Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CRYOLIFE INC | c199-20160216x8k.htm |

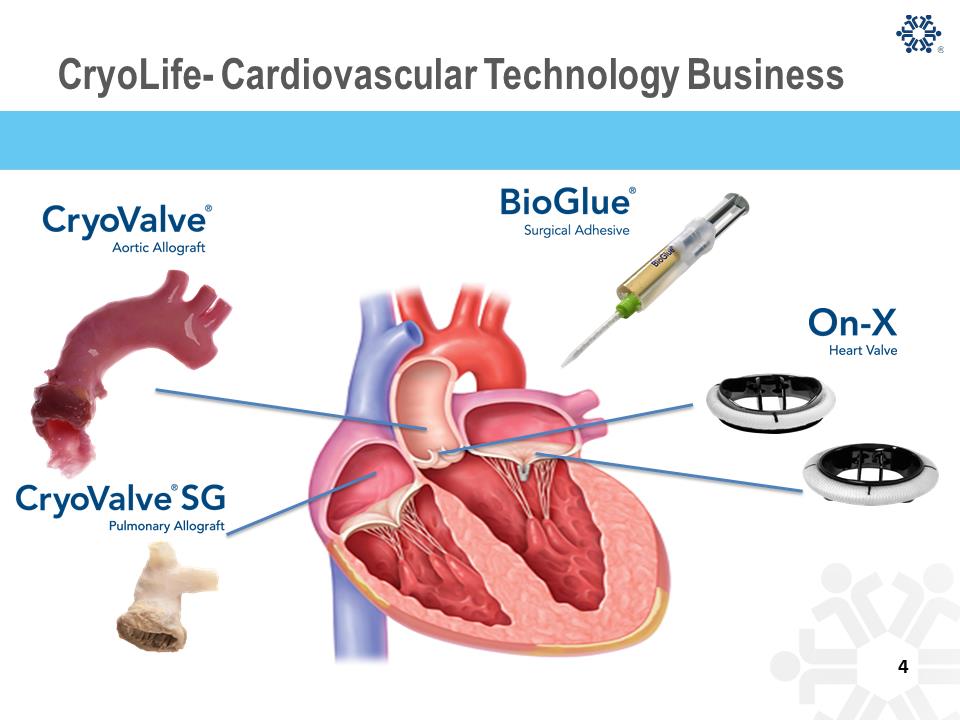

Forward Looking Statement Statements made in this presentation that look forward in time or that express management's beliefs, expectations, or hopes are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the views of management at the time such statements are made. These statements include those regarding CryoLife’s ability to become a leader in providing unique and differentiated technologies and solutions for patients with structural heart disease that will improve clinical outcomes as well as reduce overall cost to the healthcare system; the ability of our product portfolio to drive growth; the ability of the On-X acquisition to accelerate growth and expand gross margins; the expected growth of the market for our aortic heart valves due to demographics and device adoption; our expectations that our 2016 revenue and gross margins for BioGlue sales in France will improve from 2014 as a result of our move to a direct sales model in France; our expectation that there will be additional upside for our product sales in France as we leverage direct sales of our full product portfolio in France; our ability to expand our sales of BioGlue in Japan as a result of receiving in 2015 an expanded indication for BioGlue for use in thoracic aneurysm, Bentall & LVAD procedures; our expectations regarding our ability to execute on our clinical trial for BioGlue in China and the timeline for that clinical trial; our expectations regarding the ability of the On-X transaction to enhance our growth profile, increase opportunities for cross selling, drive margin expansion, provide CryoLife with a new addressable market opportunity of $220MM, generate highly attractive margins, facilitate increased adoption of On-X portfolio penetration, enhance and leverage our existing direct sales organization, and strengthen our strategic focus on aortic and mitral valve repair and replacement surgery; the ability of the INR indication for the On-X valve of 1.5 to 2.0, to be a significant differentiator, distinct competitive advantage and catalyst for us to achieve market leadership in the mechanical heart valve market; our belief that compelling clinical data regarding the On-X valve supports future growth; our belief regarding the ability to increase physician familiarity with the On-X heart valve and increase the percent of hospitals stocking the On-X heart valve; our belief in our ability to increase revenues through differenti

Forward Looking Statement Statements made in this presentation that look forward in time or that express management's beliefs, expectations, or hopes are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the views of management at the time such statements are made. These statements include those regarding CryoLife’s ability to become a leader in providing unique and differentiated technologies and solutions for patients with structural heart disease that will improve clinical outcomes as well as reduce overall cost to the healthcare system; the ability of our product portfolio to drive growth; the ability of the On-X acquisition to accelerate growth and expand gross margins; the expected growth of the market for our aortic heart valves due to demographics and device adoption; our expectations that our 2016 revenue and gross margins for BioGlue sales in France will improve from 2014 as a result of our move to a direct sales model in France; our expectation that there will be additional upside for our product sales in France as we leverage direct sales of our full product portfolio in France; our ability to expand our sales of BioGlue in Japan as a result of receiving in 2015 an expanded indication for BioGlue for use in thoracic aneurysm, Bentall & LVAD procedures; our expectations regarding our ability to execute on our clinical trial for BioGlue in China and the timeline for that clinical trial; our expectations regarding the ability of the On-X transaction to enhance our growth profile, increase opportunities for cross selling, drive margin expansion, provide CryoLife with a new addressable market opportunity of $220MM, generate highly attractive margins, facilitate increased adoption of On-X portfolio penetration, enhance and leverage our existing direct sales organization, and strengthen our strategic focus on aortic and mitral valve repair and replacement surgery; the ability of the INR indication for the On-X valve of 1.5 to 2.0, to be a significant differentiator, distinct competitive advantage and catalyst for us to achieve market leadership in the mechanical heart valve market; our belief that compelling clinical data regarding the On-X valve supports future growth; our belief regarding the ability to increase physician familiarity with the On-X heart valve and increase the percent of hospitals stocking the On-X heart valve; our belief in our ability to increase revenues through differenti

ated products such as PhotoFix; our expectations regarding our ability to execute on the PerClot clinical trial and our belief that we can obtain PMA approval for PerClot in the US by 2019; the anticipated benefits for our business development program, including double digit CAGR in adjusted non-GAAP earnings from 2016 – 2020; and our beliefs regarding our expectations for financial performance in 2016. These forward-looking statements are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. These risks and uncertainties include the risk factors detailed in our Securities and Exchange Commission filings, including our Form 10-K for the year ended December 31, 2014 and our subsequent filings with the SEC, including our Form 10-K for year ended December 31, 2015. CryoLife does not undertake to update its forward-looking statements.

ated products such as PhotoFix; our expectations regarding our ability to execute on the PerClot clinical trial and our belief that we can obtain PMA approval for PerClot in the US by 2019; the anticipated benefits for our business development program, including double digit CAGR in adjusted non-GAAP earnings from 2016 – 2020; and our beliefs regarding our expectations for financial performance in 2016. These forward-looking statements are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. These risks and uncertainties include the risk factors detailed in our Securities and Exchange Commission filings, including our Form 10-K for the year ended December 31, 2014 and our subsequent filings with the SEC, including our Form 10-K for year ended December 31, 2015. CryoLife does not undertake to update its forward-looking statements.

CryoLife Vision Slide Become a leader in providing unique and differentiated technologies and solutions for patients with structural heart disease that will improve clinical outcomes as well as reduce the overall cost to the healthcare system

CryoLife Vision Slide Become a leader in providing unique and differentiated technologies and solutions for patients with structural heart disease that will improve clinical outcomes as well as reduce the overall cost to the healthcare system

Investment Rationale Established Product Portfolio Driving Profitable Growth On-X Acquisition Accelerates Growth and Margin Expansion Highly Experienced Direct Sales Organization Active Business Development Program Proven Leadership

Investment Rationale Established Product Portfolio Driving Profitable Growth On-X Acquisition Accelerates Growth and Margin Expansion Highly Experienced Direct Sales Organization Active Business Development Program Proven Leadership

Recent Additions to Leadership Team PAT MACKIN, Chairman, President & Chief Executive Officer 20 + Years Experience Previous Companies: Medtronic, Genzyme, Deknatel/Snowden-Pencer Education: B.S. United States Military Academy at West Point and M.B.A. Kellogg Graduate School of Management at Northwestern University JEAN HOLLOWAY, Senior Vice President, General Counsel & Corporate Secretary 30 + Years Experience Previous Companies: C.R Bard, Medtronic, Boston Scientific, Guidant Corporation Education: J.D./M.B.A. (cum laude) from the University of Chicago, and two undergraduate degrees from Yale University BILL MATTHEWS, Senior Vice President, Operations, Quality and Regulatory 30 +Years Experience Previous Companies: BioDevice Solutions, Fresenius Medical Care, Cardinal Health’s Viasys Healthcare, Beiersdorf AG Education: Bachelor of Science in Chemistry from St. Peter’s University and Business Administration programs from Rutgers University and Fairleigh Dickson University JOHN DAVIS, Senior Vice President, Global Sales & Marketing 25 + Years Experience Previous Companies: CorMatrix Cardiovascular, St. Jude, Medtronic Education: Bachelor of Arts, English from Western Carolina University

Recent Additions to Leadership Team PAT MACKIN, Chairman, President & Chief Executive Officer 20 + Years Experience Previous Companies: Medtronic, Genzyme, Deknatel/Snowden-Pencer Education: B.S. United States Military Academy at West Point and M.B.A. Kellogg Graduate School of Management at Northwestern University JEAN HOLLOWAY, Senior Vice President, General Counsel & Corporate Secretary 30 + Years Experience Previous Companies: C.R Bard, Medtronic, Boston Scientific, Guidant Corporation Education: J.D./M.B.A. (cum laude) from the University of Chicago, and two undergraduate degrees from Yale University BILL MATTHEWS, Senior Vice President, Operations, Quality and Regulatory 30 +Years Experience Previous Companies: BioDevice Solutions, Fresenius Medical Care, Cardinal Health’s Viasys Healthcare, Beiersdorf AG Education: Bachelor of Science in Chemistry from St. Peter’s University and Business Administration programs from Rutgers University and Fairleigh Dickson University JOHN DAVIS, Senior Vice President, Global Sales & Marketing 25 + Years Experience Previous Companies: CorMatrix Cardiovascular, St. Jude, Medtronic Education: Bachelor of Arts, English from Western Carolina University

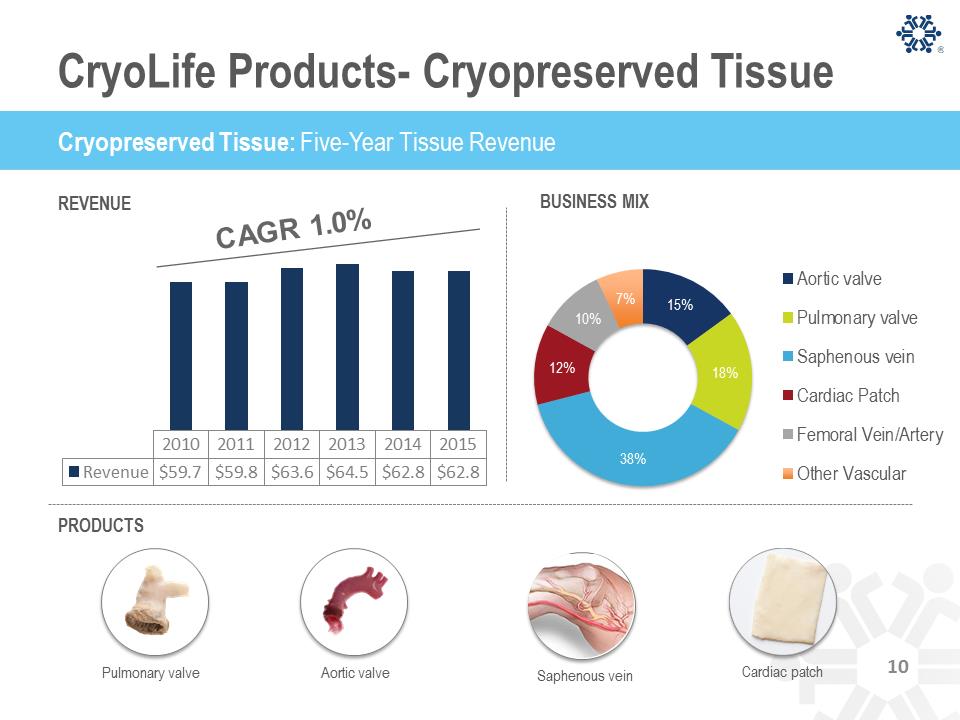

CryoLife Products- Cryopreserved Tissue 15% 18% 38% 12% 10% 7% BUSINESS MIX Aortic valve Pulmonary valve Saphenous vein Cardiac Patch Femoral Vein/Artery Other Vascular Cryopreserved Tissue: Five-Year Tissue Revenue Pulmonary valve Aortic valve Saphenous vein Picture of Cardiac Patch Cardiac patch REVENUE PRODUCTS 2010 2011 2012 2013 2014 2015 Revenue $59.7 $59.8 $63.6 $64.5 $62.8 $62.8 Cryopreserved Tissue: Five-Year Tissue Revenue 10

CryoLife Products- Cryopreserved Tissue 15% 18% 38% 12% 10% 7% BUSINESS MIX Aortic valve Pulmonary valve Saphenous vein Cardiac Patch Femoral Vein/Artery Other Vascular Cryopreserved Tissue: Five-Year Tissue Revenue Pulmonary valve Aortic valve Saphenous vein Picture of Cardiac Patch Cardiac patch REVENUE PRODUCTS 2010 2011 2012 2013 2014 2015 Revenue $59.7 $59.8 $63.6 $64.5 $62.8 $62.8 Cryopreserved Tissue: Five-Year Tissue Revenue 10

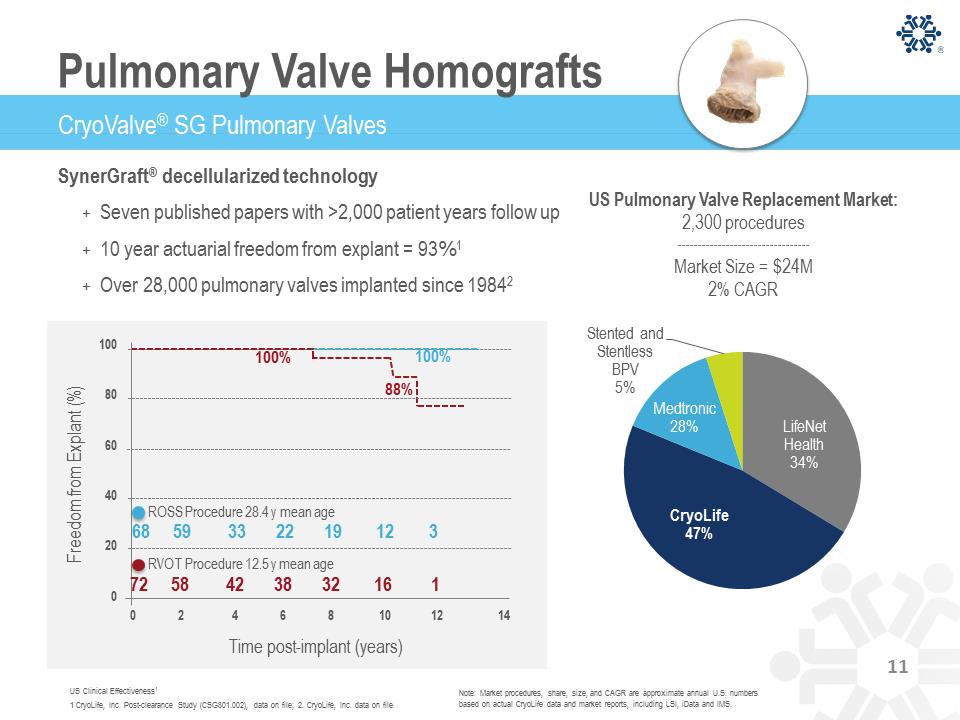

Note: Market procedures, share, size, and CAGR are approximate annual U.S. numbers based on actual CryoLife data and market reports, including LSI, iData and IMS. CryoValve® SG Pulmonary Valves Pulmonary Valve Homografts SynerGraft® decellularized technology + Seven published papers with >2,000 patient years follow up + 10 year actuarial freedom from explant = 93%1 + Over 28,000 pulmonary valves implanted since 19842 US Clinical Effectiveness1 1 CryoLife, Inc. Post-clearance Study (CSG801.002), data on file; 2. CryoLife, Inc. data on file LifeNet Health 34% CryoLife 47% Medtronic 28% Stented and Stentless BPV 5% US Pulmonary Valve Replacement Market: 2,300 procedures Market Size = $24M 2% CAGR 88% 100% 100 80 60 40 20 0 0 2 4 6 8 10 12 14 68 59 33 22 19 12 3 100% F r eedom f r om E x plant ( % ) Time post-implant (years) RVOT Procedure 12.5 y mean age ROSS Procedure 28.4 y mean age 72 58 42 38 32 16 1 11

Note: Market procedures, share, size, and CAGR are approximate annual U.S. numbers based on actual CryoLife data and market reports, including LSI, iData and IMS. CryoValve® SG Pulmonary Valves Pulmonary Valve Homografts SynerGraft® decellularized technology + Seven published papers with >2,000 patient years follow up + 10 year actuarial freedom from explant = 93%1 + Over 28,000 pulmonary valves implanted since 19842 US Clinical Effectiveness1 1 CryoLife, Inc. Post-clearance Study (CSG801.002), data on file; 2. CryoLife, Inc. data on file LifeNet Health 34% CryoLife 47% Medtronic 28% Stented and Stentless BPV 5% US Pulmonary Valve Replacement Market: 2,300 procedures Market Size = $24M 2% CAGR 88% 100% 100 80 60 40 20 0 0 2 4 6 8 10 12 14 68 59 33 22 19 12 3 100% F r eedom f r om E x plant ( % ) Time post-implant (years) RVOT Procedure 12.5 y mean age ROSS Procedure 28.4 y mean age 72 58 42 38 32 16 1 11

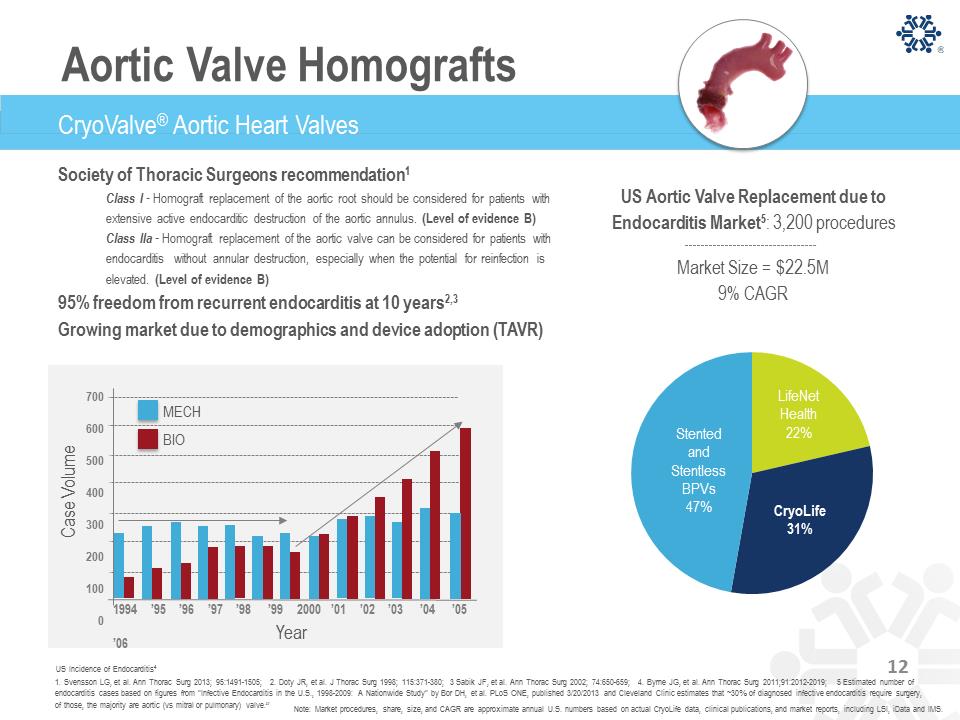

Society of Thoracic Surgeons recommendation1 Class I - Homograft replacement of the aortic root should be considered for patients with extensive active endocarditic destruction of the aortic annulus. (Level of evidence B) Class IIa - Homograft replacement of the aortic valve can be considered for patients with endocarditis without annular destruction, especially when the potential for reinfection is elevated. (Level of evidence B) 95% freedom from recurrent endocarditis at 10 years2,3 Growing market due to demographics and device adoption (TAVR) LifeNet Health 22% CryoLife 31% Stented and Stentless BPVs 47% 1. Svensson LG, et al. Ann Thorac Surg 2013; 95:1491-1505; 2. Doty JR, et al. J Thorac Surg 1998; 115:371-380; 3 Sabik JF, et al. Ann Thorac Surg 2002; 74:650-659; 4. Byrne JG, et al. Ann Thorac Surg 2011;91:2012-2019; 5 Estimated number of endocarditis cases based on figures from "Infective Endocarditis in the U.S., 1998-2009: A Nationwide Study" by Bor DH, et al. PLoS ONE, published 3/20/2013 and Cleveland Clinic estimates that ~30% of diagnosed infective endocarditis require surgery, of those, the majority are aortic (vs mitral or pulmonary) valve.” US Incidence of Endocarditis4 US Aortic Valve Replacement due to Endocarditis Market5: 3,200 procedures Market Size = $22.5M 9% CAGR Note: Market procedures, share, size, and CAGR are approximate annual U.S. numbers based on actual CryoLife data, clinical publications, and market reports, including LSI, iData and IMS. CryoValve® Aortic Heart Valves 1994 ’95 ’96 ’97 ’98 ’99 2000 ’01 ’02 ’03 ’04 ’05 ’06 700 600 500 400 300 200 100 0 C as e V olum e Year BIO

Society of Thoracic Surgeons recommendation1 Class I - Homograft replacement of the aortic root should be considered for patients with extensive active endocarditic destruction of the aortic annulus. (Level of evidence B) Class IIa - Homograft replacement of the aortic valve can be considered for patients with endocarditis without annular destruction, especially when the potential for reinfection is elevated. (Level of evidence B) 95% freedom from recurrent endocarditis at 10 years2,3 Growing market due to demographics and device adoption (TAVR) LifeNet Health 22% CryoLife 31% Stented and Stentless BPVs 47% 1. Svensson LG, et al. Ann Thorac Surg 2013; 95:1491-1505; 2. Doty JR, et al. J Thorac Surg 1998; 115:371-380; 3 Sabik JF, et al. Ann Thorac Surg 2002; 74:650-659; 4. Byrne JG, et al. Ann Thorac Surg 2011;91:2012-2019; 5 Estimated number of endocarditis cases based on figures from "Infective Endocarditis in the U.S., 1998-2009: A Nationwide Study" by Bor DH, et al. PLoS ONE, published 3/20/2013 and Cleveland Clinic estimates that ~30% of diagnosed infective endocarditis require surgery, of those, the majority are aortic (vs mitral or pulmonary) valve.” US Incidence of Endocarditis4 US Aortic Valve Replacement due to Endocarditis Market5: 3,200 procedures Market Size = $22.5M 9% CAGR Note: Market procedures, share, size, and CAGR are approximate annual U.S. numbers based on actual CryoLife data, clinical publications, and market reports, including LSI, iData and IMS. CryoValve® Aortic Heart Valves 1994 ’95 ’96 ’97 ’98 ’99 2000 ’01 ’02 ’03 ’04 ’05 ’06 700 600 500 400 300 200 100 0 C as e V olum e Year BIO

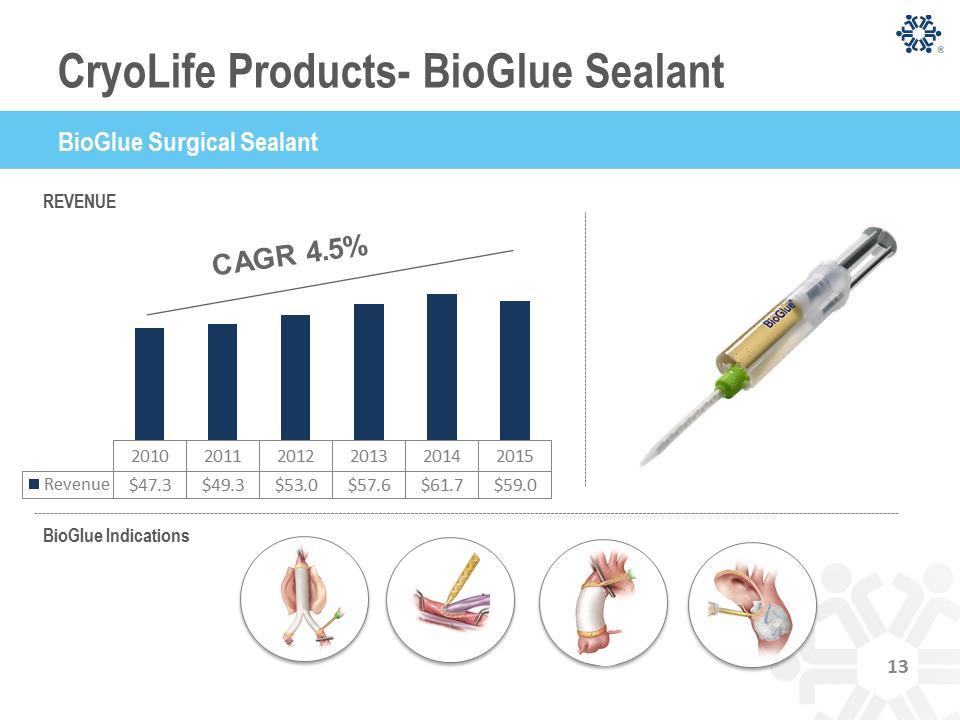

REVENUE BioGlue Indications 2010 2011 2012 2013 2014 2015 Revenue $47.3 $49.3 $53.0 $57.6 $61.7 $59.0 13

REVENUE BioGlue Indications 2010 2011 2012 2013 2014 2015 Revenue $47.3 $49.3 $53.0 $57.6 $61.7 $59.0 13

Global Expansion- Direct in France • No revenue from France January-September 2015 as distributor sold off inventory • June 22nd announced agreement with French distributor to take business direct on October 1st, 2015 • 2014 revenue of BioGlue and PerClot was $3 million • Expect 2016 revenue and gross margin will improve from 2014 as we sell directly to hospital customers • Additional upside as we leverage direct sales of the full product portfolio Direct in France

Global Expansion- Direct in France • No revenue from France January-September 2015 as distributor sold off inventory • June 22nd announced agreement with French distributor to take business direct on October 1st, 2015 • 2014 revenue of BioGlue and PerClot was $3 million • Expect 2016 revenue and gross margin will improve from 2014 as we sell directly to hospital customers • Additional upside as we leverage direct sales of the full product portfolio Direct in France

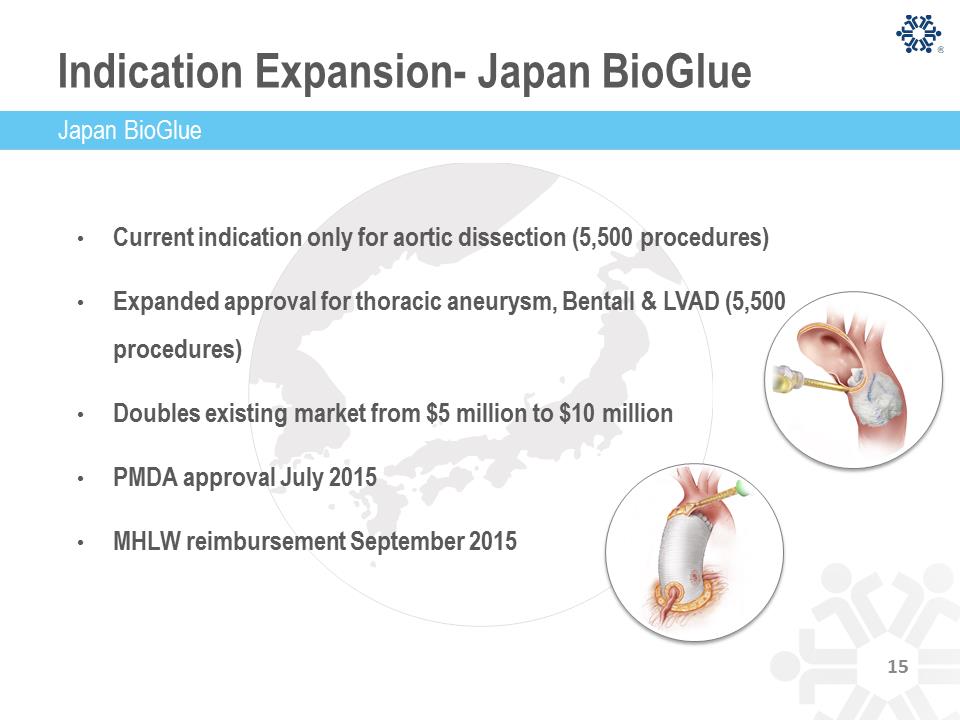

Indication Expansion- Japan BioGlue • Current indication only for aortic dissection (5,500 procedures) • Expanded approval for thoracic aneurysm, Bentall & LVAD (5,500 procedures) • Doubles existing market from $5 million to $10 million • PMDA approval July 2015 • MHLW reimbursement September 2015

Indication Expansion- Japan BioGlue • Current indication only for aortic dissection (5,500 procedures) • Expanded approval for thoracic aneurysm, Bentall & LVAD (5,500 procedures) • Doubles existing market from $5 million to $10 million • PMDA approval July 2015 • MHLW reimbursement September 2015

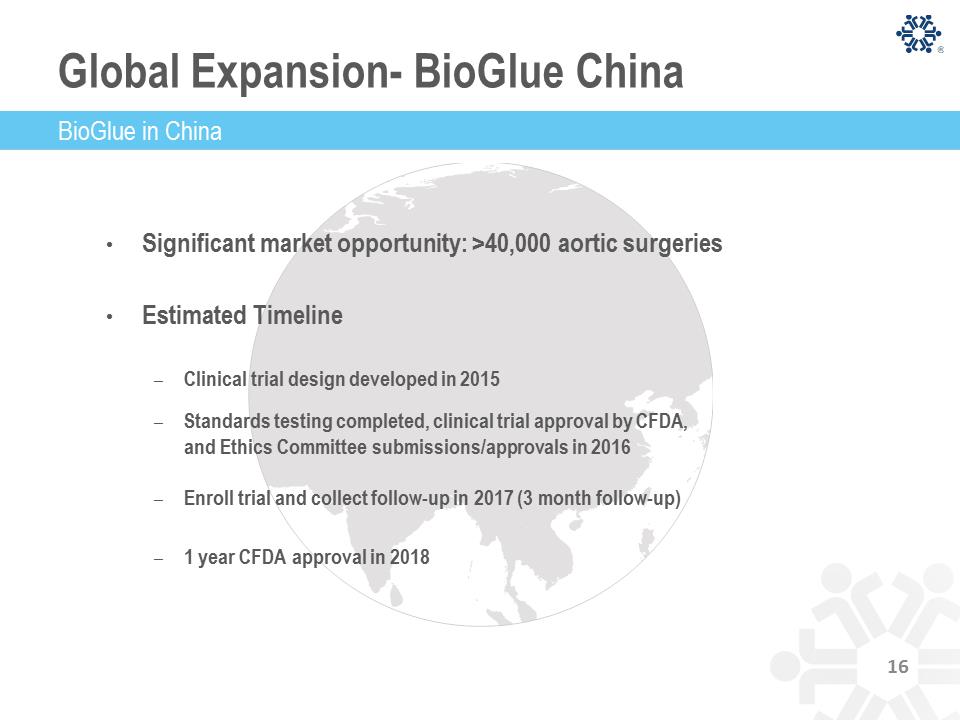

Global Expansion- BioGlue China • Significant market opportunity: >40,000 aortic surgeries • Estimated Timeline – Clinical trial design developed in 2015 – Standards testing completed, clinical trial approval by CFDA, and Ethics Committee submissions/approvals in 2016 – Enroll trial and collect follow-up in 2017 (3 month follow-up) – 1 year CFDA approval in 2018

Global Expansion- BioGlue China • Significant market opportunity: >40,000 aortic surgeries • Estimated Timeline – Clinical trial design developed in 2015 – Standards testing completed, clinical trial approval by CFDA, and Ethics Committee submissions/approvals in 2016 – Enroll trial and collect follow-up in 2017 (3 month follow-up) – 1 year CFDA approval in 2018

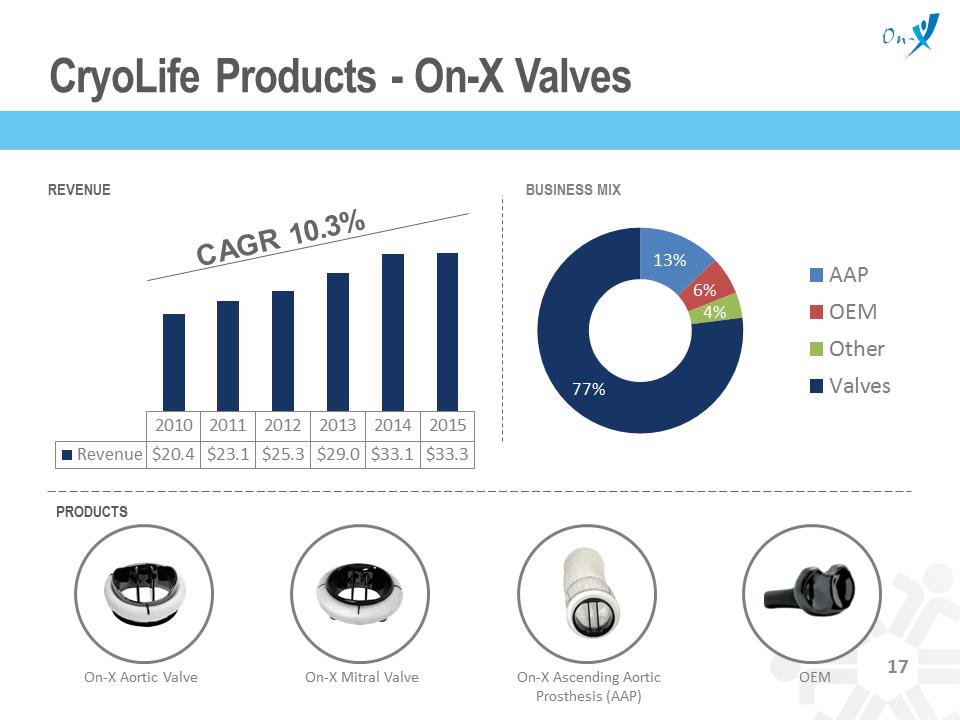

On-X Mitral Valve 2010 2011 2012 2013 2014 2015 Revenue $20.4 $23.1 $25.3 $29.0 $33.1 $33.3 CryoLife Products - On-X Valves REVENUE BUSINESS MIX PRODUCTS 13% 6% 4% 77% AAP OEM Other Valves On-X Aortic Valve On-X Ascending Aortic Prosthesis (AAP) OEM 17

On-X Mitral Valve 2010 2011 2012 2013 2014 2015 Revenue $20.4 $23.1 $25.3 $29.0 $33.1 $33.3 CryoLife Products - On-X Valves REVENUE BUSINESS MIX PRODUCTS 13% 6% 4% 77% AAP OEM Other Valves On-X Aortic Valve On-X Ascending Aortic Prosthesis (AAP) OEM 17

Transformational acquisition that enhances our growth profile, increases opportunities for cross-selling and drives margin expansion » Provides CryoLife with new addressable market opportunity of ~$220MM » Acquired products generate highly attractive margins » Facilitates increased adoption of On-X portfolio penetration » Enhances and leverages existing CryoLife direct sales organization » Strengthens our strategic focus on aortic and mitral valve repair and replacement surgery The combination of On-X best-in-class mechanical valve technology supported by extensive clinical data are key growth drivers On-X has the only FDA approved mechanical aortic valve labeled for an INR of just 1.5 to 2.0, substantially reducing a patient’s bleeding risk - a significant differentiator and distinct competitive advantage

Transformational acquisition that enhances our growth profile, increases opportunities for cross-selling and drives margin expansion » Provides CryoLife with new addressable market opportunity of ~$220MM » Acquired products generate highly attractive margins » Facilitates increased adoption of On-X portfolio penetration » Enhances and leverages existing CryoLife direct sales organization » Strengthens our strategic focus on aortic and mitral valve repair and replacement surgery The combination of On-X best-in-class mechanical valve technology supported by extensive clinical data are key growth drivers On-X has the only FDA approved mechanical aortic valve labeled for an INR of just 1.5 to 2.0, substantially reducing a patient’s bleeding risk - a significant differentiator and distinct competitive advantage

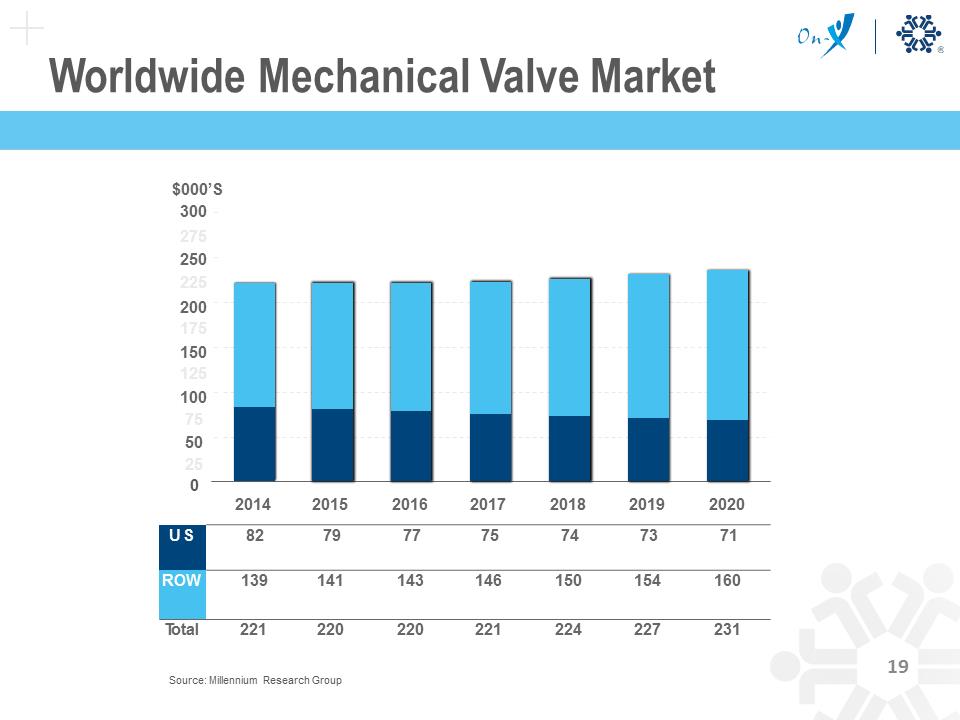

Worldwide Mechanical Valve Market $000’S 300 275 250 225 200 175 150 125 100 75 50 25 0 2014 2015 2016 2017 2018 2019 2020 US 82 79 77 75 74 73 71 ROW 139 141 143 146 150 154 160 Total 221 220 220 221 224 227 231 Source: Millennium Research Group

Worldwide Mechanical Valve Market $000’S 300 275 250 225 200 175 150 125 100 75 50 25 0 2014 2015 2016 2017 2018 2019 2020 US 82 79 77 75 74 73 71 ROW 139 141 143 146 150 154 160 Total 221 220 220 221 224 227 231 Source: Millennium Research Group

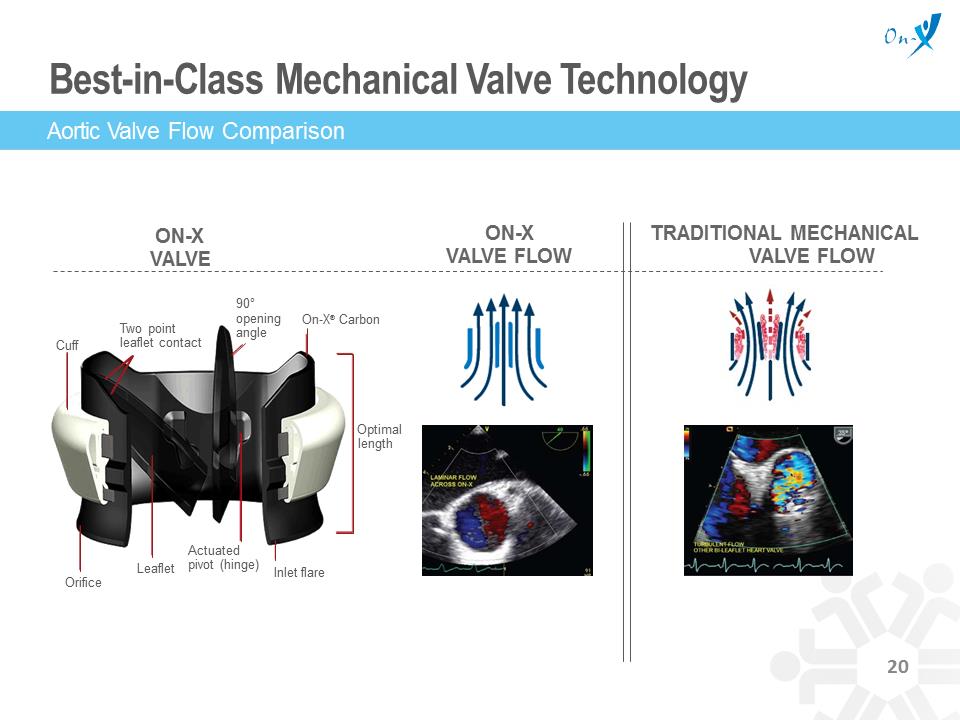

Best-in-Class Mechanical Valve Technology TRADITIONAL MECHANICAL VALVE FLOW ON-X VALVE FLOW ON-X VALVE Aortic Valve Flow Comparison Cuff Two point leaflet contact 90° opening angle On-X® Carbon Optimal length Actuated pivot (hinge) Leaflet Orifice Inlet flare

Best-in-Class Mechanical Valve Technology TRADITIONAL MECHANICAL VALVE FLOW ON-X VALVE FLOW ON-X VALVE Aortic Valve Flow Comparison Cuff Two point leaflet contact 90° opening angle On-X® Carbon Optimal length Actuated pivot (hinge) Leaflet Orifice Inlet flare

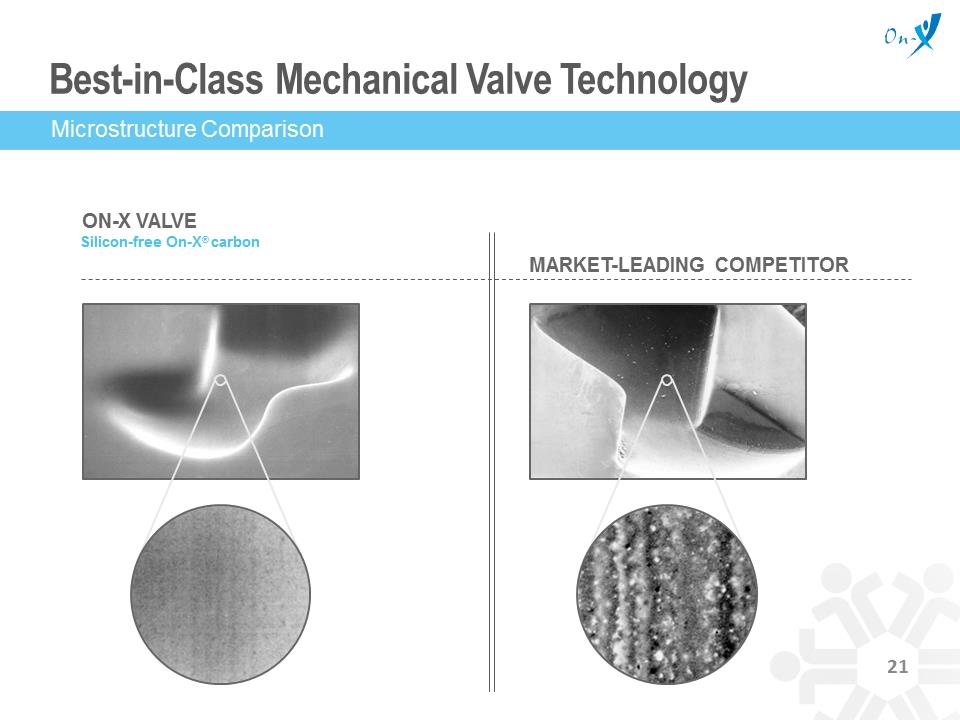

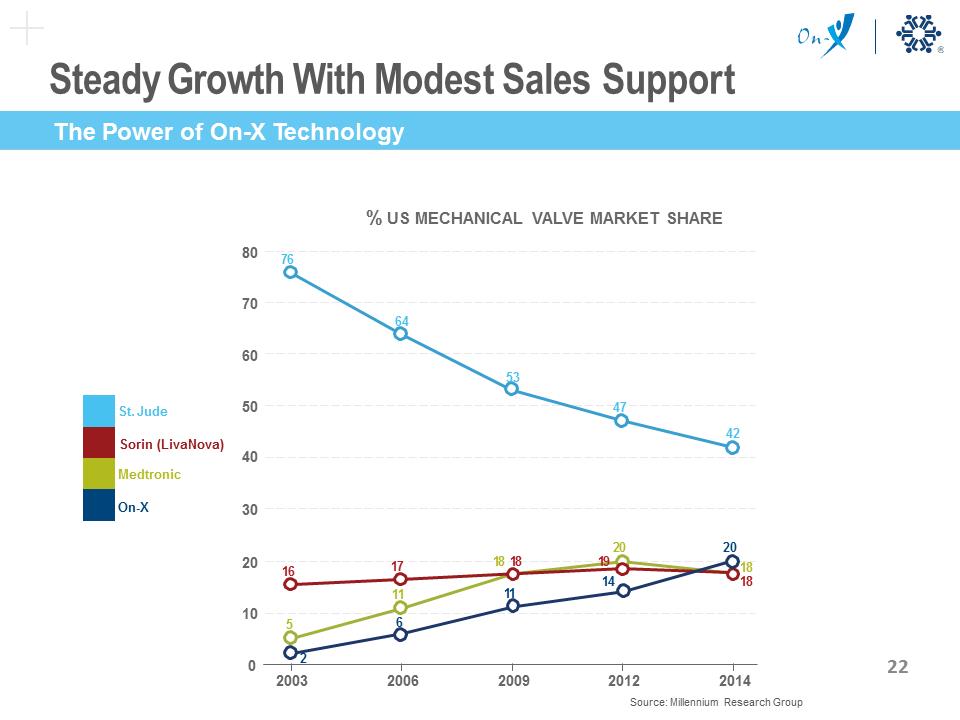

Best-in-Class Mechanical Valve Technology ON-X VALVE Silicon-free On-X® carbon MARKET-LEADING COMPETITOR Microstructure Comparison Steady Growth With Modest Sales Support % US MECHANICAL VALVE MARKET SHARE St. Jude Sorin (LivaNova) Medtronic On-X 5 2 6 11 18 18 11 20 20 19 18 18 14 16 76 70 64 60 53 47 42 40 2003 2006 2009 2012 2014 80 50 30 20 10 0 17 Source: Millennium Research Group The Power of On-X Technology

Best-in-Class Mechanical Valve Technology ON-X VALVE Silicon-free On-X® carbon MARKET-LEADING COMPETITOR Microstructure Comparison Steady Growth With Modest Sales Support % US MECHANICAL VALVE MARKET SHARE St. Jude Sorin (LivaNova) Medtronic On-X 5 2 6 11 18 18 11 20 20 19 18 18 14 16 76 70 64 60 53 47 42 40 2003 2006 2009 2012 2014 80 50 30 20 10 0 17 Source: Millennium Research Group The Power of On-X Technology

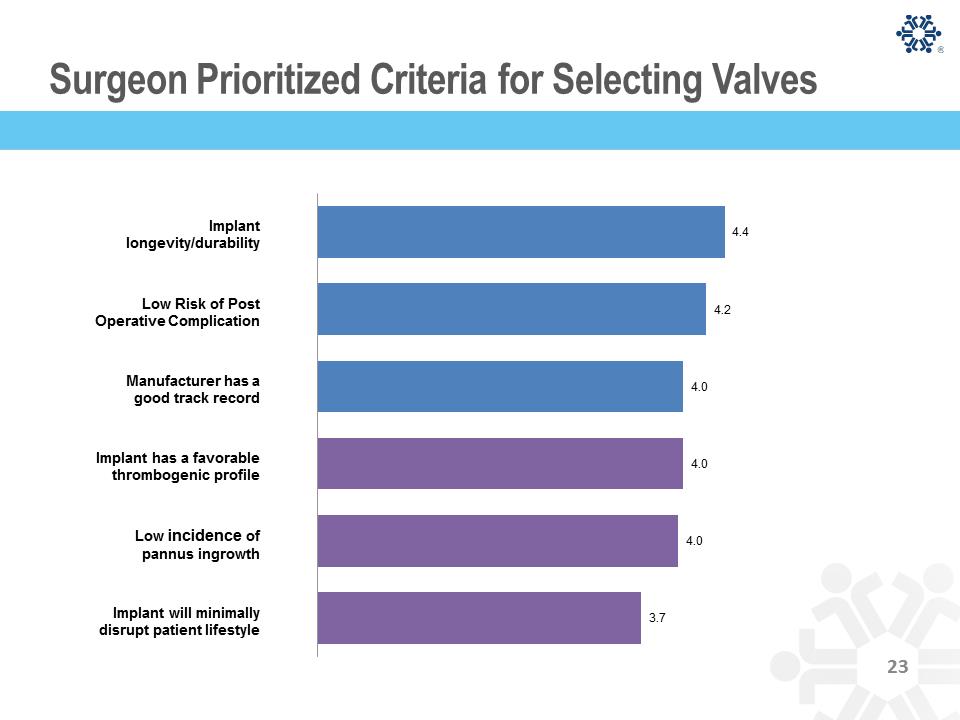

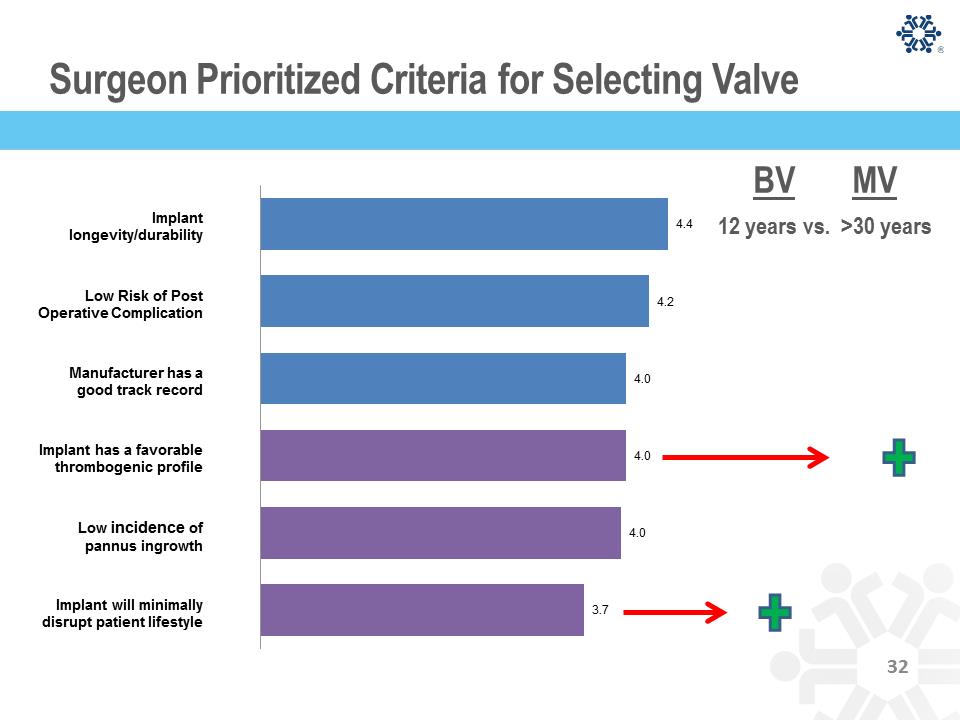

Surgeon Prioritized Criteria for Selecting Valves 4.4 4.2 4.0 4.0 4.0 3.7 Implant longevity/durability Low Risk of Post Operative Complication Manufacturer has a good track record Implant has a favorable thrombogenic profile Low incidence of pannus ingrowth Implant will minimally disrupt patient lifestyle

Surgeon Prioritized Criteria for Selecting Valves 4.4 4.2 4.0 4.0 4.0 3.7 Implant longevity/durability Low Risk of Post Operative Complication Manufacturer has a good track record Implant has a favorable thrombogenic profile Low incidence of pannus ingrowth Implant will minimally disrupt patient lifestyle

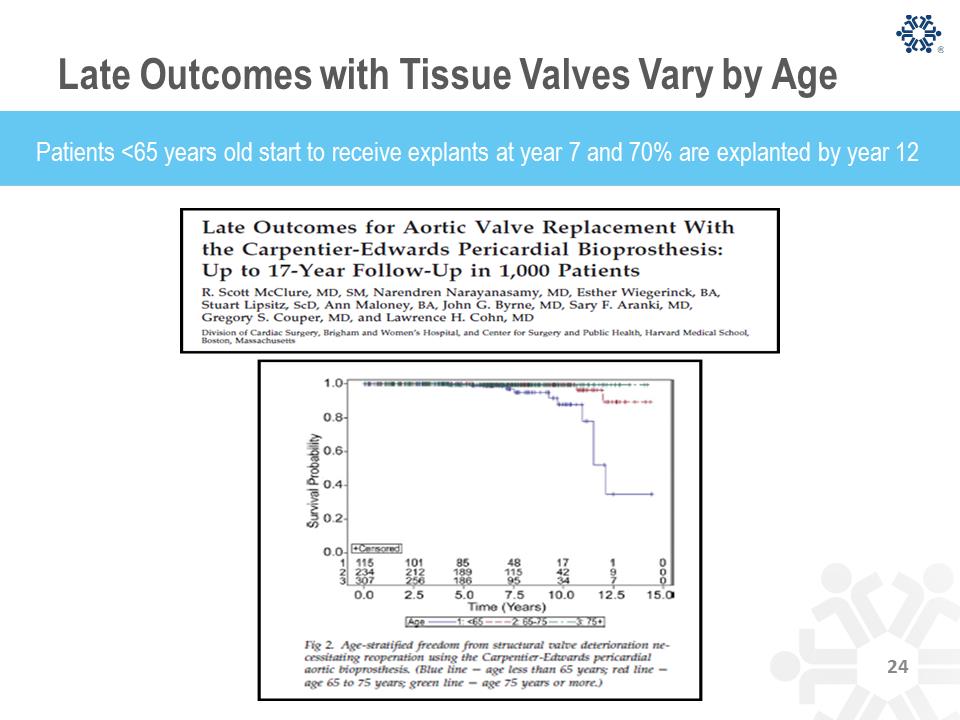

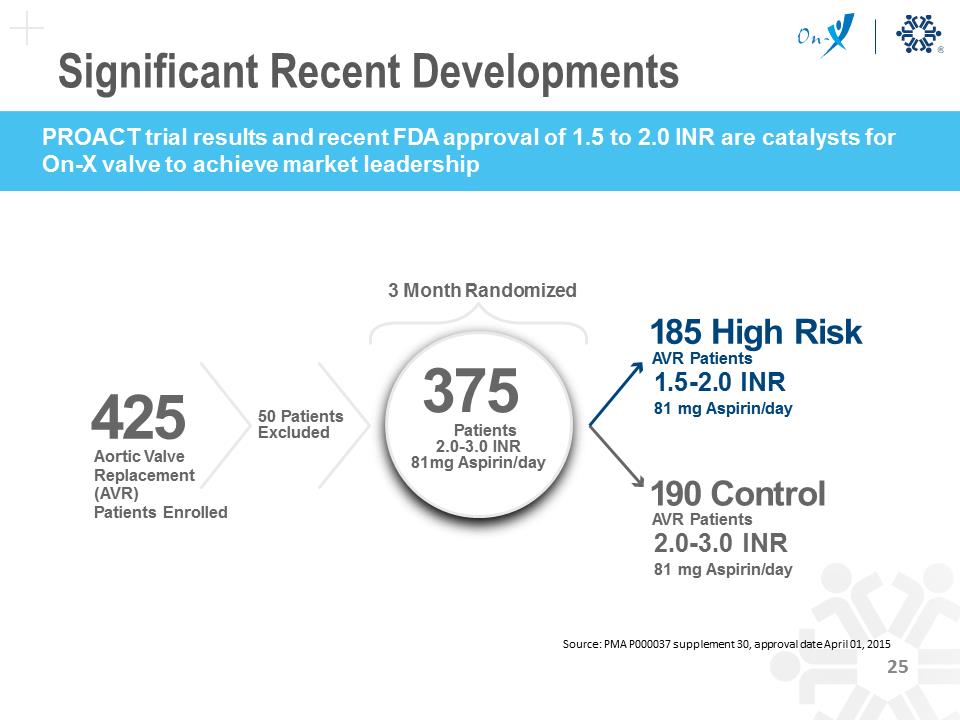

Late Outcomes with Tissue Valves Vary by Age Patients <65 years old start to receive explants at year 7 and 70% are explanted by year 12 Significant Recent Developments PROACT trial results and recent FDA approval of 1.5 to 2.0 INR are catalysts for On-X valve to achieve market leadership

Late Outcomes with Tissue Valves Vary by Age Patients <65 years old start to receive explants at year 7 and 70% are explanted by year 12 Significant Recent Developments PROACT trial results and recent FDA approval of 1.5 to 2.0 INR are catalysts for On-X valve to achieve market leadership

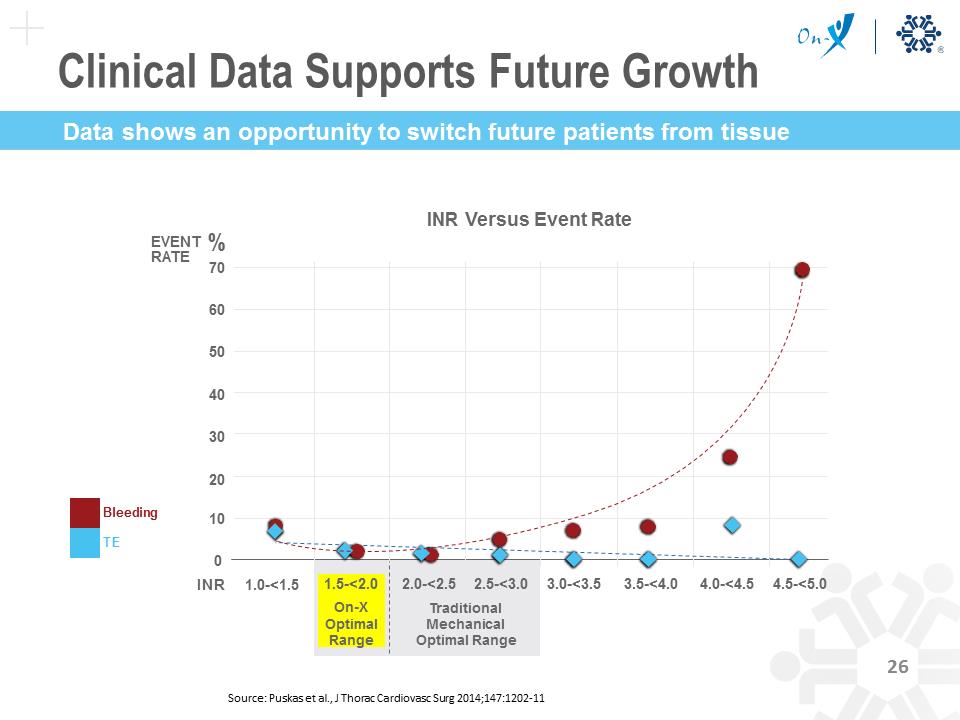

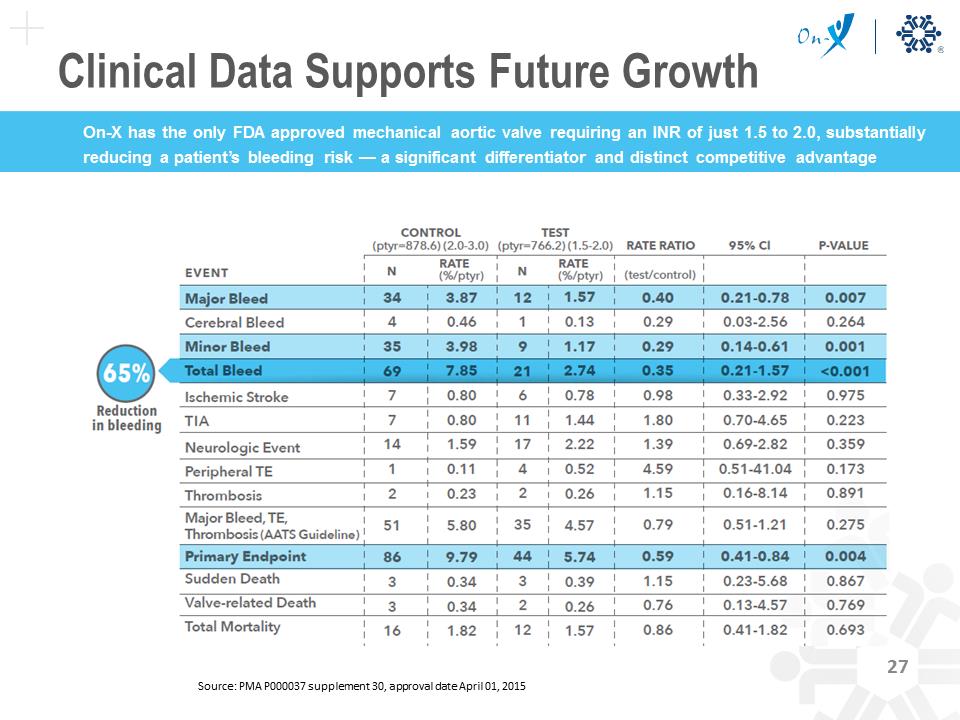

425 Aortic Valve Replacement (AVR) Patients Enrolled 375 Patients 2.0-3.0 INR 81mg Aspirin/day 185 High Risk AVR Patients 1.5-2.0 INR 81 mg Aspirin/day 190 Control AVR Patients 2.0-3.0 INR 81 mg Aspirin/day 50 Patients Excluded 3 Month Randomized Source: PMA P000037 supplement 30, approval date April 01, 2015 Clinical Data Supports Future Growth Bleeding TE 70 60 50 40 30 20 10 0 INR 1.0-<1.5 1.5-<2.0 On-X Optimal Range 2.0-<2.5 2.5-<3.0 Traditional Mechanical Optimal Range 3.0-<3.5 3.5-<4.0 4.0-<4.5 4.5-<5.0 EVENT % RATE to mechanical INR Versus Event Rate Source: Puskas et al., J Thorac Cardiovasc Surg 2014;147:1202-11 Data shows an opportunity to switch future patients from tissue Clinical Data Supports Future Growth On-X has the only FDA approved mechanical aortic valve requiring an INR of just 1.5 to 2.0, substantially reducing a patient’s bleeding risk — a significant differentiator and distinct competitive advantage Source: PMA P000037 supplement 30, approval date April 01, 2015

425 Aortic Valve Replacement (AVR) Patients Enrolled 375 Patients 2.0-3.0 INR 81mg Aspirin/day 185 High Risk AVR Patients 1.5-2.0 INR 81 mg Aspirin/day 190 Control AVR Patients 2.0-3.0 INR 81 mg Aspirin/day 50 Patients Excluded 3 Month Randomized Source: PMA P000037 supplement 30, approval date April 01, 2015 Clinical Data Supports Future Growth Bleeding TE 70 60 50 40 30 20 10 0 INR 1.0-<1.5 1.5-<2.0 On-X Optimal Range 2.0-<2.5 2.5-<3.0 Traditional Mechanical Optimal Range 3.0-<3.5 3.5-<4.0 4.0-<4.5 4.5-<5.0 EVENT % RATE to mechanical INR Versus Event Rate Source: Puskas et al., J Thorac Cardiovasc Surg 2014;147:1202-11 Data shows an opportunity to switch future patients from tissue Clinical Data Supports Future Growth On-X has the only FDA approved mechanical aortic valve requiring an INR of just 1.5 to 2.0, substantially reducing a patient’s bleeding risk — a significant differentiator and distinct competitive advantage Source: PMA P000037 supplement 30, approval date April 01, 2015

Surgeon Question Do you think the PROACT results showing 65% reduction in bleeding are compelling enough to get surgeons to change from their current mechanical valve to On-X? 83% Responded Yes N=35

Surgeon Question Do you think the PROACT results showing 65% reduction in bleeding are compelling enough to get surgeons to change from their current mechanical valve to On-X? 83% Responded Yes N=35

Surgeon Question Do you think this is a real is a real issue? 54% Answered Yes N=39 The FDA said the findings, in studies published online Monday by the New England Journal of Medicine, “have raised important questions about bioprosthetic aortic valves.” Evidence suggests minuscule clots on the valves “may cause restricted motion,” the agency said in a safety advisory. - WSJ October 5, 2015

Surgeon Question Do you think this is a real is a real issue? 54% Answered Yes N=39 The FDA said the findings, in studies published online Monday by the New England Journal of Medicine, “have raised important questions about bioprosthetic aortic valves.” Evidence suggests minuscule clots on the valves “may cause restricted motion,” the agency said in a safety advisory. - WSJ October 5, 2015

Surgeon Prioritized Criteria for Selecting Valve 4.4 4.2 4.0 4.0 4.0 3.7 12 years vs. >30 years BV MV Implant longevity/durability Low Risk of Post Operative Complication Manufacturer has a good track record Implant has a favorable thrombogenic profile Low incidence of pannus ingrowth Implant will minimally disrupt patient lifestyle

Surgeon Prioritized Criteria for Selecting Valve 4.4 4.2 4.0 4.0 4.0 3.7 12 years vs. >30 years BV MV Implant longevity/durability Low Risk of Post Operative Complication Manufacturer has a good track record Implant has a favorable thrombogenic profile Low incidence of pannus ingrowth Implant will minimally disrupt patient lifestyle

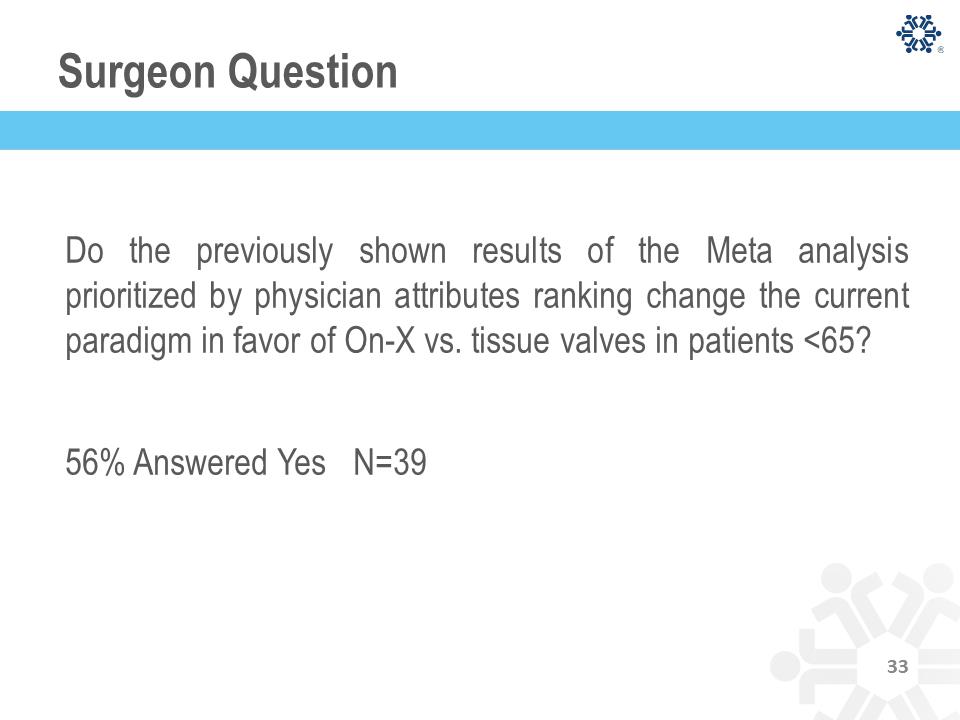

Surgeon Question Do the previously shown results of the Meta analysis prioritized by physician attributes ranking change the current paradigm in favor of On-X vs. tissue valves in patients <65? 56% Answered Yes N=39

Surgeon Question Do the previously shown results of the Meta analysis prioritized by physician attributes ranking change the current paradigm in favor of On-X vs. tissue valves in patients <65? 56% Answered Yes N=39

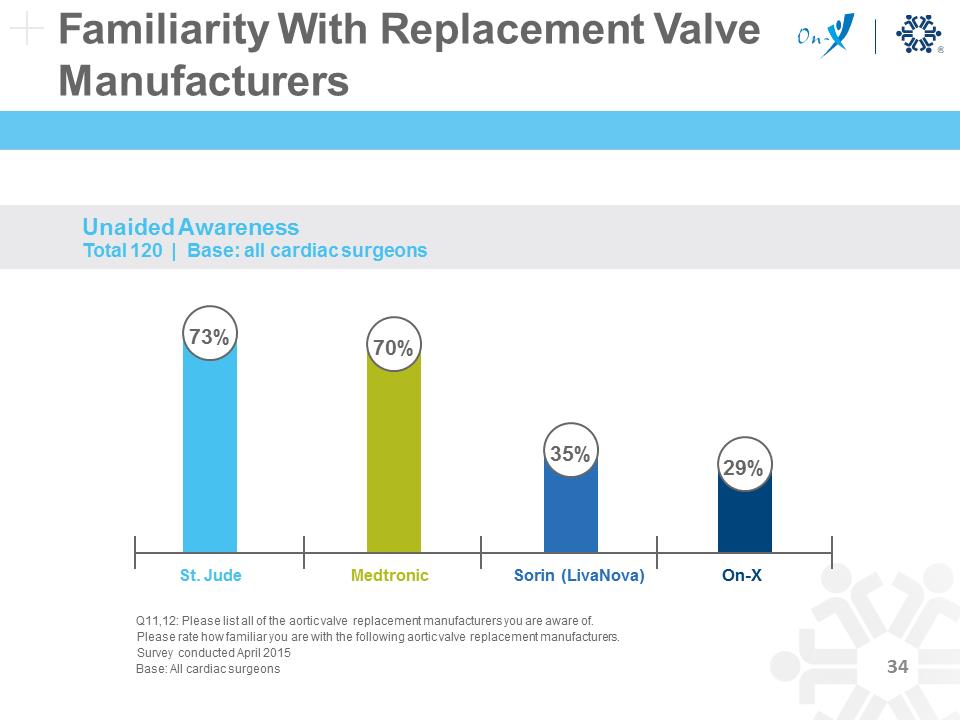

Familiarity With Replacement Valve Manufacturers Q11,12: Please list all of the aortic valve replacement manufacturers you are aware of. Please rate how familiar you are with the following aortic valve replacement manufacturers. Survey conducted April 2015 Base: All cardiac surgeons Unaided Awareness Total 120 | Base: all cardiac surgeons St. Jude Medtronic Sorin (LivaNova) On-X 70% 35% 29% 73%

Familiarity With Replacement Valve Manufacturers Q11,12: Please list all of the aortic valve replacement manufacturers you are aware of. Please rate how familiar you are with the following aortic valve replacement manufacturers. Survey conducted April 2015 Base: All cardiac surgeons Unaided Awareness Total 120 | Base: all cardiac surgeons St. Jude Medtronic Sorin (LivaNova) On-X 70% 35% 29% 73%

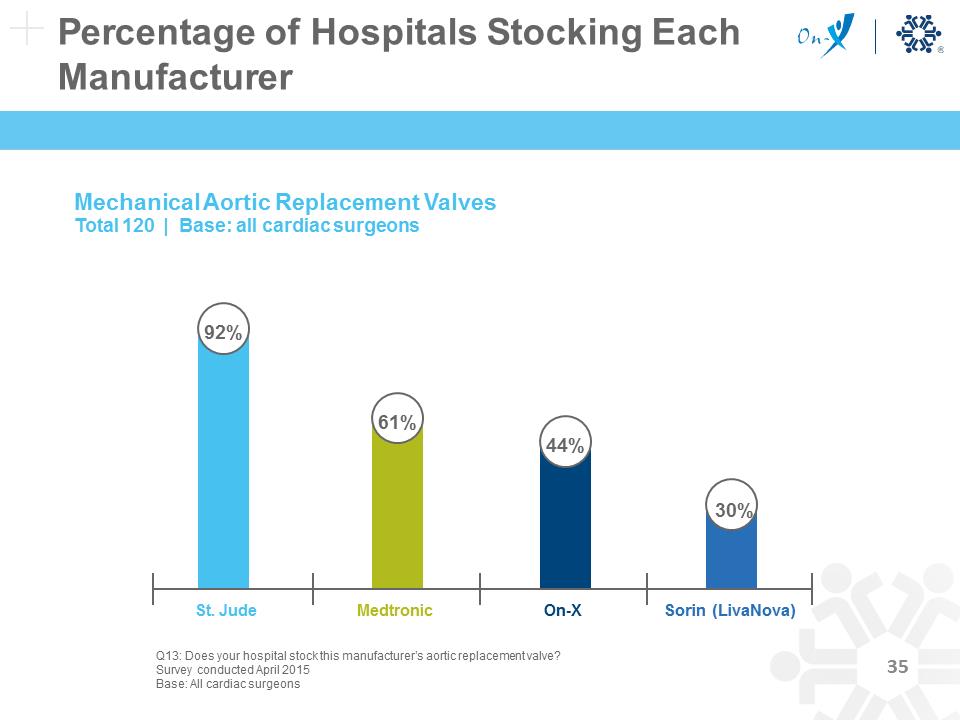

Percentage of Hospitals Stocking Each Manufacturer Mechanical Aortic Replacement Valves Total 120 | Base: all cardiac surgeons On-X St. Jude Medtronic 61% 44% 30% 92% Q13: Does your hospital stock this manufacturer’s aortic replacement valve? Survey conducted April 2015 Base: All cardiac surgeons Sorin (LivaNova)

Percentage of Hospitals Stocking Each Manufacturer Mechanical Aortic Replacement Valves Total 120 | Base: all cardiac surgeons On-X St. Jude Medtronic 61% 44% 30% 92% Q13: Does your hospital stock this manufacturer’s aortic replacement valve? Survey conducted April 2015 Base: All cardiac surgeons Sorin (LivaNova)

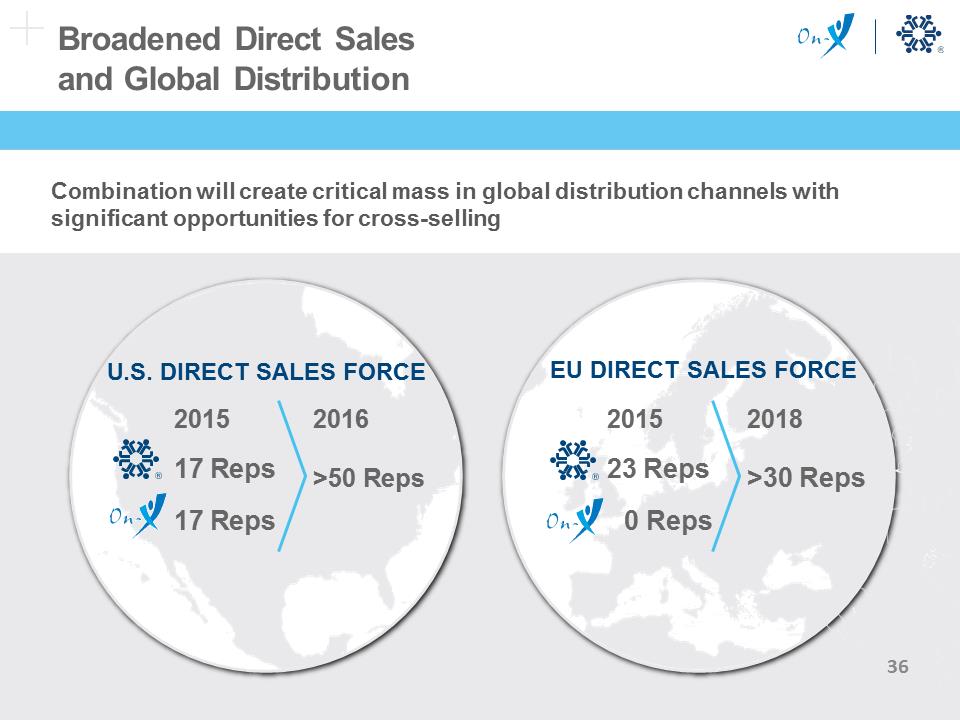

Broadened Direct Sales and Global Distribution Combination will create critical mass in global distribution channels with significant opportunities for cross-selling 2015 2016 17 Reps >50 Reps 17 Reps 2015 2018 23 Reps >30 Reps 0 Reps EU DIRECT SALES FORCE U.S. DIRECT SALES FORCE

Broadened Direct Sales and Global Distribution Combination will create critical mass in global distribution channels with significant opportunities for cross-selling 2015 2016 17 Reps >50 Reps 17 Reps 2015 2018 23 Reps >30 Reps 0 Reps EU DIRECT SALES FORCE U.S. DIRECT SALES FORCE

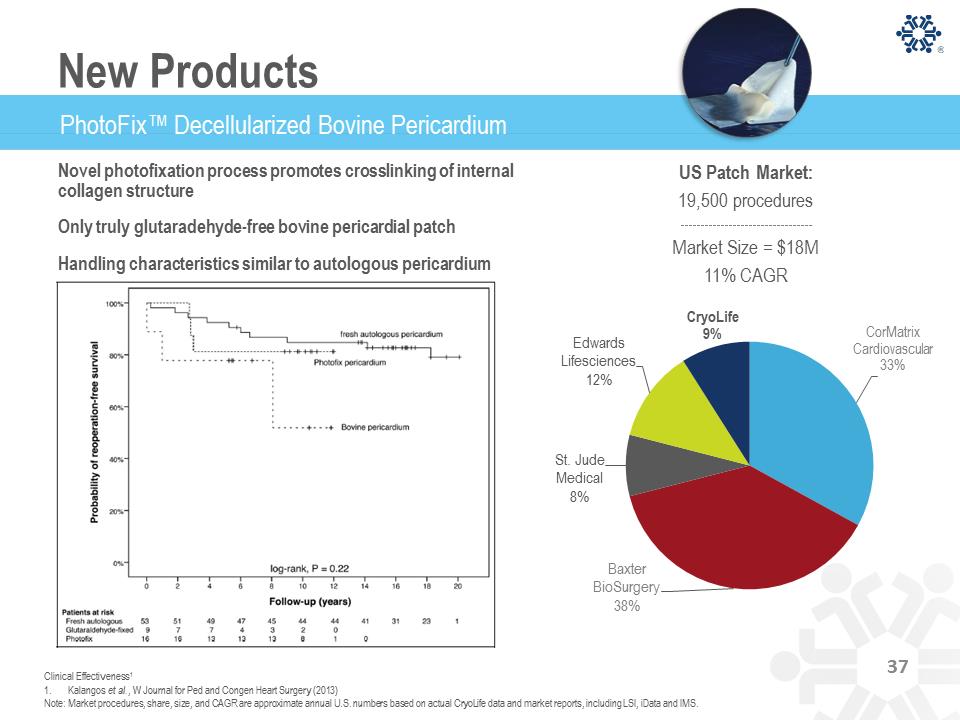

PhotoFix™ Decellularized Bovine Pericardium Novel photofixation process promotes crosslinking of internal collagen structure Only truly glutaradehyde-free bovine pericardial patch Handling characteristics similar to autologous pericardium CorMatrix Cardiovascular 33% Baxter BioSurgery 38% St. Jude Medical 8% Edwards Lifesciences 12% CryoLife 9% 1. Kalangos et al., W Journal for Ped and Congen Heart Surgery (2013) Note: Market procedures, share, size, and CAGR are approximate annual U.S. numbers based on actual CryoLife data and market reports, including LSI, iData and IMS. US Patch Market: 19,500 procedures Market Size = $18M 11% CAGR Clinical Effectiveness1 37

PhotoFix™ Decellularized Bovine Pericardium Novel photofixation process promotes crosslinking of internal collagen structure Only truly glutaradehyde-free bovine pericardial patch Handling characteristics similar to autologous pericardium CorMatrix Cardiovascular 33% Baxter BioSurgery 38% St. Jude Medical 8% Edwards Lifesciences 12% CryoLife 9% 1. Kalangos et al., W Journal for Ped and Congen Heart Surgery (2013) Note: Market procedures, share, size, and CAGR are approximate annual U.S. numbers based on actual CryoLife data and market reports, including LSI, iData and IMS. US Patch Market: 19,500 procedures Market Size = $18M 11% CAGR Clinical Effectiveness1 37

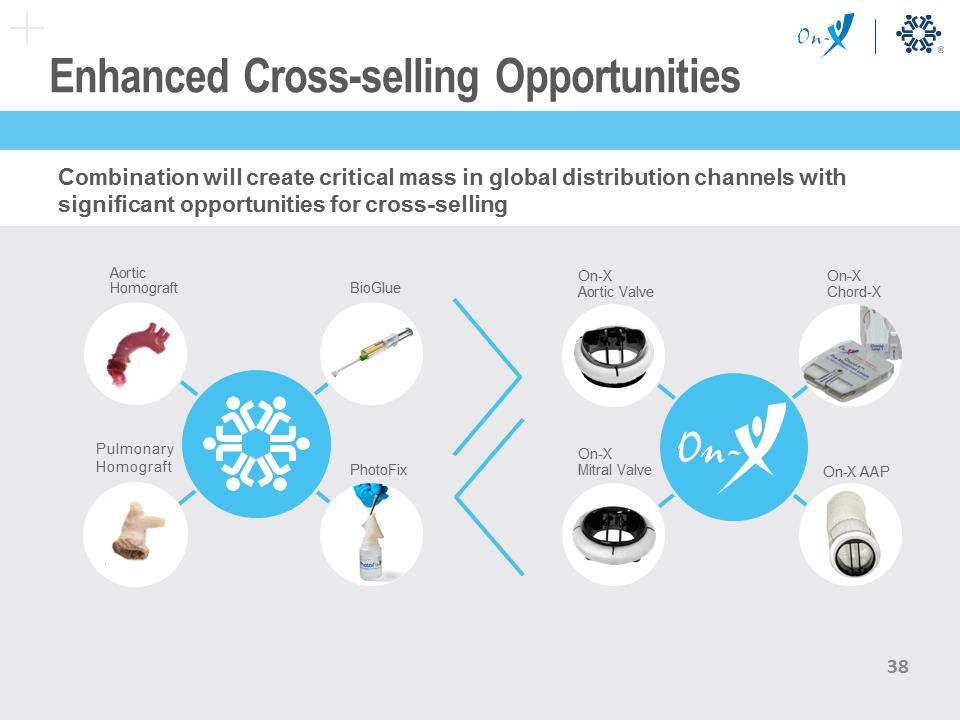

Enhanced Cross-selling Opportunities Combination will create critical mass in global distribution channels with significant opportunities for cross-selling On-X Aortic Valve On-X Mitral Valve On-X Chord-X On-X AAP Aortic Homograft Pulmonary Homograft BioGlue PhotoFix

Enhanced Cross-selling Opportunities Combination will create critical mass in global distribution channels with significant opportunities for cross-selling On-X Aortic Valve On-X Mitral Valve On-X Chord-X On-X AAP Aortic Homograft Pulmonary Homograft BioGlue PhotoFix

Strategic Focus on Aortic and Mitral Valve Surgery Aortic Homograft BioGlue PhotoFix On-X Aortic Valve On-X Chord-X On-X Mitral Valve On-X AAP Combination of CryoLife and On-X creates a highly differentiated product portfolio with a strategic focus on aortic and mitral valve repair and replacement surgery Pulmonary Homograft

Strategic Focus on Aortic and Mitral Valve Surgery Aortic Homograft BioGlue PhotoFix On-X Aortic Valve On-X Chord-X On-X Mitral Valve On-X AAP Combination of CryoLife and On-X creates a highly differentiated product portfolio with a strategic focus on aortic and mitral valve repair and replacement surgery Pulmonary Homograft

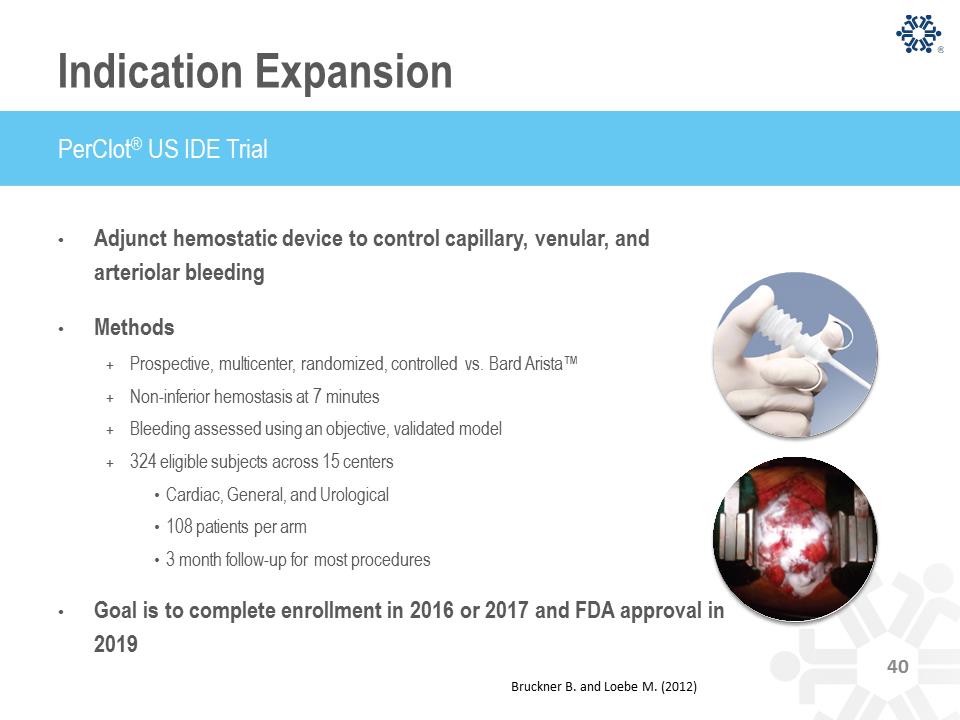

Indication Expansion • Adjunct hemostatic device to control capillary, venular, and arteriolar bleeding • Methods + Prospective, multicenter, randomized, controlled vs. Bard Arista™ + Non-inferior hemostasis at 7 minutes + Bleeding assessed using an objective, validated model + 324 eligible subjects across 15 centers • Cardiac, General, and Urological • 108 patients per arm • 3 month follow-up for most procedures • Goal is to complete enrollment in 2016 or 2017 and FDA approval in 2019 PerClot® US IDE Trial Bruckner B. and Loebe M. (2012)

Indication Expansion • Adjunct hemostatic device to control capillary, venular, and arteriolar bleeding • Methods + Prospective, multicenter, randomized, controlled vs. Bard Arista™ + Non-inferior hemostasis at 7 minutes + Bleeding assessed using an objective, validated model + 324 eligible subjects across 15 centers • Cardiac, General, and Urological • 108 patients per arm • 3 month follow-up for most procedures • Goal is to complete enrollment in 2016 or 2017 and FDA approval in 2019 PerClot® US IDE Trial Bruckner B. and Loebe M. (2012)

Active Business Development Program . Physician preference products . Higher growth rate than CRY . Higher margin than CRY . Competitive advantage in market . Synergistic to CRY

Active Business Development Program . Physician preference products . Higher growth rate than CRY . Higher margin than CRY . Competitive advantage in market . Synergistic to CRY

Anticipated Financial Benefits • Acceleration of revenue growth through acquired products, channel expansion and cross-selling opportunities • On-X product portfolio revenues projected to grow at double digit CAGR from 2016 – 2020 • Gross margin expansion • Double digit CAGR in adjusted non-GAAP earnings from 2016 – 2020 • Future opportunities to invest in the operations of the business

Anticipated Financial Benefits • Acceleration of revenue growth through acquired products, channel expansion and cross-selling opportunities • On-X product portfolio revenues projected to grow at double digit CAGR from 2016 – 2020 • Gross margin expansion • Double digit CAGR in adjusted non-GAAP earnings from 2016 – 2020 • Future opportunities to invest in the operations of the business

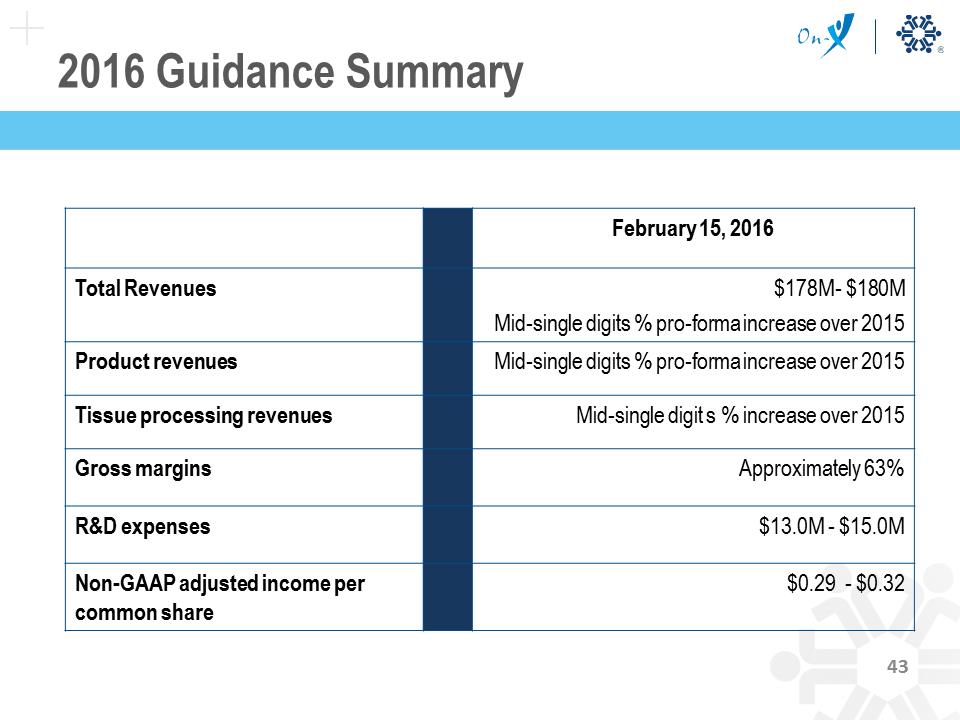

2016 Guidance Summary February 15, 2016 Total Revenues $178M- $180M Mid-single digits % pro-forma increase over 2015 Product revenues Mid-single digits % pro-forma increase over 2015 Tissue processing revenues Mid-single digit s % increase over 2015 Gross margins Approximately 63% R&D expenses $13.0M - $15.0M Non-GAAP adjusted income per common share $0.29 - $0.32

2016 Guidance Summary February 15, 2016 Total Revenues $178M- $180M Mid-single digits % pro-forma increase over 2015 Product revenues Mid-single digits % pro-forma increase over 2015 Tissue processing revenues Mid-single digit s % increase over 2015 Gross margins Approximately 63% R&D expenses $13.0M - $15.0M Non-GAAP adjusted income per common share $0.29 - $0.32