Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Forestar Group Inc. | earningsfy158-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Forestar Group Inc. | exh991forreleasefy15.htm |

Information on Execution of Key Initiatives and Fourth Quarter & Full Year 2015 Financial Results March 2, 2016

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; market demand for our non-core assets;changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward- looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

Four Key Initiatives Reducing Costs Across the Entire Organization • Actions taken to eliminate over $30 million in SG&A Reviewing Entire Portfolio of Assets • Multiple NAV scenarios completed for every asset• Non‐core assets ‐ opportunistically exiting Reviewing Capital Structure • Retired $19 million of senior secured notes to yield $1.6 million in annual interest savings Providing Additional Information • Entitlement activities discontinued on 8 projects in Georgia totaling 20,000 acres • Determined 12 Georgia entitled projects (4,000 planned lots) unlikely to be developed Key Initiatives: Update 3 Significant Progress at Forestar

Reducing Costs Across Entire Organization 4 0 10 20 30 40 50 60 70 80 90 100 2015 2016E Target Annual SG&A Costs Corporate G&A Segment Operating Costs Project Level Expenses $39 million SG&A costs in 2016 and target are estimates and actual results may vary depending on the timing of asset sales. $87 million $ i n M i l l i o n s $56 million • Over $30 million in annual savings expected in 2016 • Significant reduction in workforce – over 50% reduction compared to peak, once initiatives are fully implemented • Actions taken to reduce costs across organization – “zero-based budgeting” • Targeting additional $17 million reduction as non-core asset sales are completed 2016 Annual Savings Breakdown Corporate G&A 24% Segment Operating Costs 41% Project Level Expenses 35%

Reviewing Entire Portfolio of Assets 5 NON - CORE ASSETS Oil & Gas Working Interests Radisson Hotel Sold Kansas and Nebraska for $21 MM Executed agreement for $130 MM Multifamily Opportunistically exiting multifamily portfolio Denver 360 – Target Q1/16 close Eleven on market – Target Q2/16 close Three multifamily assets being marketed for sale by HFF1: - Dillon - Music Row - Pressler Market Acklen in Q2/16E Market Littleton in late 2016E Market Westlake and Elan in 2017E Community Development Exit non-core communities Discontinued entitlement on 20,000 acres (8 projects) in Georgia Identified 12 Georgia entitled projects (nearly 4,000 planned lots and 5,100 acres) not likely to be developed Undeveloped Land Sold 6,900 acres Q4/15 for $15 MM Pursue opportunistic exit of 89,0002 acres 2. Includes 20,000 acres in Georgia transferred from Entitlement in Process (EIP) to higher and better use timberland and 5,100 acres in Georgia classified as entitled undeveloped land 1. Holliday Fenoglio Fowler

Q4 and Full Year 2015 Results Impacted By Non-Cash Oil and Gas Impairments 6 ($ in Millions, except per share data) Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Net Income (Loss) - As Reported ($6.2) ($11.8) ($213.0) $16.6 Net Income (Loss) Per Share - As Reported ($0.18) ($0.34) ($6.22) $0.38 Special Items: Deferred Tax Asset Valuation Allowance (2.9) ---- 96.0 ---- Oil & Gas Proved Property Impairments 10.8 10.1 69.6 10.1 Oil & Gas Unproved Leasehold Interest Impairments 13.6 9.8 37.4 11.1 Severance Related Charges ---- 3.3 2.2 3.3 Total Special Items After-Tax $21.5 $23.2 $205.2 $24.5 Net Income (Loss) – Excluding Special Items $15.3 $11.4 ($7.8) $41.1 Net Income (Loss) Per Share – Excluding Special Items $0.45 $0.32 ($0.23) $0.94 • Q4 2014 and FY 2014 results include charges of ($23.2) million, or ($0.66) per share, and ($24.5) million, or ($0.56) million per share respectively, after-tax, principally associated with impairments related to proved oil and gas properties and unproved leasehold interests Note: Q4 2015 and FY 2015 weighted average diluted shares outstanding were 34.3 million, Q4 2014 and FY 2014 weighted average diluted shares outstanding were 35.0 million and 43.6 million, respectively • Q4 2015 and FY 2015 results include charges of ($21.5) million, or ($0.63) per share, and ($205.2) million or ($5.99) per share respectively, after-tax, principally associated with impairments related to unproved leasehold interests and proved oil and gas properties

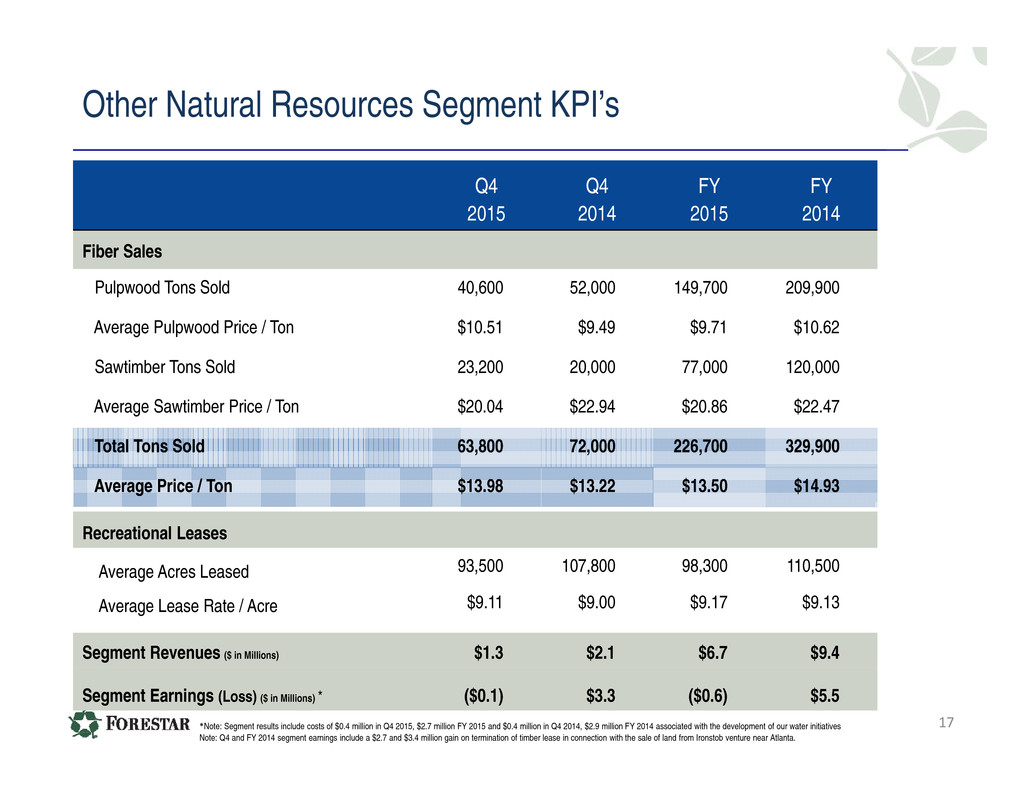

Q4 and Full Year 2015 Segment Results Segment Earnings (Loss) Q4 2015 Q4 2014 Full Year 2015 Full Year 2014 Real Estate $37.9 $30.0 $67.7 $96.9 Oil and Gas (38.4) (39.0) (184.4) (22.7) Other Natural Resources (0.1) 3.3 (0.6) 5.5 Total Segment Earnings (Loss) ($0.6) ($5.7) ($117.3) $79.7 • Q4 and FY 2015 real estate revenues include the sale of Midtown Cedar Hill, a 354-unit multifamily property we developed near Dallas for $42.9 million, generating $9.3 million of earnings, reduced debt by $24.2 million • Q4 and FY 2015 oil and gas segment results include non-cash impairment charges of ($37.6) million and ($164.8) million related respectively, related to unproved leasehold interests and proved oil and gas properties • Q4 2014 real estate segment results include $7.6 million in earnings from the sale of over 8,400 acres of timberland and a $6.6 million gain associated with $46.5 million in bond proceeds from the Cibolo Canyons Special Improvement District • Q4 2014 and FY 2014 oil and gas segment results include charges of ($35.7) million and ($37.7) million respectively, principally associated with impairments related to unproved leasehold interests, proved oil and gas properties and other costs • Other natural resources segment results include a $2.7 million and $3.4 million gain in Q4 and FY 2014 related to the termination of a timber lease in connection with land sales from the Ironstob venture 7 ($ in Millions)

Real Estate Segment - Earnings Reconciliation Q4 2015 $1.7 ($7.9) $30.0 $9.8 $7.1 $3.5 ($3.1) ($2.3) ($0.9) $37.9 $0 $10 $20 $30 $40 $50 $60 Q4 2014 Multifamily and Income Producing Properties Residential & Commercial Tract Sales Undeveloped Land Sales Mitigation Banking Gain on Asset Sales Lot Sales Opex Interest Income Q4 2015 Segment Earnings Reconciliation Q4 2014 vs. Q4 2015 ($ in millions) Q4 2015 Sales Activity • Sold Midtown Cedar Hill multifamily for $42.9 million, generating $9.3 million in earnings and reduced debt $24.2 million • Residential Tracts – 59 acres • $110,500 per acre • Commercial Tracts – 7 acres • > $491,700 per acre • Undeveloped Land – nearly 7,267 acres • Average $2,200 per acre • Residential Lots – 363 • > $83,700 average price per lot • $35,000 gross profit per lot 8 Note: Includes ventures

($0.6) $96.9 $16.3 $8.2 ($24.4) ($14.0) ($6.4) ($5.4) ($2.8) ($0.1) $67.7 $0 $25 $50 $75 $100 $125 FY 2014 Multifamily and Income Producing Properties Residential & Commercial Tract Sales Gain on Sale of Assets Undeveloped Land Sales Opex Interest Income Residential Lots Impairments Mitigation Banking FY 2015 Segment Earnings Reconciliation FY 2014 vs. FY 2015 ($ in millions) FY 2015 Sales Activity • Sold Midtown Cedar Hill multifamily for $42.9 million, generating $9.3 million in earnings, reduced debt $24.2 million • Commercial Tracts – 63 acres • Approximately $248,300 per acre • Residential Tracts – 1,062 acres • Almost $10,600 per acre • Undeveloped Land – 13,862 acres • Almost $2,300 per acre • Residential Lots – 1,472 lots • $77,200 average price per lot • $34,400 gross profit per lot - up 34% vs. 2014 9 Note: Includes ventures Real Estate Segment - Earnings Reconciliation FY 2015

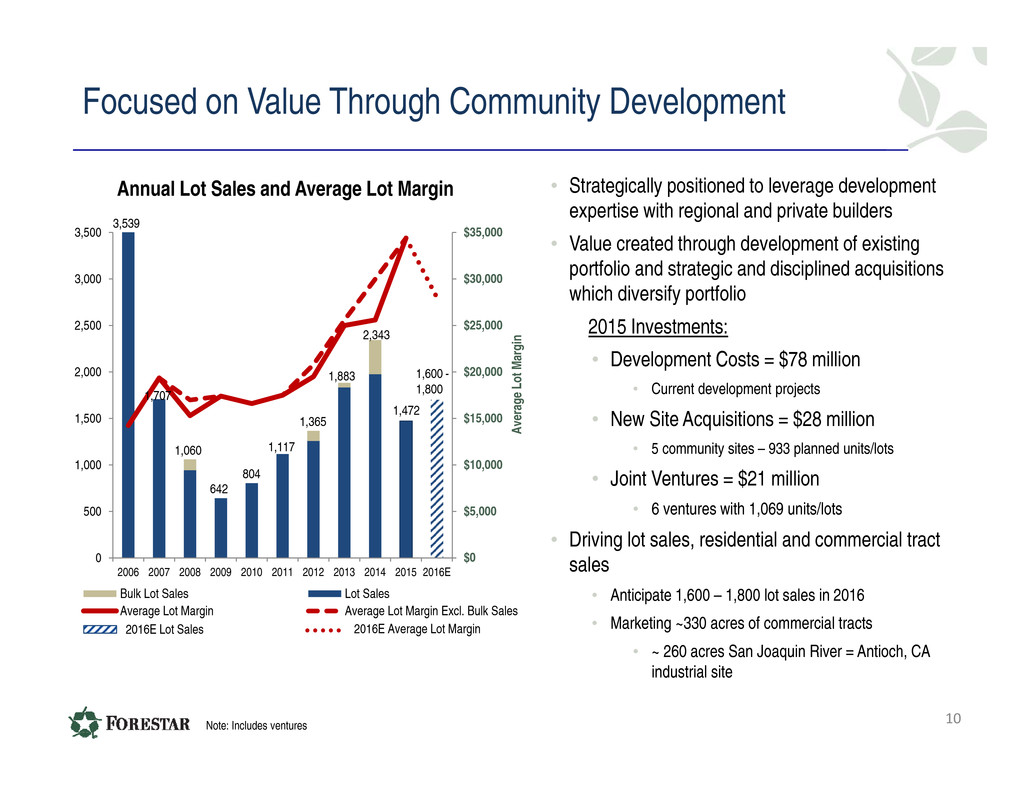

1,707 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 0 500 1,000 1,500 2,000 2,500 3,000 3,500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E Bulk Lot Sales Lot Sales Average Lot Margin Average Lot Margin Excl. Bulk Sales Focused on Value Through Community Development Annual Lot Sales and Average Lot Margin Note: Includes ventures 1,060 642 804 1,117 1,365 1,883 2,343 A v e r a g e L o t M a r g i n 10 1,472 3,539 1,600 - 1,800 2016E Lot Sales 2016E Average Lot Margin • Strategically positioned to leverage development expertise with regional and private builders • Value created through development of existing portfolio and strategic and disciplined acquisitions which diversify portfolio 2015 Investments: • Development Costs = $78 million • Current development projects • New Site Acquisitions = $28 million • 5 community sites – 933 planned units/lots • Joint Ventures = $21 million • 6 ventures with 1,069 units/lots • Driving lot sales, residential and commercial tract sales • Anticipate 1,600 – 1,800 lot sales in 2016 • Marketing ~330 acres of commercial tracts • ~ 260 acres San Joaquin River = Antioch, CA industrial site

Stable Market Demand in Most Texas Markets 11 Texas New Home Inventory Within Equilibrium 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 0 5,000 10,000 15,000 20,000 25,000 30,000 1Q01 1Q02 1Q03 1Q04 1Q05 1Q06 1Q07 1Q08 1Q09 1Q10 1Q11 1Q12 1Q13 1Q14 1Q15 Housing Inventory Months of Supply Equilibrium M o n t h s o f S u p p l y N e w H o m e I n v e n t o r i e s Note: Includes ventures Source: Metrostudy and Bureau of Labor Statistics December 2015 vs. December 2014 Austin 3.7% Dallas / Fort Worth 3.0% Houston 0.8% San Antonio 3.5% U.S. Average 1.9% Texas Job Growth vs. National Average • New home inventories remain in equilibrium in Texas • Job growth in Dallas, Austin and San Antonio holding well above U.S. average • Houston job growth lower 0 500 1,000 1,500 2,000 Q 1 1 2 Q 2 1 2 Q 3 1 2 Q 4 1 2 Q 1 1 3 Q 2 1 3 Q 3 1 3 Q 4 1 3 Q 1 1 4 Q 2 1 4 Q 3 1 4 Q 4 1 4 Q 1 1 5 Q 2 1 5 Q 3 1 5 Q 4 1 5 R e s i d e n t i a l L o t s Developed Lots Lots Under Development Forestar: > 1,300 Lots Under Option Contract No Builder Option Terminations

Lower Houston Job Growth; Markets Remain Balanced With Low Housing Inventory 12 • Houston #1 in single-family new home permits in U.S. with significant future expected population growth • Housing starts down 8.9% in Q4 2015 vs year-ago • Vacant developed lot (VDL) supply below equilibrium • New home inventory at 7.1 months; only modestly above equilibrium ($ in millions) Texas Houston Community Development 1 Projects 39 10 Pipeline: Residential Lots 9,162 2,757 Commercial Acres 637 348 Investment $283 $51 Source: Metrostudy Q4/2015; U.S. Census Bureau 1. Does not include projects in entitlement or income producing. Includes ventures. Houston Housing Market Forestar Houston Communities 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 50.0 15,000 25,000 35,000 45,000 55,000 65,000 75,000 85,000 Houston Vacant Developed Lot Supply VDL Inventory VDL MoS Equilibrium M o n t h s o f S u p p l y Forestar Houston communities well positioned with 2016E Houston lot sales consistent with 2015

13

14 Appendix

Real Estate Segment KPI’s Q4 2015 Q4 2014 FY 2015** FY 2014* Residential Lot Sales Lots Sold 363 509 1,472 2,343 Average Price / Lot $83,700 $71,800 $77,200 $58,100 Gross Profit / Lot*** $35,000 $35,700 $34,400 $25,600 Commercial Tract Sales Acres Sold 7 25 63 32 Average Price / Acre $491,700 $227,500 $248,300 $258,600 Land Sales Acres Sold 7,267 8,963 13,862 22,137 Average Price / Acre $2,200 $2,100 $2,300 $2,200 Segment Revenues ($ in Millions) $102.6 $60.0 $202.8 $213.1 Segment Earnings ($ in Millions) $37.9 $30.0 $67.7 $96.9 *FY 2014 real estate segment results include $10.5 million gain associated with the exchange of 10,000 acres of timber leases into 5,400 acres of undeveloped land, $7.6 million gain associated with acquisition of our partner’s interest in Eleven venture and $6.6 million gain associated with $46.5 million of bond proceeds received from Cibolo Canyons Special Improvement District. **FY 2015 real estate segment results include revenues of $42.9 million and earnings of $9.3 million associated with the sale of Midtown Cedar Hill multifamily community we developed near Dallas. *** FY 2014 gross profit per lot was approximately $30,000 per lot, excluding almost 370 bulk lot sales. . Note: Includes ventures 15

Oil and Gas Segment KPI’s Q4 2015** Q4 2014** FY 2015*** FY 2014*** Fee Leasing Activity Net Fee Acres Leased --- 40 3,343 3,905 Avg. Bonus / Acre --- $200 $298 $320 Total Oil and Gas Interests* Oil Produced (Barrels) 235,600 236,900 1,046,400 869,700 Average Price / Barrel $36.97 $63.91 $42.89 $83.43 NGL Produced (Barrels) 30,800 22,900 112,100 61,400 Average Price / Barrel $8.59 $38.42 $13.81 $41.02 Natural Gas Produced (MMCF) 503.6 614.1 2,134.8 2,060.2 Average Price / MCF $2.26 $3.77 $2.60 $4.19 Total BOE 350,400 362,100 1,514,300 1,274,500 Average Price / BOE $28.86 $50.63 $34.33 $65.68 Segment Revenues ($ in millions) $10.1 $18.2 $52.9 $84.3 Segment Earnings (Loss) ($ in millions) ($38.4) ($39.0) ($184.4) ($22.7) Producing Wells (end of period) 903 944 903 944 * Includes our share of venture production: 39 MMcf in Q4 2015, 168 MMcf FY 2015, 47 MMcf in Q4 2014, 200 MMcf FY 2014 ** Fourth quarter 2015 and fourth quarter 2014 oil and gas segment results include ($37.6) and ($30.6) million respectively of non-cash impairment charges related to proved oil and gas properties and unproved leasehold interests. ***FY 2015 and FY 2014 oil and gas segment results include ($164.8) million and ($32.7) million respectively of non-cash impairment charges related to proved oil and gas properties and unproved leasehold interests. 16

Other Natural Resources Segment KPI’s Q4 2015 Q4 2014 FY 2015 FY 2014 Fiber Sales Pulpwood Tons Sold 40,600 52,000 149,700 209,900 Average Pulpwood Price / Ton $10.51 $9.49 $9.71 $10.62 Sawtimber Tons Sold 23,200 20,000 77,000 120,000 Average Sawtimber Price / Ton $20.04 $22.94 $20.86 $22.47 Total Tons Sold 63,800 72,000 226,700 329,900 Average Price / Ton $13.98 $13.22 $13.50 $14.93 Recreational Leases Average Acres Leased 93,500 107,800 98,300 110,500 Average Lease Rate / Acre $9.11 $9.00 $9.17 $9.13 Segment Revenues ($ in Millions) $1.3 $2.1 $6.7 $9.4 Segment Earnings (Loss) ($ in Millions) * ($0.1) $3.3 ($0.6) $5.5 *Note: Segment results include costs of $0.4 million in Q4 2015, $2.7 million FY 2015 and $0.4 million in Q4 2014, $2.9 million FY 2014 associated with the development of our water initiatives Note: Q4 and FY 2014 segment earnings include a $2.7 and $3.4 million gain on termination of timber lease in connection with the sale of land from Ironstob venture near Atlanta. 17

Reconciliation of Non-GAAP Financial Measures (Unaudited) Forestar’s Segment EBITDA is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Segment EBITDA is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non- GAAP measures and the directly related GAAP measures. Fourth Quarter Full Year ($ in millions) 2015 2014 2015 2014 Real Estate Segment Earnings in accordance with GAAP $37.9 $30.0 $67.7 $96.9 Depreciation, Depletion & Amortization 1.8 1.7 7.6 3.7 Real Estate Segment EBITDA $39.7 $31.7 $75.3 $100.6 Oil & Gas Segment Earnings (Loss) in accordance with GAAP ($38.4) ($39.0) ($184.4) ($22.7) Depreciation, Depletion & Amortization 4.2 8.8 28.8 29.5 Oil and Gas Segment EBITDA ($34.2) ($30.2) ($155.6) $6.8 Other Natural Resources Segment Earnings in accordance with GAAP ($0.1) $3.3 ($0.6) $5.5 Depreciation, Depletion & Amortization 0.1 0.1 0.5 0.5 Other Natural Resources Segment EBITDA $--- $3.4 ($0.1) $6.0 Total Segment Total Segment Earnings (Loss) in accordance with GAAP ($0.6) ($5.7) ($117.3) $79.7 Depreciation, Depletion & Amortization 6.1 10.6 36.9 33.7 Total Segment EBITDA $5.5 $4.9 ($80.4) $113.4 18

Reconciliation of Non-GAAP Financial Measures (Unaudited) 19 In our fourth quarter and full year 2015 earnings release and conference call presentation materials furnished to the Securities and Exchange Commission on Form 8-K on March 2, 2016, we used certain non-GAAP financial measures. The non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. These non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP financial statements and the accompanying reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of our business. We strongly encourage investors to review our consolidated financial statements and publicly filed reports in their entirety. Reconciliation of Non-GAAP Financial Measures (Unaudited) The following table shows a reconciliation of net income before special items and earnings per share excluding special items to net income and earnings per share (the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles, or GAAP). Net income excluding special items and earnings per share excluding special items are useful to evaluate the performance of the company because it excludes non-recurring non-cash impairments and other costs, which management believes are not indicative of the ongoing operating results of the business. A reconciliation of net income and earnings per share excluding special items to net income and earnings per share as computed under GAAP is illustrated below: Fourth Quarter Full Year ($ in millions except per share data) 2015 2014 2015 2014 Net Income (Loss) – As Reported ($6.2) ($11.8) ($213.0) $16.6 Net Income (Loss) Per Share – As Reported ($0.18) ($0.34) ($6.22) $0.38 Special Items Deferred Tax Asset Valuation (2.9) ---- 96.0 ---- Oil & Gas Proved Property Impairments 10.8 10.1 69.6 10.1 Oil & Gas Unproved Leasehold Interest Impairments 13.6 9.8 37.4 11.1 Severance and Other Costs ---- 3.3 2.2 3.3 Total Special Items (after-tax) $21.5 $23.2 $205.2 $24.5 Total Special Items Per Share (after-tax) $0.63 $0.66 $5.99 $0.56 Net Income (Loss) – Excluding Special Items $15.3 $11.4 ($7.8) $41.1 Net Income (Loss) Per Share – Excluding Special Items $0.45 $0.32 ($0.23) $0.94

20