Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - TC PIPELINES LP | a2227406zex-23_1.htm |

| EX-31.1 - EXHIBIT 31.1 - TC PIPELINES LP | a2227406zex-31_1.htm |

| EX-99.9 - EXHIBIT 99.9 - TC PIPELINES LP | a2227406zex-99_9.htm |

| EX-32.2 - EXHIBIT 32.2 - TC PIPELINES LP | a2227406zex-32_2.htm |

| EX-23.2 - EXHIBIT 23.2 - TC PIPELINES LP | a2227406zex-23_2.htm |

| EX-99.10 - EXHIBIT 99.10 - TC PIPELINES LP | a2227406zex-99_10.htm |

| EX-99.11 - EXHIBIT 99.11 - TC PIPELINES LP | a2227406zex-99_11.htm |

| EX-12.1 - EXHIBIT 12.1 - TC PIPELINES LP | a2227406zex-12_1.htm |

| EX-21.1 - EXHIBIT 21.1 - TC PIPELINES LP | a2227406zex-21_1.htm |

| EX-23.3 - EXHIBIT 23.3 - TC PIPELINES LP | a2227406zex-23_3.htm |

| EX-32.1 - EXHIBIT 32.1 - TC PIPELINES LP | a2227406zex-32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - TC PIPELINES LP | a2227406zex-31_2.htm |

| EX-99.12 - EXHIBIT 99.12 - TC PIPELINES LP | a2227406zex-99_12.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 |

|

or |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

|

Commission File Number: 001-35358

TC PipeLines, LP

(Exact name of registrant as specified in its charter)

| Delaware State or other jurisdiction of incorporation or organization |

52-2135448 (I.R.S. Employer Identification No.) |

|

700 Louisiana Street, Suite 700 Houston, Texas (Address of principal executive offices) |

77002-2761 (Zip code) |

|

877-290-2772 (Registrant's telephone number, including area code) |

||

Securities registered pursuant to Section 12(b) of the Act: |

||

Title of each class Common units representing limited partner interests |

Name of each exchange on which registered New York Stock Exchange |

|

Securities registered pursuant to Section 12(g) of the Act: None |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "small reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a small reporting company) |

Small Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the common units of the registrant held by non-affiliates as of June 30, 2015 was approximately $2.7 billion.

As of February 22, 2016, there were 64,317,449 common units of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TC PIPELINES, LP

| Page No. | ||||

|

|

||||

| PART I | ||||

| Item 1. | Business | 7 | ||

| Item 1A. | Risk Factors | 20 | ||

| Item 1B. | Unresolved Staff Comments | 35 | ||

| Item 2. | Properties | 35 | ||

| Item 3. | Legal Proceedings | 36 | ||

| Item 4. | Mine Safety Disclosures | 36 | ||

PART II |

||||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 37 | ||

| Item 6. | Selected Financial Data | 38 | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 39 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 59 | ||

| Item 8. | Financial Statements and Supplementary Data | 61 | ||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 61 | ||

| Item 9A. | Controls and Procedures | 61 | ||

| Item 9B. | Other Information | 62 | ||

PART III |

||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 62 | ||

| Item 11. | Executive Compensation | 67 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 70 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 71 | ||

| Item 14. | Principal Accountant Fees and Services | 75 | ||

PART IV |

||||

| Item 15. | Exhibits and Financial Statement Schedules | 76 | ||

Signatures |

81 |

|||

All amounts are stated in United States dollars unless otherwise indicated.

2015 ANNUAL REPORT 3

Definitions

The abbreviations, acronyms, and industry terminology used in this annual report are defined as follows:

| 2013 Acquisition | Acquisition of an additional 45 percent membership interest in each of GTN and Bison by the Partnership to increase ownership to 70 percent on July 1, 2013 | |

2013 Term Loan Facility |

TC PipeLines, LP's term loan credit facility under a term loan agreement dated July 1, 2013 |

|

2014 Bison Acquisition |

Partnership's acquisition of the remaining 30 percent interest in Bison on October 1, 2014 |

|

2015 GTN Acquisition |

Partnership's acquisition of the remaining 30 percent interest in GTN on April 1, 2015 |

|

2015 Term Loan Facility |

TC PipeLines, LP's term loan credit facility under a term loan agreement dated September 30, 2015 |

|

AFUDC |

Allowance for funds used during construction |

|

ASC |

Accounting Standards Codification |

|

ASU |

Accounting Standards Update |

|

ATM program |

At-the-market Equity Issuance Program |

|

Bison |

Bison Pipeline LLC |

|

Carty Lateral |

GTN lateral pipeline in north-central Oregon that delivers natural gas to a power plant owned by Portland General Electric Company |

|

Consolidated Subsidiaries |

GTN, Bison, North Baja and Tuscarora |

|

Delaware Act |

Delaware Revised Uniform Limited Partnership Act |

|

DOT |

U.S. Department of Transportation |

|

Dth/day |

Dekatherms per day |

|

DSUs |

Deferred Share Units |

|

EBITDA |

Earnings Before Interest, Tax, Depreciation and Amortization |

|

EPA |

U.S. Environmental Protection Agency |

|

FASB |

Financial Accounting Standards Board |

|

FERC |

Federal Energy Regulatory Commission |

|

GAAP |

U.S. generally accepted accounting principles |

|

General Partner |

TC PipeLines GP, Inc. |

|

GHG |

Greenhouse Gas |

|

Great Lakes |

Great Lakes Gas Transmission Limited Partnership |

|

GTN |

Gas Transmission Northwest LLC |

|

HCAs |

High consequence areas |

|

IDRs |

Incentive Distribution Rights |

|

IRS |

Internal Revenue Service |

|

KPMG |

KPMG LLP |

|

LDCs |

Local Distribution Companies |

|

LIBOR |

London Interbank Offered Rate |

|

LNG |

Liquefied Natural Gas |

|

Mainline |

TransCanada's Mainline, a natural gas transmission system extending from the Alberta/Saskatchewan border east to Quebec |

4 TC PIPELINES, LP

NGA |

Natural Gas Act of 1938 |

|

North Baja |

North Baja Pipeline, LLC |

|

Northern Border |

Northern Border Pipeline Company |

|

NYSE |

New York Stock Exchange |

|

Our pipeline systems |

Our ownership interests in GTN, Northern Border, Bison, Great Lakes, North Baja, Tuscarora and, effective January 1, 2016, PNGTS |

|

Partnership |

TC PipeLines, LP including its subsidiaries, as applicable |

|

Partnership Agreement |

Third Amended and Restated Agreement of Limited Partnership of the Partnership |

|

PHMSA |

U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration |

|

PNGTS |

Portland Natural Gas Transmission System |

|

PNGTS Acquisition |

Partnership's acquisition of a 49.9 percent interest in PNGTS on January 1, 2016 |

|

SEC |

Securities and Exchange Commission |

|

Senior Credit Facility |

TC PipeLines, LP's senior credit facility under revolving credit agreement as amended and restated, dated December 23, 2015 |

|

Short-Term Loan Facility |

TC PipeLines, LP short-term loan facility under loan agreement dated October 1, 2014 |

|

TransCanada |

TransCanada Corporation and its subsidiaries |

|

Tuscarora |

Tuscarora Gas Transmission Company |

|

U.S. |

United States of America |

|

WCSB |

Western Canada Sedimentary Basin |

|

Wholly-owned subsidiaries |

GTN, Bison, North Baja, and Tuscarora |

Unless the context clearly indicates otherwise, TC PipeLines, LP and its subsidiaries are collectively referred to in this annual report as "we," "us," "our" and "the Partnership." We use "our pipeline systems" and "our pipelines" when referring to the Partnership's ownership interests in Gas Transmission Northwest LLC (GTN), Northern Border Pipeline Company (Northern Border), Bison Pipeline LLC (Bison), Great Lakes Gas Transmission Limited Partnership (Great Lakes), North Baja Pipeline, LLC (North Baja), Tuscarora Gas Transmission Company (Tuscarora), and effective January 1, 2016, Portland Natural Gas Transmission System (PNGTS).

2015 ANNUAL REPORT 5

PART I

FORWARD-LOOKING STATEMENTS AND CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report includes certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are identified by words and phrases such as: "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "forecast," "should," "predict," "could," "will," "may," and other terms and expressions of similar meaning. The absence of these words, however, does not mean that the statements are not forward-looking. These statements are based on management's beliefs and assumptions and on currently available information and include, but are not limited to, statements regarding anticipated financial performance, future capital expenditures, liquidity, market or competitive conditions, regulations, organic or strategic growth opportunities, contract renewals and ability to market open capacity, business prospects, outcome of regulatory proceedings and cash distributions to unitholders.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the results predicted. Factors that could cause actual results and our financial condition to differ materially from those contemplated in forward-looking statements include, but are not limited to:

- •

- the

ability of our pipeline systems to sell available capacity on favorable terms and renew expiring contracts which are affected by, among other factors:

- •

- demand

for natural gas;

- •

- changes

in relative cost structures and production levels of natural gas producing basins;

- •

- natural

gas prices and regional differences;

- •

- weather

conditions;

- •

- availability

and location of natural gas supplies in Canada and the United States (U.S.) in relation to our pipeline systems;

- •

- competition

from other pipeline systems;

- •

- natural

gas storage levels; and

- •

- rates

and terms of service;

- •

- the

performance by the shippers of their contractual obligations on our pipeline systems;

- •

- the

outcome and frequency of rate proceedings or settlement negotiations on our pipeline systems;

- •

- changes

in the taxation of master limited partnership investments by state or federal governments such as final adoption of proposed regulations narrowing the sources of

income qualifying for partnership tax treatment or the elimination of pass-through taxation or tax deferred distributions;

- •

- increases

in operational or compliance costs resulting from changes in laws and governmental regulations affecting our pipeline systems, particularly regulations issued by

the Federal Energy Regulatory Commission (FERC), the U.S. Environmental Protection Agency (EPA) and U.S. Department of Transportation (DOT);

- •

- the

impact of recent significant declines in oil and natural gas prices, including the effects on the creditworthiness of our shippers;

- •

- our

ongoing ability to grow distributions through acquisitions, accretive expansions or other growth opportunities, including the timing, structure and closure of further

potential acquisitions;

- •

- potential

conflicts of interest between TC PipeLines GP, Inc., our general partner (General Partner), TransCanada and us;

- •

- the

ability to maintain secure operation of our information technology;

- •

- the impact of any impairment charges;

6 TC PIPELINES, LP

- •

- cybersecurity

threats, acts of terrorism and related distractions;

- •

- operating

hazards, casualty losses and other matters beyond our control; and

- •

- the level of our indebtedness, including the indebtedness of our pipeline systems, increase of interest rates, and the availability of capital.

These and other risks are described in greater detail in Part I, Item 1A. "Risk Factors." All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Given these uncertainties, you should not place undue reliance on these forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. All forward-looking statements are made only as of the date made and except as required by applicable law, we undertake no obligation to update any forward-looking statements to reflect new information, subsequent events or other changes.

Item 1. Business

NARRATIVE DESCRIPTION OF BUSINESS

General

We are a Delaware master limited partnership, and our common units are traded on the New York Stock Exchange (NYSE) under the symbol TCP. We were formed by TransCanada Corporation and its subsidiaries (TransCanada) in 1998, to acquire, own and participate in the management of energy infrastructure businesses in North America. Our pipeline systems transport natural gas in the U.S.

We are managed by our General Partner, which is an indirect, wholly-owned subsidiary of TransCanada. Through its subsidiaries, TransCanada owns approximately 26.6 percent of our common units, 100 percent of our Class B units, 100 percent of our incentive distribution rights (IDRs) and an effective two percent general partner interest in us. See Part II, Item 5. "Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" for more information regarding TransCanada's ownership in us.

Recent Business Developments

On April 23, 2015, the board of directors of our General Partner declared the Partnership's first quarter 2015 cash distribution in the amount of $0.84 per common unit, payable on May 15, 2015 to unitholders of record as of May 5, 2015.

On July 23, 2015, the board of directors of our General Partner declared the Partnership's second quarter 2015 cash distribution in the amount of $0.89 per common unit, payable on August 14, 2015 to unitholders of record as of August 4, 2015. The declared distribution reflected a $0.05 per common unit increase to the first quarter 2015 cash distribution.

On October 22, 2015, the board of directors of our General Partner declared the Partnership's third quarter 2015 cash distribution in the amount of $0.89 per common unit payable on November 13, 2015 to unitholders of record as of November 3, 2015.

On January 21, 2016, the board of directors of our General Partner declared the Partnership's fourth quarter 2015 cash distribution in the amount of $0.89 per common unit payable on February 12, 2016 to unitholders of record as of February 2, 2016.

The first quarter 2015 distribution exceeded the first target of the General Partner's IDRs by $0.03 per common unit, resulting in an increase in the distribution on the General Partner interest from 2 percent to 15 percent on the incremental distribution in excess of the first target.

2015 ANNUAL REPORT 7

The second, third and fourth quarter 2015 distributions exceeded the first and second targets of the General Partner's IDRs by $0.07 and $0.01 per common unit, respectively, resulting in an increase in the distribution on the General Partner interest from 2 percent to 15 percent on the incremental distribution in excess of the first target and from 15 percent to 25 percent on the incremental distribution in excess of the second target.

Debt Offering – On March 13, 2015, the Partnership closed a $350 million public offering of senior unsecured notes bearing an interest rate of 4.375 percent maturing March 13, 2025. The net proceeds of $346 million were used to fund a portion of the 2015 GTN Acquisition and reduce the amount outstanding under our Senior Credit Facility.

GTN Acquisition – On April 1, 2015, the Partnership acquired the remaining 30 percent interest in GTN from a subsidiary of TransCanada (2015 GTN Acquisition). The total purchase price of the 2015 GTN Acquisition was $446 million plus purchase price adjustments. The purchase price consisted of $264 million in cash (including the final purchase price adjustment of $11 million), the assumption of $98 million in proportional GTN debt and the issuance of $95 million of new Class B units to TransCanada.

GTN Settlement – On June 30, 2015, FERC approved GTN's rate settlement as filed on April 23, 2015. The 2015 rate settlement satisfies GTN's obligations from its 2011 rate settlement for new rates to be in effect on January 1, 2016 and reduced rates on the mainline by three percent on July 1, 2015 (GTN Settlement). Beginning January 1, 2016, the rates decreased a further 10 percent. We expect any near term impact of the rate reduction to GTN's revenue will in part be offset by increased contracting and other revenue opportunities on the system as well as revenue from the Carty Lateral which was placed in-service in October 2015. See Regulatory and Rate Proceedings within Item 1. "Business – Government Regulation" for further information.

Great Lakes – On October 15, 2015, FERC accepted and approved a settlement regarding transportation service rates payable to Great Lakes from its TransCanada affiliate, ANR Pipeline Company (ANR). As a result of this settlement, Great Lakes recognized the deferred transportation revenue of approximately $23 million in the fourth quarter of 2015, inclusive of an approximate $9 million of revenue related to services performed in 2014. See Regulatory and Rate Proceedings within Item 1. "Business" of this document for detailed disclosure regarding Great Lakes suspended contracts with ANR.

GTN's Carty Lateral – In October 2015, GTN placed the Carty Lateral in-service. The lateral was constructed in north-central Oregon to deliver natural gas to an electric generation facility owned by Portland General Electric Company. Portland General Electric Company has a 30-year contract for 100 percent of Carty Lateral's capacity that began in 2015 and a 20-year GTN mainline contract for 75,000 dekatherms/day that is expected to begin in 2016.

PNGTS Acquisition – On January 1, 2016, the Partnership acquired a 49.9 percent interest in PNGTS from a subsidiary of TransCanada (PNGTS Acquisition). The total purchase price of the PNGTS Acquisition was $223 million plus preliminary purchase price adjustments of $3 million. The purchase price consisted of $191 million in cash (including the preliminary purchase price adjustment of $3 million) and the assumption of $35 million in proportional PNGTS debt. This transaction adds a new market geography for us, further diversifying our cash flow stream and extending our breadth of operations.

Great Lakes Impairment – For the year ended December 31, 2015, we determined that the carrying value of our investment in Great Lakes was in excess of its fair value and that the decline is not temporary. Accordingly, we concluded that the carrying value of our investment in Great Lakes was impaired resulting in a fourth quarter impairment charge of $199 million, reflected as Impairment of equity-method investment on our Statement of Income. See Part II, Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates – Impairment of Equity Investments, Goodwill and Long-Lived Assets – Equity Investments" for further information regarding the impairment of our equity investment in Great Lakes.

8 TC PIPELINES, LP

Business Strategies

- •

- Our

strategy is to invest in long-life critical energy infrastructure that provides reliable delivery of energy to customers.

- •

- Our

investment approach is to develop or acquire assets that provide stable cash distributions and opportunities for new capital additions, while maintaining a low-risk

profile. We are opportunistic and disciplined in our approach when identifying new investments.

- •

- Our goal is to maximize distributable cash flows over the long-term through efficient utilization of our pipeline systems and appropriate business strategies, while maintaining a commitment to safe and reliable operations.

Understanding the Natural Gas Pipeline Business

Natural gas pipelines move natural gas from major sources of supply or upstream pipelines to downstream pipelines or locations or markets that use natural gas to meet their energy needs. Pipeline systems include meter stations that record how much natural gas comes on to the pipeline and how much exits at the delivery locations; compressor stations that act like pumps to move the large volumes of natural gas along the pipeline; and the pipelines themselves that transport natural gas under high pressure.

Regulation, rates and cost recovery

Interstate natural gas pipelines are regulated by FERC. FERC approves the construction of new pipeline facilities and regulates aspects of our business including the maximum rates that are allowed to be charged. Maximum rates are based on operating costs, which include allowances for operating and maintenance costs, income and property taxes, interest on debt, depreciation expense to recover invested capital and a return on the capital invested. Although FERC regulates maximum rates for services, interstate natural gas pipelines frequently face competition and therefore may choose to discount their services in order to compete.

Because FERC rate reviews are periodic and not annual, actual revenues and costs typically vary from those projected during the rate case. If revenues no longer provide a reasonable opportunity to recover costs, a pipeline can file with FERC for a determination of new rates, subject to any moratoriums in effect. FERC also has the authority to initiate a review to determine whether a pipeline's rates of return are just and reasonable. Sometimes a settlement or agreement with the pipeline shippers is achieved, which may include mutually beneficial performance incentives. FERC must approve the components of any settlement.

Contracting

New pipeline projects are typically supported by long-term contracts. The term of the contracts is dependent on the individual developer's appetite for risk and is a function of expected rates of return and stability and certainty of returns. Transportation contracts expire at varying times and underpin varying amounts of capacity. As existing contracts approach their expiration dates, efforts are made to extend and/or renew the contracts. If market conditions are not favorable at the time of renewal, transportation capacity may remain uncontracted, be contracted at lower rates or be contracted on a shorter-term basis. Unsold capacity may be recontracted if and when market conditions become more favorable. The ability to extend and/or renew expiring contracts and the terms of such subsequent contracts will depend upon the overall commercial environment for the gas transportation and consumption.

Business environment

The North American natural gas pipeline network has been developed to connect supply to market. Use and growth of this infrastructure is affected by changes in the location and relative cost of natural gas supply and changing market demand.

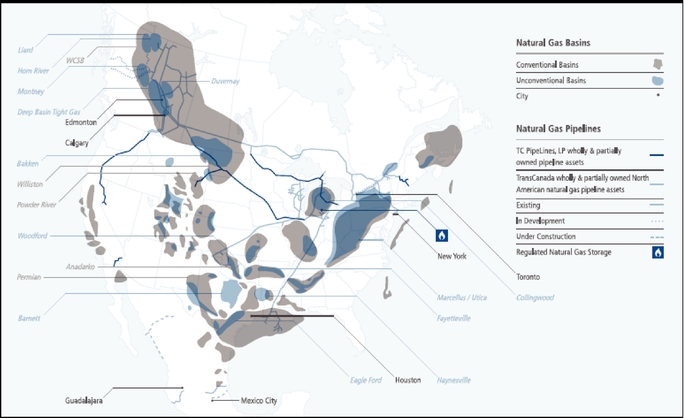

The map below shows the location of the North American basins in relation to our pipeline systems together with those of our General Partner, TransCanada Corporation.

2015 ANNUAL REPORT 9

Supply

Natural gas is primarily transported from producing regions and, in limited circumstances, from liquefied natural gas (LNG) import facilities to market hubs or interconnects for distribution to natural gas consumers. Recent development of shale and other unconventional gas reserves has resulted in increases in overall North American natural gas production and economically recoverable reserves.

There has been an increase in production from the development of shale gas reserves that are located close to traditional markets, particularly in the Northeastern U.S. This has increased the number of supply choices for natural gas consumers resulting in changes to historical natural gas pipeline flow patterns.

The supply of natural gas in North America is expected to continue increasing significantly over the next decade and over the long-term for a number of reasons, including the following:

- •

- use

of technology, including horizontal drilling in combination with multi-stage hydraulic fracturing, is allowing companies to access unconventional resources economically.

This is increasing the technically accessible resource base of existing and emerging gas basins; and

- •

- application of these technologies to existing oil fields where further recovery of the existing resource is now possible. There is often associated gas discovered in the exploration and production of liquids-rich hydrocarbons (for example the Bakken oil fields), which also contributes to an increase in the overall gas supply for North America.

Other factors that can influence the overall level of natural gas supply in North America include:

- •

- the price of natural gas – low prices in North America may increase demand but reduce drilling activities that in turn diminish production levels, particularly in dry natural gas fields where the extra revenue generated from the associated liquids is not available. High natural gas prices may encourage higher drilling activities but may decrease the level of demand;

10 TC PIPELINES, LP

- •

- producer

portfolio diversification – large producers often diversify their portfolios by developing several basins but this is

influenced by actual costs to develop the resource as well as economic access to markets and cost of pipeline transportation services. Basin-on-basin competition impacts the extent and timing of a

resource development that, in turn, drives changing dynamics for pipeline capacity demand; and

- •

- regulatory and public scrutiny – changes in regulations that apply to natural gas production and consumption could impact the cost and pace of development of natural gas in North America.

Demand

The natural gas pipeline business ultimately depends on a shipper's demand for pipeline capacity and the price paid for that capacity. Demand for pipeline capacity is influenced by, among other things, supply and market competition, economic activity, weather conditions, natural gas pipeline and storage competition, and the price of alternative fuels.

The growing supply of natural gas has resulted in relatively low natural gas prices in North America which has supported increased demand for natural gas particularly in the following areas:

- •

- natural

gas-fired power generation;

- •

- petrochemical

and industrial facilities;

- •

- the

production of Alberta's oil sands, although new greenfield projects that have not begun construction may be delayed in the current low oil price environment;

- •

- exports

to Mexico to fuel electric power generation facilities; and

- •

- exports from North America to global markets through a number of proposed LNG export facilities.

Commodity Prices

In general, the profitability of the natural gas pipelines business is not directly tied to commodity prices given we are a transporter of the commodity and the transportation costs are not tied to the price of natural gas. However, the cyclical supply and demand nature of commodities and its price impact can have a secondary impact on our business where our shippers may choose to accelerate or delay certain projects. This can impact the timing for the demand of transportation services and / or new gas pipeline infrastructure.

Competition

Competition among natural gas pipelines is based primarily on transportation rates and proximity to natural gas supply areas and consuming markets. Changes in supply locations and regional demand have resulted in changes to pipeline flow dynamics. Where pipelines historically transported natural gas from one or two supply sources to their markets under long-term contracts, today many pipelines transport gas in multiple directions and under shorter contract terms. Some pipelines have even reversed their flows in order to adapt to changing sources of supply. Competition among pipelines to attract supply and new or existing markets to their systems has also increased across North America.

Our Pipeline Systems

We have four wholly-owned pipelines and equity ownership interests in three natural gas interstate pipeline systems that are collectively designed to transport approximately 9.1 billion cubic feet per day of natural gas from producing regions and import facilities to market hubs and consuming markets primarily in the Western, Midwestern and Eastern U.S. All of our pipeline systems are operated by subsidiaries of TransCanada.

2015 ANNUAL REPORT 11

Our pipeline systems include:

| Pipeline |

Length |

Description |

Ownership |

|

|||

|---|---|---|---|---|---|---|---|

|

|

|||||||

| GTN | 1,377 miles | Extends between an interconnection near Kingsgate, British Columbia, Canada at the Canadian border to a point near Malin, Oregon at the California border and delivers natural gas to the Pacific Northwest and to California. | 100% | ||||

Northern Border |

1,408 miles |

Extends between the Canadian border near Port of Morgan, Montana to a terminus near North Hayden, Indiana, south of Chicago. Northern Border is capable of receiving natural gas from Canada, the Williston Basin and Rocky Mountain area for deliveries to the Midwest. ONEOK Partners, L.P. owns the remaining 50 percent of Northern Border. |

50% |

||||

Bison |

303 miles |

Extends from a location near Gillette, Wyoming to Northern Border's pipeline system in North Dakota. Bison transports natural gas from the Powder River Basin to Midwest markets. |

100% |

||||

Great Lakes |

2,115 miles |

Connects with the TransCanada Mainline at the Canadian border near Emerson, Manitoba, Canada and St. Clair, Michigan, near Detroit. Great Lakes is a bi-directional pipeline that can receive and deliver natural gas at multiple points along its system. TransCanada owns the remaining 53.55 percent of Great Lakes. |

46.45% |

||||

North Baja |

86 miles |

Extends between an interconnection with the El Paso Natural Gas Company pipeline near Ehrenberg, Arizona and an interconnection with a natural gas pipeline near Ogilby, California on the Mexican border transporting natural gas in the southwest. North Baja is a bi-directional pipeline. |

100% |

||||

Tuscarora |

305 miles |

Extends between the GTN pipeline near Malin, Oregon to its terminus near Reno, Nevada and delivers natural gas in northeastern California and northwestern Nevada. |

100% |

||||

PNGTS |

295 miles |

Connects with the TransQuebec and Maritimes Pipeline (TQM) at the Canadian border to deliver natural gas to customers in the U.S. northeast. TransCanada owns 11.81 percent of PNGTS. Northern New England Investment Company, Inc. owns the remaining 38.29 percent of PNGTS. |

49.9%(a) |

||||

- (a)

- Effective January 1, 2016. See Note 22 within Part IV, Item 15. "Exhibits and Financial Statements Schedules" for further information.

12 TC PIPELINES, LP

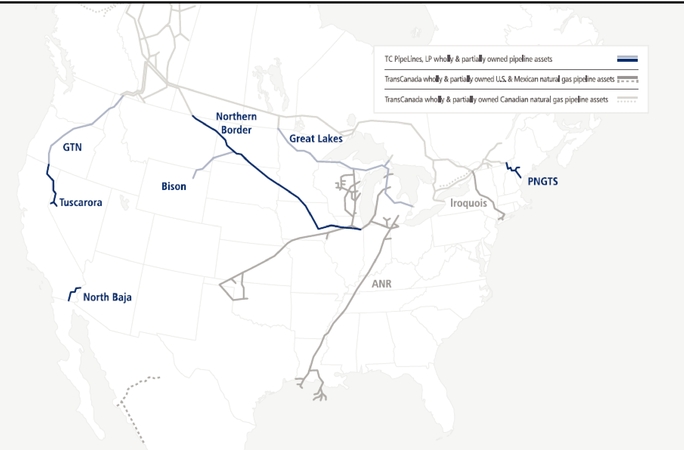

The map below shows the location of our pipeline systems.

Customers, Contracting and Demand

Our customers are generally large utilities, local distribution companies (LDCs) and major natural gas marketers and producing companies, and other interstate pipelines, including affiliates. Our pipelines generate revenue by charging rates for transporting natural gas. Natural gas transportation service is provided pursuant to long-term and short-term contracts on a firm or interruptible basis. The majority of our pipeline systems' natural gas transportation services are provided through firm service transportation contracts with a reservation or demand charge that reserves pipeline capacity, regardless of use, for the term of the contract. The revenues associated with capacity reserved under firm service transportation contracts are not subject to fluctuations caused by changing supply and demand conditions, competition or customers. Customers with interruptible service transportation agreements may utilize available capacity after firm service transportation requests are satisfied.

Our pipeline systems actively market their available capacity and work closely with customers, including natural gas producers, LDC's, marketers and end users, to ensure our pipelines are offering attractive services and competitive rates. Approximately 74 percent of our long-term contract revenues are with customers who have an investment grade rating or who have provided guarantees from investment grade parties. We have obtained financial assurances as permitted by FERC and our tariffs for the remaining long-term contracts. See Part I, Item 1A. "Risk Factors."

Two of our customers, Anadarko Energy Services Company and Pacific Gas and Electric Company, account for a significant portion of our revenue and comprised 14 percent and 12 percent, respectively, of the Partnership's revenues in 2015.

GTN – GTN's revenues are substantially supported by long-term contracts, the majority of which are expiring prior to 2023. These contracts are primarily held by LDCs that historically use a diversified portfolio of transportation options to

2015 ANNUAL REPORT 13

serve their long-term markets and marketers contracting under a variety of contract terms. We expect GTN to continue to be an important transportation component of these diversified portfolios. Incremental transportation opportunities are based on the difference in value between Western Canadian supplies and deliveries to Northern California. GTN's rates were established based on its current contracted long-term capacity. GTN continues to market its remaining long-term capacity.

Northern Border – Northern Border's revenues are substantially supported by firm transportation contracts through March 2017. As contracts have expired, market conditions have enabled Northern Border to negotiate contract extensions that are typically for terms of two years or longer. Its uncontracted capacity is subject to seasonal demand for transportation services, which has traditionally been strongest during peak winter months to serve heating demand and peak spring/summer months to serve electric cooling demand and storage injection.

Great Lakes – Great Lakes' revenue is derived from shorter-term contracts for short-haul and long-haul transportation. A majority of these contracts are with TransCanada and affiliates on multiple paths across its system. Great Lakes' ability to sell its available and future capacity will depend on future market conditions which are impacted by a number of factors including weather, levels of natural gas in storage, the capacity of upstream and downstream pipelines, and the availability and pricing of natural gas supplies. Demand for Great Lakes' services has historically been highest in the summer to fill the natural gas storage complexes in Ontario and Michigan in advance of the upcoming winter season. During the winter, Great Lakes serves peak heating requirements for customers in Minnesota, Wisconsin, Michigan and beyond.

PNGTS – Approximately 50 percent of PNGTS' current revenue stream is driven by long-term contracts that expire in 2019 with the remaining 50 percent driven by short-term contracts. PNGTS recently completed an open season for additional contract volumes. Additional contract commitments are expected to begin in 2017 with expiration in 2032. Its uncontracted capacity is subject to seasonal demand for transportation services, which has traditionally been strongest during peak winter months to serve heating demands of the area. PNGTS is continuing to market its remaining long-term capacity.

Other Pipelines – Bison, North Baja and Tuscarora revenues are substantially supported by long-term contracts through 2020.

Competition

Overall, our pipeline systems generate a substantial portion of their cash flow from long-term firm contracts for transportation services and are therefore insulated from competitive factors during the terms of the contracts. If these long-term contracts are not renewed at their expiration, our pipeline systems face competitive pressures which influence contract renewals and rates charged for transportation services.

Three of our pipeline systems, GTN, Northern Border, and Great Lakes, compete with each other for WCSB natural gas supply as well as with other pipelines, including TransCanada's Mainline system, the Alliance pipeline and the Westcoast pipeline. Northern Border and Great Lakes compete in their respective market areas for natural gas supplies from other basins as well, such as the Rocky Mountain area, Mid-Continent, Gulf Coast, Utica and Marcellus basins. GTN primarily competes with pipelines supplying natural gas into California and Pacific Northwest markets.

Bison competes for deliveries with other pipelines that transport natural gas supplies within and away from the Rocky Mountain area.

North Baja's southbound pipeline capacity competes with deliveries of LNG received at the Costa Azul terminal in Mexico. When LNG shipments are received at Costa Azul, North Baja's northbound capacity competes with pipelines that deliver Rocky Mountain area, Permian and San Juan basin natural gas into the Southern California area.

Tuscarora competes for deliveries primarily into the northern Nevada natural gas market with natural gas from the Rocky Mountain area.

14 TC PIPELINES, LP

PNGTS connects with TQM at the Canadian border and shares facilities with the Maritimes and Northeast Pipeline from Westbrook, Maine to a connection with the Tennessee Gas Pipeline System near Boston, Massachusetts. PNGTS competes with LNG supplies and production from eastern Canada transported on Maritimes and Northeast and with LNG delivered into Boston. Tennessee Gas Pipeline and Algonquin Gas Transmission also compete with PNGTS for gas deliveries into New England markets.

Relationship with TransCanada

TransCanada is the indirect parent of our General Partner and owns, through its subsidiaries, approximately 26.6 percent of our common units, 100 percent of our Class B units, 100 percent of our IDRs and an effective two percent general partner interest in us. TransCanada is a major energy infrastructure company, listed on the Toronto Stock Exchange and NYSE, with more than 65 years of experience in the responsible development and reliable operation of energy infrastructure in North America. TransCanada is primarily focused on natural gas and oil transmission and power generation services. TransCanada owns approximately $64 billion Canadian in total assets, including a 41,900 mile network of natural gas pipelines, 2,640 miles of wholly-owned oil pipelines and over 350 billion cubic feet of storage capacity. TransCanada also owns, controls or is developing over 13,100 megawatts of power generation.

TransCanada operates our pipeline systems and, in some cases, contracts for pipeline capacity. We have purchased assets from TransCanada and jointly participated with TransCanada in acquiring assets from third parties, including acquisitions that we would have been unable to pursue on our own. TransCanada views the dropdown of its remaining U.S. natural gas pipeline assets into the Partnership as an important financing option as it executes its capital growth program, subject to actual funding needs and market conditions. There can be no assurance, however, as to when and on what terms these assets will be offered to the Partnership. See Part III, Item 13. "Certain Relationships and Related Transactions, and Director Independence" for more information on our relationship with TransCanada.

Government Regulation

Federal Energy Regulatory Commission

All of our pipeline systems are regulated by FERC under the Natural Gas Act of 1938 (NGA) and Energy Policy Act of 2005, which gives FERC jurisdiction to regulate virtually all aspects of our business, including:

- •

- transportation

of natural gas in interstate commerce;

- •

- rates

and charges;

- •

- terms

of service and service contracts with customers, including counterparty credit support requirements;

- •

- certification

and construction of new facilities;

- •

- extension

or abandonment of service and facilities;

- •

- accounts

and records;

- •

- depreciation

and amortization policies;

- •

- acquisition

and disposition of facilities;

- •

- initiation

and discontinuation of services; and

- •

- standards of conduct for business relations with certain affiliates.

Our pipeline systems' operating revenues are determined based on rate options stated in our tariffs which are approved by FERC. Tariffs specify the general terms and conditions for pipeline transportation service including the rates that may be charged. FERC, either through hearing a rate case or as a result of approving a negotiated settlement, approves the maximum rates permissible for transportation service on a pipeline system which are designed to recover the pipeline's

2015 ANNUAL REPORT 15

cost-based investment, operating expenses and a reasonable return for its investors. Once maximum rates are set, a pipeline system is not permitted to adjust the maximum rates to reflect changes in costs or contract demand until new rates are approved by FERC. Pipelines are permitted to charge rates lower than the maximum tariff rates in order to compete. As a result, earnings and cash flows of each pipeline system depend on a number of factors including costs incurred, contracted capacity and transportation path, the volume of natural gas transported and rates charged.

Regulatory and Rate Proceedings

GTN – On June 30, 2015, FERC approved GTN's rate settlement as filed on April 23, 2015. The rate settlement satisfies GTN's obligations from its 2011 rate settlement for new rates to be in effect on January 1, 2016 and the 2015 settlement reduced rates on the mainline by three percent on July 1, 2015. In January 2016, GTN's rates decreased a further 10 percent and will continue in effect through December 31, 2019. Unless superseded by a subsequent rate case or settlement, GTN's rates will decrease an additional eight percent for the period January 1, 2020 through December 31, 2021 when GTN will be required to establish new rates.

Northern Border – Northern Border has a FERC-approved settlement agreement which established maximum long-term transportation rates and charges on the Northern Border system effective January 1, 2013 and requires Northern Border to file for new rates no later than January 1, 2018.

Bison – Bison continues to operate under the rates approved by FERC in connection with Bison's initial construction and has no requirement to file a new rate proceeding.

Great Lakes – Great Lakes operates under rates established pursuant to a settlement approved by FERC in November 2013. Under the settlement, Great Lakes is required to file for new rates to be effective no later than January 1, 2018.

Effective November 1, 2014, Great Lakes executed contracts with an affiliate, ANR, to provide firm service in Michigan and Wisconsin. These contracts were at the maximum FERC authorized rate and were intended to replace historical contracts. On December 3, 2014, the FERC accepted and suspended Great Lakes' tariff records to become effective May 3, 2015, subject to refund. On February 2, 2015, FERC issued an Order granting a rehearing and clarification request submitted by Great Lakes, which allowed additional time for FERC to consider Great Lakes' request. Following extensive discussions with numerous shippers and other stakeholders, on April 20, 2015, ANR filed a settlement with FERC that included an agreement by ANR to pay Great Lakes the difference between the historical and maximum rates (ANR Settlement). Great Lakes provided service to ANR under multiple service agreements and rates through May 3, 2015 when Great Lakes' tariff records became effective and subject to refund. Great Lakes deferred $9 million of revenue related to services performed in 2014 and approximately $14 million of additional revenue related to services performed through May 3, 2015 under such agreements. On October 15, 2015, FERC accepted and approved the ANR Settlement. As a result, Great Lakes recognized the deferred transportation revenue of approximately $23 million in the fourth quarter of 2015.

North Baja – North Baja continues to operate under the rates approved by FERC and has no requirement to file a new rate proceeding.

On January 6, 2014, FERC approved North Baja's application to temporarily abandon compression associated with the original design of its pipeline system up to three years. This temporary abandonment will preserve replacement options while reducing maintenance requirements and related expenses without any reduction in capacity or impact to existing firm transportation service.

Tuscarora – On January 21, 2016, the FERC issued an Order (the January 21 Order) initiating an investigation pursuant to Section 5 of the NGA to determine whether Tuscarora's existing rates for jurisdictional services are just and reasonable. Tuscarora is currently preparing its response as required by the January 21 Order. We cannot predict the outcome or potential impact of this proceeding to Tuscarora at this time.

16 TC PIPELINES, LP

PNGTS – PNGTS continues to operate under the rates approved by FERC in PNGTS' most recent rate proceeding, effective December 1, 2010. PNGTS has no requirement to file a new rate proceeding.

Environmental

Our pipelines are subject to stringent and complex federal, state and local laws and regulations governing environmental protection, including air emissions, water quality, wastewater discharges and waste management. Such laws and regulations generally require natural gas pipelines to obtain and comply with a wide variety of environmental registrations, licenses, permits and other approvals required for construction and operations. Certain violations of environmental laws can result in the imposition of strict, joint and several liability. Failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil and/or criminal penalties, the imposition of investigatory, remedial, and corrective action requirements, the occurrence of delays or restrictions in the permitting or performance of projects, and/or the issuance of orders enjoining future operations in affected areas.

The following is a discussion of some of the applicable environmental laws and regulations that relate to our business.

- •

- Solid Wastes and Hazardous Substance and Wastes Statutes – The operations of our

pipeline systems are subject to federal and state statutes that regulate the handling, management, storage and disposal of solid wastes, including hazardous wastes and hazardous substances. These

include the Resource Conservation and Recovery Act, the Solid Waste Disposal Act and the Comprehensive Environmental Response, Compensation and Liability Act, on the federal level and comparable state

statutes. These statutes subject our operations to rigorous waste management and disposal practices to ensure compliance. In addition, the improper disposal or a release of wastes or hazardous

substance could result in the imposition of investigatory or remedial obligations.

- •

- The Clean Air Act (CAA) – The CAA and comparable state laws regulate emissions of air

pollutants from various industrial sources, including compressor stations, and impose various monitoring, reporting, and in some cases, control requirements. Such laws and regulations may require

pre-approval for the construction or modification of certain facilities expected to produce air pollutants or result in an increase of existing air pollutants. Such facilities must also comply with

air permits containing various emission and operational limitations, or requiring the use of emission control or abatement technologies, which could result in the imposition of substantial costs on

our operations. For example, in October 2015, the U.S. Environmental Protection Agency (EPA) issued a final rule under the CAA, lowering the National Ambit Air Quality Standards for

ground-level ozone to 70 parts per billion. With EPA lowering the ground-level ozone standard, states may be required to implement more stringent regulations resulting in permitting delays or

increased pollution control expenditures, which could apply to our operations in nonattainment areas.

- •

- Toxic Substances Control Act (TSCA) – The TSCA addresses the production, importation,

use, and disposal of specific chemicals and provides the EPA with authority to require reporting, record-keeping and testing requirements, and restrictions relating to chemical substances and

mixtures. These include polychlorinated biphenyls (PCBs), asbestos, radon and lead-based paint.

- •

- The Clean Water Act (CWA) and the Oil Pollution Act of 1990 (OPA) – The CWA, OPA, and comparable state laws impose strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into or adjacent to state waters and waters of the U.S. The discharge of pollutants into regulated waters is generally prohibited, except in accordance with the terms of a permit issued by the EPA or a delegated state or federal agency. The CWA and federal regulations also prohibit the discharge of dredge and fill material into regulated waters, including wetlands, unless authorized by an appropriately issued permit. The EPA released a final rule in May 2015 that attempted to clarify federal jurisdiction under the CWA over waters of the United States, but a number of legal challenges to this rule are pending, and implementation of the rule has been stayed nationwide. To the extent the rule expands the scope of the CWA's jurisdiction, pipeline construction and expansion projects could face increased costs and delays with respect to obtaining permits for dredge and fill activities in wetland areas.

2015 ANNUAL REPORT 17

- •

- National Environmental Policy Act (NEPA) – Natural gas transportation activities over

federally-managed land or involving federal approval can be subject to review under NEPA, or analogous state requirements. NEPA requires federal agencies, including the Department of the Interior or

FERC, to evaluate governmental agency actions having the potential to significantly impact the environment. In the course of such evaluations, an agency will prepare an Environmental Assessment that

addresses the potential direct, indirect and cumulative impacts of a proposed project and, if necessary, will prepare a more detailed Environmental Impact Statement that is made available for public

review and comment. The current activities of our pipeline systems, as well as any proposed plans for future activities, on federal lands are subject to the requirements of NEPA in connection with any

new approval that is required for construction, operation or use on or of federal lands. NEPA reviews can take a significant amount of time and are subject to challenge by environmental groups, which

have the potential to delay current and future natural gas transportation activities.

- •

- The Endangered Species Act (ESA) – The ESA restricts activities that may affect endangered or threatened species or their habitats. The presence of threatened or endangered species, including the designation of previously unidentified or threatened species could cause us to incur additional costs or become subject to operating restrictions or bans in the affected areas.

We have not incurred and do not anticipate incurring material costs to comply with existing environmental laws and regulations. We have not accrued for any environmental liabilities.

Greenhouse Gas

Scientific studies have suggested that emissions of carbon dioxide, methane, and other greenhouse gases (GHGs) may be contributing to warming of the Earth's atmosphere. The EPA has determined that emissions of GHGs present an endangerment to public health and the environment and subsequently has adopted regulations under existing provisions of the CAA that, among other things, establish construction and operating permit reviews regarding GHGs for certain large stationary sources that are already potential major sources of conventional pollutant emissions. The EPA has also promulgated regulations requiring the monitoring and reporting of GHG emissions from, among other sources, certain onshore natural gas transmission and storage facilities, including gathering and boosting facilities, completions and workovers of oil wells with hydraulic fracturing, and blowdowns of natural gas transmission pipelines between compressor stations, in the U.S., on an annual basis. Pursuant to President Obama's Strategy to Reduce Methane Emissions from the oil and gas sector by up to 45 percent from 2012 levels by 2025, in August 2015, the EPA proposed a suite of requirements and draft guidance related to the reduction in methane emissions from certain equipment and processes in the oil and natural gas source category, including production, processing, transmission and storage activities, including proposed requirements for fugitive emissions of methane and new leak detection and repair requirements. The Pipeline and Hazardous Materials Safety Administration (PHMSA) is also expected to propose additional requirements to control methane emissions in the near future; however, we cannot predict what these requirements will be or their potential impact on our operations at this time.

Additionally, while the U.S. Congress has from time to time considered legislation to reduce emissions of GHGs, in the absence of any significant activity by Congress in recent years to adopt such legislation, a number of state and regional efforts have emerged that are aimed at tracking and/or reducing GHG emissions by means of cap and trade programs. These types of efforts may become more prevalent as a result of implementation of the EPA's Clean Power Plan (CPP), which is designed to limit GHG emissions from power plants; however, on February 9, 2015, the U.S. Supreme Court stayed implementation of the CPP pending outcome of all judicial challenges to the CPP. At this time, we cannot predict the outcome of this litigation. On an international level, the United States is one of almost 200 nations that agreed on December 12, 2015 to an international climate change agreement in Paris, France, that calls for countries to set their own GHG emission targets and be transparent about the measures each country will use to achieve its GHG emission targets. Although it is not possible at this time to predict how legislation or new regulations that may be adopted to address GHG emissions would impact our business, any such future laws and regulations that limit emissions of GHGs could adversely affect demand for the oil and natural gas that exploration and production operators produce, some of whom are our customers, which could thereby reduce demand for our natural gas transportation

18 TC PIPELINES, LP

services. Finally, it should be noted that some scientists have concluded that increasing concentrations of GHGs in the Earth's atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts and floods and other climatic events; if any such effects were to occur, it is uncertain if they would have an adverse effect on our financial condition and operations.

Safety

Our pipeline systems are subject to federal pipeline safety statutes, such as the Natural Gas Pipeline Safety Act of 1968 (NGPSA), the Pipeline Safety Improvement Act of 2002 (the PSI Act), the Pipeline Inspection, Protection, and Enforcement Act of 2006 (the PIPES Act), and the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 (the 2011 Pipeline Safety Act), as well as regulations promulgated and administered by the PHMSA. The NGPSA regulates safety requirements in the design, construction, operation and maintenance of natural gas pipeline facilities. Pursuant to the authority granted under the NGPSA, PHMSA has promulgated regulations governing pipeline design, installation, testing, maximum operating pressures, pipeline patrols and leak surveys, minimum depth requirements, and emergency procedures, as well as other matters intended to ensure adequate protection for the public and to prevent accidents and failures. The PSI Act established mandatory inspections for all U.S. natural gas transportation pipelines, and some gathering lines in high consequence areas (HCAs), which are areas where a release could have the most significant adverse consequences, including high population areas. The PIPES Act required mandatory inspections for certain natural gas transmission pipelines in HCAs and required that rulemaking be issued for, among other things, pipeline control room management. Pursuant to the authority granted under the NGPSA, as amended, PHMSA has established a series of rules requiring pipeline operators such as us to develop and implement integrity management programs for natural gas transmission pipelines in HCAs that require the performance of frequent inspections and other precautionary measures. PHMSA may assess penalties for violations of these and other requirements imposed by its regulations. The 2011 Pipeline Safety Act also increases the maximum penalty for violation of pipeline safety regulations from $100,000 to $200,000 per violation per day of violation and also from $1 million to $2 million for a related series of violations.

The ongoing implementation of the pipeline integrity management programs could cause our pipeline systems to incur significant and unanticipated capital and operating expenditures for repairs or upgrades deemed necessary to ensure their continued safe and reliable operation and to comply with the federal pipeline safety statutes and regulations. New laws and regulations related to pipeline safety could also adversely impact the operations of our pipeline systems. For example, in March 2015, PHMSA finalized new rules applicable to gas and hazardous liquid pipelines that, among other changes, impose new post-construction inspections, welding, gas component pressure testing requirements, as well as requirements related to maximum allowable operating pressure calculations. More recently, in December 2015, the Senate Commerce Committee approved the SAFE PIPES legislation, which will now be considered by the U.S. Senate. Among other things, the SAFE PIPES legislation would require PHMSA to conduct an assessment of its inspection process and integrity management programs for natural gas and hazardous liquid pipelines. While we cannot predict the outcome of these initiatives or future legislative or regulatory efforts, new laws and regulations related to pipeline inspection and integrity management requirements have the potential to adversely impact out business. Also, in July 2015, PHMSA published a Notice of Proposed Rulemaking (NPRM) that among other things, proposes to expand the Operator Qualification requirements from operations to construction, allows PHMSA to recover its costs to review the design and construction of significant projects, and requires a shorter notification period for incident and accident events. Industry groups and individual operators submitted extensive comments to the NPRM. PHMSA's response to the public comments will not be known until 2016 when the rule is finalized. It is not possible to determine the content of the rule, its effective date or the materiality of any cost impact to the pipelines until then.

It is anticipated that PHMSA will publish an NPRM to amend the pipeline safety regulations pertaining to integrity management of gas transmission pipelines in 2016. With one exception, most of the rulemaking is expected to have low-to-moderate cost impacts on the pipelines. However, in the event that the regulations are amended to require operators to verify pipe characteristics through activities such as pressure testing and materials testing, the costs could be significant. It is not possible to determine the content, the effective date, or the materiality of any cost impacts for the Final Rule associated with the NPRM until it is published. One additional NPRM is expected to be issued in 2016

2015 ANNUAL REPORT 19

addressing the remaining mandates in the 2011 Pipeline Safety Act. Once published, we will review the proposed rules to determine the ultimate impact on our pipeline systems. These proposed rulemakings could result in significant increased costs to any new or existing pipelines and the potential for temporary or permanent reductions in maximum allowable operating pressure, which would reduce available capacity on our pipelines.

There can be no assurance that future compliance with the requirements will not have a material adverse effect on our pipeline systems and the Partnership's financial position, operational costs, cash flow and our ability to maintain current distribution levels to the extent the increased costs are not recoverable through rates.

From time to time, despite compliance with applicable rules and regulations, our pipelines may experience incidents that result in leaks and ruptures that may impact the surrounding population and environment. This may result in enforcement by regulatory agencies that may seek civil and/or criminal fines and penalties, and could require our pipelines to conduct testing of the pipeline system or upgrade segments of a pipeline unrelated to the incident which costs may not be covered by insurance or recoverable through rate increases.

Other

On November 19, 2015, the Bureau of Indian Affairs published a final rule, Rights-of-Way on Indian Land; Final Rule (25 CFR 169) with the intended goal to update and streamline the process for obtaining BIA grants of rights-of-way (ROW) over and across tribal and individual Indian allotted land. The effective date of the rule is December 21, 2015. While many of the provisions simplify and expedite the process of negotiating and obtaining a ROW, certain provisions provide increased tribal authority over ROWs. As a result, tribes will have greater authority to enforce tribal laws as it relates to tax obligations for improvements, increased notification and consent for financing, and bonding requirements for restoration. The rule also sets forth additional requirements concerning real property that may affect new and existing agreements.

EMPLOYEES

We do not have any employees. We are managed and operated by our General Partner. Subsidiaries of TransCanada operate our pipelines systems pursuant to operating agreements.

AVAILABLE INFORMATION

We make available free of charge on or through our website (www.tcpipelineslp.com) our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file the material with, or furnish it to, the Securities and Exchange Commission (SEC). Copies of our Code of Business Conduct and Ethics, Corporate Governance Guidelines and the Audit Committee Charter of our General Partner are also available on our website under "Corporate Governance." We will also provide copies of these documents at no charge upon request. The information contained on our website is not part of this report.

Item 1A. Risk Factors

Limited partner interests are inherently different from the capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in a similar business. Realization of any of the risks described below could have a material adverse effect on our business, financial condition, including valuation of our equity investments, results of operations and cash flows, including our ability to make distributions to our unitholders. Investors should review and carefully consider all of the information contained in this report, including the following discussion of risks when making investment decisions relating to our Partnership.

20 TC PIPELINES, LP

RISKS RELATED TO THE PARTNERSHIP

The amount of cash we have available for distribution to holders of our common units depends primarily on our cash flow rather than on our profitability, which may prevent us from making distributions, even during periods in which we earn net income.

The amount of cash we have available for distribution depends primarily upon our cash flows and not solely on profitability, which will be affected by non-cash items. As a result, we may make cash distributions during periods when losses are incurred and may not make cash distributions during periods when we earned profits.

Our ability to make cash distributions is dependent primarily on our cash flow, financial reserves and working capital borrowings.

The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from our operations, which will fluctuate based on, among other things:

- •

- the

rates we charge for our transmission;

- •

- legislative

or regulatory action affecting the demand for natural gas, the supply of natural gas, the rates we can charge, how we contract for services, our existing

contracts, operating costs and operating flexibility;

- •

- the

commodity price of natural gas, which could reduce the quantities of natural gas available for transport;

- •

- the

creditworthiness of our customers;

- •

- changes

in, or new, statutes, regulations or governmental policies by federal, state and local authorities with respect to protection of the environment;

- •

- changes

in accounting rules and/or tax laws or their interpretations;

- •

- nonperformance

or force majeure by, or disputes with or changes in contract terms with, major customers, suppliers, dealers, distributors or other business

partners; and

- •

- changes in, or new, statutes, regulations, governmental policies and taxes, or their interpretations.

Significant changes in energy prices could impact supply and demand balances for natural gas.

Prolonged low oil and natural gas prices can have a positive impact on demand but can negatively impact exploration and development of new natural gas supplies that could impact the availability of natural gas to be transported by our pipelines. Similarly, high commodity prices can increase levels of exploration and development but can reduce demand for natural gas leading to reduced demand for transportation services. Sustained low oil and natural gas prices could also impact shippers' creditworthiness that could impact their ability to meet their transportation service cost obligations.

If we do not successfully identify and complete expansion projects or make and integrate acquisitions that are accretive, we may not be able to continue to grow our cash distributions.

Our strategy is to continue to grow the cash distributions on our common units by expanding our business. Our ability to grow depends on our ability to undertake acquisitions and organic growth projects, and the ability of our pipeline systems to complete expansion projects and make and integrate acquisitions that result in an increase in cash per common unit generated from operations. Our ability to complete successful, accretive expansion projects or acquisitions is dependent upon many factors, including our ability to secure necessary rights-of-way or regulatory approvals, our ability to finance such expansion projects or acquisitions on economically acceptable terms and the degree to which our assumptions about volumes, reserves, revenues, costs and customer commitments materialize. Acquisitions may not be available to the Partnership or occur at the prices, terms, with the same structure or on the schedule consistent with historical transactions.

2015 ANNUAL REPORT 21

TransCanada may offer its remaining U.S. natural gas pipeline assets to the Partnership, subject to TransCanada's actual funding needs and market conditions. There can be no assurance, however, as to when and on what terms these assets will be offered to the Partnership. Our ability to grow distributions depends upon the rate of acquisitions.

In addition, we face competition for acquisitions from investment funds, strategic buyers and commercial finance companies. These companies may have higher risk tolerances or different risk assessments that permit them to offer higher prices that we may be unwilling to match.

Expansion projects or future acquisitions that appear to be accretive may nevertheless reduce our cash from operations on a per unit basis.

Even if we complete expansion projects or make acquisitions that we believe will be accretive, these expansion projects or acquisitions may nevertheless reduce our cash from operations on a per-unit basis. Any expansion project or acquisition involves potential risks, including:

- •

- an

inability to complete expansion projects on schedule or within the budgeted cost due to, among other factors, the unavailability of required construction personnel,

equipment or materials, and the risk of cost overruns resulting from inflation or increased costs of materials, labor and equipment;

- •

- a

decrease in our liquidity as a result of using a significant portion of our available cash or borrowing capacity to finance the project or acquisition;

- •

- an

inability to receive cash flows from a newly built or acquired asset until it is operational; and

- •

- unforeseen difficulties operating in new business areas or new geographic areas.

As a result, our new facilities may not achieve expected investment returns, which could adversely affect our results of operations, financial position or cash flows. If any completed expansion projects or acquisitions reduce our cash from operations on a per unit basis, our ability to make distributions may be reduced.

Exposure to variable interest rates and general volatility in the financial markets and economy could adversely affect our business, our common unit price, results of operations, cash flows and financial condition.

As of December 31, 2015, $795 million of our total $1,910 million of consolidated debt was subject to variable interest rates. As a result, our results of operations, cash flows and financial condition could be adversely affected by significant increases in interest rates. From time to time, we may enter into interest rate swap arrangements which may increase or decrease our exposure to variable interest rates but there is no assurance that these will be sufficient to offset rising interest rates. As of December 31, 2015, the variable interest rate exposure related to $150 million of the $500 million 2013 Term Loan Facility was hedged by fixed interest rate swap arrangements.

On January 25, 2016, we entered into a fixed interest rate swap related to the remaining $350 million of the $500 million 2013 Term Loan Facility, significantly reducing our debt subject to variable interest rates.

For more information about our interest rate risk, see Part II, Item 7A. "Quantitative and Qualitative Disclosures About Market Risk – Market Risk."

Our indebtedness may limit our ability to obtain additional financing, make distributions or pursue business opportunities.

The amount of the Partnership's current or future debt could have significant consequences to the Partnership including the following:

- •

- our

ability to obtain additional financing, if necessary, for working capital, acquisitions, payment of distributions or other purposes may be impaired or such financing may

not be available on favorable terms;

- •

- credit rating agencies may view our debt level negatively;

22 TC PIPELINES, LP

- •

- covenants

contained in our existing debt arrangements will require us to continue to meet financial tests that may adversely affect our flexibility in planning for and

reacting to changes in our business;

- •

- our

need for cash to fund interest payments on the debt reduces the funds that would otherwise be available for operations, future business opportunities and distributions

to our unitholders; and

- •

- our flexibility in responding to changing business and economic conditions may be limited.

In addition, our ability to access capital markets to raise capital on favorable terms will be affected by our debt level, our operating and financial performance, the amount of our current maturities and debt maturing in the next several years, and by prevailing market conditions. Moreover, if the rating agencies were to downgrade our credit ratings, then we could experience an increase in our borrowing costs, face difficulty accessing capital markets or incurring additional indebtedness, be unable to receive open credit from our suppliers and trade counterparties, be unable to benefit from swings in market prices and shifts in market structure during periods of volatility in the oil and gas markets or suffer a reduction in the market price of our common units. If we are unable to access the capital markets on favorable terms at the time a debt obligation becomes due in the future, we might be forced to refinance some of our debt obligations through bank credit, as opposed to long-term public debt securities or equity securities, or sell assets. The price and terms upon which we might receive such extensions or additional bank credit, if at all, could be more onerous than those contained in existing debt agreements. Any such arrangements could, in turn, increase the risk that our leverage may adversely affect our future financial and operating flexibility and thereby impact our ability to pay cash distributions at expected rates.

If we are unable to obtain needed capital or financing on satisfactory terms to fund expansion projects or future acquisitions, our ability to make quarterly cash distributions may be diminished or our financial leverage could increase.