Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lipocine Inc. | v431917_8k.htm |

February 2016 Exhibit 99.1

Forward Looking Statements 2 This presentation contains forward - looking statements about Lipocine Inc. (the “Company”). These forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward - looking stat ements relate to the Company’s product candidates, clinical and regulatory processes and objectives, potential benefits of the Compa ny’ s product candidates, intellectual property and related matters, all of which involve known and unknown risks and uncertainties . Actual results may differ materially from the forward - looking statements discussed in this presentation . Accordingly, the Company cautions investors not to place undue reliance on the forward - looking statements contained in, or made in connection with, this presentation . Several factors may affect the initiation and completion of clinical trials, the potential advantages of the Company’s product candidates and the Company’s capital needs. Among other things, the projected commencement and completion of the Company’s clinical trials may be affected by difficulties or delays. In addition, the Company’s results ma y b e affected by its ability to manage its financial resources, difficulties or delays in developing manufacturing processes for its produc t c andidates, preclinical and toxicology testing and regulatory developments. Delays in clinical programs, whether caused by competitive developments, adverse events, patient enrollment rates, regulatory issues or other factors, could adversely affect the Compan y’s financial position and prospects. Prior clinical trial program designs and results are not necessarily predictive of future cli nical trial designs or results. If the Company’s product candidates do not meet safety or efficacy endpoints in clinical evaluations, th ey will not receive regulatory approval and the Company will not be able to market them. The Company may not be able to enter into any strategic partnership agreements. Operating expense and cash flow projections involve a high degree of uncertainty, including variances in future spending rates due to changes in corporate priorities, the timing and outcomes of clinical trials, compet iti ve developments and the impact on expenditures and available capital from licensing and strategic collaboration opportunities. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to significantly delay, scale ba ck or discontinue one or more of its drug development or discovery research programs. The Company is at an early stage of developm ent and may not ever have any products that generate significant revenue. The forward - looking statements contained in this presentation are further qualified by the detailed discussion of risks and uncertainties set forth in the documents filed by the Company w ith the Securities and Exchange Commission, all of which can be obtained on the Company’s website at www.lipocine.com or on the SEC website at www.sec.gov . The forward - looking statements contained in this document represent the Company’s estimates and assumptions only as of the date of this presentation and the Company undertakes no duty or obligation to update or revise publicly any forward - looking statements contained in this presentation as a result of new information, future events or changes in the Company’s expectations.

LPCN: Focused on Innovative Products for Men’s and Women’s Health 3 “Transformative“ Oral Testosterone Franchise First Oral Alternative for the Prevention of Pre - Term Birth PRODUCT (Indication) RESEARCH / PRECLINICAL PHASE 1 PHASE 2 PHASE 3 NDA UNDER REVIEW MEN'S HEALTH LPCN 1021 (Oral Testosterone Replacement Therapy ) LPCN 1111 (Next Generation Oral T) WOMEN'S HEALTH LPCN 1107 (Prevention of Preterm Birth)

Lipocine Investment Highlights ▪ Lipocine is well positioned to be a leader in Oral Testosterone – Targeting ~$2.0 Billion TRT US market – Differentiated products – LPCN 1021 has potential to be the first oral treatment option ▪ NDA PDUFA goal date of June 28, 2016 – LPCN 1111 QD option in Phase 2 as a “follow on” ▪ Orphan designated oral alternative for the prevention of preterm birth – Avoids painful injections of the only FDA approved intra - muscular drug – Multi - dose PK study demonstrated relevant HPC levels achieved that are amenable to dose adjustment while on therapy to optimize clinical outcomes 4

LPCN 1021 - First Oral TRT Option (PDUFA Goal Date of June 28, 2016) ▪ NDA Accepted in October 2015 – Targeting Class TRT label – No “black box” warning expected – No Advisory Committee m eeting planned ▪ Potential to be the first approved oral TRT option – Demonstrated efficacy in pivotal Phase 3 clinical study (“SOAR”) – Well tolerated in 52 week safety study – Consistent T levels not sensitive to meal fat content 5

Adherence to Current TRT Treatment Is Poor ▪ Median persistency on a TRT brand is 3 - 4 months (~100 days) MABI’s TRT Patient Metrics (Powered by Source Healthcare Analytics Patient Data). All trademarks acknowledged. 36.7% 23.4% 19.2% 17.1% 16.9% 10.9% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% M+1 M+2 M+3 M+4 M+5 M+6 M+7 M+8 M+9 M+10 M+11 M+12 Percentage of Patients Remaining “On Therapy” TRT Market: “On Therapy” Persistency Based on New - to - Market Cohorts (July 2013) Androderm AndroGel 1.62% Axiron Fortesta Injectables Testim 6

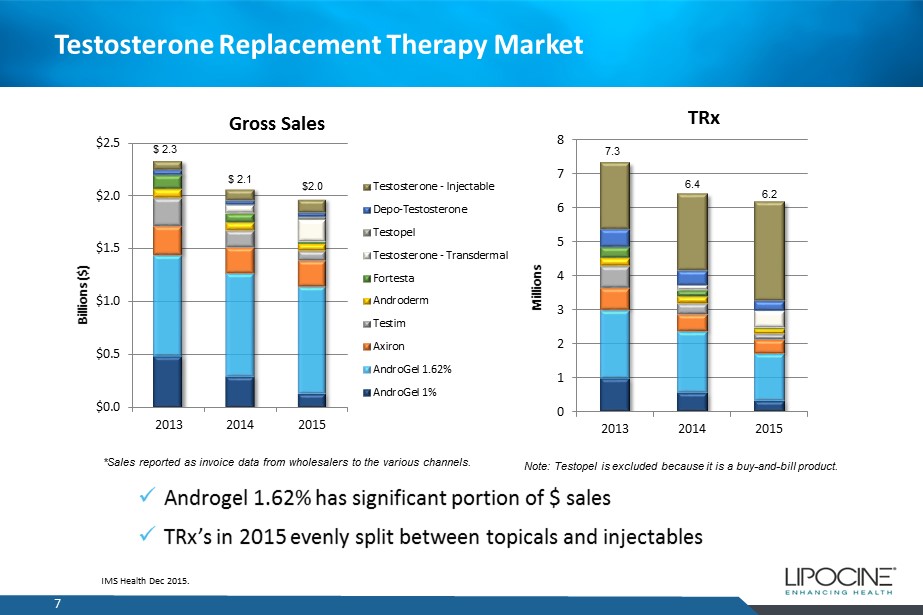

Testosterone Replacement Therapy Market 7 IMS Health Dec 2015. $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 2013 2014 2015 Billions ($) Gross Sales Testosterone - Injectable Depo-Testosterone Testopel Testosterone - Transdermal Fortesta Androderm Testim Axiron AndroGel 1.62% AndroGel 1% 0 1 2 3 4 5 6 7 8 2013 2014 2015 Millions TRx $ 2.3 $ 2.1 $2.0 *Sales reported as invoice data from wholesalers to the various channels. Note: Testopel is excluded because it is a buy - and - bill product. 7.3 6.4 6.2 x Androgel 1.62% has significant portion of $ sales x TRx’s in 2015 evenly split between topicals and injectables

TRT Monthly TRx Trend 8 x To date, minimal TRx impact of FDA TRT label change x 2015 – monthly TRx stable around 500,000/month 1 IMS Data - 100,000 200,000 300,000 400,000 500,000 600,000 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 TRT TRx's FDA Label Guidance

9 Issues with Current TRT Therapies Transfer potential to children and partner No freedom to use around pregnant loved ones Skin irritation potential Messy to apply and wait to dress Pulmonary embolism potential Pain from injection Needle phobia, needle fatigue Scarring/injection site reactions Risk of infection Not flexible for dose reversals Topicals Injectables / Implants

LPCN 1021 - First Oral TRT Option Challenges of Oral T Product ▪ Native testosterone has poor oral bioavailability with a very short half life (~30 min) – Impractical daily doses would be required to obtain effective levels – Inconsistent and unpredictable performance – Methyl testosterone – Liver toxicity – Unsafe for chronic use LPCN 1021 Advantage ▪ Novel product primarily directing Testosterone Undecanoate (TU) into the lymph – Maintains effective T blood levels in eugonadal range when dosed twice daily – Consistent and predictable performance – By - passes liver in first pass metabolism 10

Over 80% of Patient Respondents Are Likely To Ask About Oral T 14.1 % 19.2 % 38.4 % 32.3 % 47.5 % 48.5 % 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Rx < 6Mo n=99 Current Rx n=412 Percent of Respondents Likelihood to Ask Prescriber About Oral LPCN 1021 Rate 1 - 3 Rate 4 - 7 Rate 8 - 10 Q30. How likely are you to ask your doctor about this new medication when you learn it’s available and can be prescribed, where “1” equals not at all likely and “10” equals very likely? 11

12 LPCN 1021 (First Oral TRT Option): Primary Efficacy Results in Phase 3 Measure FDA Targets Efficacy Population* 1,2 Full Analysis Set #1 Number of subjects 151 193 % subjects with C avg w ithin normal range ≥75% 87.4% 87.0% 95 % CI lower bound ≥ 65% 81.7% 82.0% x LPCN 1021 met both the primary endpoint targets x C avg and overall variability comparable or better than marketed products Parameter Mean (CV) Mean (CV) C avg ( ng / dL ) 446 (38%) 471 (41%) * Subjects randomized into the study with at least one PK profile and no significant protocol deviations # Subjects randomized into the study with at least one post - baseline efficacy variable response 1 Missing data imputed by LOCF 2 3.3% of subjects were non - responders ( C avg <300 ng/ dL at highest (300 mg) dose)

LPCN 1021 (First Oral TRT Option): Secondary Endpoints in Phase 3 ▪ Proportion of subjects achieving maximum serum total T concentrations (Cmax) in predefined Cmax range 13 Measure FDA Threshold Efficacy Population Number of subjects 151 C max < 1500 ng/ dL ≥ 85 % 82.8% 1800 ≤ C max ≤ 2500 ng/ dL ≤ 5 % 4.6% C max > 2500 ng/ dL None 2.0% x Results generally consistent with approved products

14 LPCN 1021 (First Oral TRT Option): 52 Week Safety Results ▪ LPCN 1021 was well tolerated during 52 weeks of dosing ▪ No reported cardiac, hepatic or drug related serious adverse events (SAEs) ▪ Overall adverse event (AE) profile for LPCN 1021 was comparable to the active control, Androgel ® 1.62%, including GI disorders ▪ None of the cardiac AEs occurred in greater than 1% of the subjects in the LPCN 1021 arm and none were classified as severe ▪ All observed adverse drug reactions (ADRs) were classified as mild or moderate in severity and no serious ADRs occurred during the 52 - week treatment period

LPCN 1021 (First Oral TRT Option): Attributes of Special Interest Attributes LPCN 1021 Efficacy Robust to Sensitivity Analysis Consistent Inter - day / Intra - day Performance Yes Meal Fat E ffect T levels not sensitive to fat content Safety No cardiac, hepatic, or drug related SAEs DHT Levels Comparable to active control Blood Pressure No change from baseline Dose Mean maintenance dose comparable to starting dose 15

Potential for Meaningful Oral T Sales in U.S. 16 Market Share Sales Potential ( in M) Assumptions: • $400/Rx current TRT Branded pricing; • 6 Million Annual US TRT TRx (excludes ex - US, expansion due to improved Rx retention rates due to oral introduction and physician “buy and bill” sales) For Illustrative Purposes Only

LPCN 1111 (Next Generation Oral TRT Option): “Once Daily” ▪ Novel prodrug of testosterone for oral delivery through proprietary drug delivery technology ▪ Once daily is expected to sustain and improve market share or oral T franchise ▪ Once daily feasibility established – Positive Phase 2a study results in hypogonadal men ▪ Single daily oral dose provides T levels in the eugonadal range ▪ No subject exceeded peak T levels of 1500 ng/ dL ▪ Phase 2b PK dose finding study – o ngoing 17

LPCN 1111 (Next Generation Oral TRT Option): Study Design 18 ▪ Open label, two - period, multiple dose PK study ▪ 36 hypogonal males ▪ Three dose levels of LPCN 1111 in Period 1 (500mg, 750mg, and 1000mg) ▪ Two dose levels of LPCN 1111 in Period 2 (250mg QD or 1250mg QD, 500mg BID) ▪ Subjects (36) randomized to 3 treatment groups of 12 subjects each in Period 1 and receive treatment for 14 days ▪ Subjects (24) randomized to 2 treatment groups of 12 subjects each in Period 2 and receive treatment for 14 days

LPCN 1111 Phase 2a Study - Responder Analysis At Day 28 x Once daily dosing feasibility established 19 Measure 550mg QD 770mg QD Typical FDA targets for approval of TRT C avg w ithin normal range 67% 88% ≥ 75% C max < 1500 ng / dL 100% 100% ≥ 85% 1800 ≤ C max ≤ 2500 ng / dL 0% 0% ≤ 5% C max > 2500 ng / dL 0% 0% 0%

Preterm Birth (PTB) Represents a Significant Unmet Medical Need ▪ 12% of all US pregnancies 2 result in PTB (< 37 weeks) - a leading cause of neonatal mortality and morbidity 3 ▪ ~10x more first year medical costs are for PTB infants than for full term infants 4 ▪ ≥ $26 billion economic impact: 4 $1 billion market opportunity 5 20 1 Pediatric Research (2006) 60, 775 – 776 2 CDC (2010) 3 J . Maternal - Fetal and Neonatal Medicine, Dec. 2006, 19(12), 773 – 782 4 Institute of Medicine of the National Academies. Jul.2006 5 AMAG Pharmaceuticals presentation 09/29/2014 One preterm infant per minute in the U.S. 1

Preterm Birth Ranking – Worldwide 1 21 1 : Blencowe H, Cousens S, Oestergaard M, Chou D, Moller AB, Narwal R, Adler A, Garcia CV, Rohde S, Say L, Lawn JE. National, regional and worldwide estimates of preterm birth. The Lancet, June 2012. 9;379(9832):2162 - 72. Estimates from 2010.

PreTerm Birth Related Costs in US ▪ PTB occurs in 11 % of all births (14.9 million in 2010) worldwide 1 ▪ PTB occurs in 11.7% 2 (~460,000/ 4 millions) US pregnancies in 2011 ▪ PTB related time and costs in intensive care is a major women health issue 3 22 Lost Household and Market Productivity $5.7 Billion Special Education Services $1.1 Billion Medical Care Services $16.9 Billion Children’s Early Intervention Services $0.6 Billion Maternal Delivery Costs $1.9 Billion ~$51,600 Per Preterm Infant 1: Blencowe H, Cousens S, Oestergaard M, Chou D, Moller AB, Narwal R, Adler A, Garcia CV, Rohde S, Say L, Lawn JE. National, regional and worldwide estimates of preterm birth. The Lancet, June 2012. 9;379(9832):2162 - 72. Estimates from 2010. 2: Martin et al., National Vital Statistics Reports, U.S. Department of Health and Human Services. Vol. 62, No. 1, Jun 2013. 3: Behrman et al. in: Behrman RE, Butler AS, eds. Preterm Birth: Causes, Consequences, and Prevention. Washington, DC: The National Academies Press; 2006:329 - 354 .

LPCN 1107 (First Oral PTB Candidate): “Addresses Unmet Need” 23 ▪ Potential to be the first oral standard - of care therapy – Elimination of 18 - 22 injections ▪ Orphan drug designation – A major contribution to patient care ▪ Oral feasibility established – Successful Phase 1 studies in healthy non - pregnant women and pregnant women ▪ Development status – Multi - dose PK dose finding study – Complete – Next step: Request End of Phase 2 Meeting - 2Q 2016

LPCN 1107 (First Oral PTB Candidate): Single and Multi - dose Study Design 24 ▪ Open label, four - period, four - treatment, single and multiple dose PK study ▪ Three dose levels of LPCN 1107 (400mg BID, 600mg BID, and 800mg BID) ▪ Injectable HPC (Makena®) dose ▪ 12 healthy pregnant women (average age of 27 years) with gestational age of approximately 16 to 19 weeks ▪ Subjects received three dose levels of LPCN 1107 in a randomized, crossover manner during first three periods followed by 5 weekly injections of HPC during the fourth period

LPCN 1107 (First Oral PTB Candidate): Single and Multi - dose Study Results 25 ▪ Relevant hydroxyprogesterone caproate levels achieved following oral administration – Average steady state HPC levels (Cavg0 - 24) were comparable or higher for all three LPCN 1107 doses than for injectable HPC – Previous literature study of the injectable HPC reported that lowest preterm births were seen when median HPC concentrations exceeded 6.4 ng/mL 1 ▪ With all three LPCN 1107 doses tested, HPC exposure (C avg 0 - 24) did not fall below 6.4 ng/ml in all the study subjects ▪ Amenable to dose adjustment while on therapy – HPC levels as a function of daily dose were linear for the three LPCN 1107 doses – Steady state exposure was achieved for all three LPCN 1107 doses within seven days ▪ Well - tolerated with no serious adverse events or adverse drug reactions 1 Caritis SN, Venkataramanan R, Thom E, et al. Relationship between 17 - alpha hydroxyprogesterone caproate concentration and spontaneous preterm birth. Am J Obstet Gynecol 2014;210(2):128.

Several Near Term Value Drivers 26 Event Expected Timing LPCN 1107: Request End of Phase 2 Meeting 2Q16 LPCN 1111: Top - line Results from Phase 2b Study 2Q16 LPCN 1021: FDA PDUFA Date June 28, 2016 LPCN 1111: End of Phase 2 Meeting 2H16 LPCN 1021: File NDS in Canada 2H16

27 Lipocine is a Compelling Value Proposition Stock Exchange NASDAQ Capital Markets Ticker Symbol LPCN Closing Stock Price (1/31/16) $9.06/share Market Capitalization (1/31/16) $164.9 million Fully Diluted Shares Outstanding (9/30/15) 19,975,030 Cash Balance (9/30/15) $47.8 million Debt None

Lipocine Investment Highlights ▪ Lipocine is well positioned to be a leader in Oral Testosterone – Targeting ~$2.0 Billion TRT US market – Differentiated products – LPCN 1021 has potential to be the first oral treatment option ▪ NDA PDUFA goal date of June 28, 2016 – LPCN 1111 QD option in Phase 2 as a “follow on” ▪ Orphan designated oral alternative for the prevention of preterm birth – Avoids painful injections of the only FDA approved intra - muscular drug – Multi - dose PK study demonstrated relevant HPC levels achieved that are amenable to dose adjustment while on therapy to optimize clinical outcomes 28