Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ascent Solar Technologies, Inc. | march1520168-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Ascent Solar Technologies, Inc. | a201610kpr_finalxclean.htm |

1 Company Confidential. Ascent Solar© 2016

2 Company Confidential. Ascent Solar© 2016 In addition to historical information, this presentation contains forward–looking statements that are based on assumptions made by management regarding future circumstances over which the company may have little or no control and involve risks, uncertainties and other factors that may cause actual results to be materially different from any future results expressed or implied by such forward–looking statements. Please note that these forward-looking statements reflect our opinions only as of the date of this publication and we undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements in light of new information or future events. Please refer to our SEC filings for a more detailed description of the risk factors that may affect our results. These documents are available at our website, www.ascentsolar.com, and at the SEC’s website, www.sec.gov. Safe Harbor Statement

3 Company Confidential. Ascent Solar© 2016 Who Are We? Ascent Solar (“ASTI”) is a Fully Integrated Mobility Power Solution Provider Revolutionary and Proprietary Flexible Solar Technology based on CIGS (Copper-Indium-Gallium- Selenium) on Plastic Substrate

4 Company Confidential. Ascent Solar© 2016 ASTI Corporate Vision To Achieve Socially Responsible Global Leadership in Clean and Innovative Power Solutions for Everyone Everywhere

5 Company Confidential. Ascent Solar© 2016 Matchless Award-Winning Technology R&D Magazine selected Ascent’s Innovative Monolithically-Integrated CIGS Photovoltaic Product on Polyimide Substrate as one of the 100 Most Innovative Technologies for 2010 Time Magazine Selected Ascent’s Flexible & Lightweight PV Module as one of the 50 Best Inventions of 2011 R&D Magazine selected Ascent’s Innovative MilPak™ E Military-Graded Foldable PV Blanket as one of the Top 100 Technologies in the IT/Electronics Category for 2015

6 Company Confidential. Ascent Solar© 2016 Military/Defense ▪ High power output ▪ Shatterproof and durable ▪ Lightweight, flexible fabric surfaces ▪ Non-glare, non-reflective finish Transportation ▪ Durable in extreme conditions ▪ Extends capabilities of HEVs and EVs ▪ Power can offset/eliminate wasteful idling ▪ Silent Falcon™ UAV ▪ Customized packaging enables functionality in extreme conditions Drones/UAVs ▪ Partnership with Vanguard Space Technologies ▪ High Powered Space Ready PV Space & Near-space ▪ Lightweight and durable ▪ Cost efficient ▪ Reliable ▪ Highly mobile energy solution Off-Grid Structure EnerPlex Consumer Products ▪ High energy density ▪ Flexible plastic substrate, paper-thin and lightweight MIL STD 810G Certified www.silentfalconuas.com http://vst-inc.com/solar-photovoltaic- technology-passes-crucial-test/ Wider Applications In Multiple Premium Markets

7 Company Confidential. Ascent Solar© 2016 The Solar Market Has Been Commoditized The game of racing to the bottom of $X per watt www.solarcellcentral.com ~$0.50/W today

8 Company Confidential. Ascent Solar© 2016 Structure Chemistry Module Construct Substrate Integration Thin-Film PV Polycrystalline CIGS Monolithic Discrete Discrete Monolithic Monolithic CdTe Rigid Flexible Glass Stainless Steel Glass Plastic Rigid Flexible module The Ascent Advantage Representative Companies Technology Thin-Film Competitive Landscape Rigid Flexible Discrete Monolithic Silicon Monolithic Stainless Steel Glass Plastic Amorphous Lightweight Flexible encapsulant 11% efficiency (high volume) Parallel circuitry X X X X X X X X X X X = companies that have gone bankrupt or stop operation Source: All information above were obtained from published documents available on the internet Most Thin-Film Companies Were Badly Affected

9 Company Confidential. Ascent Solar© 2016 Paradigm Shift in Strategy and Business Model: Pivot away from traditional solar market Focus on high-value PV applications and consumer market • Sell products at $4 - $100/watt compared to $0.50/watt • Customers interested in functionality, lightweight and durability rather than cost • Markets that DO NOT compete with less-expensive fossil fuel generated power • Deviate from commodity-based pricing to value based pricing model, effectively shifting from $X per watt to $Y per unit/solution • Expanded product portfolio to include high-margin non PV ancillary products What Has Ascent Done While Others Fail?

10 Company Confidential. Ascent Solar© 2016 Transformation Completed Old Ascent Solar (Q1-2012 & before) • PV-only oriented management • B2B model focusing on rooftop market • Capital intensive & high fixed cost • Must achieve economies of scale to reach breakeven cash flow • Compete with commodity price of fossil fuel and c-Si panels (race to the bottom of $/watt) New Ascent Solar • Specialty PV markets & consumer electronics focused • B2B and B2C models • Solution-based pricing • Capital “Light” – minimal CAPEX • Ability to generate substantial non- PV related revenues • Current capacity able to generate up to $200m in annual sales • Established retail sales channel globally and expanding rapidly • Scalable business model

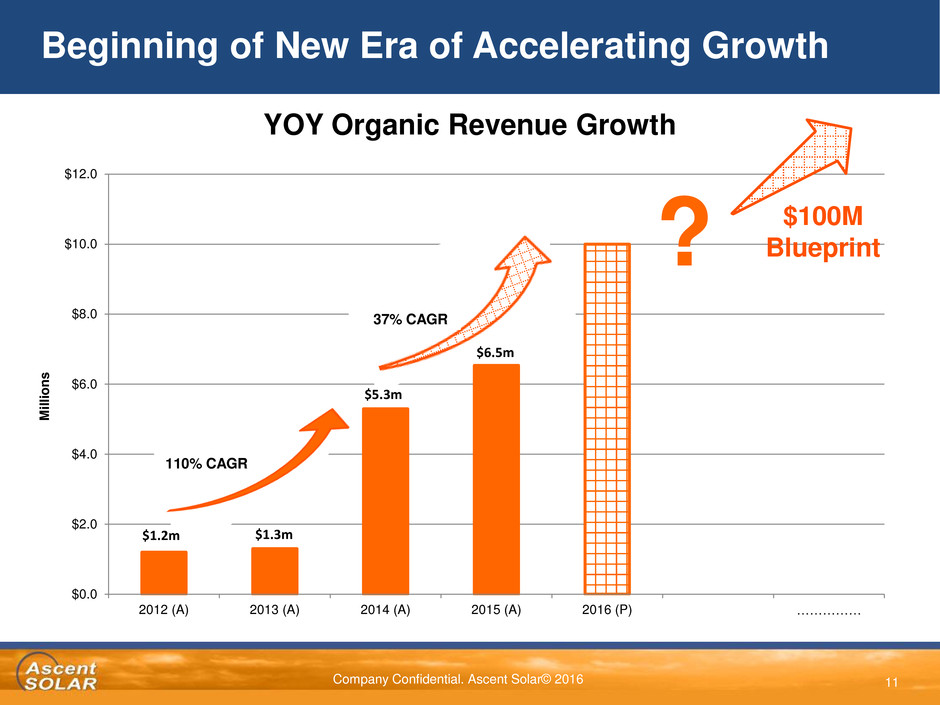

11 Company Confidential. Ascent Solar© 2016 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2012 (A) 2013 (A) 2014 (A) 2015 (A) 2016 (P) …………… M ill io n s 37% CAGR Beginning of New Era of Accelerating Growth YOY Organic Revenue Growth $1.3m $5.3m $6.5m $100M Blueprint 110% CAGR $1.2m ?

12 Company Confidential. Ascent Solar© 2016 Line Items FY2014 FY2015 +/- ($) % Change Revenues $5.34M $6.54M +$1.2M +22.5% Cost of Revenues (COGS)* N.A. $9.56M N.A. N.A. R&D & Mfg Ops* $18.8M $6.71M N.A. N.A. COGS + R&D & Mfg Ops* $18.8M $16.27M -$2.5M -13.4% SG&A $14.12M $12.36M -$1.76M -12.4% Loss from Operations ($33.9M) ($27.7M) +$6.1M +18.1% FY2015 Financial Highlights – Improvements on ALL Fronts *For 2014 and before, the majority of the Company’s costs were accounted for as R&D expenses. For 2015 and onwards, the Company now reports such expenses on 2 different line items (COGS; R&D and Manufacturing)

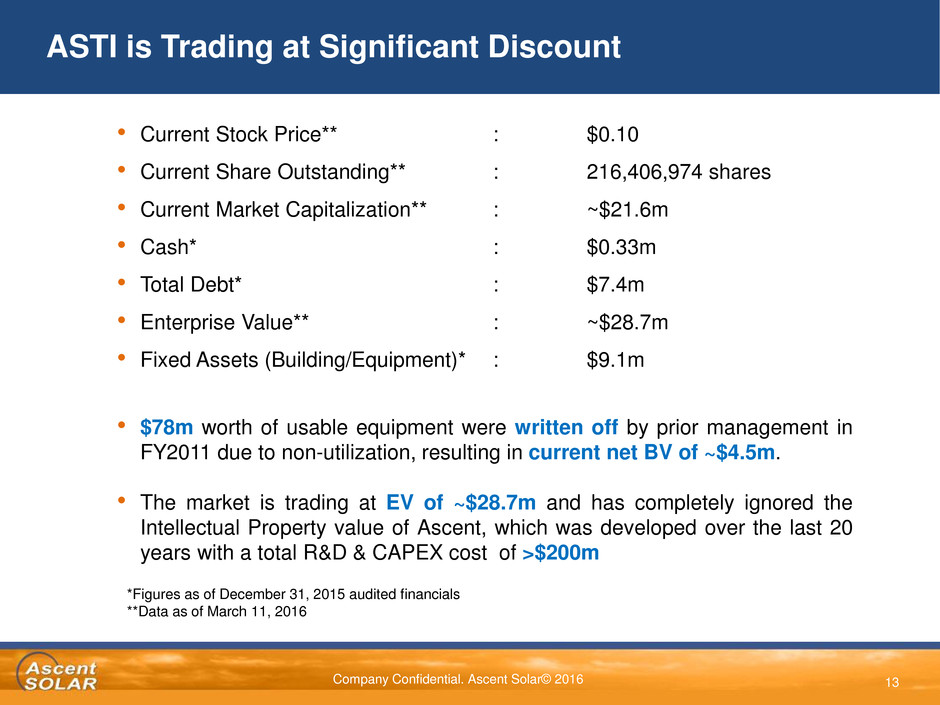

13 Company Confidential. Ascent Solar© 2016 ASTI is Trading at Significant Discount • Current Stock Price** : $0.10 • Current Share Outstanding** : 216,406,974 shares • Current Market Capitalization** : ~$21.6m • Cash* : $0.33m • Total Debt* : $7.4m • Enterprise Value** : ~$28.7m • Fixed Assets (Building/Equipment)* : $9.1m • $78m worth of usable equipment were written off by prior management in FY2011 due to non-utilization, resulting in current net BV of ~$4.5m. • The market is trading at EV of ~$28.7m and has completely ignored the Intellectual Property value of Ascent, which was developed over the last 20 years with a total R&D & CAPEX cost of >$200m *Figures as of December 31, 2015 audited financials **Data as of March 11, 2016

14 Company Confidential. Ascent Solar© 2016 $0 $50 $100 $150 $200 $250 $300 R&D and Engineering CAPEX Market Capitalization $ Millions Substantial Investments Not Currently Reflected In Valuation Market Cap does NOT reflect the large prior investments of over $200 million in CAPEX, R&D and Engineering already in place.

15 Company Confidential. Ascent Solar© 2016

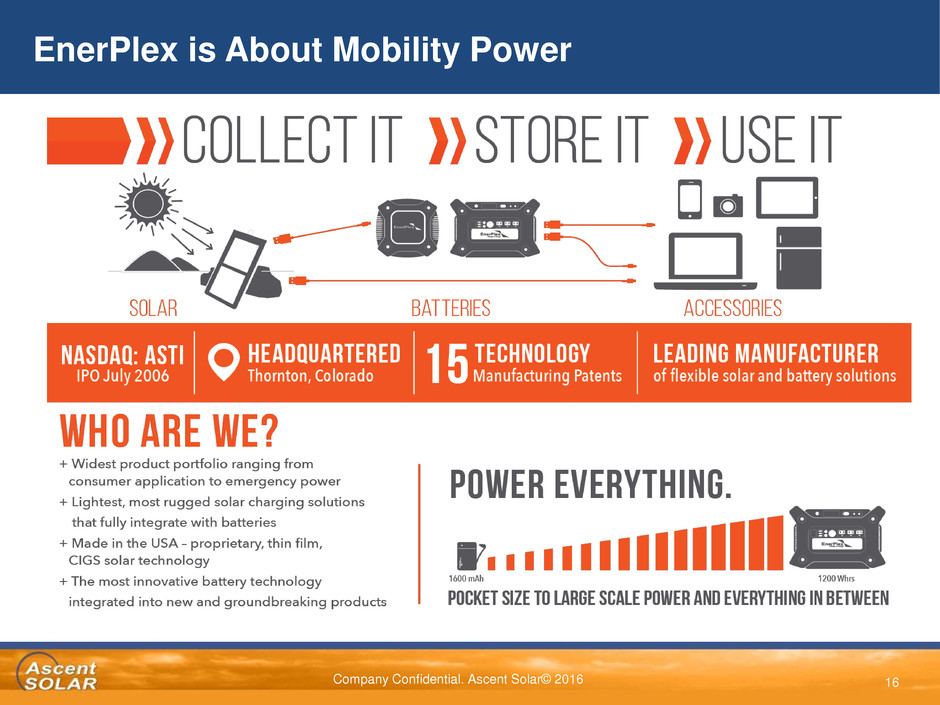

16 Company Confidential. Ascent Solar© 2016 EnerPlex is About Mobility Power

17 Company Confidential. Ascent Solar© 2016 Mobility Power in 3 Focused Verticals Mobile Power Outdoor Power Emergency Power Thin and Lightweight Power Solutions $6.7B (2015) TAM Rugged and Waterproof Power Solutions $362M (2015) TAM Emergency and Off-Grid Power Solutions $220.4M (2015) TAM

18 Company Confidential. Ascent Solar© 2016 EnerPlex Line of Products Surfr Series Jumpr Series Commandr Series Generatr Series Kickr Series Packr Series

19 Company Confidential. Ascent Solar© 2016 What Sets EnerPlex Apart?

20 Company Confidential. Ascent Solar© 2016 Retail Footprint in US…..and Growing Rapidly MicroCenter – 25 Stores Fry’s Electronics – 34 Superstores TCC Verizon Premium Retailers – 500 Stores Mike’s Camera – 13 Stores Sports Authority – 104 Stores Cabela’s – 16 Superstores

21 Company Confidential. Ascent Solar© 2016 Retail Footprint Worldwide e-commerce

22 Company Confidential. Ascent Solar© 2016

23 Company Confidential. Ascent Solar© 2016 Space and Near-Space Market The National Security Space Office (NSSO) has recently initiated an investigation into Space-based Solar Power (SBSP) The study reports “space-based solar power presents a strategic opportunity” for America that “merits significant further attention on the part of both the US Government and the Private sector”.† ASTI set to benefit from growing trends towards very large space-based solar arrays and is working with several companies to develop for space mission Our flexible CIGS PV is uniquely positioned to compete At The System Level with present and future ‘exotic’ PV †National Defense Industrial Association Conceptual designs of spacecraft using lightweight, deployable solar arrays

24 Company Confidential. Ascent Solar© 2016 Partnership with Vanguard Space Technologies ASTI lightweight PV modules were selected by Vanguard Space Technologies, Inc. (Vanguard) in 2H 2014 to create an ultra-thin, high power-to-weight ratio, large space solar array Vanguard had passed a key test milestone with its Thin Integrated Solar (THINS) PV technology , performed by the NASA Jet Propulsion Laboratory plasma facility, which is intended to power next-generation spacecraft* *Next-generation spacecraft will use electric propulsion powered by lightweight, high-power solar arrays like THINS. (http://vst-inc.com/solar- photovoltaic-technology-passes-crucial-test/

25 Company Confidential. Ascent Solar© 2016 Existing Sales - Silent Falcon™ UAS Silent Falcon is a Small Solar Electric UAV 80W of ASTI thin film solar photovoltaic (PV), Lithium-polymer batteries and advanced efficient propulsion system Lightweight, Flexibility, and Durability is a “MUST” to integrate PV on the wings of Silent Falcon Proprietary ISR sensor gimbals with daylight and low light video optics, GPS, electric autopilot and servo-control Up to double the flight endurance (12 hours) with ASTI solar at altitude of 200’ to 20,000’ Revenue of ~$3k per vehicle www.silentfalconuas.com

26 Company Confidential. Ascent Solar© 2016 UAV Market Potential for Ascent Solar

27 Company Confidential. Ascent Solar© 2016 Military Specs Portable Solar Blanket - MilPak™ E

28 Company Confidential. Ascent Solar© 2016

29 Company Confidential. Ascent Solar© 2016 Recent Corporate Development Completed $2.8m of Series E Convertible Preferred Shares Financing on 11/10/2015. Of which, ~$1.7m principle amount has been converted. Secured $32.2m of Committed Equity Line on 11/10/2015 which will provide operating capital to the Company from time to time over the next 3 years. Of which, $3.06m has been drawn down so far. Awarded 2 new US patents, securing efficiency gain in space and near-space environment. Completed $7m of Series F Convertible Preferred Shares Financing with on 1/20/2016. Of which, ~$1.34m principle amount has been converted.

30 Company Confidential. Ascent Solar© 2016 Anticipated Corporate Developments Potential award of a significant contract for our superlight modules for near-space application. Launch of an 8W pocket size version of the military grade MilPak™ E solar blanket for the mass consumer market (shipment expected in Q2-2016) Launch of multiple new EnerPlex Jumpr series with wireless charging and Quick Charge technology (shipment in Q2-2016) Significant expansion of international distribution network (through one of the largest distributors in Europe) Establishment of additional retail channels through additional Verizon Wireless Premium Stores and potentially other Telco operators.

31 Company Confidential. Ascent Solar© 2016

32 Company Confidential. Ascent Solar© 2016

33 Company Confidential. Ascent Solar© 2016 Incorporation: October 2005; IPO in July 2006 Headquarters: Thornton, Colorado (~139k sf of fab & office space) Headcount: ~135 Employees Technology: Thin-Film CIGS on flexible, plastic substrate Manufacturing: Roll-to-roll manufacturing, monolithic integration & intelligent process control Business Segments: Solar Solution Aerospace, UAVs, Military, Specialty Applications, Consumer Market & Transportation Power Storage Solution Mobile, Outdoor & Emergency Power Company Snapshot

34 Company Confidential. Ascent Solar© 2016 Lightweight ASTI CIGS panels weigh a small fraction of conventional c-Si panels CIGS chemistry – highest thin-film conversion efficiency Best Power-to-Weight Ratio (50 - 250 watt/kg) Flexible Numerous applications compared to rigid based PV Allows for easy Roll-to-Roll fabrication More efficient use of equipment and manufacturing floor space Durable (MIL-STD-810G and IEC 61646 certified) Inherent robust construction with redundant interconnects reducing failure points Plastic substrate does not crack or shatter upon impact Customizable (with Monolithic Integration) Simplified electrical and mechanical construction Customized cell shapes easily integrated into manufacturing process Meaningful Output in Small Area Higher voltages economically achieved in smaller areas ASTI’s PV Voltage is more easily integrated into electronics than Discrete Cells What Makes Ascent’s PV Unique?

35 Company Confidential. Ascent Solar© 2016 ASTI’s Super-Light Modules for Aerospace Application ICOSA Magazine, Vol. 4, Issue 2 pp 56-57.