Attached files

| file | filename |

|---|---|

| EX-32.1 - CardioGenics Holdings Inc. | ex32-1.htm |

| EX-31.1 - CardioGenics Holdings Inc. | ex31-1.htm |

| EX-31.2 - CardioGenics Holdings Inc. | ex31-2.htm |

| EX-23.1 - CardioGenics Holdings Inc. | ex23-1.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended October 31, 2015 |

OR

| [ ] | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from __________ to __________. |

Commission file number: 000-28761

CARDIOGENICS

HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| Nevada | 88-0380546 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification Number) |

6295

Northam Drive, Unit 8, Mississauga, Ontario L4V 1W8

(Address of principal executive offices) (Zip code)

(905)

673-8501

(Registrant’s telephone number, including area

code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Common Stock—$0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer or a small. See definition of “large accelerated filer, accelerated filer and smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates on February 12, 2016 (based on the closing stock price on the OTC Bulletin Board) on such date was approximately $2,655,111.

As of February 12, 2016 the Registrant had the following number of shares of its capital stock outstanding: 92,866,724 shares of Common Stock and 1 share of Series 1 Preferred Voting Stock, par value $0.0001, representing 13 exchangeable shares of the Registrant’s subsidiary, CardioGenics ExchangeCo Inc., which are exchangeable into 24,176,927 shares of the Registrant’s Common Stock.

CARDIOGENICS HOLDINGS INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED OCTOBER 31, 2015

TABLE OF CONTENTS

| 2 |

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “may,” “will,” “should,” “estimates,” “predicts,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends” and similar expressions are intended to identify forward-looking statements. Our discussions relating to our liquidity and capital resources, our business strategy, our competition, and the future of our market segment, our acquisition of CardioGenics Inc., an Ontario Canada corporation (“CardioGenics”), among others, contain such statements. Our actual results and the timing of certain events may differ significantly from the results discussed in the forward-looking statements.

Our forward-looking statements in this Annual Report on Form 10-K are based on management’s current views and assumptions regarding future events and speak only as of their dates. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by the federal securities laws. Unless the context requires otherwise, the terms “we,” “us” and “our” refer to CardioGenics Holdings Inc., our predecessors and subsidiaries. Our acquisition of CardioGenics as discussed in this Annual Report on Form 10-K is sometimes referred to as the “CardioGenics Acquisition.”

COMPANY Overview

Prior to the CardioGenics Acquisition, our primary business was providing financial and investment information to the investment community which we had been doing since 1989. In July 2009, we consummated the CardioGenics Acquisition and the main focus of our business was changed to the development of products targeting the immunoassay segment of the point-of-care in vitro diagnostic (“IVD”) testing market. In order to better reflect the new focus of our business, we changed our name to CardioGenics Holdings Inc. in October 2009.

CardioGenics was founded in Toronto, Canada in 1997 by Dr. Yahia Gawad to develop technology and products targeting the immunoassay segment of the IVD testing market. These include:

| ● | The QL Care Analyzer (the “QLCA”), a state-of-the-art proprietary Point-of-Care (“POC”) immunoassay analyzer; | |

| ● | A series of immunoassay test products to detect cardiac markers (the “Cardiovascular Tests”); and, | |

| ● | Paramagnetic beads developed through its proprietary method, which improves their light collection (the “Beads”). |

We are a Nevada corporation. Our address is 6295 Northam Drive, Unit 8, Mississauga, Ontario, Canada L4V 1W8, and our telephone number is 905-673-8501.

| 3 |

Our Industry

CardioGenics IVD POC Testing Markets

IVD Market

Medical device products include disposable medical supplies, wound-management supplies and diagnostic products. In-Vitro-Diagnostics (“IVD”) is the medical device market segment that includes reagents, diagnostics test products, instrumentations and other related testing products supplied to both clinical and research laboratories. IVD refers to testing outside the body for the identification of disease states, using samples as body fluids (blood, urine) and tissues (biopsies and tissue sections). The IVD is a well-established market, offering essential products used by health care professionals.

According to the report “In Vitro Diagnostics Market (Clinical Chemistry, Immunoassay, Diabetes Testing, Blood Testing, Molecular Diagnostics) – Global Industry Analysis, Size, Share, Growth and Forecast, 2012-2018” published by Transparency Market Research, IVD Market was valued at USD 46.0 billion in 2011 and expected to reach an estimated value of USD 74.2 billion in 2018, growing at a CAGR of 7.1% from 2012 to 2018.

The need for cost containment, an increase in out-patient procedures, technology advancements and the aging population are all contributing factors in driving the high level of IVD growth.

According to the latest Enterprise Analysis Corporation (www.eacorp.com) report in 2013, the world market for IVD products is estimated at USD 52.8 billion in 2012 with an average growth rate of 8.4% in the last preceding 12 years. Further, the market is expected to grow an average of 5.5% over the next 5 years. North America, Europe, Africa, Middle East and Japan make up 86% of the total IVD market.

Point-Of-Care (POC) Testing Market

Point-Of-Care (POC) testing refers to testing performed outside of a centralized facility, with results available within minutes. POC testing is divided into personal use tests, such as pregnancy tests, and professional use tests, that are administered in a physician’s office or hospital emergency ward. Our tests will compete in the professional use testing market sector.

According to the same Enterprise Analysis Corporation report in 2013, the market for the POC is estimated at $5,346 million with 7% growth over the prior year. It is anticipated that most of the growth will come from increased use of cardiac markers and new assays for cancer markers and diabetes/cardiac disease markers.

There is a wide perception that POC tests are more expensive than lab-based tests and that patient test results are lost to the historical record. There is also the perception that once the patient leaves the acute care area, the baseline POC tests done in that unit are of little value because the POC testing results do not correlate with lab-based systems.

The impact of POC testing on improving patients’ care is clear and has been well documented. Further, the impact of POC testing on saving healthcare resources was also demonstrated by numerous agencies and institutions.

Two critical characteristics are necessary for POC test products to become more prevalent; POC testing results must correlate with lab results and the POC devices must be more consistent and robust in delivering those results.

| 4 |

Immunoassay Market

Immunodiagnostic tests or immunoassays are set apart from other IVD clinical testing methods as they provide specificity. Results obtained can be attached to a specific marker, and therefore a specific disease. The principal behind immunoassays is the Lock and Key Theory; a certain key opens a certain lock but not others.

According to the report of Enterprise Analysis Corporation, the 2012 immunoassay testing market still represents the largest segment of the IVD market by revenue amounting to USD 13.9 billion. The fastest growing segments of the IVD market are Anatomic Pathology (8.3%), Clinical Molecular (7.2%), Point-of-Care (7.0%) and Immunoassay (6.7%). The immunoassays field is now mature. Companies continue to develop new immunoassays and immunoassay instrument platforms to further improve the sensitivity of the assays and expand the potential of immunoassays for the future.

Cardiovascular Disease (CVD) Testing Market

Cardiac markers are proteins released from heart muscle when it is damaged as a result of a heart attack (myocardial infarction), when the blood supply to part of the heart is interrupted. Physicians use cardiac markers in two ways; to diagnose a cardiac event in a hospital emergency room or within the hospital or to evaluate a risk of a cardiovascular event occurring. The routine markers of myocardial infarction – CK-MB, troponin and myoglobin and recently BNP are used in the acute care and tests such as cholesterol are used to evaluate risk.

Until recently, Troponin and CK-MB were the lead cardiac markers. Brain Natriuetic Pepetide (BNP) was recently introduced to differentiate between a myocardial infarction and heart failure. A number of companies are focused on developing new cardiac markers.

Global tracking of healthcare data indicates that CVD contribute one-third of all global deaths annually. The WHO estimates that global death by CVD will increase by 36 percent over the 20 years 1999-2020. Costs to confront CVD are high, estimated to be USD 313.5 billion in the USA in 2009, growing at a rate of 20%-25% per annum. According to a recently published market report, the market for Cardiac POC products is estimated at approximately USD 2 billion in 2011 and rose by 9% over the prior year. This was driven by the introduction of new products and increased adoption of POC products by both healthcare providers and patients. Despite the many positive aspects of POC testing, the report stresses that there are many key challenges in the marketing of POC products as healthcare providers need evidence that POC diagnostics provide lab-quality results and benefits, in terms of clinical usefulness, convenience and cost in order to adopt them.

As a result of the stated burden of CVD on healthcare costs and providers, there exists an industry-wide need for better testing methods to provide physicians with essential tools to combat this growth. With greater demand from regulatory authorities to provide more accurate testing in a quicker manner, the opportunity is there for a better POC platform.

| 5 |

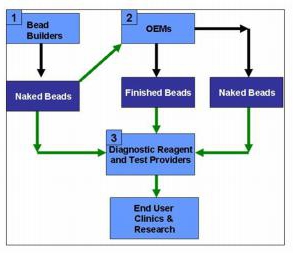

Magnetic Particles Market

Magnetic particles, or beads, are widely used as the solid phase for binding tests, both immunoassay and DNA binding. Magnetic beads are important for automating and simplifying the methods used for isolation and detection of biomolecules in both research and routine clinical laboratories. Eight of the top ten (10) IVD companies employ magnetic particles in their fully automated analyzers.

An independent 2006 market research report, prepared for CardioGenics by Adventus Research Inc. (the “Adventus Report”) and sponsored by the National Research Council of Canada (NRC), estimated the market for magnetic beads for immunoassays and molecular diagnostics to be approximately $900 million (between $833 million and $1.3 billion). This report of market size estimates did not include magnetic beads produced in-house by some of the IVD test manufacturers or beads produced for research applications. The Adventus Report was conducted using several methods, including interviews with leading particle-manufacturers and the end-users, published industry reports and data from leading IVD manufacturers.

As stated in the Adventus Report, according to Dynal, a leading magnetic beads manufacturer, the largest part of its Molecular Systems’ business is OEM sales of magnetic beads to IVD companies. Dynal stated that “the IVD market is very large and still growing”. Further, the magnetic bead-based part of this market is growing at an even higher rate per year”. According to Dynal, magnetic beads are now the gold standard for immunoassay testing, as opposed to older technologies such as microtitre plate based tests. Nucleic acid testing makes up a smaller portion of the IVD market, but is fast growing (currently USD 2 billion). Magnetic beads are the most common solid phase employed in this market.

Furthermore, according to Dynal, as stated in the Adventus Report, end-user business rather than OEM business (referred to as functionalized and naked beads markets respectively) goes to research and routine laboratories within Genomics, Expression Profiling and Proteomics. The market size for Genomics, including DNA and RNA extraction and purification products was USD 300 million in 2001. According to the same Enterprise Analysis Corporation report in 2013 the market size of molecular diagnostics was estimated to be USD 3.8 billion in 2012.

Our Products

The CardioGenics Products

QL Care Analyzer

The

QLCA represents a shift in the design of point-of-care (POC) analyzers. The QLCA is a small, portable, stand-alone and completely

automated POC immunoassay analyzer. The QLCA has successfully miniaturized lab. test technology, and combined it with a simplified

mechanical design and proprietary triggering mechanism.

The

QLCA represents a shift in the design of point-of-care (POC) analyzers. The QLCA is a small, portable, stand-alone and completely

automated POC immunoassay analyzer. The QLCA has successfully miniaturized lab. test technology, and combined it with a simplified

mechanical design and proprietary triggering mechanism.

| 6 |

The QLCA uses a proprietary self-metering cartridge to perform immunoassay tests at the POC. Each cartridge is pre-loaded with our beads, which have been coated with specific proteins which result in binding the target marker. A few drops of whole blood added to the Cartridge initiate the binding reaction and the chemiluminescent reaction needed to deliver sensitive and accurate test results. Operation of the QLCA does not require specialized training and testing can be completed in 15 minutes.

POC immunoassay analyzers are not new; however, none of the commercial analyzers can replicate the sensitivity and accuracy of a test done in a medical lab. The QLCA was designed specifically to deliver the required laboratory sensitivity and accuracy. The QLCA employs chemical light generation or “chemiluminescence” (“CL”), the same technology used in the centralized medical labs. The QLCA uses a patented automated electronic process to trigger CL, which enhances light collection, speeds up marker binding and increases sensitivity. Further, the QLCA employs several other proprietary technologies to deliver lab-quality test results.

We have rigorously tested the QLCA protocols and have compared our test results against medical laboratory test data. Based on these internal test results, we have consistently met or exceeded the sensitivity standards of medical laboratory immunoassay equipment.

Cardiovascular Tests

To support the use of the QLCA, we have developed four immunoassay tests designed to identify cardiac markers in the blood at the time of a heart attack.

| Test | Description | ||

| Troponin I (TnI) | ● | TnI testing is the current routine testing for a heart attack. | |

| ● | TnI is a heart muscle protein, released in the bloodstream shortly after a heart attack (myocardial infarction or MI). | ||

| ● | Current laboratory analyzers cannot detect TnI before 4-6 hours after the onset of symptoms, when TnI concentration in the blood reaches its detection threshold | ||

| ● | Our test will take only 15 minutes to deliver quantitative results, allowing physicians to obtain much more rapid results and therefore accelerate patient triage. | ||

| Plasminogen Activator Inhibitor Type-1 (PAI-1) | ● | This test will help to optimize the performance of a heart drug (“tPA” or tissue Plasminogen Activator), a clot buster used as the first line of therapy for MI patients. | |

| ● | This proprietary whole blood test will quantify PAI-1 levels within 15 minutes | ||

| ● | Forty percent of patients do not respond to tPA, a fact recognized only after the “golden hour” (the time period in which permanent heart damage can be prevented) has passed. | ||

| Heart Failure Risk Stratification (HFRS) | ● | We have discovered a family of related proteins that are released into the bloodstream during heart failure. | |

| ● | We are developing a proprietary test, the Heart Failure Risk Stratification or HFRS test to stratify the risk of death in patients with heart failure, thus permitting the initiation of appropriate therapy at an early stage. | ||

| Heart Failure Genomics Risk (HFGR) | ● | We are developing a proprietary HFGR test that predicts the response of heart failure patients to routinely administered drugs. | |

| ● | The need to measure the precise response to these drugs in a timely manner would minimize the trial and error methods now used by doctors to optimize drugs best suited to each patient. | ||

| 7 |

These tests are designed to be administered during the diagnostic and management process of patients with heart disease. The full scope of our core technologies our self-metering cartridge as well as the know-how we have developed over the years are covered under our patent applications.

Currently, our TnI test product is in the pilot testing phase. Although pilot testing is approximately 50% complete, testing has been suspended until the Company can raise additional funds to cover the remaining costs associated with the pilot testing program. Once the pilot testing is concluded, testing for regulatory approval will be initiated. The filing for U.S. and European regulatory approval is expected before the end of 2016. Upon receipt of FDA approval, we intend to market the QLCA and the Cardiovascular Tests through a major IVD distributor. We have initiated preliminary discussions with several of the Tier 1 IVD companies, and we anticipate that we will commence negotiations with one or more distribution partners before we receive FDA approval. In accordance with industry practice, we intend to enter into a license agreement with our distribution partner for the manufacture and distribution of our products.

Paramagnetic Beads

Clinical and research laboratories use paramagnetic particles as a solid surface in heterogeneous immunoassay tests. Paramagnetic (magnetic) beads are the most common solid phase employed during immunoassays tests in these laboratories. The process of phase separation (separation of the magnetic beads) is done by application of an electromagnetic field. The majority of centralized laboratory testing involve the measurement of light generated on the surface of paramagnetic beads coated with biological material as the outcome of the measurement.

Our Magnetic Beads represent a significant product advance. Most paramagnetic beads are made of iron oxide, and all are traditionally black or brown. We have developed proprietary process for plating the beads with a layer of silver, making them white, and more sensitive to light. Our production process is also significantly less expensive than those used by our competitors. We have internally tested our Beads against all commercially available beads, and have found our silver-coated Beads to be five times more sensitive than traditional black or brown magnetic particles. The results of this testing was presented and published in an international conference.

| 8 |

On January 19, 2009 CardioGenics Inc., one of our Canadian subsidiaries, entered into a Supply, Development & Distribution Agreement with Merck Chimie S.A.S. (“Merck Chimie”) (the “Merck Agreement”), pursuant to which CardioGenics is required to furnish Merck Chimie with certain quantities of CardioGenics’ proprietary silver-coated paramagnetic beads (the “CardioGenics Test Samples”), which Merck Chimie is then required to encapsulate, on a test-basis, using Merck Chimie’s proprietary encapsulation process. After Merck Chimie selects the best encapsulation process, Merck Chimie agreed to then establish the manufacturing parameters for the final encapsulated beads (the “Merck Encapsulated Beads”) and thereafter scale-up production for commercial distribution of the Merck Encapsulated Beads. Currently, Merck Chimie has concluded that magnetic beads encapsulated in CardioGenics meet the product specifications for commercial products. Marketing these magnetic beads has not commenced yet as both Merck Chemie and CardioGenics have not agreed on the terms of the final agreement.

Pursuant to the current executed Merck Agreement, Merck Chimie has the exclusive right, for ten (10) years, to distribute the Merck Encapsulated Beads on a worldwide basis, with CardioGenics receiving 30% of the net sales proceeds of the Merck Encapsulated Beads and Merck receiving 70% of such net sales proceeds. Merck is responsible for manufacturing and distributing the Merck Encapsulated Beads. The Company is in process of renegotiating the agreement with Merck Chimie in order to ensure sale of product.

Our Strategy

The success of our business depends on our ability to obtain the requisite financing and be able to:

| ● | complete the development and testing of our QLCA and our cardiovascular tests; | |

| ● | obtain FDA approval of our QLCA and the cardiovascular tests; | |

| ● | develop further tests that can be run on our QLCA; | |

| ● | commercialize our Beads. |

We will require additional funds in order to implement our full business strategy. Accordingly, we will need to raise additional funds through public or private financing, strategic relationships or other arrangements. We do not anticipate generating any significant revenue until after the FDA has approved our OLCA and first cardiovascular test and Merck Chimie initiates commercializing our Beads pursuant to our agreement with them.

Since our strength is product development and innovation, our strategy is focused on exploiting this strength. In terms of product development and innovation, we employ our internal resources to develop our products through the various phases of development. We also rely on external service providers to supplement our internal talents in product development.

We will outsource product manufacturing. In terms of the QLCA, both the cartridge assembly as well as the analyzer assembly will be contracted out to different OEM providers with the facilities and expertise to deliver quality products. We will maintain a quality control process to ensure that the products meet the predetermined specifications.

| 9 |

Product marketing and distribution will be achieved through partnerships with global companies with wide reach. As we have done with our magnetic beads, the QLCA will be marketed by a third party through licensing and distribution agreements. Notwithstanding this strategy, we also intend to evaluate the feasibility of directly marketing our magnetic beads and QLCA to appropriate end-users and may use such direct marketing efforts to supplement the efforts of our future distribution partner(s).

We are also focusing on protecting our intellectual property and know how though maintaining a patent filing process on a global basis as well as maintaining confidentiality agreements with our staff, employees and service providers under contractual agreements.

Although we believe in these strategies, goals and targets, we cannot guarantee that we will be successful in implementing them or that, even if implemented; they will be effective in creating a profitable business. In addition, we are dependent on having sufficient cash to carry out our strategies.

Regulation

CardioGenics Products

Our QL Analyzer, Cartridge and Tests are classified as medical devices. Our beads are reagents of medical testing equipment. Accordingly, they are subject to a number of regulations in the jurisdictions where our products are targeted to be sold.

United States

The testing, production and sale of IVD products are subject to regulation by numerous state and federal government authorities, principally the FDA.

Pursuant to the U.S. Federal Food, Drug and Cosmetic Act (“FD&C Act”), the FDA regulates the preclinical and clinical testing, manufacture, labeling, distribution and promotion of medical devices.

Medical devices are classified into three categories, Class I, Class II or Class III. The classification of a device is based on the level of control necessary to assure the safety and effectiveness of the device. Generally, the complexity of the submission and the approval times are based on the regulatory class of the device. Device classification depends on the intended use and also the indications for use of the device. Classification is also based on the risk the device poses to the patient and/or the user. Class I devices include devices with the lowest risk, and Class III devices are those with the greatest risk. Class I devices are subject to general control, Class II devices are subject to general controls and special controls, and Class III devices are subject to general controls and must receive a Premarket Assessment or PMA by the FDA.

Before some Class I and most Class II devices can be introduced in the market, either the manufacturer or distributor of the device is required to follow the pre-market notification process described in section 510(k) of the FD&C Act. A 510(k) is a pre-marketing submission made to the FDA to demonstrate that the device to be marketed is as safe and effective, and is substantially equivalent to a legally marketed device. Applicants must compare their 510(k) device to one or more similar devices currently on the US market and support their claims for substantial equivalency. The FDA requires a rigorous demonstration of substantial equivalency. It generally takes three to six months from submission to obtain 510(k) clearance. If any device cleared through 510(k) is modified or enhanced, or if there is a change of use of the device, a new amended 510(k) application must be submitted.

According to FDA regulations and our management team’s prior experiences with submissions of similar products, our QLCA and launch product (TnI) will be classified as a Class II device and will be subjected to the 510(K) process. Further, a second test product of ours (HFRS) will also be subjected to the same 510(K) process. As for both tests, predicate devices are commercially available. For other test products, depending on the claims and with a prior agreement with the FDA, the submissions would be either a PMA or 510(K). We have not yet approached the FDA for that purpose.

| 10 |

Canada

Health Canada sets out the requirements governing the sale, importation and advertisement of medical devices. These regulations are intended to ensure that medical devices distributed in Canada are both safe and effective. We are also required to comply with certain procedures for the disposal of waste products under the Canadian Code of Practice for the Management of Biological Waste (the “Code”). We believe we are currently in compliance with all required Code provisions.

Europe

Our products will be subject to registration under the EU Medical Device Directives for in-vitro diagnostic products.

Other countries

Our products will be subject to the regulations of any country where they are sold, and we will make the necessary applications for approval on a country-by-country basis.

Competition

CardioGenics Competitors

Numerous companies provide Point Of Care (POC) products, many with cardiovascular test offerings. However, in terms of quantitative POC products, few companies operate in this space with marketed devices. These include:

| ● | Biosite Diagnostics Incorporated; | |

| ● | Response Biomedicals Corp.; | |

| ● | Roche POC division; and | |

| ● | i-Stat division of Abbott Diagnostics |

The first 2 companies employ fluorescence measurements in their platforms whereas Roche employs both Fluorescence and spectroscopic methods for detection, while i-Stat employs electrochemical testing. We believe that our technology and products in development will offer superior products to the POC market. None of the above companies offer chemiluminescence in its platform, a technology that is well-recognized for its superiority as evidenced by its dominance in the laboratory testing market. We believe that harnessing chemiluminescence in our QLCA will fulfill the clinical demands for fast and accurate quantitative results at patient bedsides.

Research and Development

Our efforts are focused on the development of our QLCA and our cardiovascular tests and the commercialization of our beads. Over the years 2015 and 2014 we incurred net expenses of $215,790 and $500,935, respectively, on those efforts.

| 11 |

Website Technical Information

Our CardioGenics website (www.cardiogenics.com) and the website of our wholly owned subsidiary, LuxSpheres (www.luxspheres.com), are maintained by us internally and are hosted by DreamHost, which has hosting facilities located in Brea, California.

Employees

As of October 31, 2015, we had four (4) employees, none of whom have an employment agreement with the Company.

Facilities

See “Item 2.—Properties.”

Legal Proceedings

See “Item 3.—Legal Proceedings.”

Where You Can Find More Information About Us

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You can read and copy any of this information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 on official business days during the hours of 10:00 a.m. to 3:00 p.m. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. This information is also available from the SEC’s website at http://www.sec.gov. We will also gladly send any filing to you upon your written request to Dr. Yahia Gawad, our Chief Executive Officer, at 6295 Northam Drive, Unit 8, Mississauga, Ontario L4V 1W8.

Acquisition of Plasticap

On November 4, 2015, the Company, through 2489528 Ontario Inc., an Ontario corporation and indirect subsidiary of the Company (“Acquisition Sub”), (together, the “Buyers”) Plasticap Corporation, an Ontario corporation (“Plasticap”) and 1731861 Ontario Inc., an Ontario corporation (“173 Corp”) entered into an asset purchase agreement, dated as of November 2, 2015, pursuant to which Acquisition Sub was to acquire all of the assets of Plasticap and 173 Corp (collectively, the “Sellers”) (the “Asset Purchase Agreement”).

In consideration for the sale of the assets by the Sellers, the Company is to issue to Sellers, or their nominees (i) a convertible debt instrument, in the original principal amount of ten million Canadian dollars (CDN$10,000,000), which shall bear interest at a rate of 8% (the “Convertible Debt”); (ii) twenty million (20,000,000) shares of the Company’s common stock, par value $0.00001 ( the “Common Stock”), which shares shall not be registered for resale by the Company and shall be subject to the rights and restrictions of Rule 144 of the Securities Act of 1933 (“Rule 144”); and (iii) a warrant to purchase ten million (10,000,000) shares of Common Stock, which warrant shall have a term of three (3) years, be exercisable on a net cashless basis at an exercise price of $0.50 per share, not be registered for resale by Buyer and be subject to the rights and restrictions of Rule 144 (the “Warrant”). In addition, Acquisition Sub will assume two million nine-hundred thousand Canadian dollars (CDN $2,900,000) in secured debt from Sellers (the “Secured Debt”) as part of the consideration.

The Asset Purchase Agreement contains customary representations and warranties from the parties. Acquisition Sub and 173 Corp also agreed to various post-closing undertakings described below.

On November 4, 2015 and subject to post-closing undertakings, the Company, Acquisition Sub and the Sellers closed the sale and purchase of all of the assets of Sellers by Acquisition Sub, pursuant to the terms of the Asset Purchase Agreement. The assets acquired by Acquisition Sub comprised all of the assets of Sellers, which include, among others, the “Plasticap” trademark, all furnishings, fixtures and equipment related to Plasticap’s specialty cap and closure manufacturing business and all of the Sellers’ customer contracts, all as more particularly set forth in the Asset Purchase Agreement.

| 12 |

As part of the closing, Acquisition Sub and 173 Corp agreed to various post-closing undertakings. The following under takings have yet to be completed and hence the sale has not closed and the notes and warrants noted above have not been issued, nor has the CDN $2,900,000 secured debt been assumed:

| (i) | 173 Corp undertakes that by January 31, 2016 it shall pay all the outstanding indebtedness of Bibby Financial Services located at 4 Robert Speck Parkway, Unit 310, Mississauga, ON, L4Z 1S1. | |

| (ii) | Following the fulfilment of the undertaking specified in paragraph (i), which shall be considered fulfilled upon 173 Corp providing Acquisition Sub with a copy of the cheque payable to Bibby Financial Services for the full amount of the indebtedness, 173 Corp undertakes to provide Acquisition Sub, or as it directs, with a full and comprehensive release against any future claims Bibby Financial Services may have and a full indemnity against any future claims. | |

| (iii) | Acquisition Sub undertakes that it will advance up to fifty thousand Canadian dollars (CDN$50,000) as a deposit against any outstanding claims Jacob Van Halteran may have through any security interests duly registered on any of the Sellers’ assets and that Sellers shall provide a full and comprehensive release of those security interests other than any rights that may be asserted under the Asset Purchase Agreement specifying any assumed liabilities. | |

| (iv) | A Seller’s lender will be paid fifty thousand Canadian dollars (CDN$50,000) against the debt in 173 Corp. | |

| (v) | Acquisition Sub undertakes to pay from earnings received from time-to-time from its primary customer contract, based on a calculation of 50% before interest, taxes, depreciation and amortization, amounts to reduce the principle amount of the Secured Debt to zero by December 31, 2018. In the event, a residual balance exists, a balloon payment will be made to complete the payment. After Acquisition Sub completes the payment obligation, the Sellers undertake, acknowledge and agree that the Acquisition Sub shall have no further responsibility to make any further payments on the balance of the Secured Debt. | |

| (vi) | Acquisition Sub and 1646813 Ontario Limited undertake to enter into a new lease agreement for the premises located at 177 Crosby Avenue, Richmond Hill, Ontario, effective November 2015, with an option for Acquisition Sub to purchase the premises on the following terms: |

The term of the lease will be 5 years, with an option for an additional 5 years. Acquisition Sub has the option to acquire the building until January 15, 2016, through a purchase of all of the outstanding shares of 1646813 Ontario Limited, the owner of the real property and subject to refinancing the existing mortgages. In the event Acquisition Sub does not exercise the option, the lease shall remain in force for the duration of the lease and the Convertible Debt will be reduced by one million (CDN$1,000,000.00) Canadian dollars.

The option for acquiring the real property has expired and therefore not in consideration any more. Further, the legal position of both parties is being disputed and has currently not concluded. There are no guarantees that this acquisition will be consummated and if it does, the terms might be different than stated above.

The Company has advanced/loaned $288,126 to Acquisition Sub, Plasticap or 173 Corp. from November 4, 2015 to February 12, 2016. The Company is confident of collection of these advances/loans should the acquisition not be consummated.

Risks Related to Our Business and Industry

The requirements of being a public company may strain our resources and distract our management

As a public company, we are subject to the reporting requirements of the Exchange Act and the Sarbanes-Oxley Act. These requirements place a strain on our systems and resources. The Exchange Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls for financial reporting. Management has identified the following material weaknesses in our internal controls over financial reporting; 1) lack of documented policies and procedures; 2) lack of resources to account for complex and unusual transactions; 3) there is no effective separation of duties, which includes monitoring controls, between the members of management; and 4) lack of effective review of consolidated financial statements.

We are also required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of our internal controls over financial reporting. If we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with the Sarbanes-Oxley Act.

| 13 |

In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight will be required. This may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, we may need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge, and we cannot assure you that we will be able to do so in a timely fashion.

We have not earned any material revenues in our CardioGenics business unit since its incorporation and only have a limited operating history in its current business, which raise doubt about our ability to continue as a going concern.

Our CardioGenics business unit has a limited operating history in its current business and must be considered in the development stage. It has not generated any material revenues since its inception and we will, in all likelihood, continue to incur operating expenses without significant revenues until we complete development of our Cardiovascular Tests and commercialize our QLCA and the Cardiovascular Tests. The primary source of funds for our CardioGenics business unit has been the sale of debt and common stock. We cannot assure that we will be able to generate any significant revenues or income. These circumstances make us dependent on additional financial support until profitability is achieved. There is no assurance that we will ever be profitable and we have not yet achieved profitable operations. These factors raise substantial doubt that we will be able to continue as a going concern.

Our independent registered accounting firm, in their audit report related to our financial statements for the fiscal year ended October 31, 2015, expressed substantial doubt about our ability to continue as a going concern

As a result of our continued losses, our independent registered public accounting firm has included an explanatory paragraph in its report on our financial statements for the fiscal year ended October 31, 2015, expressing substantial doubt as to our ability to continue as a going concern. The inclusion of the going concern explanatory paragraph in the report of our independent registered public accounting firm may make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we may obtain.

We need to raise additional financing to support the research and development of our CardioGenics business but we cannot be sure that we will be able to obtain additional financing on terms favorable to us when needed. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated.

Our ability to develop new test products for our QLCA is dependent upon our ability to raise significant additional financing when needed. If we are unable to obtain such financing, we will not be able to fully develop and commercialize our platform and technology. Our future capital requirements will depend upon many factors, including:

| ● | continued scientific progress in our research and development programs; | |

| ● | cost and timing of conducting clinical trials and seeking regulatory approvals and patent prosecutions; | |

| ● | competing technological and market developments; | |

| ● | our ability to establish additional collaborative relationships; and | |

| ● | the effect of commercialization activities and facility expansions if and as required. |

We have limited financial resources and to date, no material cash flow from the operations of our CardioGenics business unit and we are dependent for funds on our ability to sell our common stock, primarily on a private placement basis. There can be no assurance that we will be able to obtain financing on that basis in light of factors such as the market demand for our securities, the state of financial markets generally and other relevant factors. Any sale of our common stock in the future will result in dilution to existing stockholders. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any future indebtedness or that we will not default on our future debts, jeopardizing our business viability. Finally, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to continue the development of our technology, which might result in the loss of some or all of your investment in our common stock.

| 14 |

We may acquire other businesses, license rights to technologies or products, form alliances, or dispose of or spin-off businesses, which could cause us to incur significant expenses and could negatively affect profitability.

We may pursue acquisitions, technology licensing arrangements, and strategic alliances, or dispose of or spin-off some of our businesses, as part of our business strategy. We may not complete these transactions in a timely manner, on a cost-effective basis, or at all, and may not realize the expected benefits. If we are successful in making an acquisition, the products and technologies that are acquired may not be successful or may require significantly greater resources and investments than originally anticipated. We may not be able to integrate acquisitions successfully into our existing business and could incur or assume significant debt and unknown or contingent liabilities. We could also experience negative effects on our reported results of operations from acquisition or disposition-related charges, amortization of expenses related to intangibles and charges for impairment of long-term assets.

The expiration or loss of patent protection and licenses may affect our future revenues and operating income.

Much of our business relies on patent and trademark and other intellectual property protection. Although most of the challenges to our intellectual property would likely come from other businesses, governments may also challenge intellectual property protections. To the extent our intellectual property is successfully challenged, invalidated, or circumvented or to the extent it does not allow us to compete effectively, our business will suffer. To the extent that countries do not enforce our intellectual property rights or to the extent that countries require compulsory licensing of our intellectual property, our future revenues and operating income will be reduced.

Competitors’ intellectual property may prevent us from selling our products or have a material adverse effect on our future profitability and financial condition.

Competitors may claim that one or more of our products infringe upon their intellectual property. Resolving an intellectual property infringement claim can be costly and time consuming and may require us to enter into license agreements. We cannot guarantee that we would be able to obtain license agreements on commercially reasonable terms. A successful claim of patent or other intellectual property infringement could subject us to significant damages or an injunction preventing the manufacture, sale or use of our affected products. Any of these events could have a material adverse effect on our profitability and financial condition.

We may not be able to adequately protect our intellectual property

We believe the patents, trade secrets and other intellectual property we use are important to our business, and any unauthorized use of such intellectual property by third parties may adversely affect our business and reputation. We rely on the intellectual property laws and contractual arrangements with our employees, business partners and others to protect such intellectual property rights. Filing, prosecuting, defending and enforcing patents on all of our technologies and products throughout the world would be prohibitively expensive. Competitors may, without our authorization, use our intellectual property to develop their own competing technologies and products in jurisdictions where we have not obtained patent protection. These technologies and products may not be covered by any of our patent claims or other intellectual property rights. Furthermore, the validity, enforceability and scope of protection of intellectual property in some countries where we may conduct business is uncertain and still evolving, and these laws may not protect intellectual property rights to the same extent as the laws of the United States.

| 15 |

Many companies have encountered significant problems in protecting and defending their intellectual property rights in foreign jurisdictions. Many countries, including certain countries in Europe, have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties (for example, the patent owner has failed to “work” the invention in that country or the third party has patented improvements). In addition, many countries limit the enforceability of patents against government agencies or government contractors. In these countries, the patent owner may have limited remedies, which could materially diminish the value of the patent. Moreover, litigation involving patent or other intellectual property matters in the United States or in foreign countries may be necessary in the future to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources, and have a material adverse effect on our business, financial condition and results of operations.

We are subject to numerous governmental regulations and it can be costly to comply with these regulations and to develop compliant products and processes.

Our products are subject to regulation by the U.S. Food and Drug Administration (“FDA”), and numerous international, federal, and state authorities. The process of obtaining regulatory approvals to market a medical device can be costly and time-consuming, and approvals might not be granted for future products, or additional uses of existing products, on a timely basis, if at all. Delays in the receipt of, or failure to obtain approvals for, future products, or additional uses of existing products, could result in delayed realization of product revenues, reduction in revenues, and in substantial additional costs. In particular, in the United States our products are regulated under the 1976 Medical Device Amendments to the Food, Drug and Cosmetic Act, which is administered by the FDA. We believe that the FDA will classify our products as “Class II” devices, thus requiring us to submit to the FDA a pre-market notification form or 510(k). The FDA uses the 510(k) to substantiate product claims that are made by medical device manufacturers prior to marketing. In our 510(k) notification, we must, among other things, establish that the product we plan to market is “substantially equivalent” to (1) a product that was on the market prior to the adoption of the 1976 Medical Device Amendment or (2) a product that the FDA has previously cleared.

The FDA review process of a 510(k) notification can last anywhere from three to six months or even longer, and the FDA must issue a written order finding “substantial equivalence” before a company can market a medical device. We are currently developing a group of cardiovascular tests that we will have to clear with the FDA through the 510(k) notification procedures. These test products are crucial for our success and if we do not receive 510(k) clearance for a particular product, we will not be able to market these products in the United States, which will have a material adverse effect on our revenues, profitability and financial condition.

In addition, no assurance can be given that we will remain in compliance with applicable FDA and other regulatory requirements once clearance or approval has been obtained for a product. We must incur expense and spend time and effort to ensure compliance with these complex regulations. Possible regulatory actions could include warning letters, fines, damages, injunctions, civil penalties, recalls, seizures of our products and criminal prosecution. These actions could result in, among other things: substantial modifications to our business practices and operations; refunds, recalls, or seizures of our products; a total or partial shutdown of production while we or our suppliers remedy the alleged violation; the inability to obtain future pre-market clearances or approvals; and, withdrawals or suspensions of current products from the market. Any of these events could disrupt our business and have a material adverse effect on our revenues, profitability and financial condition.

| 16 |

Changes in third-party payor reimbursement regulations can negatively affect our business.

By regulating the maximum amount of reimbursement they will provide for blood testing services, third-party payors, such as HMOs, pay-per-service insurance plans, Medicare and Medicaid, can indirectly affect the pricing or the relative attractiveness of our diagnostic products. For example, the Centers for Medicare and Medicaid Services set the level of reimbursement of fees for blood testing services for Medicare beneficiaries. If third-party payors decrease the reimbursement amounts for blood testing services, it may decrease the amount that physicians and hospitals are able to charge patients for such services. Consequently, we would either need to charge less for our products or incur a reduction in our profit margins. If the government and third-party payors do not provide for adequate coverage and reimbursement levels to allow health care providers to use our products, the demand for our products will decrease.

Laws and regulations affecting government benefit programs could impose new obligations on us, require us to change our business practices, and restrict our operations in the future.

Our industry is also subject to various federal, state, and international laws and regulations pertaining to government benefit program reimbursement, price reporting and regulation, and health care fraud and abuse, including anti-kickback and false claims laws, the Medicaid Rebate Statute, the Veterans Health Care Act, and individual state laws relating to pricing and sales and marketing practices. Violations of these laws may be punishable by criminal and/or civil sanctions, including, in some instances, substantial fines, imprisonment, and exclusion from participation in federal and state health care programs, including Medicare, Medicaid, and Veterans Administration health programs. These laws and regulations are broad in scope and they are subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or to alter one or more of our sales or marketing practices. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our revenues, profitability, and financial condition.

Our research and development efforts may not succeed in developing commercially successful products and technologies, which may cause our revenue and profitability to decline.

To remain competitive, we must continue to launch new products and technologies. To accomplish this, we must commit substantial efforts, funds, and other resources to research and development. A high rate of failure is inherent in the research and development of new products and technologies. We must make ongoing substantial expenditures without any assurance that its efforts will be commercially successful. Failure can occur at any point in the process, including after significant funds have been invested.

Promising new product candidates may fail to reach the market or may only have limited commercial success because of efficacy or safety concerns, failure to achieve positive clinical outcomes, inability to obtain necessary regulatory approvals, limited scope of approved uses, excessive costs to manufacture, the failure to establish or maintain intellectual property rights, or infringement of the intellectual property rights of others. Even if we successfully develop new products or enhancements or new generations of our existing products, they may be quickly rendered obsolete by changing customer preferences, changing industry standards, or competitors’ innovations. Innovations may not be accepted quickly in the marketplace because of, among other things, entrenched patterns of clinical practice or uncertainty over third-party reimbursement. We cannot state with certainty when or whether any of our products under development will be launched or whether any products will be commercially successful. Failure to launch successful new products or new uses for existing products may cause our products to become obsolete, causing our revenues and operating results to suffer.

| 17 |

New products and technological advances by our competitors may negatively affect our results of operations.

Our products face intense competition from our competitors’ products. Competitors’ products may be safer, more effective, more effectively marketed or sold, or have lower prices or superior performance features than our products. We cannot predict with certainty the timing or impact of the introduction of competitors’ products.

We depend on key members of our management and scientific staff and, if we fail to retain and recruit qualified individuals, our ability to execute our business strategy and generate sales would be harmed.

We are highly dependent on the principal members of our management and scientific staff. The loss of any of these key personnel, including in particular Dr. Yahia Gawad, our Chief Executive Officer, might impede the achievement of our business objectives. We may not be able to continue to attract and retain skilled and experienced scientific, marketing and manufacturing personnel on acceptable terms in the future because numerous medical products and other high technology companies compete for the services of these qualified individuals. We currently do not maintain key man life insurance on any of our employees.

The manufacture of many of our products is a highly exacting and complex process, and if we or one of our suppliers encounter problems manufacturing products, our business could suffer.

The manufacture of many of our products is a highly exacting and complex process, due in part to strict regulatory requirements. Problems may arise during manufacturing for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials, natural disasters, and environmental factors. In addition, we may use single suppliers for certain products and materials. If problems arise during the production of a batch of product, that batch of product may have to be discarded. This could, among other things, lead to increased costs, lost revenue, damage to customer relations, time and expense spent investigating the cause and, depending on the cause, similar losses with respect to other batches or products. If problems are not discovered before the product is released to the market, recall and product liability costs may also be incurred. To the extent we or one of our suppliers experience significant manufacturing problems, this could have a material adverse effect on our revenues and profitability.

Significant safety issues could arise for our products, which could have a material adverse effect on our revenues and financial condition.

All medical devices receive regulatory approval based on data obtained in controlled testing environments of limited duration. Following regulatory approval, these products will be used over longer periods of time with many patients. If new safety issues arise, we may be required to change the conditions of use for a product. For example, we may be required to provide additional warnings on a product’s label or narrow its approved use, either of which could reduce the product’s market acceptance. If serious safety issues with one of our products arise, sales of the product could be halted by us or by regulatory authorities. Safety issues affecting suppliers’ or competitors’ products also may reduce the market acceptance of our products.

In addition, in the ordinary course of business, we may be the subject of product liability claims and lawsuits alleging that our products or the products of other companies that we promote, or may be incorporated in our products, have resulted or could result in an unsafe condition for or injury to patients. Product liability claims and lawsuits and safety alerts or product recalls, regardless of their ultimate outcome, may have a material adverse effect on our business, reputation and financial condition, as well as on our ability to attract and retain customers. Product liability losses are self-insured.

| 18 |

The international nature of our business subjects us to additional business risks that may cause our revenue and profitability to decline.

Since we intend to market our products internationally, our business will be subject to risks associated with doing business internationally. The risks associated with any such operations outside the United States include:

| ● | changes in foreign medical reimbursement policies and programs; |

| ● | multiple foreign regulatory requirements that are subject to change and that could restrict our ability to manufacture, market, and sell our products; |

| ● | differing local product preferences and product requirements; |

| ● | trade protection measures and import or export licensing requirements; |

| ● | difficulty in establishing, staffing, and managing foreign operations; |

| ● | differing labor regulations; |

| ● | potentially negative consequences from changes in or interpretations of tax laws; |

| ● | political and economic instability; |

| ● | inflation, recession and fluctuations in foreign currency exchange and interest rates; and, |

| ● | compulsory licensing or diminished protection of intellectual property. |

These risks may, individually or in the aggregate, have a material adverse effect on our revenues and profitability.

Other factors can have a material adverse effect on our future profitability and financial condition.

Many other factors can affect our profitability and financial condition, including:

| ● | Changes in or interpretations of laws and regulations including changes in accounting standards, taxation requirements and environmental laws in domestic or foreign jurisdictions. |

| ● | Changes in the rate of inflation (including the cost of raw materials, commodities, and supplies), interest rates and the performance of investments held by us. |

| ● | Changes in the creditworthiness of counterparties that transact business with or provide services to us or to our distributors. |

| ● | Changes in business, economic, and political conditions, including: war, political instability, terrorist attacks in the U.S. and other parts of the world, the threat of future terrorist activity in the U.S. and other parts of the world and related military action; natural disasters; the cost and availability of insurance due to any of the foregoing events; labor disputes, strikes, slow-downs, or other forms of labor or union activity; and, pressure from third-party interest groups. |

| ● | Changes in our business units and investments and changes in the relative and absolute contribution of each to earnings and cash flow resulting from evolving business strategies, changing product mix, changes in tax rates both in the U.S. and abroad and opportunities existing now or in the future. |

| ● | Changes in the buying patterns of a major distributor, retailer, or wholesale customer resulting from buyer purchasing decisions, pricing, seasonality, or other factors, or other problems with licensors, suppliers, distributors, and business partners. |

| ● | Difficulties related to our information technology systems, any of which could adversely affect business operations, including any significant breakdown, invasion, destruction, or interruption of these systems. |

| 19 |

| ● | Changes in credit markets impacting our ability to obtain financing for our business operations. |

| ● | Legal difficulties, any of which could preclude or delay commercialization of products or adversely affect profitability, including claims asserting statutory or regulatory violations, adverse litigation decisions, and issues regarding compliance with any governmental consent decree. |

Risks Related to Our Capital Structure

Our stockholders may experience significant dilution from the exercise of warrants to purchase shares of our Common Stock.

The Company currently has outstanding warrants to purchase 8,457,500 shares of our Common Stock at exercise prices ranging from $0.10 to $1.00 per share. Further, outstanding notes are convertible into 7,832,026 shares of common stock as of October 31, 2015. Accordingly, if such warrants are exercised, in whole or in part, prior to their expiration dates, you may experience substantial dilution upon exercise of these warrants. In addition, the likelihood of such dilution may be accelerated if the price of our Common Stock increases to a level greater than the exercise price of these warrants.

Future Issuance of Our Common Stock Could Dilute Current Stockholder or Adversely Affect the Market.

Future issuances of our common stock could be at values substantially below the price paid by the current holders of our common stock. In addition, common stock could be issued to fend off unwanted tender offers or hostile takeovers without further stockholder approval. Sales of substantial amounts of our common stock in the public market, or even just the prospect of such sales, could depress the prevailing market price of our common stock and our ability to raise equity capital in the future.

The market for our common stock is limited.

Our common stock is traded on the OTC Bulletin Board. Trading activity in our stock has fluctuated and at times been limited. We cannot guarantee that a consistently active trading market for our stock will continue, especially while we remain on the OTC Bulletin Board.

Shares eligible for future sale may adversely affect the market price of our common stock.

From time to time, certain of our stockholders may be eligible to sell some or all of their shares of our common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act, subject to certain limitations. In general, pursuant to Rule 144, non-affiliate stockholders may sell freely after six months subject only to the current public information requirement (which disappears after one year). Affiliates may sell after six months subject to the Rule 144 volume, manner of sale, current public information and notice requirements. The eventual availability for sale of substantial amounts of our common stock under Rule 144 could adversely affect prevailing market prices for our securities and cause you to lose most, if not all, of your investment in our business.

| 20 |

We expect volatility in the price of our common stock, which may subject us to securities litigation and thereby divert our resources which may materially affect our profitability and results of operations or force us to cease operations.

The market for our common stock may be characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and liabilities, could divert management’s attention and resources, and could ultimately force us to cease operations whereby you could lose your entire investment.

Because our common stock currently trades below $5.00 per share and is quoted on the OTCBB, our common stock is considered by the SEC to be a “penny stock,” which adversely affects our liquidity.

Our common stock does not currently qualify for listing on any national securities exchange, and we do not anticipate that it will qualify for such a listing in the short-term future. If our common stock continues to be quoted on the OTC Bulletin Board or is traded on the Pink Sheets or other over-the-counter markets, and if the trading price of our common stock remains less than $5.00 per share, our common stock is considered a “penny stock,” and trading in our common stock is subject to the requirements of Rule 15g-9 under the Exchange Act. Under this rule, brokers or dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker or dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction. SEC regulations also require additional disclosure in connection with any trades involving a penny stock, including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. These requirements could severely limit the liquidity of such securities in the secondary market because few brokers or dealers are likely to undertake these compliance activities. In addition to the applicability of the penny stock rules, another risk associated with trading in penny stocks may be large price fluctuations.

Our amended charter contains provisions that may discourage an unaffiliated party to take us over.

Without further stockholder action, our Board of Directors could authorize the issuance of additional shares of our common stock as well as preferred stock with special voting rights by class or with more than one vote per share, to a “white knight” in order to deter a potential buyer. This might have the effect of preventing or discouraging an attempt by a party unable to obtain the approval of our Board of Directors to take over or otherwise gain control of us.

Terms of subsequent financings may adversely impact your investment.

We may have to raise equity, debt or preferred stock financing in the future. Your rights and the value of your investment in our Common Shares could be reduced. For example, if we issue secured debt securities, the holders of the debt would have a claim against our assets that would be prior to the rights of stockholders until the debt is paid. Interest on these debt securities would increase costs and negatively impact operating results.

Preferred stock could be issued in series from time to time with such designations, rights, preferences, and limitations as needed to raise capital. The terms of preferred stock could be more advantageous to those investors than to the holders of our Common Shares. Our articles of incorporation do not provide stockholders the pre-emptive right to buy shares from the company. As a result, you will not have the automatic ability to avoid dilution in your percentage ownership of the company.

It is not likely that we will pay dividends on the common stock or any other class of stock

We intend to retain any future earnings for the operation and expansion of our business. We do not anticipate paying cash dividends on our common stock, or any other class of stock, in the foreseeable future. Stockholders should look solely to appreciation in the market price of our Common Shares to obtain a return on investment.

| 21 |

Our stockholders ownership of our common stock may be in doubt due to possible naked short selling of our common stock.

We believe, but cannot confirm, that speculators may have engaged in a practice commonly known as a “naked short” sale of our common stock, which means that certain brokers may be permitting their short selling customers to sell shares of our common stock that their customers do not own and may have failed to borrow and therefore deliver the shares sold to the purchaser of the shares. We have from time to time been included by NASDAQ on the Regulation SHO Threshold Security List, which is indicative of a significant amount of naked shorting in the stock. Because naked shorting may result in an artificial depression of our stock price, our stockholders could lose all or part of their investment in our common stock. As a result of this naked short selling, there may be a substantial number of purchasers who believe they are our stockholders, but who in fact would not be stockholders since their brokers may never have received any shares of our common stock for their account. In addition, investors who believe they are our stockholders may not have received a stock dividend to which they are entitled or may have been deprived of the right to vote some or all of their shares.

We are classified as an “emerging growth company” as well as a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Notwithstanding the above, we are also currently a smaller reporting company. In the event that we are still considered a smaller reporting company, at such time we ceased being an emerging growth company, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an emerging growth company or a smaller reporting company. Specifically, similar to other emerging growth companies, a smaller reporting companies are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC filings due to our status as an emerging growth company or a smaller reporting company may make it harder for investors to analyze our results of operations and financial prospects.

| 22 |

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

Our executive and administrative headquarters are currently located at 6295 Northam Drive, Units 7, 8, and 9 Mississauga, Ontario L4V 1W8 Canada. We rent this space at a cost of US$ 49,891 per year.

The servers for our websites are housed at separate locations as described above. See “Item 1.—Business—Website Technical Information.” We believe that our facilities are adequate for our current needs and that, if our lease is not renewed on commercially reasonable terms, we will be able to locate suitable new office space and obtain a suitable replacement for our executive and administrative headquarters.

On April 22, 2009, CardioGenics was served with a statement of claim in the Province of Ontario, Canada, from a prior contractor claiming compensation for wrongful dismissal and ancillary causes of action including payment of monies in realization of his investment in CardioGenics, with an aggregate claim of $514,000 (the “Lawsuit”). On January 3, 2014 the Company settled the Lawsuit for an amount equal to $10,000 plus 700,000 common shares.

Item 4. MINE SAFETY DISCLOSURES

None

| 23 |