Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - FBR & Co. | fbrc-ex312_6.htm |

| EX-12.1 - EX-12.1 - FBR & Co. | fbrc-ex121_9.htm |

| EX-31.1 - EX-31.1 - FBR & Co. | fbrc-ex311_7.htm |

| EX-32.2 - EX-32.2 - FBR & Co. | fbrc-ex322_8.htm |

| EX-32.1 - EX-32.1 - FBR & Co. | fbrc-ex321_10.htm |

| EX-21.1 - EX-21.1 - FBR & Co. | fbrc-ex211_13.htm |

| EX-23.1 - EX-23.1 - FBR & Co. | fbrc-ex231_12.htm |

| EX-23.2 - EX-23.2 - FBR & Co. | fbrc-ex232_11.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33518

FBR & Co.

(Exact name of registrant as specified in its charter)

|

Virginia |

|

20-5164223 |

|

(State or other jurisdiction of Incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

1300 North Seventeenth Street, Arlington, VA |

|

22209 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(703) 312-9500

(Registrant’s telephone number, including area code)

Securities registered pursuant to section 12(b) of the act:

|

Title of Each Class |

|

Name of Each Exchange on which Registered |

|

Common Stock, Par Value $0.001 |

|

The NASDAQ Stock Market LLC (The NASDAQ Global Select MarketSM) |

Securities registered pursuant to section 12(g) of the act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K: x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

Large Accelerated Filer ¨ |

Accelerated Filer x |

Non-Accelerated Filer ¨ |

Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No x

The aggregate market value of FBR & Co.’s outstanding common stock held by non-affiliates as of June 30, 2015 was approximately $161.0 million based on the closing price of the registrant’s common stock on such date as reported on The NASDAQ Stock Market LLC. In determining this figure, the registrant has excluded all shares of common stock beneficially owned by its directors and executive officers and each person who beneficially owns 10% or more of FBR & Co.’s outstanding common stock. By doing so, the registrant does not admit that such persons are affiliates within the meaning of Rule 405 of the Securities Act of 1933, as amended, or for any other purpose.

On March 1, 2016, there were 7,384,874 shares of FBR & Co. common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document |

|

Where Incorporated |

|

FBR & Co. 2016 Proxy Statement (to be filed with the Securities and Exchange Commission on or before April 30, 2016) |

|

Part III, Items 10, 11, 12, 13 and 14 |

|

|

|

Page |

||

|

|

1 |

|||

|

|

3 |

|||

|

|

|

|

|

|

|

PART I |

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

4 |

|

|

Item 1A. |

|

|

11 |

|

|

Item 1B. |

|

|

23 |

|

|

Item 2. |

|

|

23 |

|

|

Item 3. |

|

|

23 |

|

|

Item 4. |

|

|

24 |

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

25 |

|

|

Item 6. |

|

|

26 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

28 |

|

Item 7A. |

|

|

51 |

|

|

Item 8. |

|

|

51 |

|

|

Item 9. |

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

|

52 |

|

Item 9A. |

|

|

52 |

|

|

Item 9B. |

|

|

53 |

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

53 |

|

|

Item 11. |

|

|

53 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

|

53 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

53 |

|

Item 14. |

|

|

53 |

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

54 |

|

|

|

57 |

|||

|

|

F-1 |

|||

Some of the statements contained in or incorporated by reference in this Form 10-K are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are predictive in nature and can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “goal,” “objective,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology. Statements concerning projections, future performance, developments, events, revenues, expenses, earnings, run rates, and any other guidance on present or future periods constitute forward-looking statements. Such statements include, but are not limited to, those relating to the effects of growth, our principal investing activities and our current equity capital levels. Forward-looking statements involve risks and uncertainties. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievement. You should not rely upon forward-looking statements as predictions of future events. You should be aware that a number of important factors could cause our actual results to differ materially from those in forward-looking statements. These factors include, but are not limited to:

|

|

· |

the risks identified under the section captioned “Risk Factors” in this Form 10-K; |

|

|

· |

volatility of the capital markets and in economic conditions generally; |

|

|

· |

substantial fluctuations in our financial results; |

|

|

· |

deterioration in the business environment in the specific sectors of the economy in which we focus or a decline in the market for securities of companies within these sectors; |

|

|

· |

our ability to retain our senior professionals; |

|

|

· |

pricing and other competitive pressures; |

|

|

· |

changes in laws and regulations and industry practices that adversely affect our business; |

|

|

· |

incurrence of losses in the future; |

|

|

· |

the singular nature of our capital markets and strategic advisory engagements; |

|

|

· |

competition among financial services firms for business and personnel; |

|

|

· |

larger and more frequent capital commitments in our trading and underwriting businesses; |

|

|

· |

limitations on our access to capital; |

|

|

· |

malfunctioning or failure in our operations and infrastructure; |

|

|

· |

our entry into new business areas, including entry through strategic investments, acquisitions and joint ventures; |

|

|

· |

failure to maintain effective internal controls; |

|

|

· |

declines in the market value and/or net asset value of our principal investments; |

|

|

· |

the loss of our exemption from registration as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”); |

|

|

· |

the overall environment for interest rates; |

|

|

· |

changes in our business strategy; and |

|

|

· |

availability, terms and deployment of capital. |

1

Forward-looking statements speak only as of the date they are made, and we undertake no duty to update any of these forward-looking statements after the date of this Form 10-K to conform prior statements to actual results or revised expectations unless otherwise required by law. New risks emerge from time to time and it is not possible for us to predict all risks, nor can we assess the impact of all factors or the effect which any factor, or combination of factors, may have on our business. Actual results may differ materially from those contained in any forward-looking statement. This Form 10-K, including the consolidated financial statements and notes thereto and the documents incorporated by reference herein, should be read for a complete understanding of our business, an investment in our company and the risks and other uncertainties associated with our business or an investment in our company.

2

FBR & Co. (“we,” “us,” “our company” or the “Company”) files annual, quarterly and current reports, proxy statements, information statements and other information with the United States Securities and Exchange Commission (the “SEC”). You may read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains annual, quarterly and current reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our electronic SEC filings are available to the public at http://www.sec.gov.

Our public internet site is http://www.fbr.com. We make available free of charge through our public internet site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We also make available through our public internet site statements of beneficial ownership of our equity securities filed by our directors, officers, 10% or greater shareholders and others under Section 16 of the Exchange Act.

We also make available on http://www.fbr.com (i) our Corporate Governance Guidelines, (ii) Statement of Business Principles (our code of business conduct and ethics), including any waivers, if any, therefrom granted to executive officers or directors, and (iii) the charters of the Audit, Compensation, and Nominating and Corporate Governance Committees of our Board of Directors. These documents are also available in print without charge to any person who requests them by writing or telephoning:

FBR & Co.

1300 North Seventeenth Street

Arlington, Virginia 22209

(703) 312-9500

Attention: Corporate Secretary

3

PART I

Overview

FBR & Co. is a full-service investment banking and institutional brokerage firm with a deep expertise and focus on the equity capital markets. Since the founding of certain predecessor companies, we have grown from a boutique investment bank with primary expertise in financial institutions into a full-service U.S. investment bank for middle-market companies.

Through our broker-dealer operating subsidiaries we have focused our business on providing:

|

|

· |

capital raising services, including underwriting and placement of public and private equity, equity-linked and debt securities; |

|

|

· |

financial advisory services, including merger and acquisition (“M&A”) advisory, restructuring, liability management, recapitalization and strategic alternative analysis; |

|

|

· |

institutional sales and trading services focused on equities, equity-linked securities, high-yield bonds, senior debt and bank loans, as well as securities lending activities; and |

|

|

· |

differentiated securities research focused on the core issues driving performance of our covered companies and industry sectors. |

We focus our capital markets business (investment banking and institutional brokerage) in the following industry sectors—consumer, energy and natural resources, financial institutions, healthcare, industrials, insurance, real estate, and technology, media and telecommunications (“TMT”). Approximately 70% of the companies included in the S&P 500 Index conduct business in the industry sectors in which we focus. We also make principal investments, including merchant banking investments, with our own capital.

In June 2007 we became a publicly-traded company listed on The NASDAQ Global Select MarketSM (NASDAQ: FBRC). We are a Virginia corporation formed in June 2006 and headquartered in Arlington, Virginia and also have offices in Boston, Dallas, Houston, Los Angeles, New York and San Francisco. The address of our principal executive offices is 1300 North Seventeenth Street, Arlington, Virginia 22209. Our telephone number is (703) 312-9500.

Business Segments

Our business is comprised of two separate segments: capital markets, which includes investment banking, institutional brokerage and research; and principal investing. During the first quarter of 2016, based on changes in the Company’s business profile since its IPO in 2007, including significant changes in capital allocation and revenue mix that have occurred over that time, the Company will revise its segment reporting structure. Beginning with the first quarter of 2016, the Company’s investment activities will be included within its capital markets segment and not as a separate reportable segment. This change is consistent with how the Company’s chief operating decision maker evaluates performance and allocates resources.

Financial information concerning our company for the fiscal years ended December 31, 2015, 2014, and 2013, including the amount of net revenues contributed by each segment in such periods, is set forth in our consolidated financial statements and the notes thereto in Part II, Item 8, of this Form 10-K. Information with respect to our operations by business segment is set forth under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Executive Overview” in Part II, Item 7, of this Form 10-K and in Note 17 to our consolidated financial statements in Part II, Item 8, of this Form 10-K.

4

Capital Markets

Our capital markets business is conducted by our investment banking, institutional brokerage and research professionals through our SEC-registered broker-dealer subsidiaries FBR Capital Markets & Co. (“FBRCM”) and MLV & Co. LLC (“MLV”), the latter of which we acquired in September 2015. These professionals provide investment banking services, including capital raising and financial advisory services, for our corporate issuer clients, and institutional brokerage services including sales, trading, research, and securities lending services to our institutional investor clients. We believe the capital markets transactions sourced by our investment banking professionals create the types of investment opportunities that our institutional brokerage clients seek, while our institutional brokerage clients provide demand for our investment banking clients’ securities offerings, thus helping to provide these corporate issuers with the ability to meet their corporate financing needs.

Investment Banking

Our investment banking professionals, backed by their industry knowledge and our strong distribution platform, seek to establish and maintain relationships with our investment banking clients and to provide them with capital raising and financial advisory services. We currently provide capital raising services through industry specific investment banking teams that focus on the energy and natural resources, financial institutions, healthcare, industrials, insurance, real estate and TMT industries. These teams work closely with our capital markets personnel in originating and executing capital markets transactions. In addition to our industry specific teams, our financial sponsors group delivers investment banking products and solutions to the private equity community and their portfolio companies, and our financial advisory group delivers a broad range of financial advisory services to our investment banking clients.

As an investment bank with an ability to raise equity in both the private and public capital markets, we are frequently involved with companies early in their formation in order to establish relationships that will provide us with ongoing revenues as these companies’ corporate finance and financial advisory needs grow. We seek to provide our investment banking clients with the financing and advisory services that they will need at all stages of their corporate lifecycle.

Capital Raising. We have developed a strong market presence as a leading underwriter of equity securities in the United States. We base our decision to underwrite an offering of a client’s securities on company and industry fundamentals, management’s track record, historical financial results, financial projections, and other factors, all supported by extensive due diligence. We offer a wide range of financial products and services designed to serve the needs of our investment banking clients, including private, initial public, follow-on, at-the-market (“ATM”), and secondary offerings of common equity, convertible debt offerings, preferred stock offerings and high-yield debt offerings.

Strategic Advisory Services. Our financial advisory practice builds on our capital markets expertise and focuses on helping our investment banking clients to assess strategic alternatives, including advice on M&A, liability management and financial restructuring, and strategic partnerships. In addition, we provide valuation advice, fairness opinions, market comparable valuation analysis and other corporate finance advice.

Institutional Brokerage and Research

Through our institutional brokerage professionals, we provide research, institutional sales and trading services, and securities lending to institutional investors such as mutual funds, insurance companies, hedge funds, banks and broker-dealers, family offices, money managers and pension and profit-sharing plans. Our ability to work across multiple securities classes with clients enhances our overall brokerage relationships with our clients. We currently operate desks that cover the trading of equity securities, convertible securities, high-yield debt securities, and loan products, and the borrowing and lending of equity and fixed income securities. We also provide stock buy-back services to corporate issuer clients.

Institutional Brokerage. We believe our institutional brokerage professionals are distinguished by their in-depth understanding of the companies and industries on which we focus. Our traders and salespeople are required to develop detailed knowledge and relationships and provide trade execution and sales and trading services to a diverse

5

institutional client base. Many of our institutional clients have been long-standing investors in transactions that our investment banking teams have brought to the capital markets and have continued a close relationship with us as they have grown in size and assets under management.

Our sales professionals work closely with our research analysts and our trading desks to provide the most up-to-date information to our institutional clients. Our sales, trading, and research professionals work together to maintain regular contact with the specialized portfolio managers and buy-side analysts of each institutional client. We make markets in U.S. exchange-listed and other securities, we trade listed and unlisted securities and loan products, and we service the trading desks of major institutions in the United States, Europe and elsewhere.

Our securities lending professionals maintain relationships with a broad group of banks and broker-dealers to facilitate the sourcing, borrowing and lending of equity and fixed income securities in a “matched book” securities lending business. We monitor the market value of the securities borrowed and loaned on a daily basis.

Research. We understand the importance of research and the role quality research plays in the institutional brokerage process, particularly for accounts that do not maintain a large in-house research team. We seek to differentiate ourselves through originality of perspective, depth of insight, and our ability to uncover industry trends. We believe our unique viewpoint has helped us develop relationships with investor clients in both our primary distribution and secondary trading businesses.

Our research analysts operate under three guiding principles: (i) to provide objective, independent analysis of securities, their issuers, and their place in the capital markets; (ii) to identify attractive investment opportunities in the capital markets; and (iii) to communicate effectively the fundamentals of these investment opportunities to potential investors. To achieve these objectives, we believe that industry specialization is necessary and, as a result, we organize our research staff along industry lines. Each industry team works together to identify and evaluate industry trends and developments. Within industry groups, analysts are further subdivided into specific areas of focus so that they can maintain and apply specific industry knowledge to each investment opportunity they research.

After initiating coverage of a company, our analysts seek to maintain a long-term relationship with that company and a long-term commitment to ensure that new developments are effectively communicated to our sales force and institutional investors. Our research team analyzes major trends, publishes original research on new areas of growth, provides fundamental, company-specific coverage and works with our institutional clients to identify and evaluate public equity investment opportunities.

Principal Investing

Our principal investing activity consists of investments in merchant banking, marketable equity securities, non-public equity securities, corporate debt investments, non-registered investment funds that are managed by third parties, and U.S. Treasury securities. Our merchant banking investments include investments in selected private transactions that our investment banking group underwrites and investments sourced by our investment banking team unrelated to an investment banking transaction. In many cases this strategy involves investing our capital alongside the capital of our institutional clients.

Accounting, Administration and Operations

Our accounting, administration and operations personnel are responsible for financial controls, internal and external financial reporting, human resources and personnel services, office operations, information technology and telecommunications systems, the processing of securities transactions, and corporate communications. With the exception of payroll processing, which is performed by an outside service bureau, and customer account processing, which is performed by our clearing brokers, most data processing functions are performed internally.

6

Compliance, Legal, and Risk Management

Our compliance, legal and risk management personnel (together with other appropriate personnel) are responsible for our compliance procedures with regard to the legal and regulatory requirements of our company and for our procedures with regard to our exposure to market, credit, operations, liquidity, regulatory, legal and reputational risk. In addition, compliance personnel test for compliance by our personnel with our policies and procedures. Our legal personnel also provide legal services throughout our company, including advice on managing legal risk. The supervisory personnel in these areas have direct access to, and meet regularly with, our executive management and with the Audit Committee of our Board of Directors to ensure their independence in performing these functions. In addition to our internal compliance, legal, and risk management personnel, we outsource particular functions to outside consultants and attorneys for their particular expertise.

Financial Information about Geographic Areas

We operate predominately in the United States. We also provide investment banking, research, and sales and trading services to selected companies in international jurisdictions. Our revenues and long lived assets attributable to foreign operations have been immaterial for the last three fiscal years.

Competition

As a full-service investment banking and institutional brokerage firm, all aspects of our business are intensely competitive. Our competitors include large, fully integrated bank holding companies, as well as traditional and other brokerage firms, investment banking firms, merchant banks, financial advisory firms and electronic trading firms. We compete with some firms nationally and with others on a product or business line basis. Many of our competitors have substantially greater capital and resources than we do and offer a broader range of financial products and services. In particular, the ability to provide bank loan financing has become an important advantage for some of our largest competitors. We believe that the principal factors that allow us to compete effectively include the strength and extent of our client relationships, our reputation and track record, the abilities of our professionals, our market focus and the relative quality and price of our services and products.

We have experienced intense price competition in some areas of our capital markets businesses, in particular, within our trading business. The ability to execute trades electronically and through other alternative trading systems, has increased the pressure on trading commissions and spreads. We believe that this trend toward alternative trading systems is likely to continue. We may experience competitive pressures in these and other areas in the future as some of our competitors seek to increase market share by reducing prices.

Competition is also intense for the recruitment and retention of qualified professionals. The performance of our business is in large part dependent on the skills, expertise and performance of our employees. Our ability to continue to compete effectively in our businesses will depend upon our continued ability to attract new professionals and retain and motivate our existing professionals.

7

Risk Management

In conducting our business, we are exposed to a range of risks including, without limitation:

|

|

· |

Market risk. Market risk is the risk that a change in the level of one or more market prices, rates, indices, or other market factors, such as market liquidity, will result in losses for a position or portfolio. |

|

|

· |

Credit risk. Credit risk is the risk of loss due to an individual customer’s or institutional counterparty’s unwillingness or inability to pay its obligations. |

|

|

· |

Operations risk. Operations risk is the risk of loss resulting from systems failure, inadequate controls, human error, fraud or unforeseen catastrophes. |

|

|

· |

Liquidity risk. Liquidity risk is the risk that we may be unable to meet our obligations as they come due because of our inability to liquidate assets or obtain funding. Liquidity risk also includes the risk of having to sell assets at a loss to generate liquid funds. |

|

|

· |

Regulatory risk. Regulatory risk is the risk of loss, including fines, penalties or restrictions in our activities, from failing to comply with federal, state or local laws, rules and regulations, including the rules and regulations of self-regulatory bodies, pertaining to financial services activities. |

|

|

· |

Legal risk. Legal risk is the risk of loss, disruption or other negative effect on our operations or condition that arises from unenforceable contracts, lawsuits, adverse judgments, or adverse governmental or regulatory proceedings, or the threat thereof. |

|

|

· |

Reputational risk. Reputational risk is the risk that negative publicity regarding our practices, whether true or not, will cause a decline in the customer base, reduce our revenues, or result in costly litigation. |

We monitor business risks, including market, credit, operations, liquidity, regulatory, legal, and reputational risk, through a number of control procedures designed to identify and evaluate the various risks to which our businesses and investments are exposed. We have established various committees to assess and manage risk associated with our investment banking, institutional brokerage and principal investing activities. We review, among other things, business and transactional risks associated with potential investment banking clients and engagements. We seek to manage the risks associated with our investment banking and principal investing activities by review and approval of transactions by the relevant committee, prior to accepting an engagement or pursuing a material investment transaction. We maintain an independent risk management function and our director of risk management employs a variety of systems and calculations to monitor daily changes in the risks associated with trading in our institutional brokerage business and principal investing activities. For additional detail regarding our control procedures designed to identify and evaluate our market and business risk, see “Quantitative and Qualitative Disclosures about Market Risk” below. Although we believe that our risk management program and our internal controls are appropriately designed to address the risks to which we are exposed, we cannot provide assurance that our risk management program or our internal controls will prevent or reduce such risks.

Insurance

We maintain insurance in types and amounts and with deductibles that management believes are appropriate for our business and customary for companies of similar size and engaged in similar businesses. However, the insurance market is volatile, and there can be no assurance that any particular coverage will be available in the future on terms acceptable to us.

Employees

As of December 31, 2015, we had 303 employees in comparison to 300 employees as of December 31, 2014. Our employees are not subject to any collective bargaining agreement and we consider our relationship with our employees to be good.

8

Regulation

Our business, as well as the financial services industry generally, is subject to extensive regulation in the United States and elsewhere. As a matter of public policy, regulatory bodies in the United States and the rest of the world are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In light of current conditions in the financial markets and the economy, regulators have increased their focus on the regulation of the financial services industry. Legislation in recent years, including the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), has substantially intensified the regulation of the financial services industry. Among other things, Dodd-Frank has expanded the authority of our existing regulators, broadened reporting requirements and regulation relating to executive compensation, and expanded the standards for market participants dealing with clients and customers. In addition, conditions in the global financial markets have caused regulatory agencies to increase their examination, enforcement and rulemaking activities. This regulatory environment will likely alter certain financial industry business practices and change the competitive landscape, which may have an adverse effect on our business, financial condition and results of operation.

In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. Each of FBRCM and MLV is registered as a broker-dealer with the SEC and the Financial Industry Regulatory Authority, Inc. (“FINRA”), a self-regulatory organization, and in all 50 states, Puerto Rico and the District of Columbia. Accordingly, FBRCM and MLV are subject to regulation and oversight by the SEC and FINRA, which is itself subject to oversight by the SEC and which adopts and enforces rules governing the conduct, and examines the activities, of its member firms, including FBRCM, MLV and their respective registered representatives. State securities regulators also have regulatory or oversight authority over both FBRCM and MLV. Our business may also be subject to regulation by non-U.S. governmental and regulatory bodies and self-regulatory authorities in other countries where we operate.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales methods, trade practices among broker-dealers, use and safekeeping of customers’ funds and securities, capital structure, record-keeping, the financing of customers’ purchases and the conduct and qualifications of directors, officers and employees. In particular, as registered broker-dealers and members of various self-regulatory organizations, both FBRCM and MLV are subject to the SEC’s uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of its assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC’s uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

Compliance with regulatory net capital requirements could limit those operations that require the intensive use of capital, such as underwriting and trading activities, and also could restrict our ability to withdraw capital from FBRCM and MLV, which in turn could limit our ability to pay dividends, repay debt and redeem or repurchase shares of our outstanding capital stock. The failure of either FBRCM or MLV to maintain its minimum required net capital would require it to cease executing customer transactions until it came back into compliance, and could cause it to lose its FINRA membership, its registration with the SEC or require its liquidation. Further, the decline in FBRCM’s or MLV’s net capital below certain early warning levels, even though above minimum net capital requirements, could cause material adverse consequences to us and to FBRCM or MLV, as the case may be.

9

FBRCM and MLV also are subject to “Risk Assessment Rules” imposed by the SEC which require, among other things, that certain broker-dealers maintain and preserve certain information, describe risk management policies and procedures and report on the financial condition of certain affiliates whose financial and securities activities are reasonably likely to have a material impact on the financial and operational condition of the broker-dealer. Certain “material associated persons” (as defined in the Risk Assessment Rules) of the broker-dealer and the activities conducted by such material associated persons may also be subject to regulation by the SEC. In addition, the possibility exists that, on the basis of the information it obtains under the Risk Assessment Rules, the SEC could seek authority over our unregulated subsidiaries either directly or through its existing authority over our regulated subsidiaries.

The research areas of investment banks have been and remain the subject of increased regulatory scrutiny. The New York Stock Exchange (the “NYSE”) and FINRA have adopted rules imposing heightened restrictions on the interaction between equity research analysts and investment banking personnel at member securities firms. In addition, in 2003 and 2004, several securities firms in the U.S. reached a settlement with certain federal and state securities regulators and self-regulatory organizations to resolve investigations into their equity research analysts’ alleged conflicts of interest.

The effort to combat money laundering and terrorist financing is a priority in governmental policy with respect to financial institutions. The USA PATRIOT Act of 2001, as amended (the “PATRIOT Act”), contains anti-money laundering and financial transparency laws and mandates the implementation of various new regulations applicable to broker-dealers and other financial services companies, including standards for verifying client identification at account opening, and obligations to monitor client transactions and report suspicious activities. Through these and other provisions, the PATRIOT Act seeks to promote the identification of parties that may be involved in terrorism or money laundering. Anti-money laundering laws outside the United States contain some similar provisions. The obligation of financial institutions, including us, to identify their customers, watch for and report suspicious transactions, respond to requests for information by regulatory authorities and law enforcement agencies, and share information with other financial institutions, has required the implementation and maintenance of internal practices, procedures and controls which have increased, and may continue to increase, our costs, and any failure with respect to our programs in this area could subject us to serious regulatory consequences, including substantial fines, and potentially other liabilities.

Certain of our businesses are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

Additional legislation, changes in rules promulgated by the SEC and self-regulatory organizations or changes in the interpretation or enforcement of existing laws and rules, either in the U.S. or elsewhere, may directly affect how we operate and our financial results and condition.

Our broker-dealer businesses are also subject to regulation by various foreign governments and regulatory bodies. FBRCM and MLV are registered with and subject to regulation by a number of provincial securities regulators in Canada. Foreign regulation may govern all aspects of the investment business, including regulatory capital, sales and trading practices, conflicts of interest, research, use and safekeeping of customer funds and securities, record-keeping, margin practices and procedures, registration standards for individuals, periodic reporting and settlement procedures.

The U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the United States, are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer or its directors, officers or employees. Occasionally, we have been subject to investigations and proceedings, and sanctions have been imposed on us for infractions of various regulations relating to our activities.

10

You should carefully consider the following risks and all of the other information contained in this Form 10‑K, including the consolidated financial statements and the notes thereto included in Part II, Item 8, of this Form 10‑K. If any of the risks, uncertainties, events or developments described below occurs, our business, financial condition or results of operation could be negatively impacted. In connection with the forward-looking statements that appear in this Form 10‑K, you should also carefully review the cautionary statements included under the caption “Forward-Looking Statements.”

Risks Related to Our Business

Our businesses have been and may in the future be materially and adversely affected by financial market conditions and economic conditions generally.

As an investment bank, risk is an inherent part of our business. Our businesses are materially affected by conditions in the financial markets, particularly the equity capital markets, and economic conditions generally. Conditions in the financial markets in 2015 were marked by declines in energy prices, persistent market volatility and a challenging environment for small-cap equity capital raising. Lower levels of liquidity continue to have a negative effect on trading volumes, particularly in the equity market, which has a direct negative impact on our cash equities trading business.

Our financial performance is highly dependent on the environment in which our businesses operate. A favorable business environment is generally characterized by, among other factors, high global gross domestic product growth, stable geopolitical conditions, transparent and efficient capital markets, liquid markets with active investors, low inflation, high business and consumer confidence and strong business earnings. Slowing growth, contraction of credit, increasing energy prices, declines in business or investor confidence or risk tolerance, increases in inflation, higher unemployment, outbreaks of hostilities or other geopolitical instability, corporate, political or other scandals that reduce investor confidence in capital markets and natural disasters, among other things, can affect the global financial markets. In addition, economic or political pressures in a country or region may cause local market disruptions and currency devaluations, which may also affect markets generally. In the event of changes in market conditions, such as interest or foreign exchange rates, equity, fixed income, commodity or real estate valuations, liquidity, availability of credit or volatility, our businesses could be adversely affected in many ways.

Our investment banking revenues are directly related to the number and size of the transactions in which we participate. Any future market downturns that affect the size and number of capital raising transactions will likely have a negative impact on our investment banking business. Sustained market downturns and credit market dislocations and liquidity issues in the future would also likely lead to a further decline in the volume of secondary market trading that we execute for our institutional brokerage clients and, therefore, to a decline in the revenues we receive from commissions and spreads earned from the trades we execute for our clients. Heightened risk aversion among investors may cause them to shift their trading activity to higher quality and more liquid products, which are generally less profitable for us.

We incurred a loss in 2015 and we have incurred losses in certain prior periods; we may incur losses in the future.

We incurred a net loss for the year ended December 31, 2015 of $7.5 million and we have incurred losses in certain prior periods. We may incur losses in future periods. If we are unable to fund future losses, those losses may have a significant effect on our liquidity as well as our ability to operate.

In addition, we may incur significant expenses in connection with any expansion of our capital markets businesses or in connection with strategic acquisitions and investments. Specifically, we have invested, and will continue to invest, in our capital markets businesses, including hiring a number of senior professionals to expand our product offerings. Accordingly, we would need to increase our revenues at a rate greater than our expenses to achieve and maintain profitability. If our revenues do not increase sufficiently, or if our revenues increase but we are unable to manage our expenses, we may incur losses in future periods.

11

Our financial results may fluctuate substantially from quarter-to-quarter and year-to-year.

We have experienced, and expect to experience in the future, significant quarterly variations in our revenues and results of operations. These variations may be attributed in part to the fact that our investment banking revenues are typically earned upon the successful completion of a transaction, the timing of which is uncertain and beyond our control. In most cases, we receive little or no payment for investment banking engagements that do not result in the successful completion of a transaction. As a result, our business is highly dependent on market conditions as well as the decisions and actions of our clients and interested third parties. For example, a client’s securities offering may be delayed or terminated because of adverse market conditions, failure to obtain necessary regulatory approvals or unexpected financial or other problems in the client’s business. If the parties fail to complete an offering in which we are participating as an underwriter or placement agent, we will earn little or no revenue from the transaction. This risk may be intensified by our focus on early-stage companies in certain sectors, as the market for securities of these companies may experience significant variations in the number and size of equity offerings as well as the after-market trading volume and prices of newly issued securities, and the fact most of our investment banking revenue is generated from a relatively small number of significant transactions. Many companies initiating the process of an initial public offering or private institutional equity raise are simultaneously exploring M&A exit opportunities. Our investment banking revenues would be adversely affected in the event that an equity offering for which we are acting as an underwriter is preempted by the company’s sale. As a result of the foregoing, we are unlikely to achieve steady and predictable earnings on a quarterly basis.

We are dependent on our executive management team, and we may not be able to execute our business plan in the event that members of our executive management team are no longer available to us and we are unable to find suitable replacements for them or the members of our executive management team do not dedicate a sufficient amount of their professional time to our endeavors.

We depend on the efforts, skill, reputations and business contacts of our executive management team, and we believe that our success depends to a significant extent upon the experience of these individuals, whose continued service is not guaranteed. We have no assurance that the services of our executive management team will continue to be available to the full extent of our needs. If certain members of our executive management team leave our company or are otherwise no longer available to us or are not available to the full extent of our needs, we may not be able to replace them with suitable management and may be unable to execute our business plan.

We encounter intense competition for qualified professionals from other investment banking firms and from businesses outside the investment banking industry, such as hedge, private equity and venture capital funds, and our failure to hire qualified professionals and retain our existing professionals may materially impede the success and growth of our business.

Our people are our most valuable resource. Our ability to secure and maintain investment banking engagements and brokerage business depends upon the reputation, judgment, business generation capabilities and project execution skills of our professionals. Our professionals’ reputations and relationships with our clients are a critical element in obtaining and executing client engagements. Generally, we do not have employment or non-competition agreements with our professionals. We encounter intense competition for qualified professionals from other companies in the investment banking industry and from businesses outside the investment banking industry, such as hedge, private equity and venture capital funds. We may experience losses of investment banking, brokerage, research and other professionals and our failure to hire qualified professionals and retain our existing professionals may materially impede our success and growth. While we believe that we will continue to be able to retain and recruit qualified professionals, the departure or other loss of our key professionals who manage substantial client relationships or who possess substantial experience and expertise could impair our ability to secure or successfully complete engagements, which could materially adversely affect our business and results of operations. Any negative financial performance that results in lower compensation levels may exacerbate this risk. In challenging market conditions, as have occurred in recent years, it may be difficult to pay competitive compensation without our ratio of compensation expense to revenues becoming higher. In addition, if any of our investment bankers or members of our executive management team were to join an existing competitor or form a competing company, some of our clients could choose to use the services of that competitor instead of our services. We may not be able to prevent our key professionals or the members of our executive management team from resigning to join our competitors or from forming a competing company.

12

Our capital markets and strategic advisory engagements are singular in nature and our failure to obtain new engagements may harm our operating results.

Our investment banking clients generally retain us on a short-term, engagement-by-engagement basis in connection with specific capital markets or M&A transactions, rather than on a recurring basis under long-term contracts. As these transactions are typically singular in nature and our engagements with these clients may not recur, we must continuously seek out new engagements when our current engagements are successfully completed or are terminated. As a result, high activity levels in any period are not necessarily indicative of continued high levels of activity in any subsequent period. If we are unable to generate a substantial number of new engagements that generate fees from the successful completion of transactions, our business and results of operations would be materially and adversely affected.

We depend on relatively few industries to generate a significant percentage of our revenue, which may limit our revenues and net income and may adversely affect our operating results.

We are dependent on revenues related to securities issued by companies in specific industry sectors. The real estate, energy and natural resources, industrials, insurance, and financial institutions sectors account for the majority of our investment banking, institutional trading and research activities. Therefore, any downturn in the market for the securities of companies in these industry sectors, or factors affecting such companies, could adversely affect our operating results and financial condition. Additionally, the frequency and size of securities offerings can vary significantly from industry to industry due to economic, legislative, regulatory and political factors.

Underwriting and other capital raising transactions, strategic advisory engagements and related trading activities in the industries on which we focus represent a significant portion of our businesses. This concentration of activity exposes us to the risk of substantial declines in revenues in the event of downturns in these industries. Future downturns in the industries on which we focus could result in a decrease in the size or number of transactions we complete, which would reduce our investment banking revenues.

We also derive a significant portion of our revenues from institutional sales and trading transactions related to the securities of companies in these sectors. Our revenues from such institutional sales and trading transactions may decline when underwriting activities in these industry sectors decline, the volume of trading on the NASDAQ, the NYSE or any other securities market or exchange declines, or when industry sectors or individual companies report results below investors’ expectations.

Pricing and other competitive pressures may impair the revenues and profitability of our institutional brokerage business.

We derive a significant portion of our revenues from our institutional brokerage business. Along with other firms, we have experienced intense price competition in this business in recent years. In particular, the ability to execute trades electronically and through alternative trading systems has increased the pressure on trading commissions and spreads. We expect pricing pressures in the business to continue. We believe we may experience competitive pressures in these and other areas in the future as some of our competitors seek to obtain market share by competing on the basis of price or use their own capital to facilitate client trading activities. In addition, we face pressure from our larger competitors, which may be better able to offer a broader range of complementary products and services to clients in order to win their trading business. If we are unable to compete effectively in these areas, the revenues from our sales and trading business may decline, and our business and results of operations may be adversely affected. Our research and institutional brokerage business also may be adversely affected by changes in laws and regulations and industry practices.

Our institutional brokerage revenues may decline due to competition from alternative trading systems and lower overall volume.

Securities and futures transactions are now being conducted electronically and via other alternative, non-traditional trading systems, and it appears that the trend toward alternative trading systems will continue and probably accelerate. In addition, industry-wide trading volumes of equity securities have declined in recent years. Any dramatic increase in computer-based or other electronic trading or further declines in trading volumes may

13

adversely affect our institutional brokerage revenues. The NYSE’s adoption of its hybrid market for trading securities may increase pressure on our institutional brokerage business as customers execute more of their NYSE-related trades electronically. Even if we were to develop our own electronic trading systems, we cannot assure you that the revenues generated by these systems will yield an adequate return on our investment, particularly given the relatively lower commissions arising from electronic trades. As a result, our institutional brokerage revenues could decline in the future, which would negatively impact our cash flows and the value of our common stock.

We face strong competition from larger firms, some of which have greater resources and name recognition, which may impede our ability to grow our business.

The brokerage and investment banking industries are intensely competitive and we expect them to remain so. We compete on the basis of a number of factors, including client relationships, reputation, the abilities of our professionals, market focus and the relative quality and price of our services and products. We have experienced intense price competition in some of our businesses; in particular, discounts in large block trades and trading commissions and spreads. In addition, pricing and other competitive pressures in investment banking, including multiple book runners, co-managers and multiple financial advisors handling transactions, have continued and could adversely affect our revenues. We believe we may experience competitive pressures in these and other areas in the future as some of our competitors seek to obtain market share by competing on the basis of price.

Many of our competitors in the brokerage and investment banking industries have a broader range of products and services, greater financial and marketing resources, larger customer bases, greater name recognition, more senior professionals to serve their clients’ needs, greater global reach and more established relationships with clients than we have. These larger and better capitalized competitors may be better able to respond to changes in the brokerage and investment banking industries, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally.

The scale of our competitors has increased in recent years as a result of substantial consolidation among companies in the brokerage and investment banking industries. In addition, a number of large commercial banks, insurance companies and other broad-based financial services firms have established or acquired underwriting or financial advisory practices and broker-dealers or have merged with other financial institutions. These firms have the ability to offer a wider range of products than we do, which may enhance their competitive position. They also have the ability to support investment banking with commercial banking, insurance and other financial services in an effort to gain market share, which has resulted, and could further result, in competitive and pricing pressure in our businesses. In particular, the ability to provide financing has become an important advantage for some of our larger competitors and, because we do not provide such financing, we may be unable to compete as effectively for clients in a significant part of the brokerage and investment banking market. If we are unable to compete effectively with our competitors, our business, financial condition and results of operations will be adversely affected.

Larger and more frequent capital commitments in our trading and underwriting business increase the potential for us to incur significant losses.

We commit our capital to maintain trading positions in the equity, convertible securities and debt markets. We may enter into large transactions in which we commit our own capital as part of our client trading activities. The number and size of these large transactions may adversely affect our results of operations in a given period. Although, as discussed below, we take measures to manage market risk, we may also incur significant losses from our trading activities due to market fluctuations and volatility in our results of operations. To the extent that we own assets, i.e., have long positions, in any of those markets, a downturn in the value of those assets or in those markets could result in losses. Conversely, to the extent we have sold assets we do not own, i.e., have short positions, in any of those markets, an upturn in those markets could expose us to potentially large losses as we attempt to cover our short positions by acquiring assets in a rising market. Additionally, to the extent that we purchase “when issued” securities (i.e., securities that are trading but have not been issued by the issuer) from our trading clients between the pricing date and closing date of an issuer’s securities offering, we may be unable to sell those securities if an adverse event occurs between the pricing and closing date that changes the terms of such offering or securities.

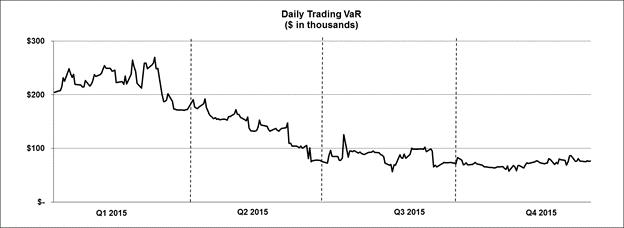

We use a number of quantitative measures to manage our exposure to market risk, including inventory position limits, scenario analysis, and value at risk, or VaR. VaR is a model that quantifies potential losses using

14

historical data. Because the historical market prices used in our VaR analysis may not be an accurate measure of future market events and conditions, especially in highly stressful market environments, and because our VaR model measures the risk of a current net trading position and does not take into account future position changes arising from transaction and/or hedging activity, we could incur losses that are materially greater than our reported VaR, and our business, financial condition and results of operations could be adversely affected.

Many financial services firms commit their own capital as part of their business activities. For example, in order to win business, investment banks may commit to purchase large blocks of stock from publicly traded issuers or significant shareholders, instead of the more traditional marketed underwriting process, in which marketing is typically completed before an investment bank commits to purchase securities for resale. Additionally, standard securities underwritings require investment banks to commit large amounts of capital prior to the closing of such offerings. We have committed capital in these ways, and expect in the future that we will continue to do so from time to time. As a result, we will be subject to risk as we commit capital to facilitate primarily client-driven business and, therefore, may suffer losses even when economic and market conditions are generally favorable for others in the industry.

Limitations on our access to capital could impair our liquidity and our ability to conduct our businesses.

Liquidity, or ready access to funds, is essential to financial services firms. Failures of financial institutions have often been attributable in large part to insufficient liquidity. Liquidity is of particular importance to our trading business and perceived liquidity issues may affect our clients’ and counterparties’ willingness to engage in brokerage transactions with us. Our liquidity could be impaired due to circumstances that we may be unable to control, such as a general market disruption or an operational problem that affects our trading clients, third parties or us. Further, our ability to sell assets may be impaired if other market participants are seeking to sell similar assets at the same time. Finally, additional repurchases by us of our shares of common stock will further reduce cash available for operations and future growth.

FBRCM and MLV, both of which are U.S. registered broker-dealers, are subject to the net capital requirements of the SEC and various self-regulatory organizations of which they are members. These requirements typically specify the minimum level of net capital a broker-dealer must maintain and also mandate that a significant part of its assets be kept in relatively liquid form. Prior to our acquisition of MLV, MLV self-reported to FINRA that its regulatory net capital levels had temporarily fallen below minimum required levels. FINRA is currently engaged in an inquiry regarding the circumstances of that event. An adverse finding by FINRA may result in censure, fines, and/or other penalties. Any other failure by either FBRCM or MLV to comply with its net capital requirements could also impair our ability to conduct our core business as a brokerage firm.

Furthermore, both FBRCM and MLV are subject to laws that authorize regulatory bodies to block or reduce the flow of funds from it to FBR & Co. As a holding company, we are dependent on dividends, distributions and other payments from our subsidiaries to fund our obligations, including any debt obligations we may incur. As a result, regulatory actions could impede access to funds that we need to make payments on our obligations, including any debt obligations we may incur.

We are highly dependent on communications, information and other systems and third parties, and any systems failures, malicious attack or unauthorized access could significantly disrupt our business.

Our business is highly dependent on communications, information and other systems, including systems provided by our clearing brokers, and by and for other third parties. Any failure or interruption of our systems, the systems of our clearing brokers or third-party trading or information systems could cause delays or other problems in our securities trading activities, which could have a material adverse effect on our operating results and negatively affect the market price of our common stock. In 2015, we switched our principal clearing brokerage firm from J.P. Morgan Clearing Corp., to Merrill, Lynch, Pierce, Fenner and Smith Incorporated. In the event that our principal clearing broker was to exit the business, we would be required to enter into alternative clearing arrangements. There can be no assurance that such arrangements will be available on terms that are not materially less favorable to us, or at all. Any failure to do so could adversely affect our ability to execute transactions, service our clients and manage our exposure to risk.

15

In addition, our clearing brokers provide elements of our principal disaster recovery system. We cannot assure you that we or our clearing brokers will not suffer any systems failure or interruption, including one caused by a hurricane, earthquake, fire, other natural disaster, power or telecommunications failure, act of God, act of war, terrorist attack, pandemic or other emergency situation, or that our or our clearing brokers’ back-up procedures and capabilities in the event of any such failure or interruption will be adequate. The occurrence of any failures or interruptions could significantly harm our business.

Secure processing, storage and transmission of confidential and other information in our internal and third-party computer systems and networks also is critically important to our business. We take protective measures and endeavor to modify them as circumstances warrant. However, despite our security measures, our computer systems, software and networks may be vulnerable to unauthorized access, attack by hackers, computer viruses or other malicious code, inadvertent, erroneous or intercepted transmission of information (including by e-mail), and other events that could have an information security impact. If one or more of such events occur, this potentially could jeopardize our or our clients’ or counterparties’ confidential and other information processed and stored in, and transmitted through, our computer systems and networks, or otherwise cause interruptions or malfunctions in our, our clients’, our counterparties’ or third parties’ operations. We may be required to expend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures, and we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance maintained by us.

Our risk management policies and procedures may leave us exposed to unidentified or unanticipated risk, which could harm our business.

We have devoted significant resources to develop our risk management strategies and techniques and expect to continue to do so in the future. However, our risk management strategies and techniques may not be fully effective in mitigating our risk exposure in all market environments or against all types of risk, including risks that are unidentified or unanticipated.

We are exposed to the risk that third parties that owe us money, securities or other assets will not perform their obligations. These parties may default on their obligations to us due to bankruptcy, lack of liquidity, operational failure, breach of contract or other reasons. We are also subject to the risk that our rights against third parties may not be enforceable in all circumstances. Although we regularly review credit exposures to specific clients and counterparties and to specific industries and regions that we believe may present credit concerns, default risk may arise from events or circumstances that are difficult to detect or foresee. In addition, concerns about, or a default by, one institution could lead to significant liquidity problems, losses or defaults by other institutions, which in turn could adversely affect us. If any of the variety of instruments, processes and strategies we utilize to manage our exposure to various types of risk are not effective, we may incur losses.

External group hires, strategic investments or acquisitions and joint ventures may result in additional risks and uncertainties in our business.

We have grown and may continue to grow our core businesses through both internal expansion and through external group hiring, strategic investments, acquisitions or joint ventures. To the extent we make external group hires, strategic investments or acquisitions or enter into joint ventures, we face numerous risks and uncertainties, including those that may relate to financial commitments undertaken in connection with any such activity, as well as those that relate to combining or integrating the relevant people, businesses and systems, including the need to combine accounting and data processing systems and management controls and to integrate relationships with customers and business partners. In the case of joint ventures, we are subject to additional risks and uncertainties in that we may be dependent upon, and subject to liability, losses or reputational damage relating to, systems, controls and personnel that are not under our control. In addition, conflicts or disagreements between us and our joint venture partners may negatively impact our businesses.

In September 2015, we acquired MLV. MLV has been named in two putative class action lawsuits involving underwritten securities offerings in 2013 and 2014. An adverse resolution of any of these matters against us could materially affect our financial condition, operating results and liquidity. See Part I, Item 3, “Legal Proceedings” of this Form 10-K for additional information concerning litigation.

16

Our principal investments expose us to a significant risk of capital loss.

We use a portion of our own capital in a variety of principal investment activities, each of which involves risks of illiquidity, loss of principal and revaluation of assets. The companies and investment funds in which we invest may concentrate on markets which are or may be disproportionately impacted by pressures in the sectors on which they focus, and their existing business operations or investment strategy may not perform as projected. As a result, we have suffered losses in the past and we may suffer losses from our principal investment activities in the future.

Our merchant banking investments are concentrated in relatively few companies and industries and a consequence of this investment strategy is that our investment returns will be materially and adversely affected if the companies or the industries we target perform poorly. As a result, if a significant investment fails to perform as we anticipated our business, financial condition and results of operations could be more negatively affected and the magnitude of the loss could be more significant than if we had made smaller investments in more companies and industries.

Even if we make an appropriate investment decision based on the intrinsic value of an enterprise or investment fund, we cannot assure you that the market value of the investment will not decline, perhaps materially, as a result of general market conditions or changes in law. For example, an increase in interest rates, a general decline in the stock markets, or other market conditions adverse to companies or investment funds of the type in which we invest could result in a decline in the value of our investments. Additionally, the companies or investment funds in which we invest may be subject to extensive regulation by U.S. and foreign federal, state and/or local agencies. Changes in existing laws, rules or regulations, or judicial or administrative interpretations thereof, or new laws, rules or regulations could have an adverse impact on the business and industries of our investment.

Our due diligence may not reveal all of a portfolio company’s or investment fund’s liabilities and may not reveal other weaknesses in a portfolio company’s or investment fund’s business.

Before we make principal investments, whether investments in non-registered investment funds that are managed by third parties, merchant banking and other equity investments, or corporate debt investments, we assess the strength and skills the managers of the enterprise and other factors that we believe will determine the success of the investment. In making the assessment and otherwise conducting customary due diligence, we rely on the resources available to us and, in some cases, an investigation by third parties. This process is particularly important and subjective with respect to newly-organized entities because there may be little or no information publicly available about the company or investment fund. We cannot assure you that our due diligence processes will uncover all relevant facts or risks about a company or investment fund in which we make a principal investment, or that any such investment will be successful. Any unsuccessful principal investments may have a material adverse effect on our financial condition and results of operation.

In any potential principal investment, we depend on management and have limited ability to influence management of companies and/or investment funds in which we have invested.

We generally do not control the management, investment decisions or operations of the enterprises in which we make principal investments. Management of those enterprises may decide to change the nature of their assets or business plan, or management may otherwise change in a manner that is not satisfactory to us. We typically have no ability to affect these management decisions, and as noted below, may have only limited ability to dispose of these investments.

We may make principal investments that have limited liquidity, which may reduce the return on those investments to our stockholders.

The investments we make in alternative asset classes such as hedge funds are typically subject to restrictions that limit the amount and timing of redemptions. Such restrictions impair the liquidity of such investments, and these restrictions are likely to increase in periods of market volatility. For these and other reasons, we may be unable to liquidate assets at times and in amounts of our choosing, which could result in harm to our investment performance and loss of invested capital.

17

The securities of any new publicly-held or privately-held entity in which we make a merchant banking or other principal investment are likely to be restricted as to resale and may otherwise be highly illiquid. We also expect that there will be restrictions on our ability to resell the securities of any private or newly-public company that we acquire for a period of at least one year after we acquire those securities. Thereafter, a public market sale may be subject to volume limitations or dependent upon securing a registration statement for a secondary offering of the securities.

The securities of newly-public entities may trade less frequently and in smaller volume than securities of companies that are more widely held and have more established trading patterns. Sales of these securities may cause their values to fluctuate more sharply. Because we have made and expect to make our principal investments through an affiliate of FBRCM and MLV, registered broker-dealers in the U.S., our ability to invest in companies may be constrained by applicable securities laws and regulations and the rules of FINRA and similar self-regulatory organizations. Our investment and trading activities are regulated by the SEC, FINRA and other governmental authorities. As a result, the rules of the SEC, FINRA, and other governmental authorities and self-regulatory organizations may limit our ability to invest in initial public offerings as well as other offerings of companies whose securities are underwritten or privately placed by FBRCM and MLV.