Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - TIMKEN CO | tkr123115exhibit101.htm |

| EX-31.2 - EXHIBIT 31.2 - TIMKEN CO | tkr123115exhibit312.htm |

| EX-10.6 - EXHIBIT 10.6 - TIMKEN CO | tkr123115exhibit106.htm |

| EX-32 - EXHIBIT 32 - TIMKEN CO | tkr123115exhibit32.htm |

| EX-31.1 - EXHIBIT 31.1 - TIMKEN CO | tkr123115exhibit311.htm |

| EX-12 - EXHIBIT 12 - TIMKEN CO | tkr123115exhibit12.htm |

| EX-10.2 - EXHIBIT 10.2 - TIMKEN CO | tkr123115exhibit102.htm |

| EX-10.5 - EXHIBIT 10.5 - TIMKEN CO | tkr123115exhibit105.htm |

| EX-10.4 - EXHIBIT 10.4 - TIMKEN CO | tkr123115exhibit104.htm |

| EX-10.3 - EXHIBIT 10.3 - TIMKEN CO | tkr123115exhibit103.htm |

| EX-21 - EXHIBIT 21 - TIMKEN CO | tkr123115exhibit21.htm |

| EX-23 - EXHIBIT 23 - TIMKEN CO | tkr123115exhibit23.htm |

| EX-24 - EXHIBIT 24 - TIMKEN CO | tkr123115exhibit24.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 | |

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______to_______ | |

Commission file number: 1-1169

THE TIMKEN COMPANY

(Exact name of registrant as specified in its charter)

Ohio | 34-0577130 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

4500 Mt. Pleasant St. NW, North Canton, Ohio | 44720-5450 | |

(Address of principal executive offices) | (Zip Code) | |

234.262.3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Shares, without par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer | o | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2015, the aggregate market value of the registrant’s common shares held by non-affiliates of the registrant was $2,734,145,335 based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding at January 29, 2016 | |

Common Shares, without par value | 80,030,053 shares | |

DOCUMENTS INCORPORATED BY REFERENCE

Document | Parts Into Which Incorporated | |

Proxy Statement for the Annual Meeting of Shareholders to be held on or about May 10, 2016 (Proxy Statement) | Part III | |

THE TIMKEN COMPANY

INDEX TO FORM 10-K REPORT

PAGE | |||

I. | |||

Item 1. | |||

Item 1A. | |||

Item 1B. | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Item 4A. | |||

II. | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A. | |||

Item 8. | |||

Item 9. | |||

Item 9A. | |||

Item 9B. | |||

III. | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

IV. | |||

Item 15. | |||

PART I.

Item 1. Business

General:

As used herein, the term “Timken” or the “Company” refers to The Timken Company and its subsidiaries unless the context otherwise requires. Timken engineers, manufactures and markets bearings, transmissions, gearboxes, belts, chain and related products and offers a spectrum of power system rebuild and repair services around the world. The Company’s growing product and services portfolio features many strong industrial brands, including Timken, Fafnir, Philadelphia Gear, Carlisle, Drives and Interlube.

The Company was founded in 1899 by Henry Timken, who received two patents on the design of a tapered roller bearing. Timken later became, and continues to be, the world's largest manufacturer of tapered roller bearings, leveraging its expertise to develop a full portfolio of industry-leading products and services. Timken built its reputation as a global leader by applying its knowledge of metallurgy, friction management and mechanical power transmission to increase the reliability and efficiency of its customers' equipment across a diverse range of industries. Today, the Company's global footprint consists of 63 manufacturing facilities/service centers, 12 technology and engineering centers and 26 distribution centers and warehouses, supported by a team comprised of more than 14,000 employees. Timken operates in 28 countries and territories around the globe.

Industry Segments and Geographical Financial Information:

Information required by this Item is incorporated herein by reference to Note 16 - Segment Information in the Notes to the Consolidated Financial Statements.

Major Customers:

The Company sells products and services to a diverse customer base globally, including customers in the following market sectors: industrial equipment, construction, agriculture, rail, aerospace and defense, automotive, heavy truck and energy. No single customer accounts for 5% or more of total net sales.

Products:

Timken manufactures and manages global supply chains for multiple product lines including anti-friction bearings and mechanical power transmission products designed to operate in demanding environments. The Company leverages its technical knowledge, research expertise, and production and engineering capabilities across all of its products and end markets to deliver high-performance products and services to its customers. Differentiation in these product lines is achieved by either: (1) product type or (2) the targeted applications utilizing the product.

Engineered Bearings:

The Timken® bearing portfolio features a broad range of anti-friction bearing products, including tapered, spherical and cylindrical roller bearings; thrust and ball bearings; and housed units. Timken is a leading authority on tapered roller bearings, and leverages its position by applying engineering know-how and technology across its entire bearing portfolio.

A bearing is a mechanical device that reduces friction between moving parts. The purpose of a bearing is to carry a load while allowing a machine shaft to rotate freely. The basic elements of the bearing include two rings, called races; a set of rollers that rotate around the bearing raceway; and a cage to separate and guide the rolling elements. Bearings come in a number of designs, featuring tapered, spherical, cylindrical or ball rolling elements. The various bearing designs accommodate radial and/or thrust loads differently, making certain bearing types better suited for specific applications.

Selection and development of bearings for customer applications and demand for high reliability require sophisticated engineering and analytical techniques. High precision tolerances, proprietary internal geometries and quality materials provide Timken bearings with high load-carrying capacity, excellent friction-reducing qualities and long service lives. The uses for bearings are diverse and can be found in transportation applications that include passenger cars and trucks, heavy trucks, helicopters, airplanes and trains. Ranging in size from precision bearings the size of a pencil eraser to those roughly three meters in diameter, Timken components are also used in a wide variety of industrial applications: paper and steel mills, mining, oil and gas extraction and production, machine tools, gear drives, health and positioning control, wind turbines and food processing.

1

Tapered Roller Bearings. Timken tapered roller bearings can increase power density and can include customized geometries, engineered surfaces and specialized sealing solutions. The Company’s tapered roller bearing line comes in thousands of combinations in single-, double- and four-row configurations. Tapered roller designs permit ready absorption of both radial and axial load combinations, which makes them particularly well-adapted to reducing friction where shafts, gears or wheels are used.

Spherical and Cylindrical Roller Bearings. Timken also produces spherical and cylindrical roller bearings that are used in large gear drives, rolling mills and other industrial and infrastructure development applications. These products are sold worldwide to original equipment manufacturers and industrial distributors serving major end-market sectors, including construction and mining, natural resources, defense, pulp and paper production, rolling mills and general industrial goods.

Ball Bearings. Timken radial, angular and precision ball bearings are used by customers in a variety of market sectors, including aerospace, agriculture, construction, health, machine tool and general industries. Radial ball bearings are designed to tolerate relatively high-speed operation under a range of load conditions. These bearing types consist of an inner and outer ring with a cage containing a complement of precision balls. Angular contact ball bearings are designed for a combination of radial and axial loading. Precision ball bearings are manufactured to tight tolerances and come in miniature and instrument, thin section and ball screw support designs.

Housed Units. Timken markets among the broadest range of bearing housed units in the industry. These products deliver durable, heavy-duty components designed to protect spherical, tapered and ball bearings in debris-filled, contaminated or high-moisture environments. Common housed unit applications include material handling and processing equipment.

Mechanical Power Transmission:

Belts. Timken makes and markets a full line of Carlisle® belts used in industrial, commercial and consumer applications. The portfolio features more than 20,000 parts designed for demanding applications, which are sold to original equipment and aftermarket customers. Carlisle® belts are engineered for maximum performance and durability, with products available in wrap molded, raw edge, v-ribbed and synchronous belt designs. Common applications include agriculture, construction, industrial machinery, outdoor power equipment and powersports.

Chains. Timken manufactures precision Drives® roller chain, pintle chain, agricultural conveyor chain, engineering class chain and oil field roller chain. These highly engineered products are used in a wide range of mobile and industrial machinery applications, including agriculture, oil and gas, aggregate and mining, primary metals, forest products and other heavy industries. These products are also utilized in the food and beverage and packaged goods sectors, which often require high-end, specialty products, including stainless-steel and corrosion-resistant roller chain.

Lubrication Systems. The Company offers 27 formulations of grease, leveraging its knowledge of tribology and anti-friction bearings to enable smooth equipment operation. Interlube® automated lubrication delivery systems dispense precise amounts of Timken grease, saving users from having to manually apply lubrication. These multifaceted delivery systems are used by the commercial vehicle, construction, mining, and heavy and general industries.

Aerospace Products. The Company's portfolio of parts, systems and services for the aerospace market sector includes products used in helicopters and fixed-wing aircraft for the military and commercial aviation industries. Timken designs, manufactures and tests a wide variety of power transmission and drive train components, including bearings, transmissions, turbine engine components, gears and rotor-head assemblies and housings. In addition to original equipment, Timken provides aftermarket component repair for bearings and compressor cases. Timken inspects and reconditions main engine, gearbox and APU bearings on a wide range of platforms, such as engines, transmissions and gearboxes.

Industrial Gearboxes. The Company’s Philadelphia Gear® line of low- and high-speed gear drive designs are used in large-scale industrial applications. These gear drive configurations are custom-made to meet user specifications, offering a wide-array of size, footprint and gear arrangements. Low-speed drives are commonly used in crushing and pulverizing equipment, cooling towers, conveyors and pumps. High-speed drives are typically used by power generation, oil and gas, marine and pipeline industries.

2

Other Products. The Company also offers a full line of seals, couplings, augers and other mechanical power transmission components. Timken industrial sealing solutions come in a variety of types and material options that are used in manufacturing, food processing, mining, power generation, chemical processing, primary metals, pulp and paper, and oil and gas industry applications. Timken couplings, another mechanical power transmission component, are commonly found in gear drives, motors and pump applications. The Company also designs and manufactures Drives helicoid and sectional augers for agricultural applications, like conveying, digging and combines.

Services:

Power Systems. Timken services components in the industrial customer's drive train, including switch gears, electric motors and generators, gearboxes, bearings, couplings and central panels. The Company’s Philadelphia Gear services for gear drive applications include onsite technical services; inspection, repair and upgrade capabilities; and manufacturing of parts to OEM specifications. In addition, the Company’s Wazee, Smith Services, Schulz, Standard Machine and H&N service centers provide customers with services that include motor and generator rewind and repair and uptower wind turbine maintenance and repair. Timken Power Systems commonly serves customers in the power, wind energy, hydro and fossil fuel, water management, paper, mining and general manufacturing sectors.

Bearing Repair. Timken bearing repair services return worn bearings to like-new specifications, which increases bearing service life and can often restore bearings in less time than required to manufacture new. Bearing remanufacturing is available for any bearing type or brand - including competitor products - and is well-suited to heavy industrial applications such as paper, metals, mining, power generation and cement; railroad locomotives, passenger cars and freight cars; and aerospace engines and gearboxes.

Services accounted for approximately 7% of the Company’s net sales for the year ended December 31, 2015.

Sales and Distribution:

Timken products are sold principally by its own internal sales organizations. A portion of each segment's sales are made through authorized distributors.

Customer collaboration is central to the Company's sales strategy. Therefore, Timken goes where its customers need them, with sales engineers primarily working in close proximity to customers rather than at production sites. In some cases, Timken may co-locate with a customer at their facility to ensure optimized collaboration. The Company's sales force constantly updates the team's training and knowledge regarding all friction management products and market sector trends, and Timken employees assist customers during development and implementation phases and provide ongoing service and support.

The Company has a joint venture in North America focused on joint logistics and e-business services. This joint venture, CoLinx, LLC, includes five equity members: Timken, SKF Group, the Schaeffler Group, ABB Group and Gates Corporation. The e-business service focuses on information and business services for authorized distributors in the Process Industries segment.

Timken has entered into individually negotiated contracts with some of its customers. These contracts may extend for one or more years and, if a price is fixed for any period extending beyond current shipments, customarily include a commitment by the customer to purchase a designated percentage of its requirements from Timken. Timken does not believe that there is any significant loss of earnings risk associated with any given contract.

Competition:

The anti-friction bearing business is highly competitive in every country where Timken sells products. Timken competes primarily based on total value, including price, quality, timeliness of delivery, product design and the ability to provide engineering support and service on a global basis. The Company competes with domestic manufacturers and many foreign manufacturers of anti-friction bearings, including SKF Group, the Schaeffler Group, NTN Corporation, JTEKT Corporation and NSK Ltd.

Joint Ventures:

Investments in affiliated companies accounted for under the equity method were approximately $2.6 million and $1.8 million, respectively, at December 31, 2015 and 2014. The amount at December 31, 2015 was reported in other non-current assets on the Consolidated Balance Sheets.

3

Backlog:

The following table provides the backlog of orders of the Company's domestic and overseas operations at December 31, 2015 and 2014:

December 31, | ||||||

(Dollars in millions) | 2015 | 2014 | ||||

Segment: | ||||||

Mobile Industries | $ | 587.1 | $ | 838.5 | ||

Process Industries | 356.1 | 450.6 | ||||

Total Company | $ | 943.2 | $ | 1,289.1 | ||

Approximately 90% of the Company’s backlog at December 31, 2015, is scheduled for delivery in the succeeding twelve months. Actual shipments depend upon customers' ever-changing production schedules. Accordingly, Timken does not believe that its backlog data and comparisons thereof, as of different dates, reliably indicate future sales or shipments.

Raw Materials:

The principal raw material used by the Company to make anti-friction bearings is special bar quality (SBQ) steel. SBQ steel is produced around the world by various suppliers. SBQ steel is purchased in bar, tube and wire forms. The primary inputs to SBQ steel include scrap metal, iron ore, alloys, energy and labor. The availability and price of SBQ steel are subject to changes in supply and demand, commodity prices for ferrous scrap, ore, alloy, electricity, natural gas, transportation fuel, and labor costs. The Company manages price variability of commodities by using surcharge mechanisms on some of its contracts with its customers that provides for partial recovery of these cost increases in the price of bearing products.

Any significant increase in the cost of steel could materially affect the Company’s earnings. Disruptions in the supply of SBQ steel could temporarily impair the Company’s ability to manufacture bearings for its customers, or require the Company to pay higher prices in order to obtain SBQ, which could affect the Company’s revenues and profitability. The availability of bearing quality tubing is relatively limited, and the Company is taking steps to diversify its processes to limit its exposure to this particular form of SBQ steel. Overall, the Company believes that the number of suppliers of SBQ steel is adequate to support the needs of global bearing production, and, in general, the Company is not dependent on any single source of supply.

Research:

Timken operates a network of technology and engineering centers to support its global customers with sites in North America, Europe and Asia. This network develops and delivers innovative friction management and mechanical power transmission solutions and technical services. Timken's largest technical center is located at the Company's world headquarters in North Canton, Ohio. Other sites in the United States include Manchester, Connecticut; Fulton, Illinois; Springfield, Missouri; Keene and Lebanon, New Hampshire; and King of Prussia, Pennsylvania. Within Europe, the Company has technology facilities in Plymouth, England; Colmar, France; and Ploiesti, Romania. In Asia, Timken operates technology and engineering facilities in Bangalore, India and Shanghai, China.

Expenditures for research and development amounted to approximately $32.6 million, $38.8 million and $39.3 million in 2015, 2014 and 2013, respectively. Of these amounts, approximately $0.3 million and $0.4 million were funded by others in 2014 and 2013, respectively. None was funded by others in 2015.

4

Environmental Matters:

The Company continues its efforts to protect the environment and comply with environmental protection laws. Additionally, it has invested in pollution control equipment and updated plant operational practices. The Company is committed to implementing a documented environmental management system worldwide and to becoming certified under the ISO 14001 standard where appropriate to meet or exceed customer requirements. As of the end of 2015, 16 of the Company’s plants had obtained ISO 14001 certification.

The Company believes it has established appropriate reserves to cover its environmental expenses and has a well-established environmental compliance audit program for its domestic and international units. This program measures performance against applicable laws, as well as against internal standards that have been established for all units worldwide. It is difficult to assess the possible effect of compliance with future requirements that differ from existing requirements.

The Company and certain of its U.S. subsidiaries previously have been and could in the future be identified as potentially responsible parties for investigation and remediation at off-site disposal or recycling facilities under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), known as the Superfund, or state laws similar to CERCLA. In general, such claims for investigation and remediation have also been asserted against numerous other entities.

Management believes any ultimate liability with respect to pending actions will not materially affect the Company’s operations, cash flows or consolidated financial position. The Company is also conducting environmental investigation and/or remediation activities at a number of current or former operating sites. The costs of such investigation and remediation activities, in the aggregate, are not expected to be material to the operations or financial position of the Company.

New laws and regulations, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements may require Timken to incur costs or become the basis for new or increased liabilities that could have a materially adverse effect on the Company's business, financial condition or results of operations.

Patents, Trademarks and Licenses:

Timken owns numerous U.S. and foreign patents, trademarks and licenses relating to certain products. While Timken regards these as important, it does not deem its business as a whole, or any industry segment, to be materially dependent upon any one item or group of items.

Employment:

At December 31, 2015, Timken had more than 14,000 employees. Approximately 7% of Timken’s U.S. employees are covered under collective bargaining agreements.

Available Information:

The Company uses its Investor Relations website at www.timken.com/investors, as a channel for routine distribution of important information, including news releases, analyst presentations and financial information. The Company posts filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (the SEC), including its annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K; its proxy statements; and any amendments to those reports or statements. All such postings and filings are available on the Company’s website free of charge. In addition, this website allows investors and other interested persons to sign up to automatically receive e-mail alerts when the Company posts news releases and financial information on the Company’s website. The SEC also maintains a website, www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report unless expressly noted.

5

Item 1A. Risk Factors

The following are certain risk factors that could affect our business, financial condition and results of operations. The risks that are described below are not the only ones that we face. These risk factors should be considered in connection with evaluating forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause our actual results and financial condition to differ materially from those projected in forward-looking statements. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected.

Risk Relating to our Business

The bearing industry is highly competitive, and this competition results in significant pricing pressure for our products that could affect our revenues and profitability.

The global bearing industry is highly competitive. We compete with domestic manufacturers and many foreign manufacturers of anti-friction bearings, including SKF Group, the Schaeffler Group, NTN Corporation, JTEKT Corporation and NSK Ltd. Due to the competitiveness within the bearing industry, we may not be able to increase prices for our products to cover increases in our costs. In many cases we face pressure from our customers to reduce prices, which could adversely affect our revenues and profitability. In addition, our customers may choose to purchase products from one of our competitors rather than pay the prices we seek for our products, which could adversely affect our revenues and profitability.

Our business is capital intensive, and if there are downturns in the industries that we serve, we may be forced to significantly curtail or suspend operations with respect to those industries, which could result in our recording asset impairment charges or taking other measures that may adversely affect our results of operations and profitability.

Our business operations are capital intensive, and we devote a significant amount of capital to certain industries. Our profitability is dependent on factors such as labor compensation and productivity and inventory management, which are subject to risks that we may not be able to control. If there are downturns in the industries that we serve, we may be forced to significantly curtail or suspend our operations with respect to those industries, including laying-off employees, reducing production, recording asset impairment charges and other measures, which may adversely affect our results of operations and profitability.

Weakness in global economic conditions or in any of the industries or geographic regions in which we or our customers operate, as well as the cyclical nature of our customers' businesses generally or sustained uncertainty in financial markets, could adversely impact our revenues and profitability by reducing demand and margins.

Our results of operations may be materially affected by the conditions in the global economy generally and in global capital markets. There has been significant volatility in the capital markets and in the end markets and geographic regions in which we and our customers operate, which has negatively affected our revenues. Our revenues may also be negatively affected by changes in customer demand, changes in the product mix and negative pricing pressure in the industries in which we operate. Margins in those industries are highly sensitive to demand cycles, and our customers in those industries historically have tended to delay large capital projects, including expensive maintenance and upgrades, during economic downturns. As a result, our revenues and earnings are impacted by overall levels of industrial production.

6

Our results of operations may be materially affected by conditions in global financial markets or in any of the geographic regions in which we, our customers and our suppliers, operate. If an end user cannot obtain financing to purchase our products, either directly or indirectly contained in machinery or equipment, demand for our products will be reduced, which could have a material adverse effect on our financial condition and earnings.

Global financial markets have experienced volatility in recent years, including volatility in securities prices and diminished liquidity and credit availability. Our access to the financial markets cannot be assured and is dependent on, among other things, market conditions and company performance. Accordingly, we may be forced to delay raising capital, issue shorter tenors than we prefer or pay unattractive interest rates, which could increase our interest expense, decrease our profitability and significantly reduce our financial flexibility.

If a customer becomes insolvent or files for bankruptcy, our ability to recover accounts receivable from that customer would be adversely affected and any payment we received during the preference period prior to a bankruptcy filing may be potentially recoverable by the bankruptcy estate. Furthermore, if certain of our customers liquidate in bankruptcy, we may incur impairment charges relating to obsolete inventory and machinery and equipment. In addition, financial instability of certain companies in the supply chain could disrupt production in any particular industry. A disruption of production in any of the industries where we participate could have a material adverse effect on our financial condition and earnings.

If any of our suppliers are unable or unwilling to provide the products or services that we require or materially increase their costs, our ability to offer and deliver our products on a timely and profitable basis could be impaired. We cannot assure you that any or all of our relationships will not be terminated or that such relationships will continue as presently in effect. Furthermore, if any of our suppliers were to become subject to bankruptcy, receivership or similar proceedings, we may be unable to arrange for alternate or replacement relationships on favorable terms, which could harm our sales and operating results.

Any change in raw material prices or the availability or cost of raw materials could adversely affect our results of operations and profit margins.

We require substantial amounts of raw materials, including steel, to operate our business. Our supply of raw materials could be interrupted for a variety of reasons, including availability and pricing. Prices for raw materials necessary for production have fluctuated significantly in the past and could do so in the future. We generally attempt to manage these fluctuations by passing along increased raw material prices to our customers in the form of price increases; however, we may be unable to increase the price of our products due to pricing pressure, contract terms or other factors, which could adversely impact our revenue and profit margins.

Moreover, future disruptions in the supply of our raw materials could impair our ability to manufacture our products for our customers or require us to pay higher prices in order to obtain these raw materials from other sources. Any significant increase in the prices for such raw materials could adversely affect our results of operations and profit margins.

Warranty, recall, quality or product liability claims could materially adversely affect our earnings.

In our business, we are exposed to warranty and product liability claims. In addition, we may be required to participate in the recall of a product. If we fail to meet customer specifications for their products, we may be subject to product quality costs and claims. A successful warranty or product liability claim against us, or a requirement that we participate in a product recall, could have a material adverse effect on our earnings.

We may incur further impairment and restructuring charges that could materially affect our profitability.

We have taken $180.7 million in impairment and restructuring charges in the aggregate during the last five years. Changes in business or economic conditions, or our business strategy, may result in additional restructuring programs and may require us to take additional charges in the future, which could have a material adverse effect on our earnings.

7

Environmental laws and regulations impose substantial costs and limitations on our operations and environmental compliance may be more costly than we expect.

We are subject to the risk of substantial environmental liability and limitations on our operations due to environmental laws and regulations. We are subject to extensive federal, state, local and foreign environmental, health and safety laws and regulations concerning matters such as air emissions, wastewater discharges, solid and hazardous waste handling and disposal and the investigation and remediation of contamination. The risks of substantial costs and liabilities related to compliance with these laws and regulations are an inherent part of our business, and future conditions may develop, arise or be discovered that create substantial environmental compliance or remediation liabilities and costs.

Compliance with environmental, health and safety legislation and regulatory requirements may prove to be more limiting and costly than we anticipate. To date, we have committed significant expenditures in our efforts to achieve and maintain compliance with these requirements at our facilities, and we expect that we will continue to make significant expenditures related to such compliance in the future. From time to time, we may be subject to legal proceedings brought by private parties or governmental authorities with respect to environmental matters, including matters involving alleged noncompliance with or liability under environmental, health and safety laws, property damage or personal injury. New laws and regulations, including those that may relate to emissions of greenhouse gases, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition or results of operations.

The Company may be subject to risks relating to its information technology systems.

The Company relies on information technology systems to process, transmit and store electronic information and manage and operate its business. A breach in security could expose the Company and its customers and suppliers to risks of misuse of confidential information, manipulation and destruction of data, production downtimes and operations disruptions, which in turn could adversely affect the Company's reputation, competitive position, business or results of operations.

The global nature of our business exposes us to foreign currency fluctuations that may affect our asset values, results of operations and competitiveness.

We are exposed to the risks of foreign currency exchange rate fluctuations because a significant portion of our net sales, costs, assets and liabilities, are denominated in currencies other than the U.S. dollar. These risks include a reduction in our asset values, net sales, operating income and competitiveness.

For those countries outside the United States where we have significant sales, devaluation in the local currency would reduce the value of our local inventory as presented in our Consolidated Financial Statements. In addition, a stronger U.S. dollar would result in reduced revenue, operating profit and shareholders' equity due to the impact of foreign exchange translation on our Consolidated Financial Statements. Fluctuations in foreign currency exchange rates may make our products more expensive for others to purchase or increase our operating costs, affecting our competitiveness and our profitability.

Changes in exchange rates between the U.S. dollar and other currencies and volatile economic, political and market conditions in emerging market countries have in the past adversely affected our financial performance and may in the future adversely affect the value of our assets located outside the United States, our gross profit and our results of operations.

8

Global political instability and other risks of international operations may adversely affect our operating costs, revenues and the price of our products.

Our international operations expose us to risks not present in a purely domestic business, including primarily:

• | changes in tariff regulations, which may make our products more costly to export or import; |

• | difficulties establishing and maintaining relationships with local original equipment manufacturers (OEMs), distributors and dealers; |

• | import and export licensing requirements; |

• | compliance with a variety of foreign laws and regulations, including unexpected changes in taxation and environmental or other regulatory requirements, which could increase our operating and other expenses and limit our operations; |

• | disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations, including the Foreign Corrupt Practices Act (FCPA); |

• | difficulty in staffing and managing geographically diverse operations; and |

• | tax exposures related to cross-border intercompany transfer pricing and other tax risks unique to international operations. |

These and other risks may also increase the relative price of our products compared to those manufactured in other countries, reducing the demand for our products in the markets in which we operate, which could have a material adverse effect on our revenues and earnings.

The funded status of our defined benefit and other postretirement plans has caused and may in the future cause a reduction in our shareholders' equity.

We may be required to record charges related to pension and other postretirement liabilities as a result of asset returns, discount rate changes or other actuarial adjustments. These charges may be significant and would cause a reduction in our shareholders' equity.

Expenses and contributions related to our defined benefit plans are affected by factors outside our control, including the performance of plan assets, interest rates, actuarial data and experience, and changes in laws and regulations.

Our future expense and funding obligations for the defined benefit pension plans depend upon a number of factors, including the level of benefits provided for by the plans, the future performance of assets set aside in trusts for these plans, the level of interest rates used to determine the discount rate to calculate the amount of liabilities, actuarial data and experience and any changes in government laws and regulations. In addition, if the various investments held by our pension trusts do not perform as expected or the liabilities increase as a result of discount rates and other actuarial changes, our pension expense and required contributions would increase and, as a result, could materially adversely affect our business. We may be legally required to make contributions to the pension plans in the future in excess of our current expectations, and those contributions could be material.

Future actions involving our defined benefit and other postretirement plans, such as annuity purchases, lump sum payouts, and/or plan terminations could cause us to incur significant pension and postretirement settlement and curtailment charges.

We have purchased annuities and offered lump sum payouts to defined benefit plan and other postretirement plan participants and retirees in the past. If we were to take similar actions in the future, we could incur significant pension settlement and curtailment charges related to the reduction in pension and postretirement obligations from annuity purchases, lump sum payouts of benefits to plan participants, and/or plan terminations.

9

Work stoppages or similar difficulties could significantly disrupt our operations, reduce our revenues and materially affect our earnings.

A work stoppage at one or more of our facilities, or at facilities of one or more of our suppliers, could have a material adverse effect on our business, financial condition and results of operations. Also, if one or more of our customers were to experience a work stoppage, that customer would likely halt or limit purchases of our products, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to a wide variety of domestic and foreign laws and regulations that could adversely affect our results of operations, cash flow or financial condition.

We are subject to a wide variety of domestic and foreign laws and regulations, and legal compliance risks, including securities laws, tax laws, employment and pension-related laws, competition laws, U.S. and foreign export and trading laws, and laws governing improper business practices. We are affected by new laws and regulations, and changes to existing laws and regulations, including interpretations by courts and regulators.

In addition, we could be adversely affected by violations of the FCPA and similar worldwide anti-bribery laws as well as export controls and economic sanction laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Recently, there has been a substantial increase in the global enforcement of anti-corruption laws. We operate in many parts of the world that have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. Our policies mandate compliance with these laws, but we cannot assure you that our internal controls and procedures will always protect us from the improper acts committed by our employees or agents. If we are found to be liable for FCPA, export control or sanction violations, we could suffer from criminal or civil penalties or other sanctions, including loss of export privileges or authorization needed to conduct aspects of our international business, which could have a material adverse effect on our business.

Compliance with the laws and regulations described above or with other applicable foreign, federal, state, and local laws and regulations currently in effect or that may be adopted in the future could materially adversely affect our competitive position, operating results, financial condition and liquidity.

If we are unable to attract and retain key personnel our business could be materially adversely affected.

Our business substantially depends on the continued service of key members of our management. The loss of the services of a significant number of members of our management could have a material adverse effect on our business. Our future success will also depend on our ability to attract and retain highly skilled personnel, such as engineering, finance, marketing and senior management professionals. Competition for these types of employees is intense, and we could experience difficulty from time to time in hiring and retaining the personnel necessary to support our business. If we do not succeed in retaining our current employees and attracting new high quality employees, our business could be materially adversely affected.

We may not realize the improved operating results that we anticipate from past and future acquisitions and we may experience difficulties in integrating acquired businesses.

We seek to grow, in part, through strategic acquisitions and joint ventures, which are intended to complement or expand our businesses, and expect to continue to do so in the future. These acquisitions involve challenges and risks. In the event that we do not successfully integrate these acquisitions into our existing operations so as to realize the expected return on our investment, our results of operations, cash flow or financial condition could be adversely affected.

10

Our operating results depend in part on continued successful research, development and marketing of new and/or improved products and services, and there can be no assurance that we will continue to successfully introduce new products and services.

The success of new and improved products and services depends on their initial and continued acceptance by our customers. Our businesses are affected, to varying degrees, by technological change and corresponding shifts in customer demand, which could result in unpredictable product transitions or shortened life cycles. We may experience difficulties or delays in the research, development, production, or marketing of new products and services which may prevent us from recouping or realizing a return on the investments required to bring new products and services to market. The end result could be a negative impact on our operating results.

If our internal controls are found to be ineffective, our financial results or our stock price may be adversely affected.

Our most recent evaluation resulted in our conclusion that, as of December 31, 2015, our internal control over financial reporting was effective. We believe that we currently have adequate internal control procedures in place for future periods, including processes related to newly acquired businesses; however, increased risk of internal control breakdowns generally exists in a business environment that is decentralized. In addition, if our internal control over financial reporting is found to be ineffective, investors may lose confidence in the reliability of our financial statements, which may adversely affect our stock price.

Risks Relating to the Spinoff of TimkenSteel

Potential indemnification liabilities to TimkenSteel Corporation (TimkenSteel) pursuant to the separation and distribution agreement and other agreements entered into in connection with the tax-free spinoff of TimkenSteel into a separate independent publicly traded company on June 30, 2014 (the Spinoff), could materially and adversely affect our business, financial condition, results of operations and cash flows.

In connection with the Spinoff, we entered into a separation and distribution agreement, an employee matters agreement and a tax sharing agreement, all with TimkenSteel, which provide for, among other things, the principal corporate transactions required to effect the Spinoff, certain conditions to the Spinoff and provisions governing the relationship between the Company and TimkenSteel with respect to and resulting from the Spinoff. Among other things, the separation and distribution agreement provides for indemnification obligations designed to make us financially responsible for substantially all liabilities that may exist relating to our continuing business operations, whether incurred prior to or after the Spinoff, as well as those obligations of TimkenSteel assumed by us pursuant to the separation and distribution agreement. If we are required to indemnify TimkenSteel under the circumstances set forth in the separation and distribution agreement, we could be subject to substantial liabilities.

In connection with the Spinoff, TimkenSteel has agreed to indemnify us for certain liabilities related to its steel business operations, but if it is unable to fulfill such obligations, it could adversely affect our business, financial condition, results of operations and cash flows.

Pursuant to the separation and distribution agreement, the employee matters agreement and the tax sharing agreement, TimkenSteel has agreed to indemnify us for certain liabilities related to its steel business operations. However, third parties could seek to hold us responsible for any of the liabilities that TimkenSteel has agreed to retain, and there can be no assurance that the indemnity from TimkenSteel will be sufficient to protect us against the full amount of such liabilities, or that TimkenSteel will be able to fully satisfy its indemnification obligations. In particular, if TimkenSteel is unable to pay any prior period taxes for which it is responsible, the Company could be required to pay the entire amount of such taxes. If TimkenSteel becomes insolvent or files for bankruptcy, our ability to recover amounts that TimkenSteel has agreed to indemnify us for would be adversely affected. Moreover, even if we ultimately succeed in recovering from TimkenSteel any amounts for which we are held liable, we may be temporarily required to bear these losses ourselves. If TimkenSteel is unable to satisfy its indemnification obligations, the underlying liabilities could have a material adverse effect on our business, financial condition, results of operations and cash flows.

11

If the Spinoff does not qualify as a tax-free transaction, the Company and its shareholders could be subject to substantial tax liabilities.

The Spinoff was conditioned on our receipt of an opinion from Covington & Burling LLP, special tax counsel to the Company, that the distribution of TimkenSteel common shares in the Spinoff qualified as tax-free (except for cash received by shareholders in lieu of fractional shares) to the Company, TimkenSteel and the Company’s shareholders for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) and related provisions of the Code. The opinion relied on, among other things, various assumptions and representations as to factual matters made by the Company and TimkenSteel, which, if inaccurate or incomplete in any material respect, could jeopardize the conclusions reached by such counsel in its opinion. We are not aware of any facts or circumstances that would cause the assumptions or representations that were relied on in the opinion of counsel to be inaccurate or incomplete in any material respect. The opinion is not binding on the Internal Revenue Service, or IRS, or the courts, and there can be no assurance that the qualification of the Spinoff as a transaction under Sections 355 and 368(a) of the Code will not be challenged by the IRS or by others in court, or that any such challenge would not prevail. If the Spinoff is determined to be taxable for U.S. federal income tax purposes, the Company and its shareholders that are subject to U.S. federal income tax could incur significant U.S. federal income tax liabilities, as each U.S. holder of the Company’s common shares that received TimkenSteel common shares in the Spinoff would generally be treated as having received a taxable distribution of property in an amount equal to the fair market value of the TimkenSteel common shares received.

Certain members of our Board of Directors and management may have actual or potential conflicts of interest because of their ownership of shares of TimkenSteel or their relationships with TimkenSteel following the Spinoff.

Certain members of our Board of Directors and management own shares of TimkenSteel and/or options to purchase shares of TimkenSteel, which could create, or appear to create, potential conflicts of interest when our directors and executive officers are faced with decisions that could have different implications for us and TimkenSteel. Two of our directors, Ward J. Timken, Jr. and John P. Reilly, are also directors of TimkenSteel and, in the case of Mr. Timken, Chairman, President and Chief Executive Officer of TimkenSteel. This may create, or appear to create, potential conflicts of interest if these directors are faced with decisions that could have different implications for TimkenSteel then the decisions have for us.

Item 1B. Unresolved Staff Comments

None.

12

Item 2. Properties

Timken has manufacturing facilities at multiple locations in the United States and in a number of countries outside the United States. The aggregate floor area of these facilities worldwide is approximately 10.6 million square feet, all of which, except for approximately 2.1 million square feet, is owned in fee. The facilities not owned in fee are leased. The buildings occupied by Timken are principally made of brick, steel, reinforced concrete and concrete block construction. The Company believes all buildings are in satisfactory operating condition to conduct business.

Timken’s Mobile Industries segment's manufacturing facilities and service centers in the United States are located in Bucyrus, Canton and New Philadelphia, Ohio; Los Alamitos, California; Manchester, Connecticut; Carlyle, Illinois; Lenexa, Kansas; Keene and Lebanon, New Hampshire; Iron Station, North Carolina; Gaffney and Honea Path, South Carolina; Pulaski and Knoxville, Tennessee; Ogden, Utah and Altavista, Virginia. These facilities, including warehouses at plant locations and a technology and wind center in North Canton, Ohio have an aggregate floor area of approximately 3.6 million square feet.

Timken’s Mobile Industries segment’s manufacturing plants and service centers outside the United States are located in Benoni, South Africa; Villa Carcina, Italy; Colmar, France; Cheltenham, Northampton, Plymouth, and Wolverhampton, England; Belo Horizonte, Curtiba and Sorocaba, Brazil; Jamshedpur, India; Sosnowiec, Poland; and Yantai, China. These facilities, including warehouses at plant locations, have an aggregate floor area of approximately 2.4 million square feet.

Timken's Process Industries segment's manufacturing plants and service centers in the United States are located in Hueytown, Alabama; Sante Fe Springs, California; Broomfield and Denver, Colorado; New Haven, Connecticut; New Castle, Delaware; Fulton and Mokena, Illinois; Mishawaka, Indiana; Fort Scott, Kansas; Augusta and Portland, Maine; Springfield, Missouri; Randleman, and Rutherfordton, North Carolina; Union, South Carolina; Ferndale and Pasco, Washington; Princeton, West Virginia; and Casper and Rock Springs, Wyoming. These facilities, including warehouses at plant locations and a technology center in North Canton, Ohio have an aggregate floor area of approximately 2.6 million square feet.

Timken's Process Industries segment's manufacturing plants and service centers outside the United States are located in Chengdu, Jiangsu and Wuxi, China; Chennai and Durg, India; Dudley, England; Saskatoon and Prince George, Canada; and Ploiesti, Romania. These facilities, including warehouses at plant locations have an aggregate floor area of approximately 2.0 million square feet.

In addition to the manufacturing and distribution facilities discussed above, Timken owns or leases warehouses and distribution facilities in the United States, Brazil, Canada, France, Mexico, Singapore, Argentina, Australia, and China.

The extent to which the Company uses its properties varies by property and from time to time. The Company believes that its capacity levels are adequate for its present and anticipated future needs. Most of the Company’s manufacturing facilities remain capable of handling additional volume increases.

Item 3. Legal Proceedings

The Company is involved in various claims and legal actions arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these matters will not have a material adverse effect on the Company’s consolidated financial position or results of operations.

In October 2014, the Brazilian government antitrust agency announced that it had opened an investigation of alleged antitrust violations in the bearing industry. The Company’s Brazilian subsidiary, Timken do Brasil Comercial Importadora Ltda, was included in the investigation. While the Company is unable to predict the ultimate length, scope or results of the investigation, management believes that the outcome will not have a material effect on the Company’s consolidated financial position; however, any such outcome may be material to the results of operations of any particular period in which costs, if any, are recognized. Based on current facts and circumstances, the low end of the range for potential penalties, if any, would be immaterial to the Company.

Item 4. Mine Safety Disclosures

Not applicable.

13

Item 4A. Executive Officers of the Registrant

The executive officers are elected by the Board of Directors normally for a term of one year and until the election of their successors. All executive officers have been employed by Timken or by a subsidiary of the Company during the past five-year period. The executive officers of the Company as of February 12, 2016 are as follows:

Name | Age | Current Position and Previous Positions During Last Five Years | ||

William R. Burkhart | 50 | 2014 Executive Vice President, General Counsel and Secretary | ||

2000 Senior Vice President and General Counsel | ||||

Christopher A. Coughlin | 55 | 2014 Executive Vice President, Group President | ||

2012 Group President | ||||

2011 President - Process Industries | ||||

Philip D. Fracassa | 47 | 2014 Executive Vice President and Chief Financial Officer | ||

2012 Senior Vice President - Planning and Development | ||||

2010 Senior Vice President and Controller - B&PT | ||||

Richard G. Kyle | 50 | 2014 President and Chief Executive Officer; Director | ||

2013 Chief Operating Officer - B&PT; Director | ||||

2012 Group President | ||||

2011 President - Mobile Industries & Aerospace | ||||

J. Ted Mihaila | 61 | 2006 Senior Vice President and Controller | ||

14

PART II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s common shares are traded on the New York Stock Exchange under the symbol “TKR.” The estimated number of record holders of the Company’s common shares at December 31, 2015 was 4,411. The estimated number of beneficial shareholders at December 31, 2015 was 40,257.

The following table provides information about the high and low sales prices for the Company’s common shares and dividends paid for each quarter for the last two fiscal years.

2015 | 2014 | ||||||||||||||||||

Stock prices | Dividends | Stock prices | Dividends | ||||||||||||||||

High | Low | per share | High | Low | per share | ||||||||||||||

First quarter | $ | 43.56 | $ | 37.65 | $ | 0.25 | $ | 61.37 | $ | 52.51 | $ | 0.25 | |||||||

Second quarter | $ | 43.06 | $ | 36.24 | $ | 0.26 | $ | 69.51 | $ | 57.69 | $ | 0.25 | |||||||

Third quarter | $ | 36.95 | $ | 26.31 | $ | 0.26 | $ | 49.96 | $ | 42.34 | $ | 0.25 | |||||||

Fourth quarter | $ | 32.89 | $ | 26.84 | $ | 0.26 | $ | 44.30 | $ | 37.62 | $ | 0.25 | |||||||

Issuer Purchases of Common Shares:

The following table provides information about purchases of its common shares by the Company during the quarter ended December 31, 2015.

Period | Total number of shares purchased (1) | Average price paid per share (2) | Total number of shares purchased as part of publicly announced plans or programs | Maximum number of shares that may yet be purchased under the plans or programs (3)(4) | |||||

10/1/2015 - 10/31/2015 | 424,530 | $ | 29.08 | 424,292 | 2,603,623 | ||||

11/1/2015 - 11/30/2015 | 866,944 | 31.34 | 866,495 | 1,737,128 | |||||

12/1/2015 - 12/31/2015 | 1,445,352 | 29.23 | 1,445,000 | 292,128 | |||||

Total | 2,736,826 | $ | 29.88 | 2,735,787 | — | ||||

(1) | Of the shares purchased in October, November and December, 238, 449 and 352, respectively, represent common shares of the Company that were owned and tendered by employees to exercise stock options, and to satisfy withholding obligations in connection with the exercise of stock options and vesting of restricted shares. |

(2) | For shares tendered in connection with the vesting of restricted shares, the average price paid per share is an average calculated using the daily high and low of the Company’s common shares as quoted on the New York Stock Exchange at the time of vesting. For shares tendered in connection with the exercise of stock options, the price paid is the real-time trading share price at the time the options are exercised. |

(3) | On February 10, 2012, the Board of Directors of the Company approved a share purchase plan pursuant to which the Company may purchase up to ten million of its common shares in the aggregate. On June 13, 2014, the Board of Directors of the Company authorized an additional ten million common shares for repurchase under this plan. This share purchase plan expired on December 31, 2015. |

(4) | On January 29, 2016, the Board of Directors of the Company approved a new share purchase plan pursuant to which the Company may purchase up to five million of its common shares, in the aggregate. This share purchase plan expires on January 31, 2017. The Company may purchase shares from time to time in open market purchases or privately negotiated transactions. The Company may make all or part of the purchases pursuant to accelerated share repurchases or Rule 10b5-1 plans. |

15

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities (continued)

*Total return assumes reinvestment of dividends. Fiscal years ending December 31.

2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||

Timken | $ | 88 | $ | 104 | $ | 122 | $ | 134 | $ | 93 | |||||

S&P 500 | 102 | 118 | 157 | 178 | 181 | ||||||||||

S&P 400 Industrials | 99 | 120 | 173 | 176 | 170 | ||||||||||

The line graph compares the cumulative total shareholder returns over five years for The Timken Company, the S&P 500 Stock Index and the S&P 400 Industrials Index. The graph assumes, in each case, an initial investment of $100 on January 1, 2011, in Timken common shares, S&P 500 Index and S&P 400 Industrials Index, based on market prices at the end of each fiscal year through and including December 31, 2015, and reinvestment of dividends (and taking into account the value of the TimkenSteel common shares distributed in the Spinoff).

16

Item 6. Selected Financial Data

Summary of Operations and Other Comparative Data:

(Dollars in millions, except per share and per employee data) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

Statements of Income | |||||||||||||||

Net sales | $ | 2,872.3 | $ | 3,076.2 | $ | 3,035.4 | $ | 3,359.5 | $ | 3,333.6 | |||||

Gross profit | 793.9 | 898.0 | 868.4 | 1,028.0 | 1,018.0 | ||||||||||

Selling, general and administrative expenses | 494.3 | 542.5 | 546.6 | 554.5 | 540.6 | ||||||||||

Impairment and restructuring charges | 14.7 | 113.4 | 8.7 | 29.5 | 14.4 | ||||||||||

Operating (loss) income (1) | (151.4 | ) | 208.4 | 305.9 | 444.0 | 463.0 | |||||||||

Other (expense) income, net | (7.5 | ) | 19.9 | 6.7 | 102.0 | (0.4 | ) | ||||||||

Interest expense, net | 30.7 | 24.3 | 22.5 | 28.2 | 31.2 | ||||||||||

(Loss) income from continuing operations | (68.0 | ) | 149.3 | 175.5 | 331.5 | 280.8 | |||||||||

Income from discontinued operations, net of income taxes | — | 24.0 | 87.5 | 164.4 | 175.8 | ||||||||||

Net (loss) income attributable to The Timken Company | $ | (70.8 | ) | $ | 170.8 | $ | 262.7 | $ | 495.5 | $ | 454.3 | ||||

Balance Sheets | |||||||||||||||

Inventories, net | $ | 543.2 | $ | 585.5 | $ | 582.6 | $ | 611.5 | $ | 669.6 | |||||

Property, plant and equipment, net | 777.8 | 780.5 | 855.8 | 834.1 | 868.6 | ||||||||||

Total assets | 2,785.3 | 3,001.4 | 4,477.9 | 4,244.2 | 4,327.4 | ||||||||||

Total debt: | |||||||||||||||

Short-term debt | 62.0 | 7.4 | 18.6 | 14.3 | 22.0 | ||||||||||

Current portion of long-term debt | 15.1 | 0.6 | 250.7 | 9.6 | 5.8 | ||||||||||

Long-term debt | 580.6 | 522.1 | 176.4 | 424.9 | 448.6 | ||||||||||

Total debt | $ | 657.7 | $ | 530.1 | $ | 445.7 | $ | 448.8 | $ | 476.4 | |||||

Net debt (cash) | |||||||||||||||

Total debt | 657.7 | 530.1 | 445.7 | 448.8 | 476.4 | ||||||||||

Less: cash and cash equivalents and restricted cash | (129.8 | ) | (294.1 | ) | (399.7 | ) | (601.5 | ) | (468.4 | ) | |||||

Net debt (cash): (2) | $ | 527.9 | $ | 236.0 | $ | 46.0 | $ | (152.7 | ) | $ | 8.0 | ||||

Total liabilities | 1,440.7 | 1,412.3 | 1,829.3 | 1,997.6 | 2,284.9 | ||||||||||

Shareholders’ equity | $ | 1,344.6 | $ | 1,589.1 | $ | 2,648.6 | $ | 2,246.6 | $ | 2,042.5 | |||||

Capital: | |||||||||||||||

Net debt (cash) | 527.9 | 236.0 | 46.0 | (152.7 | ) | 8.0 | |||||||||

Shareholders’ equity | 1,344.6 | 1,589.1 | 2,648.6 | 2,246.6 | 2,042.5 | ||||||||||

Net debt (cash) + shareholders’ equity (capital) | $ | 1,872.5 | $ | 1,825.1 | $ | 2,694.6 | $ | 2,093.9 | $ | 2,050.5 | |||||

Other Comparative Data | |||||||||||||||

(Loss) income from continuing operations / Net sales | (2.4 | %) | 4.9 | % | 5.8 | % | 9.9 | % | 8.4 | % | |||||

Net (loss) income attributable to The Timken Company / Net sales | (2.5 | %) | 5.6 | % | 8.7 | % | 14.7 | % | 13.6 | % | |||||

Return on equity (3) | (5.1 | %) | 9.4 | % | 6.6 | % | 14.8 | % | 13.7 | % | |||||

Net sales per employee (4) | $ | 197.5 | $ | 210.9 | $ | 203.1 | $ | 218.0 | $ | 218.8 | |||||

Capital expenditures | 105.6 | 126.8 | 133.6 | 118.3 | 105.5 | ||||||||||

Depreciation and amortization | 130.8 | 137.0 | 142.4 | 149.6 | 146.7 | ||||||||||

Capital expenditures / Net sales | 3.7 | % | 4.1 | % | 4.4 | % | 3.5 | % | 3.2 | % | |||||

Dividends per share | $ | 1.03 | $ | 1.00 | $ | 0.92 | $ | 0.92 | $ | 0.78 | |||||

Basic (loss) earnings per share - continuing operations (5) | $ | (0.84 | ) | $ | 1.62 | $ | 1.84 | $ | 3.41 | $ | 2.84 | ||||

Diluted (loss) earnings per share - continuing operations (5) | $ | (0.84 | ) | $ | 1.61 | $ | 1.82 | $ | 3.38 | $ | 2.81 | ||||

Basic (loss) earnings per share (6) | $ | (0.84 | ) | $ | 1.89 | $ | 2.76 | $ | 5.11 | $ | 4.65 | ||||

Diluted (loss) earnings per share (6) | $ | (0.84 | ) | $ | 1.87 | $ | 2.74 | $ | 5.07 | $ | 4.59 | ||||

Net debt (cash) to capital (2) | 28.2 | % | 12.9 | % | 1.7 | % | (7.3 | %) | 0.4 | % | |||||

Number of employees at year-end (7) | 14,709 | 14,378 | 14,794 | 15,093 | 15,722 | ||||||||||

Number of shareholders (8) | 40,257 | 44,271 | 52,218 | 50,783 | 44,238 | ||||||||||

(1) | Operating (loss) income included pension settlement charges of $465.0 million during 2015. |

(2) | The Company presents net debt (cash) because it believes net debt (cash) is more representative of the Company’s financial position than total debt due to the amount of cash and cash equivalents. |

(3) | Return on equity is defined as (loss) income from continuing operations divided by ending shareholders’ equity. |

(4) | Based on average number of employees employed during the year. |

(5) | Based on average number of shares outstanding during the year. |

(6) | Based on average number of shares outstanding during the year and includes discontinued operations for all periods presented. |

(7) | Adjusted to exclude temporary employees for all periods. |

(8) | Includes an estimated count of shareholders having common shares held for their accounts by banks, brokers and trustees for benefit plans. |

17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in millions, except per share data)

OVERVIEW

Introduction:

The Timken Company engineers, manufactures and markets bearings, transmissions, gearboxes, belts, chain and related products and offers a spectrum of power system rebuild and repair services. The Company’s growing product and services portfolio features many strong industrial brands, such as Timken, Fafnir, Philadelphia Gear, Carlisle, Drives and Interlube. Timken today applies its deep knowledge of metallurgy, friction management and mechanical power transmission across the broad spectrum of bearings and related systems to improve the reliability and efficiency of machinery and equipment all around the world. Known for its quality products and collaborative technical sales model, Timken focuses on providing value to diverse markets worldwide through both original equipment manufacturers (OEMs) and aftermarket channels. With more than 14,000 people operating in 28 countries, Timken makes the world more productive and keeps industry in motion. The Company operates under two reportable segments: (1) Mobile Industries and (2) Process Industries. The following further describes these business segments:

• | Mobile Industries serves OEM customers that manufacture off-highway equipment for the agricultural, mining and construction markets; on-highway vehicles including passenger cars, light trucks, and medium- and heavy-duty trucks; rail cars and locomotives; and rotorcraft and fixed-wing aircraft. Beyond service parts sold to OEMs, aftermarket sales to individual end users, equipment owners, operators and maintenance shops are handled through the Company's extensive network of authorized automotive and heavy-truck distributors. |

• | Process Industries serves OEM and end-user customers in industries that place heavy demands on the fixed operating equipment they make or use in heavy and other general industrial sectors. This includes metals, cement and aggregate production; coal and wind power generation; oil and gas extraction and refining; pulp and paper and food processing; and health and critical motion control equipment. Other applications include marine equipment, gear drives, cranes, hoists and conveyors. This segment also supports aftermarket sales and service needs through its global network of authorized industrial distributors. |

Timken creates value by understanding customer needs and applying its know-how in attractive market sectors. Timken’s business strengths include its channel mix and end-market diversity, serving a broad range of customers and industries across the globe. The Company collaborates with OEMs to improve equipment efficiency with its engineered products and captures subsequent equipment replacement cycles by selling through independent channels in the aftermarket. Timken focuses its international efforts and footprint in regions of the world where strong macroeconomic factors such as urbanization, infrastructure development and sustainability create demand for our products and services.

18

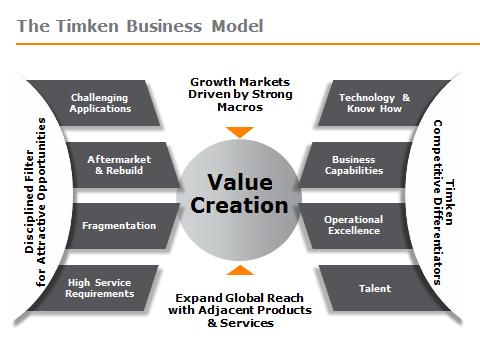

The Timken Business Model is the specific framework for how the Company evaluates opportunities and differentiates itself in the market.

The Company’s Strategy is to apply the Timken Business Model and leverage the Company’s competitive differentiators and strengths to create customer value and drive increased growth and profitability by:

Capturing Opportunities and Expanding Reach. The Company intends to expand into new and existing markets by leveraging its collective knowledge of metallurgy, friction management and mechanical power transmission to create value for Timken customers. Using a highly collaborative technical selling approach, the Company places particular emphasis on creating unique solutions for challenging and/or demanding applications. The Company intends to grow in attractive market sectors around the world, emphasizing those spaces that are highly fragmented, demand high service and value the reliability and efficiency offered by Timken products. The Company also targets those applications that offer significant aftermarket demand, thereby providing product and services revenue throughout the equipment’s lifetime.

Performing With Excellence. Timken operates with a relentless drive for exceptional results and a passion for superior execution. The Company embraces a continuous improvement culture that is charged with increasing efficiency, lowering costs, eliminating waste, encouraging organizational agility and building greater brand equity to fuel future growth. This requires the Company’s ongoing commitment to attract, retain and develop the best talent across the world.

Driving Effective Capital Deployment. The Company is intently focused on providing the highest returns for shareholders through its capital allocation framework, which includes (1) investing in the core business through capital expenditures, research and development and organic growth initiatives like DeltaX; (2) pursuing strategic acquisitions to broaden our portfolio and capabilities, with an focus on bearings, adjacent power transmission products and related services; and (3) returning capital to shareholders through share repurchases and dividends. As part of this framework, the Company may also restructure, reposition or divest underperforming product lines or assets.

19

The following items highlight certain of the Company's more significant strategic accomplishments in 2015:

Product and Global Manufacturing Footprint Expansion

• | On December 4, 2015, the Company launched the 6000 series line of metric deep groove ball bearings and introduced a new line of Drives® Leaf Chain in North America, completing the global rollout of the series as an element of the Company's DeltaX growth initiative. DeltaX is a multi-year initiative designed to accelerate product development and line expansion. |

• | On November 19, 2015, the Company announced plans to build a 161,000-square-foot manufacturing plant in Romania. The new plant will produce ISO and inch-sized Timken® tapered roller bearings up to 12 inches outside diameter for global power transmission, off-highway and distribution customers. The Company broke ground on the new plant in early February 2016, with projected start-up in 2017. |

• | On April 28, 2015, the Company expanded its product offering of high performance spherical roller bearings. The new product line includes medium bore high performance spherical roller bearings featuring either steel or brass cages in a variety of sizes. The new offering of spherical roller bearings includes several new features that are expected to contribute to longer bearing life and to run cooler than other comparable products. |

• | On April 10, 2015, the Company launched the Timken® UC-series ball bearing housed unit product line, an extension of the Company’s housed unit bearing portfolio. |

• | On March 19, 2015, the Company unveiled its new 27,000-square-foot, state-of-the-art gear drive manufacturing facility in Houston, Texas. This facility serves customers in the power generation, oil and gas exploration, refining and pipeline/pumping industries that require reliable, high-speed enclosed gearboxes to keep pumps, compressors and generators operating in harsh conditions. |

Financing Agreements and Pension Plan Transactions

• | On November 30, 2015, the Company amended its $100 million Asset Securitization Agreement (Accounts Receivable Facility) to, among other things, extend the maturity to November 30, 2018. |

• | On November 30, 2015, the Company entered into an agreement pursuant to which one of its U.S. defined benefit pension plans purchased a group annuity contract from Prudential Insurance Company of America (Prudential) that requires Prudential to pay and administer future pension benefits for approximately 3,400 U.S. Timken retirees. The purchase was funded by existing pension plan assets and required no cash contribution from the Company to Prudential in this transaction. As a result of the purchase of the group annuity contract, the Company incurred non-cash pension settlement charges of $241.8 million in the fourth quarter of 2015. Coupled with the group annuity contract purchased in January discussed below, the Company transferred a total of approximately $1.1 billion of pension obligations to Prudential in 2015, which reduced the Company's total projected benefit obligation by approximately 50%. |

• | On June 19, 2015, the Company amended and restated its five-year $500 million Senior Credit Facility to, among other things, extend the maturity to June 19, 2020. |