Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - LIFE STORAGE, INC. | d115546dex312.htm |

| EX-23.1 - EX-23.1 - LIFE STORAGE, INC. | d115546dex231.htm |

| EX-12.1 - EX-12.1 - LIFE STORAGE, INC. | d115546dex121.htm |

| EX-32.1 - EX-32.1 - LIFE STORAGE, INC. | d115546dex321.htm |

| EX-21.1 - EX-21.1 - LIFE STORAGE, INC. | d115546dex211.htm |

| EX-31.1 - EX-31.1 - LIFE STORAGE, INC. | d115546dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

Commission File Number: 1-13820

SOVRAN SELF STORAGE, INC.

(Exact name of Registrant as specified in its charter)

| Maryland | 16-1194043 | |

| (State of incorporation or organization) |

(I.R.S. Employer Identification No.) |

6467 Main Street

Williamsville, NY 14221

(Address of principal executive offices) (Zip code)

(716) 633-1850

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Securities |

Exchanges on which Registered | |

| Common Stock, $.01 Par Value | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, 35,833,639 shares of Common Stock, $.01 par value per share, were outstanding, and the aggregate market value of the Common Stock held by non-affiliates was approximately $3,042,907,782 (based on the closing price of the Common Stock on the New York Stock Exchange on June 30, 2015).

As of February 12, 2016, 39,399,691 shares of Common Stock, $.01 par value per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2016 Annual Meeting of Shareholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2015.

Table of Contents

| 3 | ||||

| 10 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 23 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 | |||

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk |

39 | |||

| 40 | ||||

| Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

69 | |||

| 69 | ||||

| 71 | ||||

| Item 10. Directors, Executive Officers and Corporate Governance |

71 | |||

| 71 | ||||

| 71 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

71 | |||

| 71 | ||||

| 71 | ||||

| 77 | ||||

| EX-12.1 |

||||

| EX-21.1 |

||||

| EX-23.1 |

||||

| EX-31.1 |

||||

| EX-31.2 |

||||

| EX-32.1 |

||||

| EX-101 |

||||

2

Table of Contents

When used in this discussion and elsewhere in this document, the words “intends,” “believes,” “expects,” “anticipates,” and similar expressions are intended to identify “forward-looking statements” within the meaning of that term in Section 27A of the Securities Act of 1933 and in Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the effect of competition from new self-storage facilities, which would cause rents and occupancy rates to decline; the Company’s ability to evaluate, finance and integrate acquired businesses into the Company’s existing business and operations; the Company’s ability to effectively compete in the industry in which it does business; the Company’s existing indebtedness may mature in an unfavorable credit environment, preventing refinancing or forcing refinancing of the indebtedness on terms that are not as favorable as the existing terms; interest rates may fluctuate, impacting costs associated with the Company’s outstanding floating rate debt; the Company’s ability to comply with debt covenants; any future ratings on the Company’s debt instruments; regional concentration of the Company’s business may subject it to economic downturns in the states of Florida and Texas; the Company’s reliance on its call center; the Company’s cash flow may be insufficient to meet required payments of operating expenses, principal, interest and dividends; and tax law changes that may change the taxability of future income.

| Item 1. | Business |

Sovran Self Storage, Inc. together with its direct and indirect subsidiaries and its consolidated joint ventures, to the extent appropriate in the applicable context, (the “Company,” “We,” “Our,” or “Sovran”) is a self-administered and self-managed real estate investment trust (“REIT”) that acquires, owns and manages self-storage properties. We refer to the self-storage properties in which we have an ownership interest, lease, and/or are managed by us as “Properties.” We began operations on June 26, 1995. We were formed to continue the business of our predecessor company, which had engaged in the self-storage business since 1985. At December 31, 2015, we had an ownership interest in and/or managed 542 self-storage properties in 25 states under the name Uncle Bob’s Self Storage ®. Among our 542 self-storage properties are 39 properties that we manage for an unconsolidated joint venture (Sovran HHF Storage Holdings LLC) of which we are a 20% owner, 30 properties that we manage for an unconsolidated joint venture (Sovran HHF Storage Holdings II LLC) of which we are a 15% owner, 21 properties that we manage and have no ownership interest. We believe we are the fifth largest operator of self-storage properties in the United States based on square feet owned and managed. Our Properties conduct business under the user-friendly name Uncle Bob’s Self Storage®.

At December 31, 2015, we own an indirect interest in 521 of the Properties through a limited partnership (the “Partnership”). Included in the 521 properties are the 69 facilities in our unconsolidated joint ventures. In total, we own a 99.5% economic interest in the Partnership and unaffiliated third parties own collectively a 0.5% limited partnership interest at December 31, 2015. We believe that this structure, commonly known as an umbrella partnership real estate investment trust (“UPREIT”), facilitates our ability to acquire properties by using units of the Partnership as currency. By utilizing interests in the Partnership as currency in facility acquisitions, we may partially defer the seller’s income tax liability which in turn may allow us to obtain more favorable pricing.

We were incorporated on April 19, 1995 under Maryland law. Our principal executive offices are located at 6467 Main Street, Williamsville, New York 14221, our telephone number is (716) 633-1850 and our website is www.unclebobs.com.

We seek to enhance shareholder value through internal growth and acquisition of additional storage properties. Internal growth is achieved through aggressive property management: optimizing rental rates, increasing occupancy levels, controlling costs, maximizing collections, and strategically expanding and enhancing the Properties. Should economic conditions warrant, we may develop new properties. We believe that there continue to be opportunities for growth through acquisitions, and constantly seek to acquire self-storage properties that are susceptible to realization of increased economies of scale and improved performance through application of our expertise.

3

Table of Contents

Industry Overview

We believe that self-storage facilities offer inexpensive storage space to residential and commercial users. In addition to fully enclosed and secure storage space, many facilities also offer outside storage for automobiles, recreational vehicles and boats. Better facilities, such as those owned and/or managed by the Company, are usually fenced and well lighted with automated access systems, surveillance cameras, and have a full-time manager. Our customers rent space on a month-to-month basis and typically have access to their storage space up to 15 hours a day and in certain circumstances are provided with 24-hour access. Individual storage spaces are secured by the customer’s lock, and the customer has sole control of access to the space.

According to the 2016 Self-Storage Almanac, of the approximately 51,000 facilities in the United States (including both core and non-core storage businesses), approximately 14% are managed by the ten largest operators. The remainder of the industry is characterized by numerous small, local operators. The scarcity of capital available to small operators for acquisitions and expansions, internet marketing, and call centers, and the potential for savings through economies of scale are factors that are leading to consolidation in the industry. We believe that, as a result of this trend, significant growth opportunities exist for operators with proven management systems and sufficient capital resources to grow either through acquisitions or third party management platforms.

Property Management

We have 30 years of experience managing self storage facilities and the combined experience of our key personnel makes us one of the leaders in the industry. All of our stores operate under the user-friendly name of Uncle Bob’s Self Storage®, and we employ the following strategies with respect to our property management:

Our People:

We recognize the importance of quality people to the success of an organization. Accordingly, we hire and train to ensure that all associates can reach their full potential. Each strives to conduct themselves in accordance with our core values: Teamwork, Respect, Accountability, Integrity, and Innovation. In turn, we support them with state of the art training tools including an online learning management system, a company intranet and a network of certified training personnel. Every store team also has frequent, and sometimes daily, interaction with an Area Manager, a Regional Vice President, an Accounting Representative, and other support personnel. As such, our store associates are held to high standards for customer service, store appearance, financial performance, and overall operations.

Training & Development:

Our employees benefit from a wide array of training and development opportunities. New store employees undergo a comprehensive, proprietary training program designed to drive sales and operational results while ensuring the delivery of quality customer service. To supplement their initial training, employees enjoy continuing edification, coaching, and performance feedback throughout their tenure.

All learning and development activities are facilitated through our online training and development portal. This portal delivers and tracks hundreds of on-demand computer based training and compliance courses; it also administers tests, surveys, and the employee appraisal process. Sovran’s training and development program encompasses the tools and support we deem essential to the success of our employees and business.

Marketing and Advertising:

We believe the avenues for attracting and capturing new customers have changed dramatically over the years. As such, we have implemented the following strategies to market our properties and increase profitability:

4

Table of Contents

| • | We employ a Customer Care Center (call center) that services an average of 35,000 rental inquiries per month. Our Sales Representatives answer incoming sales calls for all of our stores, 361 days a year, 24 hours a day. The team undertakes continuous training and coaching in effective storage sales techniques, which we believe results in higher conversions of inquiries to rentals. |

| • | The digital age has changed consumer behavior—the way people shop, their expectations, and the way we communicate with them. Our aggressive internet marketing and website provide customers with real-time pricing, online reservations, online payments, and support for mobile devices. We involve internal and external expertise to manage our internet presence and leverage a mix of mobile, desktop, and social media to attract and engage customers. |

| • | Since the need for storage is largely based on timing, the ultimate goal is to create as much positive brand recognition as possible. When the time comes for a customer to select a storage company, we want the Uncle Bob’s brand to be on the top of their mind. We employ a variety of different strategies to create brand awareness; this includes our Uncle Bob’s rental trucks, branded merchandise such as moving and packing supplies, and extensive regional marketing in the communities in which we operate. We strive to gain the most exposure as possible for the longest period of time. |

| • | Dri-guard humidity-controlled spaces are a premium storage feature intended to protect metal, electronics, furniture, fabrics and paper from moisture. We became the first self-storage operator to utilize this humidity protection technology and we believe it helps to differentiate us from other operators. |

| • | We also have a fleet of rental trucks that serve as an added incentive to choose our storage facilities. The truck rental charge is waived for new move-in customers and we believe it provides a valuable service and added incentive to choose us. Further, the prominent display of our logo turns each truck into a moving billboard. |

Ancillary Income:

We know that our 290,000 customers require more than just a storage space. Knowing this, we offer a wide range of other products and services that fulfill their needs while providing us with ancillary income. Whereas our Uncle Bob’s trucks are available with no rental charge for new move-in customers, they are available for rent to non-customers and existing customers. We also rent moving dollies and blankets, and we carry a wide assortment of moving and packing supplies including boxes, tape, locks, and other essential items. For those customers who do not carry storage insurance, we make available renters insurance through a third party carrier, on which we earn an administrative fee. We also receive incidental income from billboards and cell towers.

Information Systems:

Each of our primary business functions is linked to our customized computer applications, many of which are proprietary. These systems provide for consistent, timely and accurate flow of information throughout our critical platforms:

| • | Our proprietary operating software (“ubOS”) is installed at all locations and performs the functions necessary for field personnel to efficiently and effectively run a property. This includes customer account management, automatic imposition of late fees, move-in and move-out analysis, generation of essential legal notices, and marketing reports to aid in regional marketing efforts. Financial reports are automatically transmitted to our Corporate Offices overnight to allow for strict accounting oversight. |

| • | ubOS is linked with each of our primary sales channels (customer care center, internet, store) allowing for real-time access to space type and inventory, pricing, promotions, and other pertinent store information. This robust flow of information facilitates our commitment to capturing prospective customers from all channels. |

| • | ubOS provides our revenue management team with raw data on historical pricing, move-in and move-out activity, specials and occupancies, etc. This data is utilized in the various algorithms that form the foundation of our revenue management program. Changes to pricing and specials are “pushed out” to all sales channels instantaneously. |

| • | ubOS generates financial reports for each property that provide our accounting and audit departments with the necessary oversight of transactions; this allows us to maintain proper control of receipts. |

5

Table of Contents

Revenue Management:

Our proprietary revenue management system is constantly evolving through the efforts of our revenue management team comprised of a group of analysts. We have the ability to change pricing instantaneously for any one unit type, at any single location, based on the occupancy, competition, and forecasted changes in demand. By analyzing current customer rent tenures, we can implement rental rate increases at optimal times to increase revenues. Advanced pricing analytics enables us to reduce the amount of concessions, attracting a more stable customer base and discouraging short-term price shoppers. This system continues to drive revenues throughout our portfolio.

Property Maintenance:

We take great pride in the appearance and structural integrity of our Properties. All of our Properties go through a thorough annual inspection performed by experienced Project Managers. Those inspections provide the basis for short and long term planned projects that are all performed under a standardized set of specifications. Routine maintenance such as landscaping, pest control, and snowplowing is contracted to local providers who have a clear understanding of our standards. Further, our software tracks repairs, monitors contractor performance and measures the useful life of assets. As with many other aspects of our Company, our size has allowed us to enjoy relatively low maintenance costs because we have the benefit of economies of scale in purchasing, travel, and overhead absorption. In addition, we continually look to green alternatives and implement energy saving alternatives as new technology becomes available. This includes the installation of solar panels, LED lighting, energy efficient air conditioning units, and cool roofs which are all environmentally friendly and have the potential to reduce energy consumption (thereby reducing costs) in the buildings in which they are installed.

Environmental and Other Regulations

We are subject to federal, state, and local environmental regulations that apply generally to the ownership of real property. We have not received notice from any governmental authority or private party of any material environmental noncompliance, claim, or liability in connection with any of the Properties, and are not aware of any environmental condition with respect to any of the Properties that could have a material adverse effect on our financial condition or results of operations.

The Properties are also generally subject to the same types of local regulations governing other real property, including zoning ordinances. We believe that the Properties are in substantial compliance with all such regulations.

Insurance

Each of the Properties is covered by fire and property insurance (including comprehensive liability), and all-risk property insurance policies, which are provided by reputable companies and on commercially reasonable terms. In addition, we maintain a policy insuring against environmental liabilities resulting from tenant storage on terms customary for the industry, and title insurance insuring fee title to the Company-owned Properties in an amount that we believe to be adequate.

Federal Income Tax

We operate, and intend to continue to operate, in such a manner as to continue to qualify as a REIT under the Internal Revenue Code of 1986 (the “Code”), but no assurance can be given that we will at all times so qualify. To the extent that we continue to qualify as a REIT, we will not be taxed, with certain limited exceptions, on the taxable income that is distributed to our shareholders. We have elected to treat one of our subsidiaries as a taxable REIT subsidiary. In general, our taxable REIT subsidiary may perform additional services for customers and generally may engage in certain real estate or non-real estate related business. Our taxable REIT subsidiary is subject to corporate federal and state income taxes. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—REIT Qualification and Distribution Requirements.”

6

Table of Contents

Competition

The primary factors upon which competition in the self-storage industry is based are location, rental rates, suitability of the property’s design to prospective customers’ needs, and the manner in which the property is operated and marketed. We believe we compete successfully on these bases. The extent of competition depends significantly on local market conditions. We seek to locate facilities in a manner in which we can increase market share while not adversely affecting any of our existing locations in that market. However, the number of self-storage facilities in a particular area could have a material adverse effect on the performance of any of the Properties.

Several of our competitors are larger and have substantially greater financial resources than we do. These larger operators may, among other possible advantages, be capable of greater leverage and the payment of higher prices for acquisitions.

Investment Policy

While we emphasize equity real estate investments, we may, at our discretion, invest in mortgage and other real estate interests related to self-storage properties in a manner consistent with our qualification as a REIT. We may also retain a purchase money mortgage for a portion of the sale price in connection with the disposition of Properties from time to time. Should investment opportunities become available, we may look to acquire self-storage properties via a joint-venture partnership or similar entity. We may or may not elect to have a significant investment in such a venture, but would use such an opportunity to expand our portfolio of branded and managed properties.

Subject to the percentage of ownership limitations and gross income tests necessary for REIT qualification, we also may invest in securities of entities engaged in real estate activities or securities of other issuers, including for the purpose of exercising control over such entities.

Disposition Policy

Any disposition decision of our Properties is based on a variety of factors, including, but not limited to, the (i) potential to continue to increase cash flow and value, (ii) sale price, (iii) strategic fit with the rest of our portfolio, (iv) potential for, or existence of, environmental or regulatory issues, (v) alternative uses of capital, and (vi) maintaining qualification as a REIT.

During 2015, we sold three non-strategic storage facilities purchased during 2014 and 2015 in Missouri and South Carolina for net proceeds of approximately $4.6 million, resulting in a loss of approximately $0.5 million. During 2014, we sold two non-strategic storage facilities in Texas for net proceeds of approximately $11.0 million resulting in a gain of approximately $5.2 million. During 2013, we sold four non-strategic storage facilities in Florida, Ohio, and Virginia for net proceeds of approximately $11.7 million resulting in a gain of approximately $2.4 million.

Distribution Policy

We intend to pay regular quarterly distributions to our shareholders. However, future distributions by us will be at the discretion of the Board of Directors and will depend on the actual cash available for distribution, our financial condition and capital requirements, the annual distribution requirements under the REIT provisions of the Code and such other factors as the Board of Directors deems relevant. In order to maintain our qualification as a REIT, we must make annual distributions to shareholders of at least 90% of our REIT taxable income (which does not include capital gains). Under certain circumstances, we may be required to make distributions in excess of cash available for distribution in order to meet the minimum requirements.

7

Table of Contents

Financing Policy

Our Board of Directors currently limits the amount of debt that may be incurred by us to less than 50% of the sum of the market value of our issued and outstanding Common and Preferred Stock plus our debt. We, however, may from time to time re-evaluate and modify our borrowing policy in light of then current economic conditions, relative costs of debt and equity capital, market values of properties, growth and acquisition opportunities and other factors. In addition to our Board of Directors’ debt limits, our most restrictive debt covenants limit our leverage. However, we believe cash flow from operations, access to the capital markets and access to our credit facility, as described below, are adequate to execute our current business plan and remain in compliance with our debt covenants.

We have a $300 million revolving line of credit bearing interest at a variable rate equal to LIBOR plus a margin based on the Company’s credit rating (at December 31, 2015 the margin was 1.30%). At December 31, 2015, there was $221 million available on the unsecured line of credit without considering the additional availability under the credit facility expansion feature. The revolving line of credit has a maturity date of December 2019. In January 2016, the Company exercised the expansion feature of its revolving line of credit and increased the credit limit from $300 million to $500 million.

On March 3, 2015, the Company completed the public offering of 1,380,000 shares of its common stock at $90.40 per share. Net proceeds to the Company after deducting underwriting discounts and commissions and offering expenses were approximately $119.5 million. The Company used the net proceeds from the offering to repay a portion of the indebtedness outstanding on the Company’s unsecured line of credit.

On January 20, 2016, the Company agreed to issue and sell 2,300,000 shares of the Company’s common stock, par value $.01 per share, plus up to an additional 345,000 shares of common stock pursuant to the underwriters’ option, at a price to the public of $105.75 per share. The underwriters’ exercised their option in full. The offering of 2,645,000 shares of the Company’s common stock closed on January 25, 2016, resulting in net proceeds to the Company of approximately $269.7 million.

During 2015, the Company also issued 949,911 shares of common stock under the Company’s continuous equity offering program (“Equity Program”) at a weighted average issue price of $96.80 per share, generating net proceeds of $90.6 million. During 2014, we issued 924,403 shares under the Equity Program and 359,102 shares under our previous Equity Program for net proceeds of approximately $99.2 million. During 2013, we issued 1,667,819 shares under our previous Equity Program for net proceeds of approximately $107.8 million. As of December 31, 2015, the Company has $59.3 million availability for issuance of shares under the current Equity Program.

To the extent that we desire to obtain additional capital to pay distributions, to provide working capital, to pay existing indebtedness or to finance acquisitions, expansions or development of new properties, we may utilize amounts available under the line of credit, common or preferred stock offerings, floating or fixed rate debt financing, retention of cash flow (subject to satisfying our distribution requirements under the REIT rules) or a combination of these methods. Additional debt financing may also be obtained through mortgages on our Properties, which may be recourse, non-recourse, or cross-collateralized and may contain cross-default provisions. We have not established any limit on the number or amount of mortgages that may be placed on any single Property or on our portfolio as a whole, although certain of our existing term loans contain limits on overall mortgage indebtedness. For additional information regarding borrowings, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and Note 7 to the Consolidated Financial Statements filed herewith.

8

Table of Contents

Employees

We currently employ a total of 1,429 employees, including 542 property managers, 33 area managers, and 645 associate managers and part-time employees. At our headquarters, in addition to our six senior executive officers, we employ 203 people engaged in various support activities, including accounting, human resources, customer care, and management information systems. None of our employees are covered by a collective bargaining agreement. We consider our employee relations to be excellent.

Available Information

We file with the U.S. Securities and Exchange Commission quarterly and annual reports on Forms 10-Q and 10-K, respectively, current reports on Form 8-K, and proxy statements pursuant to the Securities Exchange Act of 1934, in addition to other information as required. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1 (800) SEC-0330. We file this information with the SEC electronically, and the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge on our web site at http://www.unclebobs.com as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. In addition, our Codes of Ethics and Charters of our Governance Committee, Audit Committee, and Compensation Committee are available free of charge on our website at http://www.unclebobs.com.

Also, copies of our annual report and Charters of our Governance Committee, Audit Committee, and Compensation Committee will be made available, free of charge, upon written request to Sovran Self Storage, Inc., Attn: Investor Relations, 6467 Main Street, Williamsville, NY 14221.

9

Table of Contents

| Item 1A. | Risk Factors |

You should carefully consider the risks described below, together with all of the other information included in or incorporated by reference into our Form 10-K, as part of your evaluation of the Company. If any of the following risks actually occur, our business could be harmed. In such case, the trading price of our securities could decline, and you may lose all or part of your investment.

Our Acquisitions May Not Perform as Anticipated

We have completed hundreds of acquisitions of self-storage facilities since our initial public offering of common stock in June 1995. Our strategy is to continue to grow by acquiring additional self-storage facilities. Acquisitions entail risks that investments will fail to perform in accordance with our expectations. Our judgments with respect to the prices paid for acquired self-storage facilities and the costs of any improvements required to bring an acquired property up to our standards may prove to be inaccurate. Acquisitions also involve general investment risks associated with any new real estate investment.

We May Incur Problems with Our Real Estate Financing

Unsecured Credit Facility and Term Notes. We have a line of credit and term note agreements with a syndicate of financial institutions and other lenders. This unsecured credit facility and the term notes are recourse to us and the required payments are not reduced if the economic performance of any of the properties declines. The unsecured credit facility limits our ability to make distributions to our shareholders, except in limited circumstances.

Rising Interest Rates. Indebtedness that we incur under the unsecured credit facility and bank term notes bears interest at a variable rate. Accordingly, increases in interest rates could increase our interest expense, which would reduce our cash available for distribution and our ability to pay expected distributions to our shareholders. We manage our exposure to rising interest rates using interest rate swaps and other available mechanisms. If the amount of our indebtedness bearing interest at a variable rate increases, our unsecured credit facility may require us to enter into additional interest rate swaps.

Refinancing May Not Be Available. It may be necessary for us to refinance our term notes and our unsecured credit facility through additional debt financing or equity offerings. If we were unable to refinance this indebtedness on acceptable terms, we might be forced to dispose of some of our self-storage facilities upon disadvantageous terms, which might result in losses to us and might adversely affect the cash available for distribution. If prevailing interest rates or other factors at the time of refinancing result in higher interest rates on refinancings, our interest expense would increase, which would adversely affect our cash available for distribution and our ability to pay expected distributions to shareholders.

Covenants and Risk of Default. Our unsecured credit facility and term notes require us to operate within certain covenants, including financial covenants with respect to leverage, fixed charge coverage, minimum net worth, limitations on additional indebtedness and dividend limitations. If we violate any of these covenants or otherwise default under our unsecured credit facility or term notes, then our lenders could declare all indebtedness under these facilities to be immediately due and payable which would have a material adverse effect on our business and could require us to sell self-storage facilities under distressed conditions and seek replacement financing on substantially more expensive terms.

Reduction in or Loss of Credit Rating. Certain of our debt instruments require us to maintain an investment grade rating from at least one and in some cases two debt ratings agencies. Should we fail to attain an investment grade rating from the agencies, the interest rate on our line of credit would increase by 0.30%, the interest rate on $325 million of our bank term notes would increase by 0.40%, and the interest rates on our $150 million term note due 2016, our $100 million term note due 2021, and our $175 million term note due 2024 would each increase by 1.750%.

10

Table of Contents

Our Debt Levels May Increase

Our Board of Directors currently has a policy of limiting the amount of our debt at the time of incurrence to less than 50% of the sum of the market value of our issued and outstanding common stock and preferred stock plus the amount of our debt at the time that debt is incurred. However, our organizational documents do not contain any limitation on the amount of indebtedness we might incur. Accordingly, our Board of Directors could alter or eliminate the current policy limitation on borrowing without a vote of our shareholders. We could become highly leveraged if this policy were changed. However, our ability to incur debt is limited by covenants in our bank credit arrangements.

We Are Subject to the Risks Posed by Fluctuating Demand and Significant Competition in the Self-Storage Industry

Our self-storage facilities are subject to all operating risks common to the self-storage industry. These risks include but are not limited to the following:

| • | Decreases in demand for rental spaces in a particular locale; |

| • | Changes in supply of similar or competing self-storage facilities in an area; |

| • | Changes in market rental rates; and |

| • | Inability to collect rents from customers. |

Our current strategy is to acquire interests only in self-storage facilities. Consequently, we are subject to risks inherent in investments in a single industry. Our self-storage facilities compete with other self-storage facilities in their geographic markets. As a result of competition, the self-storage facilities could experience a decrease in occupancy levels and rental rates, which would decrease our cash available for distribution. We compete in operations and for acquisition opportunities with companies that have substantial financial resources. Competition may reduce the number of suitable acquisition opportunities offered to us and increase the bargaining power of property owners seeking to sell. The self-storage industry has at times experienced overbuilding in response to perceived increases in demand. A recurrence of overbuilding might cause us to experience a decrease in occupancy levels, limit our ability to increase rents, and compel us to offer discounted rents.

Our Real Estate Investments Are Illiquid and Are Subject to Uninsurable Risks and Government Regulation

General Risks. Our investments are subject to varying degrees of risk generally related to the ownership of real property. The underlying value of our real estate investments and our income and ability to make distributions to our shareholders are dependent upon our ability to operate the self-storage facilities in a manner sufficient to maintain or increase cash available for distribution. Income from our self-storage facilities may be adversely affected by the following factors:

| • | Changes in national economic conditions; |

| • | Changes in general or local economic conditions and neighborhood characteristics; |

| • | Competition from other self-storage facilities; |

| • | Changes in interest rates and in the availability, cost and terms of financing; |

| • | The impact of present or future environmental legislation and compliance with environmental laws; |

| • | The ongoing need for capital improvements, particularly in older facilities; |

11

Table of Contents

| • | Changes in real estate tax rates and other operating expenses; |

| • | Adverse changes in governmental rules and fiscal policies; |

| • | Uninsured losses resulting from casualties associated with civil unrest, acts of God, including natural disasters, and acts of war; |

| • | Adverse changes in zoning laws; and |

| • | Other factors that are beyond our control. |

Illiquidity of Real Estate May Limit its Value. Real estate investments are relatively illiquid. Our ability to vary our portfolio of self-storage facilities in response to changes in economic and other conditions is limited. In addition, provisions of the Code may limit our ability to profit on the sale of self-storage facilities held for fewer than two years. We may be unable to dispose of a facility when we find disposition advantageous or necessary and the sale price of any disposition may not equal or exceed the amount of our investment.

Uninsured and Underinsured Losses Could Reduce the Value of our Self Storage Facilities. Some losses, generally of a catastrophic nature, that we potentially face with respect to our self-storage facilities may be uninsurable or not insurable at an acceptable cost. Our management uses its discretion in determining amounts, coverage limits and deductibility provisions of insurance, with a view to acquiring appropriate insurance on our investments at a reasonable cost and on suitable terms. These decisions may result in insurance coverage that, in the event of a substantial loss, would not be sufficient to pay the full current market value or current replacement cost of our lost investment. Inflation, changes in building codes and ordinances, environmental considerations, and other factors also might make it infeasible to use insurance proceeds to replace a property after it has been damaged or destroyed. Under those circumstances, the insurance proceeds received by us might not be adequate to restore our economic position with respect to a particular property.

Possible Liability Relating to Environmental Matters. Under various federal, state and local environmental laws, ordinances and regulations, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous or toxic substances on, under, or in that property. Those laws often impose liability even if the owner or operator did not cause or know of the presence of hazardous or toxic substances and even if the storage of those substances was in violation of a customer’s lease. In addition, the presence of hazardous or toxic substances, or the failure of the owner to address their presence on the property, may adversely affect the owner’s ability to borrow using that real property as collateral. In connection with the ownership of the self-storage facilities, we may be potentially liable for any of those costs.

Americans with Disabilities Act. The Americans with Disabilities Act of 1990, or ADA, generally requires that buildings be made accessible to persons with disabilities. A determination that we are not in compliance with the ADA could result in imposition of fines or an award of damages to private litigants. If we were required to make modifications to comply with the ADA, our results of operations and ability to make expected distributions to our shareholders could be adversely affected.

There Are Limitations on the Ability to Change Control of Sovran

Limitation on Ownership and Transfer of Shares. To maintain our qualification as a REIT, not more than 50% in value of our outstanding shares of stock may be owned, directly or indirectly, by five or fewer individuals, as defined in the Code. To limit the possibility that we will fail to qualify as a REIT under this test, our Amended and Restated Articles of Incorporation (“Articles of Incorporation”) include ownership limits and transfer restrictions on shares of our stock. Our Articles of Incorporation limit ownership of our issued and outstanding stock by any single shareholder to 9.8% of the aggregate value of our outstanding stock, except that the ownership by some of our shareholders is limited to 15%.

12

Table of Contents

These ownership limits may:

| • | Have the effect of precluding an acquisition of control of Sovran by a third party without consent of our Board of Directors even if the change in control would be in the interest of shareholders; and |

| • | Limit the opportunity for shareholders to receive a premium for shares of our common stock they hold that might otherwise exist if an investor were attempting to assemble a block of common stock in excess of 9.8% or 15%, as the case may be, of the outstanding shares of our stock or to otherwise effect a change in control of Sovran. |

Our Board of Directors may waive the ownership limits if it is satisfied that ownership by those shareholders in excess of those limits will not jeopardize our status as a REIT under the Code or in the event it determines that it is no longer in our best interests to be a REIT. Waivers have been granted to the former holders of our Series C preferred stock, FMR Corporation, Cohen & Steers, Inc. and Invesco Advisers, Inc. A transfer of our common stock and/or preferred stock to a person who, as a result of the transfer, violates the ownership limits may not be effective under some circumstances.

Other Limitations. Other limitations could have the effect of discouraging a takeover or other transaction in which holders of some, or a majority, of our outstanding common stock might receive a premium for their shares of our common stock that exceeds the then prevailing market price or that those holders might believe to be otherwise in their best interest. The issuance of additional shares of preferred stock could have the effect of delaying or preventing a change in control of Sovran even if a change in control were in the shareholders’ interest. In addition, the Maryland General Corporation Law, or MGCL, imposes restrictions and requires specific procedures with respect to the acquisition of stated levels of share ownership and business combinations, including combinations with interested shareholders. These provisions of the MGCL could have the effect of delaying or preventing a change in control of Sovran even if a change in control were in the shareholders’ interest. Our bylaws contain a provision exempting from the MGCL control share acquisition statute any and all acquisitions by any person of shares of our stock. However, this provision may be amended or eliminated at any time. In addition, under the Partnership’s agreement of limited partnership, in general, we may not merge, consolidate or engage in any combination with another person or sell all or substantially all of our assets unless that transaction includes the merger or sale of all or substantially all of the assets of the Partnership, which requires the approval of the holders of 75% of the limited partnership interests thereof. If we were to own less than 75% of the limited partnership interests in the Partnership, this provision of the limited partnership agreement could have the effect of delaying or preventing us from engaging in some change of control transactions.

Our Failure to Qualify as a REIT Would Have Adverse Consequences

We intend to continue to operate in a manner that will permit us to qualify as a REIT under the Code. We have not requested and do not plan to request a ruling from the Internal Revenue Service (“IRS”) that we qualify as a REIT, and the statements in this Annual Report on Form 10-K are not binding on the IRS or any court. Qualification as a REIT involves the application of highly technical and complex Code provisions for which there are only limited judicial and administrative interpretations. Continued qualification as a REIT depends upon our continuing ability to meet various requirements concerning, among other things, the ownership of our outstanding stock, the nature of our assets, the sources of our income and the amount of our distributions to our shareholders. The fact that we hold substantially all of our assets through our Partnership and its subsidiaries and joint ventures further complicates the application of the REIT requirements for us. Even a technical or inadvertent mistake could jeopardize our REIT status and, given the highly complex nature of the rules governing REITs and the ongoing importance of factual determinations, we cannot provide any assurance that we will continue to qualify as a REIT. Furthermore, Congress and the IRS might make changes to the tax laws and regulations, and the courts and the IRS might issue new rulings, that make it more difficult, or impossible, for us to remain qualified as a REIT.

13

Table of Contents

If we were to fail to qualify as a REIT in any taxable year, and are unable to avail ourselves of certain savings provisions set forth in the Code, we would not be allowed a deduction for distributions to shareholders in computing our taxable income and would be subject to federal income tax (including any applicable alternative minimum tax and possibly increased state and local taxes) on our taxable income at regular corporate rates. Unless entitled to relief under certain Code provisions, we also would be ineligible for qualification as a REIT for the four taxable years following the year during which our qualification was lost. As a result, distributions to the shareholders would be reduced for each of the years involved. Although we currently intend to continue to operate in a manner designed to qualify as a REIT, it is possible that future economic, market, legal, tax or other considerations may cause our Board of Directors to revoke our REIT election. If we fail to qualify as a REIT for federal income tax purposes and are able to avail ourselves of one or more of the statutory savings provisions in order to maintain our REIT status, we would nevertheless be required to pay penalty taxes of $50,000 or more for each such failure.

We Will Pay Some Taxes Even if We Qualify as a REIT, Reducing Cash Available for Shareholders

Even if we qualify as a REIT for federal income tax purposes, we are required to pay some federal, state and local taxes on our income and property. For example, we will be subject to income tax to the extent we distribute less than 100% of our REIT taxable income (including capital gains). Additionally, we will be subject to a 4% nondeductible excise tax on the amount, if any, by which dividends paid by us in any calendar year are less than the sum of 85% of our ordinary income, 95% of our capital gain net income and 100% of our undistributed income from prior years. Moreover, if we have net income from “prohibited transactions,” that income will be subject to a 100% tax. In general, prohibited transactions are sales or other dispositions of property held primarily for sale to customers in the ordinary course of business. The determination as to whether a particular sale is a prohibited transaction depends on the facts and circumstances related to that sale. While we will undertake sales of assets if those assets become inconsistent with our long-term strategic or return objectives, we do not believe that those sales should be considered prohibited transactions, but there can be no assurance that the IRS would not contend otherwise. The need to avoid prohibited transactions could cause us to forego or defer sales of properties that might otherwise be in our best interest to sell.

One of our subsidiaries has elected to be treated as a “taxable REIT subsidiary” of the Company for federal income tax purposes. A taxable REIT subsidiary is taxed as a regular corporation and is limited in its ability to deduct interest payments made to us in excess of a certain amount. In addition, if we receive or accrue certain amounts and the underlying economic arrangements among our taxable REIT subsidiary and us are not comparable to similar arrangements among unrelated parties, we will be subject to a 100% penalty tax on those payments in excess of amounts deemed reasonable between unrelated parties.

Finally, some state and local jurisdictions may tax some of our income even though as a REIT we are not subject to federal income tax on that income because not all states and localities follow the federal income tax treatment of REITs. To the extent that we are or any taxable REIT subsidiary is required to pay federal, foreign, state or local taxes, we will have less cash available for distribution to shareholders.

Complying with REIT Requirements May Limit Our Ability to Hedge Effectively and May Cause Us to Incur Tax Liabilities

The REIT provisions of the Code may limit our ability to hedge our assets and operations. Under these provisions, any income that we generate from transactions intended to hedge our interest rate risk will be excluded from gross income for purposes of the REIT 75% and 95% gross income tests if the instrument hedges interest rate risk on liabilities used to carry or acquire real estate assets or manages the risk of certain currency fluctuations, and such instrument is properly identified under applicable Treasury Regulations. Income from hedging transactions that do not meet these requirements will generally constitute non-qualifying income for purposes of both the REIT 75% and 95% gross income tests. As a result of these rules, we may have to limit our use of hedging techniques that might otherwise be advantageous or implement those hedges through a taxable REIT subsidiary. This could increase the cost of our hedging activities because our taxable REIT subsidiary would be subject to tax on gains or expose us to greater risks associated with changes in interest rates than we would otherwise want to bear. In addition, losses in our taxable REIT subsidiary will generally not provide any tax benefit, except for being carried back or forward against past or future taxable income in the taxable REIT subsidiary.

14

Table of Contents

Complying with the REIT Requirements May Cause Us to Forgo and/or Liquidate Otherwise Attractive Investments

To qualify as a REIT, we must continually satisfy tests concerning, among other things, the sources of our income, the nature and diversification of our assets, the amounts that we distribute to our shareholders and the ownership of our shares. To meet these tests, we may be required to take or forgo taking actions that we would otherwise consider advantageous. For instance, in order to satisfy the gross income or asset tests applicable to REITs under the Code, we may be required to forgo investments that we otherwise would make. Furthermore, we may be required to liquidate from our portfolio otherwise attractive investments. In addition, we may be required to make distributions to shareholders at disadvantageous times or when we do not have funds readily available for distribution. These actions could reduce our income and amounts available for distribution to our shareholders. Thus, compliance with the REIT requirements may hinder our investment performance.

If the Partnership Fails to Qualify as a Partnership for Federal Income Tax Purposes, We Could Fail to Qualify as a REIT and Suffer Other Adverse Consequences

We believe that our Partnership is organized and operated in a manner so as to be treated as a partnership and not an association or a publicly traded partnership taxable as a corporation, for federal income tax purposes. As a partnership, our Partnership is not subject to federal income tax on its income. Instead, each of the partners is allocated its share of our Partnership’s income. No assurance can be provided, however, that the IRS will not challenge our Partnership’s status as a partnership for federal income tax purposes, or that a court would not sustain such a challenge. If the IRS were successful in treating our Partnership as an association or publicly traded partnership taxable as a corporation for federal income tax purposes, we would fail to meet the gross income tests and certain of the asset tests applicable to REITs and, accordingly, would cease to qualify as a REIT. Also, the failure of the Partnership to qualify as a partnership would cause it to become subject to federal corporate income tax, which would reduce significantly the amount of its cash available for distribution to its partners, including us.

We May Change the Dividend Policy for Our Common Stock in the Future

In 2015, our Board of Directors authorized and we declared quarterly common stock dividends of $0.75 per share in January and April, and $0.85 per share for July and October, for a total 2015 dividend per share annual rate of $3.20 per share. In addition, our board of directors authorized and we declared a quarterly common stock dividend of $0.85 per share in January 2016. We can provide no assurance that our board will not reduce or eliminate entirely dividend distributions on our common stock in the future.

Our Board of Directors will continue to evaluate our distribution policy on a quarterly basis as they monitor the capital markets and the impact of the economy on our operations. The decisions to authorize and pay dividends on our common stock in the future, as well as the timing, amount and composition of any such future dividends, will be at the sole discretion of our board of directors in light of conditions then existing, including our earnings, financial condition, capital requirements, debt maturities, the availability of capital, applicable REIT and legal restrictions and the general overall economic conditions and other factors. Any change in our dividend policy could have a material adverse effect on the market price of our common stock.

Market Interest Rates May Influence the Price of Our Common Stock

One of the factors that may influence the price of our common stock in public trading markets or in private transactions is the annual yield on our common stock as compared to yields on other financial instruments. An increase in market interest rates will result in higher yields on other financial instruments, which could adversely affect the price of our common stock.

15

Table of Contents

Regional Concentration of Our Business May Subject Us to Economic Downturns in the States of Texas and Florida

As of December 31, 2015, 218 of our 542 self-storage facilities are located in the states of Texas and Florida. For the year ended December 31, 2015, these facilities accounted for approximately 41% of store revenues. This concentration of business in Texas and Florida exposes us to potential losses resulting from a downturn in the economies of those states. If economic conditions in those states deteriorate, we may experience a reduction in existing and new business, which may have an adverse effect on our business, financial condition and results of operations.

When We Acquire Properties in New Markets, We Will Be Subject to Increased Operational Risks

We may acquire self-storage properties in markets where we have little or no operational experience. For example, we have acquired in 2016 four self-storage properties and are under contract to acquire four more self-storage properties in California, a state where we have not previously operated. When we enter into new markets, we will be subject to increased risks resulting from our lack of experience and infrastructure in these markets and may need to incur additional costs, both expected and unexpected, in order to develop our operating capabilities in these markets. These risks could materially and adversely affect us, including our growth prospects, financial condition and results of operations.

Changes in Taxation of Corporate Dividends May Adversely Affect the Value of Our Common Stock

The maximum marginal rate of tax payable by domestic noncorporate taxpayers on dividends received from a regular “C” corporation under current federal law generally is 20%, as opposed to higher ordinary income rates. The reduced tax rate, however, does not apply to distributions paid to domestic noncorporate taxpayers by a REIT on its stock, except for certain limited amounts. The earnings of a REIT that are distributed to its stockholders generally remain subject to less federal income taxation than earnings of a non-REIT “C” corporation that are distributed to its stockholders net of corporate-level income tax. However, the lower rate of taxation to dividends paid by regular “C” corporations could cause domestic noncorporate investors to view the stock of regular “C” corporations as more attractive relative to the stock of a REIT, because the dividends from regular “C” corporations continue to be taxed at a lower rate while distributions from REITs (other than distributions designated as capital gain dividends) are generally taxed at the same rate as other ordinary income for domestic noncorporate taxpayers.

We are heavily dependent on computer systems, telecommunications and the Internet to process transactions, summarize results and manage our business. Security breaches or a failure of such networks, systems or technology could adversely impact our business and customer relationships.

We are heavily dependent upon automated information technology and Internet commerce, with many of our new customers coming from the Internet or the telephone, and the nature of our business involves the receipt and retention of personal information about them. We centrally manage significant components of our operations with our computer systems, including our financial information, and we also rely extensively on third-party vendors to retain data, process transactions and provide other systems services. These systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer worms, viruses and other destructive or disruptive security breaches and catastrophic events.

As a result, our operations could be severely impacted by a natural disaster, terrorist attack or other circumstance that resulted in a significant outage of our systems or those of our third party providers, despite our use of back up and redundancy measures. Further, viruses and other related risks could negatively impact our information technology processes. We could also be subject to a “cyber-attack” or other data security breach which would penetrate our network security, resulting in misappropriation of our confidential information, including customer personal information. System disruptions and shutdowns could also result in additional costs to repair or replace such networks or information systems and possible legal liability, including government enforcement actions and private litigation. In addition, our customers could lose confidence in our ability to protect their personal information, which could cause them to move out of rented storage spaces. Such events could lead to lost future sales and adversely affect our results of operations.

16

Table of Contents

| Item 1B. | Unresolved Staff Comments |

None.

17

Table of Contents

| Item 2. | Properties |

At December 31, 2015, we held ownership interests in, leased, and/or managed a total of 542 Properties situated in twenty-five states. Among our 542 self-storage properties are 39 properties that we manage for an unconsolidated joint venture of which we are a 20% owner, 30 properties that we manage for an unconsolidated joint venture of which we are a 15% owner and 21 properties that we manage and in which have no ownership interest.

Our self-storage facilities offer inexpensive, easily accessible, enclosed storage space to residential and commercial users on a month-to-month basis. Most of our Properties are fenced and well lighted with automated access systems and surveillance cameras. A majority of the Properties are single-story, thereby providing customers with the convenience of direct vehicle access to their storage spaces. Our stores range in size from 18,000 to 181,000 net rentable square feet, with an average of approximately 68,000 net rentable square feet. The Properties generally are constructed of masonry or steel walls resting on concrete slabs and have standing seam metal, shingle, or tar and gravel roofs. All Properties have a property manager on-site during business hours. Generally, customers have access to their storage space up to 15 hours a day, and some customers are provided 24-hour access. Individual storage spaces are secured by a lock furnished by the customer to provide the customer with control of access to the space.

All of the Properties conduct business under the user-friendly name Uncle Bob’s Self Storage ®.

The following table provides certain information regarding the Properties in which we have an ownership interest, lease, and/or manage as of December 31, 2015:

| Number of Stores at December 31, 2015 |

Square Feet |

Number of Spaces |

Percentage of Store Revenue |

|||||||||||||

| Alabama |

22 | 1,631,694 | 12,345 | 3.2 | % | |||||||||||

| Arizona |

13 | 893,428 | 7,828 | 1.8 | % | |||||||||||

| Colorado |

5 | 330,432 | 2,773 | 1.2 | % | |||||||||||

| Connecticut |

8 | 639,857 | 6,414 | 2.6 | % | |||||||||||

| Florida |

84 | 5,595,489 | 53,982 | 14.4 | % | |||||||||||

| Georgia |

30 | 2,126,533 | 18,054 | 5.3 | % | |||||||||||

| Illinois |

16 | 1,185,712 | 11,150 | 3.0 | % | |||||||||||

| Kentucky |

2 | 142,914 | 1,322 | 0.4 | % | |||||||||||

| Louisiana |

16 | 959,819 | 8,171 | 2.5 | % | |||||||||||

| Maine |

4 | 219,967 | 2,181 | 0.8 | % | |||||||||||

| Maryland |

3 | 138,659 | 1,618 | 0.5 | % | |||||||||||

| Massachusetts |

14 | 756,770 | 7,697 | 2.4 | % | |||||||||||

| Mississippi |

12 | 902,561 | 6,913 | 2.0 | % | |||||||||||

| Missouri |

14 | 877,330 | 7,865 | 2.4 | % | |||||||||||

| New Hampshire |

4 | 260,386 | 2,352 | 0.7 | % | |||||||||||

| New Jersey |

29 | 2,090,408 | 21,877 | 7.8 | % | |||||||||||

| New York |

39 | 2,350,811 | 22,408 | 8.1 | % | |||||||||||

| North Carolina |

20 | 1,192,426 | 10,810 | 2.9 | % | |||||||||||

| Ohio |

23 | 1,568,420 | 13,015 | 3.5 | % | |||||||||||

| Pennsylvania |

10 | 661,879 | 5,579 | 1.6 | % | |||||||||||

| Rhode Island |

4 | 206,121 | 1,922 | 0.6 | % | |||||||||||

| South Carolina |

12 | 787,655 | 6,935 | 1.5 | % | |||||||||||

| Tennessee |

5 | 348,504 | 3,005 | 0.8 | % | |||||||||||

| Texas |

134 | 9,804,230 | 80,902 | 26.9 | % | |||||||||||

| Virginia |

19 | 1,280,034 | 11,704 | 3.1 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

542 | 36,952,039 | 328,822 | 100.0 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

At December 31, 2015, the Properties had an average occupancy of 89.0% and an annualized rent per occupied square foot of $13.08.

18

Table of Contents

| Item 3. | Legal Proceedings |

On or about August 25, 2014, a putative class action was filed against the Company in the Superior Court of New Jersey Law Division Burlington County. The action seeks to obtain declaratory, injunctive and monetary relief for a class of consumers based upon alleged violations by the Company of the New Jersey Truth in Customer Contract, Warranty and Notice Act, the New Jersey Consumer Fraud Act and the New Jersey Insurance Producer Licensing Act. On October 17, 2014, the action was removed from the Superior Court of New Jersey Law Division Burlington County to the United States District Court for the District of New Jersey. The Company brought a motion to partially dismiss the complaint for failure to state a claim, and on July 16, 2015, the Company’s motion was granted in part and denied in part. The Company intends to vigorously defend the action, and the possibility of any adverse outcome cannot be determined at this time.

| Item 4. | Mine Safety Disclosures |

Not Applicable

19

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our Common Stock is traded on the New York Stock Exchange under the symbol “SSS.” Set forth below are the high and low sales prices for our Common Stock for each full quarterly period within the two most recent fiscal years.

| Quarter 2014 |

High | Low | ||||||

| 1st |

$ | 76.45 | $ | 62.66 | ||||

| 2nd |

79.29 | 72.88 | ||||||

| 3rd |

79.93 | 73.59 | ||||||

| 4th |

89.57 | 74.10 | ||||||

| Quarter 2015 |

High | Low | ||||||

| 1st |

$ | 97.76 | $ | 87.40 | ||||

| 2nd |

94.84 | 85.95 | ||||||

| 3rd |

99.32 | 85.69 | ||||||

| 4th |

110.60 | 93.33 | ||||||

As of February 12, 2016, there were approximately 713 holders of record of our Common Stock. These figures do not include common shares held by brokers and other institutions on behalf of shareholders.

We have paid quarterly dividends to our shareholders since our inception. Reflected in the table below are the dividends paid in the last two years.

For federal income tax purposes, distributions to shareholders are treated as ordinary income, capital gain, return of capital or a combination thereof. Distributions to shareholders for 2015 represent 100% ordinary income.

History of Dividends Declared on Common Stock

| January 2014 |

$ | 0.680 per share | ||

| April 2014 |

$ | 0.680 per share | ||

| July 2014 |

$ | 0.680 per share | ||

| October 2014 |

$ | 0.680 per share | ||

| January 2015 |

$ | 0.750 per share | ||

| April 2015 |

$ | 0.750 per share | ||

| July 2015 |

$ | 0.850 per share | ||

| October 2015 |

$ | 0.850 per share |

20

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information as of December 31, 2015, with respect to equity compensation plans under which shares of the Company’s Common Stock may be issued.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (#) |

Weighted average exercise price of outstanding options, warrants and rights ($) |

Number of securities remaining available for future issuance (#) |

|||||||||

| Equity compensation plans approved by shareholders: |

||||||||||||

| 2005 Award and Option Plan |

77,206 | $ | 45.49 | — | ||||||||

| 2015 Award and Option Plan (2) |

42,538 | $ | — | 494,193 | ||||||||

| 2009 Outside Directors’ Stock Option and Award Plan |

18,500 | $ | 79.58 | 72,880 | ||||||||

| Deferred Compensation Plan for Directors (1) |

18,973 | N/A | 25,165 | |||||||||

| Equity compensation plans not approved by shareholders: |

N/A | N/A | N/A | |||||||||

| (1) | Under the Deferred Compensation Plan for Directors, non-employee Directors may defer all or part of their Directors’ fees that are otherwise payable in cash. Directors’ fees that are deferred under the Plan will be credited to each Directors’ account under the Plan in the form of Units. The number of Units credited is determined by dividing the amount of Directors’ fees deferred by the closing price of the Company’s Common Stock on the New York Stock Exchange on the day immediately preceding the day upon which Directors’ fees otherwise would be paid by the Company. A Director is credited with additional Units for dividends on the shares of Common Stock represented by Units in such Directors’ Account. A Director may elect to receive the shares in a lump sum on a date specified by the Director or in quarterly or annual installments over a specified period and commencing on a specified date. |

| (2) | Includes the maximum number of shares (42,538) that could be issued as part of 2015 performance-based awards. The actual number of shares to be issued will be determined at the end of the three year performance period in 2018. See note 10 of our consolidated financial statements. |

21

Table of Contents

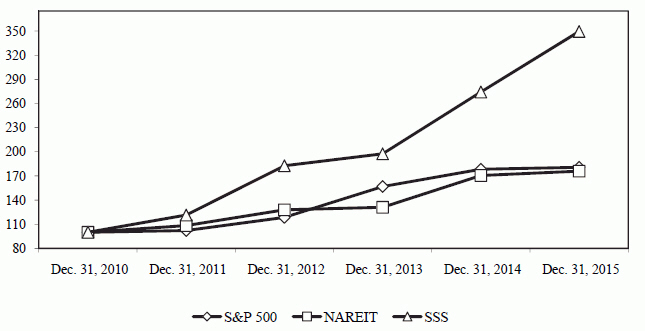

CORPORATE PERFORMANCE GRAPH

The following chart and line-graph presentation compares (i) the Company’s shareholder return on an indexed basis since December 31, 2010 with (ii) the S&P Stock Index and (iii) the National Association of Real Estate Investment Trusts Equity Index.

CUMULATIVE TOTAL SHAREHOLDER RETURN

SOVRAN SELF STORAGE, INC.

DECEMBER 31, 2010 - DECEMBER 31, 2015

| Dec. 31, 2010 |

Dec. 31, 2011 |

Dec. 31, 2012 |

Dec. 31, 2013 |

Dec. 31, 2014 |

Dec. 31, 2015 |

|||||||||||||||||||

| S&P |

100.00 | 102.11 | 118.45 | 156.82 | 178.28 | 180.75 | ||||||||||||||||||

| NAREIT |

100.00 | 108.29 | 127.85 | 131.01 | 170.49 | 175.94 | ||||||||||||||||||

| SSS |

100.00 | 121.40 | 182.69 | 197.54 | 274.38 | 349.56 | ||||||||||||||||||

The foregoing item assumes $100.00 invested on December 31, 2010, with dividends reinvested.

22

Table of Contents

| Item 6. | Selected Financial Data |

The following selected financial and operating information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K:

| At or For Year Ended December 31, | ||||||||||||||||||||

| (dollars in thousands, except per share data) |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Operating Data |

||||||||||||||||||||

| Operating revenues |

$ | 366,602 | $ | 326,080 | $ | 273,507 | $ | 234,082 | $ | 200,860 | ||||||||||

| Income from continuing operations |

113,077 | 89,057 | 71,472 | 48,121 | 27,314 | |||||||||||||||

| Income from discontinued operations (1) |

— | — | 3,123 | 7,520 | 4,215 | |||||||||||||||

| Net income |

113,077 | 89,057 | 74,595 | 55,641 | 31,529 | |||||||||||||||

| Net income attributable to common shareholders |

112,524 | 88,531 | 74,126 | 55,128 | 30,592 | |||||||||||||||

| Income from continuing operations per common share attributable to common shareholders– diluted |

3.16 | 2.67 | 2.26 | 1.61 | 0.95 | |||||||||||||||

| Net income per common share attributable to common shareholders – basic |

3.18 | 2.68 | 2.37 | 1.88 | 1.11 | |||||||||||||||

| Net income per common share attributable to common shareholders – diluted |

3.16 | 2.67 | 2.36 | 1.87 | 1.10 | |||||||||||||||

| Dividends declared per common share (2) |

3.20 | 2.72 | 2.02 | 1.80 | 1.80 | |||||||||||||||

| Balance Sheet Data |

||||||||||||||||||||

| Investment in storage facilities at cost |

$ | 2,491,702 | $ | 2,177,983 | $ | 1,864,637 | $ | 1,742,354 | $ | 1,525,283 | ||||||||||

| Total assets |

2,122,856 | 1,854,800 | 1,561,875 | 1,484,310 | 1,343,544 | |||||||||||||||

| Total debt |

830,993 | 801,127 | 626,254 | 684,251 | 625,423 | |||||||||||||||

| Total liabilities |

902,370 | 865,309 | 678,226 | 742,910 | 673,539 | |||||||||||||||

| Other Data |

||||||||||||||||||||

| Net cash provided by operating activities |

$ | 186,655 | $ | 146,068 | $ | 120,646 | $ | 98,762 | $ | 79,897 | ||||||||||

| Net cash used in investing activities |

(328,689 | ) | (334,993 | ) | (114,345 | ) | (175,664 | ) | (189,879 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

140,523 | 187,944 | (4,032 | ) | 76,836 | 111,537 | ||||||||||||||

| (1) | In 2013 we sold four stores and in 2012 we sold seventeen stores whose results of operations and gain (loss) on disposal are classified as discontinued operations for all previous years presented. |

| (2) | In 2011 and 2012 we declared regular quarterly dividends of $0.45 in January, April, July and October. In 2013 we declared regular quarterly dividends of $0.48 in January and April, and $0.53 in July and October. In 2014 we declared regular quarterly dividends of $0.68 in January, April, July and October. In 2015 we declared regular quarterly dividends of $0.75 in January and April, and $0.85 in July and October. |

23

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of the consolidated financial condition and results of operations should be read in conjunction with the financial statements and notes thereto included elsewhere in this report.

Disclosure Regarding Forward-Looking Statements