Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ESSA Bancorp, Inc. | d143676d8k.htm |

ESSA Bancorp, Inc. 2016 Annual Meeting March 3, 2016 Bank Confidently. Exhibit 99.1

Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may”, “will”, “believe”, “expect”, “estimate”, “anticipate”, “continue”, or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which ESSA Bancorp, Inc. (the “Company”) operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated event.

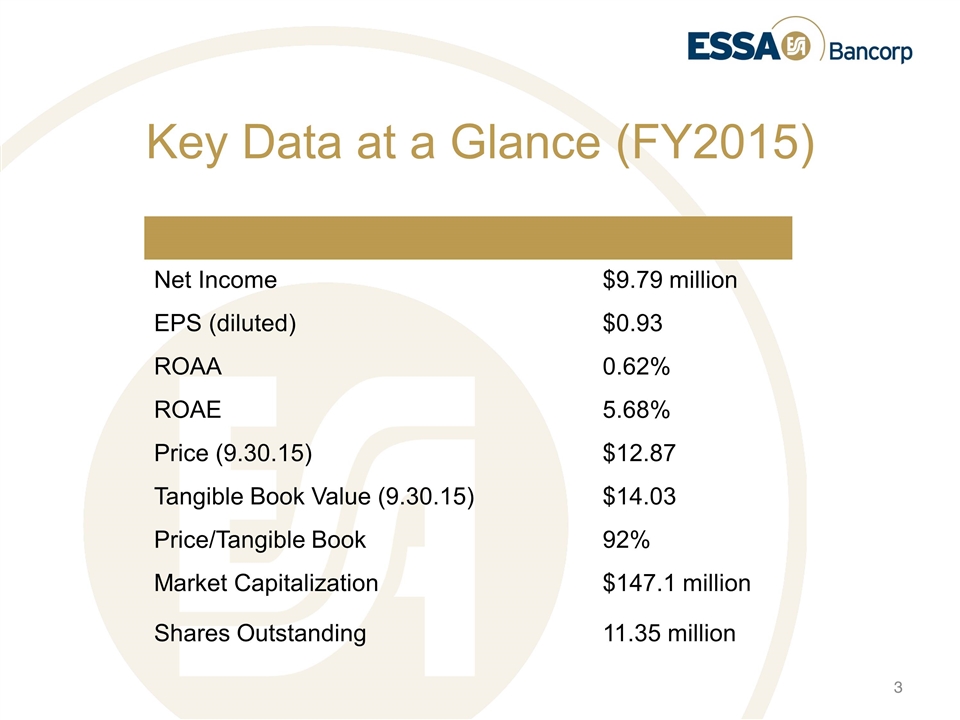

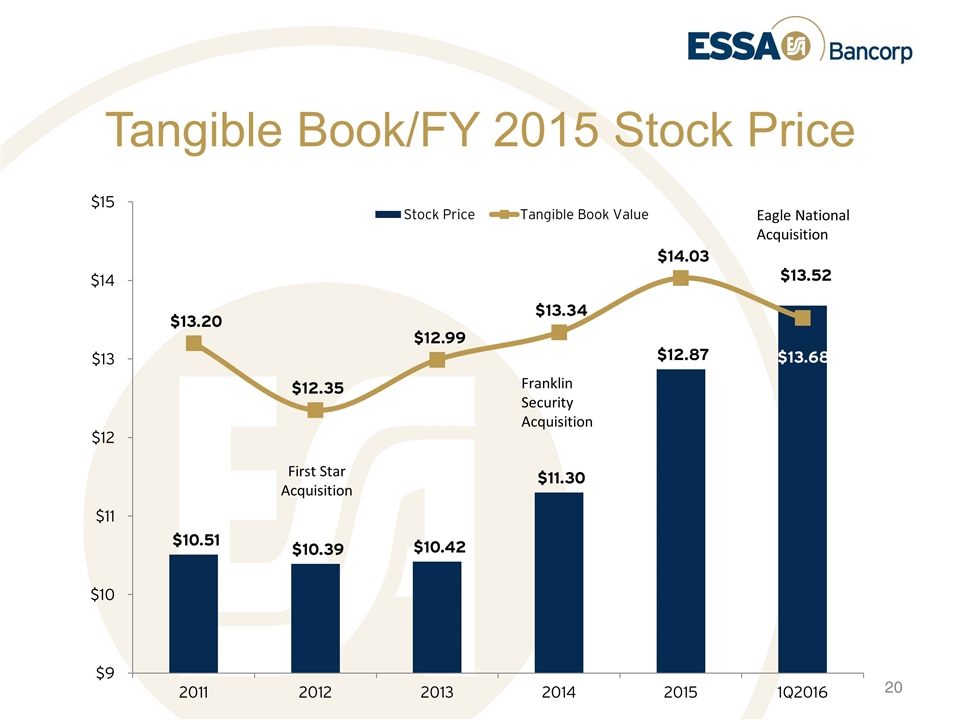

Key Data at a Glance (FY2015) Net Income $9.79 million EPS (diluted) $0.93 ROAA 0.62% ROAE 5.68% Price (9.30.15) $12.87 Tangible Book Value (9.30.15) $14.03 Price/Tangible Book 92% Market Capitalization $147.1 million Shares Outstanding 11.35 million

FY2015: Growth Drives Financials Record net income of $9.8 million and EPS of $0.93 per diluted share Loan growth drives net interest income increase of 9.1% year-over-year (up 52% since 2011) Revenue (net interest and non-interest income) reaches record $51.7 million, up 8.7% from FY 2014 Commercial and indirect auto loans lead loan expansion

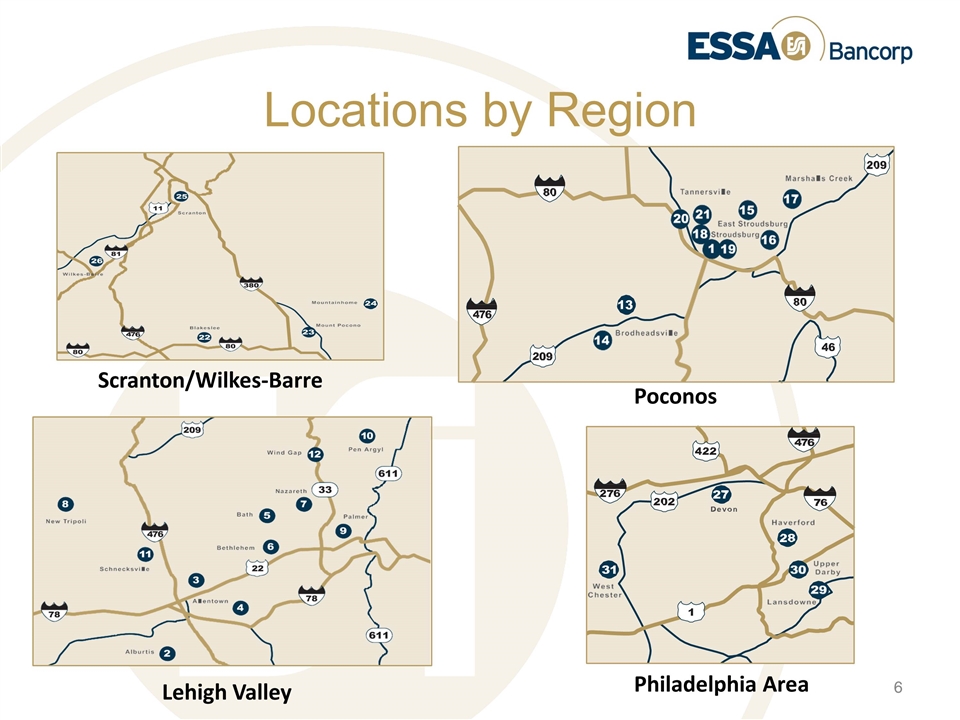

Scale, Scope, Market Reach Assets reach $1.8 billion following Eagle National Bank acquisition 29 offices serving four eastern Pennsylvania markets Diverse market economics present opportunity for the full spectrum of financial services Broad expansion of products and services into western Philadelphia suburbs: Commercial banking Indirect auto lending Services to municipalities Insurance Investments Trust services

Locations by Region Scranton/Wilkes-Barre Poconos Lehigh Valley Philadelphia Area

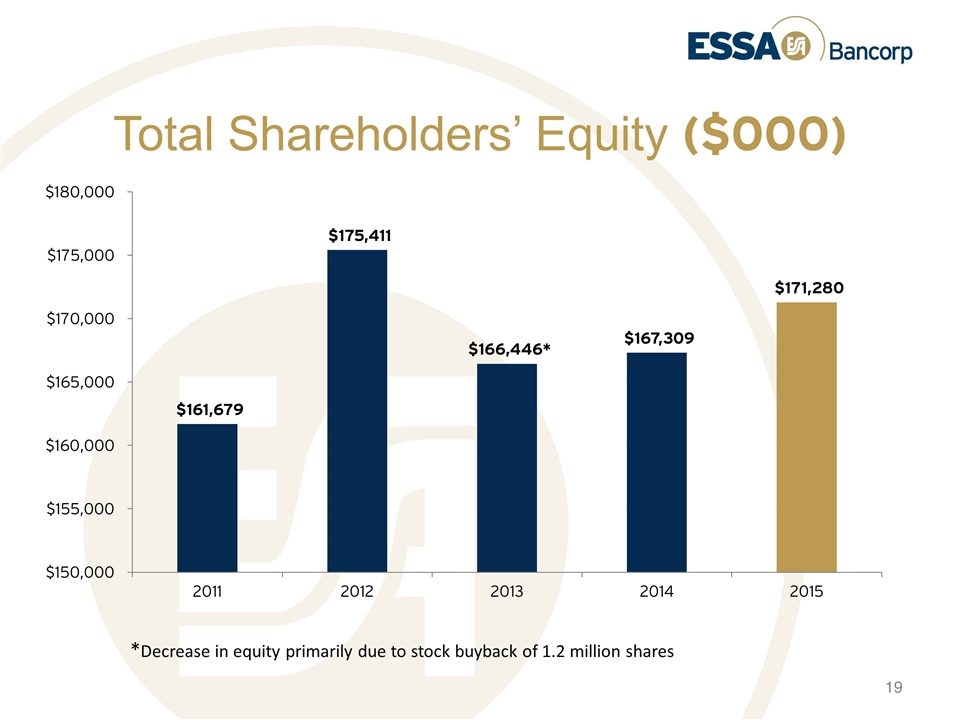

FY2015: Building Franchise Value Announced acquisition of Eagle National Bancorp (closed first quarter FY2016) Entered attractive western suburbs of Philadelphia Resources, numerous relationship opportunities in commercial banking Added $153.2 million in assets, $123.4 million in loans, $152.3 million in deposits Fully integrated acquisition of Franklin Security Bancorp Expanded ESSA’s presence in the Wilkes-Barre & Scranton markets Relocated Scranton office, expanded indirect auto and commercial lending Increased shareholder value Tangible Book Value (TBV) $14.03 per share vs. $13.34 a year earlier Repurchased common shares at or below TBV Total stockholders equity rose to $171.3 million from $167.3 million Grew dividends per share to $0.34 for FY 2015

Growing ESSA Bancorp

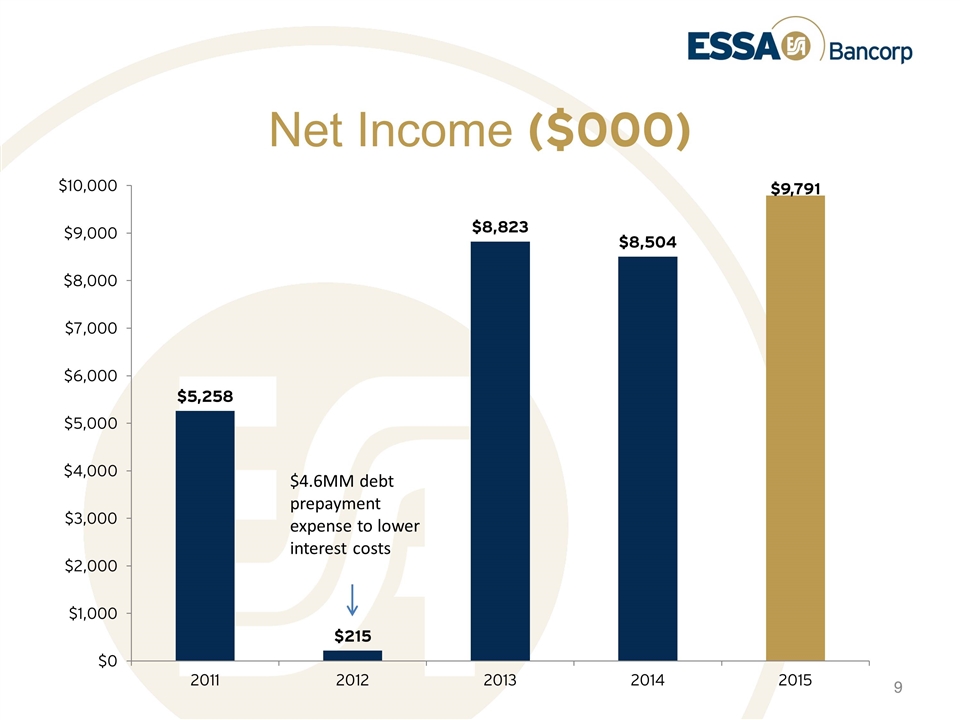

Net Income ($000) $4.6MM debt prepayment expense to lower interest costs

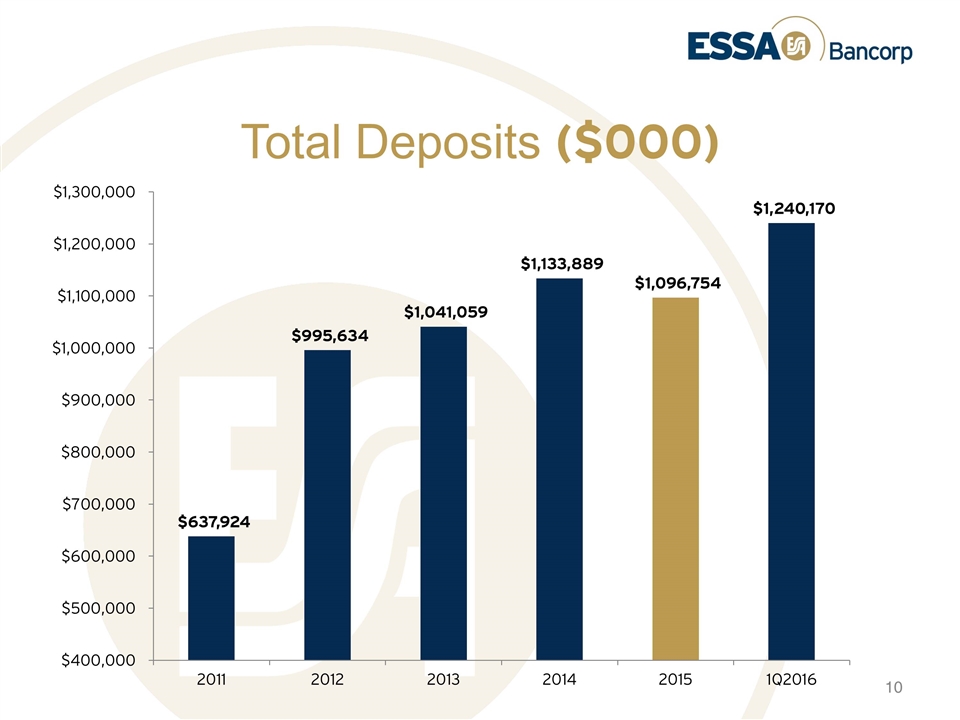

Total Deposits ($000)

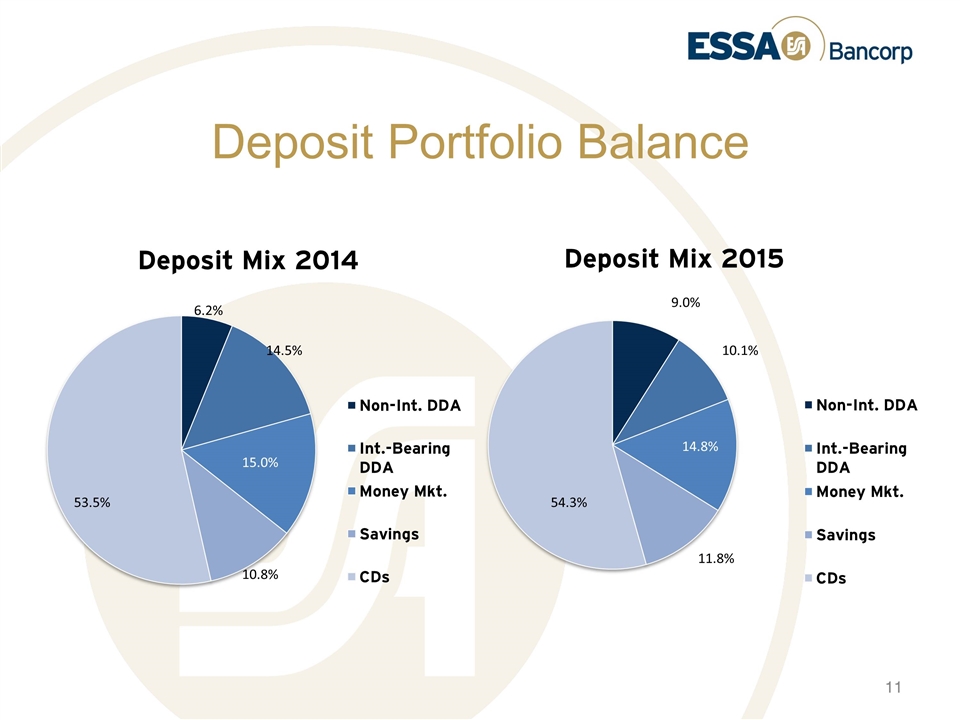

Deposit Portfolio Balance

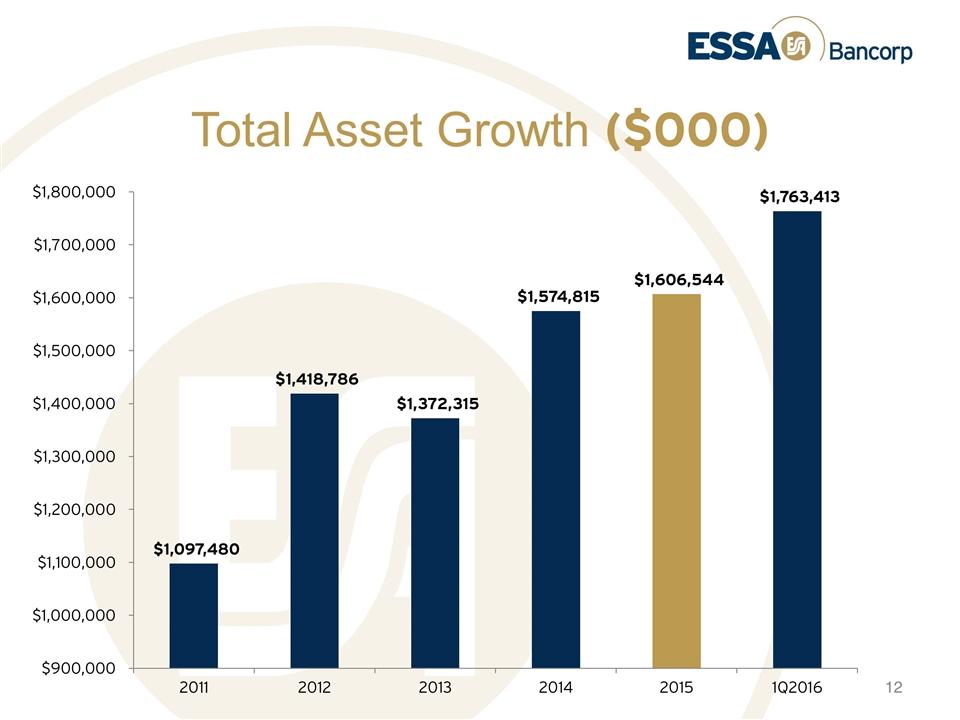

Total Asset Growth ($000)

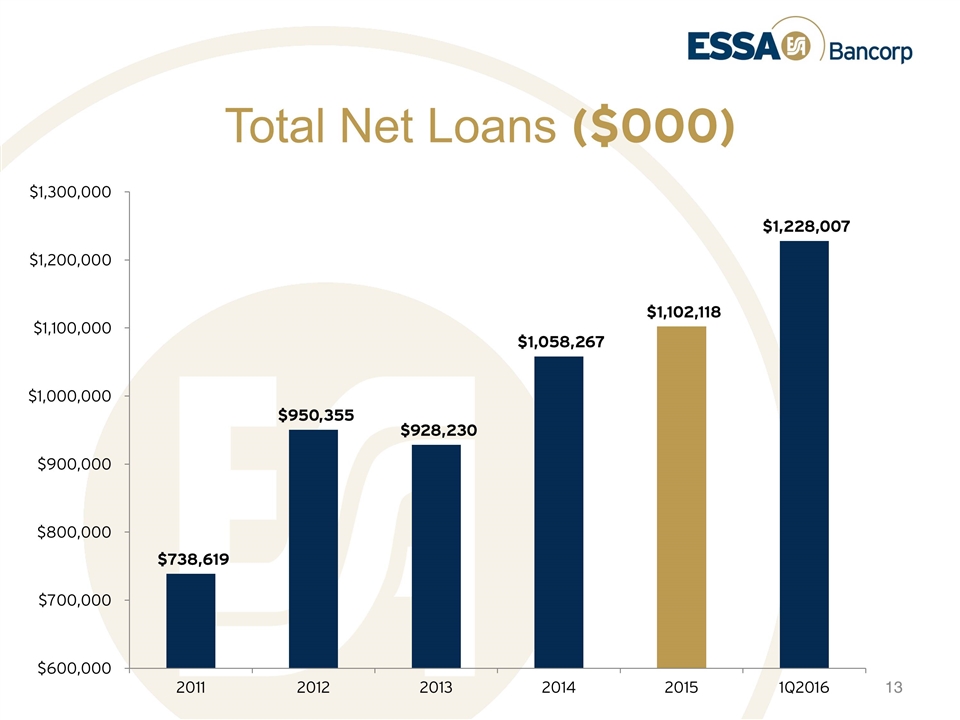

Total Net Loans ($000)

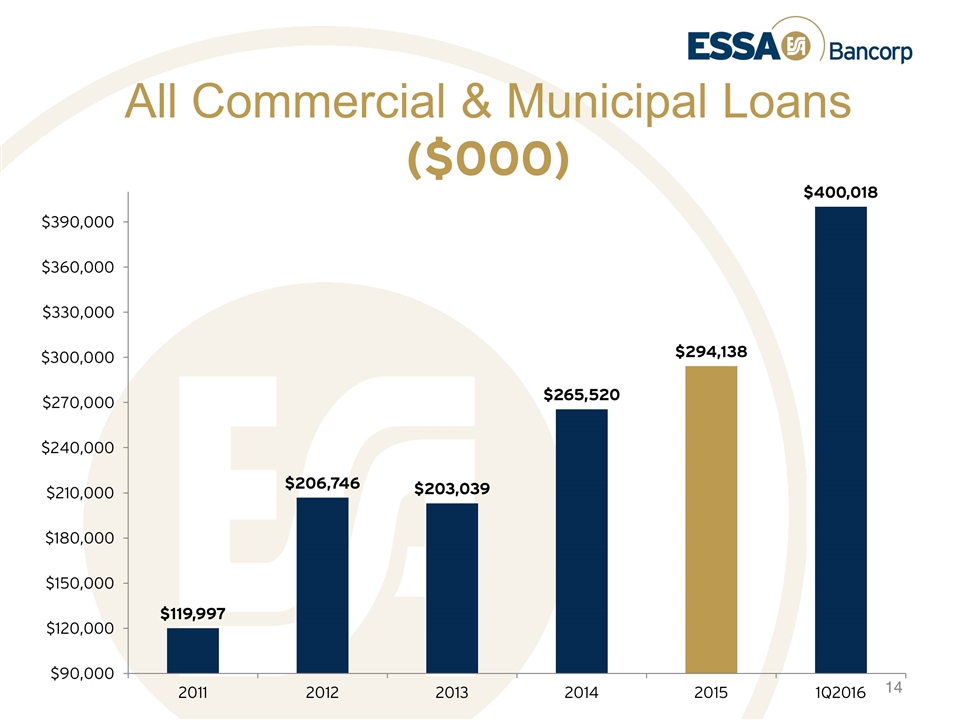

All Commercial & Municipal Loans ($000)

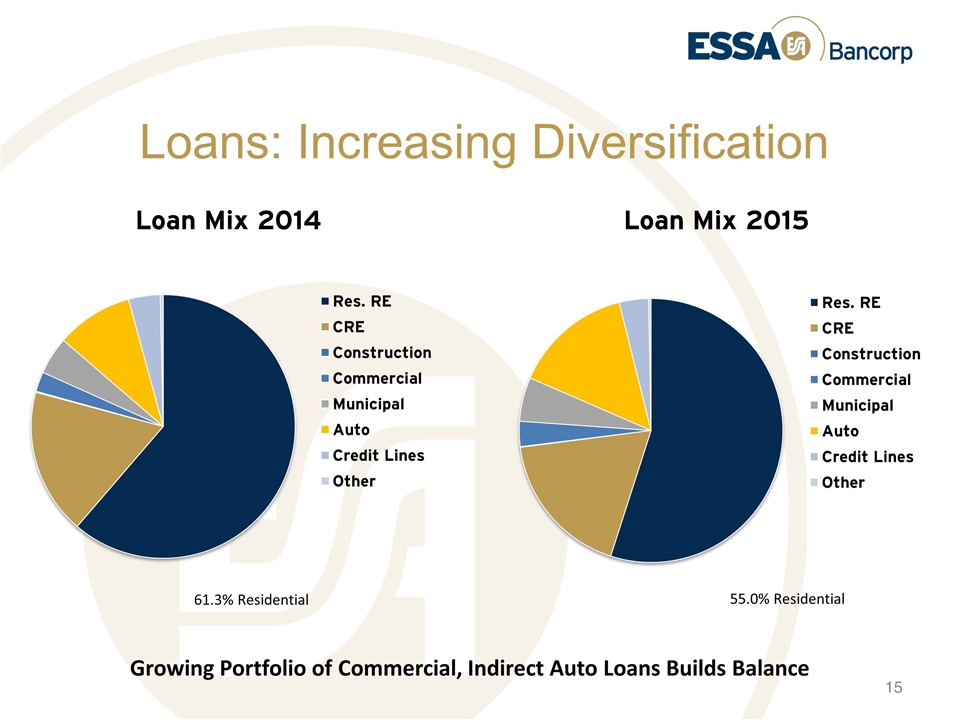

Loans: Increasing Diversification Growing Portfolio of Commercial, Indirect Auto Loans Builds Balance

Value, Quality, Strength

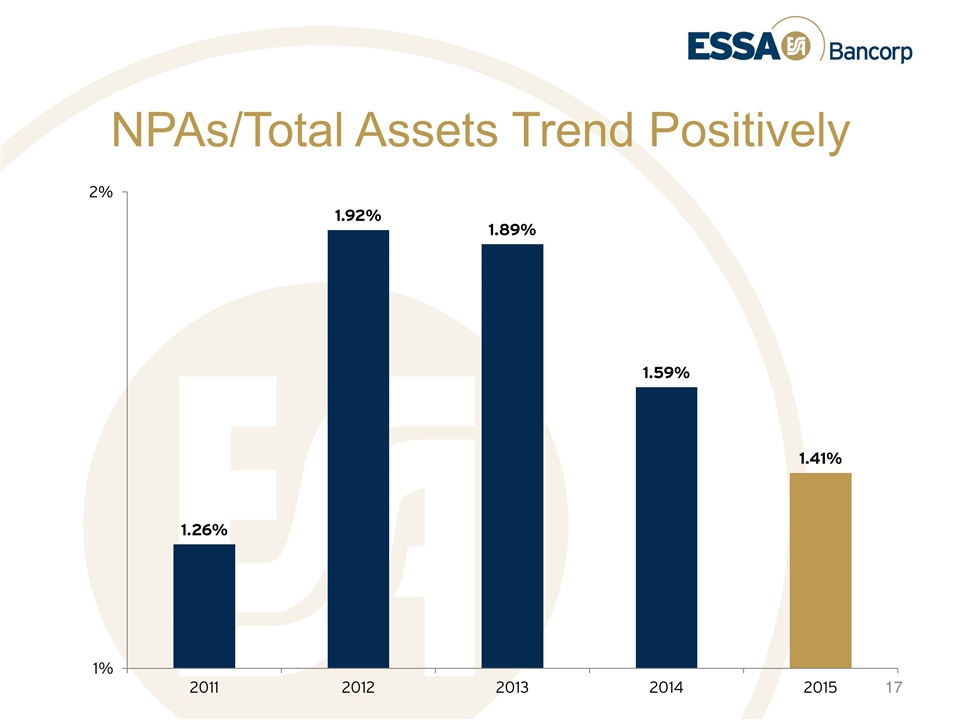

NPAs/Total Assets Trend Positively

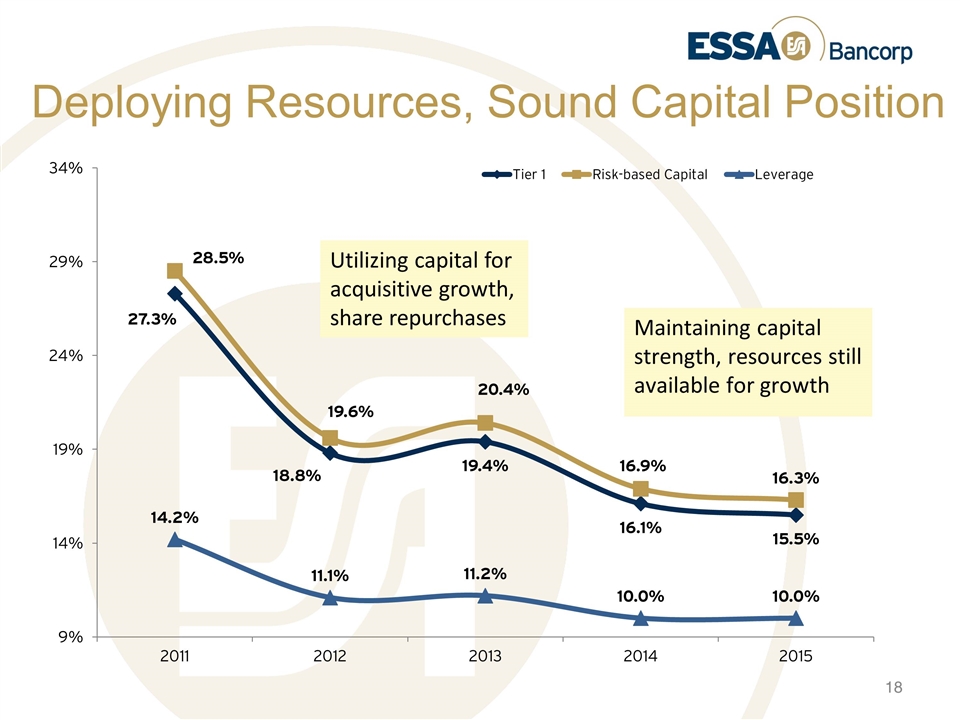

Deploying Resources, Sound Capital Position Utilizing capital for acquisitive growth, share repurchases

Total Shareholders’ Equity ($000) *Decrease in equity primarily due to stock buyback of 1.2 million shares

Tangible Book/FY 2015 Stock Price

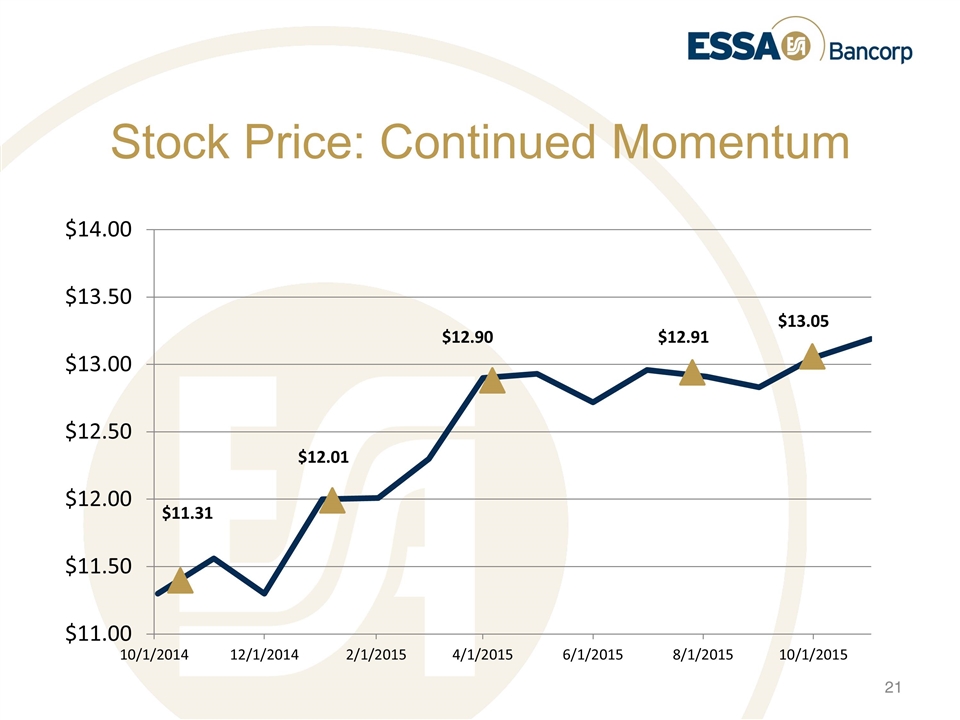

Stock Price: Continued Momentum

Looking Ahead: FY2016 Closed Eagle National Bank acquisition in 1Q 2016 and integrated operations Record assets, loans, and deposits reported in 1Q 2016 Continued focus on productivity from all locations Closed Pen Argyl office in 1Q 2016 Deliver balanced value through operational growth, earnings, opportunistic stock repurchases, and dividends Drive revenue growth through larger, diversified franchise as a commercially-focused bank Assess strategic branch and whole-bank acquisition opportunities

ESSA Bancorp, Inc. 2016 Annual Meeting