Attached files

As filed with the Securities and Exchange Commission on February 12, 2016

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REDWOOD SCIENTIFIC TECHNOLOGIES, INC

A Nevada Corporation

| 41-3165559 | ||||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

250 W. First Street,

Suite 310

Claremont, CA 91711

Tel: 310-693-5401

Copies to:

Louis Taubman, Esq.

Hunter Taubman Fischer, LLC

1450 Broadway, Floor 26

New York, New York 10018

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered (1) | Proposed maximum offering price per share (2) | Proposed maximum aggregate offering price | Amount of registration fee | ||||||||||||

| Common Stock (3) | 2,355,146 | 2.25 | 5,299,078 | 533.62 | ||||||||||||

| Common Stock underlying Warrants (4) | 1,707,127 | 2.25 | 3,841,035 | 386.79 | ||||||||||||

| Total | 4,062,273 | 2.25 | 9,140,114 | 920.41 | ||||||||||||

(1) Pursuant to Rule 416 and 457 of the Securities Act of 1933, as amended, the shares of common stock offered hereby also include such presently indeterminate number of shares of our common stock as shall be issued by the Registrant to the selling stockholders to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(a). Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the price of the shares that were sold to our shareholders in the Offering. The price of $2.25 is a fixed price at which the selling security holders shall sell their shares until they are quoted on the OTC Bulletin Board, after which time they will be sold at prevailing market prices; we are currently in the process of applying to have our common stock quoted on the OTC Bulletin Board. There can be no assurance that our application for quotation will be approved.

(3) Includes: 1,529,445 shares of common stock underlying the Units issued in the Offering and 825,701 shares of common stock underlying $1,500,000 10% Secured Convertible Notes issued pursuant to the private placement we completed on March 2, 2015 (the "Private Placement").

(4) Includes: (i) 764,723 shares of common stock underlying the Warrants included in the Units; (ii) 761,421 shares of common stock underlying warrants issued pursuant to the secured convertible notes, including the shares of common stock issued pursuant to the anti-dilution provisions of such warrants; (iii) 180,983 shares of common stock underlying the warrants issued to the Placement Agents of the Offering.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED FEBRUARY 12, 2016

PROSPECTUS

REDWOOD SCIENTIFIC TECHNOLOGIES, INC.

4,062,273 Shares of Common Stock

This prospectus relates to the sale by the selling shareholders listed on page 33 of up to 4,062,273 shares of our common stock

The selling stockholders named herein may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price, at prices related to such prevailing market price, in negotiated transactions or a combination of such methods of sale and pursuant to any other method permitted by applicable law. Unless all or a portion of the 1,707,127 shares of common stock issuable upon exercise of the Warrants, and to which this prospectus relates, are exercised, we will not receive any proceeds from the sales by the selling stockholders.

The number of shares of common stock which may be sold by each of the selling stockholders are subject under certain conditions to certain agreed upon limits described elsewhere in this prospectus.

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 6 FOR A DISCUSSION OF RISKS APPLICABLE TO US AND AN INVESTMENT IN OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is February 12, 2016.

We have not authorized any person to give you any supplemental information or to make any representations for us. You should not rely upon any information about us that is not contained in this prospectus or in one of our public reports filed with the Securities and Exchange Commission (“SEC”) and incorporated into this prospectus. Information contained in this prospectus or in our public reports may become stale. You should not assume that the information contained in this prospectus, any prospectus supplement or the documents incorporated by reference are accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus or of any sale of the shares. Our business, financial condition, results of operations and prospects may have changed since those dates. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

All dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters.

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this S-1 Registration Statement. You should carefully read the entire Registration Statement and should consider, among other things, the matters set forth in ‘‘Risk Factors’’ before deciding to invest in the Units.

In this S-1 Registration Statement, unless the context otherwise requires, all references to “we,’’ ‘‘us,’’ ‘‘our,’’ and similar terms, and “Redwood,” “RST” and “the Company” refer to Redwood Scientific Technologies, Inc., a Nevada corporation and our wholly owned subsidiary Redwood Scientific Technologies, Inc., a California corporation.

Our Business

Redwood Scientific Technologies, Inc. was organized in January 2014 under the name Advanced Men's Institute Prolongz, LLC ("AMI") in the State of California and began selling its products in February 2014. In November 2014, AMI changed its name to Redwood Scientific Technologies, LLC. Immediately after the name change Redwood Scientific Technologies, LLC filed a statement of conversion whereby it converted from an LLC into a California corporation to become Redwood Scientific Technologies, Inc. This became the operating subsidiary to Redwood Scientific Technologies Inc., a Nevada Corporation (the “Company”), as a result of a share exchange on January 6, 2015.

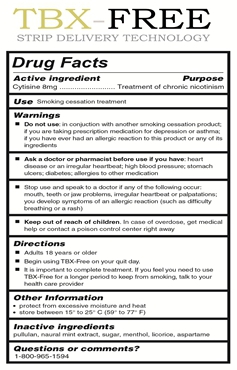

The Company develops and markets consumer homeopathic drugs and supplements. The Company utilizes patent-pending, sublingual strip delivery technology that enhances bioavailability. Currently, the Company has four products for sale or about to reach the market: ProlongzTM (FDA Registration # 69308-000-01) is the first drug of its kind that addresses a specific sexual performance dysfunction in men and is the only drug that can be taken orally through a sublingual strip; TBX-FreeTM (FDA Registration # 69461-001-01) is the first FDA registered oral strip that helps smokers safely, quickly, and effectively eliminate the craving to smoke; Product-X: The first sublingual strip delivery medication for the treatment of erectile dysfunction; and Comfort-Time: a children's aspirin is the only oral strip pain reliever that quickly reduces inflammation and the pain without the risk of chocking. All the company’s products are sold either through a membership subscription model (a direct marketing program) or at any given number of retail locations. The Company develops and markets consumer homeopathic drugs and supplements. The Company utilizes patent-pending, sublingual strip delivery technology that enhances bioavailability.

The Company’s wholly owned subsidiary began operations in the first quarter of 2014 and the Company was incorporated in Nevada in December 2014. Through our subsidiary, we develop and market consumer OTC drugs and supplements that address unmet needs in the multi-billion-dollar health and wellness consumer markets. RST utilizes Patent-pending, sublingual strip delivery technology that enhances bioavailability.

The Company’s initial product, Prolongz, an Over-the-Counter drug, designed to treat premature ejaculation in men and management believes is the only such drug that can be taken orally through sublingual strip delivery. Prolongz has been registered with the FDA ‘# 69308-000-01’, allowing Redwood to elevate itself from its competitors. As of the date of this Registration Statement and based solely on our internal research, we believe that Prolongz is the only OTC drug registered with the FDA as useful treatment for premature ejaculation through our sublingual delivery mechanism.

In the fourth quarter 2015, the Company launched its smoking cessation product TBX-FreeTM (FDA #69461-001-01), the first FDA registered sublingual strip that helps smokers safely and quickly eliminate the craving to smoke. As of the date of this Registration Statement and based on our research, we believe that TBX-FreeTM is the only nicotine free OTC drug registered with the FDA as useful treatment for the cessation of cravings to smoke.

Redwood is on course to establish itself as the industry leader for both these products in their respective markets through its membership (subscription) model. The Company is aggressively trying to expand its customer population through heavy investments in national cable television commercials and infomercials which also drive consumer awareness and retail sales.

The Company is also in the development phase for other products that address health concerns for adults and children, prostate health, and other health areas, all through the use of Company’s patent pending sublingual delivery mechanism. All of Redwood’s products will be centered on the innovative sublingual strip technology that the Company has developed. These products may include a product for prostate health, women’s sexual health and others. The Company’s launch timeline for these additional products is set for 2016. It is intended that all of RST’s products, including those in the development pipeline will be submitted to the FDA registration process.

| 1 |

The Company retained separate FDA counsel who work directly with the FDA to ensure the Company’s compliance with federal and state regulatory authorities. The FDA counsel helps RST with the evaluation and development process for new products and shepherd’s the product through the regulatory process. The process taken is determined and dependent on how the products are to be marketed and their intended effects. Each FDA regulatory category brings with it certain benefits (regarding, for instance, the claims you can make related to the product) and challenges (regarding, for instance, pre-marketing clearance requirements).

RST recognizes the unmet potential for the treatment of sexual dysfunction which is part of the estimated $7B US homeopathic market which is growing at a rate of 3% per annum reaching $7.5B by 2017.

http://www.nutraceuticalsworld.com/issues/2013-07/view_industry-news/us-sales-of-homeopathic-herbal-remedies-reach-64-billion/.

According to researcher Euromonitor International (Euromonitor.com), the U.S. nicotine replacement therapy (“NRT”)

market accounts for nearly 40% of the $2.4 billion in global annual retail sales, which is growing at a constant annual growth

rate of 3%. Both the sexual dysfunction markets and the NRT markets represent significant opportunities for Redwood. Redwood’s

domestic and international expansion plans are underway as it is developing a distribution network to expand its market activities

in the United Kingdom, Central and South America for both these products.

Our History

On January 6, 2015, we entered into and consummated the transactions (the “Share Exchange”) contemplated under a Share Exchange Agreement (the “Share Exchange Agreement”) by and among us, Redwood Scientific Technologies, Inc., a California corporation (“Redwood California”) and Jason Cardiff (“Cardiff”), the sole shareholder of Redwood California who is also our Chief Executive Officer. Under the terms of the Share Exchange Agreement, Cardiff transferred all of his shares of Redwood California, which represented 100% of Redwood California’s shares outstanding, to the Company and Redwood California became a wholly-owned subsidiary of the Company. As part of the Share Exchange, Cardiff was issued 4,400,000 shares of Redwood Nevada’s common stock, par value $0.01 (the “Common Stock”), which represented 88% of the 5,000,000 issued and outstanding shares of the Company’s common stock immediately following the Share Exchange.

Redwood California, was organized in the State of California in January 2014 under the name Advanced Men’s Institute Prolongz, LLC. In early November 2014, the Company underwent a name change to operate under the legal name Redwood Scientific Technologies, LLC. Subsequently and immediately thereafter, Redwood Scientific Technologies, LLC filed a Statement of Conversion whereby Redwood Scientific Technologies, LLC converted from a limited liability company into a California corporation under that same name.

As a result of the Company’s acquisition of Redwood California, it became our wholly-owned subsidiary. All of our operations are conducted through Redwood California.

Recent Developments

Following our launch of Prolongz

We have received our second drug code from the FDA for TBX Free, our smoking cessation product, which is the only non-nicotine stop smoking product to be delivered by sub-lingual strip. We launched TBX Free in December 2015 on a nationwide television campaign and also have interest from several national retailers. TBX-FREE is the first FDA registered oral strip that helps smokers safely, quickly, and effectively eliminate the craving to smoke. Every TBX-FREE oral strip contains a precisely measured dose of cytisine; the active ingredient that reduces the urge to smoke. It is too early to assess the long term success of this product, however initial sales have exceeded expectations.

We have also filed for registration with the FDA of Sumnusent, an all-natural sleep aid that will also be delivered by our sub-lingual strip technology. Depending on registration, we are hopeful that we will be able to launch Sumnusent in the first quarter of fiscal 2016.

Risk Factors

The securities offered by this prospectus are speculative and involve a high degree of risks associated with our business. For more comprehensive discussion of these and other risk factors affecting us and our business, see the “Risk Factors” section beginning on page 6 of this prospectus.

For a more comprehensive discussion of these and other risk factors affecting us and our business, see the “Risk Factors” section beginning on page 9 of this prospectus.

The Unit Offering

On January 18, 2016, we completed a private offering (the “Offering”) of $3,441,252 Units, each Unit consisting of: (a) 1 share of the Company’s common stock, par value $0.01 per share (the “Common Stock”) and, (b) a warrant (the “Warrants”) to purchase that number of shares of Common Stock as is equal to 50% of the number of shares of Common Stock underlying the investor's Unit (such shares of common stock underlying the Warrants are hereinafter referred to as the “Warrant Shares,” the Warrants, the Warrant Shares and the Common Stock are sometimes collectively referred to as the “Securities”), at an initial exercise price of $2.75 per share (the “Exercise Price”). The Units were sold at $2.25 per Unit. Accordingly, pursuant to the Offering we issued a total of 1,529,445 shares of Common Stock and Warrants to purchase up to a total of 764,723 shares of Common Stock. (See “Description of Securities”)

| 2 |

If the Company issues Common Stock or any type of securities giving rights to Common Stock at a price below the Unit Price, Investors will be extended full ratchet anti-dilution protection through the issuance of additional common shares. Anti-dilution protection will not apply to shares (or options to purchase shares) issued to employees, directors and consultants as part of a pre-existing equity incentive plan or agreement adopted by the Company’s board up to an aggregate of 250,000 shares and other limited exceptions.

Additionally, if the Company has less than $20,000,000 in gross revenue or less than $1 in earnings before interest, taxes, depreciation and amortization (EBITDA) for the subsequent twelve months following the close of $6,500,000 in funding (including funds received from the Bridge Financing), the Company shall issue an additional 20% of the common stock and warrants underlying the Units issued pursuant to this Offering. In addition, the Company shall use reasonable best efforts to distribute preliminary financial statements for this twelve month period within 45 days after the twelve month period ends and audited financial statements if requested sixty days after written notice of the request, for purposes of determining whether the Company shall issue such additional Units. If the Company fails to use reasonable best efforts to distribute such financial statements containing the information necessary to calculate the Company’s Revenue, such failure shall result in (i) the investors receiving an additional 100% of the Units purchased in this Offering. Since the Company did not close with $6,500,000 in funding, we do not believe this clause is operative.

We also entered into a Registration Rights Agreement with the Investors pursuant to which we agreed to file this registration statement, by the 30th day following the close of the Offering, registering for resale all of the shares underlying the Units, including those underlying the Warrants, as well as a reasonable number of shares issuable under the Units and Warrants pursuant to potential adjustments that may occur pursuant thereto. If we fail to file the registration statement or keep it effective as per the terms of the Registration Rights Agreement, we shall pay each Investor liquidated damages in cash equal to 1% of such Investor’s purchase price to be incurred each month until the registration statement is filed or declared effective, as the case may be, but in no event more than 10%.

Copies of the Unit Purchase Agreement, Form of Warrant and Registration Rights Agreements for the Offering are incorporated herein by reference and are filed as Exhibits 10.1, 10.2 and 10.3, respectively, hereto. The description of the transactions contemplated by such agreements set forth herein do not purport to be complete and is qualified in its entirety by reference to the full text of the exhibits filed herewith and incorporated herein by reference.

In connection with the Offering, we paid $122,760 to our two placement agents for the Offering, which fees shall be apportioned by the placement agent among itself, other selling agents and broker-dealers which are members of FINRA and to pay related commissions to its associated persons who are qualified and eligible to accept such commission within the state or other jurisdiction in which the Units were sold and/or such commission is paid. The Placement Agents also received three year warrants to purchase an aggregate of up to 127,379 shares of our Common Stock (the “Placement Agent Warrants”). Additionally, one placement agent received a non-accountable expense fee equal to 2% of the total proceeds raised from the sale of the Units to their investors and all of the reasonable expenses such Placement Agent incurred in connection with the Offering, which amount equaled $7,500; we previously paid this placement agent $15,000 in legal fees and a due diligence fee of $2,500 following the closing of the Bridge Financing (as described below). We also paid $5,000 in out of pocket expenses to the other placement agent, as well as $5,000 for due diligence expenses and a 2% banking fee on gross funds such placement agent raised.

We also agreed to offer the Placement Agents the indemnification protections granted to the investors in the Offering as part of the agreement governing the registration of the securities sold to investors in the Offering, as a third party beneficiary to such provisions.

The private financing described herein was made pursuant to the exemption from the registration provisions of the Securities Act of 1933, as amended, provided by Sections 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder. The securities issued have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

The Prior Private Financing

On March 2, 2015, we completed a private offering (the “Bridge Financing”) of $1,500,000 Units consisting of: (i) a one (1) year secured 10% convertible note (individually a “Bridge Note” and collectively, the “Bridge Notes”) and (ii) warrants (the “Bridge Warrants”) to purchase 100% of the number of shares underlying the Bridge Notes, with thirty (30) accredited investors1. We received net proceeds of $1,399,400. The Bridge Notes are initially convertible at a conversion price of $2.00 per share (the “Conversion Price”) and the Bridge Warrants are initially exercisable at an exercise price of $2.50 per share (the “Exercise Price”); both the Conversion Price and Exercise Price are subject to adjustment and purchase price protection. In addition, the Bridge Notes are fully secured by the assets of the Company. Pursuant to the Bridge Financing, we issued an aggregate of $1,500,000 Convertible Bridge Notes and Bridge Warrants to purchase up to an aggregate of 761,421 shares of our Common Stock.

1 We held an initial closing on February 3, 2015, pursuant to which we received aggregate gross proceeds of $1,065,000; we received and closed on the balance on March 2, 2015

| 3 |

The securities offered in the Bridge Financing were sold pursuant to a Unit Purchase Agreement (the “Purchase Agreement”) by and among our company and the investors named in the Purchase Agreement (collectively, the “Investors”). Pursuant to the Purchase Agreement, we issued the Placement Agent warrants to purchase up to 53,604 shares of Common Stock, initially exercisable at $1.97 per share on a cashless basis (the “Placement Agent Bridge Warrants”). The Placement Agent Warrants are subject to adjustment and purchase price protection, but are not redeemable (See “Description of Securities, Placement Agent Warrants”).

Pursuant to the terms of the Bridge Notes, upon the Company’s receipt of at least $2,500,000 in additional financing, the outstanding balance of the Bridge Notes (principal plus all accrued interest up to the date of closing on at least $2,500,000) shall automatically convert into Common Stock at the “Discount Conversion Price” which is equal to the lesser of (i) the Conversion Price or (ii) a 12.5% discount to the price of the securities issued pursuant to such additional financing (the “Automatic Conversion Feature”)2. Accordingly, as of November 24, 2015 (“Conversion Date”), since we received an aggregate of $2,515,501.25 pursuant to the Unit Offering, the principal amount of the Bridge Notes automatically converted at a conversion price of $1.97 into 761,421 shares of Common Stock and the exercise price of the Bridge Warrants has been adjusted from $2.50 per share to $2.25 per share, resulting in the additional issuance of up to an aggregate of 11,421 shares of common stock upon the exercise of the Bridge Warrants after this Offering.

| Common Stock to be | Up to 4,062,273 consisting of: | |

| Offered by the Selling | ||

| Security holders | a) | 1,529,445 shares of the Company’s common stock, $0.01 par value per share (the “Common Stock”) underlying the Units; |

| b) | 764,723 shares of Common Stock underlying the Warrants; | |

|

c) | 825,701 shares of Common Stock underlying the Bridge Notes; |

| d) | 761,421 shares of Common Stock underlying the Bridge Warrants; | |

| e) | 127,379 shares of Common Stock underlying the Placement Agent Warrants; and, | |

| f) | 53,604 shares of Common Stock underlying the Placement Agent Bridge Warrants. | |

| Stock Exchange Symbol | N/A | |

2 The terms of the Bridge Note provide that the Automatic Conversion Feature shall be triggered by a financing transaction, in one or more closings (not including the Bridge Financing), which results in gross proceeds of at least $2,500,000 to the Company.

| 4 |

The following table summarizes the relevant financial data for our business and should be read in conjunction with our financial statements which are included elsewhere in this prospectus. The summary set forth below should be read together with our consolidated financial statements and the notes thereto, as well as “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus.

Consolidated Statement of Operations Data:

| For the nine months ended September 30 | ||||||||

| 2015 | 2014 | |||||||

| (in thousands) | ||||||||

| Net Revenues | $ | 5,143 | $ | 2,396 | ||||

| Gross profit | 4,109 | 1,685 | ||||||

| Comprehensive Profit (loss) | $ | (1,267 | ) | $ | 80 | |||

Consolidated Balance Sheet Data:

| As of September 30, 2015 | ||||

| Balance Sheet Data: | ||||

| Current assets | $ | 2,308 | ||

| Total assets | 2,382 | |||

| Total current liabilities, net of debt discounts | 1,419 | |||

| Total liabilities, net of debt discounts | 2,361 | |||

| Total stockholders’ equity (deficit) | $ | 21 | ||

NOTES REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These include statements about the Company’s expectations, beliefs, intentions or strategies for the future, which are indicated by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “the Company believes,” “management believes” and similar words or phrases. The forward-looking statements are based on the Company’s current expectations and are subject to certain risks, uncertainties and assumptions. The Company’s actual results could differ materially from results anticipated in these forward-looking statements. All forward-looking statements included in this document are based on information available to the Company on the date hereof, and the Company assumes no obligation to update any such forward-looking statements.

| 5 |

The Company’s limited operating history and lack of cash flow and profitability may continue which will affect our ability to remain in business.

The Company has a limited history of operations and has limited history of profitability. The Company completed the audit of its first year of operations ending December 31, 2014. Audited results of operation for the first fiscal year ended December 31, 2014, show that the Company’s gross revenues are $3,234,582, cost of goods sold $951,676, producing gross profit of $2,282,906; advertising and promotional expenses totaled $907,345, with all operating and general and administrative expenses totaling $1,095,415 for total expenses of $1,903,702, producing a profit before tax of $379,204.

For the nine month period ending September 30, 2015, the Company’s gross revenues are $5,143,405, costs of goods sold is $1,033,744, producing gross profit of $4,109,661; advertising and promotional expenses totaled $2,431,795 with all other general and administrative expenses totaling $465,824 for total expenses of $4,809,347, producing a before tax loss from operations of $1,699,246.

If we do not generate positive cash flow and maintain profitability, we may not be able to remain in business. The Company is also subject to business risks associated with new business enterprises. No assurance can be given as to the ability of the Company to operate and sustain profitability.

Due to our limited operating history, our ability to operate successfully is materially uncertain and our operations and prospects are subject to all risks inherent in a developing business enterprise. In investing in this Offering, potential Investors should be aware of the difficulties normally encountered by early stage companies and the high rate of failure of such enterprises. The likelihood of our viability and potential for revenue and profit generation must be considered in light of the significant problems, expenses, difficulties, complications and delays encountered in connection with the commercialization of our technologies and products in development. These potential problems include, but are not limited to:

| ● | products may never be developed or work as planned; | |

| ● | costs and expenses that may exceed current estimates; | |

| ● | our ability to generate sales; | |

| ● | our ability to attract and retain high quality personnel for sales and marketing; | |

| ● | competition of more established and better capitalized companies; and, | |

| ● | our ability to raise capital when needed to advance our business plans. |

Although we believe that the market for our products in development or planned is very large and growing, we can provide no assurances to Investors that we will be able to fully commercialize and market our products and services or generate any operating revenues or ever achieve profitable operations. If we cannot address the inherent risks facing our company, our intended business will likely fail and you will lose your entire investment.

If we fail to raise additional capital, our ability to implement our business model and strategy could be compromised.

We have limited capital resources and operations. To date, other than the Bridge Financing, our operations have been funded entirely from Jason Cardiff (our CEO and majority shareholder) and his affiliates, which funding is treated as contributions to capital. There is no minimum in this Offering. Notwithstanding the funds we received from the Offering, we expect to require substantial additional capital in the near future to further develop and market ProlongzTM and new products, although that cannot be guaranteed. The $4,941,252 we received from the Offering and Bridge Financing is only expected to provide us with working capital to maintain our planned level of operations through the fourth quarter of fiscal 2016 without significantly altering our business plan. (See “Use of Proceeds.”)

Based on the Company’s past and anticipated operating expenses, and without its planned investment in television advertising, we believe that the Company requires approximately $200,000 per month on an annualized basis for operating expenses to fund the costs associated with our financing activities, legal and accounting expenses, other general and administrative expenses, research and development, regulatory compliance, product development and maintenance, third party manufacturing fees, and compensation of executive management and our employees. Based on our current cash position, without additional financing we may not be able to pay our obligations past the fourth quarter of fiscal 2016. The monthly cash requirement for operating expenses does not include any extraordinary items or expenditures such as the planned expenditures on direct response marketing (television ad spend). Furthermore, we expect to incur additional costs associated with operating as a public company.

Accordingly, if we do not receive additional financing by the end of 2016 when we exhaust the funds received from the Offering, we will likely be unable to carry out our business plan. We currently do not have commitments for financing to meet our expected needs and we may not be able to obtain additional financing on terms acceptable to us, or at all. Even if we obtain financing for our near term operations and product development, we expect that we will require additional capital beyond the near term. If we are unable to raise capital when needed, our business, financial condition and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue our operations.

| 6 |

Risks Related To Our Business

We are an early stage company with limited operating history, and we expect to incur net losses for the foreseeable future.

We have limited operating history and have generated limited revenue since our inception. We expect our research and development expenses to be significant for the foreseeable future. We expect to incur significant operating losses for the foreseeable future. These losses will have an adverse effect on our operations.

Our future success depends on the continued sales of our principal product.

Currently, our only proven saleable product is ProlongzTM. Accordingly, we depend on the continued acceptance of ProlongzTM by our customers and their continued renewal of our program. Our investments in and strategies used for our brand marketing are critical to achieve brand awareness with current consumers, educate potential new consumers and convert potential consumers into customers. However, there can be no assurance that ProlongzTM will continue to receive, maintain or increase market acceptance or that current customers will renew their program. The inability to successfully commercialize ProlongzTM in the future and/or expand its product distribution, for any reason, would have a material adverse effect on our financial condition, prospects and ability to continue operations. In December of 2015, we introduced our second FDA registered product called TBX-Free. TBX-FREE is the first FDA registered oral strip that helps smokers safely, quickly, and effectively eliminate the craving to smoke. TBX-FREE has the ability to help reduce smoking cravings. As a result, smokers may enjoy the freedom to live their lives without the powerful urge to light up cigarettes, cigars, and other tobacco or nicotine products. Every TBX-FREE oral strip contains a precisely measured dose of cytosine - the active ingredient that reduces the urge to smoke. It is too early to assess the long term success of this product, however initial sales have exceeded expectations.

Developing and increasing awareness of our brand is crucial to increasing our customer base and our revenues.

We believe that increasing awareness of Prolongz and TBX-Free brands will be critical to developing and expanding our customer base and our revenues. If we fail to advertise and market our products effectively, we may not succeed in maintaining or increasing awareness of our brands and we may lose customers and our revenues will decline. The delivery of quality products to our customers is also of utmost importance to maintaining and enhancing the reputation of our brand. If our customers do not perceive our products to be of high quality, demand for our products will decline, which could lead to a decline in revenues and an adverse effect on our financial condition.

Redwood depends on certain important employees, and the loss of any of those employees may harm our business.

The success of Redwood’s business will continue to be highly dependent upon Jason Cardiff, CEO, Jacques Poujade, Interim CFO, Stefan Galluppi, CTO, Eunjung Cardiff, Marketing Director and Anthony Raissen, Director of Retail Sales. The loss of services of any of these persons could have a materially adverse effect upon our business and development.

Our business is subject to significant competitive pressures.

The OTC healthcare product, life science, homeopathic drug market, and consumer product industries are highly competitive. Many of our competitors have substantially greater capital resources, technical staffs, facilities, marketing resources, product development, distribution and experience than we do. Our competitors may have certain advantages, including the ability to allocate greater resources for new product development, marketing and other purposes.

We believe that our ability to compete depends on a number of factors, including product quality and price, availability, speed to market, consumer marketing, reliability, credit terms, brand name recognition, delivery time and post-sale service and support, and new and existing product innovation and commercialization. There can be no assurance that we will be able to compete successfully in the future. If we are unable to compete effectively, our earnings may be significantly negatively impacted.

We will need to obtain additional capital to support long term product development and commercialization programs.

Our ability to achieve and sustain operating profitability depends in large part on our ability to commence, execute and complete new and existing product innovation and commercialization, and, if required, clinical programs to obtain regulatory approvals in the United States and elsewhere. We can give no assurance that we will be able to achieve such product innovation and commercialization, to obtain any required approvals or to achieve significant levels of sales.

The amount of capital that may be needed to complete product development initiatives will depend on many factors which may include but are not limited to (i) the cost involved in applying for and obtaining FDA, international regulatory or other technical approvals, (ii) whether we elect to establish partnering arrangements for development, sales, manufacturing and marketing of such products, (iii) the level of future sales of OTC related products, and expense levels for marketing efforts, and (iv) whether we can establish and maintain strategic arrangements for development, sales, manufacturing and marketing of our products.

| 7 |

Should research or commercialization activity progress on certain formulations, resulting expenditures may require substantial financial support. The current sales level of our ProlongzTM and our second product TBX-FreeTM may not generate all the funds we anticipate will be needed to support future product acquisition or development. Accordingly, in addition to funding from operations, we may in the short and long term seek to raise capital through the issuance of securities or to secure other financing sources to support our research, new product technologies, applications, licensing, commercialization and other development opportunities. If we obtain such funding through the issuance of equity securities, it would result in the dilution of current stockholders’ ownership in the Company. Any debt financing, if available, may include financial and other covenants that could restrict use of proceeds of such financing or impose other business and financial restrictions on us. In addition, we may consider alternative approaches such as licensing, joint venture, or partnership arrangements to provide long term capital. There can be no assurances that we will have access to the capital required to fund these aspects of our business on favorable terms or at all.

We currently derive our revenues primarily from direct response television marketing where we have approximately 14,900 subscribers purchasing the product on a monthly basis.

We currently rely on mainly two sales channels in order to derive revenues. The company’s main sales channel is Direct Sales using Direct Response Marketing such as commercials and infomercials broadcast on television. The customers are provided with call numbers during the infomercials. Once the customers dial in, an automated system collects the customers’ information (i.e. name, billing address, credit card information, etc.) and in turn sends an order form to the warehouse for fulfillment. The company’s secondary sales channel is its web-based system which is also advertised in the infomercial. Once accessing the company’s web site, customers can place their free-trial orders through the user-friendly, web-based platform via www.prolongz.com/www.tbxfree.com. There are no guarantees that the company will be able to continue to advertise on television because of such factors, as the cost to purchase “air time” may become too high and prohibitive, the levels of “response” from consumers decline, or whether the regulatory environment will continue to be amiable to such form of advertising and the claims made. The level of subscribers are significantly impacted by the company’s ad spend each month.

We are launching the retail store sales channel and in the very near term may have a concentration of sales to and accounts receivable from several large retail customers.

We are opening retail sales channels to expand our reach into the health and wellness market for our products. We will supply the company’s products to different retailers and utilize their networks of physical stores to promote and increase its sales. Our anticipated retail partners range from drug retailers to convenience stores, as well as grocery chains. We are currently selling product to General Nutrition Corporation throughout GNC’s network of 900+ retail locations in the US. Redwood’s products are also available at Circle K’s West Coast locations. These channel partners are an important part to the Company’s growth in the near future. The company is also working on developing its network of national drug retailers. The Company may or may not be successful in obtaining purchase orders from these retail chains. The success or not of obtaining these retail chains will significantly impact the Company’s projections and results of operations.

Although we are working on having a broad range of retail store chains and customers that includes many national chain, regional, specialty and local retail stores, our two largest retail customers did not account for a significant percentage of our sales, approximately 3% of total revenues from inception through November, 2015. These retail chain store customers however may be a significant percentage of sales in the future. In addition, although these retail chain customers did not comprise a significant accounts receivable balance at any month end, in the future they may represent a significant balance. We extend credit to retail store customers based upon an evaluation of their financial condition and credit history, and collateral is not generally required. If one or more of these large retail customers cannot pay, the write-off of their accounts receivable could have a material adverse effect on our operations and financial condition. The loss of sales to any one or more of these large retail customers would also have a material adverse effect on our financial condition, results of operations and cash flows.

If our outside suppliers and manufacturers fail to supply products in sufficient quantities and in a timely fashion, our business could suffer.

We are currently dependent on two manufacturers and a limited number of suppliers to make and supply all of our products. We do not have long-term agreements with our manufacturers or suppliers. Our profit margins and timely product delivery are dependent upon the ability of our outside suppliers and manufacturers to supply us with products in a timely and cost-efficient manner. Our ability to develop our business and enter new markets and sustain satisfactory levels of sales in each market depends upon the ability of our outside suppliers and manufacturers to produce the ingredients and products and to comply with all applicable regulations. The failure of our primary suppliers or manufacturers to supply ingredients or produce our products could adversely affect our business operations.

We do not have long-term contracts with suppliers, manufacturers and distributors and we are dependent on the services of these third parties.

We purchase all of our products from third-party suppliers and manufacturers pursuant to purchase orders, but without any long-term agreements. In the event that a current supplier or manufacturer is unable to meet our manufacturing and delivery requirements at some time in the future, we may suffer short-term interruptions of delivery of certain products while we establish an alternative source. We also rely on third-party carriers for product shipments, including shipments to and from our distribution facilities. We are therefore subject to the risks, including employee strikes and inclement weather, associated with our carrier’s ability to provide delivery services to meet our fulfillment and shipping needs. Failure to deliver products to our customers in a timely and accurate manner would harm our reputation and our business and results of operations.

| 8 |

If the outside contractors we currently use for production of our products fail to produce product in the volumes and quality that we require on a timely basis, we may be unable to meet demand for our products and may lose potential revenues.

We currently contract with specially equipped contractors to handle the large-scale mixing of the formulation components in our products. These external contractor relationships entail added costs and potential disruption to our finished goods schedule. These third-party contractors may encounter difficulties in production, including problems with quality control, quality assurance testing, shortages of qualified personnel, and compliance with federal, state and or other governmental regulations. Our contractors may not be able to expand capacity or to produce additional product requirements for us in the event that demands for our products increases. There can be no assurance that our contractors will be able to continue purchasing raw materials for our products from current suppliers or any other supplier on terms similar to current terms or at all. If these contractors were to encounter any of these difficulties, or experience any interruption in the availability of certain ingredients or significant increases in the prices paid for such materials, our ability to fulfill orders on a timely basis to our customers would be jeopardized. In the future, we intend to add the necessary industrial level mixing equipment to our current bottling facility to mix our own lubricant and lotion products, however, we cannot assure you when and if we will begin to mix such products in-house.

If we do not manage product inventory in an effective and efficient manner, our profitability could be adversely affected.

Many factors affect the efficient use and planning of product inventory, such as effectiveness of predicting demand, effectiveness of preparing manufacturing to meet demand, efficiently meeting product mix and product demand requirements and product expiration. We may be unable to manage our inventory efficiently, keep inventory within expected budget goals, or keep sufficient product on hand to meet demand. If we fail to manage inventory effectively, we may end up with unsold inventory that is past its expiration date and can no longer be sold. We periodically evaluate the composition of inventory and estimate an allowance to reduce inventory for slow moving, obsolete or damaged inventory. Our failure to manage inventory effectively may lead to increased costs and adversely affect our results of operations.

Retail customer’s strategic business plans may negatively influence the distribution of our products to consumer.

Changes in our retail and distribution customers strategic business plans including, but not limited to, (i) expansions, mergers, and/or consolidations, (ii) retail shelf space allocations for products within each outlet and in particular the cough/cold category in which we compete, (iii) changes in their private label assortment and (iv) product selections, distribution allocation, merchandising programs and retail pricing of our products as well as competitive products could affect the consumer sales of our products and could result in a material adverse effect to our business and financial condition.

Our products and potential new products are or may be subject to extensive governmental regulation.

Our business is regulated by various agencies, including federal and state agencies, where our products are sold. Governmental regulations in foreign countries where we manufacture our products, or plan to commence sales may prevent or delay entry into a market or prevent or delay the introduction, or require the reformulation of certain of our products. In addition, no prediction can be made as to whether new domestic or foreign legislation regulating our activities will be enacted. Any new legislation could have a material adverse effect on our business, financial condition and operations. Non-compliance with any applicable requirements may subject us or the manufacturers of our products to agency action, including warning letters, fines, product recalls, seizures and injunctions.

The manufacturing, processing, formulation, packaging, labeling and advertising of our products are subject to regulation by several federal agencies, including (i) the FDA, (ii) the Federal Trade Commission (“FTC”), (iii) the Consumer Product Safety Commission, (iv) the United States Department of Agriculture, (v) the United States Postal Service, (vi) the United States Environmental Protection Agency and (vii) the United States Occupational Safety and Health Administration.

In addition to OTC healthcare products and prescription drug products, the FDA regulates the safety, manufacturing, labeling and distribution of dietary supplements, including vitamins, minerals and herbs, food additives, food supplements, over-the-counter and prescription drugs and cosmetics. The FTC also has overlapping jurisdiction with the FDA to regulate the promotion and advertising of vitamins, over-the-counter drugs, cosmetics and foods. In addition, our products, ProlongzTM and TBX-FreeTM are considered homeopathic remedies, which are subject to standards established by the Homeopathic Pharmacopoeia of the United States (“HPUS”). HPUS sets the standards for source, composition and preparation of homeopathic remedies which are officially recognized under the Federal Food, Drug and Cosmetics Act, as amended.

| 9 |

Preclinical development, clinical trials, product manufacturing, labeling, distribution and marketing of potential new products are also subject to federal and state regulation in the United States and other countries. Clinical trials and product marketing and manufacturing are subject to the rigorous review and approval processes of the FDA and foreign regulatory authorities. To obtain approval of a new drug product, a company must demonstrate through adequate and well-controlled clinical trials that the drug product is safe and effective for its intended use. Obtaining FDA and other required regulatory approvals is lengthy and expensive. Typically, obtaining regulatory approval for pharmaceutical products requires substantial resources and takes several years. The length of this process depends on the type, complexity and novelty of the product and the nature of the disease or other indication to be treated. Preclinical studies must comply with FDA regulations. Clinical trials must also comply with FDA regulations to ensure safety of the human subjects in the trial and may require large numbers of test subjects, complex protocols and possibly lengthy follow-up periods. Consequently, satisfaction of government regulations may take several years: may cause delays in introducing potential new products for considerable periods of time and may require imposing costly procedures upon our activities. If regulatory approval of new products is not obtained in a timely manner or not at all, we could be materially adversely affected. Even if regulatory approval of new products is obtained, such approval may impose limitations on the indicated uses for which the products may be marketed which could also materially adversely affect our business, financial condition and future operations.

Consumers’ ability to successfully file a complaint against us and our products may be greater due to the homeopathic status of our products.

We market various OTC homeopathic drug products. Homeopathic drugs have a unique status under the FDCA because, unlike other drugs, FDA does not evaluate Homeopathic drugs for safety or efficacy prior to marketing. Instead, Homeopathic drugs must meet the standards of strength, quality, and purity set forth in the Homeopathic Pharmacopeia of the United States (“HPUS”). FDA has established a policy addressing the lawful sale of Homeopathic drugs under the FDC Act. See Compliance Policy Guide (“CPG”) 7132.15, “Conditions Under Which Homeopathic Drugs May Be Marketed,” CPG Manual § 400.400 (revised March 1995). Under this compliance policy, FDA generally exempts a homeopathic drug from regulation as a new drug if: the active ingredient is the subject of a HPUS monograph; the product does not include non-homeopathic active ingredients; the product is homeopathically prepared; the claims (indications) are consistent with homeopathic usage for the active ingredient(s) in the product, as described in a recognized “material medical” and the OTC homeopathic drug product is intended solely for self-limiting diseases amenable to self-diagnosis and treatment by consumers. CPG 7132.15. In contrast, the FTC treats Homeopathic drugs similar to other OTC drugs.

In recent years, state courts have concluded that, because Homeopathic drugs are not approved or marketed pursuant to an FDA regulation, claims against a manufacturer of a homeopathic drug are not preempted by the FDCA. Consequently, plaintiff's actions under state consumer protection laws for lack of substantiation have been allowed to proceed. Ignoring the unique character of homeopathic drug products, plaintiff's claims in these actions have been based on the evidence standard applied to conventional drugs. Generally, these actions involve claims for significant monetary damages.

The implementation of new regulations governing the marketing and sale of nutritional supplements could harm our business.

There has been an increasing movement in the U.S. and other jurisdictions to increase the regulation of supplements, which could impose additional restrictions or requirements on the marketing and sale of such products. For example, in the U.S., there has been a push to increase the FDA’s regulatory authority of nutritional supplements. Our business could be harmed if more restrictive legislation is successfully introduced and adopted in the future. Currently, our OTC healthcare product, life science, and homeopathic market product are not categorized as supplements. Nutritional supplement products are not subject to pre-market FDA approval. If regulations are adopted to require pre-market approval supplements or ingredients, our sale and release of new product could be delayed or inhibited. The adoption of similar laws in other countries in which we intend to expand sales of our OTC healthcare product could also harm our business. The FTC approved revisions to its Guides Concerning the Use of Endorsements and Testimonials in Advertising (“Guides”) in December 2009. The Guides state that advertisements that feature a consumer and his or her atypical experience with a product must clearly disclose the results that consumers generally can expect with such product. In addition, the Guides require disclosure of any material connections between an endorser and the company whose products he or she is endorsing. If we fail to comply with the Guides, the FTC could bring an enforcement action against us and we could be fined and/or forced to alter our marketing strategy.

Governmental regulation of Internet-based commerce and the collection and use of personal information may adversely affect the growth of our business or hinder our marketing efforts.

Any new law or regulation, or the application or interpretation of existing laws, regarding Internet-based commerce may decrease the growth in the use of the Internet-based commerce. Governmental regulation of Internet-based commerce continues to evolve in areas such as taxation, privacy, data protection, copyrights, patents, mobile communications and the provision of online payment services. We expect there will be an increasing number of laws and regulations implemented that govern Internet-based commerce, both in the United States and abroad. Unfavorable changes to regulations in these areas could harm our business.

| 10 |

The FTC has regulations regarding the collection and use of personal identifying information obtained from individuals when accessing websites, with particular emphasis on access by minors. In addition, other governmental authorities have regulations governing the collection and use of personal information that may be obtained from customers or visitors to websites. These regulations include requirements that procedures be established to disclose and notify users of our websites of our privacy and security policies, obtain consent from users for collection and use of personal information and provide users with the ability to access, correct or delete personal information stored by us. In addition, the FTC and other governmental authorities have made inquiries and begun investigations of companies’ practices with respect to their users’ personal information collection and dissemination practices to confirm these are consistent with stated privacy policies and to determine whether precautions are taken to secure consumer’s personal information. The FTC and certain state agencies also have made inquiries, and, in a number of situations, brought actions against companies to enforce the privacy policies of these companies, including policies relating to security of consumers' personal information. If we become a party to a similar investigation or become the subject of the FTC’s regulatory and enforcement efforts or those of other governmental bodies, our ability to collect demographic and personal information from users may be adversely affected, which could harm our marketing efforts.

Our third party manufacturers’ failure to comply with good manufacturing practices could harm our business operations.

All manufacturers and suppliers of OTC products must comply with applicable current good manufacturing practice, or cGMP, regulations for the manufacture of our nutritional supplement products, which are enforced by the FDA through its facilities inspection program. The FDA may conduct inspections of our third party manufacturers to assure they are in compliance with such regulations. These cGMP requirements include quality control, quality assurance and the maintenance of records and documentation, among other items. Our manufacturers may be unable to comply with these cGMP requirements and with other regulatory requirements. A failure to comply with these requirements may result in fines, product recalls or seizures and related publicity requirements, injunctions, total or partial suspension of production, civil penalties, warning or untitled letters, import or export bans or restrictions, and criminal prosecution and penalties. Any of these penalties could delay or prevent the promotion, marketing or sale of our products. If the safety of any products supplied to us is compromised due to a third party manufacturer’s failure to adhere to applicable laws or for other reasons, we may not be able to successfully sell our products. We cannot assure you that our third-party manufacturers will continue to reliably supply products to us at the levels of quality, or the quantities, we require, and in compliance with applicable laws and regulations, including cGMP requirements.

Our manufacturing operations are located in China, which exposes us to risks associated with doing business in that geographic area to include foreign currency risk.

Currently, Prolongz and TBX-Free are produced at a FDA-registered third party manufacturer in China. Our manufacturing operations in China could be adversely affected by changes in the interpretation and enforcement of legal standards, by strains on China's available labor pool, changes in labor costs and other employment dynamics, high turnover among Chinese employees, communications, trade, and other infrastructures, by natural disasters, by conflicts or disagreements between China and the United States, by labor unrest, and by other trade customs and practices that are dissimilar to those in the United States. Interpretation and enforcement of China's laws and regulations continue to evolve and we expect differences in interpretation and enforcement to continue in the foreseeable future.

Further, we may be exposed to fluctuations in the value of the local currency in the countries in which manufacturing occurs. Future appreciation of these local currencies could increase our component and other raw material costs. In addition, our labor costs could continue to rise as wage rates increase and the available labor pool declines. These conditions could adversely affect our gross margins and financial results.

In the event of a disruption of this facility, we would need to outsource to other third parties, at least temporarily, our manufacturing. While such secondary sources have been identified for our products, if we are unable to find other sources or there were a delay in the ramp-up for the production and distribution operations for some of our products, it could have a material adverse effect on our operations.

Our inability to find alternative sources for our manufacturing needs may have a material adverse effect on our operations and financial condition. In addition, the terms on which manufacturers and suppliers will make products and raw materials available to us could have a material effect on our success.

A deterioration in trade relations between U.S. and China could negatively impact our inventory production capacity.

The majority of components for our product line, including bottles, caps, boxes and labels, are purchased from manufacturers based in China. Any deterioration in relations between the U.S. and China could adversely affect our ability to continue obtaining such components from our current Chinese suppliers or cause delays in obtaining shipments from such suppliers. Delays in obtaining such items could cause delays in fulfilling orders which could negatively affect our reputation and business. While there are alternative domestic sources for the components that we currently buy from China, obtaining components from domestic suppliers could increase costs and negatively affect our results of operations.

| 11 |

Impediments to global shipping lanes can delay crucial deliveries and negatively impact our business, financial condition and results of operations.

Both our receipt of product packaging components and our shipment of finished goods depend heavily on ship cargo container delivery. Threats of dock workers’ strikes highlight our potential vulnerability to shipping interruption. Any shipment delays in obtaining our product packaging or shipping our finished products to our customers could negatively impact our business, financial condition and results of operations.

We are uncertain as to whether we can protect our proprietary rights.

The strength of our patent position and proprietary formulations and compounds may be important to our long-term success. We currently have applied for several U.S. patents in connection with ProlongzTM ; however there can be no assurance that these patents and proprietary formulations and compounds will effectively protect our products from duplication by others. In addition, we may not be able to afford the expense of any litigation which may be necessary to enforce our rights under any of the patents. Furthermore, there can be no assurance that third parties will not obtain access to or independently develop our technologies, know-how, ideas, concepts and documentation, which could have a material adverse effect on our financial condition.

Although we believe that current and future products do not and will not infringe upon the patents or violate the proprietary rights of others, if any of our current or future products do infringe upon the patents or proprietary rights of others, we may have to modify the products or obtain an additional license for the manufacture and/or sale of such products. We could also be prohibited from selling the infringing products. If we were found to infringe on the proprietary rights of others, it is uncertain whether we would be able to take corrective actions in a timely manner, upon acceptable terms and conditions, or at all, and the failure to do so could have a material adverse effect upon our business, financial condition and operations.

We may in the future file patent litigation claims in the U.S. and foreign jurisdictions to protect our patent portfolio. If we are unsuccessful in these claims, our business, financial condition and results of operations could be adversely affected.

We may initiate litigation to assert claims of infringement, enforce our patents, protect our trade secrets or know-how, or determine the enforceability, scope and validity of the proprietary rights of others. Any lawsuits that we initiate could be expensive, time consuming and divert management’s attention from other business concerns. Furthermore, litigation may provoke third parties to assert claims against us and may put our patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not being issued.

In addition, we may not prevail in lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially valuable. The occurrence of any of these events may have a material adverse effect on our business, financial condition, and results of operations.

If our patents and other intellectual property rights do not adequately protect our products, we may lose market share to our competitors and be unable to operate our business profitably.

Patents and other proprietary rights may be essential to our business, and our ability to compete effectively with other companies depends on the proprietary nature of our technologies. We also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop, maintain and strengthen our competitive position. We seek to protect these, in part, through confidentiality agreements with certain employees, consultants and other parties. We plan to pursue a policy of generally obtaining patent protection in both the United States and key foreign countries for patentable subject matter in our proprietary products and also attempt to review third-party patents and patent applications to the extent publicly available to develop an effective patent strategy, avoid infringement of third-party patents, identify licensing opportunities and monitor the patent claims of others. We expect our patent portfolio to initially include an exclusive license to one pending patent application. We cannot assure you that any pending or future patent applications will result in issued patents, that any current or future patents issued or licensed to us will not be challenged, invalidated or circumvented or that the rights granted thereunder will provide a competitive advantage to us or prevent competitors from entering markets that we currently serve. Any required license may not be available to us on acceptable terms, if at all. In addition, some licenses may be non-exclusive, and therefore our competitors may have access to the same technologies as we do. Furthermore, we may have to take legal action in the future to protect our trade secrets or know-how, or to defend them against claimed infringement of the rights of others. Any legal action of that type could be costly and time-consuming to us, and we cannot assure you that such actions will be successful. The invalidation of key patents or proprietary rights that we own or unsuccessful outcomes in lawsuits to protect our intellectual property may have a material adverse effect on our business, financial condition, and results of operations.

The laws of foreign countries may not protect our intellectual property rights to the same extent as the laws of the United States. If we cannot adequately protect our intellectual property rights in these foreign countries, our competitors may be able to compete more directly with us, which could adversely affect our competitive position and, as a result, our business, financial condition and results of operations.

| 12 |

Our existing product and potential new products expose us to potential product liability claims.

Our business results in exposure to an inherent risk of potential product liability claims, including claims for serious bodily injury or death caused by the sales of our existing product and the products which are being developed. These claims could lead to substantial damage awards. While we currently maintain product liability insurance, a successful claim brought against us in excess of, or outside of, existing insurance coverage could have a material adverse effect on our results of operations and financial condition. Claims against us, regardless of their merit or eventual outcome, may also have a material adverse effect on the consumer demand for our products.

The adult nature of some of our current product may prevent some companies from doing business with us.

Some companies we seek to provide products and services to us may be concerned that associating with our company due to the adult nature of our current product may prevent them from doing business with us. These companies may be reluctant to enter into or continue business relationships with us. We cannot assure you that we will be able to maintain our existing business relationships with the companies that currently provide services and products to us. We could be forced to enter into business arrangements on terms less favorable to us than we might otherwise obtain, which could lead to higher costs. If we are unable to maintain our existing business relationships or enter into business relationships with other product and service providers in the future, our business, financial condition and results of operations may be materially adversely affected.

If we experience product recalls, we may incur significant and unexpected costs, and our business reputation could be adversely affected.

We may be exposed to product recalls and adverse public relations if our products are alleged to cause injury or illness, or if we are alleged to have violated governmental regulations. A product recall could result in substantial and unexpected expenditures, which would reduce operating profit and cash flow. In addition, a product recall may require significant management attention. Product recalls may hurt the value of our brands and lead to decreased demand for our products. Product recalls also may lead to increased scrutiny by federal, state or international regulatory agencies of our operations and increased litigation and could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We are highly dependent upon consumers' perception of the safety and quality of our products as well as similar products distributed by other companies in our industry; adverse publicity and negative public perception regarding particular ingredients or products or our industry in general could limit our ability to increase revenue and grow our business.

Decisions about purchasing made by consumers of our products may be affected by adverse publicity or negative public perception regarding particular ingredients or products or our industry in general. This negative public perception may include publicity regarding the legality or quality of particular ingredients or products in general or of other companies or our products or ingredients specifically. Negative public perception may also arise from regulatory investigations, regardless of whether those investigations involve us. We are highly dependent upon consumers' perception of the safety and quality of our products as well as similar products distributed by other companies. Thus, the mere publication of reports asserting that such products may be harmful could have a material adverse effect on us, regardless of whether these reports are scientifically supported. Publicity related to nutritional supplements and OTC healthcare and wellness products may also result in increased regulatory scrutiny of our industry and/or the healthy foods channel. Adverse publicity may have a material adverse effect on our business, financial condition, and results of operations. There can be no assurance of future favorable scientific results and media attention or of the absence of unfavorable or inconsistent findings.

We face intense competition from competitors that are larger, more established and that possess greater resources than we do, and if we are unable to compete effectively, we may be unable to maintain sufficient market share to sustain profitability.

Numerous manufacturers and retailers compete actively for consumers. There can be no assurance that we will be able to compete in this intensely competitive environment. In addition, nutritional supplements and OTC healthcare and wellness products can be purchased in a wide variety of channels of distribution. These channels include mass market retail stores and the Internet. Because these markets generally have low barriers to entry, additional competitors could enter the market at any time. Private label products of our customers also provide competition to our products. Additional national or international companies may seek in the future to enter or to increase their presence in the healthy foods channel or the vitamin, mineral supplement market, and OTC healthcare and wellness products. Increased competition in either or both could have a material adverse effect on us.

| 13 |

If our current and planned sales, marketing and servicing capabilities or entry into arrangements with third parties to sell and market our products and services adversely changes, our business may be harmed.