Attached files

| file | filename |

|---|---|

| EX-23.01 - EXHIBIT 23.01 - NuStar Energy L.P. | ns2015ex2301.htm |

| EX-31.02 - EXHIBIT 31.02 - NuStar Energy L.P. | ns2015ex3102.htm |

| EX-99.03 - EXHIBIT 99.03 - NuStar Energy L.P. | ns2015ex9903.htm |

| EX-99.01 - EXHIBIT 99.01 - NuStar Energy L.P. | ns2015ex9901.htm |

| EX-10.26 - EXHIBIT 10.26 - NuStar Energy L.P. | ns2015ex1026.htm |

| EX-12.01 - EXHIBIT 12.01 - NuStar Energy L.P. | ns2015ex1201.htm |

| EX-99.02 - EXHIBIT 99.02 - NuStar Energy L.P. | ns2015ex9902.htm |

| EX-21.01 - EXHIBIT 21.01 - NuStar Energy L.P. | ns2015ex2101.htm |

| EX-10.45 - EXHIBIT 10.45 - NuStar Energy L.P. | ns2015ex1045.htm |

| EX-32.02 - EXHIBIT 32.02 - NuStar Energy L.P. | ns2015ex3202.htm |

| EX-23.02 - EXHIBIT 23.02 - NuStar Energy L.P. | ns2015ex2302.htm |

| EX-32.01 - EXHIBIT 32.01 - NuStar Energy L.P. | ns2015ex3201.htm |

| EX-31.01 - EXHIBIT 31.01 - NuStar Energy L.P. | ns2015ex3101.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-16417

NUSTAR ENERGY L.P.

(Exact name of registrant as specified in its charter)

Delaware | 74-2956831 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

19003 IH-10 West | 78257 | |

San Antonio, Texas | (Zip Code) | |

(Address of principal executive offices) | ||

Securities registered pursuant to Section 12(b) of the Act: Common units representing partnership interests listed on the New York Stock Exchange.

Securities registered pursuant to 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act:

Large accelerated filer | [X] | Accelerated filer [ ] | ||||

Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [ ] | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the common units held by non-affiliates was approximately $3,838 million based on the last sales price quoted as of June 30, 2015, the last business day of the registrant’s most recently completed second quarter.

The number of common units outstanding as of January 31, 2016 was 77,886,078.

NUSTAR ENERGY L.P.

FORM 10-K

TABLE OF CONTENTS

PART I | ||

Items 1., 1A. & 2. | ||

Item 1B. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

2

PART I

Unless otherwise indicated, the terms “NuStar Energy L.P.,” “the Partnership,” “we,” “our” and “us” are used in this report to refer to NuStar Energy L.P., to one or more of our consolidated subsidiaries or to all of them taken as a whole. In this Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions and resources. These forward-looking statements can generally be identified by the words “anticipates,” “believes,” “expects,” “plans,” “intends,” “estimates,” “forecasts,” “budgets,” “projects,” “will,” “could,” “should,” “may” and similar expressions. We do not undertake to update, revise or correct any of the forward-looking information. You are cautioned that such forward-looking statements should be read in conjunction with our disclosures beginning on page 34 of this report under the heading: “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION.”

ITEM 1., 1A. and 2. BUSINESS, RISK FACTORS AND PROPERTIES

OVERVIEW

NuStar Energy L.P. (NuStar Energy), a Delaware limited partnership, was formed in 1999 and completed its initial public offering of common units on April 16, 2001. Our common units are traded on the New York Stock Exchange (NYSE) under the symbol “NS.” Our principal executive offices are located at 19003 IH-10 West, San Antonio, Texas 78257 and our telephone number is (210) 918-2000.

We are engaged in the transportation of petroleum products and anhydrous ammonia, the terminalling and storage of petroleum products and the marketing of petroleum products. The term “throughput” as used in this document generally refers to barrels of crude oil or refined product or tons of ammonia, as applicable, that pass through our pipelines, terminals or storage tanks.

We divide our operations into the following three reportable business segments: pipeline, storage and fuels marketing. As of December 31, 2015, our assets included:

• | 5,500 miles of refined product pipelines with 21 associated terminals providing storage capacity of 5.0 million barrels and two tank farms providing storage capacity of 1.4 million barrels; |

• | 2,000 miles of anhydrous ammonia pipelines; |

• | 1,200 miles of crude oil pipelines, with 8 associated terminals, providing 4.0 million barrels of associated storage capacity; and |

• | 50 terminal and storage facilities providing 82.9 million barrels of storage capacity. |

We conduct our operations through our wholly owned subsidiaries, primarily NuStar Logistics, L.P. (NuStar Logistics) and NuStar Pipeline Operating Partnership L.P. (NuPOP). Our revenues include:

• | tariffs for transporting crude oil, refined products and anhydrous ammonia through our pipelines; |

• | fees for the use of our terminal and storage facilities and related ancillary services; and |

• | sales of crude oil and refined petroleum products. |

We strive to increase unitholder value by:

• | enhancing our existing assets through strategic internal growth projects that expand our business with current and new customers; |

• | pursuing strategic expansion projects by constructing new assets; |

• | improving our operations, including safety and environmental stewardship, cost control and asset reliability; and |

• | identifying acquisition targets that meet our financial and strategic criteria. |

Our internet website address is http://www.nustarenergy.com. Information contained on our website is not part of this report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with (or furnished to) the Securities and Exchange Commission (SEC) are available on our website, free of charge, as soon as reasonably practicable after we file or furnish such material (select the “Investors” link, then the “SEC Filings” link). We also post our corporate governance guidelines, code of business conduct and ethics, code of ethics for senior financial officers and the charters of our board’s committees on our website free of charge (select the “Investors” link, then the “Corporate Governance” link).

Our governance documents are available in print to any unitholder that makes a written request to Corporate Secretary, NuStar Energy L.P., 19003 IH-10 West, San Antonio, Texas 78257 or corporatesecretary@nustarenergy.com.

3

RECENT DEVELOPMENTS

On January 2, 2015, we acquired full ownership of a refined products terminal in Linden, NJ, for $142.5 million. Prior to the acquisition, the terminal operated as a joint venture between ourselves and Linden Holding Corp., with each party owning 50%.

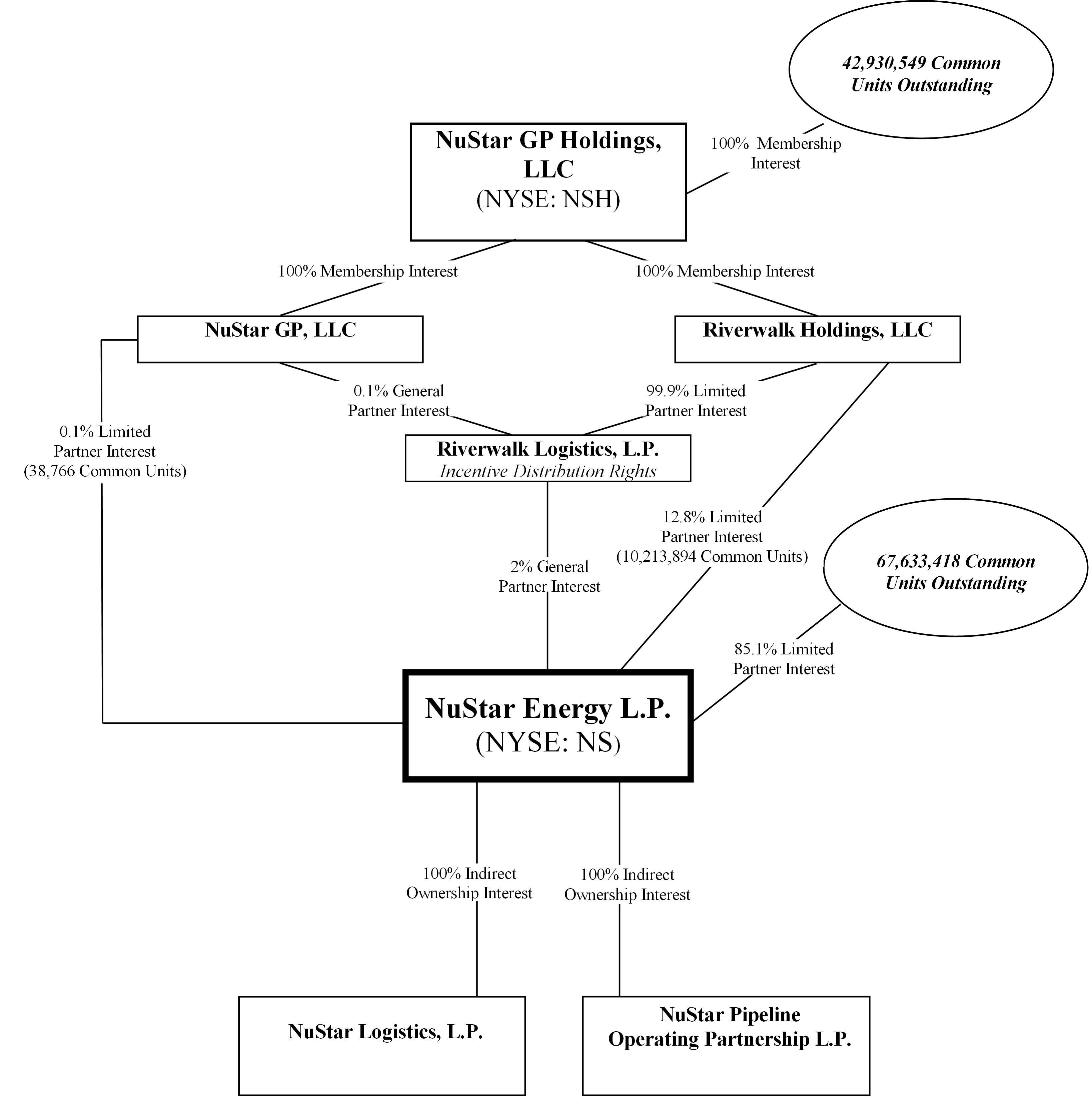

ORGANIZATIONAL STRUCTURE

Our operations are managed by NuStar GP, LLC, the general partner of our general partner. NuStar GP, LLC, a Delaware limited liability company, is a consolidated subsidiary of NuStar GP Holdings, LLC (NuStar GP Holdings) (NYSE: NSH).

The following chart depicts a summary of our organizational structure at December 31, 2015.

4

SEGMENTS

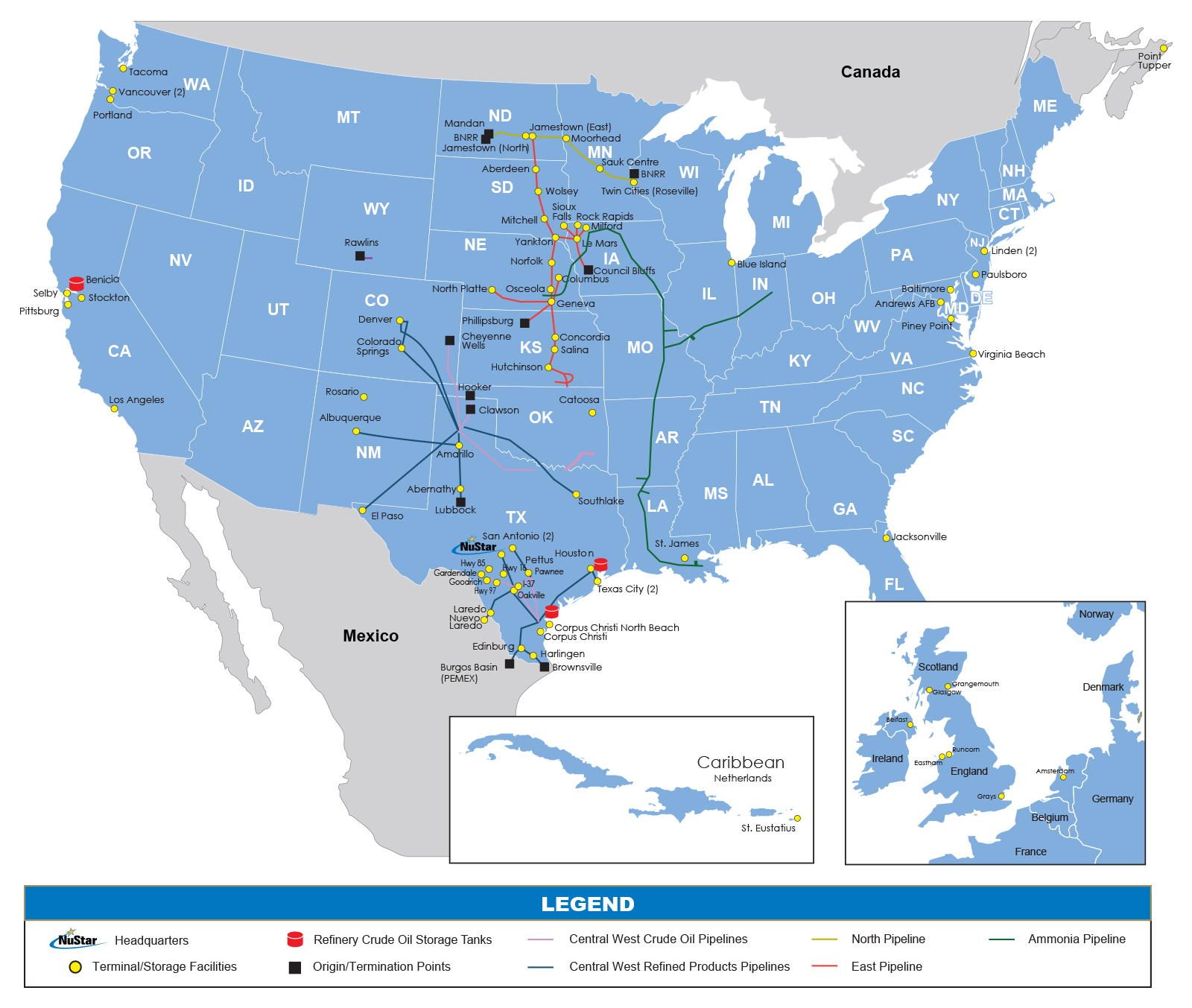

Detailed financial information about our segments is included in Note 25 of the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data.” The following map depicts our assets at December 31, 2015.

PIPELINE

Our pipeline operations consist of the transportation of refined petroleum products, crude oil and anhydrous ammonia. As of December 31, 2015, we owned and operated:

• | refined product pipelines with an aggregate length of 3,140 miles and crude oil pipelines with an aggregate length of 1,200 miles in Texas, Oklahoma, Kansas, Colorado and New Mexico (collectively, the Central West System); |

• | a 1,920-mile refined product pipeline originating in southern Kansas and terminating at Jamestown, North Dakota, with a western extension to North Platte, Nebraska and an eastern extension into Iowa (the East Pipeline); |

• | a 440-mile refined product pipeline originating at Tesoro Corporation’s (Tesoro) Mandan, North Dakota refinery and terminating in Minneapolis, Minnesota (the North Pipeline); and |

• | a 2,000-mile anhydrous ammonia pipeline originating at the Louisiana delta area that travels north through the midwestern United States forking east and west to terminate in Nebraska and Indiana (the Ammonia Pipeline). |

We charge tariffs on a per barrel basis for transporting refined products, crude oil and other feedstocks in our refined product and crude oil pipelines and on a per ton basis for transporting anhydrous ammonia in the Ammonia Pipeline.

5

The following table lists information about our pipeline assets as of December 31, 2015:

Throughput For the year ended December 31, | |||||||||||

Region / Pipeline System | Length | Tank Capacity | 2015 | 2014 | |||||||

(Miles) | (Barrels) | (Barrels/Day) | |||||||||

Central West System: | |||||||||||

McKee System | 2,276 | — | 172,590 | 164,589 | |||||||

Three Rivers System | 373 | — | 74,361 | 78,177 | |||||||

Other | 491 | — | 60,410 | 51,698 | |||||||

Central West Refined Products Pipelines | 3,140 | — | 307,361 | 294,464 | |||||||

South Texas Crude System | 319 | 2,157,000 | 179,734 | 155,439 | |||||||

Other | 196 | — | 85,495 | 75,226 | |||||||

Eagle Ford System | 515 | 2,157,000 | 265,229 | 230,665 | |||||||

McKee System | 598 | 1,039,000 | 144,077 | 140,402 | |||||||

Ardmore System | 87 | 824,000 | 62,326 | 66,690 | |||||||

Central West Crude Oil Pipelines | 1,200 | 4,020,000 | 471,632 | 437,757 | |||||||

Total Central West System | 4,340 | 4,020,000 | 778,993 | 732,221 | |||||||

Central East System: | |||||||||||

East Pipeline | 1,920 | 4,977,000 | 132,005 | 134,816 | |||||||

North Pipeline | 440 | 1,437,000 | 46,951 | 45,641 | |||||||

Ammonia Pipeline | 2,000 | — | 35,829 | 35,816 | |||||||

Total Central East System | 4,360 | 6,414,000 | 214,785 | 216,273 | |||||||

Total | 8,700 | 10,434,000 | 993,778 | 948,494 | |||||||

Description of Pipelines

Central West System. The Central West System covers a total of 4,340 miles. The Central West System pipelines support shale oil production and the refineries to which they are connected, including Valero Energy Corporation’s (Valero Energy) McKee, Three Rivers and Ardmore refineries. The refined product pipelines have an aggregate length of 3,140 miles (Central West Refined Products Pipelines) and transport gasoline, distillates (including diesel and jet fuel), natural gas liquids and other products produced at the refineries to which they are connected. The crude oil pipelines have an aggregate length of 1,200 miles (Central West Crude Oil Pipelines). Our crude oil pipelines transport crude oil and other feedstocks from various points to the refineries to which they are connected, and from the Eagle Ford Shale region to our North Beach marine terminal and refineries in Corpus Christi, Texas.

Central East System. The Central East System covers a total of 4,360 miles and consists of the East Pipeline, North Pipeline and Ammonia Pipeline.

The East Pipeline covers 1,920 miles and moves refined products and natural gas liquids north in pipelines ranging in diameter from 6 inches to 16 inches to NuStar Energy and third party terminals along the system and to receiving pipeline connections in Kansas. The East Pipeline system includes 17 terminals, discussed below, with storage capacity of approximately 3.6 million barrels and two tank farms with storage capacity of approximately 1.4 million barrels at McPherson and El Dorado, Kansas. Shippers on the East Pipeline obtain refined petroleum products from refineries in Kansas, Oklahoma and Texas.

The North Pipeline originates at Tesoro’s Mandan, North Dakota refinery and runs from west to east for approximately 440 miles to its termination in the Minneapolis, Minnesota area. The North Pipeline system includes 4 terminals, discussed below, with storage capacity of approximately 1.4 million barrels.

The East and North Pipelines include 21 truck-loading terminals through which refined petroleum products are delivered to storage tanks and then loaded into petroleum product transport trucks. Revenues earned at these terminals predominately relate to the volumes transported on the pipeline through fees included in the pipeline tariff. As a result, these terminals are included in this segment instead of the storage segment.

6

The 2,000-mile Ammonia Pipeline originates in the Louisiana delta area, where it connects to three third-party marine terminals and three anhydrous ammonia plants on the Mississippi River. The line runs north through Louisiana and Arkansas into Missouri, where at Hermann, Missouri it splits and one branch goes east into Illinois and Indiana, while the other branch continues north into Iowa and then turns west into Nebraska. The Ammonia Pipeline is connected to multiple third-party-owned terminals, which include industrial facility delivery locations. Product is supplied to the pipeline from anhydrous ammonia plants in Louisiana and imported product delivered through the marine terminals. Anhydrous ammonia is primarily used as agricultural fertilizer. It is also used as a feedstock to produce other nitrogen derivative fertilizers and explosives.

Pipeline Operations

Revenues for the pipelines are based upon origin-to-destination throughput volumes traveling through our pipelines and their related tariff rates.

In general, shippers on our crude oil and refined product pipelines deliver petroleum products to our pipelines for transport to/from: (i) refineries that connect to our pipelines, (ii) third-party pipelines or terminals and (iii) NuStar Energy terminals for further delivery to marine vessels or pipelines. We charge our shippers tariff rates based on transportation from the origination point on the pipeline to the point of delivery.

Our pipelines are subject to federal regulation by one or more of the following governmental agencies: the Federal Energy Regulatory Commission (the FERC), the Surface Transportation Board (the STB), the Department of Transportation (DOT), the Environmental Protection Agency (EPA) and Homeland Security. Additionally, the operations and integrity of the pipelines are subject to the respective state jurisdictions.

The majority of our pipelines are common carrier. Common carrier activities are those for which transportation through our pipelines is available to any shipper of petroleum products who requests such services and satisfies the conditions and specifications for transportation. Published tariffs are (i) filed with the FERC for interstate petroleum product shipments, (ii) filed with the relevant state authority for intrastate petroleum product shipments and (iii) regulated by the STB for our Ammonia Pipeline.

We use a computerized Supervisory Control and Data Acquisition (SCADA) system to remotely operate pipelines. The SCADA system allows control center operators to control pumps and valves regulating and directing the transportation of petroleum products, while monitoring flow rates and pressures to assure system integrity and conform to pipeline schedules.

Demand for and Sources of Refined Products and Crude Oil

Throughputs on our Central West Refined Product Pipelines and the East and North Pipelines depend on the level of demand for refined products in the markets served by the pipelines and the ability and willingness of refiners and marketers having access to the pipelines to supply such demand by deliveries through the pipelines.

The majority of the refined products delivered through the Central West Refined Product Pipelines and the North Pipeline are gasoline and diesel fuel that originate at refineries connected to us. Demand for these products fluctuates as prices for these products fluctuate. Prices fluctuate for a variety of reasons including the overall balance in supply and demand, which is affected by general economic conditions, among other factors. Prices for gasoline and diesel fuel tend to increase in the warm weather months when people tend to drive automobiles more often and longer distances.

Much of the refined products and natural gas liquids delivered through the East Pipeline and a portion of volumes on the North Pipeline are ultimately used as fuel for railroads, ethanol denaturant or in agricultural operations, including fuel for farm equipment, irrigation systems, trucks used for transporting crops and crop-drying facilities. Demand for refined products for agricultural use, and the relative mix of products required, is affected by weather conditions in the markets served by the East and North Pipelines. The agricultural sector is also affected by government agricultural policies and crop prices. Although periods of drought suppress agricultural demand for some refined products, particularly those used for fueling farm equipment, the demand for fuel for irrigation systems often increases during such times. The mix of refined products delivered for agricultural use varies seasonally, with gasoline demand peaking in early summer, diesel fuel demand peaking in late summer and propane demand higher in the fall.

Our refined product pipelines are also dependent upon adequate levels of production of refined products by refineries connected to the pipelines, directly or through connecting pipelines. The refineries are, in turn, dependent upon adequate supplies of suitable grades of crude oil. Certain of our Central West Refined Products Pipelines are subject to long-term throughput agreements with Valero Energy. Valero Energy refineries connected directly to our pipelines obtain crude oil from a variety of foreign and domestic sources. If operations at one of these refineries were discontinued or significantly reduced, it could have a material adverse effect on our operations, although we would endeavor to minimize the impact by seeking alternative customers for those pipelines.

7

The North Pipeline is heavily dependent on Tesoro’s Mandan, North Dakota refinery, which primarily runs North Dakota crude oil (although it has the ability to process other crude oils). If operations at the Tesoro refinery were interrupted, it could have a material adverse effect on our operations. The majority of the refined products transported through the East Pipeline are produced at three refineries located at McPherson and El Dorado, Kansas and Ponca City, Oklahoma, which are operated by CHS Inc., HollyFrontier Corporation (HollyFrontier) and Phillips 66, respectively. The East Pipeline also has access to Gulf Coast supplies of products through third party connecting pipelines that receive products originating on the Gulf Coast.

Other than the Valero Energy refineries described above and the Tesoro refinery, if operations at any one refinery were discontinued, we believe (assuming unchanged demand for refined products in markets served by the refined product pipelines) that the effects thereof would be short-term in nature and our business would not be materially adversely affected over the long-term because such discontinued production could be replaced by other refineries or other sources.

Our crude oil pipelines are dependent on our customers’ continued access to sufficient crude oil and sufficient demand for refined products for our customers to operate their refineries. The supply of crude oil production (domestic and foreign) could increase or decrease with the change in crude oil prices. Changes in crude oil prices could also affect the exploration and production of shale plays, which could impact crude oil pipelines serving those regions, such as our Eagle Ford System. However, many of our crude oil pipelines, including the McKee System, are the primary source of crude oil for our customers’ refineries. Therefore, these “demand-pull” pipelines are less affected by changes in crude oil prices.

Demand for and Sources of Anhydrous Ammonia

The Ammonia Pipeline is one of two major anhydrous ammonia pipelines in the United States and the only one capable of receiving foreign product directly into the system and transporting anhydrous ammonia into the nation’s corn belt.

Throughputs on our Ammonia Pipeline depend on overall nitrogen fertilizer use, the price of natural gas, which is the primary component of anhydrous ammonia, and the level of demand for direct application of anhydrous ammonia as a fertilizer for crop production (Direct Application). Demand for Direct Application is dependent on the weather, as Direct Application is not effective if the ground is too wet or too dry.

Corn producers have fertilizer alternatives to anhydrous ammonia, such as liquid or dry nitrogen fertilizers. Liquid and dry nitrogen fertilizers are both less sensitive to weather conditions during application but are generally more costly than anhydrous ammonia. In addition, anhydrous ammonia has the highest nitrogen content of any nitrogen-derivative fertilizer.

Customers

The largest customer of our pipeline segment was Valero Energy, which accounted for approximately 35% of the total segment revenues for the year ended December 31, 2015. In addition to Valero Energy, our customers include integrated oil companies, refining companies, farm cooperatives, railroads and others. No other customer accounted for a significant portion of the total revenues of the pipeline segment for the year ended December 31, 2015.

Competition and Business Considerations

Because pipelines are generally the lowest-cost method for intermediate and long-haul movement of crude oil and refined petroleum products, our more significant competitors are common carrier and proprietary pipelines owned and operated by major integrated and large independent oil companies and other companies in the areas where we deliver products. Competition between common carrier pipelines is based primarily on transportation charges, quality of customer service and proximity to end users. Trucks may competitively deliver products in some of the areas served by our pipelines; however, trucking costs render that mode of transportation uncompetitive for longer hauls or larger volumes.

Most of our refined product pipelines and certain of our crude oil pipelines within the Central West System are physically integrated with and principally serve refineries owned by Valero Energy. As a result, we do not believe that we will face significant competition for transportation services provided to the Valero Energy refineries we serve.

Certain of our crude oil pipelines serve areas or refineries impacted by domestic shale oil production in the Eagle Ford, Permian Basin and Granite Wash regions. Our pipelines also face competition from other crude oil pipelines and truck transportation in these regions. However, that exposure is mitigated through our long-term contracts and minimum volume commitments with credit-worthy customers.

The East and North Pipelines compete with an independent common carrier pipeline system owned by Magellan Midstream Partners, L.P. (Magellan) that operates approximately 100 miles east of and parallel to the East Pipeline and in close proximity to the North Pipeline. Certain of the East Pipeline’s and the North Pipeline’s delivery terminals are in direct competition with Magellan’s terminals. Competition with Magellan is based primarily on transportation charges, quality of customer service and proximity to end users.

8

Competitors of the Ammonia Pipeline include the other major anhydrous ammonia pipeline, owned by Magellan, which originates in Oklahoma and Texas and terminates in Minnesota. The competing pipeline has the same Direct Application demand and weather issues as the Ammonia Pipeline but is restricted to domestically produced anhydrous ammonia. Midwest production facilities, nitrogen fertilizer substitutes and barge and railroad transportation represent other forms of direct competition to the pipeline under certain market conditions.

STORAGE

Our storage segment includes terminal and storage facilities that provide storage, handling and other services for petroleum products, crude oil, specialty chemicals and other liquids. As of December 31, 2015, we owned and operated:

• | 40 terminal and storage facilities in the United States and one terminal in Nuevo Laredo, Mexico, with total storage capacity of 51.2 million barrels; |

• | A terminal on the island of St. Eustatius with tank capacity of 14.4 million barrels and a transshipment facility; |

• | A terminal located in Point Tupper, Canada with tank capacity of 7.8 million barrels and a transshipment facility; and |

• | Six terminals located in the United Kingdom and one terminal located in Amsterdam, the Netherlands, with total storage capacity of approximately 9.5 million barrels. |

Description of Major Terminal Facilities

St. Eustatius. We own and operate a 14.4 million barrel petroleum storage and terminalling facility located on the island of St. Eustatius in the Caribbean, which is located at a point of minimal deviation from major shipping routes. This facility is capable of handling a wide range of petroleum products, including crude oil and refined products, and it can accommodate heavy-laden ultra large crude carriers, or ULCCs, for loading and discharging crude oil and other petroleum products. A two-berth jetty, a two-berth monopile with platform and buoy systems, a floating hose station and an offshore single point mooring buoy with loading and unloading capabilities serve the terminal’s customers’ vessels. The fuel oil and petroleum product facilities have in-tank and in-line blending capabilities, while the crude tanks have tank-to-tank blending capability and in-tank mixers. In addition to the storage and blending services at St. Eustatius, this facility has the flexibility to utilize certain storage capacity for both feedstock and refined products to support our atmospheric distillation unit, which is capable of handling up to 25,000 barrels per day of feedstock, ranging from condensates to heavy crude oil. We own and operate all of the berthing facilities at the St. Eustatius terminal. Separate fees apply for use of the berthing facilities, as well as associated services, including pilotage, tug assistance, line handling, launch service, emergency response services and other ship services.

St. James, Louisiana. Our St. James terminal, which is located on the Mississippi River near St. James, Louisiana, has a total storage capacity of 9.2 million barrels. The facility is located on almost 900 acres of land, some of which is undeveloped. The majority of the storage tanks and infrastructure are suited for light crude oil, with four tanks capable of fuel oil or heated crude oil storage. Additionally, the facility has one barge dock and two ship docks. Our St. James terminal can receive product from gathering pipelines in the Gulf of Mexico and deliver to connecting pipelines that supply refineries in the Gulf Coast and Midwest. The St. James terminal also has two unit train rail facilities and a manifest rail facility, which are served by the Union Pacific Railroad and have a combined capacity of approximately 200,000 barrels per day. In 2016, we expect to complete construction of two additional tanks with an aggregate storage capacity of 720,000 barrels.

Point Tupper. We own and operate a 7.8 million barrel terminalling and storage facility located at Point Tupper on the Strait of Canso, near Port Hawkesbury, Nova Scotia. This facility is the deepest independent, ice-free marine terminal on the North American Atlantic coast, with access to the East Coast, Canada and the Midwestern United States via the St. Lawrence Seaway and the Great Lakes system. With one of the premier jetty facilities in North America, the Point Tupper facility can accommodate heavy-laden ULCCs for loading and discharging crude oil, petroleum products and petrochemicals. Crude oil and petroleum product movements at the terminal are fully automated. Separate fees apply for use of the jetty facility, as well as associated services, including pilotage, tug assistance, line handling, launch service, emergency response services and other ship services.

Linden, New Jersey. Our Linden terminal facility has two terminals that provide deep-water terminalling capabilities in the New York Harbor and primarily stores petroleum products, including gasoline, jet fuel and fuel oils. The two terminals have a total storage capacity of 4.6 million barrels and can receive and deliver products via ship, barge and pipeline. The terminal facility includes two docks. On January 2, 2015, we acquired full ownership of one of the terminals located at the Linden facility that we previously owned 50% through a joint venture.

Amsterdam. Our Amsterdam terminal has a total storage capacity of 3.8 million barrels. This facility is located at the Port of Amsterdam and primarily stores petroleum products including gasoline, diesel and fuel oil. This facility has two docks for vessels and five docks for inland barges.

9

Corpus Christi North Beach. We own and operate a 2.1 million barrel crude oil storage and terminalling facility located at the Port of Corpus Christi in Texas. The facility supports our South Texas Crude System and provides our customers with the flexibility to segregate and deliver crude oil and processed condensate. In addition, this facility has three docks, including one private dock, and can load crude oil onto ships simultaneously on all three docks at a maximum rate of 65,000 barrels per hour. The Corpus Christi North Beach terminal has the capacity to move on average between 350,000 and 400,000 barrels per day and can accommodate Panamax-class vessels (which carry between 350,000 and 500,000 barrels).

Terminal and Storage Facilities

The following table sets forth information about our terminal and storage facilities as of December 31, 2015:

Facility | Tank Capacity | |

(Barrels) | ||

Colorado Springs, CO | 328,000 | |

Denver, CO | 110,000 | |

Albuquerque, NM | 251,000 | |

Abernathy, TX | 160,000 | |

Amarillo, TX | 269,000 | |

Corpus Christi, TX | 329,000 | |

Corpus Christi, TX (North Beach) | 2,136,000 | |

Edinburg, TX | 340,000 | |

El Paso, TX (b) | 419,000 | |

Harlingen, TX | 286,000 | |

Laredo, TX | 215,000 | |

San Antonio, TX (c) | 375,000 | |

Southlake, TX | 569,000 | |

Nuevo Laredo, Mexico | 35,000 | |

Central West Terminals | 5,822,000 | |

Pittsburg, CA | 398,000 | |

Rosario, NM | 166,000 | |

Catoosa, OK | 358,000 | |

Houston, TX | 86,000 | |

Asphalt Terminals | 1,008,000 | |

Jacksonville, FL | 2,593,000 | |

St. James, LA | 9,190,000 | |

Texas City, TX (c) | 2,964,000 | |

Gulf Coast Terminals | 14,747,000 | |

Blue Island, IL | 690,000 | |

Andrews AFB, MD (a) | 75,000 | |

Baltimore, MD | 818,000 | |

Piney Point, MD | 5,402,000 | |

Linden, NJ (c) | 4,649,000 | |

Paulsboro, NJ | 74,000 | |

Virginia Beach, VA (a) | 41,000 | |

North East Terminals | 11,749,000 | |

10

Facility | Tank Capacity | |

(Barrels) | ||

Los Angeles, CA | 608,000 | |

Selby, CA | 3,060,000 | |

Stockton, CA | 816,000 | |

Portland, OR | 1,365,000 | |

Tacoma, WA | 391,000 | |

Vancouver, WA (c) | 774,000 | |

West Coast Terminals | 7,014,000 | |

Corpus Christi, TX | 4,030,000 | |

Texas City, TX | 3,141,000 | |

Benicia, CA | 3,683,000 | |

Refinery Storage Tanks | 10,854,000 | |

Grays, England | 1,958,000 | |

Eastham, England | 2,096,000 | |

Runcorn, England | 149,000 | |

Grangemouth, Scotland | 719,000 | |

Glasgow, Scotland | 353,000 | |

Belfast, Northern Ireland | 408,000 | |

United Kingdom Terminals | 5,683,000 | |

St. Eustatius, the Netherlands | 14,411,000 | |

Amsterdam, the Netherlands | 3,834,000 | |

Point Tupper, Canada | 7,778,000 | |

Total Terminals and Storage Facilities | 82,900,000 | |

(a) | Terminal facility also includes pipelines to U.S. government military base locations. |

(b) | We own a 67% undivided interest in the El Paso refined product terminal. The tank capacity represents the proportionate share of capacity attributable to our ownership interest. |

(c) | Location includes two terminal facilities. |

During 2015, we divested our refined product terminals with an aggregate storage capacity of 0.7 million barrels and located in Indianapolis, Indiana; Alamogordo, New Mexico and Placedo, Texas.

Storage Operations

Revenues for the storage segment include fees for tank storage agreements, where a customer agrees to pay for a certain amount of storage in a tank over a period of time (storage lease revenues), and throughput agreements, where a customer pays a fee per barrel for volumes moving through our terminals (throughput revenues). Our terminals also provide blending, additive injections, handling and filtering services for which we charge additional fees. We charge a fee for each barrel of crude oil and certain other feedstocks that we deliver to Valero Energy’s Benicia, Corpus Christi West and Texas City refineries from our crude oil refinery storage tanks. Certain of our facilities charge fees to provide marine services such as pilotage, tug assistance, line handling, launch service, emergency response services and other ship services.

Demand for Refined Petroleum Products and Crude Oil

The operations of our refined product terminals depend in large part on the level of demand for products stored in our terminals in the markets served by those assets. The majority of products stored in our terminals are refined petroleum products. Demand for our terminalling services will generally increase or decrease with demand for refined petroleum products, and demand for refined petroleum products tends to increase or decrease with the relative strength of the economy. In addition, the forward pricing curve can impact demand. For example, in a contango market (when the price for future storage is expected to exceed

11

current prices), demand for storage services will generally increase. As of December 31, 2015, almost all of our tank storage capacity is under contract.

Crude oil delivered to our St. James terminal through our unit train facilities, and crude oil delivered to our Corpus Christi North Beach terminal will generally increase or decrease with crude oil production rates in the Bakken and Eagle Ford shale plays, respectively. In addition, the market price relationship between various grades of crude oil impacts the demand for our unit train facilities at our St. James terminal, which can affect our profit sharing and volumes.

Customers

We provide storage and terminalling services for crude oil and refined petroleum products to many of the world’s largest producers of crude oil, integrated oil companies, chemical companies, oil traders and refiners. In addition, our blending capabilities in our storage assets have attracted customers who have leased capacity primarily for blending purposes. The largest customer of our storage segment is Valero Energy, which accounted for approximately 19% of the total revenues of the segment for the year ended December 31, 2015. No other customer accounted for a significant portion of the total revenues of the storage segment for the year ended December 31, 2015.

Competition and Business Considerations

Many major energy and chemical companies own extensive terminal storage facilities. Although such terminals often have the same capabilities as terminals owned by independent operators, they generally do not provide terminalling services to third parties. In many instances, major energy and chemical companies that own storage and terminalling facilities are also significant customers of independent terminal operators. Such companies typically have strong demand for terminals owned by independent operators when independent terminals have more cost-effective locations near key transportation links, such as deep-water ports. Major energy and chemical companies also need independent terminal storage when their owned storage facilities are inadequate, either because of size constraints, the nature of the stored material or specialized handling requirements.

Independent terminal owners generally compete on the basis of the location and versatility of terminals, service and price. A favorably located terminal will have access to various cost-effective transportation modes both to and from the terminal. Transportation modes typically include waterways, railroads, roadways and pipelines.

Terminal versatility is a function of the operator’s ability to offer complex handling requirements for diverse products. The services typically provided by the terminal include, among other things, the safe storage of the product at specified temperature, moisture and other conditions, as well as receipt at and delivery from the terminal, all of which must comply with applicable environmental regulations. A terminal operator’s ability to obtain attractive pricing is often dependent on the quality, versatility and reputation of the facilities owned by the operator. Although many products require modest terminal modification, operators with versatile storage capabilities typically require less modification prior to usage, ultimately making the storage cost to the customer more attractive.

Our St. Eustatius and Point Tupper terminals have historically functioned as “break bulk” facilities, which handled imports of light crude from foreign sources into the U.S. to satisfy U.S. East Coast and Gulf Coast refinery demand for light crude. Light crude suppliers brought the crude from the Middle East and other foreign regions on very large ships,which are efficient for long routes. These large ships, due to draft constraints, are unable to navigate far enough inland to deliver directly to U.S. shores, which necessitates unloading these ships to storage and subsequent loading onto smaller ships that can bring the crude to the refiners, a process referred to as “break bulk.” Both terminals are well-located to provide this service.

As the supply of light crude from various U.S. shale formations has increased, U.S. demand for foreign light crude oil has dropped substantially. This reduced demand for imported light crude has, in turn, dramatically changed oil trade flow patterns around the world, thereby depressing the demand for break bulk services. At the same time, South American and Canadian production of heavy crude has ramped up significantly. As demand for export of heavy crude and natural gas liquids (NGL) out of South America, as well as from Canada, has risen, so has the demand for “build bulk” services. In order to reduce costs and increase efficiencies for long routes to customers abroad, exporting producers need to consolidate their heavy oil cargos from the small ships used to move the heavy crude off shore to a large vessel that is more efficient for long routes, a process referred to as “build bulk.” Our St. Eustatius terminal’s location is well-suited to build bulk for South American producers headed to customers overseas, primarily in Asia. Our Point Tupper facility’s location is similarly well-positioned, in this case to build bulk for heavy Canadian crude oil and NGL production.

We may face increased competition from new and/or expanding terminals near our locations, if those facilities offer either break bulk or build bulk services, as demanded by the applicable oil trade flows, now and in the future.

12

Our crude oil refinery storage tanks are physically integrated with and serve refineries owned by Valero Energy. Additionally, we have entered into various agreements with Valero Energy governing the usage of these tanks. As a result, we believe that we will not face significant competition for our services provided to those refineries.

FUELS MARKETING

Fuels Marketing Operations

Our fuels marketing operations involve the purchase of crude oil, fuel oil, bunker fuel, fuel oil blending components and other refined products for resale. These operations provide us the opportunity to generate additional gross margin while complementing the activities of our storage segment. We utilize storage assets, including our own terminals and rail unloading facilities, at our St. James, Texas City and St. Eustatius terminals. Rates charged by our storage segment to the fuels marketing segment are consistent with rates charged to third parties.

Within our fuels marketing operations, we purchase crude oil and refined petroleum products for resale. The results of operations for the fuels marketing segment depend largely on the margin between our cost and the sales prices of the products we market. Therefore, the results of operations for this segment are more sensitive to changes in commodity prices compared to the operations of the pipeline and storage segments.

Since our fuels marketing operations expose us to commodity price risk, we enter into derivative instruments to mitigate the effect of commodity price fluctuations on our operations. The derivative instruments we use consist primarily of commodity futures and swap contracts.

Customers

Fuels marketing customers include major integrated refiners and trading companies. Customers for our bunker fuel sales are mainly ship owners, including cruise line companies. No customer accounted for a significant portion of the total revenues of the fuels marketing segment for the year ended December 31, 2015.

Competition and Business Considerations

Our fuels marketing operations have numerous competitors, including large integrated refiners, marketing affiliates of other partnerships in our industry, as well as various international and domestic trading companies. In the sale of bunker fuel, we compete with ports offering bunker fuels that are along the route of travel of the vessel.

EMPLOYEES

Our operations are managed by NuStar GP, LLC. As of December 31, 2015, NuStar GP, LLC had 1,251 domestic employees and certain of our wholly owned subsidiaries had 393 employees performing services for our international operations. We believe that NuStar GP, LLC and our subsidiaries each have satisfactory relationships with their employees. Please refer to Note 28 of the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data” for a discussion of the employee transfer from NuStar GP, LLC.

RATE REGULATION

Several of our petroleum pipelines are interstate common carrier pipelines, which are subject to regulation by the FERC under the Interstate Commerce Act (ICA) and the Energy Policy Act of 1992 (the EP Act). The ICA and its implementing regulations give the FERC authority to regulate the rates charged for service on interstate common carrier pipelines and generally require the rates and practices of interstate oil pipelines to be just, reasonable, not unduly discriminatory, and not unduly preferential. The ICA also requires tariffs that set forth the rates a common carrier pipeline charges for providing transportation services on its interstate common carrier liquids pipelines, as well as the rules and regulations governing these services, to be maintained on file with the FERC and posted publicly. The EP Act deemed certain rates in effect prior to its passage to be just and reasonable and limited the circumstances under which a complaint can be made against such “grandfathered” rates. The EP Act and its implementing regulations also allow interstate common carrier oil pipelines to annually index their rates up to a prescribed ceiling level and require that such pipelines index their rates down to the prescribed ceiling level if the index is negative. In addition, the FERC retains cost-of-service ratemaking, market-based rates and settlement rates as alternatives to the indexing approach.

The Ammonia Pipeline is subject to regulation by the STB pursuant to the Interstate Commerce Act applicable to such pipelines (which differs from the ICA applicable to interstate liquids pipelines). Under that regulation, the Ammonia Pipeline’s rates, classifications, rules and practices related to the interstate transportation of anhydrous ammonia must be reasonable and, in

13

providing interstate transportation, the Ammonia Pipeline may not subject a person, place, port or type of traffic to unreasonable discrimination.

Additionally, the rates and practices for our intrastate common carrier pipelines are subject to regulation by state commissions, including in Colorado, Kansas, Louisiana, North Dakota and Texas. Although the applicable state statutes and regulations vary, they generally require that intrastate pipelines publish tariffs setting forth all rates, rules and regulations applying to intrastate service, and generally require that pipeline rates and practices be just, reasonable and nondiscriminatory.

Shippers may challenge tariff rates, rules and regulations on our pipelines. In most instances, state commissions have not initiated investigations of the rates or practices of pipelines in the absence of shipper complaints. There are no pending challenges or complaints regarding our tariffs.

ENVIRONMENTAL AND SAFETY REGULATION

Our operations are subject to extensive federal, state and local environmental laws and regulations, including those relating to the discharge of materials into the environment, waste management and pollution prevention measures, among others. Our operations are also subject to extensive federal, state and local health and safety laws and regulations, including those relating to worker and pipeline safety, pipeline integrity and operator qualifications. The principal environmental and safety risks associated with our operations relate to unauthorized or unpermitted emissions into the air, unauthorized releases into soil, surface water or groundwater, and personal injury and property damage. Compliance with these environmental, health and safety laws, regulations and related permits increases our capital expenditures and our overall cost of business, and violations of these laws, regulations or permits can result in significant civil and criminal liabilities, injunctions or other penalties.

We have adopted policies, practices and procedures including in the areas of pollution control, pipeline integrity, operator qualifications, public relations and education, process safety management, risk management planning, hazard communication, emergency response planning, community right-to-know, occupational health and the handling, storage, use and disposal of hazardous materials, that are designed to comply with applicable federal, state and local regulations and to prevent material environmental or other damage, to ensure the safety of our pipelines, our employees, the public and the environment and to limit the financial liability that could result from such events. Future governmental action and regulatory initiatives could result in changes to expected operating permits and procedures, additional remedial actions or increased capital expenditures and operating costs that cannot be assessed with certainty at this time. In addition, contamination resulting from spills of petroleum and other products occurs within the industry. While we believe that we are in substantial compliance with the health, safety and environmental regulations applicable to us, risks of additional costs and liabilities are inherent within the industry, and there can be no assurances that significant costs and liabilities will not be incurred in the future.

Capital Expenditures Attributable to Compliance with Environmental Statutes and Regulations. It is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure our operations are in compliance. We are unable to estimate the effect on our financial condition or results of operations or the amount and timing of such required expenditures. In 2015, our capital expenditures attributable to compliance with environmental regulations were $11.4 million, and are currently estimated to be approximately $18.0 million for 2016.

RENEWABLE ENERGY AND ALTERNATIVE FUEL MANDATES

Several federal and state programs require, subsidize or encourage the purchase and use of renewable energy and alternative fuels, such as battery-powered engines, biodiesel, wind energy, and solar energy. These programs may over time offset projected increases or reduce the demand for refined petroleum products, particularly gasoline, in certain markets. The increased production and use of biofuels may also create opportunities for additional pipeline transportation and additional blending opportunities within the storage segment, although that potential cannot be quantified at present. Other legislative changes may similarly alter the expected demand and supply projections for refined petroleum products in ways that cannot be predicted.

WATER

The federal Water Pollution Control Act, as amended, also known as the Clean Water Act, and analogous or more stringent state and local statutes and regulations impose restrictions and strict controls regarding the discharge of pollutants into state waters or waters of the United States. The discharge of pollutants into state waters or waters of the United States is generally prohibited, except in accordance with the terms of a permit issued by applicable federal or state authorities. The Oil Pollution Act, enacted in 1990, amends provisions of the Clean Water Act as they pertain to prevention, response to and liability for oil spills. Spill prevention control and countermeasure requirements of the Clean Water Act and some state laws require response

14

plans and the use of dikes and similar structures to help prevent contamination of state waters or waters of the United States in the event of an unauthorized discharge. Violations of any of these statutes and the related regulations could result in significant costs and liabilities. It is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure our operations are in compliance. We are unable to estimate the effect on our financial condition or results of operations or the amount and timing of such required expenditures.

AIR

The federal Clean Air Act, as amended, and analogous or more stringent state and local statutes and regulations impose restrictions and strict controls regarding the discharge of pollutants into the air. The discharge of pollutants into the air is generally prohibited, except in accordance with the terms of a permit issued by applicable federal or state authorities, and these laws and related regulations regulate emissions of air pollutants from various sources, including some of our operations, and also impose various monitoring and reporting requirements. Such laws and regulations may require a facility to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce air emissions or result in the increase of existing air emissions, and obtain and strictly comply with the provisions of any air permits. Violations of any of these statutes and the related regulations could result in significant costs and liabilities. It is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure our operations are in compliance. We are unable to estimate the effect on our financial condition or results of operations or the amount and timing of such required expenditures.

SOLID WASTE

The federal Resource Conservation and Recovery Act (RCRA) and analogous or more stringent state and local statutes and regulations impose restrictions and strict controls regarding solid wastes, including hazardous wastes. We currently are not required to comply with a substantial portion of RCRA requirements because we do not operate any waste treatment, storage or disposal facilities. However, it is possible that additional wastes, which could include wastes currently generated during operations, will also be designated as hazardous wastes. Hazardous wastes are subject to more rigorous and costly disposal requirements than are non-hazardous wastes. Violations of any of these statutes and the related regulations could result in significant costs and liabilities. It is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure our operations are in compliance. We are unable to estimate the effect on our financial condition or results of operations or the amount and timing of such required expenditures.

HAZARDOUS SUBSTANCES

The federal Comprehensive Environmental Response, Compensation and Liability Act, referred to as CERCLA and also known as Superfund, and analogous or more stringent state and local statutes and regulations impose restrictions and liability, including joint and several liability, without regard to fault or the legality of the original act, on some classes of persons that contributed to the release or threatened release of a hazardous substance into the environment. These classes of persons can include the owner or operator of the facility and those that disposed or arranged for the disposal of the hazardous substances. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats that endanger public health or the environment and to seek recovery from the responsible classes of persons for the costs they incur. In the course of our ordinary operations, we may generate and arrange for the disposal of wastes that fall within CERCLA’s definition of a hazardous substance.

We currently own or lease, and have in the past owned or leased, properties where hazardous substances are being or have been handled. Although we believe that we have utilized operating and disposal practices that were standard in the industry at the time, substances may have been disposed of or released on or under the properties owned or leased by us or on or under other locations where these wastes have been taken for disposal. In addition, we acquired many of these properties from third parties, and we did not control those third parties’ treatment and disposal or release of hazardous substances. These properties and substances disposed thereon may be subject to CERCLA, RCRA and analogous state and local statutes and regulations. Under these laws, we could be required to remove or remediate previously disposed substances (including substances disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) or to perform remedial operations to prevent future contamination. In addition, we may be exposed to joint and several liability under CERCLA for all or part of the costs required to clean up sites at which hazardous substances may have been disposed of or released into the environment.

While remediation of subsurface contamination is in process at several of our facilities, based on current available information, we believe that the cost of these activities will not materially affect our financial condition or results of operations. Such costs, however, are often unpredictable and, therefore, there can be no assurances that the future costs will not become material.

15

Further, it is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure compliance. We are unable to estimate the effect on our financial condition or results of operations or the amount and timing of such required expenditures.

INTEGRITY AND SAFETY

Our pipeline, storage tank and other operations are subject to extensive federal, state and local statutes and regulations governing mechanical integrity and safety, including those in Title 49 of the United States Code and its implementing regulations. These statutes and regulations include requirements for safe operation, maintenance, testing and corrosion control, and qualification programs for operating personnel. In addition, other requirements can include reviewing and updating existing pipeline safety public education programs, providing information for the National Pipeline Mapping System, maintaining spill response plans, conducting spill response training, implementing integrity management programs and managing pipeline control centers. Violations of any of these statutes and the related regulations could result in significant costs and liabilities. It is possible that these statutes and the related regulations may be revised to be more restrictive in the future, necessitating additional capital expense to ensure our operations are in compliance. However, while compliance may affect our capital expenditures and operating expenses, we believe that the cost of such compliance will not materially affect our competitive position or have a material effect on our financial condition or results of operations.

16

RISK FACTORS

RISKS RELATED TO OUR BUSINESS

We may not be able to generate sufficient cash from operations to enable us to pay quarterly distributions to our unitholders at current levels.

The amount of cash that we can distribute to our unitholders each quarter principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

• | throughput volumes transported in our pipelines; |

• | lease renewals or throughput volumes in our terminals and storage facilities; |

• | tariff rates and fees we charge and the returns we realize for our services; |

• | the results of our marketing, trading and hedging activities, which fluctuate depending upon the relationship between refined product prices and prices of crude oil and other feedstocks; |

• | demand for and supply of crude oil, refined products and anhydrous ammonia; |

• | the effect of worldwide energy conservation measures; |

• | our operating costs; |

• | weather conditions; |

• | domestic and foreign governmental regulations and taxes; and |

• | prevailing economic conditions. |

In addition, the amount of cash that we will have available for distribution will depend on other factors, including:

• | our debt service requirements and restrictions on distributions contained in our current or future debt agreements; |

• | the sources of cash used to fund our acquisitions; |

• | our capital expenditures; |

• | fluctuations in our working capital needs; |

• | issuances of debt and equity securities; and |

• | adjustments in cash reserves made by our general partner, in its discretion. |

Because of these factors, we may not have sufficient available cash each quarter to continue paying distributions at their current level or at all. Furthermore, cash distributions to our unitholders depend primarily upon our cash flows, including cash flows from financial reserves and working capital borrowings, and not solely on profitability, which is affected by non-cash items. Therefore, we may make cash distributions during periods when we record net losses and may not make cash distributions during periods when we record net income.

Our inability to develop and execute growth projects and acquire new assets could limit our ability to maintain and grow quarterly distributions to our unitholders.

Our ability to maintain and grow our distributions to unitholders depends on the growth of our existing businesses and strategic acquisitions. If we are unable to implement business development opportunities and finance such activities on economically acceptable terms, our future growth will be limited, which could adversely impact our results of operations and cash flows and, accordingly, result in reduced distributions over time.

Failure to complete capital projects as planned could adversely affect our financial condition, results of operations and cash flows.

Delays or cost increases related to capital spending programs involving construction of new facilities (or improvements and repairs to our existing facilities) could adversely affect our ability to achieve forecasted operating results. Although we evaluate and monitor each capital spending project and try to anticipate difficulties that may arise, such delays or cost increases may arise as a result of factors that are beyond our control, including:

• | denial or delay in issuing requisite regulatory approvals and/or permits; |

• | unplanned increases in the cost of construction materials or labor; |

• | disruptions in transportation of modular components and/or construction materials; |

• | severe adverse weather conditions, natural disasters or other events (such as equipment malfunctions, explosions, fires or spills) affecting our facilities, or those of vendors and suppliers; |

• | shortages of sufficiently skilled labor, or labor disagreements resulting in unplanned work stoppages; |

• | market-related increases in a project’s debt or equity financing costs; or |

• | non-performance by, or disputes with, vendors, suppliers, contractors or sub-contractors involved with a project. |

Our forecasted operating results are also based upon our projections of future market fundamentals that are not within our control, including changes in general economic conditions, the supply and demand of crude oil and refined products,

17

availability to our customers of attractively priced alternative solutions for storage, transportation or supplies of crude oil and refined products and overall customer demand.

If we are unable to retain current, and obtain new, customers through renewing or establishing leases and throughput agreements at current or better rates or the utilization of our leased assets suffers a material decrease, our revenue and cash flows could be reduced to levels that could adversely affect our ability to make quarterly distributions to our unitholders.

Our revenue and cash flows are generated primarily from our customers’ payments of fees under throughput contracts and lease agreements. Failure to renew or enter into new contracts or our leasing customers’ material reduction of their utilization under our existing leases could result from many factors, including:

• | a material decrease in the supply or price of crude oil; |

• | a material decrease in demand for refined products in the markets served by our pipelines and terminals; |

• | scheduled turnarounds or unscheduled maintenance at refineries we serve; |

• | operational problems or catastrophic events at a refinery we serve or our assets; |

• | environmental proceedings or other litigation that compel the cessation of all or a portion of the operations at a refinery we serve or our assets; |

• | a decision by our current customers to redirect refined products transported in our pipelines to markets not served by our pipelines or to transport crude oil or refined products by means other than our pipelines; |

• | increasingly stringent environmental regulations; or |

• | a decision by our current customers to sell one or more of the refineries we serve to a purchaser that elects not to use our pipelines and terminals. |

Competing midstream service providers, including certain major energy and chemical companies, possess, or have greater financial resources to acquire, assets better suited to customer demand, which could undermine our ability to obtain and retain customers or reduce utilization of our leased assets, which could reduce our revenues and cash flows, thereby reducing our ability to make our quarterly distributions to unitholders.

Our competitors include major energy and chemical companies, some of which have greater financial resources, more pipelines or storage terminals, greater capacity pipelines or storage terminals and greater access to supply than we do. Certain of our competitors also may have advantages in competing for acquisitions or other new business opportunities because of their financial resources and synergies in operations. As a consequence of increased competition in the industry, some of our customers may be reluctant to renew or enter into long-term contracts or contracts that provide for minimum throughput amounts in the future. Our inability to renew or replace our current contracts as they expire, to enter into contracts for newly constructed or expanded assets and to respond appropriately to changing market conditions could have a negative effect on our revenue, cash flows and ability to make quarterly distributions to our unitholders.

Our future financial and operating flexibility may be adversely affected by our significant leverage, downgrades of our credit ratings, restrictions in our debt agreements or conditions in the financial markets.

As of December 31, 2015, our consolidated debt was $3.2 billion. We also may be required to post cash collateral under certain of our hedging arrangements, which we expect to fund with borrowings under our revolving credit agreement. In addition to any potential direct financial impact of our debt, it is possible that any material increase to our debt or other negative financial factors may be viewed negatively by credit rating agencies, which could result in ratings downgrades and increased costs for us to access the capital markets. Any downgrades in our credit ratings in the future could result in increases to the interest rates on borrowings under our credit facilities and the 7.65% senior notes due 2018, significantly increase our capital costs, reduce our liquidity and adversely affect our ability to raise capital in the future.

Our revolving credit agreement contains restrictive covenants, such as limitations on indebtedness, liens, mergers, asset transfers and certain investing activities. In addition, the revolving credit agreement requires us to maintain, as of the end of each rolling period, which consists of any period of four consecutive fiscal quarters, a consolidated debt coverage ratio (consolidated debt to consolidated EBITDA, each as defined in the revolving credit agreement) not to exceed 5.00-to-1.00. Failure to comply with any of the revolving credit agreement restrictive covenants or this coverage ratio will result in a default and could result in acceleration of this agreement and possibly other indebtedness.

Our accounts receivable securitization program contains various customary affirmative and negative covenants and default, indemnification and termination provisions. In addition, the related receivables financing agreement pursuant to which we are initial servicer and performance guarantor provides for acceleration of amounts owed upon the occurrence of certain specified events.

Our debt service obligations, restrictive covenants and maturities resulting from our leverage may adversely affect our ability to finance future operations, pursue acquisitions, fund our capital needs and pay cash distributions to our unitholders at current levels. In addition, this leverage may make our results of operations more susceptible to adverse economic or operating

18

conditions. For example, during an event of default under certain of our debt agreements, we would be prohibited from making cash distributions to our unitholders. If our lenders file for bankruptcy or experience severe financial hardship, they may not honor their pro rata share of our borrowing requests under the revolving credit agreement, which may significantly reduce our available borrowing capacity and, as a result, materially adversely affect our financial condition and ability to pay distributions to our unitholders at current levels. Additionally, we may not be able to access the capital markets in the future at economically attractive terms, which may adversely affect our future financial and operating flexibility and our ability to pay cash distributions at current levels.

Increases in interest rates could adversely affect our business and the trading price of our units.

We have significant exposure to increases in interest rates. At December 31, 2015, we had approximately $3.2 billion of consolidated debt, of which $1.8 billion was at fixed interest rates and $1.4 billion was at variable interest rates. In addition, prior ratings downgrades on our existing indebtedness caused interest rates under our revolving credit agreement and our senior notes due 2018 to increase effective January 2013, and future downgrades may cause interest rates on our variable interest rate debt to increase further. Additionally, at December 31, 2015, we had $600.0 million aggregate notional amount of interest rate swap arrangements, which increase our exposure to variable interest rates. As a result, our results of operations, cash flows and financial position could be materially adversely affected by significant increases in interest rates above current levels. In addition, we historically have funded our strategic capital expenditures and acquisitions from external sources, primarily borrowings under our revolving credit agreement or funds raised through debt or equity offerings. An increase in interest rates may negatively impact our ability to access the capital markets at economically attractive rates. Further, the trading price of our units is sensitive to changes in interest rates and any rise in interest rates could adversely impact the trading price of our units, which would effectively increase our cost of raising funds through equity offerings.

Low crude oil prices could have an adverse impact on our results of operations, cash flows and ability to make distributions to our unitholders, as well as our ability to access the capital markets at economically attractive rates.

During 2015 and early 2016, the price of crude oil has continued to decline, reaching lows not seen in 13 years. The sustained period of low prices has forced most crude oil producers to reduce their capital spending and drilling activity and narrow their focus to assets in the most cost-advantaged regions. On the other hand, refiners generally have benefitted from lower crude prices, particularly to the extent that lower feedstock price has been coupled with higher demand for certain refined products in some regional markets. However, a protracted period of depressed crude oil prices and overall economic downturn could have a negative impact on our results of operations.

In addition, regardless of insulation from or lack of exposure to commodity prices, continued low crude oil prices seem to be having a direct, negative impact on the unit price of many master limited partnerships, including our own, and unfavorable market conditions have increased the cost of financing capital spending through the public debt and equity markets.

Reduced demand for or supply of crude oil and refined products could affect our results of operations and ability to make distributions at current levels to our unitholders.

Our business is dependent upon the demand for and supply of the crude oil and refined products transported by our pipelines and stored in our terminals. Any sustained decrease in demand for refined products in the markets served by our pipelines and terminals could result in a significant reduction in throughputs in our pipelines and storage in our terminals, which would reduce our cash flows and our ability to make distributions at current levels to our unitholders. Factors that could lead to a decrease in market demand include:

• | a recession or other adverse economic condition that results in lower spending by consumers on gasoline, diesel and travel; |

• | higher fuel taxes or other governmental or regulatory actions that increase, directly or indirectly, the cost of gasoline; |

• | an increase in automotive engine fuel economy, whether as a result of a shift by consumers to more fuel-efficient vehicles or technological advances by manufacturers; |

• | an increase in the market price of crude oil that leads to higher refined product prices, which may reduce demand for refined products and drive demand for alternative products. Market prices for crude oil and refined products, including fuel oil, are subject to wide fluctuation in response to changes in global and regional supply that are beyond our control, and increases in the price of crude oil may result in a lower demand for refined products that we transport, store and market, including fuel oil; |

• | a decrease in corn acres planted, which may reduce demand for anhydrous ammonia; and |

• | the increased use of alternative fuel sources, such as battery-powered engines. |

19

Similarly, any sustained decrease in the supply of crude oil and refined products could result in a significant reduction in throughputs in our pipelines and storage in our terminals, which would reduce our cash flows and our ability to make distributions at current levels to our unitholders. Factors that could lead to a decrease in supply to our pipelines and terminals include:

• | prolonged periods of low prices for crude oil and refined products, which could lead to a decrease in exploration and development activity and reduced production in markets served by our pipelines and storage terminals; |

• | changes in the regulatory environment, governmental policies or taxation that directly or indirectly delay production or increase the cost of production of refined products; and |

• | actions taken by foreign oil and gas producing nations that impact prices for crude oil and refined products. |

Our operations are subject to operational hazards and unforeseen interruptions, and we do not insure against all potential losses. Therefore, we could be seriously harmed by unexpected liabilities.

Our operations are subject to operational hazards and unforeseen interruptions such as natural disasters, adverse weather, accidents, fires, explosions, hazardous materials releases, mechanical failures and other events beyond our control. These events might result in a loss of equipment or life, injury or extensive property damage, as well as an interruption in our operations. In the event any of our facilities are forced to shut down for a significant period of time, it may have a material adverse effect on our earnings, our other results of operations and our financial condition as a whole.

We may not be able to maintain or obtain insurance of the type and amount we desire at reasonable rates. As a result of market conditions, premiums and deductibles for certain of our insurance policies have increased substantially and could escalate further. Certain insurance coverage could become unavailable or available only for reduced amounts of coverage and at higher rates. For example, our insurance carriers require broad exclusions for losses due to terrorist acts. If we were to incur a significant liability for which we are not fully insured, such a liability could have a material adverse effect on our financial position and our ability to make distributions at current levels to our unitholders and to meet our debt service requirements.

We could be subject to damages based on claims brought against us by our customers or lose customers as a result of the failure of our products to meet certain quality specifications or other claims related to the operation of our assets and the services we provide to our customers.