Attached files

| file | filename |

|---|---|

| EX-12 - EXHIBIT 12 - NISOURCE INC. | ni-20151231xex12.htm |

| EX-21 - EXHIBIT 21 - NISOURCE INC. | ni-20151231xex21.htm |

| EX-31.2 - EXHIBIT 31.2 - NISOURCE INC. | ni-20151231xex31210kq4.htm |

| EX-32.2 - EXHIBIT 32.2 - NISOURCE INC. | ni-20151231xex32210kq4.htm |

| EX-31.1 - EXHIBIT 31.1 - NISOURCE INC. | ni-20151231xex31110kq4.htm |

| EX-32.1 - EXHIBIT 32.1 - NISOURCE INC. | ni-20151231xex32110kq4.htm |

| EX-23 - EXHIBIT 23 - NISOURCE INC. | ni-20151231xex23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-16189

NiSource Inc.

(Exact name of registrant as specified in its charter)

Delaware | 35-2108964 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

801 East 86th Avenue Merrillville, Indiana | 46410 | |

(Address of principal executive offices) | (Zip Code) | |

(877) 647-5990

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |||

Common Stock | New York | |||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12-b-2 of the Exchange Act.

Large accelerated filer þ | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant's common stock, par value $0.01 per share (the "Common Stock") held by non-affiliates was approximately $14,408,583,291 based upon the June 30, 2015, closing price of $45.59 on the New York Stock Exchange.

There were 319,741,768 shares of Common Stock outstanding as of February 10, 2016.

Documents Incorporated by Reference

Part III of this report incorporates by reference specific portions of the Registrant’s Notice of Annual Meeting and Proxy Statement relating to the Annual Meeting of Stockholders to be held on May 11, 2016.

CONTENTS

Page No. | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

DEFINED TERMS

The following is a list of abbreviations or acronyms that are used in this report:

NiSource Subsidiaries, Affiliates and Former Subsidiaries | ||

Capital Markets | NiSource Capital Markets, Inc. | |

CGORC | Columbia Gas of Ohio Receivables Corporation | |

Columbia | Columbia Energy Group | |

Columbia of Kentucky | Columbia Gas of Kentucky, Inc. | |

Columbia of Maryland | Columbia Gas of Maryland, Inc. | |

Columbia of Massachusetts | Bay State Gas Company | |

Columbia of Ohio | Columbia Gas of Ohio, Inc. | |

Columbia of Pennsylvania | Columbia Gas of Pennsylvania, Inc. | |

Columbia of Virginia | Columbia Gas of Virginia, Inc. | |

CPG | Columbia Pipeline Group, Inc. | |

CPPL | Columbia Pipeline Partners LP | |

CPRC | Columbia Gas of Pennsylvania Receivables Corporation | |

Crossroads Pipeline | Crossroads Pipeline Company | |

NARC | NIPSCO Accounts Receivable Corporation | |

NDC Douglas Properties | NDC Douglas Properties, Inc. | |

NIPSCO | Northern Indiana Public Service Company | |

NiSource | NiSource Inc. | |

NiSource Corporate Services | NiSource Corporate Services Company | |

NiSource Development Company | NiSource Development Company, Inc. | |

NiSource Finance | NiSource Finance Corporation | |

Abbreviations | ||

AFUDC | Allowance for funds used during construction | |

AOCI | Accumulated Other Comprehensive Income | |

ASC | Accounting Standards Codification | |

ASU | Accounting Standards Update | |

BBA | British Banker Association | |

Bcf | Billion cubic feet | |

BNS | Bank of Nova Scotia | |

Board | Board of Directors | |

BTMU | The Bank of Tokyo-Mitsubishi UFJ, LTD. | |

CAA | Clean Air Act | |

CAP | Compliance Assurance Program | |

CCGT | Combined Cycle Gas Turbine | |

CCRs | Coal Combustion Residuals | |

CERCLA | Comprehensive Environmental Response Compensation and Liability Act (also known as Superfund) | |

CO2 | Carbon Dioxide | |

Columbia OpCo | CPG OpCo LP | |

CPP | Clean Power Plan | |

DPU | Department of Public Utilities | |

DSM | Demand Side Management | |

3

DEFINED TERMS | ||

Dth | Dekatherm | |

ECR | Environmental Cost Recovery | |

ECRM | Environmental Cost Recovery Mechanism | |

ECT | Environmental Cost Tracker | |

EERM | Environmental Expense Recovery Mechanism | |

EPA | United States Environmental Protection Agency | |

EPS | Earnings per share | |

FAC | Fuel adjustment clause | |

FASB | Financial Accounting Standards Board | |

FERC | Federal Energy Regulatory Commission | |

FGD | Flue Gas Desulfurization | |

FTRs | Financial Transmission Rights | |

GAAP | Generally Accepted Accounting Principles | |

GCR | Gas cost recovery | |

GHG | Greenhouse gases | |

gwh | Gigawatt hours | |

hp | Horsepower | |

IBM | International Business Machines Corp. | |

IDEM | Indiana Department of Environmental Management | |

IPO | Initial Public Offering | |

IRP | Infrastructure Replacement Program | |

IRS | Internal Revenue Service | |

IURC | Indiana Utility Regulatory Commission | |

kV | Kilovolt | |

LDAF | Local Distribution Adjustment Factor | |

LDCs | Local distribution companies | |

LIBOR | London InterBank Offered Rate | |

LIFO | Last-in, first-out | |

LNG | Liquefied Natural Gas | |

MATS | Mercury and Air Toxics Standards | |

Mcf | Thousand cubic feet | |

MGP | Manufactured Gas Plant | |

MISO | Midcontinent Independent System Operator | |

Mizuho | Mizuho Corporate Bank Ltd. | |

MMDth | Million dekatherms | |

mw | Megawatts | |

mwh | Megawatt hours | |

NAAQS | National Ambient Air Quality Standards | |

NAV | Net Asset Value per Share | |

NOx | Nitrogen oxides | |

NYMEX | The New York Mercantile Exchange | |

OPEB | Other Postretirement and Postemployment Benefits | |

OUCC | Indiana Office of Utility Consumer Counselor | |

PCB | Polychlorinated biphenyls | |

PEF | Pension Expense Factor | |

4

DEFINED TERMS | ||

PNC | PNC Bank N.A. | |

ppb | Parts per billion | |

PSC | Public Service Commission | |

PUC | Public Utility Commission | |

PUCO | Public Utilities Commission of Ohio | |

RDAF | Revenue decoupling adjustment factor | |

ROE | Return on Equity | |

RTO | Regional Transmission Organization | |

Separation | The separation of NiSource's natural gas pipeline, midstream and storage business from NiSource's natural gas and electric utility business accomplished through the pro rata distribution by NiSource to holders of its outstanding common stock of all the outstanding shares of common stock of CPG. The separation was completed on July 1, 2015. | |

SEC | Securities and Exchange Commission | |

SO2 | Sulfur dioxide | |

Sugar Creek | Sugar Creek electric generating plant | |

TDSIC | Transmission, Distribution and Storage System Improvement Charge | |

TUAs | Transmission Upgrade Agreements | |

VIE | Variable Interest Entity | |

VSCC | Virginia State Corporation Commission | |

5

NiSource Inc. (the "Company") is an energy holding company under the Public Utility Holding Company Act of 2005 whose subsidiaries are fully regulated natural gas and electric utility companies serving approximately 3.9 million customers in seven states. NiSource is the successor to an Indiana corporation organized in 1987 under the name of NIPSCO Industries, Inc., which changed its name to NiSource on April 14, 1999.

NiSource is one of the nation’s largest natural gas distribution companies, as measured by number of customers. NiSource’s principal subsidiaries include NiSource Gas Distribution Group, Inc., a natural gas distribution holding company, and NIPSCO, a gas and electric company. NiSource derives substantially all of its revenues and earnings from the operating results of these rate-regulated businesses.

On July 1, 2015, NiSource completed the Separation of CPG from NiSource. CPG's operations consisted of all of NiSource's Columbia Pipeline Group Operations segment prior to the Separation. Following the Separation, NiSource retained no ownership interest in CPG.

The results of operations and cash flows for the former Columbia Pipeline Group Operations segment have been reported as discontinued operations for all periods presented. Additionally, the assets and liabilities of the former Columbia Pipeline Group Operations segment were reclassified as assets and liabilities of discontinued operations for all prior periods. See Note 3, "Discontinued Operations," in the Notes to Consolidated Financial Statements for additional information.

NiSource’s reportable segments are: Gas Distribution Operations and Electric Operations. The following is a summary of the business for each reporting segment. Refer to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 22, "Segments of Business," in the Notes to Consolidated Financial Statements for additional information for each segment.

Gas Distribution Operations

NiSource’s natural gas distribution operations serve approximately 3.4 million customers in seven states and operate approximately 59,000 miles of pipeline. Through its wholly-owned subsidiary NiSource Gas Distribution Group, Inc., NiSource owns six distribution subsidiaries that provide natural gas to approximately 2.6 million residential, commercial and industrial customers in Ohio, Pennsylvania, Virginia, Kentucky, Maryland and Massachusetts. Additionally, NiSource also distributes natural gas to approximately 812,000 customers in northern Indiana through its wholly-owned subsidiary NIPSCO.

Electric Operations

NiSource generates, transmits and distributes electricity through its subsidiary NIPSCO to approximately 463,000 customers in 20 counties in the northern part of Indiana and engages in wholesale and transmission transactions. NIPSCO owns and operates three coal-fired electric generating stations. The three operating facilities have a net capability of 2,540 mw. NIPSCO also owns and operates Sugar Creek, a CCGT plant with net capability of 535 mw, three gas-fired generating units located at NIPSCO’s coal-fired electric generating stations with a net capability of 196 mw and two hydroelectric generating plants with a net capability of 10 mw. These facilities provide for a total system operating net capability of 3,281 mw. NIPSCO’s transmission system, with voltages from 69,000 to 345,000 volts, consists of 2,805 circuit miles. NIPSCO is interconnected with five neighboring electric utilities. During the year ended December 31, 2015, NIPSCO generated 67.4% and purchased 32.6% of its electric requirements.

NIPSCO participates in the MISO transmission service and wholesale energy market. The MISO is a nonprofit organization created in compliance with FERC regulations to improve the flow of electricity in the regional marketplace and to enhance electric reliability. Additionally, the MISO is responsible for managing energy markets, transmission constraints and the day-ahead, real-time, FTR and ancillary markets. NIPSCO transferred functional control of its electric transmission assets to the MISO and transmission service for NIPSCO occurs under the MISO Open Access Transmission Tariff.

Divestiture of Non-Core Assets

In recent years, NiSource sold certain businesses judged to be non-core to NiSource’s strategy. Lake Erie Land Company, a wholly-owned subsidiary of NiSource, is pursuing the sale of the real estate assets it owns. NDC Douglas Properties, a subsidiary of NiSource Development Company, is in the process of exiting its low-income housing investments. NiSource sold the service plan and leasing business lines of its retail services business in January 2013. NiSource also sold the commercial and industrial natural gas portfolio of its unregulated natural gas marketing business in September 2013.

Business Strategy

NiSource focuses its business strategy on its core, rate-regulated asset-based businesses with most of its operating income generated from the rate-regulated businesses. NiSource’s utilities continue to move forward on core infrastructure and environmental investment programs supported by complementary regulatory and customer initiatives across all seven states in which it operates.

6

NiSource’s goal is to develop strategies that benefit all stakeholders as it addresses changing customer conservation patterns, develops more contemporary pricing structures, and embarks on long-term investment programs. These strategies will help improve reliability and safety, enhance customer services and reduce emissions while generating sustainable returns.

Competition and Changes in the Regulatory Environment

The regulatory frameworks applicable to NiSource’s operations, at both the state and federal levels, continue to evolve. These changes have had and will continue to have an impact on NiSource’s operations, structure and profitability. Management continually seeks new ways to be more competitive and profitable in this environment, including providing gas customers with increased choices for products and services.

Natural Gas Competition. Open access to natural gas supplies over interstate pipelines and the deregulation of the commodity price of gas has led to tremendous change in the energy markets. LDC customers and marketers can purchase gas directly from producers and marketers as an open, competitive market for gas supplies has emerged. This separation or “unbundling” of the transportation and other services offered by pipelines and LDCs allows customers to purchase the commodity independent of services provided by the pipelines and LDCs. The LDCs continue to purchase gas and recover the associated costs from their customers. NiSource’s Gas Distribution Operations’ subsidiaries are involved in programs that provide customers the opportunity to purchase their natural gas requirements from third parties and use the NiSource Gas Distribution Operations’ subsidiaries for transportation services.

Electric Competition. Indiana electric utilities generally have exclusive service areas under Indiana regulations and retail electric customers in Indiana do not have the ability to choose their electric supplier. NIPSCO faces non-utility competition from other energy sources, such as self-generation by large industrial customers and other distributed energy sources.

Financing Subsidiary

NiSource Finance is a 100% owned, consolidated finance subsidiary of NiSource that engages in financing activities to raise funds for the business operations of NiSource and its subsidiaries. NiSource Finance was incorporated in March 2000 under the laws of the state of Indiana. Prior to 2000, the function of NiSource Finance was performed by Capital Markets. NiSource Finance obligations are fully and unconditionally guaranteed by NiSource.

Seasonality

A significant portion of NiSource's operations is subject to seasonal fluctuations in sales. During the heating season, which is primarily from November through March, net revenues from gas sales are more significant, and during the cooling season, which is primarily June through September, net revenues from electric sales are more significant, than in other months.

Other Relevant Business Information

NiSource’s customer base is broadly diversified, with no single customer accounting for a significant portion of revenues.

As of December 31, 2015, NiSource had 7,596 employees of whom 3,157 were subject to collective bargaining agreements.

For a listing of certain subsidiaries of NiSource refer to Exhibit 21.

NiSource electronically files various reports with the Securities and Exchange Commission (SEC), including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports, as well as our proxy statements for our annual meetings of stockholders. The public may read and copy any materials that NiSource files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. NiSource makes all SEC filings available without charge to the public on its web site at http://www.nisource.com.

7

NiSource’s operations and financial results are subject to various risks and uncertainties, including those described below, that could adversely affect the Company’s business, financial condition, results of operations, cash flows, and the trading price of the Company’s common stock.

NiSource has substantial indebtedness which could adversely affect its financial condition.

NiSource had total consolidated indebtedness of $6,949.6 million outstanding as of December 31, 2015. The Company’s substantial indebtedness could have important consequences. For example, it could:

• | limit the Company’s ability to borrow additional funds or increase the cost of borrowing additional funds; |

• | reduce the availability of cash flow from operations to fund working capital, capital expenditures and other general corporate purposes; |

• | limit the Company’s flexibility in planning for, or reacting to, changes in the business and the industries in which it operates; |

• | lead parties with whom NiSource does business to require additional credit support, such as letters of credit, in order for NiSource to transact such business; |

• | place NiSource at a competitive disadvantage compared to competitors that are less leveraged; |

• | increase vulnerability to general adverse economic and industry conditions; and |

• | limit the ability of the Company to execute on its growth strategy, which is dependent upon access to capital to fund its substantial investment program. |

Some of NiSource’s debt obligations contain financial covenants related to debt-to-capital ratios and cross-default provisions. NiSource’s failure to comply with any of these covenants could result in an event of default, which, if not cured or waived, could result in the acceleration of outstanding debt obligations.

A drop in NiSource’s credit rating could adversely impact NiSource’s liquidity.

The credit rating agencies periodically review the Company’s ratings, taking into account factors such as our capital structure and earnings profile. In 2015, Moody’s affirmed the NiSource senior unsecured rating of Baa2 and its commercial paper rating of P-2, with stable outlooks. Moody’s also affirmed NIPSCO’s Baa1 rating and Columbia Gas of Massachusetts’s Baa2 rating, with stable outlooks. In 2015, Standard & Poor’s raised the senior unsecured ratings of NiSource and its subsidiaries to BBB+ and NiSource’s commercial paper rating to A-2, with stable outlooks. In 2015, Fitch affirmed the NiSource senior unsecured rating of BBB-, commercial paper rating of F3 and the existing ratings of its other rated subsidiaries. Fitch revised its outlook to positive.

The Company is committed to maintaining investment grade credit ratings, however, there is no assurance we will be able to do so in the future. The Company’s credit ratings could be lowered or withdrawn entirely by a rating agency if, in its judgment, the circumstances warrant. Any negative rating action could adversely affect our ability to access capital at rates and on terms that are attractive. A negative rating action could also adversely impact our business relationships with suppliers and operating partners.

Certain NiSource subsidiaries have agreements that contain “ratings triggers” that require increased collateral if the credit ratings of NiSource or certain of its subsidiaries are below investment grade. These agreements are primarily for insurance purposes and for the physical purchase or sale of power. As of December 31, 2015 the collateral requirement that would be required in the event of a downgrade below the ratings trigger levels would amount to approximately $26.9 million. In addition to agreements with ratings triggers, there are other agreements that contain “adequate assurance” or “material adverse change” provisions that could necessitate additional credit support such as letters of credit and cash collateral to transact business.

NiSource may not be able to execute its business plan or growth strategy, including utility infrastructure investments.

Business or regulatory conditions may result in NiSource not being able to execute its business plan or growth strategy, including identified, planned and other utility infrastructure investments. NiSource’s customer and regulatory initiatives may not achieve planned results. Utility infrastructure investments may not materialize, may cease to be achievable or economically viable and may not be successfully completed. Natural gas may cease to be viewed as an economically and ecologically attractive fuel. Any of these developments could adversely affect our results of operations and growth prospects.

8

Adverse economic and market conditions or increases in interest rates could reduce net revenue growth, increase costs, decrease future net income and cash flows and impact capital resources and liquidity needs.

While the national economy is experiencing modest growth, NiSource cannot predict how robust future growth will be or whether or not it will be sustained. Deteriorating or sluggish economic conditions in NiSource’s operating jurisdictions could adversely impact NiSource’s ability to grow its customer base and collect revenues from customers, which could reduce net revenue growth and increase operating costs.

The Company relies on access to the capital markets to finance our liquidity and long-term capital requirements. Market turmoil could adversely affect our ability to raise additional capital or refinance debt at reasonable borrowing costs and terms. Reduced access to capital markets and/or increased borrowing costs could reduce future net income and cash flows. Refer to Note 14, “Long-Term Debt,” in the Notes to Consolidated Financial Statements for information related to outstanding long-term debt and maturities of that debt.

Capital market performance and other factors may decrease the value of benefit plan assets, which then could require significant additional funding and impact earnings.

The performance of the capital markets affects the value of the assets that are held in trust to satisfy future obligations under defined benefit pension and other postretirement benefit plans. NiSource has significant obligations in these areas and holds significant assets in these trusts. These assets are subject to market fluctuations and may yield uncertain returns, which fall below NiSource’s projected rates of return. A decline in the market value of assets may increase the funding requirements of the obligations under the defined benefit pension and other postretirement benefit plans. Additionally, changes in interest rates affect the liabilities under these benefit plans; as interest rates decrease, the liabilities increase, which could potentially increase funding requirements. Further, the funding requirements of the obligations related to these benefits plans may increase due to changes in governmental regulations and participant demographics, including increased numbers of retirements or changes in life expectancy assumptions. Ultimately, significant funding requirements and increased pension or other postretirement benefit plan expense could negatively impact NiSource’s results of operations and financial position.

The majority of NiSource’s net revenues are subject to economic regulation and are exposed to the impact of regulatory rate reviews and proceedings.

Most of NiSource’s net revenues are subject to economic regulation at either the federal or state level. As such, the net revenues generated by those regulated companies are subject to regulatory review by the applicable federal or state authority. These rate reviews determine the rates charged to customers and directly impact revenues. NiSource’s financial results are dependent on frequent regulatory proceedings in order to ensure timely recovery of costs. Additionally, the costs of complying with future changes in environmental laws and regulations are expected to be significant, and their recovery through rates will be contingent on regulatory approval.

As a result of efforts to introduce market-based competition in certain markets where the regulated businesses conduct operations, NiSource may compete with independent marketers for customers. This competition exposes NiSource to the risk that certain stranded costs may not be recoverable and may affect results of NiSource’s growth strategy and financial position.

NiSource’s costs of compliance with environmental laws are significant. The costs of compliance with future environmental laws and the costs associated with environmental liabilities could impact cash flow and profitability.

NiSource is subject to extensive federal, state and local environmental requirements that, among other things, regulate air emissions, water usage and discharges, remediation and the management of chemicals, hazardous waste, solid waste, and coal combustion residuals. Compliance with these legal obligations requires NiSource to make expenditures for installation of pollution control equipment, remediation, environmental monitoring, emissions fees and permits at many of NiSource’s facilities. These expenditures are significant, and NiSource expects that they will continue to be significant in the future. Furthermore, if NiSource fails to comply with environmental laws and regulations or is found to have caused damage to the environment or persons, even if caused by factors beyond NiSource’s control, that failure or harm may result in the assessment of civil or criminal penalties and damages against NiSource.

Existing environmental laws and regulations may be revised and new laws and regulations seeking to increase environmental regulation of the energy industry may be adopted or become applicable to NiSource. Revised or additional laws and regulations could result in significant additional expense and operating restrictions on NiSource’s facilities or increased compliance costs,

9

which may not be fully recoverable from customers and would, therefore, reduce net income. Moreover, such costs could materially affect the continued economic viability of one or more of NiSource’s facilities.

Even in instances where legal and regulatory requirements are already known or anticipated, the original cost estimates for cleanup and environmental capital projects can differ materially from the amount ultimately expended. The actual future expenditures depend on many factors, including the nature and extent of impact, the method of cleanup, the cost of raw materials, contractor costs, and the availability of cost recovery. Changes in costs and the ability to recover under regulatory mechanisms could affect NiSource’s financial position, operating results and cash flows. Because NiSource operates fossil fuel facilities, emissions of GHGs are an expected aspect of the business. While NiSource continues to reduce GHG emissions through efficiency programs, leak detection, and other programs, GHG emissions cannot be eliminated. The EPA has made clear that it is focused on reducing GHG emissions from the energy industry. On October 18, 2015, the EPA finalized its CPP, which regulates greenhouse gas emissions from coal and natural gas electric generating units. The CPP is subject to various legal challenges, but, if the CPP survives these challenges, the compliance costs associated with CPP requirements could impact cash flow. In addition, the CPP could increase NiSource’s cost of producing energy, which may impact customer demand and/or NiSource’s profitability. The CPP requires states (or in some cases the EPA) to develop individualized plans to meet the CPP emission reduction requirements. Depending on the array of programs chosen by the State of Indiana or EPA, NiSource’s CPP compliance costs could be substantial. It is also possible that additional future GHG legislation and/or regulation could materially impact NiSource. The cost impact of any new and/or amended GHG legislation or regulations would depend upon the specific requirements enacted and cannot be determined at this time.

A significant portion of the gas and electricity NiSource sells is used by residential and commercial customers for heating and air conditioning. Accordingly, fluctuations in weather, gas and electricity commodity costs and economic conditions impact demand of our customers and our operating results.

Energy sales are sensitive to variations in weather. Forecasts of energy sales are based on normal weather, which represents a long-term historical average. Significant variations from normal weather could have, and have had, a material impact on energy sales. Additionally, residential usage, and to some degree commercial usage is sensitive to fluctuations in commodity costs for gas and electricity, whereby usage declines with increased costs, thus affecting NiSource’s financial results. Lastly, residential and commercial customers’ usage is sensitive to economic conditions and factors such as unemployment, consumption and consumer confidence. Therefore, prevailing economic conditions may affect NiSource’s financial results.

NiSource’s business operations are subject to economic conditions in certain industries.

Business operations throughout NiSource’s service territories have been and may continue to be adversely affected by economic events at the national and local level where it operates. In particular, sales to large industrial customers, such as those in the steel, oil refining, industrial gas and related industries, may be impacted by economic downturns. The U.S. manufacturing industry continues to adjust to changing market conditions including international competition, increasing costs, and fluctuating demand for its products.

Fluctuations in the price of energy commodities or their related transportation costs may have a negative impact on NiSource’s financial results.

NiSource’s electric generating fleet is dependent on coal and natural gas for fuel, and its gas distribution operations purchase and resell much of the natural gas they deliver. These energy commodities are vulnerable to price fluctuations and fluctuations in associated transportation costs. From time to time, NiSource has used hedging in order to offset fluctuations in commodity supply prices. NiSource relies on regulatory recovery mechanisms in the various jurisdictions in order to fully recover the commodity costs incurred in operations. However, while NiSource has historically been successful in recovery of costs related to such commodity prices, there can be no assurance that such costs will be fully recovered through rates in a timely manner.

NiSource is exposed to risk that customers will not remit payment for delivered energy or services, and that suppliers or counterparties will not perform under various financial or operating agreements.

NiSource’s extension of credit is governed by a Corporate Credit Risk Policy, involves considerable judgment and is based on an evaluation of a customer or counterparty’s financial condition, credit history and other factors. NiSource monitors its credit risk exposure by obtaining credit reports and updated financial information for customers and suppliers, and by evaluating the financial status of its banking partners and other counterparties by reference to market-based metrics such as credit default swap pricing

10

levels, and to traditional credit ratings provided by the major credit rating agencies. Adverse economic conditions could result in an increase in defaults by customers, suppliers and counterparties.

NiSource has significant goodwill and definite-lived intangible assets. An impairment of goodwill or definite-lived intangible assets could result in a significant charge to earnings and negatively impact NiSource's compliance with certain covenants under financing agreements.

In accordance with GAAP, NiSource tests goodwill for impairment at least annually and reviews its definite-lived intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill also is tested for impairment when factors, examples of which include reduced cash flow estimates, a sustained decline in stock price or market capitalization below book value, indicate that the carrying value may not be recoverable. NiSource would be required to record a charge in its financial statements for the period in which any impairment of the goodwill or definite-lived intangible assets is determined, negatively impacting the results of operations. A significant charge could impact the capitalization ratio covenant under certain financing agreements. NiSource is subject to a financial covenant under its five-year revolving credit facility, which requires NiSource to maintain a debt to capitalization ratio that does not exceed 70%. A similar covenant in a 2005 private placement note purchase agreement requires NiSource to maintain a debt to capitalization ratio that does not exceed 75%. As of December 31, 2015, the ratio was 64%.

Changes in taxation and the ability to quantify such changes could adversely affect NiSource’s financial results.

NiSource is subject to taxation by the various taxing authorities at the federal, state and local levels where it does business. Legislation or regulation which could affect NiSource’s tax burden could be enacted by any of these governmental authorities. NiSource cannot predict the timing or extent of such tax-related developments which could have a negative impact on the financial results. Additionally, NiSource uses its best judgment in attempting to quantify and reserve for these tax obligations. However, a challenge by a taxing authority, NiSource’s ability to utilize tax benefits such as carryforwards or tax credits, or a deviation from other tax-related assumptions may cause actual financial results to deviate from previous estimates.

Changes in accounting principles may adversely affect NiSource’s financial results.

Future changes in accounting rules and associated changes in regulatory accounting may negatively impact the way NiSource records revenues, expenses, assets and liabilities. These changes in accounting standards may adversely affect its financial condition and results of operations.

Distribution of natural gas, and the generation, transmission and distribution of electricity involve numerous risks that may result in incidents and other operating risks and costs.

NiSource's gas distribution and transmission activities, as well as generation, transmission, and distribution of electricity, involve a variety of inherent hazards and operating risks, such as gas leaks, downed power lines, incidents, including third-party damages, large scale outages, and mechanical problems, which could cause substantial financial losses. In addition, these risks could result in serious injury or loss of life to employees and the general public, significant damage to property, environmental pollution, impairment of its operations, adverse regulatory rulings and reputational harm, which in turn could lead to substantial losses to NiSource. The location of pipeline facilities, or generation, transmission, substation and distribution facilities near populated areas, including residential areas, commercial business centers and industrial sites, could increase the level of damages resulting from such events. The occurrence of such events could adversely affect NiSource's financial position and results of operations. In accordance with customary industry practice, NiSource maintains insurance against some, but not all, of these risks and losses.

Aging infrastructure may lead to disruptions in operations and increased capital expenditures and maintenance costs, all of which could negatively impact NiSource’s financial results.

NiSource has risks associated with aging infrastructure assets. The age of these assets may result in a need for replacement, a higher level of maintenance costs and unscheduled outages despite efforts by NiSource to properly maintain these assets through inspection, scheduled maintenance and capital investment. The failure to operate these assets as desired could result in incidents and in NiSource’s inability to meet firm service obligations, adversely impacting revenues, and could also result in increased capital expenditures and maintenance costs, which, if not fully recovered from customers, could negatively impact NiSource's financial results.

11

The impacts of climate change, natural disasters, acts of terrorism or other catastrophic events may disrupt operations and reduce the ability to service customers.

A disruption or failure of natural gas distribution systems, or within electric generation, transmission or distribution systems, in the event of a major hurricane, tornado, terrorist attack or other catastrophic event could cause delays in completing sales, providing services, or performing other critical functions. NiSource has experienced disruptions in the past from hurricanes and tornadoes and other events of this nature. The occurrence of such events could adversely affect NiSource's financial position and results of operations. In accordance with customary industry practice, NiSource maintains insurance against some, but not all, of these risks and losses. There is also a concern that climate change may exacerbate the risks to physical infrastructure. Such risks include heat stresses to power lines, storms that damage infrastructure, lake and sea level changes that damage the manner in which services are currently provided, droughts or other stresses on water used to supply services, and other extreme weather conditions. Climate change and the costs that may be associated with its impacts have the potential to affect NiSource’s business in many ways, including increasing the cost NiSource incurs in providing its products and services, impacting the demand for and consumption of its products and services (due to change in both costs and weather patterns), and affecting the economic health of the regions in which NiSource operates.

A cyber-attack on any of NiSource's or certain third-party computer systems upon which NiSource relies may adversely affect its ability to operate.

NiSource is reliant on technology to run its businesses, which are dependent upon financial and operational computer systems to process critical information necessary to conduct various elements of its business, including the generation, transmission and distribution of electricity, operation of its gas pipeline facilities and the recording and reporting of commercial and financial transactions to regulators, investors and other stakeholders. Any failure of NiSource’s computer systems, or those of its customers, suppliers or others with whom it does business, could materially disrupt NiSource’s ability to operate its business and could result in a financial loss and possibly do harm to NiSource’s reputation.

Additionally, NiSource's information systems experience ongoing, often sophisticated, cyber-attacks by a variety of sources with the apparent aim to breach NiSource's cyber-defenses. Although NiSource attempts to maintain adequate defenses to these attacks and works through industry groups and trade associations to identify common threats and assess NiSource's countermeasures, a security breach of NiSource's information systems could (i) impact the reliability of NiSource's generation, transmission and distribution systems and potentially negatively impact NiSource's compliance with certain mandatory reliability standards, (ii) subject NiSource to harm associated with theft or inappropriate release of certain types of information such as system operating information or information, personal or otherwise, relating to NiSource's customers or employees, and/or (iii) impact NiSource's ability to manage NiSource's businesses.

NiSource's capital projects and programs subject the Company to construction risks and natural gas costs and supply risks.

NiSource is engaged in an intrastate natural gas pipeline modernization program to maintain system integrity and enhance service reliability and flexibility. NIPSCO also is currently engaged in a number of capital projects, including environmental improvements to its electric generating stations, as well as the construction of new transmission facilities. As NiSource undertakes these projects and programs, it may not be able to complete them on schedule or at the anticipated costs. Additionally, NiSource may construct or purchase some of these projects and programs to capture anticipated future growth in natural gas production, which may not materialize, and may cause the construction to occur over an extended period of time. NiSource also may not receive material increases in revenue and cash flows until after the completion of the projects and programs.

Sustained extreme weather conditions may negatively impact NiSource’s operations.

NiSource conducts its operations across a wide geographic area subject to varied and potentially extreme weather conditions, which may from time to time persist for sustained periods of time. Despite preventative maintenance efforts, persistent weather related stress on NiSource’s infrastructure may reveal weaknesses in its systems not previously known to the Company or otherwise present various operational challenges across all business segments. Further, adverse weather may affect NiSource’s ability to conduct operations in a manner that satisfies customer expectations or contractual obligations, including by causing service disruptions.

12

NiSource is a holding company and is dependent on cash generated by subsidiaries to meet its debt obligations and pay dividends on its common stock.

NiSource is a holding company and conducts its operations primarily through its subsidiaries. Substantially all of NiSource’s consolidated assets are held by its subsidiaries. Accordingly, NiSource’s ability to meet its debt obligations or pay dividends on its common stock is largely dependent upon cash generated by these subsidiaries. In the event a major subsidiary is not able to pay dividends or transfer cash flows to NiSource, NiSource's ability to service its debt obligations or pay dividends could be negatively affected.

Following the Separation, all of the entities formerly included in NiSource's Columbia Pipeline Group Operations segment have been separated from NiSource and are held by a separate publicly traded company (CPG). The related assets are no longer held by subsidiaries of NiSource, which may negatively affect NiSource's ability to service its debt obligations or pay dividends.

The Separation may not achieve the intended benefits and may result in significant tax liabilities.

NiSource cannot predict with certainty when the benefits expected from the Separation will occur or the extent to which they will be achieved, if at all. Furthermore, there are various uncertainties and risks relating to the process of the Separation that could have a negative impact on our financial condition, results of operations and cash flows, including disruption of our operations and impairment of our relationship with regulators, key personnel, customers and vendors. As a result of the completion of the Separation, NiSource faces new and unique risks, including having fewer assets, reduced financial resources and less diversification of revenue sources.

The Separation was conditioned on the receipt by NiSource of a legal opinion to the effect that the distribution of CPG shares to NiSource stockholders is expected to qualify as tax-free under Section 355 of the U.S. Internal Revenue Code. Even though NiSource has received such an opinion, the IRS could determine on audit that the distribution is taxable. Both NiSource and its stockholders could incur significant U.S. federal income tax liabilities if taxing authorities conclude the distribution is taxable.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

13

Discussed below are the principal properties held by NiSource and its subsidiaries as of December 31, 2015.

Gas Distribution Operations. Refer to Item 1, "Business" of this report for further information on Gas Distribution Operations properties.

Electric Operations. Refer to Item 1, "Business" of this report for further information on Electric Operations properties.

Corporate and Other Operations. NiSource owns the Southlake Complex, its 325,000 square foot headquarters building located in Merrillville, Indiana, and other residential and development property.

Character of Ownership. The principal properties of NiSource and its subsidiaries are owned free from encumbrances, subject to minor exceptions, none of which are of such a nature as to impair substantially the usefulness of such properties. Many of NiSource's subsidiary offices in various communities served are occupied under leases. All properties are subject to routine liens for taxes, assessments and undetermined charges (if any) incidental to construction. It is NiSource’s practice regularly to pay such amounts, as and when due, unless contested in good faith. In general, the electric lines, gas pipelines and related facilities are located on land not owned by NiSource and its subsidiaries, but are covered by necessary consents of various governmental authorities or by appropriate rights obtained from owners of private property. NiSource does not, however, generally have specific easements from the owners of the property adjacent to public highways over, upon or under which its electric lines and gas distribution pipelines are located. At the time each of the principal properties was purchased a title search was made. In general, no examination of titles as to rights-of-way for electric lines, gas pipelines or related facilities was made, other than examination, in certain cases, to verify the grantors’ ownership and the lien status thereof.

14

The Company is party to certain claims and legal proceedings arising in the ordinary course of business, none of which is deemed to be individually material at this time. Due to the inherent uncertainty of litigation, there can be no assurance that the resolution of any particular claim or proceeding would not have a material adverse effect on the Company’s results of operations, financial position or liquidity. If one or more of such matters were decided against the Company, the effects could be material to the Company’s results of operations in the period in which the Company would be required to record or adjust the related liability and could also be material to the Company’s cash flows in the periods the Company would be required to pay such liability.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

15

The following is a list of the Executive Officers of the Registrant, including their names, ages, offices held and other recent business experience, as of February 1, 2016.

Name | Age | Office(s) Held in Past 5 Years | |||

Joseph Hamrock | 52 | President and Chief Executive Officer of NiSource since July 1, 2015. | |||

Executive Vice President and Group Chief Executive Officer of NiSource from May 2012 to July 2015. | |||||

President and Chief Operating Officer, American Electric Power Company (electric utility company) - Ohio from January 2008 to May 2012. | |||||

Donald E. Brown | 44 | Executive Vice President and Chief Financial Officer and Treasurer of NiSource since July 1, 2015. | |||

Executive Vice President, Finance Department of NiSource from March 2015 to July 2015. | |||||

Vice President and Chief Financial Officer, UGI Utilities, a division of UGI Corporation (gas and electric utility company) from 2010 to March 2015. | |||||

Robert D. Campbell | 56 | Executive Vice President, Corporate Affairs and Human Resources of NiSource since July 1, 2015. | |||

Senior Vice President, Human Resources of NiSource from May 2006 to July 2015. | |||||

Carrie J. Hightman | 58 | Executive Vice President and Chief Legal Officer of NiSource since December 2007. | |||

Carl W. Levander | 54 | Executive Vice President and Chief Regulatory Officer of NiSource since July 1, 2015. | |||

President of Columbia of Virginia from January 2006 to July 2015. | |||||

Violet G. Sistovaris | 54 | Executive Vice President, NIPSCO since July 1, 2015. | |||

Senior Vice President and Chief Information Officer of NiSource from May 2014 to June 2015. | |||||

Senior Vice President and Chief Information Officer of NiSource Corporate Services Company from August 2008 to June 2015. | |||||

Jim L. Stanley | 60 | Executive Vice President and Chief Operating Officer of NiSource since July 1, 2015. | |||

Executive Vice President & Group Chief Executive Officer of NiSource from October 2012 to July 2015. | |||||

Senior Vice President, Duke Energy (electric power holding company) from June 2010 to September 2012. | |||||

Joseph W. Mulpas | 44 | Vice President and Chief Accounting Officer of NiSource since May 2014. | |||

Assistant Controller, FirstEnergy Corp (diversified energy company) from November 2012 to April 2014. | |||||

Vice President, Controller and Chief Accounting Officer, Maxum Petroleum Inc. (energy logistics company) from August 2012 to October 2012. | |||||

Vice President and Chief Accounting Officer, DPL Inc. and its subsidiary, The Dayton Power and Light Company (electric utility company) from May 2009 to June 2012. | |||||

16

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

NISOURCE INC.

NiSource’s common stock is listed and traded on the New York Stock Exchange under the symbol “NI.” The table below indicates the high and low sales prices of NiSource’s common stock, on the composite tape, during the periods indicated.

2015 | 2014 | ||||||||||||||||||||||

High | Low | Dividend Per Share | High | Low | Dividend Per Share | ||||||||||||||||||

First Quarter | $ | 45.10 | $ | 40.89 | $ | 0.260 | $ | 36.82 | $ | 32.11 | $ | 0.250 | |||||||||||

Second Quarter | 49.16 | 42.25 | 0.260 | 39.69 | 34.36 | 0.250 | |||||||||||||||||

Third Quarter | 45.71(1) | 16.04(1) | 0.155(2) | 41.70 | 36.00 | 0.260 | |||||||||||||||||

Fourth Quarter | 20.13(1) | 18.33(1) | 0.155(2) | 44.91 | 37.58 | 0.260 | |||||||||||||||||

$ | 0.830 | $ | 1.020 | ||||||||||||||||||||

(1) On July 1, 2015, NiSource completed the Separation through a special pro rata stock dividend, distributing one share of CPG common stock for every one share of NiSource common stock held by any NiSource stockholder on June 19, 2015, the record date. On July 1, 2015, the last trading day before the Separation became effective, the closing price of our common stock trading “regular way” (with an entitlement to CPG shares distributed in the Separation) was $45.45. On July 2, 2015, the first day of trading after the Separation, the opening price of our common stock was $17.61 per share.

(2)On July 2, 2015, following the Separation, NiSource’s Board declared a dividend of $0.155 per share of common stock and CPG’s Board declared a dividend of $0.125 per share of CPG common stock. The amount of dividends paid by NiSource in the third and fourth quarter of 2015 is that of NiSource only, and does not include the dividend declared by CPG during the same period.

Holders of shares of NiSource’s common stock are entitled to receive dividends when, as and if declared by NiSource’s Board out of funds legally available. The policy of the Board has been to declare cash dividends on a quarterly basis payable on or about the 20th day of February, May, August, and November. At its January 27, 2016, meeting, the Board declared a quarterly common dividend of $0.155 per share, payable on February 19, 2016 to holders of record on February 8, 2016.

Although the Board currently intends to continue the payment of regular quarterly cash dividends on common shares, the timing and amount of future dividends will depend on the earnings of NiSource’s subsidiaries, their financial condition, cash requirements, regulatory restrictions, any restrictions in financing agreements and other factors deemed relevant by the Board. There can be no assurance that we will continue to pay such dividends or the amount of such dividends.

As of February 10, 2016, NiSource had 30,389 common stockholders of record and 319,741,768 shares outstanding.

17

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

NISOURCE INC.

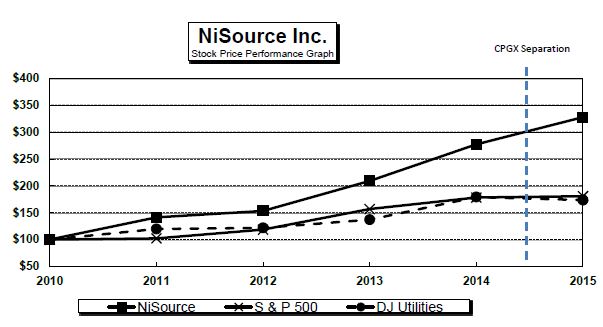

The graph below compares the cumulative total shareholder return of NiSource’s common stock for the last five years with the cumulative total return for the same period of the S&P 500 and the Dow Jones Utility indices. On July 1, 2015, NiSource completed the Separation. Following the Separation, NiSource retained no ownership interest in CPG. The Separation is treated as a special dividend for purposes of calculating the total shareholder return, with the then-current market value of the distributed shares being deemed to have been reinvested on the Separation date in shares of NiSource common stock. A vertical line is included on the graph below to identify the periods before and after the Separation.

The foregoing performance graph is being furnished as part of this annual report solely in accordance with the requirement under Rule 14a-3(b)(9) to furnish our stockholders with such information, and therefore, shall not be deemed to be filed or incorporated by reference into any filings by NiSource under the Securities Act or the Exchange Act.

The weighted average total return for NiSource common stock and the two indices is calculated from an assumed initial investment of $100 and assumes dividend reinvestment, including the impact of the distribution of CPG common stock in the Separation.

18

The selected data presented below as of and for the five years ended December 31, 2015, are derived from the Consolidated Financial Statements of NiSource. The data should be read together with the Consolidated Financial Statements including the related notes thereto included in Item 8 of this Form 10-K.

Year Ended December 31, (dollars in millions except per share data) | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Statement of Income Data: | |||||||||||||||||||

Gross Revenues | |||||||||||||||||||

Gas Distribution | $ | 2,081.9 | $ | 2,597.8 | $ | 2,226.3 | $ | 1,959.8 | $ | 2,916.6 | |||||||||

Gas Transportation | 969.8 | 987.4 | 820.0 | 692.4 | 531.9 | ||||||||||||||

Electric | 1,572.9 | 1,672.0 | 1,563.4 | 1,507.7 | 1,427.7 | ||||||||||||||

Other | 27.2 | 15.2 | 15.7 | 18.1 | 18.0 | ||||||||||||||

Total Gross Revenues | 4,651.8 | 5,272.4 | 4,625.4 | 4,178.0 | 4,894.2 | ||||||||||||||

Net Revenues (Gross Revenues less Cost of Sales, excluding depreciation and amortization) | 3,008.1 | 2,899.5 | 2,662.4 | 2,513.9 | 2,442.1 | ||||||||||||||

Operating Income | 799.9 | 789.1 | 698.1 | 638.6 | 551.7 | ||||||||||||||

Income from Continuing Operations | 198.6 | 256.2 | 221.0 | 171.0 | 108.9 | ||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Total Assets | 17,492.5 | 24,589.8 | 22,473.6 | 21,620.2 | 20,571.5 | ||||||||||||||

Capitalization | |||||||||||||||||||

Common stockholders’ equity | 3,843.5 | 6,175.3 | 5,886.6 | 5,554.3 | 4,997.3 | ||||||||||||||

Long-term debt, excluding amounts due within one year | 5,948.5 | 8,151.5 | 7,588.2 | 6,813.7 | 6,261.1 | ||||||||||||||

Total Capitalization | $ | 9,792.0 | $ | 14,326.8 | $ | 13,474.8 | $ | 12,368.0 | $ | 11,258.4 | |||||||||

Per Share Data: | |||||||||||||||||||

Basic Earnings Per Share from Continuing Operations ($) | $ | 0.63 | $ | 0.81 | $ | 0.71 | $ | 0.59 | $ | 0.39 | |||||||||

Diluted Earnings Per Share from Continuing Operations ($) | $ | 0.63 | $ | 0.81 | $ | 0.71 | $ | 0.57 | $ | 0.38 | |||||||||

Other Data: | |||||||||||||||||||

Dividends declared per share ($) | $ | 0.83 | $ | 1.02 | $ | 0.98 | $ | 0.94 | $ | 0.92 | |||||||||

Shares outstanding at the end of the year (in thousands) | 319,110 | 316,037 | 313,676 | 310,281 | 281,854 | ||||||||||||||

Number of common stockholders | 30,190 | 25,233 | 26,965 | 28,823 | 30,663 | ||||||||||||||

Capital expenditures ($ in millions) | $ | 1,367.5 | $ | 1,339.6 | $ | 1,248.5 | $ | 1,095.5 | $ | 812.6 | |||||||||

Number of employees | 7,596 | 8,982 | 8,477 | 8,286 | 7,957 | ||||||||||||||

• | On July 1, 2015, NiSource completed the Separation. The results of operations of the former Columbia Pipeline Group Operations segment have been classified as discontinued operations for all periods presented. See Note 3, "Discontinued Operations," in the Notes to the Consolidated Financial Statements for further information. |

• | Prior to the Separation, CPG closed its placement of $2,750.0 million in aggregate principal amount of its senior notes. Using the proceeds from this offering, CPG made cash payments to NiSource representing the settlement of inter-company borrowings and the payment of a one-time special dividend. In May 2015, using proceeds from the cash payments from CPG, NiSource Finance settled its two bank term loans in the amount of $1,075.0 million and executed a tender offer for $750.0 million consisting of a combination of its 5.25% notes due 2017, 6.40% notes due 2018 and 4.45% notes due 2021. In conjunction with the debt retired, NiSource Finance recorded a $97.2 million loss on early extinguishment of long-term debt, primarily attributable to early redemption premiums. |

• | On February 14, 2012, Columbia of Ohio held its first standard choice offer auction which resulted in a retail price adjustment of $1.53 per Mcf. On February 14, 2012, the PUCO issued an entry that approved the results of the auction with the new retail price adjustment level effective April 1, 2012. As a result of the implementation of the standard choice offer, Columbia of Ohio reports lower gross revenues and lower cost of sales. There is no impact on net revenues. |

• | On November 14, 2011, NiSource Finance commenced a cash tender offer for up to $250.0 million aggregate principal amount of its outstanding 10.75% notes due 2016 and 6.15% notes due 2013. A condition of the offering was that all validly tendered 2016 notes would be accepted for purchase before any 2013 notes were accepted. On December 13, 2011, NiSource Finance |

19

announced that approximately $125.3 million aggregate principal amount of its outstanding 10.75% notes due 2016 were validly tendered and accepted for purchase. In addition, approximately $228.7 million aggregate principal amount of outstanding 6.15% notes due 2013 were validly tendered, of which $124.7 million were accepted for purchase. NiSource Finance recorded a $53.9 million loss on early extinguishment of long-term debt, primarily attributable to early redemption premiums and unamortized discounts and fees.

20

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NISOURCE INC.

Note regarding forward-looking statements

This Management’s Discussion and Analysis of Financial Condition and Results of Operations, including statements regarding market risk sensitive instruments, contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Investors and prospective investors should understand that many factors govern whether any forward-looking statement contained herein will be or can be realized. Any one of those factors could cause actual results to differ materially from those projected. These forward-looking statements include, but are not limited to, statements concerning NiSource’s plans, objectives, expected performance, expenditures, recovery of expenditures through rates, stated on either a consolidated or segment basis, and any and all underlying assumptions and other statements that are other than statements of historical fact. From time to time, NiSource may publish or otherwise make available forward-looking statements of this nature. All such subsequent forward-looking statements, whether written or oral and whether made by or on behalf of NiSource, are also expressly qualified by these cautionary statements. All forward-looking statements are based on assumptions that management believes to be reasonable; however, there can be no assurance that actual results will not differ materially.

Factors that could cause actual results to differ materially from the projections, forecasts, estimates and expectations discussed in this Annual Report on Form 10-K include, among other things, NiSource’s debt obligations; any changes in NiSource’s credit rating; NiSource’s ability to execute its growth strategy; changes in general economic, capital and commodity market conditions; pension funding obligations; economic regulation and the impact of regulatory rate reviews; compliance with environmental laws and the costs of associated liabilities; fluctuations in demand from residential and commercial customers; economic conditions of certain industries; the price of energy commodities and related transportation costs; the reliability of customers and suppliers to fulfill their payment and contractual obligations; potential impairments of goodwill or definite-lived intangible assets; changes in taxation and accounting principles; potential incidents and other operating risks associated with our business; the impact of an aging infrastructure; the impact of climate change; potential cyber-attacks; risks associated with construction and natural gas cost and supply; extreme weather conditions; the ability of subsidiaries to generate cash; uncertainties related to the expected benefits of the Separation and the matters set forth in Item 1A, “Risk Factors” of this report, many of which risks are beyond the control of NiSource. In addition, the relative contributions to profitability by each segment, and the assumptions underlying the forward-looking statements relating thereto, may change over time.

CONSOLIDATED REVIEW

Executive Summary

NiSource is an energy holding company under the Public Utility Holding Company Act of 2005 whose subsidiaries are fully regulated natural gas and electric utility companies serving customers in seven states. NiSource generates substantially all of its operating income through these rate-regulated businesses. A significant portion of NiSource’s operations is subject to seasonal fluctuations in sales. During the heating season, which is primarily from November through March, net revenues from gas sales are more significant, and during the cooling season, which is primarily from June through September, net revenues from electric sales are more significant, than in other months.

NiSource reported lower income from continuing operations of $198.6 million or $0.63 per basic share for the twelve months ended December 31, 2015 compared to $256.2 million or $0.81 per basic share for the same period in 2014. The lower income

21

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NISOURCE INC.

from continuing operations during 2015 was due primarily to a $97.2 million loss on early extinguishment of long-term debt recorded as a result of the debt restructuring that occurred in 2015 as part of the Separation.

For the twelve months ended December 31, 2015, NiSource reported operating income of $799.9 million compared to $789.1 million for the same period in 2014. The slightly higher operating income was primarily due to increased net revenues from gas distribution regulatory and service programs, increased return on environmental capital investment at NIPSCO partially offset by lower net revenues due to warmer than normal weather and lower industrial customer usage. Operating expenses were higher due to increased employee and administrative expenses, higher environmental remediation costs and increased depreciation expense.

As part of our long-term regulated infrastructure investment program, NiSource invested $1,367.5 million in 2015 across our gas and electric utilities. Nisource expects to invest an additional $1,391.6 million during 2016.

NiSource believes that through income generated from operating activities, amounts available under its short-term revolving credit facility, commercial paper program, accounts receivable securitization facilities, long-term debt agreements and NiSource’s ability to access the capital markets, there is adequate capital available to fund its operating activities and capital expenditures in 2016. At December 31, 2015, NiSource had approximately $1,179.4 million of liquidity available, consisting of cash and available capacity under credit facilities.

These factors and other impacts to the financial results are discussed in more detail within the following discussions of “Results of Operations” and “Results and Discussion of Segment Operations.”

Platform for Growth

NiSource’s business plan continues to center on regulatory and customer initiatives.

Regulatory Initiatives

NiSource’s utilities continue to move forward on core infrastructure and environmental investment programs supported by complementary regulatory and customer initiatives across all seven states. NiSource invested approximately $1.4 billion across its gas and electric utilities in 2015. NiSource has now executed against approximately $2.0 billion of an estimated $30 billion in total projected long-term regulated utility infrastructure investments. NiSource expects to invest approximately $1.4 billion in capital during 2016 to continue to modernize and improve its system across all seven states. NiSource’s goal is to develop strategies that benefit all stakeholders as it addresses changing customer conservation patterns, develops more contemporary pricing structures, and embarks on long-term investment programs. These strategies will help improve reliability and safety, enhance customer services and reduce emissions while generating sustainable returns.

Gas Distribution Operations

• | On December 3, 2015, the Pennsylvania PUC approved a settlement in Columbia of Pennsylvania’s base rate case. The settlement maintains Columbia of Pennsylvania's ability to continue replacing and upgrading its natural gas distribution system. The approved rate adjustment went into effect on December 18, 2015, and will increase Columbia of Pennsylvania’s annual revenues by $28.0 million. The settlement also included new incentives that will significantly reduce costs for customers converting to natural gas. |

• | On November 1, 2015, Columbia of Massachusetts implemented new rates under its previously approved base rate case settlement. The settlement supports Columbia of Massachusetts’s continued effort to modernize its pipeline infrastructure and transform its operations to continue to serve customers safely and reliably. The approved settlement provides for increased annual revenues of $32.8 million starting November 1, 2015, with an additional $3.6 million annual increase in revenues starting November 1, 2016. |

• | On August 21, 2015, Columbia of Virginia received final VSCC approval of its 2014 base rate case. The VSCC reaffirmed the $25.2 million annual revenue increase. The case supports continued capital investments by Columbia of Virginia to improve its system and accommodate customer growth, as well as initiatives to enhance safety and reliability. |

• | NIPSCO continued executing on its seven-year, approximately $817 million natural gas system modernization program. NIPSCO filed its semi-annual tracker and program update on August 31, 2015, and expects an order from the IURC in the first quarter of 2016. |

22

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NISOURCE INC.

Electric Operations

• | On December 16, 2015, the IURC approved a settlement between NIPSCO, the Indiana Office of Utility Consumer Counselor and NIPSCO’s largest industrial customers which resolved all outstanding issues raised by parties in an Indiana Court of Appeals proceeding related to NIPSCO’s previous long-term electric infrastructure modernization plan. The settlement agreement required NIPSCO to file an electric base rate case and a new seven-year electric TDSIC plan. |

• | On December 31, 2015, NIPSCO filed a new $1.3 billion, seven-year electric infrastructure modernization plan with the IURC. The plan is focused on electric transmission and distribution investments made for safety, reliability, and system modernization. NIPSCO expects an order on its seven-year plan in the third quarter of 2016. |

• | NIPSCO remains on schedule with its electric base rate case filed on October 1, 2015 with the IURC. The case seeks to update rates to reflect the current costs of generating and distributing power, plus ongoing investments which are delivering substantial benefits to customers, including programs that have reduced the duration of power outages by 40 percent. An IURC decision is expected in the third quarter of 2016. |

• | Progress also continued on two major electric transmission projects designed to enhance region-wide system flexibility and reliability. Right-of-way acquisition, permitting and substation construction are under way for both projects. Line and tower construction is expected to begin in 2016. These projects involve an investment of approximately $450 million for NIPSCO and are anticipated to be in service by the end of 2018. |

• | NIPSCO's Michigan City Unit 12 FGD was placed in service on December 15, 2015. The approximately $255 million project, supported with cost recovery, improves air quality and helps ensure NIPSCO’s generation fleet remains in compliance with current environmental regulations. The project also helps ensure that NIPSCO can continue offering low-cost, reliable and efficient generating capacity for its customers. |

Refer to Note 7, “Regulatory Matters,” in the Notes to Consolidated Financial Statements for a complete discussion of regulatory matters.

Ethics and Controls

NiSource is committed to providing accurate and complete financial reporting as well as high standards for ethical behavior by its employees. NiSource’s senior management takes an active role in the development of this Form 10-K and the monitoring of the company’s internal control structure and performance. In addition, NiSource will continue its mandatory ethics training program for all employees.

For additional information refer to Item 9A, “Controls and Procedures.”

Results of Operations

Income from Continuing Operations

For the year ended December 31, 2015, NiSource reported income from continuing operations of $198.6 million, or $0.63 per basic share, compared to $256.2 million, or $0.81 per basic share in 2014. Income from continuing operations for the year ended December 31, 2013 was $221.0 million, or $0.71 per basic share.

Comparability of line item operating results is impacted by regulatory and tax trackers that allow for the recovery in rates of certain costs such as bad debt expense. Therefore, increases in these tracked operating expenses are offset by increases in net revenues and have essentially no impact on income from continuing operations.

Net Revenues

NiSource analyzes its operating results using net revenues. Net revenues are calculated as revenues less the associated cost of sales (excluding depreciation and amortization). NiSource believes net revenues are a better measure to analyze profitability than gross operating revenues since the majority of the cost of sales are tracked costs that are passed through directly to the customer resulting in an equal and offsetting amount reflected in gross operating revenues.

23

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NISOURCE INC.

Total consolidated net revenues for the year ended December 31, 2015, were $3,008.1 million, a $108.6 million increase compared with 2014. Net revenues increased primarily due to increased Gas Distribution Operations' net revenues of $82.4 million and higher Electric Operations' net revenues of $22.3 million.

• | Gas Distribution Operations' net revenues increased primarily due to an increase in regulatory and service programs of $88.7 million, including the impact of new rates at Columbia of Pennsylvania, Columbia of Massachusetts and Columbia of Virginia, as well as the implementation of new rates under Columbia of Ohio's approved infrastructure replacement program. Additionally, there were higher net revenues due to increased rent billed to affiliates, offset in expense, of $8.4 million and higher regulatory and tax trackers, offset in expense, of $7.5 million. These increases in net revenues were partially offset by the effects of warmer weather of $30.6 million. |

• | Electric Operations' net revenues increased primarily due to higher regulatory trackers, which are offset in expense, of $19.8 million, an increase in the return on the environmental capital investment recovery of $10.3 million due to an increased plant balance eligible for recovery and higher net revenues of $8.8 million as a result of two electric transmission projects. These increases were partially offset by lower industrial usage of $13.8 million. |

Total consolidated net revenues for the twelve months ended December 31, 2014 were $2,899.5 million, a $237.1 million increase compared with 2013. Net revenues increased primarily due to increased Gas Distribution Operations' net revenues of $197.1 million and increased Electric Operations' net revenues of $41.3 million.

• | Gas Distribution Operations' net revenues increased primarily due to an increase of $93.4 million for regulatory and service programs, including the impacts of the rate settlement in 2013 at Columbia of Pennsylvania, the rate case at Columbia of Massachusetts, as well as the implementation of rates under Columbia of Ohio's approved infrastructure replacement program. Additionally, 2014 included an increase in regulatory and tax trackers, which are offset in expense, of $49.2 million, the effects of colder weather of $18.4 million, and higher commercial, residential and industrial usage of $14.6 million. |

• | Electric Operations' net revenues increased primarily due to higher industrial usage of $21.9 million and an increase in the return on the environmental capital investment recovery of $19.8 million due to an increased plant balance eligible for recovery. |

Operating Expenses