Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - InnoVision Labs, Inc | s102832_ex21.htm |

| EX-32.2 - EXHIBIT 32.2 - InnoVision Labs, Inc | s102832_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - InnoVision Labs, Inc | s102832_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - InnoVision Labs, Inc | s102832_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - InnoVision Labs, Inc | s102832_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

| ¨ | TRANSITION REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 333-175212

INNOVISION LABS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 26-4574088 |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

5 Jabotinski St.

Ramat Gan, POB 12

Israel 5252006

(Address of principal executive offices) (zip code)

Registrant’s Telephone Number, Including Area Code: (855) 393-7243

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 if the Act).

Yes ¨ No x

The aggregate market value of the registrant’s outstanding common stock held by non-affiliates of the registrant computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $5,404,496 (based on a closing price of $1.68 per share for the registrant’s common stock on the OTCBB on June 30, 2015). For purposes of determining this number, all named executive officers and directors of the registrant as of December 31, 2015 were considered affiliates of the registrant. This number is provided only for the purposes of this Annual Report on Form 10-K and does not represent an admission by either the registrant or any such person as to the affiliate status of such person.

As of March 16, 2016, the registrant had 6,102,449 shares of common stock outstanding.

INDEX AND CROSS REFERENCE SHEET

i

cautionary STATEMENT regarding forward-looking statements

This Annual Report on Form 10-K contains “forward-looking statements”. Forward-looking statements include statements about our expectations, beliefs or intentions regarding our product offerings, business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. These forward-looking statements reflect our views as of the date they are made with respect to future events and financial performance. We undertake no obligation to update, and we do not have a policy of updating or revising, these forward-looking statements.

Risks and uncertainties, the occurrence of which could adversely affect our business, include, without limitation, the following:

| · | We have a limited operating history, and we do not expect to become profitable in the near future. |

| · | We began commercializing our first product only two years ago, and we have not generated significant revenues thus far and we may never become profitable. |

| · | Our Game Vision™ product launched in partnership with 9 times All-Star Chris Paul, under a 12 month agreement and there is no guarantee that we will be able to extend the agreement period if we are interested to do so. |

| · | Our future potential products in our application pipeline are in the early development stages and may never be commercially successful. |

| · | We are dependent on a small number of distribution channels, none of which we control, and changes in such channels could impair our ability to distribute our products and adversely impact our financial performance. |

| · | Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. |

| · | It is highly likely that we will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current stockholders’ ownership interests. |

| · | If we fail to obtain necessary funds for our operations, we will be unable to maintain and improve our technology, and we will be unable to develop and commercialize our products and technologies. |

| · | We depend on key members of our management and advisory team and will need to add and retain additional leading experts. |

| · | Under current U.S. and Israeli law, we may not be able to enforce employees’ covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees. |

| · | We only recently established limited sales and marketing capabilities, and we may be unable to effectively sell, market and distribute our products in the future, and the failure to do so would have an adverse effect on our business and results of operations. |

| · | We may suffer losses from product liability claims if our products cause harm to customers. |

| · | Failure by our customers to use our products correctly could lead to less than optimal results and customer dissatisfaction, which could have a material adverse effect on our business and results of operations. |

| · | Regulatory requirements may have an adverse effect on our business and results of operations. |

1

| · | If we acquire or license additional technology or products, we may incur a number of costs, may have integration difficulties and may experience other risks that could harm our business and results of operations. |

| · | We may not be able to successfully grow and expand our business. |

| · | We may encounter difficulties in managing our growth, which could increase our losses. |

| · | If we are unable to obtain adequate insurance, our financial condition could be adversely affected in the event of uninsured or inadequately insured loss or damage. Our ability to effectively recruit and retain qualified officers and directors could also be adversely affected if we experience difficulty in obtaining adequate directors’ and officers’ liability insurance. |

| · | We are a holding company that depends, in addition to our capital raising activities, on cash flows from our wholly owned subsidiaries to meet our obligations. |

| · | If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect fraud. Consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our common stock. |

| · | Potential political, economic and military instability in the State of Israel, where key members of our senior management and our main research and development facilities are located, may adversely affect our results of operations. |

| · | Disruptions in the financial markets and economic conditions could affect our ability to raise capital and could disrupt or delay the performance of our third-party contractors and suppliers. |

| · | We license certain technology from Talshir Medical Technologies, Ltd, which purchased this license from RevitalVision LLC, and we could lose our rights to this license if a dispute with Talshir Medical Technologies, Ltd arises or if we fail to comply with the financial and other terms of the license. |

| · | The failure to obtain or maintain patents, licensing agreements and other intellectual property could impact our ability to compete effectively. |

| · | Costly litigation may be necessary to protect our intellectual property rights, and we may be subject to claims alleging the violation of the intellectual property rights of others. |

| · | We rely on confidentiality agreements that could be breached and may be difficult to enforce, which could result in third parties using our intellectual property to compete against us. |

| · | International patent protection is particularly uncertain, and if we are involved in opposition proceedings in foreign countries, we may have to expend substantial sums and management resources. |

| · | We may be unable to protect the intellectual property rights of the third parties from whom we license certain of our intellectual property or with whom we have entered into other strategic relationships. |

| · | We are potentially subject to government regulations, and we may experience delays in obtaining required regulatory approvals, if required, to market our proposed products. |

| · | We face significant competition and continuous technological change. |

| · | Our common stock has a limited trading history, and prospective investors may not be able to sell their shares at their purchase price, if at all. |

| · | We may not require or receive the full amount of proceeds available under the Standby Equity Distribution Agreement. |

| · | Our issuance of shares of common stock under the Standby Equity Distribution Agreement could contribute to the decline of the price of the common stock, which may also lead to additional dilution of the ownership interests of our existing stockholders. |

| · | We are not a fully reporting company under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act; therefore, we are subject only to the reporting requirements of Section 15(d) of the Exchange Act. |

2

| · | We cannot assure you that our common stock will become liquid or that it will be listed on a securities exchange. |

| · | Because our common stock may be a “penny stock,” it may be more difficult for investors to sell shares of our common stock, and the market price of our common stock may be adversely affected. |

| · | We do not expect to pay dividends on our common stock, and investors will be able to receive cash in respect of their shares of our common stock only upon the sale of the shares. |

| · | Securities analysts may not initiate coverage or continue to cover our common stock, and this may have a negative impact on its market price. |

| · | Stockholders may experience dilution of ownership interests because of the future issuance of additional shares of our common stock and our preferred stock, including issuances of shares of common stock pursuant to the Standby Equity Distribution Agreement. |

| · | A significant number of shares of our common stock are eligible for sale, which could depress the market price of our stock. |

| · | The other factors referenced in this Annual Report on Form 10-K, including, without limitation, under “Risk Factors.” |

| · | Other risks detailed from time to time in the reports filed by us with the Securities and Exchange Commission, which we refer to as the SEC. |

We believe these forward-looking statements are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current expectations. Furthermore, forward-looking statements speak only as of the date they are made. If any of these risks or uncertainties materialize, or if any of our underlying assumptions are incorrect, our actual results may differ significantly from the results that we express in, or imply by, any of our forward-looking statements. These and other risks are detailed in this Annual Report on Form 10-K, in the documents that we incorporate by reference into this Annual Report on Form 10-K and in other documents that we file with the Securities and Exchange Commission, which we refer to as the SEC. We do not undertake any obligation to publicly update or revise these forward-looking statements after the date of this Annual Report on Form 10-K to reflect future events or circumstances. We qualify any and all of our forward-looking statements by these cautionary factors.

3

| Item 1. | Business |

History

Originally incorporated on December 8, 2004 under the laws of the State of Nevada as Autovative Products, Inc., on June 26, 2013, we entered into that certain Agreement and Plan of Merger, as amended by that certain First Amendment to Agreement and Plan of Merger, dated as of July 2, 2013, which we refer to collectively as the Merger Agreement, with Ucansi Acquisition Corp., a Delaware corporation and our wholly owned subsidiary, which we refer to as Merger Sub, and Ucansi Inc., a Delaware corporation, which we refer to as Ucansi. Pursuant to the Merger Agreement, on July 30, 2013, which we refer to as the Closing Date, Merger Sub merged with and into Ucansi, referred to as the Merger, with Ucansi surviving the Merger as our wholly owned subsidiary.

On the Closing Date, we sold, assigned, transferred and conveyed to Mr. David Funderburk, our former Chairman of the Board and CEO, all of the issued and outstanding capital stock of Autovative Technologies, Inc., our former subsidiary to which we had contributed all of the operations, assets and liabilities of our historical business, which we refer to as the Legacy Business, generally comprising the distribution and development of automotive parts, in exchange for which Mr. Funderburk has agreed to indemnify us for, and hold us harmless from, any and all losses and liabilities arising out of, or relating to, the Legacy Business.

Upon consummation of the Merger, we changed our name from “Autovative Products, Inc.” to “GlassesOff Inc.”, and the consolidation effected by the Merger has been accounted for as a reverse acquisition wherein Ucansi has been treated as the acquirer for accounting purposes as it has acquired control of the combined enterprise.

On December 29, 2015, we changed our name from “GlassesOff Inc.” to “InnoVision Labs, Inc.” and, in connection with our name change, our common stock, which was traded on the OTCBB under the symbol “GLSO” is now traded under the symbol “INVS”.

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company”, “InnoVision”, “we,” “us” and “our” refer to InnoVision Labs, Inc., a Nevada corporation, including its direct and indirect wholly owned subsidiaries, Ucansi Inc., a Delaware corporation, which we refer to as Ucansi, and EYEKON E.R.D. Ltd, an Israeli company.

Overview

We are a visual neuroscience software technology company, utilizing patented technology to develop and commercialize consumer-oriented software applications for improving, through exercise, vision sharpness and vision performance by improving the image processing function in the visual cortex of the brain. We deliver our scientific products through a game-like experience based on mobile applications (“apps”).

Our first app, GlassesOff™, aims to eliminate, through exercise, the dependency on reading glasses of people over the age of 40 who experience natural age-related changes in their near vision sharpness. The GlassesOff™ app is currently implemented on the Apple iOS platform (iPhone, iPod, iPad) and the Android platform and is available on the main app markets, such as the Apple App Store and The Google Play store.

Our new app, Game Vision, is based on sports themes, with a go-to-market strategy of partnering with known athletes as “brand partners”. We launched the first Game Vision app, featuring 9-time All-Star Chris Paul, on March 3, 2016. While this app is designed as a casual, fun-to-play game, it is based on extensive neuroscience research and patent pending technology that aim to enhance, through exercise, a user’s vision performance and brain processing speed. We expect that our new app, when available, will draw interest from athletes and sports enthusiasts of all ages.

4

Industry Background and Target Markets

As we age, we normally experience changes in reading abilities. These changes are influenced, among other factors, by our brain’s visual processing capabilities. The effect of these changes on most people results in slower, more difficult and less effective reading. According to a scientific review (Holden, B. A. et al., 2008), more than one billion people worldwide suffer from such age-related changes and this number is expected to rise significantly through 2050. At some point, natural age-related changes in reading abilities affect most people, who typically attempt to improve their reading abilities through the aid of magnifying devices, typically reading glasses. Such devices increase the size of words in reading material, making it easier for a person who uses them, whether that person is in his or her twenties or fifties, to read easily and quickly.

The GlassesOff™ product is designed to enhance the image processing capabilities of the brain and thus improve a person’s reading abilities. The use of the GlassesOff™ product results in faster, more efficient and more comfortable reading, thereby improving reading vision without use of reading glasses.

The Game Vision line of products targets both professional athletes and recreational athletes who want to improve their sports performance. As vision is the inception of every move made in most sports, superior vision speed is expected to have a critical impact on sports performance in any sport requiring swift response to a visual event. Our new Game Vision app platform, together with its newly-developed technology, is intended to serve as a new tool in players' training routines.

While there are many technologies and methods that aim to improve reaction speed in sports performance, we believe that Game Vision technology is innovative because of its focus on reducing the time that the vision system requires to process a visual event. Currently, most technologies and methods focus on minimizing the time it takes to respond to such visual event (once identified by the visual system) or improve the decision-making process to such visual event

GlassesOff™ Technology

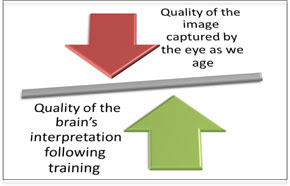

Human vision is limited by two main factors: (a) the quality of an image captured by the eyes; and (b) the image processing capabilities of the brain as it interprets an image captured by the eyes.

Our proprietary technology enables us to develop software product solutions intended to enhance the image processing abilities of the brain and therefore improve a person’s vision sharpness and vision performance. GlassesOff’s™ unique software approach provides an alternative to existing solutions, which generally rely on magnifying devices, typically reading glasses. Game Vision’s unique software approach provides athletes and recreational players a method designed to improve vision parameters critical for sports performance. Our technology platform is based on advanced scientific research of image processing functionality, and our solution utilizes the remarkable ability of the brain’s plasticity (the brain’s ability to change), which constitutes the neuronal basis for “perceptual learning”, that is, repeated practice on a demanding visual task. Our founder’s academic research into the area of image processing functions during the last 20 years has yielded a breakthrough in perceptual learning methodologies, which enhance visual skills by improving image processing speed and efficiency in the visual cortex of the brain without altering optical functions. The use of perceptual learning methodologies improves both the processing speed and the sensitivity through repetitive exercise of the brain’s image processing function, resulting in improved vision sharpness and processing speed.

InnoVision’s technology and methods are based on scientific research and achievements that have been published in leading scientific publications, such as Nature, PNAS, Vision Research, Scientific Reports and others. Our first product application, GlassesOff™, which is designed to improve near vision sharpness and reading capabilities, has been tested in several studies, including a study conducted at the University of California, Berkeley, whose results have been published in Nature’s Scientific Reports in February 2012.

5

The GlassesOff™ Application

For those persons who experience the natural age-related changes in reading abilities, GlassesOff™ is designed to exercise the visual cortex of the brain to achieve comfortable reading without the use of magnifying devices such as reading glasses. According to a scientific review (Holden, B. A. et al., 2008), the target market for natural age-related changes in reading abilities is estimated to include more than one billion people worldwide, which is the market targeted by GlassesOff™. GlassesOff™ is a software visual cortex exercise solution to improve users’ reading abilities and maintain the ability to read comfortably, through enhancement of their image processing capabilities aiming to achieve near vision sharpness. The GlassesOff™ application is delivered through cloud-based client server architecture to mobile devices and is currently implemented Apple iOS platform (iPhone, iPod, iPad) and Android platform. Users initially download the application via Apple’s App Store or Google Play Market, but their reading improvement program is delivered through the our servers.

GlassesOff™ is a personalized application that monitors user performance and progress. The application automatically adjusts improved reading sessions based on each user’s ongoing progress.

The GlassesOff™ application is composed of two components:

| (1) | Basic Program – a period of approximately three months during which users are encouraged to complete at least three, 12-minute training sessions per week. At the beginning of the program, users commence with an evaluation of their near vision processing capabilities. Those who come within the range of persons expected to benefit from GlassesOff, based on such evaluation, are expected by the end of the program to achieve image processing capabilities that would help them eliminate their dependency on magnifying devices, such as reading glasses. |

| (2) | Ongoing Care – following the Basic Program, users are encouraged to complete between two to six (as needed), 12-minute training sessions per month, intended to maintain the improvement they achieved in their reading performance. |

The Game Vision™ Application

For those persons who want to improve their sports performance, Game Vision™ is designed to exercise the visual cortex of the brain and achieve improvement in vision parameters correlated with faster vision processing speed. According to a survey conducted by SFIA/Physical Activity Council (2012), over 20 million young people aged 6 through 18 in the United States alone participated in organized sports, hence we estimate the target market for Game Vision™ comprises one hundred million of sports enthusiasts worldwide. Game Vision™ is a personalized software visual cortex exercise solution to train users’ vision parameters critical for sports performance, through enhancement of their image processing capabilities. The Game Vision™ application is delivered through cloud-based client server architecture to mobile devices and launched March 3, 2016 on both Apple iOS platform (iPhone, iPod, iPad) and Android platform. Users initially download the application via Apple’s App Store or Google Play Market, but their training programs are delivered through our servers.

6

Game Vision™ is personalized because it monitors an individual user’s performance and progress. The application automatically adjusts improved training sessions based on each user’s ongoing progress.

GlassesOff™ and Game Vision™ Main Features

Simplicity. To facilitate its easy adoption, our apps do not require any third-party intervention, such as an optometrist or ophthalmologist examination.

Ease of Use. The apps offer a user-friendly self-explanatory user interface that allows users with no special technological or scientific background to complete the training program and follow their personal progress.

Platform Compatibility. The apps can be used on practically any device with a high quality display, including smart phones, tablets and personal computers. Our apps are currently available on Apple’s iOS platform (iPhone, iPad and iPod), and on the Android operating system.

Compliance. Working under a client-server architecture, each session a user completes is logged and stored in our system, allowing us to closely monitor the progress of the user and include automatic protocols that assist him or her throughout the reading improvement program, including such protocols as session reminders and personal improvement tips.

Product Architecture

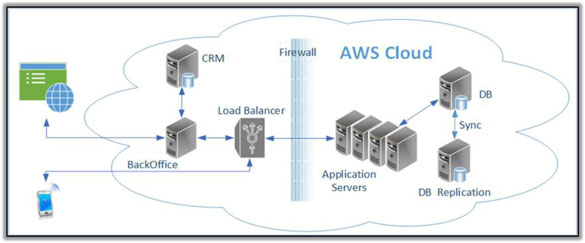

The client-server cloud-based architecture provides several key advantages for the security, scalability and redundancy of the infrastructure.

Client Security. GlassesOff™ is a “thin client”, meaning all algorithm and reading improvement logics reside on the server side. At the end of each session, the customer receives his or her personalized reading improvement session data from the server for the next session. All communications between the GlassesOff™ and Game Vision™ servers and the customer are through an encrypted channel.

Server Scalability and Redundancy. All of our web services are hosted on the Amazon Web Services (“AWS”) cloud, which is a web service that provides resizable compute capacity in the cloud. Our current architecture allows us to further scale out (add more servers) and/or scale up (add more capacity to an existing server) within minutes, and our current architecture has been tested successfully under load and stress storms, which allows us to support more than two million users. Additionally, our load balancer layers enable updates and maintenance without any downtime and all of its data is backed up and mirrored between two SQL servers.

7

Server Security. Our web services on AWS have gone through a hardening process to enhance their security according to known practices, and all algorithm and data servers are isolated from the internet. For example, only “sanitized” requests (those that comply with our predefined request methodology) received by our internet-facing servers are delivered to our algorithm and data servers, with all other connections logged and ignored.

Application Pipeline

We plan to expand our product offerings to include additional suites of applications that would cater to other market segments related to enhancement of visual processing. Specifically, we intend to develop additional applications for:

| o | diagnostic solutions for children and adults with attention deficit disorder; |

| o | diagnostic solutions for dyslexic children and adults; |

| o | improvement of reading abilities for dyslexic children and adults; and |

| o | improvement of reading speed for children and adults. |

Revenue Model

We estimate that lifetime revenue per paying user of the GlassesOff™ application will gradually increase to approximately $100, and we offer various pricing plans. Moreover, to determine different pricing plans, we apply optimization techniques, which generally analyze pricing, acquisition costs and the number of conversions from free to pay-users in order to determine a pricing model that provides the greatest return on marketing and user-acquisition expenses. The Game Vision app is using common monetization methods in casual games, and we initially expect that lifetime revenue per paying user of the Game Vision™ application will equal approximately $50.

Because we offer a mobile software application, our primary variable costs are customer acquisition, app store platform commissions and revenue share paid to Game Vision™ partners.

Customer Acquisition. We analyze our customer acquisition process on an ongoing basis and apply an optimization mechanism that helps us identify effective marketing channels and marketing messages. Once a significant number of customers successfully use the applications, we anticipate that our customer acquisition costs will decline as more people learn about our products through word-of-mouth advertising by existing users.

Platform Commissions. Under the current policy of Apple’s App Store and Google Play market, which compose our current sales channel, a commission of 30% is charged per transaction.

Sales, Marketing & Customer Support

Sales & Marketing

We currently offer GlassesOff™ and Chris Paul’s Game Vision apps directly to end users via Apple’s App Store and the Google Play market.

We believe that our primary target market for GlassesOff™ consists of people between the ages of 40 and 60; therefore, we attempt to focus our marketing efforts on what we believe are the most efficient marketing channels to reach this population, and we constantly monitor the efficacy of each marketing channel, to the best of our ability, to constantly optimize our marketing efforts and resources.

We believe that our primary target market for Game Vision™ consists of young people between the ages of 13 and 25; therefore, we attempt to focus our marketing efforts on what we believe are the most efficient marketing channels to reach this population, and we constantly monitor the efficacy of each marketing channel, to the best of our ability, to constantly optimize our marketing efforts and resources

8

Currently, we focus our marketing efforts on the following:

| · | Public Relations: We generate both international and local media coverage for the GlassesOff™ application, including through media articles and interviews. Our proactive efforts, supported by local public relations agencies, have been focused primarily on the U.S. and France markets, and we expect to extend our focus into additional markets during 2016. Game Vision™’s first product is in partnership with Chris Paul, and we also seek to generate media coverage through interviews with Chris Paul. |

| · | Online Marketing: We utilize online campaigns that are designed to direct potential customers to our application. We are investing in app store optimization (ASO), aiming to achieve top ranks in search results. |

| · | Social marketing: We believe that both our GlassesOff™ and Game Vision™ applications can generate strong viral distribution, or word-of–mouth, among their respective users. We have integrated, or are developing, several social functions in our applications to leverage the viral marketing potential, including: |

| o | Post/Share Tool – An easy-to-use tool that allows users to share their experiences with their friends via their Facebook and/or Twitter accounts. |

| o | We intend to develop friend invitation tools within the applications that will encourage users to share the apps with their friends. |

| o | Partnerships and Affiliate Marketing – Once we obtain a significant user base that allows us to provide statistically significant user acquisition and usage data, we plan to seek partnerships that may allow us to quickly grow our customer base. |

| o | As part of our partnership with Chris Paul, he has agreed to promote the Game Vision™ app through his social media channels, which have millions of followers. |

We have launched the GlassesOff™ application in English and French to target users in the United States, Canada, the United Kingdom and France. We expect to launch additional localized versions for other markets during 2016. The Game Vision™ was initially be launched only in English.

Customer Support

To ensure customer satisfaction, our customer support efforts include both proactive and responsive models.

| · | Proactive Model: We have developed an event-driven automatic communication plan that includes email messages, personal in-app notification screens and push notifications that are presented to each user according to that user’s particular training stages and personal progress. |

| · | Responsive Model: We offer online support via email. |

Intellectual Property

We have filed several patent applications to protect our core technology platform and products. We have issued patents protecting our core technology platform and products in the United States (US 7,866,817), Australia (AU 2005278771), Korea (KO 10-1016429), Japan (JP 5222556), Canada (CA 2578932), China (CN ZL200580038206.2) and Israel (IL 181660). Our pending patent applications are still in different evaluation phases in Europe and India.

We have also filed a patent application for our vision evaluation method, which was issued by the United States Patent and Trademark Office (US 8,403,485).

We also recently submitted two PCT patent applications to protect our current and future Game Vision sport products and the future diagnostic products in our pipeline.

In addition to our patent portfolio, we have an intellectual property license agreement with Talshir Medical Technologies, Ltd (“Tashir”, which purchased this IP from RevitalVision LLC), which is the owner of several patents in the area of perceptual learning systems and methods. Under this agreement, referred to as the License Agreement, we have a non-exclusive license to certain patents for the field of near-vision solutions. The License Agreement does not assign any technology to us, and, unless earlier terminated, the License Agreement terminates upon the expiration of the last of the patents included in this License Agreement, which is expected to be in 2024. Under the License Agreement, we paid an initial fee of $75,000 in installments over a period of 24 months following the effective date of the License Agreement, and we are required to pay quarterly royalty payments of 5.5% of net sales up to aggregate net sales of $3 million and of 4.5% of net sales over $3 million (calculated annually).

9

Competition

Our GlassesOff™ application competes in the market of solutions for better, faster and more effective reading. The natural changes in reading capabilities with age have typically been addressed by traditional products for improvement of reading capabilities, mainly magnification devices, such as reading glasses or contact lenses, which support reading. Manufactures of such magnifier devices could therefore be considered as competition. We believe that our product, which is designed to eliminate the constant dependency on magnifiers, is therefore highly competitive with such devices.

In addition, there are several methods and products that claim to improve reading vision through various means, usually related to muscle exercises (e.g. the Bates method, the See Clearly Method and the Power Vision Program), whereas the GlassesOff™ application does not involve any such corrective methods.

Finally, there are several competitors offering vision improvement solutions based on neuroscience methods, such as PositScience and Talshir (which obtained FDA clearance for a product that treats amblyopia, a condition typically referred to as “Lazy Eye”). We believe that there is no other software solution for the improvement of reading capabilities to the extent that magnifying devices, such as reading glasses, are not required that has also demonstrated efficacy in controlled studies.

Our Game Vision™ application competes in the market of solutions for better and faster vision for sport. There are many solutions and training methods in the market aiming to improve sports performance and specifically improve reaction time. Still, most existing solution focus on optimizing the reaction to a visual event once it has been identified by the vision system or help identify visual events through improved attention.

In addition, we are aware of one competitor, Carrot Neurotechnology, Inc., which uses brain plasticity to train vision performance in sports. According to public available data, we don’t believe that this company has a significant market presence that can significantly impact our business plans.

We believe that our technology platform and unique intellectual property assets present a high barrier to entry for others who would try to develop and sell software products for improvement of vision sharpness and vision performance using mobile devices.

Employees

We currently have one part-time employee in the United States and 24 employees in Israel, of whom 14 are full-time employees, and 10 are part-time employees (including two part-time employees with Ph.D. degrees, one part-time employee with an MSc degree in neuroscience and two part-time employees who are certified optometrists). All of our neuroscientists focus on research and development. None of our employees is represented by a labor union, and we consider our employee relations to be good. We also utilize a number of consultants to assist with research and development and commercialization activities, generally on a monthly retainer.

We intend to hire additional personnel to focus on marketing, customer support and technological support.

Research and Development

We focus significant time and resources on research and development in connection with our efforts to improve our existing GlassesOff™ application, produce versions of GlassesOff™ application for new device platforms and operating systems, as well as in connection with our development of new product applications. For the years ended December 31, 2015 and 2014, we incurred research and development expenses in the aggregate of $2,209,000 and $1,818,000, respectively. During 2015, a significant portion of our research and development budget was allocated to the Game Vision™ application.

10

Available Information

A copy of this Annual Report on Form 10-K, as well as our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on the internet at our website, www.glassesoff.com, as soon as reasonably practicable after we electronically file these reports with, or furnish these reports to, the SEC. The reference to our website address does not constitute incorporation by reference of the information contained on, or available through, the website and such information is not part of this Annual Report on Form 10-K. Our reports filed with the SEC may be read or copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Alternatively, you may access these reports at the SEC’s website at www.sec.gov.

| Item 1A. | Risk Factors |

Risks Related to Our Company and Our Business

We have a limited operating history, and we do not expect to become profitable in the near future.

We are a development stage vision exercise improvement software solutions company with a limited operating history. We are not profitable and have incurred losses since our inception. We have not generated significant operating revenue since our inception, and we continue to incur research and development and general and administrative expenses related to our operations. We expect to incur losses for the foreseeable future. If our products do not achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Accordingly, it is difficult to evaluate our business prospects. Moreover, our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company operating in a market with regulatory issues and where the need for market acceptance of our products is uncertain. There can be no assurance that our efforts will ultimately be successful or result in revenues or profits.

We began commercializing our first product only two years ago, and we have not generated significant revenues thus far and we may never become profitable.

We have only recently commercialized our first product. We will not be successful unless GlassesOff™ and any other products we develop, if any, gain market acceptance. The degree of market acceptance of our products will depend on a number of factors, including:

| · | the competitive environment; and |

| · | the adequacy and success of distribution, sales and marketing efforts. |

Physicians, users, third-party payors or the medical community in general may be unwilling to accept, utilize or recommend any of our products or products incorporating our technologies. As a result, we are unable to predict the extent of future losses or the time required to achieve profitability, if at all.

Our future potential products in our application pipeline are in the early development stages and may never be commercially successful.

Our future potential products in our application pipeline are either at very early stages of product development or pre-definition and may never be developed or commercialized. The progress and results of any future products are uncertain, and may result in a failure to develop additional effective products. Even if we successfully complete one or more of our future potential products’ development, they may not be commercially successful due to, among other things, low users’ acceptance or criticism by clinicians and other third-party opinion leaders. Third parties may develop superior products or have proprietary rights that preclude us from marketing our products.

We are dependent on a small number of distribution channels, none of which we control, and changes in such channels could impair our ability to distribute our products and adversely impact our financial performance.

Currently, our only distribution channels for our applications are Apple’s App Store and the Google Play Market, and we expect that future distribution channels will comprise other similar popular application stores, such as Amazon’s store. We do not control these application stores, and the owners of such stores can change various parameters, such as increasing fees or requiring additional product safeguards, any of which could have an adverse impact on our financial performance and our ability to distribute our products.

11

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm noted in its report accompanying our financial statements for the fiscal year ended December 31, 2015 that we have incurred operating losses and our ability to continue to operate as a going concern is dependent upon additional financial support, which raises substantial doubt about our ability to continue as a going concern. We have not yet generated significant revenues from our operations to fund our activities, and are therefore dependent upon external sources for financing our operations. There can be no assurance that we will succeed in obtaining the necessary financing to continue our operations. As a result, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. Management’s plans concerning these matters are described in Note 1b to our financial statements; however, management cannot assure you that its plans will be successful in addressing these issues. Our financial statements do not include any adjustments relating to the recoverability and classification of assets’ carrying amounts or the amount and classification of liabilities that may be required should we be unable to continue as a going concern. If we cannot successfully continue as a going concern, our stockholders may lose their entire investment in our common stock.

We may not require or receive the full amount of proceeds available under the Standby Equity Distribution Agreement, referred to as the SEDA.

On July 1, 2014, we entered into a standby equity distribution agreement, which we refer to as the SEDA, with YA Global Master SPV Ltd., which we refer to as YA Global, pursuant to which we may, at our election and in our sole discretion, issue and sell to YA Global, which we refer to as an Advance, from time to time as provided in the SEDA, and YA Global has agreed to purchase up to $15,000,000 of common stock. In accordance with the terms, and subject to the conditions, of the SEDA, we may elect from time to time, in our sole discretion, to sell to YA Global shares of Common Stock at a per share price equal to 98.5% of the lowest daily volume weighted average price of the common stock as quoted by Bloomberg, L.P., which we refer to as the Market Price, during the five consecutive trading days commencing immediately subsequent to the date on which we deliver to YA Global a notice of our election to effect an Advance, which we refer to as an Advance Notice. In no event will the Market Price be less than 85% of the daily volume weighted average price of the common stock on the trading day immediately preceding the date of the Advance Notice. The amount of each Advance may not exceed the lesser of (x) $500,000 or (y) the Daily Value Traded (as defined in the SEDA) for the five consecutive trading days immediately prior to the date of the applicable Advance Notice. Pursuant to the SEDA, YA Global is obligated to purchase the common stock under the SEDA subject to certain conditions, including, among others, our filing of a registration statement with the SEC to register the resale by YA Global of the shares of common stock acquired pursuant to the SEDA and the SEC declaring such registration statement effective.

Unless earlier terminated in accordance with its terms, the SEDA will terminate automatically on the earliest of (i) the first day of the month next following the 36-month anniversary of the date of the SEDA and (ii) the date on which YA Global shall have purchased common stock issued pursuant to the SEDA in the aggregate amount of $15,000,000.

Pursuant to the terms of the SEDA, we agreed to pay to YA Global or its designee a structuring and due diligence fee in an amount equal to $3,000 and a commitment fee in an aggregate amount of up to $450,000, which is payable either in cash or shares of Common Stock. The first $150,000 of the commitment fee became payable upon execution of the SEDA, and we issued to YA Global II an aggregate of 103,301 shares of common stock in satisfaction thereof.

Our future capital requirements will depend on many factors, including requirements for investment in developing new product versions for new territories (localization), new devices and new platforms, and potentially development of new products. Furthermore, our expected ramp-up in sales and marketing activities will require significantly greater resources. Given the foregoing, management negotiated with YA Global a three-year term for the SEDA together with $15,000,000 potentially available thereunder, $40,000 of which has already been received pursuant to issuances under the SEDA as of the date of this Annual Report on Form 10-K, which is intended to provide us capital on an as-needed basis. We are not required to draw funds under the SEDA, and we may not require or receive the full amount of proceeds available under the SEDA. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

12

It is highly likely that we will need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute current stockholders’ ownership interests.

Our future capital requirements will depend on many factors, including the progress and results of our product testing, the timing and outcome of regulatory review of our products (should some of our products require regulatory approval), the number and development requirements of other products that we pursue, and the costs of commercialization activities, including product marketing, sales, and distribution. Because of the numerous risks and uncertainties associated with the development and commercialization of our products, we are unable to reasonably estimate the amounts of additional capital outlays and operating expenditures that our business will require. It is likely that we will need to raise additional funds through public or private debt or equity financings to meet various objectives including, but not limited to:

| · | testing our products; |

| · | researching and developing new products; |

| · | pursuing growth opportunities, including more rapid expansion; |

| · | acquiring complementary businesses or technologies; |

| · | making capital improvements to improve our infrastructure; |

| · | hiring qualified management and key employees; |

| · | responding to competitive pressures; |

| · | complying with regulatory requirements; and |

| · | maintaining compliance with applicable laws. |

Any additional capital raised through the sale of equity or equity-linked securities may dilute our current stockholders’ ownership in us and could also result in a decrease in the market price of our common stock. The terms of those securities issued by us in future capital transactions may be more favorable to new investors and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect.

Furthermore, any debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain required additional capital, we may have to curtail our growth plans or cut back on existing business, and we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

If we fail to obtain necessary funds for our operations, we will be unable to maintain and improve our technology, and we will be unable to develop and commercialize our products and technologies.

Our present and future capital requirements depend on many factors, including:

| · | future revenues and profits generated from the launch of our first product; |

| · | the level of research and development investment required to develop our products, and maintain and improve our patented technology position; |

| · | the costs of product development for research and at commercial scale; |

| · | the results of testing, which can be unpredictable; |

| · | changes in product development plans needed to address any difficulties that may arise in development or commercialization; |

| · | our ability and willingness to enter into new agreements with strategic partners and the terms of these agreements; |

| · | the costs of investigating patents that might block us from developing potential products; |

13

| · | the costs of recruiting and retaining qualified personnel; |

| · | the time and costs involved in obtaining regulatory approvals should such be required; |

| · | the costs of filing, prosecuting, defending and enforcing patent claims and other intellectual property rights; and |

| · | our need or decision to acquire or license complementary technologies. |

If we are unable to obtain the funds necessary for our operations, we will be unable to maintain and improve our patented technology, and we will be unable to develop and commercialize our products and technologies, which would materially adversely affect our business, liquidity and results of operations.

We depend on key members of our management and advisory team and will need to add and retain additional leading experts.

We are highly dependent on our board members, executive officers and other key management and technical personnel. Our failure to retain our Chief Scientific Officer, Prof. Uri Polat, our Chairman, Mr. Shai Novik and our CEO, Mr. Nimrod Madar, or any other key board members or management and technical personnel could have a material adverse effect on our future operations. Our success is also dependent on our ability to attract, retain and motivate highly trained technical, marketing, sales and management personnel, among others, to market our products and to continue to develop enhanced releases of our products. We presently do not maintain “key person” life insurance policies on any of our personnel.

Our success also depends on our ability to attract, retain and motivate personnel required for the development, maintenance and expansion of our activities. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified employees. The loss of key personnel or the inability to hire and retain additional qualified personnel in the future could have a material adverse effect on our business, financial condition and results of operation.

Under current U.S. and Israeli law, we may not be able to enforce employees’ covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees.

We have entered into non-competition agreements with our key employees. These agreements prohibit our key employees, if they cease working for us, from competing directly with us or working for our competitors for a limited period. Under applicable U.S. and Israeli law, we may be unable to enforce these agreements. If we cannot enforce our non-competition agreements with our employees, then we may be unable to prevent our competitors from benefiting from the expertise of our former employees, which could materially adversely affect our business, results of operations and ability to capitalize on our proprietary information.

We only recently established limited sales and marketing capabilities, and we may be unable to effectively sell, market and distribute our products in the future, and the failure to do so would have an adverse effect on our business and results of operations.

We only recently established limited sales and marketing capabilities. If we are unable to develop an effective sales, marketing, customer relationship management and distribution capabilities or enter into agreements with third parties to perform these functions, we will not be able to successfully commercialize any of our products. We currently have only limited internal sales and marketing capabilities, and we are entirely dependent on third parties for distribution of our products. In order to successfully commercialize any of our products, we must either further internally develop sales, marketing, customer relationship management and distribution capabilities or make arrangements with third parties to perform these services.

If we do not develop a skilled marketing and sales force and supporting customer relationship management, we will be unable to market any of our products directly. To promote any of our potential products through third parties, we will have to locate acceptable third parties for these functions and enter into agreements with them on acceptable terms, and we may not be able to do so. In addition, any third-party arrangements we are able to enter into, such as our agreement with Apple’s App Store, may result in lower revenues than we could achieve by directly marketing and selling our potential products.

We may suffer losses from product liability claims if our products cause harm to customers.

Any of our products could potentially cause adverse events. These reactions may not be observed during testing, but may nonetheless occur after commercialization. If any of these reactions occur, they may render our products ineffective or harmful in some customers, and our sales would suffer, materially adversely affecting our business, financial condition and results of operations.

14

In addition, potential adverse events caused by our products could lead to product liability lawsuits. If professional liability and/or product liability lawsuits are successfully brought against us, we may incur substantial losses and may be required to limit commercialization of our products. Our business exposes us to potential product liability risks, which are inherent in the testing, marketing and selling of brain training software products. We may not be able to avoid product liability claims. Product liability insurance for our products and products in development is generally expensive, if available at all. We do not currently have product liability insurance. If we are unable to obtain insurance coverage on reasonable terms or to otherwise protect against potential product liability claims, we may be unable to commercialize our products. A successful product liability claim brought against us in excess of our insurance coverage, if any, may cause us to incur substantial liabilities, and, as a result, our business, liquidity and results of operations would be materially adversely affected.

Failure by our customers to use our product correctly could lead to less than optimal results and customer dissatisfaction, which could have a material adverse effect on our business and results of operations.

Improper use of our product or failure by users to comply with the requirements for the correct use of our product could result in less than optimal results and customer dissatisfaction. The following, among other things, may result in poor results:

| · | failure to comply with the required vision improvement protocol, such as session frequency and minimal number of sessions; |

| · | use of the product not in accordance with instructions; |

| · | use of the product by several users using the same user account on the same device; |

| · | use of the product by several users using the same user account on different devices; |

| · | use of the product by a single users on different devices; |

| · | use of the product under environmental conditions with extreme variation between training sessions; and |

| · | use of the product while using medication, alcohol or any other chemical substance that affects, among other things, vision, the ability to concentrate, attention or motor functions. |

Poor results from our product could result in customer dissatisfaction and reduced product sales, which could have a material adverse effect on our business and results of operations.

Regulatory requirements may have an adverse effect on our business and results of operations.

Healthcare is heavily regulated by the federal government and by state and local governments. The federal laws and regulations affecting healthcare change constantly thereby increasing the uncertainty and risk associated with any healthcare-related venture, including our business.

The federal government regulates healthcare through various agencies, including but not limited to the following: (i) the Food and Drug Administration, which we refer to as the FDA, which administers the Food, Drug, and Cosmetic Act, which we refer to as the FD&C Act, and (ii) the Office of Civil Rights, which administers the privacy aspects of the Health Insurance Portability and Accountability Act of 1996, which we refer to as HIPAA. We do not envision seeking third-party coverage from any government healthcare program in the foreseeable future (e.g., Medicare, Medicaid, TriCare) or any private healthcare program, and therefore we believe that we will not be subject to regulation by certain other federal healthcare agencies such as the Centers for Medicare & Medicaid Services, Health and Human Services Office of Inspector General or the Department of Defense.

FDA

The FDA regulates medical devices. A “medical device” is as an article, including software associated with another medical device, which, among other things, is intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment, or prevention of disease, in man or other animals. See FD&C Act § 201(h). We do not believe that our product is subject to FDA regulation as a medical device as its mode of operation is through exercise However, there is a real risk, especially in light of the recent FDA Guidance entitled Mobile Medical Applications (Sept. 25, 2013), that the FDA may disagree with our assessment and conclude that it is in fact a medical device subject to FDA regulation. If such were to occur, the FDA may, among other things, order us to cease marketing the product until the product satisfies FDA’s regulatory regime and controls. This risk can be affected by the manner in which the product is marketed. Medical claims increase the risk that it would be viewed by the FDA as a medical device; while pure exercise claims may lead the FDA to use its discretion not to regulate the product.

15

The regulatory requirements that would apply if our product were deemed to be a medical device would depend on the level of risk to the patient or user of the device. There are three categories of medical devices based on risk: Class I, which is the lowest risk, Class II, and Class III, which is the highest risk.

Generally speaking, companies that manufacture Class I medical devices must register with the FDA and list their product. They must also comply with quality system regulations. These regulations require companies manufacturing Class I medical devices to manufacture products and maintain documents in a prescribed manner with respect to design, manufacturing, testing and control activities. Further, such companies are required to comply with various FDA and other agency requirements for labeling and promotion and managing product complaints, which, in certain instances, requires notifying the FDA. Most Class I devices can be marketed without having submitted a premarket notification or “510(k)” to the FDA and then receiving a “clearance” from the FDA to market the device.

In addition to the Class I requirements, manufacturers of Class II products, generally, need to receive an FDA “510(k) clearance” which permits commercial distribution of that device for its intended use. The FDA will “clear” a product if it finds that such product is substantially equivalent in terms of safety and effectiveness to a similar legally marketed device. If clinical trial data are required to support the 510(k) submission, then these data must be gathered in compliance with investigational device exemption (IDE) regulations. The FDA review process for 510(k) submissions should take on average about 90 days, but it can and usually takes substantially longer, and there is no guarantee that the agency will “clear” the device for marketing, in which case the device cannot be distributed in the United States. The agency could condition clearance on our narrowing the intended uses of the device so that it may no longer be commercially feasible to market. Additionally, there may be special controls what apply to the development of a Class II product, including FDA guidance documents and recognized standards relevant to the product, which we refer to as Special Controls.

Class III manufacturers must comply with the Class I requirements and, in some instances, Special Controls. In addition, manufacturers of Class III medical devices need to get approval from the FDA before marketing their device, which we refer to as Pre-Market Approval or PMA. The PMA process is a more comprehensive approval process and requires the sponsor of the application to submit adequate data permitting the FDA to find that there is reasonable assurance that the device is safe and effective for its intended use. The manufacturer must submit a PMA application, which contains, among other things, clinical trial data, which were obtained in compliance with IDE regulations. Clinical trials associated with a Class III device are typically more complex than those of a Class II product. The PMA process also takes substantially longer than the 510(k) process.

The FDA may inspect the manufacturer’s facilities and, upon the occurrence of certain events, have the power to withdraw the clearance or require changes to a device, its manufacturing process, or its labeling or additional proof that regulatory requirements have been met. The FDA can also seize the device, ban its importation into the United States, or restrict is distribution, issue warning letters, untitled letters, impose civil or criminal penalties, fines, and injunctions, criminally prosecute a company for violations of the FD&C Act, decline to clear or approve modifications to the device, or take other regulatory action against such company.

Privacy Provisions of HIPAA

HIPAA, among other things, protects the privacy and security of individually identifiable health information by limiting its use and disclosure. HIPAA directly regulates “covered entities” (healthcare providers, insurers and clearinghouses) and indirectly regulates “business associates” with respect to the privacy of patients’ medical information. All entities that receive and process protected health information are required to adopt certain procedures to safeguard the security of that information. It is uncertain whether we would be deemed to be a covered entity under HIPAA, and it is unlikely that we, based on our current business model, would be a business associate. Nevertheless, we may be contractually required to physically safeguard the integrity and security of any patient information that we receive, store, create or transmit. If we fail to adhere to our contractual commitments, then our physician customers may be subject to civil monetary penalties and this could adversely affect our ability to market our product. If we are deemed to be a vendor, under the Health Information Technology for Economic and Clinical Health Act, enacted as part of the American Recovery and Reinvestment Act of 2009, then we will be obligated to adopt various security measures. We may also be subject to state and foreign privacy laws under which breaches could lead to substantial fines and liability.

If we acquire or license additional technology or products, we may incur a number of costs, may have integration difficulties and may experience other risks that could harm our business and results of operations.

We may acquire or license additional products and technologies. Any product or technology we license or acquire will likely require additional development efforts prior to commercial sale, including extensive testing and, potentially, approval by the FDA and applicable foreign regulatory authorities, if any. All products are prone to risks of failure, including the possibility that the product or product developed based on licensed technology will not be shown to be sufficiently safe and effective for approval by applicable regulatory authorities. In addition, we cannot assure you that any product that we develop based on acquired or licensed technology that is granted regulatory approval will be produced economically, successfully commercialized or widely accepted in the marketplace. Moreover, integrating any newly acquired products could be expensive and time-consuming. If we cannot effectively manage these aspects of our business strategy, our business may not succeed.

16

Furthermore, proposing, negotiating and implementing an economically viable acquisition or license can be a lengthy, costly and complex process. Other companies, including those with substantially greater financial, marketing and sales resources, may compete with us for the acquisition or license of products and/or technologies. We may not be able to acquire the rights to alternative products and/or technologies on terms that we find acceptable, or at all. Our failure to acquire or license alternative products and/or technologies could have a material adverse effect on our business, prospects and financial condition.

We may not be able to successfully grow and expand our business.

We may not be able to successfully expand. Successful implementation of our business plan will require management of growth, which will result in an increase in the level of responsibility for management personnel. To manage growth effectively, we will be required to continue to implement and improve our operating and financial systems and controls to expand, train and manage our employee base. The management, systems and controls currently in place or to be implemented may not be adequate for such growth, and the steps taken to hire personnel and to improve such systems and controls might not be sufficient. If we are unable to manage our growth effectively, it will have a material adverse effect on our business, results of operations and financial condition.

We may encounter difficulties in managing our growth, which could increase our losses.

We may experience rapid and substantial growth in order to achieve our operating plans, which will place a strain on our human and capital resources. If we are unable to manage this growth effectively, our losses could materially increase. Our ability to manage our operations and growth effectively requires us to continue to expend funds to enhance our operational, financial and management controls, reporting systems and procedures and to attract and retain sufficient numbers of talented employees. If we are unable to scale up and implement improvements to our control systems in an efficient or timely manner, or if we encounter deficiencies in existing systems and controls, then we will not be able to make available the products required to successfully commercialize our technology. Failure to attract and retain sufficient numbers of talented employees will further strain our human resources and could impede our growth or result in ineffective growth.

If we are unable to obtain adequate insurance, our financial condition could be adversely affected in the event of uninsured or inadequately insured loss or damage. Our ability to effectively recruit and retain qualified officers and directors could also be adversely affected if we experience difficulty in obtaining adequate directors’ and officers’ liability insurance.

We may not be able to obtain insurance policies on terms affordable to us that would adequately insure our business and property against damage, loss or claims by third parties. To the extent our business or property suffers any damages, losses or claims by third parties, which are not covered or adequately covered by insurance, our financial condition may be materially adversely affected. Additionally, we may be unable to maintain sufficient insurance as a public company to cover liability claims made against our officers and directors. If we are unable to adequately insure our officers and directors, we may not be able to retain or recruit qualified officers and directors.

We are a holding company that depends, in addition to our capital raising activities, on cash flows from our wholly owned subsidiaries to meet our obligations.

We are a holding company with no material assets other than the stock of our wholly owned subsidiaries, and all of our operations are conducted by EYEKON E.R.D. LTD, our indirect wholly owned subsidiary. We currently expect that the earnings and cash flow of EYEKON E.R.D. LTD will primarily be retained and used by it in its operations, including servicing any debt obligations it may have now or in the future. We have no current plans to pay any dividends, and our subsidiary may not be able to generate sufficient cash flow to distribute funds to us in order to allow us to pay any dividends in the future or otherwise make any distributions in respect of our common stock.

17

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or detect fraud. Consequently, investors could lose confidence in our financial reporting and this may decrease the trading price of our common stock.

We must maintain effective internal controls to provide reliable financial reports and detect fraud. Our failure to properly maintain an effective system of internal controls could harm our operating results and cause investors to lose confidence in our reported financial information. In addition, such failure may cause us to suffer violations of the U.S. federal securities laws to the extent we are unable to maintain effective internal controls. Any such loss of confidence or violations would have a negative effect on the trading price of our common stock.

Potential political, economic and military instability in the State of Israel, where key members of our senior management and our main research and development facilities are located, may adversely affect our results of operations.

We maintain offices and research and development facilities in the State of Israel. Political, economic and military conditions in Israel may directly affect our ability to conduct business. Since the State of Israel was established in 1948, a number of armed conflicts have occurred between Israel and its neighboring countries. Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its present trading partners, or a significant downturn in the economic or financial condition of Israel, could affect adversely our operations. We believe that if conditions would require relocation of our offices and key persons out of Israel, we could do so within few weeks, ongoing and revived hostilities or other Israeli political or economic factors could potentially have a short-term negative effect on our operations and product development and may have a short-term negative effect to our revenues.

Disruptions in the financial markets and economic conditions could affect our ability to raise capital and could disrupt or delay the performance of our third-party contractors and suppliers.

The U.S. and global economies have historically suffered dramatic economic downturns, including, among other things, as the result of deterioration in the credit markets. Similarly, recent years have seen extreme volatility in security prices, severely diminished liquidity and credit availability, ratings downgrades of certain investments and declining valuations of others. The United States and certain foreign governments have recently taken unprecedented actions in an attempt to address and rectify these extreme market and economic conditions by providing liquidity and stability to the financial markets. If the actions taken by these governments are not successful, a continued economic decline may cause a significant impact on our ability to raise capital, if needed, on a timely basis and on acceptable terms or at all. As a result of the current volatile and unpredictable global economic situation, our business could be severely adversely affected.

Risks Related to Our Intellectual Property

We license certain technology from Talshir Medical Technologies Ltd. (“Tashir”), and we could lose our rights to this license if a dispute with Talshir arises or if we fail to comply with the financial and other terms of the license.