Attached files

| file | filename |

|---|---|

| EX-99.1 - RESOLUTIONS APPROVING ACQUISITION - Stemcell Holdings, Inc. | bod_acq.htm |

| EX-10.1 - SHARE PURCHASE AGREEMENT - Stemcell Holdings, Inc. | spa_stemcell.htm |

| EX-3.3 - ARTICLES TRANSLATED - STEMCELL CO., LTD. - Stemcell Holdings, Inc. | articles_translated.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 28, 2016

Stemcell Holdings, Inc.

(Name of Small Business Issuer in its charter)

| Delaware | 000-55583 | 36-4827622 |

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

C/O Omotesando Helene Clinic, 3-18-17-6F, Minamiaoyama

Minato-ku, Tokyo, 107-0062, Japan

(Address of Principal Executive Offices)

Telephone: +81-3-6432-9977

(Registrant's telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

-1-

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements which involve risks and uncertainties, principally in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” or “should,” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as expressly required by law.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

All dollar amounts used throughout this Report are in US Dollars, unless otherwise stated. All amounts in Japanese yen used throughout this Report are preceded by JPY, for example JPY 500, is referring to 500 Japanese yen.

-2-

-3-

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Note: Any reference to “Stemcell” refers to Stemcell Co., Ltd

On March 23, 2016, Stemcell Holdings, Inc., a Delaware corporation (the “Company”), entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Takaaki Matsuoka, our President, CEO and Director. Pursuant to this Agreement, on March 24, 2016 Takaaki Matsuoka transferred to Stemcell Holdings, Inc., 500 shares of the common stock of Stemcell Co., Ltd., a Japan corporation (“Stemcell”), which represents all of its issued and outstanding shares, in consideration of 5,000,000 JPY ($44,291 USD).

Following the effective date of the share purchase transaction above on March 24, 2016, Stemcell Holdings, Inc. gained a 100% interest in the issued and outstanding shares of Stemcell’s common stock and Stemcell became a wholly owned subsidiary of the Company. The Company is now the controlling and sole shareholder of Stemcell.

Stemcell conducts a regenerative medicine related business which includes but is not limited to the culturing, storing and delivery of stem cells.

Following the effective date of the Stock Purchase Agreement on March 24, 2016 the Company adopted the business plan of Stemcell.

A copy of the Stock Purchase Agreement is attached hereto and is hereby incorporated by this reference. All references to the Stock Purchase Agreement and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Effective March 24, 2016, “the Company,” Stemcell Holdings, Inc., and Mr. Takaaki Matsuoka consummated a Stock Purchase Agreement for Stemcell Co., Ltd, and Stemcell became a 100% wholly-owned subsidiary of the Company.

-4-

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, the Company completed a Stock Purchase Agreement, which caused the Company to cease being defined as a “shell company” under the Securities Act of 1933, as amended. Item 2.01(f) of Form 8-K requires that if a registrant was a shell company, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the closing of the Stock Purchase Agreement, except that information relating to periods prior to the date of the Stock Purchase Agreement only relates to the Company, unless otherwise specifically indicated.

Corporate History of Stemcell Holdings, Inc.

The Company was originally incorporated with the name Perfect Acquisition, Inc., under the laws of the State of Delaware on December 31, 2015, with an objective to acquire, or merge with, an operating business.

On January 27, 2016, Jeffrey DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with Takaaki Matsuoka with an address at 3-18-17-6F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan. Pursuant to the Agreement, Mr. DeNunzio transferred to Dr. Matsuoka., 20,000,000 shares of our common stock which represents all of our issued and outstanding shares.

Following the closing of the share purchase transaction, Dr. Matsuoka gained a 100% interest in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

The sale of shares between Jeffrey DeNunzio and Takaaki Matsuoka was made pursuant to Regulation S of the Securities Act of 1933, as amended ("Regulation S"). No directed selling efforts were made in the United States. Dr. Matsuoka is a Japanese Citizen.

On January 27, 2016, the Company changed its name to Stemcell Holdings, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment.

On January 27, 2016, Jeffrey DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. The resignation was not the result of any disagreement with us on any matter relating to our operations, policies or practices.

On January 27, 2016, Mr. Takaaki Matsuoka was appointed as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On March 23, 2016, Stemcell Holdings, Inc., a Delaware corporation (the “Company”), entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Takaaki Matsuoka, our President, CEO and Director. Pursuant to this Agreement, on March 24, 2016 Takaaki Matsuoka transferred to Stemcell Holdings, Inc., 500 shares of the common stock of Stemcell Co., Ltd., a Japan corporation (“Stemcell”), which represents all of its issued and outstanding shares, in consideration of 5,000,000 JPY ($44,291 USD). Following the effective date of the share purchase transaction above on March 24, 2016, Stemcell Holdings, Inc. gained a 100% interest in the issued and outstanding shares of Stemcell’s common stock and Stemcell became a wholly owned subsidiary of the Company. The Company is now the controlling and sole shareholder of Stemcell.

-5-

Overview of Our Subsidiary: Stemcell Co., Ltd.

Stemcell Co., Ltd., also referenced in this document as “Stemcell”, was initially formed as a Tokyo, Japan Corporation on January 24, 2016. Stemcell conducts a regenerative medicine-related business which includes but is not limited to the culturing, storing and delivery of stem cells.

Regenerative Medicine-related Industry

Based on the report of the Ministry of Economy, Trade and Industry in Japan (the “METI report”), the market size of the regenerative medicine-related industries in Japan in 2012 was estimated at 9.1 billion JPY ($76 million) and was expected to grow to 95.4 billion JPY ($795 million) by the year 2020. The Japanese market of the regenerative medicine-related industries is expected to undergo significant transition in the coming years. The expected estimate of the market size of regenerative medicine-related industries in the future within Japan are as follows:

| Estimate of Market Size of Regenerative Medicine-related Industries in Japan | JPY/USD=120 | ||||||||

|

Year | ||||||||

| 2012 | 2020 | 2030 | 2050 | ||||||

| Billion JPY | Million USD | Billion JPY | Million USD | Billion JPY | Million USD | Billion JPY | Million USD | ||

| Tissue | Skin | 1.7 | 14 | 4.7 | 39 | 17.1 | 142 | 49.3 | 411 |

| Cartilage | 21 | 171 | 86 | 718 | 114 | 948 | |||

| Eye | 16 | 134 | 100 | 835 | 184 | 1,537 | |||

| Heart | 22 | 181 | 63 | 527 | 73 | 609 | |||

| Nerve | 5 | 39 | 111 | 928 | 290 | 2,417 | |||

| Alveolar bone | 0.1 | 1 | 0 | 1 | 19 | 160 | 82 | 680 | |

| Blood vessel | 0 | 2 | 32 | 263 | 76 | 633 | |||

| Kidney | 93 | 772 | 315 | 2,627 | |||||

| Liver | 66 | 546 | 223 | 1,858 | |||||

| Pancreas | 3 | 22 | 234 | 1,953 | |||||

| Blood | 118 | 982 | 287 | 2,388 | |||||

| Cancer immunity | 7.0 | 58 | 23 | 193 | 302 | 2,520 | 572 | 4,766 | |

| Other | 0.4 | 3 | 4 | 35 | 20 | 167 | 47 | 388 | |

| Total | 9.1 | 76 | 95.4 | 795 | 1,030.1 | 8,584 | 2,545.8 | 21,215 | |

| Source: 2013 Ministry of Economy, Trade and Industry's Report | |||||||||

| Estimate of Market Size of Peripheral Industries of Regenerative Medicine in Japan | JPY/USD=120 | |||||||||||

| Year | ||||||||||||

| 2012 | 2020 | 2030 | 2050 | |||||||||

| Billion JPY | Million USD | Billion JPY | Million USD | Billion JPY | Million USD | Billion JPY | Million USD | |||||

| Category | Equipment | 5.4 | 45 | 37.1 | 309 | 95.8 | 798 | 103.1 | 860 | |||

| Consumables | 7 | 59 | 30 | 250 | 478 | 3,984 | 537 | 4,473 | ||||

| Service | 5 | 39 | 26 | 220 | 551 | 4,592 | 620 | 5,165 | ||||

| Contract production | 3 | 25 | 16 | 132 | 170 | 1,415 | 419 | 3,492 | ||||

| Storage | 1 | 7 | 4 | 35 | 45 | 377 | 112 | 931 | ||||

| Application for drug development | 0 | 1 | 1 | 8 | 15 | 125 | 25 | 208 | ||||

| Total | 17.2 | 143 | 94.5 | 788 | 1,139.9 | 9,499 | 1,284.7 | 10,706 | ||||

| Source: 2013 Ministry of Economy, Trade and Industry's Report | ||||||||||||

Business Information of Stemcell Co., Ltd.

Stemcell Co., Ltd., also referenced herein as “Stemcell”, was initially formed as a Tokyo, Japan Corporation on January 24, 2014.

Stemcell conducts a regenerative medicine-related business which includes but is not limited to the culturing, storing and delivery of stem cells.

Autologous Stem Cell Harvesting

Stem cells are undifferentiated biological cells that have the ability to divide and produce the same type of cells, as well as differentiate into specialized cells. Stemcell Co., Ltd. provides injections of patients’ own harvested stem cells as well as stem cells extracted from umbilical cord blood. Our cell harvesting center has a similar bio-environment and uses the newest 3D harvesting technology to efficiently harvest autologous stem cells within 5 to 10 days. The stems cells will be injected back into the patient’s body after the harvesting procedure. There is always the risk that the body will reject implanted cells from another donor, but we eliminate this problem entirely when the patient chooses to inject their own stems cells back into a different part of their body. This can produce the regenerative results the patient desires and runs no risk of rejection. We also allow our patients to keep excess cells by freeze-preservation if they desire to do so.

Umbilical Cord Blood Stem Cells

Umbilical cord blood stem cells are extracted from placenta, which is a tissue responsible for delivering nutrients from mother to fetus. Due to the nature of the placenta they are known to contain a large amount of stem cells. However, because these stems cells are not coming from the patient’s own body, rejection may occur. In this event the results of the stem cell implantation would be less desirable. HLA testing is required prior to the injection in order to maximize the possibility of selecting suitable cells for every patient.

How Stem Cells are Harvested (Microscopic Photo)

|

| |

|

Stem cell ~harvest 2nd day~ Skin cells scattered and the cell number has not increased. |

Stem cell ~harvest 1st week~ More black dots on the left indicates cell division. |

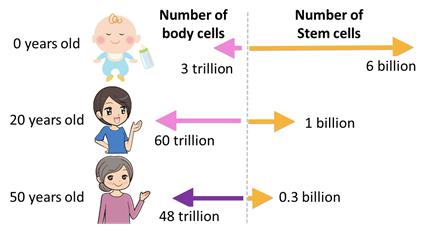

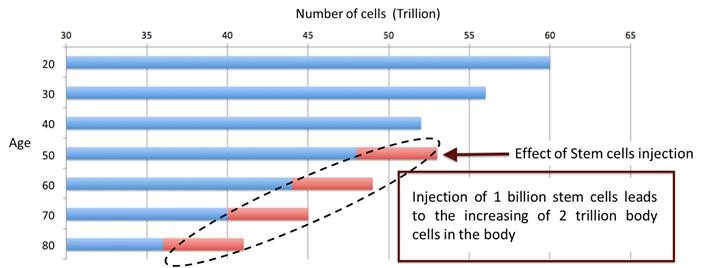

Effect of Stem Cell Therapy

As displayed in the picture below, babies contain the highest amount of stem cells which, as the infants mature, turn into body cells over the course of their lifetimes. The older we get the fewer stem cells we have and this results in a slower metabolism, among other physiological changes. Autologous stem cells harvesting as well as umbilical cord stem cell therapy will both assist in preventing cell loss and can assist in regenerative therapy.

Studies have shown that umbilical cord stem cells can help decrease the risk of having cancer, a stroke, heart disease, diabetes, high blood pressure, Alzheimers, Parkinson’s disease, etc. Injected stem cells will circulate throughout the body, find tissues that require to be repair and then start regeneration. Stem cells also stimulate the brain and stabilize hormone balance, which in turn speeds up the metabolism. Stems cells are able to replicate and regenerate, therefore skin tissues are constantly renewed and anti-aging effects can be expected. The real purpose of regenerative medicine is to prevent illness, stay healthy, and provide anti-aging benefits. Stem cell therapy revitalizes weakened cells and regenerates new healthy cells for our body to stay in the best condition every day.

-6-

Our Stem Cell Harvesting Services

Currently, we “Stemcell” have two options for stem cell regenerative treatment: autologous stem cell harvest and umbilical cord stem cells. For autologous cell harvest, we take some of patient’s own skin cells and subsequently harvest stem cells at our harvesting center. For umbilical cord stem cells, the HLA test is performed in order to find the right stem cells that suit each patient’s body. Stem cells can be inserted back to patient’s body through either muscle or IV injection in a hospital or clinic. Our stem cell harvest team consists of 2 members from Keio University School of Medicine: Dr. Matsuoka, who is an expert in stem cell therapy, and Dr. Dan, who is highly experienced and has devoted almost 30 years of his career to cell harvesting. Our professional team provides our clients with high quality harvesting service(s). Safety is always our highest priority.

Our Stem Cell Harvesting Facilities

As of March 28, 2016, Stemcell owns the following equipment valued at 2,000,000 JPY ($17,716):

|

|

Liquid Nitrogen Freezers Its purpose is to store stem cells.

|

Centrifugal Separator Its purpose is to separate cells from the culture medium. |

|

|

Biological Safety Cabinet Its purpose is to serve as a means to protect the laboratory workers and the surrounding environment from pathogens. |

Carbon Oxide Incubator Its purpose to grow and maintain microbiological cultures or cell cultures. |

*We and our parent Company Stemcell Holdings, Inc. share the same address. We both are provided the operating/office space at no cost by our Chief Executive Officer, Dr. Matsuoka. Our address is Omotesando Helene Clinic, 3-18-17-6F, Minamiaoyama, Minato-ku, Tokyo, Japan.

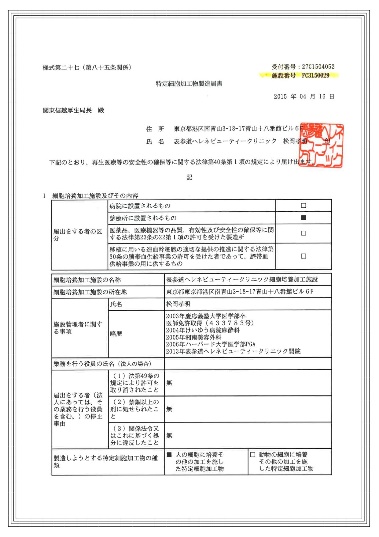

Government Regulations

If we conduct the harvesting of stem cells in Japan, which we currently intend to do, we have to file a notification for facilities to the Minister of Health, Labor and Welfare (the “MHLW”). Our Chief Executive Officer, Dr. Matsuoka has filed the notification to the MHLW in 2015. In addition, Dr. Matsuoka obtained the approval of the Regenerative Medicine Provision Plan Following by MHLW in 2015. The following pictures are copies of the certificates of the notification and approvals.

*At this time the Company has no intentions to expand its operations outside Japan.

|

| |

|

Notification for Cell Culturing Facilities.

|

Approval of the Regenerative Medicine Provision Plan - Intravenous injection of stem cells.

| |

|

| |

|

Approval of the Regenerative Medicine Provision Plan - Subcutaneous injection of stem cells |

Approval of the Regenerative Medicine Provision Plan - External administration of stem cells |

-7-

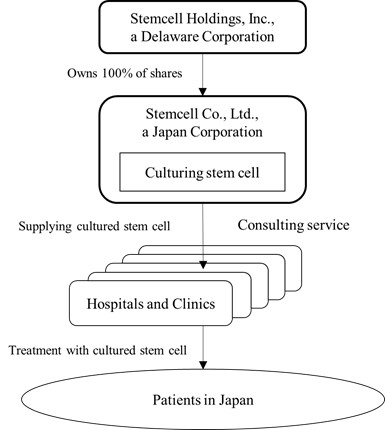

Outline of the Structure of Our Business

*Currently, we have no agreement(s) regarding the terms and conditions for the below transactions that we foresee taking place in the future. The terms and conditions described below are based on current assumptions and expectations.

As depicted in the diagram, Stemcell Co., Ltd. is the wholly owned subsidiary of Stemcell Holdings, Inc. Stemcell Co. Ltd. is responsible for the culturing, storing and delivery of stem cells to hospitals and clinics in Japan.

As of March 28, 2016, our CEO, Dr. Matsuoka owns the following six clinics (of which we intend to provide our services to):

| Clinic name | Address |

| Omotesando Helene Beauty Clinic | 3-18-17, Minamiaoyama, Minato-ku, Tokyo, Japan |

| Kobe Varix Clinic | 7-1-8, Isogamidori, Chuo-ku, Kobe, Hyogo, Japan |

| Funabashi Varix Clinic | 6-1-3, Honcho, Funabashi, Chiba, Japan |

| Ofuna Varix Clinic | 1-26-33, Ofuna, Kamakura, Kanagawa, Japan |

| Omotesando Edeme Clinic | 3-10-6, Kitaaoyama, Minato-ku, Tokyo, Japan |

| Tachikawa Varix Clinic | 2-1-4, Shibasakicho, Tachikawa, Tokyo, japan |

Additionally, we have the following eight business and clinical partners that we anticipate working with:

| Clinic name | Address |

| Akabene Varix Clinic | 2-15-10, Akabane, Kita-ku, Tokyo, Japan |

| Tokyo Central Clinic Fukushima | 7-3, Okitamacho, Fukushima, Fukushima, Japan |

| Tokyo Central Clinic Koriyama | 2-10-19, Koriyama-ekimae, Fukushima, Fukushima, Japan |

| Tokyo Central Clinic Utasunomiya | 1-5-6, Ekimaedori, Utsunomiya, Tochigi, Japan |

| Tokyo Central Varix Clinic Machida | 1-24-13, Morino, Machida, Tokyo, Japan |

| TOWACO CLINIC SHANGHAI | Shanghai, China |

| BioSolutions Korea | Seoul, Korea |

As denoted above we “Stemcell” plan to provide stem cell services to the above clinics. As we increase operations, we plan to develop new relationships with other hospitals and clinics of which we can provide our services to.

We anticipate that there will be a large increase in the number of foreign patients who are looking for stem cell therapy due to the fact that stem cell therapy is not legal in a number of Asian countries, as well as many countries all throughout the world. As the hospitals and clinics experience greater demand for therapy, we believe we will almost invariably will see a greater demand for our cultured stem cells.

*The following are diseases and ailments that we seek to treat with our stem cell therapies.

| JPY/USD=120 |

| Disease | Number of stem cells | Medical fees by clinic | Service fees by Stemcell | ||

| Cells | JPY | USD | JPY | USD | |

| Chronic fatigue syndrome | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Facial rejuvenation | 100 Million | 980,000 | 8,167 | 637,000 | 5,308 |

| Type II diabetes mellitus | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Ovarian function | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Cerebral infarction | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Alzheimer disease | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Parkinson disease | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Spinocerebellar degeneration | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Multiple sclerosis (MS) | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Amyotrophic lateral sclerosis (ALS) | 1,000 Million | 4,000,000 | 33,333 | 2,600,000 | 21,667 |

| Inflammatory colitis | 100-200 Million | 980,000 | 8,167 | 637,000 | 5,308 |

| Knee joint | 100 Million | 980,000 | 8,167 | 637,000 | 5,308 |

| Private stem cell cosmetics | For 6 months | 1,800,000 | 15,000 | ||

Competition

As of January 31, 2016, there were 2,315 cell culturing facilities in Japan, but there are only a few companies which can access patients in clinics directly. Additionally, barriers to market access are high because it is difficult to obtain the MHLW’s approval to conduct such business in Japan. As of January 31, 2016, there were only 40 facilities which have obtained the MHLW’s approval for stem cell therapy and Stemcell is one of those facilities.

-8-

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We will need to raise additional funds through public or private debt or equity sales in order to fund our future. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and develop our product line, and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

Even if we are successful in raising capital in the future we will likely need to raise additional capital to continue and/or expand our operations. If we do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business plan.

We have not generated any revenues to date since our inception.

We are a start-up stage company. Our ability to continue as a going concern is dependent upon our ability to commence a commercially viable operation and to achieve profitability. Since our inception we have not generated any revenues, and currently have only limited operations, as we are presently in the planning stage of our business development as an exploration stage company. These factors raise substantial doubt about our ability to continue as a going concern. We may not be able to generate revenues in the future and as a result the value of our common stock may become worthless. There are no assurances that we will be successful in raising additional capital or successfully developing and commercializing our products and becoming profitable.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small developing company. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

We have only recently adopted a bona fide business plan. As of March 28, 2016 we operate through our wholly owned subsidiary Stemcell Co., Ltd. We have limited financial resources and assets consisting of $17,716 of cell harvesting equipment. The likelihood of our success must be considered in light of the expenses and difficulties in development of a customer base nationally, attaining and retaining customers and obtaining financing to meet the needs of our plan of operations. Since we have a limited operating history we may not be profitable and we may not be able to generate sufficient revenues to meet our expenses and support our anticipated activities.

We are an early stage company with an unproven business strategy and may never be able to fully implement our business plan or achieve profitability.

We are at an early stage of development of our operations as a company. We have only recently started to operate business activities, and have not generated revenue from such operations. A commitment of substantial resources to conduct time-consuming research in many respects will be required if we are to complete the development of our company into one that is more profitable. There can be no assurance that we will be able to fully implement our business plan at reasonable costs or successfully operate. We expect it will take several years to implement our business plan fully, if at all.

Our limited operating history makes it difficult for us to accurately forecast net sales and appropriately plan our expenses.

We have a very limited operating history. As a result, it is difficult to accurately forecast our net sales and plan our operating expenses. This inability could cause our net income, if there is any income at all, in a given quarter to be lower than expected.

-9-

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes all other companies that are in the business of stem cell harvesting. While stem cell harvesting is illegal in many countries, it is legal within Japan and we face competition from other facilities on a national level, as well as from companies which operate in countries where such operations are legal. A highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

Because we are small and do not have much capital, our marketing campaign may not be enough to attract sufficient customers to operate profitably. If we do not make a profit, we will suspend or cease operations.

Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

• Demand for our stem cell harvesting services;

• Our ability to obtain and retain existing customers or encourage repeat purchases from clinics and hospitals;

• Our ability to manage our services;

• General economic conditions;

• Advertising and other marketing costs.

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our future success is dependent on our implementation of our business plan. We have many significant steps still to take.

Our success will depend in large part in our success in achieving several important steps in the implementation of our business plan, including the following: acquiring business information, development of a customer base, development of relationships with clinics and hospitals, patient service capabilities, and management of business process. If we are not successful, we will not be able to fully implement or expand our business plan.

Our growth will place significant strains on our resources.

The Company is currently in the exploration stage, with only limited operations, and has not generated any revenue since inception. The Company's growth, if any, is expected to place a significant strain on the Company's managerial, operational and financial resources. Moving forward, the Company's systems, procedures or controls may not be adequate to support the Company's operations and/or the Company may be unable to achieve the rapid execution necessary to successfully implement its business plan. If the Company is unable to manage growth effectively, the Company's business, results of operations and financial condition will be adversely affected.

Because the Company’s headquarters and assets are located outside the United States in Japan, investors may experience difficulties in attempting to effect service of process and to enforce judgments based upon US Federal Securities Laws against the Company and its non-US resident officers and directors.

While we are organized under the laws of State of Delaware, our officers and Directors are non-US residents and our headquarters and assets are located outside the United States in Japan. Consequently, it may be difficult for investors to affect service of process on them in the United States and to enforce in the United States judgments obtained in United States courts against them based on the civil liability provisions of the United States securities laws. Since all our assets will be located outside U.S. it may be difficult or impossible for U.S. investors to collect a judgment against us.

Our future success is dependent, in part, on the performance and continued services of Dr. Takaaki Matsuoka, our President and Director, as well as Dr. Katsuaki Dan. Without their continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of Dr. Takaaki Matsuoka, our President and Director, as well as Dr. Katsuaki Dan. The loss of their services would delay our business operations substantially.

-10-

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

-11-

MANAGEMENT’S DISCUSSION AND ANALYSIS

For our fiscal year end December 31, 2015 we did not generate any revenues.

As of our fiscal year end we did not have any cash or cash equivalents.

The period from December 31, 2015 (inception) through December 31, 2015 (fiscal year end) we had total general and administrative expenses in the amount of $4,998.

Our general and administrative expenses made up the entirety of our net loss.

As of March 24, 2016 we began operating through our wholly owned subsidiary, Stemcell Co., Ltd. Stemcell is a business focused on a regenerative medicine-related business which includes culturing, storing and delivery of stem cells to hospitals and clinics in Japan.

On behalf of Stemcell Holdings, Inc., our financials for the three month period ending March 31, 2016 will be consolidated and will include those of our new, wholly owned subsidiary Stemcell Co., Ltd.

Given that Stemcell Co., Ltd. was newly formed only recently, January 24, 2016 and did not have a significant or material operating history as of the date it was transferred to Stemcell Holdings, Inc., we the Company determined it unnecessary to include the audited financials of Stemcell herein. Rather, as mentioned above, the financials of Stemcell Co., Ltd will be consolidated with our own financial statements for the three months ended March 31, 2016.

Stemcell has generated no revenues to date and has incurred $3,551 of deficits from inception. Currently the Company holds equipment valued at $17,760.

We believe that to develop the Company’s current business plan that we must raise capital in the next twelve months. The Company has no immediate plans to raise such capital. Thus far the Company has relied solely on funds provided by our sole officer and director Takaaki Matsuoka. If we can not raise such funds we will have to continue to rely on funds provided to us by our Dr. Matsuoka.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the date of this report, the Company has 20,000,000 shares of common stock and no shares of preferred stock issued and outstanding, which number of issued and outstanding shares of common stock and preferred stock have been used throughout this report.

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Common Stock Voting Percentage Beneficially Owned | Voting Shares Preferred Stock Are Able to Vote | Preferred Stock Voting Percentage Beneficially Owned | Total Voting Percentage Beneficially Owned (1) |

| Executive Officers and Directors | |||||

| Takaaki Matsuoka | 20,000,000 | 100.0% | 0 | 0.0% | 100.0% |

| 5% Shareholders | |||||

| Takaaki Matsuoka. | 20,000,000 | 100.0% | 0 | 0.0% | 100.0% |

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

-12-

DIRECTORS AND EXECUTIVE OFFICERS

Biographical information regarding the officers and Directors of the Company, who will continue to serve as officers and Directors of the Stemcell Holdings, Inc. and Stemcell Co., Ltd. following the consummation of the Stock Purchase Agreement are provided below:

Stemcell Holdings, Inc.

| NAME | AGE | POSITION | |||||

| Takaaki Matsuoka | 39 | Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer and Director | |||||

Stemcell Co., Ltd.

| NAME | AGE | POSITION | |||||

| Takaaki Matsuoka | 39 | President, Chief Executive Officer and Director | |||||

Takaaki Matsuoka

In 2003 Dr. Takaaki Matsuoka graduated from Keio University, Department of Medicine and that same year he joined Keio University Hospital. In 2004, he served as a practicing MD at Keio for one year before transferring to Keiyu Hospital another year of residency. In 2005 Dr. Matsuoka left Keiyu Hosptial and began practicing at Shonan Beauty Clinic where he remained for the next eight years. By 2013 Dr. Takaaki had incorporated and founded Hellene Omotesando Beauty Clinic. Currently, he serves as the Hospital Director at Hellene Omotosando Beauty Clinic.

Corporate governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our sole Director believes that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

-13-

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an "audit committee financial expert" as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our officers and directors have not been involved in any of the following events during the past ten years.

| 1. | bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:(i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

-14-

Summary Compensation Table:

Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

Takaaki Matsuoka Chief Executive Officer Chief Financial Officer |

2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Jeffrey DeNunzio, Former sole officer and director |

2016 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Jeffrey DeNunzio, Former sole officer and director |

2015 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

*On January 27, 2016, Jeffrey DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with Takaaki Matsuoka., with an address at 3-18-17-6F, Minamiaoyama, Minato-ku, Tokyo, 107-0062, Japan.

On January 27, 2016 pursuant to the Agreement, Mr. DeNunzio transferred to Takaaki Matsuoka., 20,000,000 shares of our common stock which represents all of our issued and outstanding shares.

On January 27, 2016, Mr. Jeffrey DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On January 27, 2016, Mr. Takaaki Matsuoka was appointed as Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

Compensation of Directors

The table above summarizes all compensation of our directors as of March 28, 2016.

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We do not have an employment or consulting agreement with any officers or Directors.

-15-

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy

Our Board of Directors determines the compensation given to our executive officers in their sole determination. Our Board of Directors reserves the right to pay our executive or any future executives a salary, and/or issue them shares of common stock issued in consideration for services rendered and/or to award incentive bonuses which are linked to our performance, as well as to the individual executive officer’s performance. This package may also include long-term stock based compensation to certain executives, which is intended to align the performance of our executives with our long-term business strategies. Additionally, while our Board of Directors has not granted any performance base stock options to date, the Board of Directors reserves the right to grant such options in the future, if the Board in its sole determination believes such grants would be in the best interests of the Company.

Incentive Bonus

The Board of Directors may grant incentive bonuses to our executive officer and/or future executive officers in its sole discretion, if the Board of Directors believes such bonuses are in the Company’s best interest, after analyzing our current business objectives and growth, if any, and the amount of revenue we are able to generate each month, which revenue is a direct result of the actions and ability of such executives.

Long-term, Stock Based Compensation

In order to attract, retain and motivate executive talent necessary to support the Company’s long-term business strategy we may award our executive and any future executives with long-term, stock-based compensation in the future, in the sole discretion of our Board of Directors, which we do not currently have any immediate plans to award.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On January 27, 2016, Mr. Jeffrey DeNunzio, the sole shareholder of Perfect Acquisition, Inc., consummated a sale of 20,000,000 shares of our common stock to Takaaki Matsuoka. Following the closing of the share purchase transaction, Takaaki Matsuoka., gained a 100% interest in the issued and outstanding shares of our common stock.

Commensurate with the closing, Perfect Acquisition, Inc. filed with the Delaware Secretary of State, a Certificate of Amendment to change the name of Registrant to Stemcell Holdings, Inc.

On January 27, 2016, Mr. DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. The resignation was not the result of any disagreement with us on any matter relating to our operations, policies or practices.

On January 27, 2016, Dr. Takaaki Matsuoka was appointed as Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On March 23, 2016, the Company entered into a Stock Purchase Agreement with Takaaki Matsuoka, our President, CEO and Director. Pursuant to this Agreement, on March 24, 2016 Takaaki Matsuoka transferred to Stemcell Holdings, Inc., 500 shares of the common stock of Stemcell Co., Ltd., a Japan corporation which represents all of its issued and outstanding shares, in consideration of 5,000,000 JPY ($44,291 USD).

Following the effective date of the share purchase transaction above on March 24, 2016, Stemcell Holdings, Inc. gained a 100% interest in the issued and outstanding shares of Stemcell’s common stock and Stemcell became a wholly owned subsidiary of the Company. The Company is now the controlling and sole shareholder of Stemcell.

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of transactions, such as those described above, with our executive officer(s), Director(s) and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional Directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our Directors will continue to approve any related party transaction.

-16-

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Chief Financial Officer of the Company review the Company's internal accounting controls, practices and policies.

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition or results of operations. We may become involved in material legal proceedings in the future.

RECENT SALES OF UNREGISTERED SECURITIES

On January 27, 2016, Mr. Jeffrey DeNunzio, the sole shareholder of Perfect Acquisition, Inc., consummated a sale of 20,000,000 shares of our common stock to Takaaki Matsuoka. Following the closing of the share purchase transaction, Takaaki Matsuoka., gained a 100% interest in the issued and outstanding shares of our common stock.

We have authorized capital stock consisting of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). As of the date of this filing and taking into account the Share Transactions, we have 20,000,000 shares of Common Stock and none of Preferred Stock issued and outstanding.

Common Stock

The holders of outstanding shares of Common Stock are entitled to receive dividends out of assets or funds legally available for the payment of dividends of such times and in such amounts as the board from time to time may determine. Holders of Common Stock are entitled to one vote for each share held on all matters submitted to a vote of shareholders. There is no cumulative voting of the election of directors then standing for election. The Common Stock is not entitled to pre-emptive rights and is not subject to conversion or redemption. Upon liquidation, dissolution or winding up of our company, the assets legally available for distribution to stockholders are distributable ratably among the holders of the Common Stock after payment of liquidation preferences, if any, on any outstanding payment of other claims of creditors.

Preferred Stock

Shares of Preferred Stock may be issued from time to time in one or more series, each of which shall have such distinctive designation or title as shall be determined by our Board of Directors (“Board of Directors”) prior to the issuance of any shares thereof. Preferred Stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof, as shall be stated in such resolution or resolutions providing for the issue of such class or series of Preferred Stock as may be adopted from time to time by the Board of Directors prior to the issuance of any shares thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting power of all the then outstanding shares of our capital stock entitled to vote generally in the election of the directors, voting together as a single class, without a separate vote of the holders of the Preferred Stock, or any series thereof, unless a vote of any such holders is required pursuant to any Preferred Stock Designation.

Options and Warrants

None.

Convertible Notes

None.

-17-

INDEMNIFICATION OF OFFICERS AND DIRECTORS

Delaware Corporation Law and our Certificate of Incorporation, allow us to indemnify our officers and Directors from certain liabilities and our Bylaws, as amended (“Bylaws”), state that we shall indemnify every (i) present or former Director, advisory Director or officer of us and (ii) any person who while serving in any of the capacities referred to in clause (i) served at our request as a Director, officer, employee or agent of another corporation, partnership, joint venture, trust, association or other enterprise. (each an “Indemnitee”).

Our Bylaws provide that the Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that he is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, association or other enterprise, against expenses (including attorneys fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with which action, suit or proceeding, if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action or proceeding, that he had reasonable cause to believe that his conduct was unlawful.

Except as provided above, our Certificate of Incorporation provides that a Director shall be liable to the extent provided by applicable law, (i) for breach of the director's duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to Section 174 of the DELAWARE CORPORATION LAW or (iv) for any transaction from which the director derived an improper personal benefit. If the DELAWARE CORPORATION LAW hereafter is amended to authorize the further elimination or limitation of the liability of directors, then the liability of a director of the Corporation, in addition to the limitation on personal liability provided herein, shall be limited to the fullest extent permitted by the amended DELAWARE CORPORATION LAW. Neither any amendment to or repeal of this Article 7, nor the adoption of any provision hereof inconsistent with this Article 7, shall adversely affect any right or protection of any director of the Corporation existing at the time of, or increase the liability or alleged liability of any director of the Corporation for or with respect to any acts or omissions of such director occurring prior to or at the time of such amendment.

Neither our Bylaws, nor our Certificate of Incorporation include any specific indemnification provisions for our officer or Directors against liability under the Securities Act of 1933, as amended. Additionally, insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the "Act") may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

On behalf of Stemcell Holdings, Inc., our financials for the three months ended March 31, 2016 will be consolidated and will include those of our new, wholly owned subsidiary Stemcell Co., Ltd.

Given that Stemcell Co., Ltd. was newly formed only recently, January 24, 2016 and did not have a significant or material operating history as of the date it was transferred to Stemcell Holdings, Inc., we the Company determined it unnecessary to include the audited financials herein. Rather, as mentioned above, the financials of Stemcell Co., Ltd will be consolidated with our own financial statements for the three months ended March 31, 2016.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE

None.

-18-

ITEM 5.06 CHANGE IN SHELL COMPANY STATUS

Upon the closing of the Stock Purchase Agreement (as described in Item 1.01 and 2.01, above), we ceased our status as a “shell company,” as defined in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”).

Additionally, in connection with the closing of the Stock Purchase Agreement, the Company changed its business focus to that of Stemcell, the culturing, storing and delivery of stem cells.

Accordingly, we have set forth above the information, including the information with respect to our new operations that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting our common stock in this Report on Form 8-K, above.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

On behalf of Stemcell Holdings, Inc., our financials for the three months ended March 31, 2016 will be consolidated and will include those of our new, wholly owned subsidiary Stemcell Co., Ltd.,

| Exhibit Number | Description of Exhibit |

| 3.1 | Certificate of Incorporation (1) |

| 3.2 | Bylaws (1) |

| 3.3 | Articles of Incorporation of Stemcell - translated (2) |

| 10.1 | Stock Purchase Agreement (2) |

| 99.1 | Resolutions Approving Acquisition (2) |

(1) Filed as an exhibit to the Company's Registration Statement on Form 10, as filed with the SEC on February 12, 2016, and incorporated herein by this reference.

(2) Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Stemcell Holdings, Inc.

Dated: March 28, 2016

By: /s/ Takaaki Matsuoka

Takaaki Matsuoka

President and Director

-19-