Attached files

Use these links to rapidly review the document

TABLE OF CONTENTS

PART IV

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

Commission File Number 1-5794

MASCO CORPORATION

(Exact name of Registrant

as Specified in its Charter)

| Delaware | 38-1794485 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) | |

| 21001 Van Born Road, Taylor, Michigan | 48180 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: 313-274-7400

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

|

|---|---|---|

| Common Stock, $1.00 par value | New York Stock Exchange, Inc. |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the Registrant's Common Stock held by non-affiliates of the Registrant on June 30, 2015 (based on the closing sale price of $26.67 of the Registrant's Common Stock, as reported by the New York Stock Exchange on such date) was approximately $9,059,896,000.

Number of shares outstanding of the Registrant's Common Stock at January 31, 2016:

333,931,600 shares of Common Stock, par value $1.00 per share

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive Proxy Statement to be filed for its 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Masco Corporation

2015 Annual Report on Form 10-K

1

Masco Corporation is a global leader in the design, manufacture, marketing and distribution of branded home improvement and building products. Our portfolio of industry-leading brands includes KRAFTMAID® and MERILLAT® cabinets; DELTA®, PEERLESS®, and HANSGROHE® faucets, bath and shower fixtures; HOT SPRING® and CALDERA® spas; BEHR® paint, primer and stain; KILZ® primer; LIBERTY® and BRAINERD® decorative hardware; and MILGARD® windows and doors. We leverage our powerful brands across product categories, sales channels and geographies to create value for our customers and shareholders.

During 2015, we further advanced our strategy to position the Company for future growth by focusing on three strategic pillars: driving the full potential of our core businesses, leveraging opportunities across our businesses, and actively managing our portfolio. We achieved gains in each of these areas.

First, to drive the full potential of our core businesses, we pursued sales growth opportunities in adjacent markets and products, continued the deployment of standardized operating tools across the enterprise, executed cost saving initiatives and expanded our implementation of lean principles and process improvements in many areas, including production and functional support processes.

We also continued to leverage the collective strength of our enterprise, the second pillar of our strategy. We provided new assignments to selected leaders across our business units to further develop talent and facilitate operational improvements. We continued to realize supply chain efficiencies through strategic sourcing, and we continued to share best practices across all of our functional departments to enhance productivity. As a result, our operating results (excluding the impact of foreign currency translation) improved across all of our segments, particularly at our U.S. cabinets business.

The third pillar of our strategy is to actively manage our portfolio. On June 30, 2015, we completed the spin off of our Installation and Other Services businesses into an independent, publicly-traded, company, TopBuild Corp., through a tax-free distribution to our shareholders. As a result of the spin off, our business has become less dependent on new home construction, and is, therefore, less cyclical, and a greater portion of our sales are derived from international markets. In addition, we acquired two businesses in 2015 that complement our existing portfolio. First, we expanded our product offering and distribution channels into the aquatic fitness category with the acquisition of the ENDLESS POOLS® brand. We also acquired Evolution Manufacturing, which expands our offering of fiberglass and composite windows in the United Kingdom. To further enhance value creation for our shareholders, during 2015 we repurchased over 17 million shares of our common stock and increased our quarterly dividend by approximately 6 percent.

We believe that the actions we took during 2015 have positioned our company for further enhancement of shareholder value. We also believe that completion of the spin off allows us to pursue a more focused strategy of growth. We will continue to actively manage our portfolio, identify growth opportunities in key industries and produce new products that differentiate us in the marketplace by combining design and innovation. By continuing our disciplined execution of our strategy, we believe that we will increase shareholder value.

Our Business Segments

We report our financial results in four business segments aggregated by similarity in products and services. The following table sets forth the contribution of our segments to net sales and operating profit (loss) for the three years ended December 31, 2015. Additional financial information concerning our operations by segment and by geographic regions, as well as general corporate expense, net, as of and

2

for the three years ended December 31, 2015, is set forth in Note P to our consolidated financial statements included in Item 8 of this Report.

| |

|

(In Millions) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Net Sales (1) | |||||||||

| |

2015 | 2014 | 2013 | |||||||

Cabinets and Related Products |

$ | 1,025 | $ | 999 | $ | 1,014 | ||||

Plumbing Products |

3,341 | 3,308 | 3,183 | |||||||

Decorative Architectural Products |

2,020 | 1,998 | 1,927 | |||||||

Other Specialty Products |

756 | 701 | 637 | |||||||

| | | | | | | | | | | |

Total |

$ | 7,142 | $ | 7,006 | $ | 6,761 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| |

Operating Profit (Loss) (1)(2)(3) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | |||||||

Cabinets and Related Products |

$ | 51 | $ | (62 | ) | $ | (10 | ) | ||

Plumbing Products |

512 | 512 | 394 | |||||||

Decorative Architectural Products |

403 | 360 | 351 | |||||||

Other Specialty Products |

57 | 47 | 35 | |||||||

| | | | | | | | | | | |

Total |

$ | 1,023 | $ | 857 | $ | 770 | ||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Amounts exclude discontinued operations.

- (2)

- Operating profit (loss) is before general corporate expense, net.

- (3)

- Operating profit (loss) is before income of $9 million regarding the 2014 litigation settlement in the Decorative Architectural Products segment.

All of our operating segments, except the Plumbing Products segment, normally experience stronger sales during the second and third calendar quarters, corresponding with the peak season for repair and remodel activity and new home construction.

Cabinets and Related Products

In North America, we manufacture and sell value-priced, stock and semi-custom assembled cabinetry for kitchen, bath, storage, home office and home entertainment applications in a broad range of styles and price points to address consumer preferences. Our product offerings in this segment also include the fabrication and sale of integrated bathroom vanity and countertop products. In the United Kingdom, we manufacture and sell kitchen, bath, and storage cabinetry. Our KRAFTMAID® brand is sold primarily to dealers and home center retailers, and our MERILLAT®, QUALITY CABINETS™, MOORES™ and CARDELL® brands are sold primarily to dealers and homebuilders for both home improvement and new home construction. Cabinet sales are significantly affected by levels of activity in both retail consumers spending and new home construction, particularly spending for major kitchen and bathroom renovation projects. A significant portion of our sales for home improvement are made through home center retailers.

Our Cabinets and Related Products segment was particularly affected by the economic downturn and decline in new home construction and repair and remodel activity that began in 2008. Consumer spending for big ticket remodeling projects is improving, including large kitchen and bath remodeling projects, but continues to be below normal levels, which impacts our profitability. Home construction is also improving and is expected to continue to improve. Demand has increased for multi-family housing units, which are generally smaller and require fewer kitchen and bathroom cabinets than single-family housing units. Our initiatives to improve this segment have been complex, time-consuming and expensive. Although the operating results of our cabinetry businesses improved in 2015, we continue to

3

focus on obtaining profitable sales, reducing our cost structure and improving cabinet production efficiencies. We are pursuing strategies to increase sales through new product introductions and enhanced customer service, and to rationalize a portion of our customer base in our builder channel to focus on opportunities that offer more profitable growth.

The cabinet manufacturing industry in the United States and the United Kingdom includes several large competitors and numerous local and regional competitors, and in the United Kingdom, foreign manufacturers. In recent years, we have experienced significant competition in the form of new product offerings by our competitors, which have impacted the segment's results of operations. Additional local and regional competitors may enter this industry as conditions improve. In addition to price, we believe that competition in this industry is based largely on product quality, responsiveness to customer needs, product features and selection. Some of our North American competitors include American Woodmark Corporation, Fortune Brands Home & Security, Inc. and Elkay.

The raw materials used in this segment are primarily hardwood lumber, plywood and particleboard, and are available from multiple sources, both domestic and foreign.

Plumbing Products

The businesses in our Plumbing Products segment sell a wide variety of products that are manufactured or sourced by us. The majority of our faucet, bathing and showering devices are sold in North America and Europe under the brand names DELTA®, PEERLESS®, HANSGROHE®, AXOR®, BRIZO®, GINGER®, NEWPORT BRASS®, BRASSTECH® and PLUMB SHOP®. Our BRISTAN™ and HERITAGE™ products are principally sold in the United Kingdom. These plumbing products include faucets, showerheads, handheld showers, valves, bathing units, shower enclosures and toilets and are sold to home center retailers and to wholesalers and distributors that, in turn, sell them to plumbers, building contractors, remodelers, smaller retailers and consumers.

Our acrylic tub and shower systems, bath and shower enclosure units and shower trays are manufactured and sold under the DELTA, PEERLESS, and MIROLIN® brand names. These products are sold primarily to home center retailers for home improvement and new home construction in North America. Our MIROLIN products are also sold to wholesalers and distributors in Canada. Our HÜPPE® shower enclosures are sold through wholesale channels in Europe and China.

Our spas and exercise pools are manufactured and sold under HOT SPRING®, CALDERA®, FREEFLOW SPAS®, FANTASY SPAS®, ENDLESS POOLS® and other trademarks. Spa products are sold to independent specialty retailers or online mass merchant retailers, while exercise pools are available on a consumer direct basis. Competitors include Jacuzzi, Master Spas and Dynasty Spas.

Also included in our Plumbing Products segment are brass and copper plumbing system components and other plumbing specialties, which are sold to plumbing, heating and hardware wholesalers, home center retailers, hardware stores, building supply outlets and other mass merchandisers. These products are marketed in North America for the wholesale trade under our BRASSCRAFT®, PLUMB SHOP®, COBRA®, BRASSTECH®, and MASTER PLUMBER® trademarks, and are also sold under private label.

We believe that our plumbing products are among the leaders in sales in North America and Europe. Our major competitors include Lixil Group Corporation's American Standard Brands and Grohe products, Kohler Co., Fortune Brands Home & Security Inc. and Spectrum Brands Holdings, LLC's Pfister faucets. We also experience competition from foreign manufacturers, including Grohe, particularly in Germany, China and the Middle East. We face significant competition from private label products. Many of the faucet and showering products with which our products compete are manufactured by foreign manufacturers that are putting downward pressure on price. The businesses in our Plumbing Products segment manufacture products in the United States, Europe and Asia and source products from Asia and other regions. In addition to price, we believe that brand reputation is an important factor in consumer

4

selection. Competition for our plumbing products is based largely on service, product quality, product innovation and features and breadth of product offering.

Many of our plumbing products contain brass, the major components of which are copper and zinc. We have multiple sources, both domestic and foreign, for the raw materials used in this segment, and sufficient raw materials have been available for our needs. We have encountered price volatility for brass, brass components and any components containing copper and zinc; therefore, we have implemented a hedging strategy to help reduce the impact of this volatility.

Decorative Architectural Products

We produce architectural coatings, including paints, primers, specialty paint products, stains and waterproofing products. These products are sold in North America, China, and South America under the brand names BEHR®, BEHR PRO® and KILZ® to "do-it-yourself" and professional customers through home center retailers and other retailers. Net sales of architectural coatings comprised approximately 25 percent of our consolidated net sales in 2015, 2014 and 2013. Our BEHR products are sold through The Home Depot, our largest customer and this segment's largest customer. The loss of this segment's sales to The Home Depot would have a material adverse effect on this segment's business and on our consolidated business as a whole.

Our competitors include large national and international brands such as Benjamin Moore, Glidden, Olympic, PPG, Sherwin-Williams, Valspar and Zinsser, as well as many regional and other national brands. In addition to price, we believe that brand reputation is an important factor in consumer selection, and that competition in this industry is based largely on product quality, technology and product innovation, and customer service. In 2015, we introduced a new BEHR® COLOR SOLUTIONS® Center, designed to enhance the color selection process and overall shopping experience, in all North American The Home Depot stores.

Fluctuations in raw material costs can have a material impact on our operating results in this segment. Titanium dioxide and acrylic resins derived from crude oil and natural gas are used in the manufacturing of architectural coatings. Significant increases in the cost of crude oil and natural gas can adversely affect this segment's results of operations. Global supply and demand dynamics and production capacity limitations can cause fluctuations in the price of titanium dioxide and acrylic resins, which can impact our results. We have agreements with the significant suppliers of the major raw materials used in this segment which are intended to help assure continued availability.

Our Decorative Architectural Products segment also includes branded cabinet, door, window and other hardware, which are manufactured for us and sold to home center retailers, other retailers, original equipment manufacturers and wholesalers. These products are sold under the LIBERTY® and BRAINERD® brands. Key competitors in North America include Amerock, Top Knobs and house brands. Decorative bath hardware and shower accessories are sold under the brand names DELTA® and FRANKLIN BRASS® to distributors, home center retailers and other retailers. Competitors include Moen, Gatco and private label brands.

Other Specialty Products

We manufacture and sell vinyl, fiberglass and aluminum windows and patio doors, as well as the ESSENCE SERIES® windows and doors, which combines a wood interior with a fiberglass exterior, under the MILGARD® brand name for home improvement and new home construction, principally in the western United States. MILGARD products are sold primarily through dealers and, to a lesser extent, directly to production and custom homebuilders and through lumber yards and home center retailers. Our North American competitors for these products include national brands, such as Jeld-Wen, Marvin, Pella and Andersen, and numerous regional brands.

5

In the United Kingdom, we manufacture and sell vinyl windows, composite and panel doors, related products and components under several brand names including DURAFLEX™, GRIFFIN™, PREMIER™ and EVOLUTION™. Sales are primarily through dealers and wholesalers to the repair and remodeling markets, although our DURAFLEX products are also sold to other window fabricators. United Kingdom competitors include many small and mid-sized firms and a few large, vertically integrated competitors.

In addition to price, we believe that brand reputation is an important factor in consumer selection and that competition in this industry in both the domestic and foreign markets is based largely on product quality, innovative products and customer and warranty services.

We manufacture and sell a complete line of manual and electric heavy duty staple guns, hammer tackers, glue guns and rivet tools as well as the staples, glue and rivets that complement our products. We sell these products primarily in North America under the brand names ARROW®, POWERSHOT® and EASYSHOT® to professional contractors and do-it-yourself consumers through various distribution channels, including home center and other retailers and wholesalers. Our principal North American competitor in this product line is Stanley Black & Decker.

The raw materials used in this segment have been available from multiple sources, although our U.S. window business has, at times, experienced allocation of glass from its suppliers.

Additional Information

Intellectual Property

We hold numerous U.S. and foreign patents, patent applications, licenses, trademarks, trade names, trade secrets and proprietary manufacturing processes. As a manufacturer and distributor of brand name products, we view our trademarks and other intellectual property rights as important, but do not believe that there is any reasonable likelihood of a loss of such rights that would have a material adverse effect on our present business as a whole.

Laws and Regulations Affecting Our Business

We are subject to U.S. and foreign government regulations, particularly those pertaining to health and safety (including protection of employees and consumers), climate disruption and environmental issues. Our businesses are subject to requirements regarding protection of the environment and worker health and safety and have certain responsibilities for environmental remediation.

- •

- Our Cabinets and Related Products segment is subject to requirements relating to the emission of volatile organic compounds, which may

impact our sourcing of particleboard and may require that we install special equipment in manufacturing facilities.

- •

- Our Decorative Architectural Products segment is also subject to the requirements relating to the emission of volatile organic

compounds, which may require us to reformulate paint products.

- •

- Certain products in our Plumbing Products segment are subject to restrictions on lead content and on waterflow.

Compliance with these laws and regulations significantly affects product performance as well as our production costs. We monitor applicable laws and regulations relating to the protection of the environment, climate disruption and worker health and safety, and incur ongoing expense relating to compliance. We do not expect compliance with the federal, state and local regulations relating to the discharge of materials into the environment, or otherwise relating to the protection of the environment and worker health and safety, will result in material capital expenditures or have a material adverse effect on our earnings or competitive position.

6

Backlog

We do not consider backlog orders to be material in any of our segments.

Employees

At December 31, 2015, we employed approximately 25,000 people. We have generally experienced satisfactory relations with our employees.

Available Information

Our website is www.masco.com. Our periodic reports and all amendments to those reports required to be filed or furnished pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after those reports are electronically filed with or furnished to the Securities and Exchange Commission. This Report is being posted on our website concurrently with its filing with the Securities and Exchange Commission. Material contained on our website is not incorporated by reference into this Report.

7

There are a number of business risks and uncertainties that could affect our business. These risks and uncertainties could cause our actual results to differ from past performance or expected results. We consider the following risks and uncertainties to be most relevant to our specific business activities. Additional risks and uncertainties not presently known to us, or that we currently believe to be immaterial, also may adversely impact our business, financial condition and results of operations.

Our business relies on home improvement and new home construction activity, both of which are cyclical.

A significant portion of our business relies on home improvement, including repair and remodeling projects, of which our reliance has increased following the spin off of TopBuild Corp. ("TopBuild") in 2015. Our business also relies on new home construction activity. Macroeconomic conditions in the U.S. and Europe, including consumer confidence levels, fluctuations in home prices, unemployment and underemployment levels, consumer income and debt levels, household formation and the availability of home equity loans and mortgages and the interest rates for such loans, affect both consumers' discretionary spending on home improvement projects as well as new home construction activity. While improving, both consumer spending for big ticket remodeling projects and new home construction continue to be below historic average levels. Adverse changes or uncertainty regarding these macroeconomic conditions could result in a decline in spending on home improvement projects and a decline in demand for new home construction, both of which could adversely affect our results of operations and our financial position.

If we do not maintain strong brands, develop new products or respond to changing purchasing practices and consumer preferences we could lose market share.

Our competitive advantage is due, in part, to our ability to maintain our strong brands and to develop and introduce innovative new and improved products. While we continue to invest in brand building and brand awareness, these initiatives may not be successful. The uncertainties associated with developing and introducing new and improved products, such as gauging changing consumer preferences and successfully developing, manufacturing, marketing and selling these products, may impact the success of our product introductions. If we do not introduce new or improved products in a timely manner or if these products do not gain widespread acceptance, we could lose market share, which could negatively impact our operating results.

In recent years, consumer purchasing practices and preferences have shifted and our customers' business models and strategies have changed. Consumers are increasingly using the internet and mobile technology to research home improvement products and to inform and provide feedback on their purchasing and ownership experience for these products. E-business is a rapidly developing area, and the refinement and execution of a successful e-business strategy involves significant time, investment and resources. If we are unable to successfully execute our e-business strategy, our brands may lose market share.

While U.S. demand for single-family houses is increasing, the demand for multi-family housing units such as apartments and condominiums continues to be elevated compared to historic levels. Multi-family units typically are smaller than single-family houses and require fewer kitchen and bathroom cabinets than single-family houses. If this demand mix remains, it may limit our growth opportunities.

If we do not timely and effectively identify and respond to these changing purchasing practices and consumer preferences, our relationships with our customers and with consumers could be harmed, the demand for our brands and products could be reduced and our results of operations could be negatively affected.

8

We face significant competition.

Our products face significant competition. We believe that brand reputation is an important factor impacting product selection and that we compete on the basis of product features and innovation, product quality, customer service, warranty and price. Home center retailers continue to purchase products in our segments directly from low-cost foreign manufacturers for sale as private label merchandise. Additionally, home center retailers, which have historically concentrated their sales efforts on retail consumers and remodelers, are increasingly marketing directly to professional contractors and installers, which may impact our margins on our products that contractors and installers would otherwise buy through our dealers and wholesalers.

We sell many of our products through distributors and independent dealers and we rely on these customers to market and promote our products to consumers. Our success with these customers is dependent on our ability to provide quality products and timely delivery. Additionally, in these channels as well as at home center retailers, we compete with foreign manufacturers in a variety of our product groups. Some of these foreign manufacturers are putting downward pressures on price. As market dynamics change, we may experience a shift in the mix of some products we sell toward more value-priced or opening price point products, which may impact our ability to maintain or gain market share and/or our profitability.

Our ability to maintain our competitive position in our industries depends upon maintaining strong brands, developing and innovating products, maintaining strong relationships with our customers, managing our cost structure, executing a successful e-business strategy, accommodating customer demands for new and improved products on a shorter cycle, implementing growth strategies and entering new domestic and international areas, none of which is assured.

Our sales are concentrated with two significant customers.

As a result of the spin off of TopBuild in 2015, the mix of our business operations has changed and the concentration of our sales to our two largest customers has increased and may continue to increase. In 2015, net sales to our largest customer, The Home Depot, were $2.4 billion (approximately 33 percent of our consolidated net sales). In 2015, net sales to Lowe's, our second largest customer, were less than ten percent of our consolidated net sales. If the mix of our business operations continues to change, including as a result of acquisitions or divestitures, our reliance on these significant customers may further increase. These home center retailers can significantly affect the prices we receive for our products and the terms and conditions on which we do business with them. Additionally, these home center customers may reduce the number of vendors from which they purchase and could make significant changes in their volume of purchases. Although other retailers, dealers, distributors and homebuilders represent other channels of distribution for our products and services, the loss of a substantial portion of our sales to The Home Depot or the loss of all of our sales to Lowe's would have a material adverse effect on our business.

Further, as some of these home center retailers expand their markets and targeted customers and as consumer purchasing practices change and e-commerce increases, conflicts between our existing distribution channels have and will continue to occur, which could impact our results of operations. Our relationships with our customers may be impacted if we increase the amount of business we transact directly with consumers. In addition, our large retail customers request product exclusivity from time to time, which may affect our ability to offer products to other customers and may diminish our ability to leverage economies of scale.

We may not achieve all of the anticipated benefits of our strategic initiatives.

We continue to pursue our strategic initiatives, which are designed to increase shareholder value over the mid- to long-term. Our business performance and results could be adversely affected if we are

9

unable to successfully execute these initiatives, or if we are unable to execute them in a timely and efficient manner. We could also be adversely affected if we are unable to effectively manage change throughout our organization.

Pursuing the acquisition of businesses complementary to our portfolio is a component of our strategy for future growth. If we are not able to identify suitable acquisition candidates or consummate potential acquisitions, our long-term competitive positioning may be impacted. Even if we are successful in acquiring businesses, we may experience risks in integrating these businesses into our existing business. Such risks include difficulties realizing expected synergies and economies of scale, diversion of our resources, unforeseen liabilities, issues with the new or existing customers or suppliers, and difficulties in retaining critical employees of the acquired businesses. Future foreign acquisitions may also increase our exposure to foreign currency risks and risks associated with interpretation and enforcement of foreign regulations. Our failure to address these risks could cause us to incur additional costs and/or fail to realize the anticipated benefits of our acquisitions and could adversely affect our results of operations.

We may not be able to sustain the turnaround in our cabinetry businesses.

Our initiatives to improve our cabinetry operations have been complex, time-consuming and expensive. Although the operating results of our cabinetry businesses improved in 2015, we continue to focus on obtaining profitable sales, reducing our cost structure and improving production efficiencies. Our strategies in these areas require time to implement, execute and assess and may not be successful. If the improvement in our cabinetry businesses cannot be sustained or if the pace of the improvement slows, our results of operations may be negatively impacted.

Variability in commodity costs or limited availability of commodities could impact us.

We buy various commodities to manufacture our products, including, among others, brass, resins, titanium dioxide, zinc, wood and glass. In addition, water is a significant component of many of our architectural coatings products and may be subject to restrictions in certain regions. Fluctuations in the availability and prices of these commodities could increase our costs to manufacture our products. Further, increases in energy costs could increase our production costs as well as our transportation costs, each of which could negatively affect our financial condition and operating results.

It has been, and likely will continue to be, difficult for us to pass on to customers cost increases to cover our increased commodity and production costs. Our existing arrangements with customers, competitive considerations and customer resistance to price increases may delay or make us unable to adjust selling prices. If we are not able to increase the prices of our products or achieve cost savings to offset increased commodity and production costs, our financial condition and operating results could be negatively impacted. If we are able to increase our selling prices, sustained price increases for our products may lead to sales declines and loss of market share, particularly if our competitors do not increase their prices. When commodity prices decline, we have experienced and may in the future receive pressure from our customers to reduce our prices. Such reductions could impact our operating results.

To help reduce price volatility associated with certain anticipated commodity purchases, we use derivative instruments, including commodity futures and swaps. This strategy increases the possibility that we may make commitments to purchase these commodities at prices that subsequently exceed their market prices, which has and may continue to adversely affect our financial condition and operating results. We also have agreements with certain significant suppliers to help assure continued availability.

10

We are dependent on third-party suppliers.

We rely heavily on third-party suppliers for many of our products and components, and our ability to offer a wide variety of products depends on our ability to obtain an adequate supply of these products and components. Failure by our suppliers to provide us quality products on commercially reasonable terms, or to comply with applicable legal and regulatory requirements, could have a material adverse effect on our financial condition or operating results. Resourcing these products and components to another supplier could take time and involve significant costs. Accordingly, the loss of critical suppliers, or a substantial decrease in the availability of products or components from our suppliers, could disrupt our business and adversely impact our operating results.

Many of the suppliers upon whom we rely are located in foreign countries. The differences in business practices, shipping and delivery requirements and laws and regulations, together with the limited number of suppliers, have increased the complexity of our supply chain logistics and the potential for interruptions in our production scheduling. If we are unable to effectively manage our supply chain, our operating results could be negatively affected.

There are risks associated with international operations and global strategies.

Approximately 21 percent of our sales are made outside of North America (principally in Europe) and are transacted in currencies other than the U.S. dollar. Following the TopBuild spin off, a greater proportion of our sales occurs outside of the U.S., and increasing our international sales is an important part of our strategic plans. In addition to our European operations, we manufacture products in Asia and source products and components from third parties globally. Risks associated with our international operations include changes in political, monetary and social environments, labor conditions and practices, the laws, regulations and policies of foreign governments, social and political unrest, terrorist attacks, cultural differences and differences in enforcement of contract and intellectual property rights.

Our operating results are also impacted by international economic conditions, primarily in Europe. As our sales made outside of the U.S. have increased, we have experienced a greater negative impact from currency conversion rates, particularly the Euro, the Canadian dollar and the British pound sterling, on our results of operations due to the strength of the U.S. dollar compared to foreign currencies. Fluctuations in currency exchange rates may present challenges in comparing operating performance from period to period.

U.S. laws and regulations regarding activities of U.S. companies doing business abroad, including tax laws, laws regulating competition, anti-bribery/anti-corruption and other business practices, and trade regulations, which may include duties and tariffs, can also affect us. While it is difficult to assess what changes may occur and the relative impact on our international tax structure, it is possible that significant changes in how U.S. and foreign jurisdictions tax cross-border transactions could adversely impact our financial results.

We may not be able to adequately protect or prevent the unauthorized use of our intellectual property.

Protecting our intellectual property is critical to our growth and innovation efforts. We own a number of patents, trade names, brand names and other forms of intellectual property in our products and manufacturing processes throughout the world. There can be no assurance that our efforts to protect our intellectual property rights will prevent violations. Our intellectual property may be challenged or infringed upon by third parties, particularly in countries where property rights are not highly developed or protected. In addition, the global nature of our business increases the risk that we may be unable to obtain or maintain our intellectual property rights on reasonable terms. Furthermore, others may assert intellectual property infringement claims against us. Protecting and defending our intellectual property could be costly, time consuming and require significant resources. If we are not able to protect our existing

11

intellectual property rights, or prevent unauthorized use of our intellectual property, sales of our products may be affected and we may experience reputational damage to our brand names, increased litigation costs and adverse impact to our competitive position, which could affect our results of operations.

The long-term performance of our businesses relies on our ability to attract, develop and retain talented personnel.

To be successful, we must attract, develop and retain highly qualified and talented personnel who have the experience, knowledge and expertise to successfully implement our key business strategies. We compete for employees with a broad range of employers in many different industries, including large multinational firms, and we invest significant resources in recruiting, developing, motivating and retaining them. The failure to attract and retain key employees, or to develop effective succession planning to assure smooth transitions of those employees and the knowledge and expertise they possess, could negatively affect our competitive position and our operating results. If we are unable to recruit, train and retain sufficient skilled and unskilled labor, we may not be able to adequately satisfy increased demand for our products and services, and our operating results could be adversely affected.

Claims and litigation could be costly.

We are involved in various claims, litigation matters and regulatory proceedings that arise in the ordinary course of our business and which could have a material adverse effect on us. These matters may include competition, products liability, employment, warranty disputes, advertising claims, contract disputes, personal injury claims, environmental claims or proceedings, and other proceedings and litigation, including class actions.

We are subject to product safety regulations, recalls and direct claims for product liability that can result in significant liability and, regardless of the ultimate outcome, can damage the reputation of our brands and business and can be costly to defend or manage. Also, we rely on other manufacturers to provide us with products or components for products that we sell. Due to the difficulty of controlling the quality of products or components sourced from other manufacturers, we are exposed to risks relating to the quality of such products and to limitations on our recourse against such suppliers.

We intend to defend all claims and litigation matters vigorously; however, given the inherently unpredictable nature of claims and litigation, we cannot predict with certainty the outcome or effect of any claim or litigation matter. In recent years, we have experienced class action lawsuits predicated upon claims for product liability and wage and hour issues, and we may be subject to other consumer claims in the future. We have generally denied liability and have vigorously defended these cases. Due to their scope and complexity, however, these lawsuits can be particularly costly to defend and resolve, and we have and may continue to incur significant costs as a result of these types of lawsuits.

We maintain insurance against some, but not all, of these risks of loss resulting from claims and litigation. We may elect not to obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. The levels of insurance we maintain may not be adequate to fully cover any and all losses or liabilities. If any significant accident, judgment, claim or other event is not fully insured or indemnified against, it could have a material adverse impact on our business, financial condition and results of operations. We may also experience increased costs for insurance coverage that could impact our financial results.

See Note U to the consolidated financial statements included in Item 8 of this Report for additional information about litigation involving our businesses.

12

Compliance with laws, government regulation and industry standards could impact our operating results.

We are subject to federal, state and foreign government regulations, particularly those pertaining to health and safety (including protection of employees and consumers), product compliance, competition practices, import and export regulations, climate disruption and environmental issues. In addition to complying with current requirements and requirements that will become effective at a future date, even more stringent requirements could be imposed on us in the future. Additionally, some of our products must be certified by industry organizations. Compliance with these laws, regulations and industry standards may require us to alter our product designs, our manufacturing processes or our sourcing. Further, compliance activities are costly and require significant management attention and resources. If we do not effectively and timely comply with such regulations and industry standards, our results of operations could be negatively affected.

We rely on information systems and technology, and disruptions to these systems could impact our operating results.

We rely on a number of information systems and technology to process, transmit, store and manage information to support our business activities, and we have plans to make significant investments in new technology systems. We may be adversely impacted if our information systems are disrupted or fail, or if we do not appropriately select and implement our new technology systems in a timely manner. In addition to the disruptions that may occur from interruptions in our systems, increased global cybersecurity vulnerabilities, threats and more sophisticated and targeted attacks pose a risk to our information technology systems. We have established security policies, processes and layers of defense designed to help identify and protect against intentional and unintentional misappropriation or corruption of our systems and information and disruption of our operations. Despite these efforts, our systems may be damaged, disrupted, or shut down due to attacks by unauthorized access, malicious software, undetected intrusion, hardware failures, or other events, and in these circumstances our disaster recovery plans may be ineffective or inadequate. These breaches or intrusions could lead to business interruption, exposure of proprietary or confidential information, data corruption, damage to our reputation, exposure to litigation, and increased operational costs. Such events could have a material adverse impact on our operating results. In addition, we could be adversely affected if any of our significant customers or suppliers experiences any similar events that disrupt their business operations or damage their reputation.

Restrictive covenants in our credit agreement could limit our financial flexibility.

We must comply with both financial and nonfinancial covenants in our credit agreement, and in order to borrow under it, we cannot be in default with any of those provisions. Our ability to borrow under the credit agreement could be impacted if our earnings significantly decline to a level where we are not in compliance with the financial covenants or if we default on any nonfinancial covenants. In the past, we have been able to amend the covenants in our credit agreement, but there can be no assurance that in the future we would be able to further amend them. If we were unable to borrow under our credit agreement, our financial flexibility would be restricted if we were also unable to obtain alternative financing on acceptable terms and at acceptable rates or if we were not permitted to obtain alternative financing under the terms of our existing financing arrangements.

The TopBuild spin off could result in substantial tax liability to us and our stockholders.

We received an opinion of tax counsel substantially to the effect that, for U.S. Federal income tax purposes, the spin off and certain related transactions qualify for tax-free treatment under certain sections of the Internal Revenue Code. However, if the factual assumptions or representations made by us in connection with the delivery of the opinion are inaccurate or incomplete in any material respect, including

13

those relating to the past and future conduct of our business, we will not be able to rely on the opinion. Furthermore, the opinion is not binding on the Internal Revenue Service or the courts. If, notwithstanding receipt of the opinion, the spin off transaction and certain related transactions are determined to be taxable, we would be subject to a substantial tax liability. In addition, if the spin off transaction is taxable, each holder of our common stock who received shares of TopBuild in connection with the spin off would generally be treated as receiving a taxable distribution of property in an amount equal to the fair market value of the shares received, thereby potentially increasing such holder's tax liability.

Even if the spin off otherwise qualifies as a tax-free transaction, the distribution could be taxable to us (but not to our stockholders) in certain circumstances if future significant acquisitions of our stock or the stock of TopBuild are deemed to be part of a plan or series of related transactions that included the spin off. In this event, the resulting tax liability could be substantial. In connection with the spin off, we entered into a tax matters agreement with TopBuild, pursuant to which TopBuild agreed to not enter into any transaction that could cause any portion of the spin off to be taxable to us without our consent and to indemnify us for any tax liability resulting from any such transaction. These obligations and potential tax liabilities may discourage, delay or prevent a change of control of us.

Item 1B. Unresolved Staff Comments.

None.

The table below lists our principal North American properties.

Business Segment

|

Manufacturing | Warehouse and Distribution |

|||||

|---|---|---|---|---|---|---|---|

Cabinets and Related Products |

8 | 8 | |||||

Plumbing Products |

19 | 4 | |||||

Decorative Architectural Products |

8 | 9 | |||||

Other Specialty Products |

11 | 6 | |||||

| | | | | | | | |

Totals |

46 | 27 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Most of our North American facilities range from single warehouse buildings to complex manufacturing facilities. We own most of our North American manufacturing facilities, none of which are subject to significant encumbrances. A substantial number of our warehouse and distribution facilities are leased.

The table below lists our principal properties outside of North America.

Business Segment

|

Manufacturing | Warehouse and Distribution |

|||||

|---|---|---|---|---|---|---|---|

Cabinets and Related Products |

1 | 1 | |||||

Plumbing Products |

11 | 22 | |||||

Decorative Architectural Products |

— | — | |||||

Other Specialty Products |

8 | — | |||||

| | | | | | | | |

Totals |

20 | 23 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Most of our international facilities are located in China, Germany and the United Kingdom. We own most of our international manufacturing facilities, none of which are subject to significant encumbrances. A substantial number of our international warehouse and distribution facilities are leased.

14

We own our corporate headquarters in Taylor, Michigan. We own an additional building near our corporate headquarters that is used by our Masco Technical Services (research and development) department. We continue to lease an office facility in Luxembourg which serves as a headquarters for most of our foreign operations.

We have entered into a contract to lease a new corporate headquarters in Livonia, Michigan, which we expect to occupy beginning in 2017.

Each of our operating divisions assesses the manufacturing, distribution and other facilities needed to meet its operating requirements. Our buildings, machinery and equipment have been generally well maintained and are in good operating condition. We believe our facilities have sufficient capacity and are adequate for our production and distribution requirements.

Information regarding legal proceedings involving us is set forth in Note U to our consolidated financial statements included in Item 8 of this Report and is incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

15

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The New York Stock Exchange is the principal market on which our common stock is traded. The following table indicates the high and low sales prices of our common stock as reported by the New York Stock Exchange and the cash dividends declared per common share for the periods indicated:

| |

Market Price | |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Dividends Declared |

|||||||||

Quarter

|

High | Low | ||||||||

2015 |

||||||||||

Fourth |

$ | 30.61 | $ | 24.89 | $ | .095 | ||||

Third |

28.59 | 22.52 | .095 | |||||||

Second |

28.38 | 25.47 | .09 | |||||||

First |

27.40 | 23.23 | .09 | |||||||

| | | | | | | | | | | |

Total |

$ | .370 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

2014 |

||||||||||

Fourth |

$ | 25.58 | $ | 19.84 | $ | .09 | ||||

Third |

24.91 | 20.18 | .09 | |||||||

Second |

23.42 | 19.50 | .09 | |||||||

First |

23.73 | 20.60 | .075 | |||||||

| | | | | | | | | | | |

Total |

$ | .345 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

On January 31, 2016, there were approximately 4,200 holders of record of our common stock.

We expect that our practice of paying quarterly dividends on our common stock will continue, although the payment of future dividends is at the discretion of our Board of Directors and will depend upon our earnings, capital requirements, financial condition and other factors.

In September 2014, our Board of Directors authorized the purchase of up to 50 million shares, for retirement of our common stock in open-market transactions or otherwise, replacing the previous authorization established in 2007. During 2015, we repurchased and retired 17 million shares of our common stock for cash aggregating $456 million. The following table provides information regarding the repurchase of our common stock for the three months ended December 31, 2015.

Period

|

Total Number of Shares Purchased |

Average Price Paid Per Common Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

10/1/15 - 10/31/15 |

960,000 | $ | 26.63 | 960,000 | 28,573,000 | ||||||||

11/1/15 - 11/30/15 |

800,000 | $ | 29.23 | 800,000 | 27,773,000 | ||||||||

12/1/15 - 12/31/15 |

— | $ | — | — | 27,773,000 | ||||||||

| | | | | | | | | | | | | | |

Total for the quarter |

1,760,000 | $ | 27.81 | 1,760,000 | 27,773,000 | ||||||||

16

Performance Graph

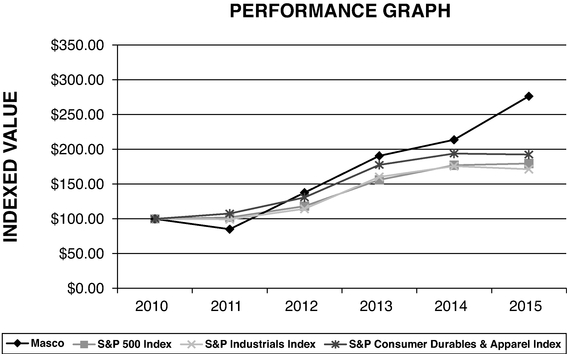

The table below compares the cumulative total shareholder return on our common stock with the cumulative total return of (i) the Standard & Poor's 500 Composite Stock Index ("S&P 500 Index"), (ii) The Standard & Poor's Industrials Index ("S&P Industrials Index") and (iii) the Standard & Poor's Consumer Durables & Apparel Index ("S&P Consumer Durables & Apparel Index"), from December 31, 2010 through December 31, 2015, when the closing price of our common stock was $28.30. The graph assumes investments of $100 on December 31, 2010 in our common stock and in each of the three indices and the reinvestment of dividends.

The table below sets forth the value, as of December 31 for each of the years indicated, of a $100 investment made on December 31, 2010 in each of our common stock, the S&P 500 Index, the S&P Industrials Index and the S&P Consumer Durables & Apparel Index and includes the reinvestment of dividends.

| |

2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Masco |

$ | 85.15 | $ | 137.80 | $ | 190.82 | $ | 213.95 | $ | 276.69 | ||||||

S&P 500 Index |

$ | 102.09 | $ | 118.30 | $ | 156.21 | $ | 177.32 | $ | 179.76 | ||||||

S&P Industrials Index |

$ | 99.39 | $ | 114.48 | $ | 160.47 | $ | 175.98 | $ | 171.52 | ||||||

S&P Consumer Durables & Apparel Index |

$ | 107.71 | $ | 130.87 | $ | 177.77 | $ | 194.10 | $ | 192.67 | ||||||

17

Item 6. Selected Financial Data.

| |

Dollars in Millions (Except Per Common Share Data) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||

Net Sales (1) |

$ | 7,142 | $ | 7,006 | $ | 6,761 | $ | 6,286 | $ | 6,093 | ||||||

Operating profit (loss) (1)(3)(4) |

914 | 721 | 612 | 384 | (153 | ) | ||||||||||

Income (loss) from continuing operations attributable to Masco Corporation (1)(2)(3)(4) |

357 | 821 | 259 | 54 | (297 | ) | ||||||||||

Income (loss) per common share from continuing operations: |

||||||||||||||||

Basic |

$ | 1.04 | $ | 2.31 | $ | .72 | $ | .15 | $ | (.86 | ) | |||||

Diluted |

1.03 | 2.28 | .72 | .15 | (.86 | ) | ||||||||||

Dividends declared |

.370 | .345 | .300 | .300 | .300 | |||||||||||

Dividends paid |

.365 | .330 | .300 | .300 | .300 | |||||||||||

At December 31: |

||||||||||||||||

Total assets |

$ | 5,680 | $ | 7,208 | $ | 6,885 | $ | 6,842 | $ | 7,294 | ||||||

Long-term debt |

2,418 | 2,919 | 3,421 | 3,422 | 3,222 | |||||||||||

Shareholders' equity (5) |

58 | 1,128 | 787 | 542 | 750 | |||||||||||

- (1)

- Amounts exclude discontinued operations.

- (2)

- The year 2014 includes a $529 million tax benefit from the release of the valuation allowance on

deferred tax assets.

- (3)

- The year 2012 includes non-cash impairment charges for other intangible assets aggregating

$27 million after tax ($42 million pre-tax).

- (4)

- The year 2011 includes non-cash impairment charges for goodwill and other intangible assets aggregating

$291 million after tax ($450 million pre-tax).

- (5)

- The decrease in shareholder's equity from 2014 to 2015 relates primarily to the spin off of TopBuild Corp.

18

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The financial and business analysis below provides information which we believe is relevant to an assessment and understanding of our consolidated financial position, results of operations and cash flows. This financial and business analysis should be read in conjunction with the consolidated financial statements and related notes.

The following discussion and certain other sections of this Report contain statements that reflect our views about our future performance and constitute "forward-looking statements" under the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "believe," "anticipate," "appear," "may," "will," "should," "intend," "plan," "estimate," "expect," "assume," "seek," "forecast" and similar references to future periods. Our views about future performance involve risks and uncertainties that are difficult to predict and, accordingly, our actual results may differ materially from the results discussed in our forward-looking statements. We caution you against relying on any of these forward-looking statements.

In addition to the various factors included in the "Executive Level Overview," "Critical Accounting Policies and Estimates" and "Outlook for the Company" sections, our future performance may be affected by the levels of home improvement activity and new home construction, our ability to maintain our strong brands and to develop and introduce new and improved products, our ability to maintain our competitive position in our industries, our reliance on key customers, our ability to achieve the anticipated benefits of our strategic initiatives, our ability to sustain the performance of our cabinetry businesses, the cost and availability of raw materials, our dependence on third party suppliers, and risks associated with international operations and global strategies. These and other factors are discussed in detail in Item 1A "Risk Factors" of this Report. Any forward-looking statement made by us speaks only as of the date on which it was made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Unless required by law, we undertake no obligation to update publicly any forward-looking statements as a result of new information, future events or otherwise.

Executive Level Overview

We design, manufacture, market and distribute branded home improvement and building products. These products are sold for home improvement and new home construction through home center retailers, mass merchandisers, hardware stores, homebuilders, distributors and other outlets for consumers and contractors and direct to the consumer.

2015 Results

Net sales were positively affected by increased repair and remodel activity and new home construction in the U.S. and Europe, favorable product mix, net selling price increases and acquisitions. Such increases were partially offset by foreign currency translation, primarily due to the stronger U.S. dollar compared to the Euro. Our results of operations were positively affected by increased sales volume, operational efficiencies due to benefits resulting from cost savings initiatives and a more favorable relationship between selling prices and commodity costs.

Our Cabinets and Related Products segment was positively affected by operational efficiencies due to benefits resulting from business rationalization activities and other cost saving initiatives and decreased business rationalization expenses. Our Plumbing Products segment benefited from increased sales volume and a favorable relationship between selling prices and commodity costs and was negatively impacted by unfavorable product mix and an increase in certain variable expenses. The Decorative Architectural Products segment benefited from increased sales volume of paints and stains and builders' hardware, a more favorable relationship between selling prices and commodity costs in

19

paints and stains and operational efficiencies due to benefits associated with cost savings initiatives. Our Other Specialty Products segment benefited from increased volume, a more favorable product mix of U.S. windows and a more favorable relationship between selling prices and commodity costs of windows in the U.S. and the U.K.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of these financial statements requires us to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We regularly review our estimates and assumptions, which are based upon historical experience, as well as current economic conditions and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of certain assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates and assumptions.

Note A to our consolidated financial statements includes our accounting policies, estimates and methods used in the preparation of our consolidated financial statements.

We believe that the following critical accounting policies are affected by significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition and Receivables

We recognize revenue as title to products and risk of loss is transferred to customers or when services are rendered. We record estimated reductions to revenue for customer programs and incentive offerings, including special pricing and co-operative advertising arrangements, promotions and other volume-based incentives. We monitor our customer receivable balances and the credit worthiness of our customers on an on-going basis and maintain allowances for doubtful accounts receivable for estimated losses resulting from the inability of customers to make required payments.

Goodwill and Other Intangible Assets

We record the excess of purchase cost over the fair value of net tangible assets of acquired companies as goodwill or other identifiable intangible assets. In the fourth quarter of each year, or as events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount, we complete the impairment testing of goodwill utilizing a discounted cash flow method. We selected the discounted cash flow methodology because we believe that it is comparable to what would be used by other market participants. We have defined our reporting units and completed the impairment testing of goodwill at the operating segment level, as defined by GAAP.

Determining market values using a discounted cash flow method requires us to make significant estimates and assumptions, including long-term projections of cash flows, market conditions and appropriate discount rates. Our judgments are based upon historical experience, current market trends, consultations with external valuation specialists and other information. While we believe that the estimates and assumptions underlying the valuation methodology are reasonable, different estimates and assumptions could result in different outcomes. In estimating future cash flows, we rely on internally generated five-year forecasts for sales and operating profits, including capital expenditures, and, currently, a one to three percent long-term assumed annual growth rate of cash flows for periods after the five-year forecast. We generally develop these forecasts based upon, among other things, recent sales

20

data for existing products, planned timing of new product launches, estimated repair and remodel activity and estimated housing starts. Our assumptions included a relatively stable U.S. Gross Domestic Product ranging from 2.4 percent to 2.9 percent and a euro zone Gross Domestic Product ranging from 1.5 percent to 1.8 percent over the five-year forecast.

We utilize our weighted average cost of capital of approximately 8.5 percent as the basis to determine the discount rate to apply to the estimated future cash flows. Our weighted average cost of capital decreased in 2015 as compared to 2014, primarily due to less risk associated with our stock in relation to the capital markets. In 2015, based upon our assessment of the risks impacting each of our businesses, we applied a risk premium to increase the discount rate to a range of 10.5 percent to 12.5 percent for our reporting units.

If the carrying amount of a reporting unit exceeds its fair value, we measure the possible goodwill impairment based upon an allocation of the estimate of fair value of the reporting unit to all of the underlying assets and liabilities of the reporting unit, including any previously unrecognized intangible assets (Step Two Analysis). The excess of the fair value of a reporting unit over the amounts assigned to its assets and liabilities is the implied fair value of goodwill. An impairment loss is recognized to the extent that a reporting unit's recorded goodwill exceeds the implied fair value of goodwill.

In the fourth quarter of 2015, we estimated that future discounted cash flows projected for all of our reporting units were greater than the carrying values. Accordingly, we did not recognize any impairment charges for goodwill.

A 10 percent decrease in the estimated fair value of our reporting units at December 31, 2015 would not have resulted in any additional analysis of goodwill impairment for any reporting unit.

We review our other indefinite-lived intangible assets for impairment annually, in the fourth quarter, or as events occur or circumstances change that indicate the assets may be impaired without regard to the business unit. We consider the implications of both external (e.g., market growth, competition and local economic conditions) and internal (e.g., product sales and expected product growth) factors and their potential impact on cash flows related to the intangible asset in both the near- and long-term. In 2015, we did not recognize any impairment charges for other indefinite-lived intangible assets.

Employee Retirement Plans

Effective January 1, 2010, we froze all future benefit accruals under substantially all of our domestic qualified and non-qualified defined-benefit pension plans.

Accounting for defined-benefit pension plans involves estimating the cost of benefits to be provided in the future, based upon vested years of service, and attributing those costs over the time period each employee works. We develop our pension costs and obligations from actuarial valuations. Inherent in these valuations are key assumptions regarding inflation, expected return on plan assets, mortality rates and discount rates for obligations and expenses. We consider current market conditions, including changes in interest rates, in selecting these assumptions. While we believe that the estimates and assumptions underlying the valuation methodology are reasonable, different estimates and assumptions could result in different reported pension costs and obligations within our consolidated financial statements.

In December 2015, our discount rate increased for obligations to an average of 4.0 percent from 3.8 percent. The discount rate for obligations is based upon the expected duration of each defined-benefit pension plan's liabilities matched to the December 31, 2015 Towers Watson Rate Link curve. The discount rates we use for our defined-benefit pension plans ranged from 2.0 percent to 4.3 percent, with the most significant portion of the liabilities having a discount rate for obligations of 4.0 percent or higher. The assumed asset return was primarily 7.25 percent, reflecting the expected long-term return on plan assets.

21

Our net underfunded amount for our qualified defined-benefit pension plans, which is the difference between the projected benefit obligation and plan assets, decreased to $401 million at December 31, 2015 from $454 million at December 31, 2014. Our projected benefit obligation for our unfunded non-qualified defined-benefit pension plans was $174 million at December 31, 2015 compared with $190 million at December 31, 2014.

The decrease in the projected benefit obligations was primarily due to lower bond rates and a change to the MP 2015 Mortality Improvement Scale issued by the U.S. Society of Actuaries, which decreased our long-term pension liabilities. Our qualified domestic pension plan assets in 2015 had a net loss of 1.8 percent.

At December 31, 2015, we reported a net liability of $575 million, of which $174 million was related to our non-qualified, supplemental retirement plans, which are not subject to the funding requirements of the Pension Protection Act of 2006. In accordance with the Pension Protection Act, the Adjusted Funding Target Attainment Percentage for the various defined-benefit pension plans ranges from 78 percent to 114 percent.

We expect pension expense for our qualified defined-benefit pension plans to be $24 million in 2016 compared with $22 million in 2015. If we assumed that the future return on plan assets was one-half percent lower than the assumed asset return and the discount rate decreased by 50 basis points, the 2016 pension expense would increase by $5 million. We expect pension expense for our non-qualified defined-benefit pension plans to be $9 million in 2016, compared to $10 million in 2015.

We anticipate that we will be required to contribute approximately $25 million in 2016 to our qualified and non-qualified defined-benefit plans. Refer to Footnote M for further information regarding the funding of our plans.

Income Taxes

Deferred taxes are recognized based on the future tax consequences of differences between the financial statement carrying value of assets and liabilities and their respective tax basis. The future realization of deferred tax assets depends on the existence of sufficient taxable income in future periods. Possible sources of taxable income include taxable income in carryback periods, the future reversal of existing taxable temporary differences recorded as a deferred tax liability, tax-planning strategies that generate future income or gains in excess of anticipated losses in the carryforward period and projected future taxable income.

If, based upon all available evidence, both positive and negative, it is more likely than not (more than 50 percent likely) such deferred tax assets will not be realized, a valuation allowance is recorded. Significant weight is given to positive and negative evidence that is objectively verifiable. A company's three-year cumulative loss position is significant negative evidence in considering whether deferred tax assets are realizable, and the accounting guidance restricts the amount of reliance we can place on projected taxable income to support the recovery of the deferred tax assets.

In 2010, we recorded a $372 million valuation allowance against our U.S. Federal deferred tax assets as a non-cash charge to income tax expense. In reaching this conclusion, we considered the weaker retail sales of certain of our building products and the slower than anticipated recovery in the U.S. housing market which led to U.S. operating losses and significant U.S. goodwill impairment charges, that primarily occurred in the fourth quarter of 2010, causing us to be in a three-year cumulative U.S. loss position.

During 2012 and 2011, objective and verifiable negative evidence, such as U.S. operating losses and significant impairment charges for U.S. goodwill and other intangible assets, continued to outweigh positive evidence necessary to reduce the valuation allowance. As a result, we recorded increases of $65 million and $87 million in the valuation allowance related to our U.S. Federal deferred tax assets in 2012 and 2011, respectively.

22

In the third quarter of 2014, we recorded a $517 million tax benefit from the release of the valuation allowance against our U.S. Federal and certain state deferred tax assets due primarily to a return to sustainable profitability in our U.S. operations. In reaching this conclusion, we considered the continued improvement in both the new home construction market and repair and remodel activity in the U.S. and our progress on strategic initiatives to reduce costs and expand our product leadership positions which contributed to the continued improvement in our U.S. operations over the past few years.

In the fourth quarter of 2014, we recorded an additional $12 million tax benefit from the release of the valuation allowances against certain U.K. and Mexican deferred tax assets primarily resulting from a return to sustainable profitability in these jurisdictions.

We continue to maintain a valuation allowance on certain state and foreign deferred tax assets as of December 31, 2015. Should we determine that we would not be able to realize our remaining deferred tax assets in these jurisdictions in the future, an adjustment to the valuation allowance would be recorded in the period such determination is made. The need to maintain a valuation allowance against deferred tax assets may cause greater volatility in our effective tax rate.

The current accounting guidance allows the recognition of only those income tax positions that have a greater than 50 percent likelihood of being sustained upon examination by the taxing authorities. We believe that there is an increased potential for volatility in our effective tax rate because this threshold allows changes in the income tax environment and the inherent complexities of income tax law in a substantial number of jurisdictions to affect the computation of our liability for uncertain tax positions to a greater extent.

While we believe we have adequately provided for our uncertain tax positions, amounts asserted by taxing authorities could vary from our liability for uncertain tax positions. Accordingly, additional provisions for tax-related matters, including interest and penalties, could be recorded in income tax expense in the period revised estimates are made or the underlying matters are settled or otherwise resolved.

Warranty