Attached files

| file | filename |

|---|---|

| 10-K - 10-K - SI Financial Group, Inc. | sifi1231201510k.htm |

| EX-10.2 - EXHIBIT 10.2 - SI Financial Group, Inc. | exhibit102.htm |

| EX-31.1 - EXHIBIT 31.1 - SI Financial Group, Inc. | sifi12312015ex311.htm |

| EX-21.0 - EXHIBIT 21.0 - SI Financial Group, Inc. | sifi12312015ex210.htm |

| EX-31.2 - EXHIBIT 31.2 - SI Financial Group, Inc. | sifi12312015ex312.htm |

| EX-32.0 - EXHIBIT 32.0 - SI Financial Group, Inc. | sifi12312015ex320.htm |

| EX-23.1 - EXHIBIT 23.1 - SI Financial Group, Inc. | sifi12312015ex231.htm |

| EX-10.14 - EXHIBIT 10.14 - SI Financial Group, Inc. | exhibit1014.htm |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

General

Management’s discussion and analysis of financial condition and results of operations is intended to assist in understanding changes in the Company’s financial condition as of December 31, 2015 and 2014 and the results of operations for the years ended December 31, 2015, 2014 and 2013. The information contained in this section should be read in conjunction with the consolidated financial statements and notes contained elsewhere in this annual report.

This report may contain certain “forward-looking statements” within the meaning of the federal securities laws, which are made in good faith pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally preceded by terms such as “expects,” “believes,” “anticipates,” “intends,” “estimates,” “projects” and similar expressions. These statements are not historical facts; rather, they are statements based on management’s current expectations regarding our business strategies, intended results and future performance.

Management’s ability to predict results of the effect of future plans or strategies is inherently uncertain. Factors that could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to, changes in interest rates, national and regional economic conditions, legislative and regulatory changes, monetary and fiscal policies of the United States government, including policies of the United States Treasury and the Federal Reserve Board, the quality and composition of the loan and investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, changes in real estate market values in the Company’s market area and changes in relevant accounting principles and guidelines. Additional factors that may affect the Company’s results are discussed in Item 1A. “Risk Factors” in the Company’s annual report on Form 10-K and in other reports filed with the Securities and Exchange Commission (the “SEC”). These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Except as required by applicable law or regulation, the Company does not undertake, and specifically disclaims any obligation, to release publicly the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of the statements or to reflect the occurrence of anticipated or unanticipated events.

Management Strategies

The Company’s mission is to operate and grow a profitable community-oriented financial institution. The Company plans to achieve this mission by continuing its strategies of:

◦ | Offering a full range of financial products and services. The Bank has a long tradition of focusing on the needs of consumers and small and medium-sized businesses in the community and being an active corporate citizen. The Bank believes its community orientation, quicker decision-making process and customized products are attractive to its customers and distinguishes it from the large regional banks that operate in its market area. The Bank serves as a financial services company offering one-stop shopping for all of its customers’ financial needs through banking, investments, insurance and trust products and services. The Bank believes that its broad array of product offerings deepen its relationships with its current customers and entice new customers to begin banking with them, ultimately increasing fee income and profitability. |

◦ | Actively managing the balance sheet and diversifying the asset mix. The recent economic recession has underscored the importance of a strong balance sheet. The Company manages its balance sheet by: (1) prudently increasing the Bank's multi-family and commercial real estate and commercial business loan portfolios, which offer higher yields, shorter maturities and more sensitivity to interest rate fluctuations; (2) managing its interest rate risk by diversifying the type and maturity of its assets in its loan and |

1

investment portfolios and monitoring the maturities in its deposit portfolio; and (3) maintaining strong capital levels and liquidity. Multi-family and commercial real estate and commercial business loans increased $126.5 million, $10.3 million and $124.5 million for the years ended December 31, 2015, 2014 and 2013, respectively, and comprised 57.7% of total loans at December 31, 2015. The Company intends to continue to pursue the opportunities from the many multi-family and commercial properties and businesses located in its market area and areas outside its market area where lenders have specialized knowledge.

◦ | Continuing conservative underwriting practices and maintaining a high quality loan portfolio. The Bank believes that strong asset quality is a key to long-term financial success. The Bank has sought to maintain a high level of asset quality and moderate credit risk by using conservative underwriting standards and by diligent monitoring and collection efforts. Nonperforming loans increased from $5.0 million at December 31, 2014 to $6.6 million at December 31, 2015. At December 31, 2015, nonperforming loans were 0.56% of the total loan portfolio and 0.44% of total assets. Although the Bank intends to continue to increase its multi-family and commercial real estate and commercial business lending, it intends to continue its philosophy of managing large loan exposures through conservative loan underwriting and credit administration standards. |

◦ | Increasing core deposits. The Bank’s primary source of funds is retail deposit accounts. At December 31, 2015, 62.7% of the Bank's deposits were core deposits, consisting of demand, savings and money market accounts. The Bank values core deposits because they represent longer-term customer relationships and a lower cost of funding compared to certificates of deposit. We expect core deposits to continue to increase primarily due to the investments the Bank has made in its branch network, new product offerings, competitive interest rates and the movement of customer funds out of riskier investments, including the stock market. The Bank intends to continue to increase its core deposits and focus on gaining market share in counties outside of Windham County in Connecticut and Newport and Washington Counties in Rhode Island by continuing to offer exceptional customer service, cross-selling its loan and deposit products and trust, insurance and investment services and increasing its commercial deposits from small and medium-sized businesses through additional business banking and cash management products. |

◦ | Supplementing fee income through expanded mortgage banking operations. The Company views the changing regulatory landscape and low interest rate environment as an opportunity to gain noninterest income by leveraging its expertise in originating residential mortgages and selling such increased originations in the secondary market. This strategy enables the Company to have a much larger lending capacity, provide a more comprehensive product offering and reduce the interest rate, prepayment and credit risks associated with originating residential loans for retention in its loan portfolio. Further, this strategy allows the Company to be more selective with the single-family residential loans that are held in portfolio. |

◦ | Grow through acquisitions. The Company intends to pursue expansion opportunities in its existing market areas or adjacent areas in strategic locations that maximize growth opportunities or with companies that add complementary products to its existing business. The Company believes that the rate of consolidation in the banking industry will continue to increase. The Company will look to be opportunistic to expand through the acquisition of banks or other financial service companies. |

Critical Accounting Policies

The discussion and analysis of the financial condition and results of operations are based on the Company’s consolidated financial statements, which are prepared in conformity with generally accepted accounting principles in the United States of America. The preparation of these financial statements requires management to make estimates and assumptions affecting the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of income and expenses. The Company considers accounting policies involving significant judgments and assumptions by management that have, or could have, a material impact on

2

the carrying value of certain assets or on income, to be its critical accounting policies. The Company considers the determination of allowance for loan losses, deferred income taxes and the impairment of long-lived assets to be its critical accounting policies.

Allowance for Loan Losses. Determining the amount of allowance for loan losses necessarily involves a high degree of judgment. Management reviews the level of the allowance on a monthly basis and establishes the provision for loan losses based on the size and the composition of the loan portfolio, delinquency levels, loss experience, economic conditions and other factors related to the collectibility of the loan portfolio. The level of the allowance for loan losses fluctuates primarily due to changes in the size and composition of the loan portfolio and in the level of nonperforming loans, delinquencies, classified assets and loan charge-offs. A portion of the allowance is established by segregating the loans by loan category and assigning allocation percentages based on our historical loss experience, delinquency trends, economic conditions and other qualitative factors. The allocation percentages are re-evaluated quarterly to ensure their relevance in the current economic environment. Accordingly, increases in the size of the loan portfolio and the increased emphasis on commercial real estate and commercial business loans, which carry a higher degree of risk of default and, thus, a higher allocation percentage, increases the allowance. Additionally, a portion of the allowance is established based on the impairment analysis of specific nonperforming loans, classified assets and troubled debt restructurings.

Although management believes that it uses the best information available to establish the allowance for loan losses, which is based on estimates that are susceptible to change, future additions to the allowance may be necessary as a result of changes in economic conditions and other factors. Additionally, the Bank’s regulators, as a part of their examination process, periodically review the allowance for loan losses and may require the Bank to increase the allowance for loan losses by recognizing additional provisions for loan losses charged to expense, or to decrease its allowance for loan losses by recognizing loan charge-offs. See Notes 1 and 4 in the Company’s Consolidated Financial Statements for additional information.

Deferred Income Taxes. The Company uses the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. If current available information raises doubt as to the realization of the deferred tax asset, a valuation allowance is established. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The Company exercises significant judgment in evaluating the amount and timing of recognition of the resulting tax assets and liabilities. These judgments require the Company to make projections of future taxable income. These judgments and estimates, which are inherently subjective, are reviewed periodically as regulatory and business factors change. A reduction in estimated future taxable income may require the Company to record a valuation allowance against its deferred tax asset. A valuation allowance would result in additional income tax expense in the period, which would negatively affect earnings. See Notes 1 and 10 in the Company’s Consolidated Financial Statements.

Impairment of Long-Lived Assets. The Company is required to record certain assets it has acquired, including identifiable intangible assets such as core deposit intangibles and goodwill, at fair value, which may involve making estimates based on third-party valuations, such as appraisals or internal valuations based on discounted cash flow analyses or other valuation techniques. Further, long-lived assets, including intangible assets and premises and equipment, that are held and used by the Company, are presumed to have a useful life. The determination of the useful lives of intangible assets is subjective, as is the appropriate amortization period for such intangible and long-lived assets. Additionally, long-lived assets are reviewed for impairment at least annually or whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. If impairment is indicated by that review, the asset is written down to its estimated fair value through a charge to noninterest expenses. Testing for impairment is a subjective process, the application of which could result in different evaluations of impairment. See Notes 1, 6 and 7 in the Company’s Consolidated Financial Statements for additional information.

Analysis of Net Interest Income

Average Balance Sheet. The following sets forth information regarding average balances of assets and liabilities as well as the total dollar amounts of interest income from average interest-earning assets and interest expense on average interest-bearing liabilities, resulting yields and rates paid, interest rate spread, net interest margin and the ratio of average interest-earning assets to average interest-bearing liabilities for the periods indicated.

Years Ended December 31, | ||||||||||||||||||||||||||||||||

2015 | 2014 | 2013 | ||||||||||||||||||||||||||||||

Average Balance | Interest & Dividends | Average Yield/ Rate | Average Balance | Interest & Dividends | Average Yield/ Rate | Average Balance | Interest & Dividends | Average Yield/ Rate | ||||||||||||||||||||||||

(Dollars in Thousands) | ||||||||||||||||||||||||||||||||

Interest-earning assets: | ||||||||||||||||||||||||||||||||

Loans (1) (2) | $ | 1,105,034 | $ | 44,396 | 4.02 | % | $ | 1,049,463 | $ | 43,673 | 4.16 | % | $ | 797,296 | $ | 33,989 | 4.26 | % | ||||||||||||||

Securities (3) | 188,695 | 3,668 | 1.94 | 185,959 | 3,863 | 2.08 | 197,047 | 4,195 | 2.13 | |||||||||||||||||||||||

Other interest-earning assets | 27,650 | 88 | 0.32 | 28,215 | 59 | 0.21 | 22,165 | 43 | 0.19 | |||||||||||||||||||||||

Total interest-earning assets | 1,321,379 | 48,152 | 3.64 | 1,263,637 | 47,595 | 3.77 | 1,016,508 | 38,227 | 3.76 | |||||||||||||||||||||||

Noninterest-earning assets | 91,778 | 91,628 | 66,689 | |||||||||||||||||||||||||||||

Total assets | $ | 1,413,157 | $ | 1,355,265 | $ | 1,083,197 | ||||||||||||||||||||||||||

Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||

Deposits: | ||||||||||||||||||||||||||||||||

Business checking | $ | 376 | — | — | $ | 158 | — | — | $ | 26 | — | — | ||||||||||||||||||||

NOW and money market | 465,888 | 523 | 0.11 | 452,393 | 575 | 0.13 | 357,736 | 504 | 0.14 | |||||||||||||||||||||||

Savings (4) | 37,895 | 70 | 0.18 | 46,964 | 79 | 0.17 | 43,253 | 75 | 0.17 | |||||||||||||||||||||||

Certificates of deposit (5) | 384,207 | 5,010 | 1.30 | 364,954 | 4,740 | 1.30 | 294,354 | 4,633 | 1.57 | |||||||||||||||||||||||

Total interest-bearing deposits | 888,366 | 5,603 | 0.63 | 864,469 | 5,394 | 0.62 | 695,369 | 5,212 | 0.75 | |||||||||||||||||||||||

Federal Home Loan Bank advances | 188,361 | 2,969 | 1.58 | 162,961 | 2,513 | 1.54 | 120,771 | 2,897 | 2.40 | |||||||||||||||||||||||

Subordinated debt | 8,248 | 329 | 3.99 | 8,248 | 336 | 4.07 | 8,248 | 336 | 4.07 | |||||||||||||||||||||||

Other borrowed funds | — | — | — | — | — | — | 3,093 | 9 | 0.29 | |||||||||||||||||||||||

Total interest-bearing liabilities | 1,084,975 | 8,901 | 0.82 | 1,035,678 | 8,243 | 0.80 | 827,481 | 8,454 | 1.02 | |||||||||||||||||||||||

Noninterest-bearing liabilities | 172,404 | 163,031 | 119,248 | |||||||||||||||||||||||||||||

Total liabilities | 1,257,379 | 1,198,709 | 946,729 | |||||||||||||||||||||||||||||

Total shareholders' equity | 155,778 | 156,556 | 136,468 | |||||||||||||||||||||||||||||

Total liabilities and shareholders' equity | $ | 1,413,157 | $ | 1,355,265 | $ | 1,083,197 | ||||||||||||||||||||||||||

Net interest-earning assets | $ | 236,404 | $ | 227,959 | $ | 189,027 | ||||||||||||||||||||||||||

Tax equivalent net interest income(3) | 39,251 | 39,352 | 29,773 | |||||||||||||||||||||||||||||

Tax equivalent interest rate spread(6) | 2.82 | % | 2.97 | % | 2.74 | % | ||||||||||||||||||||||||||

Tax equivalent net interest margin as a percentage of interest-earning assets (7) | 2.97 | % | 3.11 | % | 2.93 | % | ||||||||||||||||||||||||||

Average of interest-earning assets to average interest-bearing liabilities | 121.79 | % | 122.01 | % | 122.84 | % | ||||||||||||||||||||||||||

Less tax equivalent adjustment (3) | (26 | ) | (74 | ) | (35 | ) | ||||||||||||||||||||||||||

Net interest income | $ | 39,225 | $ | 39,278 | $ | 29,738 | ||||||||||||||||||||||||||

(1) Amount is net of deferred loan origination fees and costs. Average balances include nonaccrual loans and loans held for sale and excludes the allowance for loan losses. | |

(2) Loan fees are included in interest income and are immaterial. | |

(3) Municipal securities income and net interest income are presented on a tax equivalent basis using a tax rate of 34%. The tax equivalent adjustment is deducted from tax equivalent net interest income to agree to the amounts reported in the statements of operations. | |

(4) Includes mortgagors' and investors' escrow accounts. | |

(5) Includes brokered deposits. | |

(6) Tax equivalent net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities. | |

(7) Tax equivalent net interest margin represents tax equivalent net interest income divided by average interest-earning assets. | |

Rate/Volume Analysis. The following table sets forth the extent to which changes in interest rates and changes in volume of interest-earning assets and interest-bearing liabilities have on the Company’s interest income and interest expense for the periods presented. The rate column shows the effects attributable to changes in rate (changes in rate multiplied by prior volume). The volume column shows the effects attributable to changes in volume (changes in volume multiplied by prior rate). The net column represents the sum of the rate and volume columns. For purposes of this table, changes attributable to both changes in rate and volume that cannot be segregated have been allocated proportionately based on the changes due to rate and the changes due to volume.

2015 Compared to 2014 | 2014 Compared to 2013 | ||||||||||||||||||||||

Increase (Decrease) Due To | Increase (Decrease) Due To | ||||||||||||||||||||||

Rate | Volume | Net | Rate | Volume | Net | ||||||||||||||||||

(In Thousands) | |||||||||||||||||||||||

Interest-earning assets: | |||||||||||||||||||||||

Interest and dividend income: | |||||||||||||||||||||||

Loans (1)(2) | $ | (1,542 | ) | $ | 2,265 | $ | 723 | $ | (828 | ) | $ | 10,512 | $ | 9,684 | |||||||||

Securities (3) | (251 | ) | 56 | (195 | ) | (100 | ) | (232 | ) | (332 | ) | ||||||||||||

Other interest-earning assets | 30 | (1 | ) | 29 | 5 | 11 | 16 | ||||||||||||||||

Total interest-earning assets | (1,763 | ) | 2,320 | 557 | (923 | ) | 10,291 | 9,368 | |||||||||||||||

Interest-bearing liabilities: | |||||||||||||||||||||||

Interest expense: | |||||||||||||||||||||||

Deposits (4) | (43 | ) | 252 | 209 | (946 | ) | 1,128 | 182 | |||||||||||||||

Federal Home Loan Bank advances | 71 | 385 | 456 | (1,218 | ) | 834 | (384 | ) | |||||||||||||||

Subordinated debt | (7 | ) | — | (7 | ) | — | — | — | |||||||||||||||

Other borrowed funds | — | — | — | (5 | ) | (4 | ) | (9 | ) | ||||||||||||||

Total interest-bearing liabilities | 21 | 637 | 658 | (2,169 | ) | 1,958 | (211 | ) | |||||||||||||||

Change in net interest income (5) | $ | (1,784 | ) | $ | 1,683 | $ | (101 | ) | $ | 1,246 | $ | 8,333 | $ | 9,579 | |||||||||

(1) Amount is net of deferred loan origination fees and costs. Average balances include nonaccrual loans and loans held for sale. | |

(2) Loan fees are included in interest income and are immaterial. | |

(3) Municipal securities income and net interest income are presented on a tax equivalent basis using a tax rate of 34%. The tax equivalent adjustment is deducted from tax equivalent net interest income to agree to the amounts reported in the statements of operations. | |

(4) Includes mortgagors' and investors' escrow accounts and brokered deposits. | |

(5) Presented on a tax equivalent basis using a tax rate of 34%. | |

3

Comparison of Financial Condition at December 31, 2015 and December 31, 2014

Assets:

Summary. Total assets increased $131.3 million, or 9.7%, to $1.48 billion at December 31, 2015, primarily due to increases of $120.5 million in net loans receivable, $3.6 million in Federal Reserve Bank stock, $2.5 million in Federal Home Loan Bank stock and $2.1 million in available for sales securities at fair value.

Loans Receivable, Net. Net loans receivable increased $120.5 million during 2015, which reflects increases in multi-family and commercial mortgage loans of $87.0 million, SBA and USDA guaranteed loans of $26.8 million

and time share loans of $9.5 million, offset by a decrease in residential mortgage loans of $13.1 million. Loan

originations totaled $266.5 million for 2015, an increase of $98.5 million, or 58.6%, compared to 2014. Changes in the loan portfolio consisted of the following:

◦ | Residential Real Estate. Residential mortgage loans comprised 35.6% of total loans at December 31, 2015. The residential mortgage portfolio decreased $13.1 million, or 3.0%, primarily due to the sale of $28.2 million of fixed-rate residential mortgage loans. Residential mortgage loan originations increased $33.8 million during 2015 as a result of lower interest rates and increased activity in the housing market. |

◦ | Multi-family and Commercial Real Estate. At December 31, 2015, multi-family and commercial real estate represented 32.8% of the Company’s total loan portfolio and increased $87.0 million, or 29.2%, during 2015. Loan originations for multi-family and commercial real estate loans were $116.7 million during 2015, representing an increase of $53.1 million. |

◦ | Construction. Construction loans, which include both residential and commercial construction loans, increased $8.2 million, or 60.4%, during 2015 as a result of increased commercial construction volume. |

◦ | Commercial Business. Commercial business loans represented 24.8% of total loans at December 31, 2015 and increased $39.5 million during 2015 primarily due to increases of $26.8 million in SBA and USDA guaranteed loans and $9.5 million in time share loans. Commercial business loan originations increased $17.0 million during 2015 as compared to 2014. At December 31, 2015, unfunded lines of credit related to time share lending totaled $23.7 million as a result of focused efforts dedicated to growth within the time share industry. |

Consumer Loans. Consumer loans represented 4.9% of the Company’s total loan portfolio and increased $817,000, or 1.4%, during 2015. Home equity loans increased $2.7 million, offset by decreases in indirect automobile lending of $2.0 million due to principal repayments. Loan originations for consumer loans totaled $22.9 million for 2015, representing a decrease of $5.4 million compared to the same period in 2014.

The allowance for loan losses totaled $9.9 million at December 31, 2015 compared to $7.8 million at December 31, 2014. The ratio of the allowance for loan losses to total loans increased from 0.74% at December 31, 2014 to 0.84% at December 31, 2015. This was necessitated by an increase in the commercial loan portfolio, which carry a higher degree of risk (excluding guaranteed SBA and USDA loans) than other loans held in portfolio, and an increase in nonperforming assets.

Liabilities. Total liabilities increased $134.7 million, or 11.3%, to $1.33 billion at December 31, 2015. The increase in total liabilities included an increase in borrowings of $86.3 million from $156.5 million at December 31, 2014 to $242.8 million at December 31, 2015, which was used to fund increased commercial lending, including the $52.3 million purchase of SBA guaranteed loans in April 2015. Deposits increased $47.3 million, or 4.7%, which included increases in NOW and money market accounts of $23.6 million, noninterest-bearing demand deposits of $17.8 million and certificates of deposit of $16.9 million, offset by a decrease of $11.4 million in savings accounts.

Equity:

Summary. Shareholders’ equity decreased $3.4 million from $157.7 million at December 31, 2014 to $154.3 million at December 31, 2015. The decrease in shareholders’ equity was attributable to the repurchase of 855,754

common shares totaling $10.3 million and dividends of $1.9 million, offset by income of $4.3 million and 298,146

stock options exercised totaling $3.3 million.

4

Accumulated Other Comprehensive Income (Loss). Accumulated other comprehensive income (loss) comprises the unrealized gains and losses on available for sale securities and a derivative instrument designated as a cash flow hedge, net of taxes. Net unrealized losses on available for sale securities, net of taxes, totaled $190,000 at December 31, 2015 compared to net unrealized gains on available for sale securities, net of taxes, of $199,000 at December 31, 2014. Unrealized holding gains (losses) on available for sale securities primarily resulted from a change in the market value of mortgage-backed securities, which was recognized in accumulated other comprehensive income(loss) on the consolidated balance sheet and a component of comprehensive income on the consolidated statements of comprehensive income (loss). There were no net unrealized losses on derivative instruments, net of taxes, at December 31, 2015, as the agreement for the derivative instrument designated as a cash flow hedge terminated on December 15, 2015. Net unrealized losses on derivative instruments, net of taxes, were $104,000 at December 31, 2014.

Comparison of Operating Results for the Years Ended December 31, 2015 and 2014

General. The Company’s results of operations depends primarily on net interest income, which is the difference between the interest income earned on the Company’s interest-earning assets, such as loans and investments, and the interest expense on its interest-bearing liabilities, such as deposits and borrowings. The Company also generates noninterest income such as gains on the sale of securities, fees earned from mortgage banking activities, fees from deposit and trust and investment management services, insurance commissions and other fees. The Company’s noninterest expenses primarily consist of employee compensation and benefits, occupancy, computer services, furniture and equipment, outside professional services, electronic banking fees, marketing and other general and administrative expenses. The Company’s results of operations are significantly affected by general economic and competitive conditions, particularly changes in market interest rates, governmental policies and actions of regulatory agencies.

The Company recorded net income of $4.3 million for 2015, a decrease of $63,000, compared to net income of $4.4 million for 2014.

Interest and Dividend Income. Total interest and dividend income increased $605,000, or 1.3%, for 2015, primarily due to an increase in the average balance of loans, offset by lower yields on loans and securities versus the comparable period in 2014. Average interest-earning assets increased $57.7 million to $1.32 billion in 2015, due to a higher average balance of loans and securities of $55.6 million and $2.7 million, respectively, partially offset by a decrease in other interest earning assets of $565,000. The average yield on interest-earning assets decreased 13 basis points to 3.64%. The average yields on both loans and securities decreased 14 basis points during 2015 as a result of lower market interest rates. The average yield on federal funds and other interest-earning assets increased 11 basis points during 2015. The average yield on loans continues to be negatively impacted by unrecognized interest related to nonaccrual loans.

Interest Expense. Interest expense increased $658,000, or 8.0%, to $8.9 million for 2015 compared to $8.2 million in 2014, primarily due to higher average balance of FHLB advances and deposits. Average interest-bearing deposits increased $23.9 million to $888.4 million and the average rate increased 1 basis point to 0.63%. Increases in the average balance of certificate of deposit accounts of $19.3 million and NOW and money market accounts of $13.5 million contributed to the increase in the average balance of deposit accounts. The average balance of FHLB advances increased $25.4 million while the average rate increased 4 basis points to 1.58% for 2015.

Provision for Loan Losses. The provision for loan losses increased $970,000 to $2.5 million in 2015 compared to $1.5 million in 2014, primarily due to increases in nonperforming loans and commercial loans outstanding, which carry a higher degree of risk than other loans held in the loan portfolio, offset by lower net loan charge-offs. At December 31, 2015, nonperforming loans totaled $6.6 million, compared to $5.0 million at December 31, 2014, primarily due to increases in nonperforming multi-family and commercial mortgage loans of $1.3 million and residential mortgage loans of $727,000. For 2015, net loan charge-offs totaled $443,000, consisting primarily of multi-family and commercial real estate loan charge-offs, compared to $658,000 for 2014.

5

Noninterest Income. Total noninterest income increased $155,000 to $10.3 million in 2015. The following table shows the components of noninterest income and the dollar and percentage changes from 2014 to 2015.

Years Ended December 31, | Change | |||||||||||||

2015 | 2014 | Dollars | Percent | |||||||||||

(Dollars in Thousands) | ||||||||||||||

Service fees | $ | 6,726 | $ | 6,964 | $ | (238 | ) | (3.4 | )% | |||||

Wealth management fees | 1,204 | 1,221 | (17 | ) | (1.4 | ) | ||||||||

Increase in cash surrender value of bank-owned life insurance | 618 | 580 | 38 | 6.6 | ||||||||||

Net gain on sale of securities | 146 | 64 | 82 | 128.1 | ||||||||||

Mortgage banking | 721 | 535 | 186 | 34.8 | ||||||||||

Net gain on trading securities and derivatives | 50 | 60 | (10 | ) | (16.7 | ) | ||||||||

Other | 856 | 742 | 114 | 15.4 | ||||||||||

Total noninterest income | $ | 10,321 | $ | 10,166 | $ | 155 | 1.5 | % | ||||||

Mortgage banking activities increased $186,000 during 2015 due to a higher volume of residential mortgage loan sales as compared to 2014. Other noninterest income increased $114,000 for 2015 primarily due to an increase in rental income from renting additional office space on the second floor of our Newport branch. Service fees decreased $238,000 in 2015 predominately due to lower overdraft privilege fees.

Noninterest Expenses. Noninterest expenses decreased $921,000 for 2015 compared to 2014. The following table shows the components of noninterest expenses and the dollar and percentage changes from 2014 to 2015.

Years Ended December 31, | Change | |||||||||||||

2015 | 2014 | Dollars | Percent | |||||||||||

(Dollars in Thousands) | ||||||||||||||

Salaries and employee benefits | $ | 19,903 | $ | 20,001 | $ | (98 | ) | (0.5 | )% | |||||

Occupancy and equipment | 7,409 | 7,724 | (315 | ) | (4.1 | ) | ||||||||

Computer and electronic banking services | 5,629 | 5,630 | (1 | ) | — | |||||||||

Outside professional services | 1,872 | 1,808 | 64 | 3.5 | ||||||||||

Marketing and advertising | 964 | 977 | (13 | ) | (1.3 | ) | ||||||||

Supplies | 586 | 612 | (26 | ) | (4.2 | ) | ||||||||

FDIC deposit insurance and regulatory assessments | 1,015 | 1,234 | (219 | ) | (17.7 | ) | ||||||||

Core deposit intangible amortization | 601 | 613 | (12 | ) | (2.0 | ) | ||||||||

Other real estate operations | 538 | 425 | 113 | 26.6 | ||||||||||

Other | 2,068 | 2,482 | (414 | ) | (16.7 | ) | ||||||||

Total noninterest expenses | $ | 40,585 | $ | 41,506 | $ | (921 | ) | (2.2 | )% | |||||

Other noninterest expenses decreased $414,000 during 2015 compared to 2014 as a result of fraudulent debit card transactions of $412,000 and prepayment penalties totaling $110,000 for the early extinguishment of certain FHLB borrowings recognized in 2014. Decreased occupancy and equipment expense of $315,000 for 2015 versus 2014, was in large part a result of reconfiguring and optimizing telephone and data services. The Bank's conversion to a state-chartered financial institution effective in December 2014 contributed to a decrease of $219,000 in the regulatory assessment for 2015. Costs related to other real estate operations increased $113,000 in 2015, compared to the same period in 2014. Salaries and employee benefits decreased $98,000, as a result of a reduction in staffing levels and associated benefit costs year-over-year.

Income Tax Provision. For 2015, the Company recorded an income tax provision of $2.1 million compared to $2.0 million in 2014. The effective tax rate was 32.6% and 31.1% for 2015 and 2014, respectively. See Note 10 in the Company's Consolidated Financial Statements for more details.

6

Comparison of Operating Results for the Years Ended December 31, 2014 and 2013

The Company recorded net income of $4.4 million for 2014, an increase of $5.3 million, compared to a net loss of $855,000 for 2013. The acquisition of Newport in September 2013 contributed to higher net income for 2014. Contributing to the net loss for 2013 were $2.6 million in pretax costs associated with the Newport acquisition, losses realized on security sales of $1.2 million and penalties of $659,000 related to the prepayment of FHLB advances.

Interest and Dividend Income. Total interest and dividend income increased $9.3 million, or 24.4%, for 2014, primarily due to an increase in the average balance of loans, offset by lower yields on loans and securities versus 2013. Average interest-earning assets increased $247.1 million to $1.26 billion in 2014, due to a higher average balance of loans and other interest-earning assets of $252.2 million and $6.1 million, respectively, partially offset by a decrease in the average balance of securities of $11.1 million. The yield on interest-earning assets increased by 1 basis point to 3.77%, despite decreases in the yield on loans of 10 basis points and 5 basis points on securities during 2014 as a result of lower market interest rates. The yield on federal funds and other interest-earning assets increased 2 basis points during 2014. The yield on loans continues to be negatively impacted by unrecognized interest related to nonaccrual loans.

Interest Expense. Interest expense decreased $211,000, or 2.5%, to $8.2 million for 2014 compared to $8.5 million in 2013, primarily due to lower rates paid on deposits and borrowings, offset by a higher average balance of deposits and FHLB advances. Average interest-bearing deposits increased $169.1 million to $864.5 million and the average rate decreased 13 basis points to 0.62%. Increases in the average balance of NOW and money market accounts of $94.7 million and certificate of deposit accounts of $70.6 million contributed to the increase in the average balance of deposit accounts. The average balance of FHLB advances increased $42.2 million while the average rate decreased 86 basis points to 1.54% for 2014. The lower rate on FHLB advances was attributable to the prepayment or modification of certain higher rate advances and new advances at significantly lower rates.

Provision for Loan Losses. The provision for loan losses increased $220,000 to $1.5 million in 2014 compared to 2013, primarily due to an increase in commercial loans outstanding, which carry a higher degree of risk than other loans held in the loan portfolio, offset by decreases in nonperforming loans and net loan charge-offs. At December 31, 2014, nonperforming loans totaled $5.0 million, compared to $7.0 million at December 31, 2013, primarily due to decreases in nonperforming multi-family and commercial mortgage loans of $2.1 million and residential mortgage loans of $393,000. For 2014, net loan charge-offs totaled $658,000, consisting primarily of residential mortgage loan charge-offs, compared to $790,000 for 2013.

Noninterest Income. Total noninterest income increased $1.9 million to $10.2 million in 2014. The following table shows the components of noninterest income and the dollar and percentage changes from 2013 to 2014.

Years Ended December 31, | Change | |||||||||||||

2014 | 2013 | Dollars | Percent | |||||||||||

(Dollars in Thousands) | ||||||||||||||

Service fees | $ | 6,964 | $ | 5,766 | $ | 1,198 | 20.8 | % | ||||||

Wealth management fees | 1,221 | 1,157 | 64 | 5.5 | ||||||||||

Increase in cash surrender value of bank-owned life insurance | 580 | 400 | 180 | 45.0 | ||||||||||

Net gain (loss) on sale of securities | 64 | (1,155 | ) | 1,219 | (105.5 | ) | ||||||||

Net impairment losses recognized in earnings | — | (8 | ) | 8 | (100.0 | ) | ||||||||

Mortgage banking | 535 | 1,083 | (548 | ) | (50.6 | ) | ||||||||

Net gain on trading securities and derivatives | 60 | 205 | (145 | ) | (70.7 | ) | ||||||||

Other | 742 | 857 | (115 | ) | (13.4 | ) | ||||||||

Total noninterest income | $ | 10,166 | $ | 8,305 | $ | 1,861 | 22.4 | % | ||||||

7

Service fees increased $1.2 million in 2014 as a result of additional deposit customers from the Newport acquisition and fees associated with higher electronic banking usage. Mortgage banking fees declined $548,000 during 2014 due to a lower volume of residential mortgage loan sales as compared to 2013 due to a rising interest rate environment. Other noninterest income for 2014 included the reimbursement of $250,000 in legal fees and other foreclosure expenses incurred in a prior period on two commercial loans, partially offset by an impairment charge of $175,000 to reduce the carrying value of one of the Bank's small business investment company limited partnerships. For 2013, the Company realized net losses of $1.2 million primarily related to the sale of $6.0 million in collateralized debt obligations and non-agency mortgage-backed securities previously classified as substandard, offset by a gain of $201,000 on the sale of $3.0 million in commercial business loans held for investment.

Noninterest Expenses. Noninterest expenses increased $3.8 million for 2014 compared to 2013. The following table shows the components of noninterest expenses and the dollar and percentage changes from 2013 to 2014.

Years Ended December 31, | Change | |||||||||||||

2014 | 2013 | Dollars | Percent | |||||||||||

(Dollars in Thousands) | ||||||||||||||

Salaries and employee benefits | $ | 20,001 | $ | 17,924 | $ | 2,077 | 11.6 | % | ||||||

Occupancy and equipment | 7,724 | 5,971 | 1,753 | 29.4 | ||||||||||

Computer and electronic banking services | 5,630 | 4,177 | 1,453 | 34.8 | ||||||||||

Outside professional services | 1,808 | 1,296 | 512 | 39.5 | ||||||||||

Marketing and advertising | 977 | 705 | 272 | 38.6 | ||||||||||

Supplies | 612 | 459 | 153 | 33.3 | ||||||||||

FDIC deposit insurance and regulatory assessments | 1,234 | 1,058 | 176 | 16.6 | ||||||||||

Merger expenses | — | 2,608 | (2,608 | ) | (100.0 | ) | ||||||||

Core deposit intangible amortization | 613 | 220 | 393 | 178.6 | ||||||||||

Other real estate operations | 425 | 564 | (139 | ) | (24.6 | ) | ||||||||

Other | 2,482 | 2,695 | (213 | ) | (7.9 | ) | ||||||||

Total noninterest expenses | $ | 41,506 | $ | 37,677 | $ | 3,829 | 10.2 | % | ||||||

Excluding merger costs, noninterest expenses increased $6.4 million, or 18.4%, in 2014 as a result of 12 months of operating costs attributable to the six branches acquired in the Newport merger, compared to four months of costs included in the results for 2013. Salaries and employee benefits increased $2.1 million as a result of additional staff and higher benefit costs. Outside professional services expense increased primarily as a result of contractual payment obligations to former Newport officers under their noncompetition agreements. Higher other noninterest expenses for 2014 were comprised of increases in fraudulent debit card transactions of $412,000 and prepayment penalties of $110,000 for the early extinguishment of certain higher-rate FHLB borrowings. For 2013, noninterest expenses included pre-tax merger costs for the acquisition of Newport of $2.6 million and $659,000 of prepayment penalties for the early extinguishment of FHLB borrowings for the year.

Income Tax Provision. For 2014, the Company recorded an income tax provision of $2.0 million compared to an income tax benefit of $98,000 in 2013. The effective tax rate was 31.1% and 10.3% for 2014 and 2013, respectively. The effective tax rate for 2013 was impacted by nondeductible costs associated with the Newport merger. See Note 10 in the Company's Consolidated Financial Statements for more details.

Liquidity and Capital Resources

Liquidity is the ability to meet current and future financial obligations of a short- and long-term nature. The Bank's primary sources of funds consist of deposit inflows, loan sales and repayments, maturities and sales of securities and FHLB borrowings. While maturities and scheduled amortization of loans and securities are predictable sources of funds, deposit flows, mortgage prepayments and loan and security sales are greatly influenced by general interest rates, economic conditions and competition.

8

The Bank regularly adjusts its investment in liquid assets based upon its assessment of (1) expected loan demand, (2) expected deposit flows, (3) yields available on interest-earning deposits and securities and (4) the objectives of the Company’s asset/liability management, funds management and liquidity policies. The Company’s policy is to maintain liquid assets less short-term liabilities within a range of 9.0% to 20.0% of total assets. Liquid assets were 9.9% of total assets at December 31, 2015. Excess liquid assets are generally invested in interest-earning deposits and short- and intermediate-term securities.

The Bank’s most liquid assets are cash and cash equivalents. The levels of these assets depend on the Bank’s operating, financing, lending and investing activities during any given period. At December 31, 2015, cash and cash equivalents totaled $40.8 million. Securities classified as available for sale, which provide additional sources of liquidity, totaled $175.1 million at December 31, 2015. In addition, at December 31, 2015, the Bank had the ability to borrow an additional $38.1 million from the FHLB, which includes overnight lines of credit of $10.0 million. On that date, the Bank had FHLB advances outstanding of $234.6 million and no overnight advances outstanding. Additionally, the Bank has the ability to access the Federal Reserve Bank’s Discount Window on a collateralized basis and maintains a $7.0 million unsecured line of credit with a financial institution to access federal funds. The Bank believes that its liquid assets combined with the available lines from the FHLB and Federal Reserve Bank provide adequate liquidity to meet its current financial obligations.

In addition, the Bank believes that deposit inflows through its branch network, which is presently comprised of 25 full-service retail banking offices located throughout its primary market area, and the general cash flows from its existing lending and investment activities, will afford it sufficient long-term liquidity.

The Bank’s primary investing activities are the origination, purchase and sale of loans and the purchase and sale of securities. For the year ended December 31, 2015, the Bank originated $266.5 million of loans and purchased $45.4 million of securities and $113.2 million of loans. In 2014, the Bank originated $168.0 million of loans and purchased $36.2 million of securities and $59.9 million of loans.

At December 31, 2015, the Bank had $132.1 million in loan commitments outstanding, which included $7.5 million in commitments to grant loans, $46.8 million in unused home equity lines of credit, $47.4 million in commercial lines of credit, $28.9 million in undisbursed construction loans, $1.3 million in overdraft protection lines and $173,000 in standby letters of credit.

Financing activities consist primarily of activity in deposit accounts and in borrowed funds. The increased liquidity needed to fund asset growth has been provided through proceeds from the sale of loans and securities and increased deposits and borrowings. The net increase in total deposits, including mortgagors’ and investors’ escrow accounts, was $47.2 million and $26.4 million for the years ended December 31, 2015 and 2014, respectively.

Certificates of deposit due within one year of December 31, 2015 totaled $176.5 million, or 16.7% of total deposits. Management believes that the amount of deposits in shorter-term certificates of deposit reflects customers’ hesitancy to invest their funds in longer-term certificates of deposit due to the uncertain interest rate environment. To compensate, the Bank has increased the duration of its borrowings with the FHLB. The Bank will be required to seek other sources of funds, including other certificates of deposit and lines of credit, if maturing certificates of deposit are not retained. Depending on market conditions, the Bank may be required to pay higher rates on such deposits or other borrowings than are currently paid on certificates of deposit. Additionally, a shorter duration in the securities portfolio may be necessary to provide liquidity to compensate for any deposit outflows. The Bank believes, however, based on past experience, a significant portion of its certificates of deposit will be retained. The Bank has the ability, if necessary, to adjust the interest rates offered to its customers in an effort to attract and retain deposits.

Deposit flows are affected by the overall level of interest rates, the interest rates and products offered by the Bank and its local competitors and other factors. The Bank generally manages the pricing of its deposits to be competitive and to increase core deposits and commercial banking relationships. Occasionally, the Bank offers promotional rates on certain deposit products to attract deposits.

9

FHLB advances increased $86.3 million for the year ended December 31, 2015 and decreased $28.0 million for the year ended December 31, 2014.

SI Financial Group, Inc. is a separate legal entity from the Bank and must provide for its own liquidity. In addition to its operating expenses, SI Financial Group is responsible for paying any dividends declared to its shareholders and making payments on its subordinated debentures. SI Financial Group may continue to repurchase shares of its common stock in the future. SI Financial Group's primary sources of funds are interest and dividends on securities and dividends received from the Bank. The amount of dividends that the Bank may declare and pay to SI Financial Group in any calendar year, without prior regulatory approval, cannot exceed net income for that year to date plus retained net income (as defined) for the preceding two calendar years. SI Financial Group believes that such restriction will not have an impact on SI Financial Group's ability to meet its ongoing cash obligations. At December 31, 2015 and 2014, SI Financial Group had cash and cash equivalents of $3.5 million and $12.9 million, respectively.

The Company's Board of Directors approved the repurchase of up to 5%, or 630,000 shares, of the Company's outstanding common stock. During 2015, the Company purchased all shares under the repurchase plan.

The Company and the Bank have managed their capital to maintain strong protection for depositors and creditors. The Company and the Bank are subject to regulatory capital requirements promulgated by federal bank regulatory agencies, including a risk-based capital measure. The risk-based capital guidelines include both a definition of capital and a framework for calculating risk-weighted assets by assigning balance sheet assets and off-balance sheet items to broad risk categories. At December 31, 2015, the Company and the Bank met all the capital adequacy requirements to which they were subject and are “well capitalized” under regulatory guidelines. The Company became subject to Basel III capital requirements that became effective January 1, 2015. See Note 14 in the Company’s Consolidated Financial Statements for additional information relating to regulatory capital requirements.

Payments Due Under Contractual Obligations

The following table presents information relating to the Company’s payments due under contractual obligations as of December 31, 2015.

Payments Due by Period | ||||||||||||||||||||

Less Than One Year | One to Three Years | Three to Five Years | More Than Five Years | Total | ||||||||||||||||

(In Thousands) | ||||||||||||||||||||

Federal Home Loan Bank advances | $ | 53,034 | $ | 100,828 | $ | 59,500 | $ | 21,233 | $ | 234,595 | ||||||||||

Operating lease obligations (1) | 1,470 | 2,478 | 2,099 | 7,040 | 13,087 | |||||||||||||||

Purchase obligations | 1,342 | 681 | — | — | 2,023 | |||||||||||||||

Other long-term liabilities reflected on the balance sheet (2) | — | — | — | 8,248 | 8,248 | |||||||||||||||

Total contractual obligations | $ | 55,846 | $ | 103,987 | $ | 61,599 | $ | 36,521 | $ | 257,953 | ||||||||||

(1) Payments are for the lease of real property.

(2) Represents junior subordinated debt owed to an unconsolidated trust.

Off-Balance Sheet Arrangements

As a financial services provider, we routinely are a party to various financial instruments with off-balance sheet risks, such as commitments to extend credit, standby letters of credit and unused lines of credit. While these contractual obligations represent our future cash requirements, a significant portion of the commitments to

10

extend credit may expire without being drawn upon. The contractual amounts of commitments to extend credit represent the amounts of potential accounting loss should the contract be fully drawn upon, the customer defaults and the value of any existing collateral becomes worthless. The Company uses the same credit policies in making commitments and conditional obligations as it does for on-balance sheet instruments.

Financial instruments whose contract amounts represent credit risk at December 31, 2015 and 2014 are as follows:

December 31, | |||||||

2015 | 2014 | ||||||

(In Thousands) | |||||||

Commitments to extend credit: | |||||||

Commitments to originate loans | $ | 7,531 | $ | 26,170 | |||

Undisbursed construction loans | 28,939 | 25,107 | |||||

Undisbursed home equity lines of credit | 46,819 | 45,403 | |||||

Undisbursed commercial lines of credit | 47,354 | 60,363 | |||||

Overdraft protection lines | 1,262 | 1,230 | |||||

Standby letters of credit | 173 | 81 | |||||

Total commitments | $ | 132,078 | $ | 158,354 | |||

Commitments to originate loans at December 31, 2015 and 2014 included fixed-rate loan commitments of $5.3 million and $10.8 million, respectively, at interest rates ranging from 2.88% to 5.75% and 3.00% to 5.75%, respectively.

Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. The Company evaluates each customer’s creditworthiness on a case-

by-case basis. The amount of collateral obtained, if deemed necessary by the Company upon extension of credit, is based on management’s credit evaluation of the counterparty. Collateral held varies but may include residential and commercial property, accounts receivable, inventory, property, plant and equipment, deposits and securities.

Undisbursed commitments under construction, home equity or commercial lines of credit are commitments for future extensions of credit to existing customers. Total undisbursed amounts on lines of credit may expire without being fully drawn upon and therefore, do not necessarily represent future cash requirements.

Standby letters of credit are conditional commitments issued by the Company to guarantee the performance of a customer to a third party. Letters of credit are primarily issued to support public or private borrowing arrangements. Essentially all letters of credit issued have expiration dates within one year.

The Bank is a limited partner in three small business investment corporations. At December 31, 2015, the Bank’s remaining off-balance sheet commitment for the capital investments was $1.0 million. See Note 12 in the Company’s Consolidated Financial Statements.

In 2004, the Bank established an Employee Stock Ownership Plan (“ESOP”) for the benefit of its eligible employees. In conjunction with the "second step" public stock offering completed in 2011, the Company provided an additional loan to the ESOP totaling $3.1 million to purchase additional common shares. As of December 31, 2015, the remaining principal balance on the ESOP debt totaled $4.2 million. At December 31, 2015, allocated shares, including shares committed to be allocated to participants, totaled 324,491 and the amount of unallocated common shares held in suspense totaled 410,525, with a fair value of $5.6 million. See Note 11 in the Company’s Consolidated Financial Statements.

11

As of December 31, 2015, the Company did not engage in any off-balance sheet transactions reasonably likely to have a material effect on its financial condition, results of operations or cash flows. See Note 12 in the Company’s Consolidated Financial Statements.

Impact of Inflation and Changes in Prices

The financial statements and financial data presented within this document have been prepared in accordance with U.S. generally accepted accounting principles, which require the measurement of financial condition and operating results in terms of historical dollars without considering the change in the relative purchasing power of money over time due to inflation. The primary impact of inflation on the Company’s operations is reflected in increased operating costs. Unlike most industrial companies, virtually all the assets and liabilities of a financial institution are monetary in nature. As a result, interest rates generally have a more significant impact on a financial institution’s performance than do the effects of general levels of inflation. Interest rates do not necessarily move in the same direction or to the same extent as the prices of goods and services.

Impact of Recent Accounting Standards

For information relating to new accounting pronouncements, reference Note 1 – “Nature of Business and Summary of Significant Accounting Policies – Recent Accounting Pronouncements” in the Company’s Consolidated Financial Statements.

Quantitative and Qualitative Disclosures About Market Risk

Qualitative Aspects of Market Risk

The primary market risk affecting the financial condition and operating results of the Company is interest rate risk. Interest rate risk is the exposure of current and future earnings and capital arising from movements in interest rates. The Company manages the interest rate sensitivity of its interest-bearing liabilities and interest-earning assets in an effort to minimize the adverse effects of changes in the interest rate environment. To reduce the volatility of its earnings, the Company has sought to improve the match between asset and liability maturities and rates, while maintaining an acceptable interest rate spread. The Company’s strategy for managing interest rate risk generally is to emphasize the origination of adjustable-rate mortgage loans for retention in its loan portfolio. However, the ability to originate adjustable-rate loans depends to a great extent on market interest rates and borrowers’ preferences. As an alternative to adjustable-rate mortgage loans, the Company purchases variable-rate SBA and USDA loans in the secondary market that are fully guaranteed by the U.S. government. These loans have a significantly shorter duration than fixed-rate mortgage loans. Fixed-rate mortgage loans typically have an adverse effect on interest rate sensitivity compared to adjustable-rate loans. Accordingly, the Company has sold more longer-term fixed-rate mortgage loans in the secondary market in recent years to manage interest rate risk. The Company offers 10-year fixed-rate mortgage loans that it retains in its portfolio. The Company may offer attractive rates for existing certificates of deposit accounts to extend their maturities. The Company also uses shorter-term investment securities and longer-term borrowings from the FHLB to help manage interest rate risk.

The Company has an Asset/Liability Committee to communicate, coordinate and control all aspects involving asset/liability management. The committee establishes and monitors the volume, maturities, pricing and mix of assets and funding sources with the objective of managing assets and funding sources to provide results that are consistent with liquidity, growth, risk limits and profitability goals.

In July 2010, the Company entered into an interest rate swap agreement with a third-party financial institution with a notional amount of $8.0 million whereby the counterparty will pay a variable rate equal to three-month LIBOR and the Company will pay a fixed rate of 2.44%. The agreement was effective on December 15, 2010 and terminated on December 15, 2015. This agreement was designated as a cash flow hedge against the trust preferred securities issued by SI Capital Trust II. This effectively fixed the interest rate on the $8.0 million of trust preferred securities at 4.14% for the duration of the agreement.

12

In January 2012, the Company entered into an interest rate swap agreement with a third-party financial institution with a notional amount of $15.0 million, whereby the counterparty will pay a variable rate equal to three-month LIBOR and the Company will pay a fixed-rate of 1.26%. The agreement was effective January 11, 2012 and terminates January 11, 2017. This agreement was not designated as a hedging instrument.

Quantitative Aspects of Market Risk

The Company analyzes its interest rate sensitivity position to manage the risk associated with interest rate movements through the use of interest income simulation. The matching of assets and liabilities may be analyzed by examining the extent to which such assets and liabilities are “interest rate sensitive.” An asset or liability is said to be interest rate sensitive within a specific time period if it will mature or reprice within that time period. The Company’s goal is to manage asset and liability positions to moderate the effect of interest rate fluctuations on net interest income.

Net Interest Income Simulation Analysis

Interest income simulations are completed quarterly and presented to the Asset/Liability Committee. The simulations provide an estimate of the impact of changes in interest rates on net interest income under a range of assumptions. The numerous assumptions used in the simulation process are reviewed by the Asset/Liability Committee on a quarterly basis. Changes to these assumptions can significantly affect the results of the simulation. The simulation incorporates assumptions regarding the potential timing in the repricing of certain assets and liabilities when market rates change and the changes in spreads between different market rates. The simulation analysis incorporates management’s current assessment of the risk that pricing margins will change adversely over time due to competition or other factors. Simulation analysis is only an estimate of the Company’s interest rate risk exposure at a particular point in time. The Company continually reviews the potential effect changes in interest rates could have on the repayment of rate sensitive assets and funding requirements of rate sensitive liabilities.

The table below sets forth an approximation of the Company’s exposure as a percentage of estimated net interest income for the next 12- and 24-month periods using interest income simulation. The simulation uses projected repricing of assets and liabilities at December 31, 2015 on the basis of contractual maturities, anticipated repayments and scheduled rate adjustments. Prepayment rates can have a significant impact on interest income simulation. Because of the large percentage of loans and mortgage-backed securities the Company holds, rising or falling interest rates have a significant impact on the prepayment speeds of the Company’s earning assets that in turn affect the rate sensitivity position. When interest rates rise, prepayments tend to slow. When interest rates fall, prepayments tend to rise. The Company’s asset sensitivity would be reduced if prepayments slow and vice versa. While the Company believes such assumptions to be reasonable, there can be no assurance that assumed prepayment rates will approximate actual future mortgage-backed security and loan repayment activity.

The following table reflects changes in estimated net interest income at December 31, 2015.

Percentage Change in Estimated Net Interest Income Over | |||||

12 Months | 24 Months | ||||

100 basis point decrease in rates | (0.52 | )% | (1.04 | )% | |

150 basis point increase in rates | 0.70 | (0.92 | ) | ||

400 basis point increase in rates | (0.85 | ) | (2.99 | ) | |

As indicated by the results of the above scenarios, net interest income would be adversely affected (within our internal guidelines) if rates decreased 100 basis points or increased 400 basis points in the 12- and 24-month periods or if rates increased 150 basis points in the 24-month period. Conversely, net interest income would be positively impacted if rates increased 150 basis points in the 12-month period as a result of the Company's strategy to position the balance sheet for the anticipated increase in market interest rates. The Company's strategy for mitigating interest rate risk includes the purchase of adjustable-rate investment securities and SBA and

13

USDA guaranteed loans that will reprice in a rising rate environment, selling longer-term and lower fixed-rate residential mortgage loans in the secondary market, restructuring FHLB advances to current lower market interest rates while extending their duration and utilizing certain derivative instruments such as forward loan sale commitments to manage the risk of loss associated with its mortgage banking activities.

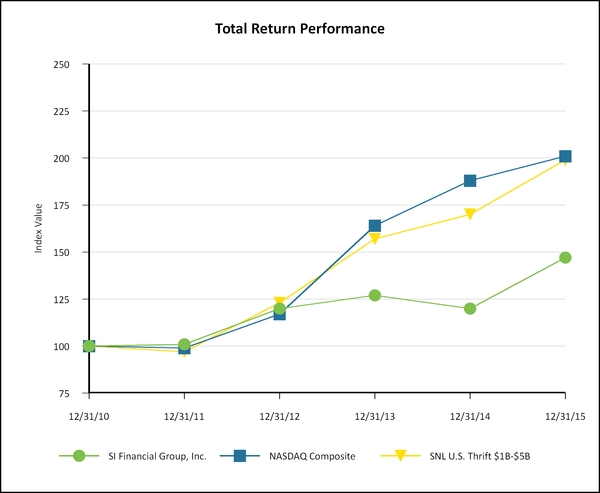

Stock Performance Graph

The following graph compares the cumulative total shareholder return on the Company's common stock with the cumulative total return on the Nasdaq Composite (U.S. Companies) and with the SNL $1B - $5B Thrift Index. Total return assumes the reinvestment of all dividends. The graph assumes $100 was invested at the close of business on December 31, 2010.

SI Financial Group, Inc. | ||||

Period Ending | ||||||||||||

Index | 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | ||||||

SI Financial Group, Inc. | 100.00 | 101.45 | 119.73 | 126.79 | 120.49 | 147.11 | ||||||

NASDAQ Composite | 100.00 | 99.21 | 116.82 | 163.75 | 188.03 | 201.40 | ||||||

SNL U.S. Thrift $1B-$5B | 100.00 | 97.18 | 122.94 | 156.89 | 169.72 | 199.21 | ||||||

Common Stock Information

The common stock of the Company is listed on NASDAQ Global Market ("NASDAQ") under the trading symbol "SIFI." As of March 7, 2016, there were 12,217,088 shares of common stock outstanding, which were held by approximately 1,261 shareholders of record.

The following table sets forth the market price and dividend information for the Company's common stock for the periods indicated, as reported by NASDAQ.

Years Ended December 31, | |||||||||||||||||||||||

2015 | 2014 | ||||||||||||||||||||||

Price Range | Dividends Declared | Price Range | Dividends Declared | ||||||||||||||||||||

High | Low | High | Low | ||||||||||||||||||||

First Quarter | $ | 12.29 | $ | 10.82 | $ | 0.04 | $ | 12.14 | $ | 11.20 | $ | 0.03 | |||||||||||

Second Quarter | 12.20 | 11.25 | 0.04 | 11.83 | 11.00 | 0.03 | |||||||||||||||||

Third Quarter | 12.20 | 11.25 | 0.04 | 11.72 | 10.66 | 0.03 | |||||||||||||||||

Fourth Quarter | 14.00 | 11.81 | 0.04 | 11.79 | 10.90 | 0.03 | |||||||||||||||||

14

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON

INTERNAL CONTROL OVER FINANCIAL REPORTING

The Board of Directors and Shareholders

of SI Financial Group, Inc.

We have audited SI Financial Group, Inc. and subsidiaries’ (the “Company”) internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. SI Financial Group, Inc. and subsidiaries’ management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the accounting principles generally accepted in the United States of America. A company's internal control over financial reporting includes those policies and procedures that (a) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (b) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (c) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, SI Financial Group, Inc. and subsidiaries maintained, in all material respects, effective internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the December 31, 2015 consolidated financial statements of SI Financial Group, Inc. and our report, dated March 11, 2016, expressed an unqualified opinion thereon.

/s/ Wolf & Company, P.C.

Boston, Massachusetts

March 11, 2016

15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders

of SI Financial Group, Inc.

We have audited the accompanying consolidated balance sheets of SI Financial Group, Inc. and subsidiaries (the “Company”) as of December 31, 2015 and 2014, and the related consolidated statements of operations, comprehensive income (loss), changes in shareholders’ equity and cash flows for each of the years in the three-year period ended December 31, 2015. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of SI Financial Group, Inc. and subsidiaries as of December 31, 2015 and 2014, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), SI Financial Group, Inc. and subsidiaries’ internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control- Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and our report, dated March 11, 2016, expressed an unqualified opinion thereon.

/s/ Wolf & Company, P.C.

Boston, Massachusetts

March 11, 2016

16

SI FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Share and Per Share Amounts)

December 31, | |||||||

2015 | 2014 | ||||||

ASSETS: | |||||||

Cash and due from banks: | |||||||

Noninterest-bearing | $ | 14,373 | $ | 18,965 | |||

Interest-bearing | 26,405 | 20,286 | |||||

Total cash and cash equivalents | 40,778 | 39,251 | |||||

Available for sale securities, at fair value | 175,132 | 173,040 | |||||

Loans held for sale | 1,804 | 747 | |||||

Loans receivable (net of allowance for loan losses of $9,863 and $7,797 at December 31, 2015 and 2014, respectively) | 1,165,372 | 1,044,864 | |||||

Federal Home Loan Bank stock, at cost | 12,874 | 10,333 | |||||

Federal Reserve Bank Stock, at cost | 3,621 | — | |||||

Bank-owned life insurance | 21,924 | 21,306 | |||||

Premises and equipment, net | 21,188 | 21,711 | |||||

Goodwill and other intangibles | 18,096 | 18,697 | |||||

Accrued interest receivable | 4,283 | 3,853 | |||||

Deferred tax asset, net | 8,961 | 8,048 | |||||

Other real estate owned, net | 1,088 | 1,271 | |||||

Other assets | 6,713 | 7,412 | |||||

Total assets | $ | 1,481,834 | $ | 1,350,533 | |||

LIABILITIES AND SHAREHOLDERS' EQUITY: | |||||||

Liabilities: | |||||||

Deposits: | |||||||

Noninterest-bearing | $ | 163,893 | $ | 146,062 | |||

Interest-bearing | 894,124 | 864,651 | |||||

Total deposits | 1,058,017 | 1,010,713 | |||||

Mortgagors' and investors' escrow accounts | 3,508 | 3,600 | |||||

Federal Home Loan Bank advances | 234,595 | 148,277 | |||||

Junior subordinated debt owed to unconsolidated trust | 8,248 | 8,248 | |||||

Accrued expenses and other liabilities | 23,136 | 21,956 | |||||

Total liabilities | 1,327,504 | 1,192,794 | |||||

Commitments and contingencies (Notes 6, 11 and 12) | |||||||

Shareholders' Equity: | |||||||

Preferred stock ($0.01 par value per share; 1,000,000 shares authorized; none issued) | — | — | |||||

Common stock ($0.01 par value per share; 35,000,000 shares authorized; 12,218,818 shares and 12,776,426 shares issued and outstanding at December 31, 2015 and 2014, respectively) | 122 | 128 | |||||

Additional paid-in-capital | 124,997 | 125,459 | |||||

Unallocated common shares held by ESOP | (3,648 | ) | (4,128 | ) | |||

Unearned restricted shares | (815 | ) | (1,312 | ) | |||

Retained earnings | 33,864 | 37,497 | |||||

Accumulated other comprehensive income (loss) | (190 | ) | 95 | ||||

Total shareholders' equity | 154,330 | 157,739 | |||||

Total liabilities and shareholders' equity | $ | 1,481,834 | $ | 1,350,533 | |||

See accompanying notes to consolidated financial statements.

17

SI FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands, Except Per Share Amounts)

Years Ended December 31, | |||||||||||

2015 | 2014 | 2013 | |||||||||

Interest and dividend income: | |||||||||||

Loans, including fees | $ | 44,396 | $ | 43,673 | $ | 33,989 | |||||

Securities: | |||||||||||

Taxable interest | 3,130 | 3,488 | 4,132 | ||||||||

Tax-exempt interest | 77 | 117 | 1 | ||||||||

Dividends | 435 | 184 | 27 | ||||||||

Other | 88 | 59 | 43 | ||||||||

Total interest and dividend income | 48,126 | 47,521 | 38,192 | ||||||||

Interest expense: | |||||||||||

Deposits | 5,603 | 5,394 | 5,212 | ||||||||

Federal Home Loan Bank advances | 2,969 | 2,513 | 2,897 | ||||||||

Subordinated debt and other borrowings | 329 | 336 | 345 | ||||||||

Total interest expense | 8,901 | 8,243 | 8,454 | ||||||||

Net interest income | 39,225 | 39,278 | 29,738 | ||||||||

Provision for loan losses | 2,509 | 1,539 | 1,319 | ||||||||

Net interest income after provision for loan losses | 36,716 | 37,739 | 28,419 | ||||||||

Noninterest income: | |||||||||||

Other-than-temporary impairment losses on securities | — | — | (8 | ) | |||||||

Service fees | 6,726 | 6,964 | 5,766 | ||||||||

Wealth management fees | 1,204 | 1,221 | 1,157 | ||||||||

Increase in cash surrender value of bank-owned life insurance | 618 | 580 | 400 | ||||||||

Net gain (loss) on sale of securities | 146 | 64 | (1,155 | ) | |||||||

Mortgage banking | 721 | 535 | 1,083 | ||||||||

Net gain on derivatives | 50 | 60 | 205 | ||||||||

Other | 856 | 742 | 857 | ||||||||

Total noninterest income | 10,321 | 10,166 | 8,305 | ||||||||

Noninterest expenses: | |||||||||||

Salaries and employee benefits | 19,903 | 20,001 | 17,924 | ||||||||

Occupancy and equipment | 7,409 | 7,724 | 5,971 | ||||||||

Computer and electronic banking services | 5,629 | 5,630 | 4,177 | ||||||||

Outside professional services | 1,872 | 1,808 | 1,296 | ||||||||

Marketing and advertising | 964 | 977 | 705 | ||||||||

Supplies | 586 | 612 | 459 | ||||||||

FDIC deposit insurance and regulatory assessments | 1,015 | 1,234 | 1,058 | ||||||||

Merger expenses | — | — | 2,608 | ||||||||

Core deposit intangible amortization | 601 | 613 | 220 | ||||||||

Other real estate operations | 538 | 425 | 564 | ||||||||

Other | 2,068 | 2,482 | 2,695 | ||||||||

Total noninterest expenses | 40,585 | 41,506 | 37,677 | ||||||||

Income (loss) before income tax provision (benefit) | 6,452 | 6,399 | (953 | ) | |||||||

Income tax provision (benefit) | 2,104 | 1,988 | (98 | ) | |||||||

Net income (loss) | $ | 4,348 | $ | 4,411 | $ | (855 | ) | ||||

Earnings (loss) per share: | |||||||||||

Basic | $ | 0.36 | $ | 0.36 | $ | (0.08 | ) | ||||

Diluted | $ | 0.36 | $ | 0.36 | $ | (0.08 | ) | ||||

See accompanying notes to consolidated financial statements.

18