Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - DC Industrial Liquidating Trust | d116973dex211.htm |

| EX-31.1 - EX-31.1 - DC Industrial Liquidating Trust | d116973dex311.htm |

| EX-32.1 - EX-32.1 - DC Industrial Liquidating Trust | d116973dex321.htm |

| EX-31.2 - EX-31.2 - DC Industrial Liquidating Trust | d116973dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE PERIOD FROM NOVEMBER 3, 2015 TO DECEMBER 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-54372*

DC Industrial Liquidating Trust

(Exact name of registrant as specified in its charter)

| Maryland | 47-7297235 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 518 Seventeenth Street, 17th Floor, Denver, CO | 80202 | |

| (Address of principal executive offices) | (Zip Code) | |

(303) 228-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.* Yes ¨ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.* Yes ¨ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). * Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.* ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

No shares of common stock were held by non-affiliates as of June 30, 2015.

As of February 26, 2016, there were 214,262,901 units of beneficial interest in DC Industrial Liquidating Trust outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

| * | DC Industrial Liquidating Trust is the transferee of the assets and liabilities of Industrial Income Trust Inc. and files reports under the Securities and Exchange Commission (the “SEC”) file number for Industrial Income Trust Inc. Industrial Income Trust Inc. filed a Form 15 on November 4, 2015, indicating its notice of termination of registration and filing requirements. |

Table of Contents

| PART I | ||||||

| Item 1. | 1 | |||||

| Item 1A. | 6 | |||||

| Item 1B. | 16 | |||||

| Item 2. | 17 | |||||

| Item 3. | 18 | |||||

| Item 4. | 18 | |||||

| PART II |

||||||

| Item 5. | 19 | |||||

| Item 6. | 19 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 | ||||

| Item 7A. | 26 | |||||

| Item 8. | 27 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

34 | ||||

| Item 9A. | 34 | |||||

| Item 9B. | 34 | |||||

| PART III |

||||||

| Item 10. | 35 | |||||

| Item 11. | 39 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

40 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

40 | ||||

| Item 14. | 42 | |||||

| PART IV |

||||||

| Item 15. | 43 | |||||

i

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes certain statements that may be deemed forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements relate to, without limitation, changes in rent and occupancy, general conditions in our geographic markets, our future debt levels and financial position, our future capital expenditures, future distributions, future dispositions and other developments and trends of the real estate industry. Forward-looking statements are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “project,” or the negative of these words or other comparable terminology. These statements are not guarantees of future performance, and they are based upon our current expectations, plans, estimates, assumptions, and beliefs that involve numerous risks and uncertainties.

Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors that could have a material adverse effect on our operations and future results include, but are not limited to:

| • | The inability to find buyers for properties at our expected sales prices; |

| • | Failure to lease our properties, defaults on or non-renewal of existing leases by customers, or lease renewals at lower than expected rent; |

| • | A decrease in value of our properties; |

| • | Difficulties in economic conditions in our geographic markets and industry sector; |

| • | Competition for customers; |

| • | Risks associated with disposition and development of properties; |

| • | Greater than expected liquidation costs or liabilities; |

| • | Environmentally hazardous conditions at our properties and the cost of environmental compliance; |

| • | The failure to achieve the desired tax impact of the transactions contemplated with respect to the liquidating trust and resultant tax treatment relating to, arising from or incurred in connection with such transactions; |

| • | Our failure to renew or extend necessary financing or an increase in interest rates or unfavorable changes in other financing terms; |

| • | Conflicts of interest arising out of our relationships with our advisor and its affiliates; |

| • | Increases in interest rates, operating costs or greater than expected capital expenditures; and |

| • | Changes to U.S. generally accepted accounting principles (“GAAP”). |

Any of the assumptions underlying forward-looking statements could prove to be inaccurate. Our beneficiaries are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report on Form 10-K. All forward-looking statements are made as of the date of this Annual Report on Form 10-K, and the risk that actual results will differ materially from the expectations expressed in this Annual Report on Form 10-K will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report on Form 10-K, whether as a result of new information, future events, changed circumstances, or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report on Form 10-K, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report on Form 10-K will be achieved.

ii

Table of Contents

PART I

| ITEM 1. | BUSINESS |

As used herein, the terms “DC Industrial Liquidating Trust,” the “Trust”, “we,” “our,” or “us” refer to DC Industrial Liquidating Trust and its consolidated subsidiaries, except where otherwise indicated.

Overview

We were formed on September 18, 2015 as a statutory trust under Maryland law to hold and liquidate the 11 properties excluded from the merger (the “Merger”) of Industrial Income Trust Inc. (“IIT”) with and into a subsidiary of Western Logistics, LLC (“Western Logistics”), an affiliate of Global Logistic Properties Limited (“GLP”).

IIT, a Maryland corporation formed in May 2009, was a leading U.S. industrial real estate investment trust (“REIT”) that had built a national operating company of high-quality distribution warehouses leased to creditworthy corporate customers. IIT’s properties generated revenue through the rents the corporate customers paid to use the properties in their supply chain. IIT purchased its first property in June 2010, and from 2010 through mid-2015, raised approximately $2.2 billion of equity capital from investors. IIT operated and elected to be treated as a REIT for U.S. federal income tax purposes, commencing with its taxable year ended December 31, 2010.

On November 4, 2015, IIT completed the Merger with Western Logistics. At the merger effective time, each share of common stock, $0.01 par value per share, of IIT then issued and outstanding was converted into the right to receive an amount in cash equal to $10.30 per share, without interest and subject to any applicable withholding tax obligations. Immediately prior to completion of the Merger on November 4, 2015, IIT distributed to its stockholders, in a special dividend, all of the units of beneficial interest in the Trust, together with net cash proceeds of borrowings under our credit facility, with each share of IIT common stock receiving (i) one unit of beneficial interest in the Trust valued at an estimated $0.56 per share, and (ii) an additional $0.26 per share of net cash proceeds.

On November 4, 2015, IIT filed a Form 15 with the SEC to terminate the registration of IIT’s common stock under the Exchange Act, at which point IIT ceased filing reports under the Exchange Act.

The Trust

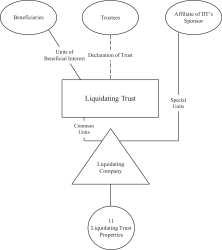

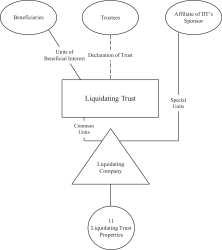

On November 3, 2015, in accordance with certain provisions of the merger agreement (the “Merger Agreement”), which provisions (together with the Liquidating Trust Agreement (as defined below)) we refer to herein as our “plan of liquidation,” IIT contributed the Trust’s properties to DC Liquidating Assets Holdco LLC (the “Liquidating Company”) in exchange for all of the common equity interests in the Liquidating Company.

The Trust holds its 11 properties through its ownership of 100% of the common membership interests in the Liquidating Company, which indirectly wholly owns each of the properties. The Trust acts as managing member of the Liquidating Company. An affiliate of Industrial Income Advisors Group LLC (“IIT’s Sponsor”), which was the owner of IIT’s external advisor, owns the additional interests in the Liquidating Company. These interests are special units (the “Special Units”) that are intended to be consistent in economic effect to the special partnership units that IIT’s Sponsor previously held in Industrial Income Operating Partnership LP, which was IIT’s operating partnership. The Special Units entitle IIT’s Sponsor to receive 15% of each distribution of “Net Sale Proceeds” (as defined below), while the Trust is entitled to receive 85% of Net Sale Proceeds and 100% of any other distributions. The Liquidating Company’s limited liability company agreement generally defines Net Sale Proceeds to be the proceeds of any sale or disposition transaction with respect to any of our properties or any other asset or portion thereof, less selling expenses and secured indebtedness repaid or assumed in connection with the transaction, together with any other available amounts that the Trust, as managing member

1

Table of Contents

of the Liquidating Company, determines to be economically equivalent to sale proceeds, such as proceeds from any loan that are available for distribution. The organizational structure of the Trust and its properties is as follows:

On November 4, 2015, prior to completion of the Merger, IIT distributed to its stockholders, in a special dividend, all of the units of beneficial interest in the Trust, together with net cash proceeds of borrowings under our credit facility, with each share of IIT common stock receiving (i) one unit of beneficial interest in the Trust valued at an estimated $0.56 per share, and (ii) $0.26 per share of net cash proceeds (collectively, the “Special Dividend”). On November 3, 2015, prior to the distribution of the Special Dividend to the IIT stockholders on November 4, 2015, the Trust and our three trustees, Dwight L. Merriman, Marshall M. Burton and Stanley A. Moore, entered into an Amended and Restated Agreement and Declaration of Trust (the “Liquidating Trust Agreement”).

The beneficial interests in the Trust are expressed in terms of units for ease of administration, but they are not certificated. Each distribution by the trustees to the beneficiaries will be made pro rata according to the beneficiaries’ respective units. Units of beneficial interest may not be transferred or assigned, except by will, intestate succession or operation of law or through certain transfers of beneficial interests held by a tax-qualified employee retirement plan or account to the extent that the transfer is required to satisfy a required minimum distribution under the plan or account.

The Liquidating Trust Agreement provides that our trustees are responsible for overseeing the management and liquidation of our properties, including selling or otherwise disposing of our properties, and that our trustees have the discretion to make distributions of available cash to the beneficiaries as and when they deem such distributions to be in the best interests of the beneficiaries, taking into account the administrative costs of making such distributions, our anticipated costs and expenses and such other factors as they may consider appropriate. The trustees do not expect to make distributions to beneficiaries, other than the distribution of net loan proceeds and other available cash on the Merger closing date and distributions of Net Sale Proceeds of our properties.

The Liquidating Trust Agreement further provides that the Trust will terminate upon the earlier of (i) the liquidation and distribution of the net proceeds of all the assets held by the Trust and its subsidiaries or (ii) three years from November 4, 2015. Notwithstanding the foregoing, the trustees may continue the existence of the Trust beyond the three-year term if the trustees reasonably determine that an extension is necessary to fulfill the purposes of the Trust, provided that the trustees have requested and obtained additional no-action assurance from the SEC regarding relief from registration and reporting requirements under the Exchange Act, as amended prior to such extension.

2

Table of Contents

We currently operate as one reportable segment comprised of industrial real estate. Refer to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data,” for further details concerning our financial information and Item 2, “Properties,” for further details concerning our portfolio.

The Trust Advisor

On November 3, 2015, the Trust, the Liquidating Company, and DCG Liquidating Advisor LLC (the “Trust Advisor”) entered into a management services agreement (the “Management Services Agreement”) pursuant to which the Trust Advisor was appointed to provide certain development, construction, and asset management oversight services for each of our properties, to assist in the sale of our properties, and to provide administrative services to us, the Liquidating Company and our subsidiaries. The Trust Advisor is a controlled affiliate of IIT’s Sponsor, which is the indirect owner of the Special Units in the Liquidating Company. Mr. Merriman, a trustee and chief executive officer of the Trust, is a member of the board of managers of the Trust Advisor.

Investment Objectives

Our primary investment objective is to sell all of our properties with the goal of maximizing value for our beneficiaries. At the merger effective time, we estimated that an additional $0.56 net per unit would be paid in cash upon consummation of the sale of all of our properties (net of certain estimated expenses), based on management’s estimates of the market value of each property upon stabilization, the costs to complete the development and leasing of our properties, and liquidation expenses. The actual amounts ultimately distributed by the Trust will likely differ, perhaps materially, from this estimate based on, among other things, market conditions for sales of our properties, the amount of time it takes to complete the liquidation and the potential costs associated with the liquidation. There can be no assurance regarding the amount of cash that ultimately will be distributed to the beneficiaries in connection with the Trust or the timing of the liquidation of the Trust.

Liquidation Update

As of the date of this report, we had not sold any properties nor did we have any commitments to purchase any of our properties. All of our properties, with the exception of the one land parcel, were either under development or in the lease-up stage. We currently anticipate completing our liquidation by selling our properties within the next 12 to 24 months. However, we can provide no assurance that we will be able to accomplish this within the estimated timeframe.

Tax Status and Treatment

We are treated as a grantor trust for income tax purposes and accordingly, are not subject to federal or state income tax on any income earned or gain recognized by us. We may recognize taxable income or loss, as the case may be, from our operation of the properties prior to their disposition, and taxable gain or loss as and when our assets are disposed of for an amount greater or less than the fair market value of such assets at the time of the initial distribution of the units in the Trust on November 4, 2015. Our beneficiaries will be treated as the owner of a pro rata portion of each remaining asset, including cash, received by and held by us and will be required to report on their federal and state income tax return his or her pro rata share of taxable income, including gains and losses recognized by us.

We have issued an annual information statement to our beneficiaries with tax information for their tax returns for the period from November 4, 2015 to December 31, 2015. Beneficiaries are urged to consult with their tax advisors as to their own filing requirements and the appropriate tax reporting of this information on their returns.

3

Table of Contents

Reports to Beneficiaries

The Trust will file with the SEC annual reports showing the consolidated assets and liabilities of the Trust, as well as the receipts and disbursements of the Trust, although the Liquidating Trust Agreement does not require the financial statements of the Trust to be audited by an independent, registered public accounting firm. During the course of each fiscal year, whenever a material event relating to the assets of the Trust occurs, the Trust will file with the SEC an interim report describing such event.

Competition

As we complete our plan of liquidation, we will be in competition with other sellers of similar properties to identify suitable purchasers, which may result in us receiving lower net proceeds than our estimated liquidation proceeds. Additionally, until we sell our remaining assets, we will be in competition for customers from other existing assets in proximity to our buildings, as well as from proposed new developments. The market for the leasing of industrial real estate is very competitive. As a result, we may have to provide free rental periods, incur charges for tenant improvements, or offer other inducements, all of which could have an adverse impact on our valuations in a sale. Principal factors of competition in the industrial real estate business are the quality of properties, leasing terms (including rent and other charges and allowances for tenant improvements), attractiveness and convenience of location, proposed new developments, the quality and breadth of tenant services provided, and the reputation as an owner and operator of quality industrial properties in the relevant markets.

Conflicts of Interest

We are subject to various potential conflicts of interest that could arise out of our relationship with the Trust Advisor and other affiliates and related parties, including: conflicts related to the compensation arrangements among the Trust Advisor, certain affiliates and related parties, and us; conflicts with respect to the allocation of the Trust Advisor’s and its key personnel’s time; and conflicts related to the potential leasing and sale of properties. As a result of our potential competition with these entities, certain opportunities that would otherwise be available to us may not in fact be available. See Item 1A, “Risk Factors,” for additional detail. The independent trustees have an obligation to function on our behalf in all situations in which a conflict of interest may arise. The trustees are required to exercise their rights and powers in good faith, and use the same degree of care and skill in their exercise as a prudent person would exercise or use under the circumstances in the conduct of their own affairs.

Compliance with Federal, State and Local Environmental Laws

The properties underlying our investments are subject to various federal, state, and local environmental laws, ordinances, and regulations. Under these laws, ordinances, and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances or petroleum product releases at, on, under, or in its property. These laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of the hazardous or toxic substances. The costs of investigation, remediation, or removal of these substances may be substantial and could exceed the value of the property. An owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to materials containing asbestos. These laws allow third parties to seek recovery from owners of properties for personal injuries associated with materials containing asbestos. Our operating costs and the values of these assets may be adversely affected by the obligation to pay for the cost of complying with existing environmental laws, ordinances, and regulations, as well as the cost of complying with future legislation, and our income and ability to make distributions to our beneficiaries could be affected adversely by the existence of an environmental liability with respect to our properties. We will endeavor to ensure our properties are in compliance in all material respects with all federal, state and local laws, ordinances, and regulations regarding hazardous or toxic substances or petroleum products.

4

Table of Contents

Employees

We have no employees. Pursuant to the terms of the Management Services Agreement, the Trust Advisor assumes principal responsibility for managing our affairs and we compensate the Trust Advisor for these services.

5

Table of Contents

| ITEM 1A. | RISK FACTORS |

If we are unable to find buyers for properties at our expected sales prices, our liquidating distributions to our beneficiaries may be delayed or reduced.

As of the date of this Annual Report on Form 10-K, none of our properties are subject to a binding sales agreement providing for its disposition. In calculating the estimated range of liquidating distributions to our beneficiaries, we assumed that we would be able to find buyers for our properties at an amount based on our best estimate of market value for each property, net of certain estimated development, leasing, and other transaction costs. However, we may have overestimated the sales price that we will ultimately be able to obtain for these assets. For example, in order to find a buyer in a timely manner, we may be required to lower our asking price below the low end of our current estimate of the property’s fair value. Furthermore, the projected amount of liquidating distributions to our beneficiaries are based upon current appraisals and/or other indicators of value of our properties, but real estate market values are constantly changing and fluctuate with changes in interest rates, supply and demand dynamics, occupancy percentages, lease rates, the availability of suitable buyers, the perceived quality and dependability of income flows from tenancies and a number of other factors, both local and national. The net liquidation proceeds from each property may also be affected by the terms of prepayment or assumption costs associated with debt encumbering each property. In addition, transactional fees and expenses, environmental contamination at our properties or unknown liabilities, if any, may adversely impact the net liquidation proceeds from our remaining assets. If we are not able to find buyers for our assets in a timely manner or if we have overestimated the sales prices we will receive or underestimated the costs we will incur, our liquidating distributions to our beneficiaries would be delayed and/or reduced.

There could be delays in leasing up our properties or our properties could be difficult to sell, which could delay or reduce the liquidating distributions to our beneficiaries.

As of the date of this report, all of our properties, with the exception of the one land parcel, were under development or in the lease-up stage. If we are unable to lease up our properties for an extended period of time, this could result in rental revenues below expectations, resulting in less cash available for distributions to our beneficiaries. In addition, such delays could diminish the resale value of the properties because the market value of a particular property depends to a large degree upon the value of the cash flows generated by the leases associated with that property. Such a reduction on the resale value of a property could reduce distributions available for our beneficiaries upon the sale of that property. In addition, we may face certain difficulties selling our properties. The following factors, among others, may adversely affect our ability to lease up and maintain occupancy at our properties or our ability to sell our properties, which could delay or reduce the liquidating distributions to our beneficiaries:

| • | weak economic conditions may result in defaults by customers at our properties or require us to provide rent concessions or reduced rental rates to maintain or increase occupancy levels; |

| • | weak economic conditions may preclude us from leasing our properties or increase the vacancy level of our assets; |

| • | increases in supply of competing properties or decreases in demand for our properties may impact our ability to maintain or increase occupancy levels; |

| • | changes in interest rates and availability of debt financing could render our properties difficult to sell or unattractive to prospective buyers; |

| • | increased insurance premiums, real estate taxes or energy or other expenses may reduce funds available for distribution or, to the extent such increases are passed through to customers, may lead to tenant defaults. Also, any such increased expenses may make it difficult to increase rents to customers on turnover, which may limit our ability to increase our returns; and |

| • | inability to increase or maintain the current occupancy rates and/or further deterioration of property values may prevent prospective buyers from obtaining financing for the acquisition of our properties due to stricter loan to value ratios, which could increase the amount of equity investment needed to purchase the property. |

6

Table of Contents

Decreases in property values generally may reduce the amount that we receive upon a sale of our properties.

The underlying value of our properties may be reduced by a number of factors that are beyond our control, including, without limitation, the following:

| • | adverse changes in economic conditions; |

| • | the financial performance of our customers, and the ability of our customers to satisfy their obligations under their leases; |

| • | potential major repairs which are not presently contemplated; |

| • | terminations and renewals of leases by our customers; |

| • | changes in interest rates and the availability of financing; |

| • | competition; and |

| • | changes in real estate tax rates and other operating expenses. |

Any reduction in the value of our properties would make it more difficult for us to sell our remaining assets for the amounts that we have estimated. Reductions in the amounts that we receive when we sell our remaining assets could decrease or delay the payment of liquidating distributions to our beneficiaries.

Our properties are concentrated in the industrial real estate sector and primarily in several of the largest distribution and logistics markets in the U.S., and our properties could be adversely affected by an economic downturn in that sector or in those geographic areas.

Our investments are concentrated in the industrial real estate sector and primarily in several of the largest distribution and logistics markets in the U.S. Such industry concentration may expose us to the risk of economic downturns in this sector to a greater extent than if our business activities included investing in other sectors of the real estate industry, and such market concentrations may expose us to the risk of economic downturns in these areas. Adverse conditions in these markets may reduce our ability to lease our properties, reduce occupancy levels, restrict our ability to increase rental rates or force us to lower rental rates or offer customer incentives. In addition, if our customers are concentrated in any particular industry, any adverse economic developments in such industry could expose us to additional risks. These concentration risks could negatively impact our properties and adversely affect our ability to make distributions to our beneficiaries.

We will be dependent on customers for revenue, and our inability to collect rent from our customers could delay or reduce the liquidating distributions to our beneficiaries.

Revenues from our properties will depend on the creditworthiness of our customers and would be adversely affected by the loss of or default by significant customers. In addition, certain of our properties may become occupied by a single customer, and as a result, the success of those properties will depend on the financial stability of that customer. Lease payment defaults by customers could cause us to reduce the amount of distributions to our beneficiaries and could force us to find an alternative source of funding to pay any debt obligations, taxes, or other obligations relating to the property. In the event of a customer default, we may also experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and re-leasing our property. If a lease is terminated or if a customer defaults, the value of the property may be immediately and negatively affected and we may be unable to lease the property for the rent previously received or at all or sell the property without incurring a loss, which could delay or reduce the liquidating distributions to our beneficiaries.

7

Table of Contents

We compete with numerous other parties or entities for customers and may not compete successfully.

Our properties are all under development or in the lease-up stage. We compete with numerous other persons or entities in seeking to attract customers to our properties, including entities sponsored or advised by affiliates of IIT’s Sponsor. These competitors may have greater experience and financial strength, and there is no assurance that we can offer more favorable terms to customers than they can. For example, our competitors may be willing to offer space at rental rates below our rates, causing us to lose existing or potential customers and pressuring us to reduce our rental rates to retain existing customers or convince new customers to lease space at our properties. Similarly, the opening of new competing assets near the assets that we own may hinder our ability to renew our existing leases or to lease to new customers, because the proximity of new competitors may divert existing or new customers to such competitors. Each of these factors may lead to a reduction in our cash flow and operating income and could adversely affect our ability to pay distributions to our beneficiaries.

If any of the parties to our future sale agreements default thereunder, or if these sales do not otherwise close, our liquidating distributions to our beneficiaries may be delayed or reduced.

We will seek to enter into binding sale agreements for all of our remaining assets. The consummation of the potential sales for which we will enter into sale agreements in the future will be subject to satisfaction of certain closing conditions. If any of the transactions contemplated by these future sale agreements do not close because of a buyer default, failure of a closing condition or for any other reason, we will need to locate a new buyer for the asset which we may be unable to do promptly or at prices or on terms that are as favorable as the original sale agreement. We will also incur additional costs involved in locating a new buyer and negotiating a new sale agreement for the asset. These additional costs are not included in our projections. In the event that we incur these additional costs, our liquidating payments to our beneficiaries could be delayed or reduced.

We may delay or reduce our estimated liquidating distributions.

Our expectations about the amount of liquidating distributions that we will make and when we will make them are based on many estimates and assumptions, one or more of which may prove to be incorrect. As a result, the actual amount of liquidating distributions we pay to our beneficiaries may differ materially from our estimate. In addition, the liquidating distributions may be paid later than we predict. We have the authority to sell our remaining assets on such terms and to such parties as we determine, in our trustees’ sole discretion. Moreover, our trustees have the discretion to make distributions of available cash to our beneficiaries as and when they deem such distributions to be in the best interests of the beneficiaries, taking into account the administrative costs of making such distributions, anticipated costs and expenses of the Trust and such other factors as they may consider appropriate. We do not currently expect to make distributions to beneficiaries other than distributions of net proceeds from future sales, financings and refinancings of our properties, and we may not make any such distributions to our beneficiaries until after all of our assets have been sold. Our beneficiaries will have no opportunity to vote on such matters and will, therefore, have no right to approve or disapprove the terms of such sales.

Lack of diversification and illiquidity of real estate may make it difficult for us to sell properties or recover our investment in one or more properties.

We are subject to risks associated with investment solely in real estate. Real estate investments are relatively illiquid. Pursuant to our plan of liquidation, we expect to liquidate our remaining assets within the next 12 to 24 months; however, due to the illiquid nature of real estate and the short timeframe that we have to sell our remaining assets, we may not recoup the estimated fair value of our assets within this estimated timeframe or at all. We cannot provide assurance that we will be able to dispose of our assets within the next 12 to 24 months, or at all, which could adversely impact the timing and amount of liquidating distributions to our beneficiaries.

8

Table of Contents

If our liquidation costs or unpaid liabilities are greater than we expect, our liquidating distributions to our beneficiaries may be delayed or reduced.

Before making the final liquidating distribution to our beneficiaries, we will need to pay or arrange for the payment of all of our transaction costs in the liquidation, and all other costs and all valid claims of our creditors. Our trustees may also decide to acquire one or more insurance policies covering unknown or contingent claims against us, for which we would pay a premium which has not yet been determined. Our trustees may also decide to establish a reserve fund to pay these contingent claims. The total amount of transaction costs in the liquidation is not yet known and, therefore, we have used estimates of these costs in calculating the amounts of our projected liquidating distributions to our beneficiaries. To the extent that we have underestimated these costs in calculating our projections, our actual net liquidation values may be lower than our estimates. In addition, if the claims of our creditors are greater than we have anticipated, or we decide to acquire one or more insurance policies covering unknown or contingent claims against us or to establish a reserve fund, payment of liquidating distributions to our beneficiaries may be delayed and/or reduced.

If we are not able to sell our properties in a timely manner, we may experience liquidity problems, may not be able to meet our obligations to our creditors, which could subject our properties to foreclosure actions.

In the event we are not able to sell our properties within a reasonable period of time and for a reasonable amount, or if our expenses exceed our estimates, we may experience severe liquidity problems and not be able to meet our financial obligations to our creditors in a timely manner. If we cannot meet our obligations to our creditors in a timely manner, our properties could become subject to foreclosure actions.

Our properties are subject to property and other taxes that may increase in the future, which could adversely affect our ability to make distributions to our beneficiaries.

Our properties are subject to real and personal property and other taxes that may increase as tax rates change and as the properties are assessed or reassessed by taxing authorities. Certain of our leases may provide that the property taxes, or increases therein, are charged to the lessees as an expense related to the properties that they occupy while other leases will generally provide that we are responsible for such taxes. In any case, as the owner of the properties, we are ultimately responsible for payment of the taxes to the applicable governmental authorities. If property taxes increase, our customers may be unable to make the required tax payments, ultimately requiring us to pay the taxes even if otherwise stated under the terms of the lease. If we fail to pay any such taxes, the applicable taxing authorities may place a lien on the property and the property may be subject to a tax sale. In addition, we will generally be responsible for property taxes related to any vacant space.

Risks related to property development may adversely affect our ability to dispose of our properties, which could delay or reduce the liquidating distributions to our beneficiaries.

Certain of our properties are under development and therefore are subject to certain risks associated with real estate development and construction activities. These risk include the following, among others:

| • | Long periods of time may elapse between the commencement and the completion of our projects; |

| • | Construction and development costs may exceed original estimates; |

| • | The developer/builder may be unable to index costs or receivables to inflation indices prevailing in the industry; |

| • | The level of interest of potential customers for a recently launched development may be low; |

| • | There could be delays in obtaining necessary permits; |

| • | The supply and availability of construction materials and equipment may decrease and the price of construction materials and equipment may increase; |

9

Table of Contents

| • | Construction and sales may not be completed on time, resulting in a cost increase; |

| • | Labor may be in limited availability; |

| • | Changes in tax, real estate and zoning laws may be unfavorable to us; and |

| • | Unforeseen environmental or other site conditions. |

The combination of these risks may adversely affect our ability to dispose of our properties, or may increase the costs we incur, which could delay or reduce the liquidating distributions to our beneficiaries.

Lease agreements may have specific provisions that may adversely affect our ability to make distributions to our beneficiaries.

Our lease agreements are regulated by local, municipal, state and federal laws, which may grant certain rights to customers, such as the compulsory renewal of their leases by filing lease renewal actions when certain legal conditions are met. A lease renewal action may represent two principal risks for us: if we planned to vacate a given unit in order to change or adapt an asset’s mix of customers, the customer could remain in that unit by filing a lease renewal action and interfere with our strategy; and if we desired to increase the lease price for a specific unit, this increase may need to be approved in the course of a lease renewal action, and the final value could be decided at the discretion of a judge. We would then be subject to the court’s interpretation and decision, and could be forced to accept an even lower price for the lease of the unit. The compulsory renewal of our lease agreements and/or the judicial review of our lease prices may adversely affect our cash flow and our operating results. Certain of our lease agreements may not be “triple net leases,” under which the lessee undertakes to pay all the expenses of maintaining the leased property, including insurance, taxes, utilities and repairs. We could be exposed to higher maintenance, taxes, and property management expenses with respect to all of our leases that are not “triple net.”

We depend on the availability of public utilities and services, especially for water and electric power. Any reduction, interruption or cancellation of these services may adversely affect us.

Public utilities, especially those that provide water and electric power, are fundamental for the sound operation of our assets. The delayed delivery or any material reduction or prolonged interruption of these services could allow certain customers to terminate their leases or result in an increase in our costs, as we may be forced to use backup generators, which also could be insufficient to fully operate our facilities and could result in our inability to provide services. Accordingly, any interruption or limitation in the provision of these essential services may adversely affect us and our ability to make distributions to our beneficiaries.

The real estate industry is subject to extensive regulation, which may result in higher expenses or other negative consequences that could adversely affect us.

Our activities are subject to federal, state and municipal laws, and to regulations, authorizations and license requirements with respect to, among other things, zoning, environmental protection and historical heritage, all of which may affect our business. We may be required to obtain licenses and permits with different governmental authorities in order to manage and liquidate our assets. In addition, public authorities may enact new and more stringent standards, or interpret existing laws and regulations in a more restrictive manner, which may force companies in the real estate industry, including us, to spend funds to comply with these new rules. Any such action on the part of public authorities may adversely affect our results from operations. In the event of noncompliance with such laws, regulations, licenses and authorizations, we may face the payment of fines, project shutdowns, cancellation of licenses, and revocation of authorizations, in addition to other civil and criminal penalties.

10

Table of Contents

Uninsured losses or premiums for insurance coverage relating to property may adversely affect our properties, which could delay or reduce the liquidating distributions to our beneficiaries.

We attempt to adequately insure all of our properties against casualty losses. There are types of losses, generally catastrophic in nature, such as losses due to wars, acts of terrorism, earthquakes, floods, hurricanes, pollution or environmental matters that are uninsurable or not economically insurable, or may be insured subject to limitations, such as large deductibles or co-payments. Risks associated with potential terrorism acts could sharply increase the premiums we pay for coverage against property and casualty claims. Additionally, lenders sometimes require commercial property owners to purchase specific coverage against terrorism as a condition for providing loans. These policies may not be available at a reasonable cost, if at all, which could inhibit our ability to finance or refinance our properties. In such instances, we may be required to provide other financial support, either through financial assurances or self-insurance, to cover potential losses. Changes in the cost or availability of insurance could expose us to uninsured casualty losses. In the event that any of our properties incurs a casualty loss which is not fully covered by insurance, the value of our assets will be reduced by any such uninsured loss. In addition, we could be held liable for indemnifying possible victims of an accident. There can be no assurance that funding will be available to us for repair or reconstruction of damaged property in the future or for liability payments to accident victims.

Environmentally hazardous conditions may adversely affect our properties, which could delay or reduce the liquidating distributions to our beneficiaries.

Under various federal, state and local environmental laws, a current or previous owner or operator of property may be liable for the cost of removing or remediating hazardous or toxic substances on such property. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Even if more than one person may have been responsible for the contamination, each person covered by the environmental laws may be held responsible for all of the clean-up costs incurred. In addition, third parties may sue the owner or operator of a site for damages based on personal injury, natural resources or property damage or other costs, including investigation and clean-up costs, resulting from the environmental contamination. The presence of hazardous or toxic substances on one of our properties, or the failure to properly remediate a contaminated property, could give rise to a lien in favor of the government for costs it may incur to address the contamination, or otherwise adversely affect our ability to sell or lease the property or borrow using the property as collateral. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated. A property owner who violates environmental laws may be subject to sanctions which may be enforced by governmental agencies or, in certain circumstances, private parties. In connection with the ownership of our properties, we may be exposed to such costs. The cost of defending against environmental claims, of compliance with environmental regulatory requirements or of remediating any contaminated property could materially adversely affect our properties, consequently, amounts available for distribution to our beneficiaries.

Environmental laws in the U.S. also require that owners or operators of buildings containing asbestos properly manage and maintain the asbestos, adequately inform or train those who may come into contact with asbestos and undertake special precautions, including removal or other abatement, in the event that asbestos is disturbed during building renovation or demolition. These laws may impose fines and penalties on building owners or operators who fail to comply with these requirements and may allow third parties to seek recovery from owners or operators for personal injury associated with exposure to asbestos. Some of our properties may contain asbestos-containing building materials.

Some of our properties may contain underground storage tanks for the storage of petroleum products and other hazardous or toxic substances. All of these operations create a potential for the release of petroleum products or other hazardous or toxic substances. Some of our properties may be adjacent to or near other properties that have contained or then currently contain underground storage tanks used to store petroleum products or other hazardous or toxic substances. In addition, certain of our properties may be on or adjacent to or near other properties upon which others, including former owners or customers of our properties, have engaged, or may in the future engage, in activities that may release petroleum products or other hazardous or toxic substances.

11

Table of Contents

Costs of complying with environmental laws and regulations may delay or reduce the liquidating distributions to our beneficiaries.

All property and the operations conducted on property are subject to federal, state and local laws and regulations relating to environmental protection and human health and safety. Customers’ ability to operate and to generate income to pay their lease obligations may be affected by permitting and compliance obligations arising under such laws and regulations. Some of these laws and regulations may impose joint and several liability on customers, owners or operators for the costs to investigate or remediate contaminated properties, regardless of fault or whether the acts causing the contamination were legal. Leasing properties to customers that engage in industrial, manufacturing, and commercial activities will cause us to be subject to the risk of liabilities under environmental laws and regulations. In addition, the presence of hazardous or toxic substances, or the failure to properly remediate these substances, may adversely affect our ability to sell, rent or pledge such property as collateral for future borrowings.

Some of these laws and regulations have been amended so as to require compliance with new or more stringent standards as of future dates. Compliance with new or more stringent laws or regulations or stricter interpretation of existing laws may require us to incur material expenditures. Future laws, ordinances or regulations may impose material environmental liability. In addition, there are various local, state and federal fire, health, life-safety and similar regulations with which we may be required to comply and which may subject us to liability in the form of fines or damages for noncompliance. Any material expenditures, fines or damages we must pay will reduce our ability to make distributions. In addition, changes in these laws and governmental regulations, or their interpretation by agencies or the courts, could occur.

The costs associated with complying with the Americans with Disabilities Act may reduce the amount of cash available for distribution to our beneficiaries.

Our properties may also be subject to the Americans with Disabilities Act of 1990 (the “Act”), as amended. Under this act, all places of public accommodation are required to comply with federal requirements related to access and use by disabled persons. The Act has separate compliance requirements for “public accommodations” and “commercial facilities” that generally require that buildings and services be made accessible and available to people with disabilities. The Act’s requirements could require us to remove access barriers and could result in the imposition of injunctive relief, monetary penalties or, in some cases, an award of damages. Any monies we use to comply with the Act will reduce the amount of cash available for distribution to our beneficiaries.

We may not have funding for future customer improvements which may adversely affect the value of our assets and delay or reduce the liquidating distributions to our beneficiaries.

If a customer at one of our properties does not renew its lease or otherwise vacates its space in one of our buildings, it is likely that, in order to attract one or more new customers, we will be required to expend substantial funds to construct new customer improvements in the vacated space. If we do not establish sufficient reserves for working capital or obtain adequate secured financing to supply necessary funds for capital improvements or similar expenses, we may be required to defer necessary or desirable improvements to our properties. If we defer such improvements, the applicable properties may decline in value, and it may be more difficult for us to attract or retain customers to such properties or the amount of rent we can charge at such properties may decrease. There can be no assurance that we will have any sources of funding available to us for repair or reconstruction of damaged property in the future.

We have, and intend to continue to incur secured indebtedness and other borrowings, which could hinder our ability to make distributions to our beneficiaries.

We intend to continue to finance a portion of our properties with borrowed funds. We may also borrow funds to make distributions or for any working capital purposes. High debt levels will cause us to incur higher interest charges, which would result in higher debt service payments and could be accompanied by restrictive covenants. If there is a shortfall between the cash flow from a property and the cash flow needed to service debt on that

12

Table of Contents

property, then the amount available for distributions to beneficiaries may be reduced. In addition, incurring secured debt increases the risk of loss since defaults on indebtedness secured by a property may result in lenders initiating foreclosure actions. In that case, we could lose the property securing the loan that is in default, thus reducing the value of beneficiaries’ units. For tax purposes, a foreclosure on any of our properties will be treated as a sale of the property for a purchase price equal to the outstanding balance of the debt secured by the mortgage. If the outstanding balance of the debt secured by the mortgage exceeds our tax basis in the property, we will recognize taxable income on foreclosure, but we would not receive any cash proceeds. We may give full or partial guarantees to lenders of debt secured by our properties. When we give a guaranty on behalf of an entity that owns one of our properties, we will be responsible to the lender for satisfaction of the debt if it is not paid by such entity. If any secured debt contains cross collateralization or cross default provisions, a default on a single property could affect multiple properties. If any of our properties are foreclosed upon due to a default, our ability to pay cash distributions to our beneficiaries could be adversely affected.

Increases in interest rates and/or unfavorable changes in other financing terms may make it more difficult for us to finance or refinance properties, which could reduce the amount of cash distributions we can make to our beneficiaries.

If debt is unavailable on reasonable terms as a result of increased interest rates, increased credit spreads, decreased liquidity or other factors, we may not be able to finance our properties. In addition, when we incur debt on properties, we run the risk of being unable to refinance such debt when the loans come due, or of being unable to refinance on favorable terms. If interest rates are higher or other financing terms, such as principal amortization, are not as favorable when we refinance debt, our income could be reduced. We may be unable to refinance debt at appropriate times, which may require us to sell properties on terms that are not advantageous to us, or could result in the foreclosure of such properties. If any of these events occur, our cash flow would be reduced. This, in turn, would reduce cash available for distribution to our beneficiaries and may hinder our ability to raise more capital by borrowing more money.

Increases in interest rates could increase the amount of our debt payments and therefore negatively impact our operating results.

Our debt may be subject to the fluctuation of market interest rates such as the London Interbank Offered Rate (“LIBOR”), prime rate, and other benchmark rates. Should such interest rates increase, our debt payments may also increase, reducing cash available for distributions. Furthermore, if we need to repay existing debt during periods of rising interest rates, we could be required to liquidate one or more of our investments at times which may not permit realization of the maximum return on such investments.

Lenders may require us to enter into restrictive covenants that relate to or otherwise limit our operations, which could limit our ability to make distributions to our beneficiaries, to replace the Trust Advisor or to otherwise achieve our investment objectives.

When providing financing, a lender may impose restrictions on us that affect our distribution and operating policies and our ability to incur additional debt. Loan documents we enter into may contain covenants that limit our ability to further leverage property, discontinue insurance coverage or make distributions under certain circumstances. In addition, provisions of our loan documents may deter us from replacing the Trust Advisor or terminate certain operating or lease agreements related to the property. These or other limitations may adversely affect our flexibility and our ability to achieve our investment objectives.

Interest-only indebtedness may increase our risk of default.

We have obtained, and continue to incur interest on, interest-only indebtedness through our credit facility and may continue to obtain interest-only indebtedness in the future. Of our approximately $71.4 million of outstanding debt at December 31, 2015, all of it currently requires interest-only payments. During the interest-only period, interest on the loan is payable monthly but may be advanced by the lender, which has the effect of

13

Table of Contents

increasing the outstanding principal balance of the loan by the amount of interest so paid. During the development and stabilization periods of the properties we expect to pay interest by adding it to the outstanding principal balance in this manner; however, we cannot continue to add interest to principal once interest reserves are depleted or once the outstanding principal balance of the loan equals the maximum available to be borrowed. If the amount available under the loan is insufficient to pay interest when due, we are still obligated to pay that interest. After the interest-only period, we will be required to make a lump-sum or “balloon” payment at maturity, which is November 3, 2017 (subject to our ability to extend the maturity by one year in certain circumstances). This required balloon principal payment and obligation to pay interest may increase our risk of default under the related loan and will otherwise reduce the funds available for other purposes, including our ability to pay cash distributions to our beneficiaries because cash otherwise available for distribution will be required to pay principal and interest associated with the credit facility.

Our ability to make a balloon payment at maturity is uncertain and may depend upon our ability to obtain additional financing or our ability to sell our properties. At the time the balloon payment is due, we may or may not be able to obtain financing or refinance the loan on terms as favorable as the original loan, or sell the property at a price sufficient to make the balloon payment, which, in turn, could affect the distributions available to our beneficiaries and the projected time of disposition of our assets. In an environment of increasing interest rates, we risk being unable to refinance such debt if interest rates are higher at a time a balloon payment is due.

Payments to the holder of the Special Units will reduce cash available for distribution to our beneficiaries.

An affiliate of IIT’s Sponsor, as the holder of the Special Units in the Liquidating Company, is entitled to receive a cash payment upon dispositions of our assets, which further will reduce cash available for distribution to our beneficiaries. The holder of the Special Units is entitled to receive 15% of each distribution of Net Sale Proceeds, and the Trust, as the holder of the common membership units in the Liquidating Company, is entitled to receive 85% of each distribution of Net Sale Proceeds and 100% of any other distributions.

The Trust Advisor and its affiliates and related parties, including our officers and some of our trustees, face conflicts of interest caused by compensation arrangements with us, which could result in actions that are not in our beneficiaries’ best interests.

The Trust Advisor and its affiliates and related parties and our officers and some of our trustees, indirectly through their relationships with the Trust Advisor, receive substantial fees from us in return for their services and these fees could influence the Trust Advisor’s advice to us. The Trust Advisor will receive the following fees in exchange for the services it performs under the Management Services Agreement:

| • | Acquisition development fees, in connection with services related to the development, construction, improvement or stabilization or overseeing the provision of these services by third parties on the Trust’s behalf, will equal up to 4.0% of total project cost, including debt; and |

| • | An asset management fee, as partial compensation for services rendered in connection with the management and disposition of each of our properties, consisting of (i) a monthly fee equal to one-twelfth of 0.80% of the aggregate cost (before non-cash reserves and depreciation) of each such property and (ii) in connection with a disposition of any such property, a fee equal to 2.0% of the sales price in connection with such disposition. |

Among other matters, the compensation arrangements could affect the Trust Advisor’s judgment with respect to property dispositions, which allow the Trust Advisor to earn additional asset management fees and distributions from sales. These fees may incentivize the Trust Advisor to recommend the disposition of a property or properties through a sale, merger, or other transaction that may not be in our best interests at the time. Moreover, the Trust Advisor has considerable discretion with respect to the terms and timing of disposition transactions. Considerations relating to compensation from us to the Trust Advisor and its affiliates or related parties, other Sponsor affiliated entities and related parties and other business ventures could result in decisions that are not in our beneficiaries’ best interests, which could hurt our ability to pay them distributions.

14

Table of Contents

The Trust Advisor’s management personnel, other employees and affiliates face conflicts of interest relating to time management and, accordingly, may not be able to devote adequate time to the Trust, and the Trust Advisor may not be able to hire or retain adequate additional employees.

All of the Trust Advisor’s management personnel, other personnel, affiliates and related parties may also provide services to other entities affiliated with IIT’s Sponsor and related parties. We are not able to estimate the amount of time that such management personnel, other personnel, affiliates and related parties will devote to the Trust. In addition, we may only terminate our Management Services Agreement with the Trust Advisor for misconduct by the Trust Advisor or material breach of the Trust Advisor Agreement by the Trust Advisor. As a result, the Trust Advisor’s management personnel, other personnel, affiliates and related parties may have conflicts of interest in allocating their time between the Trust and their other activities, which may include advising and managing various other real estate programs and ventures, which may be numerous and may change as programs are closed or new programs are formed. During times of significant activity in other programs and ventures, the time they devote to our business may decline. Accordingly, there is a risk that the Trust Advisor’s affiliates and related parties may not devote adequate time to our business activities and the Trust Advisor may not be able to hire adequate additional personnel. Moreover, if the Trust Advisor were to lose the benefit of the experience, efforts and abilities of one or more of these individuals through their resignation, retirement, or due to an internalization transaction effected by another investment program sponsored by IIT’s Sponsor or its affiliates, or due to such individual or individuals becoming otherwise unavailable because of other activities on behalf of IIT’s Sponsor or its affiliates, we may be adversely affected and our liquidating distributions to our beneficiaries could be reduced or delayed.

We may enter into transactions with the Trust Advisor or affiliates or other related entities of the Trust Advisor; as a result, in any such transaction, we may not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties and we may incur additional expenses.

We may enter into transactions with the Trust Advisor or with affiliates or other related entities of the Trust Advisor. For example, we may sell our assets to affiliates or other related entities of the Trust Advisor. The Trust Advisor and/or its management team could experience a conflict in representing our interests in such transactions. In any such transaction, we may not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties and may receive terms that are less beneficial to us than if such transactions were with a third party, which could have an adverse effect on the funds available to be distributed to our beneficiaries.

There is currently no public market for our units of beneficial interest and the units of beneficial interest may not be transferred except by operation of law or upon the death of a beneficiary.

Our beneficiaries will not be able to transfer their units other than in limited circumstances. The units of beneficial interest are not and will not be listed on any exchange, quoted by a securities broker or dealer, nor admitted for trading in any market, including the over-the-counter market. The units of beneficial interest generally are not transferable except by will, intestate succession or operation of law. Therefore, our units of beneficial interest are illiquid and our beneficiaries will have no ability to dispose of them other than in limited circumstances

Our board of trustees generally has full discretion to manage our properties, which increases the uncertainties faced by our beneficiaries.

Our board of trustees generally has full discretion to manage our properties, including determining our policies regarding dispositions, financing and distributions. Our board of trustees may amend or revise these and other policies without providing notice to or obtaining the consent of our beneficiaries. Under our Management Services Agreement and the Liquidating Trust Agreement, our beneficiaries have a right to vote only on limited matters. Our board of trustees’ broad discretion in managing our properties and setting policies and our

15

Table of Contents

beneficiaries’ inability to exert control over those policies increases the uncertainty and risks our beneficiaries face, especially if our board of trustees and beneficiaries disagree as to what course of action is in our beneficiaries’ best interests.

Our organizational documents limit our beneficiaries’ rights to bring claims against our officers and trustees.

The Liquidating Trust Agreement provides that, subject to the applicable limitations set forth therein or under Maryland law, no trustee or officer will be liable to us or our beneficiary for monetary damages. The Liquidating Trust Agreement also provides that we will generally indemnify and advance payment for expenses to our trustees, our officers, the Trust Advisor and its affiliates for losses they may incur by reason of their service in those capacities, subject to limitations described in the Liquidating Trust Agreement. Moreover, we have entered into separate indemnification agreements with each of our officers and trustees. As a result, we and our beneficiaries have more limited rights against these persons than might otherwise exist under common law. In addition, we are obligated to fund the defense costs incurred by these persons in some cases.

Our beneficiaries may recognize taxable income as a result of their ownership of units in the Trust.

The Trust is intended to be treated as a grantor trust for federal income tax purposes. Accordingly, each unit in the Trust will represent ownership of an undivided proportionate interest in all of the assets and liabilities of the Trust, and each unitholder will be treated for federal income tax purposes as receiving or paying directly a pro rata portion of all income, gain, loss, deduction and credit of the Trust. The long-term or short-term character of any capital gain or loss recognized in connection with the sale of the Trust’s assets will be determined based upon a holding period commencing at the time of the acquisition by each unitholder of his or her units in the Trust. If the Trust fails to qualify as a grantor trust, its treatment will depend, among other things, upon the reasons for its failure to so qualify. In such case, the Trust could be taxable as a corporation, which could mean that any income generated by the Trust would be subject to double taxation (i.e., taxed first at the Trust level and then a second time at the unitholder level upon any distribution by the Trust).

We may compete with entities sponsored or advised by affiliates of our Trust Advisor for opportunities to sell properties and for customers, which may have an adverse impact on our ability to pay distributions to our beneficiaries.

We may finance or sell properties at the same time as entities sponsored or advised by affiliates of our Trust Advisor. Therefore, our properties may compete for buyers or customers with other properties owned and/or managed by entities sponsored or advised by affiliates of our Trust Advisor. The Trust Advisor may face conflicts of interest when evaluating disposition or customer leasing opportunities for our properties and other properties owned and/or managed by entities sponsored or advised by affiliates of the Trust Advisor, and these conflicts of interest may have a negative impact on our ability to attract and retain customers or dispose of our terms that are as beneficial to us, which may have an adverse effect on our ability to pay distributions to our beneficiaries.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

16

Table of Contents

| ITEM 2. | PROPERTIES |

Portfolio Overview

As of December 31, 2015, we owned 11 industrial properties, of which eight were in the lease-up stage, two were under development and one was a land parcel. The ten properties in the lease-up stage or under development consist of warehouse distribution facilities suitable for single or multiple customers. Upon completion of such development and lease up, as applicable, we expect that most of our properties will be subject to leases on a “triple net basis,” in which customers pay their proportionate share of real estate taxes, insurance, common area maintenance, and certain other operating costs. In addition we expect that our leases will typically include fixed rental increases or consumer price index-based rental increases. We expect that our lease terms typically will range from one to ten years, and will often include renewal options.

As of December 31, 2015, none of our properties were occupied and approximately 32,000 square feet of our total portfolio was leased. The leased rate reflects square footage with leases in-place that have not yet commenced. We expect that the majority of our customers will not have a corporate credit rating. We evaluate creditworthiness and financial strength of prospective customers based on financial, operating and business plan information that is provided to us by such prospective customers, as well as other market, industry, and economic information that is generally publicly available.

The following table presents certain additional information about these properties:

| (square feet in thousands) |

Market | Number of Properties |

Rentable Square Feet (1) |

Percent Leased |

Stage | Completion Date (2) | ||||||||||||

| Bluegrass DC II |

Atlanta | 1 | 163 | — | % | Under Development | Q2-2016 | |||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Subtotal—Atlanta Market |

1 | 163 | — | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Cajon DC |

So. California | 1 | 831 | — | % | Lease Up | Q3-2014 | |||||||||||

| Redlands DC |

So. California | 1 | 771 | — | % | Lease Up | Q3-2015 | |||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Subtotal—So. California Market |

2 | 1,602 | — | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Lehigh Valley Crossing DC I |

Pennsylvania | 1 | 400 | — | % | Lease Up | Q4-2015 | |||||||||||

| Lehigh Valley Crossing DC II |

Pennsylvania | 1 | 210 | — | % | Under Development | Q4-2016 | |||||||||||

| Lehigh Valley Crossing DC III |

Pennsylvania | 1 | 106 | — | % | Lease Up | Q4-2015 | |||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Subtotal—Pennsylvania Market |

3 | 716 | — | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Miami DC III |

So. Florida | 1 | 102 | — | % | Lease Up | Q4-2015 | |||||||||||

| Miami DC IV |

So. Florida | 1 | 88 | — | % | Lease Up | Q4-2015 | |||||||||||

| Miami DC III Land |

So. Florida | 1 | — | N/A | N/A | N/A | ||||||||||||

| Tamarac Commerce Center II |

So. Florida | 1 | 104 | 31 | % | Lease Up | Q4-2015 | |||||||||||

| Tamarac Commerce Center III |

So. Florida | 1 | 42 | — | % | Lease Up | Q4-2015 | |||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Subtotal— So. Florida Market |

5 | 336 | 10 | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

| Total Portfolio |

11 | 2,817 | 1 | % | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||

| (1) | Rentable square feet for projects under development is projected and cannot be assured. |

| (2) | The completion date represents the fiscal quarter in which the acquisition date, date of building shell completion, or estimated date of shell completion occurred or is estimated to occur. There can be no assurances that properties with completion dates in the future will be completed within the time frame provided in the table above. |

Debt Obligations

On November 4, 2015, the Liquidating Company entered into a secured credit facility with commitments of up to $120.0 million. The credit facility is available to finance up to 100% of budgeted construction, debt service, leasing commissions, tenant improvement work and other operating and carrying costs on the properties owned by the Liquidating Company, and to fund general working capital, including, without limitation, advisory fees, asset management and development management fees.

17

Table of Contents