Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - BLUE CALYPSO, INC. | ex32-2.htm |

| EX-31.1 - EX-31.1 - BLUE CALYPSO, INC. | ex31-1.htm |

| EX-31.2 - EX-31.2 - BLUE CALYPSO, INC. | ex31-2.htm |

| EX-32.1 - EX-32.1 - BLUE CALYPSO, INC. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2015

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 333-143570

BLUE CALYPSO, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-8610073

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

101 W. Renner Rd., Suite 200

Richardson, TX

|

75082

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(800) 378-2297

(Registrant’s telephone number, including area code)

Securities Registered pursuant to Section 12(b) of the Act: None

Securities Registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨. No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

|

Non-accelerated filer ¨

|

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨. No x

On June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value (based on the closing sales price on that date) of the voting stock held by non-affiliates of the registrant was $17,418,543. Shares of common stock held by each current executive officer and director and by each person who is known by the registrant to own 5% or more of the outstanding common stock have been excluded from this computation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not a conclusive determination for other purposes.

The number of outstanding shares of the registrant’s common stock as of March 17, 2016, was 6,007,443.

BLUE CALYPSO, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2015

|

|

Page

|

|

|

PART I

|

||

|

Item 1.

|

3

|

|

|

Item 1A.

|

11

|

|

|

Item 1B.

|

23

|

|

|

Item 2.

|

23

|

|

|

Item 3.

|

24

|

|

|

Item 4.

|

24

|

|

|

PART II

|

||

|

Item 5.

|

25

|

|

|

Item 6.

|

26

|

|

|

Item 7.

|

26

|

|

|

Item 7A.

|

32

|

|

|

Item 8.

|

32

|

|

|

Item 9.

|

32

|

|

|

Item 9A.

|

32

|

|

|

Item 9B.

|

33

|

|

|

PART III

|

||

|

Item 10.

|

34

|

|

|

Item 11.

|

37

|

|

|

Item 12.

|

40

|

|

|

Item 13.

|

41

|

|

|

Item 14.

|

41

|

|

|

PART IV

|

||

|

Item 15.

|

42

|

|

PART I

ITEM 1. BUSINESS

OUR COMPANY

Blue Calypso, Inc. (the “Company,” “Blue Calypso,” “we,” or “us”) develops and delivers mobile shopper marketing and analytics solutions for the business-to-consumer (B2C) marketplace leveraging mobile, social media, gamification and our intellectual property portfolio. We have developed a patented technology platform that enables brands and retailers to engage with shoppers when they are on the path-to-purchase products and services. Our technology also allows brands to leverage customer relationships to increase brand loyalty and drive revenue through sharing and influencer marketing. We generate revenue from the mobile and cloud-based consumption of our technology platform, consulting/services fees, and licensing and/or enforcement of our patented technologies. Our intellectual property portfolio consists of five US patents (an appeal at the Federal Circuit as a result of the PTAB ruling in December 2014 is in progress, which may affect the validity of one of the patents) and eleven pending patent applications that generally cover methods and systems for communicating and syndicating electronic offers and advertisements. One of the applications has recently been allowed by the patent office and we expect it to issue as a patent in the near future. Once granted the number of patents held by the Company will increase to six. All of the patents and patent applications that cover the core of our business, i.e., a “System and Method for Peer-to-Peer Advertising Between Mobile Communication Devices”, have been developed internally by our Founder and Chief Executive Officer, Andrew Levi, and our Director of Innovation, Bradley Bauer, and assigned to our wholly owned subsidiary, Blue Calypso, LLC. In September 2013, we acquired proprietary mobile gamification technology and subsequently applied for two additional patents based upon the enhancement and integration of this technology into our platform.

Our proprietary technology platform enables retailers to harness the power and adoption that today’s mobile devices bring to the consumer shopping experience. We connect brands with store visitors when they are on the path-to-purchase and enable those customers to engage with, and redeem brand content as well as leverage their brand affinity across the most popular social media channels. Our platform tracks performance, monitors engagement, manages attribution and delivers robust, real-time analytics that provide acute insight regarding the adoption, performance and return on investment of our client’s promotions and location-based content. Our technology is designed to help clients target their marketing messages, attract new customers, increase awareness and drive product sales. For example, campaigns facilitated through our platform can encourage consumers to learn more about products, watch promotional videos about particular products, see product reviews and comparative pricing or click to buy products. All delivered through a highly engaging mobile “kiosk” or “digital concierge” type experience.

Over the last five years, the world has seen mobile, social media, and digital advertising evolve dramatically and actually converge. Through this technological evolution, a sociological shift has occurred in how influential digital media can be when deployed strategically with hyper-targeted content.

Today retailers are aggressively exploring mobile shopper engagement as the next frontier of the shopping experience. In an article issued by Reuters on December 2, 2014 titled, Majority of Mobile Shoppers Turn To Their Devices Over Store Employees And In-Store Info, according to CEA Survey”, more than half (58 percent) of shoppers who use mobile devices, such as smartphones and tablets, indicate they prefer to look up information on their devices while shopping, rather than talk to store employees – especially among men and shoppers aged 25-44. However we believe that retailers have yet to find a comfortable way of co-existing in this ecosystem of traditional consumer engagement.

Through mobile and social media, consumers and brands have their own unique and significant digital audience. According to Statista, the average Facebook user has 350 Friends. As reported in an article published by The Telegraph, the average Twitter user is an American woman with an iPhone and 208 followers. The claims in the article are based on data culled from a sample of 36 million Twitter profiles by Beevolve, a social media marketing firm. We believe that on average an individual has 25 unique frequent contacts they communicate with weekly via text messages or mobile calls. We also believe that active participation in LinkedIn, Google+, Tumblr and/or a personal blog can further extend one’s direct social reach significantly. With our platform, brand content is not bound by any single app, social media community, website, carrier or device. As a result, brand influencers have the capability to immediately reach hundreds or even thousands of people through their direct personal and digital social relationships.

As a by-product of campaign delivery and recipient interaction, we deliver real-time analytics and business intelligence capabilities, which provide brands the ability to see how campaigns are deployed, where they are getting the most traction, and which are seeing the most activity. The platform also allows brands to assess the conversational response and sentiment to their messages which enables them to adjust their campaigns based on performance.

OUR PRODUCTS AND SERVICES

Our core platform called KIOSENTRIX® is the basis for our business model. Additionally, we offer outsourced consulting and customized software development services through our Blue Calypso Labs (“BC Labs”) services.

KIOSENTRIX® provides manufacturers and brick-and-mortar retailers with a highly targeted and personalized way of engaging with store visitors when they are on the path-to-purchase. There are several methods of activation with store visitors including but not limited to short-code messaging, iBeacons, Near Field Communications (NFC), Quick Response (QR) codes, wifi and Geo-fencing. Once invited through store messaging and activated, a store visitor is guided by store-centric content through their shopping experience which is unique for each retailer. All interactions with the store shopper are tracked in order to deliver targeted content which is both circumstantially and geographically relevant and ultimately drives more store visits and increases the purchase size while creating a higher degree of customer affinity and satisfaction.

Blue Calypso Labs™, or BC Labs, was launched in October 2013 to offer software development, innovation and related consulting services to clients. BC Lab’s mission is to help clients develop unique software solutions that solve strategic business problems, focus on integrating our digital marketing and analytics technologies into various client applications as well as seek licensing revenue from our broad portfolio of intellectual property.

We intend to continue to develop new technology and expand on our intellectual property portfolio and product offerings to meet the needs of companies seeking to amplify their brand messages through social media networks.

Our principal executive offices are located at 101 W. Renner Rd. Suite 200, Richardson, Texas 75082. Our telephone number is (800) 378-2297. Our website address is http://www.bluecalypso.com.

MARKET OPPORTUNITY

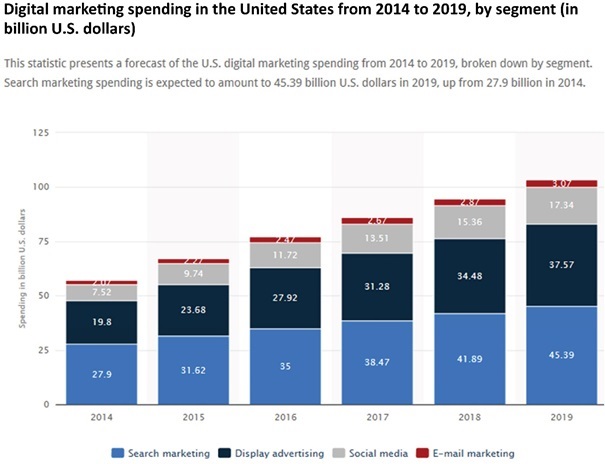

We believe that the market opportunities for our existing products and technology are significant and continuing to expand. According to the figure below, Forrester Research estimates that in 2015, approximately $67 billion will be spent in the United States on interactive marketing. Forrester estimates this amount will increase to approximately $103 billion by 2019. We believe social media marketing is experiencing rapid growth because consumers are much more receptive to recommendations from their friends and family. The below chart demonstrates these trends.

We believe that as advertisers adapt to the changing media and content distribution landscape, they will place an increasing priority on the next frontier of mobile while leveraging social media communities and properties.

We believe that historical advertising media such as print, television and radios, and even Internet banner ads, are beginning to shift to mobile platforms and generally explore alternatives to traditional advertising techniques. Mobile platforms enable advertisers to put relevant messages out to a more highly targeted buyer community, while encouraging branded and personal content syndication. In addition, mobile devices have become a ubiquitous extension of many target buyers and a critical part of the lifestyle of most generations.

We believe that one of the most attractive characteristics of mobile consumers for advertisers is the opportunity for more accurate content targeting. Typical parameters include carrier, device type and mobile channel, with the possibility to add geo-location, behavioral, demographic and interest-based information (the latter two generally require user opt in) infused with a user’s actual purchase history. For instance, mobile technology can enable relevant promotional offers and coupons to be delivered to shoppers’ phones while they are in the store. That level of personalization will likely affect purchase behavior. According to the Telemetrics/xAd report, coupons and relevant targeting also motivate consumers to take further action.

Mobile marketing has the ability to connect brands with consumers on an intimate one-to-one basis, providing relevant information that is important to them when it interests them the most. While the sector is still in its infancy, we believe that brands, retailers, advertising executives, content publishers and technology enablers have high expectations regarding the potential of the mobile advertising market. We believe that our platform offers an effective tool for advertisers seeking to enter or expand their advertising presence in the mobile market, target specific customers with selected messages, and capitalize on the power of peer recommendations. In fact, according to an article published by eMarketer on January 5, 2015 titled, In-Store Mobile Use Redefines Customer Service, a Deloitte study found that mobile devices used before or during in-store shopping trips converted or helped to convert nearly $600 billion in US in-store retail sales in 2013 or 19% of total brick-and-mortar sales.

We also believe that peer-to-peer or “friend-to-friend” advertising (also known as influencer marketing) is the most powerful and effective form of communicating with consumers. According to eMarketer’s October 24, 2014 report titled, Millennials’ Social Shares Don’t Stop with the Post, two thirds of 18-34-year-olds were at least somewhat likely to make a purchase based on content shared by one of their peers on social. According to Nielsen as published in the Simply Measured report titled, Influencer Marketing: Stats and Quotes You Need to Know, 90% of consumers trust peer recommendations but only 33% trust ads. We believe that this ability to share retail offers and product information in real-time with friends and family, makes mobile content delivery even more valuable. Our products enable our customers to combine great mobile-targeted content with word-of-mouth recommendations.

COMPETITIVE STRENGTHS

Mobile shopper engagement, digital market awareness and branding through mobile and digital media is an extremely competitive and fragmented industry. Adequate protection of intellectual property, successful product development, adequate funding and retention of experienced personnel are critical to our success. We believe that we have the following strengths:

|

•

|

Prominent Intellectual Property Position. We believe that our patents provide us with broad and comprehensive coverage for the electronic delivery of brand content and electronic offers on any electronic communication device. Our policy is to seek to protect our proprietary position by filing patent applications related to our proprietary technology and improvements that we believe are important to the development of our business. We also pursue companies that we believe are infringing on our intellectual property in order to protect our intellectual property assets and our competitive position.

|

|

•

|

Extensive Knowledge and Experience in Product Advertising, Awareness and Branding. We believe that our management and personnel have extensive knowledge and experience in product advertising, digital marketing and awareness and branding which significantly adds to our competitive position.

|

|

•

|

Highly Scalable Platform. We have the ability to rapidly customize products to meet our client’s diverse needs. Our technology platform has evolved and matured as we have refined our go-to-market strategy and target market.

|

OUR STRATEGY

We intend to continue innovating and will attempt to maximize the economic benefits of our intellectual property. We currently have two key areas of operation:

Development and Delivery of Mobile Shopper Engagement Solutions- We have developed a proprietary platform that enables brands to engage with shoppers when they are on the path-to-purchase in order to deliver a unique shopper experience, increase brand loyalty and drive revenue.

We believe that our strong intellectual property and our extensive experience in mobile technologies, affinity/advocacy, awareness and branding will enable us to continue to develop new products and services. We will execute on this strategy through a combination of: organic customer acquisition; indirect customer acquisition through strategic partners such as IntegraColor; and through synergistic acquisitions.

Our direct to market approach includes aggressive market awareness through public relations, and digital and traditional marketing awareness such as mailings, calls, email campaigns, social media, trade show attendance, and industry association participation. Partnering with organizations that are part of the marketing supply chain who focus on our target market (multi-location brick-and-mortar retailers) gives us immediate access to and credibility with a portfolio of existing customers. Furthermore, by aligning with the right partners, our solutions become part of a larger program which drives revenue for our customers. These programs include our customer’s branding, demand generation, marketing programs/campaigns, deals/offers/coupons, customer affinity programming and other initiatives already in existence with their brands. Finally, we expect to identify and pursue strategic acquisitions that help us grow our feature set, customer base, services capabilities, and our intellectual property portfolio.

Maximization of the Economic Benefits of Our Intellectual Property– The Company was founded based on the opportunities created when the vision and opportunity for mobile adoption caused our founders to file our first patent in 2004. Since then we have expanded our portfolio and will continue to innovate and file for additional patent protection of our inventions. This IP portfolio is a very valuable asset and we have a duty to the Company and to the shareholders to protect these assets. Therefore we intend to continue to identify and pursue those in the marketplace that are infringing our IP.

In summary, we have developed a proprietary platform that enables brands to engage with shoppers when they are on the path-to-purchase in order to deliver a unique shopper experience, increase brand loyalty and drive revenue. We believe that our strong intellectual property and our extensive experience in mobile technologies, awareness and branding will enable us to continue to develop new products and services.

We intend to expand our intellectual property portfolio through both internal development and acquisition. Our goal is to monetize our intellectual property through licensing and strategic partnerships.

Marketing

We target multi-location brick-and-mortar retailers as well as product manufacturers through partnerships and indirect sales channels as well as brand-direct. We have a multi-touch marketing and branding strategy as well as exhibit at trade shows and market directly utilizing current digital techniques such as social media and pay-per-click advertising.

Customers

We enter into written agreements with each of our customers, which vary in term. Customers’ fees are based on the complexity of the solution we deliver for them and generally include a setup fee, monthly service fee and sometimes a performance fee. Further, our test programs tend to be much smaller as we seek to prove the concept with a particular customer before rolling out a full national campaign. We have also entered into license agreements pursuant to which we derive revenue for the use of our intellectual property on a perpetual license basis. Through BC Labs we provide consulting and software development services.

Technology to Capture Data

Our platform allows the collection of business intelligence and analytics resulting from data accumulated as content is deployed, adopted, consumed and shared. Our technology allows the brand/advertiser to monitor the full cycle of a campaign, from the first engagement to the final redemption or intent to purchase. With this data, we show each client the return on investment (ROI) of each dollar spent using our unique platform. This allows us to prove the effectiveness of the engagement in near real time and enables clients to quickly improve their campaign effectiveness.

Intellectual Property

We believe we have advantages over competitors in the mobile advertising industry due to the intellectual property we possess and have on file with the United States Patent and Trademark Office. In February 2010, we received United States Patent number 7,664,516.

Subsequently we have received continuation-in-part (CIP) patents 8,155,679, 8,438,055, 8,452,646 and 8,457,670. With the payment of all maintenance fees, ‘516, ‘679, ‘055 and ‘646 patents will not expire until December 14, 2026.

We believe that the patents cover the core of our business, i.e., a basic method and system for peer-to-peer advertising between mobile communications devices. We also have four (4) additional CIP patent applications pending which build on the functionality of our issued patents, one patent application which covers a digital game of tag played on mobile devices through which participants can earn points and incentives from game sponsors, and one patent application that covers cumulative incentives.

On December 17, 2014, the Patent Trial and Appeal Board issued final decisions in Covered Business Method Review proceedings CBM2013-00035, CBM2013-00033, CBM2013-00034, CBM2013-00046 and CBM2013-00044. In each case, certain claims of each patent were held to be invalid for various reasons. With respect to the ‘516, ‘679, ‘055 and ‘646 patents, many of the claims survived and the patents remain enforceable. All of the claims of the ‘670 patent were held invalid. The Company appealed each of the final decisions to the United States Federal Circuit Court of Appeals. The Company appealed the unpatentability determinations including the decision of invalidity based on anticipation of several claims of the patents by prior art (the Paul reference). The Company also appealed the decision to review its patents under the provisions for CBMR and that the ‘516 patent lacked sufficient written description under § 112 to support the claims. Groupon appealed the Board’s decision that the patents were not valid under § 103 and the determination by the PTAB that the Ratismor reference was not publically available prior art.

On March 1, 2016, the Federal Circuit overturned the PTAB decision as to insufficient written description but upheld the decision that the Ratismore reference was not publically available prior art. However, the Federal Circuit confirmed the Board’s decision to institute the CBMR process on the basis that Blue Calypso’s patent portfolio qualified as a business method patent which was financial in nature. The Federal Circuit also upheld the decision of invalidity based on anticipation of several claims of the patents by the prior art Paul reference.

The Company has an option to pursue an en banc review of the holding with respect to anticipation by the Paul reference. An en banc review would occur before a panel of eight judges of the Federal Circuit as compared to the recently completed appeals process which utilized three. We also have the option of requesting that the Supreme Court review the Federal Circuit’s decision. These options for appeal must be filed within 30 and 90 days respectively from the date of the March 1, 2016 decision.

The reversal of the written description matter is significant as it re-establishes the ‘516 parent patent issue date of February 2010 as the date that damages begin to accrue. Prior to this reversal, the first date of infringement was relegated to the later issue date of the ‘679 patent on April 2012.

The court dockets for each case, including the parties’ briefs are publicly available on the Public Access to Court Electronic Records website, or PACER, www.pacer.gov, which is operated by the Administrative Office of the U.S. Courts.

Below is a brief overview of our issued patents:

U.S. Patent No. 7,644,516

The ‘516 Patent discloses a method and system for communicating advertisements between mobile communication devices. An advertising campaign and a set of incentives are arranged between an advertiser and an intermediary, such as Blue Calypso. A subscriber is identified for the advertiser based on a profile of a subscriber. A subscriber, once qualified for the advertising campaign, is presented with an opportunity to participate. In operation, when a communication transmission is received from the participant, the advertisement is associated with the communication transmission and sent to a destination.

U.S. Patents 8,155,679 and 8,457,670 are continuations of the ‘516 Patent and include claims which disclose similar subject matter.

U.S. Patent No. 8,438,055

The ‘055 Patent discloses a system and method for distribution of advertisements between communication devices. The system and method provides for accounting and distribution of incentives related to distribution of the advertisements. The system further provides for association of testimonials from advertising recipients related to the advertisement and for distribution of the testimonials to communication devices. A bi-lateral selection between subscribers and advertisers using the system is created whereby both advertisers and subscribers agree to participate in the distribution of advertisements and testimonials.

U.S. Patent No. 8,452,646

The ‘646 Patent discloses a system and method for distribution of advertisements and electronic offers between communication devices. The system and method provides for accounting and distribution of incentives related to distribution of the advertisements and offers. A bi-lateral selection between subscribers and advertisers using the system is created whereby both advertisers and subscribers agree to participate in the distribution of advertisements and offers. The system further provides for a means of redeeming offers utilizing points of sale and analytics associated to the redemption of electronic offers.

We believe that all of the technology that delivers our platform to both advertisers and endorsers has been developed and is fully owned by us with the exception of several web controls that are licensed by us pursuant to a royalty-free license with unlimited distribution rights. The architecture of the platform was designed to support millions of participants through server and application clustering and load-balancing. We believe the elegance of the data flow makes for an extremely light-weight and highly scalable system that can easily be enhanced. By using a standards-based SMS protocol coupled with tight integration to social communities such as Facebook, Twitter, LinkedIn and blogs as the primary delivery mechanisms, and by serving the dynamic content via a standard mobile web browser, we are capable of supporting most any receiving mobile device with Internet access. Platform smartphone support is available for Apple iPhone and Google Android devices as well as through a standard desktop web browser.

We own twelve registered trademarks in the United States: “BLUE CALYPSO®,” “WHEN FRIENDS TALK, FRIENDS LISTEN®,” “CALYP®,” “POWER TO THE PEOPLE®,” “SOCIALLY YOURS®,” “ENDORSE SHARE EARN®,” “EMGAGE®,” “DASHTAGG®” (two registrations for different classes), “POPSHARE®,” “SHARE ADVERTISING®,” and “KIOSENTRIX®,” In addition, we have four pending trademark applications for the following: “SOCIALECHO™,” “MOBILE ADVANTAGE™,” “OFTIN™,” and “POPTRAX™.”

We also believe that we have common law rights in these trademarks that arise from use of the marks in commerce. The trademark registrations will continue in force as long as all renewals are timely paid and use of the marks continues. Our common law trademark rights will continue as long as the marks are used in commerce.

Employees

As of December 31, 2015, we had a total of 17 full-time employees. We also utilize the services of independent contractors. We have no labor union contracts and believe relations with our employees are satisfactory.

Competition

We face formidable competition in every aspect of our business, particularly from other companies that seek to deliver a mobile targeted brand-driven experience for consumers. First and foremost, we consider ourselves a next generation mobile shopping experience including customer engagement, customer presentation, social sharing, brand loyalty and rewards so we believe our primary competitors are companies that embrace true brand loyalty, not just providers of discounted transactions. We believe that our space is large and has no first movers or any company with a notable share of the market. We believe that our approach to the market, value proposition to large retail brands, combined with our strong intellectual property are clear differentiators in a nascent yet quickly evolving industry for mobile shopper marketing.

We also face competition from other mobile and Internet advertising providers, including companies that are not yet known to us. We may compete with companies that sell products and services online, because these companies, like us, are trying to attract users to their websites to search for information about products and services. Our biggest competitor is each of the retail brands for which we are in pursuit as many of them have or are building their own mobile apps. The problem we predict most of them will face at some point is the fact that consumers do not want a mobile app on their phone for every retailer they shop at. Therefore, with few exceptions, the adoption has been and will continue to be poor. Thus, we expect that retailers will abandon this expensive route for mobile engagement and transition to what we believe is a much more effective route to success by partnering with Blue Calypso.

We believe that we compete favorably on the factors described above. However, product advertising, marketing, awareness and branding through social media sites is an extremely competitive space. As we expand our product offerings to include private branded products, instant access products, as well as other technology offerings, we will continue to face new competitors. Further, as the technology marketplace is always expanding, new competitors continuously innovate, and can become a competitor in the future.

Government Regulation

Aspects of the digital marketing and advertising industry and how our business operates are highly regulated. We are subject to a number of domestic and, to the extent our operations are conducted outside the U.S., foreign laws and regulations that affect companies conducting business on the Internet and through other electronic means, many of which are still evolving and could be interpreted in ways that could harm our business. In particular, we are subject to rules of the Federal Trade Commission (“FTC”), the Federal Communications Commission (“FCC”) and potentially other federal agencies and state laws related to our advertising content and methods, the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003, or CAN-SPAM Act, which became effective on January 1, 2004, establishes certain requirements for commercial electronic mail messages and specifies penalties for the transmission of commercial electronic mail messages that follow a recipient’s opt-out request or are intended to deceive the recipient as to source or content, federal and state regulations covering the treatment of member data that we collect from endorsers.

U.S. and foreign regulations and laws potentially affecting our business are evolving frequently. We are, and will continue to update and improve our regulatory compliance features and functionality, and we will need to continue to identify and determine how to effectively comply with all the regulations to which we are subject now or in the future. If we are unable to identify all regulations to which our business is subject and implement effective means of compliance, we could be subject to enforcement actions, lawsuits and penalties, including but not limited to fines and other monetary liability or injunction that could prevent us from operating our business or certain aspects of our business. In addition, compliance with the regulations to which we are subject now or in the future may require changes to our products or services, restrictor impose additional costs upon the conduct of our business or cause users to abandon material aspects of our services. Any such action could have a material adverse effect on our business, results of operations and financial condition.

The FTC adopted Guides Concerning the Use of Endorsements and Testimonials in Advertising (“Guides”) on October 5, 2009. The Guides recommend that advertisers and publishers clearly disclose in third-party endorsements made online, such as in social media, if compensation was received in exchange for said endorsements. Because our business connects endorsers and advertisers, relies on endorsers sharing their brand endorsements within their digital social circles, and both we and endorsers may earn cash and other incentives, any failure on our part to comply with the Guides may be damaging to our business. We are currently taking several steps to ensure that our endorsers indicate in social media posts that compensation is being provided to the endorsers, including by listing the phrase “paid” or “ad” or other appropriate language in advertisements that our endorsers circulate on social media. We also advise endorsers of the need to comply with the Guides, and we can terminate accounts with endorsers for noncompliance. Nonetheless, the FTC could potentially identify a violation of the Guides, which could subject us to a financial penalty or loss of endorsers or advertisers.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as the 2002 amendment to California’s Information Practices Act, or requiring the adoption of minimum information security standards that are often vaguely defined and difficult to practically implement. The costs of compliance with these laws may increase in the future as a result of changes in interpretation. Furthermore, any failure on our part to comply with these laws may subject us to significant liabilities.

We are also subject to federal, state, and foreign laws regarding privacy and protection of member data. Any failure by us to comply with these privacy-related laws and regulations could result in proceedings against us by governmental authorities or others, which could harm our business. In addition, the interpretation of data protection laws, and their application to the Internet is unclear and in a state of flux. There is a risk that these laws may be interpreted and applied in conflicting ways from state to state, country to country, or region to region, and in a manner that is not consistent with our current data protection practices. Complying with these varying international requirements could cause us to incur additional costs and change our business practices. Further, any failure by us to adequately protect our members’ privacy and data could result in a loss of member confidence in our services and ultimately in a loss of members and customers, which could adversely affect our business.

We post on our website our privacy policy and user agreement, which describe our practices concerning the use, transmission and disclosure of member data. Any failure by us to comply with our privacy policy and user agreement could result in proceedings against us by members, customers, governmental authorities or others, which could harm our business.

Many states have passed laws requiring notification to subscribers when there is a security breach of personal data. There are also a number of legislative proposals pending before the United States Congress, various state legislative bodies and foreign governments concerning data protection. In addition, data protection laws in Europe and other jurisdictions outside the United States may be more restrictive, and the interpretation and application of these laws are still uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change our data practices, which could have an adverse effect on our business. Furthermore, the Digital Millennium Copyright Act has provisions that limit, but do not necessarily eliminate, our liability for linking to third-party websites that include materials that infringe copyrights or other rights, so long as we comply with the statutory requirements of this Act. Complying with these various laws could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.

Our client's consumers/brand advocates communicate across email, mobile, social and/or web-based channels. These communications are governed by a variety of U.S. federal, state, and foreign laws and regulations. With respect to email campaigns, for example, in the United States, the CAN-SPAM Act, establishes certain requirements for the distribution of “commercial” email messages for the primary purpose of advertising or promoting a commercial product, service, or Internet website and provides for penalties for transmission of commercial email messages that are intended to deceive the recipient as to source or content or that do not give opt-out control to the recipient. The U.S. Federal Trade Commission, a federal consumer protection agency, is primarily responsible for enforcing the CAN-SPAM Act, and the U.S. Department of Justice, other federal agencies, state attorneys general, and Internet service providers also have authority to enforce certain of its provisions.

The CAN-SPAM Act’s main provisions include:

|

•

|

prohibiting false or misleading email header information;

|

|

•

|

prohibiting the use of deceptive subject lines;

|

|

•

|

ensuring that recipients may, for at least 30 days after an email is sent, opt out of receiving future commercial email messages from the sender, with the opt-out effective within 10 days of the request;

|

|

•

|

requiring that commercial email be identified as a solicitation or advertisement unless the recipient affirmatively assented to receiving the message; and

|

|

•

|

requiring that the sender include a valid postal address in the email message.

|

The CAN-SPAM Act preempts most state restrictions specific to email marketing. However, some states have passed laws regulating commercial email practices that are significantly more punitive and difficult to comply with than the CAN-SPAM Act, particularly Utah and Michigan, which have enacted do-not-email registries listing minors who do not wish to receive unsolicited commercial email that markets certain covered content, such as adult content or content regarding harmful products. Some portions of these state laws may not be preempted by the CAN-SPAM Act.

Violations of the CAN-SPAM Act’s provisions can result in criminal and civil penalties, including statutory penalties that can be based in part upon the number of emails sent, with enhanced penalties for commercial email senders who harvest email addresses, use dictionary attack patterns to generate email addresses, and/or relay emails through a network without permission.

With respect to text message campaigns, for example, the CAN-SPAM Act and regulations implemented by the U.S. Federal Communications Commission pursuant to the CAN-SPAM Act, and the Telephone Consumer Protection Act, also known as the Federal Do-Not-Call law, among other requirements, prohibit companies from sending specified types of commercial text messages unless the recipient has given his or her prior express consent.

We, our clients and our client's consumers/brand advocates may all be subject to various provisions of the CAN-SPAM Act. If we are found to be subject to the CAN-SPAM Act, we may be required to change one or more aspects of the way we operate our business.

If we were found to be in violation of the CAN-SPAM Act, other federal laws, applicable state laws not preempted by the CAN-SPAM Act, or foreign laws regulating the distribution of commercial email, whether as a result of violations by our endorsers or any determination that we are directly subject to and in violation of these requirements, we could be required to pay penalties, which would adversely affect our financial performance and significantly harm our reputation and our business.

In addition, because our services are accessible worldwide, certain foreign jurisdictions may claim that we are required to comply with their laws, including in jurisdictions where we have no local entity, employees, or infrastructure.

Corporate History

We were incorporated as a Nevada corporation on March 2, 2007 under the name JJ&R Ventures, Inc. for the purpose of developing and marketing an educational book series, consisting of books, presentations and flash cards focusing on healthy nutrition for children. On or about July 2011, we were presented with a business opportunity by the management of a privately held Texas company named Blue Calypso Holdings, Inc. that upon evaluation was determined to be more desirable than our previous business plan. As a result, we suspended our efforts in relation to our original business plan and entered into negotiations with Blue Calypso Holdings, Inc. to consummate a reverse merger transaction.

In contemplation of a possible transaction with Blue Calypso Holdings, Inc., we changed our name from “JJ&R Ventures, Inc.” to “Blue Calypso, Inc.” on July 21, 2011 and completed a three and four tenths (3.4) for one (1) forward stock split of our common stock.

On September 1, 2011, we entered into an Agreement of Merger and Plan of Reorganization (the “Merger Agreement”) with Blue Calypso Holdings, Inc. and our newly formed wholly-owned subsidiary, Blue Calypso Acquisition Corp. Upon the closing of the transactions contemplated under the Merger Agreement, Blue Calypso Acquisition Corp. merged with and into Blue Calypso Holdings, Inc., and Blue Calypso Holdings, Inc. as the surviving corporation became our wholly-owned subsidiary. In connection with this merger, we discontinued all of our prior operations and assumed the business of Blue Calypso Holdings, Inc. as our sole line of business. We refer to this merger transaction as the “reverse merger.”

Immediately following the closing of the reverse merger, we transferred all of our pre-merger assets and liabilities to JJ&R Ventures Holdings, Inc., a wholly-owned subsidiary, and transferred all of the outstanding stock of JJ&R Ventures Holdings, Inc. to Deborah Flores, our then majority stockholder and our former president, secretary, treasurer and sole director, in exchange for the cancellation of 51,000,000 shares of our common stock then owned by Ms. Flores.

On October 17, 2011, we merged with and into Blue Calypso, Inc., a Delaware corporation and wholly-owned subsidiary, for the sole purpose of changing our state of incorporation from Nevada to Delaware. We refer to this merger transaction as the “reincorporation merger.”

ITEM 1A. RISK FACTORS.

Investing in our common stock involves a high degree of risk. Before investing in our common stock, you should carefully consider the risks described below and the financial and other information included in this Annual report. If any of the following risks, or any other risks not described below, actually occur, it is likely that our business, financial condition, and/or operating results could be materially adversely affected. In such case, the trading price and market value of our common stock could decline and you may lose part or all of your investment in our common stock. The risks and uncertainties described below include forward-looking statements and our actual results may differ from those discussed in these forward-looking statements.

Risks Relating to our Business

We have a history of losses which may continue, which may negatively impact our ability to achieve our business objectives.

We incurred net losses of $3,303,150 and $7,735,464 for the years ended December 31, 2015 and 2014, respectively. While a significant portion of the losses for the years ended December 31, 2015 and 2014 is attributed to non-cash equity compensation expense, we cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise in the relatively new and volatile market for product marketing and branding through social media communities. Revenues and profits, if any, will depend upon various factors, including whether we will be able to continue expansion of our revenue model. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We are an early stage company and we have generated very limited revenue to date. To date, our business focuses on the development of our patented proprietary technology platform, through which we offer various shopper marketing, social media advertising and loyalty campaigns, and the assertion of our patents. Therefore, we not only have a very limited operating history, but also a limited track record of executing our business model which includes, among other things, creating, prosecuting, licensing, litigating or otherwise monetizing our patent assets. Our limited operating history and limited revenues generated to date make it difficult to evaluate our current business model and future prospects.

In light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development with minimal operating history, there is a significant risk that we will not be able to:

● implement or execute our current business plan, or demonstrate that our business plan is sound; and/or

● raise sufficient funds in the capital markets to effectuate our long-term business plan.

If we are unable to execute any one of the foregoing or similar matters relating to our operations, our business may fail.

We will require additional capital to support our present business plan and our anticipated business growth, and such capital may not be available on acceptable terms, or at all, which would adversely affect our ability to operate.

Based on our current operating plans, our current resources are expected to be sufficient to fund our planned operations into May 2016. We may also need to raise additional funds in connection with any acquisitions of technology or intellectual property assets that we pursue for a new opportunity to innovate our platform, a change in our approach to the market or to fund licensing and enforcement actions.

While we will need to seek additional funding, we may not be able to obtain financing on acceptable terms, or at all. If we are unable to obtain additional funding on a timely basis, we may be required to curtail or terminate some or all of our business plans.

Our independent registered public accounting firm's report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a going concern.

As of December 31, 2015, our accumulated deficit was $35,470,384. Primarily as a result of our recurring losses from operations, negative cash flows and our accumulated deficit, our independent registered public accounting firm has included in its report for the year ended December 31, 2015 an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is contingent upon, among other factors, our ability to obtain sufficient financing to support our operations. If we are not able to obtain sufficient financing to support our operations, we may be forced to limit or cease our operations.

The markets that we are targeting for revenue opportunities may change before we can access them.

The markets for traditional Internet and mobile web products and services that we target for revenue opportunities change rapidly and are being pursued by many other companies. Further, the barriers to entry are relatively low. Therefore, we cannot provide assurance that we will be able to realize our targeted revenue opportunities before they change or before other companies dominate the market. With the introduction of new technologies and the influx of new entrants to the market, we expect competition to persist and intensify in the future, which could harm our ability to increase sales, limit client attrition and maintain our prices.

We operate within a highly competitive and complex market, which could have an adverse effect on our business.

Technology for retail, product advertising, marketing, awareness and branding is an extremely competitive and fragmented industry. The industry can be significantly affected by many factors, including changes in local, regional, and national economic conditions, changes in consumer preferences, brand name recognition, marketing and the development of new and competing products or technologies. We expect that existing businesses that compete with us and have greater financial resources will be able to undertake more extensive marketing campaigns and more aggressive advertising strategies than us, thereby generating more attention to their companies. These competitive pressures could have a material adverse effect on our business, prospects, financial condition, and results of operations.

We are presently reliant exclusively on a limited number of patented technologies.

We derive substantially all of our revenue from a relatively small number of key technologies. As new technological advances occur, many of our patented technologies may become obsolete before they are completely monetized. If we are unable to monetize our current patent assets for any reason, including obsolescence of our technology, the expiration of our patents or any other reason, we may be unable to acquire additional assets. If this occurs, our business and prospects would be materially harmed.

Any failure to protect or enforce our patent or other intellectual property rights could significantly impair our business.

Our ability to successfully operate our business depends largely on the validity and enforceability of our patent rights and the relevance of our patent rights to commercially viable products or services. Third parties have challenged, and we expect will continue to challenge, the infringement, validity and enforceability of certain of our patents. In some instances, our patent claims could be substantially narrowed or declared invalid, unenforceable, not essential or not infringed. We cannot assure you that the validity and enforceability of our patents will be maintained or that our patent claims will be applicable to any particular product or service. In addition, the U.S. Patent and Trademark Office, or the “USPTO,” could invalidate or render unenforceable our current or future patents (if any) or materially narrow the scope of their claims during the course of a re-examination. Any significant adverse finding as to the validity, enforceability or scope of certain of our patents and/or any successful design around certain of our patents could materially and adversely affect our ability to secure future settlements or licenses on beneficial terms, if at all, and otherwise harm our business.

On December 17, 2014, the Patent Trial and Appeal Board issued final decisions in Covered Business Method Review proceedings CBM2013-00035, CBM2013-00033, CBM2013-00034, CBM2013-00046 and CBM2013-00044. In each case, certain claims of each patent were held to be invalid for various reasons. With respect to the ‘516, ‘679, ‘055 and ‘646 patents, many of the claims survived and the patents remain enforceable. All of the claims of the ‘670 patent were held invalid. The Company appealed each of the final decisions to the United States Federal Circuit Court of Appeals. The Company appealed the unpatentability determinations including the decision of invalidity based on anticipation of several claims of the patents by prior art (the Paul reference). The Company also appealed the decision to review its patents under the provisions for CBMR and that the ‘516 patent lacked sufficient written description under § 112 to support the claims. Groupon appealed the Board’s decision that the patents were not valid under § 103 and the determination by the PTAB that a certain reference (the Ratismor reference) was not publically available prior art.

On March 1, 2016, the Federal Circuit overturned the PTAB decision as to insufficient written description but upheld the decision that the Ratismore reference was not publically available prior art. However, the Federal Circuit confirmed the Board’s decision to institute the CBMR process on the basis that Blue Calypso’s patent portfolio qualified as a business method patent which was financial in nature. The Federal Circuit also upheld the decision of invalidity based on anticipation of several claims of the patents by the prior art (the Paul reference).

The Company has an option to pursue an en banc review of the holding with respect to anticipation by the Paul reference. An en banc review would occur before a panel of eight judges of the Federal Circuit as compared to the recently completed appeals process which utilized three. We also have the option of requesting that the Supreme Court review the Federal Circuit’s decision. These options for appeal must be filed within 30 and 90 days respectively from the date of the March 1, 2016 decision.

The reversal of the written description matter is significant as it re-establishes the ‘516 parent patent issue date of February 2010 as the date that damages begin to accrue. Prior to this reversal the first date of infringement was relegated to the later issue date of the ‘679 patent on April 2012.

The court dockets for each case, including the parties’ briefs are publicly available on the Public Access to Court Electronic Records website, or PACER, www.pacer.gov, which is operated by the Administrative Office of the U.S. Courts.

The value of our patent assets may decline.

We will likely be required to spend significant time and resources to maintain the effectiveness of our issued patents by paying maintenance fees and making filings with the USPTO as well as prosecuting our patent applications. In the future, we may acquire patent assets, including patent applications, which require us to spend resources to prosecute the applications with the USPTO.

Despite efforts to protect our intellectual property rights, any of the following or similar occurrences may reduce the value of our intellectual property:

• our applications for patents may not be granted and, if granted, may be challenged or invalidated;

• issued patents may not provide us with any competitive advantages versus potentially infringing parties;

• our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology; or

• our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we acquire and/or prosecute.

Moreover, we may not be able to effectively protect our intellectual property rights in certain foreign countries where we may do business in the future or where competitors may operate. If we fail to maintain, defend or prosecute our patent assets properly, the value of those assets would be reduced or eliminated, and our business would be harmed.

We commenced legal proceedings against several companies and we expect such proceedings to be time-consuming, which may adversely affect our ability to operate our business.

We commenced legal proceedings against certain daily deal, social promotion and check-in applications (including Groupon, LivingSocial, Yelp, IZEA, MyLikes, and Foursquare), pursuant to which we alleged that such companies infringe on our patents. Certain of these defendants have substantially more resources than we do, which could make our litigation efforts more difficult. We reached settlement in our patent infringement disputes with MyLikes in July 2013, with LivingSocial in August 2013 with IZEA in August 2015, and with Yelp in September 2015.

We anticipate that certain of our ongoing legal proceedings may continue for several years and will require significant attention from our senior management. Disputes regarding the assertion of patents and other intellectual property rights are highly complex and technical. Once initiated, we may be forced to litigate against others to enforce or defend our intellectual property rights or to determine the validity and scope of other parties’ proprietary rights. The defendants or other third parties involved in the lawsuits in which we are involved may allege defenses and/or file counterclaims in an effort to avoid or limit liability and damages for patent infringement. If such defenses or counterclaims are successful, they may preclude our ability to derive licensing revenue from the patents. A negative outcome of any such litigation, or one or more claims contained within any such litigation, could materially and adversely impact our business. Our failure to monetize our patent assets could significantly harm our business and financial position.

While we believe that the patents we own are being infringed by certain leading daily deal, social promotion and check-in applications, there is a risk that a court will find the patents invalid, not infringed or unenforceable and/or that the U.S. Patent Office (USPTO) will either invalidate the patents or materially narrow the scope of their claims during the course of a re-examination. In addition, even with a positive trial court verdict, the patents may be invalidated, found not infringed or rendered unenforceable on appeal. This risk may occur either presently or from time to time in connection with future litigations we may bring. If this were to occur, it could have a material adverse effect on the viability of our company and our operations.

We believe that there are companies that have, and continue to, infringe our patents, but actually obtaining and collecting a judgment against such companies may be difficult or impossible. Patent litigation is inherently risky and the outcome is uncertain. Some of the parties we believe infringe on our patents are large and well-financed companies with substantially greater resources than ours. We believe that these parties would devote a substantial amount of resources in an attempt to avoid or limit a finding that they are liable for infringing our patents or, in the event liability is found, to avoid or limit the amount of associated damages. In addition, there is a risk that these parties may file re-examinations or other proceedings with the USPTO or other government agencies in an attempt to invalidate, narrow the scope or render unenforceable the patents we own.

Moreover, in connection with any of our present or future patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries or award attorneys’ fees and/or expenses to one or more defendants, which could be material, and if we or our subsidiaries are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could materially harm our operating results and financial position.

In addition, it is difficult in general to predict the outcome of patent enforcement litigation at the trial or appellate level. There is a higher rate of appeals in patent enforcement litigation than standard business litigation. The defendants in any patent action we bring in the United States may file an appeal to the Court of Appeals to the Federal Circuit and possibly in the United States Supreme Court. Such appeals are expensive and time-consuming, and the outcomes of such appeals are sometimes unpredictable, resulting in increased costs and reduced or delayed revenue.

Finally, we believe that the more prevalent patent enforcement actions become, the more difficult it will be for us to license our patents without engaging in litigation. As a result, we may need to increase the number of our patent enforcement actions to cause infringing companies to license the patent or pay damages for lost royalties. This will adversely affect our operating results due to the high costs of litigation and the uncertainty of the results.

Trial judges and juries often find it difficult to understand complex patent enforcement litigation, and as a result, we may need to appeal adverse decisions by lower courts in order to successfully enforce our patents.

It is difficult to predict the outcome of patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented technologies, and as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we will diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions made by juries and trial courts.

Federal courts are becoming more crowded, and as a result, patent enforcement litigation is taking longer.

Federal trial courts that hear our patent enforcement actions also hear criminal cases. Criminal cases always take priority over patent enforcement actions. As a result, it is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings before federal judges, and as a result, we believe that the risk of delays in our patent enforcement actions will have a greater effect on our business in the future unless this trend changes.

If a court finds that any of our patents are invalid or narrows their scope over the course of a re-examination or we are otherwise unable to protect our proprietary rights, our ability to competitively conduct our business will be adversely effected.

We rely on our proprietary rights to deliver our platform. To protect our proprietary rights, we rely on a combination of patent and trade secret laws, confidentiality agreements, and protective contractual provisions. Despite these efforts, our patents and intellectual property relating to our business may not provide us with adequate protection of our platform or any competitive advantages.

Our five issued patents have been and may be subjected to further challenge and possibly invalidated by third parties. Changes in either the patent laws or in the interpretations of patent laws in the United States or other countries may diminish the value of our intellectual property.

We own eleven pending patent applications in the United States. We cannot assure that these patent applications will be issued, in whole or in part, as patents. Patent applications in the United States are maintained in secrecy until the patents are published or issued. Since publication of discoveries in the scientific or patent literature tends to lag behind actual discoveries by several months, we cannot be certain that we are the first creator of the inventions covered by pending patent applications.

The status of patents involves complex legal and factual questions and the breadth of claims allowed is uncertain. Accordingly, we cannot be certain that the patent applications that we file will actually afford protection against competitors with similar technology. Others may independently develop similar or alternative products and technologies that may be outside the scope of our intellectual property. In addition, patents issued to us may be infringed upon or designed around by others and others may obtain blocking patents that we need to license or design around, either of which would increase costs and may adversely affect our operations.

Further, effective protection of intellectual property rights may be unavailable or limited in some foreign countries. Our inability to adequately protect our proprietary rights would have an adverse impact on our ability to competitively market our platform on a world-wide basis.

We also rely on trade secrets law to protect our technology. Trade secrets, however, are difficult to protect. While we believe that we use reasonable efforts to protect our trade secrets, our or our strategic partners’ employees, consultants, contractors or advisors may unintentionally or willfully disclose our information to competitors. We seek to protect this information, in part, through the use of non-disclosure and confidentiality agreements with employees, consultants, advisors, and others. However, these agreements may be breached and we may not have adequate remedies for a breach. In addition, we cannot ensure that those agreements will provide adequate protection for our trade secrets, know-how or other proprietary information or prevent their unauthorized use or disclosure.

If our trade secrets become known to competitors with greater experience and financial resources, the competitors may copy or use our trade secrets and other proprietary information in the advancement of their products, methods or technologies. If we were to prosecute a claim that a third party had illegally obtained and was using our trade secrets, it could be expensive and time consuming and the outcome could be unpredictable. In addition, courts outside the United States are sometimes less willing to protect trade secrets than courts in the United States. Moreover, if our competitors independently develop equivalent knowledge, we would lack any contractual claim to this information, and our business could be harmed.

To the extent that consultants and key employees apply technological information independently developed by them or by others to our potential products, disputes may arise as to the proprietary rights of the information, which may not be resolved in our favor. Consultants and key employees that work with our confidential and proprietary technologies are required to assign all intellectual property rights in their discoveries to us. However, these consultants and key employees may terminate their relationship with us, and we cannot preclude them indefinitely from dealing with our competitors.

We may seek to internally develop additional new inventions and intellectual property, which would take time and would be costly. Moreover, the failure to obtain or maintain intellectual property rights for such inventions could lead to the loss of our investments in such activities.

Members of our management team have significant experience as inventors. As such, part of our business may include the internal development of new inventions or intellectual property that we will seek to monetize. However, this aspect of our business would likely require significant capital and would be time consuming. Such activities could also distract our management team from its present business initiatives, which could have a material and adverse effect on our business. There is also the risk that our initiatives in this regard would not yield any viable new inventions or technology, which would lead to a loss of our investments in time and resources in such activities.

In addition, even if we are able to internally develop new inventions, in order for those inventions to be viable and to compete effectively, we would need to develop and maintain a proprietary position with respect to such inventions and intellectual property. However, there are significant risks associated with any such intellectual property we may develop principally including the following:

● patent applications we file may not result in issued patents or may take longer than we expect to result in issued patents;

● we may be subject to interference proceedings;

● we may be subject to opposition proceedings in the U.S. or foreign countries;

● any patents that are issued to us may not provide meaningful protection;

● we may not be able to develop additional proprietary technologies that are patentable;

● other companies may challenge patents issued to us;

● other companies may have independently developed and/or patented (or may in the future independently develop and patent) similar or alternative technologies, or duplicate our technologies;

● other companies may design around technologies we have developed; and

● enforcement of our patents would be complex, uncertain and very expensive.

We cannot be certain that patents will be issued as a result of any future applications, or that any of our patents, once issued, will provide us with adequate protection from competing products. For example, issued patents may be circumvented or challenged, declared invalid or unenforceable, or narrowed in scope. In addition, since publication of discoveries in scientific or patent literature often lags behind actual discoveries, we cannot be certain that we will be the first to make our additional new inventions or to file patent applications covering those inventions. It is also possible that others may have or may obtain issued patents that could prevent us from commercializing our products or require us to obtain licenses requiring the payment of significant fees or royalties in order to enable us to conduct our business. As to those patents that we may license or otherwise monetize, our rights will depend on maintaining our obligations to the licensor under the applicable license agreement, and we may be unable to do so. Our failure to obtain or maintain intellectual property rights for our inventions would lead to the loss of our investments in such activities, which would have a material and adverse effect on our company.

Moreover, patent application delays could cause delays in recognizing revenue from our internally generated patents and could cause us to miss opportunities to license patents before other competing technologies are developed or introduced into the market.

We could become involved in intellectual property disputes that create a drain on our resources and could ultimately impair our assets.

We do not knowingly infringe on any patents, copyrights or other intellectual property rights owned by other parties; however, in the event of an infringement claim, we may be required to spend a significant amount of money to defend a claim, develop a non-infringing alternative or to obtain licenses. We may not be successful in developing such an alternative or obtaining licenses on reasonable terms, if at all. Any litigation, even if without merit, could result in substantial costs and diversion of our resources and could materially and adversely affect our business and operating results.

Third-party intellectual property rights in our field are complicated and continuously evolving. We have not performed searches for third-party intellectual property rights that may raise freedom-to-operate issues, and we have not obtained legal opinions regarding commercialization of our potential products. As such, there may be existing patents that may affect our ability to commercialize our potential products.

In addition, because patent applications are published up to 18 months after their filing, and because applications can take several years to issue, there may be currently pending third-party patent applications that are unknown to us, which may later result in issued patents that result in challenges to our use of intellectual property.

If a third party claims that we infringe on its patents or other proprietary rights, we could face a number of issues that could seriously harm our competitive position, including:

● infringement claims, with or without merit, which can be costly and time consuming to litigate, delay any regulatory approval process and divert management’s attention from our core business strategy;

● substantial damages for past infringement, which we may have to pay if a court determines that our products or technologies infringe upon a competitor’s patent or other proprietary rights; and

● a court order prohibiting us from commercializing our potential products or technologies unless the holder licenses the patent or other proprietary rights to us, which such holder is not required to do.

Future competitive technology for advertising, branding and awareness campaigns in the mobile device market may render our technology obsolete.

Newer technology may render our technology obsolete which would have a material adverse effect on our business and results of operations. In addition, in order to adapt to new technology, we may be required to collaborate with third parties to develop and deploy our services, and we may not be able to do so on a timely and cost-effective basis, if at all.

New legislation, regulations or court rulings related to enforcing patents could harm our business and operating results.

If Congress, the USPTO or courts implement new legislation, regulations or rulings that impact the patent enforcement process or the rights of patent holders, these changes could negatively affect our business model. For example, limitations on the ability to bring patent enforcement claims, limitations on potential liability for patent infringement, lower evidentiary standards for invalidating patents, increases in the cost to resolve patent disputes and other similar developments could negatively affect our ability to assert our patent or other intellectual property rights.

Recently, United States patent laws were amended with the enactment of the Leahy-Smith America Invents Act, or the America Invents Act, which took effect on March 16, 2013. The America Invents Act includes a number of significant changes to U.S. patent law. In general, the legislation attempts to address issues surrounding the enforceability of patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation. For example, the America Invents Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood that such actions will need to be brought against individual parties allegedly infringing by their respective individual actions or activities. At this time, it is not clear what, if any, impact the America Invents Act will have on the operation of our enforcement business. However, the America Invents Act and its implementation could increase the uncertainties and costs surrounding the enforcement of our patented technologies, which could have a material adverse effect on our business and financial condition.