Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Wayfair Inc. | a2015-12x31exx231.htm |

| EX-21.1 - EXHIBIT 21.1 - Wayfair Inc. | a2015-12x31exx211.htm |

| EX-32.2 - EXHIBIT 32.2 - Wayfair Inc. | a2015-12x31exx322.htm |

| EX-31.2 - EXHIBIT 31.2 - Wayfair Inc. | a2015-12x31exx312.htm |

| EX-31.1 - EXHIBIT 31.1 - Wayfair Inc. | a2015-12x31exx311.htm |

| EX-10.13 - EXHIBIT 10.13 - Wayfair Inc. | a2015-12x31exx1013.htm |

| 10-K - 10-K - Wayfair Inc. | a2015-12x31form10xk.htm |

| EX-32.1 - EXHIBIT 32.1 - Wayfair Inc. | a2015-12x31exx321.htm |

Exhibit 10.9

COPLEY PLACE

BOSTON, MASSACHUSETTS

OFFICE LEASE

Between

COPLEY PLACE ASSOCIATES, LLC

as Landlord

and

WAYFAIR LLC,

as Tenant

DATED April 18, 2013

FROM THE OFFICE OF:

Goulston & Storrs, P.C.

400 Atlantic Avenue

Boston, Massachusetts 02110-3333

TABLE OF CONTENTS

ARTICLE 1. BASIC DATA | ||

1.01 | Date | |

1.02 | Landlord | |

1.03 | Present Mailing Address of Landlord | |

1.04 | Tenant | |

1.05 | Present Mailing Address of Tenant | |

1.06 | Guarantor | |

1.07 | Present Mailing Address of Guarantor | |

1.08 | Commencement Date | |

1.09 | Rent Commencement Date | |

1.10 | Termination Date | |

1.11 | Base Rent | |

1.12 | Operating Expense Base Year | |

1.13 | Base Year Operating Expenses | |

1.14 | Tax Base Year | |

1.15 | Base Year Taxes | |

1.16 | Tenant’s Proportionate Tax Share | |

1.17 | Tenant’s Proportionate Expense Share | |

1.18 | Use | |

1.19 | Premises | |

1.20 | Common Areas | |

1.21 | Letter of Credit Amount | |

1.22 | Brokers | |

ARTICLE 2. HABENDUM; TERM | ||

ARTICLE 3. POSSESSION | ||

3.01 | Rent Commencement | |

3.02 | Early Entry | |

3.03 | No Change in Lease Term | |

3.04 | Appurtenant Rights | |

3.05 | Roof Deck | |

ARTICLE 4. BASE RENT | ||

ARTICLE 5. ADDITIONAL RENT | ||

5.01 | Obligation as to Additional Rent | |

5.02 | Definitions | |

5.03 | Expense & Tax Adjustment | |

5.04 | Adjustment for Services not Rendered by Landlord | |

5.05 | Audit Rights | |

5.06 | Billing for Electricity | |

ARTICLE 6. USE OF PREMISES | ||

ARTICLE 7. CONDITION OF PREMISES; LANDLORD’S WORK | ||

7.01 | Condition of Premises | |

7.02 | Building Renovations | |

7.03 | Landlord’s Work | |

ARTICLE 8. SERVICES | ||

8.01 | List of Services | |

8.02 | Landlord Repairs and Maintenance | |

8.03 | Interruption of Services | |

8.04 | Additional Services | |

8.05 | Energy Conservation | |

ARTICLE 9. COMPLIANCE WITH LAWS; REPAIRS; HAZARDOUS MATERIALS | ||

9.01 | Compliance With Laws | |

9.02 | Repairs | |

9.03 | Hazardous Materials | |

ARTICLE 10. ADDITIONS AND ALTERATIONS | ||

10.01 | Consent Required | |

10.02 | Improvements are Landlord’s Property | |

10.03 | Lines | |

10.04 | Specialty Alterations | |

ARTICLE 11. COVENANT AGAINST LIENS | ||

ARTICLE 12. INSURANCE | ||

12.01 | Waiver of Subrogation | |

12.02 | Coverage | |

12.03 | Avoid Action Increasing Rates | |

12.04 | Landlord’s Insurance | |

ARTICLE 13. FIRE OR OTHER CASUALTY | ||

13.01 | Effect of Casualty | |

13.02 | Intentionally Omitted | |

13.03 | Responsibility for Reconstruction of Improvements | |

ARTICLE 14. WAIVER OF CLAIMS -INDEMNIFICATION | ||

14.01 | Tenant’s Indemnification | |

14.02 | Landlord’s Indemnification | |

ARTICLE 15. NONWAIVER | ||

ARTICLE 16. CONDEMNATION | ||

ARTICLE 17. ASSIGNMENT AND SUBLETTING | ||

17.01 | No Transfer Without Consent | |

17.02 | Rent Premium on Transfer | |

17.03 | Change in Control | |

ARTICLE 18. SURRENDER OF POSSESSION | ||

ARTICLE 19. HOLDING OVER | ||

ARTICLE 20. ESTOPPEL CERTIFICATE | ||

ARTICLE 21. SUBORDINATION | ||

ARTICLE 22. CERTAIN RIGHTS RESERVED BY LANDLORD | ||

ARTICLE 23. RULES AND REGULATIONS | ||

ARTICLE 24. LANDLORD’S REMEDIES | ||

ARTICLE 25. EXPENSES OF ENFORCEMENT | ||

ARTICLE 26. COVENANT OF QUIET ENJOYMENT | ||

ARTICLE 27. LETTER OF CREDIT | ||

27.01 | General Provisions | |

27.02 | Drawings under Letter of Credit | |

27.03 | Use of Proceeds by Landlord | |

27.04 | Additional Covenants of Tenant | |

27.05 | Nature of Letter of Credit | |

ARTICLE 28. REAL ESTATE BROKER | ||

ARTICLE 29. NOTICE TO MORTGAGEE AND GROUND LESSOR | ||

ARTICLE 30. ASSIGNMENT OF RENTS | ||

ARTICLE 31. PERSONAL PROPERTY TAXES | ||

ARTICLE 32. MISCELLANEOUS | ||

ARTICLE 33. NOTICES | ||

ARTICLE 34. LIMITATION ON LIABILITY | ||

ARTICLE 35. LANDLORD’S DESIGNATED AGENT | ||

ARTICLE 36. COMMENCEMENT DATE | ||

ARTICLE 37. PARKING | ||

ARTICLE 38. TENANT IMPROVEMENT ALLOWANCE | ||

ARTICLE 39. FINANCIAL STATEMENTS | ||

ARTICLE 40. TENANT AUTHORITY TO EXECUTE LEASE | ||

40.01 | Tenant Authority to Execute Lease | |

40.02 | Landlord Authority to Execute Lease | |

ARTICLE 41. OPTION TO EXTEND LEASE | ||

ARTICLE 42. EXPANSION RIGHTS | ||

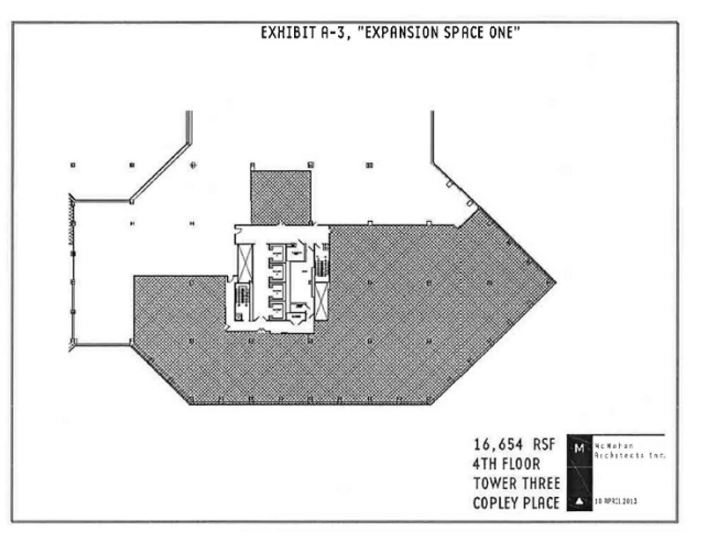

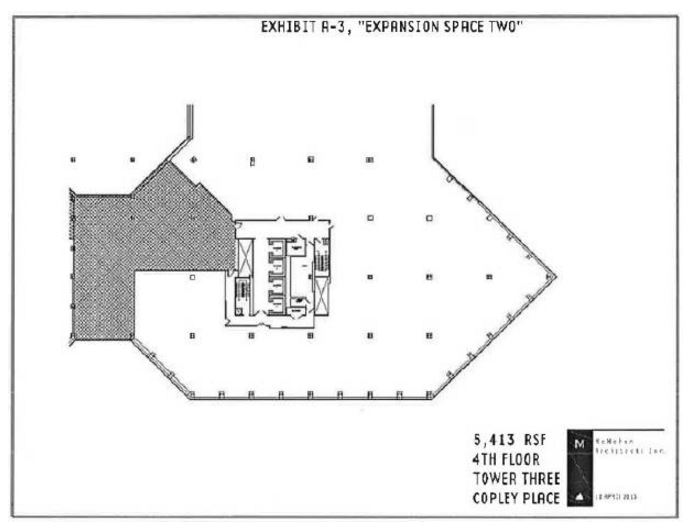

42.01 | Special Expansion Rights | |

42.02 | Expansion Rights | |

42.03 | Expansion Amendment | |

42.04 | Bentley Space | |

ARTICLE 43. RIGHT OF FIRST OFFER | ||

43.01 | Grant of Option; Conditions | |

43.02 | Terms for Offering Space | |

43.03 | Definition of Prevailing Market Rent | |

43.04 | Determination of Prevailing Market Rent | |

43.05 | Condition of Offering Space | |

43.06 | Offering Amendment | |

ARTICLE 44. ROOFTOP COMMUNICATIONS | ||

ARTICLE 45. EMERGENCY GENERATOR | ||

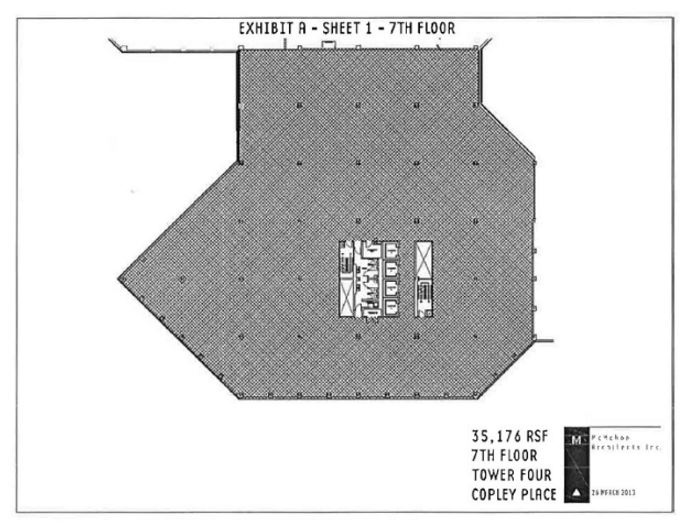

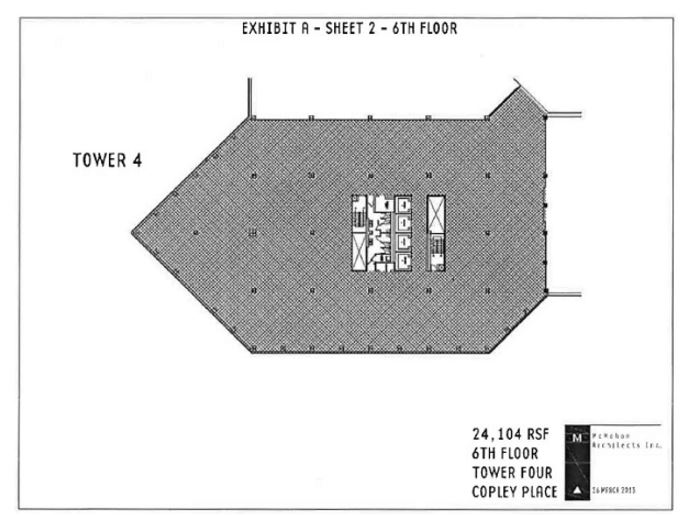

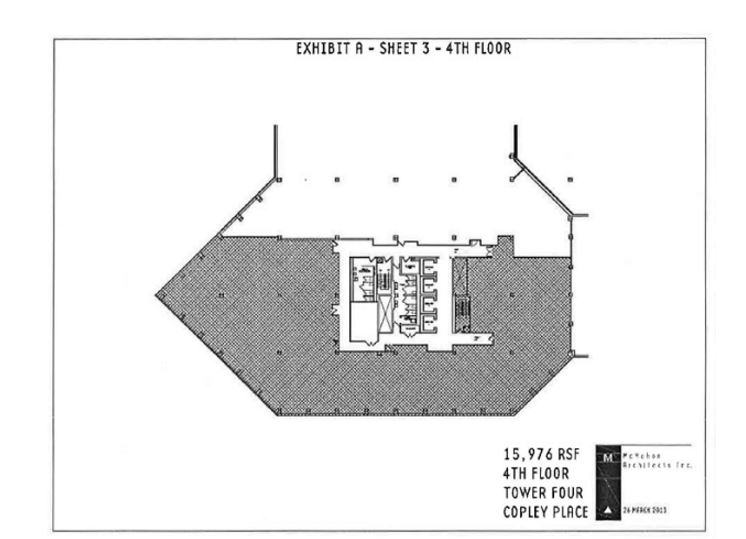

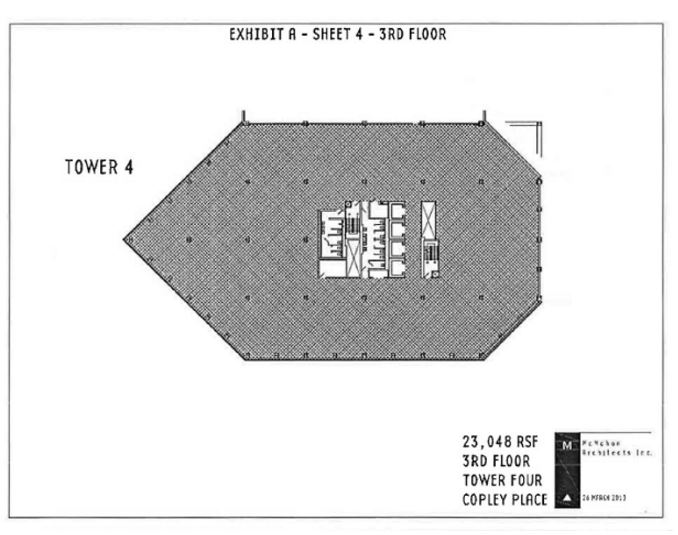

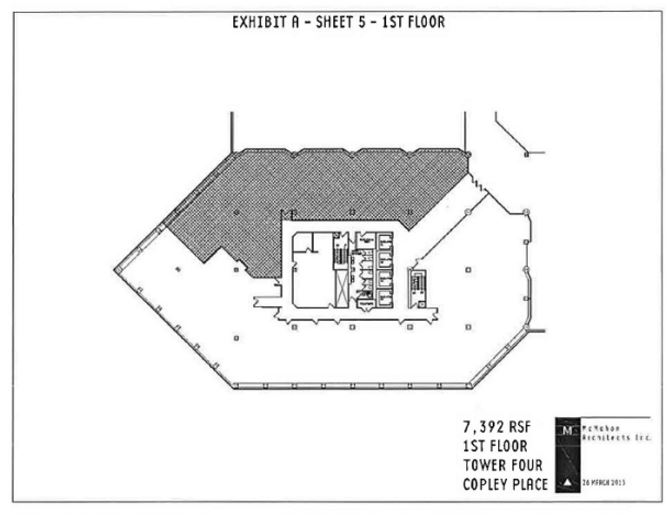

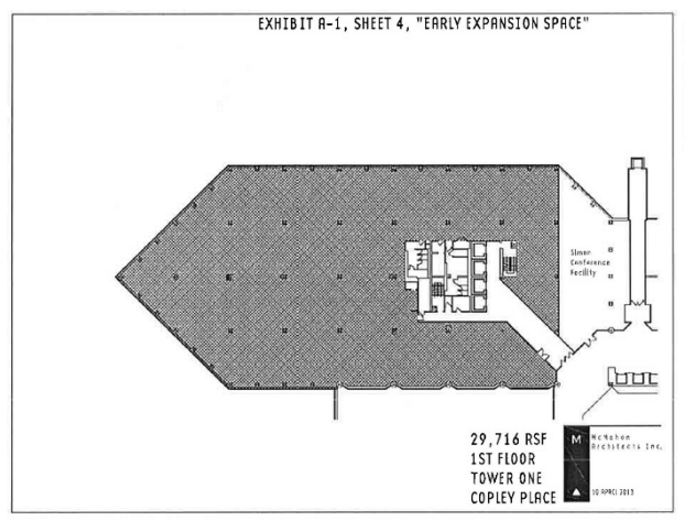

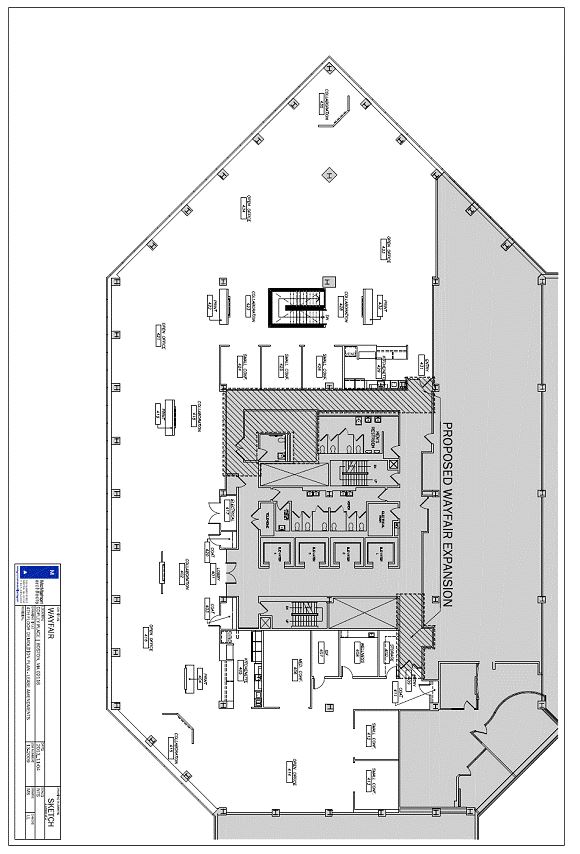

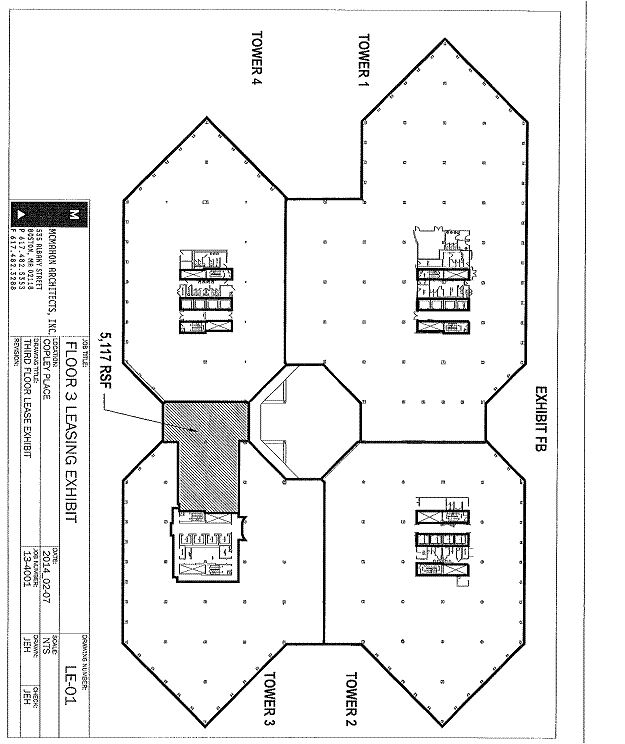

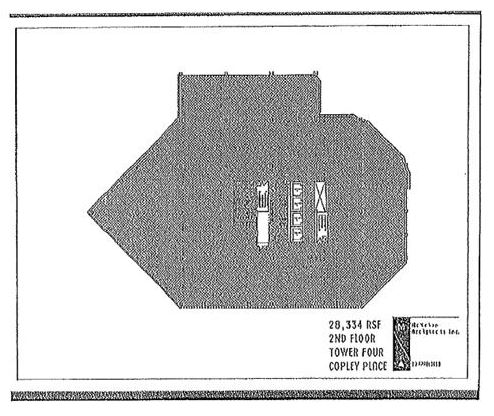

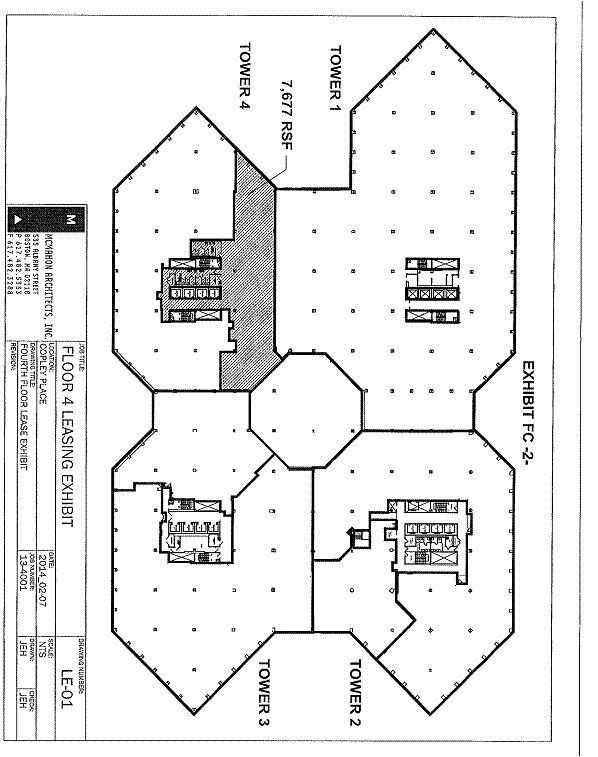

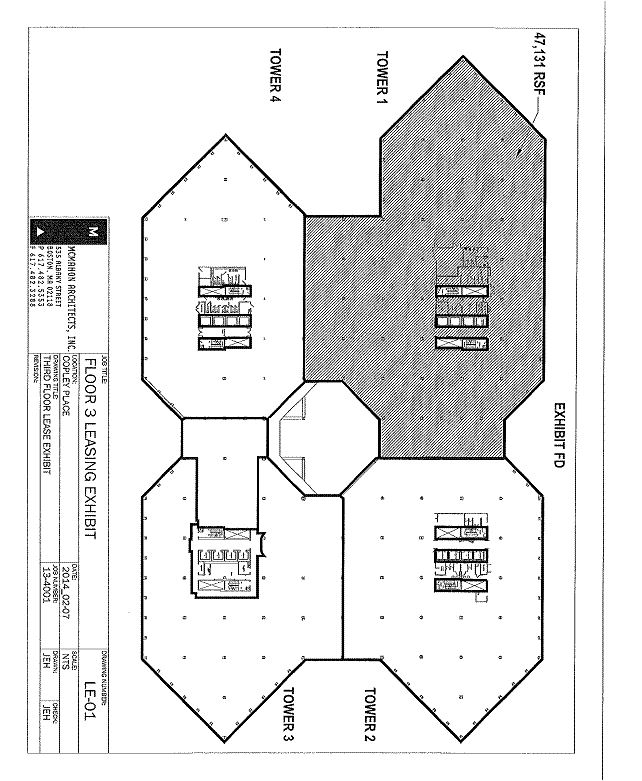

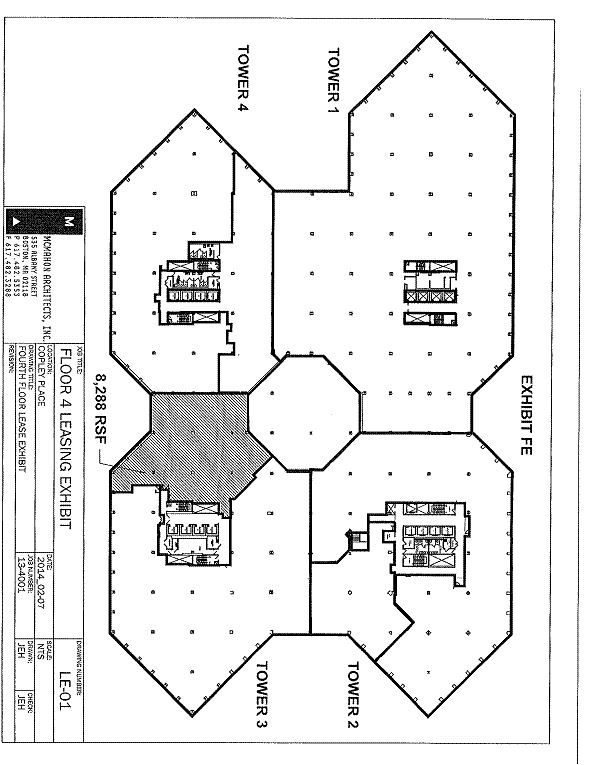

Exhibit A | Plan of Premises | |

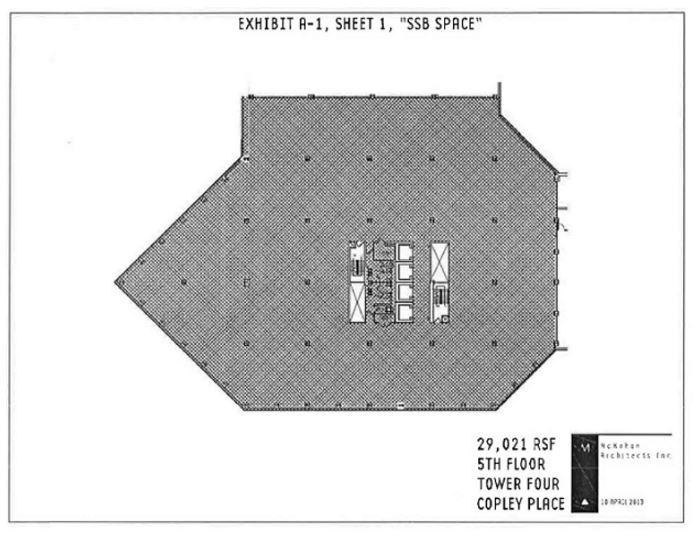

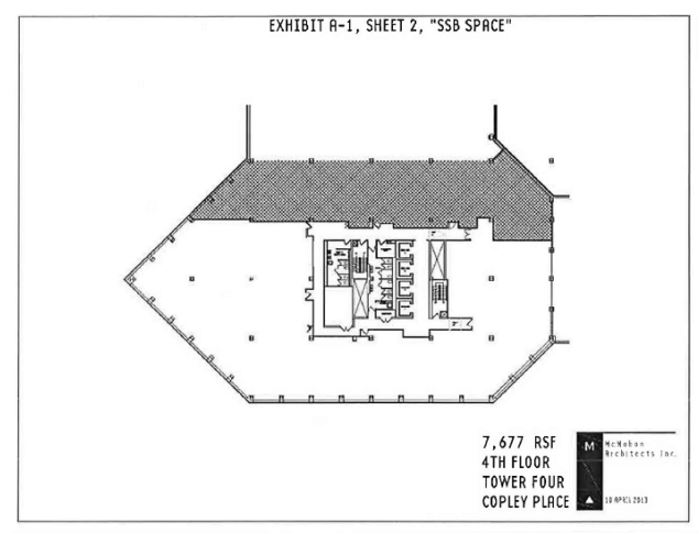

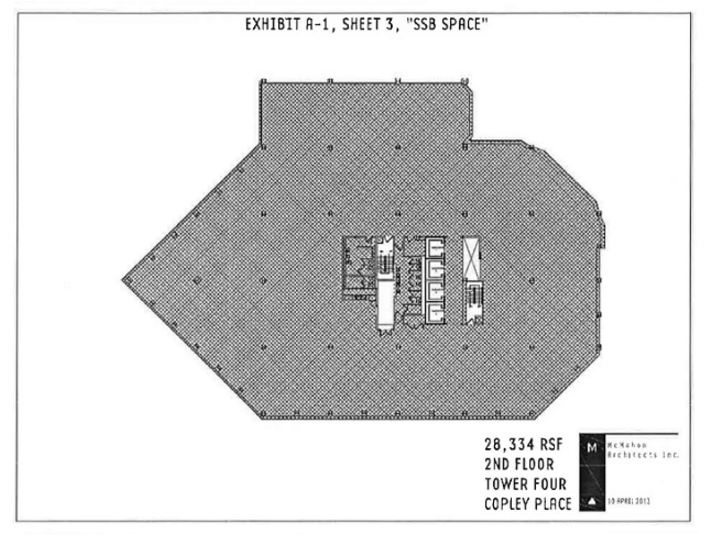

Exhibit A-1 | Early Expansion Spaces | |

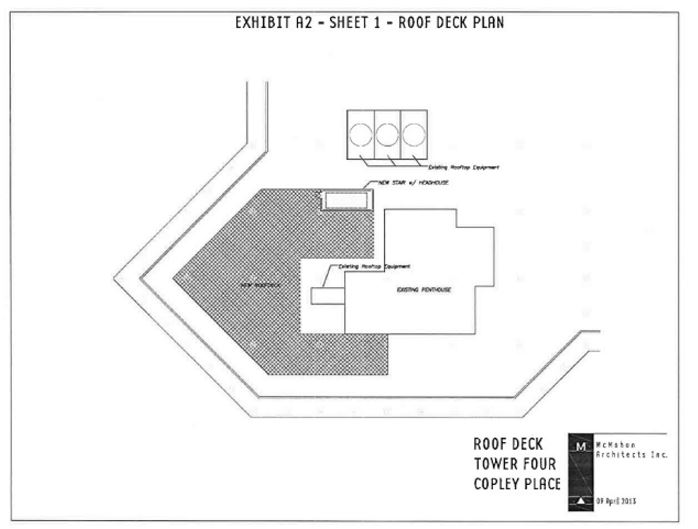

Exhibit A-2 | Roof Deck Plan | |

Exhibit A-3 | Expansion Space One and Expansion Space Two | |

Exhibit B-1 | Shell Work | |

Exhibit B-2 | Landlord’s Work | |

Exhibit C | Rules and Regulations | |

Exhibit D | Cleaning Specifications | |

Exhibit E | Measurement Standards | |

Exhibit F | Letter of Credit Form | |

Schedule 8.01 | Tenant’s HVAC Requirements | |

OFFICE LEASE

COPLEY PLACE

BOSTON, MASSACHUSETTS

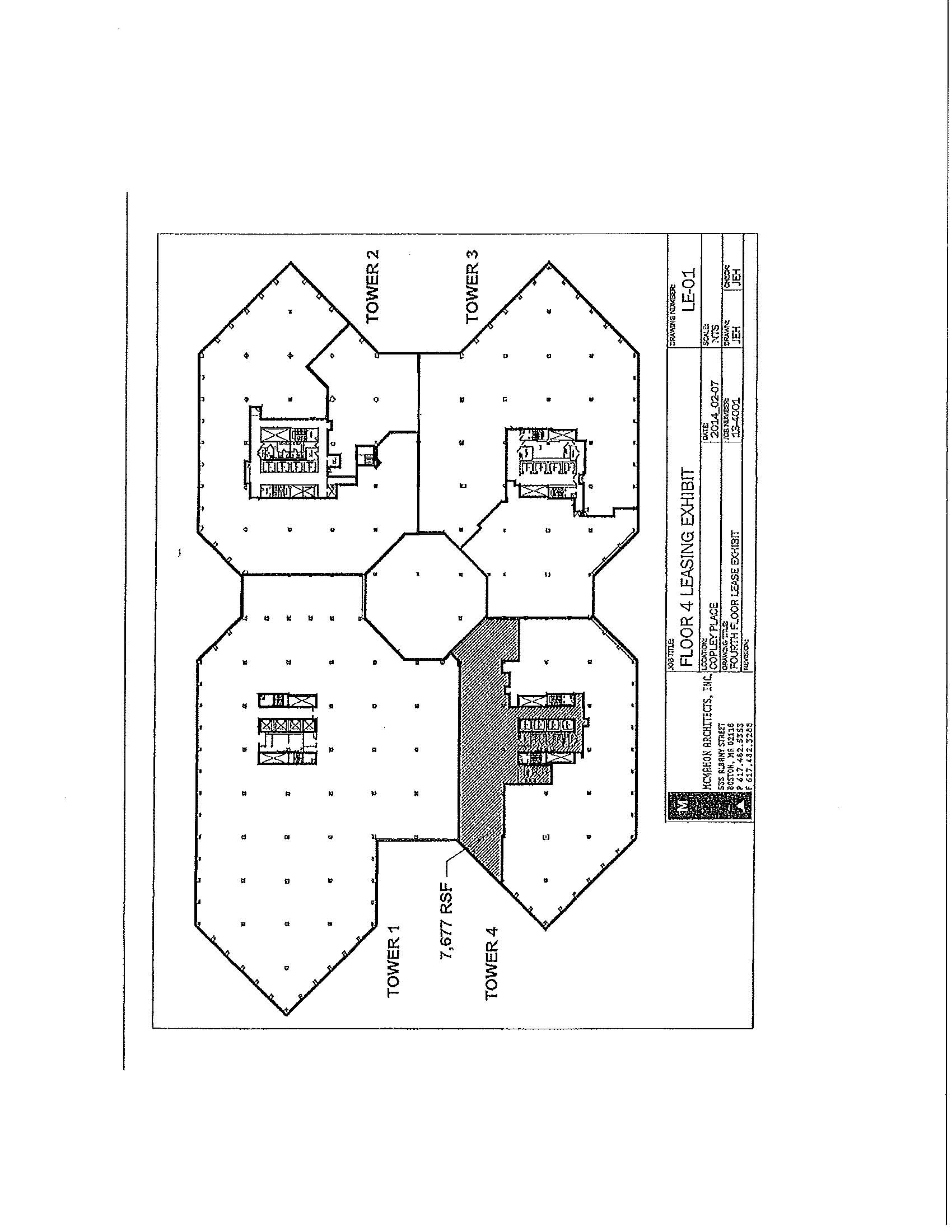

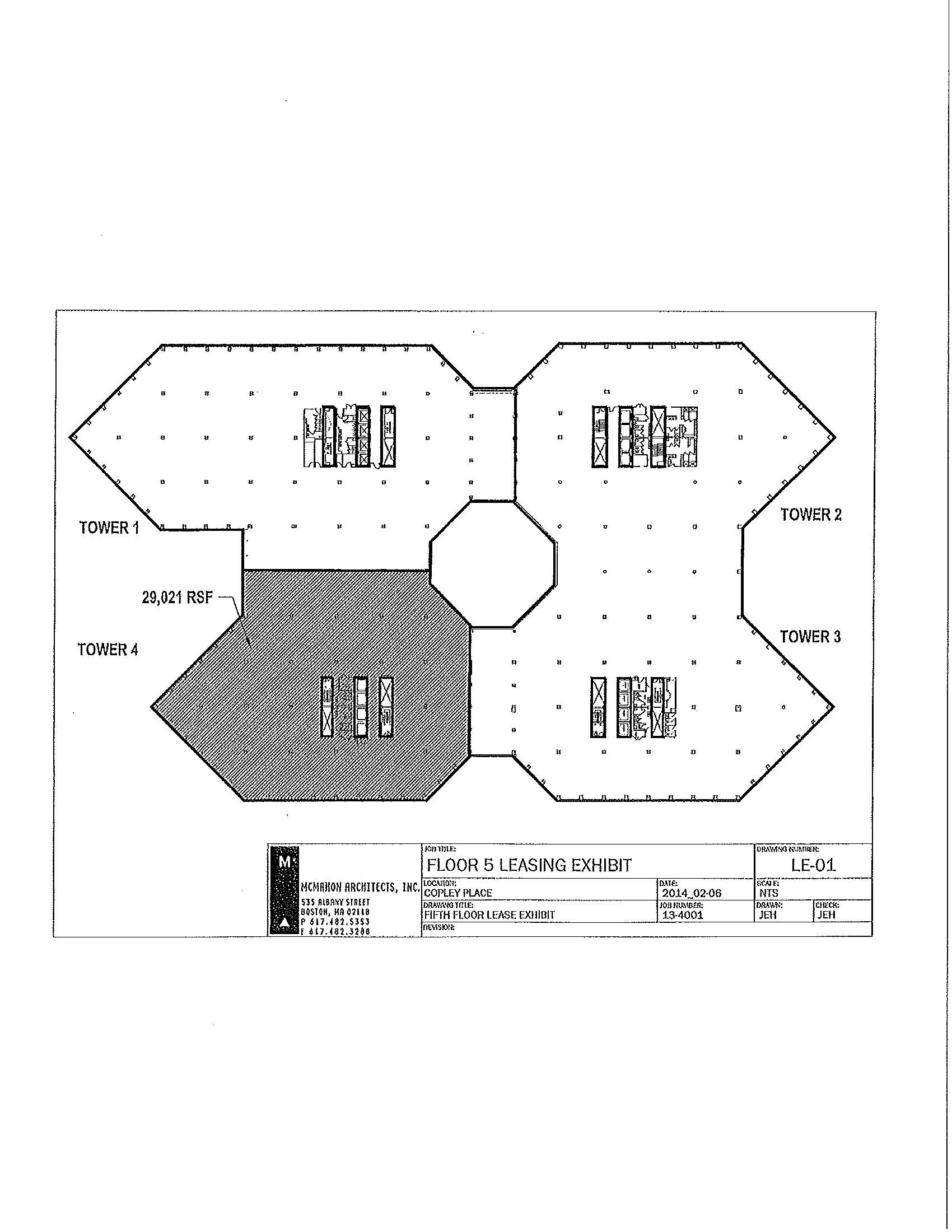

THIS INSTRUMENT is an Agreement of Lease in which the Landlord and the Tenant are the parties hereinafter named, and which relates to space in the Office Section of Copley Place (hereinafter referred to as the “Office Section”) located at 100 Huntington Avenue, Boston, Suffolk County, Massachusetts (the project known as Copley Place, including without limitation the hotel portions thereof, plazas, pedestrian bridges, service areas and all other common areas, together with all present and future easements, additions, improvements, air rights and other rights appurtenant thereto, is hereinafter referred to as the “Property”), subject to the covenants, terms, provisions and conditions of this Lease. The “Office Section” means the seven (7) levels of office area in four so-called “Towers” (denoted, respectively, as “One Copley Place”, “Two Copley Place”, “Three Copley Place” and “Four Copley Place” or as “Tower 1”, “Tower II”, “Tower Ill” and “Tower IV”, respectively), containing approximately 867,564 square feet of rentable floor area constituting a portion of the building (the “Building”) located at the aforesaid address. The Building also contains retail shopping, restaurant, parking and other facilities, which are not included within the Office Section. The Building does not, however, include the hotel or residential portions of the Property or the pedestrian bridges.

The provisions set forth in this lease are the result of a negotiation in which the parties were represented by counsel experienced in lease transactions of office space in the Commonwealth of Massachusetts. Each of the provisions was negotiated in view of the entire transaction including the type and location of the property, the rental, the term and the respective rights, obligations and remedies of the Landlord and Tenant. As a result, the rights, obligations and remedies which have been agreed to herein are, as negotiated, a part of the transaction as a whole and neither party intends that the absence of any particular remedy being specified for a particular action or lack of action by the other party imply that the parties intended any remedy not so specified. Without limiting the generality of the foregoing, in no event shall Tenant have the right to terminate or cancel this lease as a result of any default by Landlord or breach by Landlord of its covenants or any warranties or promises hereunder, except in the case of a wrongful eviction of Tenant from the demised premises (constructive or actual) by Landlord or as otherwise specifically set forth herein. In consideration of the covenants herein contained, Landlord and Tenant hereby agree as follows:

ARTICLE 1.

BASIC DATA

The following sets forth basic data and, where the context admits, constitutes definitions of the terms hereinafter listed.

1.01 | Date: | April 18, 2013 | ||

1.02 | Landlord: | COPLEY PLACE ASSOCIATES, LLC, a Delaware limited liability company | ||

1.03 | Present Mailing Address of Landlord: | Simon Property Group, Inc. Attention: Property Manager Two Copley Place, Suite 100 Boston, MA 02116-6502 | ||

1.04 | Tenant: | WAYFAIR LLC, a Delaware limited liability company | ||

1.05 | Present Mailing Address of Tenant: | 177 Huntington Avenue, Suite 6000 Boston, MA 02115 Attention: General Counsel | ||

1.06 | Guarantor: | None | ||

1.07 | Present Mailing Address of Guarantor: | Not Applicable | ||

1.08 | Commencement Date: | Subject to ARTICLE 3 and ARTICLE 36 hereof, July 1, 2014. | ||

1.09 | Rent Commencement Date: | The Commencement Date | ||

1.10 | Termination Date: | June 30, 2024 as the same may be extended pursuant to the option of extension set forth in ARTICLE 41, unless, in any case, sooner terminated as provided in this Lease. | ||

1.11 | Base Rent: | Subject to ARTICLE 3, ARTICLE 4 and ARTICLE 36 hereof, Base Rent shall be payable in accordance with the following table: | ||

Period | Annual Base Rent Per Rentable Square Foot | Annual Base Rent | Monthly Installment of Annual Base Rent | |||||||||

July 1, 2014 through June 30, 2015 | $ | 34.65 | $ | 3,662,366.40 | $ | 305,197.20 | ||||||

July 1, 2015 through June 30, 2016 | $ | 35.65 | $ | 3,768,062.40 | $ | 314,005.20 | ||||||

July 1, 2016 through June 30, 2017 | $ | 36.65 | $ | 3,873,758.40 | $ | 322,813.20 | ||||||

July 1, 2017 through June 30, 2018 | $ | 37.65 | $ | 3,979,454.40 | $ | 331,621.20 | ||||||

July 1, 2018 through June 30, 2019 | $ | 38.65 | $ | 4,085,150.40 | $ | 340,429.20 | ||||||

July 1, 2019 through June 30, 2020 | $ | 39.65 | $ | 4,190,846.40 | $ | 349,237.20 | ||||||

July 1, 2020 through June 30, 2021 | $ | 40.65 | $ | 4,296,542.40 | $ | 358,045.20 | ||||||

July 1, 2021 through June 30, 2022 | $ | 41.65 | $ | 4,402,238.40 | $ | 366,853.20 | ||||||

July 1, 2022 through June 30, 20233 | $ | 42.65 | $ | 4,507,934.40 | $ | 375,661.20 | ||||||

July 1, 2023 through June 30, 2024 | $ | 43.65 | $ | 4,613,630.40 | $ | 384,469.20 | ||||||

1.12 | Operating Expense Base Year: | The Calendar Year 2014. | ||

1.13 | Base Year Operating Expenses: | The amount of Operating Expenses incurred with respect to the Base Year, determined in accordance with subsection 5.02(v) (including the grossing up thereof as provided therein). | ||

1.14 | Tax Base Year: | The Calendar Year 2014. | ||

1.15 | Base Year Taxes: | The amount of Taxes incurred with respect to the Tax Base Year determined in accordance with subsection 5.02(iv) (including the grossing up thereof as provided therein). | ||

1.16 | Tenant’s Proportionate Tax Share: | 12.82% for the Premises initially leased hereunder (computed on the basis of 95% occupancy). | ||

1.17 | Tenant’s Proportionate Expense Share: | 12.82% for the Premises initially leased hereunder (computed on the basis of 95% occupancy). | ||

1.18 | Use: | Subject to ARTICLE 23, general executive, professional and administrative offices and uses ancillary or accessory thereto. | ||

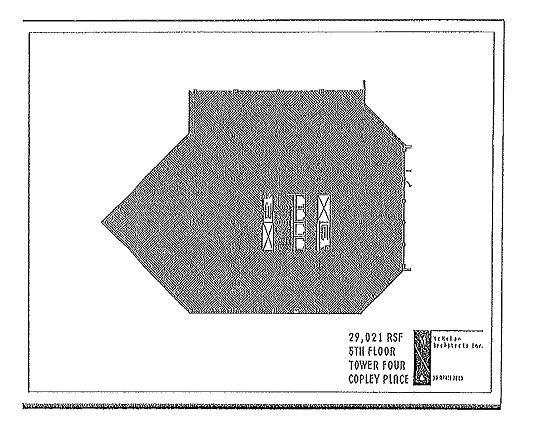

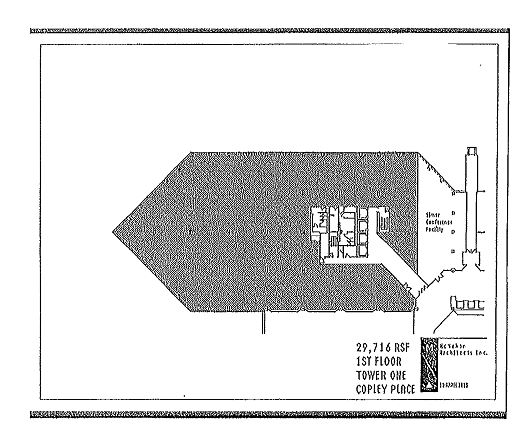

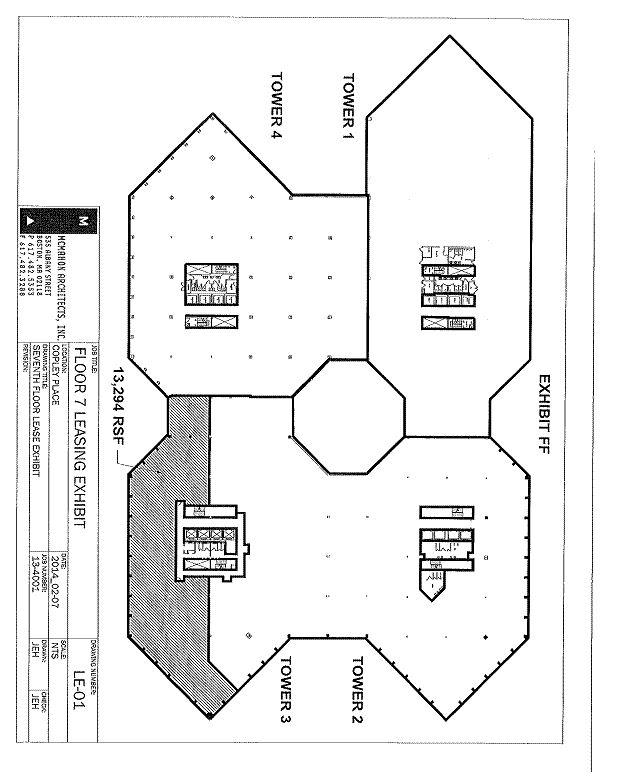

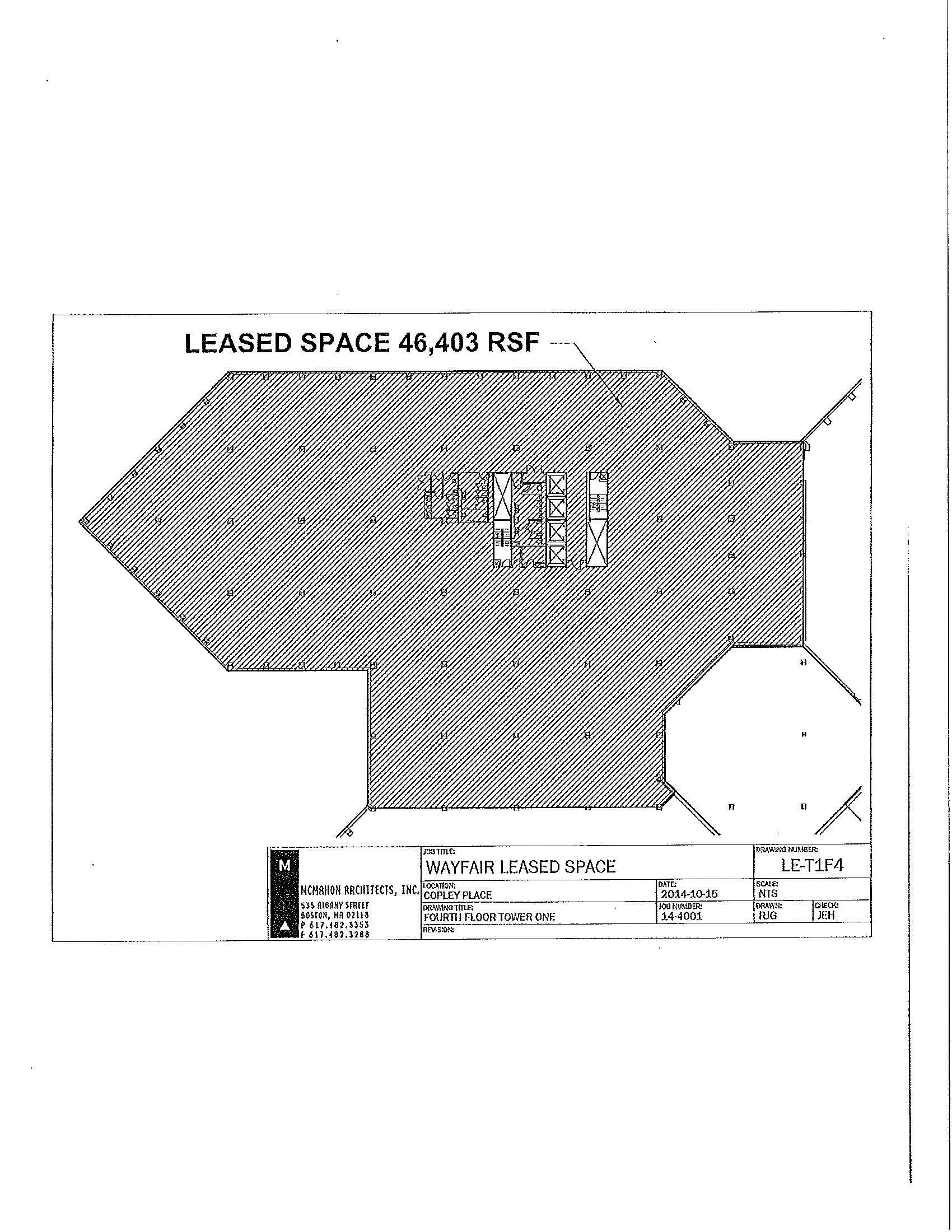

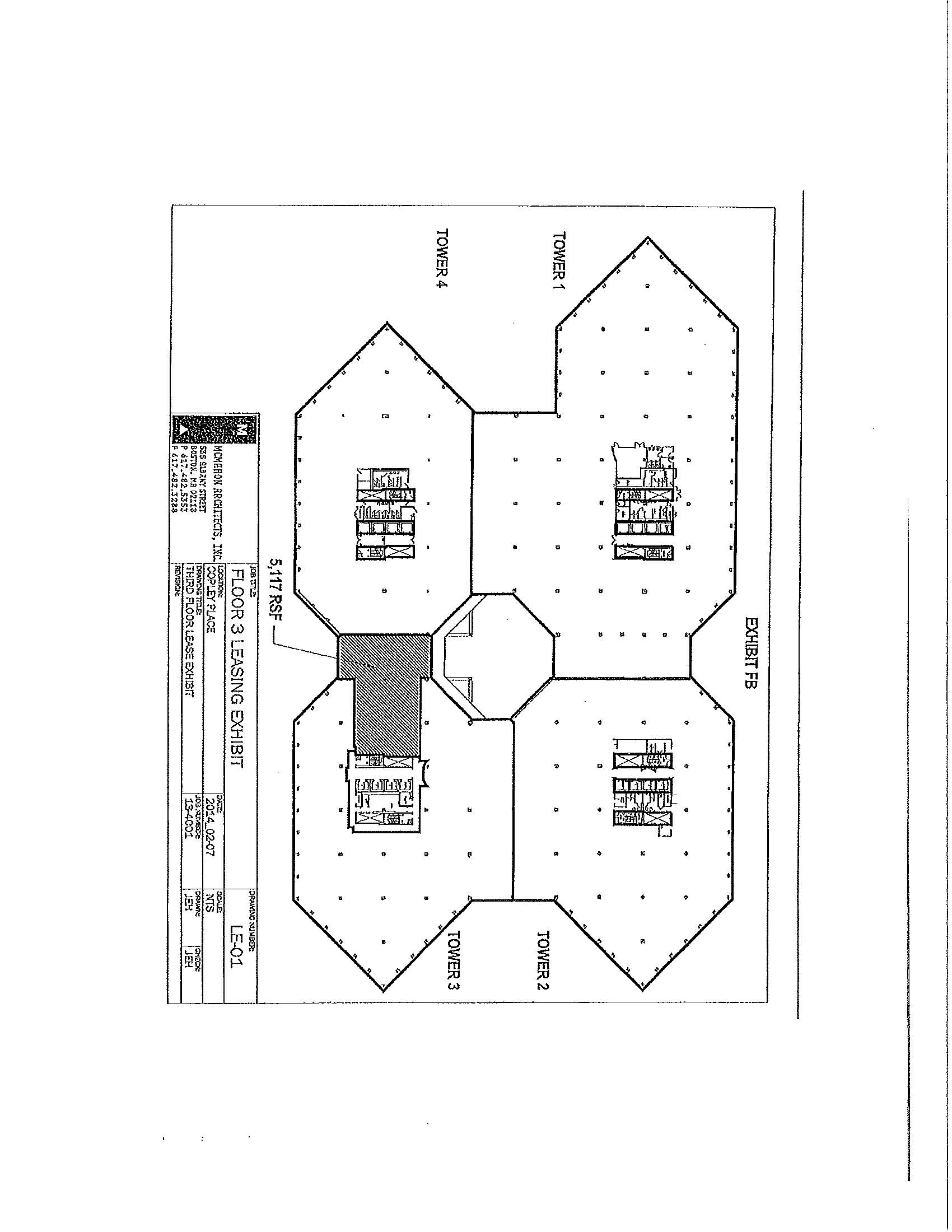

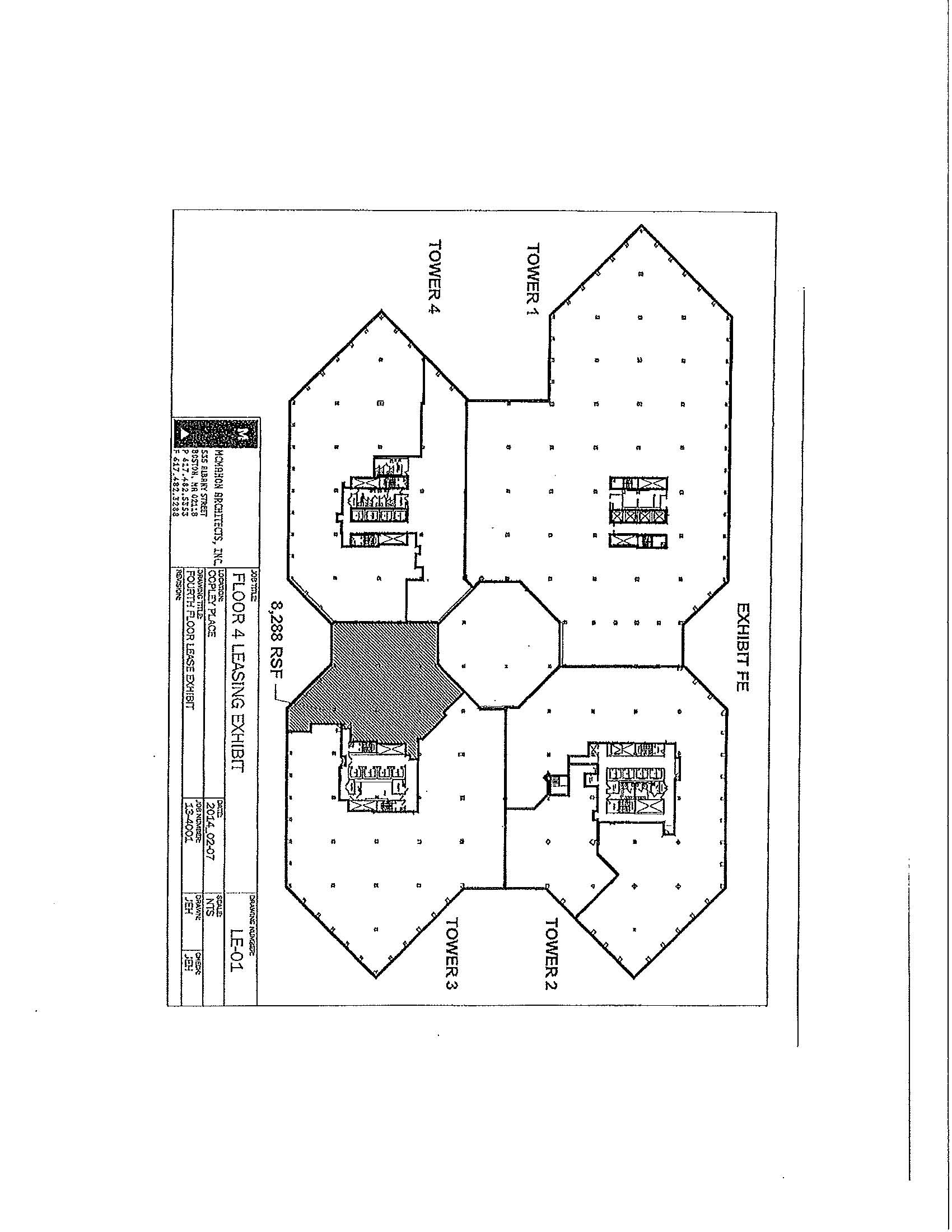

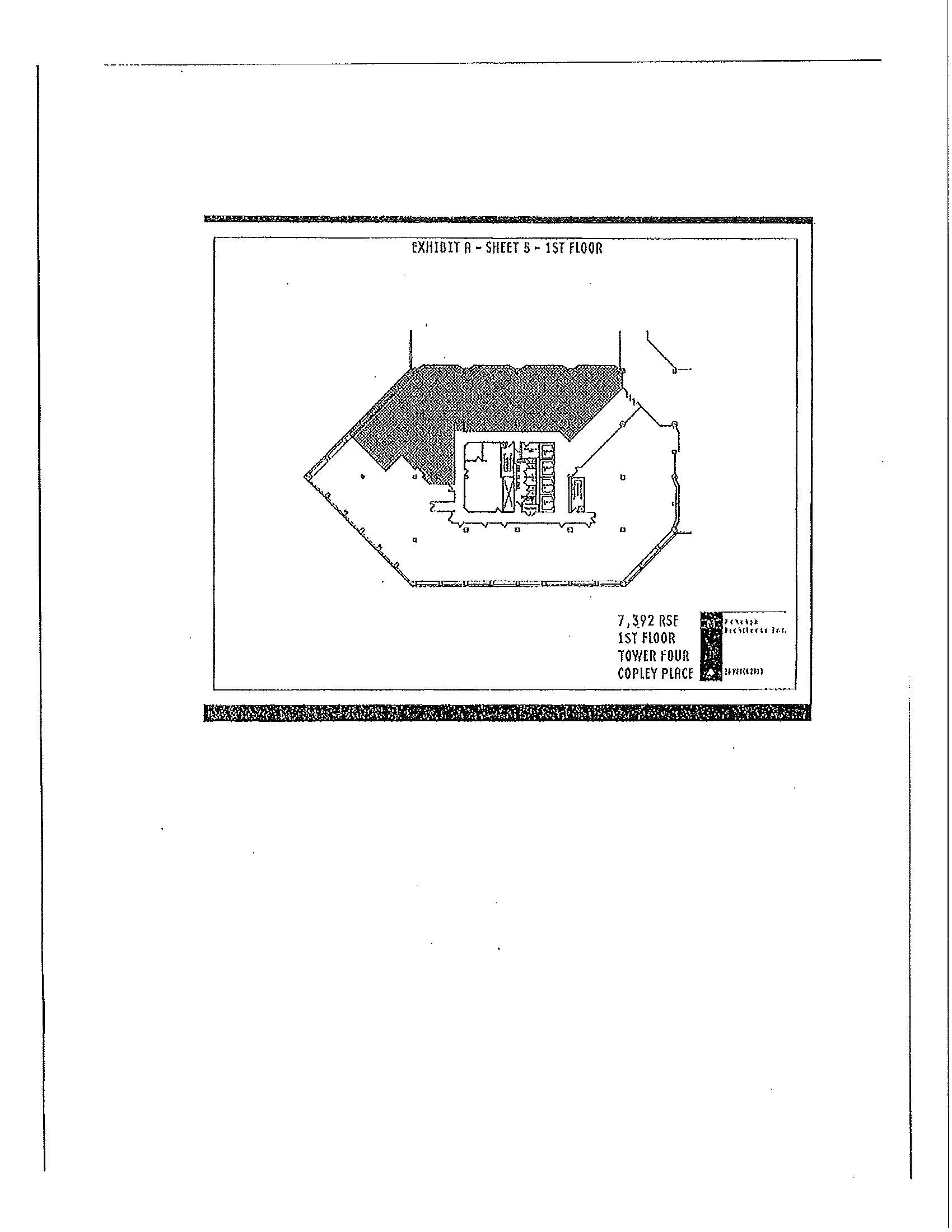

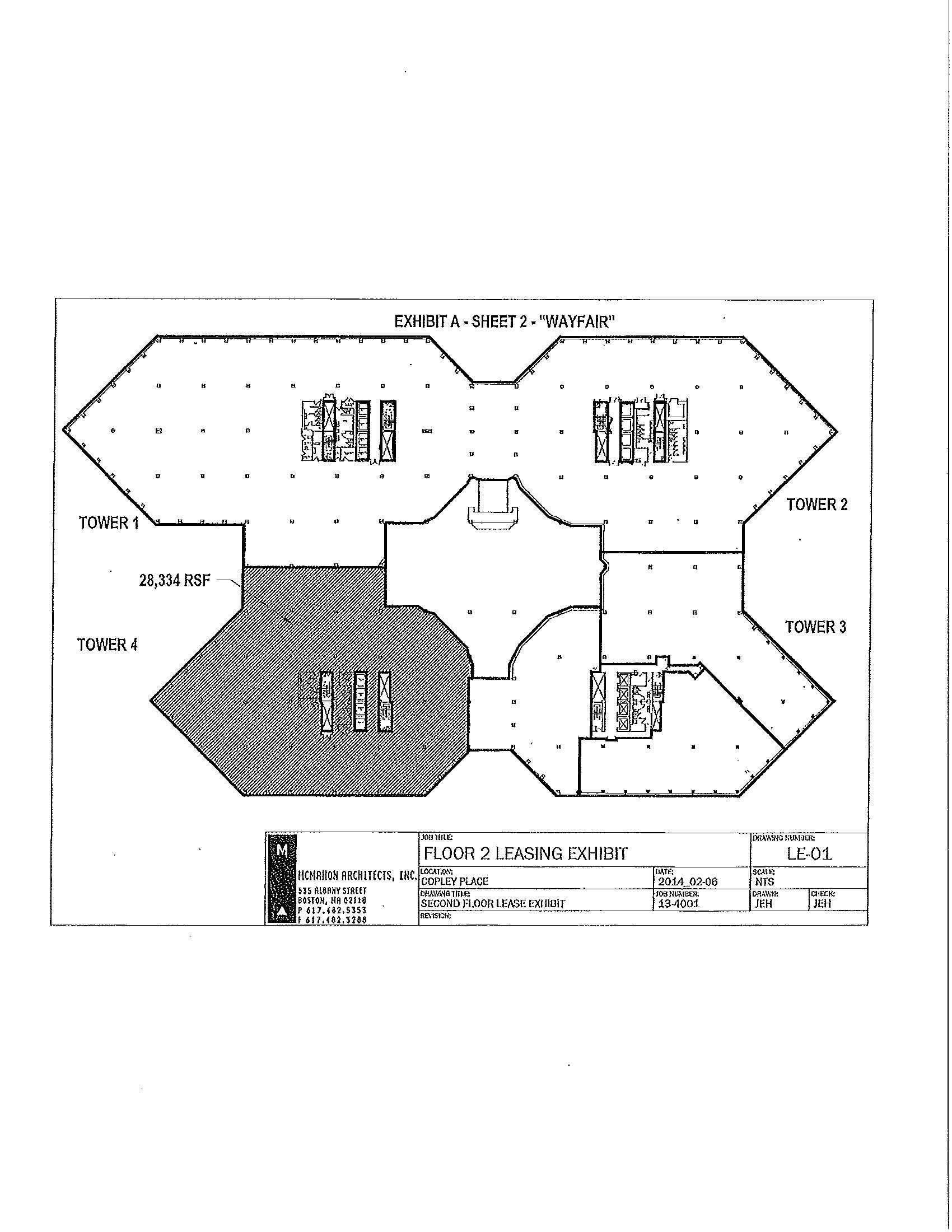

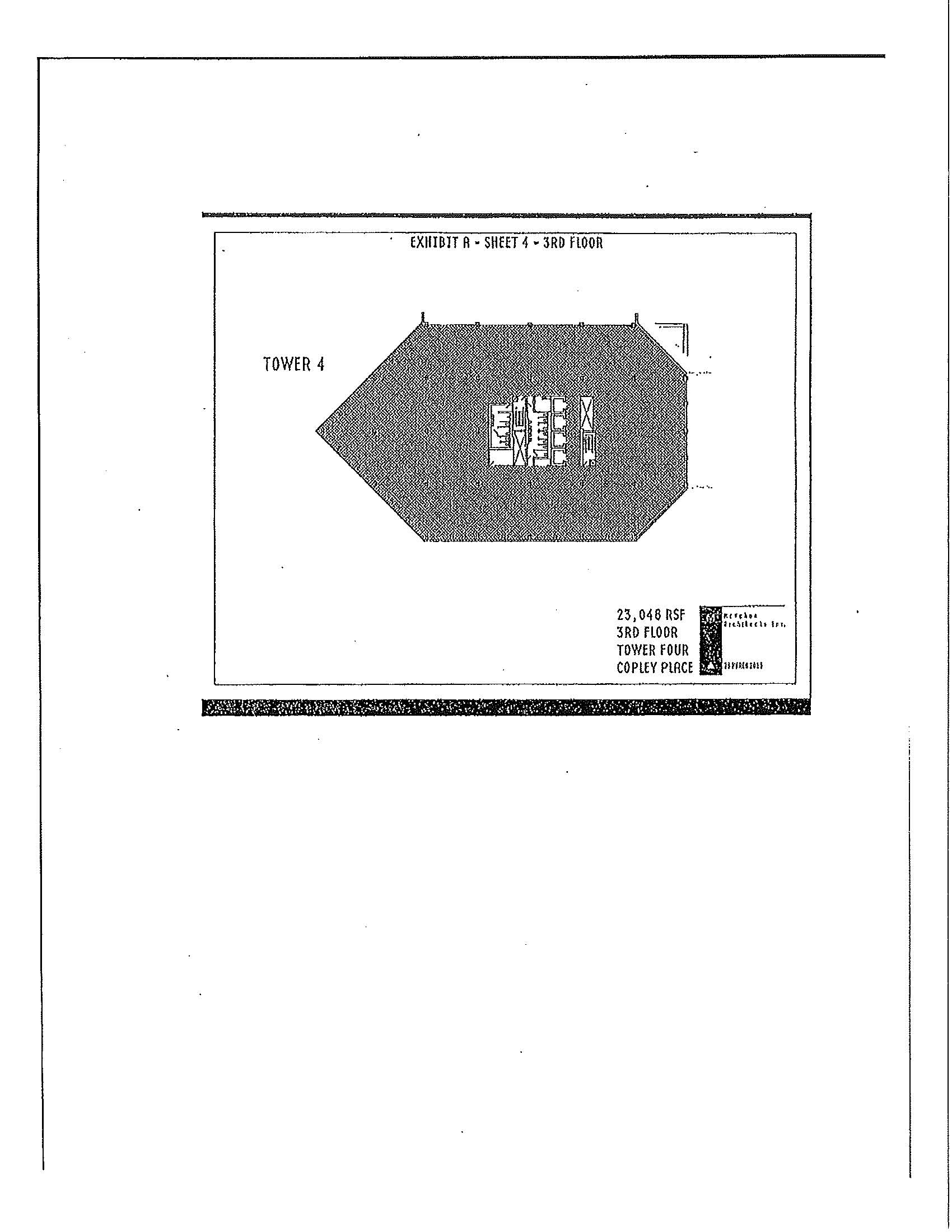

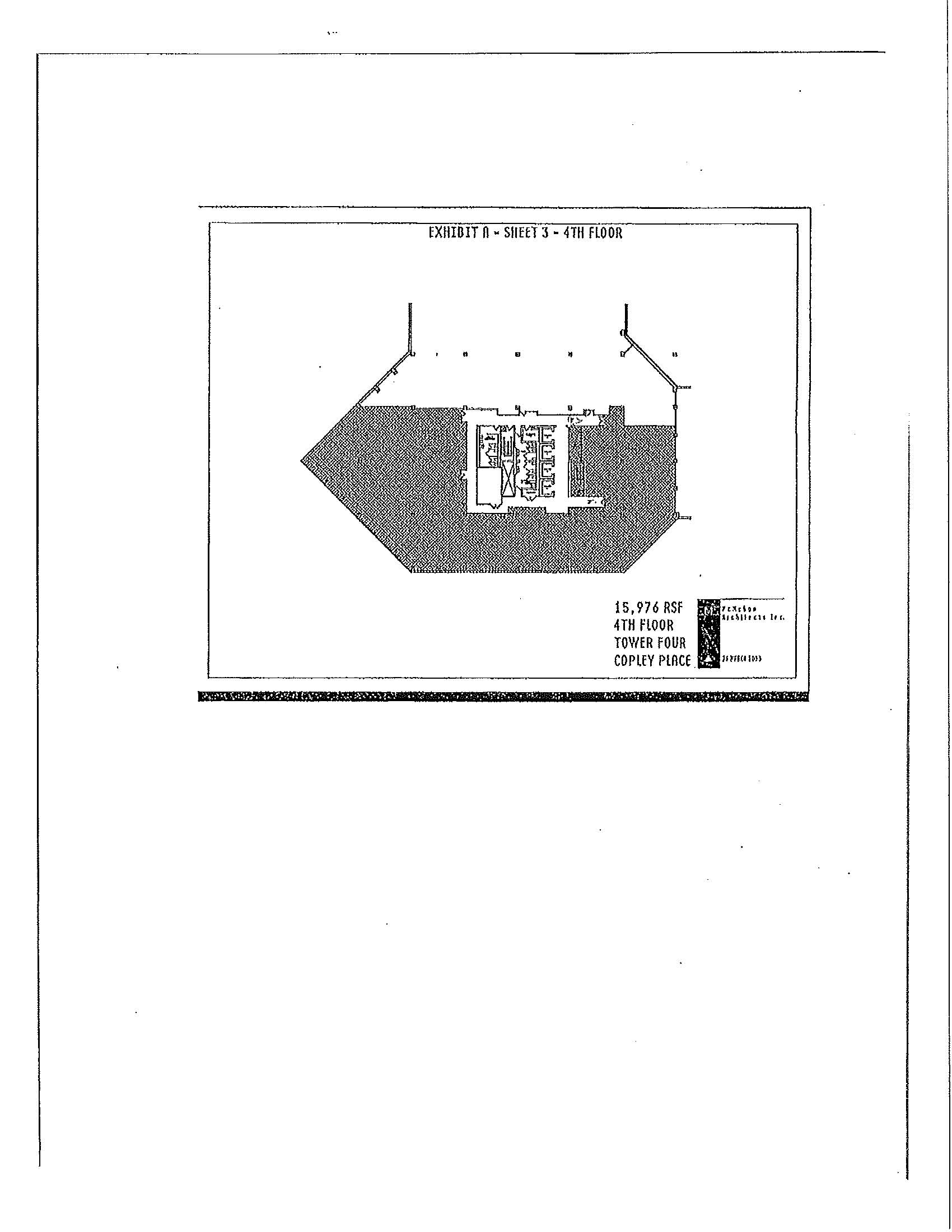

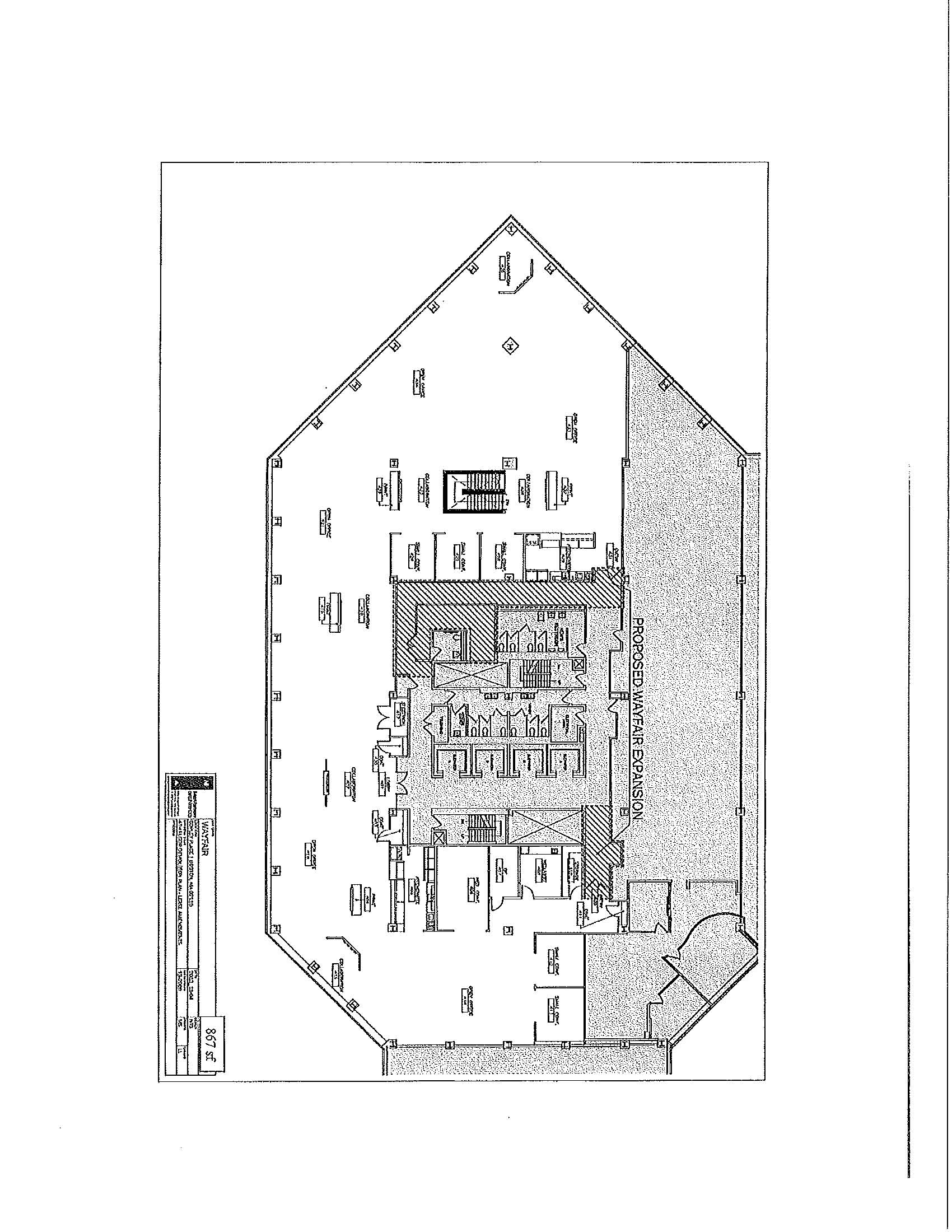

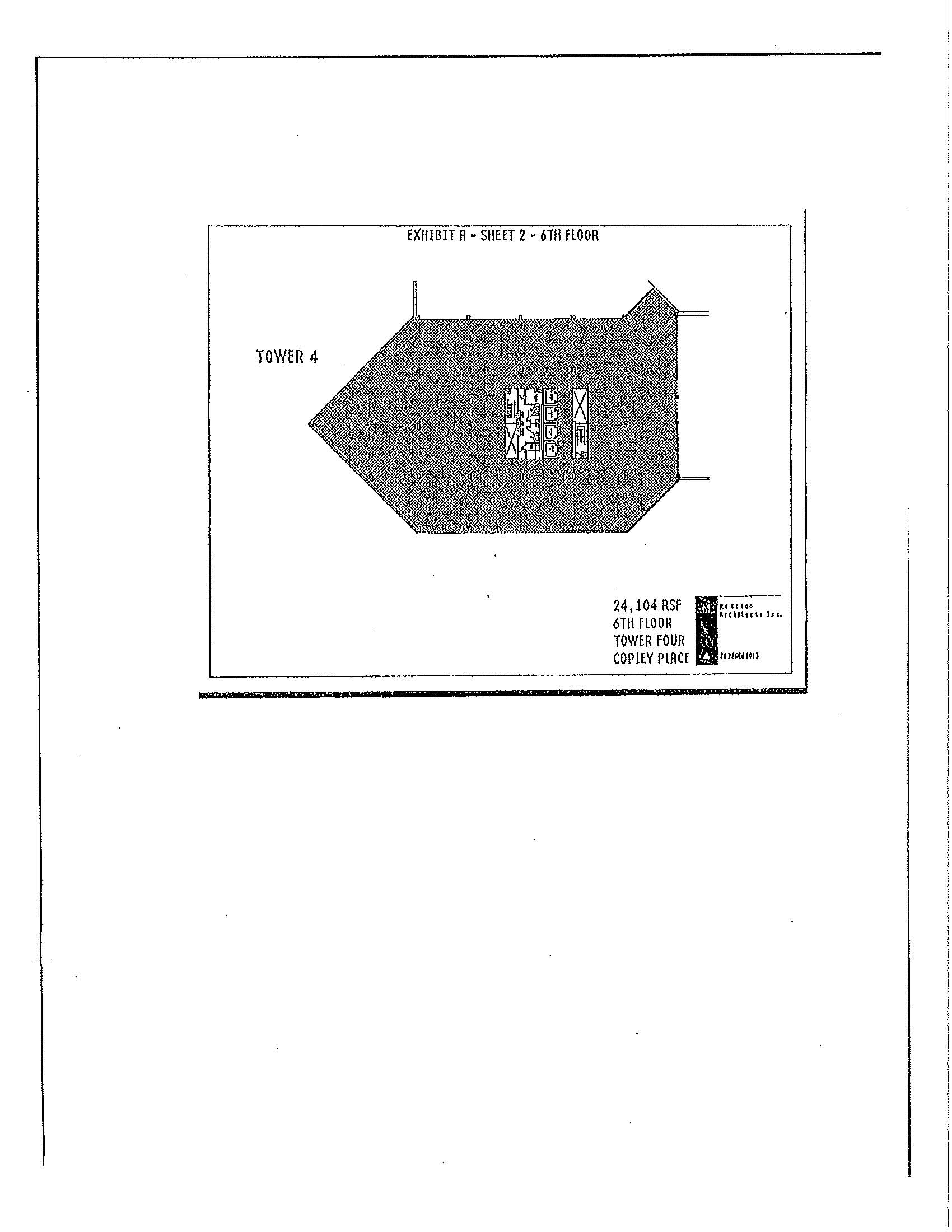

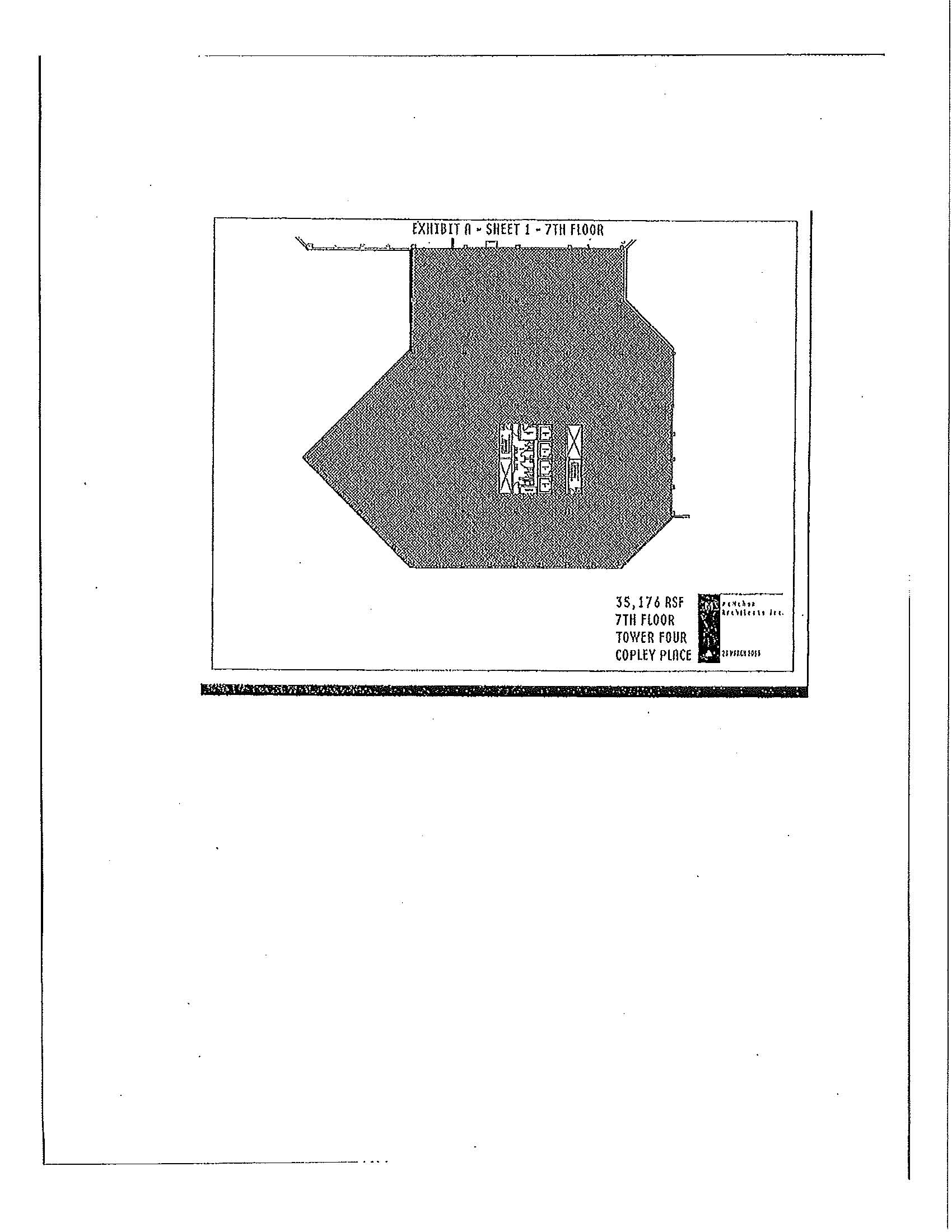

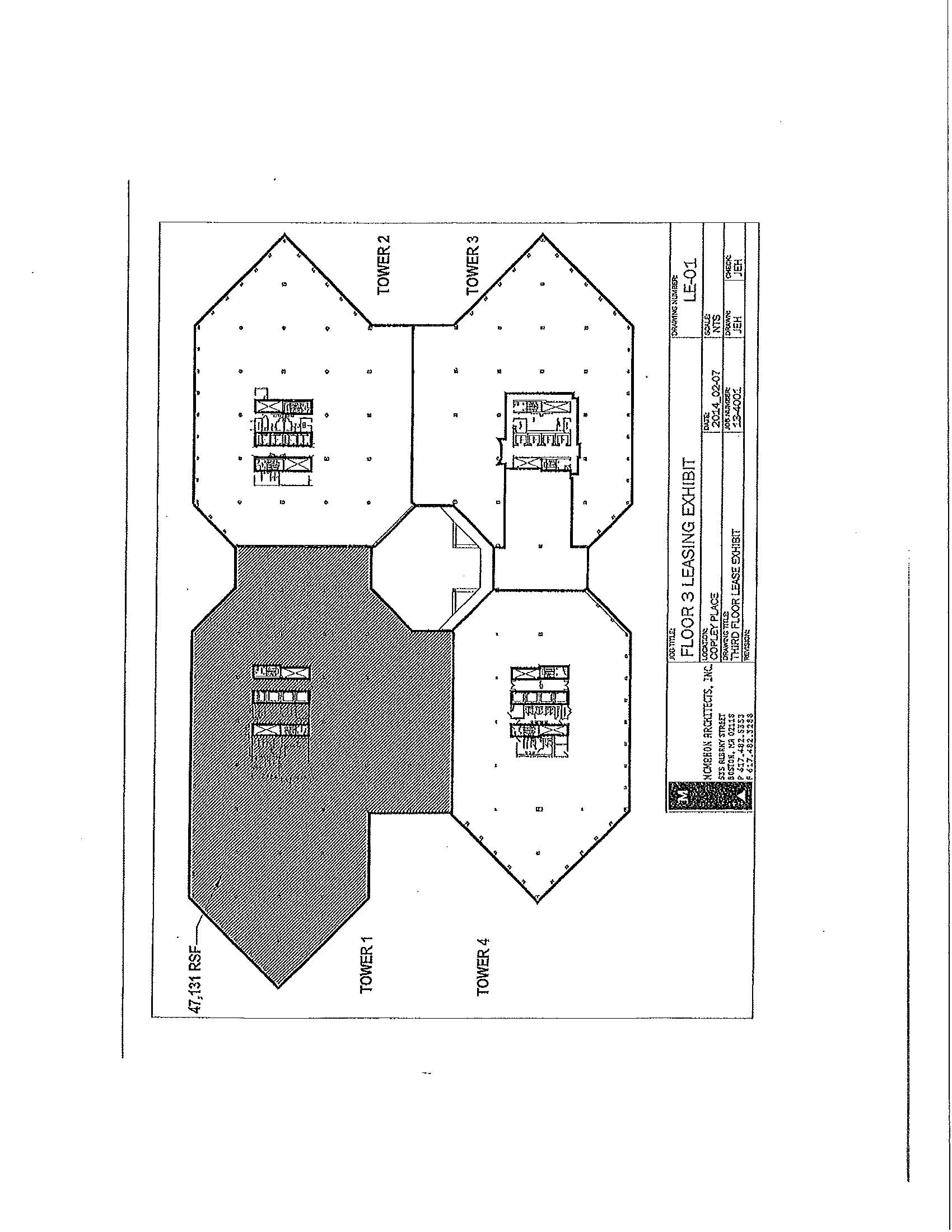

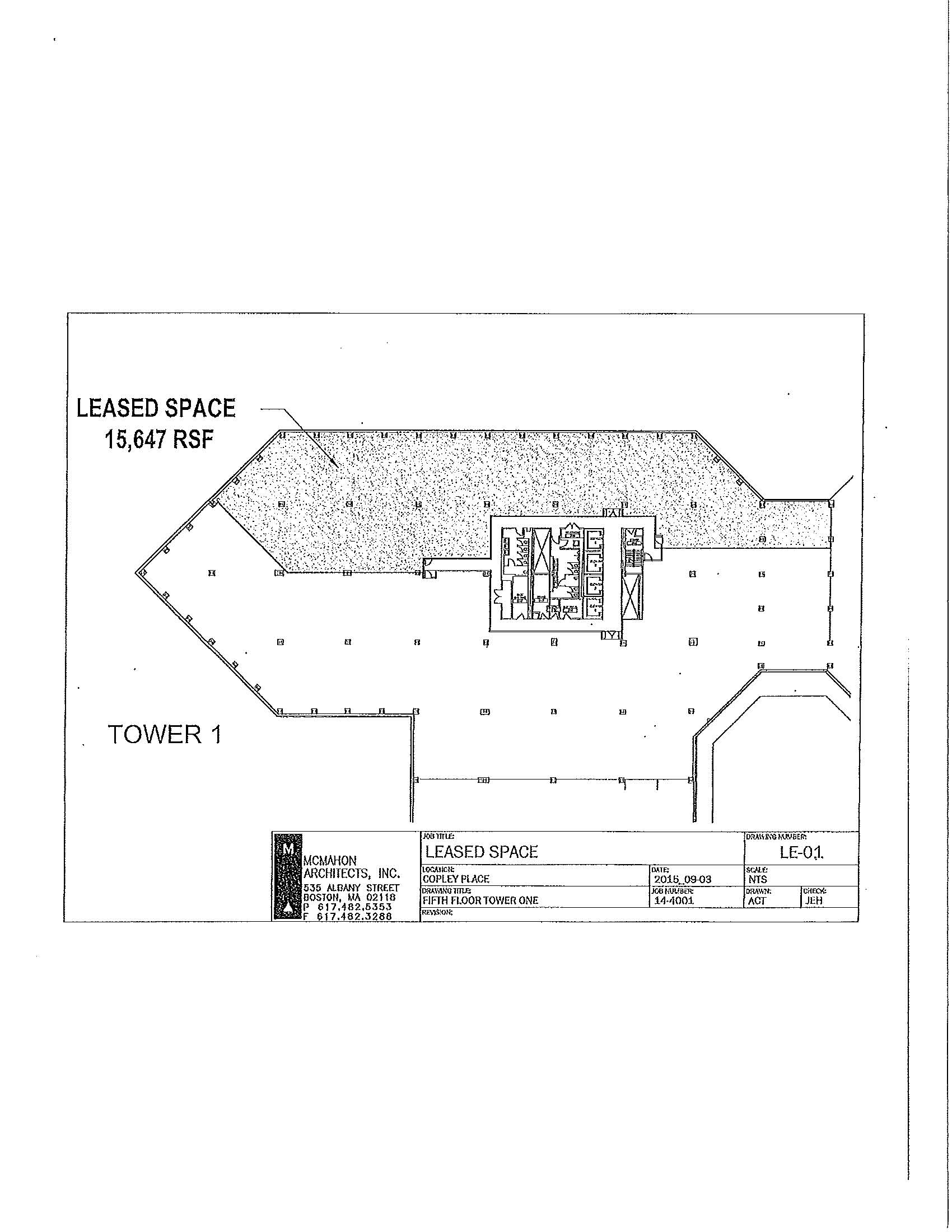

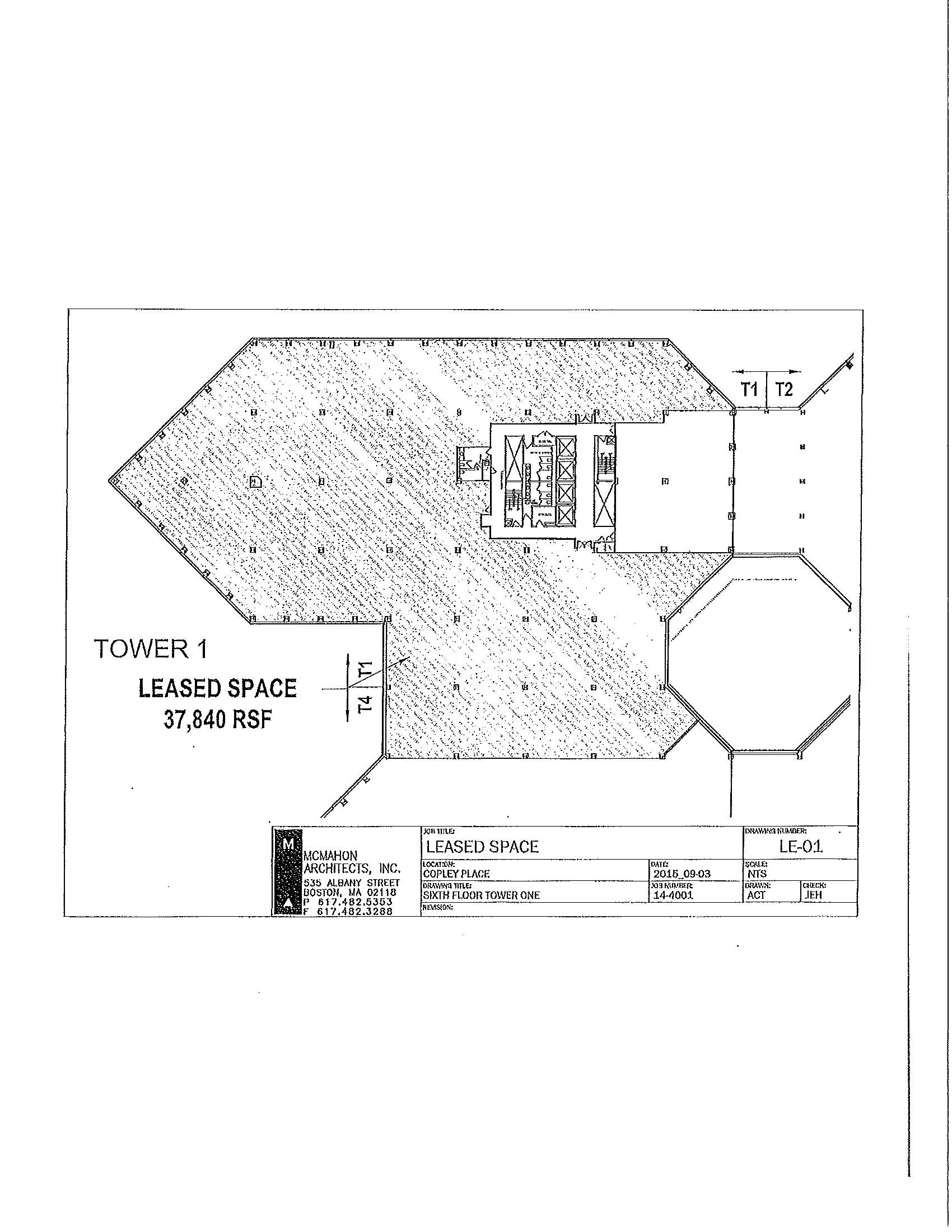

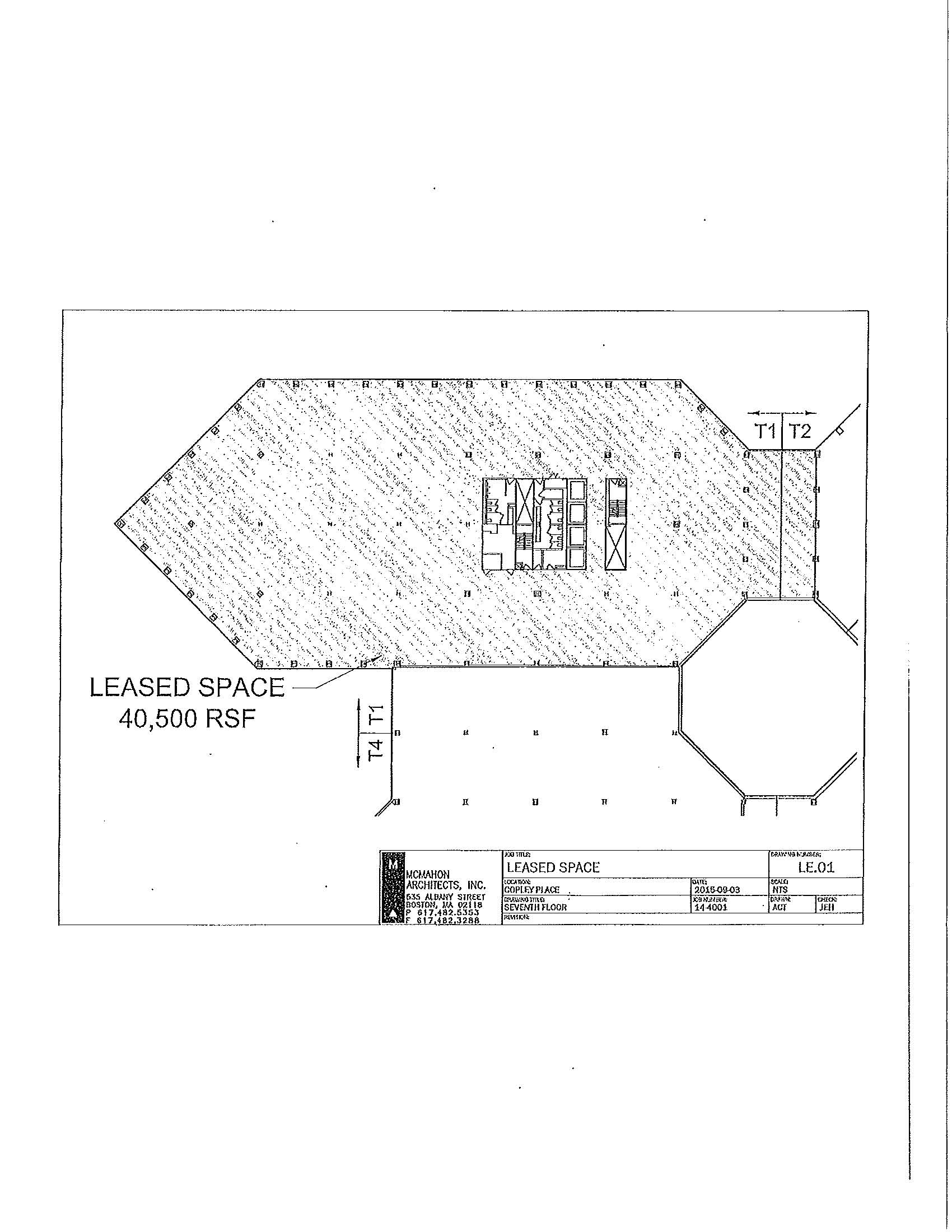

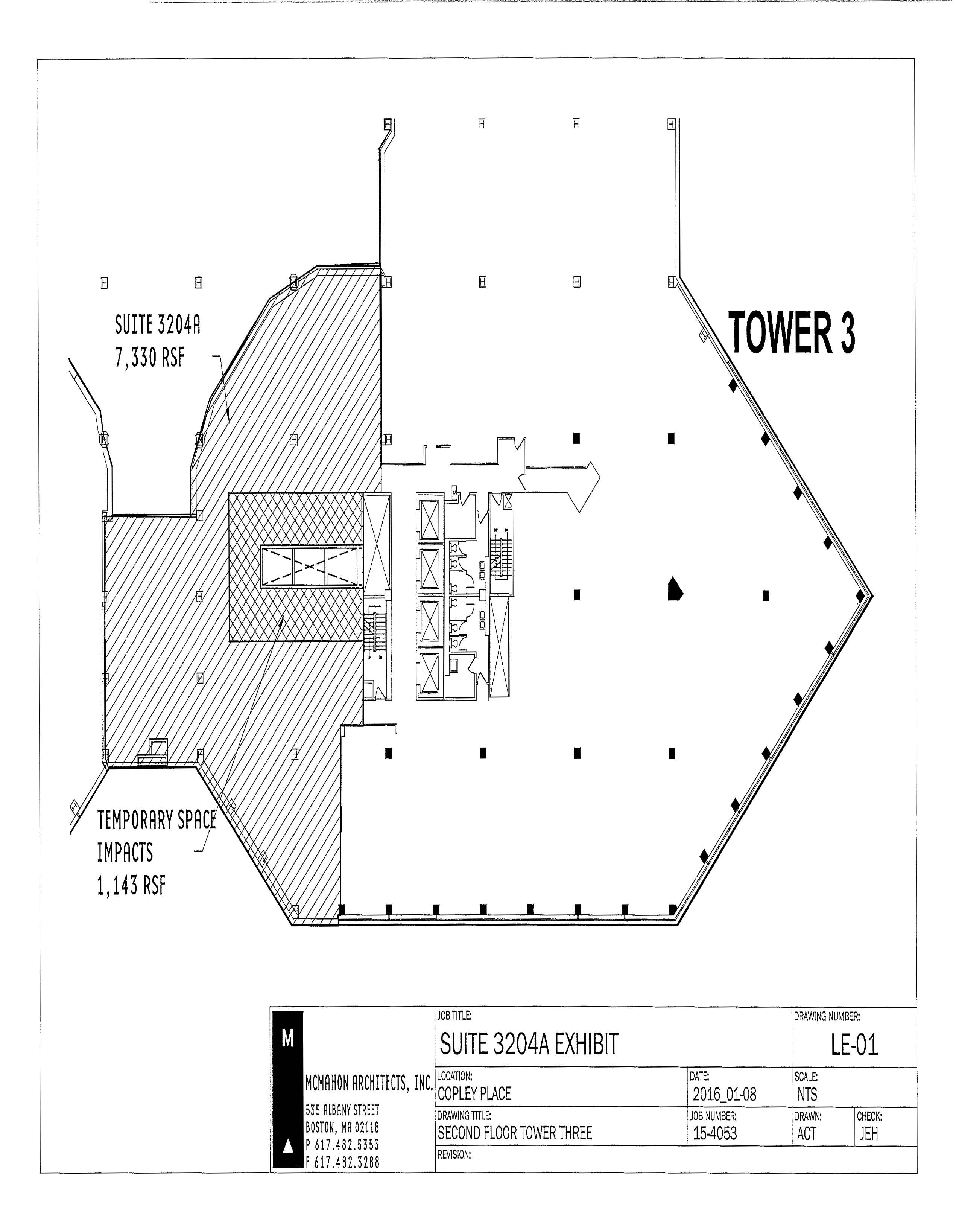

1.19 | Premises: | That portion of the Office Section designated on the plan attached hereto as Exhibit A consisting of a Sheet for each floor of Tower IV in which a portion of the Premises is located and containing a total of approximately 105,696 rentable square feet, consisting of the following approximate rentable square footages in Tower IV of the Building: 35,176 rentable square feet on the 7th floor 24,104 rentable square feet on the 6th floor 15,976 rentable square feet on the 4th floor 23,048 rentable square feet on the 3rd floor 7,392 rentable square feet on the 1st floor The foregoing described Premises (“Initial Premises”) is subject to an expansion of the Premises pursuant to the Expansion Rights provided in ARTICLE 42 and the exercise(s) of a Right of First Offer provided in ARTICLE 43. Excepted and excluded from the Premises are the roof or ceiling, the floor and all perimeter walls of the Premises, except the inner surfaces thereof, but the entry doors to the Premises are not excluded from the Premises and are a part thereof for all purposes; and Tenant agrees that Landlord shall have the right to place in the Premises (but in such manner as to reduce to a minimum interference with Tenant’s use of the Premises) utility lines, pipes and the like, to serve premises other than the Premises, and to replace and maintain and repair such utility lines, pipes and the like, in, over and upon the Premises, but in no event shall such installations reduce the usable square footage of the Premises by more than de minimus amounts. | ||

1.20 | Common Areas: | Those portions of the Property not leased to any tenant, but for the benefit of the Property and its tenants, such as landscaped areas, malls, pedestrian walkways and bridges, public restrooms, service areas and the like | ||

and if the Premises include less than the entire rentable floor area of any floor, the common toilets, corridor and elevator lobby of such floor. | ||||

1.21 | Letter of Credit Amount: | $1,220,788.80 | ||

1.22 | Brokers: | Richards Barry Joyce & Partners for Tenant CB Richard Ellis-N.E. Partners, L.P. for Landlord | ||

ARTICLE 2.

HABENDUM; TERM

To have and to hold the Premises for the Term (as hereinafter defined), and the right to use the Common Areas during the Term in common with others entitled thereto. The term of this Lease (the “Term”) shall be that period of time commencing on the Commencement Date specified in ARTICLE 1 hereof and ending on the Termination Date specified in ARTICLE 1 hereof, unless extended as set forth in ARTICLE 41 hereof or sooner terminated as provided herein.

ARTICLE 3.

POSSESSION

3.01 Rent Commencement. In the event Landlord is unable to deliver possession of the Premises on or before September 1, 2013 in the condition required pursuant to Section 7.1 by reason of the holding over or retention of possession by any tenant or occupant, or for any other reason, this Lease shall nevertheless continue in force and effect, except the Commencement Date and the Rent Commencement Date for any portion of the Initial Premises that Landlord is delayed in delivering beyond September 1, 2013 shall be delayed day for day for each day following September 1, 2013 that Landlord is unable to so deliver possession of such portion of the Premises. In addition, (i) if Landlord is unable to so deliver possession of all or any portion of the Initial Premises by December 31, 2013, then following the Rent Commencement Date, Tenant shall have the right to receive an abatement of one (1) day of Base Rent allocable to the portion of the Initial Premises which Landlord has not so delivered for each and every day of delay in such delivery following December 31, 2013 and (ii) if Landlord is unable to so deliver possession of fifty percent (50%) or more of the Initial Premises by February 1, 2014, Tenant shall have the right, by giving written notice thereof to Landlord, to terminate this Lease and in such event all obligations of Landlord and Tenant with respect to this Lease shall terminate and be of no further force and effect.

3.02 Early Entry. Landlord shall deliver the Premises to Tenant, in the condition set forth in Section 7.1 on September 1, 2013 for purposes of performing Tenant’s Initial Alterations (as hereinafter defined) of the Premises and for installation of telecommunications, business equipment and furniture, and may, subject to Legal Requirements (as hereinafter defined) use the Premises for the conduct of Tenant’s business prior to the Commencement Date. Such entry by

Tenant prior to the Commencement Date shall be at Tenant’s sole risk and without material interference to any work then being performed in the Building by Landlord or to any work then being performed by other tenants in space occupied by such tenants, and all of the covenants and conditions of this Lease shall be binding upon the parties hereto with respect to such whole or part of the Premises. Nevertheless, Tenant’s obligation to pay Rent shall not commence until the Rent Commencement Date and Tenant shall pay Base Rent and any Additional Rent that may be due under ARTICLE 5 on the Rent Commencement Date and upon the first day of each calendar month thereafter at the rates set forth in ARTICLES 1 and 5 hereof. Tenant shall pay for electricity used by Tenant following commencement of Tenant’s construction of the Initial Alterations in the Premises as determined by actual check metering of such usage.

3.03 No Change in Lease Term. The occurrence of any of the events described in this ARTICLE 3 shall not be deemed to accelerate or defer the Termination Date.

3.04 Appurtenant Rights. Tenant shall have, as appurtenant to the Premises, the right (i) to use, in common with others, to the extent space is available therein, the shafts, stacks, pipes, ducts, risers and conduits that are not for the exclusive use of other tenants in the Building, (ii) to use vertical conduits, installed by Tenant at its sole cost and expense, in locations approved by Landlord, for telecommunications running from the Premises to the roof of the Building or a below grade point of entry into the Building, (iii) to install, at Tenant’s sole cost and expense, fiber optic cabling, in conduits and locations approved by Landlord, (iv) to install, use, maintain and repair, a standby generator, in accordance with ARTICLE 45 below, and the Dish/Antenna (as defined in ARTICLE 44 below), and (v) to use the roof area designated on Exhibit A-2 for the installation and maintenance of a roof deck on the terms and conditions set forth in Section 3.05.

3.05 Roof Deck. If Tenant elects to install a roof deck as described in Section 3.04; such roof deck shall be subject to all Legal Requirements as if the same were a part of the Premises; installed and maintained at Tenant’s expense (but the Allowance provided hereunder may be used for design and installation of the same), removed and replaced at Tenant’s expense as required for roof maintenance, and otherwise subject to all requirements and rights applicable to Initial Alterations, including, without limitation, that the Tenant shall have no obligation of restoration with regard to the roof deck. Tenant shall maintain liability insurance with respect thereto as if the same were part of the Premises. Tenant shall be responsible for any material damage caused to the roof or any other part of the Building by the installation, use, maintenance, removal or replacement of the roof deck, to the extent caused by Tenant, Tenant’s invitees or any of Tenant’s agents or representatives as a result of Tenant’s exercise of its rights with respect to the roof deck. Tenant agrees that if it makes use of the roof for a roof deck, it will keep the roof of the Building free of all trash or waste materials produced by Tenant, Tenant’s invitees or any of Tenant’s agents or representatives. Except as may arise from the negligence of the Landlord, neither Landlord nor its agents shall have any responsibility or liability for the conduct or safety of any of Tenant, Tenant’s invitees or any of Tenant’s agents or representatives while on the roof deck. If Tenant elects to remove the roof deck, Tenant shall repair any damage to the roof caused by such removal, including the patching of any holes. Tenant specifically acknowledges and agrees that the terms and conditions of ARTICLE 14 regarding indemnification and waiver of claims shall apply with full force and effect to the roof deck.

ARTICLE 4.

BASE RENT

Commencing on the Rent Commencement Date, Tenant shall pay to Landlord or Landlord’s agent without notice or demand at Copley Place Associates, LLC, c/o Simon Property Group, Inc., P.O. Box 5631, Indianapolis, Indiana 40206-5631, or at such other place as Landlord may from time to time designate in writing, in coin or currency which, at the time of payment, is legal tender for private or public debts in the United States of America, the Base Rent specified in ARTICLE 1 hereof in the equal monthly installments specified in ARTICLE 1 hereof in advance on or before the first day of each and every month (and partial month, if any) during the Term following the Rent Commencement Date, without any abatement, counterclaim, set-off or deduction whatsoever, except as expressly provided herein; in this regard, it is understood that the parties have agreed to such remedies with respect to those instances, if any, in which the parties have determined that such remedies are appropriate. If the Rent Commencement Date for any portion of the Premises is other than on the first day of a month or the Term ends other than on the last day of the month, the Base Rent for such month shall be prorated. The prorated Base Rent for the portion of the month in which the Rent Commencement Date occurs shall be paid on the Rent Commencement Date.

ARTICLE 5.

ADDITIONAL RENT

5.01 Obligation as to Additional Rent. In addition to paying the Base Rent specified in ARTICLE 4 hereof, Tenant shall, commencing on the Rent Commencement Date and for the duration of the Term, pay as “Additional Rent” the amounts determined pursuant to Sections 5.03 and 5.04 of this ARTICLE 5. The Base Rent and the Additional Rent are sometimes collectively referred to in this Lease as the “Rent”. All amounts due under this ARTICLE as Additional Rent shall be payable for the same periods and in the same manner, time and place as the Base Rent and in the same currency, without any abatement, counterclaim, set-off or deduction whatsoever, except as expressly set forth herein. Without limitation on other obligations of Tenant that shall survive the expiration of the Term, the obligations of Tenant to pay the Additional Rent provided for in this ARTICLE 5 shall survive the expiration of the Term for a period of eighteen (18) months. For any partial Calendar Year following the Rent Commencement Date, Tenant shall be obligated to pay only a pro rata share of the Additional Rent, based on the number of days of the Term falling within such Calendar Year.

5.02 Definitions. As used in this ARTICLE 5, the terms:

(i) “Calendar Year” shall mean each calendar year in which any part of the Term falls, through and including the year in which the Term expires.

(ii) “Tenant’s Proportionate Tax Share” shall mean the percentage specified in ARTICLE 1 hereof, being the percentage calculated by dividing the rentable area contained in the Premises by 824,186 (being 95% of the rentable square foot area of the Office Section).

(iii) “Tenant’s Proportionate Expense Share” shall mean the percentage specified in ARTICLE 1 hereof, being the percentage calculated by dividing the rentable area contained in the Premises by 824,186 (being 95% of the rentable square foot area of the Office Section).

(iv) “Taxes” shall mean all real estate taxes and assessments, special or otherwise, levied or assessed upon or with respect to the Property or any part thereof including without limitation Common Areas as such taxes and assessments are reasonably determined by Landlord to be for the benefit of the Office Section and ad valorem taxes for any personal property of Landlord to the extent used in connection with the Office Section. For purposes of clarity, it is understood that there is one real estate tax bill for the Property and that Landlord allocates to the Office Section real estate taxes and assessments on the entire Property based upon the reasonable determination of Landlord. Should the Commonwealth of Massachusetts, or any political subdivision thereof, or any other governmental authority having jurisdiction over the Building, (a) impose a tax, assessment, charge or fee, which Landlord shall be required to pay, by way of substitution for or as a supplement to such real estate taxes and ad valorem personal property taxes, or (b) impose an income or franchise tax or a tax on rents in substitution for or as a supplement to a tax levied against the Property or any part thereof and/or the personal property used by Landlord in connection with the Property or any part thereof, all such taxes, assessments, fees or charges (hereinafter defined as “in lieu of taxes”) shall be deemed to constitute Taxes hereunder. Taxes shall also include, in the year paid, all fees and costs reasonably incurred by Landlord in seeking to obtain a reduction of, or a limit on the increase in, any Taxes, regardless of whether any reduction or limitation is obtained. Taxes shall not include any inheritance, estate, succession, transfer, gift, franchise, corporate excise taxes, transfer taxes, or net income or capital stock tax. If less than 95% of the Office Section is occupied during all or a portion of the Tax Base Year or any Adjustment Year, Landlord shall make an appropriate adjustment in Taxes for such year by adjusting the amount deemed to be Taxes for such Calendar Year so that Tenant’s responsibility for Taxes shall be an amount equal to the amount it would have paid on account of Taxes had the Office Section been 95% occupied. In computing the Adjustment Amount under Section 5.03, any refund of Taxes received by Landlord in the period during which Taxes is being computed and which is available to benefit Tenant as described in this ARTICLE 5, shall, net of the cost of obtaining such refund (to the extent costs were not previously included in Taxes or Operating Expenses), reduce Taxes to which Section 5.03 is applicable; and if Tenant expands into space formerly occupied by other tenants, which expansion space becomes subject to this Lease, Tenant shall not be entitled to any refund or credit in connection with a refund or abatement of Taxes for periods prior to the commencement date for Tenant’s lease of such expansion space. All references to Taxes “for” a particular Calendar Year shall be deemed to refer to Taxes due and payable during such Calendar Year without regard to when such Taxes are assessed or levied.

(v) “Operating Expenses” mean all expenses, costs and disbursements of every kind and nature, other than Taxes, paid or incurred by Landlord in operating, managing, repairing and maintaining the Property and its appurtenances as such expenses, costs and disbursements are reasonably allocated on a fair and equitable basis to the Office Section by the

Landlord in its sole reasonable judgment, or as the same are incurred directly in the operation of the Office Section. Operating Expenses shall include, without limitation: premiums for fire, casualty, liability and such other insurance as Landlord may from time to time maintain; security expenses; compensation and all fringe benefits, workmen’s compensation insurance premiums and payroll taxes paid by Landlord to, for or with respect to all persons engaged in operating, maintaining, or cleaning the Property (equitably apportioned, if such personnel serve the Property and other properties); steam, water, sewer, stormwater, electric, gas, telephone, and other utility charges to the Building not billed directly to tenants by Landlord or the utility; expenses incurred in connection with the central plant furnishing heating, ventilating and air conditioning to the Office Section (and to the Building and the Property where and to the extent the expenses of the Building and the Property are otherwise allocable to the Office Section), which expenses may include a reasonable fee paid to the independent operator of such central plant; costs of lighting, ventilating, (including maintaining and repairing ventilating fans and fan rooms) making routine repairs to and maintenance of underground roadways (and the access ramps servicing such roadways) and railroad platforms and railroad rights of way (including track); costs of repairing and maintaining fire protection systems relating to the underground roadways, access ramps, railroad platforms and railroad rights of way; costs of building and cleaning supplies and equipment (including rental); cost of maintenance, cleaning and repairs; cost of snow plowing or removal, or both, and care of interior and exterior landscaping; payments to independent contractors under contracts for cleaning, operating, management, maintenance and repair (which payments may be to affiliates of Landlord so long as not more than the market rate for such services is included in determining Tenant’s share of Operating Expenses); all other expenses paid in connection with cleaning, operating, management, maintenance and repair, and the amortized cost of capital expenditures (provided that replacement parts or components which are essentially in the nature of regular maintenance replacements even though classified for accounting purposes as capital and which are installed in the ordinary course of business shall not be deemed capital for these purposes and shall not therefore be capital expenditures for purposes of this Lease) which are: (a) in good faith based upon engineering estimates intended to (I) stabilize or reduce, over the portion of the useful life of such improvements or equipment within the then Term, operating expense costs that would otherwise be incurred or (II) improve the operating efficiency of the Property; or (b) required to comply with any Laws that are enacted, or first become effective, after the date of this Lease. The amount included in any Calendar Year with respect to such capital expenditure shall be the total expenditure amortized by Landlord over the useful life thereof determined in accordance with generally accepted accounting principles or, in the case of those items described in clause (a)(I) or clause (a)(II) above, the lesser of the useful life of such items and the Payback Period (defined below). The amortized cost of a capital expenditure may, at Landlord’s option, include actual rate paid by Landlord to finance the capital expenditure or imputed interest at the rate that Landlord is charged for moneys then borrowed by Landlord or by an affiliate that makes such funds available to Landlord for operations. “Payback Period” means the reasonably estimated period of time that it takes for the cost savings resulting from a capital expenditure to equal the total capital expenditure.

Operating Expenses shall not, however, include the following:

(a) costs of any alterations or special services rendered to individual tenants (including Tenant), for which a special, separate charge shall be made or which is not furnished generally to all office tenants of the Building;

(b) Taxes;

(c) interest or principal or financing costs on mortgages encumbering the land on which the Building is located or the Building or relating to funds borrowed by Landlord, or any ground lease rent or other rent payable by Landlord to the holder of any ground lease or other lease to the Landlord, as tenant, of the Property or any portion thereof;

(d) leasing commissions, marketing costs, advertising, legal, space planning, construction and related expenses (including permitting, licensing and inspection fees), and lease concessions incurred in procuring, negotiating or disputing leases or subleases with, and installing leasehold improvements for, tenants, subtenants or prospective tenants or subtenants of the Building;

(e) any other expenses for which Landlord actually receives during the applicable period direct reimbursement from insurance (or if Landlord fails to carry the insurance required hereunder, the reimbursement Landlord would have received had it carried such requisite insurance), condemnation awards, other tenants or any other source;

(f) any costs in connection with the repair, replacement or correction of any defective construction work or equipment which is covered by an applicable warranty and for which (and to the extent which) Landlord recovers with respect thereto;

(g) any charges under any maintenance or management contract made with an affiliate of Landlord to the extent such charges exceed what would have been paid at arm’s length with an unrelated party;

(h) any costs, fines or penalties incurred due to the violation by Landlord or any other tenant of any law;

(i) any costs of environmental remediation for which Landlord is responsible under this Lease, or for which any other tenant or other third party is responsible under the law;

(j) costs incurred in connection with the sale, financing or refinancing of the Property or any portion thereof;

(k) fines, interest and penalties incurred due to the late payment of Taxes, or the failure to file tax or informational returns when due, or due to the late payment of Operating Expenses;

(l) organizational expenses associated with the creation and operation of the entity which constitutes Landlord, including Landlord’s general corporate overhead, in-house legal fees and any entertainment, dining or travel expenses of Landlord;

(m) any penalties or damages that Landlord pays to Tenant under this Lease or to other tenants in the Building under their respective leases;

(n) the amount of judgments against Landlord or settlements of third party claims against Landlord and the amount of attorneys’ fees in connection with any of the same (but the foregoing shall not prevent the application of insurance carried by Landlord under this Lease to the same);

(o) costs of the operation of the Copley Garage or the Dartmouth Street Garage (as such terms are hereinafter defined);

(p) rentals and other related expenses incurred in leasing heating, ventilating and air conditioning systems, elevators or other equipment ordinarily considered to be capital items, except (i) expenses in connection with making repairs on or keeping Buildings systems in operation while repairs are being made and (ii) costs of equipment not affixed to the Building which is used in providing janitorial or similar services;

(q) capital expenditures which are not specifically included in Operating Expenses as set forth above;

(r) advertising and promotional expenditures and costs of signs in or on the Building identifying the owner of the Building or other tenants’ signs, costs arising from Landlord’s charitable or political contributions, costs for sculpture, paintings or other objects of art, other than maintenance of the same, and the cost of any “tenant relations” parties, events or promotion;

(s) the cost of any electric power used by any tenant in the Building for which such tenant is billed directly by Landlord including without limitation by reason of such tenant’s usage being metered or sub-metered, or electric power costs for which any tenant directly contracts with the local public service company;

(t) bad debt, rental loss or any reserves for repairs or replacements; or services and utilities provided, taxes attributable to, and costs incurred in connection with the operation of the retail, parking, and restaurant operations in the Building; or

(u) costs of so-called lease or credit enhancement insurance or similar insurance products, whether or not the same is required by any mortgagee of the Property, which are obtained for the purpose of obtaining financing or similar credit benefits that inure to the owner or mortgagee of the Property.

If less than 95% of the Office Section’s rentable area shall have been occupied by tenant(s) at any time during any Calendar Year (including the Operating Expense Base Year), for purposes of determining the Adjustment Amount (as hereinafter defined) and the Operating Expense in the Base Year, each component of Operating Expenses for such Calendar Year allocated to the Office Section that varies with fluctuations in occupancy shall be deemed to be an amount equal to the like component which would reasonably be expected to have been incurred had such occupancy been 95% throughout such Calendar Year (including the Operating Expense Base Year, as applicable), so that the amount Tenant actually pays on account of Operating Expenses paid or incurred by Landlord reflects the amount Tenant would have paid if the Office Section would

have been 95% occupied during such period. If any item of Operating Expenses, though paid or incurred in one calendar year, relates to more than one Calendar Year, at the option of Landlord such item may be proportionately allocated among such related calendar years.

5.03 Expense & Tax Adjustment. Tenant shall pay to Landlord or Landlord’s agent as Additional Rent, a sum (“Adjustment Amount”) equal to the sum of (i) Tenant’s Proportionate Expense Share multiplied by the amount by which (a) Operating Expenses incurred in each Calendar Year exceeds (b) Base Year Operating Expenses plus (ii) Tenant’s Proportionate Tax Share multiplied by the amount by which (a) Taxes payable with respect to each Calendar Year exceeds (b) Base Year Taxes. The Adjustment Amount with respect to each Calendar Year shall be paid in monthly installments, in an amount reasonably estimated from time to time by Landlord and communicated by written notice to Tenant, which estimate may be revised to reflect increases in Taxes and Operating Expense adjustments. Landlord shall cause to be kept books and records showing Operating Expenses in accordance with an appropriate system of accounts and accounting practices consistently maintained for a period of at least two (2) years following the conclusion of each Calendar Year during the Term. Following the close of each Calendar Year, Landlord shall cause the amount of the Adjustment Amount for such Calendar Year to be computed based on Operating Expenses and Taxes for such Calendar Year and Landlord shall deliver to Tenant a statement of such amount and within thirty (30) days after receipt of such statement, Tenant shall pay any deficiency to Landlord as shown by such statement, as the same may have been adjusted by reason of such review. If the total of the estimated monthly installments paid by Tenant during any Calendar Year exceed the actual Adjustment Amount due from Tenant for such Calendar Year, at Landlord’s option such excess shall be either credited against payments next due hereunder or refunded by Landlord provided Tenant is not then in default hereunder with respect to any monetary obligation or in default beyond applicable notice and cure periods with respect to any other obligations. Delay in computation of the Adjustment Amount or a delay in the delivery of a statement of such amount shall not be deemed a default hereunder or a waiver of Landlord’s right to collect the Adjustment Amount hereunder; provided, however, Landlord’s failure to deliver such computation and statement within eighteen (18) months after the end of the applicable Calendar Year shall be deemed a waiver of Landlord’s right to collect any amount in addition to the amounts theretofore collected with respect to such applicable Calendar Year on account of Operating Expenses and Taxes (but such failure or delay in delivery shall not entitle Tenant to a refund of estimated amounts collected with respect to Operating Expenses and Taxes with respect to such applicable Calendar Year). The provisions of this Section 5.03 shall survive the expiration or earlier termination of this Lease.

5.04 Adjustment for Services not Rendered by Landlord. Tenant acknowledges that if Landlord is not furnishing any particular work or service the cost of which, if performed by Landlord, would be included in Operating Expenses, to any tenant who has undertaken to perform such work or service in lieu of the performance thereof by Landlord, and, as a result, Operating Expenses are reduced, Operating Expenses shall be deemed for the purpose of determining the Adjustment Amount to be increased by an amount equal to the additional Operating Expenses which would reasonably have been incurred during such period by Landlord if it had at its own expense furnished such work or service to such tenant. Furthermore, to the extent Landlord incurs any category or item contained within Operating Expenses that should have been but was not included in the

Base Year, then the Base Year Operating Expenses shall be increased by the amount which should have been included in the Base Year Operating Expenses.

5.05 Audit Rights. Tenant may, within one hundred eighty (180) days after receiving Landlord’s statement of Operating Expenses or Taxes, give Landlord written notice (“Review Notice”) that Tenant intends to review Landlord’s records of the Operating Expenses or Taxes for that calendar year and, if Tenant so chooses, the Calendar Year immediately preceding and/or the Operating Expense Base Year and Tax Base Year. Within a reasonable time after receipt of the Review Notice, Landlord shall make all pertinent records available for inspection by electronic files or in hard copy (which hard copies shall be provided at the Building and may, at Tenant’s expense, be copied). Such records shall set forth in reasonable detail the Operating Expenses or Taxes and shall include reasonable backup necessary for Tenant to conduct its review, including the records for the previous calendar year or base year for comparison. Within one hundred eighty (180) days after the records are made available to Tenant, Tenant shall have the right to give Landlord written notice (an “Objection Notice”) stating in reasonable detail any objection to Landlord’s statement of Operating Expenses or Taxes for the years under review. Tenant shall be deemed to have approved Landlord’s statement of Expenses or Taxes and shall be barred from raising any claims regarding the Operating Expenses or Taxes for that year if Tenant fails to give Landlord an Objection Notice within the 180 day period following the receipt of the statement for the next succeeding Calendar Year or fails to provide Landlord with a Review Notice within the applicable 180 day period described above. If Tenant provides Landlord with a timely Objection Notice, Landlord and Tenant shall work together in good faith to resolve any issues raised in Tenant’s Objection Notice. In the event Landlord and Tenant are unable to reach a mutual determination of the issues, Tenant shall have the right to have professional auditors conduct a review of Landlord’s books and records relating to Operating Expenses or Taxes incurred during the period. Such professional auditors may not, however, be engaged on a contingent fee basis. Such an audit may occur not more often than once in a year; shall be conducted within twelve (12) months (plus any period for which Landlord defers the audit as provided in this sentence) of receipt of a statement of the statement of Operating Expenses and Taxes (and the other documentation to which Tenant is entitled as set forth above) for the period being audited; shall be conducted during regular business hours of Landlord’s property manager at its office in the Boston, Massachusetts metropolitan area; provided, however, so long as Simon Property Group, Inc. or an affiliate is the property manager of the Building and the Building is owned by an entity in which an affiliate of Simon Property Group has an economic interest, such audit must be conducted in the Indianapolis, Indiana office of Landlord. Such audit shall occur on the date requested by Tenant which shall be on not less than fifteen (15) business days’ notice from Tenant to Landlord and may be deferred by Landlord, by notice to Tenant given at least ten (10) business days before the date proposed by Tenant, for up to one (1) month to a date convenient to Landlord’s property manager and Tenant. Landlord shall be provided with a copy of such third-party audit. If Landlord and Tenant determine without a third party audit, or if such audit demonstrates, that Operating Expenses or Taxes for the calendar year are less than reported, Landlord shall provide Tenant with a credit against the next installment of Rent in the amount of the overpayment by Tenant. Likewise, if Landlord and Tenant determine that Operating Expenses or Taxes for the calendar year are greater than reported, or if the audit so demonstrates, Tenant shall pay Landlord the amount of any underpayment within thirty (30) days. In addition, if as a result of an audit, Operating Expenses or Taxes are found to be overstated by more than five percent (5%), Landlord shall pay to

Tenant, Tenant’s reasonable cost of conducting such audit, not to exceed $15,000.00, plus, if applicable, reasonable travel costs to Indianapolis for necessary auditing staff. The records obtained by Tenant shall be treated as confidential. In no event shall Tenant be permitted to examine Landlord’s records or to dispute any statement of Operating Expenses or Taxes unless Tenant has paid and continues to pay during the period of the audit all Rent when due.

5.06 Billing for Electricity.

(i) Lack of Separate Metering. The Premises are not separately metered for electricity and, accordingly, Tenant shall pay Landlord as further Additional Rent, in monthly installments at the time prescribed for monthly installments, the electrical charge computed by Landlord based on a check meter installed at Landlord’s sole cost and expense and the applicable rates and surcharges of the electrical utility serving the Premises (without any surcharges by Landlord).

(ii) Separate Metering. In the event that Landlord in its sole discretion subsequently makes arrangements with the utility company supplying electricity to the Premises for separate metering and billing, Tenant shall pay (as hereinafter described) for the use of all electrical service to the Premises (other than the electrical service necessary for Landlord to fulfill its obligation to provide heating and air conditioning as provided in subsection 8.01(i) hereof). In such event, Tenant shall be billed directly by such utility company and Tenant agrees to pay each bill promptly in accordance with its terms. In the event that for any reason Tenant cannot be billed directly, Landlord shall forward each bill received by it with respect to the Premises to Tenant and Tenant shall pay such bill promptly in accordance with its terms.

ARTICLE 6.

USE OF PREMISES

Tenant shall use and occupy the Premises in accordance with law; and solely for the Permitted Uses specified in ARTICLE 1 hereof and for no other purpose or purposes. For purposes of clarity, it is understood that an office use shall include the right of the Tenant to conduct an on-line retail operation; provided, however, Tenant shall have no right to conduct an in-person retail operation on the Premises.

ARTICLE 7.

CONDITION OF PREMISES; LANDLORD’S WORK

7.01 Condition of Premises. The Premises are demised to Tenant and Tenant accepts the same “as-is”, except that (a) if, not later than sixty (60) days following the date of this Lease, Tenant notifies Landlord that the Initial Premises or a portion thereof (clearly designated in such notice to Landlord) are to be delivered in shell condition (but absent such notice Landlord will not otherwise be obligated to perform the Shell Work, time being of the essence of such notice), the Landlord shall, with respect to such designated portion(s) of the Premises, perform the Shell Work described in Exhibit B-1 at Landlord’s sole cost and expense prior to September 1, 2013, and all other work necessary to prepare the Initial Premises for Tenant’s

occupancy shall be performed at Tenant’s sole cost and expense, in accordance with the applicable provisions of this Lease and (b) as to space added to the Premises pursuant to Section 42.01, if Tenant elects as provided therein, that some or all of the space so added shall be delivered in shell condition (but absent such notice Landlord will not otherwise be obligated to perform the Shell Work, time being of the essence of such notice), the Landlord shall, with respect to such designated portion(s) of the Premises, perform the Shell Work described in Exhibit B-1 at Landlord’s sole cost and expense prior to the date which is ninety (90) days following the date on which the additional space would be delivered under Section 42.01 but for the Tenant election that the same be delivered in shell condition, and all other work necessary to prepare the space so added under Section 42.01 for Tenant’s occupancy shall be performed at Tenant’s sole cost and expense, in accordance with the applicable provisions of this Lease. Tenant’s taking possession of any portion of the Premises shall be conclusive evidence that such portion of the Premises was in good order and satisfactory condition when Tenant took possession, and except for latent defects not readily apparent from a careful inspection of the Premises without cutting into or otherwise disturbing walls, floors or ceilings and punchlist items of which Tenant has delivered notice to Landlord, excluding items of damage caused by Tenant or its agents, independent contractors or suppliers (subject to the provisions of Section 3.01 of this Lease). No promise of Landlord to alter, remodel or improve the Property and no representation by Landlord or its agents respecting the condition of the Property has been made to Tenant or relied upon by Tenant other than as may be contained in this Lease or in any written amendment hereto signed by Landlord and Tenant.

7.02 Building Renovations. Subject to Landlord obtaining Boston Redevelopment Authority and City of Boston approvals, as well as approvals and/or relocation agreements of tenants affected by proposed construction, including without limitation Barneys New York, Banana Republic, Sovereign Bank, BCBG and Karen Clarke, Landlord shall, at Landlord’s sole cost and expense, complete the planned renovations to the Property (not limited to new office lobby on retail level, upgraded sky lobby, conference center and roof deck). Landlord’s intention is that such approvals will be diligently pursued so as to permit completion of such renovations no later than the Commencement Date.

7.03 Landlord’s Work. Prior to the Commencement Date, Landlord shall, at its sole cost and expense substantially complete, in a good and workmanlike manner and in accordance with Legal Requirements, Landlord’s Work as set forth in Exhibit B-2.

ARTICLE 8.

SERVICES

8.01 List of Services. Landlord shall provide the following services, the costs of which are included within Operating Expenses, on all days during the Term, except Sundays and holidays, unless otherwise stated, and subject to all governmental rules, regulations and guidelines applicable thereto:

(i) HVAC. Heating and air conditioning in the Premises during the normal heating and air conditioning seasons, from Monday through Friday, during the period from 8 a.m. to 6 p.m. and on Saturday during the period from 8 a.m. to 1 p.m., satisfying the standards set forth in Schedule 8.01 attached hereto. Tenant will pay for all heating and air conditioning

requested and furnished prior to or following such hours at rates to be established from time to time by Landlord and intended by Landlord to reflect, when set, Landlord’s good faith estimate of its cost to deliver such after-hours heating and air conditioning. Requests for any additional services shall be in writing and delivered to Landlord’s property manager not later than 2 p.m. of the previous day.

(ii) Electric. Adequate electrical wiring and facilities for standard building lighting fixtures provided by Landlord and for Tenant’s incidental uses (it being understood that Tenant is to bear the cost of replacement of all lamps, tubes, ballasts and starters for lighting fixtures in the Premises); provided that (a) the connected electrical load for lighting and incidental use equipment does not exceed an average of six (6) watts per rentable square foot of the Premises; (b) the electricity so furnished for incidental uses will be at 277 volts (and may be stepped down at Tenant’s expense in accordance with Tenant’s requirements) and no electrical circuit for the supply of such incidental use will have a current capacity exceeding 20 amperes; and (c) such electricity will be used only for equipment and accessories normal to office usage, including without limitation a server room. If Tenant’s requirements for such electricity (including without limitation supplemental cooling requirements by reason of such uses) are in excess of those set forth in the preceding sentence, Landlord reserves the right to require Tenant to install the conduit, wiring and other equipment necessary to supply electricity for such excess use requirements at Tenant’s expense.

(iii) Water. Water at temperatures and otherwise as supplied by the City of Boston or other water provider for drinking, lavatory and toilet purposes and to water which Tenant can use to supply its condenser units for supplemental heating, ventilation and air-conditioning as provided in Section 8.3(c) below (but Landlord shall not have an obligation to provide so-called condenser water).

(iv) Janitorial. Janitorial services as delineated in Exhibit D attached hereto.

(v) Window Washing. Window washing of the inside and outside of windows in the Building’s perimeter walls as may be situated in the Premises as delineated in Exhibit D attached hereto.

(vi) Passenger Elevator. Non-exclusive automatic passenger elevator service twenty-four hours (24) a day, seven (7) days a week, three hundred sixty-five (365) days a year.

(vii) Freight Elevator and Loading Dock. Non-exclusive freight elevator service to all floors of the Premises and access to the Buildings loading dock, subject to scheduling by Landlord.

(viii) Access. Access to the Premises twenty-four (24) hours per day, seven (7) days a week, three hundred sixty-five (365) days per year, subject to fire, casualty and other causes beyond Landlord’s control.

8.02 Landlord Repairs and Maintenance. Landlord shall operate the Building in a good and quality manner at all times and shall maintain and repair the Building components described in this subsection 8.02 in good condition and repair, consistent with standards for similar office buildings in downtown Boston, Massachusetts which have services, systems and facilities comparable to the Building. Landlord agrees to keep neat and clean and in good order, condition and repair, and in compliance with all Legal Requirements, the roof, public and common areas, plazas, exterior walls (including exterior glass), foundation, footings, structure and structural elements of the Building and the plumbing, mechanical, electrical, fire safety, sprinkler, heating, ventilation, air conditioning, elevator and telecommunications systems, ducts, pipes and conduits serving the Premises and the other portions of the Building, but nothing herein shall require the Landlord to repair or maintain any portion thereof that is for the exclusive use of Tenant or any tenant or occupant of the Building. All costs incurred by Landlord in the performance of its obligations under this Section 8.02 shall be included in Operating Expenses subject to and in accordance with ARTICLE 5. If (a) Landlord fails to make repairs or replacements which Landlord has undertaken to make under the provisions of this subsection 8.02 or elsewhere in this Lease and (b) by reason of such failure, there is an imminent threat in the Premises to persons or property or Tenant is prevented from conducting its business operations in the Premises, Tenant may elect to take reasonable action within the Premises (and without affecting structure or systems outside of the Premises) solely to remedy the condition threatening such persons or property or Tenant’s business operations. Tenant shall endeavor to give Landlord advance notice of the condition and the action, but if such notice is not reasonable under the circumstances, shall give notice to Landlord as soon as practicable. Tenant shall not have any such right with respect to any condition which Landlord intends to remedy in accordance with a comprehensive plan, intended to manage the necessary repair or replacement, which has been communicated to Tenant. In the event that Tenant remedies such imminent threat or condition preventing the conduct of Tenant’s business in the Premises, Landlord shall reimburse Tenant for all actual out-of-pocket costs reasonably incurred in connection which such repairs completed by Tenant hereunder within thirty (30) days after submission by Tenant to Landlord of a statement of such costs and a request for reimbursement thereof, together with reasonable back up documentation. In the event Landlord does not, within such thirty (30) day period following the submission of the request for reimbursement and the necessary documentation, make payment of the full amount for which Tenant submitted a request for reimbursement, Tenant may cause the matter to be submitted to arbitration by notice given to Landlord within five (5) business days of the end of the end of the thirty (30) day period, in which event Landlord and Tenant shall, during the ensuing ten (10) business days, attempt to agree on an arbitrator not affiliated with either party (and if they are unable to do so, either party may request that the President of the American Arbitration Association in Boston choose an arbitrator, as promptly as possible, meeting the criteria set forth below; provided, however, the parties shall each have the right during a five (5) business day period following the end of the ten (10) business day period to submit the names of not more than two (2) potential arbitrators meeting the said criteria and if the parties or either of them makes such a submission, the choice of the President of the American Arbitration Association shall be made from the list of potential arbitrators so submitted). The arbitrator shall have a period of ten (10) business days to determine (1) whether Tenant was authorized under this Section 8.02 to make the repairs made by it and (2) if so authorized the amount which Tenant is entitled to be reimbursed consistent with the rights of Tenant and the obligations of Landlord under this Section 8.02. If any amount is owed by Landlord in addition to any amount which Landlord

may have theretofore paid to Tenant with respect hereto, Landlord shall pay such amount within thirty (30) days following the decision of the arbitrator and if Landlord does not make such payment within such thirty (30) day period, Tenant may offset the amount the arbitrator determined was due to Tenant, less any portion thereof theretofore paid to Tenant, from Base Rent thereafter becoming due under this Lease. The arbitrator shall be a person with knowledge of commercial office property management (and not less than ten (10) years’ experience in the field of property management) sufficient to enable such person (a) to assess the requirement for Tenant having taken the actions taken by Tenant and (b) to analyze the cost of the repair work undertaken to assure the reasonability thereof. The expenses of the arbitrator shall be borne equally by the Landlord and the Tenant.

8.03 Interruption of Services. Tenant agrees that Landlord shall not be liable in damages, by abatement of Rent or otherwise, for failure to furnish or delay in furnishing any service, or for any diminution in the quality or quantity thereof, when such failure or delay or diminution is occasioned, in whole or in part, by repairs, renewals, or improvements, by any strike, lockout or other labor trouble, by inability to secure electricity, gas, water, or other fuel at the Building after reasonable effort so to do, by any accident or casualty whatsoever, by act or default of Tenant or other parties, or by any other cause beyond Landlord’s reasonable control; and such failures or delays or diminution (any such event, a “Service Failure”) shall never be deemed to constitute an eviction or disturbance of Tenant’s use and possession of the Premises or relieve Tenant from paying Rent or performing any of its obligations under this Lease. Notwithstanding the foregoing, if the Premises, or a material portion of the Premises, is made untenantable (that is, Tenant cannot conduct its business in such portion) or inaccessible for a period in excess of five (5) consecutive business days as a result of the Service Failure that has been caused by Landlord’s act or omission with respect to matters within Landlord’s control (“Controlled Service Failure”), then Tenant, as its sole remedy, shall be entitled to receive an abatement of Rent payable hereunder during the period beginning on the sixth (61 ) consecutive business day of the Controlled Service Failure and ending on the day the service has been restored. If the entire Premises has not been rendered untenantable or inaccessible by such a Controlled Service Failure, the amount of abatement that Tenant is entitled to receive by reason of such a Controlled Service Failure shall be prorated based upon the percentage of the Premises rendered untenantable or inaccessible and not used by Tenant. Notwithstanding the foregoing, business days during which the Premises or a material portion thereof are untenantable or inaccessible, or during which all or nearly all the Premises are unusable, by reason of a Service Failure which arises from a fire or other casualty which is covered by the provisions of ARTICLE 13 shall in no event be considered in determining whether Tenant is entitled to an abatement of Rent under this Section 8.03 (in such event the provisions of Section 13.01 shall govern Tenant’s rights). In no event shall Landlord be liable to Tenant for any loss or damage, including the theft of Tenant’s property, arising out of or in connection with the failure of any security services, personnel or equipment.

8.04 Additional Services. Landlord may, but shall have no obligation to, provide such extra or additional services (beyond the services described in Section 8.01) as it is reasonably possible for Landlord to provide, and as Tenant may from time to time request in writing, within a reasonable period after the time such extra or additional services are requested; furthermore, if extra or additional elevator or heating and air conditioning services are requested, Landlord shall not be required

to furnish any such services unless Landlord has received advance notice from Tenant requesting such services prior to 2:00 p.m. on the business day next preceding the day with respect to which such services are requested. Failure by Landlord to furnish such services shall not constitute an actual or constructive eviction, in whole or in part, or entitle Tenant to any abatement or diminution of Rent, or relieve Tenant from any of its obligations under this Lease, or impose any liability upon Landlord or its agents by reason of inconvenience or annoyance to Tenant, or injury to or interruption of Tenant’s business or otherwise. Tenant shall pay for such extra or additional services at Landlord’s scheduled rate therefor from time to time as quoted to other tenants of the Office Section, or if there be no scheduled rate, then at Landlord’s cost in providing them, such amount to be considered additional Rent hereunder. All charges for such extra or additional services shall be due and payable at the same time as the installment of Base Rent with which they are billed, or if billed separately, shall be due and payable within ten (10) days after Tenant receives Landlord’s bill therefor. Any such billings for extra or additional services shall include an itemization of the extra or additional services rendered and the charge for each such service.

8.05 Energy Conservation. Notwithstanding anything to the contrary in this ARTICLE 8 or elsewhere in this Lease, Landlord shall have the right to institute such policies, programs and measures as may be necessary or desirable, in Landlord’s discretion, for the conservation and/or preservation of energy or energy related services if consistent with similar programs instituted generally in first-class office buildings in Boston, or as may be required to comply with any applicable codes, rules and regulations, whether mandatory or voluntary.

ARTICLE 9.

COMPLIANCE WITH LAWS; REPAIRS; HAZARDOUS MATERIALS

9.01 Compliance With Laws. Subject to the following provisions, each of Landlord, in the Base Building Work and in performance of its obligations under Section 8.02, and in its use, ownership, operation and management of the Property, and Tenant, in the Tenant Improvements and any other work it performs in the Building and in its use and occupancy of the Premises, shall comply in all material respects with the requirements of all applicable governmental laws, codes, ordinances, rules and regulations, whether now or hereinafter enacted, including without limitation the Americans With Disabilities Act (42 U.S.C. §12101 et. seq.) and the regulations and accessibility guidelines issued pursuant thereto and the laws set forth in M.G.L. Ch. 22, §13A and the regulations promulgated thereunder (Architectural Access Board Regulations) (collectively, “Legal Requirements”), to the extent that the same are applicable to the Building, and with any and all directions, rules and regulations of Boards of Fire Underwriters, Rating Boards or the like (or successor agencies); and Tenant shall obtain and maintain all permits, licenses and the like, required by all applicable laws in respect of Tenant’s particular use and occupancy of the Premises, as opposed to office use in general. Landlord will cooperate with Tenant’s efforts to obtain any such permits, licenses and the like, at no cost to Landlord. Notwithstanding the foregoing, in no event shall Tenant be responsible or liable for, or obligated to cure, any noncompliance with Legal Requirements existing on or before the Commencement Date, nor shall Tenant be responsible for any future violation of Legal Requirements that results in whole or in part, from Landlord’s acts or omissions or improvements to the Property. Furthermore, Tenant’s obligations under this Section 9.01 shall not include making any structural repairs or improvements to the Building.

9.02 Repairs. Subject to Section 12.01, Tenant will, at Tenant’s own expense, keep the Premises, including all improvements, fixtures and furnishings therein, in good order, repair and condition at all times during the Term, and, except as to damage resulting from ordinary wear and tear, Tenant shall promptly and adequately repair all damage to the Premises and replace or repair all damaged or broken glass, fixtures and appurtenances, under the supervision and subject to the approval of Landlord, and within any reasonable period of time specified by Landlord; provided, however, as to any damage resulting from casualty, Tenant shall have no responsibility for repair or replacement which is Landlord’s responsibility under this Lease. If Tenant does not do so, Landlord may, but shall not be obligated to, make such repairs and replacements, and Tenant shall pay Landlord the cost thereof, including a percentage of the cost thereof (to be uniformly established for the Office Section) sufficient to reimburse Landlord for all overhead, general conditions, fees and other costs or expenses arising from Landlord’s involvement with such repairs and replacements forthwith upon being billed for same. Landlord may, but shall not be required to, enter the Premises at all reasonable times on reasonable advance notice (and at any time in emergency situations, with such notice as is commensurate with the emergency) to make such repairs, alterations, improvements and additions to the Premises, to the Office Section or the Building or to any equipment located in the Office Section or the Building as Landlord shall desire or deem necessary or as Landlord may be required to do by governmental authority or court order or decree.

9.03 Hazardous Materials.

(i) Tenant shall not (either with or without negligence) cause or permit the escape, disposal or release of any biologically or chemically active or hazardous substances, or materials (collectively the “Hazardous Materials”). Tenant shall not allow the storage or use of Hazardous Materials in any manner not sanctioned by law or by the highest standards prevailing in the industry for the storage and use of such Hazardous Materials, nor allow to be brought into the Building any Hazardous Materials except to use in the ordinary course of Tenant’s business, and then only after written notice is given to Landlord of the identity of Hazardous Materials. Without limitation, Hazardous Materials shall include those described in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. Section 9601 et seq., the Resource Conservation and Recovery Act, as amended, 42 U.S.C. Section 6901 et seq., any applicable state or local laws and the regulations adopted under these acts; provided, however, Hazardous Materials shall not include customary office and cleaning supplies, in reasonable quantities which are maintained and stored in accordance with manufacturer’s specification for maintenance and storage in an office environment. If any lender or governmental agency shall ever require testing to ascertain whether or not there has been any release of Hazardous Materials, then the reasonable costs thereof shall be reimbursed by Tenant to Landlord upon demand as additional charges if such requirement applies to the Premises. In addition, Tenant shall execute affidavits, representations and the like from time to time at Landlord’s request concerning Tenant’s best knowledge and belief regarding the presence of Hazardous Materials on the Premises. In all events, Tenant shall indemnify Landlord in the manner elsewhere provided in this Lease from any release of Hazardous Materials on the Premises occurring while Tenant is in possession or elsewhere if caused by Tenant or persons acting under Tenant. The within covenants shall survive the expiration or earlier termination of the Term.

(ii) Landlord hereby represents to Tenant that, to the best of its knowledge, there are no Hazardous Materials present on, in or under the land on which the Building is located that require investigation or remediation under applicable law. Tenant shall have no responsibility for and shall not assume or be deemed to have assumed any liability of Landlord on account of oil or Hazardous Materials on, at or in the Property prior to the date Tenant takes possession of the Premises. In no event, unless caused by Tenant or persons for whose conduct Tenant is responsible, shall Tenant be liable for any release of oil or hazardous substances occurring or accruing after the Term. Landlord shall indemnify, defend and hold Tenant harmless from and against any claims, damages, costs and liabilities, including consultants’ fees and reasonable attorneys fees, arising out of Landlord’s use, generation, storage or disposal of hazardous substances or oil on, under or about, or transported to or from, the Building or the Land. Landlord’s indemnification obligations under this Section 9.03(ii) shall survive the expiration or earlier termination of this Lease.

ARTICLE 10.

ADDITIONS AND ALTERATIONS

10.01 Consent Required. Tenant shall not, without the prior written consent of Landlord, make any alterations, improvements or additions (sometimes referred to in this Lease, collectively, as “Alterations”) to the Premises, which consent shall not be unreasonably, withheld, conditioned or delayed. Alterations to be made to the Initial Premises prior to the commencement of the Term or made initially to SSB Expansion Space and Early Expansion Space (as those terms are defined under Section 42.01) are referred to in this Lease as the “Initial Alterations”. If Landlord consents to said alterations, improvements or additions, it may impose such conditions with respect thereto as Landlord deems reasonable, including, without limitation, requiring Tenant to provide reasonable assurance that all costs incurred with respect to such work shall be fully and timely paid, insurance against liabilities which may arise out of such work, and plans and specifications plus permits necessary for such work, requiring Tenant to perform such work at times reasonably designated by Landlord; provided, however, such conditions shall not require Tenant to construct Initial Alterations during particular hours (although reasonable rules and regulations relating to regulating noise, odor and vibration resulting from such construction may be imposed). Notwithstanding the foregoing, Landlord’s consent shall not be necessary with respect to Alterations that do not affect the Building systems or structure or the roof skin and (a) are cosmetic in nature (such as paint, carpet and attached furniture) or (b) which in the aggregate (together with any reasonably related set of Alterations) cost less than $50,000.00 plus the costs of painting and carpeting related to the particular Alterations. Tenant shall have the right to hire its own contractors, subject to Landlord’s approval, which approval shall not be unreasonably withheld, conditioned or delayed; provided, that it is agreed that it shall not be unreasonable for Landlord to withhold consent to work in the Building by any contractor with whom Landlord has had quality or cooperation issues in the past. It is further understood that Landlord’s consent to the hiring by Tenant of Tenant’s own contractors may be withheld if Landlord’s permitting such hiring might reasonably be expected to adversely affect other construction in the Building or might reasonably be expected to result in a material interruption of services

provided to tenants of the Building. Any contractor hired by Tenant shall be appropriately insured as reasonably determined by Landlord. Tenant shall promptly pay to the contractor, when due, the cost of all such work and of all decorating required by reason thereof. In connection with seeking Landlord’s approval, plans and specifications regarding proposed Alterations shall be in such form and with such content as Landlord shall reasonably require and Tenant shall, in addition to all other expenses which Tenant is obligated to pay to Landlord hereunder, reimburse Landlord for all sums reasonably expended for unaffiliated third party consultants’ examination and approval of the architectural and working plans and specifications for the Alterations and, except in connection with the Initial Alterations to the Premises, shall pay Landlord for use of elevators and hoists during the making of the Alterations; provided, however, that Landlord shall have the exclusive right to determine the scheduling of (and shall cooperate reasonably with Tenant to coordinate) the use of such elevators and hoists which shall not be unreasonably withheld, conditioned or delayed. Landlord shall review and approve (or provide comments on) Tenant’s plans and specifications no later than ten (10) business days after submission. If Landlord fails to approve, object to or provide comments on Tenant’s submission of a set of plans and specifications within such ten (10) business day period, then Tenant may deliver a notice to Landlord stating that if Landlord fails to approve, object to or provide comments on such plans within two (2) business days following the delivery of such notice, and in such event, if Landlord fails to so approve, object to or provide comments on such plans within such two (2) business day period, Landlord shall be deemed to have approved the submitted set of plans and specifications. If any of the plans and specifications are disapproved by Landlord, Landlord shall provide Tenant with reasonably detailed reasons for such disapproval and the foregoing process shall be repeated until all of the plans and specifications shall have been approved or deemed approved by Landlord, except that Landlord’s approval of any revisions to the plans and specifications submitted in response to Landlord’s comments or objections shall be deemed given unless Landlord submits written comments or objections to Tenant within five (5) business days after receipt thereof, subject to the delivery of a second notice and Landlord’s failure to approve, object to or provide comments within two (2) business days following Landlord’s receipt thereof. Except for the reimbursement for third party consultants at commercially reasonable rates, Tenant will not be charged any Landlord supervisory, management or review fees in connection with any Alterations. Landlord’s architect and base building contractor will reasonably cooperate with Tenant to ensure timely completion of Alterations. Upon completion of such work Tenant shall deliver to Landlord, if payment is made directly to contractors, evidence of payment, contractors’ affidavits and full and final waivers of all liens for labor, services or materials, all in form satisfactory to Landlord. Tenant shall defend and hold Landlord, any mortgagee, the DOT (defined in Article 33U), the Property and the Building harmless from all costs, damages, liens and expenses related to such work. All work done by Tenant or its contractors pursuant to ARTICLES 9 or 10 shall be done in a good and workmanlike manner using only good grades of materials and shall comply with all insurance requirements and all applicable laws and ordinances and rules and regulations of governmental departments or agencies.