Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Surgery Partners, Inc. | d134310d8k.htm |

Lender Presentation March 2016 Exhibit 99.1

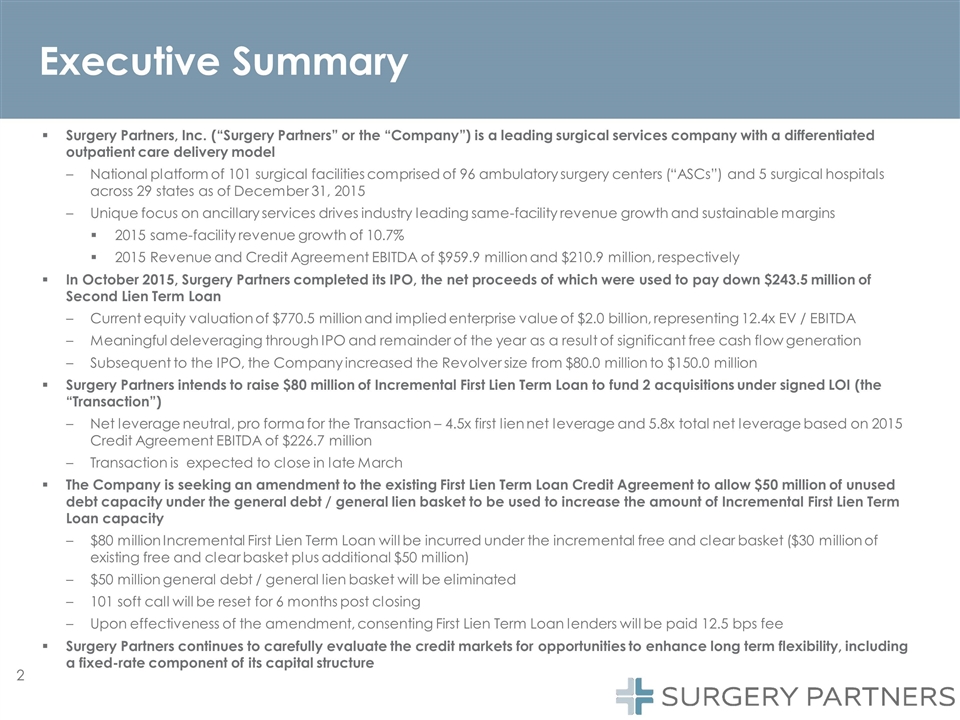

2 Executive Summary Surgery Partners, Inc. (“Surgery Partners” or the “Company”) is a leading surgical services company with a differentiated outpatient care delivery model National platform of 101 surgical facilities comprised of 96 ambulatory surgery centers (“ASCs”) and 5 surgical hospitals across 29 states as of December 31, 2015 Unique focus on ancillary services drives industry leading same-facility revenue growth and sustainable margins 2015 same-facility revenue growth of 10.7% 2015 Revenue and Credit Agreement EBITDA of $959.9 million and $210.9 million, respectively In October 2015, Surgery Partners completed its IPO, the net proceeds of which were used to pay down $243.5 million of Second Lien Term Loan Current equity valuation of $770.5 million and implied enterprise value of $2.0 billion, representing 12.4x EV / EBITDA Meaningful deleveraging through IPO and remainder of the year as a result of significant free cash flow generation Subsequent to the IPO, the Company increased the Revolver size from $80.0 million to $150.0 million Surgery Partners intends to raise $80 million of Incremental First Lien Term Loan to fund 2 acquisitions under signed LOI (the “Transaction”) Net leverage neutral, pro forma for the Transaction – 4.5x first lien net leverage and 5.8x total net leverage based on 2015 Credit Agreement EBITDA of $226.7 million Transaction is expected to close in late March The Company is seeking an amendment to the existing First Lien Term Loan Credit Agreement to allow $50 million of unused debt capacity under the general debt / general lien basket to be used to increase the amount of Incremental First Lien Term Loan capacity $80 million Incremental First Lien Term Loan will be incurred under the incremental free and clear basket ($30 million of existing free and clear basket plus additional $50 million) $50 million general debt / general lien basket will be eliminated 101 soft call will be reset for 6 months post closing Upon effectiveness of the amendment, consenting First Lien Term Loan lenders will be paid 12.5 bps fee Surgery Partners continues to carefully evaluate the credit markets for opportunities to enhance long term flexibility, including a fixed-rate component of its capital structure

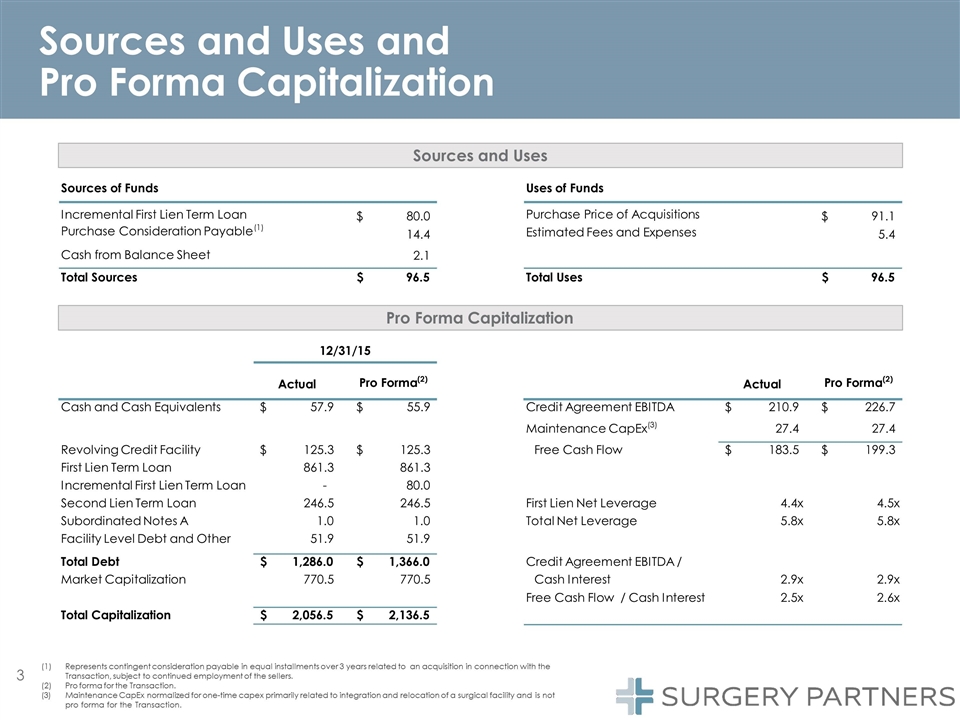

3 Sources and Uses and Pro Forma Capitalization Sources and Uses Pro Forma Capitalization 12/31/15 Represents contingent consideration payable in equal installments over 3 years related to an acquisition in connection with the Transaction, subject to continued employment of the sellers. Pro forma for the Transaction. Maintenance CapEx normalized for one-time capex primarily related to integration and relocation of a surgical facility and is not pro forma for the Transaction. Sources of Funds Uses of Funds Incremental First Lien Term Loan Purchase Consideration Payable(1) Cash from Balance Sheet 80.0 14.4 2.1 $ Purchase Price of Acquisitions Estimated Fees and Expenses 91.1 5.4 $ Total Sources 96.5 $ Total Uses 96.5 $ Actual Pro Forma(2) Actual Pro Forma(2) Cash and Cash Equivalents $57.9 $55.9 Credit Agreement EBITDA $210.9 $226.7 Maintenance CapEx(3) 27.4 27.4 Revolving Credit Facility $125.3 $125.3 Free Cash Flow $183.5 $199.3 First Lien Term Loan 861.3 861.3 Incremental First Lien Term Loan - 80.0 Second Lien Term Loan 246.5 246.5 First Lien Net Leverage 4.4x 4.5x Subordinated Notes A 1.0 1.0 Total Net Leverage 5.8x 5.8x Facility Level Debt and Other 51.9 51.9 Total Debt $1,286.0 $1,366.0 Credit Agreement EBITDA / Market Capitalization 770.5 770.5 Cash Interest Free Cash Flow / Cash Interest 2.9x 2.5x 2.9x 2.6x Total Capitalization $2,056.5 $2,136.5

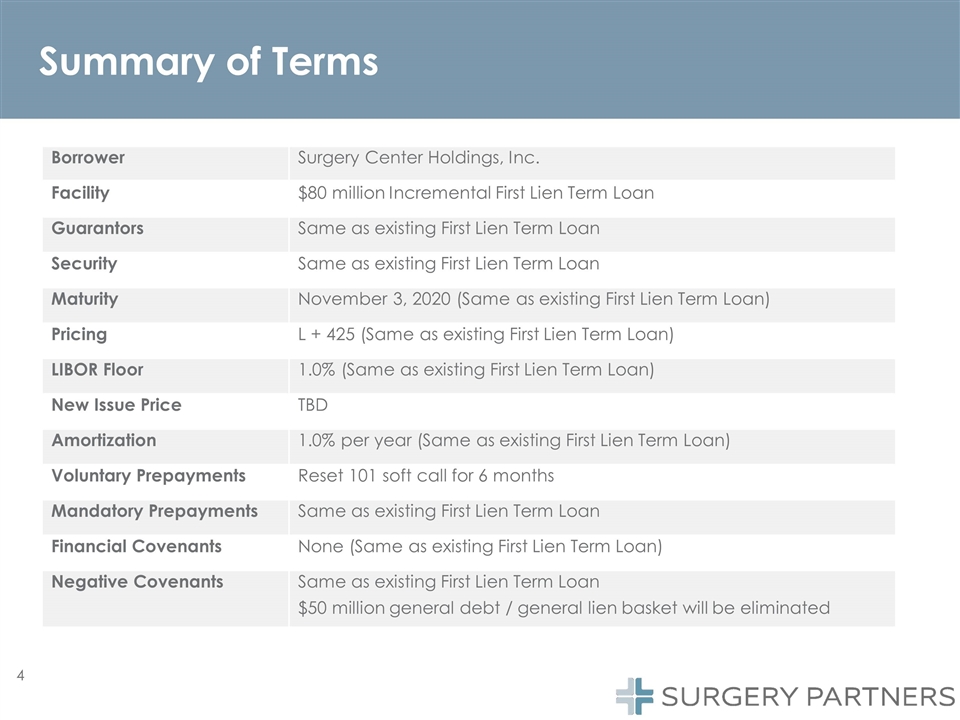

Summary of Terms Borrower Surgery Center Holdings, Inc. Facility $80 million Incremental First Lien Term Loan Guarantors Same as existing First Lien Term Loan Security Same as existing First Lien Term Loan Maturity November 3, 2020 (Same as existing First Lien Term Loan) Pricing L + 425 (Same as existing First Lien Term Loan) LIBOR Floor 1.0% (Same as existing First Lien Term Loan) New Issue Price TBD Amortization 1.0% per year (Same as existing First Lien Term Loan) Voluntary Prepayments Reset 101 soft call for 6 months Mandatory Prepayments Same as existing First Lien Term Loan Financial Covenants None (Same as existing First Lien Term Loan) Negative Covenants Same as existing First Lien Term Loan $50 million general debt / general lien basket will be eliminated

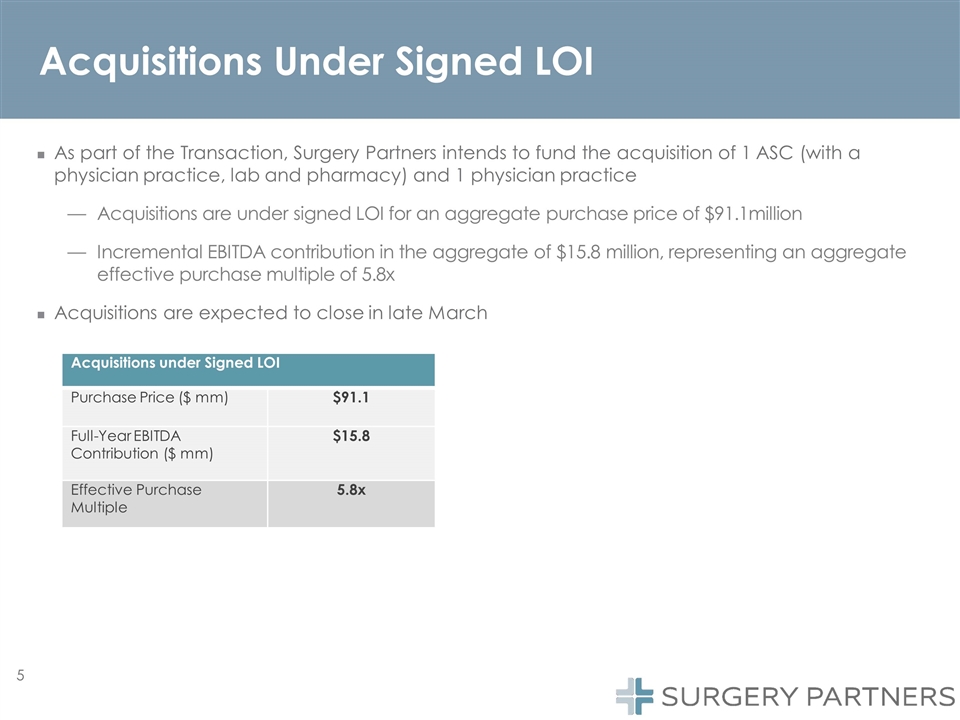

Acquisitions Under Signed LOI As part of the Transaction, Surgery Partners intends to fund the acquisition of 1 ASC (with a physician practice, lab and pharmacy) and 1 physician practice Acquisitions are under signed LOI for an aggregate purchase price of $91.1million Incremental EBITDA contribution in the aggregate of $15.8 million, representing an aggregate effective purchase multiple of 5.8x Acquisitions are expected to close in late March Acquisitions under Signed LOI Purchase Price ($ mm) $91.1 Full-Year EBITDA Contribution ($ mm) $15.8 Effective Purchase Multiple 5.8x

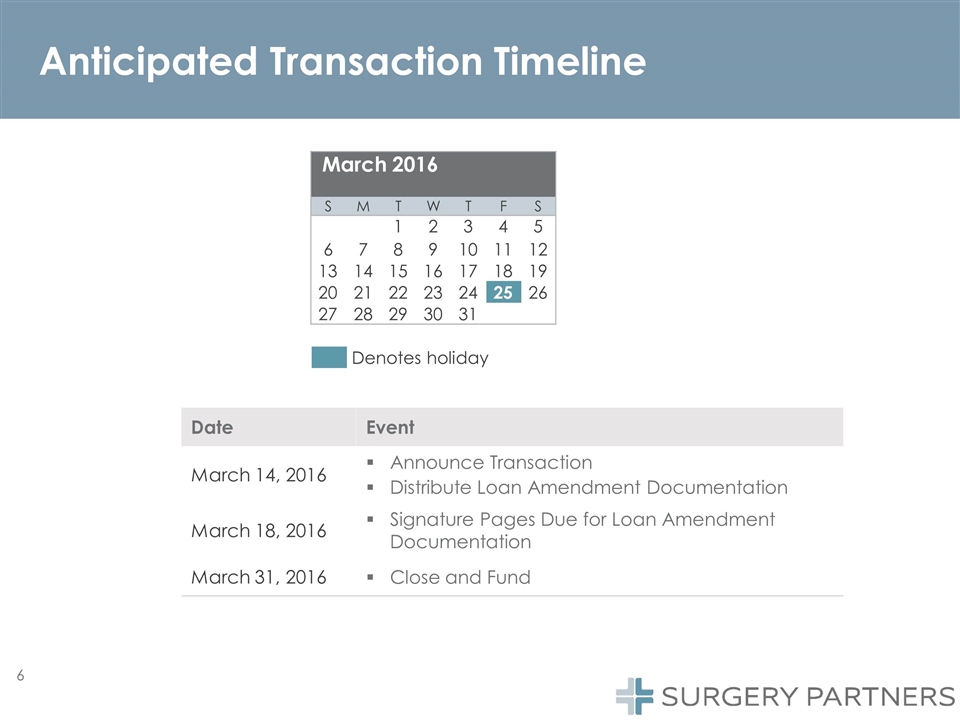

Anticipated Transaction Timeline Date Event March 14, 2016 Announce Transaction Distribute Loan Amendment Documentation Signature Pages Due for Loan Amendment Documentation Close and Fund March 18, 2016 March 31, 2016 Denotes holiday March 2016 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Appendix

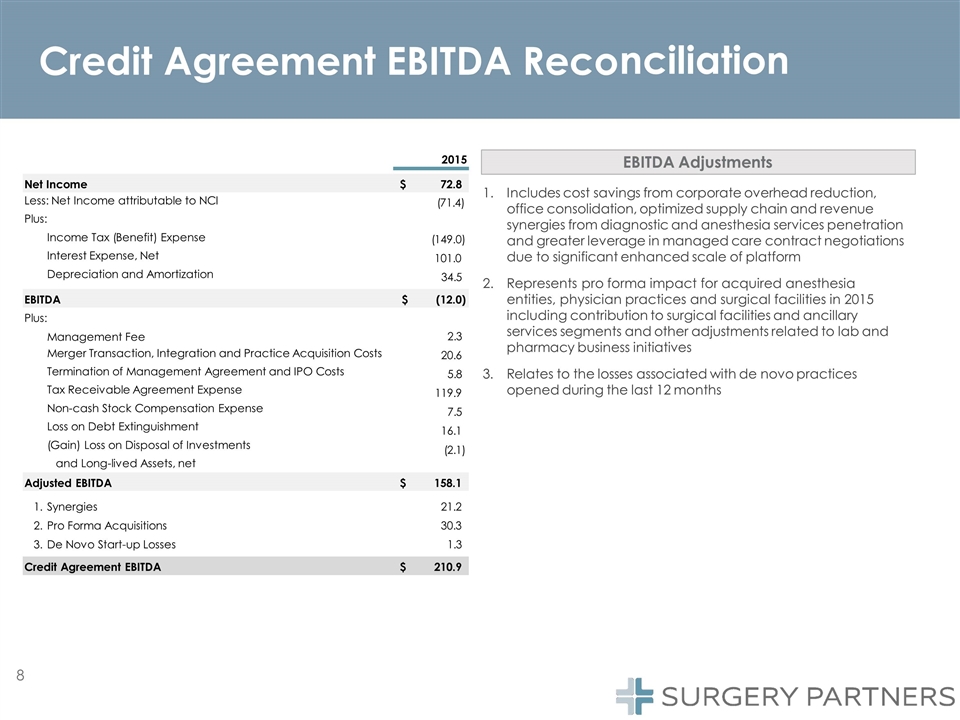

Credit Agreement EBITDA Reco nciliation Includes cost savings from corporate overhead reduction, office consolidation, optimized supply chain and revenue synergies from diagnostic and anesthesia services penetration and greater leverage in managed care contract negotiations due to significant enhanced scale of platform Represents pro forma impact for acquired anesthesia entities, physician practices and surgical facilities in 2015 including contribution to surgical facilities and ancillary services segments and other adjustments related to lab and pharmacy business initiatives Relates to the losses associated with de novo practices opened during the last 12 months EBITDA Adjustments 2015 Net Income 72.8 $ Less: Net Income attributable to NCI Plus: Income Tax (Benefit) Expense Interest Expense, Net Depreciation and Amortization (71.4) (149.0) 101.0 34.5 EBITDA (12.0) $ Plus: Management Fee Merger Transaction, Integration and Practice Acquisition Costs Termination of Management Agreement and IPO Costs Tax Receivable Agreement Expense Non-cash Stock Compensation Expense Loss on Debt Extinguishment (Gain) Loss on Disposal of Investments and Long-lived Assets, net 2.3 20.6 5.8 119.9 7.5 16.1 (2.1) Adjusted EBITDA 158.1 $ Synergies Pro Forma Acquisitions De Novo Start-up Losses 21.2 30.3 1.3 Credit Agreement EBITDA 210.9 $