Attached files

| file | filename |

|---|---|

| 8-K - 8-K 3/14/16 CITI INVESTOR PRESENTATION - APARTMENT INVESTMENT & MANAGEMENT CO | a31416citiinvestorpresenta.htm |

CITI 2016 GLOBAL PROPERTY CEO CONFERENCE

2 STRATEGIC AREAS OF FOCUS REDEVELOPMENT • Redevelopment is a core business activity • Robust pipeline of redevelopment opportunities within existing portfolio • Occasional development when warranted by risk-adjusted returns • Above-average property operating results over cycle • Above-average resident retention • Peer-leading expense control PROPERTY OPERATIONS • Diversified across markets and price points to reduce volatility in revenue • Disciplined capital recycling to upgrade portfolio • Peer-leading growth in average revenue per apartment home PORTFOLIO MANAGEMENT • Quantity of leverage in line with peers and declining • Quality of leverage superior to peers • Growing unencumbered pool adding financial flexibility • Rated investment grade by S&P and by Fitch BALANCE SHEET • Focus on ownership and operation of apartment communities • Add value through operational excellence and redevelopment • Live our values, foster a culture of success and work collaboratively every day to achieve our goals BUSINESS & CULTURE

3 AIMCO VALUE CREATION ECONOMIC INCOME: year-over-year NAV growth plus annual dividend 2015 Economic Income: $5.28 per share* 14% Return on Beginning-of-Year NAV $3.10 Property Operations Aimco’s 2015 Same Store NOI growth of 5.6% created ~$3.00 of NAV per share. $0.50 Redevelopment Annual investment of $200 - $300M, at value creation averaging 25 - 35% of investment. Adds $0.50 to NAV per share annually. $0.50 Balance Sheet Each year, Aimco funds from retained earnings ~$80M of property debt amortization, adding $0.50 to NAV per share. $1.18 Annual Dividend Cash dividends per share up 13% to $1.18. * Represents the sum of a) the year-over-year change in consensus NAV as reported by KeyBanc Capital Markets and b) cash dividends per share paid by Aimco during 2015.

PROPERTY OPERATIONS STRATEGY 4 STRATEGY PROVIDES FOR • Greater NOI contribution: Renewal lease rate increases are generally higher than new lease rate increases; renewals avoid costs associated with turnover: higher vacancy, refurbishment, and marketing. • More predictable operating results: Renewal lease rate increases are less volatile; operating costs more predictable. PRODUCE ABOVE- AVERAGE OPERATING RESULTS • Focus on customer satisfaction, resident retention, and superior cost control

• Focus on customer satisfaction and resident retention: from 2011 through 2015, Aimco turnover averaged 47% compared to the peer average of 53%*. • Continued strong demand: Aimco lease rate increases in 2015 were greater than in 2014, and to date, 2016 lease rate increases have accelerated. SAME STORE RENTAL RATES 5 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Same Store Rental Rates 2014 Wt. Avg. 2015 Wt. Avg. 2016 Wt. Avg. * Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR. Source: Bank of America Merrill Lynch.

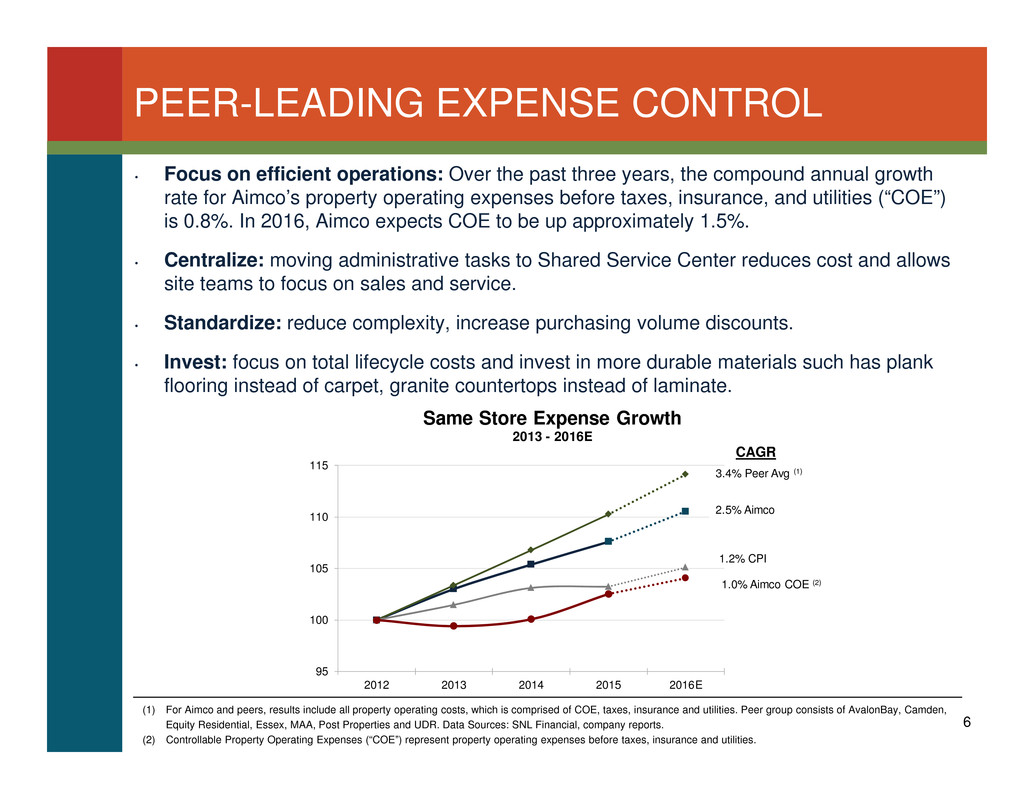

1.2% CPI 2.5% Aimco 3.4% Peer Avg (1) 1.0% Aimco COE (2) 95 100 105 110 115 2012 2013 2014 2015 2016E Same Store Expense Growth 2013 - 2016E PEER-LEADING EXPENSE CONTROL 6 (1) For Aimco and peers, results include all property operating costs, which is comprised of COE, taxes, insurance and utilities. Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR. Data Sources: SNL Financial, company reports. (2) Controllable Property Operating Expenses (“COE”) represent property operating expenses before taxes, insurance and utilities. • Focus on efficient operations: Over the past three years, the compound annual growth rate for Aimco’s property operating expenses before taxes, insurance, and utilities (“COE”) is 0.8%. In 2016, Aimco expects COE to be up approximately 1.5%. • Centralize: moving administrative tasks to Shared Service Center reduces cost and allows site teams to focus on sales and service. • Standardize: reduce complexity, increase purchasing volume discounts. • Invest: focus on total lifecycle costs and invest in more durable materials such has plank flooring instead of carpet, granite countertops instead of laminate. CAGR

Looking ahead: Aimco expects same-store NOI growth above trend due to solid demand for apartments and our continued focus on cost control. Our 2017 Forecast assumes: • Renewal rents increases at 4.5% and New Lease rents increase at 3.9%, the average of submarket growth rates projected by REIS and AXIOMetrics as of 3Q 2015. • Operating expenses increase at a market-weighted inflation rate as projected by Moody's Economy.com. Sensitivity to assumptions: • $0.025 impact to 2017 AFFO per share for each 50 basis point change in the assumed rate of 2017 revenue growth. • $0.01 impact to 2017 AFFO per share for each 50 basis point change in the assumed rate of expense growth. PROPERTY OPERATIONS FORECAST 7 4.75% 2.75% 5.75% 4.25% 2.75% 4.75% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Revenue Expense NOI Projected Same Store Growth Rates 2016 Outlook 2017 Forecast

• During 2016 and 2017, Aimco expects to lease-up three newly-constructed communities, which communities are projected to make a neutral contribution to NOI in 2016, and to contribute $0.12 per share to 2017 NOI. Sensitivity to assumptions: • If the lease-up of these communities is six months faster or slower, the contribution to NOI would be plus or minus $0.02 per share in 2016, and plus or minus $0.03 per share in 2017. • If the lease-up of these communities is achieved at rents 10% higher or lower, the contribution to NOI would be plus or minus $0.01 per share in 2016, and plus or minus $0.02 per share in 2017. LEASE-UP COMMUNITIES 8 Schedule Total Apt. Homes Apt. Homes Leased as of 3/10/2016 Initial Occupancy Stabilized Occupancy Stabilized NOI Stabilized Revenue per Apt. Home Commercial Revenue ONE CANAL, BOSTON 310 14 2Q 2016 3Q 2017 4Q 2018 $ 3,865 $1.1M VIVO, CAMBRIDGE 91 55 4Q 2015 3Q 2016 4Q 2017 $ 2,600 $0.3M 2016 ACQUISITION, BAY AREA 463 16 2Q 2016 3Q 2017 4Q 2018 $ 4,130 -

REDEVELOPMENT STRATEGY 9 BUY RIGHT • Own and operate real estate in special locations where land value appreciates faster than buildings depreciate • Higher-growth markets support strategic redevelopment opportunities REDEVELOP WITHIN PORTFOLIO • Reposition existing operating properties through phased redevelopment • Vacate smaller properties on a select basis • Take advantage of opportunities to increase density through development of existing vacant land or zoning modifications Lincoln Place, Venice, CA

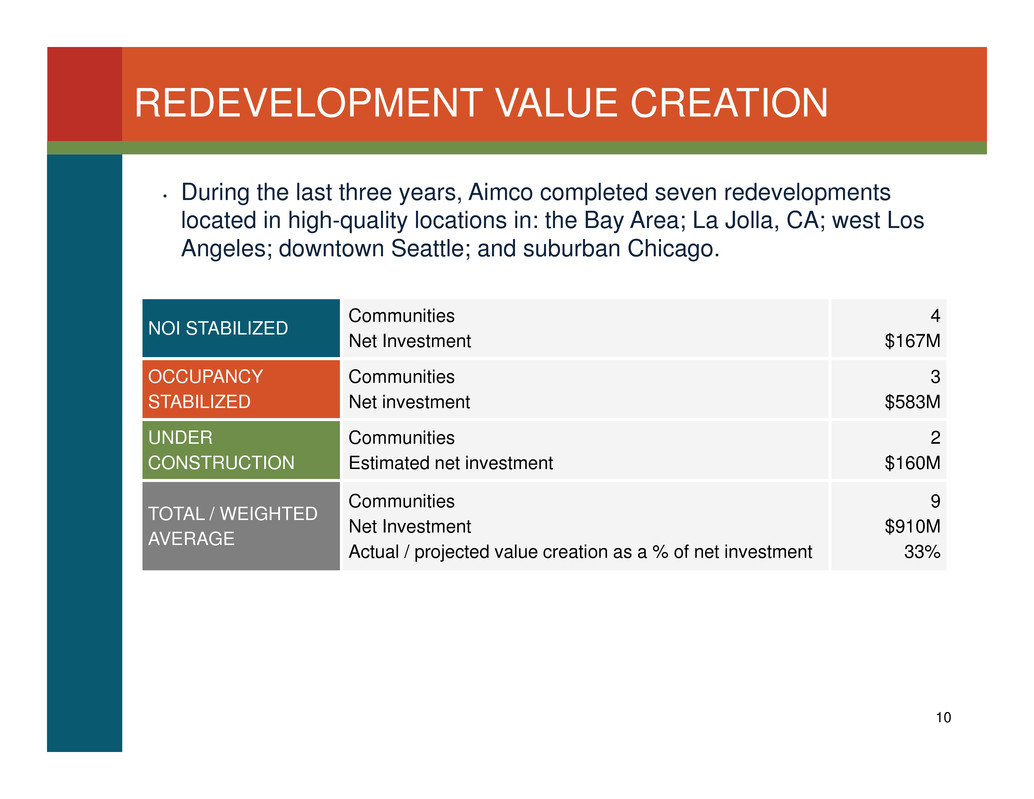

10 REDEVELOPMENT VALUE CREATION NOI STABILIZED Communities Net Investment 4 $167M OCCUPANCY STABILIZED Communities Net investment 3 $583M UNDER CONSTRUCTION Communities Estimated net investment 2 $160M TOTAL / WEIGHTED AVERAGE Communities Net Investment Actual / projected value creation as a % of net investment 9 $910M 33% • During the last three years, Aimco completed seven redevelopments located in high-quality locations in: the Bay Area; La Jolla, CA; west Los Angeles; downtown Seattle; and suburban Chicago.

11 2016 REDEVELOPMENT FOCUS NOI STABILIZATION OF COMPLETED CALIFORNIA REDEVELOPMENTS BAY AREA Preserve at Marin (126 Apartments) PHILADELPHIA The Sterling (Expanded Scope) Park Towne Place (Expanded Scope) GREATER LA Lincoln Place (795 Apartments) BOSTON One Canal (310 Apartments) SAN DIEGO Ocean House on Prospect (53 Apartments) COMPLETION OF CONSTRUCTION OF APPROVED REDEVELOPMENTS AND DEVELOPMENT PROJECTS IN PHILADELPHIA AND BOSTON • Achieve NOI stabilization of occupancy stabilized communities and occupancy stabilization of communities under construction, contributing incremental NOI of $0.06 per share in 2016 and $0.09 per share in 2017. • Continue to plan additional 2017 and 2018 starts to backfill redevelopment pipeline and support spending of $200M to $300M per annum.

12 WHAT’S NEXT FOR REDEVELOPMENT? REDEVELOPMENT PIPELINE BAY AREA 707 Leahy (110 Apartments) CHICAGO Yorktown Apartments (364 Apartments) Yorktown Apartments Expansion (~100 Apartments) MIAMI Yacht Club at Brickell (357 Apartments) PHILADELPHIA The Sterling (Expanded Scope) Park Towne Place (Expanded Scope) DENVER Eastpointe (140 Apartments) GREATER LA Palazzo East (611 Apartments) Villas at Park La Brea (250 Apartments) The Palazzo at Park La Brea (Expanded Scope) 3400 Avenue of the Arts (Expanded Scope) Pipeline projects included in the above have not yet been approved by Aimco’s Investment Committee. Approved redevelopment projects and scope may differ materially from the above.

13 PORTFOLIO STRATEGY To continuously upgrade our portfolio through redevelopment, property upgrades, acquisitions, and limited development activity. • We do this through a strict paired-trade discipline with: • DISPOSITION of 5-10% of our portfolio annually, primarily from submarkets with lower revenue growth prospects; and • REINVESTMENT of these proceeds in properties in target submarkets with above-average revenue growth prospects. • We maintain sufficient geographic and price point DIVERSIFICATION to limit volatility and concentration risk, while focusing investment in higher growth, higher margin submarkets. • We offer a product that ATTRACTS highly qualified residents with positive prospects for income growth and the ability and willingness to pay for high quality properties and service.

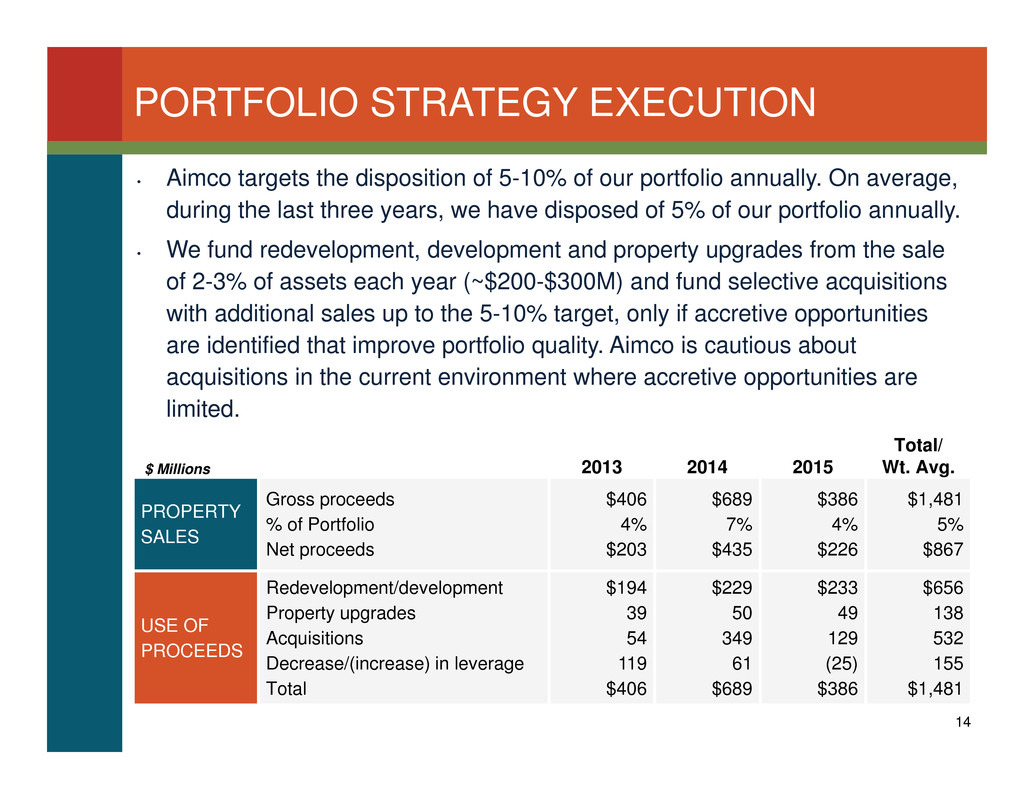

PORTFOLIO STRATEGY EXECUTION 14 • Aimco targets the disposition of 5-10% of our portfolio annually. On average, during the last three years, we have disposed of 5% of our portfolio annually. • We fund redevelopment, development and property upgrades from the sale of 2-3% of assets each year (~$200-$300M) and fund selective acquisitions with additional sales up to the 5-10% target, only if accretive opportunities are identified that improve portfolio quality. Aimco is cautious about acquisitions in the current environment where accretive opportunities are limited. $ Millions 2013 2014 2015 Total/ Wt. Avg. PROPERTY SALES Gross proceeds % of Portfolio Net proceeds $406 4% $203 $689 7% $435 $386 4% $226 $1,481 5% $867 USE OF PROCEEDS Redevelopment/development Property upgrades Acquisitions Decrease/(increase) in leverage Total $194 39 54 119 $406 $229 50 349 61 $689 $233 49 129 (25) $386 $656 138 532 155 $1,481

• Aimco’s portfolio management activities have resulted in a significant improvement in portfolio quality. • Over the last three years, Aimco has exited: Dallas; Daytona Beach; Detroit; Fort Wayne, IN; Grand Rapids, MI; Houston; Jacksonville; Lexington, MD; Naples, FL; Orlando; Palm Beach, FL; Phoenix; and Tampa. 15 PORTFOLIO TRANSFORMATION (1) Aimco defines asset quality as follows: "A" quality assets are those with rents greater than 125% of local market average; "B" quality assets are those with rents 90% to 125% of local market average; and “C+” quality assets are those with rents greater than $1,100 per month but less than 90% of local market average. The table above illustrates Aimco’s Conventional portfolio quality based on market data for fourth quarter 2012 and fourth quarter 2015. Average revenue per apartment home figures are for the fourth quarter 2015. (2) Assumes capital replacements of $1,200 per apartment home per year. Year-End 2012 Year-End 2015 % Change FOOTPRINT Communities Apartment Homes % NOI in Target Markets 175 55,879 85% 140 40,464 91% - 20% - 28% + 7% QUALITY(1) Revenue per Apartment Home Percentage A (Rev/Home $2,340) Percentage B (Rev/Home $1,630) Percentage C+ (Rev/Home $1,540) Percentage C $1,362 34% 35% 21% 10% $1,840 51% 32% 17% - + 35% + 50% - 9% - 19% -100% PROFITABILITY NOI Margin Free Cash Flow Margin(2) 64% 56% 67% 61% + 5% + 9%

PORTFOLIO MANAGEMENT FOCUS 16 Acquisition Avg. of Sold to Fund Acquisition Acquisition vs. Sold QUALITY COMPARISON Age Stabilized revenue per apartment home (1) Median home values (2) Newly constructed $4,130 $765,000 36 years $1,459 $344,000 - 36 + $2,671 + 421,000 FINANCIAL COMPARISON 10-Year FCF IRR (3) 10-Year avg. annual revenue growth rate (4) Stabilized NOI yield Stabilized FCF yield (3) Stabilized NOI margin Stabilized FCF margin (3) 7.9% 3.6% 4.9% 4.7% 67% 65% 6.6% 2.8% 4.9% 4.4% 59% 52% + 130 bps + 80 bps - + 30 bps + 800 bps + 1200 bps • Through market rent growth and disciplined capital recycling, we expect revenue per apartment home to approximate $1,950 at 2016 year-end and $2,050 at 2017 year-end. • We anticipate closing the acquisition of a newly constructed apartment community located in the Bay Area upon its completion in 2Q 2016. • This paired trade results in: higher portfolio average rents; higher NOI and FCF margins; higher quality customers; and lower portfolio average age. Bay Area Acquisition Analysis (1) For acquisition property, represents projected average revenue per apartment home upon NOI stabilization in 4Q 2018. Aimco projects revenues at lease-up beginning in 2Q 2016 to average $3,800 per apartment home, representing a discount to stabilized rents to account for concessions offered through lease-up. (2) Source: ESRI (3) FCF assumes annual capital replacements spending of $1,200 per apartment home for the community acquired and for the communities sold. (4) Source: REIS

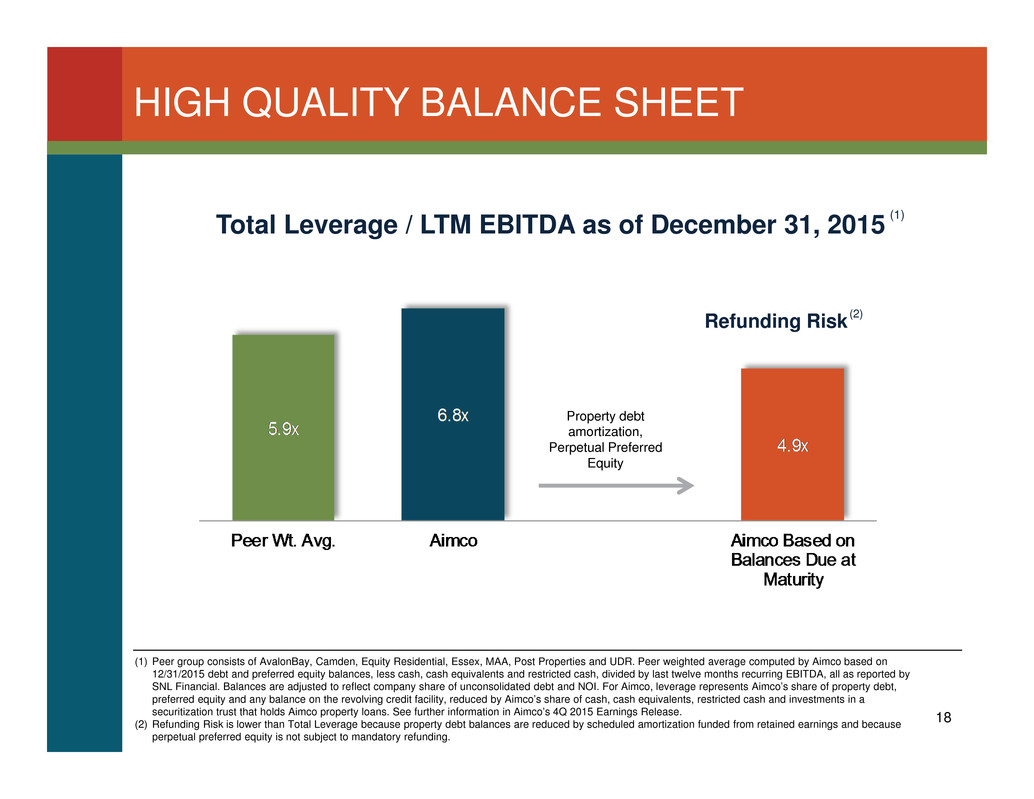

HIGH QUALITY BALANCE SHEET • During the last three years, Aimco has reduced leverage and added financial flexibility by creating an unencumbered pool of assets. In 2015, both S&P and Fitch rated the Aimco balance sheet “investment grade.” • Aimco Debt and Preferred Equity to EBITDA of 6.8x reflects outstanding balances at 12/31/2015, but overstates the refunding risk of our leverage. • Our property debt balances at maturity are more than $800 million lower than year-end 2015 balances as principal amortization is paid from retained earnings. 17 Year-End 2012 Year-End 2015 % Change DEBT TO EBITDA 7.5x 6.4x - 15% DEBT AND PREFERRED EQUITY TO EBITDA 7.8x 6.8x - 13% VALUE OF UNENCUMBERED ASSETS $0.0B $1.8B +100%

HIGH QUALITY BALANCE SHEET (1) Peer group consists of AvalonBay, Camden, Equity Residential, Essex, MAA, Post Properties and UDR. Peer weighted average computed by Aimco based on 12/31/2015 debt and preferred equity balances, less cash, cash equivalents and restricted cash, divided by last twelve months recurring EBITDA, all as reported by SNL Financial. Balances are adjusted to reflect company share of unconsolidated debt and NOI. For Aimco, leverage represents Aimco’s share of property debt, preferred equity and any balance on the revolving credit facility, reduced by Aimco’s share of cash, cash equivalents, restricted cash and investments in a securitization trust that holds Aimco property loans. See further information in Aimco’s 4Q 2015 Earnings Release. (2) Refunding Risk is lower than Total Leverage because property debt balances are reduced by scheduled amortization funded from retained earnings and because perpetual preferred equity is not subject to mandatory refunding. Property debt amortization, Perpetual Preferred Equity Total Leverage / LTM EBITDA as of December 31, 2015 (1) Refunding Risk (2) 18

Year-End 2015 Year-End 2017 Forecast % Change DEBT TO EBITDA 6.4x ~ 5.9x - 8% DEBT AND PREFERRED EQUITY TO EBITDA 6.8x ~ 6.3x - 7% VALUE OF UNENCUMBERED ASSETS $1.8B $2.1B +17% • Looking ahead: We expect the quantum of leverage to remain fairly constant over the next several years and that our leverage ratios will improve due to NOI growth in our same store portfolio and the earn-in from stabilization of redevelopments and lease-up properties. • Exposure to interest rates: Aimco has limited near-term exposure to changes in interest rates due to the long duration and fixed rates of its leverage. A 100 basis point change in the 10-year treasury rate leading to an equal change in Aimco borrowing rates would have a negligible impact on projected 2016 AFFO per share and would change, plus or minus, forecasted 2017 AFFO per share by $0.01. • Exposure to capital markets: Aimco's operating, investing and financing activities have limited exposure to capital markets with 2016 and 2017 fully funded by: (i) continuing operations, (ii) selling $625M - $725M in properties (a reduction of approximately 30% from our average annual sales during the past three years), and (iii) the refinancing of $575M of maturing property debt with average LTVs at maturity of 30%. Aimco's business plans do not contemplate equity issuance. FOCUS ON REDUCING LEVERAGE 19

Integrity Respect CollaborationCustomer Focus Performance Our Vision To be the best owner and operator of apartment communities, inspired by a talented team committed to exceptional customer service, strong financial performance, and outstanding corporate citizenship. Aimco Cares In 2014, we celebrated 10 years of Aimco Cares. Over the last decade: Aimco team members have contributed tens of Top Work Place In 2015, Aimco was again recognized by the Denver Post as a Top Work Place based on independent surveys of ~300 team members. thousands of volunteer hours to hundreds of non-profit organizations; the annual Aimco Cares Charity Golf Classic has raised nearly $3 million for patriotic and educational causes; and Aimco has awarded nearly 500 college scholarships to help team members with the cost of their child’s higher education. 2013 2014 2015 WE LIVE OUR VALUES 20

• Aimco's expectations for the 2016 and 2017 reflect continuation of the strategy Aimco has executed over the last several years. Consistent execution of that strategy has produced: • Improved operating results; • An improved portfolio; • A simpler business with lower non-core earnings; • Safer leverage; • Reduced offsite costs; and • Increased AFFO per share, cash dividends per share; and NAV per share. • At the midpoint of guidance, Aimco expects 2016 AFFO per share to increase approximately 4% compared to 2015. We anticipate re-acceleration of AFFO per share growth in 2017 with: • Same Store revenue and Net Operating Income growth in 2017, adding $0.15 per share to AFFO; • Earn-in of Net Operating Income from redevelopment communities of $0.09; • Earn-in of Net Operating Income from lease-up communities of $0.12 per share; • Lower AFFO of $0.09 per share caused by selling properties in 2016 and 2017 to fund investment activities; • Lower non-core earnings as Aimco continues to simplify its business, lowering AFFO by $0.08 per share compared to 2016; and • Lower offsite costs as Aimco scales its overhead to its more focused activities, adding $0.01 to AFFO per share in 2017. SUMMARY EXPECTATIONS FOR 2016 & 2017 21

22 FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation contains forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected results and specifically forecasts of: selected components of Pro forma FFO and AFFO per share; Aimco's redevelopment and development timelines and NOI contribution; Aimco's lease-up timelines and NOI contribution; expectations regarding sales of Aimco apartment communities and the use of proceeds therefrom; and Aimco liquidity and leverage metrics. These forward-looking statements are based on management's judgment as of this date and include certain risks and uncertainties. Risks and uncertainties include, but are not limited to: Aimco's ability to maintain current or meet projected occupancy, rental rates and property operating results; the effect of acquisitions, dispositions, redevelopments and developments; Aimco's ability to meet budgeted costs and timelines, and achieve budgeted rental rates related to our developments and redevelopments; Aimco's ability to meet timelines and budgeted rental rates related to our lease-up properties; and Aimco's ability to comply with debt covenants, including financial coverage ratios. Actual results may differ materially from those described in these forward-looking statements and, in addition, will be affected by a variety of risks and factors, some of which are beyond Aimco's control, including, without limitation: real estate risks, including fluctuations in real estate values and the general economic climate in the markets in which Aimco operates and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new supply; financing risks, including the availability and cost of capital markets financing and the risk that our cash flows from operations may be insufficient to meet required payments of principal and interest; the risk that our earnings may not be sufficient to maintain compliance with debt covenants; the terms of governmental regulations that affect Aimco and interpretations of those regulations; the competitive environment in which Aimco operates; the timing of acquisitions, dispositions, redevelopments and developments; insurance risk, including the cost of insurance; natural disasters and severe weather such as hurricanes; litigation, including costs associated with prosecuting or defending claims and any adverse outcomes; energy costs; and possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently or previously owned by Aimco. In addition, Aimco's current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code and depends on its ability to meet the various requirements imposed by the Internal Revenue Code, through actual operating results, distribution levels and diversity of stock ownership. Readers should carefully review Aimco's financial statements and the notes thereto, as well as the section entitled "Risk Factors" in Item 1A of Aimco's Annual Report on Form 10-K for the year ended December 31, 2015, and the other documents Aimco files from time to time with the Securities and Exchange Commission. These forward-looking statements reflect management's judgment as of this date, and Aimco assumes no obligation to revise or update them to reflect future events or circumstances. This presentation does not constitute an offer of securities for sale. Glossary & Reconciliations of Non-GAAP Financial and Operating Measures Financial and operating measures discussed in this document include certain financial measures used by Aimco management, some of which are measures not defined under accounting principles generally accepted in the United States, or GAAP. These measures are defined in the Glossary included in Aimco's Fourth Quarter 2015 Earnings Release dated February 4, 2016. Where appropriate, the non-GAAP financial measures for Aimco's 2015 results and 2016 guidance included within this document have been reconciled to the most comparable GAAP measures within Aimco's Fourth Quarter 2015 Earnings Release referenced above.