from Owner and Sublessor and the approval of Sublessor may considered reasonably withheld if Master Landlord’s consent is not obtained, provided that Sublessor shall use reasonable efforts to obtain the consent or approval of Owner.

Page 5

5. The parties agree that the following provisions of the Master Lease are, for the purposes of this Sublease, hereby deleted:

All references in the Master Lease to “Landlord’s” or “Owner’s Work”; the parties acknowledging that neither Landlord nor Sublessor are required to complete any improvements or alterations to the Sublease Premises;

All references to Rent Abatements; the parties acknowledge that there are no subrent abatements except as expressly set forth herein;

All references to security deposits; the parties acknowledge that no security deposit is required of Subtenant under this Sublease;

The remaining provisions of said Master Lease shall, for the purposes of this Sublease and to the extent that same are applicable, remain in full force and effect as between Sublessor and Sublessee as provided in Paragraph 4 of this Sublease, except as said provisions have been otherwise amended or modified by this Sublease. Should there be any conflict between the terms of this Sublease as specifically set out herein and the terms of the Master Lease which are incorporated herein by reference, the terms specifically set out herein shall control.

6. It is further understood and agreed that some of the provisions of the Master Lease incorporated herein by reference are hereby amended as follows:

Paragraph 15 (“Insurance”) shall require Sublessee to name Sublessor and Owner as additional insureds on Sublessee’s liability coverage;

Page 6

Any provision of the Master Lease that requires the prior written consent of Owner shall also require the prior written consent of Sublessor, provided that Sublessor’s consent shall not be unreasonably withheld, delayed or conditioned;

Sublessee shall have no right to enter the Sublease Premises until Owner consents to this Sublease, except for the purposes of taking measurements, and permitting its professionals to examine the space in anticipation of moving into the Premises;

Sublessee shall only be entitled to a refund of Additional Rent to the extent that Sublessor receives such reimbursement from the Owner except to the extent that Owner withholds payment from Sublessor on account of a dispute with Sublessor;

Sublessor, as sublessor hereunder, shall not be required to carry the insurance required to be carried by Landlord under the Master Lease; and

Subject to Owner’s consent as set forth in the Master Lease, Sublessee shall have all signage rights granted to Sublessor under the Master Lease.

7. Any holding over by Sublessee beyond the Expiration Date of this Sublease shall be deemed unlawful unless expressly consented to by Sublessor in writing, and Sublessor shall be entitled to any and all remedies in law or in equity by reason of such unlawful holding over by Sublessee. Sublessee agrees to indemnify and save Sublessor harmless against and from any and all loss, cost, expense and liability incurred by Sublessor under the Master Lease by reason of any such holding over, including any consequential damages.

8. All notices, requests, demands and other communications with respect to this Sublease, whether or not herein expressly provided for, shall be in writing and shall be deemed to have been duly given the next business day after being deposited (in time for delivery by such service on such business day) with Federal Express or another national courier service, for delivery to the parties at the addresses listed below, or to such other address or addresses as may hereafter be designated by either party in writing for such purpose:

Page 7

Sublessor:

PLANCK, LLC

c/o Patch Media

134 W. 29th St., 11th F1

New York, NY 10001

Sublessee:

ALDEYRA THERAPEUTICS, INC.

131 Hartwell Avenue, Suite 320

Lexington, MA 02421

Attention: Stephen Tulipano, CFO

9. This Sublease is subject and subordinate to the Master Lease in all respects, which Master Lease is attached hereto as Exhibit “B”. Sublessee acknowledges that it has received a copy of said Master Lease and amendments and that no right, power or privilege granted to Sublessee benefiting Sublessee or binding Sublessor shall be operative if and to the extent that such exercise, enjoyment or operation would not be permitted by or would violate any term, covenant or condition of the Master Lease. Sublessor shall not voluntarily terminate or surrender the Master Lease. In the event of the expiration or earlier termination of the Master Lease, this Sublease shall automatically terminate on the date of the expiration or termination of the Master Lease, which shall be no less than thirty days from the date written notice is given to the Subtenant; provided, however, that those terms and conditions of this Sublease, that, by their nature, suggest at least partial performance or enforcement following such expiration or termination, including, but not limited to, indemnity obligations, shall survive any such expiration or termination of the Sublease. Further, in the event of any damage to or destruction of the Premises or the Building or in the

Page 8

event that the Premises or the Building (or any portion thereof, including, any parking spaces allocated to Sublessor under the Master Lease) are taken for any public or quasi-public use in condemnation proceedings or by any right of eminent domain or sale in lieu of condemnation and if Sublessor or Owner elect to terminate the Master Lease pursuant to the terms of the Master Lease as a result of such damage, destruction or condemnation, then this Sublease shall automatically terminate. Upon any termination of this Sublease pursuant to the foregoing provisions of this Paragraph 9, Sublessee shall not have any right or claim against Sublessor on account of such termination. Sublessor, as “Tenant” under the Master Lease shall be entitled to any and all awards from any such condemnation permitted under the Master Lease without any payment to Sublessee, except that in the event such condemnation occurs prior to the second anniversary of the Sublease, Sublessee shall be entitled to a payment equaling the reasonable costs of moving from the Premises. Sublessee hereby waives any and all rights to pursue a reward in respect of condemnation loss against any condemning authority. Sublessor represents that it has not received any notice of condemnation proceedings, and has no actual knowledge of any condemnation proceedings.

10. Sublessee shall not assign this Sublease. Further, Sublessee shall not, without the prior written consent of Sublessor, which shall not be unreasonably withheld, delayed or conditioned, let or underlet or permit the said Sublease Premises or any part thereof to be used by others for hire. Any such assignment or sublet in violation of the foregoing shall, at the option of Sublessor, be void and of no force or effect.

Page 9

11. Sublessee acknowledges that it has inspected the Sublease Premises demised hereunder, and, except as otherwise expressly set forth herein, agrees to accept the Sublease Premises in “AS IS” “WHERE IS CONDITION” condition “WITH ALL FAULTS” and subject to all applicable zoning, federal, state and local laws, ordinances and regulations governing and regulating the Sublease Premises, including but not limited to the Americans with Disabilities Act, and any covenants and restrictions of record and all matters disclosed thereby and by any exhibits attached to this Sublease. Sublessee further acknowledges that, except as otherwise expressly set forth herein, neither Sublessor or Owner has made any representations or warranties whatsoever with respect to the Sublease Premises, expressed and/or implied, or arising by operation of law, including, but not limited to, any warranty of condition, habitability, merchantability or fitness for a particular purpose and Sublessee agrees that neither Sublessor nor Owner have any obligation to alter or repair the Sublease Premises or to prepare the same in any way for Sublessee’s occupancy or use (provided that the foregoing shall not derogate from Owner’s repair and maintenance obligations under the Master Lease). Sublessor does not repeat or make any representation or warranty made by Owner in the Master Lease. Notwithstanding the foregoing, Sublessor represents that it has not received notice and has no actual knowledge that the conditions of the Subleased Premises is in violation of any Massachusetts or United States rules or regulations. Notwithstanding anything to the contrary contained herein, Sublessee shall make no alterations or improvements on or to the Sublease Premises without first obtaining the prior written consent of Sublessor and Owner, which consent of Sublessor shall not be unreasonably withheld, delayed or conditioned. Sublessee agrees and acknowledges that in granting consent to any Sublessee alterations, Owner may impose numerous conditions, procedures, fees and other requirements in accordance with the Master Lease.

Page 10

12. Intentionally deleted.

13. SUBLESSOR and Sublessee each represent and warrant to the other that it has had no dealings with any real estate broker or agent in connection with the negotiation of this Sublease. The parties know of no real estate broker or agent who is or might be entitled to a commission in connection with this Sublease. Sublessor and Sublessee each agree to indemnify, defend and hold the other harmless from all costs and liabilities, including reasonable attorneys’ fees and costs, arising out of or in connection with claims made by any other broker or individual who alleges that it is entitled to commissions or fees with regard to this Sublease as a result of dealings it had with the indemnifying party.

14. (a) Sublessee shall indemnify and save harmless Sublessor and its officers, directors, agents and employees, against and from any and all liability, damage, expense, cause of action, suits, claims or judgments for injury or death to persons or damage to property sustained by anyone in and about said Sublease Premises or any part thereof, arising out of or in any way connected with Sublessee’s or its agents, employees, contractors or invitees, use or occupation of the Sublease Premises or any breach of this Sublease or the Master Lease. Furthermore, all furnishings, fixtures, equipment, and property of every kind and description of Sublessee and of persons claiming by or through Sublessee which may be on the Sublease Premises shall be at the sole risk and hazard of Sublessee and no part of loss or damage thereto for whatever cause is to be charged to or borne by Sublessor.

(b) Sublessor shall indemnify and save harmless Sublessee and its officers, directors, agents and employees, against and from any and all liability, damage, expense, cause of action, suits, claims or judgments for injury or death to persons or damage to property sustained by anyone in and about said Sublease Premises or any part thereof, arising out of or in any way connected with Sublessor’s or its agents, employees, contractors or invitees, use or occupation of the Sublease Premises or any breach of this Sublease or the Master Lease.

Page 11

15. Sublessee shall not cause or permit any “Hazardous Substances” (as hereinafter defined) to be used, stored, generated or disposed of in, on or about the Sublease Premises by Sublessee, its agents, employees, contractors or invitees, except for such de minimis quantities of Hazardous Substances commonly found in office environments and which are necessary to Sublessee’s business. Any such Hazardous Substances permitted on the Sublease Premises as hereinabove provided, and all containers therefor, shall be used, kept, stored and disposed of in a manner that complies with all federal, state and local laws or regulations applicable to any such Hazardous Substances. Sublessee shall indemnify and hold harmless Sublessor from any and all claims, damages, fines, judgments, penalties, costs, expenses or liabilities (including, without limitation, any and all sums paid for settlement of claims, attorneys’ fees, consultant and expert fees) arising during or after the Sublease term from or in connection with the use, storage, generation or disposal of Hazardous Substances in, on or about the Sublease Premises by Sublessee, Sublessee’s agents, employees, contractors or invitees. As used herein, “Hazardous Substances” means any substance with is toxic, ignitable, reactive, or corrosive and which is regulated by any state or local government or by the United States government. “Hazardous Substances” includes any and all material or substances which are defined as “hazardous waste”, “extremely hazardous waste” or a “hazardous substance” pursuant to state, federal or local governmental law. “Hazardous Substances” includes but is not restricted to asbestos, polychlorinated biphenyls (“PCBs”) and petroleum products. Sublessor represents and covenants that, as of the Commencement Date, the Sublease Premises shall be free of Hazardous Substances.

Page 12

16. This Agreement and any Exhibits attached hereto:

(a) Contain the entire agreement among the parties hereto with respect to the subject matter covered hereby;

(b) May not be amended or rescinded except by an instrument in writing executed by each of the parties hereto;

(c) Shall inure to the benefit of and be binding upon the successors and permitted assigns of the parties hereto;

(d) May be executed in one or more counterparts, each of which, when so executed and delivered shall be deemed an original and all of which taken together shall constitute one and the same instrument;

(e) In the event that any covenant, condition or other provision herein contained is held to be invalid, void or illegal by any court of competent jurisdiction, the same shall be deemed severable from the remainder of this Sublease and shall in no way affect, impair or invalidate any other covenant, condition or other provision herein contained. If such condition, covenant or other provision shall be deemed invalid due to its scope or breadth, such covenant, condition or other provisions shall be deemed valid to the extent of the scope or breadth permitted by law;

(f) Sublessee represents and warrants that this Sublease has been duly authorized, executed, and delivered by and on behalf of Sublessee, and that this Sublease constitutes the valid, binding and enforceable agreement of the Sublessee in accordance with the terms hereof. Sublessor represents and warrants that this Sublease has been duly authorized, executed, and delivered by and on behalf of Sublessor, and that this Sublease constitutes the valid, binding and enforceable agreement of the Sublessor in accordance with the terms hereof;

Page 13

(g) The waiver by Sublessor or Sublessee of any breach of any term, condition or covenant of this Sublease shall not be deemed to be a waiver of such provision or any subsequent breach of the same or any other term, condition or covenant of this Sublease. No covenant, term or condition of this Sublease shall be deemed to have been waived by Sublessor or Sublessee unless such waiver is in writing and signed by the waiving party;

(h) Sublessor may transfer the Sublease Premises and any of its rights under this Sublease or Master Lease without the consent of Sublessee. In the event that Sublessor, or any successor to the Sublessor’s interest in the Sublease Premises, shall sell, convey, transfer or assign the Sublease Premises, all liabilities and obligations on the part of Sublessor, or such successor, under this Sublease, shall thereupon and thereby be released, and thereupon all such liabilities and obligations shall be binding upon the new sublessor and Sublessee shall look solely to such new sublessee for the performance of any of Sublessor’s obligations hereunder. This Sublease and Sublessee’s rights and obligations hereunder shall not otherwise be affected by any such sale, conveyance, transfer or assignment and Sublessee agrees to attorn to such new owner and execute any such documents evidencing such attornment;

(i) The submission of this Sublease for examination or the negotiation of the transaction described herein or the execution of this Sublease by only one of the parties shall not in any way constitute an offer to sublease on behalf of either Sublessor or Sublessee, and this Sublease shall not be binding on either party until duplicate originals thereof, duly executed on behalf of both parties, have been delivered to each of the parties hereto; and

(j) To the extent that Sublessor is entitled to an abatement of Rent under the Master Lease on account of a casualty, condemnation, a failure of services or a default of Owner, Sublessee shall be entitled to a corresponding abatement of Rent under this Sublease.

Page 14

17. This Sublease is subject to and conditioned upon the written consent of Owner to this subletting, such consent to be given by Owner, per separate written agreement (“Owner’s Consent Form”), no later than sixty (60) days after the date of this Sublease. In the event that the Owner fails to give its consent on or before the date that is sixty (60) days after the date of this Sublease, this Sublease shall be terminable by either Sublessee or Sublessor. Sublessee shall have no right to access the Sublease Premises or perform any work therein until such time as Sublessee has received an Owner’s Consent Form acceptable to Sublessor and Sublessee in their respective reasonable discretion. Without limiting the foregoing, it is understood and agreed that the Owner’s Consent Form shall not be deemed acceptable unless Owner agrees therein to waive Owner’s relocation right under Section 28 of the Master Lease. Sublessor shall use reasonable efforts to promptly obtain an acceptable Owner’s Consent Form.

18. Upon the expiration or sooner termination of the Sublease, Sublessee shall be responsible, to the extent required under the Master Lease, for the restoration of the Sublease Premises, but only to the extent of the removal of any and all alterations, furnishings, fixtures and wiring undertaken by Sublessee (it being understood and agreed that Sublessor shall remain responsible for the removal and restoration of all alterations, furnishings, fixtures and wiring undertaken by Sublessor to the extent required under the Master Lease). Notwithstanding the foregoing, in the event that Sublessee shall fail to restore the Sublease Premises to the extent required of Sublessee hereunder, Sublessor shall have the right to enter upon the Sublease Premises, in order to restore the same in accordance with the provisions hereof without incurring any liability or damages to the Sublessee and Sublessee shall have no right to abate Rent as

Page 15

result of such entry by Sublessor. Notwithstanding the foregoing, provided (i) Sublessee enters into a Replacement Lease that allows Sublessee to remain in possession of the Sublease Premises beyond the Expiration Date, or (ii) Owner does not require any restoration in accordance with and subject to the terms of the Master Lease, then neither Sublessor nor Sublessee shall be obligated to comply with the restoration provisions of this Section 18.

19. Each of Sublessor and Sublessee, each as to itself, hereby represents its compliance with all applicable anti-money laundering laws, including, without limitation, the USA Patriot Act, and the laws administered by the United States Treasury Department’s Office of Foreign Assets Control, including, without limitation, Executive Order 13224 (“Executive Order”). Expect with respect to any of Sublessor’s or Sublessee’s stock traded on a public stock exchange, each of Sublessor and Sublessee further represents (i) that it is not, and it is not owned or controlled directly or indirectly by any person or entity, on the SDN List published by the United States Treasury Department’s Office of Foreign Assets Control and (ii) that it is not a person otherwise identified by government or legal authority as a person with whom a U.S. Person is prohibited from transacting business. As of the date hereof, a list of such designations and the text for the Executive Order are published under the internet website address www.ustreas.gov/offices/enforcement/ofac. If Sublessor transfers its interest under this Sublease by assignment or by other means (including any transfer by operation of law) and the transferee, assignee or other successor to Sublessor’s interest (collectively, “Sublessor Transferee”) is not a subsidiary or affiliate of Sublessor, then, in connection with such transfer, Sublessor Transferee shall warrant and represent to Sublessee, at the time of such transfer, each of the foregoing warranties and representations set forth above. If Sublessee transfers its interest under this Sublease,

Page 16

by assignment or by other means (including any transfer by operation of law), and the transferee, assignee or other successor to Sublessee’s interest (collectively, “Sublessee Transferee”) is not a subsidiary or affiliate of Sublessee, then, in connection with such transfer, Sublessee Transferee shall warrant and represent to Sublessor, at the time of such transfer, each of the foregoing warranties and representations set forth above.

20. Sublessor represents and covenants to Sublessee as follows:

(a) the Master Lease attached hereto as Exhibit “B” is true, correct and complete and sets forth the entire agreement between Sublessor and Owner with respect to the Sublease Premises;

(b) the Master Lease is scheduled to expire on September 30, 2017;

(c) Sublessor is not in default of any of its obligations as tenant under the Master Lease;

(d) Owner is not in default of any of its obligations as landlord under the Master Lease;

(e) Sublessor shall pay all Base Rent and Additional Rent when due under the Master Lease and shall perform all other obligations of the tenant under Master Lease except to the extent imposed upon Sublessee hereunder;

(f) Sublessor shall, at its expense, promptly remove or cause Owner to remove all of Sublessor’s signage at the Sublease Premises, the Building and the Common Areas, and shall cooperate with Sublessee, at Sublessee’s expense, to have Sublessee’s signage installed in place thereof;

(g) Sublessor shall not amend the Master Lease or voluntarily surrender the Sublease Premises or terminate the Master Lease without Sublessee’s prior written consent;

Page 17

(h) Sublessor is the owner of the entire interest of the tenant under the Master Lease and has not subleased or granted occupancy rights in the Sublease Premises to any other party; and

(i) Subject to the provisions of the Master Lease and this Sublease, Subtenant shall quietly hold and enjoy the Sublease Premises during the Term.

21. This Sublease may be executed in any number of counterparts. Each such counterpart shall for all purposes be deemed to be an original, and all such counterparts shall together constitute the same instruments. Faxed signatures and/or emailed, scanned signatures shall be deemed to be originals for the purpose of this Sublease.

(SIGNATURE PAGE TO FOLLOW)

Page 18

IN WITNESS WHEREOF, the parties have hereunto set their hands and seals as of the day and year first above written.

| PLANK LLC | ||

| By: |

| |

| Title: | CFO | |

| ALDEYRA THERAPEUTICS, INC. | ||

| By: |

| |

| Title: | CFO | |

Page 19

LEASE AGREEMENT

by and between

WLC THREE VI, L.L.C.,

as Landlord

and

PLANCK, LLC,

as Tenant

With respect to the property known as

131 Hartwell Avenue,

Lexington, Massachusetts

Dated as of

June 3, 2014

TABLE OF CONTENTS

| SECTION | PAGE | |||||||

| 1. |

DEFINITIONS | 1 | ||||||

| 1.1 | “Additional Rent” | 1 | ||||||

| 1.2 | “Base Rent” | 1 | ||||||

| 1.3 | “Base Year” | 1 | ||||||

| 1.4 | “Broker(s)” | 2 | ||||||

| 1.5 | “Building” | 2 | ||||||

| 1.6 | “Building Standard” | 2 | ||||||

| 1.7 | “Business Days” | 2 | ||||||

| 1.8 | “Common Areas” | 2 | ||||||

| 1.9 | “Default Rate” | 2 | ||||||

| 1.10 | “Guarantor(s)” | 2 | ||||||

| 1.11 | “Lease Term” | 2 | ||||||

| 1.12 | “Lease Year” | 2 | ||||||

| 1.13 | “Legal Requirements” | 2 | ||||||

| 1.14 | “Operating Expenses” | 3 | ||||||

| 1.15 | “Operating Hours” | 3 | ||||||

| 1.16 | “Permitted Use” | 3 | ||||||

| 1.17 | “Premises” | 3 | ||||||

| 1.18 | “Property” | 3 | ||||||

| 1.19 | “Rentable Area of the Premises” | 3 | ||||||

| 1.20 | “Rentable Area of the Building” | 3 | ||||||

| 1.21 | “Tax Fiscal Year” | 3 | ||||||

| 1.22 | “Taxes” | 3 | ||||||

| 1.23 | “Tenant’s Pro Rata Share” | 3 | ||||||

| 2. |

LEASE GRANT/POSSESSION | 3 | ||||||

| 3. |

RENT | 4 | ||||||

| 4. |

SECURITY DEPOSIT/LETTER OF CREDIT | 5 | ||||||

| 5. |

USE | 6 | ||||||

| 6. |

ENVIRONMENTAL HAZARDS | 6 | ||||||

| 7. |

RULES AND REGULATIONS | 7 | ||||||

| 8. |

INITIAL IMPROVEMENTS TO THE PREMISES | 8 | ||||||

| 8.1 | Landlord’s Work | 8 | ||||||

| 8.2 | Tenant’s Work | 9 | ||||||

| 8.3 | Quality and Performance of Work | 10 | ||||||

| 9. |

CABLE WORK | 10 | ||||||

| 10. |

ALTERATIONS, ADDITIONS AND IMPROVEMENTS TO THE PREMISES | 11 | ||||||

| 10.1 | Generally | 11 | ||||||

| 10.2 | Removal | 12 | ||||||

| 10.3 | Tenant’s Property | 12 | ||||||

| 10.4 | Additional Covenants | 12 | ||||||

| 10.5 | Mechanic’s Liens | 13 | ||||||

i

| SECTION | PAGE | |||||||

| 11. |

SIGNAGE | 13 | ||||||

| 12. |

LANDLORD’S OBLIGATIONS | 13 | ||||||

| 13. |

MAINTENANCE AND REPAIRS | 14 | ||||||

| 14. |

ELECTRICITY | 14 | ||||||

| 15. |

INSURANCE | 15 | ||||||

| 15.1 | Intentionally Omitted | 15 | ||||||

| 15.2 | Tenant’s Insurance | 15 | ||||||

| 15.3 | Insurance During Construction | 16 | ||||||

| 15.4 | Waiver of Subrogation | 16 | ||||||

| 16. |

INDEMNIFICATION | 16 | ||||||

| 17. |

DAMAGES FROM CERTAIN CAUSES | 17 | ||||||

| 18. |

FIRE OR OTHER CASUALTY | 17 | ||||||

| 19. |

EMINENT DOMAIN | 18 | ||||||

| 20. |

ASSIGNMENT AND SUBLETTING | 19 | ||||||

| 20.1 | Generally | 19 | ||||||

| 20.2 | Consent Process | 20 | ||||||

| 20.3 | Right to Share Profits | 20 | ||||||

| 20.4 | Certain Transfers | 21 | ||||||

| 21. |

EVENTS OF DEFAULT | 22 | ||||||

| 22. |

LANDLORD’S REMEDIES | 23 | ||||||

| 23. |

LANDLORD’S DEFAULT | 25 | ||||||

| 24. |

FORCE MAJEURE | 26 | ||||||

| 25. |

COSTS AND EXPENSES | 26 | ||||||

| 26. |

NO WAIVER | 26 | ||||||

| 27. |

QUIET ENJOYMENT | 26 | ||||||

| 28. |

RELOCATION | 26 | ||||||

| 29. |

PARKING | 27 | ||||||

| 30. |

FINANCIAL STATEMENTS | 27 | ||||||

| 31. |

TENANT ESTOPPEL CERTIFICATES | 27 | ||||||

| 32. |

SUBORDINATION | 28 | ||||||

| 33. |

BROKERS | 29 | ||||||

| 34. |

NOTICES | 29 | ||||||

| 34.1 | If to Landlord | 29 | ||||||

| 34.2 | If to Tenant | 30 | ||||||

| 34.3 | Payments of Rent | 31 | ||||||

| 35. |

SURRENDER OF PREMISES | 31 | ||||||

| 36. |

HOLDING OVER | 32 | ||||||

| 37. |

RIGHTS RESERVED TO LANDLORD | 32 | ||||||

| 38. |

OFAC CERTIFICATION | 33 | ||||||

| 39. |

MISCELLANEOUS | 33 | ||||||

| 39.1 | Authority | 33 | ||||||

| 39.2 | Successors and Assigns | 34 | ||||||

| 39.3 | Governing Law | 34 | ||||||

| 39.4 | Jurisdiction; Waiver of Trial by Jury | 34 | ||||||

ii

| SECTION | PAGE | |||||||

| 39.5 | Limitation of Liability | 34 | ||||||

| 39.6 | Independent Covenants; Severability | 35 | ||||||

| 39.7 | No Recording | 35 | ||||||

| 39.8 | Time of the Essence | 35 | ||||||

| 39.9 | More Than One Tenant | 35 | ||||||

| 39.10 | More Than One Lease | 35 | ||||||

| 39.11 | Continuing Obligations | 35 | ||||||

| 39.12 | No Inference Against Drafting Party | 36 | ||||||

| 39.13 | Headings and Titles; Construction | 36 | ||||||

| 39.14 | Lease Not Binding Until Executed and Delivered | 36 | ||||||

| 39.15 | Counterparts | 36 | ||||||

| 39.16 | Entire Agreement; Amendment and Modification | 36 | ||||||

| 39.17 | No Representations or Warranties | 36 | ||||||

| 39.18 | Waiver of Counterclaims | 37 | ||||||

| 39.19 | Consents | 37 | ||||||

| 39.20 | Merger | 37 | ||||||

| 39.21 | Right to Lease | 37 | ||||||

| 39.22 | Confidentiality | 37 | ||||||

| 40. |

TEMPORARY PREMISES | 37 | ||||||

| 41. |

EXHIBITS | 39 | ||||||

| EXHIBIT A PLAN OF PREMISES | A-1 | |||||||

| EXHIBIT B RULES AND REGULATIONS | B-1 | |||||||

| EXHIBIT C PROVISIONS REGARDING ADDITIONAL RENT | C-1 | |||||||

| EXHIBIT D JOB BUDGET | D-1 | |||||||

| EXHIBIT E FORM OF COMMENCEMENT DATE CERTIFICATE | E-1 | |||||||

| EXHIBIT F PLAN OF TEMPORARY PREMISES | F-1 | |||||||

iii

LEASE AGREEMENT

This Lease Agreement (this “Lease”) is made and entered into as of this day of , 2014, by and between WLC THREE VI, L.L.C., a Delaware limited liability company (“Landlord”) and Planck, LLC, a Delaware limited liability company (“Tenant”).

W I T N E S S E T H:

| 1. | DEFINITIONS. |

The following are definitions of some of the defined terms used in this Lease. The definitions of other defined terms are found throughout this Lease.

1.1 “Additional Rent” shall mean Tenant’s Pro Rata Share (as hereinafter defined) of Operating Expenses (as hereinafter defined), Tenant’s Pro Rata Share of Taxes (as hereinafter defined), and all such other sums of money (exclusive of Base Rent) that are required to be paid by Tenant to Landlord hereunder.

1.2 “Base Rent” shall mean the amounts set forth in the schedule below, which shall be paid pursuant to Section 3 of this Lease.

| Period |

Annual Base Rent (Based on 12 months) |

Monthly Base Rent | ||||||

| Commencement Date – Month 3 |

*$ | 55,798.00 | *$ | 4,649.83 | ||||

| Months 4 – 14 |

$ | 55,798.00 | $ | 4,649.83 | ||||

| Month 15 |

$ | 73,324.00 | $ | 6,110.33 | ||||

| Months 16 – 27 |

$ | 76,512.00 | $ | 6,376.00 | ||||

| Months 28 – 39 |

$ | 79,700.00 | $ | 6,641.67 | ||||

| * | Notwithstanding the foregoing Base Rent schedule or any contrary provision of this Lease, but subject to the terms of Section 3.5, Tenant shall not be obligated to pay any Base Rent otherwise attributable to the Premises during the first three (3) months of the Lease Term (as hereinafter defined). |

1.3 “Base Year” shall mean calendar year 2014 with respect to Operating Expenses and Tax Fiscal Year 2014 with respect to Taxes.

1

1.4 “Broker(s)” shall mean CB Richard Ellis-N.E. Partners, Limited Partnership (representing Landlord exclusively) and Cassidy Turley (representing Tenant exclusively).

1.5 “Building” shall mean the building known and numbered as 131 Hartwell Avenue, Lexington, Massachusetts.

1.6 “Building Standard” shall mean work performed in the manner and with the materials selected by Landlord as the standard for the Building subject to availability and Landlord’s right to select alternative types, models, brands, grades, designs, manufacturers and suppliers from time to time as the Building Standard.

1.7 “Business Days” shall mean those days of the week which are not a Saturday, Sunday, or federal, state or local holiday in which the banks in Lexington, Massachusetts are not open for business.

1.8 “Common Areas” shall mean those areas, including any applicable Parking Area (as hereinafter defined), located within the Property (as hereinafter defined) designated by Landlord, from time to time, for the common use or benefit of tenants generally and/or the public.

1.9 “Default Rate” shall mean the lower of (a) fifteen percent (15%) per annum and (b) the highest rate of interest from time to time permitted under applicable federal and state law.

1.10 “Guarantor(s)” N/A

1.11 “Lease Term” shall mean a period commencing on the date upon which Landlord’s Work (as hereinafter defined) is Substantially Complete (as hereinafter defined) (the “Commencement Date”) and ending approximately thirty-nine (39) months thereafter (the “Expiration Date”), unless sooner terminated as provided herein. After the Commencement Date, Landlord and Tenant shall execute a Commencement Date Certificate in the form of Exhibit E (Form of Commencement Date Certificate) attached hereto.

1.12 “Lease Year” shall mean the twelve (12) month period commencing on the Commencement Date, and ending at midnight on the day before the anniversary of the Commencement Date; provided, however, that if the Commencement Date does not occur on the first day of a calendar month, the first Lease Year shall end at midnight on the last day of the calendar month which includes the first anniversary of the Commencement Date.

1.13 “Legal Requirements” shall mean all applicable laws, statutes, codes, ordinances, orders, rules, regulations, certificates of occupancy, conditional use or other permits, variances, covenants and restrictions of record, the requirements of Landlord’s insurance carrier or any fire insurance underwriters, rating bureaus or government agencies, and the requirements of all federal, state, county, municipal and other government authorities, including the requirements of the Americans with Disabilities Act (“ADA”), now in effect or which may hereafter come into effect during the Lease Term.

2

1.14 “Operating Expenses” are defined in Exhibit C (Provisions Regarding Additional Rent) attached hereto.

1.15 “Operating Hours” shall mean 7:00 a.m. to 6:00 p.m. Monday through Friday.

1.16 “Permitted Use” shall mean general office use and no other use or purpose.

1.17 “Premises” shall mean a portion of the 3rd Floor of the Building measuring approximately 3,188 rentable square feet, and shown on Exhibit A (Plan of Premises) to this Lease. If the Premises include one or more floors in their entirety, all corridors and restroom facilities located on such full floor(s) shall be considered part of the Premises.

1.18 “Property” shall mean the property known as “Lexington Crossing” and comprised of five (5) buildings known and numbered as (a) 83 Hartwell Avenue, Lexington, Massachusetts, (b) 81 Hartwell Avenue, Lexington, Massachusetts, (c) 131 Hartwell Avenue, Lexington, Massachusetts, (d) 70 Westview Street, Lexington, Massachusetts, and (e) 20 Maguire Road, Lexington, Massachusetts, together with the parcel(s) of land on which they are located, and any other improvements serving the same.

1.19 “Rentable Area of the Premises” shall mean 3,188 rentable square feet, as adjusted by Landlord from time to time due to a remeasurement of or change in the physical size of the Premises.

1.20 “Rentable Area of the Building” shall mean 78,717 rentable square feet, as adjusted by Landlord from time to time due to a remeasurement of or change in the physical size of the Building.

1.21 “Tax Fiscal Year” shall mean the twelve (12) month fiscal year for the Town of Lexington, Massachusetts, which currently commences on July 1 of each calendar year and ends on June 30 of each subsequent calendar year.

1.22 “Taxes” are defined in Exhibit C (Provisions Regarding Additional Rent) attached hereto.

1.23 “Tenant’s Pro Rata Share” shall mean 4.05%, which is a fraction, the numerator of which shall mean the Rentable Area of the Premises and the denominator of which shall mean the Rentable Area of the Building, as adjusted by Landlord from time to time due to a remeasurement of or change in the physical size of the Premises or the Building. In addition, notwithstanding the foregoing, Landlord may equitably adjust Tenant’s Pro Rata Share for all or part of any item or expense or cost reimbursable by Tenant that relates to a repair, replacement, or service that benefits only the Premises or only a portion of the Building or that varies with the occupancy of the Building.

2. LEASE GRANT/POSSESSION. Except as modified by Landlord’s Work, Landlord leases to Tenant and Tenant leases from Landlord the Premises on an “as is,” “where-is,” and “with all faults” basis, together with the right, in common with others, to use the Common Areas. By taking possession of the Premises, Tenant is deemed to have accepted the Premises and

3

agreed that the Premises are in good order and satisfactory condition, with no representations or warranties of any kind or nature, expressed or implied, by Landlord as to the condition of the Premises, the Building, the Property, or the suitability thereof for Tenant’s use. Subject to the terms, covenants and conditions of this Lease, Tenant shall have access to the Premises and the Common Areas 24 hours per day, 7 days per week, during the Lease Term.

3. RENT.

3.1 Tenant covenants to pay to Landlord during the Lease Term, without any setoff or deduction except as otherwise specifically provided in this Lease, the full amount of all Base Rent and Additional Rent due hereunder and the full amount of all such other sums of money as shall become due under this Lease, all of which hereinafter may be collectively called “Rent.” In addition, Tenant shall pay, as Additional Rent, all rent, sales and use taxes or other similar taxes, if any, levied or imposed by any city, county, state or other governmental body having authority, such payments to be in addition to all other payments required to be paid by Tenant to Landlord under this Lease. Such payments shall be paid concurrently with payments of Taxes. Base Rent and Additional Rent for each calendar year or portion thereof during the Lease Term, shall be due and payable in advance in monthly installments on the first day of each calendar month during the Lease Term, without demand. If the Lease Term commences on a day other than the first day of a month or terminates on a day other than the last day of a month, then the installments of Base Rent and Additional Rent for such month or months shall be prorated, based on the number of days in such month. All amounts received by Landlord from Tenant hereunder shall be applied first to the earliest accrued and unpaid Rent then outstanding. Tenant’s covenant to pay Rent shall be independent of every other covenant set forth in this Lease.

3.2 To the extent allowed by law, if Tenant fails to pay any Base Rent, Additional Rent, or other item of Rent when due and payable hereunder, such item (a) shall bear interest at the Default Rate from the date due until the date paid and (b) shall bear a “Late Charge” equal to five percent (5%) of the unpaid amount, both (a) and (b) of which shall be due and payable to Landlord immediately upon demand. Notwithstanding the foregoing, Tenant shall be entitled to a grace period of five (5) days after written notice from Landlord with respect to the first late payment in any calendar year.

3.3 Additional Rent payable hereunder shall be adjusted from time to time in accordance with the provisions of Exhibit C (Provisions Regarding Additional Rent) attached hereto.

3.4 Tenant’s obligation so to pay Rent under this Lease shall be absolute, unconditional, and independent and shall not be discharged or otherwise affected by any law or regulation now or hereafter applicable to the Premises, or any other restriction on Tenant’s use, or, except as otherwise specifically provided in this Lease, any casualty or taking, or any failure by Landlord to perform or other occurrence; and Tenant waives all rights now or hereafter existing to quit or surrender this Lease or the Premises or any part thereof, or to assert any defense in the nature of constructive eviction to any action seeking to recover Rent.

4

3.5 Provided that Tenant is not then in an Event of Default (as hereinafter defined) under this Lease, then, during the first three (3) months of the Lease Term (the “Rent Abatement Period”), Tenant shall not be obligated to pay any Base Rent otherwise attributable to the Premises during such Rent Abatement Period (the “Rent Abatement”). Landlord and Tenant acknowledge and agree that the amount of the Rent Abatement equals $13,949.49 (3 x $4,649.83 = $13,949.49). Tenant acknowledges and agrees that the foregoing Rent Abatement has been granted to Tenant as additional consideration for entering into this Lease, and for agreeing to pay the rental and performing the terms and conditions otherwise required under this Lease. If, prior to the expiration of the Rent Abatement Period, Tenant shall be in an Event of Default under this Lease, beyond any applicable notice and grace period, or if this Lease is terminated for any reason other than Landlord’s breach of this Lease, fire or other casualty (pursuant to Section 18), or eminent domain (pursuant to Section 19), then the dollar amount of the unapplied portion of the Rent Abatement as of the date of such default or termination, as the case may be, shall be converted to a credit to be applied to the Base Rent applicable at the end of the Lease Term and Tenant shall immediately be obligated to begin paying Base Rent for the Premises in full. Notwithstanding anything to the contrary contained herein, at any time prior to or during the Rent Abatement Period, Landlord shall have the option to purchase, by check or wire transfer of available funds, all or any part of the remaining Rent Abatement, by providing Tenant with written notice thereof (“Landlord’s Rent Abatement Purchase Notice”). Landlord’s Rent Abatement Purchase Notice shall set forth the total portion of the remaining Rent Abatement that Landlord elects to purchase (the “Purchase Amount”). The Purchase Amount shall be paid by Landlord to Tenant simultaneously with the giving of Landlord’s Rent Abatement Purchase Notice. Upon Landlord’s tender of the Purchase Amount, the Rent Abatement shall be reduced by the number of months of Rent Abatement so purchased by Landlord. Upon request by Landlord, Landlord and Tenant shall enter into an amendment to this Lease to reflect the Purchase Amount paid by Landlord and the corresponding reduction of the Rent Abatement.

4. SECURITY DEPOSIT/LETTER OF CREDIT. Simultaneously with the execution and delivery of this Lease, Tenant shall deliver to Landlord the sum of $13,949.49 (the “Security Deposit”). During the Lease Term, including any extensions thereof, and for sixty (60) days after the expiration of the Lease Term, or for so long thereafter as Tenant is in possession of the Premises (or any portion thereof) or has unsatisfied obligations hereunder to Landlord, the Security Deposit shall be held by Landlord without liability for interest and as security for the full and timely performance by Tenant of Tenant’s covenants and obligations under this Lease, it being expressly understood that the Security Deposit shall not be considered an advance payment of Rent or a measure of Tenant’s liability for damages in case of any failure by Tenant to perform any of Tenant’s covenants or obligations hereunder. Landlord shall not be required to keep the Security Deposit separate from its other accounts, and shall have no fiduciary responsibilities or trust obligations whatsoever with regard to the Security Deposit. Tenant shall have no right to require Landlord to so draw and apply the Security Deposit, nor shall Tenant be entitled to credit the same against Rent or other sums payable hereunder. Landlord may, from time to time, without prejudice to any other remedy, use the Security Deposit to the extent necessary to cure or attempt to cure, in whole or in part, any failure by Tenant to perform any of Tenant’s covenants or obligations hereunder, without waiving any rights or remedies as a result of such failure. Following any such application of the Security Deposit, Tenant shall pay to Landlord within five (5) days after demand the amount so applied in order to restore the Security Deposit to its original amount, and failure to so restore within such time period shall be an Event

5

of Default (as hereinafter defined) hereunder giving rise to all of Landlord’s rights and remedies applicable to an Event of Default in the payment of Rent. If Tenant does not have any unsatisfied obligations hereunder at the termination of this Lease (or thereafter if Tenant is in possession of the Premises (or any portion thereof)), the balance of the Security Deposit remaining after any such application shall be returned by Landlord to Tenant within sixty (60) days thereafter. If Landlord transfers its interest in the Premises during the Lease Term, Landlord shall assign the Security Deposit to the transferee and thereafter shall have no further liability for the return of such Security Deposit. Notwithstanding anything to the contrary contained herein, provided that Tenant shall not be in an Event of Default (beyond any applicable notice and grace period) on the twelve-month anniversary of the Commencement Date, the Security Deposit shall be decreased to $9,299.66 on the twelve-month anniversary of the Commencement Date. If Tenant shall be in an Event of Default (beyond any applicable notice and grace period) on the twelve-month anniversary of the Commencement Date, the Security Deposit then in effect shall remain in place (without reduction) for the balance of the Lease Term.

5. USE. The Premises shall be used for the Permitted Use and for no other use or purpose. Tenant agrees not to use or permit the use of the Premises for any purpose which is illegal or dangerous, which creates a nuisance, or which increases the cost of insurance coverage with respect to the Building. Tenant will conduct its business and control its agents, employees, contractors, servants, licensees, and invitees (“Tenant’s Agents”) in such a manner as not to interfere with or disturb other tenants or Landlord in the management of the Property. Tenant will maintain the Premises in a clean and healthful condition, and comply with all Legal Requirements with reference to the use, condition, configuration or occupancy of the Premises.

6. ENVIRONMENTAL HAZARDS.

6.1 Tenant and Tenant’s Agents shall not use, maintain, generate, allow or bring on the Premises or the Property or transport or dispose of, on or from the Premises or the Property (whether into the ground, into any sewer or septic system, into the air, by removal off-site or otherwise) any Hazardous Matter (as hereinafter defined).

6.2 Tenant shall promptly deliver to Landlord copies of any notices, orders or other communications received from any governmental agency or official affecting the Premises and concerning alleged violations of the Environmental Requirements (as hereinafter defined).

6.3 Tenant shall save Landlord, together with Landlord’s members and managers, and their respective members and managers, partners, shareholders, officers, directors, agents and employees (“Landlord’s Agents”), harmless and indemnified from and against any and all Environmental Damages (as hereinafter defined) which may be asserted by any person or entity, or government agency, or which the indemnified parties may sustain or be put to on account of: (a) the presence or release of any Hazardous Matter in, upon or from the Property (including the Premises) caused by the act or omission of Tenant or Tenant’s Agents; (b) the act or omission of Tenant or Tenant’s Agents in violation of Environmental Requirements; and (c) the breach of any of Tenant’s obligations under Section 6.

6

6.4 The provisions of this Section shall be in addition to any other obligations and liabilities Tenant may have to Landlord under this Lease or otherwise at law or equity, and in the case of conflict between Section 6 and any other provision of this Lease, the provision imposing the most stringent requirement on Tenant shall control. The obligations of Tenant under Section 6 shall survive the expiration or earlier termination of this Lease and the transfer of title to the Premises.

6.5 The following terms as used herein shall have the meanings set forth below:

(a) “Hazardous Matter” shall mean any substance: (i) which is or becomes defined as Hazardous Substance, Hazardous Waste, Hazardous Material, Oil or similar substance or material under any Legal Requirements, including, without limitation, The Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. Section 9601 et seq., and the regulations promulgated thereunder, as the same may be amended from time to time; or (ii) which is toxic, explosive, corrosive, flammable, infectious, radioactive, carcinogenic, mutagenic or otherwise hazardous to health or the environment and which is or becomes regulated and the presence of which requires investigation or remediation pursuant to all applicable law

(b) “Environmental Requirements” shall mean all applicable law, the provisions of any and all approvals, and the terms, covenants and conditions of this Lease insofar as the same relate to the release, maintenance, use, keeping in place, transportation, disposal or generation of Hazardous Matter, including, without limitation, those pertaining to reporting, licensing, permitting, health and safety of persons, investigation, containment, remediation, and disposal.

(c) “Environmental Damages” shall mean all liabilities, injuries, losses, claims, damages (whether punitive, special, consequential or otherwise), settlements, attorneys’ and consultants’ fees, fines and penalties, interest and expenses, and costs of environmental site investigations, reports and cleanup, including, without limitation, costs incurred in connection with any investigation or assessment of site conditions or of health of persons using the Building or the Property; risk assessment and monitoring; any cleanup, remedial, removal or restoration work required by any governmental agency or recommended by Landlord’s environmental consultant; any decrease in value of the Property; any damage caused by loss or restriction of rentable or usable space in the Property; or any damage caused by adverse impact on marketing or financing of the Property.

7. RULES AND REGULATIONS. Tenant agrees to comply with, and cause Tenant’s Agents to comply with, the rules and regulations (the “Rules and Regulations”) of the Property attached hereto as Exhibit B (Rules and Regulations) and Landlord’s commercially reasonable changes thereto. In the event of a conflict between the terms, covenants and conditions of this Lease and the Rules and Regulations, the terms, covenants and conditions of this Lease shall control.

7

8. INITIAL IMPROVEMENTS TO THE PREMISES.

8.1 Landlord’s Work.

(a) Landlord, at Landlord’s sole cost and expense, shall perform the work (“Landlord’s Work”) set forth in the job budget (the “Job Budget”) prepared by Vantage Builders, Inc., dated May 22, 2014, consisting of two (2) pages, and attached hereto as Exhibit D (Job Budget) in order to deliver the Premises in accordance with the space plan prepared by Design-Science, dated April 29, 2014, consisting of one (1) page, and attached hereto as Exhibit A (Plan of Premises).

(b) Subject to delays due to events of Force Majeure (as hereinafter defined) or Tenant Delay (as hereinafter defined), Landlord shall use reasonable care and diligence to complete Landlord’s Work as quickly and efficiently as possible, but Tenant shall have no claim against Landlord for failure to complete Landlord’s Work; provided, however, that in the event that Landlord does not Substantially Complete (as hereinafter defined) Landlord’s Work on or before June 27, 2014 (the “Outside Completion Date”), Landlord shall provide Tenant with a license to use a portion of the 2nd Floor of the Building measuring approximately 2,426 rentable square feet, and shown on Exhibit F (Plan of Temporary Premises) to this Lease (the “Temporary Premises”).

(c) Landlord’s Work shall be performed in a Building Standard manner using Building Standard materials.

(d) If Tenant wants Landlord to perform or supply any additional work or non-Building Standard work, installations, materials or finishes (“Extra Work”) over and above, or in lieu of, Landlord’s Work, Landlord may refuse such request for Extra Work. Any agreement to do Extra Work must be in writing describing the Extra Work, the price to be paid by Tenant and any payment terms therefor. Any and all costs incurred for the preparation, filing or approval of plans and specifications relating to Extra Work shall be paid for by Tenant without regard to whether or not Landlord agrees to do Extra Work. If Tenant fails to make any agreed payment for Extra Work within five (5) days after Landlord invoices Tenant for the same, Landlord shall have the same remedies against Tenant for such non-payment as for non-payment of any other item of Rent.

(e) Notwithstanding anything contained herein or elsewhere in this Lease to the contrary, if there is any increase in Landlord’s cost for Landlord’s Work or if Landlord is delayed in substantial completion of Landlord’s Work as a result of: (i) Landlord’s performance of Extra Work; or (ii) the performance of any work by Tenant or Tenant’s Agents, then, in such event, (a) Tenant shall be responsible for the increase in Landlord’s cost for Landlord’s Work, and (b) the Commencement Date shall be deemed to be the date on which Landlord’s Work would have been Substantially Complete but for the delay.

(f) Substantial Completion of Landlord’s Work. Landlord’s Work shall be deemed “Substantially Complete” when Landlord’s construction representative certifies that Landlord’s Work has been completed in accordance with the Job Budget and the Plan of Premises, Punchlist Items (as hereinafter defined) excepted.

(g) Tenant Delay. A “Tenant Delay” shall be defined as any act or omission by Tenant, or Tenant’s Agents, which causes an actual delay in the performance of Landlord’s Work. Notwithstanding the foregoing, no event shall be deemed to be a Tenant Delay unless and until Landlord has given Tenant written notice (the “Tenant Delay Notice”) advising Tenant: (i)

8

that a Tenant Delay is occurring, (ii) of the basis on which Landlord has determined that a Tenant Delay is occurring, and (iii) the actions which Landlord believes that Tenant must take to eliminate such Tenant Delay and Tenant has failed to correct the Tenant Delay specified in the Tenant Delay Notice within forty-eight (48) hours following receipt of the Tenant Delay Notice. No period of time prior to the expiration of the cure period shall be included in the period of time charged to Tenant pursuant to such Tenant Delay Notice.

(h) Punchlist Items. Promptly following delivery of the Premises to Tenant with Landlord’s Work with respect thereto Substantially Complete, Landlord, Tenant and their respective construction representatives shall inspect the Premises and prepare a list of outstanding items which need to be completed to make Landlord’s Work comply with the Job Budget (“Punchlist Items”). Landlord shall use good faith to complete all Punchlist Items within sixty (60) days of the date of the Punchlist. If Landlord fails to complete any Punchlist Items as a result of events of Force Majeure or Tenant Delay, Landlord shall have such additional time as is reasonably necessary to complete the delayed Punchlist Items.

8.2 Tenant’s Work.

(a) Cost of Tenant’s Work; Priority of Work. Landlord agrees to allow Tenant access to the Premises fourteen (14) days prior to the Commencement Date for the sole purpose of installing Tenant’s furniture, fixtures and equipment (“Tenant’s Work”) and Cable Work (as hereinafter defined). Tenant’s Work shall be performed at Tenant’s sole cost and expense. Landlord and Tenant shall each take commercially reasonable measures to ensure that Landlord’s contractors and Tenant’s contractors cooperate in commercially reasonable ways with each other to avoid any delay in either Landlord’s Work or Tenant’s Work or any conflict with the performance of either Landlord’s Work or Tenant’s Work, Tenant acknowledging, however, that in the case of conflict that is not reasonably avoidable, the performance of Landlord’s Work shall have priority. Tenant shall reimburse Landlord, within thirty (30) days after demand therefor, for any out-of-pocket expenses (including third-party charges) incurred by Landlord in connection with the performance of Tenant’s Work. Tenant shall not perform any portions of Tenant’s Work outside of normal construction hours (i.e., outside of 6:00 a.m. to 6:00 p.m. on Business Days) (“After-Hours Work”) without the prior written consent of Landlord. Tenant acknowledges and agrees that (i) if Tenant performs any After-Hours Work, and (ii) such After-Hours Work (a) requires access to any areas outside of the Premises, or (b) affects the exterior, architectural design or structural components of the Building, or affects the Building systems (including, without limitation, the roof, mechanical, electrical, plumbing, heating, ventilation, and air conditioning (“HVAC”), telecommunication, life safety, and security systems), then Tenant shall (y) give Landlord at least twenty-four (24) hours’ notice of such After-Hours Work so that Landlord may arrange to have Landlord’s supervisory personnel on site, and (z) reimburse Landlord, within thirty (30) days after demand therefor, for the cost of Landlord’s supervisory personnel overseeing the After-Hours Work at the rate of $75.00 per hour.

(b) If Tenant, with Landlord’s prior written approval, takes possession of the Premises prior to the Commencement Date, such possession shall be subject to all of the terms, covenants and conditions of this Lease, including, without limitation, Section 10 (Alterations, Additions and Improvements to the Premises) and Section 15 (Insurance), except that Tenant

9

shall not be required to pay Base Rent and Additional Rent with respect to the period of time prior to the Commencement Date during which Tenant performs such work; provided, however, that Tenant shall be liable for the cost of any utilities and services that are provided to Tenant during the period of Tenant’s possession prior to the Commencement Date. Tenant shall coordinate such entry and installations with Landlord’s property manager.

8.3 Quality and Performance of Work. All work required or permitted by this Lease, whether constituting part of Landlord’s Work, Tenant’s Work, Cable Work or Alterations (as hereinafter defined), shall be done in a good and workmanlike manner, by contractors approved by Landlord, and in compliance with all Rules and Regulations, construction rules and regulations (“Construction Rules and Regulations”), Legal Requirements, and other provisions (including, without limitation, insurance provisions) of this Lease. Each party authorizes the other party to rely upon the written approval or other written authorizations of any construction representative of the party designated by the party in connection with design and construction.

9. CABLE WORK.

9.1 Tenant may install, maintain, replace, remove (collectively, the “Cable Work”) or use any electronic, phone and data wires, cables, fibers, connections and related telecommunications equipment and/or other facilities for telecommunications (collectively, “Cable(s)”) within or serving the Premises, provided: (a) any such installation, maintenance, replacement, removal or use shall comply with Section 8.3 (Quality and Performance of Work) and shall not interfere with the use of any then-existing Cables within or serving the Building, (b) an acceptable number of spare Cables and space for additional Cables shall be maintained for existing and future occupants of the Building, as determined in Landlord’s reasonable opinion, (c) if Tenant at any time uses any equipment that may create an electromagnetic field exceeding the normal insulation ratings of ordinary twisted pair riser Cable or cause radiation higher than normal background radiation, the Cables therefor (including riser Cables) shall be appropriately insulated to prevent such excessive electromagnetic field or radiation, (d) Tenant’s rights shall be subject to the rights of any regulated telephone company, and (e) Tenant shall pay all costs in connection therewith. Landlord shall at all times maintain exclusive control over all risers (including their use) in the Building. Landlord reserves the right to require that Tenant remove any Cables located in or serving the Premises that are installed by or on behalf of Tenant in violation of these provisions, or which are at any time in violation of any applicable Legal Requirements or represent a dangerous or potentially dangerous condition, within three (3) days after receipt of notice by Tenant or such longer period of time as is reasonably necessary.

9.2 Landlord may (but shall not have the obligation to) (a) install new Cable at the Building, (b) create additional space for Cable at the Building, and (c) reasonably direct, monitor and/or supervise the installation, maintenance, replacement and removal of the allocation and periodic reallocation of available space (if any) for, and the allocation of excess capacity (if any) on, any Cable now or hereafter installed at the Building by Landlord, Tenant or any other party (but Landlord shall have no right to monitor or control the information transmitted through) the Cables. Such rights shall not be in limitation of other rights that may be available to Landlord by law, in equity or otherwise. If Landlord exercises any such rights, Landlord may charge Tenant for such costs attributable to Tenant, or may include those costs and all other such costs in

10

Operating Expenses (including without limitation, costs for acquiring and installing Cable and risers to accommodate new Cable and spare Cable, any associated computerized system and software for maintaining records of Cable connections, and the fees of any consulting engineers and other experts).

9.3 Notwithstanding anything to the contrary contained in this Lease, Landlord reserves the right to require that Tenant remove any or all Cables installed by or for Tenant within or serving the Premises upon the expiration or earlier termination of this Lease. Any Cables not required by Landlord to be removed pursuant to this Section 9.3 at the expiration or earlier termination of this Lease shall, at Landlord’s option, become the property of Landlord (without payment by Landlord). If Tenant fails to remove such Cables as required by Landlord, or violates any other provision of this Section 9.3, Landlord may, after twenty (20) days’ notice to Tenant, remove such Cables or remedy such other violation, at Tenant’s expense (without limiting Landlord’s other remedies available under this Lease, at law or in equity), which amount shall be paid by Tenant within fifteen (15) days after Tenant’s receipt of demand by Landlord. Tenant shall not, without the prior consent of Landlord in each instance (which may be withheld in Landlord’s sole and absolute discretion), grant to any third party a security interest or lien in or on the Cable, and any such security interest or lien granted without Landlord’s consent shall be null and void. Notwithstanding anything to the contrary contained in this Lease, Landlord shall have no liability for damages arising from, and Landlord does not warrant that the Tenant’s use of any Cable will be free from, the following (collectively, “Cable Problems”): (a) any eavesdropping or wiretapping by unauthorized parties, (b) any failure of any Cable to satisfy Tenant’s requirements, or (c) any shortages, failures, variations, interruptions, disconnections, loss or damage caused by the installation, maintenance, replacement, use or removal of Cables or by any failure of the environmental conditions or the power supply for the Building to conform to any requirements for the Cables or any associated equipment, or any other problems associated with any Cable by any other cause. Under no circumstances shall any Cable Problems be deemed an actual or constructive eviction of Tenant, render Landlord liable to Tenant for abatement of Rent or otherwise, or relieve Tenant from performance of Tenant’s other obligations under this Lease. Landlord in no event shall be liable for damages by reason of loss of profits, business interruption or other consequential damage arising from any Cable Problems. The provisions of this Section 9.3 shall survive the expiration or earlier termination of this Lease.

10. ALTERATIONS, ADDITIONS AND IMPROVEMENTS TO THE PREMISES.

10.1 Generally. Other than Tenant’s Work (which shall be governed by the provisions of Section 8 above) and Cable Work (which shall be governed by the provisions of Section 9 above), Tenant shall not make any alterations, additions, improvements or other changes in or to the Premises (“Alterations”), other than the installation of typical office decorations and furnishings which are not affixed to the realty, without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed; provided, however, that if the proposed Alterations affect the exterior, architectural design or structural components of the Building, or affect the Building systems (including, without limitation, the roof, mechanical, electrical, plumbing, heating, ventilation, and air conditioning (“HVAC”), telecommunication, life safety, and security systems), Landlord may withhold its consent to such Alterations in Landlord’s sole and absolute discretion. Without limitation, it shall not be

11

unreasonable for Landlord to withhold its consent to any Alterations which would require Landlord to make improvements to the Building or the Property (or undertake special maintenance, repair or replacement obligations with respect to the Building or the Property) not within the scope of those expressly provided for herein, unless Tenant agrees, at the time of its request for approval or notice of such Alterations, to pay all costs associated with Landlord’s improvements or obligations.

10.2 Removal. Landlord shall notify Tenant in writing, before the end of the Lease Term, whether or not Tenant’s Work or Alterations will be required to be removed by Tenant at the end of the Lease Term. Tenant shall be obligated to remove any Tenant’s Work or Alterations that Landlord has not designated in writing will be permitted to remain on the Premises in accordance with Section 35. Tenant acknowledges and agrees that any work or alterations (including, without limitation, Tenant’s Work and Alterations) performed by or for the benefit of Tenant shall be the property of Tenant during the Lease Term.

10.3 Tenant’s Property. Tenant shall pay, prior to delinquency, all taxes assessed against and levied upon Tenant’s Property (as hereinafter defined). If any of Tenant’s Property shall be assessed with Landlord’s real or personal property, Tenant shall pay to Landlord the taxes attributable to Tenant within ten (10) days after receipt of a written statement from Landlord setting forth the taxes applicable to Tenant’s Property. As used herein, “Tenant’s Property” includes, but is not limited to, all tangible and intangible goods and accounts, inventory, merchandise, furniture, fixtures, equipment (including computer equipment and any data stored thereon) and systems, as well as the property of others held or leased by Tenant or otherwise in the Premises.

10.4 Additional Covenants.

(a) All Alterations shall be made (i) at Tenant’s sole cost and expense, and (ii) according to plans and specifications approved in writing by Landlord (to the extent plans and specifications and Landlord’s approval are required).

(b) Tenant shall pay to Landlord a fee equal to five percent (5%) of the cost of any Alterations to compensate Landlord for the overhead and other costs it incurs in reviewing the plans therefor and in monitoring the construction of the Alterations.