Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EARNINGS RELEASE - KAR Auction Services, Inc. | exhibit991-q42015earningsr.htm |

| EX-99.2 - EXHIBIT 99.2 - EARNINGS RELEASE SUPPLEMENT - KAR Auction Services, Inc. | exhibit992-q42015ersupplem.htm |

| 8-K - 8-K - Q4 EARNINGS RELEASE, SUPPLEMENT & SLIDES - KAR Auction Services, Inc. | form8-kxersupplementslides.htm |

KAR Auction Services, Inc. Q4 2015 & Year-to-Date Earnings Slides February 17, 2016

Forward-Looking Statements This presentation includes forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. Many of these risk factors are outside of the company’s control, and as such, they involve risks which are not currently known to the company that could cause actual results to differ materially from forecasted results. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The forward-looking statements in this document are made as of the date hereof and the company does not undertake to update its forward-looking statements. 2

Fourth Quarter and YTD 2015 Highlights 3 Summary • Revenue +12% • Adjusted EBITDA +9% • Operating Adjusted EPS +11% • In 2015, returned $379.5 million to shareholders; retired approximately 5.3 million shares • Net Debt / Adjusted EBITDA of 2.78X ADESA Q4 • Volume +12% • Revenue +13% • Adjusted EBITDA +13% • 6% physical volume sold growth / RPU $740 • Achieved record volumes at ADESA.com, CarsArrive, PAR and RDN IAA Q4 • Volume +16% • Revenue +14% • Adjusted EBITDA +9% • Inventory +14% AFC Q4 • Loan Transaction Units +9% • Revenue +3% • Managed receivables of $1.6 billion; +20%

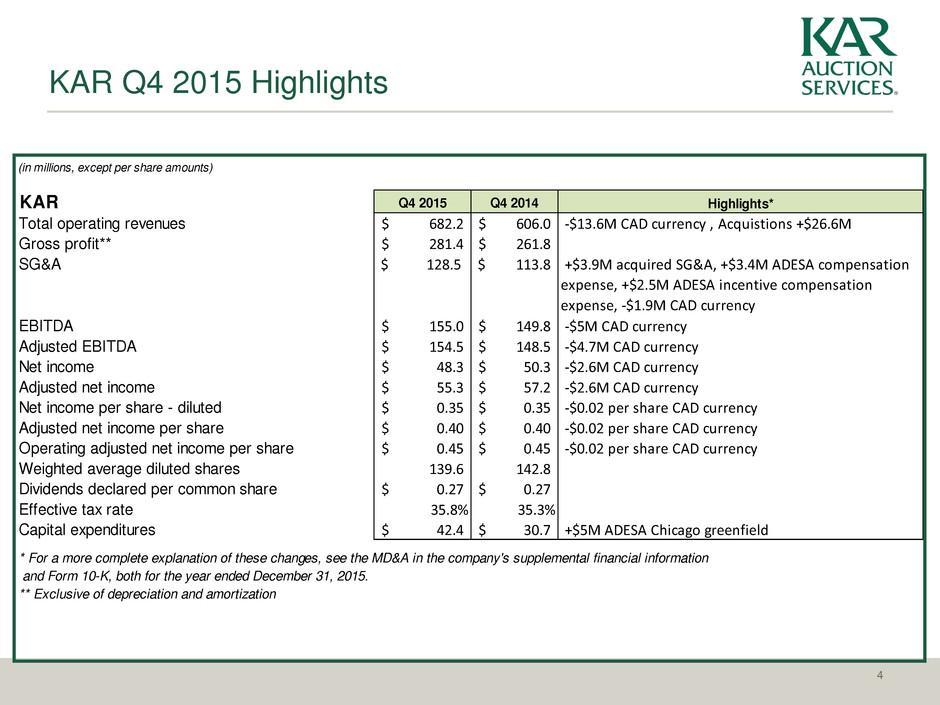

KAR Q4 2015 Highlights 4 (in millions, except per share amounts) KAR Q4 2015 Q4 2014 Highlights* Total operating revenues 682.2$ 606.0$ -$13.6M CAD currency , Acquistions +$26.6M Gross profit** 281.4$ 261.8$ SG&A $ 128.5 $ 113.8 +$3.9M acquired SG&A, +$3.4M ADESA compensation expense, +$2.5M ADESA incentive compensation expense, -$1.9M CAD currency EBITDA 155.0$ 149.8$ -$5M CAD currency Adjusted EBITDA 154.5$ 148.5$ -$4.7M CAD currency Net income 48.3$ 50.3$ -$2.6M CAD currency Adjusted net income 55.3$ 57.2$ -$2.6M CAD currency Net income per share - diluted 0.35$ 0.35$ -$0.02 per share CAD currency Adjusted net income per share 0.40$ 0.40$ -$0.02 per share CAD currency Operating adjusted net income per share 0.45$ 0.45$ -$0.02 per share CAD currency Weighted average diluted shares 139.6 142.8 Dividends declared per common share 0.27$ 0.27$ Effective tax rate 35.8% 35.3% Capital expenditures 42.4$ 30.7$ +$5M ADESA Chicago greenfield * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization

ADESA Q4 2015 Highlights 5 ADESA Q4 2015 Q4 2014 Highlights* Revenue $ 352.4 $ 310.5 +12% volume, +2% RPU (net of -$9.7M CAD currency), +$14.8M acquisitions Gross profit** 144.6$ 129.6$ Gross profit % 41.0% 41.7% SG&A $ 69.3 $ 63.2 +$3.4M compensation expense, +$2.8M acquired SG&A , +$2.5M incentive based compensation expense, -$1.9M CAD currency, -$0.9M bad debt expense EBITDA 73.2$ 65.7$ -$3.2M CAD currency Adjusted EBITDA 77.6$ 68.9$ -$3.2M CAD currency Total volume growth - % 12% 9% Physical 6% 7% Online only 32% 17% Dealer consignment growth (physical) 10% 3% Dealer consignment % (physical) 49% 47% Conversion rate (physical) 56.1% 56.8% Online volume as a % of total volume 41% 37% Online only volume 152,000 115,000 Online grounding dealer volume 80,000 72,000 Grounding dealer - % online only 53% 63% Total revenue per vehicle 583$ 574$ -$16 CAD currency Physical RPU 740$ 700$ -$20 CAD currency Online only RPU 113$ 106$ -$3 CAD currency * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization

IAA Q4 2015 Highlights 6 ($ in millions) IAA Q4 2015 Q4 2014 Highlights* Revenue $ 261.6 $ 229.6 +16% volume, -2% RPU (net of -$3.2M CAD currency) +$11.8M HBC Gross profit** 88.6$ 84.2$ +$1.3M HBC Gross profit % 33.9% 36.7% HBC -1.10%, Purchase contract vehicles -0.8% SG&A $ 25.5 $ 25.2 +$1.4M telecom and compensation and incentive compensation expense, +$1.1M acquired SG&A, -$1.5M professional fees, -$0.7M non-income based taxes EBITDA 65.6$ 59.9$ -$1.3M CAD currency Adjusted EBITDA 65.6$ 60.0$ -$1.1M CAD currency % Volume growth 16% 10% % Purchase contract vehicles 7% 7% +1% HBC volume in Q4 2015 * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization

AFC Q4 2015 Highlights 7 AFC Q4 2015 Q4 2014 Highlights* Revenue 68.2$ 65.9$ +9% LTUs, +4% in "Other service revenue", -5% revenue per LTU (net of -$0.7M CAD currency) Other service revenue 7.1$ 6.8$ Provision for credit losses (5.5)$ (2.7)$ Gross profit** 48.2$ 48.0$ Gross profit % 70.7% 72.8% SG&A 6.8$ 6.7$ EBITDA 41.4$ 41.3$ -$0.5M CAD currency Adjusted EBITDA 36.7$ 38.6$ -$0.4M CAD currency Loan transactions 408,247 373,916 % Volume growth 9% 10% Revenue per loan transaction unit (LTU)*** 150$ 158$ -$2 CAD currency Managed receivables 1,641.0$ 1,371.1$ Obligations collateralized by finance receivables 1,201.2$ 865.2$ * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization *** Excludes "Other service revenue" ($ in millions except for revenue per loan transaction)

ADESA Incremental Operating Profit Margin Analysis 8 Reported Impact of Acquisitions ADESA Excluding Acquisitions Q4 2015 Revenue $352.4 $14.8 $337.6 Operating Profit $52.9 $0.9 $52.0 Operating Profit % 15.0% 6.1% 15.4% Q4 2014 Revenue $310.5 Operating Profit $45.2 Operating Profit % 14.6% Q4 2015 Reported Growth Reported Revenue Growth $41.9 Reported Operating Profit Growth $7.7 Incremental Operating Margin 18.4% Q4 2015 Excluding Acquisitions Revenue Growth $27.1 Operating Profit Growth $6.8 Incremental Operating Margin 25.1%

9 2016 Capital Allocation Actions Completed ASR; Retired an Additional 800K Shares in January 2016 Increased Annual Dividend 7% to $1.16 Per Share Announced Intent to Acquire Brasher’s Auto Auctions Increased Revolving Credit Facility $300M to $550M

10 Brasher’s Acquisition Announced Intent to acquire Brasher’s Auto Auctions on Feb 17, 2016 8 locations in Western U.S. – Sacramento, Salt Lake City, Portland, Idaho, Northwest, Fresno, San Jose, Reno Purchase price - ~$283M; Asset Purchase 2015 volume ~190K units; strong mix of dealer consignment and commercial business 2015 Revenue ~$140M; Adjusted EBITDA ~$34M Subject to regulatory approvals and other customary closing conditions

Year-to-Date Slides

KAR YTD 2015 Highlights 12 KAR YTD 2015 YTD 2014 Highlights* Total operating revenues 2,639.6$ 2,364.5$ -$48.7M CAD currency, Acquistions +$65.0M Gross profit** 1,142.1$ 1,045.7$ SG&A $ 502.0 $ 471.4 +$9.7M ADESA compensation expense, +$9.6M acquired SG&A, +$4.9M ADESA incentive compensation expense, -$9.1M ADESA stock-based compensation expense, -$7.2M CAD currency EBITDA 644.1$ 547.5$ -$18.4M CAD currency Adjusted EBITDA 649.8$ 598.8$ -$18.1M CAD currency Net income 214.6$ 169.3$ -$9.2M CAD currency Adjusted net income 241.8$ 230.4$ -$9.2M CAD currency Net income per share - diluted 1.51$ 1.19$ -$0.06 per share CAD currency Adjusted net income per share 1.70$ 1.62$ -$0.06 per share CAD currency Operating adjusted net income per share 1.90$ 1.71$ -$0.06 per share CAD currency Weighted average diluted shares 142.3 141.8 Dividends declared per common share 1.08$ 1.02$ Effective tax rate 37.0% 36.1% Capital expenditures 134.7$ 101.0$ +$16M ADESA Chicago greenfield Cash flow from operating activities 475.0$ 431.3$ * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization

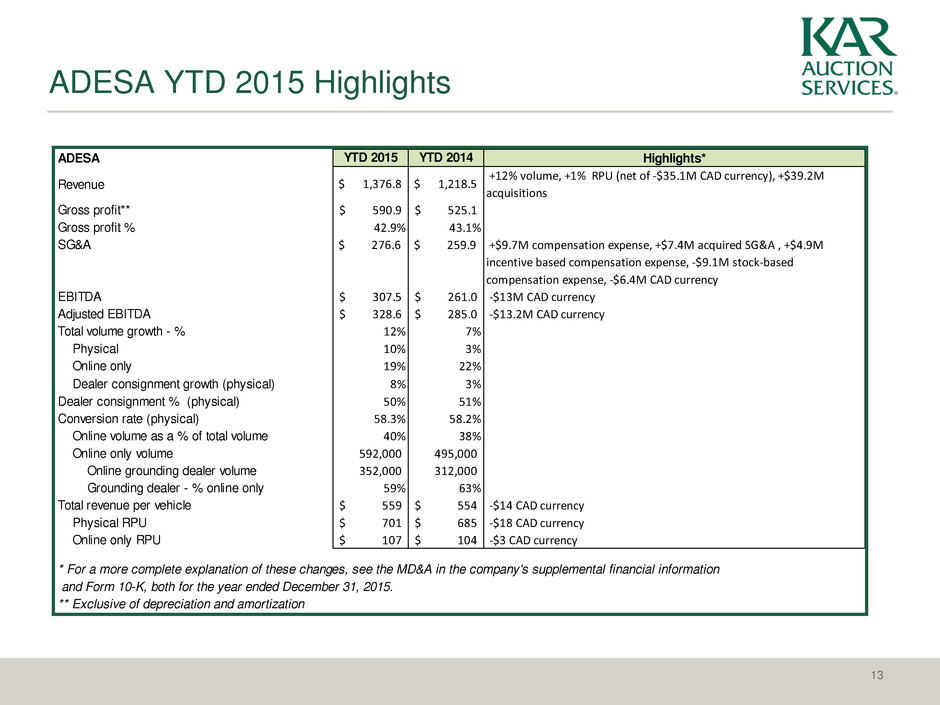

ADESA YTD 2015 Highlights 13 ADESA YTD 2015 YTD 2014 Highlights* Revenue $ 1,376.8 $ 1,218.5 +12% volume, +1% RPU (net of -$35.1M CAD currency), +$39.2M acquisitions Gross profit** 590.9$ 525.1$ Gross profit % 42.9% 43.1% SG&A $ 276.6 $ 259.9 +$9.7M compensation expense, +$7.4M acquired SG&A , +$4.9M incentive based compensation expense, -$9.1M stock-based compensation expense, -$6.4M CAD currency EBITDA 307.5$ 261.0$ -$13M CAD currency Adjusted EBITDA 328.6$ 285.0$ -$13.2M CAD currency Total volume growth - % 12% 7% Physical 10% 3% Online only 19% 22% Dealer consignment growth (physical) 8% 3% Dealer consignment % (physical) 50% 51% Conversion rate (physical) 58.3% 58.2% Online volume as a % of total volume 40% 38% Online only volume 592,000 495,000 Online grounding dealer volume 352,000 312,000 Grounding dealer - % online only 59% 63% Total revenue per vehicle 559$ 554$ -$14 CAD currency Physical RPU 701$ 685$ -$18 CAD currency Online only RPU 107$ 104$ -$3 CAD currency * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization

IAA YTD 2015 Highlights 14 ($ in millions) IAA YTD 2015 YTD 2014 Highlights* Revenue $ 994.4 $ 895.9 +14% volume, -2% RPU (net of -$11.2M CAD currency) +$25.8M HBC Gross profit** 360.8$ 340.2$ +$2.3M HBC Gross profit % 36.3% 38.0% HBC -0.7%, N.A. Purchase cars -0.6% SG&A $ 98.1 $ 98.8 -$5.1M stock-based compensation expense, non-income based taxes -$1.6M, +$3.6M telecom and other IT expenses, +$2.2M acquired SG&A, +$2.0M compensation expense EBITDA 263.7$ 242.2$ -$3.9M CAD currency Adjusted EBITDA 265.1$ 247.4$ -$3.7M CAD currency % Volume growth 14% 7% % Purchase contract vehicles 7% 6% +1% HBC volume * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization

AFC YTD 2015 Highlights 15 AFC YTD 2015 YTD 2014 Highlights* Revenue 268.4$ 250.1$ +11% LTUs, +9% in "Other service revenue", -3% revenue per LTU ( net of -$2.4M CAD currency) Other service revenue 27.9$ 25.5$ Provision for credit losses (16.0)$ (12.3)$ Gross profit** 190.4$ 180.4$ Gross profit % 70.9% 72.1% SG&A 27.8$ 28.8$ EBITDA 164.1$ 151.6$ -$1.5M CAD currency Adjusted EBITDA 147.3$ 143.5$ -$1.2M CAD currency Loan transactions 1,606,720 1,445,077 % Volume growth 11% 7% Revenue per loan transaction unit (LTU)*** 150$ 155$ -$1 CAD currency Managed receivables 1,641.0$ 1,371.1$ Obligations collateralized by finance receivables 1,201.2$ 865.2$ * For a more complete explanation of these changes, see the MD&A in the company's supplemental financial information and Form 10-K, both for the year ended December 31, 2015. ** Exclusive of depreciation and amortization *** Excludes "Other service revenue" ($ in millions except for revenue per loan transaction)

ADESA Incremental Operating Profit Margin Analysis 16 Reported Impact of Acquisitions ADESA Excluding Acquisitions 2015 Revenue 1,376.8$ 39.2$ 1,337.6$ Operating Profit 228.1$ 2.9$ 225.2$ Operating Profit % 16.6% 7.4% 16.8% 2014 Revenue 1,218.5$ Operating Profit 185.0$ Operating Profit % 15.2% 2015 Reported Growth Reported Revenue Growth 158.3$ Reported Operating Profit Growth 43.1$ Incremental Operating Margin 27.2% 2015 Excluding Acquisitions Revenue Growth 119.1$ Operating Profit Growth 40.2$ Incremental Operating Margin 33.8%

Acquired Amortization Expense 17 (in millions, except per share amounts) Q1 Q2 Q3 Q4 YTD 2015 Acquired amortization expense, pre-tax 21.1$ 21.8$ 22.4$ 22.3$ 87.5$ Acquired amortization expense, net of tax $ 12.9 $ 13.8 $ 14.3 $ 14.3 55.1$ Acquired amortization expense per share - diluted, net of tax $ 0.09 $ 0.10 $ 0.10 $ 0.10 $ 0.39 2014 Acquired amortization expense, pre-tax 21.3$ 21.3$ 21.3$ 21.3$ 85.3$ Acquired amortization expense, net of tax 14.5$ 13.4$ 13.3$ 13.8$ 54.5$ Acquir d amortization expense per share - diluted, net of tax $ 0.10 $ 0.09 $ 0.10 $ 0.10 $ 0.38

Appendix

Non-GAAP Financial Measures EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in the company's senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by the company’s creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the company’s performance. The revaluation of certain assets of the company, and resultant increase in depreciation and amortization expense which resulted from the 2007 merger, as well as stock-based compensation expense incurred in connection with service and exit options tied to the 2007 merger, have had a continuing effect on the company’s reported results. Non-GAAP measures of adjusted net income and adjusted net income per share, in the opinion of the company, provide comparability to other companies that may have not incurred these types of noncash expenses. In addition, net income and net income per share have been adjusted for certain other charges, as seen in the reconciliations that follow. Depreciation expense for property and equipment and amortization expense of capitalized internally developed software costs relate to ongoing capital expenditures; however, amortization expense associated with acquired intangible assets, such as customer relationships, software, tradenames and noncompete agreements are not representative of ongoing capital expenditures, but have a continuing effect on our reported results. Non-GAAP financial measures of operating adjusted net income and operating adjusted net income per share, in the opinion of the company, provide comparability to other companies that may not have incurred these types of non-cash expenses or that report a similar measure. In addition, net income and net income per share have been adjusted for certain other charges, as seen in the following reconciliation. EBITDA, Adjusted EBITDA, adjusted net income, adjusted net income per share, operating adjusted net income and operating adjusted net income per share have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies. 19

Q4 2015 Adjusted EBITDA Reconciliation 20 ($ in millions) Three Months ended December 31, 2015 ADESA IAA AFC Corporate Consolidated Net income (loss) $25.1 $23.3 $21.4 ($21.5) $48.3 Add back: Income taxes 13.9 11.1 13.4 (11.5) 26.9 Interest expense, net of interest income (0.3) – 6.9 17.2 23.8 Depreciation and amortization 22.4 21.7 7.6 4.3 56.0 Intercompany interest 12.1 9.5 (7.9) (13.7) – EBITDA $73.2 $65.6 $41.4 ($25.2) $155.0 Adjustments per the Credit Agreement 4.4 – (4.7) (0.2) (0.5) Adjusted EBITDA $77.6 $65.6 $36.7 ($25.4) $154.5 Revenue $352.4 $261.6 $68.2 – $682.2 Adjusted EBITDA % margin 22.0% 25.1% 53.8% 22.6%

Q4 2014 Adjusted EBITDA Reconciliation 21 ($ in millions) Three Months ended December 31, 2014 ADESA IAA AFC Corporate Consolidated Net income (loss) $23.9 $18.5 $19.9 ($12.0) $50.3 Add back: Income taxes 7.5 12.4 13.9 (6.4) 27.4 Interest expense, net of interest income 0.1 – 4.9 15.8 20.8 Depreciation and amortization 21.2 19.6 7.7 2.8 51.3 Intercompany interest 13.0 9.4 (5.1) (17.3) – EBITDA $65.7 $59.9 $41.3 ($17.1) $149.8 Adjustments per the Credit Agreement 3.2 0.1 (2.7) (1.9) (1.3) Adjusted EBITDA $68.9 $60.0 $38.6 ($19.0) $148.5 Revenue $310.5 $229.6 $65.9 – $606.0 Adjusted EBITDA % margin 22.2% 26.1% 58.6% 24.5%

2015 Adjusted EBITDA Reconciliation 22 ($ in millions) Year ended December 31, 2015 ADESA IAA AFC Corporate Consolidated Net income (loss) $109.2 $92.8 $83.2 ($70.6) $214.6 Add back: Income taxes 62.3 52.4 51.3 (40.1) 125.9 Interest expense, net of interest income 0.1 – 24.1 66.6 90.8 Depreciation and amortization 86.2 80.8 30.8 15.0 212.8 Intercompany interest 49.7 37.7 (25.3) (62.1) – EBITDA $307.5 $263.7 $164.1 ($91.2) $644.1 Adjustments per the Credit Agreement 21.1 1.4 (16.8) – 5.7 Adjusted EBITDA $328.6 $265.1 $147.3 ($91.2) $649.8 Revenue $1,376.8 $994.4 $268.4 – $2,639.6 Adjusted EBITDA % margin 23.9% 26.7% 54.9% 24.6%

2014 Adjusted EBITDA Reconciliation 23 ($ in millions) Year ended December 31, 2014 ADESA IAA AFC Corporate Consolidated Net income (loss) $86.4 $79.7 $76.6 ($73.4) $169.3 Add back: Income taxes 43.2 48.4 48.6 (44.5) 95.7 Interest expense, net of interest income 0.6 0.2 18.7 66.4 85.9 Depreciation and amortization 80.2 76.2 30.4 9.8 196.6 Intercompany interest 50.6 37.7 (22.7) (65.6) – EBITDA $261.0 $242.2 $151.6 ($107.3) $547.5 Adjustments per the Credit Agreement 24.0 5.2 (8.1) 30.2 51.3 Adjusted EBITDA $285.0 $247.4 $143.5 ($77.1) $598.8 Revenue $1,218.5 $895.9 $250.1 – $2,364.5 Adjusted EBITDA % margin 23.4% 27.6% 57.4% 25.3%

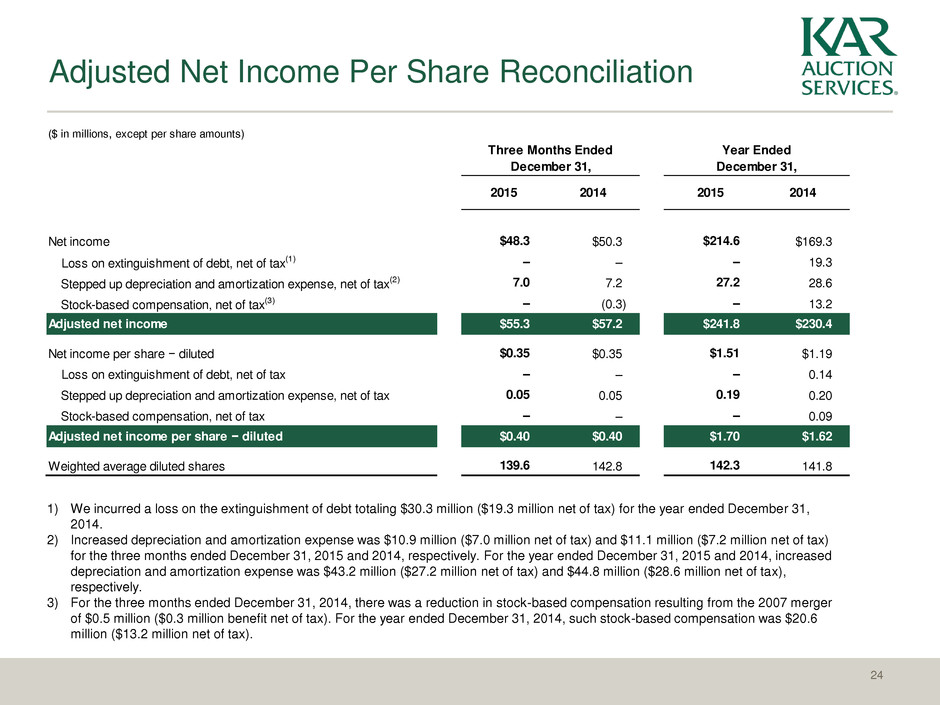

Adjusted Net Income Per Share Reconciliation 24 ($ in millions, except per share amounts) 2015 2014 2015 2014 Net income $48.3 $50.3 $214.6 $169.3 Loss on extinguishment of debt, net of tax(1) – – – 19.3 Stepped up depreciation and amortization expense, net of tax(2) 7.0 7.2 27.2 28.6 Stock-based compensation, net of tax(3) – (0.3) – 13.2 Adjusted net income $55.3 $57.2 $241.8 $230.4 Net income per share − diluted $0.35 $0.35 $1.51 $1.19 Loss on extinguishment of debt, net of tax – – – 0.14 Stepped up depreciation and amortization expense, net of tax 0.05 0.05 0.19 0.20 Stock-based compensation, net of tax – – – 0.09 Adjusted net income per share − diluted $0.40 $0.40 $1.70 $1.62 Weighted average diluted shares 139.6 142.8 142.3 141.8 Three Months Ended December 31, Year Ended December 31, 1) We incurred a loss on the extinguishment of debt totaling $30.3 million ($19.3 million net of tax) for the year ended December 31, 2014. 2) Increased depreciation and amortization expense was $10.9 million ($7.0 million net of tax) and $11.1 million ($7.2 million net of tax) for the three months ended December 31, 2015 and 2014, respectively. For the year ended December 31, 2015 and 2014, increased depreciation and amortization expense was $43.2 million ($27.2 million net of tax) and $44.8 million ($28.6 million net of tax), respectively. 3) For the three months ended December 31, 2014, there was a reduction in stock-based compensation resulting from the 2007 merger of $0.5 million ($0.3 million benefit net of tax). For the year ended December 31, 2014, such stock-based compensation was $20.6 million ($13.2 million net of tax).

Operating Adjusted Net Income Per Share Reconciliation 25 ($ in millions, except per share amounts) 2015 2014 2015 2014 Net income $48.3 $50.3 $214.6 $169.3 Acquired amortization expense, net of tax (1) 14.3 13.8 55.1 54.5 Loss on extinguishment of debt, net of tax (2) – – – 19.3 Operating adjusted net income $62.6 $64.1 $269.7 $243.1 Net income per share − diluted $0.35 $0.35 $1.51 $1.19 Acquired amortization expense, net of tax 0.10 0.10 0.39 0.38 Loss on extinguishment of debt, net of tax – – – 0.14 Operating adjusted net income per share − diluted $0.45 $0.45 $1.90 $1.71 Weighted average diluted shares 139.6 142.8 142.3 141.8 Three Months Ended December 31, Year Ended December 31, 1) Acquired amortization expense was $22.3 million ($14.3 million net of tax) and $21.3 million ($13.8 million net of tax) for the three months ended December 31, 2015 and 2014, respectively. For the year ended December 31, 2015 and 2014 acquired amortization expense was $87.5 million ($55.1 million net of tax) and $85.3 million ($54.5 million net of tax), respectively. 2) We incurred a loss on the extinguishment of debt totaling $30.3 million ($19.3 million net of tax) for the year ended December 31, 2014.