Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Newtek Business Services Corp. | newt-123115xexh311.htm |

| EX-21 - EXHIBIT 21 - Newtek Business Services Corp. | listofsubsidiaries-123115x.htm |

| EX-32.1 - EXHIBIT 32.1 - Newtek Business Services Corp. | newt-123115xexh321.htm |

| EX-31.2 - EXHIBIT 31.2 - Newtek Business Services Corp. | newt-123115xexh312.htm |

| EX-99.1 - EXHIBIT 99.1 - Newtek Business Services Corp. | upsofwillcdecember312015.htm |

| 10-K - 10-K - Newtek Business Services Corp. | newt-123115x10k.htm |

| EX-32.2 - EXHIBIT 32.2 - Newtek Business Services Corp. | newt-123115xexh322.htm |

Universal Processing Services of Wisconsin, LLC (A Limited Liability Company) and Subsidiary Consolidated Financial Report As of December 31, 2014 and for the Period November 12, 2014 to December 31, 2014 (Unaudited)

Universal Processing Services of Wisconsin, LLC and Subsidiary Index December 31, 2014 Pages Financial Statements Consolidated Balance Sheet .......................................................................................................................... 1 Consolidated Statement of Operations .......................................................................................................... 2 Consolidated Statement of Changes in Member’s Equity ............................................................................ 3 Consolidated Statement of Cash Flows ........................................................................................................ 4 Notes to Consolidated Financial Statements ............................................................................................ 5-10

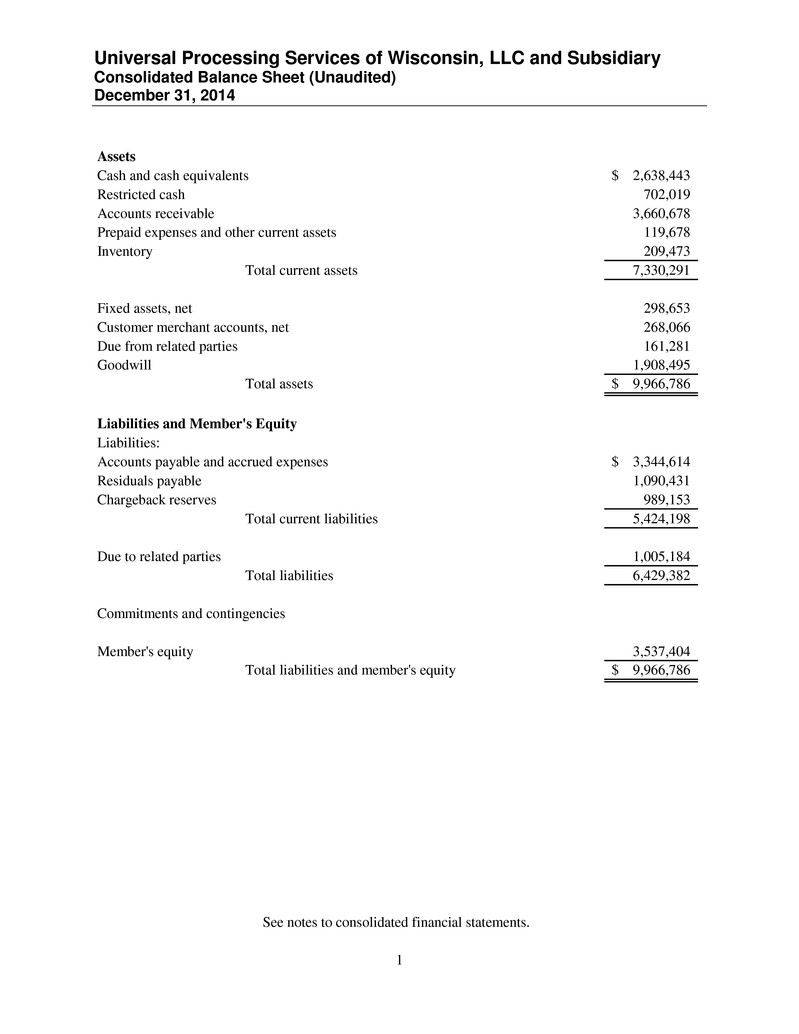

Universal Processing Services of Wisconsin, LLC and Subsidiary Consolidated Balance Sheet (Unaudited) December 31, 2014 See notes to consolidated financial statements. 1 Assets Cash and cash equivalents 2,638,443$ Restricted cash 702,019 Accounts receivable 3,660,678 Prepaid expenses and other current assets 119,678 Inventory 209,473 Total current assets 7,330,291 Fixed assets, net 298,653 Customer merchant accounts, net 268,066 Due from related parties 161,281 Goodwill 1,908,495 Total assets 9,966,786$ Liabilities and Member's Equity Liabilities: Accounts payable and accrued expenses 3,344,614$ Residuals payable 1,090,431 Chargeback reserves 989,153 Total current liabilities 5,424,198 Due to related parties 1,005,184 Total liabilities 6,429,382 Commitments and contingencies Member's equity 3,537,404 Total liabilities and member's equity 9,966,786$

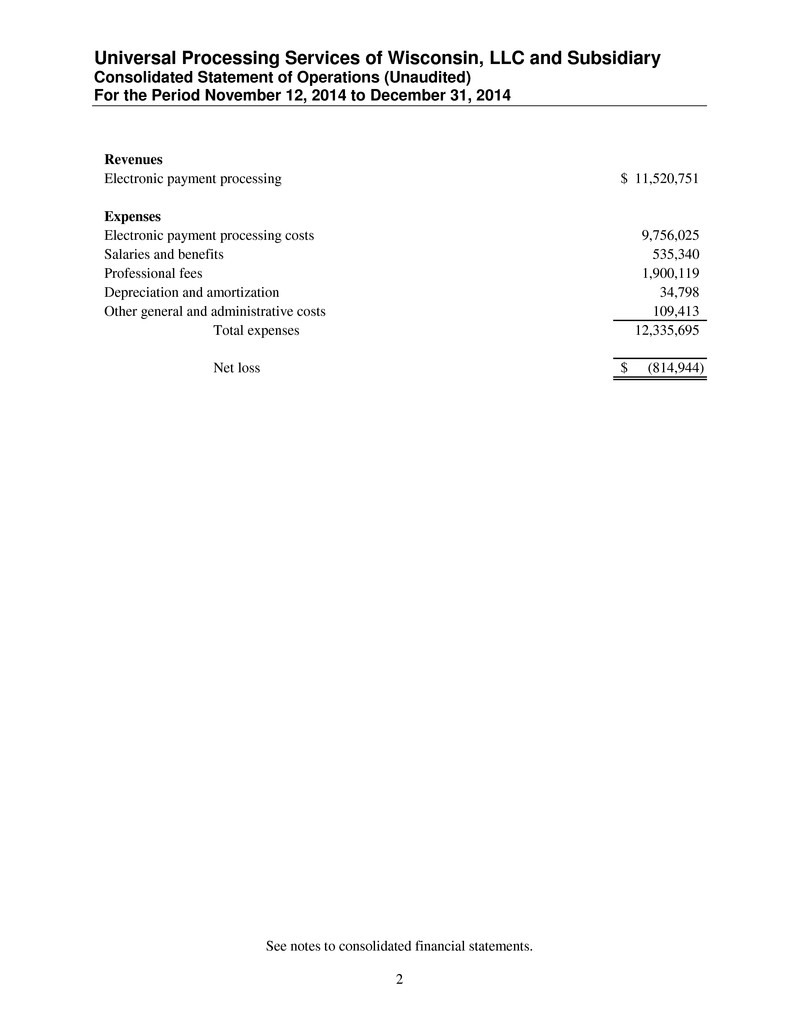

Universal Processing Services of Wisconsin, LLC and Subsidiary Consolidated Statement of Operations (Unaudited) For the Period November 12, 2014 to December 31, 2014 See notes to consolidated financial statements. 2 Revenues Electronic payment processing 11,520,751$ Expenses Electronic payment processing costs 9,756,025 Salaries and benefits 535,340 Profes ional fees 1,900,119 Depreciation and amortization 34,798 Other general and administrative costs 109,413 Total expenses 12,335,695 Net loss (814,944)$

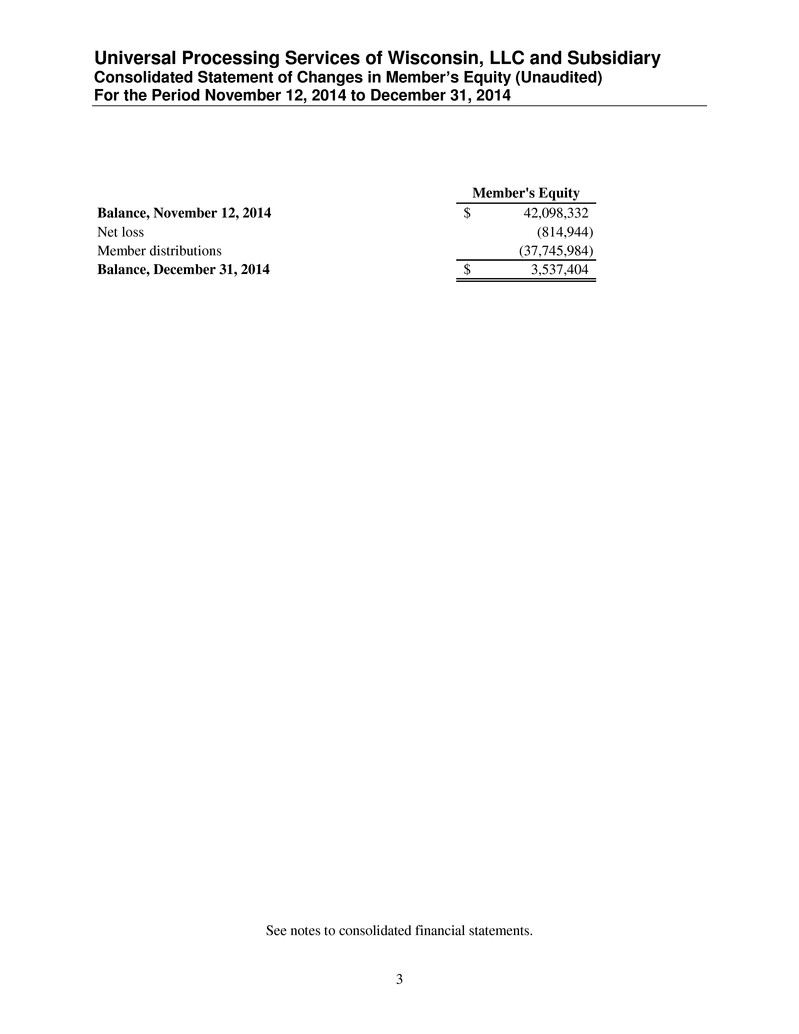

Universal Processing Services of Wisconsin, LLC and Subsidiary Consolidated Statement of Changes in Member’s Equity (Unaudited) For the Period November 12, 2014 to December 31, 2014 See notes to consolidated financial statements. 3 Member's Equity Balance, November 12, 2014 42,098,332$ Net loss (814,944) Member distributions (37,745,984) Balance, December 31, 2014 3,537,404$

Universal Processing Services of Wisconsin, LLC and Subsidiary Consolidated Statement of Cash Flows (Unaudited) For the Period November 12, 2014 to December 31, 2014 See notes to consolidated financial statements. 4 Cash flows from operating activities: Net loss (814,944)$ Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 34,798 Changes in operating assets and liabilities: Restricted cash (68,753) Accounts receivable 797,773 Prepaid expenses and other current assets 23,891 Inventory (22,939) Accounts payable and accrued expenses 1,683,666 Due from related parties (34,620) Due to related parties (138,782) Net cash provided by operating activities 1,460,090 Cash flows from investing activities: Purchase of customer merchant accounts (7,172) Purchase of fixed assets (9,889) Net cash used in investing activities (17,061) Cash flows used in financing activities: Advances on revolving credit line - related party (9,472,390) Net increase in cash and cash equivalents 1,443,029 Cash and cash equivalents, beginning of year 1,195,414 Cash and cash equivalents, end of year 2,638,443$ Supplemental disclosure of cash flow activities Non-cash financing activity: Advances/distributions to related party 37,745,984$

Universal Processing Services of Wisconsin, LLC and Subsidiary Notes to Consolidated Financial Statements (Unaudited) December 31, 2014 5 1. Organization, Basis of Presentation and Description of Business Universal Processing Services of Wisconsin, LLC (“UPS-WI”), was organized as a limited liability company (“LLC”) under the laws of the State of Wisconsin and is a wholly owned subsidiary of The Whitestone Group, LLC (“The Whitestone Group”). The accompanying consolidated financial statements include the accounts of UPS-WI and its wholly owned subsidiary, Solar Processing Services, LLC (“Solar”). All significant intercompany accounts and transactions have been eliminated in consolidation. UPS-WI, along with its subsidiary, Solar, are hereinafter referred to as “the Company". The Company markets credit and debit card processing services, check approval services and ancillary processing equipment and software to merchants who accept credit cards, debit cards, checks and other non-cash forms of payment. 2. Significant Accounting Policies Use of Estimates The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates, by their nature, are based on judgment and available information. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant changes in the near term relate to the determination of the reserve for chargeback losses. Financial Instruments The Company’s financial instruments include cash and cash equivalents, accounts receivable, and accounts payable including residuals payable. The carrying amounts of the cash and cash equivalents, accounts receivable, and accounts and residuals payable approximate fair value because of their short term maturity and interest rates which approximate current rates. Cash and Cash Equivalents The Company considers all highly liquid investments with maturities of three months or less when purchased to be cash equivalents. Invested cash is held exclusively at financial institutions of high credit quality. As of December 31, 2014, cash deposits in excess of FDIC deposit insurance and SIPC insurance totaled approximately $2,207,000. Restricted Cash Under the terms of the processing agreement between UPS-WI and its processing banks, UPS-WI maintains cash accounts as reserves against chargeback losses. As fees are received by the processing bank, a certain percentage is allocated to the cash reserve account.

Universal Processing Services of Wisconsin, LLC and Subsidiary Notes to Consolidated Financial Statements (Unaudited) December 31, 2014 6 Inventory Inventory consists primarily of equipment to be installed in merchant locations to enable them to process electronic transactions. Inventory is stated at the lower of cost or market, determined on the FIFO (first in-first out) basis. Fixed Assets Fixed assets, which are comprised of furniture and fixtures, software, computer office equipment and leasehold improvements, are stated at cost less accumulated depreciation and amortization. Depreciation of fixed assets is provided on a straight-line basis using estimated useful lives of the related assets. Amortization of leasehold improvements is provided on a straight-line basis using the lesser of the useful life of the asset or lease term. Useful lives of assets are generally three to five years. Goodwill and Customer Merchant Accounts Goodwill is not amortized and is subject to impairment tests, at least annually. Customer merchant accounts with finite lives are amortized over their useful lives ranging from 18 to 66 months, and evaluated as discussed in Note 5. The Company considers the following to be some examples of indicators that may trigger an impairment review outside its annual impairment review: (i) significant under-performance or loss of key contracts acquired in an acquisition relative to expected historical or projected future operating results; (ii) significant changes in the manner or use of the acquired assets or in the Company’s overall strategy with respect to the manner or use of the acquired assets or changes in the Company’s overall business strategy; (iii) significant negative industry or economic trends; (iv) increased competitive pressures; (v) a significant decline in the Company’s stock price for a sustained period of time; and (vi) regulatory changes. In assessing the recoverability of the Company’s goodwill and customer merchant accounts, the Company must make assumptions regarding estimated future cash flows and other factors to determine the fair value of the respective assets. These include estimation of future cash flows, which is dependent on internal forecasts, estimation of the long-term rate of growth for the Company, the useful life over which cash flows will occur, and determination of the Company’s cost of capital. Changes in these estimates and assumptions could materially affect the determination of fair value and conclusions on goodwill impairment. Revenue Recognition Electronic payment processing and fee income is derived from the electronic processing of credit and debit card transactions that are authorized and captured through third-party networks. Typically, merchants are charged for these processing services on a percentage of the dollar amount of each transaction plus a flat fee per transaction. Certain merchant customers are charged miscellaneous fees, including fees for handling charge-backs or returns, monthly minimum fees, statement fees and fees for other miscellaneous services. Revenues derived from the electronic processing of MasterCard®, Visa® and Discover® sourced credit and debit card transactions are reported gross of amounts paid to sponsor banks.

Universal Processing Services of Wisconsin, LLC and Subsidiary Notes to Consolidated Financial Statements (Unaudited) December 31, 2014 7 Reserve for Losses on Merchant Accounts Disputes between a cardholder and a merchant periodically arise as a result of, among other things, cardholder dissatisfaction with merchandise quality or merchant services. Such disputes may not be resolved in the merchant’s favor. In these cases, the transaction is “charged back” to the merchant, which means the purchase price is refunded to the customer through the merchant’s acquiring bank and charged to the merchant. If the merchant has inadequate funds, the Company or, under limited circumstances, the Company and the acquiring bank, must bear the credit risk for the full amount of the transaction. The Company evaluates its risk for such transactions and estimates its potential loss for charge-backs based primarily on historical experience and other relevant factors. The Company records reserves for charge-backs and contingent liabilities when such amounts are deemed to be probable and estimable. The required reserves may change in the future due to new developments, including, but not limited to, changes in litigation or increased charge-back exposure as the result of merchant insolvency, liquidation, or other reasons. The required reserves are reviewed periodically to determine if adjustments are required. Electronic Payment Processing Costs Electronic payment processing costs consist principally of costs directly related to the processing of merchant sales volume, including interchange fees, VISA®, MasterCard® and Discover® dues and assessments, bank processing fees and costs paid to third-party processing networks. Such costs are recognized at the time the merchant transactions are processed or when the services are performed. Two of the most significant components of electronic processing expenses include interchange and assessment costs, which are set by the credit card associations. Interchange costs are passed on to the entity issuing the credit card used in the transaction and assessment costs are retained by the credit card associations. Interchange and assessment fees are billed primarily as a percent of dollar volume processed and, to a lesser extent, as a per transaction fee. In addition to costs directly related to the processing of merchant sales volume, electronic payment processing costs also include residual expenses. Residual expenses represent fees paid to third-party sales referral sources. Residual expenses are paid under various formulae as contracted. These are generally linked to revenues derived from merchants successfully referred to the Company and that begin using the Company for merchant processing services. Such residual expenses are recognized in the Company’s consolidated statements of income. Income Taxes The Company is an LLC and in lieu of corporate taxes, the members of the LLC are taxed on their proportionate share of the entity’s taxable income. Accordingly, no liability for federal, state and local income taxes has been recorded in the accompanying consolidated financial statements. As a controlled portfolio company of a public company, the Company evaluated its tax positions at year end, and based on its analysis, determined that there were no uncertain tax positions. The Company’s U.S. Federal and state income tax returns prior to fiscal 2011 are closed and management continually evaluates expiring statutes of limitations, audits, proposed settlements, changes in tax law and new authoritative rulings. Subsequent Events The Company has evaluated subsequent events for potential recognition and/or disclosure through March 31, 2015, the date these financial statements were available to be issued.

Universal Processing Services of Wisconsin, LLC and Subsidiary Notes to Consolidated Financial Statements (Unaudited) December 31, 2014 8 3. Fixed Assets The Company’s fixed assets are comprised of the following at December 31, 2014: Accumulated Depreciation and Net Book Cost Amortization Value Computer equipment 75,730$ 62,382$ 13,348$ Furniture and fixtures 125,639 48,670 76,969 Software 292,829 118,770 174,059 Website 5,205 4,771 434 Leasehold improvements 63,644 29,801 33,843 Total 563,047$ 264,394$ 298,653$ Depreciation expense related to fixed assets for the period November 12, 2014 to December 31, 2014 was $17,088. 4. Goodwill The carrying value of goodwill at December 31, 2014 is $1,908,495. Based upon the Company’s performance of an impairment test using the fair value approach of the discounted cash flows method, the Company determined that goodwill was not impaired at December 31, 2014. 5. Customer Merchant Accounts The carrying amount of customer merchant accounts, net of accumulated amortization at December 31, 2014 is $268,066. Customer merchant accounts are being amortized over sixty-six months. Total amortization expense of customer merchant accounts included in the accompanying consolidated statement of income was $17,710. Total expected amortization expense for the next five fiscal years and thereafter is as follows: December 31, Amount 2015 103,671$ 2016 74,579 2017 50,418 2018 29,127 2019 10,065 Thereafter 206 Total 268,066$

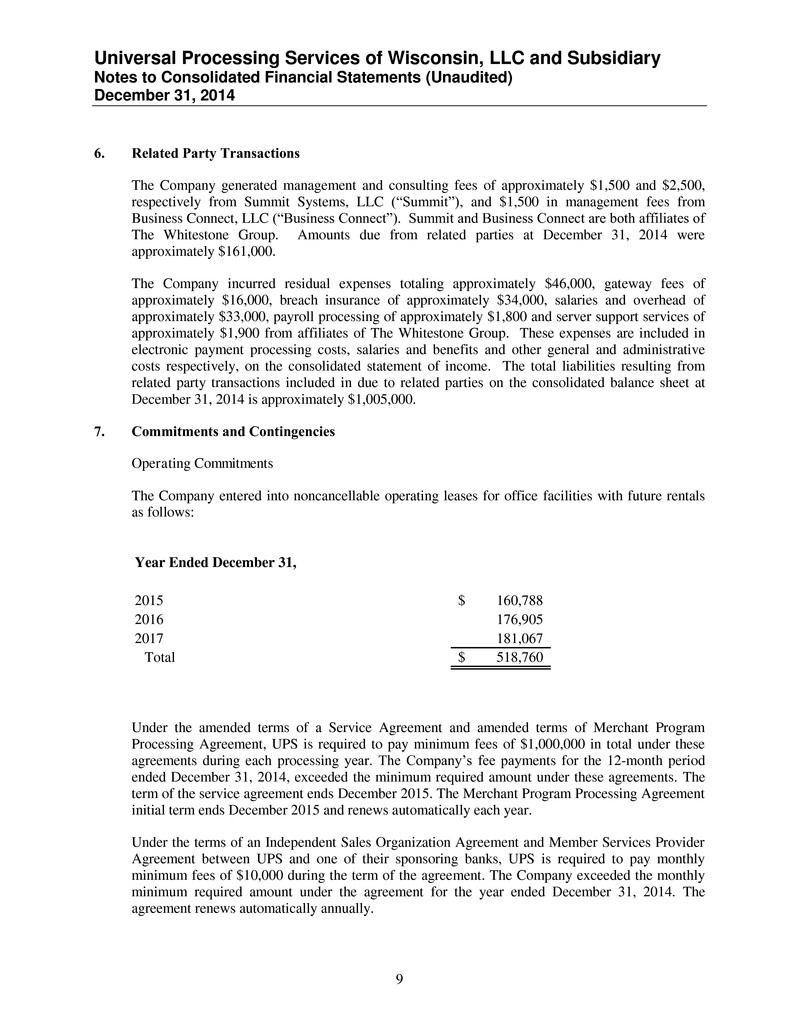

Universal Processing Services of Wisconsin, LLC and Subsidiary Notes to Consolidated Financial Statements (Unaudited) December 31, 2014 9 6. Related Party Transactions The Company generated management and consulting fees of approximately $1,500 and $2,500, respectively from Summit Systems, LLC (“Summit”), and $1,500 in management fees from Business Connect, LLC (“Business Connect”). Summit and Business Connect are both affiliates of The Whitestone Group. Amounts due from related parties at December 31, 2014 were approximately $161,000. The Company incurred residual expenses totaling approximately $46,000, gateway fees of approximately $16,000, breach insurance of approximately $34,000, salaries and overhead of approximately $33,000, payroll processing of approximately $1,800 and server support services of approximately $1,900 from affiliates of The Whitestone Group. These expenses are included in electronic payment processing costs, salaries and benefits and other general and administrative costs respectively, on the consolidated statement of income. The total liabilities resulting from related party transactions included in due to related parties on the consolidated balance sheet at December 31, 2014 is approximately $1,005,000. 7. Commitments and Contingencies Operating Commitments The Company entered into noncancellable operating leases for office facilities with future rentals as follows: Year Ended December 31, 2015 160,788$ 2016 176,905 2017 181,067 Total 518,760$ Under the amended terms of a Service Agreement and amended terms of Merchant Program Processing Agreement, UPS is required to pay minimum fees of $1,000,000 in total under these agreements during each processing year. The Company’s fee payments for the 12-month period ended December 31, 2014, exceeded the minimum required amount under these agreements. The term of the service agreement ends December 2015. The Merchant Program Processing Agreement initial term ends December 2015 and renews automatically each year. Under the terms of an Independent Sales Organization Agreement and Member Services Provider Agreement between UPS and one of their sponsoring banks, UPS is required to pay monthly minimum fees of $10,000 during the term of the agreement. The Company exceeded the monthly minimum required amount under the agreement for the year ended December 31, 2014. The agreement renews automatically annually.

Universal Processing Services of Wisconsin, LLC and Subsidiary Notes to Consolidated Financial Statements (Unaudited) December 31, 2014 10 Under the amended terms of a Processing Services Agreement between UPS and one of their front- end processors, UPS is required to pay a quarterly minimum of $68,000 during the term of the amended agreement. The Company’s fee payments for the 12-month period ended December 31, 2014, exceeded the minimum required amount under these agreements. The agreement expires July 2016. Litigation In 2013, the Federal Trade Commission (the “FTC”) amended an existing complaint in the matter Federal Trade Commission v. WV Universal Management, LLC et al., pending in the United States District Court for the Middle District of Florida (the “Court”), to add Universal Processing Services of Wisconsin, LLC, as an additional defendant on one count of providing substantial assistance in violation of the Telemarketing Sales Rule. On November 18, 2014, the Court issued an Order granting the FTC’s motion for summary judgment against UPS-WI on the single count. Subsequently, the FTC filed motions for a permanent injunction and equitable monetary relief against UPS-WI and the other remaining defendants. Prior to the Court hearing on the motions, UPS-WI and the FTC reached a settlement on the FTC’s motion for a permanent injunction. The Court granted the FTC’s motion for equitable relief against UPS-WI and the other remaining defendants, ordering that the remaining defendants pay $1,734,972 in equitable monetary relief. While the court has yet to issue a judgment setting forth the terms of the relief granted, UPS-WI has recorded a reserve for the full amount of the potential loss as of December 31, 2014, which is reflected in the consolidated statement of income.