Attached files

| file | filename |

|---|---|

| EX-10.35 - EMPLOYMENT AGREEMENT BETWEEN RACKSPACE US, INC. AND GENE DEFELICE - RACKSPACE HOSTING, INC. | raxex-1035_123115.htm |

| EX-10.37 - REVOLVING CREDIT AGREEMENT DATED NOVEMBER 25, 2015 - RACKSPACE HOSTING, INC. | raxex-1037_123115.htm |

| EX-10.36 - EMPLOYMENT AGREEMENT BETWEEN RACKSPACE US, INC. AND MARK ROENIGK - RACKSPACE HOSTING, INC. | raxex-1036_123115.htm |

| 10-K - FORM 10-K - RACKSPACE HOSTING, INC. | rax1231201510-k.htm |

| EX-32.1 - SECTION 906 CERTIFICATION OF CEO - RACKSPACE HOSTING, INC. | raxex-321_123115.htm |

| EX-32.2 - SECTION 906 CERTIFICATION OF CFO - RACKSPACE HOSTING, INC. | raxex-322_123115.htm |

| EX-31.2 - SECTION 302 CERTIFICATION OF CFO - RACKSPACE HOSTING, INC. | raxex-312_123115.htm |

| EX-31.1 - SECTION 302 CERTIFICATION OF CEO - RACKSPACE HOSTING, INC. | raxex-311_123115.htm |

| EX-23.1 - CONSENT OF KPMG LLP - RACKSPACE HOSTING, INC. | raxex-231_123115.htm |

| EX-10.38 - INDENTURE AGREEMENT DATED NOVEMBER 25, 2015 - RACKSPACE HOSTING, INC. | raxex-1038_123115.htm |

OFFICE LEASE |

by and between |

RAND BUILDING, LTD. |

and |

OPEN CLOUD ACADEMY, LLC |

TABLE OF CONTENTS

I. | BASIC LEASE INFORMATION AND DEFINITIONS | 1 | |||

II. | PREMISES | 5 | |||

III. | TERM | 6 | |||

IV. | RENT | 7 | |||

V. | SECURITY DEPOSIT | 12 | |||

VI. | PARKING | 12 | |||

VII. | RIGHT OF ENTRY | 13 | |||

VIII. | SERVICES AND UTILITIES | 13 | |||

IX. | USE AND REQUIREMENTS OF LAW | 14 | |||

X. | MAINTENANCE AND REPAIR | 16 | |||

XI. | ALTERATIONS | 16 | |||

XII. | SIGNS | 18 | |||

XIII. | ASSIGNMENT AND SUBLETTING | 18 | |||

XIV. | RULES AND REGULATIONS | 20 | |||

XV. | INSURANCE AND INDEMNIFICATION | 21 | |||

XVI. | CASUALTY DAMAGE; CONDEMNATION | 23 | |||

XVII. | SUBORDINATION; ESTOPPELS | 24 | |||

XVIII. | DEFAULT OF TENANT | 25 | |||

XIX. | MISCELLANEOUS | 29 | |||

Exhibit A-1 Plan Showing Premises | Exhibit A-2 Legal Description of Land | ||||

Exhibit B-1 Work Agreement | Exhibit B-2 Space Plan | ||||

Exhibit C Rules and Regulations | Exhibit D Secretary’s Certificate | ||||

Exhibit E Commencement Date Memorandum | |||||

1

OFFICE LEASE

THIS OFFICE LEASE (“Lease”) is made as of the 27th day of May, 2015 (“Lease Date”), by and between RAND BUILDING, LTD., a Texas limited partnership (“Landlord”), and OPEN CLOUD ACADEMY, LLC, a Delaware limited liability company (“Tenant”).

I. BASIC LEASE INFORMATION AND DEFINITIONS

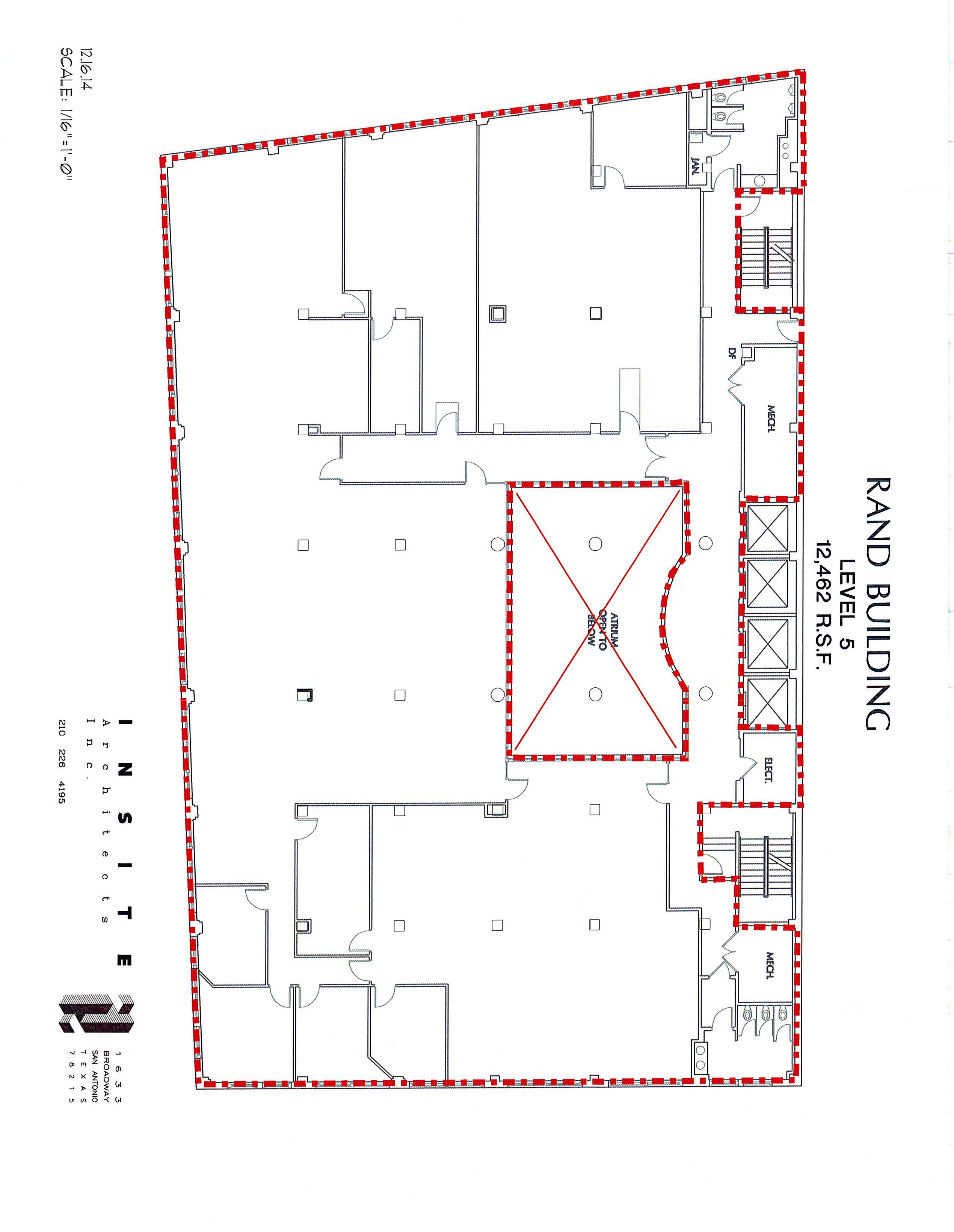

1.1 Premises. 12,462 Rentable Square Feet (as defined in Section 1.22) known as Suite 500 and includes the entire fifth (5th) floor of the Building (as defined in Section 1.16), as outlined on Exhibit A-1.

1.2 Commencement Date. The earlier of the date of Substantial Completion (as defined in Exhibit B-1) of the Tenant Work (as defined in Exhibit B-1), which is estimated to be September 1, 2015, or the date Tenant occupies the Premises, subject to Section 3.1. Within ten (10) days after Landlord’s request, Tenant shall execute a Commencement Date Memorandum in substantially the form attached as Exhibit E.

1.3 Expiration Date. The date that is sixty (60) months following the Commencement Date, which is estimated to be August 31, 2020; provided, however, the Expiration Date shall be extended by the number of days necessary to provide for an Expiration Date on the last calendar day of the month of expiration.

1.4 Term. Sixty (60) months from the Commencement Date plus the number of days necessary to provide for an Expiration Date on the last calendar day of the month of expiration.

1.5 Rent; Basic Rent; Additional Rent.

(a) | “Basic Rent” means the amounts set forth in the following schedule: |

Month(s) | Annual Rate | Monthly | ||

Per RSF | Basic Rent | |||

Months 1-12 | $10.00 | $10,385.00 | ||

Months 13-24 | $10.30 | $10,696.55 | ||

Months 25-36 | $10.61 | $11,018.49 | ||

Months 37-48 | $10.93 | $11,350.81 | ||

Months 49-60 | $11.26 | $11,693.51 | ||

(b) “Additional Rent” means Operating Expense Rent (as defined in Section 4.3), Parking Rent (as defined in Section 1.9) and all other sums payable by Tenant under this Lease, other than Basic Rent.

(c) “Rent” means Basic Rent and Additional Rent, collectively, and is payable in accordance with Section 4.1, unless otherwise expressly provided in the Lease. As of the Lease Date, Landlord’s current estimate of the monthly installment of Operating Expense Rent that will be due from Tenant as of the Commencement Date is $12,462.00.

1.6 Security Deposit; Advanced Rent Payment. The Security Deposit is $24,155.51 (the Base Rent for the last month plus the estimated Additional Rent). Upon execution and delivery of the Lease, Tenant shall deliver the Security Deposit and $22,847.00 (“Advanced Rent Payment”) comprised of the installment of the Basic Rent in the amount of $10,385.00 and the installment of Additional Rent in the amount of $12,462.00 due for the first full calendar month of the Term in which Basic Rent and Additional Rent, respectively, are due.

1

1.7 Tenant’s Proportionate Share. Tenant’s Proportionate Share of the Project (as defined in Section 1.21) is 10.81% (determined by dividing the Rentable Square Feet of the Premises by the Rentable Square Feet of the Project and multiplying the resulting quotient by one hundred and rounding to the second decimal place).

1.8 Parking Space Allocation. Tenant’s Parking Space Allocation is comprised as follows: Tenant’s agents, invitees, employees, customers and students will have the right to park passenger vehicles in up to a maximum of sixty (60) parking spaces (the “Student Garage Spaces”) within the Parking Garage (as defined in Section 1.20) as follows: (i) up to twenty-five (25) employees, customers and students of Tenant will have the right to park in the Parking Garage from and after 5:30 p.m., San Antonio, Texas time, each day; and (ii) up to an additional thirty-five (35) agents, invitees, employees, customers and students of Tenant will have the right to park in the Parking Garage from and after 6:30 p.m., San Antonio, Texas time, each day. In addition to the Student Garage Spaces, Tenant’s agents, invitees, employees and/or instructors will have the right to park passenger vehicles in up to a maximum of ten (10) non-reserved parking spaces (the “Instructor Garage Spaces”) in the Parking Garage at any time during the day and/or evening (i.e., without any time restriction).

1.9 Parking Rent. For and in consideration of the rights of Tenant and Tenant’s agents, invitees, employees, instructors, customers and students to park in the Student Garage Spaces and the Instructor Garage Spaces, Tenant will pay the following monthly fees to Landlord: (a) $20.00 per month for each of the Student Garage Spaces; and (b) the prevailing monthly contract rate for the Instructor Garage Spaces, as prevailing from time to time, plus state and local taxes (the “Parking Rent”). The current rate is $90.00 per space per month for each of the Instructor Garage Spaces. In connection with the foregoing, but without limiting the maximum number of parking spaces reserved for Tenant’s use during the term of this Lease as set forth herein above, for and with respect to each calendar quarter during the term of this Lease, Tenant shall be responsible and liable to pay the Parking Rent for, and Tenant and Tenant’s agents, invitees, employees, instructors, customers, students, and visitors shall have the right to use, only the number of Student Garage Spaces and Instructor Garage Spaces specified by Tenant in a written notice (each, a “Parking Notice”) provided by Tenant to Landlord’s Parking Contact (defined below) via email at least forty-five (45) days prior to the first day of each calendar quarter during the term of this Lease. If Tenant fails to deliver a Parking Notice as aforesaid at least forty-five (45) days prior to the first day of any calendar quarter during the term of this Lease, then, for and with respect to any such calendar quarter, Tenant shall be deemed to require use of sixty (60) Student Garage Spaces and ten (10) Instructor Garage Spaces. Tenant shall have the right to modify the number of parking spaces specified in any Parking Notice by delivery of written notice to Landlord’s Parking Contact via email at least forty-five (45) days prior to the first day of the relevant calendar quarter. As used herein, “Landlord’s Parking Contact” means Tammy Cunningham, whose email address is tjames@westoncentre.com. Landlord may replace Landlord’s Parking Contact at any time during the term of this Lease by providing written notice thereof to Tenant in accordance with Section 19.4 below. The garage access is currently automated and, at all times during the Term, shall be available for use twenty-four (24) hours per day, seven (7) days per week.

1.10 Renewal Option. If Tenant is not in default beyond any notice and opportunity to cure period, Tenant shall have the right to renew this Lease for one (1) additional term of five (5) years. The rental rate for the renewal term shall be at the then-current rate for the Rand Building which will be provided to Tenant within ten (10) days following Tenant’s written notice exercising the renewal option (the “Renewal Rate Notice”). Tenant may withdraw its exercise of the renewal option within ten (10) days after its receipt of the Renewal Rate Notice. Tenant will exercise the renewal option by giving Landlord not less than nine (9) months’ or more than twelve (12) months’ prior written notice before the expiration of the initial term.

1.11 Tenant Work. Landlord’s and Tenant’s obligations with respect to the Tenant Work are set forth in Exhibit B-1.

1.12 Broker(s). Landlord’s: N/A Tenant’s: N/A

1.13 Guarantor(s). N/A

2

1.14 Landlord’s Notice

Address.

Rand Building, Ltd. |

c/o Weston Urban, LLC |

112 East Pecan, Suite 100 |

San Antonio, TX 78205 |

Attention: Heath Cover |

E-mail: heath@westonurban.com |

With a copy to | Weston Properties, L.C. | |

112 East Pecan, Suite 175 | ||

San Antonio, TX 78205 | ||

Attention: Tammy Cunningham | ||

E-mail: tjames@westoncentre.com | ||

1.15 Tenant’s

Notice Address.

c/o Rackspace US, Inc. |

1 Fanatical Place |

San Antonio, Texas 78218 |

Attn: Brian Carney |

1.16 Building. The building having an address of 110 E. Houston Street, San Antonio, TX 78205, containing approximately 105,972 Rentable Square Feet and commonly known as the Rand Building.

1.17 Land. The land on which the Building and Parking Garage are located, as more particularly described on Exhibit A-2.

1.18 Common Area. All areas from time to time designated by Landlord for the general and nonexclusive common use or benefit of Tenant, other tenants of the Project, and Landlord, including, without limitation, driveways, entrances and exits, loading areas, landscaped areas, open areas, walkways, atriums, concourses, ramps, hallways, stairs, washrooms, lobbies, elevators, Parking Garage, Service Areas (as defined in Section 1.19) and common trash, vending or mail areas.

1.19 Service Areas. Maintenance and utility rooms and closets, together with common pipes, conduits, wires and appurtenant equipment within such maintenance and utility rooms and closets or elsewhere in the Building or the Parking Garage, exterior lighting, and exterior utility lines.

1.20 Parking Garage. The adjacent parking garage having an address of 121 Soledad, San Antonio, TX 78205, containing Common Area and approximately 9,317 Rentable Square Feet. The Parking Garage and the Building are connected for access on the second (2nd) and fifth (5th) floors.

3

1.21 Project. The Land, Building, Common Area, and Parking Garage, containing approximately 115,289 Rentable Square Feet.

1.22 Rentable Square Feet (Foot) or Rentable Area. The rentable area within the Premises, Building or Project deemed to be the amounts set forth in this Article I. Landlord and Tenant stipulate and agree that the Rentable Square Footage of the Premises, Building, Parking Garage and Project are correct and shall not be remeasured, except as provided in Section 2.2.

1.23 Permitted Use. Solely for general business office purposes and uses incidental thereto, and provision of IT-related educational courses to the public, subject to and in accordance with the terms, covenants and conditions set forth in this Lease, and applicable governmental regulations, restrictions and permitting (without the necessity of obtaining any zoning changes, conditional use permits or other special permits).

1.24 Lease Year. Each consecutive 12 month period elapsing after: (i) the Commencement Date if the Commencement Date occurs on the first day of a month; or (ii) the first day of the month following the Commencement Date if the Commencement Date does not occur on the first day of a month. If the Commencement Date does not occur on the first day of a month, the first Lease Year shall include the additional days, if any, between the Commencement Date and the first day of the month following the Commencement Date.

1.25 Calendar Year. For the purpose of this Lease, Calendar Year shall be a period of 12 months commencing on each January 1 during the Term, except that the first Calendar Year shall be the period starting on the Commencement Date and ending on December 31 of that same year, and the last Calendar Year shall be the period starting on the last January 1 of the Term through the Expiration Date or earlier termination.

1.26 Interest Rate. The per annum interest rate listed as the U.S. “prime” rate as published from time to time under “Money Rates” in the Wall Street Journal plus 5%, but in no event greater than the maximum rate permitted by law, statute, ordinance or govern-mental rule or regulation which is now in force or which may be enacted or promulgated after the Lease Date (“Law”). In the event the Wall Street Journal ceases to publish such rates, Landlord shall choose, at Landlord’s reasonable discretion, a similarly published rate.

1.27 Agents. Officers, partners, directors, employees, agents, licensees, contractors, customers and invitees; to the extent customers and invitees are under the principal’s control or direction.

II. PREMISES

2.1 Lease of Premises. Landlord leases the Premises to Tenant, and Tenant leases the Premises from Landlord, for the Term and upon the terms and conditions set forth in this Lease. As an appurtenance to the Premises, Tenant shall have the general and nonexclusive right, together with Landlord and the other tenants of the Project, to use the Common Area subject to the terms and conditions of this Lease; provided, however, except to the extent Landlord’s prior written approval is obtained, Landlord excepts and reserves exclusively to itself the use of roofs and Service Areas. Tenant hereby acknowledges that the Premises is one of two floors in the Building that has an access connection to the Parking Garage. Tenant further acknowledges that other tenants, their employees and invitees may access the Building from the Parking Garage on the fifth (5th) floor and proceed from that point to other areas of the Building. Tenant covenants that Tenant or Tenant’s employees or agents will not block such other tenants, their employees and invitees from accessing the Building or the Parking Garage through the Fifth Floor Common Area (defined in Section 15.9).

2.2 Quiet Enjoyment; Landlord’s Reservations. Landlord covenants that so long as there is no uncured Event of Default, Tenant shall during the Term peaceably and quietly occupy and enjoy possession of the Premises and, except in the event of an emergency, have access to the Premises and the Parking Garage on all days and at all

4

times during the Term, without hindrance by Landlord or any party claiming through or under Landlord, subject to the provisions of this Lease, any restrictions effective as of the Lease Date, any Mortgage or Ground Lease (as such terms are defined in Section 17.1) to which this Lease is subordinate and Landlord’s reservations under this Lease. Provided Tenant’s use of, and access to, the Premises and Parking Garage is not materially adversely affected, Landlord reserves the right from time to time to: (i) install, use, maintain, repair, replace and relocate pipes, ducts, conduits, wires and appurtenant meters and equipment above the ceiling surfaces, below the floor surfaces, within the walls and in the central core areas of the Project; (ii) make changes to the design and layout of the Project; (iii) use or close temporarily the Common Areas, and/or other portions of the Project while engaged in making improvements, repairs or changes to the Project; (iv) change the name(s) of the Project, the Building or the Parking Garage; and (v) adjust the Rentable Square Footage of the Project, the Building and the Parking Garage, in which case Landlord shall deliver notice to Tenant of the adjustment in Rentable Square Footage and any associated adjustment to Tenant’s Proportionate Share based on the formula set forth in Section 1.7. Notwithstanding anything to the contrary herein, Landlord shall not make any modifications to the Parking Garage which would reduce Tenant’s Parking Space Allocation. Further, in the event of invasion, mob, riot, or other circumstances rendering such action advisable in Landlord’s reasonable opinion, Landlord will have the right to prevent access to the Building or Project during the continuance of the same by such means as Landlord, in its reasonable discretion may deem appropriate, including, without limitation, locking doors and closing Common Areas.

2.3 Initial Construction. If Landlord is obligated to construct any improvements within the Premises then such construction shall be governed by the terms of the Work Agreement attached hereto as Exhibit B-1. Subject to any obligation of Landlord to construct Tenant Work (as defined in Exhibit B-1) and except as otherwise expressly set forth herein, Landlord shall have no obligations whatsoever to construct any improvements to the Premises and Tenant accepts the Premises “AS IS” and “with any and all faults”, and Landlord neither makes nor has made any representations or warranties, express or implied, with respect to the quality, suitability or fitness thereof of the Premises or the Project, or the condition or repair thereof. Subject to any obligation of Landlord to construct Tenant Work (as defined in Exhibit B-1) and except as otherwise expressly set forth herein, Tenant taking possession of the Premises shall be conclusive evidence for all purposes of Tenant’s acceptance of the Premises in good order and satisfactory condition, and in a state and condition satisfactory, acceptable and suitable for the Tenant’s use pursuant to this Lease.

2.4 Tenant's Security. Tenant will (1) lock the doors to the Premises (other than doors leading from outside the Premises to the Fifth Floor Common Area) and take other reasonable steps to secure the Premises (other than the Fifth Floor Common Area) and Tenant’s Property and the personal property of Tenant’s Agents in the Common Areas and Parking Garage, from unlawful intrusion, theft, fire, and other hazards, (2) keep and maintain in good working order all security devices installed on the Premises (other than in the Fifth Floor Common Area) by or for the benefit of Tenant (such as locks, smoke detectors, and burglar alarms), and (3) cooperate with Landlord and other tenants in the Building on security matters. Tenant acknowledges that any security measures employed by Landlord or any Parking Operator (as defined in Section 4.3.3(a)) are for the protection of Landlord; that Landlord is not a responsible for the security or safety of Tenant or Tenant’s Agents or their property; and that such security matters are the responsibility of Tenant and the local law enforcement authorities. Following Tenant’s receipt of Landlord’s prior approval (which approval shall not be unreasonably withheld, delayed or conditioned), Tenant is permitted to install, at Tenant’s expense, any additional security measures deemed necessary by Tenant in Tenant’s reasonable discretion including, without limitation, a key-card entry system; provided, however, such security measures shall not prevent Landlord from accessing the Premises to the extent permitted under Article VII.

III. TERM

3.1 Commencement Date. The Term shall commence on the Commencement Date and expire at 11:59 pm on the Expiration Date. If requested by Tenant, Landlord shall permit Tenant non-exclusive access (“Early Access Right”) to portions of the Premises prior to the Commencement Date for the limited purpose (“Early Access Activities”) of installing Cabling (as defined in Section 11.3) and Tenant’s equipment, furniture, inventory, trade fixtures and other personal property (collectively, “Tenant Property”); provided however, Tenant’s Early Access Right shall not

5

commence until approximately thirty (30) days prior to the Commencement Date. Any access by Tenant to the Premises before the Commencement Date, whether pursuant to the Early Access Right or otherwise, shall be subject to the terms and conditions of this Lease; provided, however, except for the cost of services requested by Tenant, Tenant shall not be required to pay Rent for any days of possession before the Commencement Date during which Tenant is in possession of the Premises for the sole purpose of the Early Access Activities. Tenant’s early access shall be conditioned upon Tenant’s coordination of the Early Access Activities with Landlord so as not to interfere with Landlord or with other occupants of the Building. If Landlord, in its sole reasonable discretion, determines that any such interference has been or may be caused, then Landlord may terminate any access by Tenant to the Premises prior to Commencement Date upon written notice to Tenant.

3.2 Surrender of the Premises. Tenant shall peaceably surrender the Premises to Landlord on the Expiration Date or earlier termination of this Lease, in broom-clean condition and in as good condition as on the Commencement Date, including, without limitation, the repair of any damage to the Premises caused by the removal of any Alterations (as defined in Section 11.1) and Tenant Property from the Premises, except for Casualty damage that is Landlord’s responsibility to repair under Section 16.1 and reasonable wear and tear. If Tenant fails to remove the Alterations required to be removed hereunder and Tenant Property, and repair and restore the Premises and Project as required under this Section 3.2, then Landlord may (but shall not be obligated to) remove, repair and restore such Alterations and Tenant Property, in which case Tenant shall reimburse Landlord upon demand for the cost incurred by Landlord for such removal, repair and restoration (together with any and all damages which Landlord may suffer and sustain by reason of the failure of Tenant to remove, repair and restore the same). All Alterations and Tenant Property left on or in the Premises or the Project after the Expiration Date or earlier termination of this Lease will be deemed conclusively to have been abandoned and may be removed, sold, stored, destroyed or otherwise disposed of by Landlord without notice to Tenant or any other person and without obligation to account for them; provided, however, Tenant will pay Landlord upon demand for all expenses incurred by Landlord in connection with the same. Tenant’s obligations under this Section 3.2 will survive the expiration or other termination of this Lease.

3.3 Holding Over. In the event that Tenant fails to immediately surrender the Premises to Landlord on the Expiration Date or earlier termination of this Lease in accordance with Section 3.2, Tenant shall be deemed to be a tenant-at-sufferance (and not a month-to-month tenancy) pursuant to the terms and provisions of this Lease, except the daily Basic Rent shall be 150% of the daily Rent in effect on the Expiration Date or earlier termination of this Lease (computed on the basis of a 30-day month) for the first 60 days of the holdover period and, thereafter, twice the daily Rent in effect on the Expiration Date or earlier termination of this Lease (computed on the basis of a 30-day month). Notwithstanding the foregoing, if Tenant shall hold over after the Expiration Date or earlier termination of this Lease, Landlord may re-enter and take possession of the Premises without process, or by any legal process provided under applicable Texas Law. If Landlord is unable to deliver possession of the Premises to a new tenant or to perform improvements for a new tenant as a result of Tenant’s holdover, Tenant shall be liable to Landlord for all damages, including, without limitation, special or consequential damages, that Landlord suffers from the holdover.

IV. RENT

4.1 Basic Rent; Additional Rent; Rent. Tenant shall pay to Landlord Basic Rent in monthly installments in the amounts specified in Section 1.5, Operating Expense Rent in estimated monthly installments in accordance with Section 4.3.1, and Parking Rent in monthly installments in the amounts specified in Section 1.9. Unless otherwise set forth in the Lease, such monthly installments of Rent shall be payable, in advance, without demand, notice, deduction, offset or counterclaim except as specifically provided herein, on or before the first day of each and every calendar month during the Term. Landlord may credit any payment of Rent made by Tenant to the payment of any late charges then due and payable and to any Basic Rent or Additional Rent then past due before crediting to Basic Rent and Additional Rent currently due. Tenant’s covenant to pay Rent and the obligation of Tenant to perform Tenant’s other covenants and duties hereunder constitute independent, unconditional obligations to be performed at all times provided for hereunder, save and except only when an abatement thereof or reduction therein is expressly provided for in this Lease and not otherwise.

6

4.2 Method of Payment. Tenant shall pay Rent electronically via automatic debit, ACH credit or wire transfer to such account as Landlord designates in writing to Tenant. Alternatively, at Tenant’s option, Tenant may pay by good check or in lawful currency of the United States of America to such address as Landlord designates in writing to Tenant. If the Term commences on a day other than the first day of a calendar month or terminates on a day other than the last day of a calendar month, the monthly Rent shall be prorated based upon the number of days in such calendar month.

(a)

If Rent is paid by check, send to: |

Attn: |

Account No: |

Account Name: |

(b)

If Rent is paid by wire transfer: |

Bank Name: |

Account No: |

Account Name: |

4.3 Additional Rent for Operating Expenses. Tenant shall pay as Additional Rent to Landlord throughout the Term Tenant’s Proportionate Share of Operating Expenses (as defined in Section 4.3.3) (“Operating Expense Rent”). In the event the Expiration Date is other than the last day of a Calendar Year, Operating Expense Rent for applicable Calendar Year shall be appropriately prorated. Landlord, in its reasonable discretion, may equitably allocate Operating Expenses among office, retail or other portions or occupants of the Project.

4.3.1 Estimate Statement. Approximately 90 days after the beginning of each Calendar Year or as soon thereafter as practicable, Landlord shall submit a statement of Landlord’s estimate of Operating Expense Rent due from Tenant during such Calendar Year. In addition to Basic Rent, Tenant shall pay to Landlord on or before the first day of each month during such Calendar Year an amount equal to 1/12th of Landlord’s estimated Operating Expense Rent as set forth in Landlord’s statement. If Landlord fails to give Tenant notice of its estimated payments due for any Calendar Year, then Tenant shall continue making monthly estimated Operating Expense Rent payments in accordance with the estimate for the previous Calendar Year until a new estimate is provided. If Landlord determines that Landlord’s estimate of the Operating Expense Rent needs to be adjusted, then Landlord shall have the right to give a new statement of the estimated Operating Expense Rent due from Tenant for the balance of such Calendar Year and bill Tenant for any deficiency. Tenant shall thereafter pay monthly estimated payments based on such new statement.

4.3.2 Reconciliation Statement. Approximately 120 days after the expiration of each Calendar Year or as soon thereafter as practicable, Landlord shall submit a statement to Tenant showing the actual Operating Expenses Rent due from Tenant for such Calendar Year. If for any Calendar Year, Tenant’s estimated Operating Expense Rent payments exceed the actual Operating Expense Rent due from Tenant, then Landlord shall give Tenant a credit in the amount of the overpayment toward Tenant’s next monthly payment of estimated Rent. If the Term has expired or the

7

Lease has terminated, and no Event of Default (as defined in Section 18.1) exists, Landlord shall pay Tenant the total amount of such excess upon delivery of the reconciliation to Tenant. If for any Calendar Year, Tenant’s estimated Operating Expense Rent payments are less than the actual Operating Expense Rent, as applicable, due from Tenant, then Tenant shall pay the total amount of such deficiency to Landlord within 30 days after receipt of the reconciliation from Landlord. Landlord’s and Tenant’s obligations with respect to any overpayment or underpayment of Operating Expense Rent shall survive the expiration or termination of this Lease.

4.3.3 Operating Expenses Defined. As used herein, the term “Operating Expenses” means all expenses, costs and disbursements of every kind and nature, except for the exclusions set forth in Section 4.3.4), incurred by Landlord in connection with the ownership, maintenance, management and operation of the Project, including, without limitation, all costs, expenses and disbursements incurred or made in connection with the following:

(a) Wages and salaries of all employees, whether employed by Landlord or any management companies (each a “Manager”) managing the Project (“Property Manager”) or the Parking Garage (“Parking Operator”) on Landlord’s behalf, to the extent engaged in the operation, security, management and maintenance of the Project or Parking Garage, as applicable, and all costs related to or associated with such employees or the carrying out of their duties, including uniforms and their cleaning, taxes, training, insurance and benefits;

(b) A commercially reasonable management fee payable to Landlord or any Manager and the costs of equipping and maintaining a management office, including, but not limited to, rent, accounting, consulting and legal fees, and other administrative costs;

(c) All supplies, tools, equipment and materials, including, without limitation, administrative, janitorial and lighting supplies and any equipment lease payments to the extent used in connection with the maintenance or operation of the Project;

(d) All utilities, including, without limitation, electricity, water, sewer, telephone and gas, for the Project, together with the utility, telephone, mechanical, sanitary, storm-drainage, and elevator systems, and the cost of maintenance and service contracts in connection therewith;

(e) All maintenance, together with associated maintenance, operating and service agreements, for the Project, including, without limitation, for (i) the Parking Garage, (ii) energy management, Base Building HVAC (as defined in Section 8.1), sanitary, storm-water drainage, elevator, mechanical, plumbing and electrical systems, (iii) window cleaning, (iv) janitorial service, (v) groundskeeping, interior and exterior landscaping and plant maintenance; (vi) repainting Common Areas, (vii) replacing Common Area wall coverings, window coverings, ceiling tiles and flooring, (viii) ice and snow removal, (ix) cleaning and servicing of any Project grease trap, (x) trash removal and (xi) the patching, painting, resealing and complete resurfacing of parking spaces in the Parking Garage and the Project’s roads, driveways, curbs, and walkways;

(f) Premiums and deductibles paid for insurance relating to the Project;

(g) All repairs to the Project, including interior, exterior, roof, structural or nonstructural repairs, and regardless of whether foreseen or unforeseen;

(h) Any capital improvements made to the Project for the purpose of reducing Operating Expenses, enhancing the environmental sustainability, safety or security of the Project, or which are required under any Law that was not applicable to the Project as of the Lease Date, the cost of which shall be amortized on a straight-line basis over the improvement’s useful life, not to exceed the Project’s useful life, together with interest on the unamortized balance of such cost at the Interest Rate, or, if lower, such rate as may have been paid by Landlord on funds borrowed for the purposes of making such capital improvements, or, at Landlord’s election in the case of capital improvements that lower operating costs, the amortization amount will be the Landlord’s reasonable estimate of annual cost savings;

8

(i) All licenses, permits, and inspection fees, together with the cost of contesting any Laws that may affect Operating Expenses and the costs of complying with any governmentally-mandated transportation-management or similar program;

(j) Real Estate Taxes; and

(k) Any dues, fees and assessments incurred under any covenants, reciprocal easement agreement or traffic management agreement or assessed by an owners’ association pursuant to the extent related to the operation or maintenance of the Project.

If the Project is not 100% occupied during any Calendar Year or if Landlord is not supplying services to 100% of the Project at any time during a Calendar Year, Operating Expenses shall, at Landlord’s option, be determined as if the Project had been 100% occupied and Landlord had been supplying services to 100% of the Project during the Calendar Year. The extrapolation of Operating Expenses under this provision shall be performed by appropriately adjusting the cost of those components of Operating Expenses that are impacted by changes in the occupancy of the Project.

4.3.4 Operating Expense Exclusions. Operating Expenses shall not include the following: (a) depreciation; (b) costs of tenant improvements incurred in renovating leased space for the exclusive use of a particular tenant of the Project; (c) brokers’ commissions and costs for marketing space in the Project; (d) Project mortgage principal or interest; (e) capital items other than those referred to in Section 4.3.3(h); (f) costs of repairs or other work to the extent Landlord is reimbursed by insurance or condemnation proceeds; (g) utilities charged directly to, or paid directly by, a tenant of the Project other than as a part of the Operating Expenses; (h) fines, interest and penalties incurred due to the late payment of Operating Expenses; (i) organizational expenses associated with the creation and operation of the entity which constitutes Landlord; (j) any penalties or damages that Landlord pays to Tenant under this Lease or to other tenants in the Project under their respective leases; (k) costs of selling, financing or refinancing the Building; (l) legal fees, accounting fees or other professional or consulting fees in connection with the negotiation of tenant leases; (m) costs incurred (less costs of recovery) for any items to the extent covered by a manufacturer's, materialmen's, vendor's or contractor's warranty and/or a service contract; (n) any cost incurred in connection with the investigation or remediation of any "Hazardous Materials" (as defined in Section 9.2, below) located in, on, under or about the Premises as of the date hereof or any Hazardous Materials not stored, used, or released by Tenant, its employees, agents, contractors or invitees, and any cost incurred in connection with any government investigation, order, proceeding or report with respect thereto; (o) costs of initial construction of the Project, including the “Cost of the Tenant Work” (as defined in Exhibit B-1); (p) the cost of repairs required, or costs incurred, to cure violations of laws enacted and applicable to the Project existing prior to the date of this Lease; (q) damages and the cost of repairs necessitated by the gross negligence or willful misconduct of Landlord, or any tenant, employee, agent, contractor or vendor of Landlord; (r) the cost of incremental expense to Landlord incurred by Landlord in curing its defaults or any other cost attributable to a breach of any obligation of Landlord under this Lease; (s) legal fees, accounting fees, and other costs or expenses incurred in connection with disputes with tenants or occupants of the Building or associated with the enforcement of the terms of any leases with tenants or with any tenant default under any such leases, or the defense of Landlord's title or interest in the Project or any part thereof; (t) any operating costs incurred by Landlord to the extent the same are not for the benefit of the Project or equitably allocable to the Project, as reasonably determined by Landlord in accordance with sound accounting and property management practices and pursuant to the terms of this Lease; (u) costs for which Landlord is reimbursed by any tenant or any third party, other than payments by tenants on account of Operating Expenses; (v) amounts paid to Landlord or Landlord's subsidiaries or affiliates for goods and services furnished to the Project to the extent in substantial excess of competitive market rates for the same; (w) Landlord's general overhead, except as it relates specifically to the management and operation of the Project; (x) the cost of acquiring sculptures, paintings and other objects of art; (y) the costs of installing or operating any specialty service, such as an observatory, broadcasting facility, meeting room, conference center, special event space, luncheon club or athletic or recreational club; or (z) compensation paid to clerks, attendants or other persons in commercial concessions operated by Landlord which customarily sell products or services to the public, including tenants of the Building.

9

4.3.5 Real Estate Taxes. “Real Estate Taxes” means all federal, state, county or local governmental or municipal taxes, fees, charges, assessments, levies, licenses or other impositions, whether general, special, ordinary or extraordinary, that are paid or accrued during a Calendar Year (without regard to any different fiscal year used by such governmental or municipal authority) because of or in connection with the ownership, leasing or operation of the Project. Real Estate Taxes shall include (a) real property taxes; (b) general and special assessments; (c) transit taxes; (d) leasehold taxes; (e) personal property taxes imposed upon the fixtures, machinery, equipment, systems, appurtenances, furniture and other personal property used in connection with the Project; (f) any tax on the rent, right to rent or other income from any portion of the Project or as against the business of leasing any portion of the Project; (g) any assessment, tax, fee, levy or charge imposed by any governmental agency, public improvement district or by any non-governmental entity pursuant to any private cost-sharing agreement, in order to fund the provision or enhancement of any fire-protection, street-, sidewalk- or road-maintenance, refuse-removal or other service that is normally provided by governmental agencies to property owners or occupants without charge (other than through real property taxes); and (h) margin taxes on revenue or income derived from the Project (“Margin Tax”) and any other assessment, tax, fee, levy or charge allocable or measured by the area of the Premises or by the Rent payable hereunder, including any business, gross income, gross receipts, sales or excise tax with respect to the receipt of such Rent. Any costs and expenses (including reasonable attorneys’ and consultants’ fees) incurred in the compliance review of Real Estate Taxes or attempting to protest, reduce or minimize Real Estate Taxes shall be included in Real Estate Taxes for the year in which they are incurred. Landlord shall have no obligation to challenge Real Estate Taxes. If as a result of any such challenge, a tax refund is made to Landlord, then provided no Event of Default exists under this Lease, the amount of such refund less the expenses of the challenge shall be deducted from Real Estate Taxes due in the Calendar Year such refund is received; provided however that any tax refund shall be only applicable if this Lease was in force during the time period that the tax refund applies. In the case of any Real Estate Taxes which may be evidenced by improvement or other bonds or which may be paid in annual or other periodic installments, Landlord shall elect to cause such bonds to be issued or cause such assessment to be paid in installments over the maximum period permitted by Law. Notwithstanding any contrary provision hereof, Real Estate Taxes shall be determined without regard to any “green building” credit and shall exclude (i) except for the Margin Tax, all excess profits taxes, franchise taxes, gift taxes, transfer taxes, capital stock taxes, inheritance and succession taxes, estate taxes, federal and state income taxes, and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents, receipts or income attributable to operations at the Project), (ii) any Operating Expenses and (iii) any taxes paid by Tenant directly on Tenant’s Property. Tenant hereby waives any and all rights under Section 41.413 of the Texas Tax Code and any other applicable Laws to protest appraised values or to receive notice of reappraised values regarding the Project or other property of Landlord.

4.4 Sales or Excise Taxes. Tenant shall pay to Landlord, as Additional Rent, concurrently with payment of Basic Rent all taxes, including, but not limited to any and all sales, rent or excise taxes (but specifically excluding income taxes calculated upon the net income of Landlord) on Basic Rent, Additional Rent or other amounts otherwise benefiting Landlord, as levied or assessed by any governmental or political body or subdivision thereof against Landlord on account of such Basic Rent, Additional Rent or other amounts otherwise benefiting Landlord, or any portion thereof.

4.5 Method of Calculation. Tenant is knowledgeable and experienced in commercial transactions and does hereby acknowledge and agree that the provisions of this Lease for determining charges and amounts payable by Tenant are commercially reasonable and valid and constitute satisfactory methods for determining such charges and amounts as required by Section 93.012 of the Texas Property Code. TENANT FURTHER VOLUNTARILY AND KNOWINGLY WAIVES (TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW) ALL RIGHTS AND BENEFITS OF TENANT UNDER SUCH SECTION, AS IT NOW EXISTS OR AS IT MAY BE HEREAFTER AMENDED OR SUCCEEDED.

4.6 Tenant’s Personal Property Taxes. Tenant shall pay, 10 days before delinquency, any taxes levied against Tenant Property located in or about the Premises. If any such taxes are levied against Landlord or its property (or if the assessed value of Landlord’s property is increased by the inclusion therein of a value placed upon such Tenant

10

Property), Landlord may pay such taxes (or such increased assessment) regardless of their (or its) validity, in which event Tenant, upon demand, shall repay to Landlord the amount so paid. If the Tenant Work or Alterations are assessed for real property tax purposes at a valuation higher than the valuation at which tenant improvements conforming to Landlord’s “building standard” in other space in the Building are assessed, the Real Estate Taxes levied against Landlord or the Property by reason of such excess assessed valuation shall be deemed taxes levied against Tenant Property for purposes of this Section 4.6. Notwithstanding any contrary provision hereof, Tenant shall pay, 10 days before delinquency, (i) any rent tax, sales tax, service tax, transfer tax or value added tax, or any other tax respecting the rent or services described herein or otherwise respecting this transaction or this Lease; and (ii) any taxes assessed upon the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of any portion of the Project.

4.7 Historical Status of the Project. Landlord may from time to time seek tax credits, abatements and other similar incentives based on the historic status of the Building and all such incentives shall inure to the benefit of Landlord; provided that any reduction in, or credit with respect to, ad valorem taxes resulting therefrom shall proportionately reduce Tenant’s contribution with respect to ad valorem taxes.

V. SECURITY DEPOSIT

Concurrently with its execution and delivery of this Lease, Tenant shall deposit with Landlord the Security Deposit, if any, as security for Tenant’s performance of its obligations hereunder. If Tenant breaches any provision hereof, Landlord may, at its option, without notice to Tenant, apply all or part of the Security Deposit to pay any past-due Rent, cure any breach by Tenant, compensate Landlord for any other loss or damage caused by such breach or remedy the condition of the Premises. If Landlord so applies any portion of the Security Deposit, Tenant, within three (3) days after demand therefor, shall restore the Security Deposit to its original amount. The Security Deposit is not an advance payment of Rent or measure of damages. Any unapplied portion of the Security Deposit shall be returned to Tenant within 30 days after the latest to occur of (a) the expiration of the Term, (b) Tenant’s surrender of the Premises as required hereunder, or (c) Tenant’s delivery to Landlord of notice of Tenant’s forwarding address. Landlord shall not be required to keep the Security Deposit separate from its other accounts. The Security Deposit shall not bear interest to Tenant. If Landlord shall sell or transfer its interest in the Building, Landlord shall have the right to transfer the Security Deposit to such purchaser or transferee, in which event Tenant shall look solely to the new landlord for the return of the Security Deposit, and Landlord thereupon shall be released from all liability to Tenant for the return of the Security Deposit, subject only to delivery to Tenant of any notice required under the Texas Property Code.

VI. PARKING

During the Term, Tenant shall pay the Parking Rent for the Parking Space Allocation and shall have the right to use the Parking Space Allocation in common with other tenants in the Building and other parties to whom Landlord grants the right to park in the Parking Garage. All parking rights are subject to the Rules and Regulations (as defined in Article XIV), validation, key-card, sticker or other identification systems set forth by Landlord from time to time. Landlord may restrict certain portions of or parking spaces in the Parking Garage for the exclusive use of one or more tenants of the Building and may designate other areas to be used at large by customers and visitors of tenants of the Building and other parties to whom Landlord grants the right to park in the Parking Garage. Landlord reserves the right, but shall not be obligated, to impose traffic controls, provide security protection and delegate the operation of the Parking Garage to a Parking Operator. If Landlord delegates the operation of the Parking Garage to a Parking Operator, then (i) such Parking Operator shall have all the rights of control reserved herein by Landlord and (ii) if requested by Landlord, Tenant shall enter into a parking agreement with such Parking Operator pursuant to which Tenant shall pay such Parking Operator, rather than Landlord, the Parking Rent. Tenant’s parking rights and privileges described herein are personal to Tenant and may not be assigned or transferred, except in connection with an assignment or sublease approved by Landlord pursuant to Article XIII. Landlord shall have the right to cause to be removed at the vehicle owner’s cost any vehicles of Tenant or its Agents that are parked in violation of this Lease or in violation of the Rules and Regulations of the Building, without Landlord becoming liable to Tenant or Tenant’s Agents for any

11

injury or damage caused in connection with such removal. Tenant’s inability to use the Parking Space Allocation will not relieve Tenant of any of its obligations under the Lease.

VII. RIGHT OF ENTRY

Tenant shall permit Landlord, Property Manager and their respective Agents to enter the Premises without charge therefor to Landlord and without diminution of Rent or claim of constructive eviction: (i) to clean, inspect and protect the Premises and the Project; (ii) to perform such maintenance and repairs to the Premises or any portion of the Building, including other tenants’ premises, which Landlord determines to be reasonably necessary; (iii) to exhibit the same to prospective purchaser(s) of the Building or the Project to present or future Mortgagees or Ground Lessors; (iv) to exhibit the same to prospective tenants during the last 9 months of the Term; (v) or during any period when an Event of Default exists. Landlord will endeavor to minimize, as reasonably practicable, any interference with Tenant’s business and shall provide Tenant with prior notice of entry into the Premises (which may be given verbally or via email), except with respect to the provision of janitorial services after Normal Business Hours (as defined in the Rules and Regulations) or in the event of an apparent emergency condition arising within or affecting the Premises that endangers or threatens to endanger property or the safety of individuals. Tenant may, at its option, require that Landlord be accompanied by a representative of Tenant during any such entry, excluding any emergency and the provision of janitorial services, provided that such representative of Tenant does not interfere with or delay Landlord exercising its rights or satisfying its obligations under this Lease.

VIII. SERVICES AND UTILITIES

8.1 Ordinary Services to the Premises. Landlord shall furnish to the Premises throughout the Term so long as the Premises are occupied: (i) the heating, ventilation, and air conditioning system serving the Building (“Base Building HVAC”) in such quantity and of such quality, and in temperature ranges and at such humidity levels, as are consistent with comparable office buildings in San Antonio, Texas, at such time periods as required by Tenant (including, for the avoidance of doubt, after Normal Business Hours), as determined by Tenant in its sole and absolute discretion and specified by Tenant from time to time in writing to Landlord; (ii) reasonable janitorial service five days per week (less any legal holidays observed by the federal government), including trash removal from the Premises; (iii) reasonable use of all existing basic intra-Building telephone and network cabling; (iv) water supplied by the applicable public utility from points of supply for Building standard use; (v) Common Area restrooms; (vi) elevator service; and (vii) electricity for Building standard lighting, personal computers, printers, copiers and other customary business equipment, but not including electricity required for Supplemental HVAC (as defined in Section 8.3) and any other equipment of Tenant that exceeds the Building standard electrical design load or the capacity of the Project’s feeders, risers or wiring installation (“Excess Electricity Use”). The cost of all services provided by Landlord hereunder shall be included within Operating Expenses, unless charged directly (and not as a part of Operating Expenses) to Tenant or another tenant of the Project. Landlord may establish reasonable measures to conserve energy and water.

8.2 HVAC Service. As the electricity for the Premises Base Building HVAC is separately metered, there shall be no additional charge for after-hours use (without limitation of Tenant’s Separately-Metered Utility Use reimbursement to Landlord).

8.3 Separate Meters. Without first obtaining Landlord’s consent, Tenant shall not install or operate in the Premises (i) any equipment or other machinery that may generate or require Excess Electricity Use or use of water or Base Building HVAC in excess of Building standard; (ii) any equipment or machinery that will require any changes to plumbing, Base Building HVAC, electrical or life-safety systems serving the Building; or (iii) any equipment which exceeds the floor load capacity per square foot for the Building. Landlord’s consent to such installation or operation may be conditioned upon the payment by Tenant of additional compensation for any excess consumption of utilities and any additional power, wiring, cooling or other service that may result from such equipment. At Landlord’s expense, Landlord shall install separate meters (“Meters”) as a part of the Tenant Work in order to measure Tenant’s utility usage (“Separately-Metered Utility Use”) in the Premises, including, without limitation, Excess Electricity Use and use of water or Base Building HVAC, including, without limitation, for any computer server rooms in the Premises

12

and for heating, ventilation and air conditioning systems used by Tenant in addition to Base Building HVAC (“Supplemental HVAC”). Tenant shall pay Landlord, within 30 days after Landlord’s delivery of an invoice, the cost of any Separately-Metered Utility Use, including any costs of operating and maintaining any Meters or other equipment that is installed in order to supply or measure such Separately-Metered Utility Use.

8.4 Additional Services. Should Tenant desire any other additional services beyond those described in Sections 8.1 or 8.2 or pursuant to Section 8.3, Landlord may (at Landlord's option), if requested by Tenant with reasonable prior notice to Landlord, furnish such services, and Tenant agrees to pay Landlord upon demand Landlord's additional expenses resulting therefrom. Landlord may, from time to time during the Term, set a charge for such additional services, or a per hour charge for additional or after hours service which shall include the utility, service, labor, and administrative costs and a cost for depreciation of the equipment used to provide such additional or after hours service. At Tenant’s expense payable to Landlord, within thirty (30) days of demand, Landlord shall also have the right to install and operate any machinery or equipment that Landlord considers reasonably necessary to restore the temperature balance between the Premises and the rest of the Building, including equipment which modifies the Base Building HVAC, if Landlord determines that the density of staff in the Premises exceeds the density limitations set forth in the Rules and Regulations or that the electricity used by Tenant materially affects the temperature otherwise maintained by the Base Building HVAC or generates substantially more heat than that which is normally generated by other tenants in the Building. In addition, if Tenant installs or operates machines and equipment which cause noise or vibration that is objectionable to Landlord or any other Project tenant, then Tenant shall install and maintain, at its expense, vibration eliminators or other devices sufficient to eliminate such noise and vibration.

8.5 Interruption of Utilities or Services. Except as expressly provided in this Section 8.5, neither a Service Interruption (as defined herein) nor Landlord’s exclusion from the Building or Project of any person shall render Landlord liable to Tenant, constitute a constructive eviction, or excuse Tenant from any obligation under this Lease. “Service Interruption” means (a) any failure to furnish, delay in furnishing, discontinuance, or diminution in the quality or quantity of any service Landlord has agreed to supply resulting from any application of any Law, failure of equipment, accident, performance of maintenance, repairs, improvements or alterations, utility interruption or surge, Event of Force Majeure (as defined in Section 19.14), or compliance with any mandatory or voluntary governmental energy conservation or environ-mental protection program. Notwithstanding the foregoing, if all or a material portion of the Premises is made untenantable for more than five (5) consecutive business days after notice from Tenant to Landlord by a Service Interruption to any service Landlord is obligated to provide under Section 8.1 and such Service Interruption is restricted to the Project, is not caused by an Event of Force Majeure, and can be corrected by Landlord through commercially reasonable efforts, then as Tenant’s sole remedy, Rent shall abate for the period beginning on the day immediately following such 5-business-day period (and shall not be retroactive) and ending on the day such Service Interruption ends, but only in proportion to the percentage of the Rentable Square Footage of the Premises made untenantable and that Tenant actually ceases to occupy as a result of such Service Interruption.

8.6 Telephone and Communication Charges. All telephone and other communication utility service used by Tenant in the Premises shall be paid for directly by Tenant, except to the extent the cost of same is included within Operating Expenses.

IX. USE AND REQUIREMENTS OF LAW

9.1 Use. Tenant shall not, and shall not permit Tenant’s Agent’s to, (a) use the Premises for any purpose other than the Permitted Use, (b) do anything in or about the Premises that (i) violates any of the Rules and Regulations or any recorded covenants and restrictions affecting the use, condition, configuration and occupancy of the Premises, (ii) damages the reputation of the Project, (iii) interferes with, injures or annoys other occupants of the Project, or (iv) constitutes a nuisance or waste. Tenant, at its expense, shall comply with all Laws relating to (a) the operation of its business at the Project, (b) the use, condition, configuration or occupancy of the Premises (except to the extent of Landlord’s obligations under Sections 9.2 and 9.3.1 and under Exhibit B-1 with respect to the Tenant Work), (c) the Building systems located in or exclusively serving the Premises (other than Building systems located in the Fifth Floor Common Area but not exclusively serving the Premises); or (d) the certificate of occupancy issued for the Building

13

and the Premises. If, in order to comply with any such Law, Tenant must obtain or deliver any permit, certificate or other document evidencing such compliance, Tenant shall provide a copy of such document to Landlord promptly after obtaining or delivering it. If a change to any Common Area, the Building structure, or any Building system located outside of and not exclusively serving the Premises becomes required under Law (or if any such requirement is enforced) as a proximate result of any specific Alteration made by or at the request of Tenant (as opposed to changes that would be required as the result of the review of Law requirements by a governmental authority regardless of which alterations or improvements to the Project triggers such a review), the installation of Tenant Property, or any use of the Premises other than general office use, then Landlord shall have the right to make such change and Tenant shall pay as Additional Rent to Landlord the cost of making such change, plus a construction supervision fee in an amount up to 5% of the cost of such change, within 30 days after Landlord’s demand; provided, however, Landlord shall have the option to require Tenant to make such change, in which case Tenant shall make such change promptly upon Landlord’s demand at Tenant’s cost.

9.2 Hazardous Materials. Tenant shall not, and shall not permit Tenant’s Agents, to bring on the Premises or the Project, any asbestos, petroleum or petroleum products, used oil, explosives, toxic materials or substances defined as hazardous wastes, hazardous materials or hazardous substances under applicable Laws (“Hazardous Materials”), except for routine office and janitorial supplies used on the Premises and stored in minimal quantities in compliance with all applicable environmental Laws. In the event of any release of Hazardous Materials on, from, under or about the Premises or the Project as the result of Tenant’s occupancy of the Premises, then Landlord shall have the right to clean up, remove, remediate and repair any contamination or other damage in conformance with the requirements of applicable Law and Tenant shall pay as Additional Rent to Landlord the cost of such work, plus a construction supervision fee in an amount up to 10% of the cost of such work, within 30 days after Landlord’s demand; provided, however, Landlord shall have the option to require Tenant to perform such work, in which case Tenant shall perform such work promptly upon Landlord’s demand at Tenant’s cost. Tenant shall immediately give Landlord written notice (a) of any suspected breach of this Section 9.2, (b) upon learning of the release of any Hazardous Materials, or (c) upon receiving any notices from governmental agencies or other parties pertaining to Hazardous Materials present in or otherwise affecting the Premises. Landlord shall have the right from time to time, but not the obligation, to enter upon the Premises in accordance with Article VII to conduct such inspections and undertake such sampling and testing activities as Landlord deems necessary or desirable to determine whether Tenant is in compliance with this Section 9.2.

9.3 ADA Compliance. Notwithstanding anything to the contrary in this Lease, Sections 9.3.1 and 9.3.2 shall govern the parties’ compliance with the Americans With Disabilities Act of 1990, as amended from time to time, Public Law 101-336; 42 U.S.C. §§12101, et seq. (the foregoing, together with any similar Texas Law governing access for the disabled or handicapped collectively referred to as the “ADA”).

9.3.1 Landlord’s ADA Obligations. To the extent governmentally required as of the Commencement Date of this Lease, Landlord shall be responsible for the cost of compliance with Title III of the ADA, and such cost shall not be included as an Operating Expense of the Project, with respect to (i) if Landlord is obligated to perform the Tenant Work, then the Tenant Work (as defined in Exhibit B-1) (provided that the cost thereof shall be included in the Cost of the Tenant Work (as defined in Exhibit B-1) and applied to any tenant improvement allowance available for the same; and (ii) any repairs, replacements or alterations to the Common Areas of the Project and the Fifth Floor Common Area. To the extent governmentally required subsequent to the Commencement Date of this Lease as a result of an amendment to Title III of the ADA or any regulation thereunder enacted subsequent to the Commencement Date of this Lease, Landlord shall be responsible for compliance with Title III of the ADA with respect to any repairs, replacements or alterations to the Common Area of the Project, and such expense shall be included as an Operating Expense of the Project; provided, however, Landlord’s responsibility under this Section 9.3.1 shall not include any repairs, replacements or alterations that are Tenant’s responsibility under Section 9.1 in connection with Alterations.

9.3.2 Tenant’s ADA Obligations. To the extent governmentally required, Tenant shall be responsible for compliance from and after the Commencement Date and throughout the Term, at its expense, with Titles I and III of the ADA with respect to Tenant’s use of the Premises other than the Fifth Floor Common Area, Alterations to the

14

Premises made by or at the request of Tenant, those portions of the Premises Tenant is obligated to maintain under Section 10.2 and, to the extent required under Section 9.1, the Common Areas, the Building structure, and any Building system. Landlord shall have the right to perform any work required to achieve such compliance and Tenant shall pay Additional Rent to Landlord the cost of such work, plus a construction supervision fee in an amount up to 5% of the cost of such work, within 30 days after Landlord’s demand; provided, however, Landlord shall have the option to require Tenant to perform such work, in which case Tenant shall perform such work promptly upon Landlord’s demand at Tenant’s cost.

X. MAINTENANCE AND REPAIR

10.1 Landlord’s Obligation. Landlord will maintain, repair and restore in reasonably good order and condition (i) the Common Area; (ii) the mechanical, plumbing, electrical and Base Building HVAC equipment serving the Building; (iii) the structure of the Building (including roof, exterior walls and foundation); (iv) exterior windows of the Building; (v) Building standard lighting; and (vi) the Fifth Floor Common Area. The cost of such maintenance and repairs to the Building shall be included in the Operating Expenses and paid by Tenant as Operating Expense Rent as provided in Section 4.3; provided, however, Tenant shall pay as Additional Rent to Landlord the cost of any maintenance, repair or restoration necessitated by the negligence or willful misconduct of Tenant or its Agents or invitees, plus a construction supervision fee in an amount up to 5% of the cost of such work, within 30 days after Landlord’s demand. Tenant waives all rights to make repairs at the expense of Landlord, to deduct the cost of such repairs from any payment owed to Landlord under this Lease, to claim a lien under §91.004(b) of the Texas Property Code or any other Law against the Rent, the Project or Landlord’s property, or to vacate the Premises.

10.2 Tenant’s Obligation. Subject to Landlord’s express obligations set forth in Section 10.1, Tenant, at its expense, shall maintain the Premises (other than the Fifth Floor Common Area) in good condition and repair, reasonable wear and tear and Casualty governed by the provisions of Section 16.1 excepted. Tenant’s obligation shall include without limitation the obligation to maintain and repair all (i) interior walls; (ii) floor coverings; (iii) ceilings; (iv) doors; (v) entrances to the Premises (but not entrances leading from outside the Premises to the Fifth Floor Common Area); (vi) Supplemental HVAC systems within the Premises; (vii) private restrooms and kitchens, including hot water heaters, dishwashers, plumbing and similar facilities serving Tenant exclusively; and (viii) Tenant Work and Alterations; provided that Landlord shall be responsible for the maintenance of each of such items in the Fifth Floor Common Area. Tenant will promptly advise Landlord of any damage Tenant observes to the Premises and, except in the event of an emergency, provide at least 5 days prior notice before commencing any work (including, but not limited to, any maintenance, repairs or Alteration) to remedy such damage in or to the Premises, together with the names, addresses and insurance certificates evidencing compliance with Landlord’s insurance requirements of the general contractor and major mechanical, electrical and plumbing subcontractors for the proposed work. Notwithstanding the foregoing, Landlord shall have the right to perform any such work in which case Tenant shall pay as Additional Rent to Landlord the cost of such work, plus a construction supervision fee in an amount up to 5% of the cost of such work, within 30 days after Landlord’s demand. If Landlord does not elect to perform such work and Tenant fails to make any repairs to the Premises for more than 30 days after notice from Landlord (although notice shall not be required in the event of an apparent emergency condition arising within or affecting the Premises that endangers or threatens to endanger property or the safety of individuals), Landlord may, at its option, cause all required maintenance or repairs, restorations or replacements to be made and Tenant shall pay Landlord pursuant to this Section 10.2.

10.3 Cooling Tower Maintenance. Landlord agrees to provide Tenant with at least two (2) weeks written notice before shutting down the Building’s cooling tower for scheduled maintenance. In the event of an emergency condition in connection with the cooling tower, no prior notice shall be required before Landlord shuts down the cooling tower for repair.

XI. ALTERATIONS

11.1 Consent to Alterations. Tenant shall not make or permit any alterations, decorations, additions or improvements of any kind or nature to the Premises or the Project, whether structural or nonstructural, interior, exterior

15

or otherwise (“Alterations”) without the prior written consent of Landlord, which consent not to be unreasonably withheld or delayed. For the avoidance of doubt, “Alterations” do not include the Tenant Work. Landlord may impose any reasonable conditions to its consent, including, without limitation: (a) prior approval of the plans and specifications and contractor(s) with respect to the Alterations; (b) a construction supervision fee up to 5% of the cost of the Alterations; (c) evidence of insurance maintained by the contractor and subcontractors as Landlord may reasonably require; (d) delivery to Landlord of completion affidavits and written mechanic’s and materialmen’s lien waivers signed and acknowledged by all general contractors and major mechanical, electrical and plumbing subcontractors, materialmen and suppliers (which the total amount of the contract or proposed work is $5,000 or more) participating in the Alterations; (e) delivery of permits, certificates of occupancy, “as-built” plans, and equipment manuals; and (f) any security for performance or payment that is reasonably required by Landlord.

11.2 Performance of Alterations. Any Alterations made on or about the Premises must be performed (a) in accordance with applicable Laws, any required governmental permits; the plans and specifications approved by Landlord and the terms and provisions of this Lease and (b) in a good and workmanlike manner by the contractor(s) approved by Landlord using material of a quality that is at least equal to the quality designated by Landlord as the minimum standard for the Building. Landlord may designate reasonable rules, regulations and procedures for the performance of work in the Building and, to the extent reasonably necessary to avoid disruption to the occupants of the Building, shall have the right to designate the time when Alterations may be performed. If the Alterations are not performed as herein required, Landlord shall have the right, at Landlord’s option, to halt any further Alterations until Tenant remedies any noncompliance or to require Tenant to return the Premises to its condition before such Alterations. Notwithstanding anything to the contrary in this Article XI, Landlord shall have the right, at its option, to perform any of Tenant’s requested Alterations, in which case Tenant shall pay as Additional Rent to Landlord the cost of such Alterations, plus a construction supervision fee in an amount up to 5% of the cost of such work, within 30 days after Landlord’s demand.

11.3 Cabling; Telecommunications. All computer, telecommunications or other cabling, wiring and associated appurtenances (collectively, “Cabling”) installed by, or on behalf of, Tenant inside any of the interior walls of the Premises, above the ceiling of the Premises, in any portion of the ceiling plenum above or below the Premises, or in any portion of the Common Areas of the Building, including but not limited to any of the shafts or utility rooms of the Building, shall be clearly labeled or otherwise identified as having been installed by Tenant. All Cabling installed by, or on behalf of, Tenant shall constitute Alterations and must comply with the requirements of the National Electric Code and any other applicable fire and safety codes. Tenant and Tenant’s telecommunications companies, including but not limited to, local exchange telecommunications companies and alternative access vendor services companies, shall have no right of access to the Premises or the Project for the installation and operation of telecommunications systems, including but not limited to, voice, video, data, and any other telecommunications services provided over wire, fiber optic, microwave, wireless, and any other transmission systems, for part or all of Tenant’s telecommunications within the Building without Landlord’s prior written consent, such consent not to be unreasonably withheld.

11.4 Removal of Alterations and Cabling. Before the expiration of the Term or earlier termination of this Lease Tenant shall remove at Tenant’s expense (a) at Landlord’s option, all Cabling installed by Tenant anywhere in the Premises or the Building to the point of the origin of such Cabling and (b) at Landlord’s election, all or any part of the Alterations, whether made with or without the consent of Landlord. With respect to any Alterations Landlord does not require to be removed, Tenant shall surrender the Premises, together with such Alterations, in the condition required by Section 3.2. If Landlord requires the removal of all or part of the Alterations, Tenant, at its expense, shall repair any damage to the Premises or the Project caused by such removal and restore the Premises and the Project to the condition required by Section 3.2. For purposes of this Section 11.4, Alterations are deemed to include any specialized Tenant Work or leasehold improvements, of which Landlord notifies Tenant, at the time of Landlord’s approval of the plans and specifications therefor, must be removed at the expiration of the Term or earlier termination of the Lease (“Specialized Tenant Improvements”). Notwithstanding anything to the contrary in this Article XI, Landlord shall have the right, at its option, to perform the work to remove any of Tenant’s Cabling and other Alterations Landlord is permitted to designate for removal pursuant to the terms of this Lease, in which case Tenant shall pay as

16

Additional Rent to Landlord the cost of such removal and associated repairs and restoration, plus a construction supervision fee in an amount up to 5% of the cost of such work, within 30 days after Landlord’s demand.

11.5 Mechanics’ Liens. Tenant will pay or cause to be paid all costs and charges for: (i) Alterations and other work done by Tenant or on behalf of Tenant in or to the Premises; and (ii) materials furnished for or in connection with such work. Tenant shall keep the Project free from any lien arising out of any work performed, material furnished or obligation incurred by or on behalf of Tenant. Tenant will immediately give Landlord written notice of any notice that Tenant receives that any such lien has been or may be filed against the Premises or any part of the Project. Tenant shall remove any such lien within 10 business days after notice from Landlord, and if Tenant fails to do so, Landlord, without limiting its remedies, may pay the amount necessary to cause such removal, whether or not such lien is valid. The amount so paid, together with reasonable attorneys’ fees and expenses, shall be reimbursed by Tenant upon demand.

XII. SIGNS

Landlord shall include Tenant’s name in any tenant directory located in the lobby on the first floor of the Building. If any part of the Premises is located on a multi-tenant floor, Landlord, at Tenant’s cost, shall provide identifying suite signage for Tenant comparable to that provided by Landlord on similar floors in the Building. Tenant may not install without Landlord’s prior reasonable consent (a) any advertisements, notices or signs outside the Premises or visible from outside the Premises or Building, or (b) any window coverings, blinds or similar items that are visible from outside the Premises or Building. Landlord shall have the right to perform any installations Tenant requests pursuant to this Article XII and to remove any installations made by Tenant in violation of this Article XII, in which case Tenant shall pay as Additional Rent to Landlord the cost of such installations or removal, as applicable, together with any associated repairs and restoration, plus a construction supervision fee in an amount up to 5% of the cost of such work, within 30 days after Landlord’s demand. Subject to all applicable historical regulations and other applicable sign regulations in the City of San Antonio, Tenant shall be permitted to install signage in the Fifth Floor Common Area (defined in Section 15.9) in the location and pursuant to the plans and specifications reasonably approved by Landlord.

XIII. ASSIGNMENT AND SUBLETTING

13.1 Transfer. Tenant shall not assign, transfer, mortgage or otherwise encumber this Lease or sublet or rent (or permit a third party to occupy or use) all or any portion of the Premises (each a “Transfer”), without the prior written consent of Landlord, which consent shall not be unreasonably withheld. A Transfer shall also include the following: (a) if Tenant is a closely held professional service firm, the withdrawal or change (whether voluntary, involuntary or by operation of law) of 25% or more of its equity owners within a 12-month period; and (b) in all other cases, any transaction(s) resulting in the acquisition of a Controlling Interest (defined below) by one or more parties that did not own a Controlling Interest immediately before such transaction(s). As used herein, “Controlling Interest” means any direct or indirect equity or beneficial ownership interest in Tenant that confers upon its holder(s) the direct or indirect power to direct the ordinary management and policies of Tenant, whether through the ownership of voting securities, by contract or otherwise (but not through the ownership of voting securities listed on a recognized securities exchange).