Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - ANIXTER INTERNATIONAL INC | axe201510-kex311.htm |

| EX-32.2 - EXHIBIT 32.2 - ANIXTER INTERNATIONAL INC | axe201510-kex322.htm |

| EX-21.1 - EXHIBIT 21.1 - ANIXTER INTERNATIONAL INC | axe201510-kex211.htm |

| EX-23.1 - EXHIBIT 23.1 - ANIXTER INTERNATIONAL INC | axe201510-kex231.htm |

| EX-31.2 - EXHIBIT 31.2 - ANIXTER INTERNATIONAL INC | axe201510-kex312.htm |

| EX-24.1 - EXHIBIT 24.1 - ANIXTER INTERNATIONAL INC | axe201510-kex241.htm |

| EX-32.1 - EXHIBIT 32.1 - ANIXTER INTERNATIONAL INC | axe201510-kex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended January 1, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission file number 001-10212

Anixter International Inc.

(Exact name of Registrant as Specified in Its Charter)

Delaware | 94-1658138 | |

(State or other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

2301 Patriot Blvd.

Glenview, IL 60026

(224) 521-8000

(Address and telephone number of principal executive offices in its charter)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class on Which Registered | Name of Each Exchange on Which Registered | |

Common stock, $1 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | x | Accelerated Filer | ¨ | |||

Non-Accelerated Filer | ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the shares of registrant’s Common Stock, $1 par value, held by nonaffiliates of the registrant was approximately $1,832,219,494 as of July 3, 2015.

At February 10, 2016, 32,970,320 shares of registrant’s Common Stock, $1 par value, were outstanding.

Documents Incorporated by Reference:

Certain portions of the registrant’s Proxy Statement for the 2016 Annual Meeting of Stockholders of Anixter International Inc. are incorporated by reference into Part III.

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

i

PART I

ITEM 1. BUSINESS.

Company Overview

Anixter International Inc. and its subsidiaries (collectively referred to as "Anixter" or the "Company") and sometimes referred to in this Annual Report on Form 10-K as "we", "our", "us", or "ourselves", founded in 1957, is headquartered near Chicago, Illinois and trades on the New York Stock Exchange under the symbol AXE. The Company was formerly known as Itel Corporation which was incorporated under Delaware law in 1967. Through Anixter Inc. and its subsidiaries, we are a leading distributor of network and security solutions, electrical and electronic solutions, and utility power solutions.

Through our global presence, technical expertise and supply chain solutions, we help our customers reduce the risk, cost and complexity of their supply chains. We add value to the distribution process by providing over 125,000 customers access to innovative inventory management programs, over 450,000 products and over $1.1 billion in inventory, 319 warehouses/branch locations with approximately 9 million square feet of space, and locations in over 300 cities across 50 countries. We are a leader in the provision of advanced inventory management services including procurement, just-in-time delivery, quality assurance testing, advisory engineering services, component kit production, small component assembly and e-commerce and electronic data interchange to a broad spectrum of customers.

Our customers are international, national, regional and local companies, covering a broad and diverse set of industry groups including manufacturing, resource extraction, telecommunications, internet service providers, finance, education, healthcare, retail, transportation, utilities (both public power and investor owned), aerospace and defense and government; and include contractors, installers, system integrators, value-added resellers, architects, engineers and wholesale distributors. Our customer base is well-diversified with no single customer accounting for more than 2% of sales.

Our differentiated operating model is premised on our belief that our customers and suppliers value a partner with consistent global product offerings, technical expertise (including product and application knowledge and support) and customized supply chain solutions, all supported by a common operating system and business practices that ensure the same "look, touch and feel" worldwide.

Our growth strategy is driven by constant refresh and expansion of our product and solution offerings to meet marketplace needs. This organic growth approach extends to a constantly evolving set of supply chain services that are designed to lower the customer’s total cost of procuring, owning and deploying the products we sell. We have identified security solutions, emerging markets, utilities, industrial communications and control and in-building wireless as growth opportunities we are pursuing. Organic growth will periodically be supplemented with acquisitions where the benefits associated with geographic expansion, market penetration or new product line additions are weighted in favor of "buying versus building."

In the third quarter of 2014, we acquired all of the outstanding shares of Tri-Northern Acquisition Holdings, Inc. ("Tri-Ed"), a leading independent distributor of security and low-voltage technology products headquartered in Woodbury, NY. The acquisition of Tri-Ed offers a strategic opportunity for us and our security business, consistent with our vision to create a leading global security platform. Through expanding our offering into highly complementary products lines, our customers benefit from a broader set of products and solutions in the areas of video, access control, fire/life safety, and intrusion detection. In addition, this transaction provides access to the residential construction end-market and a community of security integrators and dealers we did not historically service. For further information regarding Tri-Ed, refer to Note 3. "Business Combinations".

During the second quarter of 2015, we completed the sale of the OEM Supply - Fasteners ("Fasteners") business to American Industrial Partners ("AIP"), excluding certain foreign locations. This transaction sharpened our focus on our then core Enterprise Cabling and Security Solutions ("ECS") and Electrical and Electronic Wire and Cable ("W&C") segments and provided additional financial flexibility to build on these strong global platforms. For further information regarding the sale of our Fasteners business, refer to Note 2. "Discontinued Operations".

In the fourth quarter of 2015, we completed the acquisition of the Power Solutions business ("Power Solutions") from HD Supply, Inc. Power Solutions represents the largest acquisition in Anixter's history and transforms Anixter into a leading North American distributor to the utility sector, enhances our competitive position in the electrical wire and cable markets and further strengthens our overall customer and supplier value proposition. For further information regarding Power Solutions, refer to Note 3. "Business Combinations" in the notes to the Consolidated Financial Statements.

1

Business Segments and Products

Beginning in the fourth quarter of 2012 and through the first quarter of 2015, the Company's operating and reportable segments were ECS, W&C, and Fasteners. Following the sale of the Fasteners business in the second quarter of 2015, our remaining operating segments were ECS and W&C. In the fourth quarter of 2015, in connection with the acquisition of Power Solutions, we renamed our legacy ECS segment to Network & Security Solutions ("NSS"). The low voltage business of Power Solutions was combined into our historical W&C segment to form the Electrical & Electronic Solutions ("EES") segment. The high voltage business of Power Solutions forms our new Utility Power Solutions ("UPS") segment. The following is a brief description of each of our reportable segments and business activities.

Network & Security Solutions ("NSS")

The Network & Security Solutions segment, with operations in over 50 countries, supplies products and customized Supply Chain Solutions to customers in a diverse range of industries including finance, transportation, education, government, healthcare and retail. NSS provides solutions to end-users and sells the products through various channels including data communications contractors, security, network and systems integrators, and directly to end users. NSS has a broad product portfolio that includes copper and fiber optic cable and connectivity, access control, video surveillance, intrusion and fire/life safety, cabinets, power, cable management, voice and networking switches and other ancillary products. The NSS segment includes more than 2,300 technically trained salespeople, approximately 40 Supply Chain Solutions specialists and approximately 90 sales engineers.

Through a variety of value-added supply chain solutions, including inventory management, product packaging and enhancement and other customized supply chain services, NSS helps customers reduce the risk, complexity and cost associated with their IT infrastructure and physical security deployments. The NSS commitment to quality products and services and technical leadership is demonstrated by its participation in many global standards organizations. Its technical expertise extends to performance and interoperability testing at our Infrastructure Solutions LabSM, which provides NSS the opportunity to demonstrate solutions and proof-of-concepts to customers. The NSS Data Center HealthCheckSM and ipAssuredSM programs help customers make intelligent buying decisions around network and security infrastructure and improve efficiency to meet their sustainability goals.

Electrical & Electronic Solutions ("EES")

The Electrical & Electronic Solutions segment, with operations in over 30 countries, supplies a broad range of wire and cable products and customized supply chain solutions to the Industrial and Original Equipment Manufacturer ("OEM") markets. The Industrial group supplies products for the transmission of power and signals in industrial applications to customers in key markets including oil, gas and petrochemical, alternative energy, utility, power generation and distribution, industrial, natural resource and water and wastewater treatment. It sells through channels including electrical contractors, security and automation integrators, and engineering, procurement and construction firms. The OEM group supplies products used in the manufacturing of audio/video, automotive, industrial, medical, military and communications equipment, selling to OEM and panel, cable and harness shops. The product portfolio in this global business includes electrical and electronic wire and cable, shipboard cable, support and supply products, low-voltage cable, instrumentation cable, industrial communication and control products, security cable, connectors, industrial Ethernet switches, and voice and data cable. Value-added services, including supply chain management services and engineering support are tailored to position us as a specialist in fast growing emerging markets, OEMs and industrial verticals. EES helps customers achieve their sustainability goals by using its value-added services to minimize scrap, reduce lead times and improve energy efficiency.

The EES team of nearly 900 technical experts includes its sales personnel, supply chain specialists, industrial communication specialists and engineers. EES provides world-class technical assistance, products and support through code and standards interpretation, product selection assistance, on-site customer training and customer specification reviews. EES brings value to its customers through its global reach, ability to provide global infrastructure project coordination, technical and engineering support, financial strength, and sourcing and supplier relationships. These capabilities help customers reduce costs and risks and gain competitive advantage in their marketplace.

2

Utility Power Solutions ("UPS")

The Utility Power Solutions segment, with primary operations in the United States and Canada, supplies electrical transmission and distribution products, power plant maintenance, repair and operations supplies and smart-grid products, and arranges materials management and procurement outsourcing for the power generation and distribution industries. The UPS segment serves the utilities (both public power and investor owned) and electrical markets. It serves electric power plant customers primarily through a bid-based model and, to a lesser extent, sells maintenance, repair and operations products through print catalogs. Products include conductors such as wire and cable, transformers, overhead transmission and distribution hardware, switches, protective devices and underground distribution, connectors used in the construction or maintenance and repair of electricity transmission and substation distribution infrastructure, and electrical wire and cable, switchgear, supplies, lighting and conduit used in non-residential and residential construction. UPS also provides materials management and procurement outsourcing services. Its capabilities allow us to integrate with our customers and perform part of our customers' sourcing and procurement function. The UPS segment includes more than 200 technically trained salespeople and nearly 90 Supply Chain Solutions specialists.

For more information concerning our business segments, foreign and domestic operations and export sales, see Note 8. "Income Taxes" and Note 11. "Business Segments" in the Notes to the Consolidated Financial Statements.

Suppliers

We source products from thousands of suppliers, with approximately one-third of our annual dollar volume purchases sourced from our five largest suppliers. An important element of our overall business strategy is to develop and maintain close relationships with our key suppliers, which include the world’s leading manufacturers of communication cabling, connectivity, support and supply products, electrical wire and cable, and utility products. Such relationships emphasize joint product planning, inventory management, technical support, advertising and marketing. In support of this strategy, we generally do not compete with our suppliers in product design or manufacturing activities. We do sell a small amount of private label products that carry a brand name exclusive to us.

Our typical distribution agreement generally includes the following significant terms:

• | a non-exclusive right to resell products to any customer in a geographical area (typically defined as a country, with the exception of our UPS business which is typically defined as a county); |

• | cancelable upon 60 to 90 days notice by either party for any reason; |

• | no minimum purchase requirements, although pricing may change with volume on a prospective basis; and |

• | the right to pass through the manufacturer’s warranty to our customers. |

Distribution and Service Platform

We cost-effectively serve our customers’ needs through our proprietary computer systems, which connect nearly all of our warehouses and sales offices throughout the world. The systems are designed for sales support, order entry, inventory status, order tracking, credit review and material management. Customers may also conduct business through our e-commerce platform, which we believe is one of the most comprehensive and user-friendly websites in the industry.

We operate a series of large, modern, regional distribution centers in key geographic locations in North America, Europe and Emerging Markets that provide for cost-effective, reliable storage and delivery of products to our customers. We have designated 16 warehouses as regional distribution centers. Collectively, these facilities store approximately 30% of our inventory. In certain cities, some smaller warehouses are also maintained to maximize transportation efficiency and to provide for the local needs of customers. Our network of regional distribution centers, local distribution centers, service centers, branch locations and sales offices consists of 264 locations in the United States, 32 in Canada, 25 in the United Kingdom, 26 in Continental Europe and the Middle East, 36 in Latin America, 13 in Asia and 6 in Australia/New Zealand.

We have developed close relationships with certain freight, package delivery and courier services to minimize transit times between our facilities and customer locations, as well as a dedicated delivery fleet of over 500 vehicles with the Power Solutions acquisition. The combination of our information systems, distribution network and delivery partnerships allows us to provide a high level of customer service while maintaining a reasonable level of investment in inventory and facilities.

Employees

At January 1, 2016, we employed over 8,700 people. Approximately 50% of the employees are engaged in sales or sales-related activities, 30% are engaged in warehousing and distribution operations and 20% are engaged in support activities, including inventory management, information services, finance, human resources and general management. We do not have any significant concentrations of employees subject to collective bargaining agreements within any of our segments.

3

Competition

Given our role as an aggregator of many different types of products from many different sources and because these products are sold to many different industry groups, there is no well-defined industry group against which we compete. We view the competitive environment as highly fragmented with hundreds of distributors and manufacturers that sell products directly or through multiple distribution channels to end users or other resellers. There is significant competition within each end market and geography served that creates pricing pressure and the need for constant attention to improve services. Competition is based primarily on breadth of products, quality, services, relationships, price and geographic proximity. We believe that we have a significant competitive advantage due to our comprehensive product and service offerings, global distribution network, technically-trained sales team and customized supply chain solutions. We believe our global distribution platform provides a competitive advantage to serving multinational customers’ needs. Our operations and logistics platform gives us the ability to ship orders from inventory for delivery within 24 to 48 hours to all major global markets. In addition, we have common systems and processes throughout the majority of our operations in more than 50 countries that provide our customers and suppliers with global consistency.

We enhance our value proposition to both key suppliers and customers through our technical expertise, global standards participation testing and demonstration facilities and numerous quality assurance certification programs such as ISO 9001:2008 and ISO/TS 16949:2009. Our NSS and EES segments leverage our certified Infrastructure Solutions Lab located at our suburban Chicago headquarters to support customers with technology needs related to enterprise networks, data centers, physical security, building technologies and industrial communications and control. At this lab, we evaluate performance and interoperability to help customers reduce risk through informed purchasing decisions. Our Solutions Briefing Centers, premier technology education and demonstration facilities located in various regions around the globe, focus on enabling our customers with the necessary information to make informed decisions around complex, end-to-end technology solutions.

Because privately held companies account for a significant share of our markets, reliable competitive information is not available.

Contract Sales and Backlog

We have a number of customers who purchase products under long-term contractual arrangements. In such circumstances, the relationship with the customer typically involves a high degree of material requirements planning and information systems interfaces and, in some cases, may require the maintenance of a dedicated distribution facility or dedicated personnel and inventory at, or in close proximity to, the customer site to meet the needs of the customer. Such contracts do not generally require the customer to purchase any minimum amount of goods from us, but would require that materials acquired by us, as a result of joint material requirements planning between us and the customer, be purchased by the customer. Backlog orders, excluding large contractual orders, represent approximately four weeks of sales and ship to customers within 30 to 60 days from order date.

Seasonality

The operating results are not significantly affected by seasonal fluctuations except for the impact resulting from variations in the number of billing days from quarter to quarter. Consecutive quarter sales from the third to fourth quarters are generally lower due to the holidays and lower number of billing days as compared to other consecutive quarter comparisons. There were 253 billing days in both 2015 and 2014.

Available Information

We maintain an Internet website at http://www.anixter.com which includes an Investor Relations section that links to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to these reports. These forms are available without charge as soon as reasonably practical following the time they are filed with or furnished to the Securities and Exchange Commission ("SEC"). Shareholders and other interested parties may request email notifications of the posting of these documents through the Investor Relations section of our website. In addition, copies of our reports will be made available, free of charge, upon written request.

Our website also contains corporate governance information including corporate governance guidelines; audit, compensation and nominating and governance committee charters; nomination process for directors; and our business ethics and conduct policy.

4

ITEM 1A. RISK FACTORS.

The following factors could materially adversely affect our operating results and financial condition. Although we have tried to discuss key factors, please be aware that other risks may prove to be important in the future. New risks may emerge at any time, and we cannot predict those risks or estimate the extent to which they may affect our financial performance.

A change in sales strategy or financial viability of our suppliers could adversely affect our sales or earnings.

Most of our agreements with suppliers are terminable by either party on short notice for any reason. We currently source products from thousands of suppliers. However, approximately one-third of our annual dollar volume purchases are sourced from our five largest suppliers. If any of these suppliers changes its sales strategy to reduce its reliance on distribution channels, or decides to terminate its business relationship with us, our sales and earnings could be adversely affected until we are able to establish relationships with suppliers of comparable products. Although we believe our relationships with these key suppliers are good, they could change their strategies as a result of a change in control, expansion of their direct sales force, changes in the marketplace or other factors beyond our control, including a key supplier becoming financially distressed.

We have risks associated with the sale of nonconforming products and services.

Historically, we have experienced a small number of cases in which our vendors supplied us with products that did not conform to the agreed upon specifications without our knowledge. Additionally, we may inadvertently sell a product not suitable for a customer’s application. We address this risk through our quality control processes, by seeking to limit liability and our warranty in our customer contracts, by obtaining indemnification rights from vendors and by maintaining insurance responsive to these risks. However, there can be no assurance that we will be able to include protective provisions in all of our contracts, that vendors will have the financial capability to fulfill their indemnification obligations to us, or that insurance can be obtained with sufficiently broad coverage or in amounts sufficient to fully protect us.

Our foreign operations are subject to political, economic and currency risks.

We derive over 30% of our revenues from sales outside of the United States. Economic and political conditions in some of these markets may adversely affect our results of operations, cash flows and financial condition in these markets. Our results of operations and the value of our foreign assets are affected by fluctuations in foreign currency exchange rates (as further discussed in "Item 7A. Quantitative and Qualitative Disclosures About Market Risk") and different legal, tax, accounting and regulatory requirements. In addition, some of the products that we distribute are produced in foreign countries, which involve longer and more complex supply chains that are vulnerable to numerous risks that could cause significant interruptions or delays in delivery of such products. Many of these factors are beyond our control and include risks, such as as political instability, financial instability of suppliers, suppliers' noncompliance with applicable laws, trade restrictions, labor disputes, currency fluctuations, changes in tariff or import policies, severe weather, terrorist attacks and transport capacity and cost. A significant interruption in our supply chains caused by any of the above factors could result in increased costs or delivery delays and result in a decrease in our net sales and profitability.

We have risks associated with inventory.

We must identify the right product mix and maintain sufficient inventory on hand to meet customer orders. Failure to do so could adversely affect our sales and earnings. However, if circumstances change (for example, an unexpected shift in market demand, pricing or customer defaults) there could be a material impact on the net realizable value of our inventory. To guard against inventory obsolescence, we have negotiated various return rights and price protection agreements with certain key suppliers. We also maintain an inventory valuation reserve account against diminution in the value or salability of our inventory. However, there is no guaranty that these arrangements will be sufficient to avoid write-offs in excess of our reserves in all circumstances.

Our operating results are affected by copper prices.

Our operating results have been affected by changes in prices of copper, which is a major component in a portion of the electrical wire and cable products we sell. As our purchase costs with suppliers change to reflect the changing copper prices, our percent mark-up to customers remains relatively constant, resulting in higher or lower sales revenue and gross profit depending upon whether copper prices are increasing or decreasing.

The degree to which price changes in the copper commodity spot market correlate to product price changes, is a factor of market demand for products. When demand is strong, there is a high degree of correlation but when demand is weak, there can be significant time lags between spot price changes and market price changes.

5

We have risks associated with the integration of acquired businesses.

In connection with recent and future acquisitions, it is necessary for us to continue to create an integrated business from the various acquired entities. This requires the establishment of a common management team to guide the acquired businesses, the conversion of numerous information systems to a common operating system, the establishment of a brand identity for the acquired businesses, the streamlining of the operating structure to optimize efficiency and customer service and a reassessment of the inventory and supplier base to ensure the availability of products at competitive prices. No assurance can be given that these various actions can be completed without disruption to the business, or in a short period of time or that anticipated improvements in operating performance can be achieved. Any inability on our part to successfully implement strategic transactions could have an adverse impact on our reputation, business, financial position, results of operations and cash flows. There can be no assurance that any businesses acquired will perform in accordance with expectations or that business judgments concerning the value, strengths and weaknesses of businesses acquired will prove to be correct. In addition, any acquisition that we make may not provide us with the synergies and other benefits that were anticipated when entering into such acquisition.

Our debt agreements could impose restrictions on our business.

Our debt agreements contain certain financial and operating covenants that limit our discretion with respect to certain business matters. These covenants restrict our ability to, among other things:

• | incur additional indebtedness; |

• | create liens on assets; |

• | make certain investments; |

• | transfer, lease or dispose of assets; and |

• | engage in certain mergers, acquisitions, consolidations or other fundamental changes. |

These covenants also limit the amount of dividends or share repurchases we may make. As a result of these restrictions, we are limited in how we may conduct business and may be unable to compete effectively or take advantage of new business opportunities. Our ability to comply with the covenants and restrictions contained in our debt agreements may be affected by economic, financial and industry conditions or regulatory changes beyond our control. The breach of any of these covenants or restrictions could result in a default under either the Inventory Facility, the Canadian Term Loan, the Receivables Facility or the indentures governing our outstanding notes that would permit the applicable lenders or noteholders, as the case may be, to declare all outstanding amounts to be due and payable, together with accrued and unpaid interest. If we are unable to repay indebtedness, lenders having secured obligations, such as the lenders under the Inventory Facility, the Canadian Term Loan, or the Receivables Facility, could proceed against the collateral securing these obligations. This could have a significant negative impact on our financial condition and results of operations.

We have substantial debt which could adversely affect our profitability, limit our ability to obtain financing in the future and pursue certain business opportunities.

As of January 1, 2016, we had an aggregate principal amount of $1.7 billion of outstanding debt. As a result, a substantial portion of our cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for other purposes. This may also limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt service requirements, general corporate purposes and other purposes in the future. Our indebtedness also reduces our flexibility to adjust to changing market conditions or may prevent us from making capital investments that are necessary or important to our operations and strategic growth.

If our cash flow and capital resources are not sufficient to fund our debt service obligations, we could face substantial liquidity problems and may be required to reduce or delay capital expenditures, sell assets, seek to obtain additional equity capital or refinance our debt. We cannot make assurances that we will be able to refinance our debt on terms acceptable to us, or at all. Our debt agreements and the indentures governing our outstanding notes restrict our ability to dispose of assets and how we use the proceeds from any such dispositions. We cannot make assurances that we will be able to consummate those dispositions, or if we do, what the timing of the dispositions will be or whether the proceeds that we realize will be adequate to meet our debt service obligations when due.

6

We have risks associated with accounts receivable.

Although no single customer accounts for more than 2% of our sales, a payment default by one of our larger customers could have a short-term impact on earnings. Given the current economic environment, constrained access to capital and general market uncertainties, our exposure to customer defaults may be heightened.

A decline in project volume could adversely affect our sales and earnings.

While most of our sales and earnings are generated by comparatively smaller and more frequent orders, the fulfillment of large orders for capital projects generates significant sales and earnings. Slow macro-economic growth rates, difficult credit market conditions for our customers, weak demand for our customers’ products or other customer spending constraints can result in project delays or cancellations, potentially having a material adverse effect on our financial results.

We may experience a failure in or breach of our operational or information security systems, or those of our third-party service providers, as a result of cyber attacks or information security breaches.

Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cyber-attacks. A failure in or breach of our operational or information security systems, or those of our third-party service providers, as a result of cyber attacks or information security breaches could disrupt our business, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and/or cause losses. As a result, cyber security and the continued development and enhancement of the controls and processes designed to protect our systems, computers, software, data and networks from attack, damage or unauthorized access remain a priority for us. Although we believe that we have robust information security procedures and other safeguards in place, as cyber threats continue to evolve, we may be required to expend additional resources to continue to enhance our information security measures and/or investigate and remediate any information security vulnerabilities.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Our distribution network consists of 319 warehouses/branch locations in 50 countries with approximately 9 million square feet of space. This includes 16 regional distribution centers (100,000 — 500,000 square feet), 45 local distribution centers (35,000 — 100,000 square feet), and 189 service centers and 69 branch locations. Additionally, we have 83 sales offices throughout the world. All but eight of these facilities are leased. No one facility is material to our overall operations, and we believe there is ample supply of alternative warehousing space available on similar terms and conditions in each of our markets.

ITEM 3. LEGAL PROCEEDINGS.

Incorporated by reference to Note 7. "Commitments and Contingencies" of this Annual Report on Form 10-K.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

7

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table lists the name, age as of February 19, 2016, position, offices and certain other information with respect to our executive officers. The term of office of each executive officer will expire upon the appointment of his successor by the Board of Directors.

Robert J. Eck, 57 | Director of the Company since 2008; President and Chief Executive Officer of the Company since July 2008. Mr. Eck has served in a variety of senior management positions since joining the Company in 1990. Mr. Eck has also been a Director of Ryder Systems, Inc. since 2011 and a member of the Board of Trustees for Marquette University since September 2014. |

Theodore A. Dosch, 56 | Executive Vice President - Finance and Chief Financial Officer of the Company since July 2011; Senior Vice President - Global Finance of the Company from January 2009 to June 2011; CFO - North America and Vice President - Maytag Integration at Whirlpool Corporation from 2006 to 2008; Corporate Controller at Whirlpool Corporation from 2004 to 2006; CFO - North America at Whirlpool Corporation from 1999 to 2004. |

Justin C. Choi, 50 | Executive Vice President - General Counsel & Corporate Secretary of the Company since May 2013; Vice President - General Counsel & Corporate Secretary of the Company from June 2012 to May 2013; Executive Vice President, General Counsel and Secretary -Trustwave Holdings from January 2011 to June 2012; Senior Vice President, General Counsel & Secretary - Andrew Corporation from March 2006 to December 2007; Vice President of Law - Avaya Inc. from September 2000 to February 2006. |

William Galvin, 53 | Executive Vice President - Network & Security Solutions of the Company since 2012; Executive Vice President - North America and EMEA Enterprise Cabling and Security Solutions from 2007 to 2012. Mr. Galvin has held several sales and marketing management roles over his 26 years of experience with the Company. |

Bob Graham, 48 | Executive Vice President - Electrical & Electronic Solutions of the Company since July 2015; Senior Vice President - U.S. Electrical and Electronic Wire and Cable from 2011 to 2015. Mr. Graham came to Anixter with the acquisition of the Pentacon business in September 2002, and since then, he has held various senior leadership roles for Anixter’s former OEM Fastener business with his most recent position before joining the Wire & Cable division being Senior Vice President for the North American business. |

Scott Ramsbottom, 42 | Executive Vice President - Chief Information Officer since February 2015; Senior Vice President Global Information Service from February 2014 to February 2015. Mr. Ramsbottom held various roles in the information services group since joining the Company in 1999. |

Rodney A. Smith, 58 | Executive Vice President - Human Resources of the Company since May 2013; Vice President - Human Resources from August 2006 to May 2013. |

William Standish, 61 | Executive Vice President - Operations of the Company since 2004. Since joining the Company in 1984, Mr. Standish has held several corporate and reporting unit senior management roles. |

John Tisera, 50 | Executive Vice President - Utility Power Solutions since October 2015; President of HD Supply Power Solutions in 2015; HD Supply Power Solutions Southeast Region Vice President from 2013 to 2015. Mr. Tisera held several leadership roles across HD Supply and its business units from 2006 to 2013. |

Terrance A. Faber, 64 | Senior Vice President - Controller since May 2014; Vice President - Controller since joining the Company in 2000. |

Rodney A. Shoemaker, 58 | Senior Vice President - Treasurer of the Company since May 2014; Vice President - Treasury since July 1999. Mr. Shoemaker has been with the Company since 1986. |

8

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Anixter International Inc.’s Common Stock is traded on the New York Stock Exchange under the symbol AXE. Stock price information, dividend information and shareholders of record are set forth in Note 13. "Selected Quarterly Financial Data (Unaudited)" in the Notes to the Consolidated Financial Statements. There have been no sales of unregistered securities.

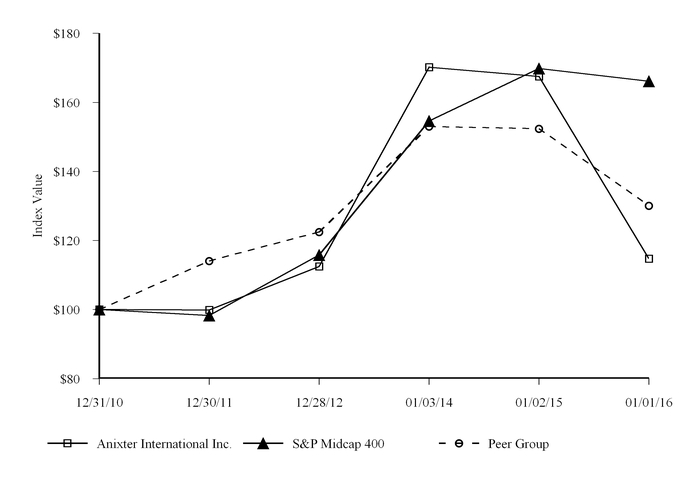

PERFORMANCE GRAPH

The following graph sets forth the annual changes for the five-year period indicated in a theoretical cumulative total shareholder return of an investment of $100 in our common stock and each comparison index, assuming reinvestment of dividends. This graph reflects the comparison of shareholder return on our common stock with that of a broad market index and a peer group index consistent with the prior year. Our Peer Group Index for 2015 changed from 2014 and now consists of the following companies: Arrow Electronics Inc., Avnet Inc., Belden Inc., Fastenal Company, General Cable Corp., Houston Wire and Cable Company, Ingram Micro, MSC Industrial Direct Co. Inc., Rexel, Scansource Inc., Tech Data Corp, WESCO International, Inc., and W.W. Grainger Inc. This peer group was selected based on a review of publicly available information about these companies and our determination that they are engaged in distribution businesses similar to ours. Due to our Power Solutions and Tri-Ed acquisitions as well as the sale of our Fasteners business, our review of our peer group members in 2015 was appropriate.

9

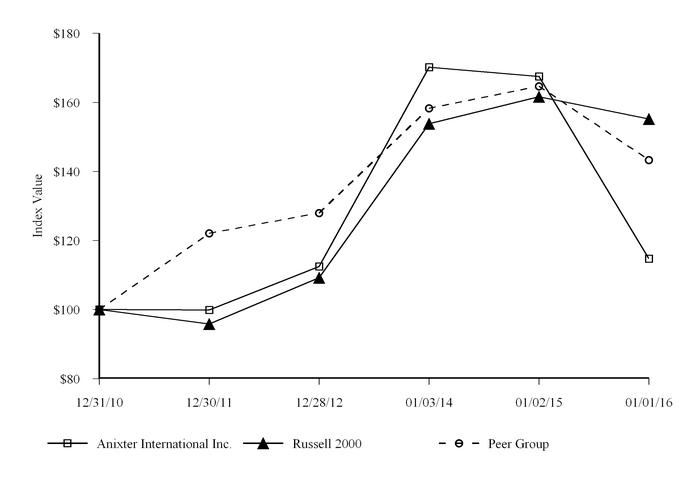

The graph below reflects the 2014 peer group. Our Peer Group Index for 2014 consists of the following companies: Agilysys Inc., Arrow Electronics Inc., Avnet Inc., Fastenal Company, W.W. Grainger Inc., Houston Wire and Cable Company, Ingram Micro, MSC Industrial Direct Co. Inc., Park Ohio Holdings Corp., Richardson Electronics Ltd., Tech Data Corp, and WESCO International, Inc.

10

ITEM 6. SELECTED FINANCIAL DATA.

(In millions, except per share amounts) | Fiscal Year | |||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

Selected Income Statement Data: | ||||||||||||||||||||

Net sales | $ | 6,190.5 | $ | 5,507.0 | $ | 5,291.1 | $ | 5,347.6 | $ | 5,195.2 | ||||||||||

Operating income | 267.8 | 310.1 | 310.9 | 301.3 | 335.3 | |||||||||||||||

Interest expense and other, net (a) | (84.9 | ) | (60.5 | ) | (52.8 | ) | (68.2 | ) | (53.1 | ) | ||||||||||

Net income from continuing operations | 96.9 | 163.4 | 175.0 | 154.7 | 186.2 | |||||||||||||||

Net income (loss) from discontinued operations | 30.7 | 31.4 | 25.5 | (29.9 | ) | 2.0 | ||||||||||||||

Net income | $ | 127.6 | $ | 194.8 | $ | 200.5 | $ | 124.8 | $ | 188.2 | ||||||||||

Diluted Income (Loss) Per Share: | ||||||||||||||||||||

Continuing operations | $ | 2.90 | $ | 4.90 | $ | 5.27 | $ | 4.58 | $ | 5.30 | ||||||||||

Discontinued operations | $ | 0.91 | $ | 0.94 | $ | 0.77 | $ | (0.89 | ) | $ | 0.06 | |||||||||

Net income | $ | 3.81 | $ | 5.84 | $ | 6.04 | $ | 3.69 | $ | 5.36 | ||||||||||

Dividend declared per common share | $ | — | $ | — | $ | 5.00 | $ | 4.50 | $ | — | ||||||||||

Selected Balance Sheet Data: | ||||||||||||||||||||

Total assets (a) | $ | 4,142.0 | $ | 3,580.8 | $ | 2,851.3 | $ | 3,078.7 | $ | 3,027.7 | ||||||||||

Total short-term debt | $ | — | $ | — | $ | — | $ | 0.9 | $ | 3.0 | ||||||||||

Total long-term debt (a) | $ | 1,642.9 | $ | 1,202.0 | $ | 826.5 | $ | 971.3 | $ | 800.5 | ||||||||||

Stockholders’ equity | $ | 1,179.4 | $ | 1,133.0 | $ | 1,027.4 | $ | 969.9 | $ | 1,001.2 | ||||||||||

Book value per diluted share | $ | 35.26 | $ | 33.99 | $ | 30.95 | $ | 28.70 | $ | 28.50 | ||||||||||

Weighted-average diluted shares | 33.4 | 33.3 | 33.2 | 33.8 | 35.1 | |||||||||||||||

Year-end outstanding shares | 33.3 | 33.1 | 32.9 | 32.5 | 33.2 | |||||||||||||||

Other Financial Data: | ||||||||||||||||||||

Working capital (a) | $ | 1,571.6 | $ | 1,559.3 | $ | 1,373.3 | $ | 1,482.8 | $ | 1,376.0 | ||||||||||

Capital expenditures | $ | 26.7 | $ | 34.2 | $ | 27.3 | $ | 28.9 | $ | 21.6 | ||||||||||

Depreciation | $ | 22.2 | $ | 20.0 | $ | 18.6 | $ | 17.3 | $ | 15.4 | ||||||||||

Amortization of intangibles (a) | $ | 24.9 | $ | 10.6 | $ | 6.7 | $ | 4.8 | $ | 3.2 | ||||||||||

(a) Year-over-year changes from fiscal 2013 to fiscal 2014 and fiscal 2014 to fiscal 2015 are primarily due to the acquisitions of Tri-Ed and Power Solutions, respectively, and related financing costs such as interest on borrowings.

Items Impacting Comparability of Results

Over the last six years, we have completed four acquisitions and the respective sales and operating income have impacted the comparability of the results as reflected below. The acquisitions were accounted for as purchases and the results of operations of the acquired businesses are included in the Consolidated Financial Statements from the dates of acquisition. The following represents the incremental impact of the results for the one year period following the acquisitions:

(In millions) | Years Ended | |||||||||||||||||||

January 1, 2016 | January 2, 2015 | January 3, 2014 | December 28, 2012 | December 30, 2011 | ||||||||||||||||

(a)(b) | (b) | (c) | (c) | (d) | ||||||||||||||||

Net sales | $ | 921.2 | $ | 176.0 | $ | 60.7 | $ | 62.8 | $ | 120.1 | ||||||||||

Operating income | 29.3 | 6.4 | 1.9 | 5.2 | 2.6 | |||||||||||||||

(a) | October 2015 acquisition of Power Solutions for $824.7 million. |

(b) | September 2014 acquisition of Tri-Ed for $418.4 million. |

(c) | June 2012 acquisition of Jorvex, S.A. ("Jorvex") for $55.3 million. |

(d) | December 2010 acquisition of Clark Security Products, Inc and General Lock, LLC (collectively "Clark") for $36.4 million. |

In 2015, we sold our Fasteners business for $371.8 million in cash, resulting in a pre-tax gain of $41.0 million ($23.7 million, net of tax). In August 2011, we sold our Aerospace Hardware business for $155.0 million. As a result of these divestitures, results of these businesses are reflected as "discontinued operations" and all prior periods have been revised to reflect this classification.

11

The following reflects various items that impact the comparability of the results for the last five fiscal years:

Items Impacting Comparability of Results from Continuing Operations: | ||||||||||||||||||||

(In millions, except per share amounts) | Years Ended | |||||||||||||||||||

January 1, 2016 | January 2, 2015 | January 3, 2014 | December 28, 2012 | December 30, 2011 | ||||||||||||||||

Items impacting operating income: | Favorable / (Unfavorable) | |||||||||||||||||||

Acquisition and integration costs | $ | (13.2 | ) | $ | (7.2 | ) | $ | — | $ | — | $ | — | ||||||||

Latin America assets write-off | (11.7 | ) | — | — | — | — | ||||||||||||||

Restructuring charge | (8.2 | ) | — | — | (6.9 | ) | (3.1 | ) | ||||||||||||

Write-off of capitalized software | (3.1 | ) | — | — | — | — | ||||||||||||||

Dilapidation provision | (1.7 | ) | — | — | — | — | ||||||||||||||

Pension-related charge | (0.4 | ) | — | — | (13.9 | ) | — | |||||||||||||

Impairment of goodwill and long-lived assets | — | — | — | (11.2 | ) | — | ||||||||||||||

Total of items impacting operating income | $ | (38.3 | ) | $ | (7.2 | ) | $ | — | $ | (32.0 | ) | $ | (3.1 | ) | ||||||

Items impacting interest expense: | ||||||||||||||||||||

Write-off of debt issuance costs | (0.3 | ) | — | — | — | — | ||||||||||||||

Total of items impacting interest expense | $ | (0.3 | ) | $ | — | $ | — | $ | — | $ | — | |||||||||

Items impacting other expenses: | ||||||||||||||||||||

Foreign exchange loss | (3.6 | ) | (8.0 | ) | — | — | — | |||||||||||||

Extinguishment of debt | (0.9 | ) | — | — | — | — | ||||||||||||||

Acquisition financing costs | — | (0.3 | ) | — | — | — | ||||||||||||||

Penalty and interest from prior year tax liabilities | — | — | 0.7 | (1.7 | ) | — | ||||||||||||||

Total of items impacting other expenses | $ | (4.5 | ) | $ | (8.3 | ) | $ | 0.7 | $ | (1.7 | ) | $ | — | |||||||

Total of items impacting pre-tax income | $ | (43.1 | ) | $ | (15.5 | ) | $ | 0.7 | $ | (33.7 | ) | $ | (3.1 | ) | ||||||

Items impacting income taxes: | ||||||||||||||||||||

Tax impact of items above impacting pre-tax income | 17.4 | 4.3 | (0.2 | ) | 7.8 | 1.2 | ||||||||||||||

Establishment/reversal of deferred income tax valuation allowances | (11.3 | ) | 6.9 | — | 9.8 | 10.8 | ||||||||||||||

Other tax items | (0.5 | ) | 1.9 | 4.2 | — | — | ||||||||||||||

Total of items impacting income taxes | $ | 5.6 | $ | 13.1 | $ | 4.0 | $ | 17.6 | $ | 12.0 | ||||||||||

Net income impact of these items | $ | (37.5 | ) | $ | (2.4 | ) | $ | 4.7 | $ | (16.1 | ) | $ | 8.9 | |||||||

Diluted EPS impact of these items | $ | (1.12 | ) | $ | (0.07 | ) | $ | 0.14 | $ | (0.50 | ) | $ | 0.26 | |||||||

12

The following table presents a reconciliation from net income from continuing operations to EBITDA and Adjusted EBITDA:

Fiscal Year | ||||||||||||||||||||

(In millions) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

Net income from continuing operations | $ | 96.9 | $ | 163.4 | $ | 175.0 | $ | 154.7 | $ | 186.2 | ||||||||||

Interest expense | 63.8 | 44.5 | 43.9 | 56.4 | 44.4 | |||||||||||||||

Income taxes | 86.0 | 86.2 | 83.1 | 78.5 | 95.9 | |||||||||||||||

Depreciation | 22.2 | 20.0 | 18.6 | 17.3 | 15.4 | |||||||||||||||

Amortization of intangible assets | 24.9 | 10.6 | 6.7 | 4.7 | 3.2 | |||||||||||||||

EBITDA | $ | 293.8 | $ | 324.7 | $ | 327.3 | $ | 311.6 | $ | 345.1 | ||||||||||

Total of items impacting operating income | 38.3 | 7.2 | — | 32.0 | 3.1 | |||||||||||||||

Foreign exchange and other non-operating expense | 21.1 | 16.0 | 8.9 | 11.8 | 8.8 | |||||||||||||||

Stock-based compensation | 13.9 | 12.6 | 12.3 | 12.6 | 8.9 | |||||||||||||||

Adjusted EBITDA | $ | 367.1 | $ | 360.5 | $ | 348.5 | $ | 368.0 | $ | 365.9 | ||||||||||

EBITDA is defined as net income from continuing operations before interest, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before items impacting operating income, foreign exchange and other non-operating expense and non-cash stock-based compensation. The components of the items impacting operating income can be found in the table on the previous page. EBITDA and Adjusted EBITDA are presented because we believe they are useful indicators of our performance and our ability to meet debt service requirements. They are not, however, intended as an alternative measure of operating results or cash flow from operations as determined in accordance with generally accepted accounting principles. EBITDA and Adjusted EBITDA are not necessarily comparable to similarly titled measures used by other companies.

13

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Executive Overview

Despite an extremely weak macro environment, including a steep decline in commodity prices in both oil and copper, sharp slowdowns in Latin America and Canada in connection with the declines in the oil and gas and mining markets and the impact of the much stronger dollar, we experienced organic sales growth of 1.3% in 2015. As a result of the acquisition of Tri-Ed in the third quarter of 2014 combined with the 2015 sale of the Fasteners business and the acquisition of Power Solutions in the fourth quarter of 2015, we have transformed Anixter into a leading North American electrical products distribution platform, enhanced our competitive position in the electrical wire and cable business and further strengthened our overall customer and supplier value proposition.

During 2015, we focused on the integration of the acquired Tri-Ed business and driving synergies. The sale of the Fasteners business allowed us to simplify our organization, reduce our exposure in Europe, increase our exposure to the more stable North America market and position our financial profile for higher and more stable revenue growth and improved working capital and return on investment. In 2016, we will continue our focus on integration and execution of our Power Solutions business to capture the significant synergy opportunities we anticipate will result from the acquisition and actively pursue further synergies from the Tri-Ed acquisition.

Sales Growth Trends | ||||||||||||||||||||||||||||||||

Twelve Months Ended January 1, 2016 | Twelve Months Ended January 2, 2015 | |||||||||||||||||||||||||||||||

($ millions) | As Reported | Foreign Exchange Impact | Copper Impact | As Adjusted | As Reported | Acquisition Impact | Pro Forma | Organic Growth / (Decline) | ||||||||||||||||||||||||

Network & Security Solutions (NSS) | ||||||||||||||||||||||||||||||||

North America | $ | 3,061.8 | $ | 54.4 | $ | — | $ | 3,116.2 | $ | 2,610.1 | $ | 417.7 | $ | 3,027.8 | 2.9 | % | ||||||||||||||||

Europe | 340.4 | 39.4 | — | 379.8 | 332.7 | — | 332.7 | 14.2 | % | |||||||||||||||||||||||

Emerging Markets | 522.2 | 37.4 | — | 559.6 | 538.4 | 2.0 | 540.4 | 3.5 | % | |||||||||||||||||||||||

NSS | $ | 3,924.4 | $ | 131.2 | $ | — | $ | 4,055.6 | $ | 3,481.2 | $ | 419.7 | $ | 3,900.9 | 4.0 | % | ||||||||||||||||

Electrical & Electronic Solutions (EES) | ||||||||||||||||||||||||||||||||

North America | $ | 1,439.6 | $ | 48.3 | $ | 66.1 | $ | 1,554.0 | $ | 1,447.6 | $ | 138.0 | $ | 1,585.6 | (2.0 | )% | ||||||||||||||||

Europe | 261.4 | 23.5 | 4.4 | 289.3 | 315.8 | — | 315.8 | (8.3 | )% | |||||||||||||||||||||||

Emerging Markets | 229.2 | 9.8 | 6.6 | 245.6 | 262.4 | — | 262.4 | (6.4 | )% | |||||||||||||||||||||||

EES | $ | 1,930.2 | $ | 81.6 | $ | 77.1 | $ | 2,088.9 | $ | 2,025.8 | $ | 138.0 | $ | 2,163.8 | (3.5 | )% | ||||||||||||||||

Utility Power Solutions (UPS) | ||||||||||||||||||||||||||||||||

North America | $ | 335.9 | $ | 8.4 | $ | 0.3 | $ | 344.6 | $ | — | $ | 341.6 | $ | 341.6 | 0.9 | % | ||||||||||||||||

UPS | $ | 335.9 | $ | 8.4 | $ | 0.3 | $ | 344.6 | $ | — | $ | 341.6 | $ | 341.6 | 0.9 | % | ||||||||||||||||

Total | $ | 6,190.5 | $ | 221.2 | $ | 77.4 | $ | 6,489.1 | $ | 5,507.0 | $ | 899.3 | $ | 6,406.3 | 1.3 | % | ||||||||||||||||

Geographic Sales | ||||||||||||||||||||||||||||||||

North America | $ | 4,837.3 | $ | 111.1 | $ | 66.4 | $ | 5,014.8 | $ | 4,057.7 | $ | 897.3 | $ | 4,955.0 | 1.2 | % | ||||||||||||||||

Europe | 601.8 | 62.9 | 4.4 | 669.1 | 648.5 | — | 648.5 | 3.2 | % | |||||||||||||||||||||||

Emerging Markets | 751.4 | 47.2 | 6.6 | 805.2 | 800.8 | 2.0 | 802.8 | 0.3 | % | |||||||||||||||||||||||

Total | $ | 6,190.5 | $ | 221.2 | $ | 77.4 | $ | 6,489.1 | $ | 5,507.0 | $ | 899.3 | $ | 6,406.3 | 1.3 | % | ||||||||||||||||

14

Organic sales growth from 2014 to 2015 excludes the impact of the following items and is summarized by segment and geography below:

• | $479.6 million favorable impact from the acquisition of Power Solutions; |

• | $419.7 million favorable impact from the acquisition of Tri-Ed; |

• | $221.2 million unfavorable impact from the fluctuation in foreign exchange; and |

• | $77.4 million unfavorable impact from the lower average price of copper. |

Despite ongoing macro-economic headwinds and the current disinflationary environment, we achieved organic sales growth of 1.3% for the year ended January 1, 2016, excluding the unfavorable impact from foreign exchange and lower copper prices and the combined $899.3 million favorable impact from the Tri-Ed and Power Solutions acquisitions.

Our organic growth of 1.3% in 2015 compared to the prior year was driven by strong growth in our NSS segment of 4.0%, reflecting solid trends in sales in our North American and European geographies. Organic security sales increased 5.4% in 2015 compared to 2014. The soft industrial economy combined with even weaker commodity prices caused organic sales to decline compared to the prior year in our EES segment, especially in Europe and Emerging Markets. UPS contributed 0.9% organic growth in 2015 on a pro forma basis. Sales in the UPS segment were adversely impacted by the Canadian oil and gas industry, caused by utility customers deferring investment based on lower power consumption.

Additional highlights of the year included:

• | NSS organic sales up 4.0%; |

• | Worldwide organic security sales up 5.4%; |

• | Approximately $92 million of cash flow from operations and improved working capital efficiency; |

• | Adjusted earnings per diluted share from continuing operations of $4.02; |

• | To finance the Power Solutions acquisition and provide sufficient liquidity to ongoing operations, the entry into two new revolving credit facilities and a Canadian Term Loan, and the issuance of $350.0 million of Senior notes due 2023; |

• | Termination of our accounts receivable securitization facility and senior unsecured revolving credit agreement, repayment of our borrowings under the previous term loan and retirement of the Senior notes due 2015. |

We believe that the positive momentum and growth trends in our NSS segment will continue driven by growth in the U.S. and Europe. We continue to experience softer trends in our EES and UPS segments due in part to industrial and manufacturing end markets with continued headwinds from copper and currency, resulting in a more cautious outlook on this portion of the business. Combining our more positive outlook in NSS with a more conservative outlook in our EES and UPS segments, we expect full year 2016 organic sales growth from continuing operations in the negative 2% to positive 2% range.

Acquisitions and Divestiture of Businesses

On October 5, 2015, through our wholly-owned subsidiaries, Anixter Inc. and Anixter Canada Inc., we completed the acquisition of the Power Solutions business from HD Supply, Inc. and certain subsidiaries of HD Supply, Inc. in exchange for $824.7 million. Power Solutions reported fiscal 2014 revenue of $1.9 billion and adjusted EBITDA of $79 million. The acquisition is expected to be accretive to earnings by $0.45 - $0.50 in fiscal year 2016, exclusive of transaction and one-time integration expenses.

On June 1, 2015, we completed the sale of the Fasteners business to American Industrial Partners ("AIP"), excluding certain foreign locations. In connection with the acquisition, we received cash proceeds of $371.8 million. Including transaction related costs of $16.3 million, the sale resulted in a pre-tax gain of $41.0 million ($23.7 million, net of tax). The assets and liabilities and operating results of the Fasteners business for fiscal year 2015 are presented as "discontinued operations" in our Consolidated Financial Statements. Accordingly, all prior periods have been revised to reflect this classification.

On September 17, 2014, we acquired Tri-Ed, a leading independent distributor of security and low-voltage technology products, from Tri-NVS Holdings, LLC for $418.4 million. A portion of the proceeds from a subsequent issuance of $400.0 million principal amount of senior notes were used to repay certain incurred borrowings to finance the Tri-Ed acquisition.

15

Consolidated Results of Operations

(In millions, except per share amounts) | Years Ended | |||||||||||

January 1, 2016 | January 2, 2015 | January 3, 2014 | ||||||||||

Net sales | $ | 6,190.5 | $ | 5,507.0 | $ | 5,291.1 | ||||||

Gross profit | 1,340.5 | 1,239.3 | 1,198.9 | |||||||||

Operating expenses | 1,072.7 | 929.2 | 886.3 | |||||||||

Impairment of long-lived assets | — | — | 1.7 | |||||||||

Operating income | 267.8 | 310.1 | 310.9 | |||||||||

Other expense: | ||||||||||||

Interest expense | (63.8 | ) | (44.5 | ) | (43.9 | ) | ||||||

Other, net | (21.1 | ) | (16.0 | ) | (8.9 | ) | ||||||

Income from continuing operations before income taxes | 182.9 | 249.6 | 258.1 | |||||||||

Income tax expense from continuing operations | 86.0 | 86.2 | 83.1 | |||||||||

Net income from continuing operations | 96.9 | 163.4 | 175.0 | |||||||||

Net income from discontinued operations | 30.7 | 31.4 | 25.5 | |||||||||

Net income | $ | 127.6 | $ | 194.8 | $ | 200.5 | ||||||

Diluted income per share: | ||||||||||||

Continuing operations | $ | 2.90 | $ | 4.90 | $ | 5.27 | ||||||

Discontinued operations | 0.91 | 0.94 | 0.77 | |||||||||

Net income | $ | 3.81 | $ | 5.84 | $ | 6.04 | ||||||

Items Impacting Comparability of Results

In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles ("GAAP") above, this report includes certain financial measures computed using non-GAAP components as defined by the Securities and Exchange Commission. Specifically, net sales comparisons to the prior corresponding period, both worldwide and in relevant segments, are discussed in this report both on a GAAP and non-GAAP basis. We believe that by reporting non-GAAP organic growth, which adjusts for the impact of acquisitions (when applicable), foreign exchange fluctuations and copper prices, both management and investors are provided with meaningful supplemental sales information to understand and analyze our underlying trends and other aspects of our financial performance. Beginning in 2015, we calculate the year-over-year organic sales growth impact relating to the Power Solutions and Tri-Ed acquisitions by including their 2013 and 2014 comparable period results prior to the acquisition with our results (on a "pro forma" basis) as we believe this represents the most accurate representation of organic growth, considering the nature of the companies we acquired and the synergistic revenues that have been or will be achieved. From time to time, we may also exclude other special items from reported financial results (e.g., impairment charges, inventory adjustments, restructuring charges, tax items, currency devaluations, etc.) so that both management and financial statement users can use these non-GAAP financial measures to better understand and evaluate our performance period over period and to analyze the underlying trends of our business.

EBITDA is defined as net income from continuing operations before interest, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before foreign exchange and other non-operating expense and non-cash stock-based compensation, excluding the other special items from reported financial results, as defined above. EBITDA and Adjusted EBITDA are presented because we believe they are useful indicators of our performance and our ability to meet debt service requirements. They are not, however, intended as an alternative measure of operating results or cash flow from operations as determined in accordance with generally accepted accounting principles.

Non-GAAP financial measures provide insight into selected financial information and should be evaluated in the context in which they are presented. These non-GAAP financial measures have limitations as analytical tools, and should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies. The non-GAAP financial measures should be considered in conjunction with the Consolidated Financial Statements, including the related notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this report. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above.

16

Our operating results can be affected by changes in prices of commodities, primarily copper, which are components in some of the electrical wire and cable products sold. Generally, as the costs of inventory purchases increase due to higher commodity prices, our mark-up percentage to customers remains relatively constant, resulting in higher sales revenue and gross profit. In addition, existing inventory purchased at previously lower prices and sold as prices increase may result in a higher gross profit margin. Conversely, a decrease in commodity prices in a short period of time would have the opposite effect, negatively affecting financial results. The degree to which spot market copper prices change affects product prices and the amount of gross profit earned will be affected by end market demand and overall economic conditions. Importantly, however, there is no exact measure of the impact of changes in copper prices, as there are thousands of transactions in any given year, each of which has various factors involved in the individual pricing decisions. Therefore, all references to the effect of copper prices are estimates.

We recorded the following items that impacted the comparability of the results for the last three fiscal years:

2015

• | $13.2 million ($7.9 million, net of tax) of acquisition and integration costs; |

• | $11.7 million ($7.0 million, net of tax) of Latin America assets write-off; |

• | $8.2 million ($4.9 million, net of tax) of restructuring costs; |

• | $3.1 million ($1.9 million, net of tax) write-off of capitalized software that has no ongoing economic benefit to continuing operations; |

• | $1.7 million ($1.0 million, net of tax) dilapidation provision related to our leasehold properties; |

• | $0.4 million ($0.2 million, net of tax) related to pension divestiture costs; |

• | $3.6 million ($2.1 million, net of tax) of foreign exchange losses due to the devaluation of the Venezuela bolivar and the Argentina peso; |

• | $0.9 million loss ($0.5 million, net of tax) which is included in "Other, net" related to the modification of debt and $0.3 million ($0.2 million, net of tax) of additional interest expense related to the write-off of debt issuance costs on early repayment of a portion of our Canadian Term Loan; and |

• | $11.3 million primarily related to the establishment of deferred income tax valuation allowances and $0.5 million of other tax items. |

2014

• | $7.5 million ($5.9 million, net of tax) of acquisition and integration costs and financing costs. In connection with the acquisition transaction costs, tax benefits were offset by $1.3 million of tax costs that were capitalized for tax purposes; |

• | $8.0 million ($5.3 million, net of tax) of foreign exchange losses due to the devaluation of the Venezuela bolivar and the Argentina peso; |

• | $6.9 million of net tax benefit primarily related to the reversal of deferred income tax valuation allowances in Europe; and |

• | $1.9 million of net tax benefit primarily related to closing prior tax years. |

2013

• | $4.7 million of net tax benefits primarily related to closing prior tax years. The net benefit included related interest income of $0.7 million which is included in "Other, net." |

17

Items Impacting Comparability of Results from Continuing Operations: | ||||||||||||

(In millions, except per share amounts) | Years Ended | |||||||||||

January 1, 2016 | January 2, 2015 | January 3, 2014 | ||||||||||

Items impacting operating income: | Favorable / (Unfavorable) | |||||||||||

Acquisition and integration costs | $ | (13.2 | ) | $ | (7.2 | ) | $ | — | ||||

Latin America assets write-off | (11.7 | ) | — | — | ||||||||

Restructuring charge | (8.2 | ) | — | — | ||||||||

Write-off of capitalized software | (3.1 | ) | — | — | ||||||||

Dilapidation provision | (1.7 | ) | — | — | ||||||||

Pension divestiture costs | (0.4 | ) | — | — | ||||||||

Total of items impacting operating income | $ | (38.3 | ) | $ | (7.2 | ) | $ | — | ||||

Items impacting interest expense: | ||||||||||||

Write-off of debt issuance costs | (0.3 | ) | — | — | ||||||||

Total of items impacting interest expense | $ | (0.3 | ) | $ | — | $ | — | |||||

Items impacting other expenses: | ||||||||||||

Foreign exchange loss from the devaluation of foreign currencies | (3.6 | ) | (8.0 | ) | — | |||||||

Extinguishment of debt | (0.9 | ) | — | — | ||||||||

Acquisition financing costs | — | (0.3 | ) | — | ||||||||

Penalty and interest from prior year tax liabilities | — | — | 0.7 | |||||||||

Total of items impacting other expenses | $ | (4.5 | ) | $ | (8.3 | ) | $ | 0.7 | ||||

Total of items impacting pre-tax income | $ | (43.1 | ) | $ | (15.5 | ) | $ | 0.7 | ||||

Items impacting income taxes: | ||||||||||||

Tax impact of items above impacting pre-tax income | 17.4 | 4.3 | (0.2 | ) | ||||||||

Establishment/reversal of deferred income tax valuation allowances | (11.3 | ) | 6.9 | — | ||||||||

Other tax items | (0.5 | ) | 1.9 | 4.2 | ||||||||

Total of items impacting income taxes | $ | 5.6 | $ | 13.1 | $ | 4.0 | ||||||

Net income impact of these items | $ | (37.5 | ) | $ | (2.4 | ) | $ | 4.7 | ||||

Diluted EPS impact of these items | $ | (1.12 | ) | $ | (0.07 | ) | $ | 0.14 | ||||

The items impacting operating income by segment are reflected in the table below. There were no items impacting operating income in 2013.

Items Impacting Comparability of Operating Income by Segment: | ||||||||||||||||||||

Year Ended January 1, 2016 | ||||||||||||||||||||

(In millions) | NSS | EES | UPS | Corporate | Total | |||||||||||||||

Acquisition and integration costs | $ | — | $ | — | $ | (0.2 | ) | $ | (13.0 | ) | $ | (13.2 | ) | |||||||

Latin America assets write-off | (10.7 | ) | (1.0 | ) | — | — | (11.7 | ) | ||||||||||||

Restructuring charge | (4.0 | ) | (4.0 | ) | (0.1 | ) | (0.1 | ) | (8.2 | ) | ||||||||||

Write-off of capitalized software | (1.9 | ) | (0.9 | ) | — | (0.3 | ) | (3.1 | ) | |||||||||||

Dilapidation provision | (0.9 | ) | (0.8 | ) | — | — | (1.7 | ) | ||||||||||||

Pension divestiture costs | (0.3 | ) | (0.1 | ) | — | — | (0.4 | ) | ||||||||||||

Total of items impacting operating income | $ | (17.8 | ) | $ | (6.8 | ) | $ | (0.3 | ) | $ | (13.4 | ) | $ | (38.3 | ) | |||||

Year Ended January 2, 2015 | ||||||||||||||||||||

(In millions) | NSS | EES | UPS | Corporate | Total | |||||||||||||||

Acquisition and integration costs | $ | (7.0 | ) | $ | (0.2 | ) | $ | — | $ | — | $ | (7.2 | ) | |||||||

18

GAAP to Non-GAAP Net Income and EPS Reconciliation: | |||||||||||

(In millions, except per share amounts) | Years Ended | ||||||||||

January 1, 2016 | January 2, 2015 | January 3, 2014 | |||||||||

Reconciliation to most directly comparable GAAP financial measure: | |||||||||||

Net income from continuing operations - Non-GAAP | $ | 134.4 | $ | 165.8 | $ | 170.3 | |||||

Items impacting net income from continuing operations | (37.5 | ) | (2.4 | ) | 4.7 | ||||||

Net income from continuing operations - GAAP | $ | 96.9 | $ | 163.4 | $ | 175.0 | |||||

Diluted EPS from continuing operations – Non-GAAP | $ | 4.02 | $ | 4.97 | $ | 5.13 | |||||

Diluted EPS impact of these items from continuing operations | (1.12 | ) | (0.07 | ) | 0.14 | ||||||

Diluted EPS from continuing operations – GAAP | $ | 2.90 | $ | 4.90 | $ | 5.27 | |||||

The Power Solutions and Tri-Ed acquisitions were accounted for as purchases and their results of operations are included in the Consolidated Financial Statements from the respective date of the acquisition. Had the acquisition of Power Solutions been completed as of the beginning of fiscal 2014 and had the acquisition of Tri-Ed been completed as of the beginning of fiscal 2013, our pro forma net sales, net income from continuing operations and diluted income per share from continuing operations would have been the following as compared to our reported results.

As Reported | Pro Forma | |||||||||||||||||||||||

Years Ended | Years Ended | |||||||||||||||||||||||

(In millions, except per share amounts) | January 1, 2016 | January 2, 2015 | January 3, 2014 | January 1, 2016 | January 2, 2015 | January 3, 2014 | ||||||||||||||||||

Net sales | $ | 6,190.5 | $ | 5,507.0 | $ | 5,291.1 | $ | 7,733.4 | $ | 7,831.0 | $ | 5,863.2 | ||||||||||||

Net income from continuing operations | $ | 96.9 | $ | 163.4 | $ | 175.0 | $ | 107.1 | $ | 180.5 | $ | 178.3 | ||||||||||||

Income per diluted share from continuing operations | $ | 2.90 | $ | 4.90 | $ | 5.27 | $ | 3.20 | $ | 5.41 | $ | 5.37 | ||||||||||||

Excluding the unfavorable impact of items impacting net income from continuing operations of $37.5 million and $2.4 million in 2015 and 2014, respectively, and the favorable tax items of $4.7 million in 2013, as described above, the pro forma diluted earnings per share from continuing operations would have been the following as compared to our non-GAAP diluted earnings per share from continuing operations.

As Adjusted | Pro Forma As Adjusted | |||||||||||||||||||||||

Years Ended | Years Ended | |||||||||||||||||||||||

January 1, 2016 | January 2, 2015 | January 3, 2014 | January 1, 2016 | January 2, 2015 | January 3, 2014 | |||||||||||||||||||

Income per diluted share from continuing operations | $ | 4.02 | $ | 4.97 | $ | 5.13 | $ | 4.32 | $ | 5.48 | $ | 5.23 | ||||||||||||

For further pro forma information regarding Power Solutions and Tri-Ed, refer to Note 3. "Business Combinations" in the Notes to the Consolidated Financial Statements.

19

2015 EBITDA by Segment: | ||||||||||||||||||||

Year Ended January 1, 2016 | ||||||||||||||||||||

(In millions) | NSS | EES | UPS | Corporate | Total | |||||||||||||||

Net income from continuing operations | $ | 189.4 | $ | 92.5 | $ | 10.4 | $ | (195.4 | ) | $ | 96.9 | |||||||||

Interest expense | — | — | — | 63.8 | 63.8 | |||||||||||||||

Income taxes | — | — | — | 86.0 | 86.0 | |||||||||||||||

Depreciation | 13.7 | 7.0 | 1.1 | 0.4 | 22.2 | |||||||||||||||

Amortization of intangible assets | 14.7 | 6.3 | 3.9 | — | 24.9 | |||||||||||||||

EBITDA | $ | 217.8 | $ | 105.8 | $ | 15.4 | $ | (45.2 | ) | $ | 293.8 | |||||||||

Total of items impacting operating income | $ | 17.8 | $ | 6.8 | $ | 0.3 | $ | 13.4 | $ | 38.3 | ||||||||||

Foreign exchange and other non-operating expense | — | — | — | 21.1 | 21.1 | |||||||||||||||

Stock-based compensation | 9.0 | 4.7 | 0.1 | 0.1 | 13.9 | |||||||||||||||

Adjusted EBITDA | $ | 244.6 | $ | 117.3 | $ | 15.8 | $ | (10.6 | ) | $ | 367.1 | |||||||||

2014 EBITDA by Segment: | ||||||||||||||||||||

Year Ended January 2, 2015 | ||||||||||||||||||||

(In millions) | NSS | EES | UPS | Corporate | Total | |||||||||||||||

Net income from continuing operations | $ | 182.8 | $ | 139.0 | $ | — | $ | (158.4 | ) | $ | 163.4 | |||||||||

Interest expense | — | — | — | 44.5 | 44.5 | |||||||||||||||

Income taxes | — | — | — | 86.2 | 86.2 | |||||||||||||||

Depreciation | 12.5 | 7.5 | — | — | 20.0 | |||||||||||||||

Amortization of intangible assets | 4.9 | 5.7 | — | — | 10.6 | |||||||||||||||

EBITDA | $ | 200.2 | $ | 152.2 | $ | — | $ | (27.7 | ) | $ | 324.7 | |||||||||

Total of items impacting operating income | $ | 7.0 | $ | 0.2 | $ | — | $ | — | $ | 7.2 | ||||||||||

Foreign exchange and other non-operating expense | — | — | — | 16.0 | 16.0 | |||||||||||||||

Stock-based compensation | 7.6 | 5.0 | — | — | 12.6 | |||||||||||||||

Adjusted EBITDA | $ | 214.8 | $ | 157.4 | $ | — | $ | (11.7 | ) | $ | 360.5 | |||||||||

2013 EBITDA by Segment: | ||||||||||||||||||||

Year Ended January 3, 2014 | ||||||||||||||||||||

(In millions) | NSS | EES | UPS | Corporate | Total | |||||||||||||||

Net income from continuing operations | $ | 167.1 | $ | 155.2 | $ | — | $ | (147.3 | ) | $ | 175.0 | |||||||||

Interest expense | — | — | — | 43.9 | 43.9 | |||||||||||||||

Income taxes | — | — | — | 83.1 | 83.1 | |||||||||||||||

Depreciation | 11.5 | 7.1 | — | — | 18.6 | |||||||||||||||

Amortization of intangible assets | 0.8 | 5.9 | — | — | 6.7 | |||||||||||||||

EBITDA | $ | 179.4 | $ | 168.2 | $ | — | $ | (20.3 | ) | $ | 327.3 | |||||||||

Foreign exchange and other non-operating expense | $ | — | $ | — | $ | — | $ | 8.9 | $ | 8.9 | ||||||||||

Stock-based compensation | 7.4 | 4.9 | — | — | 12.3 | |||||||||||||||

Adjusted EBITDA | $ | 186.8 | $ | 173.1 | $ | — | $ | (11.4 | ) | $ | 348.5 | |||||||||