Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HERMAN MILLER INC | hmi8k_030816.htm |

Delivering Growth by Design NASDAQ: MLHR Raymond James 37th Annual Institutional Investors Conference Brian Walker, President and Chief Executive Officer Jeff Stutz, Executive Vice President, Chief Financial Officer March 9, 2016

2 This information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act, as amended, that are based on management’s beliefs, assumptions, current expectations, estimates, and projections about the office furniture industry, the economy, and the company itself. Words like “anticipates,” “believes,” “confident,” “estimates,” “expects,” “forecasts,” likely,” “plans,” “projects,” “should,” variations of such words, and similar expressions identify such forward-looking statements. These statements do not guarantee future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. These risks include, without limitation, the success of our growth strategy, employment and general economic conditions, the pace of economic recovery in the U.S, and in our International markets, the increase in white-collar employment, the willingness of customers to undertake capital expenditures, the types of products purchased by customers, competitive-pricing pressures, the availability and pricing of raw materials, our reliance on a limited number of suppliers, our ability to expand globally given the risks associated with regulatory and legal compliance challenges and accompanying currency fluctuations, the ability to increase prices to absorb the additional costs of raw materials, the financial strength of our dealers and the financial strength of our customers, the mix of our products purchased by customers, our ability to locate new DWR studios, negotiate favorable lease terms for new and existing locations and the implementation of our studio portfolio transformation, our ability to attract and retain key executives and other qualified employees, our ability to continue to make product innovations, the success of newly introduced products, our ability to serve all of our markets, possible acquisitions, divestitures or alliances, the pace and level of government procurement, the outcome of pending litigation or governmental audits or investigations, political risk in the markets we serve, and other risks identified in our filings with the Securities and Exchange Commission. Therefore, actual results and outcomes may materially differ from what we express or forecast. Furthermore, Herman Miller, Inc., undertakes no obligation to update, amend or clarify forward-looking statements. Forward looking statements

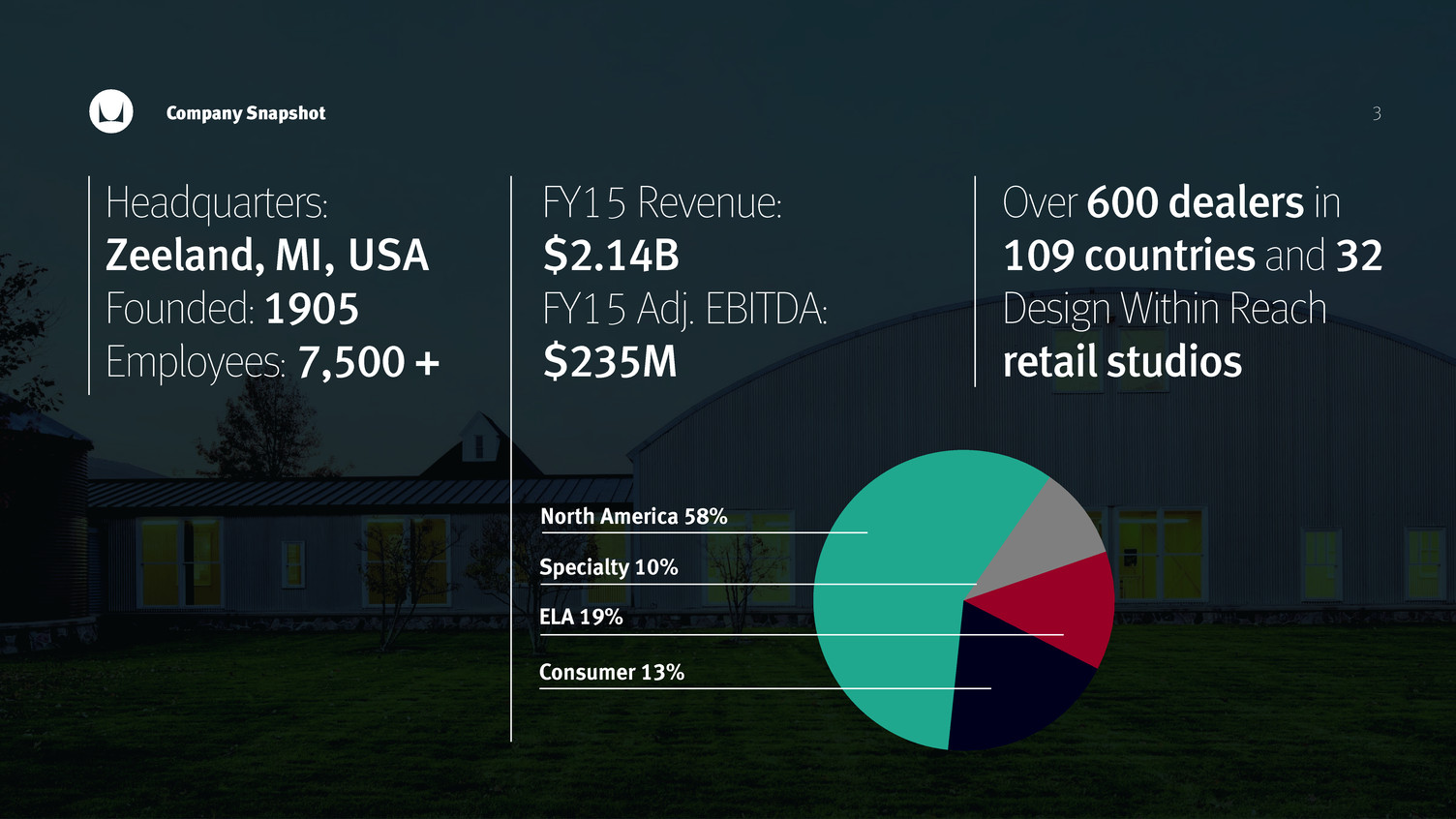

Headquarters: Zeeland, MI, USA Founded: 1905 Employees: 7,500 + FY15 Revenue: $2.14B FY15 Adj. EBITDA: $235M Company Snapshot Over 600 dealers in 109 countries and 32 Design Within Reach retail studios North America 58% Specialty 10% ELA 19% Consumer 13% 3

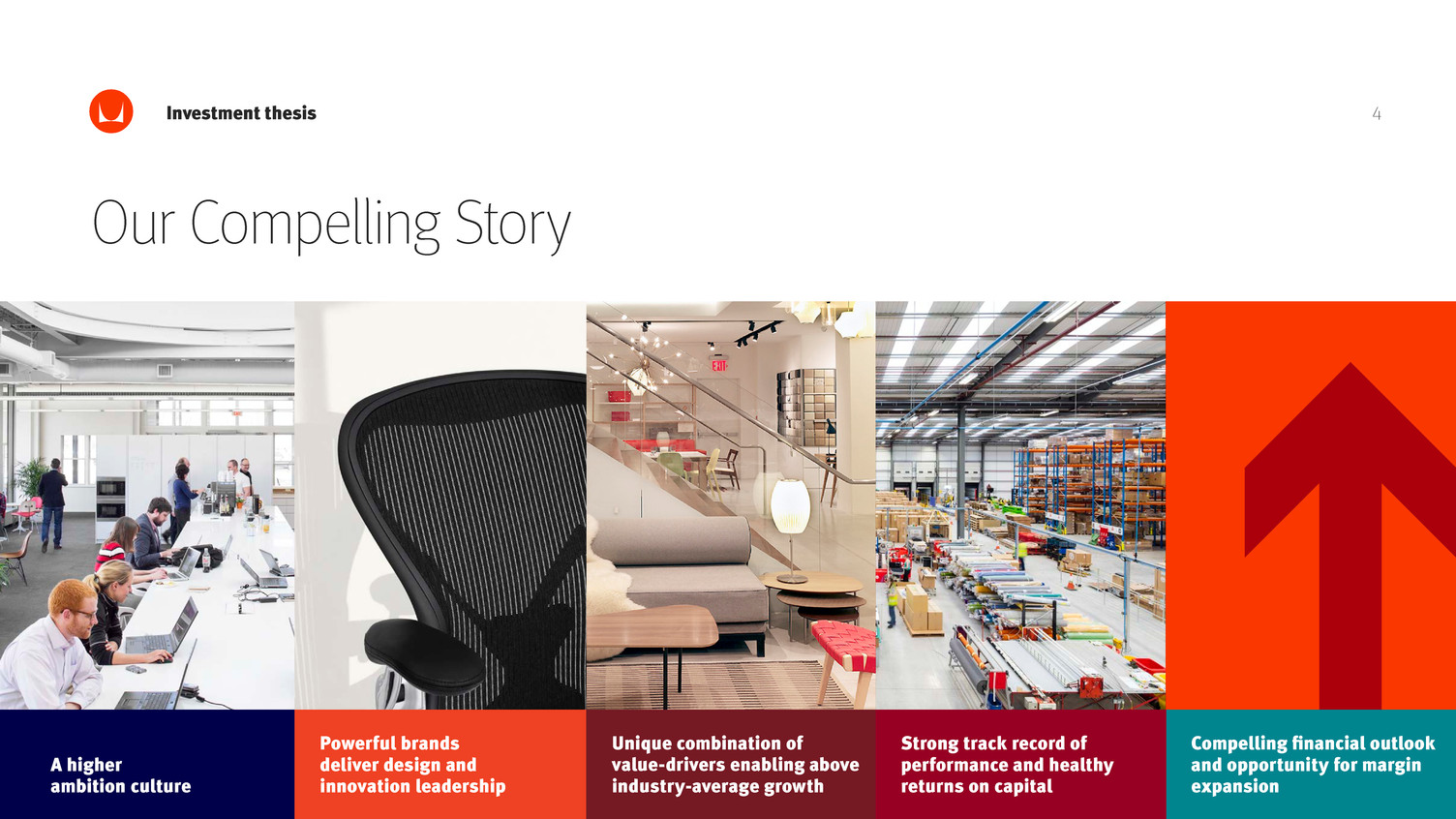

4 Our Compelling Story Investment thesis Powerful brands deliver design and innovation leadership A higher ambition culture Unique combination of value-drivers enabling above industry-average growth Compelling financial outlook and opportunity for margin expansion Strong track record of performance and healthy returns on capital

5 A higher ambition culture

6 Driven by a sense of purpose and values A higher ambition culture “A business is rightly judged by its products and services, but it must also face scrutiny as to its humanity.” - D.J. De Pree, Herman Miller Founder Nine Consecutive Perfect Scores in Human Rights Campaign Foundation’s Corporate Equality Index Twelve Straight Years on the Dow Jones Sustainability World Index Corporation of the Year in the Commercial sector for 8 of the last 10 years by the Michigan Minority Supplier Development Council

7 Powerful brands deliver design and innovation leadership

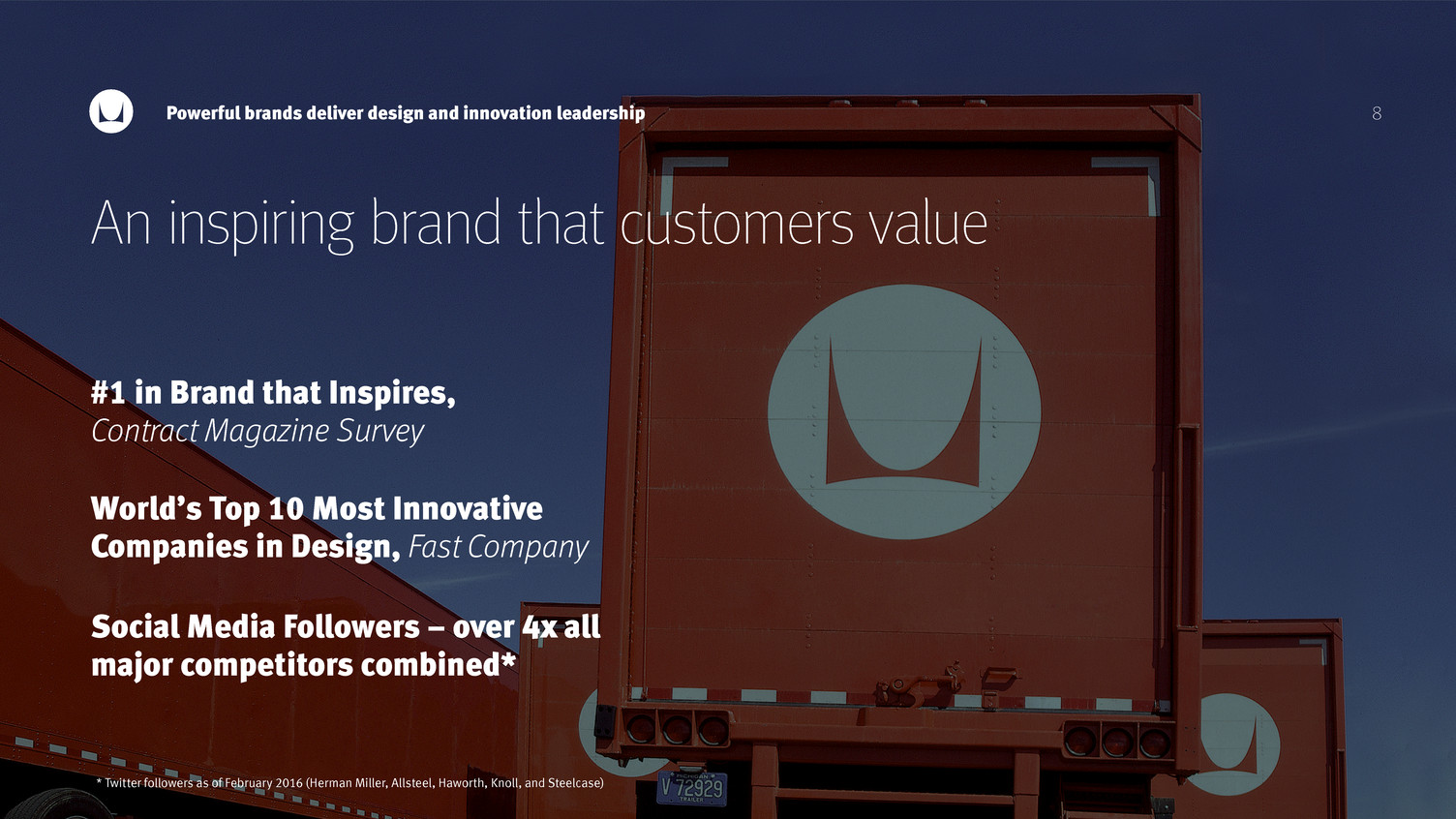

8 An inspiring brand that customers value Powerful brands deliver design and innovation leadership * Twitter followers as of February 2016 (Herman Miller, Allsteel, Haworth, Knoll, and Steelcase) #1 in Brand that Inspires, Contract Magazine Survey World’s Top 10 Most Innovative Companies in Design, Fast Company Social Media Followers – over 4x all major competitors combined*

9Powerful brands deliver design and innovation leadership Healthcare Performance textiles Ergonomic work tools Asia distribution Nemschoff Maharam Colebrook Bosson Saunders POSH A portfolio of leading global brands TIMELESS CRAFT The convergence of world-class designers, impeccable craftsmanship, and superior materials. Brabo Sofa by Vincent Van Duysen Crosshatch™ Chair by EOOS H Frame Table by Ward Bennett Full Twist™ Chair by Mark Goetz Domino Storage™ by Isay Weinfeld geigerfurniture.com Herman Miller brands are #1 in seven categories, Contract Magazine Survey Craft wood furnishings Geiger Design Within Reach Marketplace for authentic modern furnishings

10 Commitment to innovation Powerful brands deliver design and innovation leadership – Innovation Priorities: – 22% of our sales in fiscal 2015 were from products developed in the past 4 years – Introduced over 40 new products and extensions in fiscal 2015 – Industry-leading investment in design, research and development at 3.3% of sales in fiscal 2015 Collaborative and other work points Active/healthy postures Outdoor, lighting, and materials Technology enhanced user experience

11 Design of the Century, Time Magazine Three straight Design of the Decade Awards* Powerful brands deliver design and innovation leadership 1980 1900 - 2000 1990 1990 2000 2000 2010 EquaEames Molded Plywood Aeron Setu * Industrial Designer’s Society of America

12 Bringing innovative solutions to our customers through the Living Office framework Powerful brands deliver design and innovation leadership – An insight-driven and research-based framework for making place a strategic asset – Delivers measurable results through improved: • Workplace Effectiveness • Work Activity Support • Workplace Experience

13 Unique combination of value-drivers enabling above industry-average growth

14 LiveWork Heal Learn The global leader dedicated to creating inspiring places Unique combination of value-drivers enabling above industry-average growth

Capitalizing on an expanded total addressable market Unique combination of value-drivers enabling above industry-average growth North America (Contract)(1) European (Contract)(2) Target Emerging Markets (Contract)(3) Consumer Lifestyle(4) Healthcare/Education/Hospitality(3) Small/Medium Business(3) Textiles(5) $8B $10B $8B $4B $6B $4B $2B $1B $9B $2B $4B 2010—$24B 2015—$35B Source: (1) BIFMA; (2) CSIL; (3) Company Estimate; (4) Parthenon Group (2014); (5) ACT Financial Survey (2014) 15

Unparalleled multi-channel reach including direct to consumer Unique combination of value-drivers enabling above industry-average growth – Over 600 contract dealers in 109 countries – 33 Design Within Reach retail studios – Direct to consumer catalog – Multiple global e-commerce storefronts – Opportunities to grow share of channel/customer wallet Catalog 33 Studios600 Dealers y E-Commerce 16

17 Clear path to revenue growth and margin expansion in Consumer business Unique combination of value-drivers enabling above industry-average growth – Double digit revenue growth opportunity from Design Within Reach by transforming legacy studios to larger formats and adding new locations • 4 to 6 new or expanded studios per year • Increase studio count from 33 today to mid-forties by 2020 • Double square footage to over 500,000 in four years – Increase exclusive product mix from 60% to 70% of revenue – Continued e-commerce growth – Double digit operating margin target by 2020

18 Positioned for global growth Unique combination of value-drivers enabling above industry-average growth – Growing and profitable business outside North America – Favorable trends and demographics in Asia-Pacific – Further growth opportunities: • Leverage Herman Miller and POSH brands in Asia-Pacific • Expand dealer networks and e-commerce platforms • Regional R&D and manufacturing capabilities support new product growth • Leverage Healthcare, Education and Consumer franchises 2010 2015 +13% CAGR ( +10% organic) ELA Revenue $410M $223M

19 Strong track record of performance and healthy returns on capital

20 Organic revenue growth of 8% at a premium to North America Contract industry growth of 5.5%, and robust EBITDA growth over last 5 years Strong track record of performance and healthy returns on capital FY10 FY11 FY12 FY13 FY14 FY15 $1.9B $2.1B$1.8B$1.7B$1.6B $1.3B FY10 FY11 FY12 FY13 FY14 FY15 $206M $235M $182M$180M$165M $113M Revenue Adjusted EBITDA(1) (1) Represents a non-GAAP measure; see Appendix for reconciliation 16% 10% CAGR CAGR

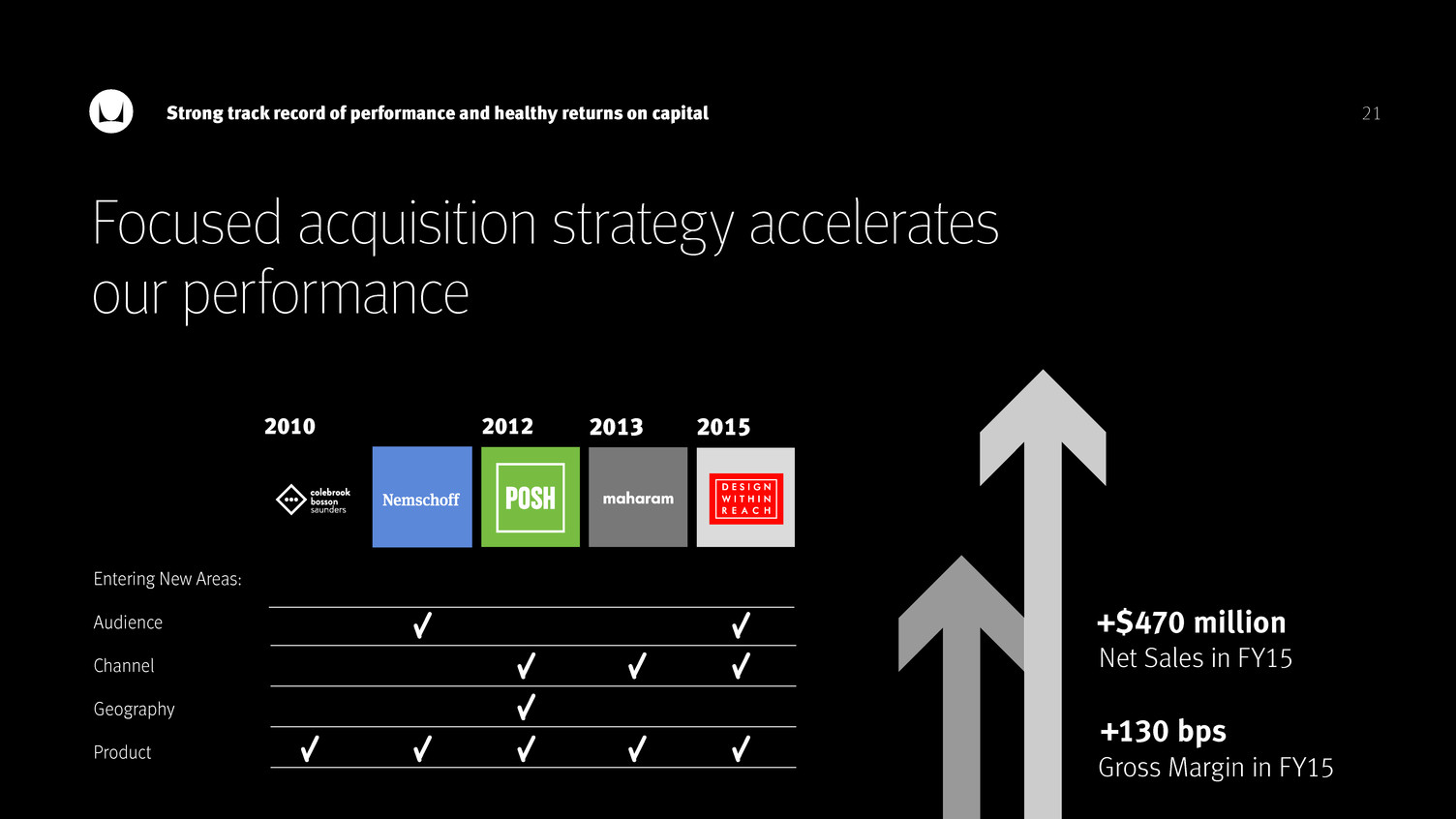

21 Focused acquisition strategy accelerates our performance Strong track record of performance and healthy returns on capital 2010 2012 2013 2015 Net Sales in FY15 +$470 million Entering New Areas: Audience Channel Geography Product Gross Margin in FY15 +130 bps

22 Best-in-class lean enterprise delivers leverage Strong track record of performance and healthy returns on capital – Focused improvement through: • Customer first orientation • Waste reduction • Asset efficiency – One of three U.S. companies showcased by Toyota Production System Support Center – Further opportunity to spread more broadly and deeply through the organization and across the entire value chain Sales per Operational Sq. Foot +54% Sales per Employee Tangible Asset Turnover +23% +50% to 3x Improvement from FY10 to FY15

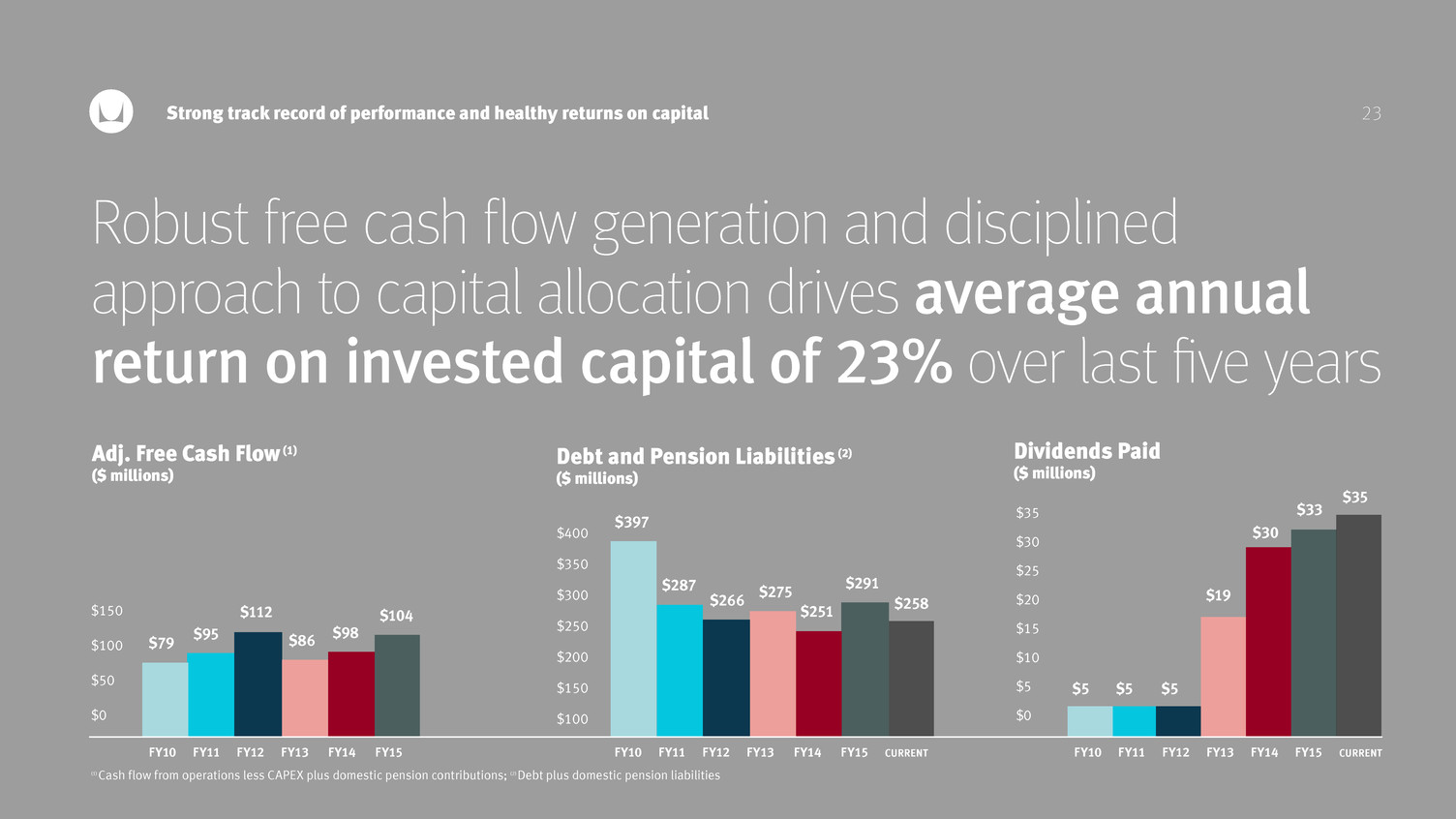

Robust free cash flow generation and disciplined approach to capital allocation drives average annual return on invested capital of 23% over last five years Strong track record of performance and healthy returns on capital (1) Cash flow from operations less CAPEX plus domestic pension contributions; (2) Debt plus domestic pension liabilities FY10 FY11 FY12 FY13 FY14 FY15 CURRENT $5 $5 $19 $30 $33 $35 $95 $98 $112 $86 Adj. Free Cash Flow (1) ($ millions) FY10 FY11 FY12 FY13 FY14 FY15 $150 $100 $50 $0 Debt and Pension Liabilities (2) ($ millions) $287 $266 $275 $251 $291 $258 $400 $350 $300 $250 $200 $150 $100 $79 $104 FY10 FY11 FY12 FY13 FY14 FY15 CURRENT $397 Dividends Paid ($ millions) $5 $35 $30 $25 $20 $15 $10 $5 $0 23

24 Compelling financial outlook and opportunity for margin expansion

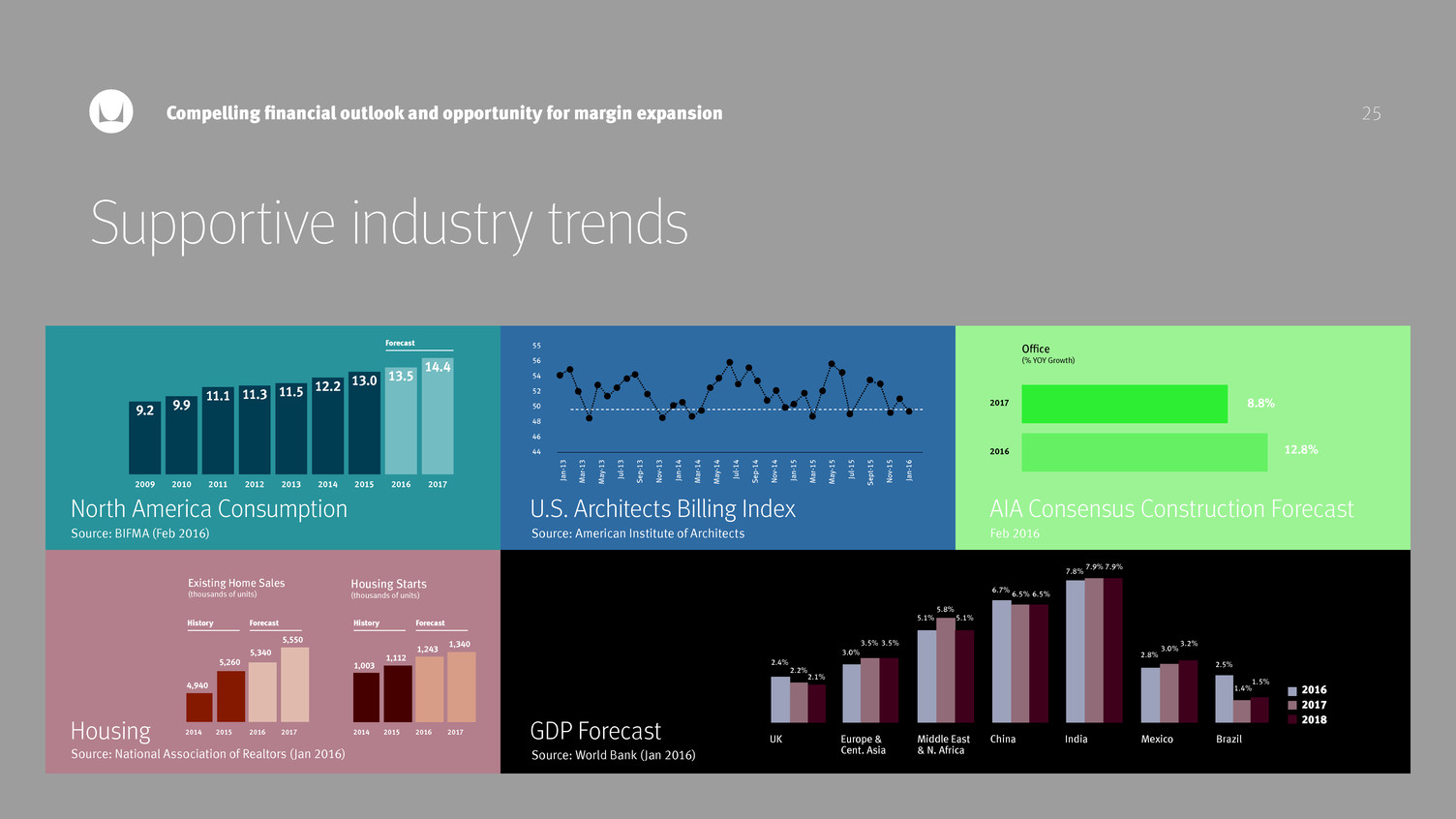

25 Housing GDP Forecast 9.2 9.9 11.1 11.3 11.5 13.012.2 13.5 14.4 2009 2010 2011 2012 2013 2014 2015 2016 2017 North America Consumption U.S. Architects Billing Index AIA Consensus Construction Forecast Existing Home Sales (thousands of units) Office (% YOY Growth) Housing Starts (thousands of units) 2014 2015 2016 2017 4,940 5,260 5,340 5,550 History Forecast Forecast 2014 2015 2016 2017 1,003 1,112 1,243 1,340 History Forecast UK Europe & Cent. Asia Middle East & N. Africa IndiaChina Mexico Brazil Supportive industry trends Compelling financial outlook and opportunity for margin expansion 55 56 54 52 50 48 46 44 Ja n- 13 M ar -1 3 M ay -1 3 Ju l-1 3 Se p- 13 N ov -1 3 Ja n- 14 M ar -1 4 M ay -1 4 Ju l-1 4 Se p- 14 N ov -1 4 Ja n- 15 M ar -1 5 M ay -1 5 Ju l-1 5 Se pt -1 5 N ov -1 5 Ja n- 16 2016 2017 12.8% 8.8% Source: BIFMA (Feb 2016) Source: American Institute of Architects Source: World Bank (Jan 2016)Source: National Association of Realtors (Jan 2016) Feb 2016 2.4% 2.2% 2.1% 3.0% 3.5% 3.5% 5.1% 5.1% 5.8% 6.7% 7.8% 7.9% 7.9% 2.8% 3.0% 3.2% 2.5% 1.4% 1.5% 6.5% 6.5% 2016 2017 2018

Opportunity for continued above-average revenue performance over the next three to five years Compelling financial outlook and opportunity for margin expansion Core Contract Industry 2-3% New Products and Initiatives 1-1.5% Consumer Growth 1-1.5% Estimated Annual Organic Revenue Growth 4-6% Targeted Acquisitions 1-2% Estimated Annual Revenue Growth Including Acquisitions 5-8% Revenue 26

Operating income growth of 2x to 2.5x the rate of organic revenue growth Compelling financial outlook and opportunity for margin expansion – Structurally higher operating margins driven by: • Expanding business and channel mix • Consumer growth and higher exclusive product mix • Volume leverage • Lean enterprise focus 27

28 Our Compelling Story Investment thesis Compelling financial outlook and opportunity for margin expansion Powerful brands deliver design and innovation leadership A higher ambition culture Unique combination of value-drivers enabling above industry-average growth Strong track record of performance and healthy returns on capital

Appendix

Segment Overviews

31Appendix – Segment Overviews Overview FY15 Percent of Consolidated Revenues Macro-Economic Drivers Five Year Revenue Trend (in US$ millions) FY15 Adj. EBITDA Margin 12.2% Description: Design, manufacture and sale of furniture products for office, education and healthcare environments in the United States and Canada Source: BIFMA, February 2016 North America Consumption (in US$ billions) Healthcare Construction Spending (in US$ billions) Education Construction Spending (in US$ billions) FY10 FY11 FY12 FY13 FY14 FY15 5 YEAR CAGR 5% (7% organic) Other Leading Economic Indicators include: Corporate profitability, service sector employment, Architectural Billings Index (ABI), Office vacancy rates, CEO and small business confidence, Non-residential Construction North America Furniture Solutions Source: U.S. Census Bureau and AIA Fcst, Feb 2016 Source: U.S. Census Bureau and AIA Fcst, Feb 2016 19 93 19 94 19 95 1 99 6 1 99 7 1 99 8 1 99 9 2 00 0 2 00 1 2 00 2 2 00 3 2 00 4 2 00 5 2 00 6 2 00 7 2 00 8 2 00 9 2 01 0 2 01 1 2 01 2 2 01 3 2 01 4 2 01 5 2 01 6 20 17 20 02 2 00 3 2 00 4 2 00 5 2 00 6 2 00 7 2 00 8 2 00 9 2 01 0 2 01 1 2 01 2 2 01 3 2 01 4 2 01 5 2 01 6 20 17 20 02 2 00 3 2 00 4 2 00 5 2 00 6 2 00 7 2 00 8 2 00 9 2 01 0 2 01 1 2 01 2 2 01 3 2 01 4 2 01 5 2 01 6 20 17 HistoryHistory ForecastForecast History Forecast 73.9 74.3 74.3 79.7 84.9 96.8 104.9 103.2 88.4 90.6 96.6 85.1 79.784.785.0 79.1 27.1 79.3 32.2 34.4 38.5 43.8 46.9 44.8 39.3 45.642.6 40.038.4 42.5 40.2 40.7 990 1,225 1,219 1,222 1,216 1,242$1300 $1100 $900 $700 $500 On-going revenue Divested dealers North America 58% Specialty 10% ELA 19% Consumer 13% 8.3 9.2 9.9 10.6 12.3 13.4 13.6 14.9 12.4 10.3 10.1 10.6 11.9 12.9 13.4 13.0 9.2 9.9 11.1 11.3 11.5 12.2 13.0 13.5 14.4

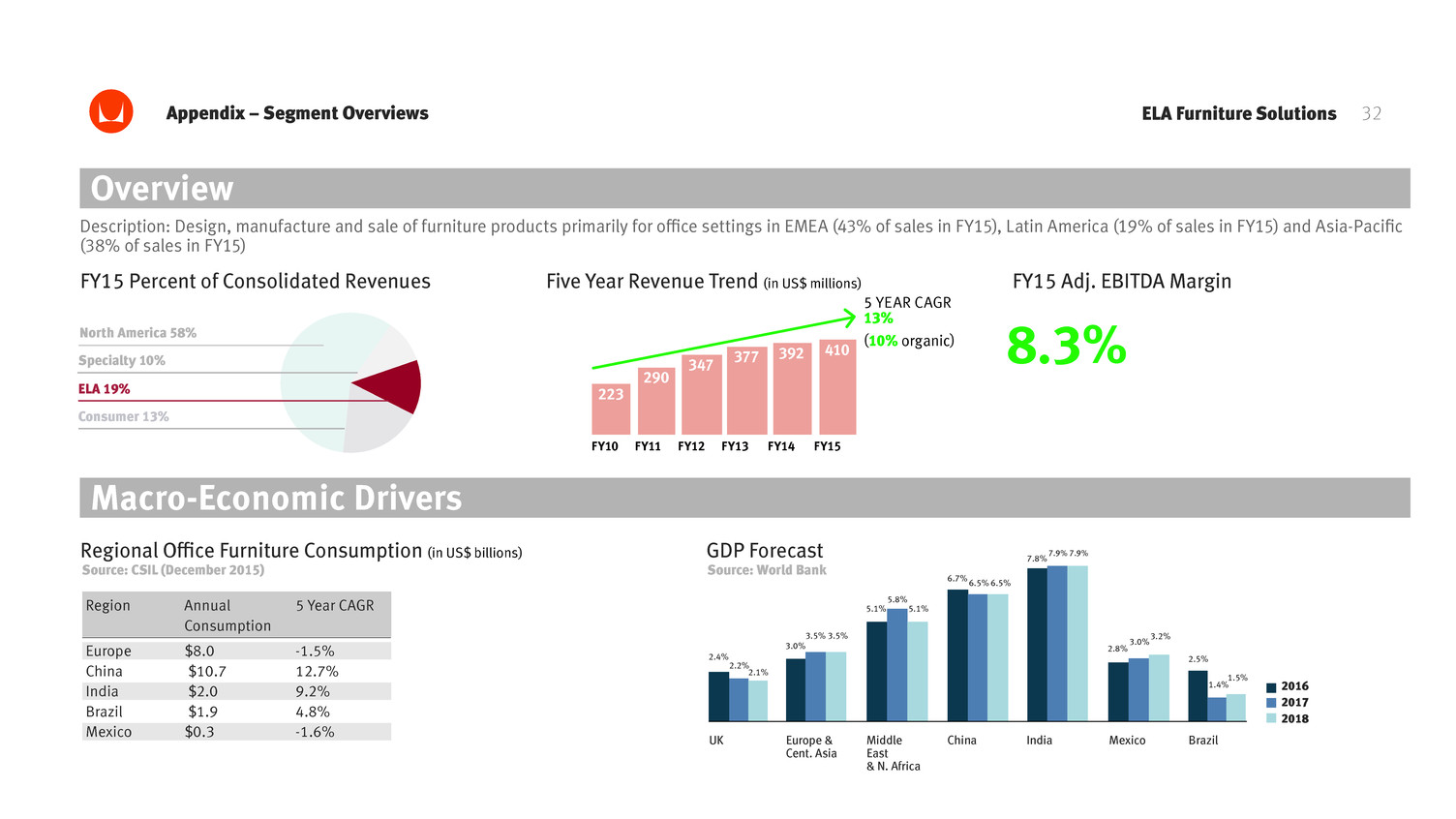

32 North America 58% Specialty 10% ELA 19% Consumer 13% Appendix – Segment Overviews FY15 Percent of Consolidated Revenues Five Year Revenue Trend (in US$ millions) FY15 Adj. EBITDA Margin Source: CSIL (December 2015) Regional Office Furniture Consumption (in US$ billions) GDP Forecast 223 290 347 377 392 410 5 YEAR CAGR 13% (10% organic) 2.4% 2.2% 2.1% 3.0% 3.5% 3.5% 5.1% 5.1% 5.8% 6.7% 7.8% 7.9% 7.9% 2.8% 3.0% 3.2% 2.5% 1.4% 1.5% 6.5% 6.5% 2016 2017 2018 UK Europe & Cent. Asia Middle East & N. Africa IndiaChina Mexico Brazil Region Annual 5 Year CAGR Consumption Europe $8.0 -1.5% China $10.7 12.7% India $2.0 9.2% Brazil $1.9 4.8% Mexico $0.3 -1.6% Source: World Bank 8.3% Overview Macro-Economic Drivers Description: Design, manufacture and sale of furniture products primarily for office settings in EMEA (43% of sales in FY15), Latin America (19% of sales in FY15) and Asia-Pacific (38% of sales in FY15) ELA Furniture Solutions FY10 FY11 FY12 FY13 FY14 FY15

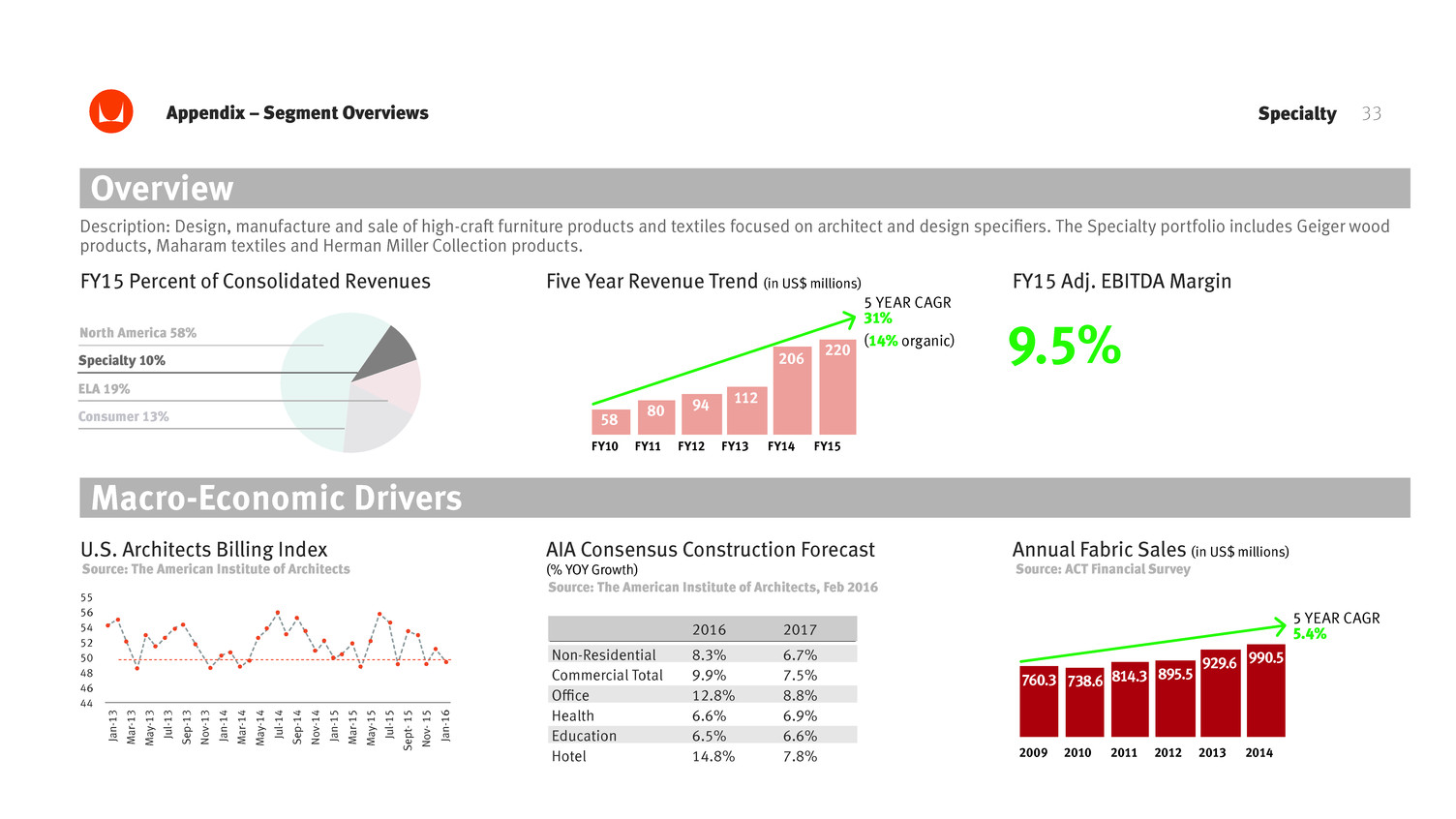

33 North America 58% Specialty 10% ELA 19% Consumer 13% FY15 Percent of Consolidated Revenues Five Year Revenue Trend (in US$ millions) FY15 Adj. EBITDA Margin 58 80 94 112 206 220 5 YEAR CAGR 31% (14% organic) 9.5% SpecialtyAppendix – Segment Overviews FY10 FY11 FY12 FY13 FY14 FY15 Overview Macro-Economic Drivers Description: Design, manufacture and sale of high-craft furniture products and textiles focused on architect and design specifiers. The Specialty portfolio includes Geiger wood products, Maharam textiles and Herman Miller Collection products. Annual Fabric Sales (in US$ millions) Source: ACT Financial Survey AIA Consensus Construction Forecast (% YOY Growth) Source: The American Institute of Architects, Feb 2016 2016 2017 Non-Residential 8.3% 6.7% Commercial Total 9.9% 7.5% Office 12.8% 8.8% Health 6.6% 6.9% Education 6.5% 6.6% Hotel 14.8% 7.8% U.S. Architects Billing Index 55 56 54 52 50 48 46 44 Jan-1 3 M ar -1 3 M ay -1 3 Ju l-1 3 Sep-1 3 N ov -1 3 Jan-1 4 M ar -1 4 M ay -1 4 Ju l-1 4 Sep-1 4 N ov -1 4 Jan-1 5 M ar -1 5 M ay -1 5 Ju l-1 5 Sep t- 1 5 N ov - 1 5 Jan-1 6 Source: The American Institute of Architects 2009 2010 2011 2012 2013 2014 738.6 814.3 895.5 929.6 990.5 760.3 5 YEAR CAGR 5.4%

34 North America 58% Specialty 10% ELA 19% Consumer 13% FY15 Percent of Consolidated Revenues Five Year Revenue Trend (in US$ millions) FY15 Adj. EBITDA Margin 48 54 64 64 68 271 5 YEAR CAGR 41% (10% organic) 11% ConsumerAppendix – Segment Overviews FY10 FY11 FY12 FY13 FY14 FY15 Overview Macro-Economic Drivers Description: Sale of modern design furnishings and accessories in North America through multiple channels, including 32 Design Within Reach studios, eCommerce storefronts, direct mailing catalogs and independent retailers. Source: National Assoc. of Realtors U.S. Economic Outlook (Jan 2016) Existing Home Sales (thousands of units) Housing Starts (thousands of units) Furniture and Home Furnishing Stores Annual Sales Growth FY10 FY11 FY12 FY13 FY14 FY15 0.6% 2.6% 4.4% 3.6% 3.5% 5.7%Source: US Census Bureau 2014 2015 2016 2017 4,940 5,260 5,340 5,550 Source: National Assoc. of Realtors U.S. Economic Outlook (Jan 2016) History Forecast 2014 2015 2016 2017 1,112 1,243 1,340 History Forecast 1,003

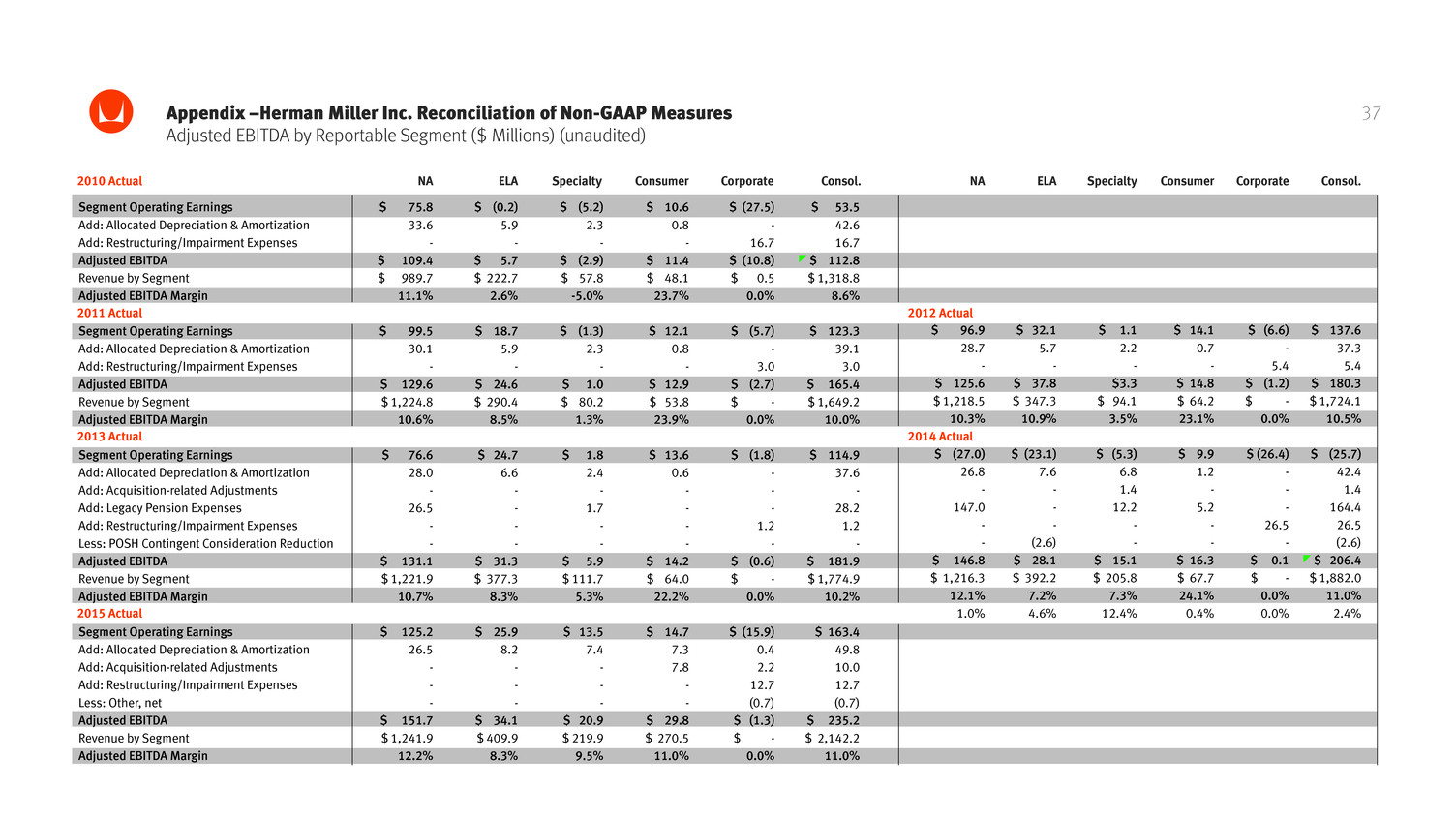

35 This presentation contains Adjusted EBITDA, Adjusted EBITDA ratios, and Organic Sales Growth, all of which constitute non-GAAP financial measures. Each of these financial measures is calculated by excluding items the Company believes are not indicative of its ongoing operating performance. The Company presents these non-GAAP financial measures because it considers them to be important supplemental indicators of financial performance and believes them to be useful in analyzing ongoing results from operations. These non-GAAP financial measures are not measures of financial performance under GAAP and should not be considered alternatives to GAAP. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. In addition, you should be aware that in the future the Company may incur expenses similar to the adjustments presented. Appendix –Reconciliation of Non-GAAP Measures

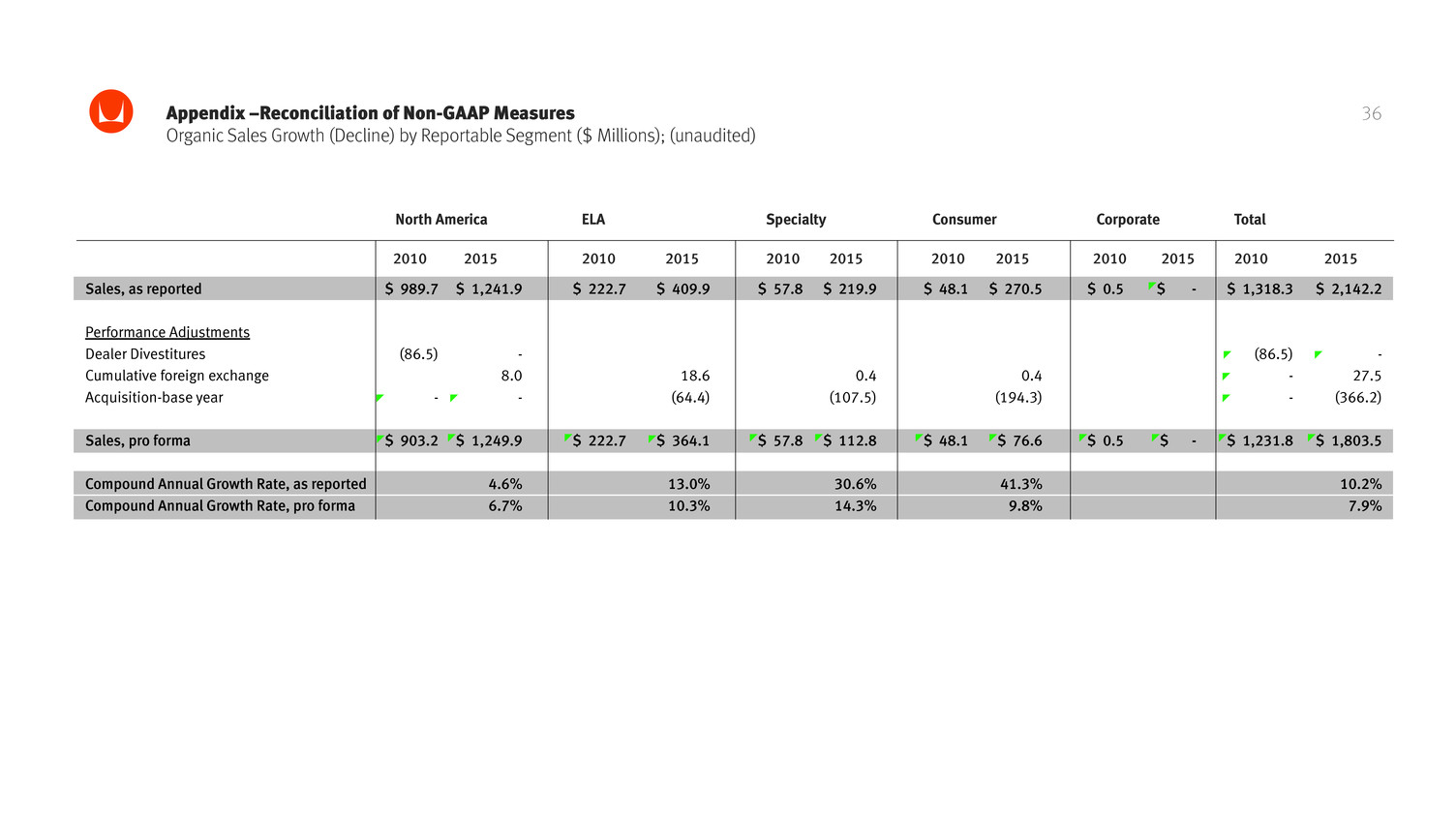

36Appendix –Reconciliation of Non-GAAP Measures Organic Sales Growth (Decline) by Reportable Segment ($ Millions); (unaudited) Sales, as reported Performance Adjustments Dealer Divestitures Cumulative foreign exchange Acquisition-base year Sales, pro forma Compound Annual Growth Rate, as reported Compound Annual Growth Rate, pro forma $ 989.7 (86.5) - $ 903.2 $ 1,318.3 (86.5) - - $ 1,231.8 $ 222.7 $ 222.7 $ 57.8 $ 57.8 $ 48.1 $ 48.1 $ 0.5 $ 0.5 $ 1,241.9 - 8.0 - $ 1,249.9 4.6% 6.7% $ 2,142.2 - 27.5 (366.2) $ 1,803.5 10.2% 7.9% $ 409.9 18.6 (64.4) $ 364.1 13.0% 10.3% $ 219.9 0.4 (107.5) $ 112.8 30.6% 14.3% $ 270.5 0.4 (194.3) $ 76.6 41.3% 9.8% $ - $ - North America ELA Specialty Consumer Corporate Total 2010 2010 2010 2010 2010 20102015 2015 2015 2015 2015 2015

37Appendix –Herman Miller Inc. Reconciliation of Non-GAAP Measures Adjusted EBITDA by Reportable Segment ($ Millions) (unaudited) Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Restructuring/Impairment Expenses Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Restructuring/Impairment Expenses Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Acquisition-related Adjustments Add: Legacy Pension Expenses Add: Restructuring/Impairment Expenses Less: POSH Contingent Consideration Reduction Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin Segment Operating Earnings Add: Allocated Depreciation & Amortization Add: Acquisition-related Adjustments Add: Restructuring/Impairment Expenses Less: Other, net Adjusted EBITDA Revenue by Segment Adjusted EBITDA Margin $ 75.8 33.6 - $ 109.4 $ 989.7 11.1% $ 99.5 30.1 - $ 129.6 $ 1,224.8 10.6% $ 76.6 28.0 - 26.5 - - $ 131.1 $ 1,221.9 10.7% $ 125.2 26.5 - - - $ 151.7 $ 1,241.9 12.2% $ (0.2) 5.9 - $ 5.7 $ 222.7 2.6% $ 18.7 5.9 - $ 24.6 $ 290.4 8.5% $ 24.7 6.6 - - - - $ 31.3 $ 377.3 8.3% $ 25.9 8.2 - - - $ 34.1 $ 409.9 8.3% $ (5.2) 2.3 - $ (2.9) $ 57.8 -5.0% $ (1.3) 2.3 - $ 1.0 $ 80.2 1.3% $ 1.8 2.4 - 1.7 - - $ 5.9 $ 111.7 5.3% $ 13.5 7.4 - - - $ 20.9 $ 219.9 9.5% $ 10.6 0.8 - $ 11.4 $ 48.1 23.7% $ 12.1 0.8 - $ 12.9 $ 53.8 23.9% $ 13.6 0.6 - - - - $ 14.2 $ 64.0 22.2% $ 14.7 7.3 7.8 - - $ 29.8 $ 270.5 11.0% $ (27.5) - 16.7 $ (10.8) $ 0.5 0.0% $ (5.7) - 3.0 $ (2.7) $ - 0.0% $ (1.8) - - - 1.2 - $ (0.6) $ - 0.0% $ (15.9) 0.4 2.2 12.7 (0.7) $ (1.3) $ - 0.0% $ 53.5 42.6 16.7 $ 112.8 $ 1,318.8 8.6% $ 123.3 39.1 3.0 $ 165.4 $ 1,649.2 10.0% $ 114.9 37.6 - 28.2 1.2 - $ 181.9 $ 1,774.9 10.2% $ 163.4 49.8 10.0 12.7 (0.7) $ 235.2 $ 2,142.2 11.0% $ 96.9 28.7 - $ 125.6 $ 1,218.5 10.3% $ (27.0) 26.8 - 147.0 - - $ 146.8 $ 1,216.3 12.1% 1.0% $ 32.1 5.7 - $ 37.8 $ 347.3 10.9% $ (23.1) 7.6 - - - (2.6) $ 28.1 $ 392.2 7.2% 4.6% $ 1.1 2.2 - $3.3 $ 94.1 3.5% $ (5.3) 6.8 1.4 12.2 - - $ 15.1 $ 205.8 7.3% 12.4% $ 14.1 0.7 - $ 14.8 $ 64.2 23.1% $ 9.9 1.2 - 5.2 - - $ 16.3 $ 67.7 24.1% 0.4% $ (6.6) - 5.4 $ (1.2) $ - 0.0% $ (26.4) - - - 26.5 - $ 0.1 $ - 0.0% 0.0% $ 137.6 37.3 5.4 $ 180.3 $ 1,724.1 10.5% $ (25.7) 42.4 1.4 164.4 26.5 (2.6) $ 206.4 $ 1,882.0 11.0% 2.4% NA NAELA ELASpecialty Specialty2010 Actual 2011 Actual 2012 Actual 2013 Actual 2014 Actual 2015 Actual Consumer ConsumerCorporate CorporateConsol. Consol.