Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-20151231xex312.htm |

| EX-32.1 - EX-32.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-20151231xex321.htm |

| EX-21.1 - EX-21.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-20151231xex211.htm |

| EX-31.1 - EX-31.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-20151231xex311.htm |

| EX-23.1 - EX-23.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-20151231xex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-25032

UNIVERSAL STAINLESS & ALLOY PRODUCTS, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

DELAWARE |

|

25-1724540 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

600 MAYER STREET, BRIDGEVILLE, PA 15017 |

(412) 257-7600 |

|

(Address of principal executive offices, including zip code) |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of exchange on which registered |

|

|

Common Stock, par value $0.001 per share |

The NASDAQ Stock Market, LLC |

|

|

|

Securities registered pursuant to Section 12(g) of the Act: [None]

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definitions of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check One)

|

|

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 30, 2015, based on the closing price of $19.65 per share on that date, was approximately $52,785,000. For the purposes of this disclosure only, the registrant has assumed that its directors, executive officers, and beneficial owners of 5% or more of the registrant’s common stock are the affiliates of the registrant. The registrant has made no determination that such persons are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

As of February 19, 2016, there were 7,477,400shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE Part III of this Form 10-K incorporates by reference portions of the Company’s definitive Proxy Statement for the 2016 Annual Meeting of Stockholders.

|

INDEX |

|||

|

PART I |

|||

|

Item 1. |

Business |

1 |

|

|

Item 1A. |

Risk Factors |

5 |

|

|

Item 1B. |

Unresolved Staff Comments |

7 |

|

|

Item 2. |

Properties |

7 |

|

|

Item 3. |

Legal Proceedings |

8 |

|

|

Item 4. |

Mine Safety Disclosures |

8 |

|

|

PART II |

|||

|

Item 5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

9 |

|

|

Item 6. |

Selected Financial Data |

10 |

|

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

11 |

|

|

Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk |

23 |

|

|

Item 8. |

Financial Statements and Supplementary Data |

24 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

44 |

|

|

Item 9A. |

Controls and Procedures |

44 |

|

|

Item 9B. |

Other Information |

44 |

|

|

PART III |

|||

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

44 |

|

|

Item 11. |

Executive Compensation |

44 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

45 |

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

45 |

|

|

Item 14. |

Principal Accountant Fees and Services |

45 |

|

|

PART IV |

|||

|

Item 15. |

Exhibits and Financial Statement Schedules |

45 |

|

i

PART I

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The statements contained in this Annual Report on Form 10-K (“Form 10-K”) of Universal Stainless and Alloy Products, Inc. (“Universal,” the “Company,” “us,” “our,” or “we”), including, but not limited to, the statements contained in Item 1, “Business,” and Item 7, "Management's Discussion and Analysis of the Financial Condition and Results of Operations,” along with statements contained in other reports that we have filed with the Securities and Exchange Commission (the “SEC”), external documents and oral presentations, which are not historical facts are considered to be "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. These statements which may be expressed in a variety of ways, including the use of forward looking terminology such as “believe,” “expect,” “seek,” “intend,” “may,” “will,” “should,” “could,” “potential,” “continue,” “estimate,” “plan,” or “anticipate,” or the negatives thereof, other variations thereon or compatible terminology, relate to, among other things, statements regarding future growth, cost savings, expanded production capacity, broader product lines, greater capacity to meet customer quality reliability, price and delivery needs, enhanced competitive posture, and the effect of new accounting pronouncements. We do not undertake any obligation to publicly update any forward-looking statements.

These forward-looking statements, and any forward looking statements contained in other public disclosures of the Company which make reference to the cautionary factors contained in this Form 10-K, are based on assumptions that involve risks and uncertainties and are subject to change based on the considerations described below. We discuss many of these risks and uncertainties in greater detail in Item 1A, “Risk Factors,” of this Form 10-K. These and other risks and uncertainties may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements.

Universal, which was incorporated in 1994, and its wholly-owned subsidiaries, manufacture and market semi-finished and finished specialty steel products, including stainless steel, nickel alloys, tool steel and certain other premium alloyed steels. Our manufacturing process involves melting, remelting, heat treating, hot and cold rolling, forging, machining and cold drawing of semi-finished and finished specialty steels. Our products are sold to service centers, forgers, rerollers, original equipment manufacturers (“OEMs”) and wire redrawers. Our customers further process our products for use in a variety of industries, including the aerospace, power generation, oil and gas, heavy equipment and general industrial markets. We also perform conversion services on materials supplied by customers.

We operate in four locations: Bridgeville and Titusville, Pennsylvania; Dunkirk, New York; and North Jackson, Ohio. Our corporate headquarters is located at our Bridgeville location. We operate these four manufacturing locations as one reportable business segment.

We produce a wide variety of specialty steel grades using several manufacturing processes including argon oxygen decarburization (“AOD”), electro-slag remelted (“ESR”), vacuum induction melting (“VIM”) and vacuum-arc remelted (“VAR”). At our Bridgeville and North Jackson facilities, we produce specialty steel products in the form of semi-finished and finished long products (ingots, blooms, billets and bars). In addition, the Bridgeville facility produces flat rolled products (slabs and plates). Semi-finished long products are primarily used by our Dunkirk facility and certain customers to produce finished bar, rod, wire and plate products. Finished bar products that we manufacture are primarily used by OEMs and by service center customers for distribution to a variety of end users. We also produce customized shapes primarily for OEMs that are cold rolled from purchased coiled strip, flat bar or extruded bar at our precision rolled products department, located at our Titusville facility.

INDUSTRY OVERVIEW

The specialty steel industry is a relatively small but distinct segment of the overall steel industry. Specialty steels include stainless steels, nickel alloys, tool steels, electrical steels, high-temperature alloys, magnetic alloys and electronic alloys. Specialty steels are made with a high alloy content, suitable for use in environments that demand exceptional hardness, toughness, strength and resistance to heat, corrosion or abrasion, or combinations thereof. Specialty steels generally must conform to more demanding customer specifications for consistency, straightness and surface finish than carbon steels. For the years ended December 31, 2015, 2014 and 2013, more than 75% of our net sales were derived from stainless steel products.

1

We primarily manufacture our products within the following product lines and, generally, in response to customer orders:

Stainless Steel. Stainless steel, which represents the largest part of the specialty steel market, contains elements such as nickel, chrome and molybdenum that give it the unique qualities of high strength, good wear characteristics, natural attractiveness, ease of maintenance and resistance to rust, corrosion and heat. Stainless steel is used, among other applications, in the, aerospace, oil and gas, power generation and automotive industries, as well as in the manufacturing of equipment for food handling, health and medical, chemical processing and pollution control.

High-Strength Low Alloy Steel. High-strength low alloy steel is a relative term that refers to those steels that maintain alloying elements that range in versatility. The alloy element of nickel, chrome and molybdenum in such steels typically exceeds the alloy element of carbon steels but not that of high-temperature alloy steel. High-strength low alloy steels are manufactured for use generally in the aerospace industry.

Tool Steel. Tool steels contain elements of manganese, silicon, chrome and molybdenum to produce specific hardness characteristics that enable tool steels to form, cut, shape and shear other materials in the manufacturing process. Heating and cooling at precise rates in the heat-treating process bring out these hardness characteristics. Tool steels are utilized in the manufacturing of metals, plastics, paper and aluminum extrusions, pharmaceuticals, electronics and optics.

High-Temperature Alloy Steel. These steels are designed to meet critical requirements of heat resistance and structural integrity. They generally have very high nickel content relative to other types of specialty steels. High-temperature alloy steels are manufactured for use generally in the aerospace industry.

Our net sales by principal product line were as follows:

|

For the years ended December 31, |

2015 |

2014 |

2013 |

||||||

|

(dollars in thousands) |

|||||||||

|

Stainless steel |

$ |

135,945 |

$ |

159,799 |

$ |

137,383 | |||

|

High-strength low alloy steel |

16,045 | 16,853 | 17,894 | ||||||

|

Tool steel |

16,197 | 16,680 | 18,112 | ||||||

|

High-temperature alloy steel |

7,557 | 6,295 | 4,277 | ||||||

|

Conversion services and other sales |

4,916 | 5,933 | 3,102 | ||||||

|

Total net sales |

$ |

180,660 |

$ |

205,560 |

$ |

180,768 | |||

RAW MATERIALS

We depend on the delivery of key raw materials for our day-to-day operations. These key raw materials are carbon and stainless scrap metal and alloys, primarily consisting of nickel, chrome, molybdenum, and copper. Scrap metal is primarily generated by industrial sources and is purchased through a number of scrap brokers and processors. We also recycle scrap metal generated from our own production operations as a source of metal for our melt shops. Alloys are generally purchased from domestic agents and originate in the United States, Australia, Canada, China, Russia, Brazil and South Africa.

Our Bridgeville and North Jackson facilities currently supply semi-finished specialty steel products as starting materials to our other operating facilities. Semi-finished specialty steel starting materials, which we cannot produce at a competitive cost, are purchased from other suppliers. We generally purchase these starting materials from steel strip coil suppliers, extruders, flat rolled producers and service centers. We believe that adequate supplies of starting material will continue to be available.

The cost of raw materials represents approximately half of the cost of products sold in 2015, 2014 and 2013. Raw material costs can be impacted by significant price changes. Raw material prices vary based on numerous factors, including quality, and are subject to frequent market fluctuations. Future raw material prices cannot be predicted with any degree of certainty. We do not maintain any fixed-price long-term agreements with any of our raw material suppliers.

We maintain a sales price surcharge mechanism on certain of our products to match sales prices to raw material price changes. For certain products, the surcharge is calculated at the time of order entry, based on current raw material prices or prices at the time of shipment. For certain finished products, the surcharge is calculated based on the monthly average raw material prices two months prior to the promised ship date.

2

CUSTOMERS

Our five largest customers in the aggregate accounted for approximately 42% of our net sales for the year ended December 31, 2015, and 46% of our net sales for each of the years ended December 31, 2104 and 2013, respectively. Our largest customer in 2015, Reliance Steel & Aluminum Co., accounted for approximately 16%, 18% and 15% of our net sales for the years ended December 31, 2015, 2014 and 2013, respectively. No other customer accounted for more than 10% of our net sales for the years ended December 31, 2015 and 2014. In addition, one other customer accounted for over 10% of our net sales in 2013. International sales approximated 9%, 7% and 6% of 2015, 2014 and 2013 total net sales, respectively.

BACKLOG

Our backlog of orders (excluding surcharges) on hand as of December 31, 2015 was approximately $38.2 million compared to approximately $61.1 million at the same time in 2014. We believe that this 37% decrease in our backlog is largely a result of decreased demand for our products due to the industry-wide downtown, shorter lead times, and customer destocking. Our backlog may not be indicative of actual sales because certain surcharges are not determinable until the order is shipped to the customer and, therefore, should not be used as a direct measure of future revenue. However, we expect that our actual sales will be higher than the backlog once the actual surcharges are determined.

COMPETITION

Competition in our markets is based upon product quality, delivery capability, customer service, customer approval and price. Maintaining high standards of product quality, while responding quickly to customer needs and keeping production costs at competitive levels, is essential to our ability to compete in these markets.

We believe that there are several companies that manufacture one or more similar specialty steel products that are significant competitors. There are a few smaller producing companies and material converters that are also considered to be competitors of ours.

High import penetration of specialty steel products, especially stainless and tool steels, also impacts the competitive nature within the United States. Unfair pricing practices by foreign producers have resulted in high import penetration into the U.S. markets in which we participate.

EMPLOYEE RELATIONS

We consider the maintenance of good relations with our employees to be important to the successful conduct of our business. We have profit-sharing plans for certain salaried and hourly employees and for all of our employees represented by United Steelworkers (the “USW”) and have equity ownership programs for all of our eligible employees, in an effort to forge an alliance between our employees’ interests and those of our stockholders. At December 31, 2015, 2014 and 2013, we had 634, 714, and 675 employees, respectively, of which 449, 501, and 475, respectively, were USW members.

Collective Bargaining Agreements

Our Bridgeville, Titusville and Dunkirk facilities recognize the USW as the exclusive representative for their hourly employees with respect to the terms and conditions of their employment. The North Jackson facility is not unionized. We have entered into the following collective bargaining agreements:

|

|

|

|

|

Facility

|

Commencement Date

|

Expiration Date

|

|

Dunkirk |

November 2012 |

October 2017 |

|

Bridgeville |

September 2013 |

August 2018 |

|

Titusville |

October 2015 |

September 2020 |

We believe a critical component of our collective bargaining agreements is the inclusion of a profit sharing plan.

Employee Benefit Plans

We maintain a 401(k) retirement plan for our hourly and salaried employees. Pursuant to the 401(k) plan, participants may elect to make pre-tax and after-tax contributions, subject to certain limitations imposed under the Internal Revenue Code of 1986, as amended. In addition, we make periodic contributions to the 401(k) plan for the hourly employees employed at the Dunkirk and Titusville facilities, based on service, and at the North Jackson facility, based upon the employee’s age and wage rate. We make periodic contributions for the salaried employees at all locations, except for North Jackson, based upon their service and their individual contribution to the 401(k) retirement plan. For North Jackson salaried employees, we make periodic contributions based upon the employee’s age, annual salary, and their individual contributions.

We participate in the Steelworkers Pension Trust (the “Trust”), a multi-employer defined-benefit pension plan that is open to all hourly and salaried employees associated with the Bridgeville facility. We make periodic contributions to the Trust based on hours worked at a fixed rate for each hourly employee and a fixed monthly contribution on behalf of each salaried employee.

3

We also provide group life and health insurance plans for our hourly and salary employees.

Employee Stock Purchase Plan

Under the 1996 Employee Stock Purchase Plan, as amended (the “Plan”), the Company is authorized to issue up to 200,000 shares of common stock to its full-time employees, nearly all of whom are eligible to participate. Under the terms of the Plan, employees can choose as of January 1 and July 1 of each year to have up to 10% of their total earnings withheld to purchase up to 100 shares of our common stock each six-month period. The purchase price of the stock is 85% of the lower of its beginning-of-the-period or end-of-the-period market prices. At December 31, 2015, we have issued 178,636 shares of common stock since the Plan’s inception.

ENVIRONMENTAL

We are subject to federal, state and local environmental laws and regulations (collectively, “Environmental Laws”), including those governing discharges of pollutants into the air and water, and the generation, handling and disposal of hazardous and non-hazardous substances. We monitor our compliance with applicable Environmental Laws and, accordingly, believe that we are currently in compliance with all laws and regulations in all material respects. We are subject periodically to environmental compliance reviews by various regulatory offices. We may be liable for the remediation of contamination associated with generation, handling and disposal activities. Environmental costs could be incurred, which may be significant, related to environmental compliance, at any time or from time to time in the future.

EXECUTIVE OFFICERS

The following table sets forth, as of February 26, 2016, certain information with respect to the executive officers of the Company:

|

Name (Age) |

Executive Officer Since |

Position |

||

|

Dennis M. Oates (63) |

2008 |

Chairman, President and Chief Executive Officer |

||

|

Larry J. Pollock (51) |

2015 |

Executive Vice President, Chief Manufacturing Officer |

||

|

Christopher M. Zimmer (42) |

2010 |

Executive Vice President and Chief Commercial Officer |

||

|

Paul A. McGrath (64) |

1996 |

Vice President of Administration, General Counsel and Secretary |

||

|

Graham McIntosh, Ph.D. (53) |

2015 |

Vice President and Chief Technology Officer |

||

|

Ross C. Wilkin (45) |

2015 |

Vice President of Finance, Chief Financial Officer and Treasurer |

||

Dennis M. Oates has been President and Chief Executive Officer of the Company since 2008. Mr. Oates was named to the Company’s Board of Directors in 2007. Mr. Oates previously served as Senior Vice President of the Specialty Alloys Operations of Carpenter Technology Corporation from 2003 to 2007. Mr. Oates also served as President and Chief Executive Officer of TW Metals, Inc. from 1998 to 2003. In May 2010, the Board of Directors elected Mr. Oates to the additional position of Chairman.

Larry J. Pollock has been Executive Vice President, Chief Manufacturing Officer since May 2015. Mr. Pollock served as Director of Tube Manufacturing at TimkenSteel prior to joining the Company and General Manager at The Timken Company from 2010 through 2014. Prior to joining Timken, Mr. Pollock was the General Manager at SPS Technologies/PCC where he was responsible for the aerospace fasteners business unit. From 1987 to 2009, Mr. Pollock held several positions at Pilkington/Nippon Sheet Glass Company.

Christopher M. Zimmer has been Executive Vice President and Chief Commercial Officer since July 2014. Mr. Zimmer served as Vice President of Sales and Marketing from 2008 to July 2014. Mr. Zimmer previously served as Vice President of Sales and Marketing for Schmoltz+Bickenbach USA from 1995 to 2008. He held positions of increasing responsibility including inside sales, commercial manager—stainless bar, general manager—nickel alloy products, and National Sales Manager.

Paul A. McGrath has been Vice President of Administration of the Company since 2007, General Counsel since 1995 and was appointed Secretary in 1996. Mr. McGrath served as Vice President of Operations from 2001 to 2006. Previously, he was employed by Westinghouse Electric Corporation for approximately 24 years in various management positions.

Graham McIntosh, Ph.D. has been Vice President and Chief Technology Officer since November 2013. Dr. McIntosh previously served as Director of Global Technology Initiatives for Carpenter Technology Corporation where he joined in 2008. Dr. McIntosh

4

also served as Vice President of Technology and Director of Quality for Firth Rixson Viking from 2001-2008, and also held several management and technical positions at Wyman-Gordon Livingston from 1987-2001, where he began his career.

Ross C. Wilkin has been Vice President of Finance, Chief Financial Officer and Treasurer since August 2015. Mr. Wilkin previously served as Chief Financial Officer of Dynamics Inc. From 2003 to 2014, Mr. Wilkin held several financial positions at the H.J. Heinz Company, including VP CFO of Heinz Australia and New Zealand, and Divisional Finance Director for Heinz North America. Prior to joining H.J. Heinz, Mr. Wilkin served as Finance Director for the European Access division of Marconi plc. He began his finance career at KPMG in 1992.

PATENTS AND TRADEMARKS

We do not consider our business to be materially dependent on patent or trademark protection, and believe we own or maintain effective licenses covering all the intellectual property used in our business. We benefit from our proprietary rights relating to designs, engineering and manufacturing processes and procedures. We seek to protect our proprietary information by use of confidentiality and non-competition agreements with certain employees.

AVAILABLE INFORMATION

Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as well as proxy and information statements that we file with the SEC, are available free of charge on our website at www.univstainless.com as soon as reasonably practicable after such reports are filed with the SEC. The contents of our website are not part of this Form 10-K. Copies of these documents will be available to any shareholder upon request. Requests should be directed in writing to Investor Relations at 600 Mayer Street, Bridgeville, PA 15017. You also may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, like us, that file electronically with the SEC.

We wish to caution each reader of this Form 10-K to consider the following factors and other factors discussed herein and in other past reports, including but not limited to prior year Form 10-K and Form 10-Q reports filed with the SEC. Our business and results of operations could be materially affected by any of the following risks. The factors discussed herein are not exhaustive. Therefore, the factors contained herein should be read together with other reports that we file with the SEC from time to time, which may supplement, modify, supersede, or update the factors listed in this document.

A substantial amount of our sales are derived from a limited number of customers.

Our five largest customers in the aggregate accounted for approximately 42% of our net sales for the year ended December 31, 2015, and 46% of our net sales for each of the years ended December 31, 2104 and 2013, respectively. The accounts receivable balance from these five customers comprised approximately 23% of total accounts receivable at December 31, 2015. An adverse change in, or termination of, the relationship with one or more of our customers or market segments could have a material adverse effect on our results of operations.

Our business is very competitive and increased competition could reduce our sales.

We compete with domestic and foreign producers of specialty steel products. In addition, many of the finished products sold by our customers are in direct competition with finished products manufactured by foreign sources, which may affect the demand for those customers’ products. Any competitive factors that adversely affect the market for finished products manufactured by us or our customers could indirectly adversely affect the demand for our semi-finished products. Additionally, our products compete with products fashioned from alternative materials such as aluminum, composites and plastics, the production of which includes domestic and foreign enterprises. Competition in our field is intense and is expected to continue to be so in the foreseeable future. The majority of our business is not covered under long term supply contracts. There can be no assurance that we will be able to compete successfully in the future.

A substantial amount of our sales are derived from the aerospace industry.

Approximately 60% of our sales and 46% of our tons shipped represented products sold to customers in the aerospace market in 2015. The aerospace market is historically cyclical due to both external and internal market factors. These factors include general economic conditions, supply chain fluctuations, diminished credit availability, airline profitability, demand for air travel, age of fleets, varying fuel and labor costs, price competition, new technology development and international and domestic political conditions such as military conflict and the threat of terrorism. The length and degree of cyclical fluctuation can be influenced by any one or a combination of these factors and therefore are difficult to predict with certainty. While the aerospace industry is currently experiencing good growth, a downturn in the aerospace industry would adversely affect the demand for products and/or the prices at

5

which we are able to sell our products, and our results of operations, business and financial condition could be materially adversely affected.

We are dependent on the availability and price of raw materials.

We purchase carbon and stainless scrap metal and alloy additives, principally nickel, chrome, molybdenum, manganese and copper, for our melting operation. A substantial portion of the alloy additives is available only from foreign sources, some of which are located in countries that may be subject to unstable political and economic conditions. Those conditions might disrupt supplies or affect the prices of the raw materials used by us. We maintain sales price surcharges on certain of our products to help offset the impact of raw material price fluctuations.

We do not maintain long-term fixed-price supply agreements with any of our raw material suppliers. If our supply of raw materials were interrupted, we might not be able to obtain sufficient quantities of raw materials, or obtain sufficient quantities of such materials at satisfactory prices, which, in either case, could adversely affect our results of operations. In addition, significant volatility in the price of our principal raw materials could adversely affect our financial results and there can be no assurance that the raw material surcharge mechanism employed by us will completely offset immediate changes in our raw material costs.

Our business requires substantial amounts of energy.

The production of specialty steel requires the ready availability of substantial amounts of electricity and natural gas for which we negotiate competitive agreements for the supply of electricity and natural gas. While we believe that our energy agreements allow us to compete effectively within the specialty steel industry, the potential of curtailments exists as a result of decreased supplies during periods of increased demand for electricity and natural gas. These interruptions not only can adversely affect our operating performance, but also can lead to increased costs. We have a sales price surcharge mechanism on our products to help offset the impact of natural gas price fluctuations.

We are subject to risks associated with global economic and market factors.

Our results of operations are affected directly by the level of business activity of our customers, which in turn is affected by global economic and market factors impacting the industries and markets that we serve. We are susceptible to macroeconomic downturns in the United States and abroad that may affect the general economic climate, our performance and the demand of our customers. We may face significant challenges if conditions in the financial markets deteriorate. There can be no assurance that global economic and market conditions will not adversely impact our results of operations, cash flow or financial position in the future.

We may experience a shortage in the supply of energy or an increase in energy costs to operate our facilities.

The manufacturing of specialty steels is an energy-intensive industry. While we believe that our energy agreements allow us to compete effectively within the specialty steel industry, we are subject to curtailments as a result of decreased supplies and increased demand for electricity and natural gas. These interruptions not only can adversely affect our operating performance, but also can lead to increased costs for energy.

Our business depends largely on our ability to attract and retain key personnel.

We depend on the continued service, availability and ability to attract skilled personnel, including members of our executive management team, other management positions, metallurgists, along with maintenance and production positions. Our inability to attract and retain such people may adversely impact our ability to fill existing roles and support growth. Further, the loss of key personnel could adversely affect our ability to perform until suitable replacements can be found.

Our business may be harmed by strikes or work stoppages.

At December 31, 2015, we had 449 employees out of a total of 634 who were covered under collective bargaining agreements expiring at various dates in 2017 to 2020. There can be no assurance that we will be successful in timely concluding collective bargaining agreements with the USW to succeed the agreements that expire, in which case, we may experience strikes or work stoppages that may have a material adverse impact on our results of operations.

Our business may be harmed by failures on critical manufacturing equipment.

Our manufacturing processes are dependent upon certain critical pieces of specialty steel making equipment, such as our 50-ton electric-arc furnace and AOD vessel, our ESR, VIM and VAR furnaces, our radial hydraulic forge and our universal rolling mill. In the event a critical piece of equipment should become inoperative as a result of unexpected equipment failure, there can be no assurance that our operations would not be substantially curtailed, which may have a negative effect on our financial results.

6

Our business may be harmed if we are unable to meet our debt service requirements or the covenants in our credit agreement or if interest rates increase.

We have debt upon which we are required to make scheduled interest and principal payments, and we may incur additional debt in the future. A significant portion of our debt bears interest at variable rates that may increase in the future. Our ability to satisfy our debt obligations, and our ability to refinance any of our indebtedness in the future if we determine that doing so would be advisable, will depend upon our future operating performance, which will be affected by prevailing economic conditions in the markets that we serve and financial, business and other factors, many of which are beyond our control. If we are unable to generate sufficient cash to service our debt or if interest rates increase, our results of operations and financial condition could be adversely affected. Our credit agreement, which provides for a $65.0 million senior secured revolving credit facility and a $30.0 million senior secured term loan facility, also requires us to comply with certain covenants. A failure to comply with the covenants contained in the credit agreement could result in a default, which, if not waived by our lenders, could substantially increase our borrowing costs and result in acceleration of our debt. As of December 31, 2015, we were in compliance with the covenants in our credit agreement. In January, 2016 we entered into a new credit agreement that replaces the credit agreement in place at December 31, 2015.

We believe that our international sales are associated with various risks.

We conduct business with suppliers and customers in foreign countries which exposes us to risks associated with international business activities. We could be significantly impacted by those risks, which include the potential for volatile economic and labor conditions, political instability, collecting accounts receivable and exchange rate fluctuations (which may affect sales revenue to international customers and the margins on international sales when converted into U.S. dollars).

If we are unable to protect our information technology infrastructure against service interruptions, data corruption, cyber-based attacks or network security beaches, our operations could be disrupted.

We rely on information technology networks and systems to manage and support a variety of business activities, including procurement and supply chain, engineering support, and manufacturing. Our information technology systems, some of which are managed by third-parties, may be susceptible to damage, disruptions or shutdown due to failures during the process of upgrading or replacing software, databases or components thereof, power outages, hardware failures, computer viruses, attacks by computer hackers, telecommunications failures, user errors or catastrophic events. In addition, security breaches could result in unauthorized disclosures of confidential information. If our information technology systems suffer severe damage, disruption or shutdown and our business continuity plans do not effectively resolve the issues in a timely manner, our manufacturing process could be disrupted resulting in late deliveries or even no deliveries if there is a total shutdown.

ITEM 1B.UNRESOLVED STAFF COMMENTS

None.

We own our Bridgeville, Pennsylvania facility, which consists of approximately 760,000 square feet of floor space and our executive offices on approximately 74 acres. The Bridgeville facility contains melting, remelting, conditioning, rolling, annealing and various other processing equipment. Substantially all products shipped from the Bridgeville facility are processed through its melt shop and universal rolling mill operations.

We own our North Jackson, Ohio facility, which consists of approximately 257,000 square feet of floor space on approximately 110 acres. The North Jackson facility contains melting, remelting, forging, annealing and various other processing operations. Our obligations under our credit agreement, which is more fully described under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources,” are collateralized by a first lien in our real property in North Jackson, Ohio. Also, our obligations under the convertible notes also more fully described under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” are collateralized by a second lien in our North Jackson, Ohio real property.

We own our Dunkirk, New York facility, which consists of approximately 680,000 square feet of floor space on approximately 81 acres. The Dunkirk facility processes semi-finished billet and bar stock through one or more of its four rolling mills, a high temperature annealing facility and/or a round bar finishing facility.

We own our Titusville, Pennsylvania facility, which consists of seven buildings on approximately 10 acres, including two principal buildings of approximately 265,000 square feet in total area. The Titusville facility contains five VAR furnaces and various rolling and finishing equipment.

Specialty steel production is a capital-intensive industry. We believe that our facilities and equipment are suitable for our present manufacturing needs. We believe, however, that we will continue to require capital from time to time to add new equipment and to repair or replace our existing equipment to remain competitive and to enable us to manufacture quality products and provide delivery and other support service assurances to our customers.

7

ITEM 3.LEGAL PROCEEDINGS

From time to time, various lawsuits and claims have been or may be asserted against us relating to the conduct of our business, including routine litigation relating to commercial and employment matters. The ultimate cost and outcome of any litigation or claim cannot be predicted with certainty. We believe, based on information presently available, that the likelihood that the ultimate outcome of any such pending matter will have a material adverse effect on our financial condition, or liquidity or a material impact to our results of operations is remote, although the resolution of one or more of these matters may have a material adverse effect on our results of operations for the period in which the resolution occurs.

ITEM 4.MINE SAFETY DISCLOSURES

Not applicable.

8

PART II

ITEM 5.MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

At December 31, 2015, a total of 7,404,193 shares of common stock, par value $0.001 per share, were issued and held by approximately 112 holders of record. There were 292,855 shares of the issued common stock held in treasury at December 31, 2015.

Certain holders of our common stock and the Company are party to a stockholder agreement. That agreement maintains in effect certain registration rights granted to certain stockholders and provides to them two demand registration rights exercisable at any time upon written request for the registration of shares of common stock having an aggregate net offering price of at least $5.0 million.

PRICE RANGE OF COMMON STOCK

Our common stock is listed on the NASDAQ Global Select Market under the symbol “USAP.” The following table sets forth the range of high and low sales prices per share of our common stock, for the periods indicated below:

|

2015 |

2014 |

|||||||||||

|

High |

Low |

High |

Low |

|||||||||

|

First quarter |

$ |

28.41 |

$ |

19.03 |

$ |

38.88 |

$ |

30.15 | ||||

|

Second quarter |

$ |

27.11 |

$ |

17.76 |

$ |

36.81 |

$ |

28.79 | ||||

|

Third quarter |

$ |

19.82 |

$ |

10.15 |

$ |

34.22 |

$ |

25.92 | ||||

|

Fourth quarter |

$ |

13.59 |

$ |

8.01 |

$ |

28.79 |

$ |

22.85 | ||||

PERFORMANCE GRAPH

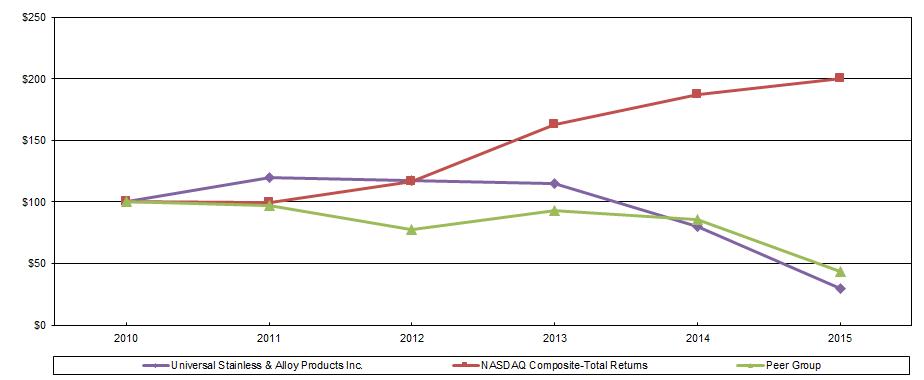

The performance graph below compares the cumulative total stockholder return on our common stock with the cumulative total return on the equity securities of the NASDAQ Composite Index and a peer group selected by us. The peer group consists of domestic specialty steel producers: Allegheny Technologies Incorporated; Materion Corporation; Carpenter Technology Corporation; and Haynes International, Inc. RTI International Metals, Inc., which previously was included in our peer group, was acquired by Alcoa Inc. in July 2015. The graph assumes an investment of $100 on December 31, 2010 reinvestment of dividends, if any, on the date of dividend payment and the peer group is weighted by each company’s market capitalization. The performance graph represents past performance and should not be considered to be an indication of future performance.

Comparison of 5-Year Cumulative Total Shareholder Return among Universal Stainless & Alloy Products, Inc., the NASDAQ Composite Index and a Peer Group

|

For the years ended December 31, |

||||||||||||||||||

|

Company/Peer/Market |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

||||||||||||

|

Universal Stainless & Alloy Products, Inc. |

$ |

100.00 |

$ |

119.44 |

$ |

117.55 |

$ |

115.28 |

$ |

80.40 |

$ |

29.70 | ||||||

|

Peer Group |

$ |

100.00 |

$ |

96.94 |

$ |

77.22 |

$ |

92.62 |

$ |

85.58 |

$ |

43.68 | ||||||

|

NASDAQ Composite Index |

$ |

100.00 |

$ |

99.17 |

$ |

116.48 |

$ |

163.21 |

$ |

187.27 |

$ |

200.31 | ||||||

9

PREFERRED STOCK

Our Certificate of Incorporation provides that we may, by vote of our Board of Directors, issue up to 1,980,000 shares of preferred stock. The preferred stock may have rights, preferences, privileges and restrictions thereon, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting any series or designation of such series, without further vote or action by the stockholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of the Company without further action by the stockholders and may adversely affect the voting and other rights of the holders of common stock. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of common stock, including the loss of voting control to others. We have no outstanding preferred stock and have no current plans to issue any of the authorized preferred stock.

DIVIDENDS

We have never paid a cash dividend on our common stock. Our credit agreement does not permit the payment of cash dividends on our common stock.

ITEM 6.SELECTED FINANCIAL DATA

|

For the years ended December 31, |

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||

|

(dollars in thousands, except per share amounts) |

|||||||||||||||

|

Summary of operations: |

|||||||||||||||

|

Net sales |

$ |

180,660 |

$ |

205,560 |

$ |

180,768 |

$ |

250,990 |

$ |

252,596 | |||||

|

Goodwill impairment |

$ |

20,268 |

$ |

- |

$ |

- |

$ |

- |

$ |

- |

|||||

|

Operating (loss) income |

$ |

(30,079) |

$ |

10,900 |

$ |

(4,005) |

$ |

23,403 |

$ |

29,687 | |||||

|

Net (loss) income |

$ |

(20,672) |

$ |

4,050 |

$ |

(4,062) |

$ |

14,617 |

$ |

18,122 | |||||

|

Financial position at year-end: |

|||||||||||||||

|

Cash |

$ |

112 |

$ |

142 |

$ |

307 |

$ |

321 |

$ |

274 | |||||

|

Working capital1 |

$ |

85,006 |

$ |

98,069 |

$ |

86,512 |

$ |

106,607 |

$ |

85,304 | |||||

|

Property, plant and equipment, net |

$ |

193,505 |

$ |

199,795 |

$ |

203,590 |

$ |

206,150 |

$ |

183,148 | |||||

|

Total assets1 |

$ |

298,555 |

$ |

354,874 |

$ |

334,882 |

$ |

352,959 |

$ |

333,001 | |||||

|

Long-term debt |

$ |

74,137 |

$ |

83,875 |

$ |

86,796 |

$ |

105,242 |

$ |

91,650 | |||||

|

Stockholders’ equity |

$ |

184,977 |

$ |

203,630 |

$ |

196,458 |

$ |

197,713 |

$ |

180,073 | |||||

|

Common share data: |

|||||||||||||||

|

Net (loss) income per common share - Basic |

$ |

(2.92) |

$ |

0.58 |

$ |

(0.58) |

$ |

2.13 |

$ |

2.65 | |||||

|

Net (loss) income per common share - Diluted |

$ |

(2.92) |

$ |

0.57 |

$ |

(0.58) |

$ |

2.02 |

$ |

2.56 | |||||

We acquired the North Jackson facility in August 2011. The results and balances related to North Jackson have been included in our consolidated results since that time.

1Total assets and working capital, for prior periods, have been adjusted to reflect the reclassification of deferred tax assets to noncurrent deferred income taxes to be consistent with the current year presentation.

10

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management Discussion and Analysis (“MD&A”) is intended to help the reader understand the consolidated results of operations and financial condition of Universal Stainless & Alloy Products, Inc. and its wholly-owned subsidiaries (collectively, “we,” “us,” “our,” or the “Company”). This MD&A should be read in conjunction with our consolidated financial statements and accompanying notes included in this Form 10-K. When reviewing the discussion, you should keep in mind the substantial risks and uncertainties that characterize our business. In particular, we encourage you to review the risk and uncertainties described under Item 1A., “Risk Factors,” of this Form 10-K. These risks and uncertainties could cause actual results to differ materially from those forecasted in forward-looking statements or implied by past results and trends. Forward-looking statements are statements that attempt to project or anticipate future developments in our business; we encourage you to review the discussion of forward-looking statements under “Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995,” at the beginning of this report. These statements, like all statements in this report, speak only as of the date of this report (unless another date is indicated), and we undertake no obligation to update or revise the statements in light of future developments. Unless otherwise specified, any reference to a “year” is to the year ended December 31.

Business Overview

We manufacture and market semi-finished and finished specialty steel products, including stainless steel, nickel alloys, tool steel and certain other alloyed steels. Our manufacturing process involves melting, remelting, heat treating, hot and cold rolling, forging, machining and cold drawing of semi-finished and finished specialty steels. Our products are sold to service centers, forgers, rerollers, original equipment manufacturers and wire redrawers. Our customers further process our products for use in a variety of industries, including the aerospace, power generation, oil and gas and general industrial markets. We also perform conversion services on materials supplied by customers.

Despite relatively strong demand in the first half of 2015, which delivered first half net sales growth of 6.7% compared to the first half of 2014, full year 2015 demand was down in all of our end markets due to a second half industry-wide downturn and customer destocking, combined with the impact of lower commodity-driven surcharges. Our customers reduced their inventory levels in anticipation of continued declines in commodity prices. Given this, our overall 2015 net sales were $180.7 million, a decline of $24.9 million, or 12.1%, compared to 2014 net sales of $205.6 million. In our primary market, aerospace, which approximates 60% of total net sales, our sales declined to $108.8 million in 2015 from $120.9 million in 2014, a decrease of $12.2 million, or 10.1%. In addition, net sales in power generation, general industrial (including conversion services and other sales), oil and gas markets, and heavy equipment end markets decreased in 2015 by 18.2%, 16.6%, 12.2% and 12.0%, respectively, reflecting broad-based customer destocking and low oil and gas end market activity. On a positive note, for the 2015 full year, our premium alloy products, which we define as all vacuum induction melt (“VIM”), sales increased by 27.4% over 2014 levels, and represented $17.6 million, or 9.7%, of our total net sales compared to $13.8 million, or 6.7%, of total net sales in 2014. Our premium alloy products are primarily sold to the aerospace end market. Backlog at the end of 2015, before surcharges, was $38.2 million, a decrease of approximately 37% compared to a backlog of $61.1 million at the end of 2014. One of our top priorities over the last 36 months has been to earn customer approvals. In 2015, we earned an additional 15 approvals that are critical to our focus on the aerospace, oil & gas and power generation industries. We added seven more new products in 2015 on top of the 13 added in 2014, as new product introductions are also essential to move to a higher value product mix. We continue to work on gaining other customer approvals and to add more products, with a focus on high value nickel alloy products.

For 2015, our gross margin was 5.3% of net sales compared to 15.6% of net sales in 2014. Gross margin was negatively impacted by the misalignment of customer surcharges with melt costs, as well as overall lower volumes. Reduced mill activity, including a 29% reduction in primary melt volumes, as well as employee severances and non-cash inventory write downs, resulted in charges of $4.7 million, or 2.6% of net sales during the second half of 2015. In addition, during the second half of 2015, charges related to losses incurred from a supplier error impacted gross margin by an additional negative $938,000, or 0.5% of net sales. In light of the weak business conditions in the second half of the year, our focus was to reduce inventory, generate cash, and implement productivity initiatives to better position us when the industry rebounds. In addition, we continued to focus our attention on reducing scrap rates, improving on-time performance, and increasing yields, while controlling spending at each of plants. As we move into 2016 we expect that surcharge misalignment will improve by the second quarter, assuming that nickel and other commodity prices continue to stabilize. Stabilization of commodity prices is a key catalyst for us to return to normal gross margin levels.

Selling, general and administrative (“SG&A”) expenses decreased by $1.7 million in 2015, compared to 2014, primarily as a result of incurring $2.0 million less variable incentive compensation due to our reduced profitability in 2015 compared to 2014. In addition, SG&A charges totaling $0.5 million for the exit of a non-compete contract and employee severance costs negatively impacted 2015. In addition to reducing headcount, and instituting unpaid leave, the Company negotiated savings on contracts with suppliers and service providers and reduced spending on SG&A in the second half of the year. Also impacting operating results, we recorded a $20.3 million charge in the third quarter of 2015 for the impairment of goodwill. The decline in our stock price had caused the Company’s market capitalization to fall sufficiently below book value to necessitate an impairment review under generally accepted accounting principles. The impairment charge fully eliminates goodwill from the balance sheet.

11

Overall, our operating loss in 2015 was $30.1 million, compared to operating income of $10.9 million in 2014. However, the charges noted above related to goodwill impairment, idle plant costs, supplier losses, non-cash inventory write-offs, employee severance and exit costs, and the exit of a non-compete contract accounted for $26.4 million of the change in 2015 compared to 2014.

During 2015 we generated $19.2 million cash from operating activities, and incurred $9.6 million of capital spending. Total debt was reduced by $9.7 million. We believe that demand in the majority of our end markets, especially aerospace where both Boeing and Airbus have production backlogs out for the next several years along with growth in the aftermarket parts markets, will continue to improve as we move through 2016. However, we see no sign that the oil and gas market will rebound in 2016.

Our operating facilities are integrated, and therefore our chief operating decision maker (“CODM”) views the Company as one business unit. Our CODM sets performance goals, assesses performance and makes decisions about resource allocations on a consolidated basis. As a result of these factors, as well as the nature of the financial information available which is reviewed by our CODM, we maintain one reportable segment.

Results of Operations

2015 Results as Compared to 2014

|

For the years ended December 31, |

2015 |

2014 |

||||||||||||||||

|

(dollars in thousands, except per shipped ton information) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar / ton variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Stainless steel |

$ |

135,945 | 75.2 |

% |

$ |

159,799 | 77.7 |

% |

$ |

(23,854) | (14.9) |

% |

||||||

|

High-strength low alloy steel |

16,045 | 8.9 | 16,853 | 8.2 | (808) | (4.8) | ||||||||||||

|

Tool steel |

16,197 | 9.0 | 16,680 | 8.1 | (483) | (2.9) | ||||||||||||

|

High-temperature alloy steel |

7,557 | 4.2 | 6,295 | 3.1 | 1,262 | 20.0 | ||||||||||||

|

Conversion services and other sales |

4,916 | 2.7 | 5,933 | 2.9 | (1,017) | (17.1) | ||||||||||||

|

Total net sales |

180,660 | 100.0 | 205,560 | 100.0 | (24,900) | (12.1) | ||||||||||||

|

Cost of products sold |

171,065 | 94.7 | 173,538 | 84.4 | (2,473) | (1.4) | ||||||||||||

|

Gross margin |

9,595 | 5.3 | 32,022 | 15.6 | (22,427) | (70.0) | ||||||||||||

|

Selling, general and administrative expenses |

19,406 | 10.7 | 21,122 | 10.3 | (1,716) | (8.1) | ||||||||||||

|

Goodwill impairment |

20,268 | 11.2 |

- |

- |

20,268 | 100.0 | ||||||||||||

|

Operating (loss) income |

(30,079) | (16.6) | 10,900 | 5.3 | (40,979) | (376.0) | ||||||||||||

|

Interest expense |

(2,324) | (1.3) | (3,035) | (1.5) | (711) | 23.4 | ||||||||||||

|

Deferred financing amortization |

(566) | (0.3) | (644) | (0.3) | (78) | 12.1 | ||||||||||||

|

Other income (expense) |

153 | 0.1 | (22) |

- |

175 | 795.5 | ||||||||||||

|

(Loss) income before income taxes |

(32,816) | (18.2) | 7,199 | 3.5 | (40,015) | (555.8) | ||||||||||||

|

(Benefit) provision for income taxes |

(12,144) | (6.7) | 3,149 | 1.5 | (15,293) | (485.6) | ||||||||||||

|

Net (loss) income |

$ |

(20,672) | (11.4) |

% |

$ |

4,050 | 2.0 |

% |

$ |

(24,722) | (610.4) |

% |

||||||

|

Tons shipped |

32,388 | 38,869 | (6,481) | (16.7) |

% |

|||||||||||||

|

Sales dollars per shipped ton |

$ |

5,578 |

$ |

5,289 |

$ |

289 | 5.5 |

% |

||||||||||

12

Market Segment Information:

|

For the years ended December 31, |

2015 |

2014 |

||||||||||||||||

|

(dollars in thousands) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Service centers |

$ |

121,090 | 67.0 |

% |

$ |

137,298 | 66.8 |

% |

$ |

(16,208) | (11.8) |

% |

||||||

|

Forgers |

15,143 | 8.4 | 24,918 | 12.1 | (9,775) | (39.2) | ||||||||||||

|

Rerollers |

17,848 | 9.9 | 21,129 | 10.3 | (3,281) | (15.5) | ||||||||||||

|

Original equipment manufacturers |

21,663 | 12.0 | 16,282 | 7.9 | 5,381 | 33.0 | ||||||||||||

|

Conversion services and other sales |

4,916 | 2.7 | 5,933 | 2.9 | (1,017) | (17.1) | ||||||||||||

|

Total net sales |

$ |

180,660 | 100.0 |

% |

$ |

205,560 | 100.0 |

% |

$ |

(24,900) | (12.1) |

% |

||||||

Melt Type Information:

|

For the years ended December 31, |

2015 |

2014 |

||||||||||||||||

|

(dollars in thousands) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Specialty alloys |

$ |

158,145 | 87.6 |

% |

$ |

185,811 | 90.4 |

% |

$ |

(27,666) | (14.9) |

% |

||||||

|

Premium alloys |

17,599 | 9.7 | 13,816 | 6.7 | 3,783 | 27.4 | ||||||||||||

|

Conversion services and other sales |

4,916 | 2.7 | 5,933 | 2.9 | (1,017) | (17.1) | ||||||||||||

|

Total net sales |

$ |

180,660 | 100.0 |

% |

$ |

205,560 | 100.0 |

% |

$ |

(24,900) | (12.1) |

% |

||||||

The majority of our products are sold to service centers rather than the ultimate end market customers. The end market information in this Annual Report is our estimate based upon our knowledge of our customers and the grade of material sold to them, that they will in-turn sell to the ultimate end market customer.

End Market Information:

|

For the years ended December 31, |

2015 |

2014 |

||||||||||||||||

|

(dollars in thousands) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Aerospace |

$ |

108,791 | 60.2 |

% |

$ |

120,947 | 58.8 |

% |

$ |

(12,156) | (10.1) |

% |

||||||

|

Power generation |

19,212 | 10.6 | 23,498 | 11.4 | (4,286) | (18.2) | ||||||||||||

|

Oil and gas |

17,094 | 9.5 | 19,470 | 9.6 | (2,376) | (12.2) | ||||||||||||

|

Heavy equipment |

15,961 | 8.8 | 18,147 | 8.8 | (2,186) | (12.0) | ||||||||||||

|

General industrial, conversion services and other sales |

19,602 | 10.9 | 23,498 | 11.4 | (3,896) | (16.6) | ||||||||||||

|

Total net sales |

$ |

180,660 | 100.0 |

% |

$ |

205,560 | 100.0 |

% |

$ |

(24,900) | (12.1) |

% |

||||||

13

Net sales:

Net sales for the year ended December 31, 2015 decreased $24.9 million or 12.1%, as compared to the same period in 2014. The decrease in our sales primarily reflects a 16.7% decrease in consolidated tons shipped in 2015 compared to 2014 as demand for our products decreased as a result of declining market conditions in 2015 including customer destocking, declines in the oil and gas end market, and lower commodity driven surcharges. Although sales dollars and tons shipped decreased in 2015 compared to 2014, sales dollars per shipped ton increased by 5.5% primarily a result of more favorable product mix of our higher value-added products. Our product sales to all of our end markets decreased as noted in the above table. During the year ended December 31, 2015, we recognized a $3.8 million, or a 27.4%, increase in premium alloy sales when compared to 2014. It is a primary focus of ours to ship higher value-added products. Overall, our premium alloy sales, which are sold primarily to the aerospace end market increased from 6.7% of total sales for the year ended December 31, 2014 to 9.7% of total sales during the year ended December 31, 2015.

Gross margin:

Our gross margin, as a percentage of sales, decreased to 5.3% in 2015 from 15.6% for 2014. The decrease in gross margin is largely the result of the misalignment of sales surcharges, declining commodity prices, and lower sales volumes. The Company also incurred approximately $4.7 million of costs, in the second half of 2015, in response to the sharp industry downturn including costs to temporarily idle plants, non-cash inventory write downs, and costs for reducing the hourly and salary workforce. In addition, the Company incurred approximately $938,000 of costs associated with the unauthorized substitution by a vendor of a critical supply part for the melting process.

Selling, general and administrative expenses:

Our SG&A expenses consist primarily of employee costs, which include salaries, payroll taxes and benefit related costs, legal and accounting services, stock compensation and insurance costs. Our SG&A expenses decreased by $1.7 million in the year ended December 31, 2015 as compared to the year ended December 31, 2014 primarily due to decreased expenses of $2.0 million related to our variable incentive compensation plan as the result of our decreased profitability in 2015 as compared to 2014. In addition we incurred approximately $225,000 of severance costs for reductions in the salary workforce and a non-cash write off of $255,000 for the exit of a non-compete contract. The Company implemented cost savings programs in the second half of the year including headcount reductions, unpaid leave, negotiating savings on existing contracts with suppliers and service providers and reducing spending on SG&A.

Goodwill impairment:

We recorded a goodwill impairment in the third quarter of 2015. Due to a significant and sustained drop in our share price and continued weak operating results driven by slower market conditions, the Company determined that an interim goodwill impairment review was required in accordance with Accounting Standards Codification (“ASC”) 350, “Intangibles – Goodwill and Other”. Based on the guidance in ASC 350, the Company performed the two-step quantitative analysis. Under the first step, the Company determined that the carrying value exceeded the fair value of the Company and, therefore, the second step of the analysis was performed. The fair value was estimated using a combination of an income approach, which estimates fair value based on projected discounted cash flows and a market approach, which estimates fair value using the recent stock price of the Company. The income approach is supported by a Level 3 fair value measurement, which means that the valuation reflects the Company’s own estimates of market participant assumptions. The market approach is supported by a Level 1 fair value measurement which is the observable stock price of the Company. The income approach was weighted 30% and the market approach was weighted 70% in determining the fair value. This assessment resulted in the recognition of a non-cash goodwill impairment charge of $20.3 million, which eliminated all goodwill from the balance sheet at September 30, 2015. The after-tax impact of this charge was $13.1 million. As a result of the step two analysis no other assets were deemed to be impaired at September 30, 2015. The Company reviewed long-lived assets for impairment at December 31, 2015 and no impairment was noted.

Interest expense and deferred financing amortization:

Our interest costs on our debt decreased to $2.3 million from $3.0 million for the same period of 2014. This decrease is primarily due to lower interest rates incurred on our debt in 2015 as compared to 2014 as well as lower debt balances in 2015. The interest rate on our variable rate debt is determined by a LIBOR-based rate plus an applicable margin based upon achieving certain covenant levels. Our deferred financing costs are associated with the issuance and subsequent amendments to our credit facility and convertible notes. During the years ended December 31, 2015 and 2014, we recognized $566,000 and $644,000, respectively, of deferred financing amortization.

Other income:

Other income (expense) increased to approximately $153,000 of income from approximately $22,000 of expense for the same period of 2014. The increase is due to an insurance recovery of approximately $218,000 offset by foreign currency losses.

14

Income tax (benefit) provision:

Our effective tax rates for the years ended December 31, 2015 and 2014 were (37.0)% and 43.7%, respectively. Our overall effective tax rate for the year ended December 31, 2015, which reflects a pre-tax loss, also includes approximately $517,000 of current and prior year research and development (“R&D”) tax credits. The effective tax rate in 2014 was negatively impacted by net tax expenses of $570,000 due to a change in the New York state tax rate to zero percent (0%) for qualified New York manufacturers.

Net (loss) income:

We incurred a net loss of $20.7 million for the year ended December 31, 2015 compared to net income of $4.1 million for the year ended December 31, 2014. However, charges noted above related to goodwill impairment, idle plant costs, supplier losses, non-cash inventory write-offs, employee severance and exit costs, and the exit of a non-compete contract negatively impacted the 2015 net income by $17.0 million.

2014 Results as Compared to 2013

|

For the years ended December 31, |

2014 |

2013 |

||||||||||||||||

|

(dollars in thousands, except per shipped ton information) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar / ton variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Stainless steel |

$ |

159,799 | 77.7 |

% |

$ |

137,383 | 76.0 |

% |

$ |

22,416 | 16.3 |

% |

||||||

|

High-strength low alloy steel |

16,853 | 8.2 | 17,894 | 9.9 | (1,041) | (5.8) | ||||||||||||

|

Tool steel |

16,680 | 8.1 | 18,112 | 10.0 | (1,432) | (7.9) | ||||||||||||

|

High-temperature alloy steel |

6,295 | 3.1 | 4,277 | 2.4 | 2,018 | 47.2 | ||||||||||||

|

Conversion services and other sales |

5,933 | 2.9 | 3,102 | 1.7 | 2,831 | 91.3 | ||||||||||||

|

Total net sales |

205,560 | 100.0 | 180,768 | 100.0 | 24,792 | 13.7 | ||||||||||||

|

Cost of products sold |

173,538 | 84.4 | 166,888 | 92.3 | 6,650 | 4.0 | ||||||||||||

|

Gross margin |

32,022 | 15.6 | 13,880 | 7.7 | 18,142 | 130.7 | ||||||||||||

|

Selling, general and administrative expenses |

21,122 | 10.3 | 17,885 | 9.9 | 3,237 | 18.1 | ||||||||||||

|

Operating income (loss) |

10,900 | 5.3 | (4,005) | (2.2) | 14,905 | (372.2) | ||||||||||||

|

Interest expense |

(3,035) | (1.5) | (2,598) | (1.4) | 437 | 16.8 | ||||||||||||

|

Deferred financing amortization |

(644) | (0.3) | (444) | (0.2) | 200 | 45.0 | ||||||||||||

|

Other income, net |

(22) |

- |

481 | 0.3 | (503) | (104.6) | ||||||||||||

|

Income (loss) before income taxes |

7,199 | 3.5 | (6,566) | (3.6) | 13,765 | (209.6) | ||||||||||||

|

Provision (benefit) for income taxes |

3,149 | 1.5 | (2,504) | (1.4) | 5,653 | (225.8) | ||||||||||||

|

Net income (loss) |

$ |

4,050 | 2.0 |

% |

$ |

(4,062) | (2.2) |

% |

$ |

8,112 | (199.7) |

% |

||||||

|

Tons shipped |

38,869 | 36,477 | 2,392 | 6.6 |

% |

|||||||||||||

|

Sales dollars per shipped ton |

$ |

5,289 |

$ |

4,956 |

$ |

333 | 6.7 |

% |

||||||||||

15

Market Segment Information:

|

For the years ended December 31, |

2014 |

2013 |

||||||||||||||||

|

(dollars in thousands) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Service centers |

$ |

137,298 | 66.8 |

% |

$ |

115,859 | 64.1 |

% |

$ |

21,439 | 18.5 |

% |

||||||

|

Forgers |

24,918 | 12.1 | 21,254 | 11.8 | 3,664 | 17.2 | ||||||||||||

|

Rerollers |

21,129 | 10.3 | 27,021 | 14.9 | (5,892) | (21.8) | ||||||||||||

|

Original equipment manufacturers |

16,282 | 7.9 | 13,532 | 7.5 | 2,750 | 20.3 | ||||||||||||

|

Conversion services and other sales |

5,933 | 2.9 | 3,102 | 1.7 | 2,831 | 91.3 | ||||||||||||

|

Total net sales |

$ |

205,560 | 100.0 |

% |

$ |

180,768 | 100.0 |

% |

$ |

24,792 | 13.7 |

% |

||||||

Melt Type Information:

|

For the years ended December 31, |

2014 |

2013 |

||||||||||||||||

|

(dollars in thousands) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Specialty alloys |

$ |

185,811 | 90.4 |

% |

$ |

167,040 | 92.4 |

% |

$ |

18,771 | 11.2 |

% |

||||||

|

Premium alloys |

13,816 | 6.7 | 10,626 | 5.9 | 3,190 | 30.0 | ||||||||||||

|

Conversion services and other sales |

5,933 | 2.9 | 3,102 | 1.7 | 2,831 | 91.3 | ||||||||||||

|

Total net sales |

$ |

205,560 | 100.0 |

% |

$ |

180,768 | 100.0 |

% |

$ |

24,792 | 13.7 |

% |

||||||

The majority of our products are sold to service centers rather than the ultimate end market customers. The end market information in this Annual Report is our estimate based upon our knowledge of our customers and the grade of material sold to them, that they will in-turn sell to the ultimate end market customer.

End Market Information:

|

For the years ended December 31, |

2014 |

2013 |

||||||||||||||||

|

(dollars in thousands) |

||||||||||||||||||

|

Amount |

Percentage of net sales |

Amount |

Percentage of net sales |

Dollar variance |

Percentage variance |

|||||||||||||

|

Net sales: |

||||||||||||||||||

|

Aerospace |

$ |

120,947 | 58.8 |

% |

$ |

102,341 | 56.6 |

% |

$ |

18,606 | 18.2 |

% |

||||||

|

Power generation |

23,498 | 11.4 | 21,671 | 12.0 | 1,827 | 8.4 | ||||||||||||

|

Oil and gas |

19,470 | 9.6 | 18,880 | 10.5 | 590 | 3.1 | ||||||||||||

|

Heavy equipment |

18,147 | 8.8 | 19,788 | 10.9 | (1,641) | (8.3) | ||||||||||||

|

General industrial, conversion services and other sales |

23,498 | 11.4 | 18,088 | 10.0 | 5,410 | 29.9 | ||||||||||||

|

Total net sales |

$ |

205,560 | 100.0 |

% |

$ |

180,768 | 100.0 |

% |

$ |

24,792 | 13.7 |

% |

||||||

16

Net sales: