Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vyant Bio, Inc. | pressrelease2015.htm |

| EX-99.1 - EXHIBIT 99.1 - Vyant Bio, Inc. | pressreleasemarch102016.htm |

March 10, 2016 Q4 2015 Earnings Call Nasdaq (CGIX) THE ONCOLOGY DIAGNOSTICS PARTNER FROM BENCH TO BEDSIDE

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call Forward-Looking Statements This slides contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements pertaining to future financial and/or operating results, future growth in research, technology, clinical development and potential opportunities for Cancer Genetics, Inc. products and services, along with other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management constitute forward-looking statements. Any statements that are not historical fact (including, but not limited to, statements that contain words such as "will," "believes," "plans," "anticipates," "expects," "estimates") should also be considered to be forward-looking statements. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of potential products, risks of cancellation of customer contracts or discontinuance of trials, risks that anticipated benefits from acquisitions will not be realized, uncertainty in the results of clinical trials or regulatory approvals, need and ability to obtain future capital, maintenance of intellectual property rights and other risks discussed in the Cancer Genetics, Inc. Forms 10-K for the year ended December 31, 2014 and 10-Q for the quarter ended September 30, 2015 along with other filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof. Cancer Genetics, Inc. disclaims any obligation to update these forward-looking statements These slides also contain “forward-looking statements” and proforma information regarding the Company’s acquisition of Response Genetics, Inc. (“Response Genetics”) and the anticipated benefits from the acquisition. The Company cautions that these statements are subject to certain risks, including, but not limited to, the effects of the bankruptcy proceeding on the business of Response Genetics; risks that the Company will not realize the anticipated benefits of such transaction; and risks that the proforma financial information included in this presentation may not necessarily reflect the Company’s operating results and financial condition following the acquisition. 2

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call Large, Global Market Opportunities $458B GLOBAL ONCOLOGY SPEND BY 2030 Global Footprint Created by Highly Strategic M&A 3 TRANSFORMATIVE ACQUISITIONS IN 2014 & 2015 Strong & Growing Partnerships with Leading BioPharma Companies CONTRACTS WITH 8 of 10 TOP BIOPHARMA +650% INCREASE WITH BIOPHARMA(1) CUSTOMERS (2012-2015) Innovation Engine & Expertise Driven by Key Collaborations 15 RESEARCH COLLABORATIONS WITH LEADING INSTITUTIONS Unique, Proprietary Portfolio of Genomic Tests & Panels 11 COMMERCIALLY LAUNCHED TESTS 49 US PATENTS AND 175 FOREIGN PATENTS Diversified & High Growth Revenue Streams REVENUE GROWTH: 77% Revenue Growth 2014-15 / 43% 4 Year CAGR World-Class Management Team 100+ CUMULATIVE YEARS OF EXPERIENCE Investor Highlights: Cancer Genetics Addresses the Trends in Oncology from Bench to Bedside 1) In signed contracts & potential revenue 3

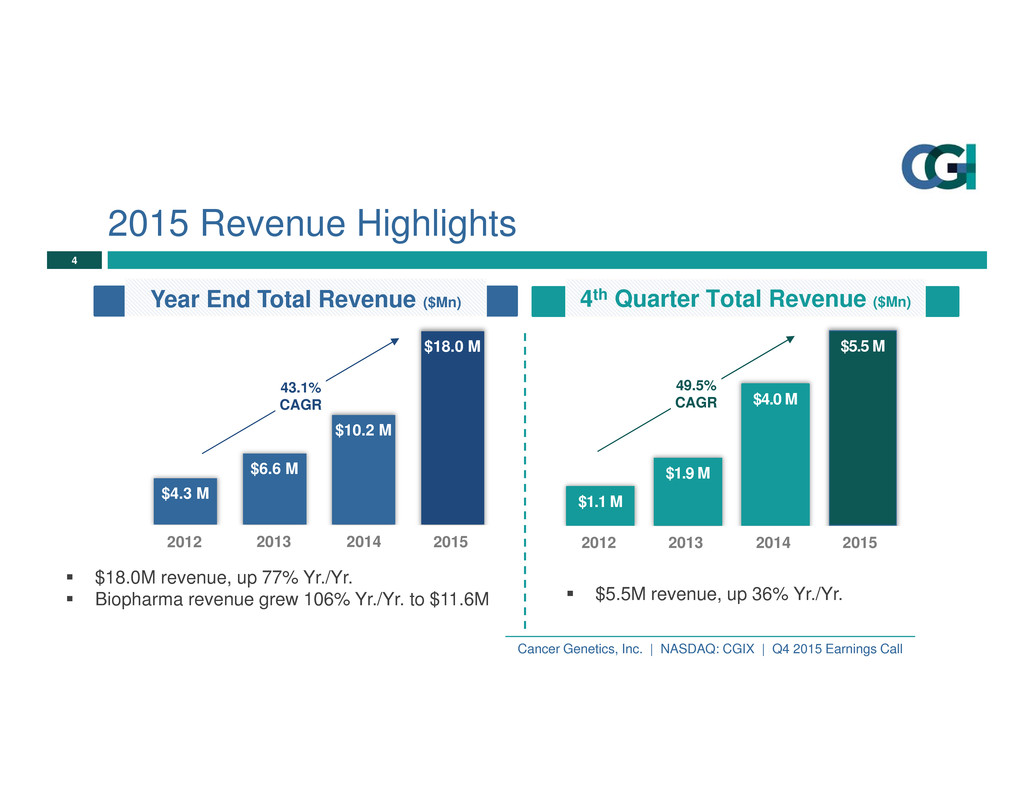

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call 2015 Revenue Highlights $18.0M revenue, up 77% Yr./Yr. Biopharma revenue grew 106% Yr./Yr. to $11.6M Year End Total Revenue ($Mn) $4.3 M $6.6 M $10.2 M $18.0 M 2012 2013 2014 2015 43.1% CAGR 22 4th Quarter Total Revenue ($Mn) $5.5M revenue, up 36% Yr./Yr. $1.1 M $1.9 M $4.0 M $5.5 M 2012 2013 2014 2015 49.5% CAGR 4

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call 31% 64% 5% Revenues By Category * Direct Bill includes hospitals or facilities are billed directly by CGI and not through insurance ** 3rd Party Insurers include non-Medicare and non-Medicaid insurers Clinical Services Biopharma Services Direct Bill* 9% 3rd Party Insurers** 12% Medicare 10% Discovery Services 2015 43% 55% 2% Clinical Services Biopharma Services Direct Bill* 16% 3rd Party Insurers** 16% Medicare 11% Discovery Services 2014 5

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call Full year 2015 Financial Highlights FY 2015 revenues were $18.0 million, a 77% increase over FY 2014 revenues of $10.2 million. Revenue from Biopharma Services grew 106%; Clinical Services grew 28%; and Discovery Services grew 412% year-over-year. Total operating expenses were $25.3 million, including $4.9 million of non-cash items. Gross margin percentage improved to 22% (from 17%). Sales and Marketing expenses increased by 33% to $5.3 million from $4.0 million, primarily due to the acquisition of Response Genetics (RGI) during the fourth quarter. Net loss for the year was $20.2 million, or $1.96 per diluted share, compared to a net loss of $16.6 million, or $1.80 per diluted share, in 2014. Cash and cash equivalents was $19.5 million as of December 31, 2015. Shareholder’s equity was $33.0 million as of December 31, 2015. 6

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call Q4 2015 Financial Highlights Q4 2015 revenues were $5.5 million, a 36% increase over Q4 2014 revenues of $4.0 million. Revenue from Biopharma Services grew 6%; Clinical Services increased by 106%; and Discovery Services grew 45% year-over-year during the fourth quarter. Total operating expenses were $7.9 million, including $1.6 million of non-cash items and ~$1 million of one-time items related to the acquisition – an increase of 15% year-over-year during the fourth quarter. Sales and Marketing expenses increased by 41% from $1.2 million to $1.7 million, year- over-year in the fourth quarter as a result of the acquisition of RGI. Net loss for the quarter was $5.7 million, including $1.6 million of non-cash items, or $0.48 per diluted share, compared to a net loss of $5.2 million, or $0.55 per diluted share in the fourth quarter of 2014. 7

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call Income Statement Items ($ in Thousands) Q4 2015 Q4 2014 12 mos 2015 12 mos 2014 Revenue $5,484 $4,035 $18,040 $10,199 Gross Profit $728 $941 $3,942 $1,746 Gross Margin (%) 13% 23% 22% 17% Research & Development (R&D) $1,148 $1,529 $5,483 $4,622 Sales & Marketing (S&M) $1,726 $1,226 $5,269 $3,964 General & Administrative (G&A) $5,031 $4,138 $14,567 $12,369 Operating (Loss) ($7,177) ($5,952) ($21,377) ($19,209) Net (Loss) ($5,714) ($5,173) ($20,184) ($16,643) Non Cash Adjustments $1,609 $2,994 $4,882 $5,503 Net (Loss) Excluding Non Cash Items+ ($4,105) ($2,179) ($15,302) ($11,140) Summary Statement of Operations +This is non GAAP measure. Adjustments for Q4 2015 and Q4 2014 are depreciation ($665 and $330), equity compensation ($656 and $1,705) and other ($288 and $959) respectively. Adjustments for 12 months are depreciation ($1,503 and $810), equity compensation ($2,834 and $3,835) and other ($545 and $858) respectively. 8

Cancer Genetics, Inc. | NASDAQ: CGIX | Q4 2015 Earnings Call Cash Discussion & Overview CASH DISCUSSION (in Millions USD) Q4 2015 Q1 2016 (Expected) Net Loss $ -5.7 $ -4.6 Non Cash Items 1.6 1.7 Loss Excluding Non-Cash Items $ -4.1 $ -2.9 One Time Adjustments - 0.9 0.0 Tax Benefits (From Sale of Net Operating Losses) 1.2 0.0 Operating Cash Flow -4.9 -3.4 Adjusted Cash Consumed* -5.5 -4.0 Expected Cash Position $ 19.5 $ 15.5 * “Adjusted Cash Consumed” is a non-GAAP number used internally for planning purposes at CGI 9

THE ONCOLOGY DIAGNOSTICS PARTNER FROM BENCH TO BEDSIDE WWW.CGIX.COM WWW.CANCERGENETICS.COM CGI Headquarters 201 Route 17 North Rutherford, NJ 07070 Phone: +1 201-528-9200 Fax: +1 201-528-9235 RUTHERFORD, NJ Research Triangle Park 133 Southcenter Court Morrisville, NC 27569 Phone: +1 919-465-0100 Fax: +1 919-465-0554 RALEIGH, NC LOS ANGELES, CA 1640 Marengo Street Fourth Floor Los Angeles, CA 90033 Phone: +1 323-224-3900 Fax: +1 323-224-3096 #3-1-135/1A CNR Complex Mallapur Main Road, R.R. Dst. Hyderabad – 500 076, Telangana Toll-free: +91 040-2717-8178 Fax: +91 040-2717-8176 HYDERABAD, INDIA 781 Cai Lun Road, Room 803 Shanghai 201203 P.R. China Toll-free: +91 040-2717-8178 Fax: +91 040-2717-8176 SHANGHAI, CHINA