Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36189

Tandem Diabetes Care, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

20-4327508 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

11045 Roselle Street |

|

92121 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(858) 366-6900

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2015, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $193.8 million based on the closing price for the common stock of $10.84 on that date. Shares of common stock held by each executive officer, director, and their affiliated stockholders have been excluded from this calculation as such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 19, 2016, there were 30,281,164 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2016 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference in Part III, Items 10-14 of this Form 10-K. Except for the portions of the Proxy Statement specifically incorporated by reference in this Form 10-K, the Proxy Statement shall not be deemed to be filed as part hereof.

|

Part I |

|

|

|

|

|

Item 1 |

|

|

3 |

|

|

Item 1A |

|

|

28 |

|

|

Item 1B |

|

|

52 |

|

|

Item 2 |

|

|

52 |

|

|

Item 3 |

|

|

52 |

|

|

Item 4 |

|

|

52 |

|

|

|

|

|

|

|

|

Part II |

|

|

|

|

|

Item 5 |

|

|

53 |

|

|

Item 6 |

|

|

55 |

|

|

Item 7 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

56 |

|

Item 7A |

|

|

67 |

|

|

Item 8 |

|

|

68 |

|

|

Item 9 |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

91 |

|

Item 9A |

|

|

92 |

|

|

Item 9B |

|

|

92 |

|

|

|

|

|

|

|

|

Part III |

|

|

|

|

|

Item 10 |

|

|

93 |

|

|

Item 11 |

|

|

93 |

|

|

Item 12 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

93 |

|

Item 13 |

|

Certain Relationships and Related Transactions, and Director Independence |

|

93 |

|

Item 14 |

|

|

93 |

|

|

|

|

|

|

|

|

Part IV |

|

|

|

|

|

Item 15 |

|

|

94 |

|

|

|

|

|

||

|

|

|

|

98 |

|

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or this Annual Report, contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements included or incorporated by reference in this Annual Report, other than statements of historical fact, are forward-looking statements. You can identify forward-looking statements by the use of words such as “may,” “will,” “could,” “anticipate,” “expect,” “intend,” “believe,” “continue” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to such statements.

Our forward-looking statements are based on our management’s current assumptions and expectations about future events and trends, which affect or may affect our business, strategy, operations or financial performance. Although we believe that these forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of information currently available to us. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under the caption “Risk Factors” in Part I, Item 1A and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, and elsewhere in this Annual Report, as well as in the other reports we file with the Securities and Exchange Commission, or the SEC. You should read this Annual Report with the understanding that our actual future results may be materially different and worse from what we expect.

Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking statements speak only as of the date they were made, and, except to the extent required by law or the rules of the NASDAQ Stock Market, we undertake no obligation to update or review any forward-looking statement because of new information, future events or other factors.

We qualify all of our forward-looking statements by these cautionary statements.

2

|

Item 1. |

Business |

Overview

We are a medical device company with an innovative approach to the design, development and commercialization of a family of products for people with insulin-dependent diabetes. We believe that our competitive advantage is rooted in our unique consumer-focused approach and proprietary technology platform. This allows us to deliver innovative hardware and software solutions to meet the various needs and preferences of people with diabetes and their healthcare providers. We currently manufacture and sell three insulin pump products in the United States that are designed to address large and differentiated segments of the insulin-dependent diabetes market:

|

|

· |

the t:slim® Insulin Delivery System, or t:slim, our flagship product that can easily and discreetly fit into a pocket, |

|

|

· |

the t:flex® Insulin Delivery System, or t:flex, for people with greater insulin needs, and |

|

|

· |

the t:slim G4TM Insulin Delivery System, or t:slim G4, the first continuous glucose monitoring, or CGM, enabled pump with touch-screen simplicity. |

According to the Centers for Disease Control and Prevention, or CDC, in 2014 approximately 25 million people in the United States had diagnosed diabetes. Close Concerns, Inc., an independent consulting and publishing company that provides diabetes advisory services, or Close Concerns, estimates that there are approximately 1.6 million people with type 1 diabetes in the United States and 1.7 million people with type 2 diabetes in the United States who require daily administration of rapid-acting insulin. All people with type 1 diabetes require daily rapid acting insulin, but only a subset of people with type 2 diabetes require daily rapid acting insulin, as a majority manage their therapy through improvements in diet and exercise, oral medications, or injectable therapies, such as long acting insulin. Our target market consists of the approximately 3.3 million people in the United States who require daily rapid acting insulin.

We began commercial sales of our first insulin pump product, t:slim, in August 2012. During 2015, we commenced commercial sales of two additional insulin pumps: t:flex in May 2015, and t:slim G4 in September 2015. We have experienced three consecutive years of greater than 40 percent annual sales growth. From the launch of our first product in August 2012 through December 2015, we have shipped nearly 34,000 pumps, nearly half of which were shipped in the last 12 months. Based on customer surveys, approximately half of our customers are new to insulin pump therapy, and the average age of our existing customers is 31 years old, with relatively equal distribution between men and women. By offering a family of products, all of which are based on our proprietary technology platform, we leverage a single sales and clinical organization, shared manufacturing infrastructure, and expertise of our customer technical and support services.

Our innovative approach to product design and development is consumer-focused and based on our extensive market research, as we believe the user is the primary decision maker when purchasing an insulin pump. Our market research consists of interviews, focus groups and online surveys, to understand what people with diabetes, their caregivers and healthcare providers are seeking in order to improve diabetes therapy management. We also apply the science of human factors to our design and development process, which seeks to optimize our devices, allowing users to successfully operate our devices in their intended environment.

We developed our products to provide the specific features that people with insulin-dependent diabetes seek in a next-generation insulin pump. Our proprietary pumping technology allows us to design the slimmest and smallest durable insulin pumps on the market, without sacrificing insulin capacity. Our technology platform features our patented Micro-Delivery® technology, a miniaturized pumping mechanism that draws insulin from a flexible bag within the pump’s cartridge, rather than relying on a syringe and plunger mechanism. It also features an easy-to-navigate software architecture, a vivid color touch screen and a micro-USB connection that supports both a rechargeable battery and uploads to t:connect® Diabetes Management Application, or t:connect, our custom cloud-based data management application that provides a fast, easy and visual way to display therapy management data from the pump and supported blood glucose meters.

For the years ended December 31, 2015, 2014 and 2013, our sales were $72.9 million, $49.7 million and $29.0 million, respectively. For the years ended December 31, 2015, 2014 and 2013, our net loss was $72.4 million, $79.5 million, and $63.1 million, respectively. Our accumulated deficit as of December 31, 2015 was $321.1 million. Pump sales accounted for 83% and 86% of sales, respectively, for the years ended December 31, 2015 and 2014, while pump-related supplies primarily accounted for the remainder in each year. Sales of accessories were not material in either year.

3

We have rapidly increased sales by developing, commercializing and marketing a family of products that utilize our technology platform and consumer-focused approach, and by providing strong customer support. Our sales, clinical and marketing organization was made up of a team of approximately 175 people as of December 31, 2015 and we expect to further expand this infrastructure. We believe we can continue to increase sales and that our sales growth during the next 12 months will outpace growth in our sales and marketing costs during this period. We believe further expansion of our sales, clinical and marketing infrastructure will allow us to engage with more potential customers, their caregivers and healthcare providers on a more frequent basis to promote our products. In addition, by leveraging our sales and marketing infrastructure to demonstrate our product benefits, and the shortcomings of existing insulin therapies, we believe more people will choose our insulin pumps for their therapy needs, allowing us to further penetrate and expand the market. We also believe we are positioned to address consumers’ needs in different segments of the large and growing insulin-dependent diabetes market with our current products and products in development that offer greater flexibility and discretion through reduced size, mobile connectivity and advancements in the automated delivery of insulin.

Our headquarters and our manufacturing facility are located in San Diego, California and we employed 482 full-time employees as of December 31, 2015.

The Market

Diabetes is a chronic, life-threatening disease for which there is no known cure. The disease is caused when the pancreas does not produce enough insulin or the body cannot effectively use the insulin it produces. Insulin is a life-sustaining hormone that allows cells in the body to absorb glucose from blood and convert it to energy. As a result, a person with diabetes cannot utilize the glucose properly and it continues to accumulate in the blood. If not closely monitored and properly treated, diabetes can lead to serious medical complications, including damage to various tissues and organs, seizures, coma and death.

The International Diabetes Federation estimates that in 2014 approximately 387 million people had diabetes worldwide and that by 2035, this number will increase to 592 million people worldwide. According to the Center for Disease Control and Prevention, or CDC, in 2014 nearly 25 million people in the United States had diagnosed diabetes.

There are two primary types of diabetes:

|

|

● |

Type 1 diabetes is caused by an autoimmune response in which the body attacks and destroys the insulin-producing cells of the pancreas. As a result, the pancreas can no longer produce insulin, requiring patients to administer daily insulin to survive. According to Close Concerns, Inc., an independent consulting and publishing company that provides diabetes advisory services, or Close Concerns, approximately 1.6 million people have type 1 diabetes in the United States. |

|

|

● |

Type 2 diabetes occurs when the body does not produce enough insulin to regulate the amount of glucose in the blood, or cells become resistant to insulin and are unable to use it effectively. Initially, many people with type 2 diabetes attempt to manage their diabetes with improvements in diet, exercise and oral medications. However, as their diabetes advances, some patients progress to requiring injectable therapies, such as long acting insulin, and a subset of this population will require daily rapid-acting insulin therapy. According to Close Concerns, approximately 1.7 million people in the United States with type 2 diabetes require daily administration of rapid-acting insulin. |

Our target market consists of approximately 3.3 million people in the United States who require daily administration of insulin, which includes approximately 1.6 million people with type 1 diabetes and approximately 1.7 million people with type 2 diabetes who require daily rapid acting insulin. Throughout this Annual Report, we refer to people with type 1 diabetes and people with type 2 diabetes who require daily rapid acting insulin as people with insulin-dependent diabetes.

People with insulin-dependent diabetes require intensive insulin therapy to manage their blood glucose levels within a healthy range, which is typically between 70-120 milligrams per deciliter, or mg/dL. Blood glucose levels can be affected by many factors, such as type or quantity of food eaten, illness, stress and exercise. Hypoglycemia, or low blood glucose levels, can cause a variety of long-term effects or complications, including damage to various tissues and organs, seizures, coma or death. Hyperglycemia, or high blood glucose levels, can also cause a variety of long-term effects or complications, including cardiovascular disease and damage to various tissues and organs. It can also cause the emergency condition ketoacidosis, which can result in vomiting, shortness of breath, coma or death.

There are two primary therapies practiced by people with insulin-dependent diabetes, insulin injections and insulin pumps, each of which is designed to supplement or replace the insulin-producing function of the pancreas. Insulin injections are often referred to as multiple daily injection, or MDI, and involve the use of syringes or insulin pens to inject insulin into the person’s body. Insulin pumps are used to perform what is often referred to as continuous subcutaneous insulin infusion, or insulin pump therapy, and typically use a programmable device and an infusion set to administer insulin into the person’s body.

4

MDI therapy involves the administration of a rapid-acting insulin before meals, or bolus insulin, to bring blood glucose levels down into the healthy range. MDI therapy may also require a separate injection of a long-acting insulin, or basal insulin, to control glucose levels between meals; this type of insulin is typically taken once or twice per day. By comparison, insulin pump therapy uses only rapid-acting insulin to fulfill both mealtime (bolus) and background (basal) requirements. Insulin pump therapy allows a person to customize their bolus and basal insulin doses to meet their insulin needs throughout the day, and is intended to more closely resemble the physiologic function of a healthy pancreas.

According to the American Association of Diabetes Educators, insulin pump therapy is considered the “gold standard” of care for people with insulin-dependent diabetes. It has been shown to provide people with insulin-dependent diabetes with numerous advantages relative to MDI therapy. The following chart illustrates some of the key advantages and disadvantages of using MDI therapy versus insulin pump therapy:

Comparison of MDI Therapy vs. Insulin Pump Therapy

|

Therapy |

|

Advantages |

|

Disadvantages |

|

Multiple Daily Injection or MDI |

|

● Less training and shorter time to educate

● Does not tether the user to a device

● Lower upfront and ongoing supply costs

● Lower risk of technological malfunction |

|

● Requires injections up to seven times per day

● Delivers insulin less accurately than insulin pumps

● Results in greater variability in blood glucose levels or less accurate glycemic control

● Requires more planning around and restrictions regarding meals and exercise |

|

|

|

|

||

|

Insulin Pump |

|

● Eliminates individual insulin injections

● Delivers insulin more accurately and precisely than injections

● Often improves HbA1c, a common measure of blood glucose levels over time

● Fewer large swings in blood glucose levels

● Provides greater flexibility with meals, exercise and daily schedules

● Can improve quality of life

● Reduces severe low blood glucose episodes

● Eliminates unpredictable effects of intermediate or long-acting insulin

● Allows exercise without having to eat large amounts of carbohydrates, as insulin delivery can be adjusted |

|

● Requires intensive education on insulin pump therapy and management

● Wearing a pump can be bothersome

● Can be more costly

● Risk of diabetic ketoacidosis if the catheter comes out and insulin infusion is interrupted |

5

According to Close Concerns, approximately 425,000 people with type 1 diabetes in the United States use an insulin pump, or approximately 27% of the type 1 diabetes population. In addition, approximately 125,000 people with type 2 diabetes in the United States use an insulin pump, or approximately 7% of the type 2 diabetes population who are insulin-dependent. Close Concerns also estimates that in 2014, the U.S. insulin pump market was approximately $1.4 billion, representing an 11% growth in sales compared to 2013.

We believe that the distinct advantages and increased awareness of insulin pump therapy as compared to other available insulin therapies will continue to generate demand for insulin pump devices and pump-related supplies. We also believe that the adoption of insulin pump therapy would have been even greater if not for the significant and fundamental perceived shortcomings of durable syringe-and-plunger insulin pumps currently available, which we refer to as traditional pumps.

The Opportunity

The foundation of our consumer-focused approach is market research, through which we seek to better understand the opportunity within the insulin-dependent diabetes market, as well as the reasons why the adoption rate of insulin pump therapy has not been greater in light of its benefits when compared to MDI therapy. We have conducted extensive research obtained from interviews, focus groups and online surveys to understand what people with diabetes, their caregivers and healthcare providers are seeking to improve diabetes therapy management, as we believe the user is the primary decision-maker when purchasing an insulin pump. Based on our research, we believe that the limited adoption of insulin pump therapy by people with insulin-dependent diabetes has been largely due to the shortcomings of traditional pumps currently available. These shortcomings include:

Antiquated style. While consumer electronic devices have rapidly evolved in form and function over the past decade, traditional pumps have not achieved similar advances. Our market research has shown that consumers believe traditional pumps resemble a pager, as they generally still feature small, low contrast display screens, push-button interfaces, plastic cases and disposable batteries. Because an insulin pump must be used multiple times throughout the day, often in social settings, its style and appearance are important to users. Our market research has shown that traditional insulin pump users frequently report being embarrassed by the style of their traditional pump. For current MDI users, the style of traditional pumps is often cited as a reason for not adopting pump therapy.

Not adaptable. Traditional pumps are typically sold as a single-product offering that are then linearly iterated to add features, rather than designed as a product family to offer different features to people with different needs. We believe this is due to form factor and user interface limitations that prevent the pump from being easily adaptable to new feature offerings. As a result, consumers have had limited product choices from each manufacturer and healthcare providers are required to learn a greater number of user interfaces. We believe the lack of adaptability of traditional pump platforms has been a restricting factor in offering people with diabetes differentiated product features to best meet their therapy needs.

Bulky size. Our market research has shown that consumers view traditional pumps as large, bulky and inconvenient to carry or wear, especially when compared to modern consumer electronic devices, such as smartphones. The size of the pump further contributes to users being embarrassed by the pump. This complaint, along with concerns relating to how and where the pump can be utilized due to its size and shape, is frequently cited among users of traditional pumps. For current MDI users, the size of traditional pumps is often communicated as a reason for not adopting pump therapy.

Difficult to learn and teach. Traditional pumps often rely on complicated and outdated technology and are not intuitive to operate. Our research has shown that it can take several days to competently learn how to use traditional pumps, leading to frustration, frequent mistakes and additional training, each of which may discourage adoption. We believe difficult-to-use traditional pumps result in a higher frequency of calls by the user to the pump manufacturer or their healthcare provider for support. We also believe that the complicated functionality of traditional pumps significantly limits the willingness of healthcare providers to recommend insulin pump therapy to many patients, and limits the number of patients they consider as candidates for insulin pump therapy.

Complicated to use. Traditional pumps are designed with linear software menus, which require the user to follow display screens sequentially, limiting their ability to access information within workflows or easily return to the starting point. Most traditional pumps require users to scroll through numerous menus and input multiple commands to make selections. This process can be time-consuming, and must be performed multiple times per day. Our research has shown that the complicated nature of the process can lead to confusion, frustration and fear of making mistakes with the pump, which in turn can limit the user’s willingness to take advantage of advanced therapy features, or even discourage use entirely.

6

Pump mechanism limitations. Traditional pumps utilize a syringe and plunger mechanism to deliver insulin. This design limits the ability to reduce the size of the pump due to the length and diameter of the syringe and plunger. The design also potentially exposes the user to the unintended delivery of the full volume of insulin within the pump, which can cause hypoglycemia or death. This effect is well documented and can occur when traditional pumps are elevated above the user’s infusion site, referred to as siphoning, or when the user experiences pressure changes during air travel. Our research has shown that the fear of adverse health events due to technical malfunctions related to traditional pump mechanism limitations deters the adoption of insulin pump therapy.

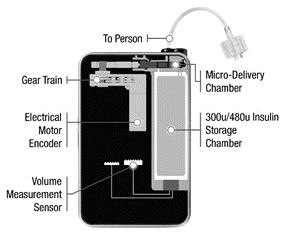

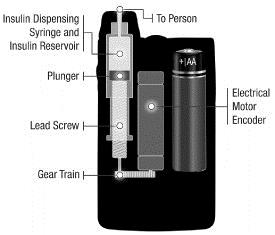

Traditional Pump Mechanism

We believe that these shortcomings of traditional pumps have limited the adoption of pump therapy. By addressing these issues, there is a meaningful opportunity to not only respond to the concerns and unmet needs of traditional insulin pump users, but also to motivate eligible MDI users to adopt pump therapy.

Our Solution

We developed our proprietary technology platform using a consumer-focused approach by first utilizing extensive market research to ascertain what consumers want and then designing products to meet those specific consumer demands. Our development process then applies the science of human factors, which optimizes a device or system to the intended user through iterative usability and design refinement. This multi-step approach has resulted in products that provide users with the distinct product features they seek and in a manner that makes the features usable. We believe this approach is fundamentally different from the approach applied to the traditional medical device development process, which often does not involve seeking out specific consumer feedback in advance or applying the science of human factors to optimize the design of a product. Our t:slim, t:flex, and t:slim G4 products were all developed using this approach.

Our solution, which addresses the shortcomings of traditional pumps, includes:

Contemporary style. Our current products, as well as our products under development, have the look and feel of a modern consumer electronic device, such as a smartphone. Relying on significant consumer input and feedback during the development process, we believe the aesthetically-pleasing, modern design of our products addresses the embarrassing appearance-related concerns of insulin pump users. Key product features such as a high-resolution, color touch screen with shatter-resistant glass, aluminum casing and rechargeable battery, make our products unique in the insulin pump market. In addition, we designed a broad range of accessories allowing users to customize their pump to their individual lifestyle and sense of style.

7

Our Insulin Pump Form Factor (Actual Size of t:slim, t:flex and t:slim G4)

Adaptable platform. Our family of products shares a pump form factor, as well as an easy-to-navigate software architecture combined with a touch screen user interface. This enables us to offer differentiated features across multiple products while leveraging the same sales, clinical, marketing, manufacturing, and customer service infrastructures. It also creates efficiencies when training healthcare providers as our products’ user interface operations are the same across all products, subject only to slight differences that relate to specific features such as a large volume cartridge or CGM integration. We believe the adaptability of our pump platform uniquely positions us to offer a family of products that addresses different needs of people with insulin-dependent diabetes, rather than iterating a single product offering.

Compact size. With a narrow profile, similar to many smartphones, our products can easily and discreetly fit into a pocket. t:slim and t:slim G4 are the slimmest and smallest durable insulin pumps on the market, while still offering a cartridge with 300 units of insulin. t:flex offers this same sleek pump form factor, while utilizing a cartridge with 480 units of insulin, providing enhanced flexibility to people with greater insulin needs. The size and shape of our products are designed to provide increased flexibility with respect to how and where a pump can be worn. Based on extensive consumer input during development, we believe our products address both the embarrassment and functionality concerns related to the size and inconvenience of carrying a traditional pump.

t:slim and t:slim G4 Insulin Delivery System Profile (Actual Size)

Easy to learn and teach. Our technology platform allows for the use of a color touch screen and easy-to-navigate software architecture, providing users simple access to the key functions of their pump directly from the Home Screen. Insulin pump users can quickly learn how to efficiently navigate their pump’s software, thereby enabling healthcare providers to spend less time teaching a person how to use the pump and more time improving management of their diabetes. We believe these features also allow healthcare providers to more efficiently train people to use our pump and have a higher degree of confidence that users can successfully operate our pump, including its more advanced features. Our use of touch-screen technology also allows us to offer our t:simulator App, which allows anyone to experience the easy-to-navigate software for any of our three pumps free of charge on a mobile device. We believe the ease with which our pump can be learned and taught, and the accessibility of our t:simulator App to broadly and easily demonstrate our software technology, will help attract current insulin pump users as well as people who may have been frustrated or intimidated by traditional pumps.

8

Easy-to-Navigate Pump Software Architecture

Intuitive to use. Similar to what is found in modern consumer electronic devices, the embedded software displayed on our color touch screen features intuitive and commonly interpreted colors, language, icons and feedback. Our software also features numerous shortcuts, including a simple way to return to the Home Screen and view critical information for therapy management. These features were designed to enable users to operate their pump with greater confidence and expand the set of functions that they regularly utilize. Users can also execute most tasks in fewer steps than traditional pumps. We believe these features allow users to more efficiently manage their diabetes without fear or frustration.

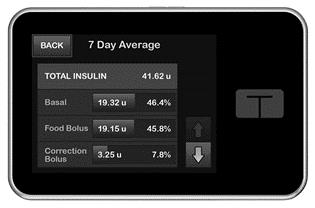

Quick Access to Pump History

Next generation technology platform. Our Micro-Delivery technology is unique compared to traditional pumps. Its miniaturized pumping mechanism draws insulin from a flexible bag within the pump’s cartridge rather than relying on a mechanical syringe and plunger mechanism. The pump is specifically designed to help prevent the unintentional delivery of insulin from the reservoir by limiting the volume of insulin that can be delivered to a person at any one time and to reduce fear associated with using a pump. Our technology was tested under typical and extreme operating conditions and is designed to last for at least the anticipated four-year life of the pump. Our technology also allows us to reduce the size of the device as compared to traditional pumps and is capable of delivering the smallest increment of insulin to users of any pump currently available.

9

Our Insulin Pump Mechanism

Our technology platform also features a touch screen and a micro-USB connection that supports rapid recharging and connectivity to t:connect, both of which can be performed without disconnecting or interrupting insulin delivery.

We believe our technology platform will allow our products to further penetrate and expand the insulin pump therapy market by addressing the specific product and technology limitations that were raised by people with diabetes, their caregivers and healthcare providers throughout our market research and iterative human factors-based design process. We also believe our product platform provides us with the opportunity to address unmet needs in the insulin-dependent diabetes market, including further device miniaturization and advancements in automated insulin delivery.

Our Strategy

Our goal is to significantly expand and further penetrate the insulin-dependent diabetes market and become the leading provider of insulin pump therapy by focusing on both consumer and clinical needs. By offering a family of differentiated products, we believe we are uniquely positioned to provide options in insulin pump therapy to people with insulin-dependent diabetes, allowing us to address multiple segments of the diabetes market. This approach also allows us to leverage our existing infrastructure, including our sales, marketing and clinical efforts, manufacturing efficiencies, and customer technical and support services. To achieve these goals, we intend to pursue the following business strategies:

Drive adoption of our products through our expanded sales and marketing infrastructure and multiple product offerings. We have achieved commercial success since the launch of our first commercial product, t:slim. Our sales and marketing infrastructure is scalable, and we have invested and will continue to invest in the expansion of this infrastructure to increase our access to people with insulin-dependent diabetes, their caregivers and healthcare providers. For example, we are leveraging this infrastructure by marketing new products, such as t:flex and t:slim G4, to primarily the same healthcare providers, thereby increasing our efficiency. We believe that further investment in our sales and marketing infrastructure combined with the launch of additional product offerings utilizing the same infrastructure will drive continued adoption of our products and increase our revenues.

Promote awareness of our product family to consumers, their caregivers and healthcare providers. Our products were specifically designed to address the shortcomings of currently available technologies that we believe have limited the adoption of insulin pump therapy. We intend to broaden our direct-to-consumer marketing to promote the differentiated benefits offered by our family of products through our new website, the use of social media tools, our t:simulator App and motivational spokespeople at industry forums and events. We also expect to leverage our sales and marketing force, together with our clinical specialists, to cultivate relationships with diabetes clinics, insulin-prescribing healthcare professionals and other key opinion leaders. By promoting awareness of our products, we believe that we will attract users of other pump therapies and MDI to our products.

Invest in our consumer-focused approach. We believe that our consumer-focused approach to product design, marketing and customer care is a key differentiator. Our extensive market research involving people with diabetes, their caregivers and healthcare providers has driven the design and development of our current products and customer care model. This approach allows us to add the product features most requested by people with insulin-dependent diabetes, thereby affording the consumer the opportunity to more efficiently manage their diabetes. We will continue to apply the science of human factors throughout the design, development and continuous improvement of our products to optimize our products for intended users. We will continue to invest in our consumer-focused approach throughout our business.

10

Advance our platform of innovative, consumer-focused products to address the unmet needs of people in the insulin-dependent diabetes market. We believe that our proprietary technology platform allows us to provide the most sophisticated and intuitive insulin pump therapy products on the market. We intend to continue utilizing this platform, and to explore additional advancements in our platform technology, to expand our product offerings, as well as the features offered by our family of products, to address different segments of the large and growing insulin-dependent diabetes market, including supporting advances in the automated delivery of insulin through strategic agreements and commercial product development efforts. As part of this effort, we have entered into development agreements with DexCom, Inc., or DexCom, to allow the integration of our insulin pumps with the DexCom continuous glucose monitoring systems.

Broaden direct access to third-party payor reimbursement for our products in the United States. We believe that third-party reimbursement is an important determinant in driving consumer adoption. We also believe that customer and healthcare provider interest in our products is an important factor that enhances our prospect of contracting with third-party payors. We intend to intensify our efforts to encourage third-party payors to establish direct reimbursement for our products as we expand our market presence and family of products.

Leverage our manufacturing operations to achieve cost and production efficiencies. We manufacture our products at our headquarters in San Diego, California. We utilize a semi-automated manufacturing process for our pump products and disposable cartridges. We have significantly increased our manufacturing output since we began commercialization of our products and we have the ability to expand our production capacity by replicating our production lines. We intend to install additional equipment for the automated manufacturing of our disposable cartridges in the next 12 months. Our production system is also adaptable to new products due to shared product design features. We intend to reduce our product costs and drive operational efficiencies by leveraging our manufacturing infrastructure, and as demand for our products increases, we may seek additional facilities in order to further scale our manufacturing operations.

Our Technology Platform

Utilizing our unique consumer-focused approach, which is based on our extensive market research and the science of human factors, we have developed an innovative technology platform that is fundamental to the design of our existing products and provides the foundation for development of future products. The key elements of our platform are:

Advanced core technology. Our patented Micro-Delivery technology is unique compared to traditional pumps. Our miniaturized pumping mechanism allows us to reduce the size of the pump as compared to traditional pumps. Reducing the size of the pumping mechanism also allows us to support various insulin cartridge capacities. It was designed to provide precise dosing as frequently as every five minutes and in increments as small as 0.001 u/hr, or units per hour, as compared to the smallest increment available in traditional pumps, which is 0.025 u/hr. This technology also helps prevent unintentional insulin delivery by limiting the volume of insulin that can be delivered to a person at any one time.

Easy-to-navigate embedded software architecture. Our technology platform was developed using an iterative human factors design process that results in the intuitive software architecture which features commonly interpreted colors, language, icons and feedback. This allows the user to easily navigate the system and perform necessary functions in fewer steps than traditional pumps, including a one-touch method to return to the Home Screen that facilitates ease of learning, teaching and use. The flexible software architecture may also allow for updates to the software without requiring any hardware changes.

Vivid color touch screen. Our full color touch screen allows users to access a streamlined, easy-to-use interface. The high-grade, shatter-resistant glass touch screen provides the user the ability to enter numbers and access features directly, rather than scrolling through numerous screens and options. The touch screen facilitates safety features that were designed to prevent unintended pump operations. The touch screen also supports enhanced visual and tactile feedback.

Lithium-polymer rechargeable battery technology. Our products are the first and only insulin pumps to use a rechargeable battery, unlike traditional pumps that rely on disposable batteries. By using a built-in rechargeable battery, we eliminate the risk of losing personal settings associated with replacing batteries. Our lithium-polymer rechargeable battery charges rapidly with a standard micro-USB connection, and a full charge lasts for up to seven days. Users report that they keep their battery powered by charging it for just 10 to 15 minutes each day, often while showering or commuting with the use of the car charger we provide with the pump. Our battery has been tested to last for at least the four-year life of the pump. Our battery also allows for precise and accessible monitoring of the current charge level on the device’s Home Screen.

11

Compatibility and connectivity. Our PC- and Mac-compatible, cloud-based data management application, t:connect, provides our insulin pump users a fast, easy and visual way to display therapy management data from all of our pump products and supported blood glucose meters. Our platform empowers people with diabetes, as well as their caregivers and healthcare providers, to easily and quickly identify meaningful insights and trends, allowing them to fine-tune therapy and lifestyle choices for better control of their diabetes. Additionally, our platform enables rapid data uploads through a micro-USB connection, without interrupting insulin delivery.

Our Products

In 2012, we introduced to the market our flagship product, t:slim. t:connect, its companion diabetes management application was launched during 2013. In 2015, we launched two new pumps, t:flex and t:slim G4. We believe our unique products address the significant and fundamental shortcomings of traditional pumps and will allow people to manage their diabetes more efficiently.

Commercial Products

Our Insulin Pump Products

All of our insulin pump products share important common features, including a black aluminum case and chrome trim, that give them the look and feel of a modern consumer electronic device, such as a smartphone. Our insulin pumps are also watertight, with an IPX7 rating, eliminating concerns about accidentally getting it wet. Each device also features a micro-USB connection that supports rapid recharging and connectivity to t:connect, both of which can be performed without disconnecting or interrupting insulin delivery.

All of our insulin pumps also feature a vivid, full-color touch screen made of high-grade, shatter-resistant glass that provides users the ability to enter numbers and access features directly, rather than scrolling through a list of numbers and screens. We designed the streamlined, user-friendly interface of our products to facilitate rapid access to the features people use most, such as delivering a bolus, viewing insulin remaining on board, viewing insulin cartridge volume and monitoring current pump status and settings. The interface also includes an options menu that provides quick and intuitive navigation to key insulin management features, pump settings, cartridge loading and use history. Our insulin pumps also feature a Home Screen button that immediately returns the user to the Home Screen where important administrative features are displayed, including the current battery charge level, a time and date display and an LED indicator for alerts, alarms and reminders.

All of our insulin pump products allow for the creation of multiple customizable personal profiles, each supporting up to 16 timed insulin delivery settings. This feature allows users to manage their day-to-day insulin therapy with less effort and interruption. Users can quickly and easily adjust insulin settings based on a number of key factors, including basal rate, correction factor, insulin-to-carbohydrate ratio and target blood glucose levels.

t:slim® Insulin Delivery System

Our flagship product, t:slim Insulin Delivery System, is comprised of t:slim Pump, its 300-unit disposable insulin cartridge and an infusion set. We began commercial sales of t:slim in the United States in the third quarter of 2012. Measuring 2.0 x 3.1 x 0.6 inches, t:slim and t:slim G4 are the slimmest and smallest durable insulin pumps on the market.

Cartridge being inserted into t:slim Insulin Pump

12

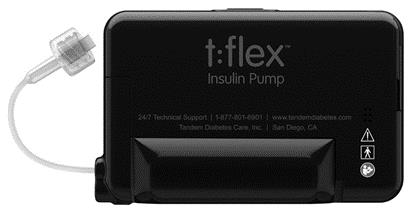

t:flex Insulin Delivery System

t:flex Insulin Delivery System is comprised of t:flex Pump, its 480-unit disposable insulin cartridge and an infusion set. We began commercial sales of t:flex in the United States in the second quarter of 2015.

t:flex Insulin Pump

People with insulin-dependent diabetes require different amounts of insulin based on their level of insulin sensitivity, which can vary significantly from person to person. t:flex is designed for individuals who require more than 100 units of U-100 insulin per day on MDI or more than 80 units per day using a pump, such as teenagers with type 1 diabetes and many people with type 2 diabetes. t:flex incorporates the same technology platform as t:slim, but offers a 480-unit insulin reservoir, the largest capacity currently approved in the United States. This provides users the benefits of pump therapy without the frequent cartridge changes required by 200- and 300-unit capacity pumps. t:flex cartridge extends out slightly on one side to accommodate the extra volume while maintaining all of the other benefits of t:slim, including its slim and sleek appearance.

In our market research, two-thirds of endocrinologists cited limited volume capacity as the number one barrier to pump adoption for their patients with type 2 diabetes who use daily rapid acting insulin. We believe that offering a 480-unit cartridge addresses the typical insulin needs of a person with type 2 diabetes who is insulin-dependent. Our research has also shown that the appearance and bulky size of traditional pumps is another deterrent to pump adoption for people with greater insulin needs. We believe the combination of t:flex’s larger insulin reservoir, combined with the other features and benefits offered by our technology platform, provides us with an opportunity to expand the current insulin pump market to address the unmet needs of individuals with greater insulin requirements.

t:slim G4 Insulin Pump with Integrated CGM System

t:slim G4 Insulin Delivery System is the first and only touch-screen pump with CGM integration. It combines features of t:slim pump and DexCom G4 PLATINUM CGM System, devices that have consistently ranked #1 in independent surveys, into a single device that is simple to use. We began commercial sales of t:slim G4 in the United States in the third quarter of 2015.

We have a development and commercialization agreement with DexCom, which provides us a non-exclusive license to integrate our product platform with the DexCom G4 PLATINUM CGM System. t:slim G4 incorporates the same pump technology and user interface as t:slim but also provides the added convenience of allowing CGM information to be displayed on the pump, eliminating the need to carry an additional device. Based on this information, users are able to utilize the pump to take direct action with their insulin pump therapy.

CGM is a therapy used in conjunction with blood glucose testing, and provides users with real-time access to their glucose levels as well as trend information. Close Concerns estimates that approximately 10 percent of people with type 1 diabetes use CGM. We believe that CGM utilization will be increased by offering an accurate CGM sensor in combination with an innovative and consumer-focused insulin pump, such as t:slim.

We commenced commercial sales of t:slim G4 in September 2015. During the fourth quarter of 2015, t:slim G4 represented the majority of our insulin pump shipments and we expect that trend to continue during 2016. Based on a customer survey conducted in the fourth quarter of 2015, we believe approximately 45 percent of our t:slim G4 customers did not previously use any form of CGM and nearly 10 percent of our t:slim G4 customers were previously using a competitive CGM system.

13

t:connect Diabetes Management Application

We commercially introduced t:connect Diabetes Management Application, or t:connect, our cloud-based data management application, in the first quarter of 2013. It provides users, their caregivers and their healthcare providers a fast, easy and visual way to display therapy management data from our pumps and supported blood glucose meters. This application empowers people with diabetes, as well as their caregivers and healthcare providers, to easily and quickly identify meaningful insights and trends, allowing them to refine therapy and lifestyle choices for better management of their diabetes. We also believe that t:connect can serve as a key component of mobile health applications that are currently in development.

We developed t:connect to be intuitive, with the same consumer-focused approach utilized in the development of our insulin pumps. It features built-in smart logic that manages duplicate blood glucose readings from a user’s pump and blood glucose meter to ensure report accuracy. t:connect also can generate color-coded graphs and interactive, multi-dimensional reports that make it easy to identify therapy management trends, problems and successes. While our insulin pumps hold the data generated over a period of up to 90 days, once a user uploads to t:connect their therapy management information is retained in their account. t:connect maintains the highest standards of patient data privacy and is hosted on secure, Health Insurance Portability and Accountability Act of 1996, or HIPAA, compliant servers.

In 2016, we intend to launch an enhanced version of t:connect that will simplify the ability of patients to share their t:connect data with their healthcare providers, which we refer to as t:connect HCP. We expect t:connect HCP will also allow a healthcare provider to establish a separate account that centralizes t:connect data from all of their enrolled patients.

t:connect Diabetes Management Application

Infusion Sets

We offer our customers various infusion set choices for use with our insulin pump products. During 2015, we launched a Tandem-branded infusion set under the t:90 brand name. The t:90 offers a 90-degree soft cannula and comes pre-loaded in an automatic spring inserter, so one-handed insertions are quick and easy, even in hard-to-reach areas. We expect to launch the second Tandem-branded infusion set under the t:30 brand name during 2016. The t:30 will offer the same features and benefits as the t:90, but with a 30-degree soft cannula, which is often preferred by users who are lean or lead an active lifestyle.

Both t:90 and t:30 infusion sets will come in a wide variety of tubing lengths to fit customers’ individual needs. We intend to continue to invest in the development of enhancements to our infusion set products to address the perceived shortcomings of existing products on the market.

Pump Accessories

We offer our customers a broad range of accessories for their pumps, allowing users to customize their device to their individual lifestyle and sense of style. We believe our accessories increase user flexibility and willingness to use and carry their insulin pump. These accessories include different color casings, belt clips, and leather cases.

14

Insulin Pump Accessories

Products in Development

Our products in development support our strategy to focus on both consumer and clinical needs. We intend to leverage our consumer-focused approach and proprietary technology platform to continue to develop products targeted at different segments of the insulin-dependent diabetes market.

Tandem Device Updater

The Tandem Device Updater, formerly referred to as Project Odyssey, is a proprietary PC and Mac-compatible web-based system that is being developed to give users the ability to update their pump’s software remotely, similar to how a user would update software on a smartphone. We are positioned to offer this capability due to the intuitive software architecture and convenient micro-USB connection included within our pump products. We anticipate that the Device Updater will allow users to conveniently update their pump software, and provide them the opportunity to quickly utilize enhanced features made available through our products.

We submitted a 510(k) for the Device Updater in the first quarter of 2016. If approved, the Device Updater will serve as a vehicle to update our 510(k)-approved pumps, t:slim and t:flex.

t:sport Insulin Delivery System

The t:sport Insulin Delivery System, or t:sport, is being designed for people who seek even greater discretion and flexibility with the use of their insulin pump by further reducing the size of the insulin pump and controlling its operation through a separate controller or mobile device application. We are developing a compact insulin pump capable of communicating wirelessly with a mobile device, such as a smartphone, which will be used to program its operations instead of a touch screen on the device. During 2015, we completed market research to support our development of t:sport and developed several hardware prototypes.

The FDA issued Radio Frequency Wireless Technology in Medical Devices Guidance in August 2013. At this time, there is not a predicate device for an insulin pump wirelessly controlled through a mobile device application.

Automated Insulin Delivery

The concept of an artificial pancreas system generally involves an external device, or combination of devices, intended to aid a person with insulin-dependent diabetes by automatically testing and controlling their blood glucose through the administration of insulin by itself or in combination with a second hormone. This may be achievable by combining an insulin pump and a CGM with computer software that allows the two devices to automatically communicate to determine and provide the right amount of insulin, or insulin plus another hormone, at the correct time.

We have supported leading researchers at facilities such as the University of Virginia, Boston University, Massachusetts General Hospital and Stanford University by providing pump hardware and software to advance development of artificial pancreas solutions. Within our commercial t:slim product there is a blue-tooth low energy radio, or BLE, that is not enabled. In July 2013, we submitted a Master File to the FDA, allowing researchers to use t:slim technology with the BLE enabled. This device provides researchers wireless use of our device with their selected algorithm and CGM for single hormone or dual hormone clinical studies.

15

We anticipate our first commercial artificial pancreas offering will be based on our proprietary technology platform and will partially automate insulin delivery based on CGM information. We believe partial automated insulin delivery can be achieved through predictive algorithms that aid a user in maintaining their targeted blood glucose level, thereby reducing the frequency and severity of hyperglycemic or hypoglycemic events and the associated short and long-term complications.

We believe our first commercial artificial pancreas offering will require a pre-market approval, or PMA, and that the submission will include data from one or more clinical studies. We anticipate filing an investigational device exemption, or IDE, with the FDA in 2016 for our first clinical study involving a first-generation product with the capability of partial automation of insulin delivery.

Sales and Marketing

Our sales and marketing objectives are to:

|

|

● |

generate demand and acceptance for our current product family and future products developed with our technology platform among people with insulin-dependent diabetes; and |

|

|

● |

promote advocacy and support for healthcare providers. |

As of December 31, 2015, we had a sales, clinical and marketing team of approximately 175 full-time employees. In late 2015, we announced that we would expand our sales and clinical organization from 60 to 72 territories. We expect to complete the expansion of our sales territories during the first quarter of 2016. Each territory within our sales organization consists of a territory manager and a clinical diabetes specialist who as a team call on endocrinologists, primary care physicians, certified diabetes educators and potential customers. Based on historical sales force performance, we expect most of the new territories to reach their steady state level of sales performance within nine to twelve months from their date of hire. Our sales team is augmented by individuals in our customer sales support organization who follow up on leads generated through promotional activities and educate people on the benefits of our proprietary technology and products. As our market penetration continues to build momentum, and as we launch new products into the market, we expect to further expand our sales, clinical and marketing infrastructure in the United States and may evaluate international commercialization opportunities.

In addition, as of December 31, 2015, we had executed agreements with approximately 40 independent distributors. For the year ended December 31, 2015, Edgepark Medical Supplies, Inc., and Byram Healthcare accounted for 17.8%, and 17.2% of our sales, respectively. For the year ended December 31, 2014, Edgepark Medical Supplies, Inc., CCS Medical, Inc. and Byram Healthcare accounted for 16.0%, 11.6% and 10.9% of our sales, respectively. None of our independent distributors has been required to sell our products exclusively and each of them may freely sell the products of our competitors. Our distributor agreements generally have one-year initial terms with automatic one-year renewal terms, and are terminable in connection with a party’s material breach.

We expect our sales will fluctuate on a quarterly basis in the future due to a variety of factors, including the impact of:

|

|

· |

seasonality associated with summer vacations, annual deductibles and coinsurance requirements associated with most medical insurance plans utilized by our individual customers and the individual customers of our distributors, |

|

|

· |

the buying patterns of our distributors and other customers, |

|

|

· |

the size and timing of sales force expansions, and |

|

|

· |

anticipated and actual regulatory approvals of new products. |

We have generally experienced and expect to continue to experience sequential growth of sales in each quarter from the first quarter to the fourth quarter, and we also expect sequential sales from the fourth quarter to the following first quarter to decrease. In 2014, the expansion of our sales force during the first half of the year contributed to our sales being weighted heavily towards the second half of the year. In 2015, the timing of the regulatory approval and commercial launch of t:slim G4 contributed to our sales being weighted even more heavily towards the fourth quarter of the year. In 2016, we expect the combined effect of product enhancements, the increasing productivity of our existing sales force and the expansion of our sales force will result in sales continuing to being weighted heavily towards the second half of the year.

Healthcare provider focused initiatives. Healthcare providers are a critical resource in helping patients understand and select their diabetes therapy options. Each of our territories is supported by a clinical diabetes specialist who is a certified diabetes educator and holds either a registered nurse or registered dietician license. Our clinical diabetes specialists support and educate healthcare providers on our products and proprietary technology, certify healthcare providers to train people to use our products and support our customers with initial training following the purchase of our products.

16

In addition to calling on healthcare providers in their offices, some of our recent marketing initiatives include:

|

|

● |

presentations and product demonstrations at local, regional, and national tradeshows, including American Diabetes Association Scientific Sessions and the American Association of Diabetes Educators Annual Meeting; |

|

|

● |

our Demonstration Unit Program, through which we provide healthcare professionals with our products, or a mobile device that operates our t:simulator App, for pump demonstrations to their patients; and |

|

|

● |

partnerships with third-party diabetes management systems for the display of Tandem pump data, including diasend® Clinic and Tidepool. |

Consumer-focused initiatives. We sell our products directly to consumers through referrals from healthcare providers and through leads generated through our promotional activities. Our direct-to-consumer marketing efforts focus on positioning our products as innovative, consumer-focused insulin pumps with a unique Micro-Delivery technology, slim touch screen design and an intuitive user interface designed to meet different needs in the diabetes community. In connection with the launch of our t:slim G4, our marketing also emphasizes the greater accuracy of the DexCom G4 PLATINUM CGM over competitive products. Some of our recent consumer-focused marketing initiatives include:

|

|

● |

participation at consumer-focused regional diabetes conferences and events including the JDRF Type One Nation Summits, the American Diabetes Association Expos, Children With Diabetes Friends for Life and Taking Control Of Your Diabetes, or TCOYD, conferences and local diabetes camps; |

|

|

● |

website enhancements and utilization of social media, online webinars and consumer-focused newsletters to drive online awareness and expand web presence; |

|

|

● |

promotion of our t:simulator App, which allows anyone the ability to explore the key features of our pump products for free using the convenience of their mobile device; |

|

|

● |

corporate sponsorships of organizations focused on people with diabetes, including JDRF, TCOYD, Diabetes Hands Foundation, Students with Diabetes, College Diabetes Network, Diabetes Scholars; and |

|

|

● |

community diabetes fundraising and awareness events. |

Branding. We developed our comprehensive branding strategy to engage consumers and communicate our identity as a modern and progressive company that works “in tandem” with the diabetes community, healthcare providers, our employees and business partners. We strive to embody this through our product offerings, marketing efforts and interactions throughout our business. Our product names are family branded using a “t:” to create uniformity and help consumers quickly identify our products. Our “touch simplicity” marketing campaign highlights the slim touch screen design and easy-to-navigate software associated with our pump products. Our other product packaging, website, advertising and promotional materials are a reflection of our consumer-focused approach and modern style. We value having clear, friendly and helpful communications throughout our business.

Training and Customer Care

Given the chronic nature of diabetes, and the potentially complicated dynamic of health insurance coverage, training and customer care is important for developing long-term relationships with our customers. Our customer care infrastructure consists of individuals focused on training, technical services and insurance verification. We believe our consumer-focused approach enables us to develop a personal relationship with the customer, or potential customer, beginning with the process of evaluating our products, then navigating insurance coverage and extending to our provision of training and ongoing support. Providing reliable and effective ongoing customer support reduces anxiety, improves our customers’ overall experiences with our products and helps reinforce our positive reputation in the diabetes community. In order to provide complete training and customer care solutions, we leverage the expertise of our clinical diabetes specialists who provide one-on-one training, and we offer ongoing complementary technical services, as well as ongoing support with insurance verification.

Training. Our research has shown that it can take several days for a user to competently learn how to use a traditional pump, leading to frustration, frequent mistakes and additional training, each of which may ultimately discourage adoption. As a result, we believe that healthcare providers may be less likely to recommend pump therapy to potential candidates.

17

By offering an intuitive user interface, we believe healthcare providers will be able to train people to use our products more efficiently than traditional pumps, and will have a higher degree of confidence in their patients’ ability to operate it, including the more advanced features. In addition, the intuitive nature of our family of pump products likely will allow healthcare providers to spend less time teaching a person how to use their pump and more time helping to improve the management of their diabetes. This ease of training may also help users feel less intimidated and fearful of pump therapy, leading to increased adoption and market expansion.

We tailor our training efforts for insulin pump users and healthcare providers. In some cases, our clinical training managers may certify clinic-based healthcare providers to train their patients on our products. In other cases, a member of our clinical team will conduct one-on-one training on our products with the customer. We have also established a network of independent, licensed diabetes educators who have been certified to train on our products and will conduct customer training on our behalf.

In connection with the launch of our t:slim G4, we also offer our customers with online training on the use of the CGM components of the system. Customers can access one or more modules of the training system at their own pace and at the location that they prefer, which offers them a convenient method to access the latest training available.

Technical Services. We believe that a difficult-to-use pump will result in users making more frequent calls to the pump manufacturer or their healthcare provider for support in using the device. This can be frustrating for the customer and costly for the pump manufacturer as well as for the healthcare provider. We expect the intuitive nature of our products to result in fewer calls from users requesting support from our technical services team or their healthcare provider. However, because of the significant percentage of our customers that are new to pump therapy, we also anticipate receiving high call volume from customers who are still becoming familiar with the fundamentals of insulin pump therapy.

Our customer-focused technical services team provides support seven days a week, 24 hours a day by answering questions, trouble-shooting and addressing issues or concerns. Our insulin pump products are covered by a four-year warranty that includes our product replacement program through which our technical services team members can provide a customer with a replacement device within as little as 24 hours to minimize the interruption of his or her therapy.

Insurance Verification. Our insurance verification team provides support to help customers, and potential customers, understand their insurance benefits. We work with the customers and their healthcare providers to collect information required by the insurance provider and to determine their insurance benefit coverage for our products and notify them of their benefit.

Following communication of a person’s estimated financial responsibility, final confirmation of their desire to purchase the device and method of fulfillment, the customer’s order is typically shipped to their home. The initial order generally contains their insulin pump as well as a 90-day supply of infusion sets and cartridges. For customers that we service on a direct basis, a member of our internal team then contacts the customer prior to the end of their 90-day supply to re-verify their insurance benefits and assist in reordering supplies. For customers who purchase our insulin pump through one of our authorized distributors, ongoing supplies are typically also arranged through the distributor.

Third-Party Reimbursement

Customer orders are typically fulfilled by billing third-party payors on behalf of our customers, or by utilizing our network of distributors who then bill third-party payors on our customers’ behalf. Our fulfillment and reimbursement systems are fully integrated such that our products are shipped only after receipt of a valid physician’s order and verification of current health insurance information.

We are accredited by the Community Health Accreditation Program and are an approved Medicare provider. We currently bill for all of our insulin pump products and associated supplies using existing Healthcare Common Procedure Coding System codes for which Medicare reimbursement is well established. However, pump eligibility criteria for people with type 2 diabetes can be different and often requires additional documentation and laboratory testing to gain in-network insurance reimbursement benefits.

Over the last ten years, Medicare reimbursement rates for insulin pumps and disposable cartridges have remained relatively unchanged. However, Medicare periodically reviews its reimbursement practices for diabetes-related products. Medicare implemented a competitive bidding process for blood glucose strip reimbursement, which resulted in a significant reduction in the reimbursement rate for those products. Medicare also initiated a competitive bidding process for insulin pumps in limited geographies. As a result, there is some uncertainty as to the future Medicare reimbursement rate for our current and future products.

18

As of December 31, 2015, we had entered into commercial contracts with approximately 136 national and regional third-party payors to establish reimbursement for our insulin pump products, disposable cartridges and other related supplies. We employ a team of managed care managers who are responsible for negotiating and securing contracts with third-party payors throughout the United States. For the year ended December 31, 2015, approximately 22% of our sales were generated through our direct third-party payor contracts.

If we are not contracted with a person’s third-party payor and in-network status cannot be otherwise obtained, then to the extent possible we utilize distribution channels so our customers’ orders can be serviced. As of December 31, 2015, we had executed distributor agreements with approximately 40 independent distributors. In some cases, but not all, this network of distributors allows us to access people who are covered by commercial payors with whom we are not contracted, at in-network rates that are generally more affordable for our customers.

Manufacturing and Quality Assurance

We currently manufacture our products at our headquarters in San Diego, California. By locating our manufacturing operations near our other business functions, we believe we have significantly enhanced our ability to monitor and manage our manufacturing, and to adjust manufacturing operations quickly in response to our business needs.

We currently utilize a semi-automated manufacturing process for our pump products and disposable cartridges. The pump production line requires approximately 20 manufacturing assemblers and limited support staff to run the line and reaches a maximum output of approximately 30,000 pumps per year on a single shift. Disposable cartridges are manufactured on a production line that requires 14 manufacturing operators and limited support staff and reaches a maximum output of approximately 1,000,000 cartridges per year on a single shift. We are actively working on improving the efficiency of our disposable cartridge manufacturing process. For instance, we are currently working towards manufacturing t:flex cartridges primarily using the same semi-automated manufacturing equipment used in the manufacture of t:slim and t:slim G4 cartridges. In addition, we are in the process of further automating the manufacturing of our disposable cartridges.

The cartridge automation equipment was designed to operate at capacity. As such, the line was constructed in several modular sections that perform different aspects of the assembly. This is important because at any given time, maintenance, service or inspection can be performed on any one section independent of the rest of the line. The manufacturing process may then continue uninterrupted while the assembly step is performed manually until the automation section is back on-line.

We have significantly increased our manufacturing output since we began the commercialization of our first product and we have the ability to expand our production capacity by replicating our production lines. We intend to install additional equipment for the automated manufacturing of our disposable cartridges in the next 12 months. Our production system is also adaptable to new products due to shared product design features. We intend to reduce our product costs and drive operational efficiencies by leveraging our manufacturing infrastructure. As demand for our products increases, we may seek additional facilities in order to further scale our manufacturing operations.

Outside suppliers are the source for most of the components and some sub-assemblies in the production of our insulin pumps. Any sole and single source supplier is managed through our supplier management program that is focused on reducing supply chain risk. Key aspects of this program include managing component inventory in house and at the supplier, contractual requirements for last time buy opportunities and second sourcing approaches for specific suppliers. Typically, our outside vendors produce the components to our specifications and in many instances to our designs.