Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Digital Turbine, Inc. | v434171_8k.htm |

Exhibit 99.1

28 th Annual ROTH Conference March 14, 2016

2 © 2016 Digital Turbine, Inc. Safe Harbor Statements . This presentation includes “forward - looking statements” within the meanings of the U . S . federal securities laws . Statements in this presentation that are not statements of historical fact and that concern future results from operations, financial position, economic conditions, product releases, and any other statement that may be construed as a prediction of future performance or events, including financial projections, new customers and growth in various products, are forward - looking statements that speak only as of the date made and which involve known and unknown risks, uncertainties and other factors which may, should one or more of these risks uncertainties or other factors materialize, cause actual results to differ materially from those expressed or implied by such statements . These factors include risks associated with DT Ignite adoption among existing customers (including the impact of possible delays with major carriers and OEM partners in the roll out for mobile phones deploying DT Ignite) ; actual mobile device sales and sell - through where DT Ignite is deployed is out of our control ; risks associated with the timing of the launch of the Samsung Galaxy S 7 ; new customer adoption and time to revenue with new carrier and OEM partners is subject to delays and factors out of our control ; risks associated with fluctuations in the number of DT Ignite slots across US carrier partners ; required customization and technical integration which may slow down time to revenue notwithstanding the existence of a distribution agreement ; risk that strong Apple iPhone sales could result in a disproportionately low amount of Android sales ; the difficulty of extrapolating monthly demand to quarterly demand ; the challenges, given the Company's comparatively small size, to expand the combined Company's global reach, accelerate growth and create a scalable, low capex business model that drives EBITDA (as well as Adjusted EBITDA) ; challenges to realize anticipated operational efficiencies, revenue (including projected revenue) and cost synergies and resulting revenue growth, EBITDA ( and Adjusted EBITDA) and free cash flow conversion from the Appia merger ; the impact of currency exchange rate fluctuations on our reported GAAP financial statements, particularly in regard to the Australian dollar ; ability as a smaller company to manage international operations ; varying and often unpredictable levels of orders ; the challenges inherent in technology development necessary to maintain the Company’s competitive advantage ; such as adherence to release schedules and the costs and time required for finalization and gaining market acceptance of new products ; changes in economic conditions and market demand ; rapid and complex changes occurring in the mobile marketplace ; pricing and other activities by competitors ; pricing risks associated with potential commoditization of the Appia Core as competition increases and new technologies add pricing pressure ; technology management risk as the company needs to adapt to complex specifications of different carriers and the management of a complex technology platform given the company's relatively limited resources, and other risks including those described from time to time in Digital Turbine’s filings on Forms 10 - K and 10 - Q with the SEC, press releases and other communications . You should not place undue reliance on these forward - looking statements . The Company does not undertake to update forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law .

Carriers and OEM’s look for new sources of revenue from both advertising and data Current market trends driving opportunity Carriers search for relevance from a subscriber perspective (avoid the dumb pipe) App economy is here to stay – 80%+ of content consumed on smartphones through apps App discovery continues to be an issue for the ecosystem Content is king but distribution is the emperor Mobile advertising is in it’s infancy Media spend over - indexed on traditional formats and significantly under - indexed on mobile

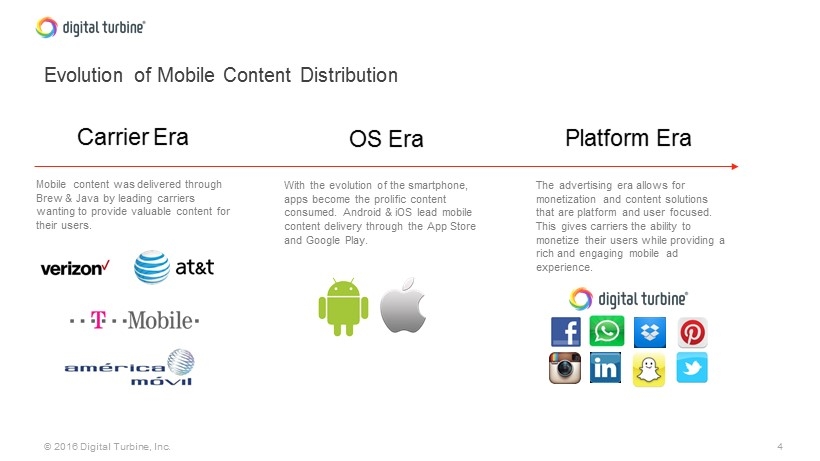

4 © 2016 Digital Turbine, Inc. Evolution of Mobile Content Distribution Mobile content was delivered through Brew & Java by leading carriers wanting to provide valuable content for their users. Carrier Era With the evolution of the smartphone, apps become the prolific content consumed. Android & iOS lead mobile content delivery through the App Store and Google Play. OS Era The advertising era allows for monetization and content solutions that are platform and user focused. This gives carriers the ability to monetize their users while providing a rich and engaging mobile ad experience. Platform Era

5 © 2016 Digital Turbine, Inc. Facebook is currently driving approximately $4.5 billion in quarterly mobile ad revenue FB stock hits low of $17.73 on September 4, 2012 Launches app install ads on October 17, 2012 Facebook now has generated over 1.2B downloads with ~1.4 billion mobile monthly active users Source: Facebook Fourth Quarter 2015 Results Parallel

6 © 2016 Digital Turbine, Inc. Digital Turbine’s platform solves problems for all participants in the app economy Consumer • Discovery • Provides user control and choices • Relevant content through data science and analytics Advertiser • User acquisition • Unique ad format through device home screen • Consumer eyeballs in mobile applications Operators and OEMs • Monetization disproportionately going to other players • Connects the dots to reintroduce into the app economy • Retaining ownership of consumer experience

Digital Turbine is uniquely positioned to capitalize on this market opportunity • Platform vs. ad tech • Unique ad unit through the device home screen • Access to unique data sets • Scale economics where the winners win disproportionately

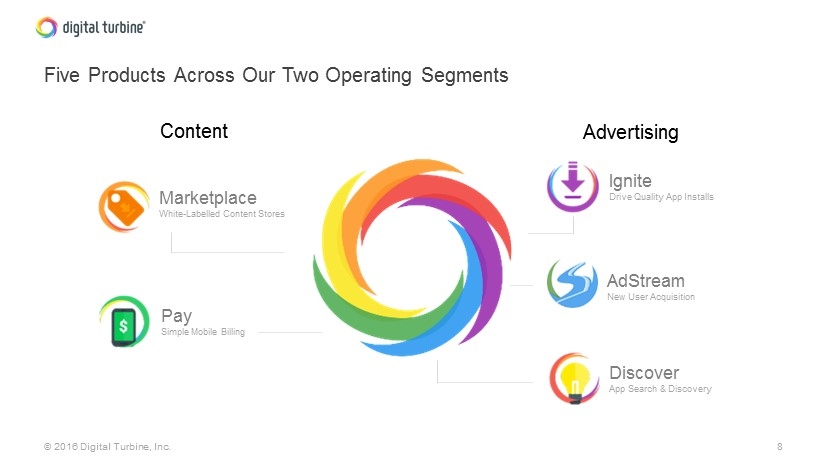

8 © 2016 Digital Turbine, Inc. Five Products Across Our T wo Operating Segments Marketplace White - Labelled Content Stores Pay Simple Mobile Billing Ignite Drive Quality App Installs AdStream New User Acquisition Content Discover App Search & Discovery Advertising

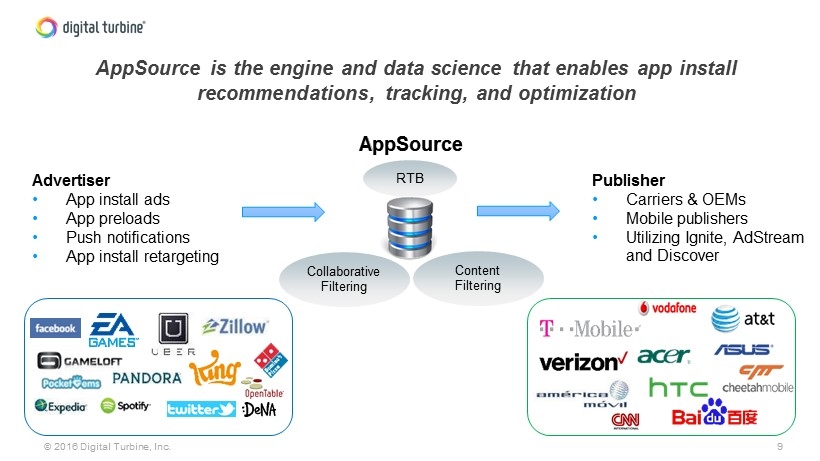

9 © 2016 Digital Turbine, Inc. AppSource is the engine and data science that enables app install recommendations, tracking, and optimization AppSource RTB Collaborative Filtering Content Filtering Advertiser • App install ads • App preloads • Push notifications • App install retargeting Publisher • Carriers & OEMs • Mobile publishers • Utilizing Ignite, AdStream and Discover

10 © 2016 Digital Turbine, Inc. Ignite attacking four market segments Operators OEMs SIM Cards Alternative Distribution Ignite Drive Quality App Installs

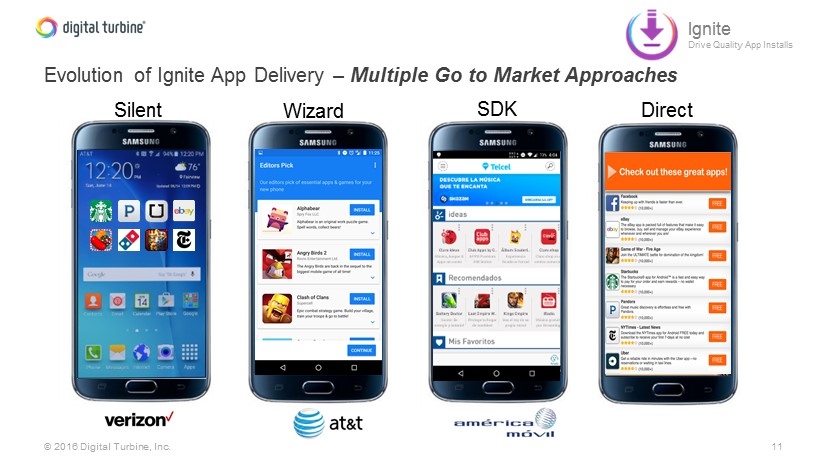

11 © 2016 Digital Turbine, Inc. Evolution of Ignite App Delivery – Multiple Go to Market Approaches Silent Wizard SDK Ignite Drive Quality App Installs Direct

12 © 2016 Digital Turbine, Inc. Ignite Direct expands addressable market including Apple iOS • In some markets >80% of activations are SIM only • Ignite Direct loads on the SIM card: • Sold in operator shops • Already in the market • Customers pre - select apps that match their needs • Expand market to other devices and operating systems • First path to implementation on iOS • Includes Android • Tablets and other connected devices • Expect first pilot launch in Summer in Asia Ignite Drive Quality App Installs

13 © 2016 Digital Turbine, Inc. Signed contracts with major global players Partnered with 25+ mobile operators and OEM’s Major anchor tenants in key geographies

14 © 2016 Digital Turbine, Inc. Roadmap for deployment of new major distributor partners Source: Company websites • Launched • 62M subs • Launched • 5 M subs • Expected launch 3/25 • >100 M subs • Expected launch June quarter • 2M annual devices • Expected launch June quarter • 15M annual devices • Expansion to six total markets • 96M subs • Expected Launch June quarter • Embedded Base opportunity • 289M subs • Re - booting for expected June quarter launch • Touch over 100M Smartphones/year in India • Expected Launch June quarter • 123M subs • Multiple Devices expected this Summer including S7

15 © 2016 Digital Turbine, Inc. Travel Social Real Estate Finance Strong Demand for DT Media Advertising Inventory Digital Turbine works with top tier Advertisers & Advertising Agencies including the top grossing apps on the App Store and Google Play Retail Music Entertainment Gaming Shopping Agency

16 © 2016 Digital Turbine, Inc. Operational updates over next 100 days impacting results • Opportunities : • Embedded - base push to América Móvil Android users • Cricket – six devices identified for deployment between now and 6/30 • Deutsche Telekom – multiple devices across 6 countries • India – material new carrier announcement and MSAI deployment • AT&T – multiple devices for deployment , including Samsung Galaxy S7 • MTS – multiple devices • Content Business strength driven by record DT Pay performance • Samsung Galaxy S7 on T - Mobile (Discover) and US Cellular • Risks • Average slot count across one North American operator • Timing of Ignite launch on Samsung Galaxy S7 with Verizon • Timing of InfoSonics deployment • Softness in Appia Core syndicated network business Q4 and Q1 – Opportunities & Risks

17 © 2016 Digital Turbine, Inc. x At center of the secular trend of mobile application media dollar growth x Unique access to a device’s home screen to deliver apps and ads x Growing global customer base of carriers, OEMs, advertisers, and other partners x Products and services attacking all parts of the market x Tremendous operating leverage within the business x Experienced management team Investment Thesis

Thank You Digital Turbine @digitalTurbine digitalTurbine